The information provided in this Exhibit is presented only in connection with the reporting changes described in the accompanying Form 8-K. This information does not reflect events occurring after February 28, 2019, the date we filed our 2018 Form 10-K, and does not modify or update the disclosures therein in any way, other than as required to reflect FMC Lithium as a discontinued operation, as described in the Form 8-K and set forth in Exhibits 99.1 through 99.4 attached thereto. You should therefore read this information in conjunction with the 2018 Form 10-K filed with the Securities and Exchange Commission on February 28, 2019 and in conjunction with our June 30, 2019 Form 10-Q filed with the Securities and Exchange Commission on July 31, 2019.

PART I

FMC Corporation was incorporated in 1928 under Delaware law and has its principal executive offices at 2929 Walnut Street, Philadelphia, Pennsylvania 19104. Throughout this current report on Form 8-K, except where otherwise stated or indicated by the context, “FMC,” the “Company,” “We,” “Us,” or “Our” means FMC Corporation and its consolidated subsidiaries and their predecessors. Copies of the annual, quarterly and current reports we file with the Securities and Exchange Commission (“SEC”), and any amendments to those reports, are available on our website at www.fmc.com as soon as practicable after we furnish such materials to the SEC.

General

We are an agricultural sciences company providing innovative solutions to growers around the world with a robust product portfolio fueled by a market-driven discovery and development pipeline in crop protection, plant health, and professional pest and turf management. We operate in a single distinct business segment: FMC Agricultural Solutions. Our FMC Agricultural Solutions segment develops, markets and sells all three major classes of crop protection chemicals: insecticides, herbicides and fungicides. These products are used in agriculture to enhance crop yield and quality by controlling a broad spectrum of insects, weeds and disease, as well as in non-agricultural markets for pest control.

FMC Lithium (Livent Corporation)

In March 2017, we announced our intention to separate our FMC Lithium segment (subsequently renamed Livent Corporation, or "Livent") into a publicly traded company. The initial step of the separation, the initial public offering ("IPO") of Livent, closed on October 15, 2018. In connection with the IPO, Livent had granted the underwriters an option to purchase additional shares of common stock to cover over-allotments at the IPO price, less the underwriting discount. On November 8, 2018, the underwriters exercised in full their option to purchase additional shares. After completion of the IPO and the underwriters' exercise to purchase additional shares of common stock, FMC owned 123 million shares of Livent's common stock, representing approximately 84 percent of the total outstanding shares of Livent's common stock. FMC presently intends to distribute the remaining Livent shares to FMC stockholders (the "Distribution") on March 1, 2019. Our FMC Lithium segment and its results have been presented as a discontinued operation for all periods presented throughout this document.

DuPont Crop Protection Business

On March 31, 2017, we entered into a definitive Transaction Agreement (the “Transaction Agreement”) with E. I. du Pont de Nemours and Company (“DuPont"). On November 1, 2017, pursuant to the terms and conditions set forth in the Transaction Agreement, we completed the acquisition of certain assets relating to DuPont's Crop Protection business and research and development organization ("DuPont Crop Protection Business") (collectively, the "DuPont Crop Protection Business Acquisition"). In connection with this transaction, we sold to DuPont our FMC Health and Nutrition segment and paid DuPont $1.2 billion in cash. Our FMC Health and Nutrition business and its results have been presented as a discontinued operation for all periods presented throughout this document.

FMC Strategy

FMC has streamlined its portfolio over the past eight years to focus on technology-driven end markets with attractive long-term demand trends. The actions we have taken over the past year have better positioned each of our businesses to capitalize on future growth opportunities.

2018 was another pivotal year for FMC, as we made substantial progress toward integrating the recently acquired DuPont Crop Protection Business into FMC Agricultural Solutions and toward separating our Lithium business into a standalone public company,

Livent Corporation. Our Agricultural Solutions segment grew revenue by 11 percent, on a pro forma basis, due to robust demand for our acquired insecticides, Rynaxypr® and Cyazypyr ® insect control, and broad cross-selling opportunities for all our products around the world. Rynaxypr® is now the second largest active ingredient in the crop protection market. We also launched 30 new formulated products in 2018, which is key to life cycle management of our products. We far outperformed the crop protection market, which we estimate grew by just 2 to 3 percent in 2018. FMC will begin launching its technology pipeline of six new active ingredients, starting with our bixafen fungicide launch - under the Lucento brand - in North America in the first quarter of 2019.

The November 2017 acquisition of a significant portion of the DuPont Crop Protection Business transformed FMC into a tier-one leader and the fifth largest global provider in the agricultural chemicals market. The acquisition included DuPont’s industry-leading insecticides and herbicides (the majority of which are patented technologies), exceptional discovery research capabilities and a global manufacturing network. The acquisition also added 16 discovery leads to our pipeline, and we expect to spend approximately 7 percent of FMC Agricultural Solutions sales on research and development annually. FMC acquired 14 manufacturing plants from DuPont, and with 26 total plants today, we have the scale to operate this business with greater resources and global reach to address changing market conditions.

