Exhibit 99.1

FMC Corporation

Green River Analyst Meeting

July 14, 2004

Disclaimer

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995

These slides and the accompanying presentation contain “forward-looking statements” that represent management’s best judgment as of the date hereof based on information currently available. Actual results of the Company may differ materially from those contained in the forward-looking statements.

Additional information concerning factors that may cause results to differ materially from those in the forward-looking statements is contained in the Company’s periodic reports filed under the Securities Exchange Act of 1934, as amended.

The Company undertakes no obligation to update or revise these forward-looking statements to reflect new events or uncertainties.

1

Use of Non-GAAP Terms

These slides contain certain “non-GAAP financial terms” which are defined below and on FMC’s Investor Relations web site (http://ir.fmc.com) in the Glossary of Financial Terms section. In addition, in the Conference Calls and Presentations section of the web site, we have provided reconciliations of non-GAAP terms to the closest GAAP term. Lastly, these slides contain references to segment financial items which are presented in detail in Note 19 of FMC’s 2003 Form 10-K.

EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) is the sum of Income (loss) from continuing operations before income taxes and cumulative effect of change in accounting principle and Depreciation and Amortization.

EBITDA Margin is the quotient of EBITDA (defined above) and Revenue.

ROIC (Return on Invested Capital) is the sum of Earnings from continuing operations before restructuring and other charges (gains) and after-tax Interest expense divided by the sum of Short-term debt, Current portion of long-term debt, Long-term debt and Total shareholders’ equity.

2

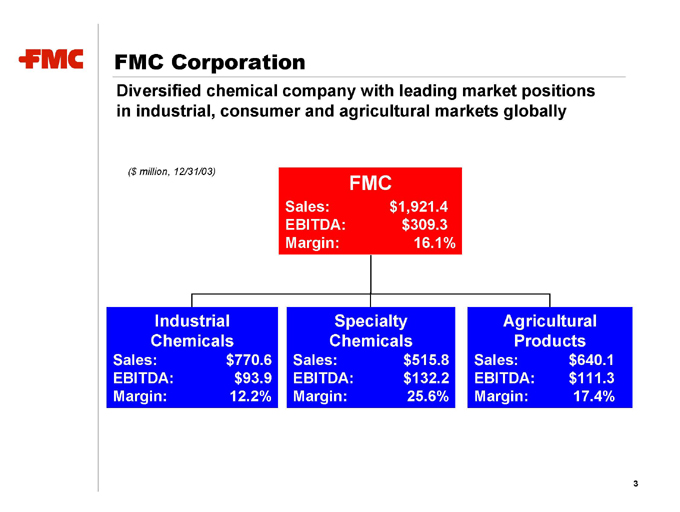

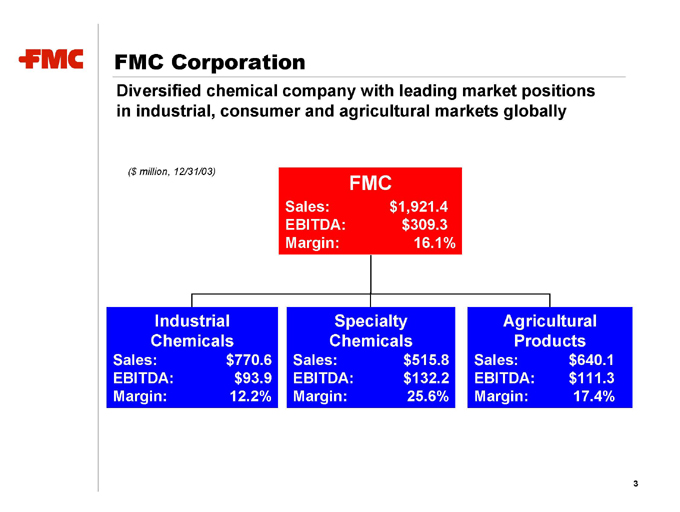

FMC Corporation

Diversified chemical company with leading market positions in industrial, consumer and agricultural markets globally

($ million, 12/31/03)

