Exhibit 99.1

FMC Corporation

Citigroup 12th Annual High Yield /

Leveraged Finance Conference

February 9, 2004

Thomas C. Deas, Jr.

Vice President & Treasurer

Disclaimer

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995

These slides and the accompanying presentation contain “forward-looking statements” that represent management’s best judgment as of the date hereof based on information currently available. Actual results of the Company may differ materially from those contained in the forward-looking statements.

Additional information concerning factors that may cause results to differ materially from those in the forward-looking statements is contained in the Company’s periodic reports filed under the Securities Exchange Act of 1934, as amended.

The Company undertakes no obligation to update or revise these forward-looking statements to reflect new events or uncertainties.

Use of Non-GAAP Terms

These slides contain certain “non-GAAP financial terms” which are defined on FMC’s Investor Relations web site (http://ir.fmc.com) in the Glossary of Financial Terms section. In addition, in the Conference Calls and Presentations section, we have provided reconciliations of non-GAAP terms to the closest GAAP term.

Following is a list of some of these non-GAAP terms:

Adjusted EBITDA (Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization) is the sum of Income from continuing operations before equity earnings in affiliates, minority interests, interest income and expense, income taxes and cumulative effect of change in accounting principle and Depreciation and Amortization less Restructuring and other charges (gains).

Adjusted EBITDA Margin is the quotient of Adjusted EBITDA (defined above) and Revenue.

Segment EBITDA is the sum of Income (loss) from continuing operations before income taxes and cumulative effect of change in accounting principle and Depreciation and Amortization for a segment.

Segment EBITDA Margin is the quotient of EBITDA (defined above) and Revenue for a segment.

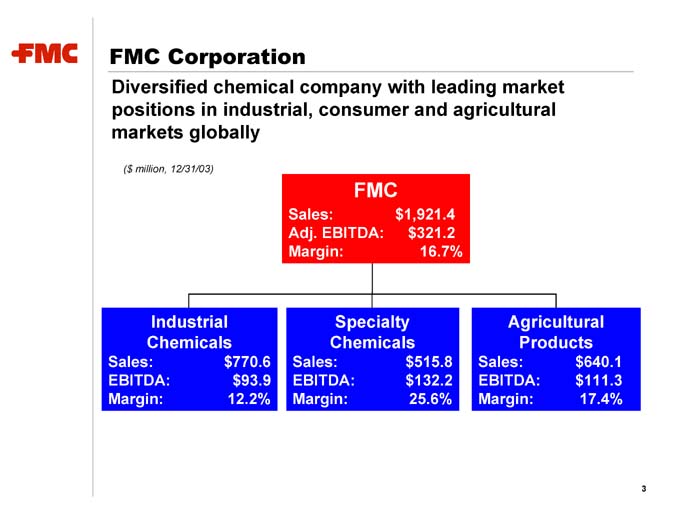

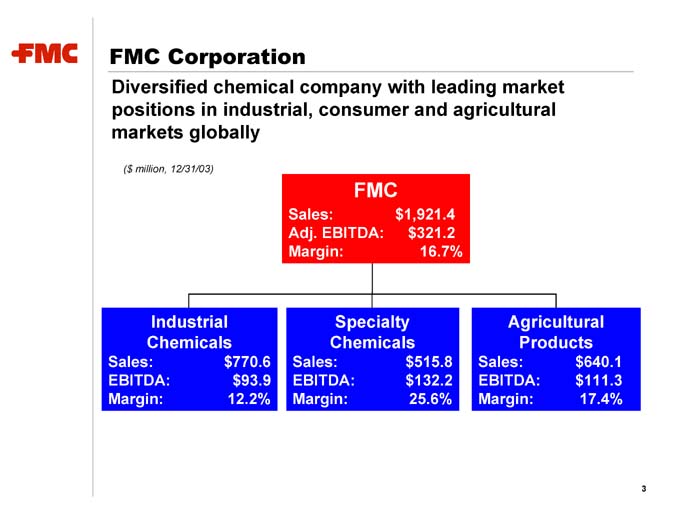

FMC Corporation

Diversified chemical company with leading market positions in industrial, consumer and agricultural markets globally

($ million, 12/31/03)

