Exhibit 99.1

Exhibit 99.1

FMC Corporation

Presentation to Senior Lenders

June 8, 2004

PUBLIC VERSION

Agenda

Performance Update and Outlook

Transaction Overview

Public Q&A

Financial Projections

Private Q&A

1

Performance Update and Outlook

Thomas C. Deas, Jr. Vice President & Treasurer

Disclaimer

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995:

These slides and the accompanying presentation contain “forward-looking statements” that represent management’s best judgment as of the date hereof based on information currently available. Actual results of the Company may differ materially from those contained in the forward-looking statements.

Additional information concerning factors that may cause results to materially differ from those in the forward-looking statements is contained in the Company’s periodic reports filed under the Securities Exchange Act of 1934, as amended.

The Company undertakes no obligation to update or revise these forward-looking statements to reflect new events or uncertainties.

3

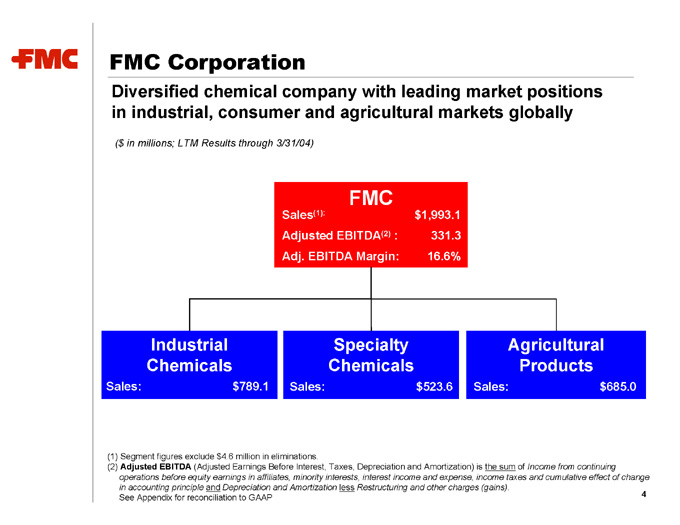

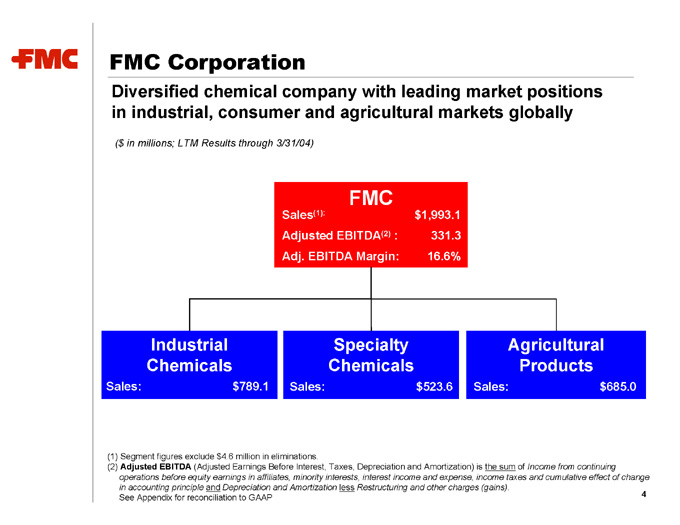

FMC Corporation

Diversified chemical company with leading market positions in industrial, consumer and agricultural markets globally

($ in millions; LTM Results through 3/31/04)

FMC

Sales(1): $ 1,993.1

Adjusted EBITDA(2) : 331.3

Adj. EBITDA Margin: 16.6%

Industrial Chemicals

Sales: $789.1

Specialty Chemicals

Sales: $523.6

Agricultural Products

Sales: $685.0

(1) Segment figures exclude $4.6 million in eliminations.

(2) Adjusted EBITDA (Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization) is the sum of Income from continuing operations before equity earnings in affiliates, minority interests, interest income and expense, income taxes and cumulative effect of change in accounting principle and Depreciation and Amortization less Restructuring and other charges (gains).

See Appendix for reconciliation to GAAP 4

FMC’s Strengths

Leading market positions

Global presence

Diversified business mix and high-quality customer base

Diversified and integrated cost structure

Focused R&D and strong applications expertise

Proven management with extensive industry experience

5

Operating Performance: 1st Quarter 2004

Revenue up 17% *

– Higher revenue in all three business segments

Adjusted EBITDA up 16% *

– Agricultural Products up

– Specialty Chemicals flat

– Industrial Chemicals weaker

Free cash flow up $30 million *

– Working capital focus

– Capital spending less than D&A

* Compared to the 1st quarter of 2003.

