Exhibit 99.1

Exhibit 99.1

FMC Corporation

First Annual Chemical Industry Conference

The Chemical Heritage Foundation

June 22, 2004

W. Kim Foster

Senior Vice President and CFO

Disclaimer

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995

These slides and the accompanying presentation contain “forward-looking statements” that represent management’s best judgment as of the date hereof based on information currently available. Actual results of the Company may differ materially from those contained in the forward-looking statements.

Additional information concerning factors that may cause results to differ materially from those in the forward-looking statements is contained in the Company’s periodic reports filed under the Securities Exchange Act of 1934, as amended.

The Company undertakes no obligation to update or revise these forward-looking statements to reflect new events or uncertainties.

1

Use of Non-GAAP Terms

These slides contain certain “non-GAAP financial terms” which are defined below and on FMC’s Investor Relations web site (http://ir.fmc.com) in the Glossary of Financial Terms section. In addition, in the Conference Calls and Presentations section of the web site, we have provided reconciliations of non-GAAP terms to the closest GAAP term. Lastly, these slides contain references to segment financial items which are presented in detail in Note 19 of FMC’s 2003 Form 10-K.

EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) is the sum of Income (loss) from continuing operations before income taxes and cumulative effect of change in accounting principle and Depreciation and Amortization.

EBITDA Margin is the quotient of EBITDA (defined above) and Revenue.

ROIC (Return on Invested Capital) is the sum of Earnings from continuing operations before restructuring and other charges (gains) and after-tax Interest expense divided by the sum of Short-term debt, Current portion of long-term debt, Long-term debt and Total shareholders’ equity.

2

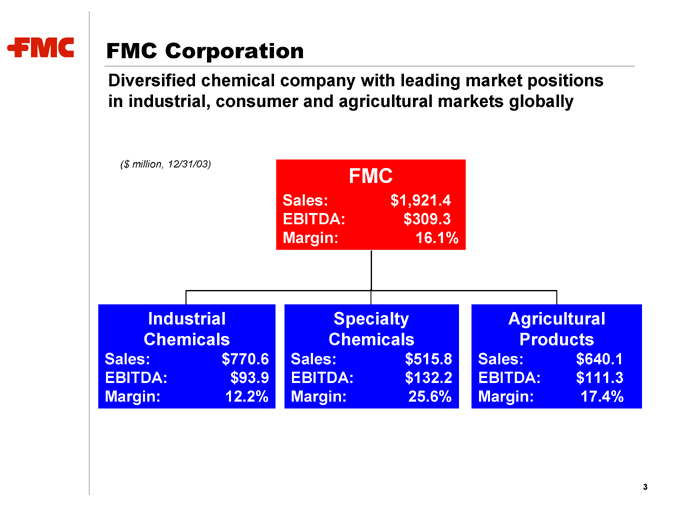

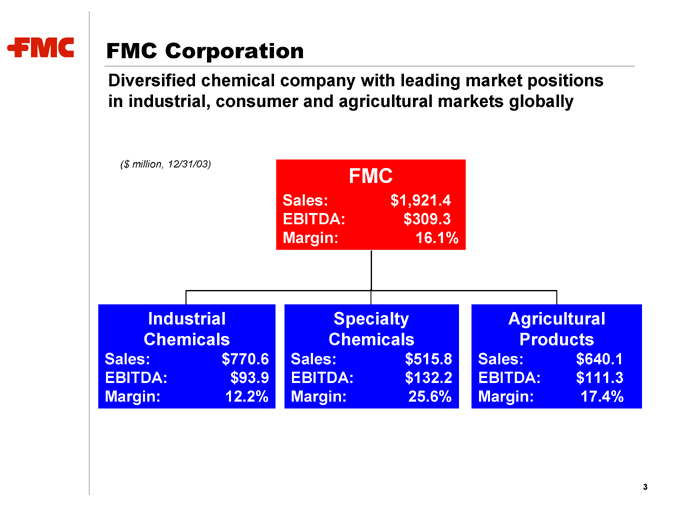

FMC Corporation

Diversified chemical company with leading market positions in industrial, consumer and agricultural markets globally

($ million, 12/31/03)