FMC

Sales: $1,921.4 Adj. EBITDA: $321.2 Margin: 16.7%

Industrial Chemicals

Sales: $770.6 EBITDA: $93.9 Margin: 12.2%

Specialty Chemicals

Sales: $515.8 EBITDA: $132.2 Margin: 25.6%

Agricultural Products

Sales: $640.1 EBITDA: $111.3 Margin: 17.4%

FMC Strengths

Leading market positions

Global presence

Diversified business mix and high-quality customer base

Diversified and integrated cost structure

Focused R&D and strong applications expertise

Strong credit profile

Proven management with extensive industry experience

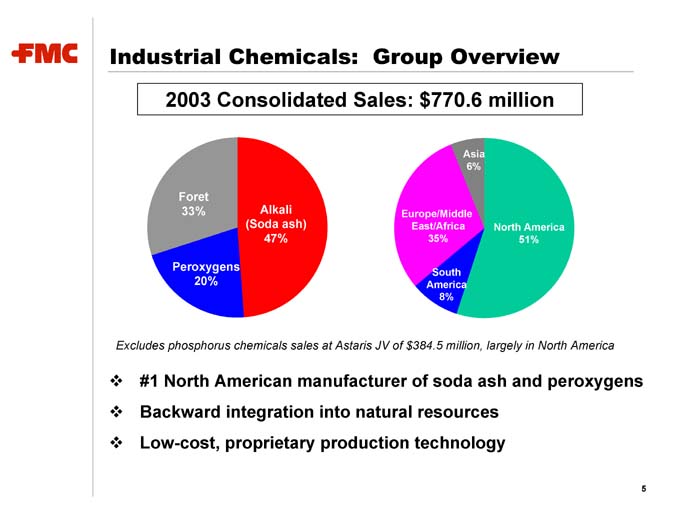

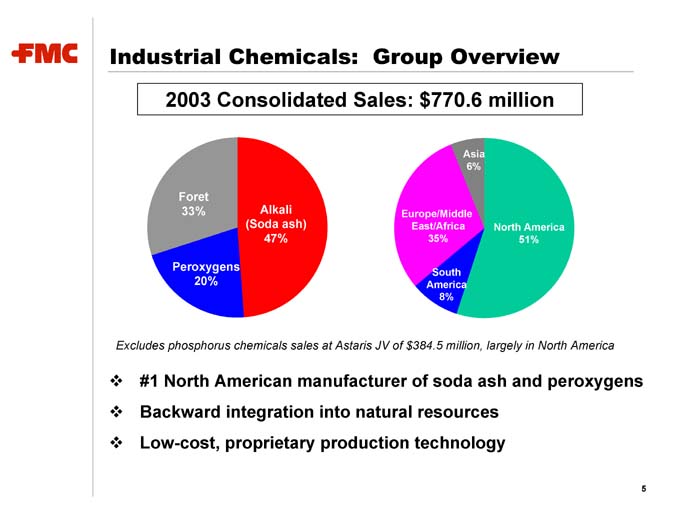

Industrial Chemicals: Group Overview

2003 Consolidated Sales: $770.6 million

Foret 33%

Alkali (Soda ash) 47%

Peroxygens 20%

Asia 6%

North America 51%

South America 8%

Europe/Middle East/Africa 35%

Excludes phosphorus chemicals sales at Astaris JV of $384.5 million, largely in North America

#1 North American manufacturer of soda ash and peroxygens

Backward integration into natural resources

Low-cost, proprietary production technology

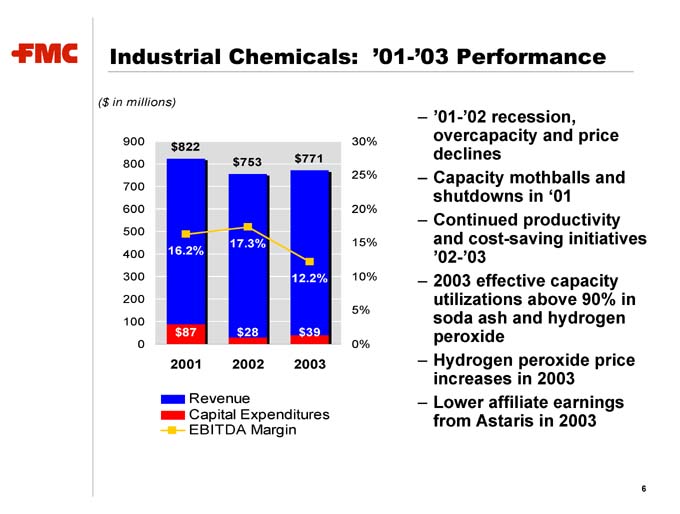

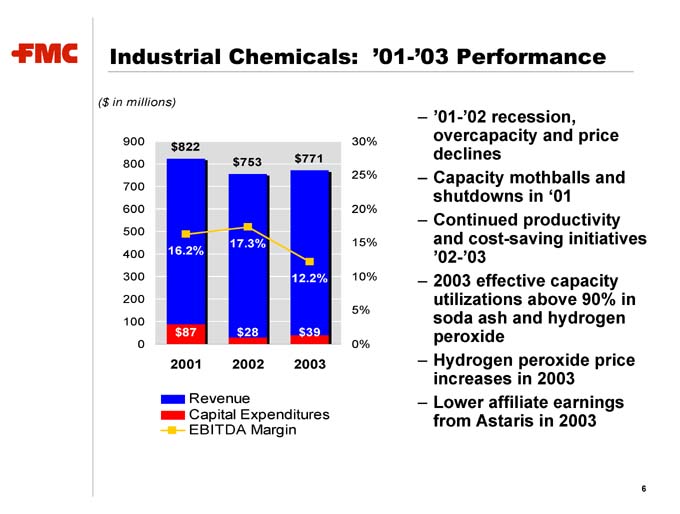

Industrial Chemicals: ‘01-’03 Performance

($ in millions) $822

16.2% $87 $753

17.3% $28 $771

12.2% $39

– ‘01-’02 recession, overcapacity and price declines

– Capacity mothballs and shutdowns in ‘01

– Continued productivity and cost-saving initiatives ‘02-’03

– 2003 effective capacity utilizations above 90% in soda ash and hydrogen peroxide

