Exhibit 99.1

Exhibit 99.1

Agricultural Products Group

Welcomes:

Mike Judd – Greenwich Consultants Jay Chen – Wellington Management Company Josh Kaufthal – Reich & Tang Jim O’Melia—Sunnymeath Joe Pilaro – Brae Partners Richard Rosen – J. & W. Seligman & Co., Inc.

Wayne Simon – Mutual of America Capital Management Corp.

10 June 2004 1

Agricultural Products Group

Agricultural Products Group

Business Overview and R&D Presentation Milton Steele and Ann B. Orth, Ph.D.

FMC Investor Meeting 10 June 2004

10 June 2004

Agricultural Products Group

Disclaimer

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995

These slides and the accompanying presentation contain “forward-looking statements” that represent management’s best judgment as of the date hereof based on information currently available. Actual results of the Company may differ materially from those contained in the forward-looking statements.

Additional information concerning factors that may cause results to differ materially from those in the forward-looking statements is contained in the Company’s periodic reports filed under the Securities Exchange Act of 1934, as amended.

The Company undertakes no obligation to update or revise these forward-looking statements to reflect new events or uncertainties.

10 June 2004 3

Agricultural Products Group

Use of Non-GAAP Terms

These slides contain certain “non-GAAP financial terms” which are defined below and on FMC’s Investor Relations web site (http://ir.fmc.com) in the Glossary of Financial Terms section. In addition, in the Conference Calls and Presentations section of the web site, we have provided reconciliations of non-GAAP terms to the closest GAAP term. Lastly, these slides contain references to segment financial items which are presented in detail in Note 19 of FMC’s 2003 Form 10-K.

EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) is the sum of Income (loss) from continuing operations before income taxes and cumulative effect of change in accounting principle and Depreciation and Amortization.

EBITDA Margin is the quotient of EBITDA (defined above) and Revenue.

ROIC (Return on Invested Capital) is the sum of Earnings from continuing operations before restructuring and other charges (gains) and after-tax Interest expense divided by the sum of Short-term debt, Current portion of long-term debt, Long-term debt and Total shareholders’ equity.

10 June 2004 4

Agricultural Products Group

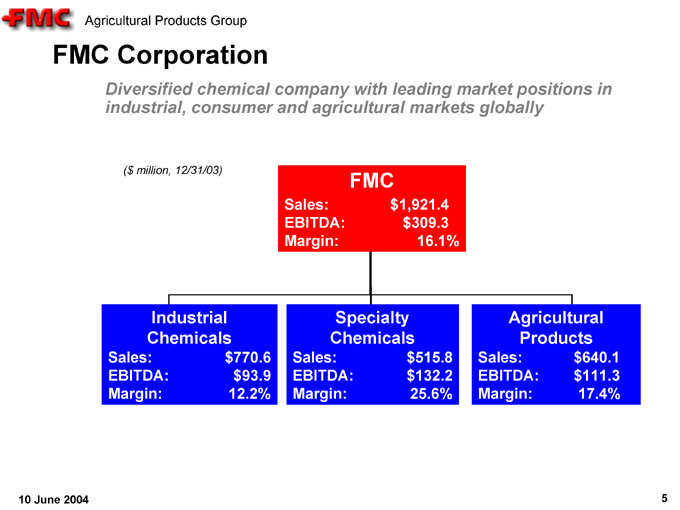

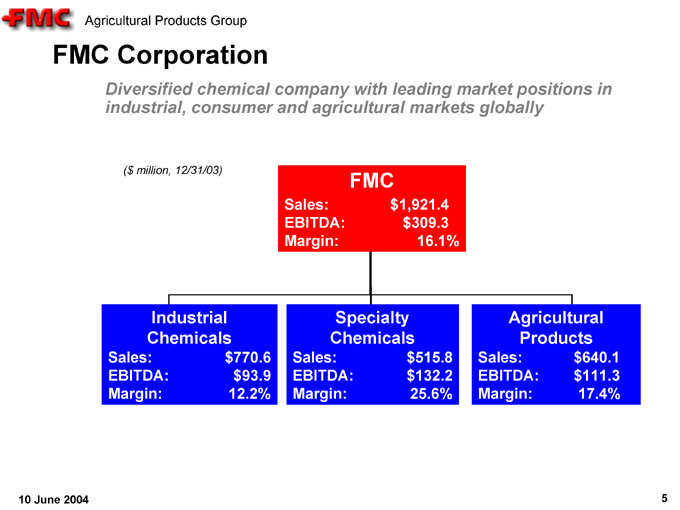

FMC Corporation

Diversified chemical company with leading market positions in industrial, consumer and agricultural markets globally

($ million, 12/31/03)

FMC

Sales: $1,921.4

EBITDA: $309.3

Margin: 16.1%

Industrial Chemicals

Sales: $770.6

EBITDA: $93.9

Margin: 12.2%

Specialty Chemicals

Sales: $515.8

EBITDA: $132.2

Margin: 25.6%

Agricultural Products

Sales: $640.1

EBITDA: $111.3

Margin: 17.4%

10 June 2004 5

Agricultural Products Group

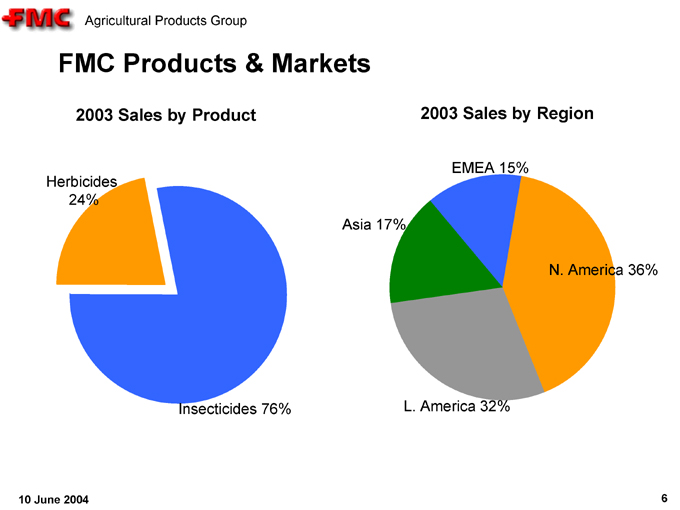

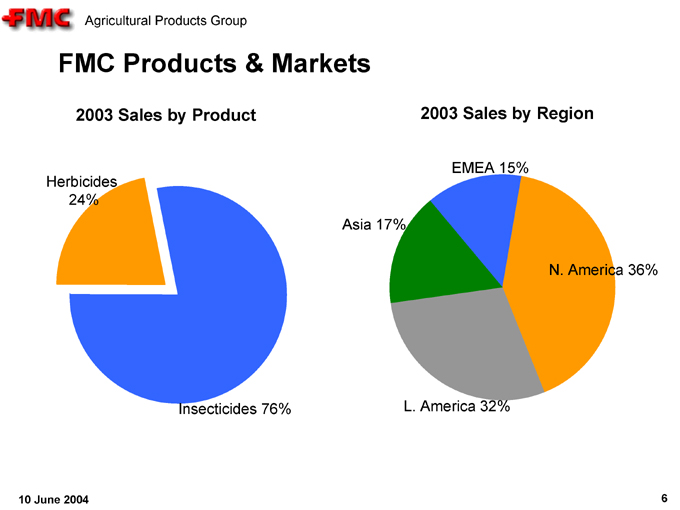

FMC Products & Markets

2003 Sales by Product

2003 Sales by Region

Herbicides 24%

Insecticides 76%

Asia 17%

EMEA 15%

N. America 36%

L. America 32%

10 June 2004 6

Agricultural Products Group

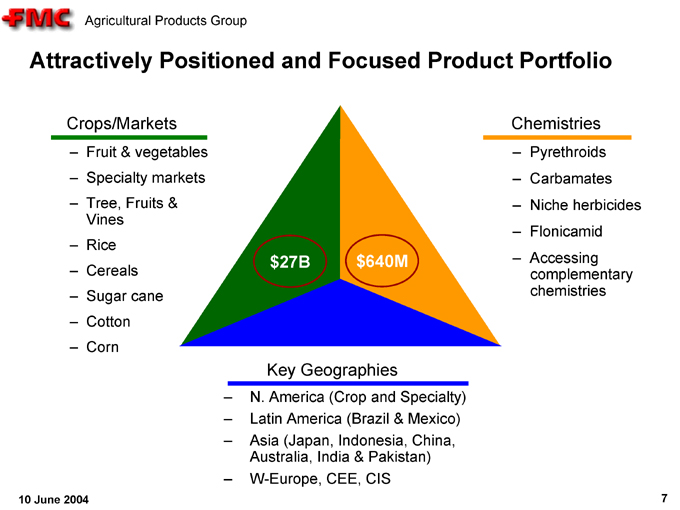

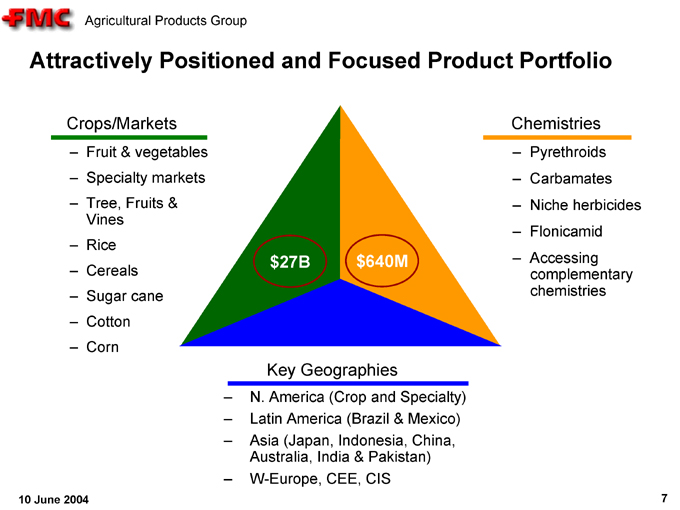

Attractively Positioned and Focused Product Portfolio

Crops/Markets

Fruit & vegetables

Specialty markets

Tree, Fruits & Vines

Rice

Cereals

Sugar cane

Cotton

Corn

$27B

$640M

Chemistries

Pyrethroids

Carbamates

Niche herbicides

Flonicamid

Accessing complementary chemistries

Key Geographies

N. America (Crop and Specialty)

Latin America (Brazil & Mexico)