We maintain our commitment to enterprise sustainability, including responsible stewardship. As we grow, we will do so in a responsible way. Safety and business ethics will remain of utmost importance. Meeting and exceeding our customers’ expectations will continue to be a primary focus.

Financial Information About Our Business Segment

(Financial Information in Millions)

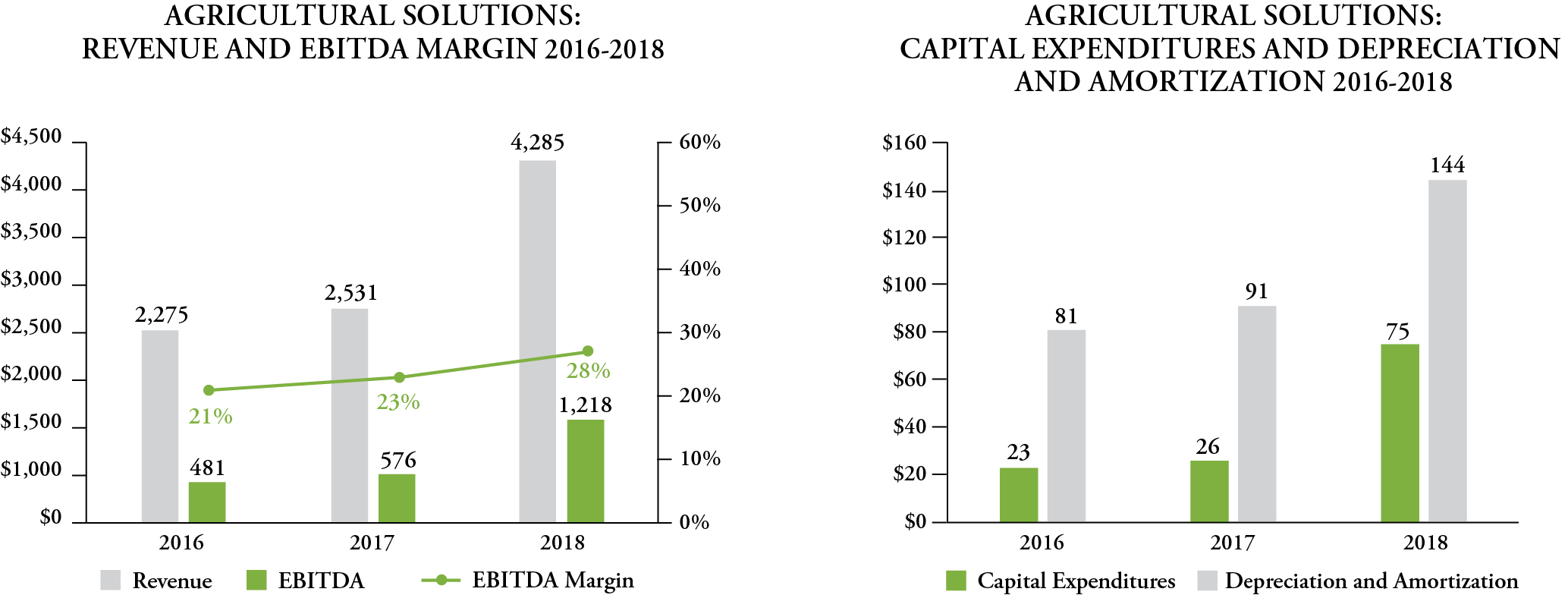

See Note 20 "Segment Information" to our consolidated financial statements included in this Form 8-K as Exhibit 99.4. Also see below for selected financial information related to our segment.

The following table shows the principal products produced by our business segment, their raw materials and uses:

|

| | | |

| Segment | Product | Raw Materials | Uses |

| FMC Agricultural Solutions | Insecticides | Synthetic chemical intermediates | Protection of crops, including soybean, corn, fruits and vegetables, cotton, sugarcane, rice, and cereals, from insects and for non-agricultural applications including pest control for home, garden and other specialty markets |

| | Herbicides | Synthetic chemical intermediates | Protection of crops, including cotton, sugarcane, rice, corn, soybeans, cereals, fruits and vegetables from weed growth and for non-agricultural applications including turf and roadsides |

| | Fungicides | Synthetic and biological chemical intermediates | Protection of crops, including fruits and vegetables from fungal disease |