6

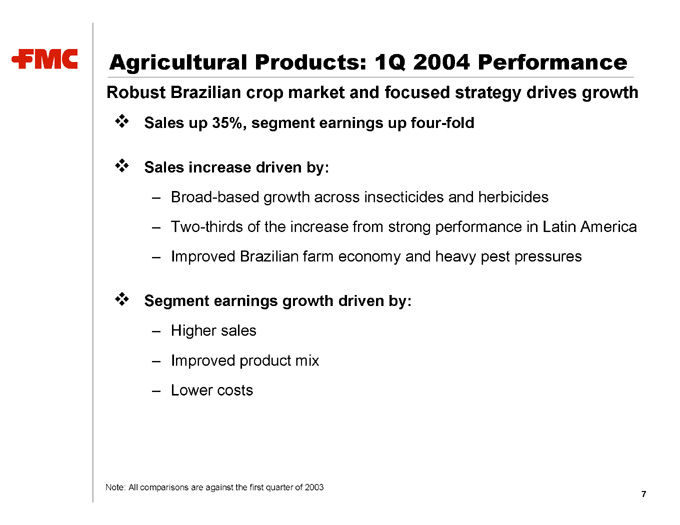

Agricultural Products: 1Q 2004 Performance

Robust Brazilian crop market and focused strategy drives growth

Sales up 35%, segment earnings up four-fold

Sales increase driven by:

– Broad-based growth across insecticides and herbicides

– Two-thirds of the increase from strong performance in Latin America

– Improved Brazilian farm economy and heavy pest pressures

Segment earnings growth driven by:

– Higher sales

– Improved product mix

– Lower costs

Note: All comparisons are against the first quarter of 2003

7

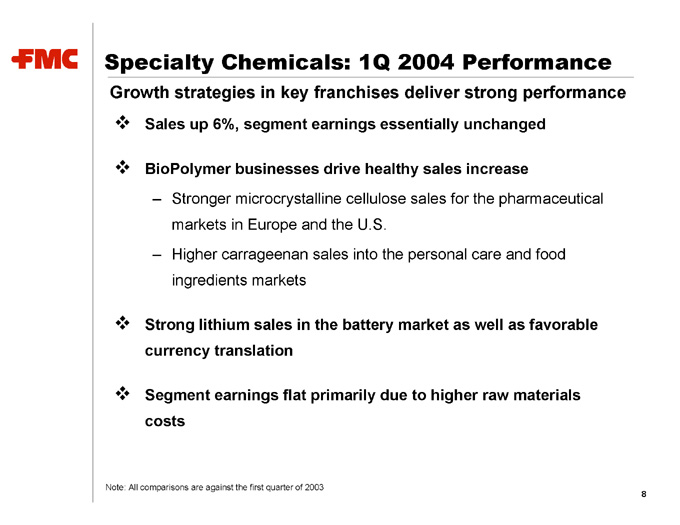

Specialty Chemicals: 1Q 2004 Performance

Growth strategies in key franchises deliver strong performance

Sales up 6%, segment earnings essentially unchanged

BioPolymer businesses drive healthy sales increase

– Stronger microcrystalline cellulose sales for the pharmaceutical markets in Europe and the U.S.

– Higher carrageenan sales into the personal care and food ingredients markets

Strong lithium sales in the battery market as well as favorable currency translation

Segment earnings flat primarily due to higher raw materials costs

Note: All comparisons are against the first quarter of 2003

8

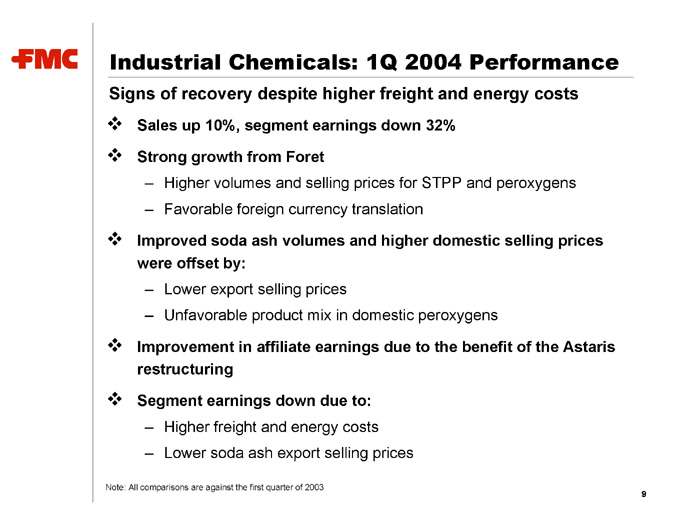

Industrial Chemicals: 1Q 2004 Performance

Signs of recovery despite higher freight and energy costs

Sales up 10%, segment earnings down 32%

Strong growth from Foret

– Higher volumes and selling prices for STPP and peroxygens

– Favorable foreign currency translation

Improved soda ash volumes and higher domestic selling prices

were offset by:

– Lower export selling prices

– Unfavorable product mix in domestic peroxygens

Improvement in affiliate earnings due to the benefit of the Astaris

restructuring

Segment earnings down due to:

– Higher freight and energy costs

– Lower soda ash export selling prices

Note: All comparisons are against the first quarter of 2003

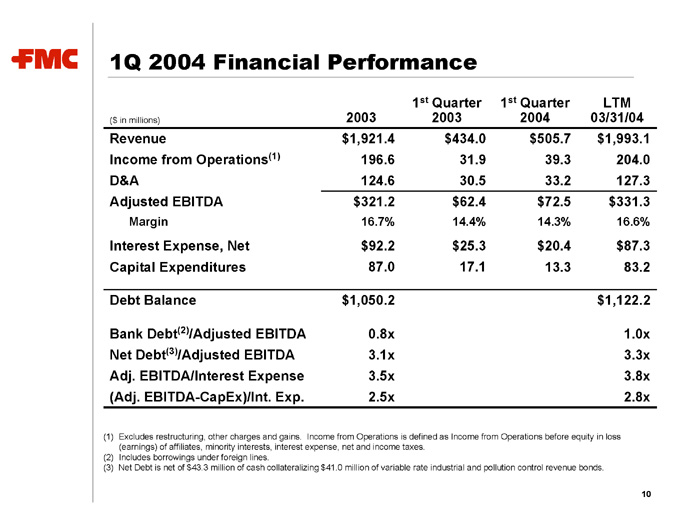

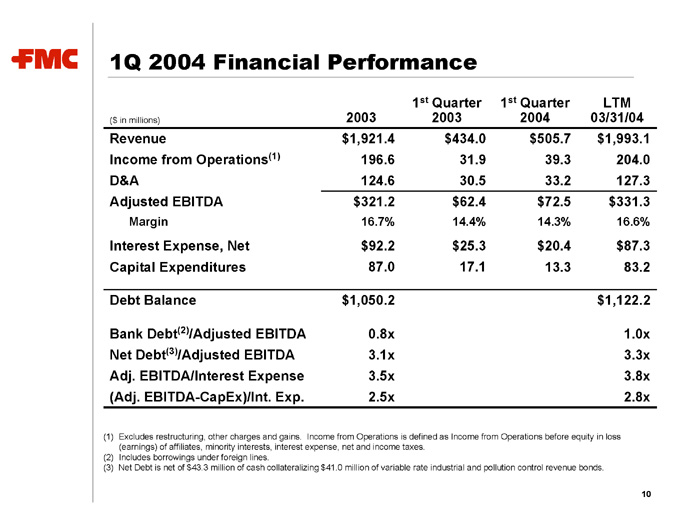

1Q 2004 Financial Performance

1st Quarter 1st Quarter LTM

($ in millions) 2003 2003 2004 03/31/04

Revenue $ 1,921.4 $ 434.0 $ 505.7 $ 1,993.1 Income from Operations(1) 196.6 31.9 39.3 204.0

D&A 124.6 30.5 33.2 127.3 Adjusted EBITDA $ 321.2 $ 62.4 $ 72.5 $ 331.3

Margin 16.7% 14.4% 14.3% 16.6% Interest Expense, Net $ 92.2 $ 25.3 $ 20.4 $ 87.3

Capital Expenditures 87.0 17.1 13.3 83.2

Debt Balance $ 1,050.2 $ 1,122.2

Bank Debt(2)/Adjusted EBITDA 0.8x 1.0x

Net Debt(3)/Adjusted EBITDA 3.1x 3.3x

Adj. EBITDA/Interest Expense 3.5x 3.8x

(Adj. EBITDA-CapEx)/Int. Exp. 2.5x 2.8x

(1) Excludes restructuring, other charges and gains. Income from Operations is defined as Income from Operations before equity in loss (earnings) of affiliates, minority interests, interest expense, net and income taxes.

(2) Includes borrowings under foreign lines.

(3) Net Debt is net of $43.3 million of cash collateralizing $41.0 million of variable rate industrial and pollution control revenue bonds.