FMC

Sales: $1,921.4

EBITDA: $309.3

Margin: 16.1%

Industrial Chemicals

Sales: $770.6

EBITDA: $93.9

Margin: 12.2%

Specialty Chemicals

Sales: $515.8

EBITDA: $132.2

Margin: 25.6%

Agricultural Products

Sales: $640.1

EBITDA: $111.3

Margin: 17.4%

3

FMC Strengths

Leading market positions

Global presence

Diversified business mix and high-quality customer base

Diversified and integrated cost structure

Focused R&D and strong applications expertise

Proven management with extensive industry experience

4

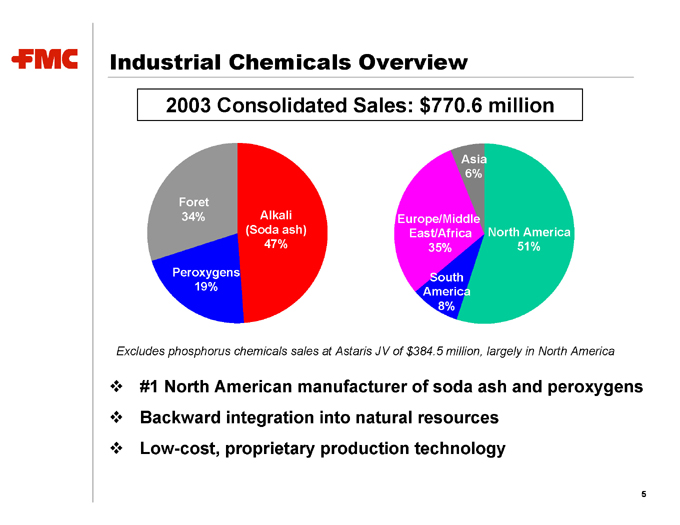

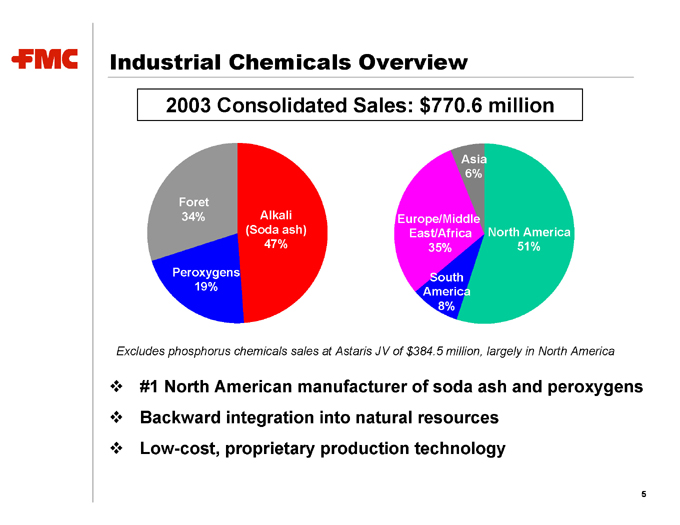

Industrial Chemicals Overview

2003 Consolidated Sales: $770.6 million

Foret 34%

Peroxygens 19%

Alkali (Soda ash) 47%

Asia 6%

Europe/Middle East/Africa 35%

South America 8%

North America 51%

Excludes phosphorus chemicals sales at Astaris JV of $384.5 million, largely in North America

#1 North American manufacturer of soda ash and peroxygens

Backward integration into natural resources

Low-cost, proprietary production technology

5

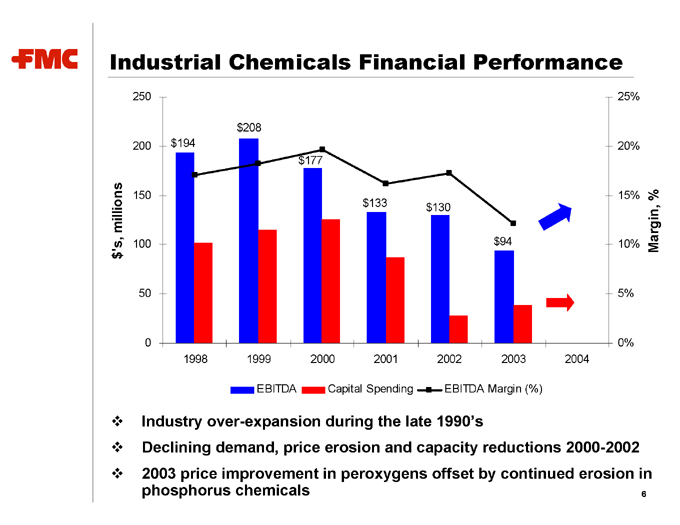

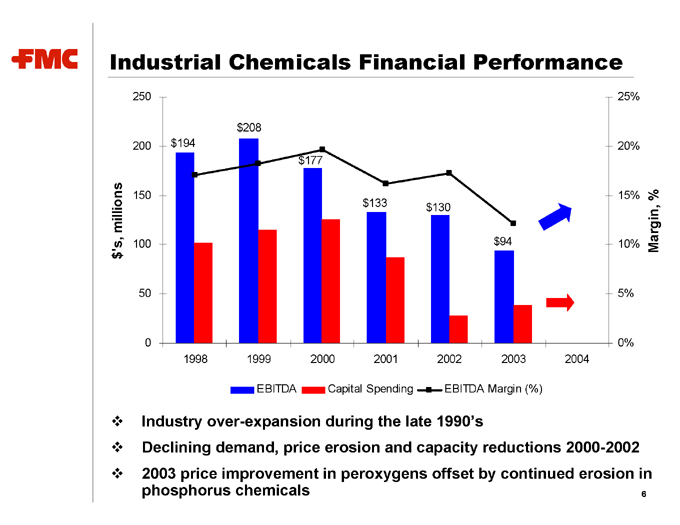

Industrial Chemicals Financial Performance

$’s, millions

250 200 150 100 50 0

Margin, %

25% 20% 15% 10% 5% 0%

1998 1999 2000 2001 2002 2003 2004

EBITDA

Capital Spending

EBITDA Margin (%)

$194 $208 $177 $133 $130 $94

Industry over-expansion during the late 1990’s

Declining demand, price erosion and capacity reductions 2000-2002

2003 price improvement in peroxygens offset by continued erosion in phosphorus chemicals