– Hydrogen peroxide price increases in 2003

– Lower affiliate earnings from Astaris in 2003

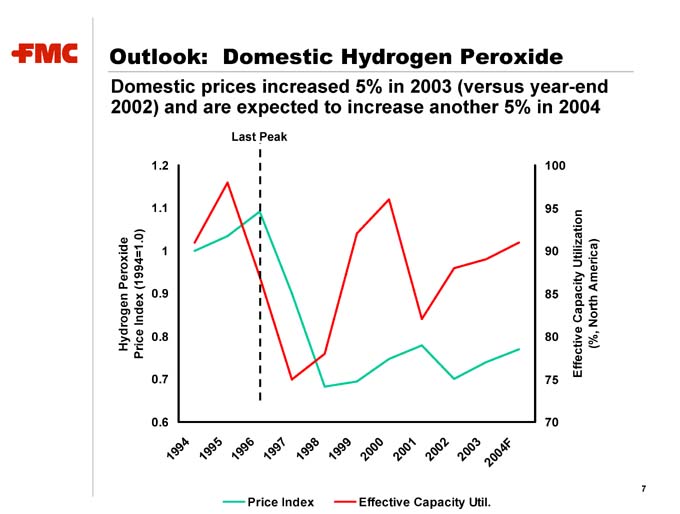

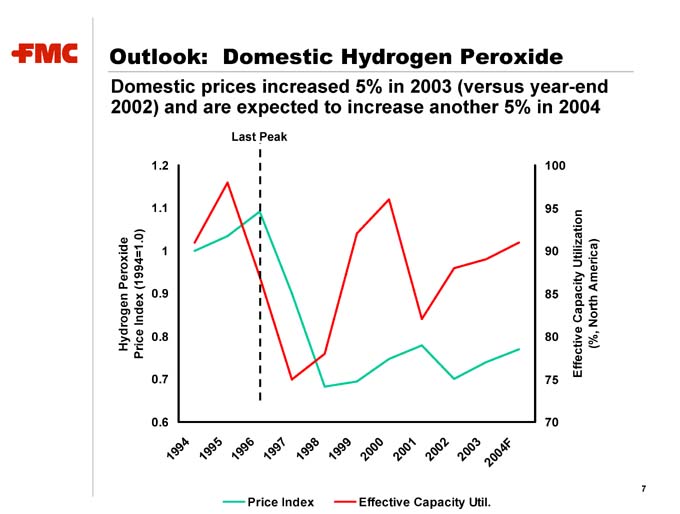

Outlook: Domestic Hydrogen Peroxide

Domestic prices increased 5% in 2003 (versus year-end 2002) and are expected to increase another 5% in 2004

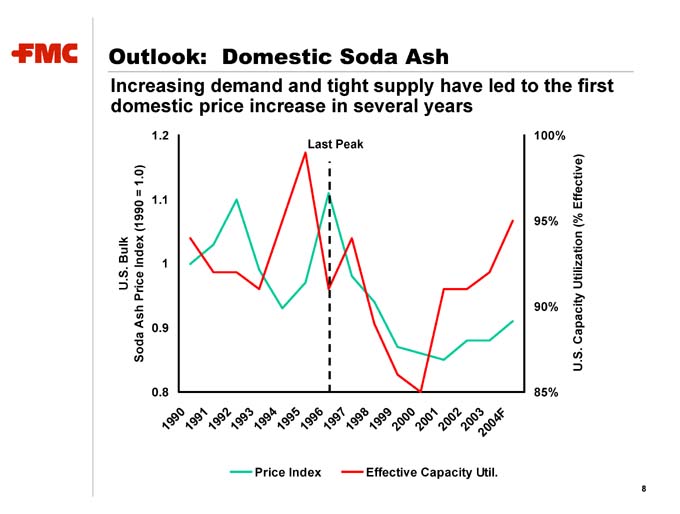

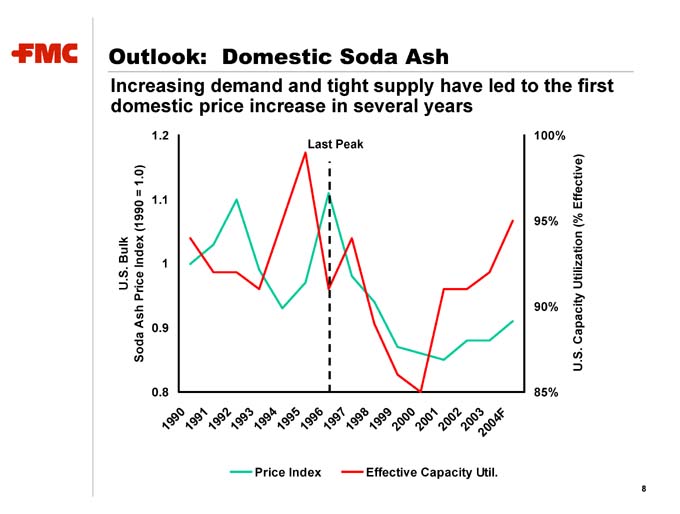

Outlook: Domestic Soda Ash

Increasing demand and tight supply have led to the first domestic price increase in several years

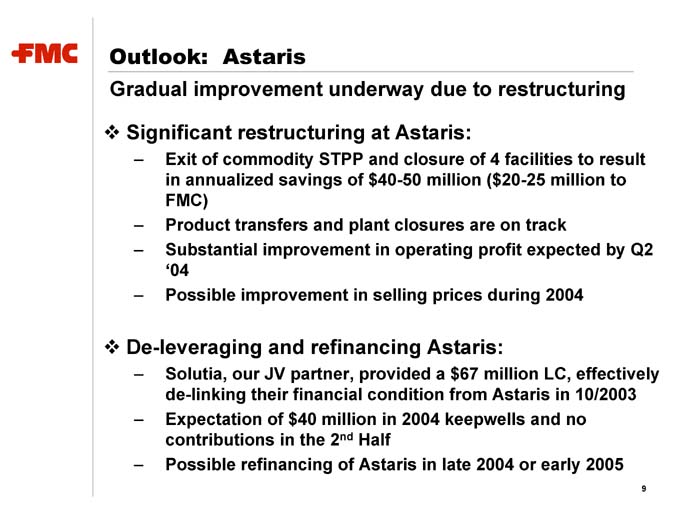

Outlook: Astaris

Gradual improvement underway due to restructuring

Significant restructuring at Astaris:

– Exit of commodity STPP and closure of 4 facilities to result in annualized savings of $40-50 million ($20-25 million to FMC)

– Product transfers and plant closures are on track

– Substantial improvement in operating profit expected by Q2 ‘04

– Possible improvement in selling prices during 2004

De-leveraging and refinancing Astaris:

– Solutia, our JV partner, provided a $67 million LC, effectively de-linking their financial condition from Astaris in 10/2003

– Expectation of $40 million in 2004 keepwells and no contributions in the 2nd Half

– Possible refinancing of Astaris in late 2004 or early 2005

Outlook: Foret –

European Industrial Chemicals

Steady recovery across all product lines

Phosphorus chemicals in a slow recovery driven by capacity reduction:

– Rhodia’s shutdown of STPP facility in Rhouen, France has improved capacity utilization

– Foret has recovered STPP volume that was lost in 2002

– Price recovery is beginning

After a strong 2003, peroxygens expected to continue to grow in 2004:

– Hydrogen peroxide demand growth of 4% per year driven by strength of Scandinavian pulp industry