Asia (Japan, Indonesia, China, Australia, India & Pakistan)

W-Europe, CEE, CIS

10 June 2004 7

Agricultural Products Group

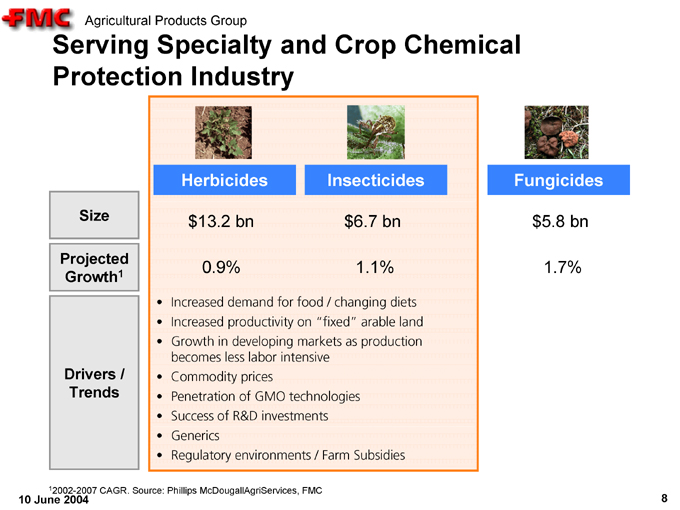

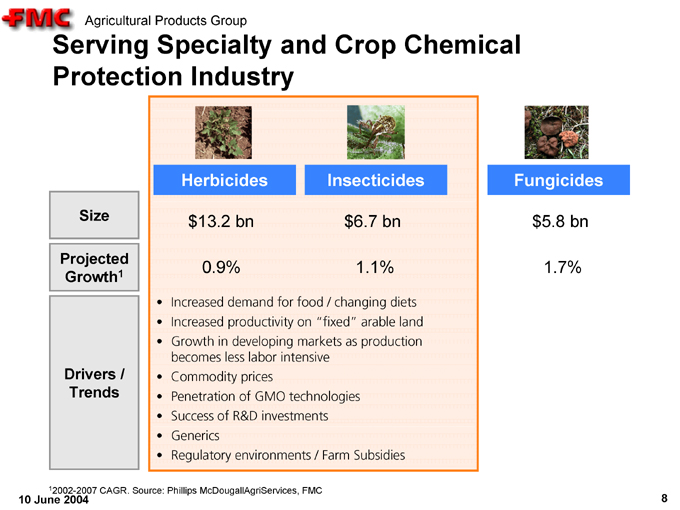

Serving Specialty and Crop Chemical Protection Industry

Size

Projected Growth1

Drivers / Trends

Herbicides

Insecticides

$13.2 bn

0.9%

$6.7 bn

1.1%

Increased demand for food / changing diets

Increased productivity on “fixed” arable land

Growth in developing markets as production

becomes less labor intensive

Commodity prices

Penetration of GMO technologies

Success of R&D investments

Generics

Regulatory environments / Farm Subsidies

Fungicides

$5.8 bn

1.7%

12002-2007 CAGR. Source: Phillips McDougallAgriServices, FMC

10 June 2004 8

Agricultural Products Group

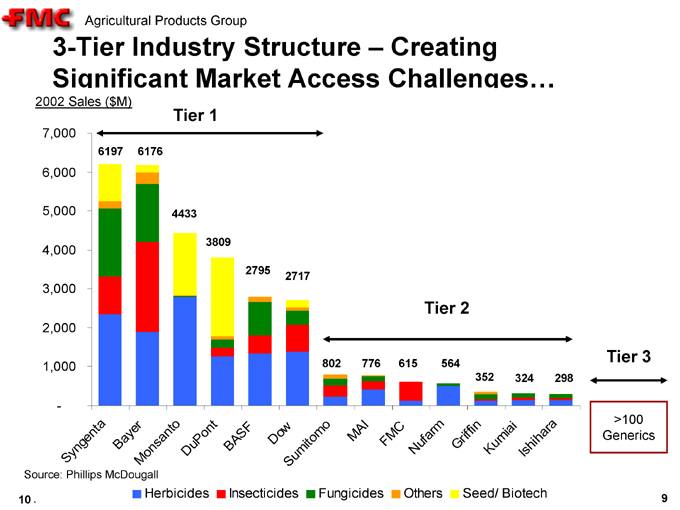

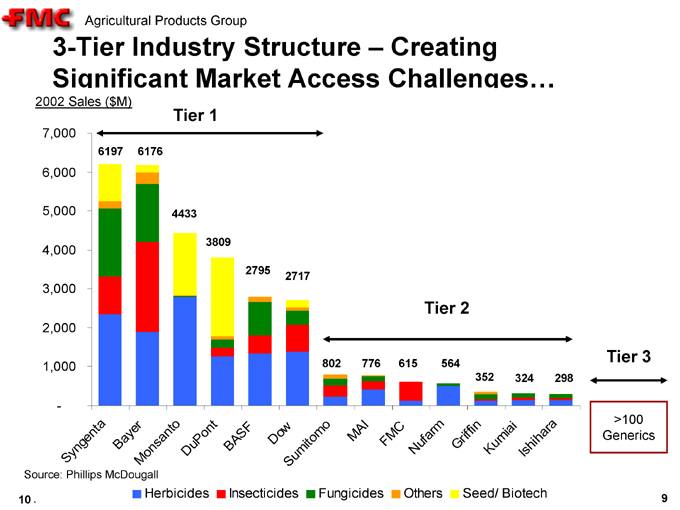

3-Tier Industry Structure – Creating Significant Market Access Challenges…

2002 Sales ($M)

Tier 1

7,000

6,000

5,000

4,000

3,000

2,000

1,000

-

6197

6176

4433

3809

2795

2717

Tier 2

802

776

615

564

352

324

298

Tier 3

Syngenta

Bayer

Monsanto

DuPont

BASF

Dow

Sumitomo

MAI

FMC

Nufarm

Griffin

Kumiai

Ishihara

>100 Generics

Source: Phillips McDougall

Herbicides Insecticides Fungicides Others Seed/ Biotech

10 June 2004 9

Agricultural Products Group

Recent Industry Threats / Changes and APG’s Response

Over the past six years, four phenomena, in particular have significantly impacted the chemical crop protection:

Genetically Modified Crops (GMO)

Asian generics pesticide competitors

Low commodity prices

Declining industry profitability and massive consolidation leading to significant market access challenges

APG is successfully implementing a multifaceted strategy that is dealing with these threats and industry inflection points;

Our Goal is to Create a

Sustainable Business in Focused Global Crop Protection and Specialty Markets

10 June 2004 10

Agricultural Products Group

Our Strategy is Enabling Us to Contend with the Key Challenges & Opportunities Facing the Business

People / Org Growth & Development

Focus

Global Cost Competitiveness

Innovation

Growth in Specialty Crops / Markets

Leverage Alliances

Voluntary Stakeholder Alignment

Become Tier 2 Market Access Vehicle of Choice

10 June 2004 11

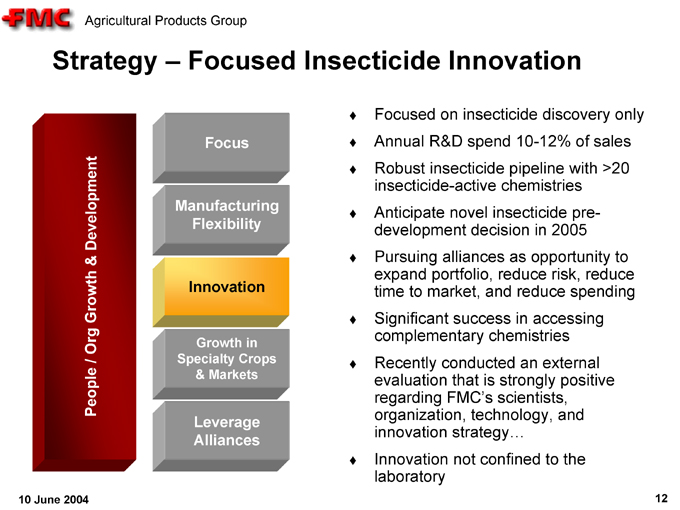

Agricultural Products Group

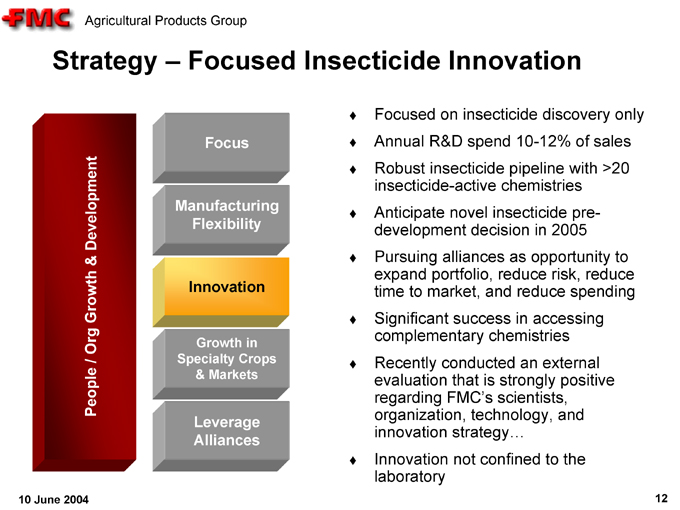

Strategy – Focused Insecticide Innovation

People / Org Growth & Development

Focus

Manufacturing Flexibility

Innovation

Growth in Specialty Crops & Markets

Leverage Alliances

Focused on insecticide discovery only

Annual R&D spend 10-12% of sales

Robust insecticide pipeline with >20 insecticide-active chemistries

Anticipate novel insecticide pre-development decision in 2005

Pursuing alliances as opportunity to expand portfolio, reduce risk, reduce time to market, and reduce spending