FMC

Sales: $1,921.4 EBITDA: $309.3 Margin: 16.1%

Industrial Chemicals

Sales: $770.6 EBITDA: $93.9 Margin: 12.2%

Specialty Chemicals

Sales: $515.8 EBITDA: $132.2 Margin: 25.6%

Agricultural Products

Sales: $640.1 EBITDA: $111.3 Margin: 17.4%

3

FMC Strengths

Leading market positions

Global presence

Diversified business mix and high-quality customer base

Diversified and integrated cost structure

Focused R&D and strong applications expertise

Proven management with extensive industry experience

4

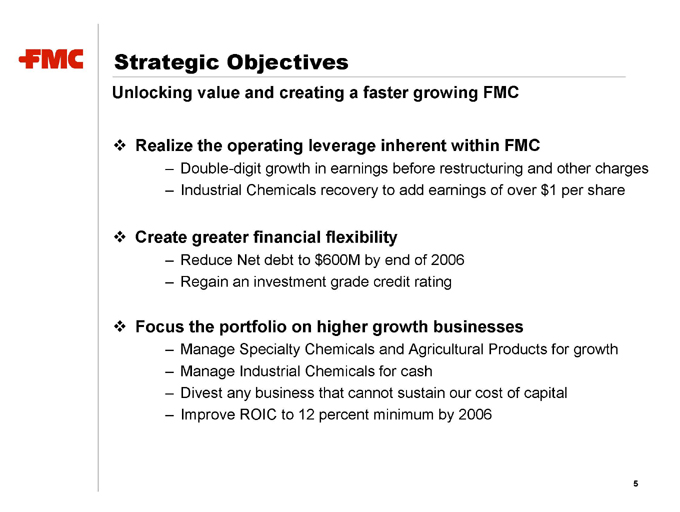

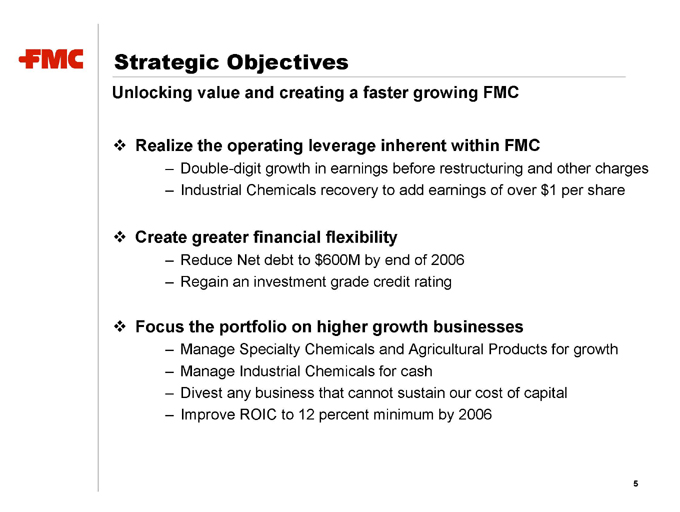

Strategic Objectives

Unlocking value and creating a faster growing FMC

Realize the operating leverage inherent within FMC

Double-digit growth in earnings before restructuring and other charges

Industrial Chemicals recovery to add earnings of over $1 per share

Create greater financial flexibility

Reduce Net debt to $600M by end of 2006

Regain an investment grade credit rating

Focus the portfolio on higher growth businesses