6

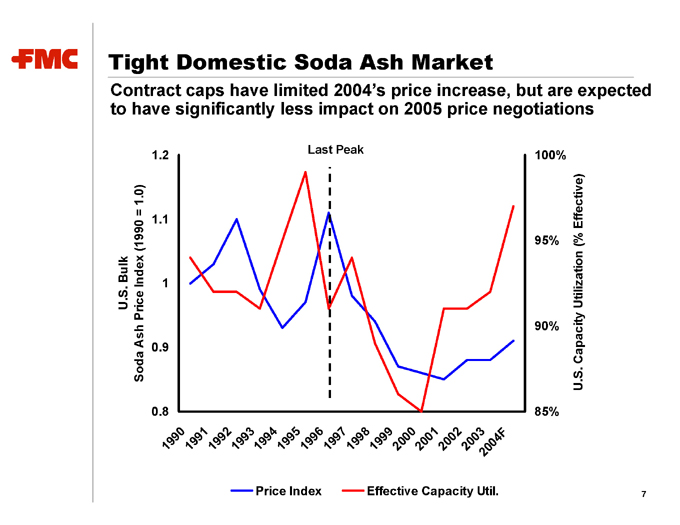

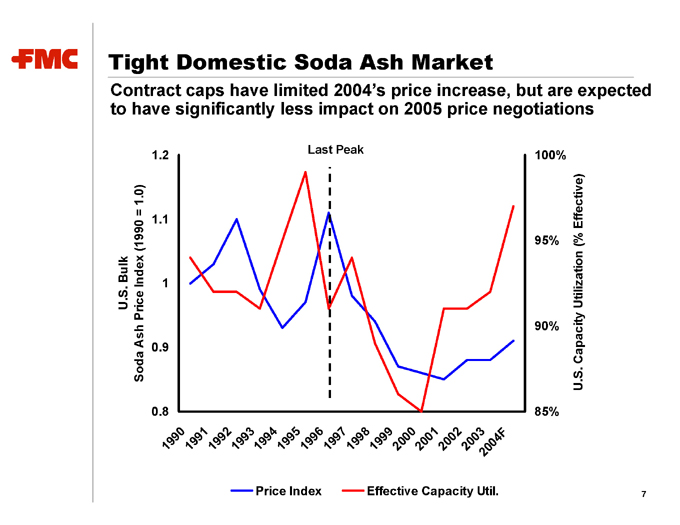

Tight Domestic Soda Ash Market

Contract caps have limited 2004’s price increase, but are expected to have significantly less impact on 2005 price negotiations

U.S. Bulk

Soda Ash Price Index (1990 = 1.0)

1.2 1.1 1 0.9 0.8

Last Peak

U.S. Capacity Utilization (% Effective)

100% 95% 90% 85%

1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004F

Price Index Effective Capacity Util.

7

Stabilizing Export Soda Ash Market

We expect the impact of excess Chinese capacity to be short-lived

Growth of the Chinese soda ash market

Demand of 11 million metric tons growing about 8-10 percent per year

Excess supply of 2 million metric tons can be readily absorbed

Domestic Chinese pricing is at or below many producers’ costs

There are 47 soda ash producers, the majority of which are small

With market pricing near $100 per ton, many may have to shut down

Higher costs are limiting Chinese soda ash production

Salt, a key ingredient in synthetic production, is in short supply

Energy costs, particularly coal, have escalated substantially

VAT drawback for exported soda ash has decreased

Ocean freight for soda ash exports has risen significantly

8

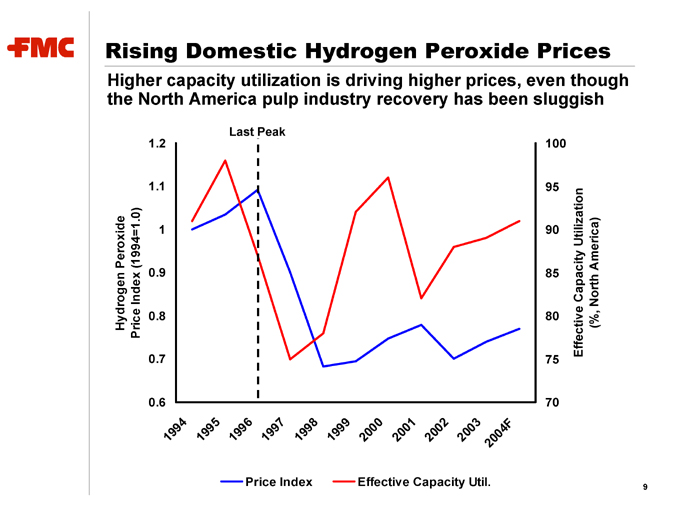

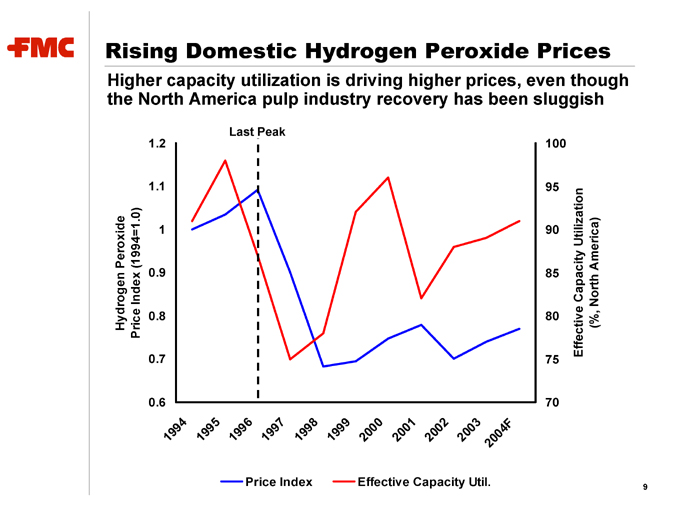

Rising Domestic Hydrogen Peroxide Prices

Higher capacity utilization is driving higher prices, even though the North America pulp industry recovery has been sluggish

Hydrogen Peroxide

Price Index (1994=1.0)

1.2 1.1 1 0.9 0.8 0.7 0.6

Last Peak

100 95 90 85 80 75 70

Effective Capacity Utilization

(%, North America)

1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004F

Price Index Effective Capacity Util.