Significant success in accessing complementary chemistries

Recently conducted an external evaluation that is strongly positive regarding FMC’s scientists, organization, technology, and innovation strategy…

Innovation not confined to the laboratory

10 June 2004 12

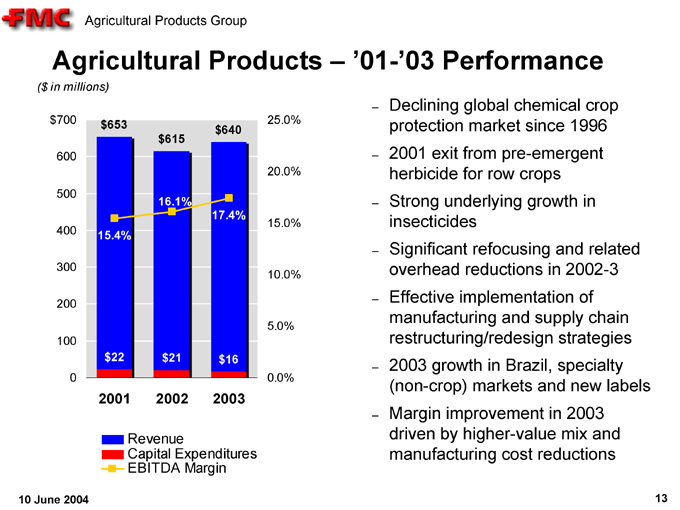

Agricultural Products Group

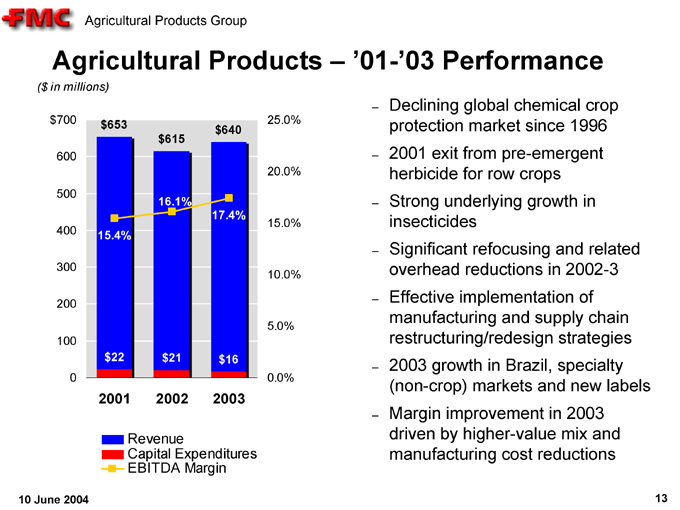

Agricultural Products – ’01-’03 Performance

($ in millions)

$700

600

500

400

300

200

100

0

2001 $22 15.4% $653

2002 $21 16.1% $615

2003 $16 17.4% $640

25.0%

20.0%

15.0%

10.0%

5.0%

0.0%

Revenue

Capital Expenditures

EBITDA Margin

Declining global chemical crop protection market since 1996

2001 exit from pre-emergent herbicide for row crops

Strong underlying growth in insecticides

Significant refocusing and related overhead reductions in 2002-3

Effective implementation of manufacturing and supply chain restructuring/redesign strategies

2003 growth in Brazil, specialty (non-crop) markets and new labels

Margin improvement in 2003 driven by higher-value mix and manufacturing cost reductions

10 June 2004 13

Agricultural Products Group

Positive Outlook in 2004 Driven by robust crop markets and our focused strategy

Improving global farm economy:

Rising global crop prices

Significant cost savings from productivity initiatives:

Manufacturing initiatives continue to produce savings

Refocus and deployment of SG&A

Global supply chain redesign being implemented

Success of market access strategies (alliances) in various key markets

Focused, successful innovation:

Label expansions in both crop and specialty markets

Novel ISK chemistry targeting sucking pests to launch 2005

Access to two other new and complementary chemistries being negotiated

Discovery efforts have resulted in many promising chemistries, several of which are now entering global field trials

10 June 2004 14

Agricultural Products Group

Research and Development

Dr. Ann Orth

10 June 2004 15

Agricultural Products Group

Agenda

Insecticide Market

People (This section omitted for 8-K filing)

Discovery Technology

Development Capabilities

Research Strategy and Pipeline Status

Summary

Q&A

10 June 2004 16

Agricultural Products Group

APG R&D Overview – Focused Insecticide Innovation

Consistently invests 10-12% of sales on R&D innovation

Recently completed external evaluation puts our APG’s Insecticide discovery program as among the most competitive in the industry

Sustainable long-term growth enabled by robust pipeline; we have >20 chemistry areas with activity between 0.1-100 ppm

We have the potential to commercialize 2-4 new active ingredients (ai’s) in next ~10 years

We have three new ai’s (molecules) that we’ve accessed externally

We have created a novel development approach that should reduce total spending by millions of $’s, and reduce time to market by years

State-of-the-art technologies are leveraged by world class scientists

New technologies allow a sustainable HTS (high throughput screening) program for whole insects and complex biochemical insect targets

Investment in genomics technologies created a unique asset, enabling previously unattainable understanding of gene targets & new ai MOAs

10 June 2004 17

Agricultural Products Group

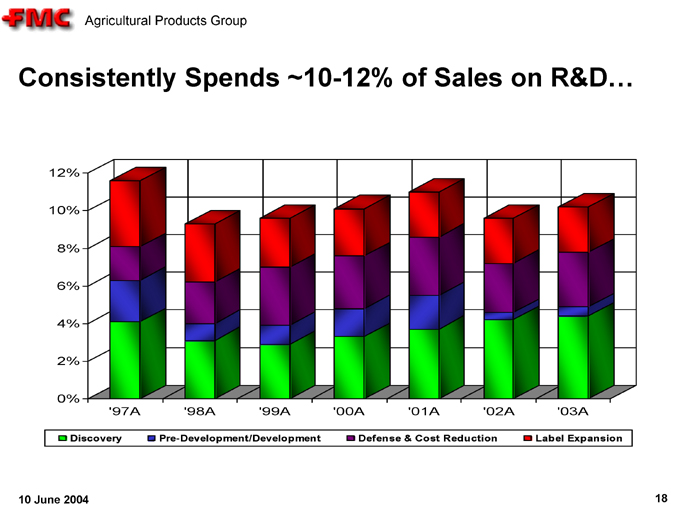

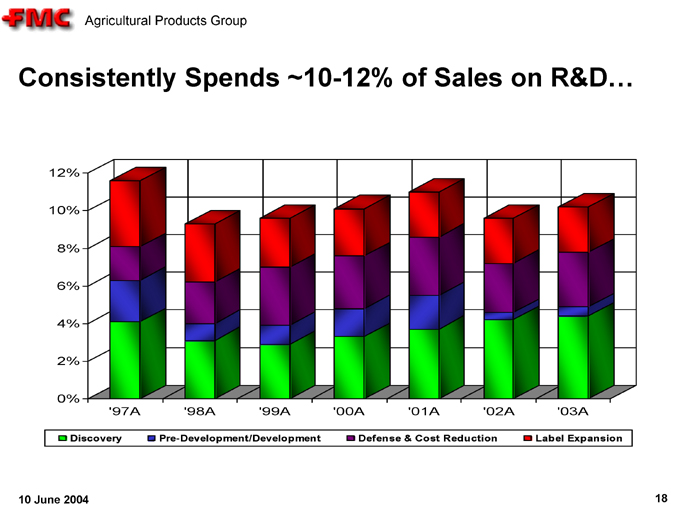

Consistently Spends ~10-12% of Sales on R&D…

12%

10%

8%

6%

4%

2%

0%

‘97A

‘98A

‘99A

‘00A

‘01A

‘02A

‘03A

Discovery Pre-Development/Development Defense & Cost Reduction Label Expansion

10 June 2004 18

Agricultural Products Group

The Insecticide Market…

10 June 2004 19

Agricultural Products Group

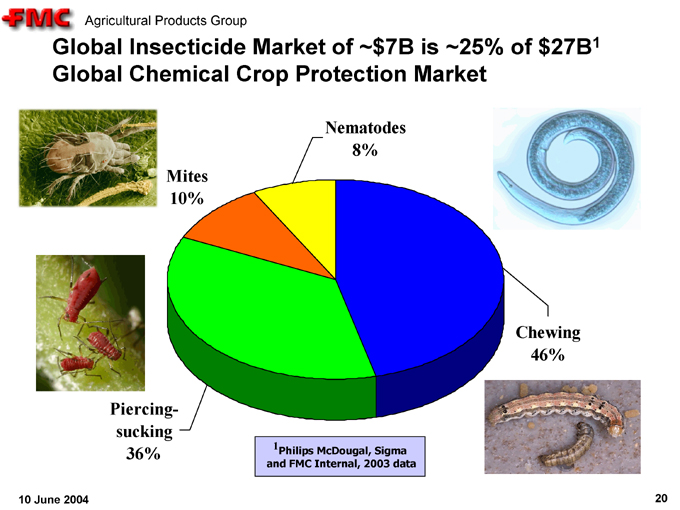

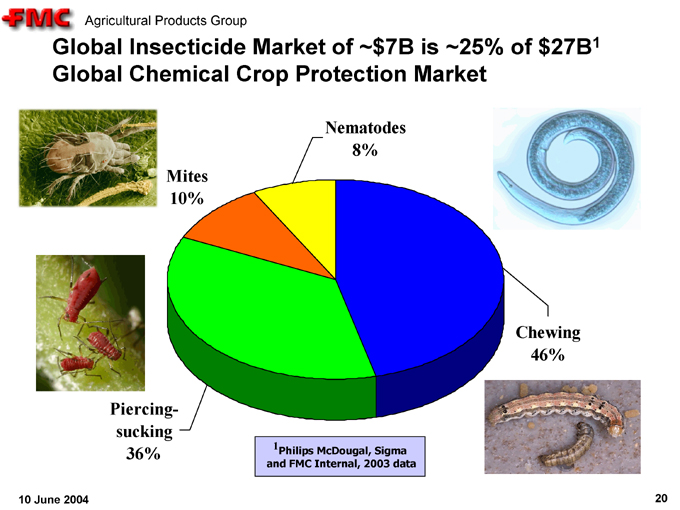

Global Insecticide Market of ~$7B is ~25% of $27B1 Global Chemical Crop Protection Market