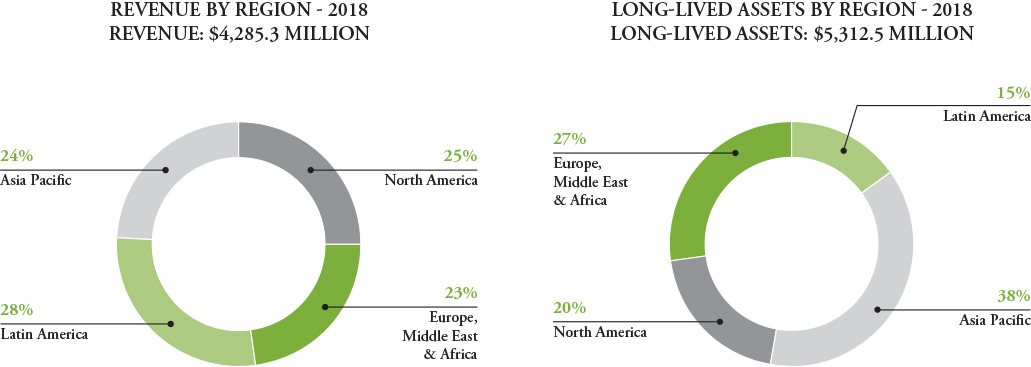

With a worldwide manufacturing and distribution infrastructure, we are better able to respond rapidly to global customer needs, offset downward economic trends in one region with positive trends in another and match local revenues to local costs to reduce the impact of currency volatility. The charts below detail our sales and long-lived assets by major geographic region.

FMC Agricultural Solutions

Overview

Our FMC Agricultural Solutions segment, which represents all of our 2018 consolidated revenues, operates in the agrochemicals industry. This segment develops, manufactures and sells a portfolio of crop protection, professional pest control and lawn and garden products.

Products and Markets

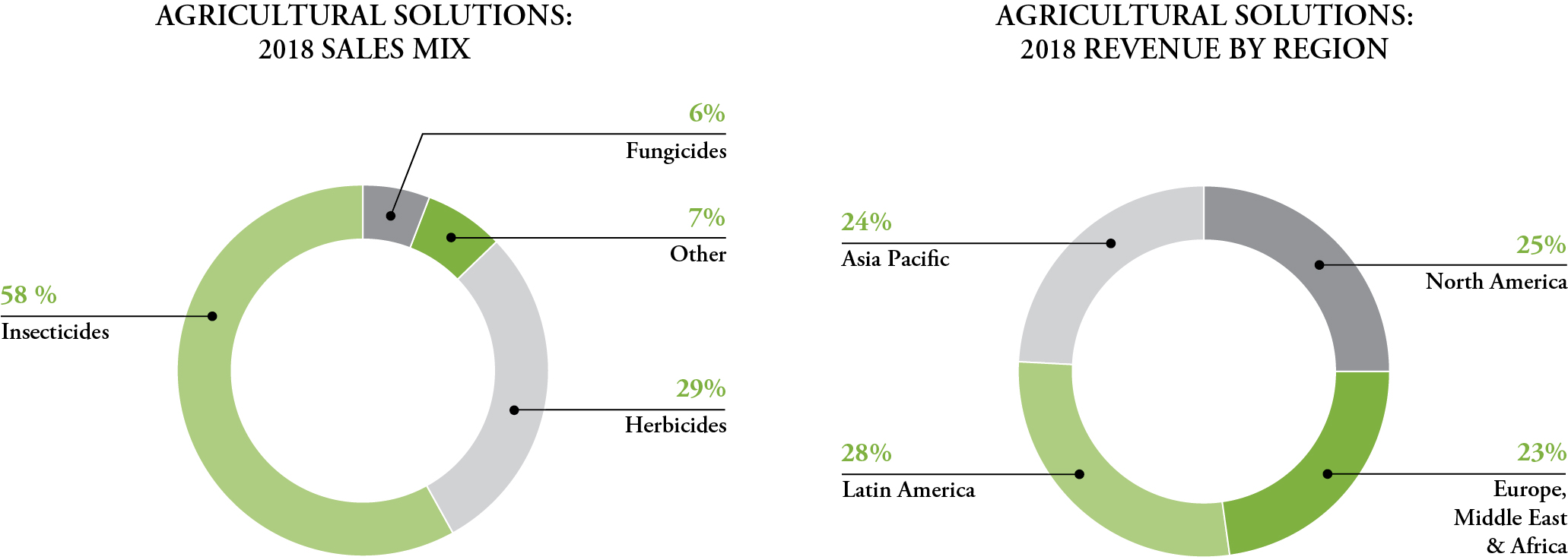

FMC Agricultural Solutions' portfolio is comprised of three major pesticide categories: insecticides, herbicides and fungicides. The majority of our product lines consist of insecticides and herbicides, and we have a small but fast-growing portfolio of fungicides mainly used in high value crop segments. Our insecticides are used to control a wide spectrum of pests, while our herbicide portfolio primarily targets a large variety of difficult-to-control weeds. We are also investing substantially in a plant health program that includes biological crop protection products, seed treatments and micro-nutrients.