9

Industrial Chemicals Improvement in Europe

Steady recovery across nearly all of Foret’s product lines

After a strong 2003, peroxygens expected to continue to grow

Hydrogen peroxide demand growth of 4% per year driven by strength of Scandinavian pulp industry

Peroxide price increase of 8% in 2003; another 5% expected during 2004

Phosphorus chemicals in a slow recovery driven by capacity reduction

Rhodia’s shutdown of Rouen STPP facility has improved industry capacity utilization

Foret has recovered STPP volume that was lost in 2002

Price recovery is beginning

10

Turnaround In Domestic Phosphorus

Significant restructuring at Astaris

Plant closures and product line transitions on schedule

Annualized savings of $40-50 million on track ($20-25 million for FMC)

North American market dynamics are improving

Astaris capacity reductions have tightened domestic supply

Strong euro has reduced import pressures from Europe

Chinese P4 supply has greatly subsided due to energy constraints

Broad-based price increases of 4-7 percent have been announced

De-leveraging and refinancing Astaris

Expectation of $40 million in 2004 keepwells, paid entirely in 1H ‘04, after which Astaris is expected to be debt free

Possible refinancing of Astaris in late 2004 or early 2005

11

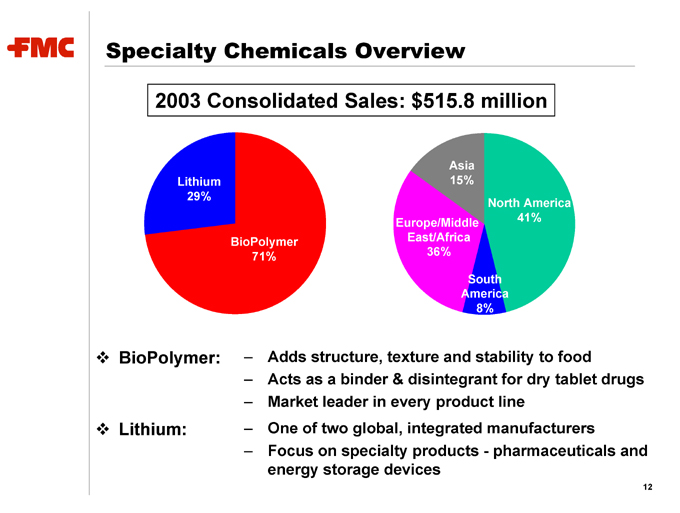

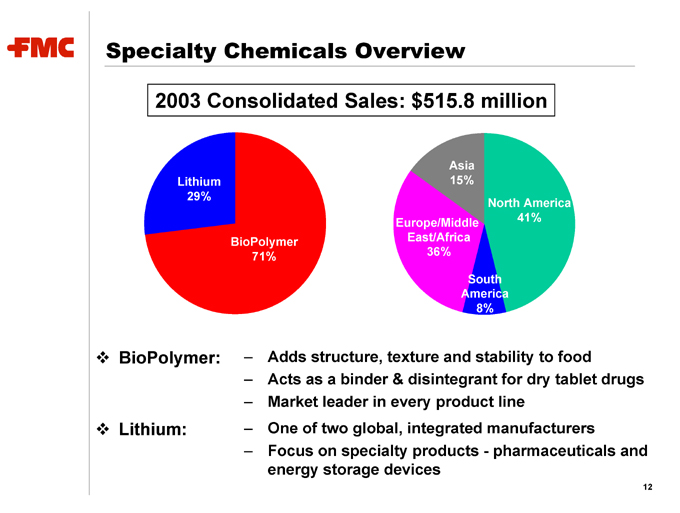

Specialty Chemicals Overview

2003 Consolidated Sales: $515.8 million

Lithium 29%

BioPolymer 71%

Asia 15%

Europe/Middle East/Africa 36%

South America 8%

North America 41%

BioPolymer:

Adds structure, texture and stability to food

Acts as a binder & disintegrant for dry tablet drugs

Market leader in every product line

Lithium:

One of two global, integrated manufacturers

Focus on specialty products—pharmaceuticals and energy storage devices

12

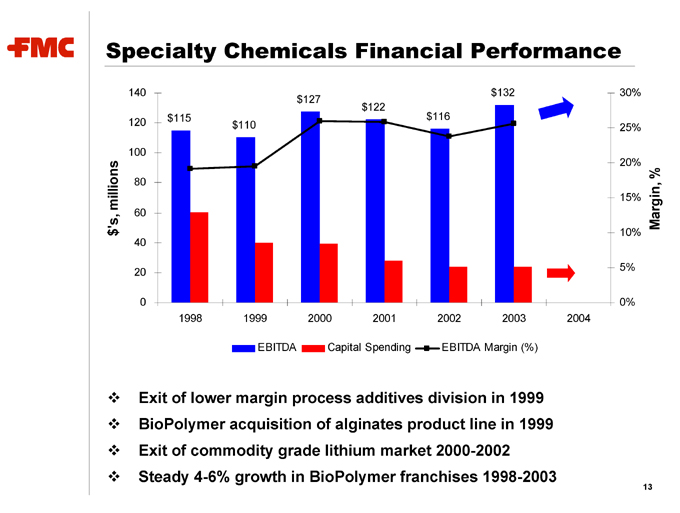

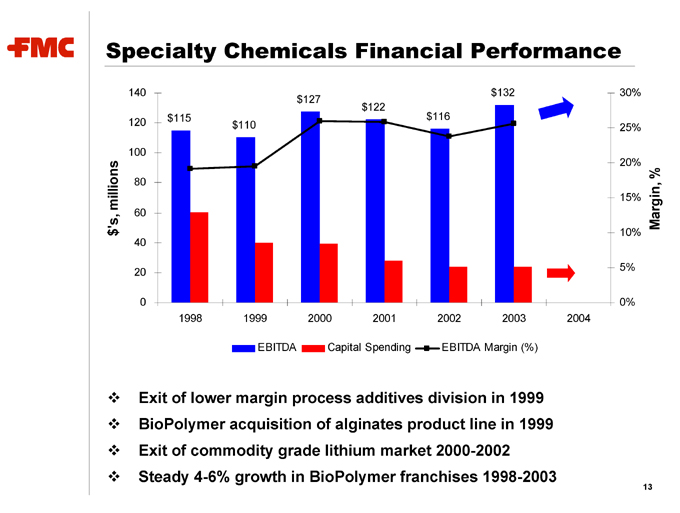

Specialty Chemicals Financial Performance

$’s, millions

140 120 100 80 60 40 20 0

30% 25% 20% 15% 10% 5% 0%

Margin, %

1998 1999 2000 2001 2002 2003 2004

EBITDA

Capital Spending

EBITDA Margin (%)

$115 $110 $127 $122 $116 $132

Exit of lower margin process additives division in 1999

BioPolymer acquisition of alginates product line in 1999

Exit of commodity grade lithium market 2000-2002

Steady 4-6% growth in BioPolymer franchises 1998-2003

13

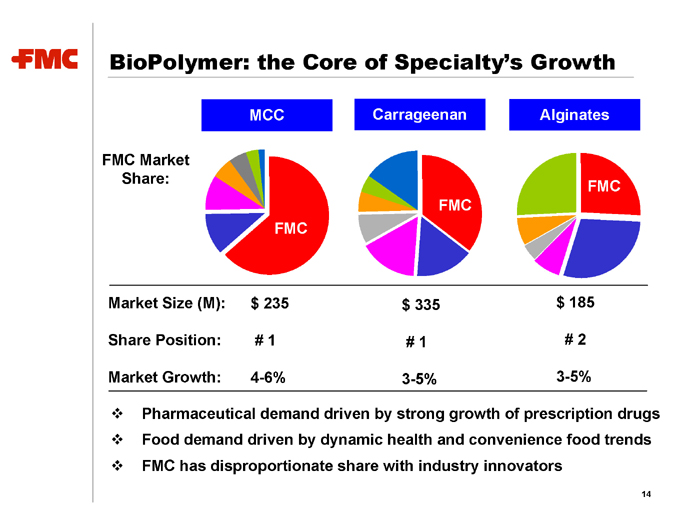

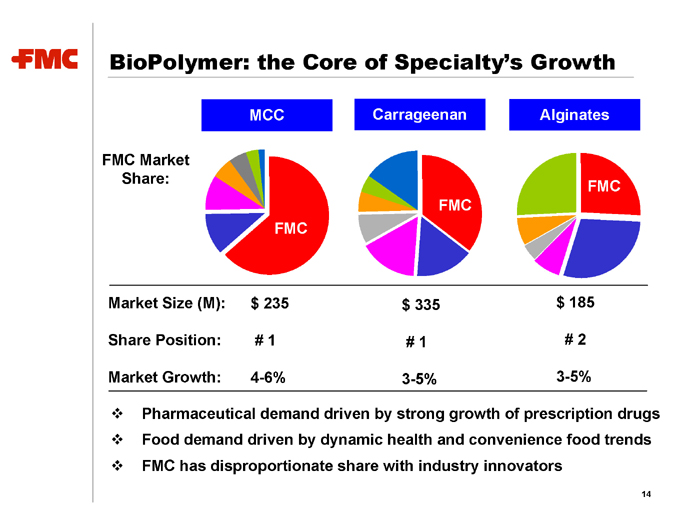

BioPolymer: the Core of Specialty’s Growth

FMC Market Share:

MCC Carrageenan Alginates

FMC FMC FMC

Market Size (M): $ 235 $ 335 $ 185

Share Position: # 1 # 1 # 2

Market Growth: 4-6% 3-5% 3-5%

Pharmaceutical demand driven by strong growth of prescription drugs

Food demand driven by dynamic health and convenience food trends

FMC has disproportionate share with industry innovators

14

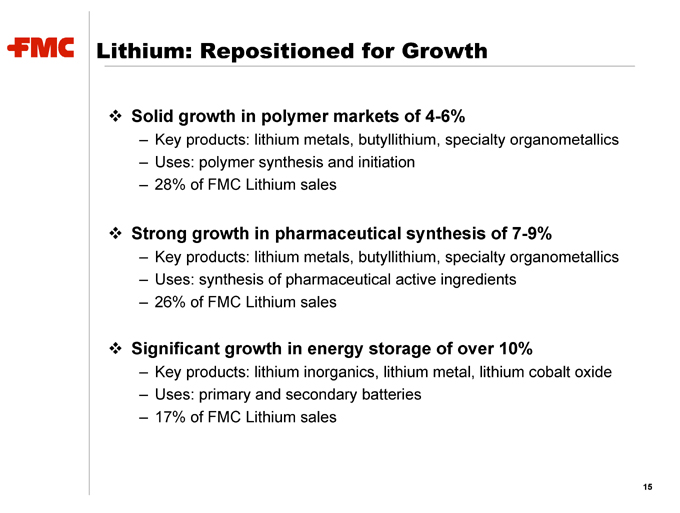

Lithium: Repositioned for Growth

Solid growth in polymer markets of 4-6%

Key products: lithium metals, butyllithium, specialty organometallics

Uses: polymer synthesis and initiation

28% of FMC Lithium sales

Strong growth in pharmaceutical synthesis of 7-9%

Key products: lithium metals, butyllithium, specialty organometallics

Uses: synthesis of pharmaceutical active ingredients

26% of FMC Lithium sales

Significant growth in energy storage of over 10%

Key products: lithium inorganics, lithium metal, lithium cobalt oxide

Uses: primary and secondary batteries

17% of FMC Lithium sales

15

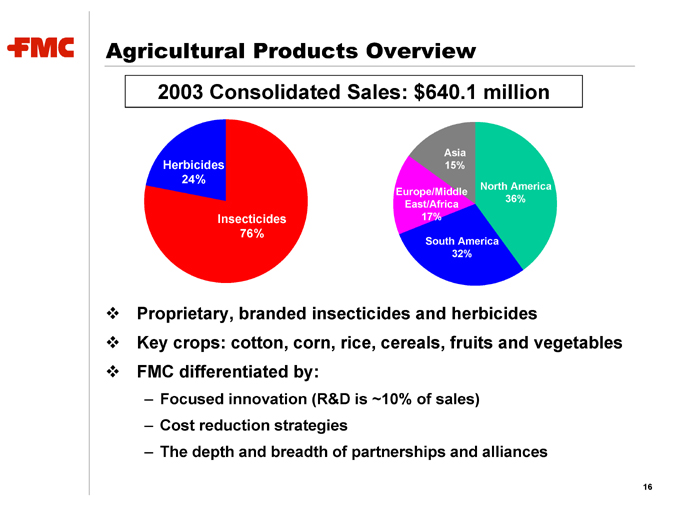

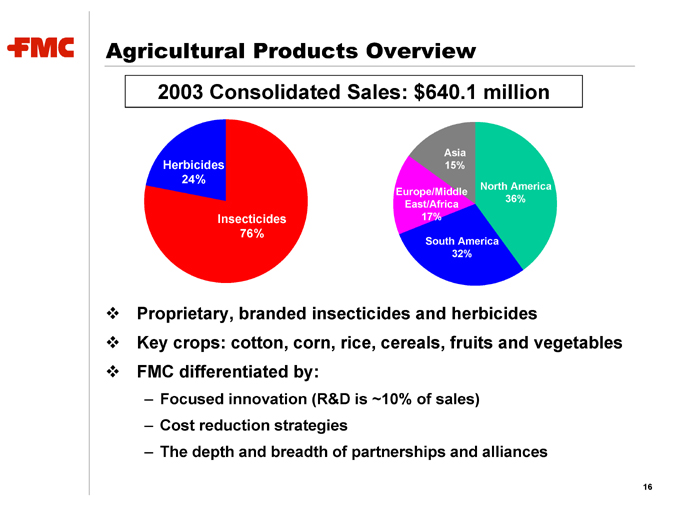

Agricultural Products Overview

2003 Consolidated Sales: $640.1 million

Herbicides 24%

Insecticides 76%

Asia 15%

Europe/Middle East/Africa 17%

South America 32%

North America 36%

Proprietary, branded insecticides and herbicides

Key crops: cotton, corn, rice, cereals, fruits and vegetables

FMC differentiated by:

Focused innovation (R&D is ~10% of sales)