Manage Specialty Chemicals and Agricultural Products for growth

Manage Industrial Chemicals for cash

Divest any business that cannot sustain our cost of capital

Improve ROIC to 12 percent minimum by 2006

5

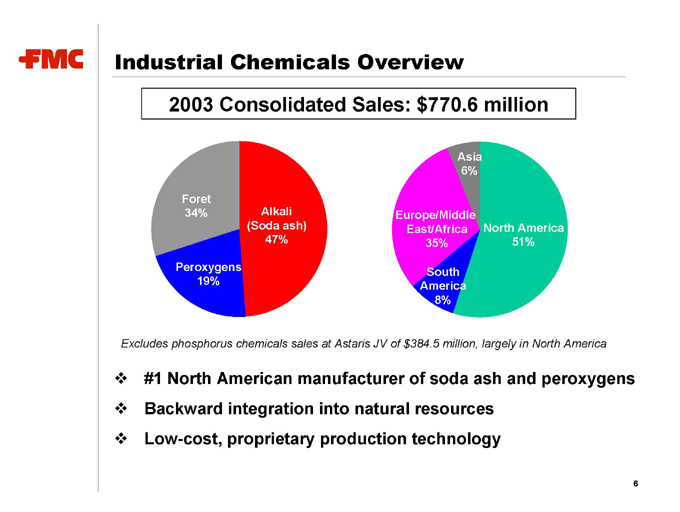

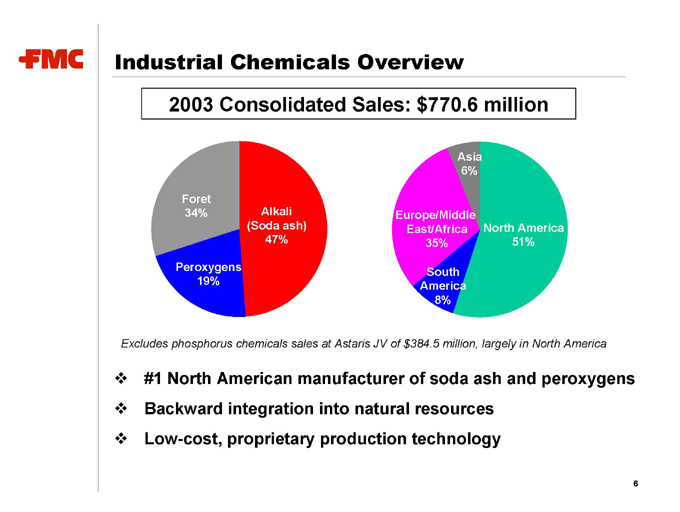

Industrial Chemicals Overview

2003 Consolidated Sales: $770.6 million

Foret 34%

Alkali (Soda ash) 47%

Peroxygens 19%

Asia 6%

Europe/Middle East/Africa 35%

North America 51%

South America 8%

Excludes phosphorus chemicals sales at Astaris JV of $384.5 million, largely in North America

#1 North American manufacturer of soda ash and peroxygens

Backward integration into natural resources

Low-cost, proprietary production technology

6

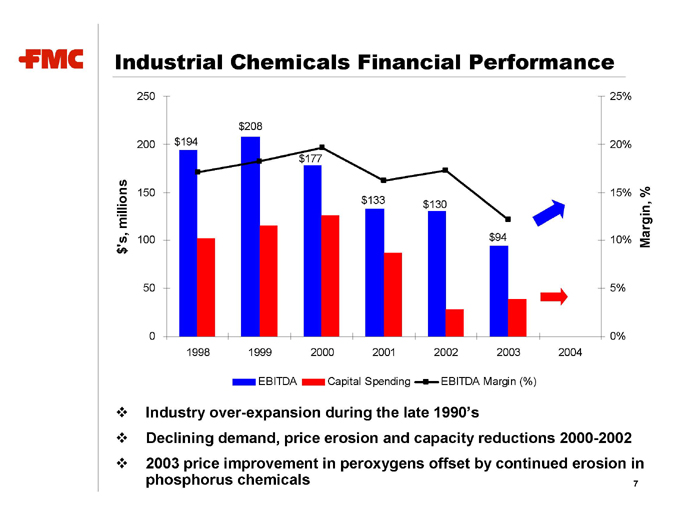

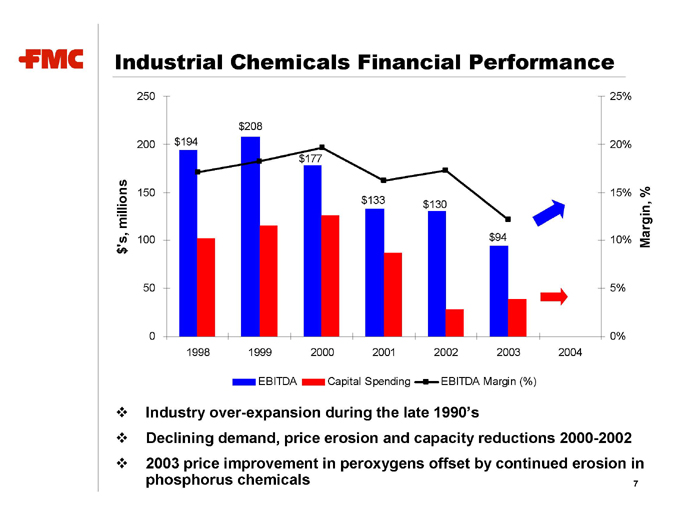

Industrial Chemicals Financial Performance

$’s, millions

250 200 150 100 50 0

$194 $208 $177 $133 $130 $94

1998 1999 2000 2001 2002 2003 2004

25% 20% 15% 10% 5% 0%

Margin, %

EBITDA Capital Spending EBITDA Margin (%)