In the Latin American region, which includes the large agricultural market of Brazil, we sell directly to large growers through our own sales and marketing organization, and we access the market through independent distributors and co-ops. In North America,

we access the market through several major national and regional distributors and have our own sales and marketing organization in Canada. We access the European markets through our own sales and marketing organizations. With the 2017 acquisition of the DuPont Crop Protection Business, we now access key Asian markets through large distributors, in addition to either local independent distributors or our own sales and marketing organizations. Through these and other alliances, along with our own targeted marketing efforts, access to novel technologies and our innovation initiatives, we expect to maintain and enhance our access in key agricultural and non-crop markets and develop new products that will help us continue to compete effectively.

Industry Overview

The three principal categories of agricultural and non-crop chemicals are: herbicides, insecticides and fungicides, representing approximately 43 percent, 25 percent and 29 percent of global industry revenue, respectively.

The agrochemicals industry is more consolidated following several recent mergers of the leading crop protection companies, which now include FMC, ChemChina (owners of Syngenta and Adama), Bayer AG (acquired Monsanto in 2018), BASF AG and DowDuPont (Corteva Agriscience, the agricultural division of DowDuPont, is expected to be spun out in June 2019). These five companies currently represent approximately 74 percent of the crop protection industry’s global sales. The next tier of agrochemical producers include Sumitomo Chemical Company Ltd., Nufarm Ltd. and United Phosphorous Ltd. (UPL also acquired Arysta on February 1, 2019). FMC employs various differentiated strategies and competes with unique technologies focusing on certain crops, markets and geographies, while also being supported by a low-cost manufacturing model.

Growth

The 2017 acquisition of a significant portion of the DuPont Crop Protection Business positions FMC among leading agrochemical producers in the world. The acquired insecticides are predominantly based on patent-protected active ingredients and are growing well above market patterns. Our complementary technologies combine improved formulation capabilities and a broader innovation pipeline, resulting in new and differentiated products. We will take advantage of enhanced market access positions and an expanded portfolio to deliver near-term growth.

We will continue to grow by obtaining new and approved uses for existing product lines and acquiring, accessing, developing, marketing, distributing and/or selling complementary chemistries and related technologies in order to strengthen our product portfolio and our capabilities to effectively service our target markets and customers.

Our growth efforts focus on developing environmentally compatible and sustainable solutions that can effectively increase farmers’ yields and provide cost-effective alternatives to chemistries which may be prone to resistance. We are committed to providing unique, differentiated products to our customers by acquiring and further developing technologies as well as investing in innovation to extend product life cycles. Our external growth efforts include product acquisitions, in-licensing of chemistries and technologies and alliances that bolster our market access, complement our existing product portfolio or provide entry into adjacent spaces. We have entered into a range of development and distribution agreements with other companies that provide access to new technologies and products which we can subsequently commercialize.

Source and Availability of Raw Materials

Raw materials used by FMC Agricultural Solutions, primarily processed chemicals, are obtained from a variety of suppliers worldwide.

Patents

We own and license a significant number of U.S. and foreign patents, trademarks, trade secrets and other intellectual property that are cumulatively important to our business. The FMC intellectual property estate provides us with an important competitive advantage. Our patents cover many of our products, processes and product uses as well as many aspects of our research and development activities supporting the FMC new product pipeline. Patents are granted by individual jurisdictions and the duration of our patents depends on their respective jurisdictions and payment of annuities. We also own many trademarks that are well recognized by customers or product end-users. Unlike patents, ownership rights in trademarks can be continued indefinitely so long as the trademarks are properly used and renewal fees are paid. We actively monitor and manage our patents and trademarks to maintain our rights in these assets. We believe that the invalidity or loss of any particular patent, trademark or license would be a remote possibility and/or would not likely have a material adverse effect on the overall business of FMC.

Seasonality

The seasonal nature of the crop protection market and the geographic spread of the FMC Agricultural Solutions business can result in significant variations in quarterly earnings among geographic locations. FMC Agricultural Solutions' products sold in the northern hemisphere (North America, Europe and parts of Asia) serve seasonal agricultural markets from March through September, generally resulting in significant earnings in the first and second quarters, and to a lesser extent in the fourth quarter. Markets in

the southern hemisphere (Latin America and parts of the Asia Pacific region, including Australia) are served from July through February, generally resulting in earnings in the third, fourth and first quarters.

Competition

We encounter substantial competition in our business. We market our products through our own sales organization and through alliance partners, independent distributors and sales representatives. The number of our principal competitors varies from segment to segment. In general, we compete by providing advanced technology, high product quality, reliability, quality customer and technical service, and by operating in a cost-efficient manner.