– Peroxide price increase of 8% in 2003; another 5% expected during 2004

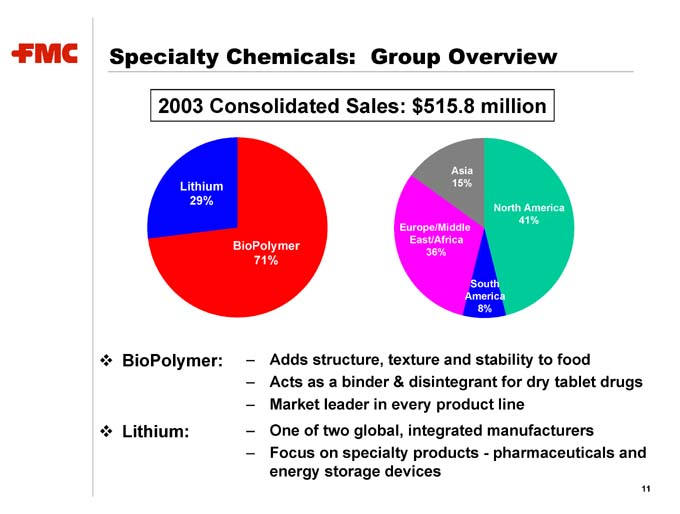

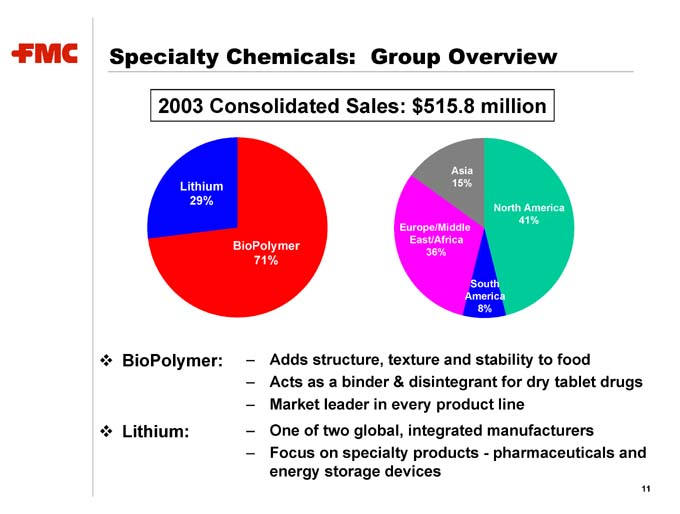

Specialty Chemicals: Group Overview

2003 Consolidated Sales: $515.8 million

Lithium 29%

BioPolymer 71%

Asia 15%

North America 41%

South America 8%

Europe/Middle East/Africa 36%

BioPolymer: – Adds structure, texture and stability to food

– Acts as a binder & disintegrant for dry tablet drugs

– Market leader in every product line

Lithium: – One of two global, integrated manufacturers

– Focus on specialty products—pharmaceuticals and energy storage devices

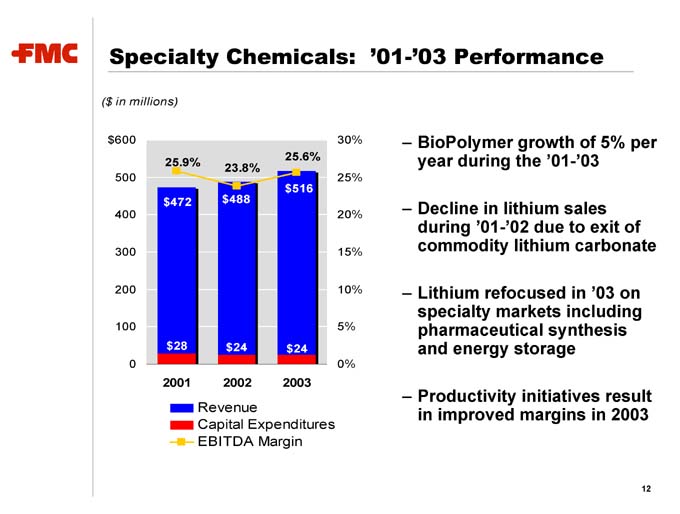

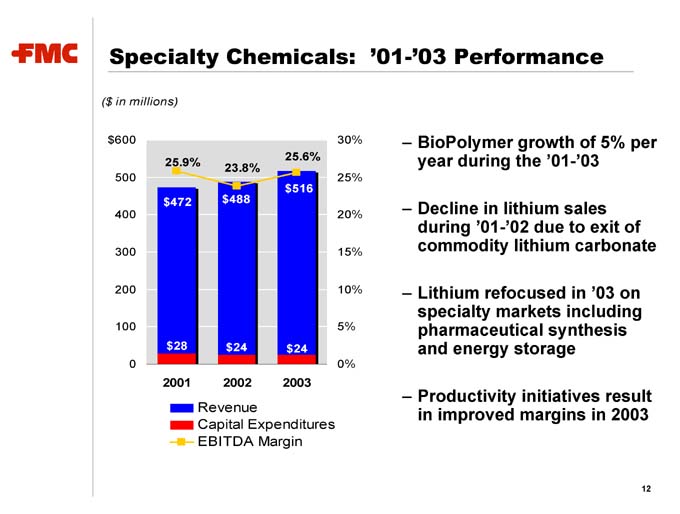

Specialty Chemicals: ‘01-’03 Performance

($ in millions)

25.9% $472 $28

23.8% $488 $24

25.6% $516 $24

– BioPolymer growth of 5% per year during the ‘01-’03

– Decline in lithium sales during ‘01-’02 due to exit of commodity lithium carbonate

– Lithium refocused in ‘03 on specialty markets including pharmaceutical synthesis and energy storage

