FMC Corporation

Credit Suisse First Boston

Meetings

November 13th, 2003

William G. Walter

Chairman, President and CEO

Exhibit 99.1

Safe Harbor Statement under the Private Securities

Litigation Reform Act of 1995:

These slides and the accompanying presentation contain

“forward-looking statements” that represent management’s

best judgment as of the date hereof based on information

currently available. Actual results of the Company may differ

materially from those contained in the forward-looking

statements.

Additional information concerning factors that may cause

results to materially differ from those in the forward-looking

statements is contained in the Company’s periodic reports

filed under the Securities Exchange Act of 1934, as

amended.

The Company undertakes no obligation to update or revise

these forward-looking statements to reflect new events or

uncertainties.

Disclaimer

These slides contain certain “non-GAAP financial terms” which are defined on FMC’s Investor

Relations web site (http://ir.fmc.com) in the Glossary of Financial Terms section. In addition, in

the Conference Calls and Presentations section, we have provided reconciliations of non-

GAAP terms to the closest GAAP term.

These slides also contain references to segment financial terms which are defined below in

reference to Note 18 of FMC’s 2002 Form 10-K:

Use of Non-GAAP Terms

EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) for a segment is the

sum of Income (loss) from continuing operations before income taxes and cumulative effect of

change in accounting principle for that segment and Depreciation and Amortization for that

segment.

EBITDA Margin for segment is the quotient of EBITDA (defined above) and Revenue for that

segment.

OPAT (Operating Profit After Tax) for a segment is the after-tax value of Income (loss) from

continuing operations before income taxes and cumulative effect of change in accounting

principle for that segment.

ROCE (Return on Capital Employed) for segment is the quotient of OPAT (defined above) and

Operating capital employed for that segment.

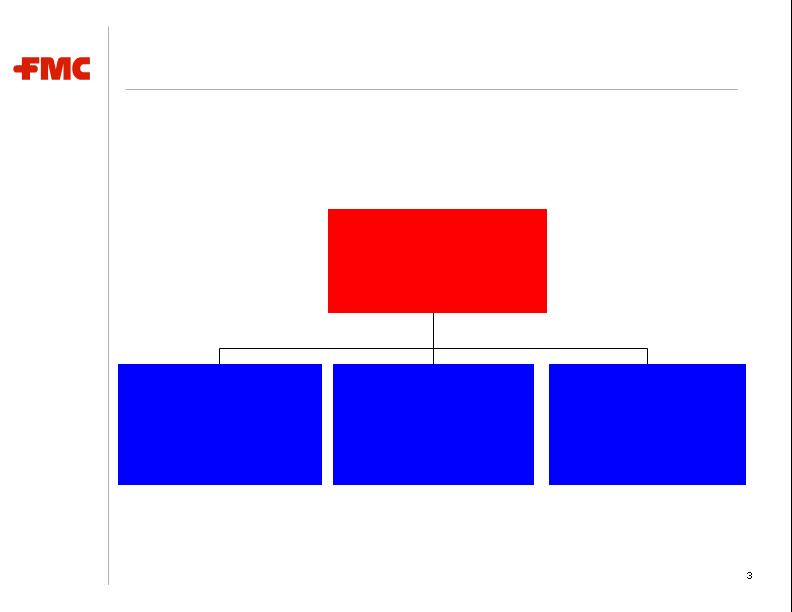

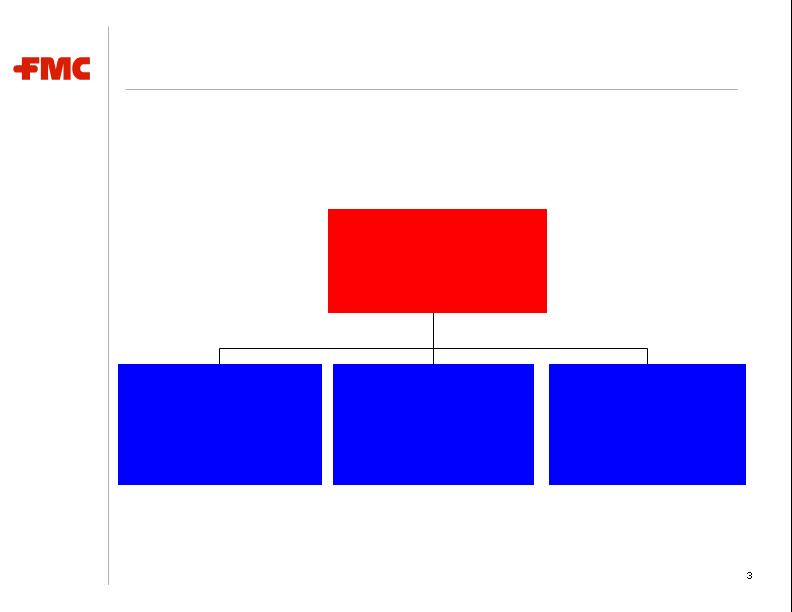

FMC Corporation

Diversified chemical company with leading market positions

in industrial, consumer and agricultural markets globally

($ million, 12/31/02)

FMC

Sales:

$1,852.9

EBITDA:

$313.7

Margin:

16.9%

Industrial

Chemicals

Sales:

$753.4

EBITDA:

$130.3

Margin:

17.3%

Agricultural

Products

Sales:

$615.1

EBITDA:

$99.0

Margin:

16.1%

Specialty

Chemicals

Sales:

$488.2

EBITDA:

$116.3

Margin:

23.8%

FMC’s Strengths

Leading market positions

Global presence

Diversified business mix and high-quality customer base

Diversified and integrated cost structure

Focused R&D and strong applications expertise

Proven management with extensive industry experience

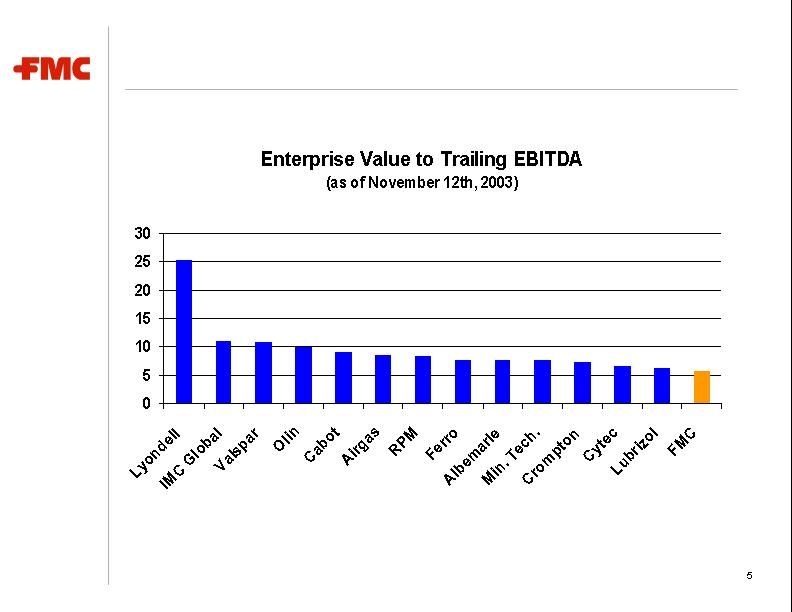

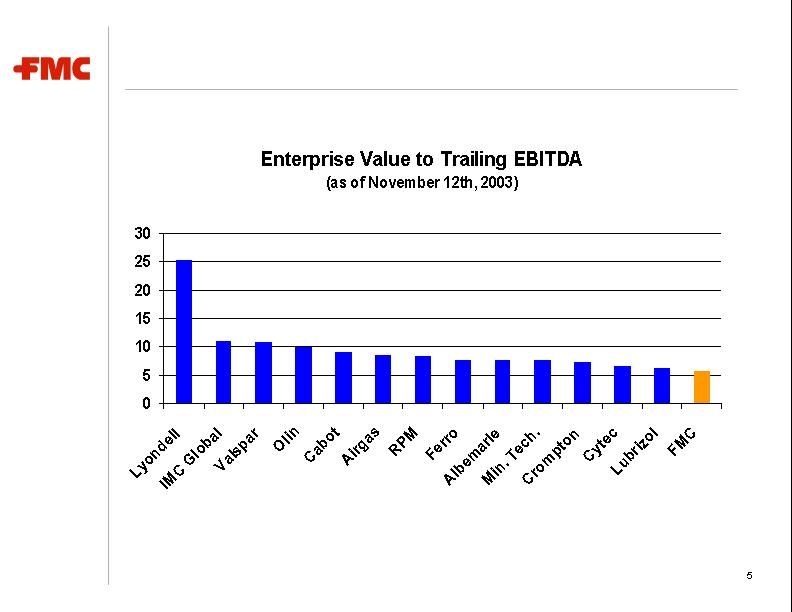

S&P 400 Chemicals Index Components

FMC Valuation

Source: Bloomberg Financial and SEC Filings

For all our strengths, we continue to be grossly undervalued

Unlocking Shareholder Value

Maximize and realize operating leverage

Create greater financial flexibility

Focus the portfolio on higher growth businesses

Maximize and Realize Operating Leverage

Capacity utilizations continue to tighten following capacity

mothballs and steady demand growth

Price recovery has begun in hydrogen peroxide, and price

outlook in soda ash is improving

Timing of selling price recovery to take several years

Recovery to be enhanced by significant restructuring at

Astaris

Industrial Chemicals price recovery is only a matter of time

Creating Greater Financial Flexibility

Expected 2003 Performance:

Working capital reductions of $30-35 million in 2003

Flat capital spending versus 2002, well below D&A

Astaris keepwells of $60 million in 2003

2003 free cash flow of $30-40 million

Outlook for 2004 and beyond:

Keepwells to cease in 2004 at a maximum of $40-50 million

Free cash flow to strengthen in 2004, and again in 2005

Net debt reduction of $300 million by the end of 2006

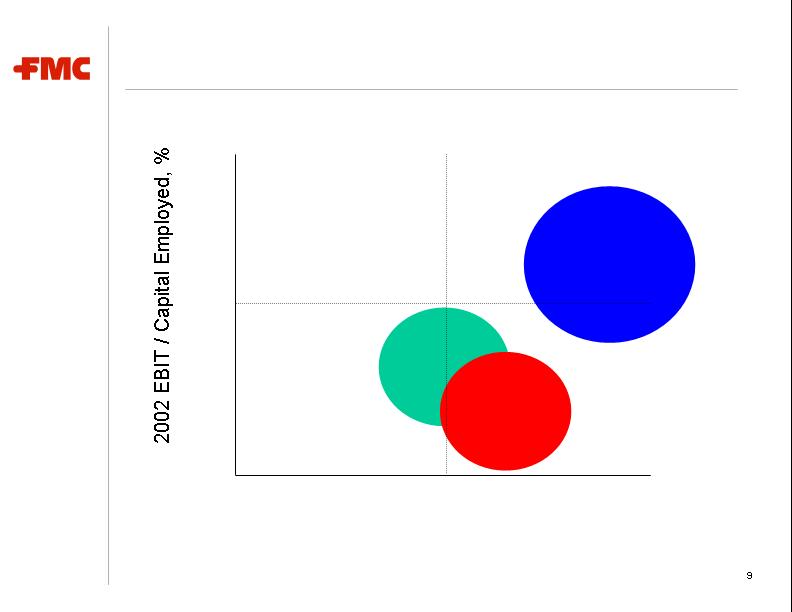

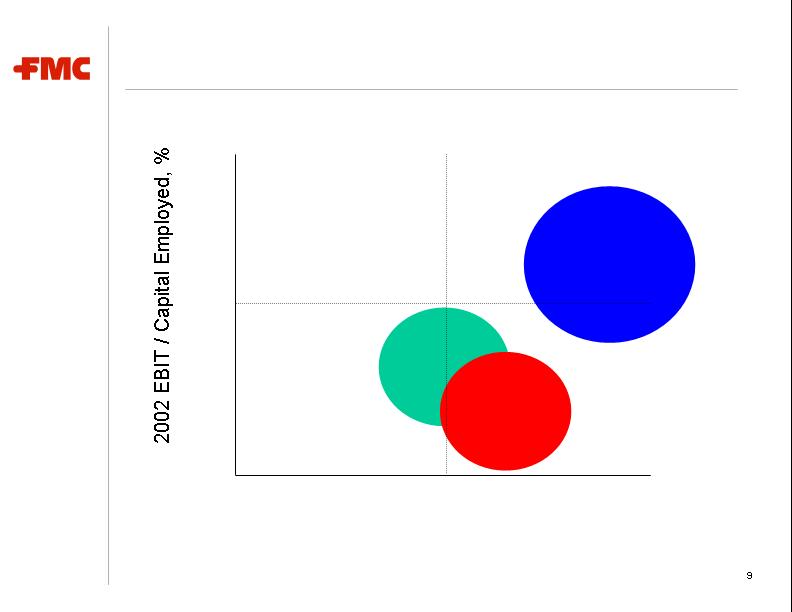

Expected 5-yr. Sales Growth (CGR %, ’02-’07)

15

10

20

3

6

0

Note: Size of bubble

corresponds to 2002

EBIT $’s

Note: For presentation purposes, EBIT is used as proxy for OPAT; sales growth is used as a proxy for OPAT

growth; and EBIT/Capital Employed is used as a proxy for ROCE.