10

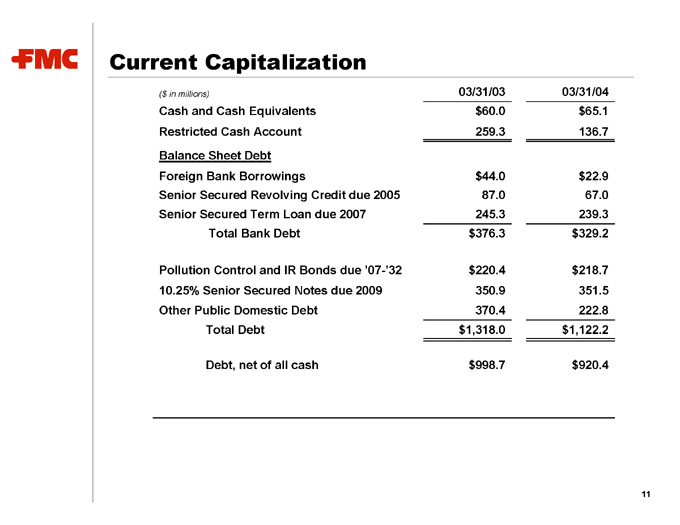

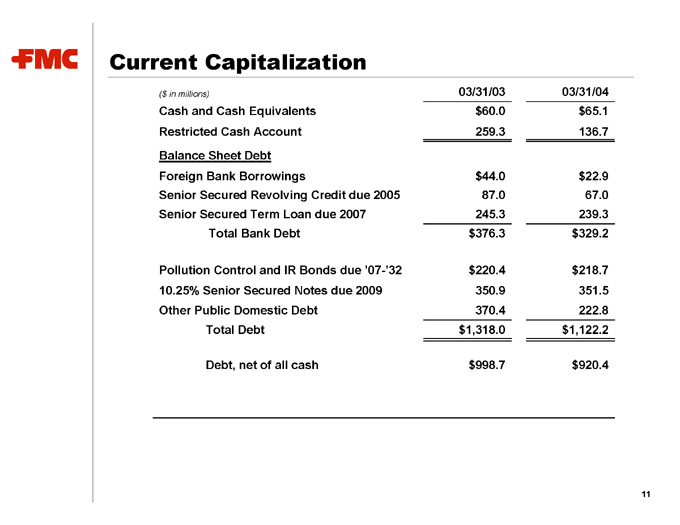

Current Capitalization

($ in millions) 03/31/03 03/31/04

Cash and Cash Equivalents $ 60.0 $ 65.1

Restricted Cash Account 259.3 136.7

Balance Sheet Debt

Foreign Bank Borrowings $ 44.0 $ 22.9

Senior Secured Revolving Credit due 2005 87.0 67.0

Senior Secured Term Loan due 2007 245.3 239.3

Total Bank Debt $ 376.3 $ 329.2

Pollution Control and IR Bonds due ‘07-’32 $ 220.4 $ 218.7

10.25% Senior Secured Notes due 2009 350.9 351.5

Other Public Domestic Debt 370.4 222.8

Total Debt $ 1,318.0 $ 1,122.2

Debt, net of all cash $ 998.7 $ 920.4

11

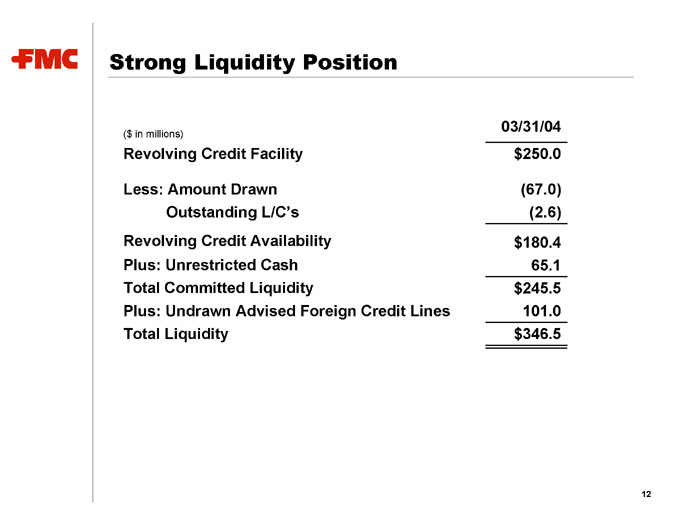

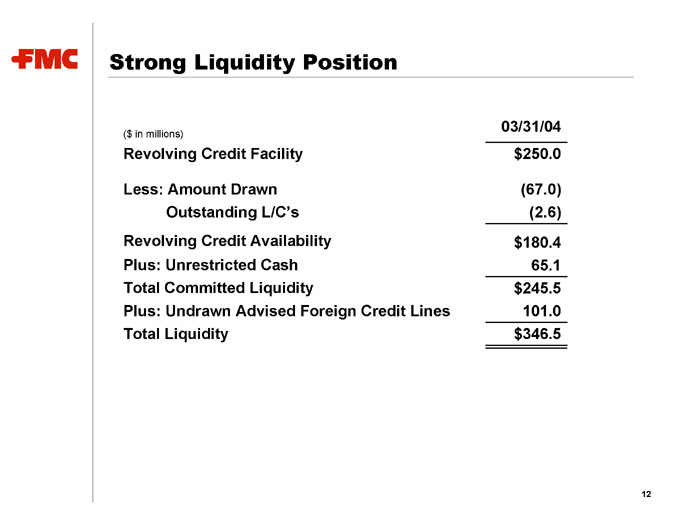

Strong Liquidity Position

03/31/04

($ in millions)