– Productivity initiatives result in improved margins in 2003

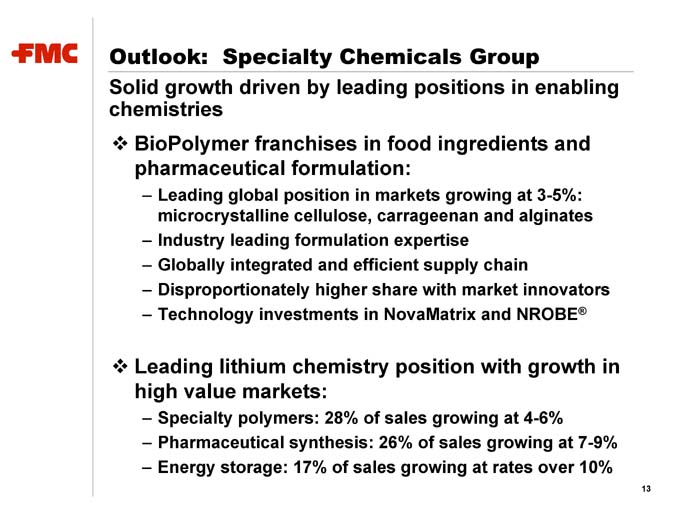

Outlook: Specialty Chemicals Group

Solid growth driven by leading positions in enabling chemistries

BioPolymer franchises in food ingredients and pharmaceutical formulation:

– Leading global position in markets growing at 3-5%: microcrystalline cellulose, carrageenan and alginates

– Industry leading formulation expertise

– Globally integrated and efficient supply chain

– Disproportionately higher share with market innovators

– Technology investments in NovaMatrix and NROBE®

Leading lithium chemistry position with growth in high value markets:

– Specialty polymers: 28% of sales growing at 4-6%

– Pharmaceutical synthesis: 26% of sales growing at 7-9%

– Energy storage: 17% of sales growing at rates over 10%

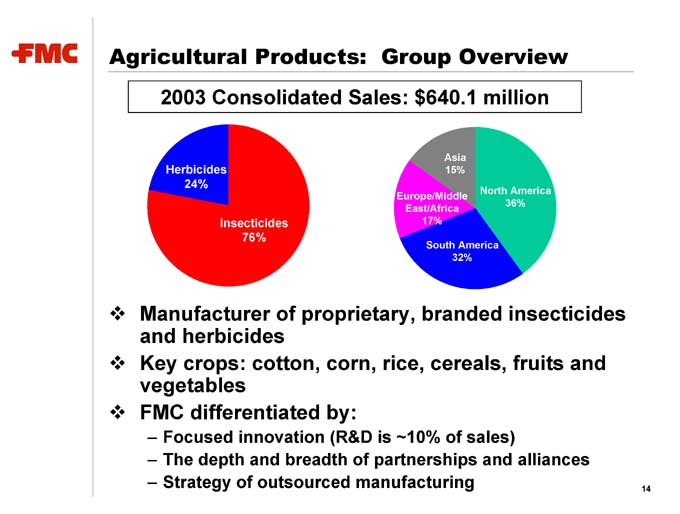

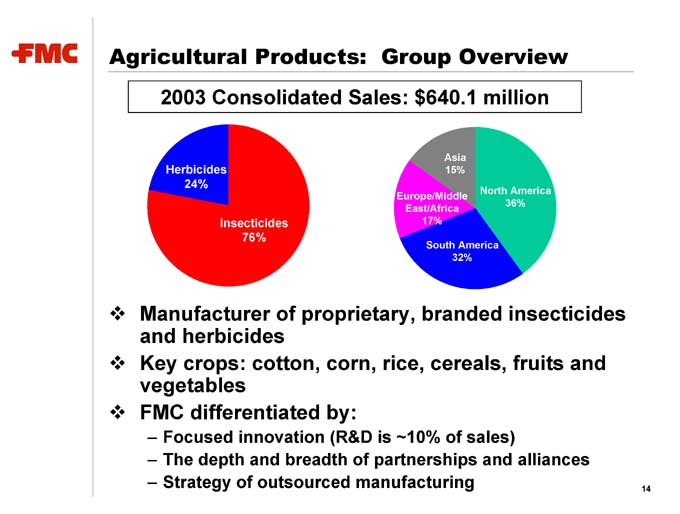

Agricultural Products: Group Overview

2003 Consolidated Sales: $640.1 million

Herbicides 24%

Insecticides 76%

Asia 15%

North America 36%

South America 32%

Europe/Middle East/Africa 17%

Manufacturer of proprietary, branded insecticides and herbicides

Key crops: cotton, corn, rice, cereals, fruits and vegetables

FMC differentiated by:

– Focused innovation (R&D is ~10% of sales)