Specialty

Chemicals

Agricultural

Products

Industrial

Chemicals

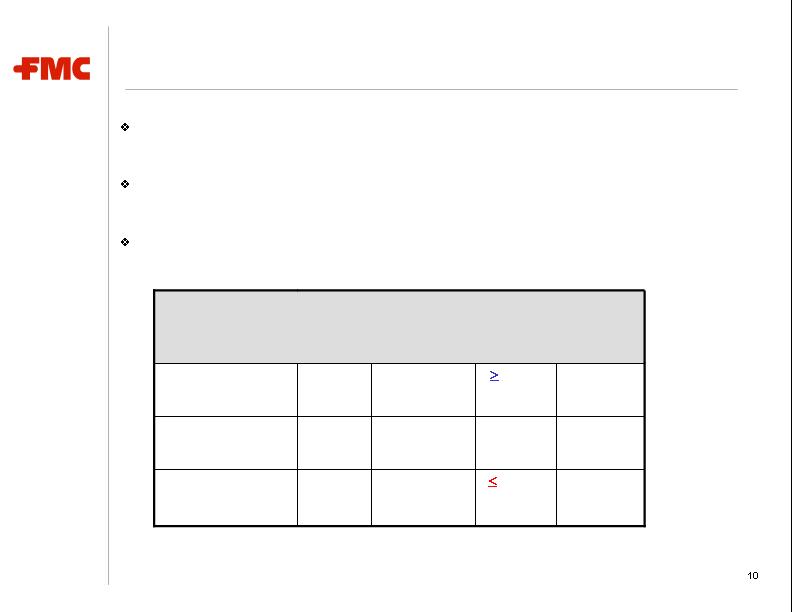

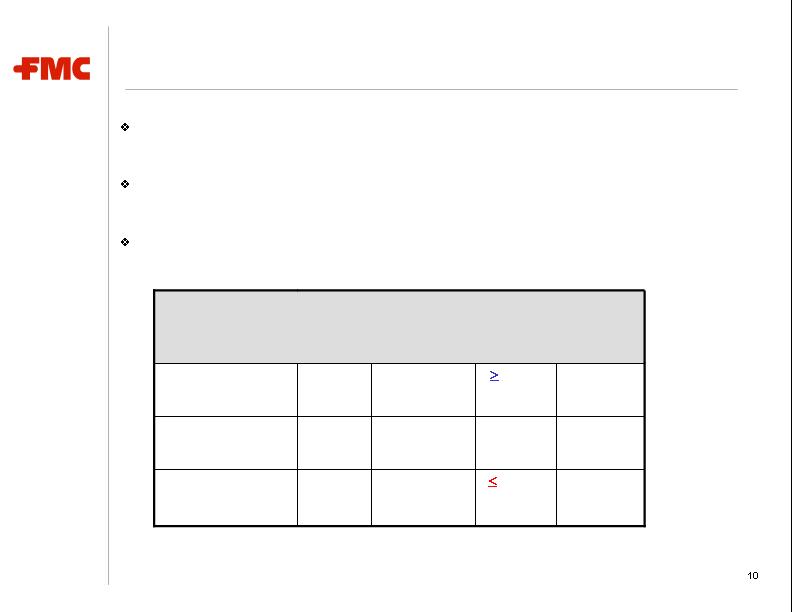

Focus the Portfolio on Higher Growth Businesses

Key metrics: return on capital and OPAT growth

No

Yes

Yes

Licensing/

Partnering

No

D&A

Flat-to-

lower

Ind. Chemicals

<< D&A

D&A

$’s Cap.

Expend.

Increase

Increase

$’s R&D

No

Yes

Bolt-on

Acq(s).