Revolving Credit Facility $ 250.0

Less: Amount Drawn (67.0)

Outstanding L/C’s (2.6)

Revolving Credit Availability $ 180.4

Plus: Unrestricted Cash 65.1

Total Committed Liquidity $ 245.5

Plus: Undrawn Advised Foreign Credit Lines 101.0

Total Liquidity $ 346.5

12

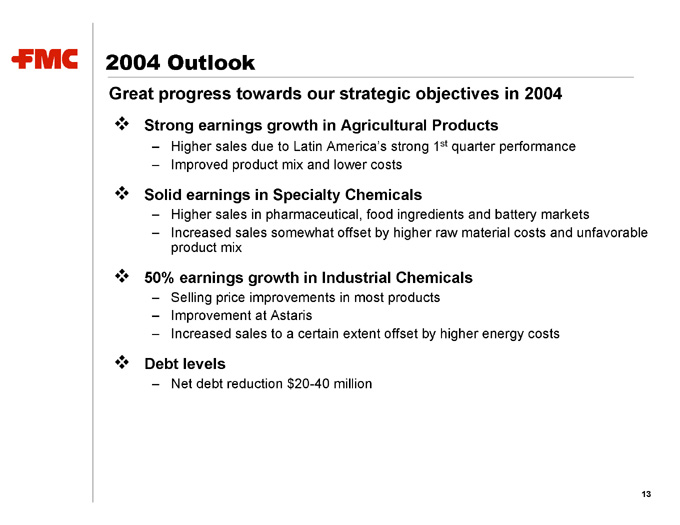

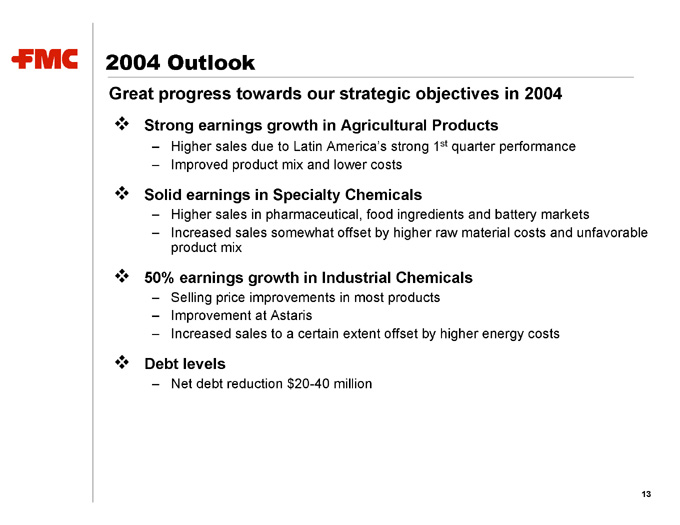

2004 Outlook

Great progress towards our strategic objectives in 2004

Strong earnings growth in Agricultural Products

– Higher sales due to Latin America’s strong 1st quarter performance

– Improved product mix and lower costs

Solid earnings in Specialty Chemicals

– Higher sales in pharmaceutical, food ingredients and battery markets

– Increased sales somewhat offset by higher raw material costs and unfavorable product mix