Our FMC Agricultural Solutions segment competes primarily in the global chemical crop protection market for insecticides, herbicides and fungicides. Industry products include crop protection chemicals and, for certain major competitors, genetically engineered (crop biotechnology) products. Competition from generic agrochemical producers is significant as a number of key product patents have expired in the last decade. In general, we compete as an innovator by focusing on product development, including novel formulations, proprietary mixes, and advanced delivery systems and by acquiring or licensing (mostly) proprietary chemistries or technologies that complement our product and geographic focus. We also differentiate ourselves by our global cost-competitiveness through our manufacturing strategies, establishing effective product stewardship programs and developing strategic alliances that strengthen market access in key countries and regions.

Research and Development Expense

The development efforts in the FMC Agricultural Solutions segment focus on developing environmentally sound solutions — both new active ingredients and new product formulations — that cost-effectively increase farmers’ yields and provide alternatives to existing and new chemistries.

Environmental Laws and Regulations

A discussion of environmental related factors can be found in Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and in Note 11 “Environmental Obligations” in the notes to our consolidated financial statements included in this Form 8-K attached as Exhibit 99.3 and Exhibit 99.4, respectively.

Employees

We employ approximately 6,500 people with about 1,600 and 4,900 people in our continuing domestic and foreign operations, respectively.

Approximately 3 percent of our U.S.-based and 29 percent of our foreign-based employees, respectively, are represented by collective bargaining agreements. We have successfully concluded most of our recent contract negotiations without any material work stoppages. In those rare instances where a work stoppage has occurred, there has been no material effect on consolidated sales and earnings. We cannot predict, however, the outcome of future contract negotiations. In 2019, eight foreign collective-bargaining agreements will be expiring. These contracts affect approximately 22 percent of our foreign-based employees. There will be no U.S. collective-bargaining agreements expiring in 2019.

SEC Filings

SEC filings are available free of charge on our website, www.fmc.com. Our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports are posted as soon as practicable after we furnish such materials to the SEC.

Below lists our risk factors updated for these events.

Among the factors that could have an impact on our ability to achieve operating results and meet our other goals are:

Industry Risks:

Pricing and volumes in our markets are sensitive to a number of industry specific and global issues and events including:

| |

| • | Competition - Our business faces competition, which could affect our ability to maintain or raise prices, successfully enter certain markets or retain our market position. Competition for our FMC Agricultural Solutions segment includes not only generic suppliers of the same pesticidal active ingredients but also alternative proprietary pesticide chemistries and crop protection technologies that are bred into or applied onto seeds. Increased generic presence in agricultural chemical markets has been driven by the number of significant product patents and product data protections that have expired in the last decade, and this trend is expected to continue. Also, there are changing competitive dynamics in the agrochemical industry as some of our competitors have consolidated, resulting in them having greater scale and diversity. These competitive differences may not be overcome and may erode our business. |

| |

| • | Climatic conditions - Our FMC Agricultural Solutions markets are affected by climatic conditions, which could adversely impact crop pricing and pest infestations. For example, drought may reduce the need for fungicides, which could result in fewer sales and greater unsold inventories in the market, whereas excessive rain could lead to increased plant disease or weed growth requiring growers to purchase and use more pesticides. Natural disasters can impact production at our facilities in various parts of the world. The nature of these events makes them difficult to predict. |

| |

| • | Changing regulatory environment - Changes in the regulatory environment, particularly in the United States, Brazil, China, Argentina and the European Union, could adversely impact our ability to continue producing and/or selling certain products in our domestic and foreign markets or could increase the cost of doing so. FMC Agricultural Solutions is most sensitive to this general regulatory risk given the need to obtain and maintain pesticide registrations in every country in which we sell our products. Many countries require re-registration of pesticides to meet new and more challenging requirements; while we defend our products vigorously, these re-registration processes may result in significant additional data costs, reduced number of permitted product uses, or potential product cancellation. Compliance with changing laws and regulations may involve significant costs or capital expenditures or require changes in business practice that could result in reduced profitability. In the European Union, the regulatory risk specifically includes the chemicals regulation known as REACH (Registration, Evaluation, and Authorization of Chemicals), which requires manufacturers to verify through a special registration system that their chemicals can be marketed safely. |

| |

| • | Geographic presence outside of United States - With the acquisition of the DuPont Crop Protection Business, FMC Agricultural Solutions has a strong presence in Latin America, Europe and Asia, as well as in the United States. Growth of our geographic footprint particularly in Europe and key Asian countries such as India means that developments outside the United States will generally have a more significant effect on our operations than in the past. Our operations outside the United States are subject to special risks and restrictions, including: fluctuations in currency values; exchange control regulations; changes in local political or economic conditions; governmental pricing directives; import and trade restrictions; import or export licensing requirements and trade policy; restrictions on the ability to repatriate funds; and other potentially detrimental domestic and foreign governmental practices or policies affecting U.S. companies doing business abroad. |