Ag. Products

Spec. Chemicals

Growing Specialty Chemicals

Maintaining and enhancing value of Ag Products business

Managing Industrial Chemicals for cash

Focus the Portfolio on Higher Growth Businesses

Dispose of product lines, markets or divisions consistently

performing below the cost of capital

Divest those businesses in which another company places a

higher value

Opportunistically manage the portfolio to achieve focus

Focus the Portfolio on Higher Growth Businesses

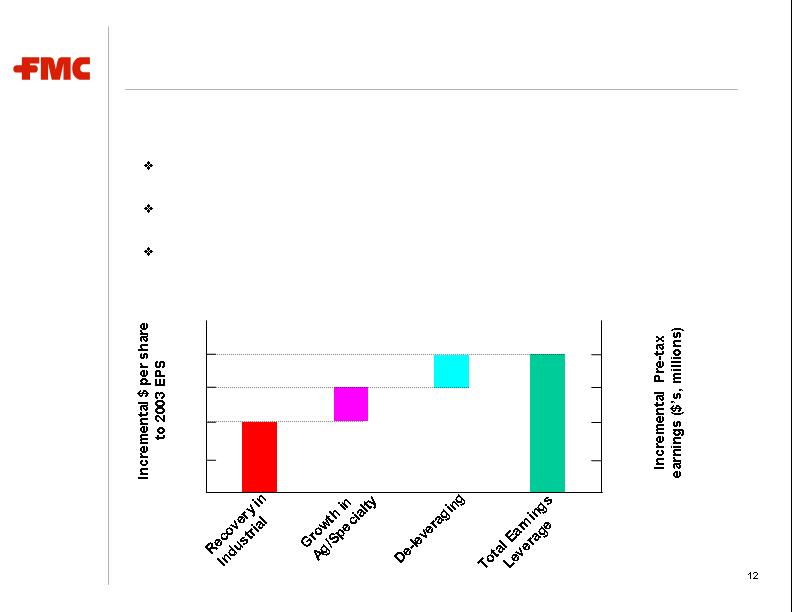

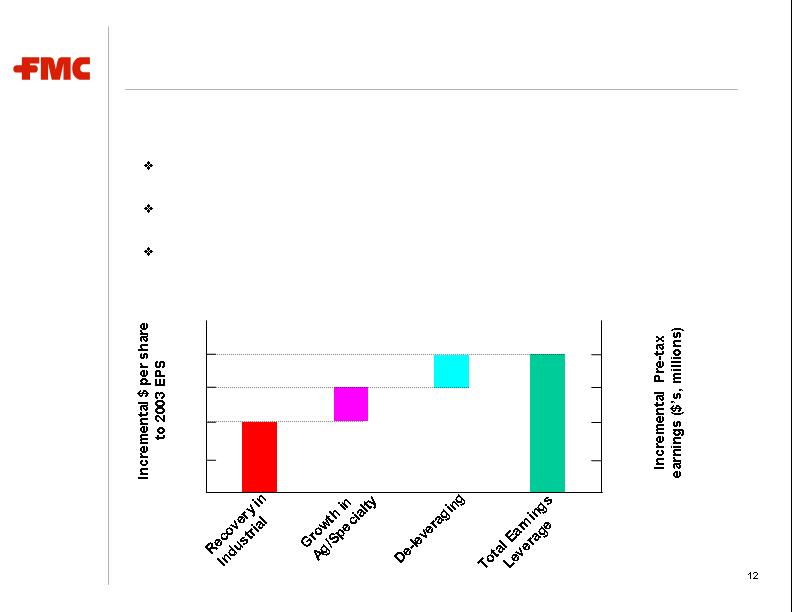

Significant Earnings Leverage

1

2

3

4

50

100

150

200

Recovery in Industrial Chemicals

Growth in Agricultural Products and Specialty Chemicals

Debt reduction of $300 million by the end of 2006

FMC strategies to add $4 per share to today’s trough levels

FMC Corporation

Credit Suisse First Boston

Meetings

November 13th, 2003

Michael Wilson

Vice President and Group Manager

Industrial Chemicals

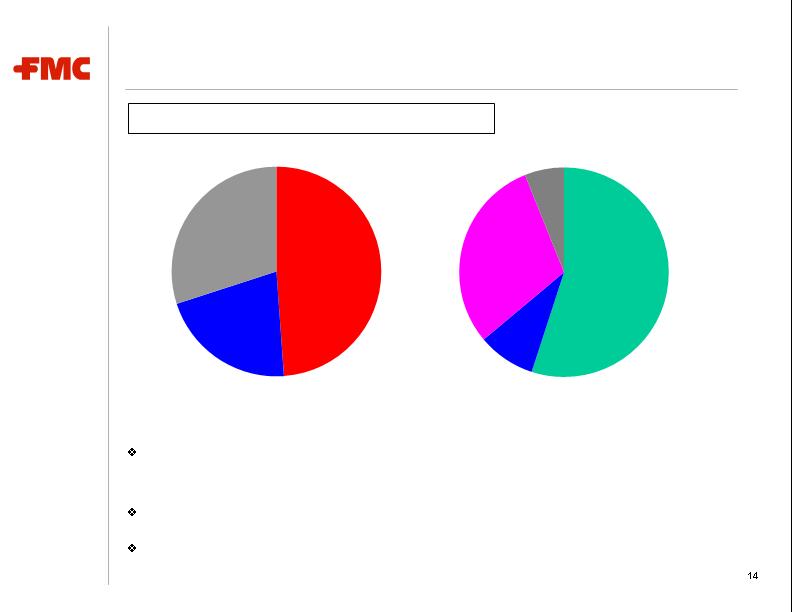

Industrial Chemicals: Group Overview

South

America

9%

North America

55%

Europe/Middle

East/Africa

30%

Asia

6%

Alkali

(Soda ash)

49%

Peroxygens

21%

Foret

30%

#1 North American manufacturer of soda ash, peroxygens and

phosphorus chemicals

Backward integration into natural resources

Low-cost, proprietary production technology

Excludes phosphorus chemicals sales at Astaris JV of $445.7 million, largely in North America