Mites 10%

Piercing-sucking 36%

Nematodes 8%

Chewing 46%

1Philips McDougal, Sigma and FMC Internal, 2003 data

10 June 2004 20

Agricultural Products Group

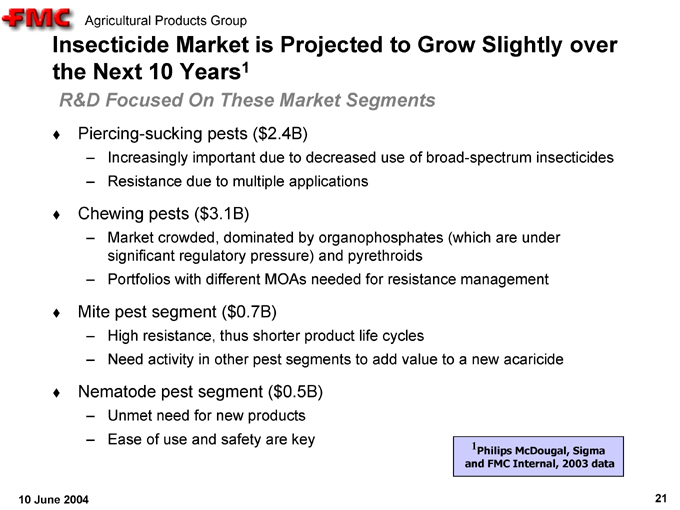

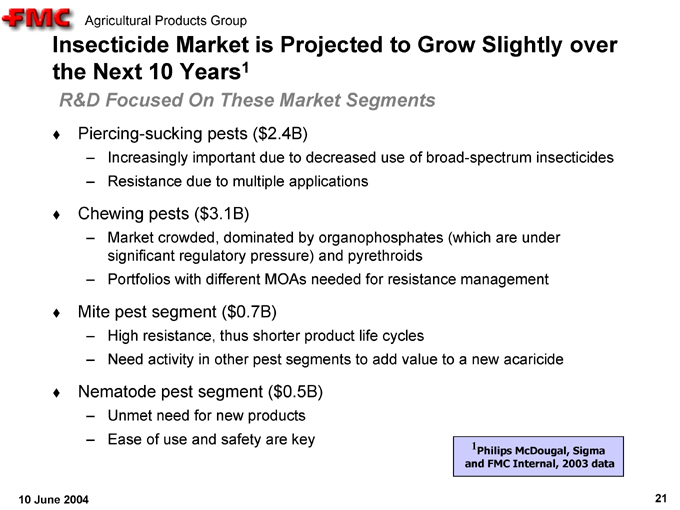

Insecticide Market is Projected to Grow Slightly over the Next 10 Years1

R&D Focused On These Market Segments

Piercing-sucking pests ($2.4B)

Increasingly important due to decreased use of broad-spectrum insecticides

Resistance due to multiple applications

Chewing pests ($3.1B)

Market crowded, dominated by organophosphates (which are under significant regulatory pressure) and pyrethroids

Portfolios with different MOAs needed for resistance management

?Mite pest segment ($0.7B)

High resistance, thus shorter product life cycles

Need activity in other pest segments to add value to a new acaricide

Nematode pest segment ($0.5B)

Unmet need for new products

Ease of use and safety are key

1Philips McDougal, Sigma and FMC Internal, 2003 data

10 June 2004 21

Agricultural Products Group

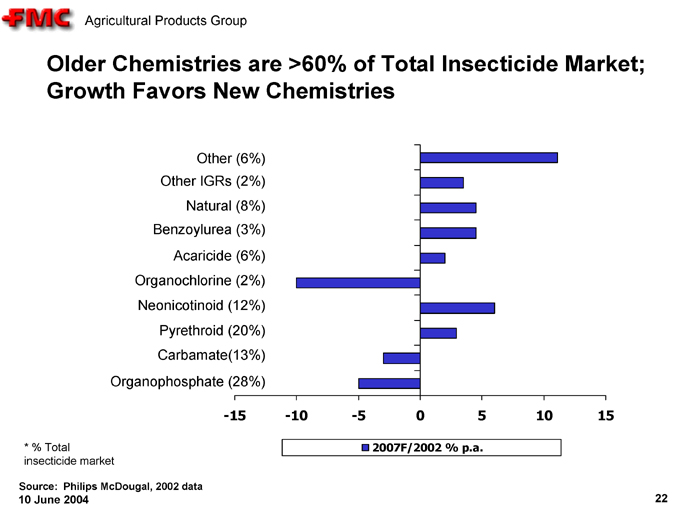

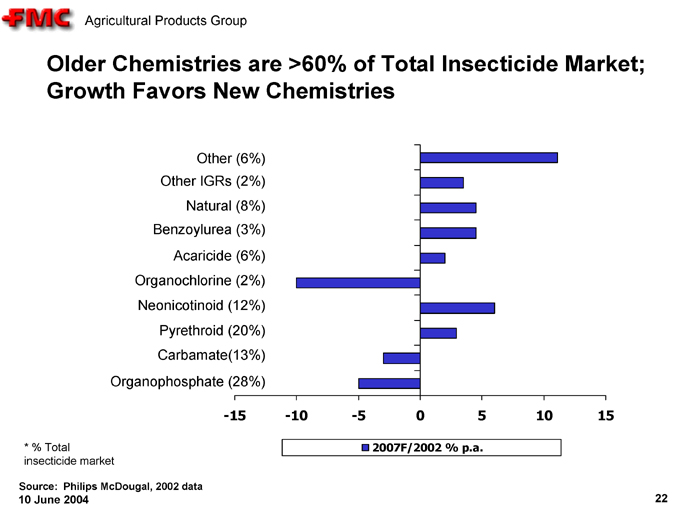

Older Chemistries are >60% of Total Insecticide Market; Growth Favors New Chemistries

Other (6%)

Other IGRs (2%)

Natural (8%)

Benzoylurea (3%)

Acaricide (6%)

Organochlorine (2%)

Neonicotinoid (12%)

Pyrethroid (20%)

Carbamate(13%)

Organophosphate (28%)

-15

-10

-5

0

5

10

15

* % Total insecticide market

2007F/2002 % p.a.

Source: Philips McDougal, 2002 data

10 June 2004 22

Agricultural Products Group

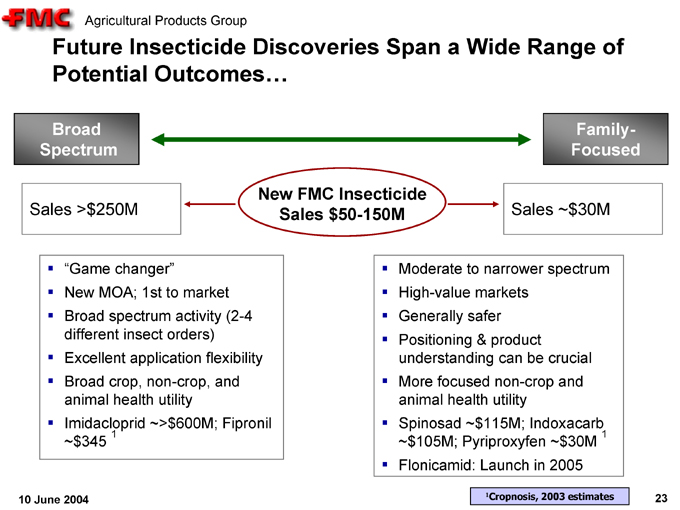

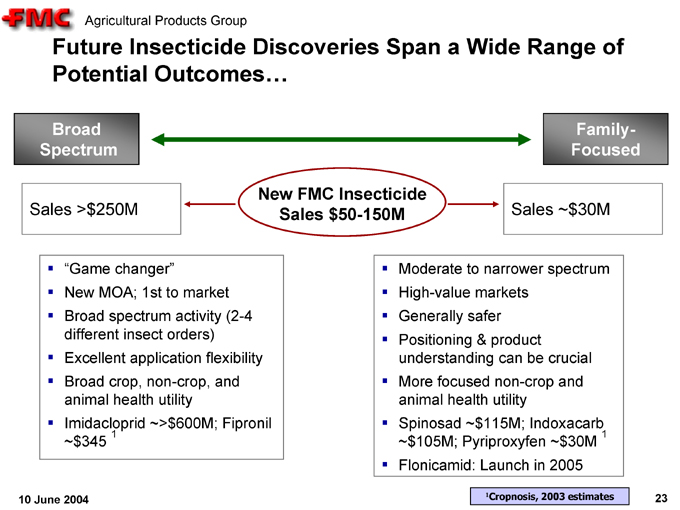

Future Insecticide Discoveries Span a Wide Range of Potential Outcomes…

Broad Spectrum

Family-Focused

Sales >$250M

New FMC Insecticide Sales $50-150M

Sales ~$30M

“Game changer” ?

New MOA; 1st to market

?Broad spectrum activity (2-4 different insect orders) ?