– The depth and breadth of partnerships and alliances

– Strategy of outsourced manufacturing

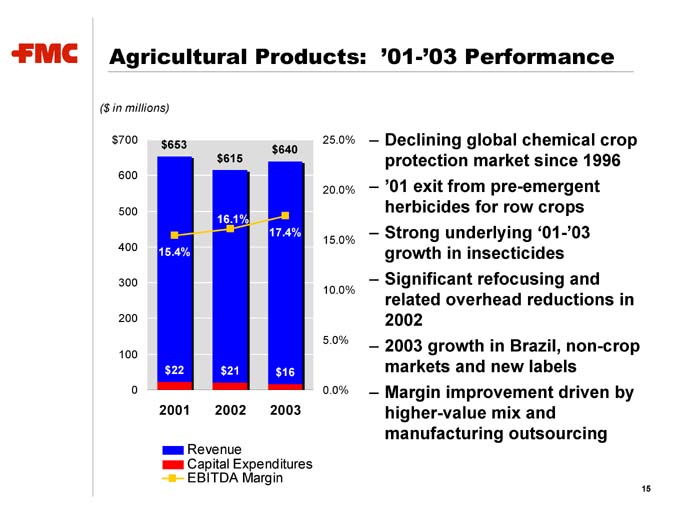

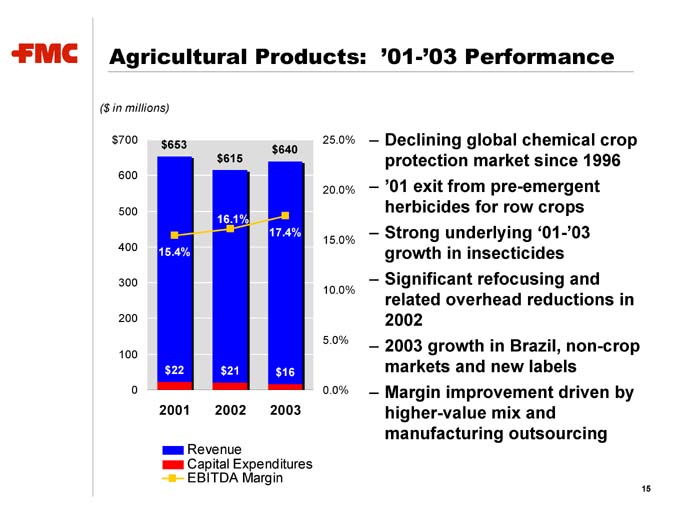

Agricultural Products: ‘01-’03 Performance

($ in millions) $653

15.4% $22 $615

16.1% $21 $640

17.4% $16

– Declining global chemical crop protection market since 1996

– ‘01 exit from pre-emergent herbicides for row crops

– Strong underlying ‘01-’03 growth in insecticides

– Significant refocusing and related overhead reductions in 2002

– 2003 growth in Brazil, non-crop markets and new labels

– Margin improvement driven by higher-value mix and manufacturing outsourcing

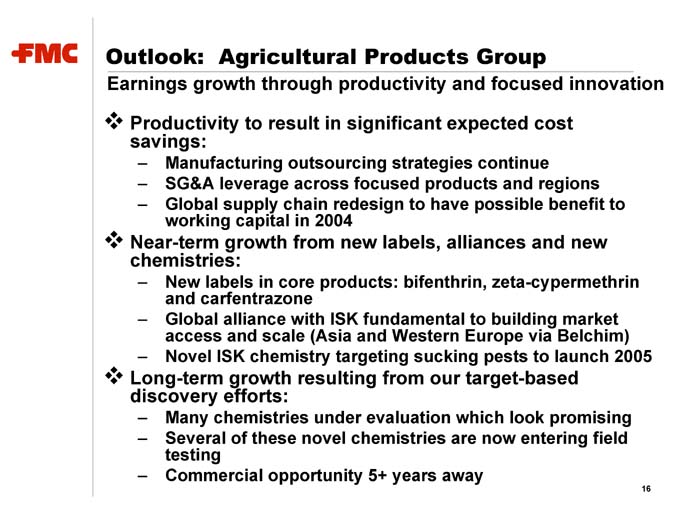

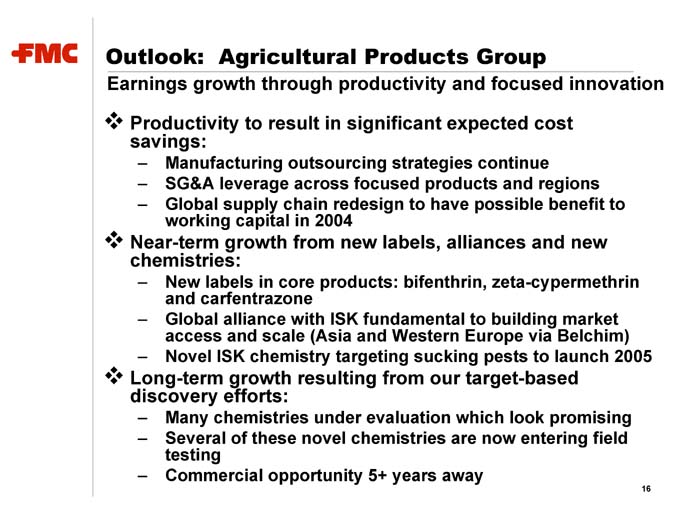

Outlook: Agricultural Products Group

Earnings growth through productivity and focused innovation

Productivity to result in significant expected cost savings:

– Manufacturing outsourcing strategies continue

– SG&A leverage across focused products and regions

– Global supply chain redesign to have possible benefit to working capital in 2004

Near-term growth from new labels, alliances and new chemistries:

– New labels in core products: bifenthrin, zeta-cypermethrin and carfentrazone

– Global alliance with ISK fundamental to building market access and scale (Asia and Western Europe via Belchim)

– Novel ISK chemistry targeting sucking pests to launch 2005

Long-term growth resulting from our target-based discovery efforts:

– Many chemistries under evaluation which look promising

– Several of these novel chemistries are now entering field testing

– Commercial opportunity 5+ years away

Financial Objectives

FMC is committed to strengthening its credit profile

Continued debt reduction through use of cash from operations and proceeds from divestitures

No dividends

No share repurchases

Foreign currency and energy hedging contracts to reduce foreign exchange risk and minimize downsides