50% earnings growth in Industrial Chemicals

– Selling price improvements in most products

– Improvement at Astaris

– Increased sales to a certain extent offset by higher energy costs

Debt levels

– Net debt reduction $20-40 million

13

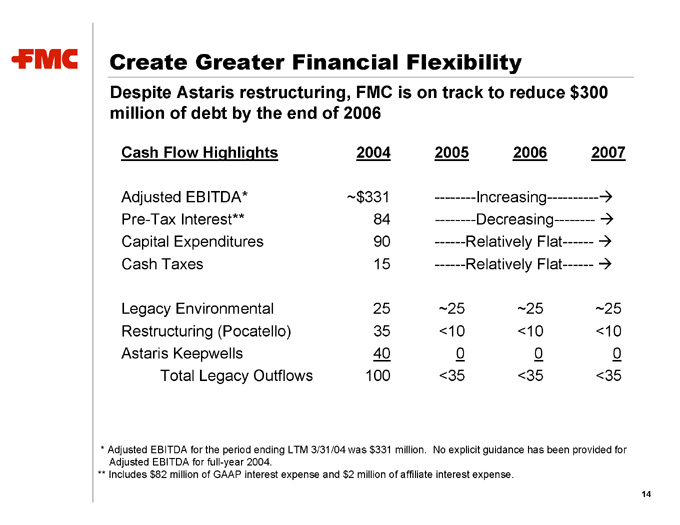

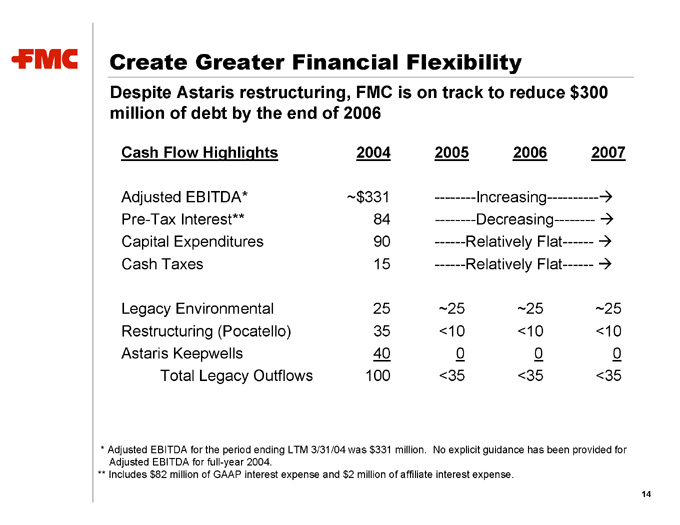

Create Greater Financial Flexibility

Despite Astaris restructuring, FMC is on track to reduce $300 million of debt by the end of 2006

Cash Flow Highlights 2004 2005 2006 2007

Adjusted EBITDA* ~$ 331 ————Increasing—————Æ

Pre-Tax Interest** 84 ————Decreasing———— A

Capital Expenditures 90 ———Relatively Flat——— A

Cash Taxes 15 ———Relatively Flat——— A

Legacy Environmental 25 ~25 ~25 ~25

Restructuring (Pocatello) 35 <10 <10 <10

Astaris Keepwells 40 0 0 0

Total Legacy Outflows 100 <35 <35 <35

* Adjusted EBITDA for the period ending LTM 3/31/04 was $331 million. No explicit guidance has been provided for

Adjusted EBITDA for full-year 2004.