| |

| • | Climate change regulation - Changes in the regulation of greenhouse gases, depending on their nature and scope, could subject our manufacturing operations to significant additional costs or limits on operations. |

| |

| • | Fluctuations in commodity prices - Our operating results could be significantly affected by the cost of commodities. We may not be able to raise prices or improve productivity sufficiently to offset future increases in chemical raw material commodity pricing. Accordingly, increases in such commodity prices may negatively affect our financial results. We use hedging strategies to address material commodity price risks, where hedge strategies are available on reasonable terms. However, we are unable to avoid the risk of medium- and long-term increases. Additionally, fluctuations in harvested crop commodity prices could negatively impact our customers' ability to sell their products at previously forecasted prices resulting in reduced customer liquidity. Inadequate customer liquidity could affect our customers’ abilities to pay for our products and, therefore, affect existing and future sales or our ability to collect on customer receivables. |

| |

| • | Supply arrangements - Certain raw materials are critical to our production processes and our purchasing strategy and supply chain design are complex. While we have made supply arrangements to meet planned operating requirements, an inability to obtain the critical raw materials or operate under contract manufacturing arrangements would adversely impact our ability to produce certain products and could lead to operational disruption and increase uncertainties around business performance. We increasingly source critical intermediates and finished products from a number of suppliers, largely outside of the U.S. and principally in China. An inability to obtain these products or execute under contract sourcing arrangements would adversely impact our ability to sell products. |

| |

| • | Economic and political change - Our business has been and could continue to be adversely affected by economic and political changes in the markets where we compete including: inflation rates, recessions, trade restrictions, tariff increases or potential new tariffs, foreign ownership restrictions and economic embargoes imposed by the United States or any of the foreign countries in which we do business; changes in laws, taxation, and regulations and the interpretation and application of these laws, taxes, and regulations; restrictions imposed by the United States government or foreign governments through exchange controls or taxation policy; nationalization or expropriation of property, undeveloped property rights, and legal systems or political instability; other governmental actions; and other external factors over which we have no control. Economic and political conditions within the United States and foreign jurisdictions or strained relations between countries can cause fluctuations in demand, price volatility, supply disruptions, or loss of property. In Argentina, continued inflation and foreign exchange controls could adversely affect our business. Realignment of change in regional economic arrangements could have an operational impact on our businesses. In China, unpredictable enforcement of environmental regulations could result in unanticipated shutdowns in broad geographic areas, impacting our contract manufacturers and raw material suppliers. |

Operational Risks:

| |

| • | Market access risk - Our results may be affected by changes in distribution channels, which could impact our ability to access the market. |

| |

| • | Business disruptions - We produce product through a combination of owned facilities and contract manufacturers. As a result of the DuPont Crop Protection Acquisition we now own and operate large-scale manufacturing facilities in the United States (Mobile), Puerto Rico (Manati) and China (Pudong and Jinshan) in addition to our legacy active ingredient plants in Denmark (Ronland) and India (Panoli). This presents us with additional operating risks as our operating results will be dependent in part on the continued operation of the acquired production facilities. Interruptions at these facilities may materially reduce the productivity of a particular manufacturing facility, or the profitability of our business as a whole. Although we take precautions to enhance the safety of our operations and minimize the risk of disruptions, our operations and those of our contract manufacturers are subject to hazards inherent in chemical manufacturing and the related storage and transportation of raw materials, products and wastes. These potential hazards include explosions, fires, severe weather and natural disasters, mechanical failure, unscheduled downtimes, supplier disruptions, labor shortages or other labor difficulties, information technology systems outages, disruption in our supply chain or manufacturing and distribution operations, transportation interruptions, chemical spills, discharges or releases of toxic or hazardous substances or gases, shipment of contaminated or off-specification product to customers, storage tank leaks, other environmental risks, or other sudden disruption in business operations beyond our control as a result of events such as acts of sabotage, terrorism or war, civil or political unrest, natural disasters, pandemic situations and large scale power outages. Some of these hazards may cause severe damage to or destruction of property and equipment or personal injury and loss of life and may result in suspension of operations or the shutdown of affected facilities. |

| |

| • | Information technology security risks - As with all enterprise information systems, our information technology systems could be penetrated by outside parties’ intent on extracting information, corrupting information, or disrupting business processes. Our systems have in the past been, and likely will in the future be, subject to unauthorized access attempts. Unauthorized access could disrupt our business operations and could result in failures or interruptions in our computer systems and in the loss of assets and could have a material adverse effect on our business, financial condition or results of operations. In addition, breaches of our security measures or the accidental loss, inadvertent disclosure, or unapproved dissemination of proprietary information or sensitive or confidential information about the Company, our employees, our vendors, or our customers, could result in litigation, violations of various data privacy regulations in some jurisdictions, and also potentially result in liability to us. While we have taken measures to assess the requirements of, and to comply with the European Union's General Data Protection Regulation and other data privacy regulations, these measures may be challenged by authorities that regulate data-related compliance. We could incur significant expense in facilitating and responding to investigations and if the measures we have taken prove to be inadequate, we could face fines or penalties. This could damage our reputation, or otherwise harm our business, financial condition, or results of operations. |