Maximize liquidity and address near-term maturities

Reestablish a full investment-grade rating

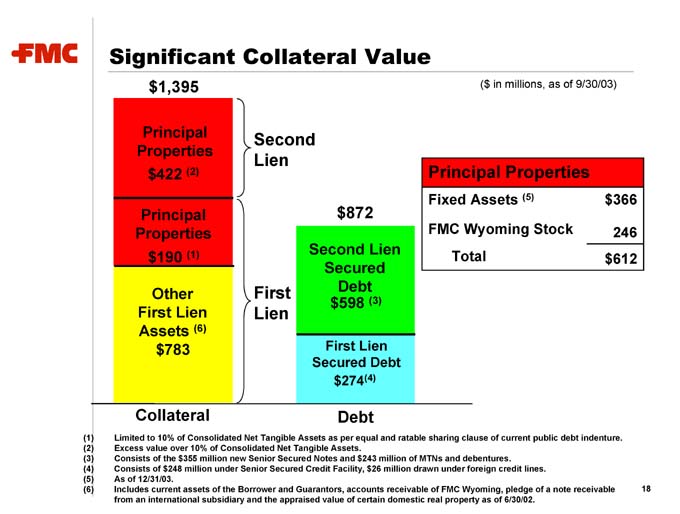

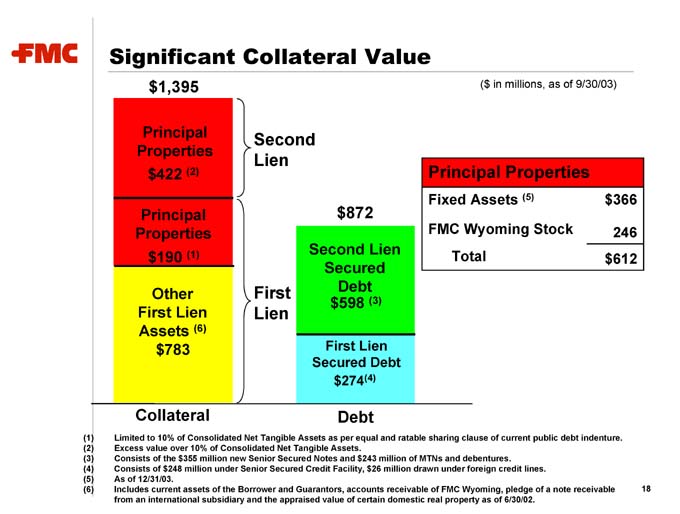

Significant Collateral Value

($ in millions, as of 9/30/03) $1,395

Second Lien

Principal Properties $422 (2)

First Lien

Principal Properties $190 (1)

Other First Lien Assets (6) $783

Collateral $872

Second Lien Secured Debt $598 (3)

First Lien Secured Debt $274(4)

Debt

Principal Properties

Fixed Assets (5) $ 366

FMC Wyoming Stock 246

Total $ 612

(1) Limited to 10% of Consolidated Net Tangible Assets as per equal and ratable sharing clause of current public debt indenture.

(2) Excess value over 10% of Consolidated Net Tangible Assets.

(3) Consists of the $355 million new Senior Secured Notes and $243 million of MTNs and debentures.

(4) Consists of $248 million under Senior Secured Credit Facility, $26 million drawn under foreign credit lines. (5) As of 12/31/03.

(6) Includes current assets of the Borrower and Guarantors, accounts receivable of FMC Wyoming, pledge of a note receivable from an international subsidiary and the appraised value of certain domestic real property as of 6/30/02.

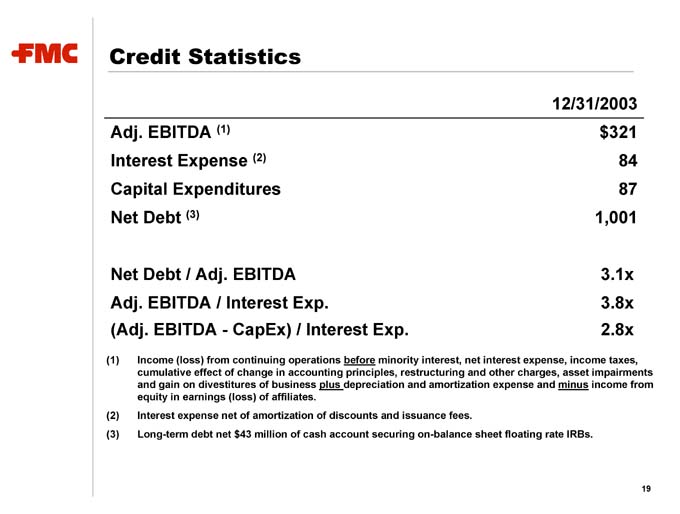

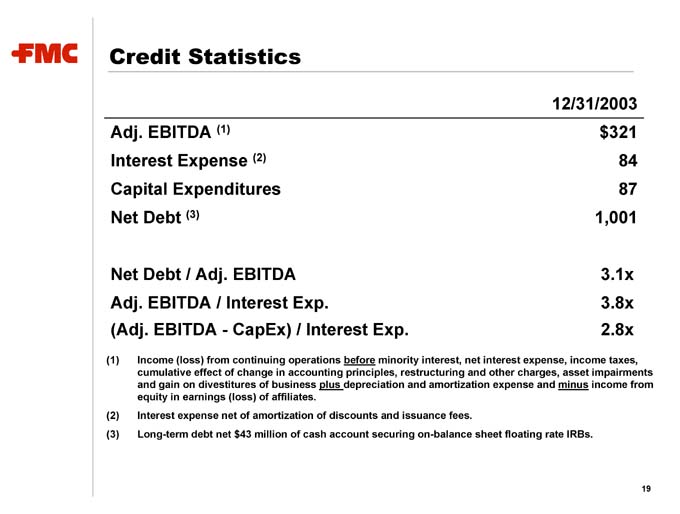

Credit Statistics

12/31/2003

Adj. EBITDA (1) $ 321

Interest Expense (2) 84

Capital Expenditures 87

Net Debt (3) 1,001

Net Debt / Adj. EBITDA 3.1x

Adj. EBITDA / Interest Exp. 3.8x

(Adj. EBITDA - CapEx) / Interest Exp. 2.8x

(1) Income (loss) from continuing operations before minority interest, net interest expense, income taxes, cumulative effect of change in accounting principles, restructuring and other charges, asset impairments and gain on divestitures of business plus depreciation and amortization expense and minus income from equity in earnings (loss) of affiliates.

(2) Interest expense net of amortization of discounts and issuance fees.

(3) Long-term debt net $43 million of cash account securing on-balance sheet floating rate IRBs.