Excellent application flexibility ?Broad crop, non-crop, and animal health utility

?Imidacloprid ~>$600M; Fipronil

~$ 345 1

Moderate to narrower spectrum

High-value markets

Generally safer

Positioning & product understanding can be crucial

More focused non-crop and animal health utility

Spinosad ~$115M; Indoxacarb ~$105M; Pyriproxyfen ~$30M 1

Flonicamid: Launch in 2005

10 June 2004 1Cropnosis, 2003 estimates 23

Agricultural Products Group

The Market – Implications & Conclusions

Increasing populations, changing dietary habits of majority of the world’s population, restricted growth of arable land are likely to drive need for increased agricultural productivity;

Older products likely to decline due to resistance and regulatory pressures at the expense of newer, safer products;

New chemistries with different Mechanism of Action (MOA) needed and valued for resistance management;

The insecticide market potential likely to be in replacement markets and new uses that include unique pest or product combinations;

GMOs remain a limited threat to high-value crop and specialty markets:

Prophylactic treatments on row crops the main target of GMO input traits, and majority of the impact on row crops has already occurred;

New opportunities will arise as pest spectrums shift due to GMO, and we move to protecting crops with valuable output traits;

APG’s key focus areas are global high-value crops and non-crop Specialty markets

10 June 2004 24

Agricultural Products Group

Our People…

World-Class Scientists State-of-the-Art Technologies

An Organization Passionate and Motivated about Discovering Novel Insecticides

10 June 2004 25

Agricultural Products Group

Discovery Process and Technology…

10 June 2004 26

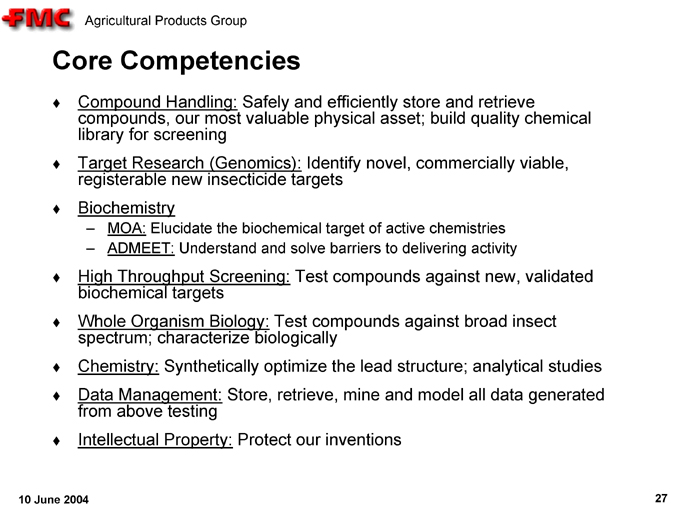

Agricultural Products Group

Core Competencies

Compound Handling: Safely and efficiently store and retrieve compounds, our most valuable physical asset; build quality chemical library for screening

Target Research (Genomics): Identify novel, commercially viable, registerable new insecticide targets

Biochemistry

MOA: Elucidate the biochemical target of active chemistries

ADMEET: Understand and solve barriers to delivering activity

High Throughput Screening: Test compounds against new, validated biochemical targets

Whole Organism Biology: Test compounds against broad insect spectrum; characterize biologically

Chemistry: Synthetically optimize the lead structure; analytical studies

Data Management: Store, retrieve, mine and model all data generated from above testing

Intellectual Property: Protect our inventions

10 June 2004 27

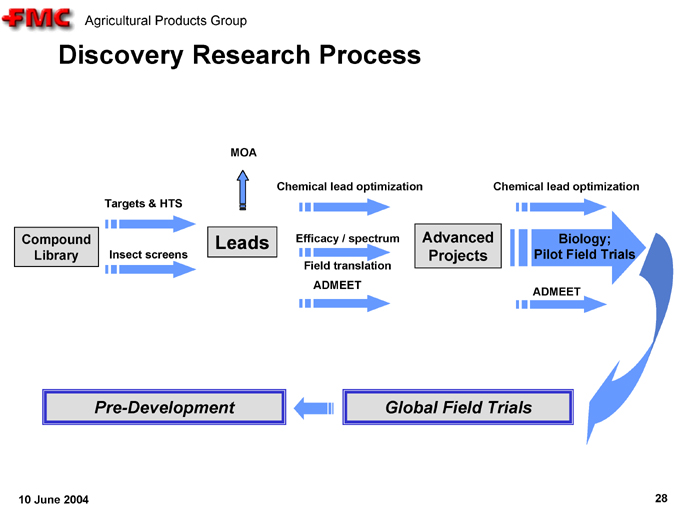

Agricultural Products Group

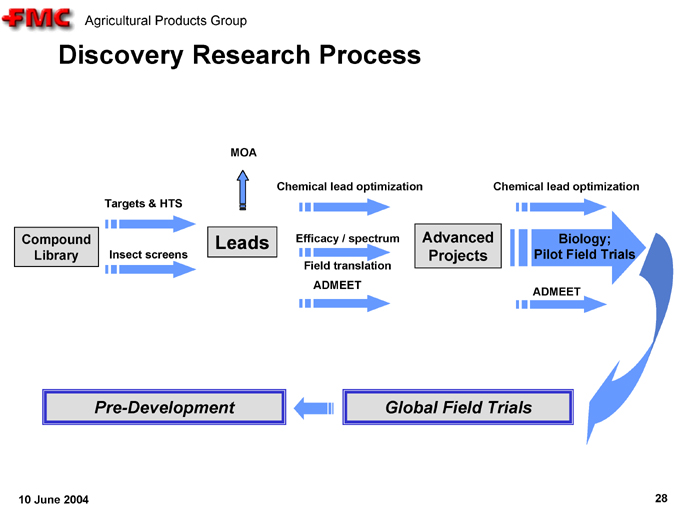

Discovery Research Process

Compound Library

Targets & HTS

Insect screens

Leads

MOA

Chemical lead optimization

Efficacy / spectrum

Field translation ADMEET

Advanced Projects

Chemical lead optimization

Biology; Pilot Field Trials

Global Field Trials

Pre-Development

ADMEET

10 June 2004 28

Agricultural Products Group

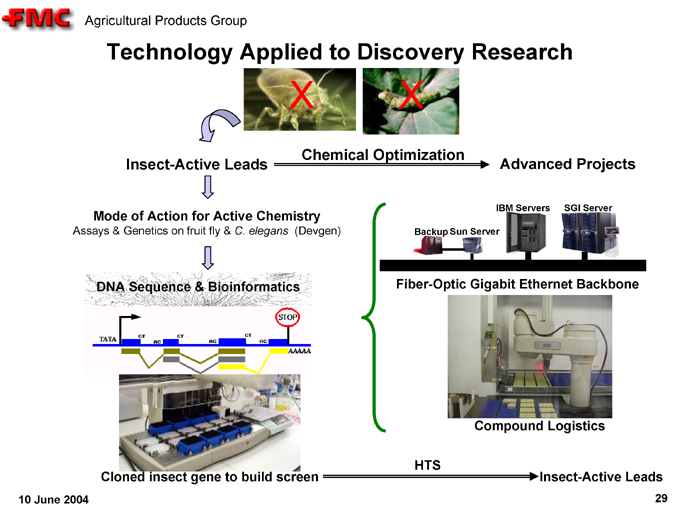

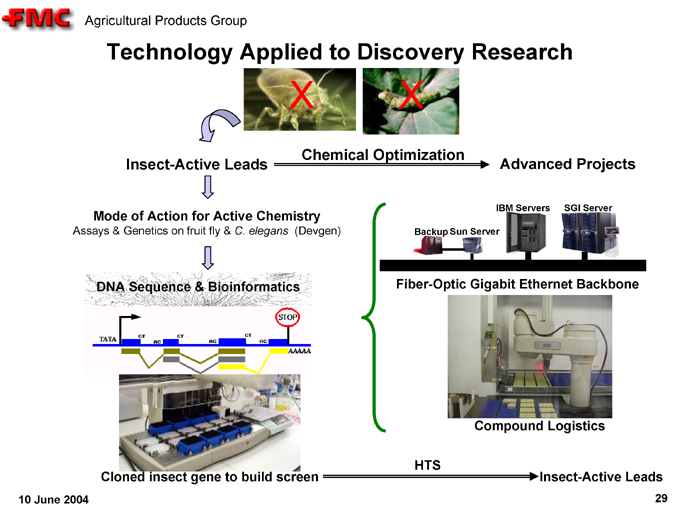

Technology Applied to Discovery Research

Chemical Optimization

Insect-Active Leads

Advanced Projects

Mode of Action for Active Chemistry

Assays & Genetics on fruit fly & C. elegans (Devgen)

DNA Sequence & Bioinformatics

Compound Logistics

Fiber-Optic Gigabit Ethernet Backbone

Backup Sun Server

IBM Servers

SGI Server

Cloned insect gene to build screen

HTS

Insect-Active Leads

10 June 2004 29

Agricultural Products Group

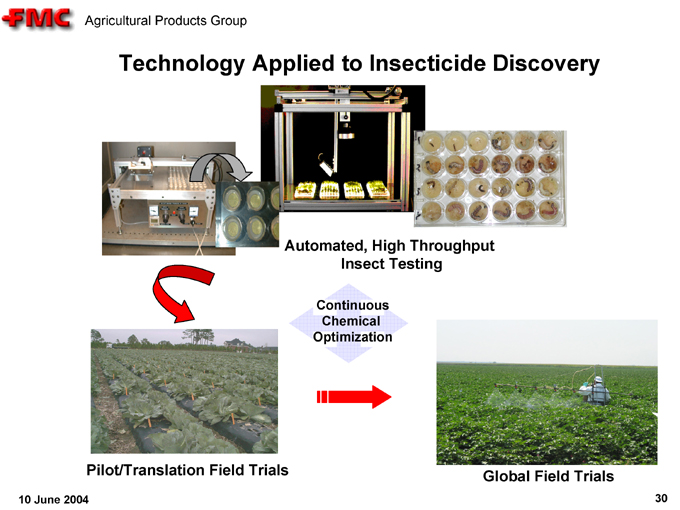

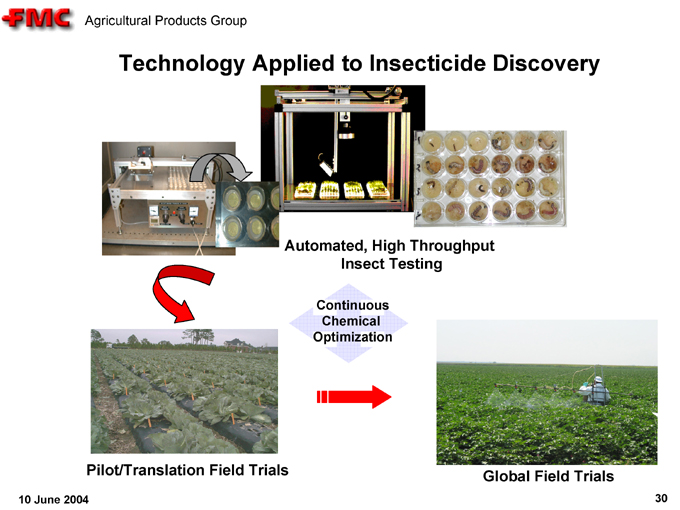

Technology Applied to Insecticide Discovery

Automated, High Throughput Insect Testing

Pilot/Translation Field Trials

Continuous Chemical Optimization

Global Field Trials

10 June 2004 30

Agricultural Products Group

Development Capabilities…

10 June 2004 31

Agricultural Products Group

We Have a Full Complement of Development Capabilities, Technology and Scientific Expertise