Industry over-expansion during the late 1990’s

Declining demand, price erosion and capacity reductions 2000-2002

2003 price improvement in peroxygens offset by continued erosion in phosphorus chemicals

7

Alkali Chemicals Division

Agenda:

Background China Demand Supply Pricing FMC Strengths Summary

8

Defining Characteristics of the Soda Ash Industry

Commodity

Cyclical

Large Concentrated Customers

Growth Export Driven

High Fixed Costs

Relatively Flat Supply Curve

Hallmarks of Profitable Industries With Similar Characteristics

Supply/demand can be influenced to allow profitable operating rates

underlying volume growth and/or

closure of uneconomic capacity

“Market share = Capacity Share” describes long term historical pattern

Goal: Pricing reflects hurdle rate returns across the cycle

9

Recent Events ...............

OCI announced shutdown of Incheon, Korea facility

Solvay announced shutdown of Colorado soda ash operation

Searles Valley Minerals (formerly IMC)

Departed from ANSAC

80% share acquired by Sun Capital Partners

Weaker US dollar

China remains in balance

Synthetic producers impacted by soaring coke prices

......... have reset the global environment

10

Soda Ash Demand Overview

Global demand ~ 38M Metric Tonnes

China is the largest consuming region ~ 11M Metric Tonnes

Worldwide growth of ~ 2-3% per year with focus in developing regions

Glass represents largest end use sector ~ 50-55% of total demand

Two production routes natural and synthetic

Low cost position has made the US largest export player ~ 4.5M Metric Tonnes

11

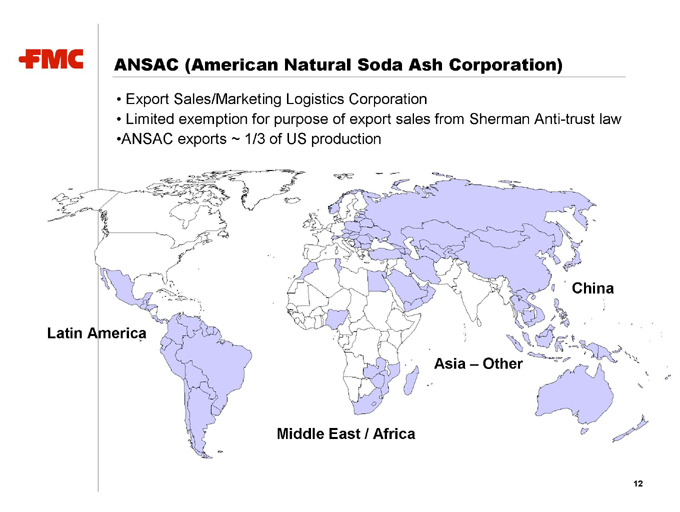

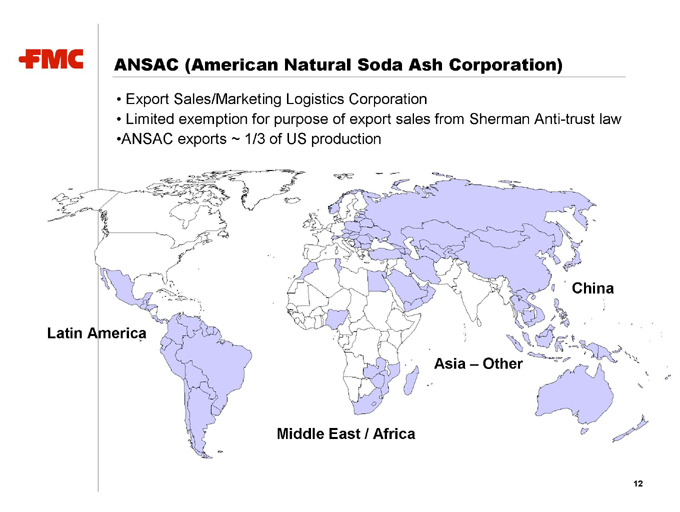

ANSAC (American Natural Soda Ash Corporation)