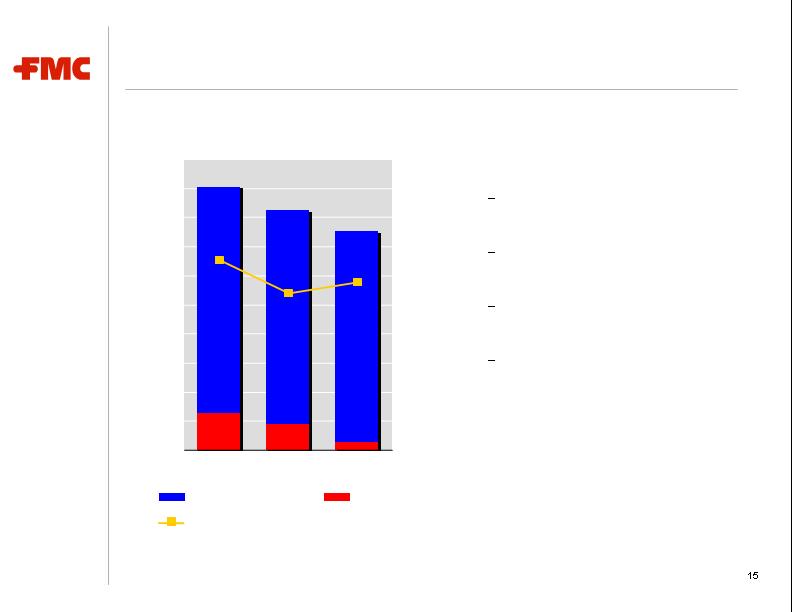

2002 Consolidated Sales: $753.4 million

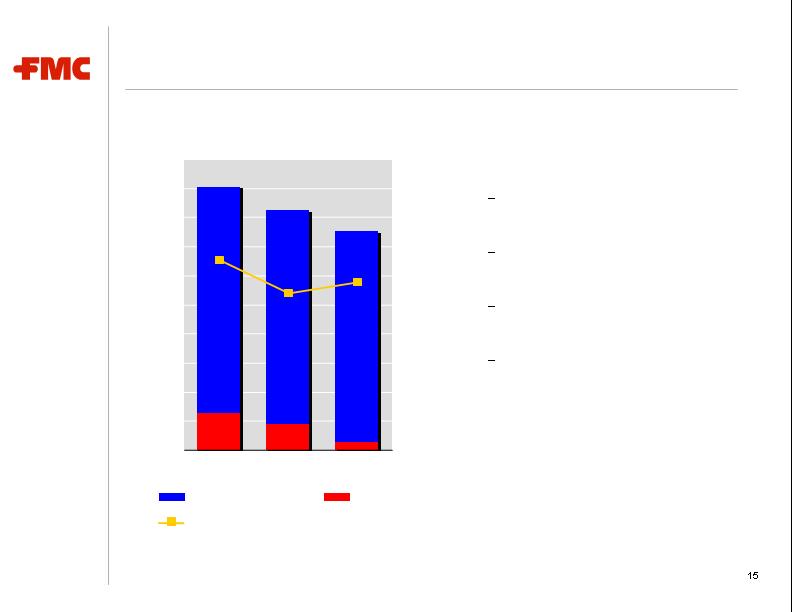

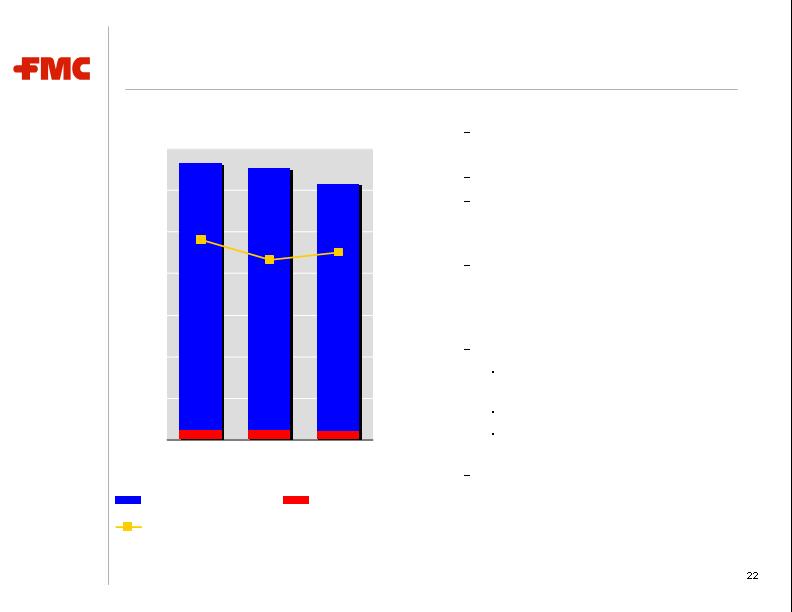

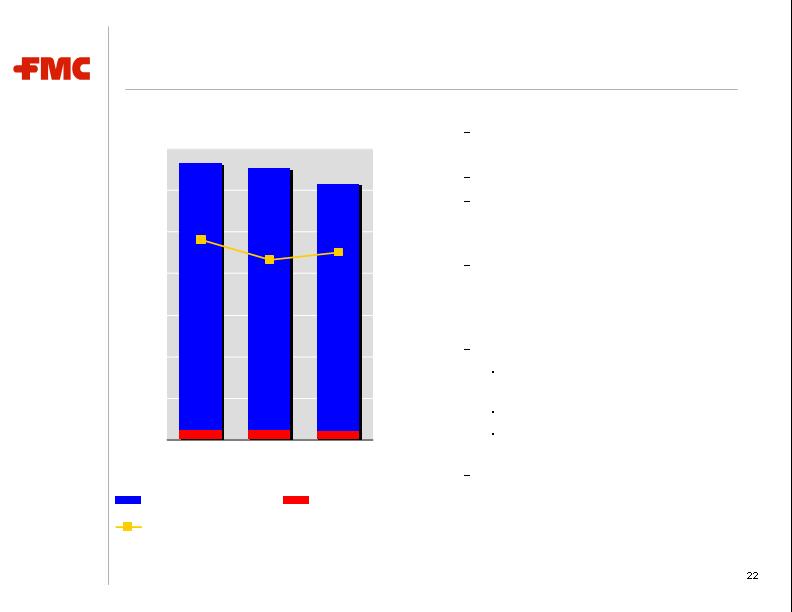

($ in millions)

$906

$822

$753

$126

$87

$28

19.6%

16.2%

17.3%

0

200

400

600

800

$1,000

2000

2001

2002

0%

5%

10%

15%

20%

25%

30%

Revenue

Capital Expenditures

EBITDA Margin

1

1Incudes $79.2 million of phosphorus sales prior to formation of Astaris JV.

’01-’02 recession and

overcapacity

Capacity mothballs and

shutdowns

Significant cost savings in

2002

In 2003, weak performance

at Astaris to result in

substantially lower earnings

Industrial Chemicals: Financial Performance

Industrial Chemicals: Outlook

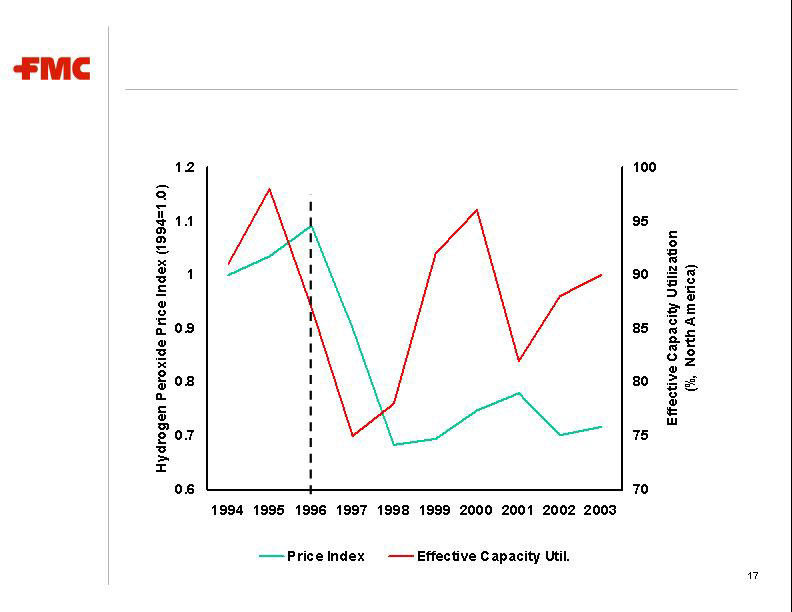

Price recovery in hydrogen peroxide

Volume growth of 2% expected in 2003

Effective capacity utilization above 90%

Price increase announcements now in negotiation for 2004

Higher expected energy costs in 2004 as hedges roll over

Improving capacity utilization in soda ash

Volume growth of 2% expected in 2003

Effective capacity utilization above 90%

Industry structure in flux with one producer being acquired by another

Domestic price increase of $7 per ton now in negotiation for 2004

Continued risk of weaker selling prices in the export market (ANSAC)