| |

| • | Litigation and environmental risks - Current reserves relating to our ongoing litigation and environmental liabilities may ultimately prove to be inadequate. |

| |

| • | Hazardous materials - We manufacture and transport certain materials that are inherently hazardous due to their toxic or volatile nature. While we take precautions to handle and transport these materials in a safe manner, if they are mishandled or released into the environment, they could cause property damage or result in personal injury claims against us. |

| |

| • | Environmental compliance - We are subject to extensive federal, state, local, and foreign environmental and safety laws, regulations, directives, rules and ordinances concerning, among other things, emissions in the air, discharges to land and water, and the generation, handling, treatment, disposal and remediation of hazardous waste and other materials. We may face liability arising out of the normal course of business, including alleged personal injury or property damage due to exposure to chemicals or other hazardous substances at our current or former facilities or chemicals that we manufacture, handle or own. We take our environmental responsibilities very seriously, but there is a risk of environmental impact |

inherent in our manufacturing operations and transportation of chemicals. Any substantial liability for environmental damage could have a material adverse effect on our financial condition, results of operations and cash flows.

| |

| • | Compliance with Laws and Regulations: The global regulatory environment is becoming increasingly complex and requires more resources to effectively manage, which may increase the potential for misunderstanding or misapplication of regulatory standards. |

| |

| • | Workforce - The inability to recruit and retain key personnel or the unexpected loss of key personnel may adversely affect our operations. In addition, our future success depends in part on our ability to identify and develop talent to succeed senior management and other key members of the organization. |

Technology Risks:

| |

| • | Technological change - Our ability to compete successfully depends in part upon our ability to maintain a superior technological capability and to continue to identify, develop and commercialize new and innovative, high value-added products for existing and future customers. Our investment in the discovery and development of new pesticidal active ingredients for FMC Agricultural Solutions relies on discovery of new chemical molecules. Such discovery processes depend on our scientists being able to find new molecules, which are novel and outside of patents held by others, and such molecules being efficacious against target pests without creating an undue risk to human health and the environment, and then meeting applicable regulatory criteria. |

| |

| • | Failure to make process improvements - Failure to continue to make process improvements to reduce costs could impede our competitive position. |

| |

| • | Patents of competitors - Some of our competitors may secure patents on production methods or uses of products that may limit our ability to compete cost-effectively. |

Portfolio Management and Integration Risks:

| |

| • | Portfolio management risks - We continuously review our portfolio which includes the evaluation of potential business acquisitions that may strategically fit our business and strategic growth initiatives. If we are unable to successfully integrate and develop our acquired businesses, we could fail to achieve anticipated synergies which would include expected cost savings and revenue growth. Failure to achieve these anticipated synergies, could materially and adversely affect our financial results. In addition to strategic acquisitions we evaluate the diversity of our portfolio in light of our objectives and alignment with our growth strategy. In implementing this strategy we may not be successful in separating underperforming or non-strategic assets. The gains or losses on the divestiture of, or lost operating income from, such assets (e.g., divesting) may affect the Company’s earnings. Moreover, we may incur asset impairment charges related to acquisitions or divestitures that reduce earnings. Significant effort will likely be required to ensure that the right mix of resources are trained, engaged and focused on achieving business objectives while adhering to our core values of safety, ethics and compliance. |

| |

| • | Intellectual property - Our patents cover many of our products, manufacturing processes, and product uses, as well as many aspects of our research and development activities supporting our new product pipeline. Patents are granted by individual jurisdictions and the duration of our patents depends on their respective jurisdictions and payment of annuities. Our future performance will depend on our ability to address patent expirations through effective portfolio life cycle management for our high value assets. |

| |

| • | System implementation and integration risks - Failure to successfully integrate the acquired DuPont Crop Protection Business and transition the management information systems of the DuPont Crop Protection Business from the ERP system provided under Transition Services Agreement by DuPont to a management information system integrated with FMC’s legacy processes could result in interruption of operations or failure to achieve synergies we expect. This could cause our future results of operations to be materially worse than expected. |

| |

| • | Major enterprise initiatives - In addition to the continued integration of the DuPont Crop Protection Business assets into FMC Agricultural Solutions, we are implementing other major initiatives such as the migration to a single global instance of SAP S4 HANA. These projects will place significant demands on certain of our internal functional groups, particularly finance and information technology. Failure to successfully execute these projects could materially and adversely affect our expected performance. |