Export Sales/Marketing Logistics Corporation

Limited exemption for purpose of export sales from Sherman Anti-trust law

ANSAC exports ~ 1/3 of US production

Latin America

Middle East / Africa

Asia – Other

China

12

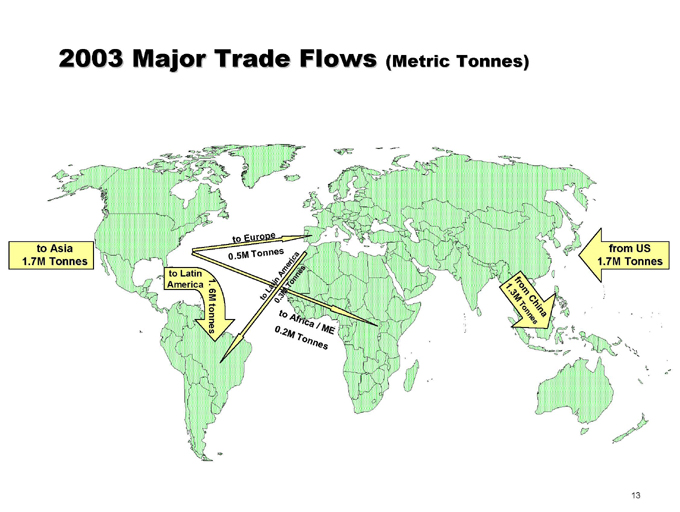

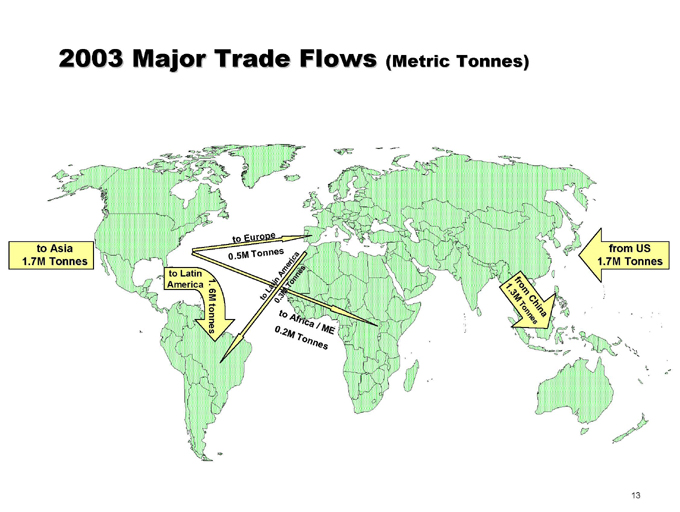

2003 Major Trade Flows (Metric Tonnes)

to Asia 1.7M Tonnes

to Latin America

1. 6M tonnes

to Europe

0.5M Tonnes

to Latin America

0.3M Tonnes

to Africa / ME

0.2M Tonnes

from China

1.3M Tonnes

from US

1.7M Tonnes

13

2003 Global Market Overview / Trade Flows

ANSAC – Land

North Western Asia Latin

America Europe China (ex. China) America

% of Global Demand 17% 17% 28% 10% 7%

Market Growth—% pa 0-1% 0-1% 7-8% 2-3% 2-3%

Net Exports/ 4.3 (0.6) 1.0 (2.8) (2.0)