Cost reduction strategies

The depth and breadth of partnerships and alliances

16

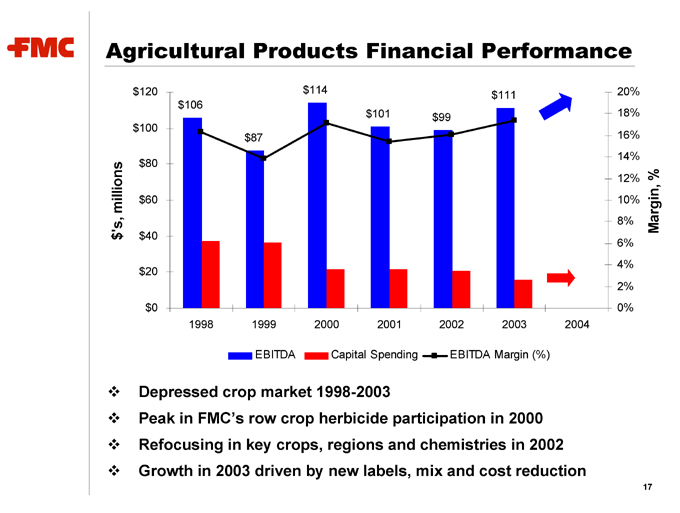

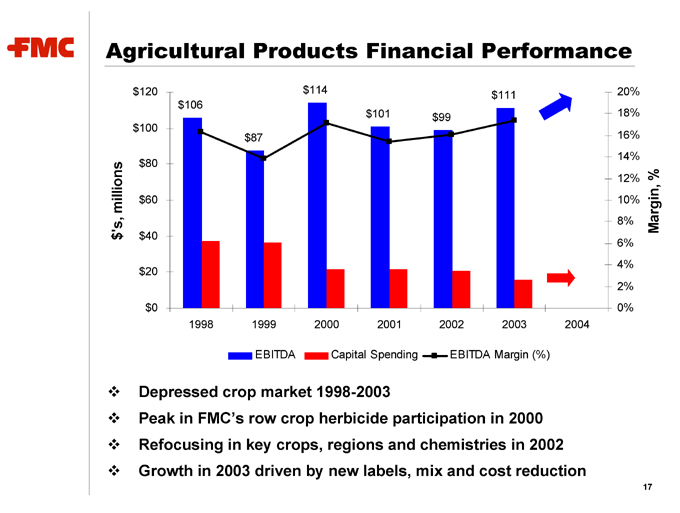

Agricultural Products Financial Performance

$’s, millions

$120 $100 $80 $60 $40 $20 $0

20% 18% 16% 14% 12% 10% 8% 6% 4% 2% 0%

Margin, %

1998 1999 2000 20012002 2003 2004

EBITDA Capital Spending EBITDA Margin (%)

$106 $87 $114 $101 $99 $111

Depressed crop market 1998-2003

Peak in FMC’s row crop herbicide participation in 2000

Refocusing in key crops, regions and chemistries in 2002

Growth in 2003 driven by new labels, mix and cost reduction

17

Positive Outlook for Ag Products

Driven by robust crop markets and our focused strategy

Improving global farm economy

Rising global crop prices

Significant cost savings from productivity initiatives

Manufacturing initiatives continue to produce savings

Global supply chain redesign being implemented

Success of market access strategies (alliances) in key markets

Focused product development

Label expansions in both crop and specialty markets

Novel ISK chemistry targeting sucking pests to launch 2005

Access to two new and complementary chemistries under negotiation

18

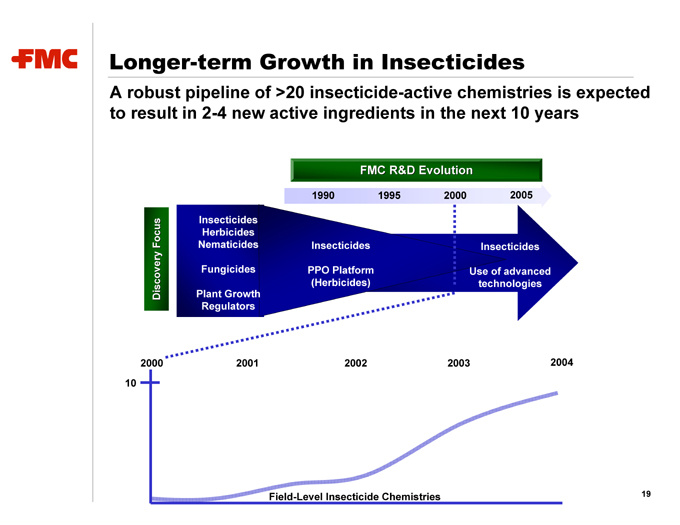

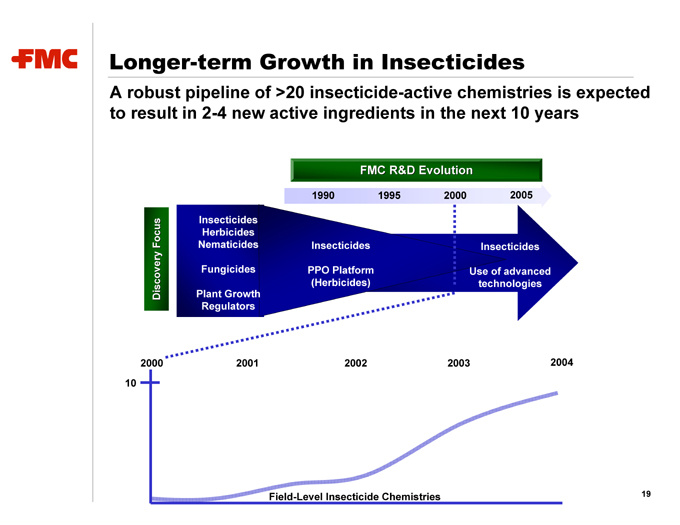

Longer-term Growth in Insecticides

A robust pipeline of >20 insecticide-active chemistries is expected to result in 2-4 new active ingredients in the next 10 years

FMC R&D Evolution

1990 1995 2000 2005

Discovery Focus

Insecticides Herbicides Nematicides

Fungicides

Plant Growth Regulators

Insecticides

PPO Platform (Herbicides)