| |

| • | Potential tax implications of FMC Lithium separation - We have received an opinion from outside counsel to the effect that the spin-off of FMC Lithium as a distribution to our stockholders qualifies as a non-taxable transaction for U.S. federal income tax purposes. The opinion is based on certain assumptions and representations as to factual matters from both FMC and FMC Lithium, as well as certain covenants by those parties. The opinion cannot be relied upon if any of the assumptions, representations or covenants is incorrect, incomplete or inaccurate or is violated in any material respect. The opinion of counsel is not binding upon the IRS or the courts and there is no assurance that the IRS or a court will not take a contrary position. It is possible that the IRS or a state or local taxing authority could take the position that aforementioned transaction results in the recognition of significant taxable gain by FMC, in which case FMC may be subject to material tax liabilities. |

Financial Risks:

| |

| • | Cyclicality - We may experience seasonal variations in the demand for our products given the nature of the crop protection market and the geographic regions in which we operate. |

| |

| • | Access to debt and capital markets - We rely on cash generated from operations and external financing to fund our growth and working capital needs. Limitations on access to external financing could adversely affect our operating results. Moreover, interest payments, dividends and the expansion of our business or other business opportunities may require significant amounts of capital. We believe that our cash from operations and available borrowings under our revolving credit facility will be sufficient to meet these needs in the foreseeable future. However, if we need external financing, our access to credit markets and pricing of our capital will be dependent upon maintaining sufficient credit ratings from credit rating agencies and the state of the capital markets generally. There can be no assurances that we would be able to obtain equity or debt financing on terms we deem acceptable, and it is possible that the cost of any financings could increase significantly, thereby increasing our expenses and decreasing our net income. If we are unable to generate sufficient cash flow or raise adequate external financing, including as a result of significant disruptions in the global credit markets, we could be forced to restrict our operations and growth opportunities, which could adversely affect our operating results. |

| |

| • | Credit default risks - We may use our existing revolving credit facility to meet our cash needs, to the extent available. In the event of a default in this credit facility or any of our senior notes, we could be required to immediately repay all outstanding borrowings and make cash deposits as collateral for all obligations the facility supports, which we may not be able to do. Any default under any of our credit arrangements could cause a default under many of our other credit agreements and debt instruments. Without waivers from lenders party to those agreements, any such default could have a material adverse effect on our ability to continue to operate. |

| |

| • | Exposure to global economic conditions - Deterioration in the global economy and worldwide credit and foreign exchange markets could adversely affect our business. A worsening of global or regional economic conditions or financial markets could adversely affect both our own and our customers' ability to meet the terms of sale or our suppliers' ability to perform all their commitments to us. A slowdown in economic growth in our international markets, or a deterioration of credit or foreign exchange markets could adversely affect customers, suppliers and our overall business there. Customers in weakened economies may be unable to purchase our products, or it could become more expensive for them to purchase imported products in their local currency, or sell their commodities at prevailing international prices, and we may be unable to collect receivables from such customers. |

| |

| • | Foreign exchange rate risks - We are an international company and face foreign exchange rate risks in the normal course of our business. We are particularly sensitive to the Brazilian real, the euro, the Indian rupee, the Chinese yuan, the Mexican peso, and the Argentine peso. Our acquisition of the DuPont Crop Protection Business has significantly expanded our operations and sales in certain foreign countries and correspondingly may increase our exposure to foreign exchange risks. |

| |

| • | Uncertain tax rates - Our future effective tax rates may be materially impacted by numerous items including: a future change in the composition of earnings from foreign and domestic tax jurisdictions, as earnings in foreign jurisdictions are typically taxed at different rates than the United States federal statutory rate; accounting for uncertain tax positions; business combinations; expiration of statute of limitations or settlement of tax audits; changes in valuation allowance; changes in tax law; currency gains and losses; and the potential decision to repatriate certain future foreign earnings on which United States or foreign withholding taxes have not been previously accrued. |

| |

| • | Uncertain recoverability of investments in long-lived assets - We have significant investments in long-lived assets and continually review the carrying value of these assets for recoverability in light of changing market conditions and alternative product sourcing opportunities. |

| |

| • | Pension and postretirement plans - Obligations related to our pension and postretirement plans reflect certain assumptions. To the extent our plans' actual experience differs from these assumptions, our costs and funding obligations could increase or decrease significantly. |

FMC leases executive offices in Philadelphia, Pennsylvania and operates 26 manufacturing facilities in 18 countries. Our major research and development facilities are in Newark, Delaware, Shanghai, China and Copenhagen, Denmark.

We believe our facilities are in good operating conditions. The number and location of our owned or leased production properties for continuing operations are as follows:

|

| | | | | | | | | |

| | North America | | Latin America | | Europe, Middle East and Africa | | Asia- Pacific | | Total |

| Total | 5 | | 2 | | 6 | | 13 | | 26 |