** Includes $82 million of GAAP interest expense and $2 million of affiliate interest expense.

14

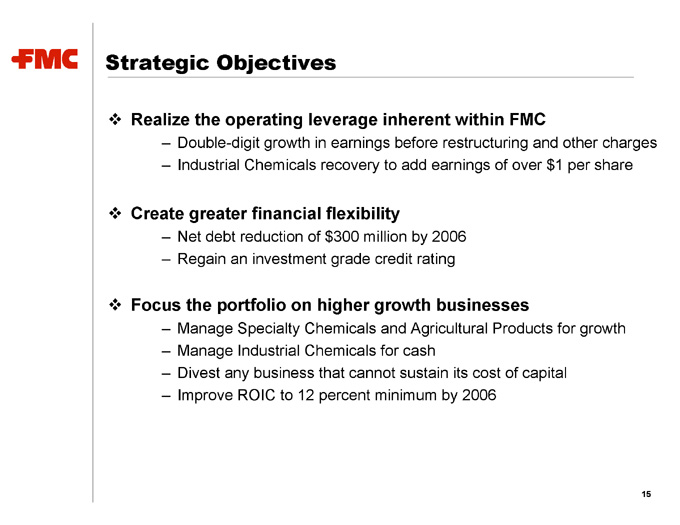

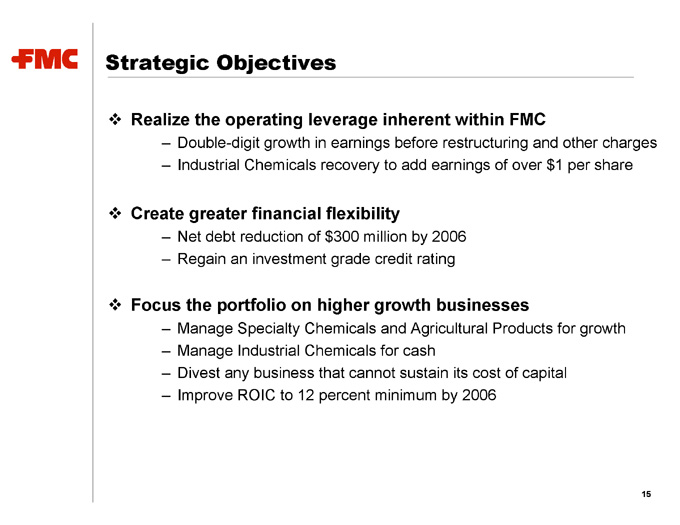

Strategic Objectives

Realize the operating leverage inherent within FMC

– Double-digit growth in earnings before restructuring and other charges

– Industrial Chemicals recovery to add earnings of over $1 per share

Create greater financial flexibility

– Net debt reduction of $300 million by 2006

– Regain an investment grade credit rating

Focus the portfolio on higher growth businesses

– Manage Specialty Chemicals and Agricultural Products for growth

– Manage Industrial Chemicals for cash

– Divest any business that cannot sustain its cost of capital

– Improve ROIC to 12 percent minimum by 2006

15

Transaction Overview

Michael Mauer

Managing Director, Citigroup

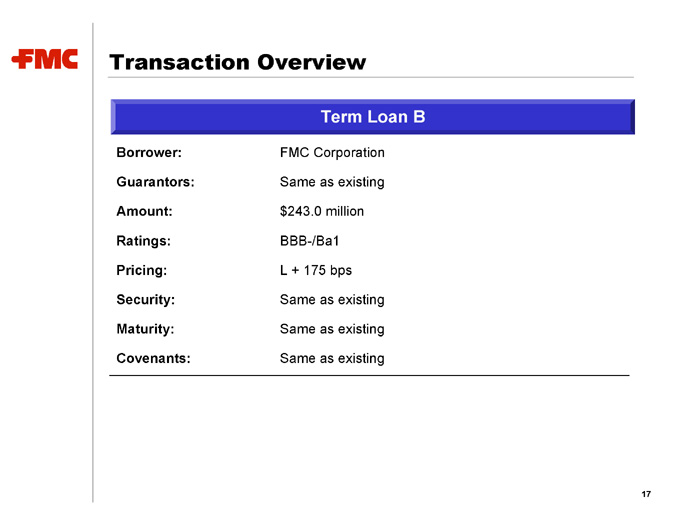

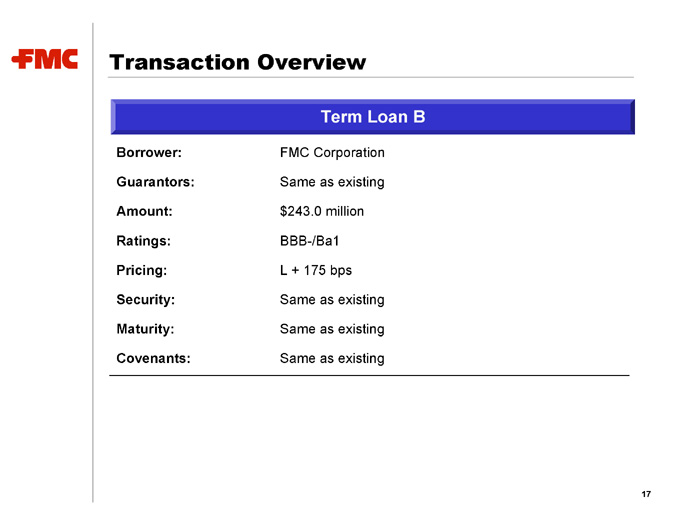

Transaction Overview

Term Loan B

Borrower: FMC Corporation

Guarantors: Same as existing

Amount: $243.0 million

Ratings: BBB-/Ba1