(Imports) – MT

U.S. Share—% 100% 7% 3% 35% 64%

14

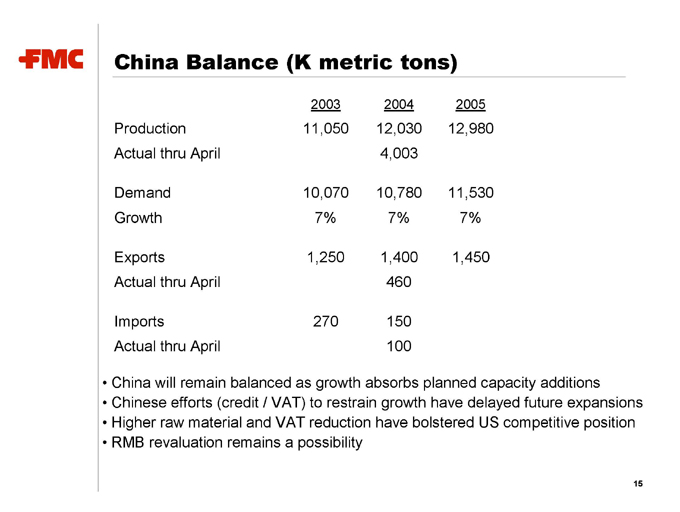

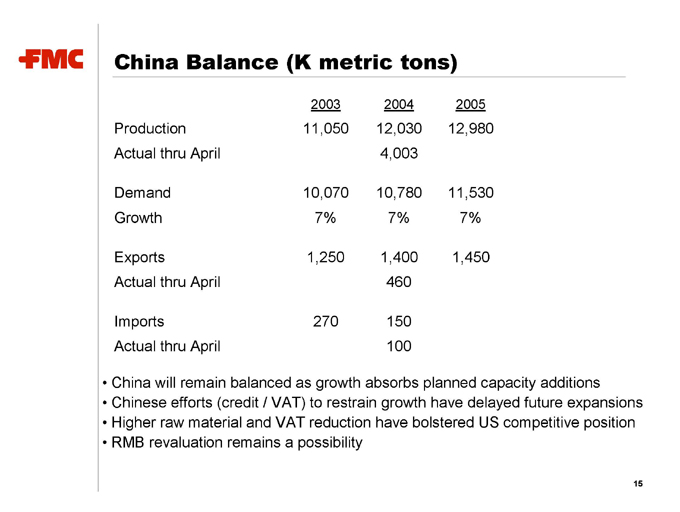

China Balance (K metric tons)

2003 2004 2005

Production 11,050 12,030 12,980

Actual thru April 4,003

Demand 10,070 10,780 11,530

Growth 7% 7% 7%

Exports 1,250 1,400 1,450

Actual thru April 460

Imports 270 150

Actual thru April 100

China will remain balanced as growth absorbs planned capacity additions Chinese efforts (credit / VAT) to restrain growth have delayed future expansions Higher raw material and VAT reduction have bolstered US competitive position RMB revaluation remains a possibility