Analytical Sciences

Formulations

Residue/Environmental Fate/Metabolism

Toxicology/Ecotoxicology/Risk Assessment

Product Understanding

Process Chemistry & Engineering

Quality Assurance

Global Regulatory

Internationally recognized scientific experts

Globally staffed with facilities in USA, South America, Europe, and Asia

Experienced in conducting studies in compliance with regulatory guidelines to support registration, re-registration, label expansion, and product defense

Excellent relationship with leading regulatory agencies

In-house risk assessment capability (occupational, residential, dietary, ecotox, probabilistic RA)

10 June 2004 32

Agricultural Products Group

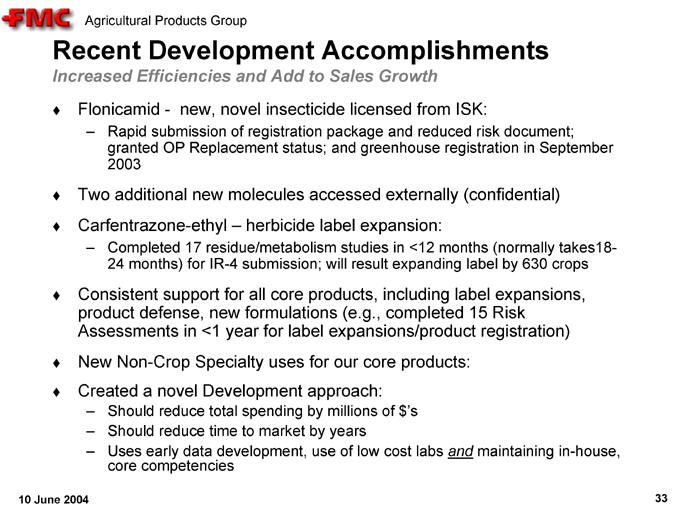

Recent Development Accomplishments

Increased Efficiencies and Add to Sales Growth

Flonicamid—new, novel insecticide licensed from ISK:

Rapid submission of registration package and reduced risk document; granted OP Replacement status; and greenhouse registration in September 2003

Two additional new molecules accessed externally (confidential) Carfentrazone-ethyl – herbicide label expansion:

Completed 17 residue/metabolism studies in <12 months (normally takes18-24 months) for IR-4 submission; will result expanding label by 630 crops

Consistent support for all core products, including label expansions, product defense, new formulations (e.g., completed 15 Risk Assessments in <1 year for label expansions/product registration) New Non-Crop Specialty uses for our core products: Created a novel Development approach:

Should reduce total spending by millions of $’s

Should reduce time to market by years

Uses early data development, use of low cost labs and maintaining in-house, core competencies

10 June 2004 33

Agricultural Products Group

Success in Discovery, a Robust Pipeline…

10 June 2004 34

Agricultural Products Group

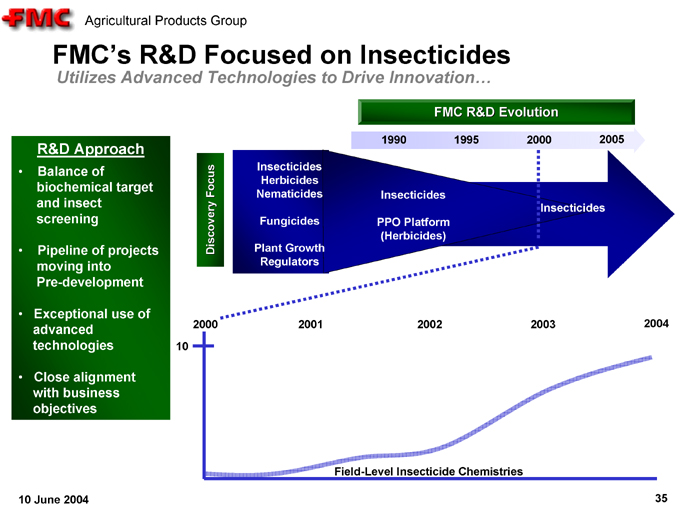

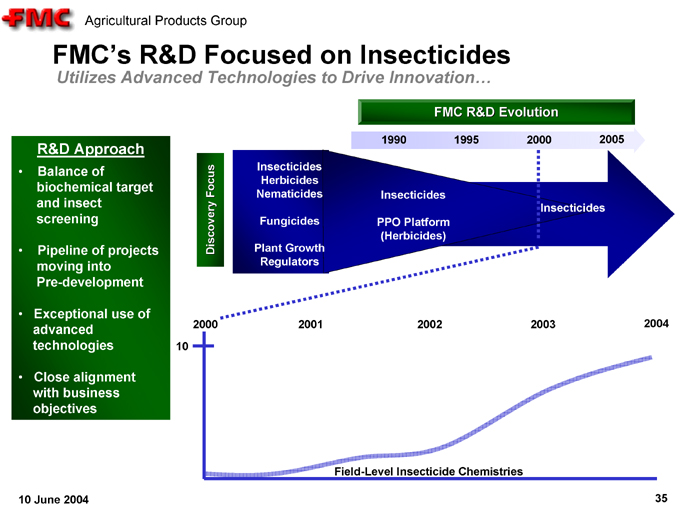

FMC’s R&D Focused on Insecticides

Utilizes Advanced Technologies to Drive Innovation…

R&D Approach

Balance of biochemical target and insect screening

Pipeline of projects moving into Pre-development

Exceptional use of advanced technologies

Close alignment with business objectives

FMC R&D Evolution

1990 1995 2000 2005

Discovery Focus

Insecticides Herbicides Nematicides

Fungicides

Plant Growth Regulators

Insecticides

PPO Platform (Herbicides)