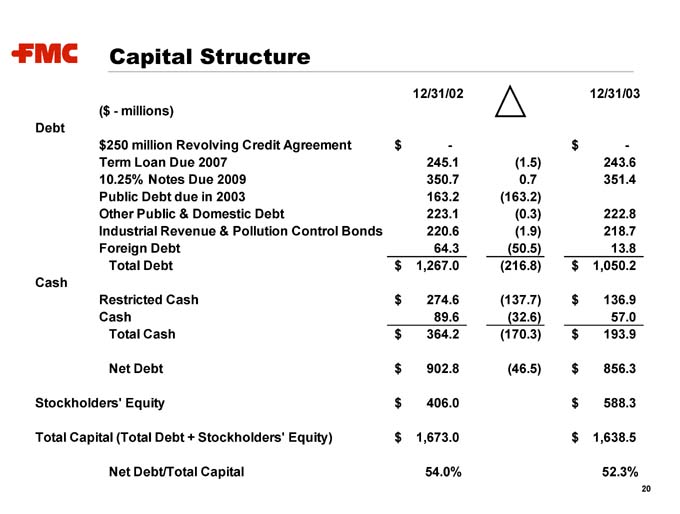

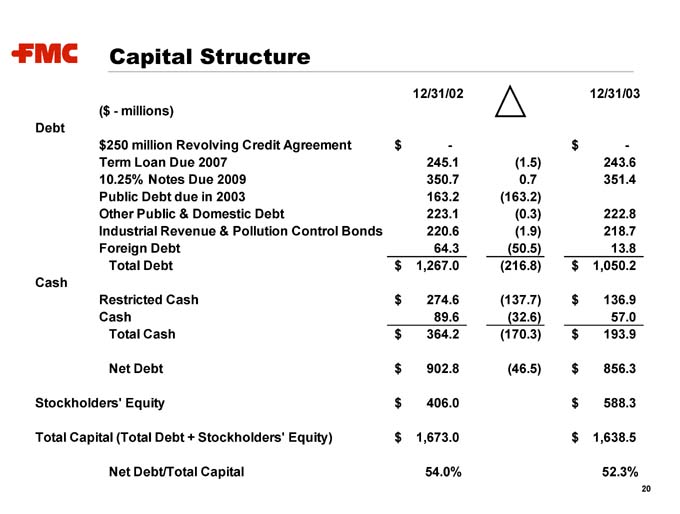

Capital Structure

Capital Structure

12/31/02 12/31/03

($ - millions)

Debt

$ 250 million Revolving Credit Agreement $ - $ -

Term Loan Due 2007 245.1 (1.5) 243.6

10.25% Notes Due 2009 350.7 0.7 351.4

Public Debt due in 2003 163.2 (163.2)

Other Public & Domestic Debt 223.1 (0.3) 222.8

Industrial Revenue & Pollution Control Bonds 220.6 (1.9) 218.7

Foreign Debt 64.3 (50.5) 13.8

Total Debt $ 1,267.0 (216.8) $ 1,050.2

Cash

Restricted Cash $ 274.6 (137.7) $ 136.9

Cash 89.6 (32.6) 57.0

Total Cash $ 364.2 (170.3) $ 193.9

Net Debt $ 902.8 (46.5) $ 856.3

Stockholders’ Equity $ 406.0 $ 588.3

Total Capital (Total Debt + Stockholders’ Equity) $ 1,673.0 $ 1,638.5

Net Debt/Total Capital 54.0% 52.3%

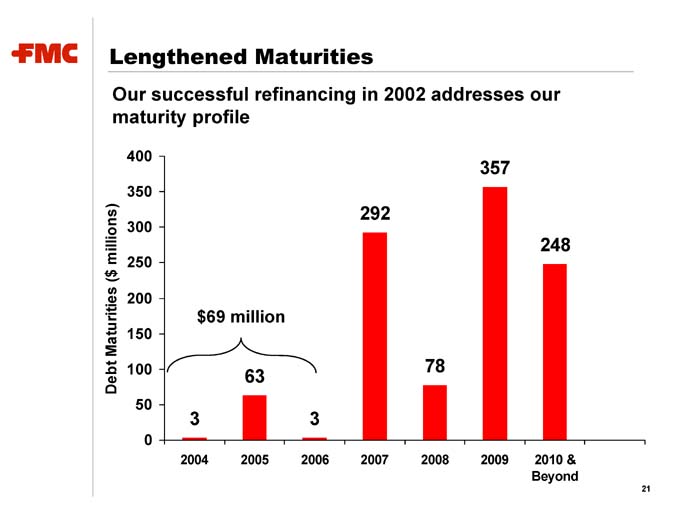

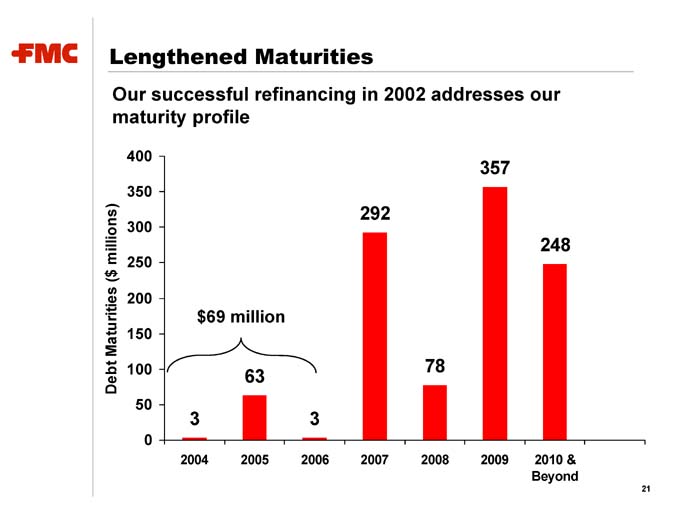

Lengthened Maturities

Our successful refinancing in 2002 addresses our maturity profile

$69 million

3

63

3

292

78

357

248

Strong Cash Flow

Free cash flow generation of $300 million expected over 2003-2006 timeframe, which will be used to reduce debt.

Trough adjusted EBITDA of over $320 million should grow with: – recovery in Industrial Chemicals and – continued growth in Specialty Chemicals and Agricultural Products.

Captial expenditures should be relatively flat from:

– Mothballed capacity

– De-bottlenecking

– Manufacturing outsourcing

Strong 2004 cash flow partially offset by

– Astaris keepwells of ~$40 million

– Last major component of Pocatello remediation

Strategic Objectives

Unlocking value and creating a faster growing FMC

Realize the operating leverage inherent within FMC

– Drive cost improvements and higher selling prices in Industrial

– Achieve peak Industrial earnings of over $100 million

Create greater financial flexibility

– Reduce net debt to $600 million by 2006

– Regain an investment grade credit rating

Focus the portfolio on higher growth businesses

– Grow Specialty Chemicals and Agricultural Products

– Manage Industrial Chemicals for cash

– Divest underperforming assets

FMC Corporation