Turnaround in phosphorus chemicals

Volume growth of 2% expected in 2003

North American prices have stabilized, albeit at a 4-5% decline vs. 2002

Some selective price increases in specialty grades during 2003

Significant restructuring and asset rationalization now underway at Astaris

Businesses are in various early stages of recovery

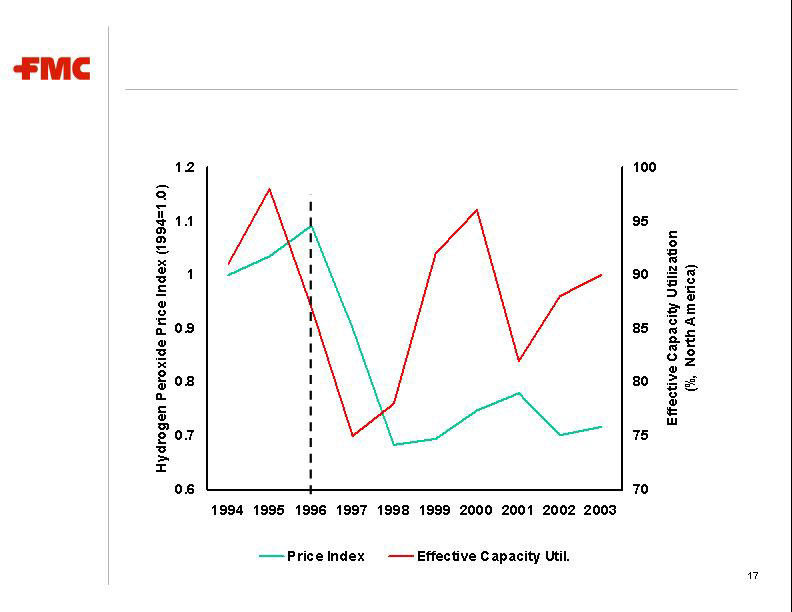

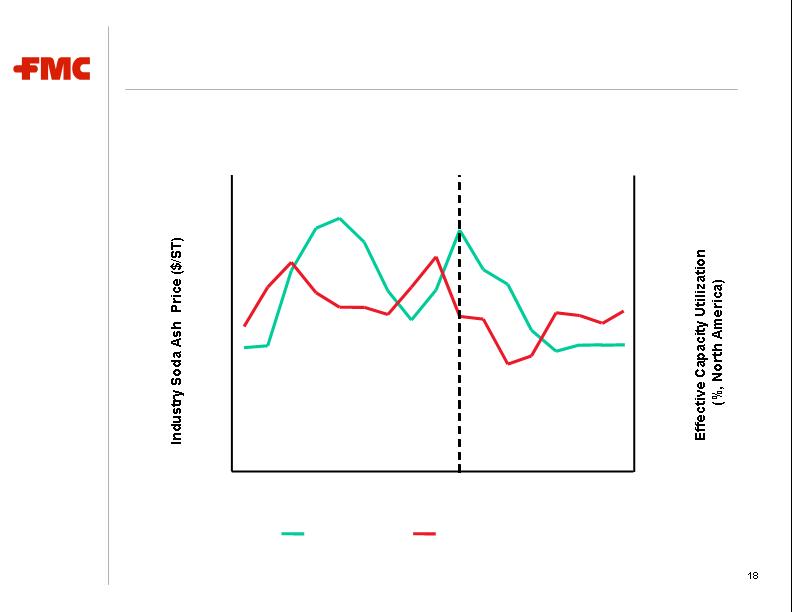

Last Peak

Price Recovery in Hydrogen Peroxide

In North America, about ~1 cent per lb. increase in hydrogen

peroxide has been achieved in 2003 with more expected in 2004

Source: Isonex/USGS and FMC

50

55

60

65

70

75

80

85

90

1987

1991

1995

1997

Industry Price

Effective Capacity Util.

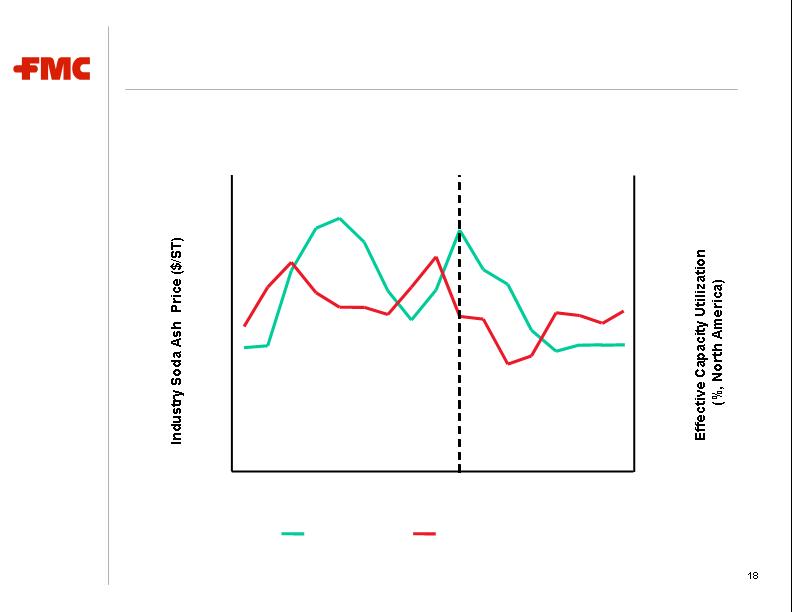

Last Peak

Improving Capacity Utilization in Soda Ash

Soda ash price increase of $7 per ton announced in North America;

acquisition of American Soda by Solvay

1993

2001

1989

1999

2003

70

80

90

100

75

85

95

105

Weak Astaris performance in 2003

Lower sales due principally to 4-5% drop in selling prices

Lack of a $25 million power resale benefit ($12.5 million to FMC)

Resulting, expected FMC keepwell obligation of over $60 million

Significant restructuring at Astaris during 2003-2004

Exit of commodity STPP

Closure of 4 facilities

Annualized savings of $40-50 million ($20-25 million to FMC) once restructuring

is complete in mid-2004

De-leveraging and refinancing Astaris in 2004

Expectation of $40-50 million in 2004 keepwells, which will end FMC’s obligation

Possibility of mid-2004 refinancing which could result in even lower keepwells

Turnaround in Phosphorus Chemicals

Restructuring and refinancing the Astaris JV

FMC Corporation

Credit Suisse First Boston

Meetings

November 13th, 2003

Milton Steele

Vice President and Group Manager

Agricultural Products

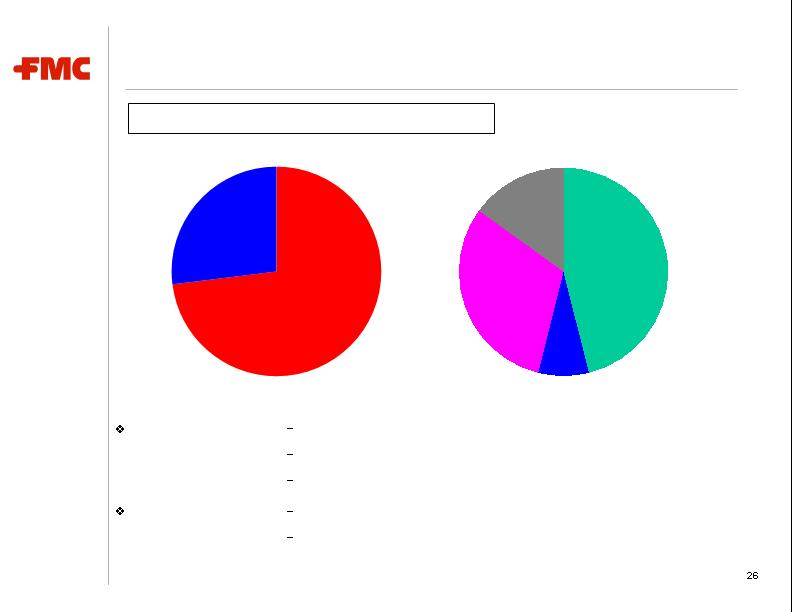

Insecticides

78%

Herbicides

22%

South America

29%

North America

40%

Europe/Middle

East/Africa

16%

Asia

15%

2002 Consolidated Sales: $615.1 million

Agricultural Products: Group Overview

Manufacturer of proprietary, branded insecticides and herbicides

Key crops: cotton, corn, rice, cereals, fruits and vegetables

Strong focused market positions in the Americas (crop & non-crop)