Insecticides

Use of advanced technologies

2000 2001 2002 2003 2004

10

Field-Level Insecticide Chemistries

19

Summary: Great Businesses

Great businesses, each generating EBITDA of near $100 million

Industrial Chemicals earnings that are $50 million below normal

Steady growth in Specialty Chemicals and Ag Products

Low capital expenditure requirements

However, legacy items and restructuring have impaired free cash flow over the past three years

20

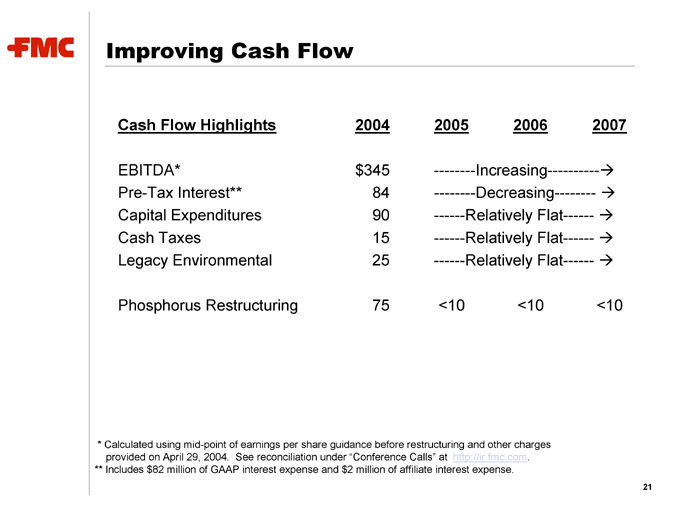

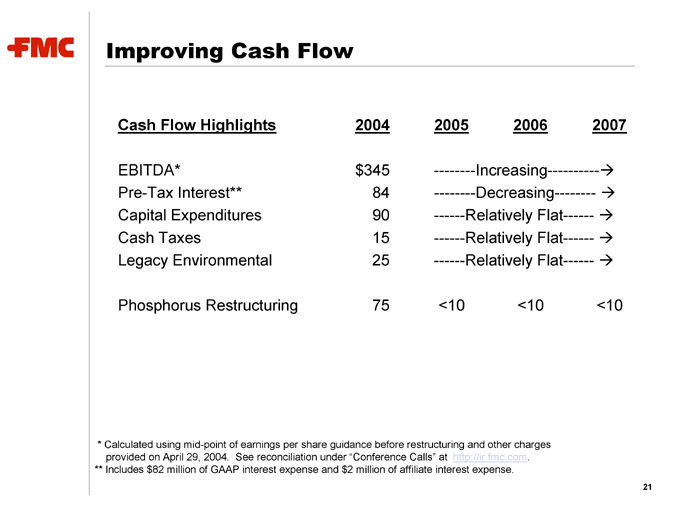

Improving Cash Flow

Cash Flow Highlights 2004 2005 2006 2007

EBITDA * $345 ————Increasing—————

Pre-Tax Interest ** 84 ————Decreasing————

Capital Expenditures 90 ———Relatively Flat———

Cash Taxes 15 ———Relatively Flat———

Legacy Environmental 25 ———Relatively Flat———

Phosphorus Restructuring 75 <10 <10 <10

* Calculated using mid-point of earnings per share guidance before restructuring and other charges provided on April 29, 2004. See reconciliation under “Conference Calls” at http://ir.fmc.com.

** Includes $82 million of GAAP interest expense and $2 million of affiliate interest expense.

21

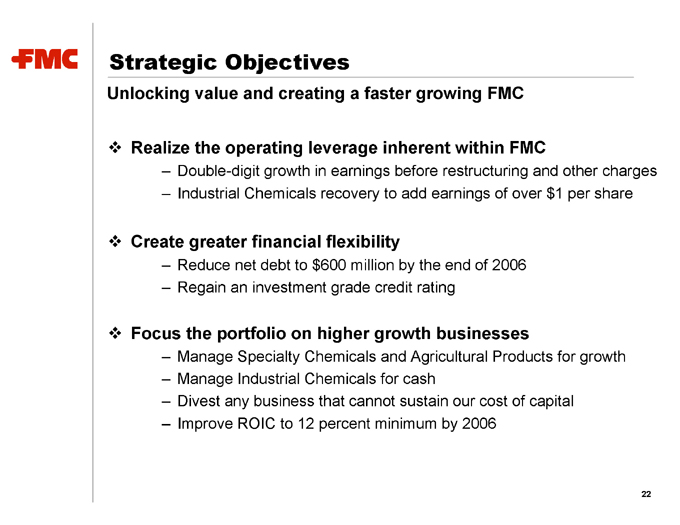

Strategic Objectives

Unlocking value and creating a faster growing FMC

Realize the operating leverage inherent within FMC

Double-digit growth in earnings before restructuring and other charges

Industrial Chemicals recovery to add earnings of over $1 per share

Create greater financial flexibility

Reduce net debt to $600 million by the end of 2006

Regain an investment grade credit rating

Focus the portfolio on higher growth businesses

Manage Specialty Chemicals and Agricultural Products for growth

Manage Industrial Chemicals for cash

Divest any business that cannot sustain our cost of capital

Improve ROIC to 12 percent minimum by 2006

22

FMC Corporation