Insecticides

2000 2001 2002 2003 2004

10

Field-Level Insecticide Chemistries

10 June 2004 35

Agricultural Products Group

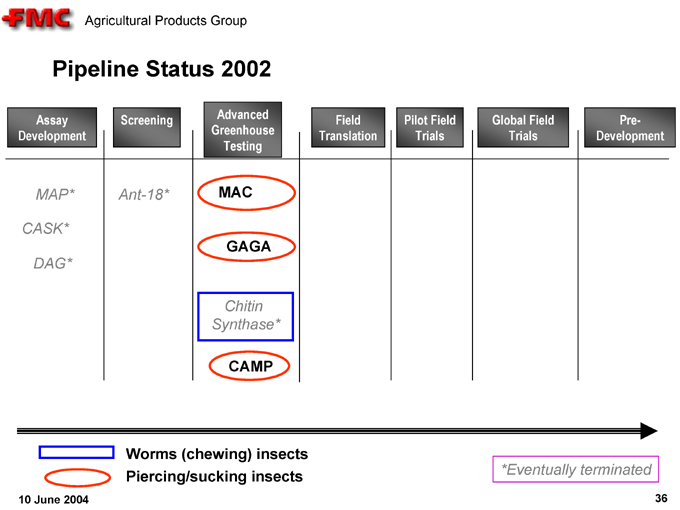

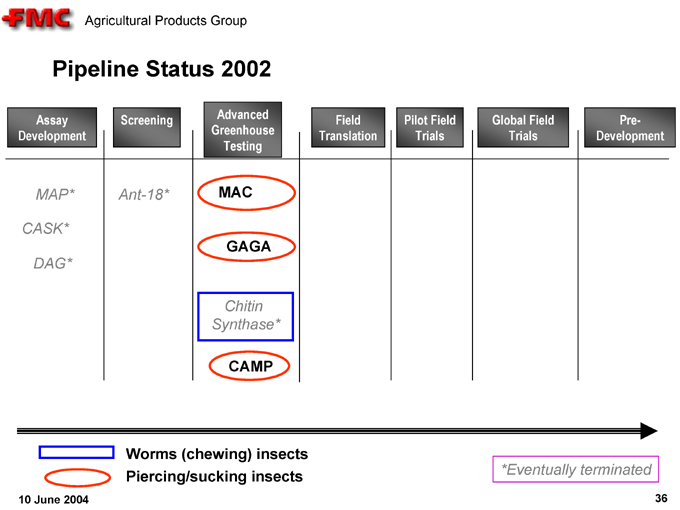

Pipeline Status 2002

Assay Screening Advanced Field Pilot Field Global Field Pre-

Development Greenhouse Translation Trials Trials Development

Testing

MAP* Ant-18* MAC

CASK*

GAGA

DAG*

Chitin

Synthase*

CAMP

Worms (chewing) insects Piercing/sucking insects

*Eventually terminated

10 June 2004 36

Agricultural Products Group

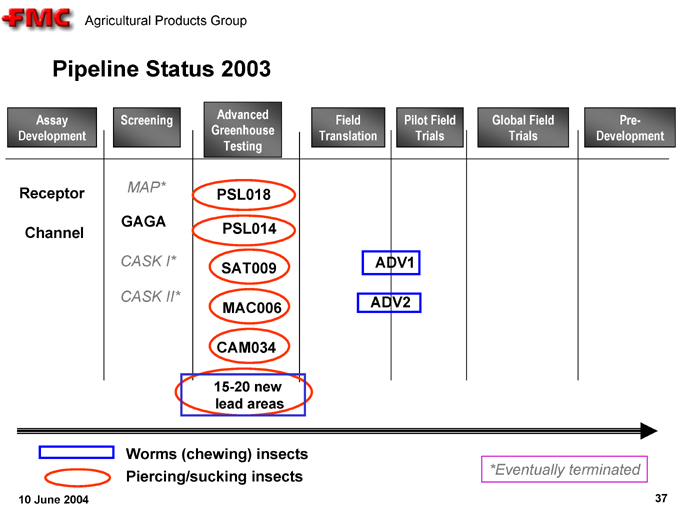

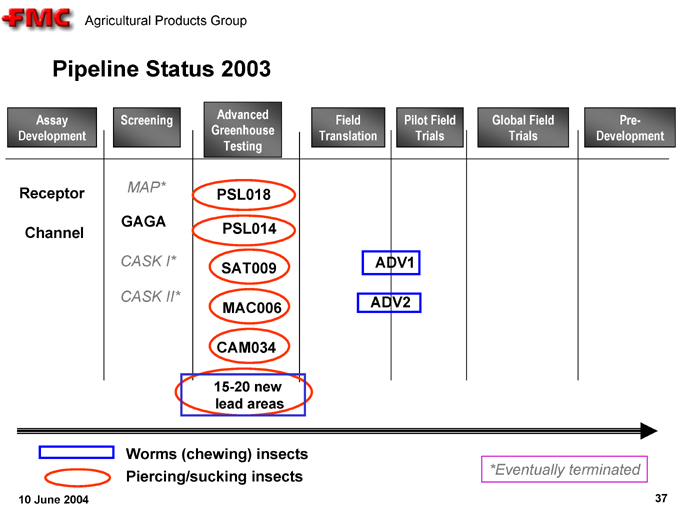

Pipeline Status 2003

Assay Screening Advanced Field Pilot Field Global Field Pre-

Development Greenhouse Translation Trials Trials Development

Testing

Receptor MAP*

PSL018

GAGA

Channel PSL014

CASK I* ADV1

SAT009

CASK II* ADV2

MAC006

CAM034

15-20 new lead areas

Worms (chewing) insects Piercing/sucking insects

*Eventually terminated

10 June 2004 37

Agricultural Products Group

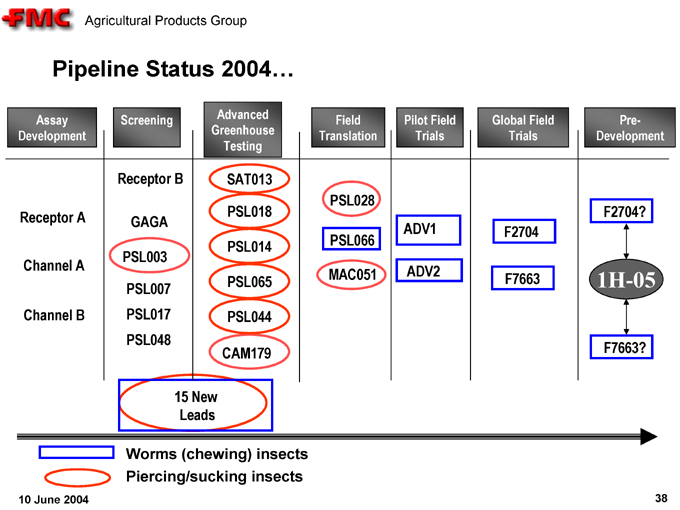

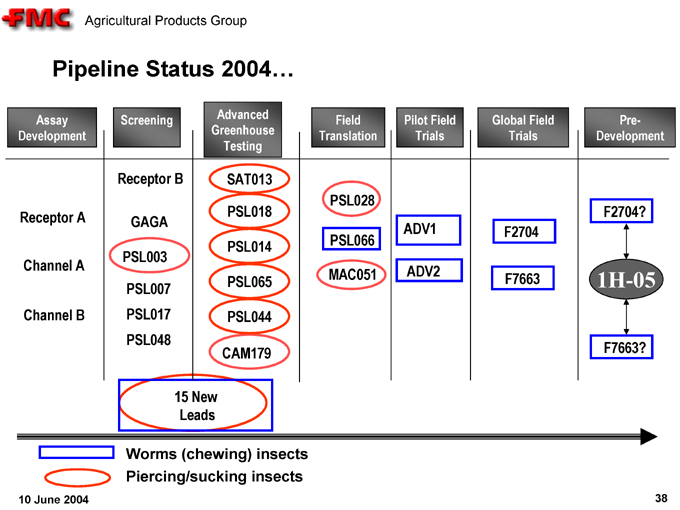

Pipeline Status 2004…

Assay Screening Advanced Field Pilot Field Global Field Pre-

Development Greenhouse Translation Trials Trials Development

Testing

Receptor B SAT013

PSL028

Receptor A PSL018 F2704?

GAGA ADV1

F2704

PSL014 PSL066

PSL003

Channel A ADV2

MAC051 F7663

PSL007 PSL065 1H-05

Channel B PSL017 PSL044

PSL048

CAM179 F7663?

15 New Leads

Worms (chewing) insects Piercing/sucking insects

10 June 2004 38

Agricultural Products Group

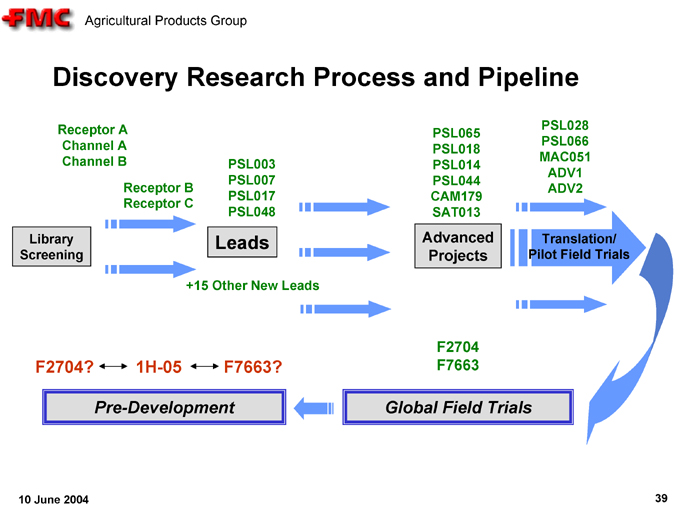

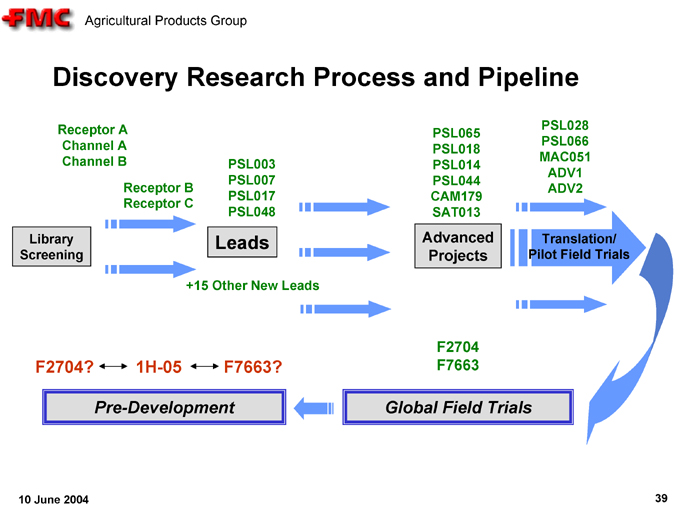

Discovery Research Process and Pipeline

Receptor A Channel A Channel B

Receptor B

Receptor C

PSL003

PSL007

PSL017

PSL048

PSL065

PSL018

PSL014

PSL044

CAM179

SAT013

PSL028

PSL066

MAC051

ADV1

ADV2

Library Screening

Leads

Advanced Projects

Translation/Pilot Field Trials

+15 Other New Leads

F2704? 1H-05 F7663?