Key positions in Europe/Asia via alliances

Innovation -- ~10% of sales on R&D

FMC differentiated by:

Focus on insecticides

Virtualizing manufacturing

Depth and breadth of partnerships / alliances

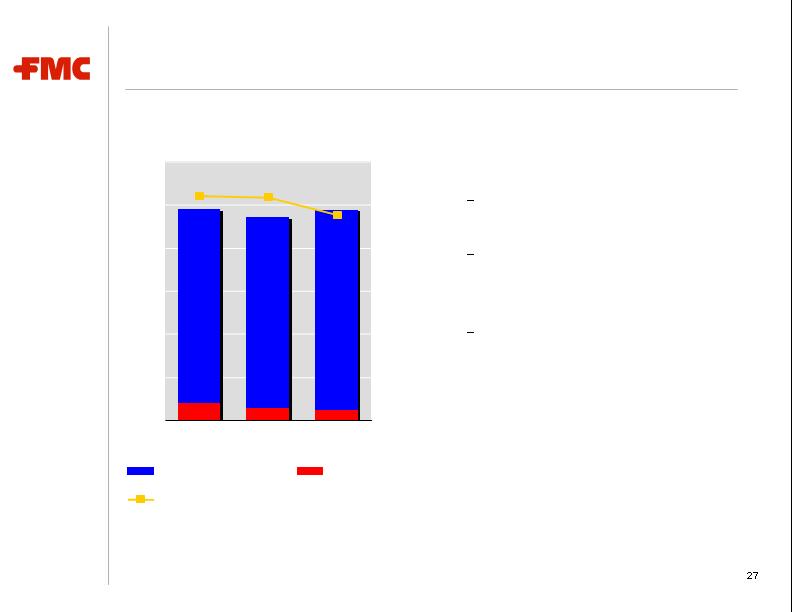

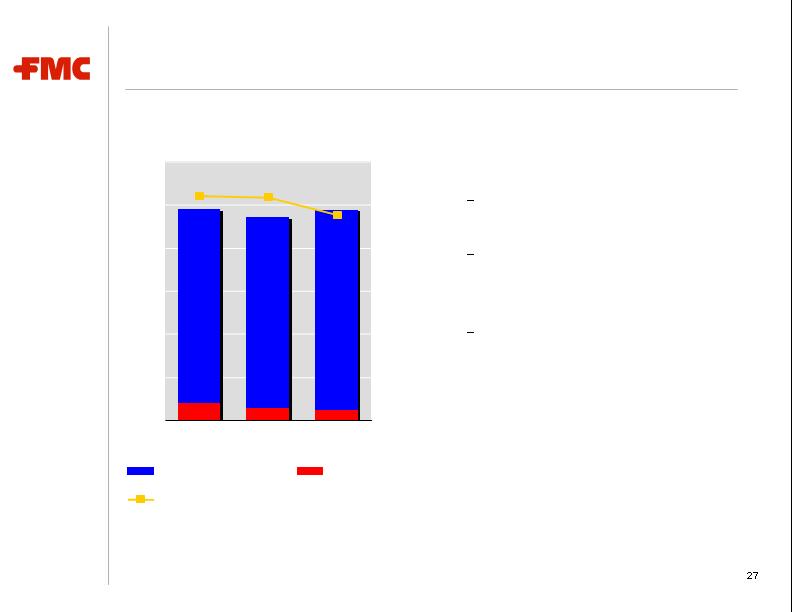

($ in millions)

$653

$615

$22

$22

$21

$665

17.1%

16.1%

15.4%

0

100

200

300

400

500

600

$700

2000

2001

2002

0%

5%

10%

15%

20%

25%

Revenue

Capital Expenditures

EBITDA Margin

Agricultural Products: Financial Performance

Declining global chemical crop

protection market since 1996

Multi-faceted competitive rivalry

Steady 2000-02 sales growth in

pyrethroid insecticides of 5%

CAGR

Sulfentrazone row crop peak in

2000, followed by $20 million

profit protection payment from

DuPont in 2001

2002 refocus strategy:

Global cost competitiveness &

Supply Chain optimization

Leveraging SG&A

Focus on insecticides, key crops

and select regions

New alliances with ISK and

Belchim (EU distributor)

Agricultural Products: 2003 Performance

YTD EBIT up 11% compared with last year

Improved margins from manufacturing cost reductions and

favorable product mix

Strong non-crop sales

Significant (and fundamental) improvements in our Brazil business

Alliances in Europe exceeding expectations

Solid cash flow from higher profitability, lower capital spending,

and working capital reduction initiatives

Refocus strategy resulting in solid financial performance

Agricultural Products: Driving Earnings Growth

Focus on select products, regions and markets

Productivity to result in significant expected cost savings

Manufacturing outsourcing strategies continue

SG&A leverage across focused products and regions

Global supply chain efficiencies: reducing SKU’s and third party products

Near-term growth from new labels, alliances and new chemistries

New labels in core products: bifenthrin, zeta-cypermethrin and carfentrazone

Global alliance with ISK fundamental to building market access and scale (Asia

and Western Europe via Belchim)

Novel ISK chemistry targeting sucking pests to launch 2005

Pursuing access to several complementary chemistries

Long-term growth resulting from our target-based discovery efforts

Numerous chemistries under evaluation which look promising

Several of these novel chemistries are now entering field testing

Commercial opportunity 5+ years away

Building and leveraging the talent of our organization

FMC Corporation

Credit Suisse First Boston

Meetings

November 13th, 2003

Ted Butz

Vice President and Group Manager

Specialty Chemicals

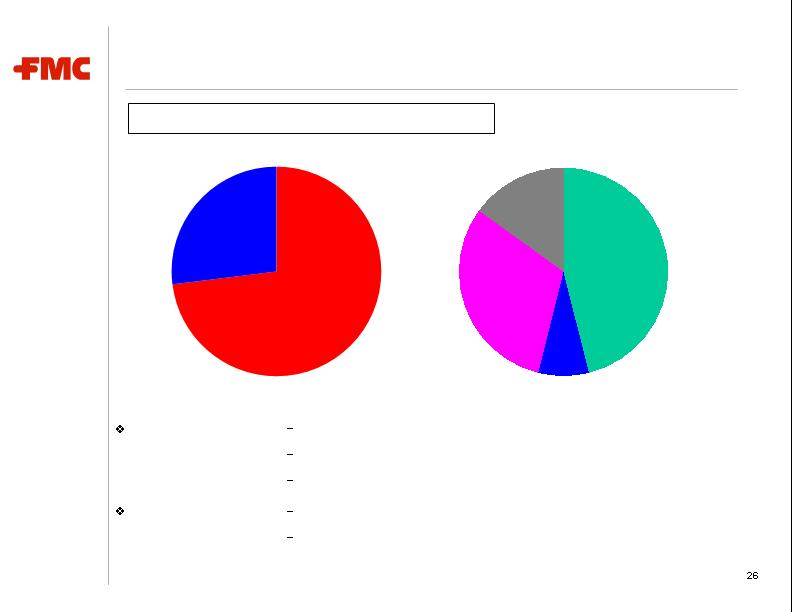

BioPolymer

73%

Lithium

27%

South

America

8%

North America

46%

Europe/Middle

East/Africa

31%

Asia

15%

Specialty Chemicals: Group Overview

One of two global, integrated manufacturers

Focus on specialty products - pharmaceuticals and

energy storage devices

Lithium:

Adds structure, texture and stability to food

Acts as a binder & disintegrant for dry tablet drugs

Market leader in each product line

BioPolymer:

2002 Consolidated Sales: $488.2 million

($ in millions)

$39

$28

$24

$488

$472

$489

23.8%

26.0%

25.9%

0

100

200

300

400

500

$600

2000

2001

2002

0%

5%

10%

15%

20%

25%

30%

Revenue

Capital Expenditures

EBITDA Margin

BioPolymer growth of 5% CGR

driven during the ’00-’02 period

Decline in lithium sales due to

exit of commodity lithium

carbonate

Good growth in 2003 to be

highlighted by steady

BioPolymer growth and a strong

recovery in lithium

Specialty Chemicals: Financial Performance

Specialty Chemicals: Strong 2003 Performance

YTD 2003 results highlight improved performance over 2002

Sales up 7.6%

Segment earnings up 17.7%

BioPolymer and Lithium show good earnings improvement

Strong Euro benefits earnings

4th Quarter, as expected, should be flat with prior year

Full year results expectations

5% growth in sales

Double digit growth in segment earnings

EBITDA margin above 25%

Capital Spending consistent with 2002 levels

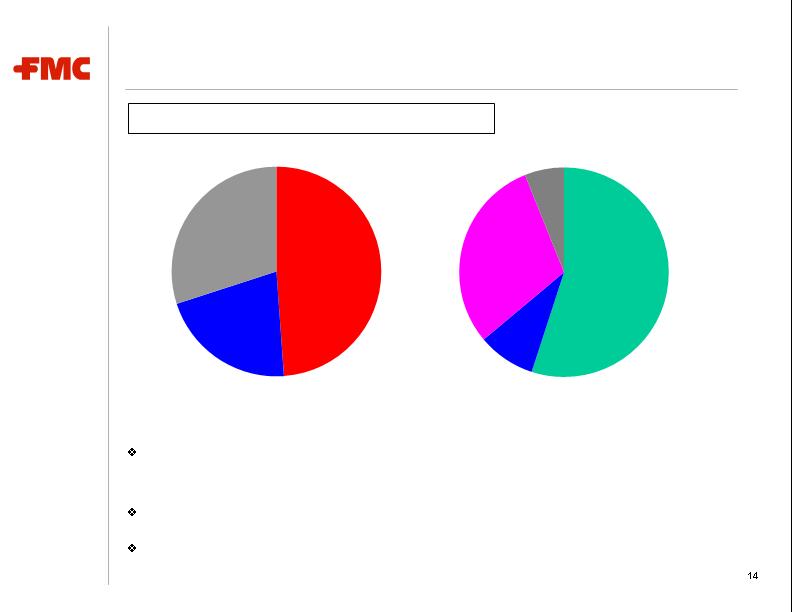

Specialty Chemicals: BioPolymer Sales Mix

Estimated 2003 Sales: $370 Million

Mix by market

Mix by product

Specialty Chemicals: BioPolymer Growth

Continued drive for productivity improvements

Commercialization of new technology initiatives

In food ingredients:

Improvement following 2003 weakness in nutritional beverages

In pharmaceuticals:

Continuation of growth trend achieved over last several years

Increased investment in new technology initiatives

In personal care:

Increased sales and development across a broader customer base

Development of next generation products for oral care market

Expectation for continued sales growth in low-to-mid-single

digits, and higher earnings growth

New Process

technology

Industry thrives on

innovation

Alternative gum

systems

Narrow product /

customer mix

Strong position in oral

care

Dedicated sales and

technology teams

Excellent customer

relationships

Personal Care

Technology alliances to

expand beyond

traditional excipients

Good position with key

generic and innovators

Increased competitive

activity

Consolidation

Very strong market

positions

Customer relationships

QSR (Quality, Safety,

Reliability)

Pharmaceuticals

New applications for

microcrystalline

cellulose

Productivity

opportunities

Formulated solutions

Price pressure

Slowdown in N. America

Consolidation

Leading market

positions

Strong technology base

Good global coverage

Food Ingredients

Opportunities

Issues

BioPolymer

Franchise

Specialty Chemicals:

Strong BioPolymer Franchises

Specialty Chemicals: Lithium Sales Mix

Estimated 2003 Sales: $140 Million

Achieve above hurdle rate return on investment in 2004

In pharmaceutical synthesis:

High single-digit growth in specialty organics and butyllithium

Quarterly timing driven by campaign runs of our customers

In energy storage:

Double-digit growth foreseen in use of lithium

Improved profitability through sales of more proprietary technologies

Polymer market to grow in line with economy

Manage the balance of the business for cash

Expectation for continued sales growth in mid-single digits and

double digit earnings growth

Specialty Chemicals: Lithium Growth

FMC Corporation

Credit Suisse First Boston

Meetings

November 13th, 2003

Kim Foster

Senior Vice President and CFO

Financial Objectives

Maximize free cash generation through disciplined working

capital management and capital spending

Monetize assets for cash:

Real estate

Asset divestitures

Reduce debt $300 million of debt by the end of 2006

Creating Greater Financial Flexibility

*Includes Astaris interest

Free cash flow of $30-40 million in 2003; to be higher in 2004

2003

2004

2005

2006

Expected EBITDA

~$300

--------Increasing----------

Sale of Assets

$ 13

TBD

TBD

TBD

Working Capital Benefit

~$ 35

TBD

TBD

TBD

Pre-Tax Interest*

$100

--------Decreasing--------

Capital Expenditures

$ 85

------Relatively Flat------

Legacy Environmental

$ 25

~25

~25

~25

Restructuring (Pocatello)

$ 15

~35

~10

~10

Tg Acquisition Payment

$ 35

0

0

0

Astaris Keepwells

$ 63

~45

0

0

FMC Corporation