Pricing: L + 175 bps

Security: Same as existing

Maturity: Same as existing

Covenants: Same as existing

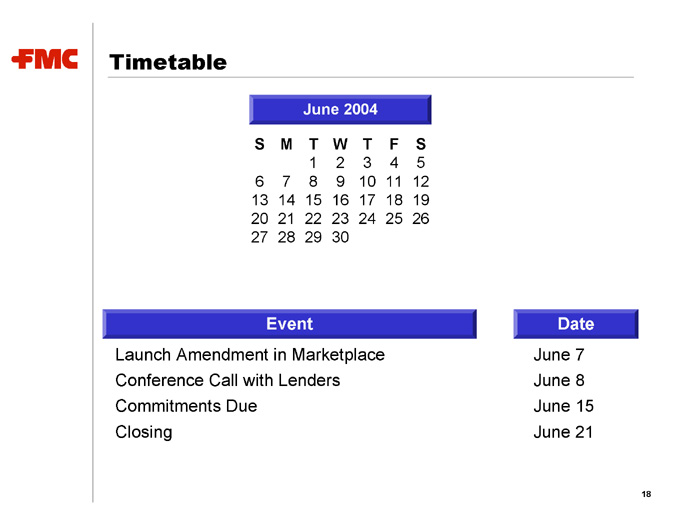

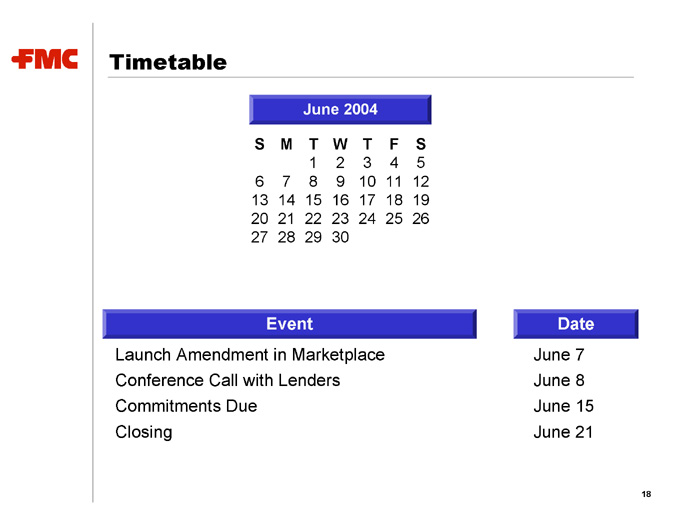

Timetable

June 2004

S M T W T F S

1 2 3 4 5

6 7 8 9 10 11 12

13 14 15 16 17 18 19

20 21 22 23 24 25 26

27 28 29 30

Event Date

Launch Amendment in Marketplace June 7

Conference Call with Lenders June 8

Commitments Due June 15

Closing June 21

18

FMC Corporation

Public Q&A

Appendix

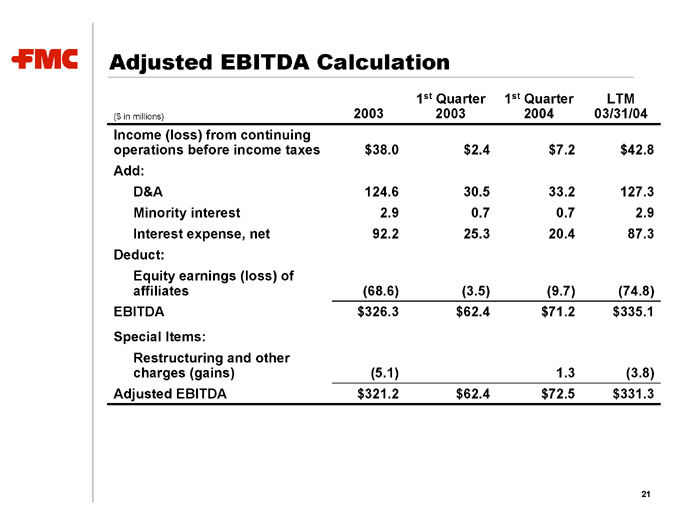

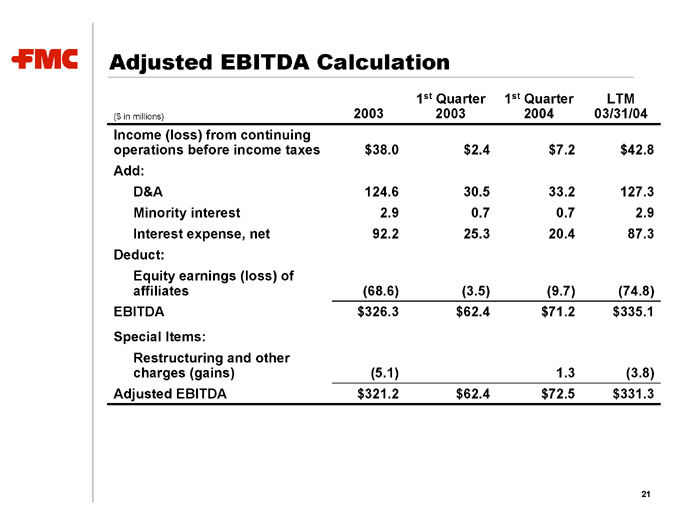

Adjusted EBITDA Calculation

1st Quarter 1st Quarter LTM ($ in millions) 2003 2003 2004 03/31/04 Income (loss) from continuing operations before income taxes $38.0 $2.4 $7.2 $42.8 Add: D&A 124.6 30.5 33.2 127.3 Minority interest 2.9 0.7 0.7 2.9 Interest expense, net 92.2 25.3 20.4 87.3 Deduct: Equity earnings (loss) of affiliates (68.6) (3.5) (9.7) (74.8) EBITDA $326.3 $62.4 $71.2 $335.1 Special Items: Restructuring and other charges (gains) (5.1) 1.3 (3.8) Adjusted EBITDA $321.2 $62.4 $72.5 $331.3

21