Pre-Development

F2704

F7663

Global Field Trials

10 June 2004 39

Agricultural Products Group

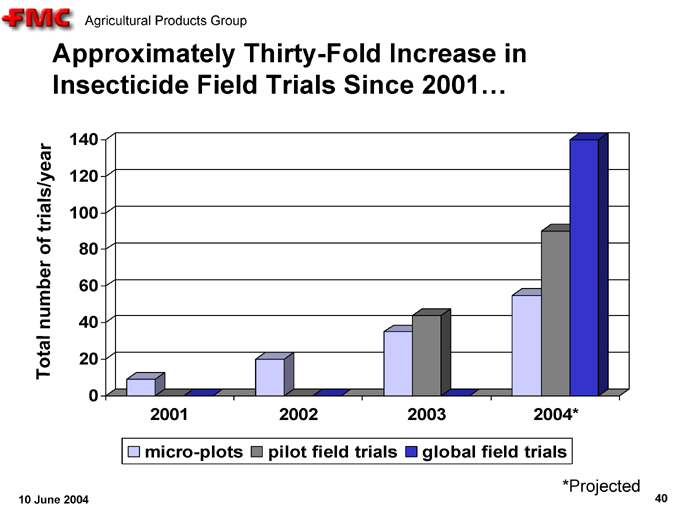

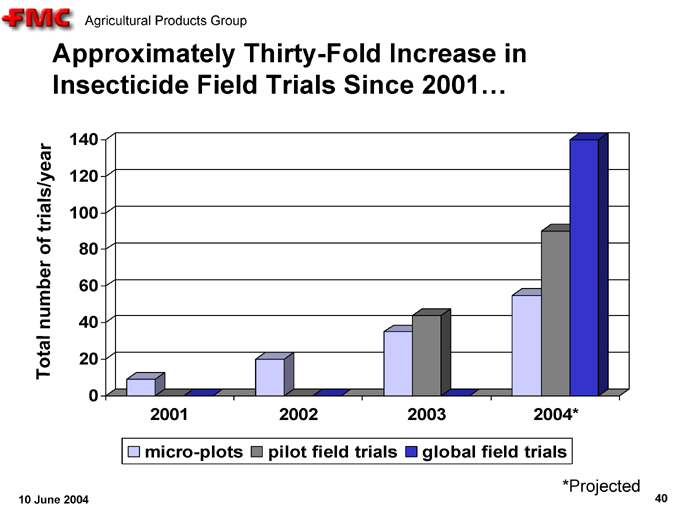

Approximately Thirty-Fold Increase in Insecticide Field Trials Since 2001…

Total number of trials/year

140

120

100

80

60

40

20

0

2001

2002

2003

2004*

micro-plots pilot field trials global field trials

*Projected

10 June 2004 40

Agricultural Products Group

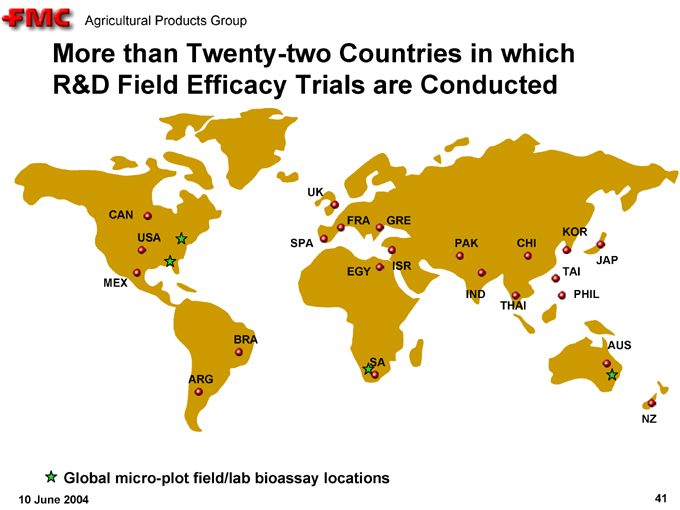

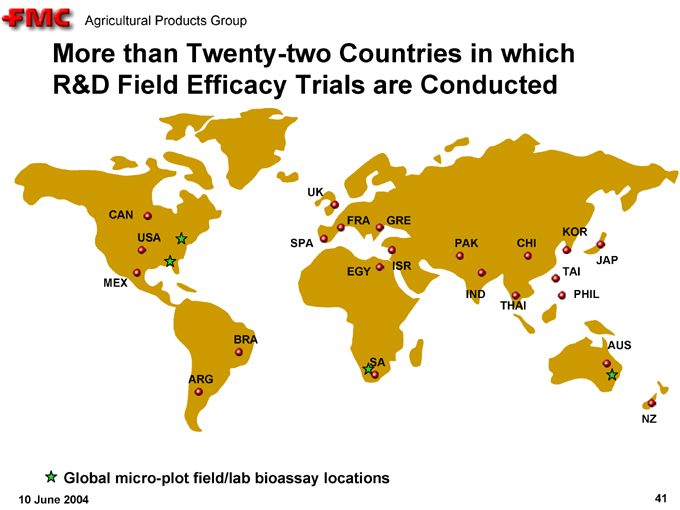

More than Twenty-two Countries in which R&D Field Efficacy Trials are Conducted

CAN

USA

MEX

BRA

ARG

SPA

UK

FRA

GRE

EGY

ISR

PAK

IND

CHI

KOR

TAI

JAP

THAI

PHIL

SA

AUS

NZ

Global micro-plot field/lab bioassay locations

10 June 2004 41

Agricultural Products Group

A Full, Sustainable Pipeline, State of the Art Technology, and World-Class Scientific Talent…

10 June 2004 42

Agricultural Products Group

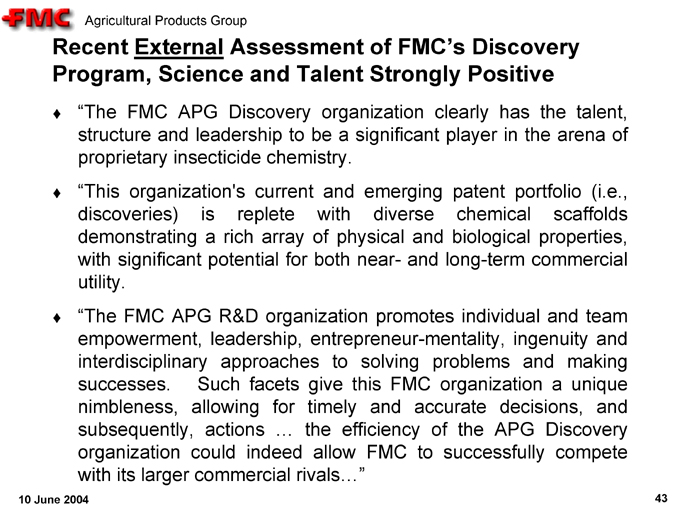

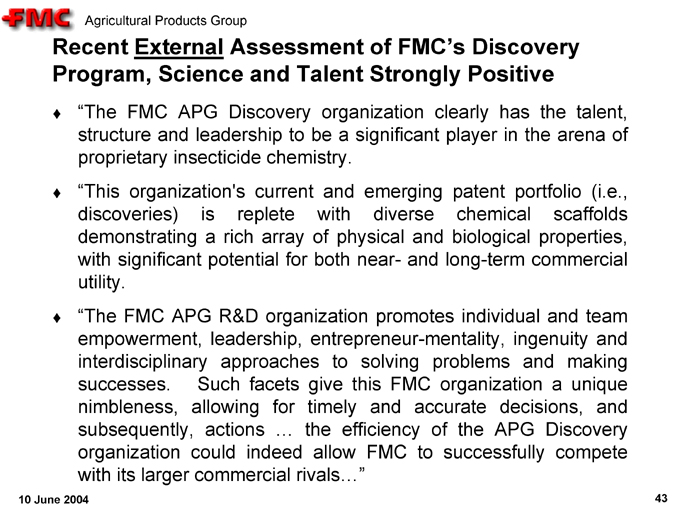

Recent External Assessment of FMC’s Discovery Program, Science and Talent Strongly Positive

“The FMC APG Discovery organization clearly has the talent, structure and leadership to be a significant player in the arena of proprietary insecticide chemistry.

“This organization’s current and emerging patent portfolio (i.e., discoveries) is replete with diverse chemical scaffolds demonstrating a rich array of physical and biological properties, with significant potential for both near- and long-term commercial utility.

“The FMC APG R&D organization promotes individual and team empowerment, leadership, entrepreneur-mentality, ingenuity and interdisciplinary approaches to solving problems and making successes. Such facets give this FMC organization a unique nimbleness, allowing for timely and accurate decisions, and subsequently, actions … the efficiency of the APG Discovery organization could indeed allow FMC to successfully compete with its larger commercial rivals…”

10 June 2004 43

Agricultural Products Group

In Summary…

Our pipeline is full and sustainable, from early stage leads to pre-development; recently validated by an external expert In 2004, we are conducting:

– 150 full-scale global field trials on 2 new products from two different areas of chemistry;

– 100 small plot pilot trials on 3-4 compounds, all from different chemistries;

– >50 early translation trials on 6-8 different areas of chemistry

Based on the progress we have made in discovering novel new insecticides and the extent of our current pipeline, we believe that our continued efforts should result in the commercialization of 2-4 novel insecticides over the next ~10 years We have created a new product Development strategy that can potentially reduce development costs by millions of dollars and time to commercialization by years

10 June 2004 44

Agricultural Products Group

Q & A…

10 June 2004 45

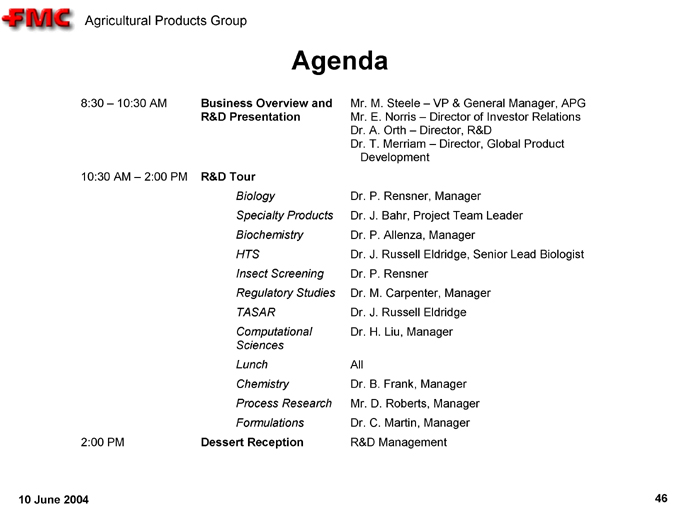

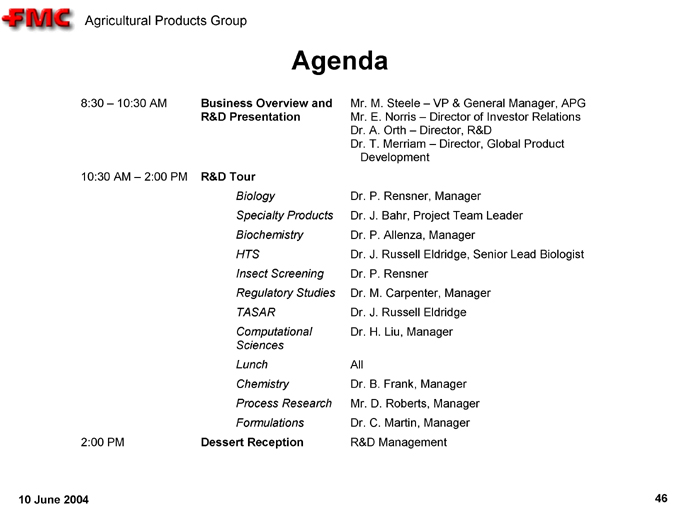

Agricultural Products Group

Agenda

8:30 – 10:30 AM Business Overview and Mr. M. Steele – VP & General Manager, APG

R&D Presentation Mr. E. Norris – Director of Investor Relations

Dr. A. Orth – Director, R&D

Dr. T. Merriam – Director, Global Product

Development

10:30 AM – 2:00 PM R&D Tour

Biology Dr. P. Rensner, Manager

Specialty Products Dr. J. Bahr, Project Team Leader

Biochemistry Dr. P. Allenza, Manager

HTS Dr. J. Russell Eldridge, Senior Lead Biologist

Insect Screening Dr. P. Rensner

Regulatory Studies Dr. M. Carpenter, Manager

TASAR Dr. J. Russell Eldridge

Computational Dr. H. Liu, Manager

Sciences

Lunch All

Chemistry Dr. B. Frank, Manager

Process Research Mr. D. Roberts, Manager

Formulations Dr. C. Martin, Manager

2:00 PM Dessert Reception R&D Management

10 June 2004 46