15

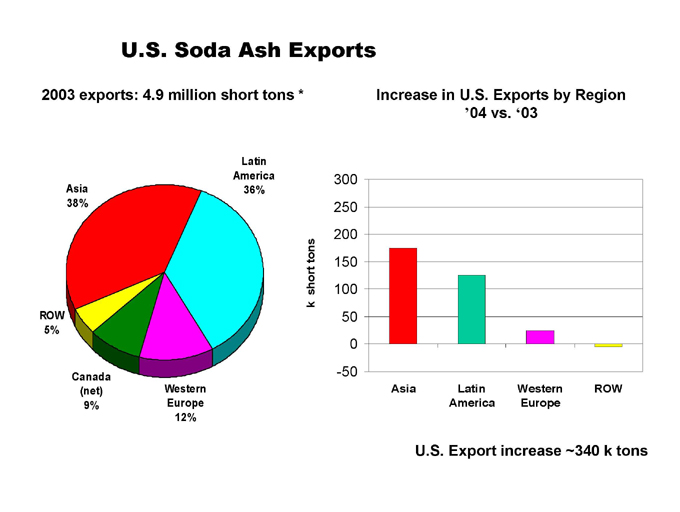

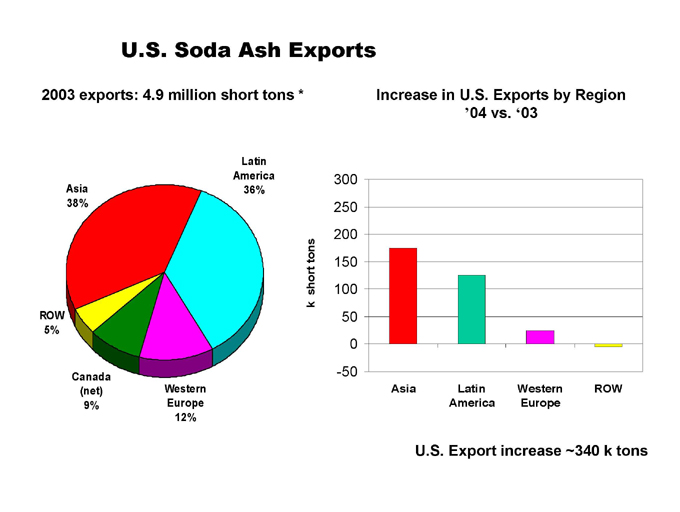

U.S. Soda Ash Exports

2003 exports: 4.9 million short tons *

Increase in U.S. Exports by Region ’04 vs. ‘03

Latin America 36%

Asia 38%

ROW 5%

Canada (net) 9%

Western Europe 12%

k short tons

300 250 200 150 100 50 0 -50

Asia Latin Western ROW

America Europe

U.S. Export increase ~340 k tons

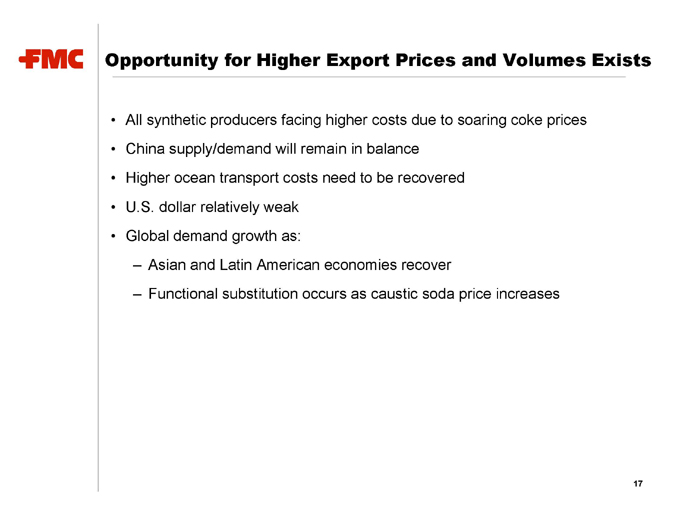

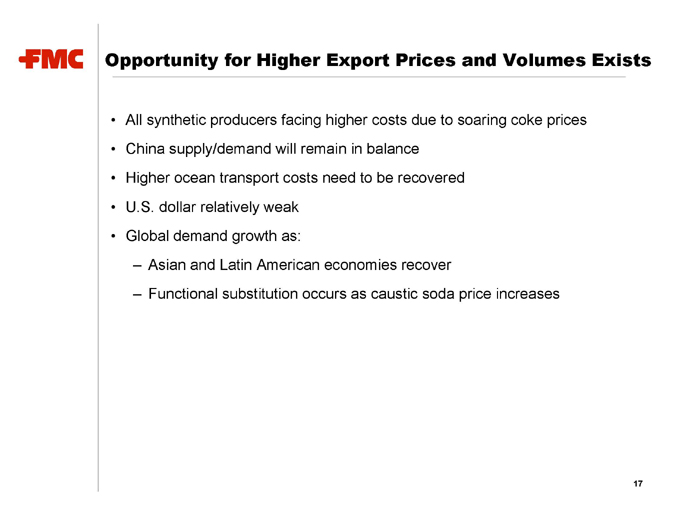

Opportunity for Higher Export Prices and Volumes Exists

All synthetic producers facing higher costs due to soaring coke prices China supply/demand will remain in balance Higher ocean transport costs need to be recovered U.S. dollar relatively weak Global demand growth as:

Asian and Latin American economies recover

Functional substitution occurs as caustic soda price increases

17

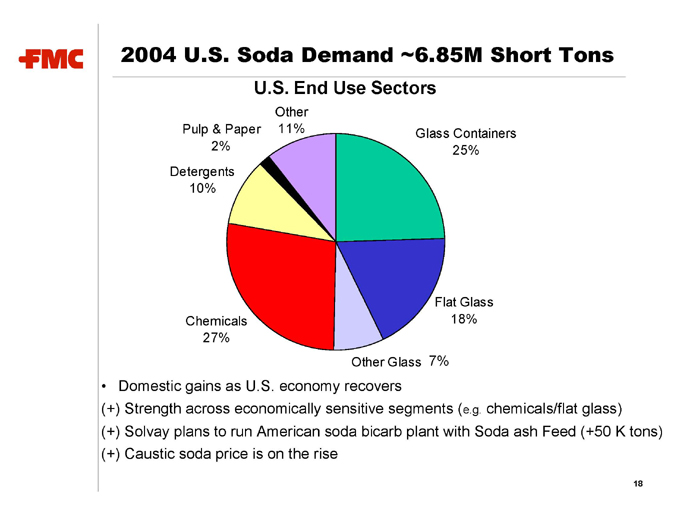

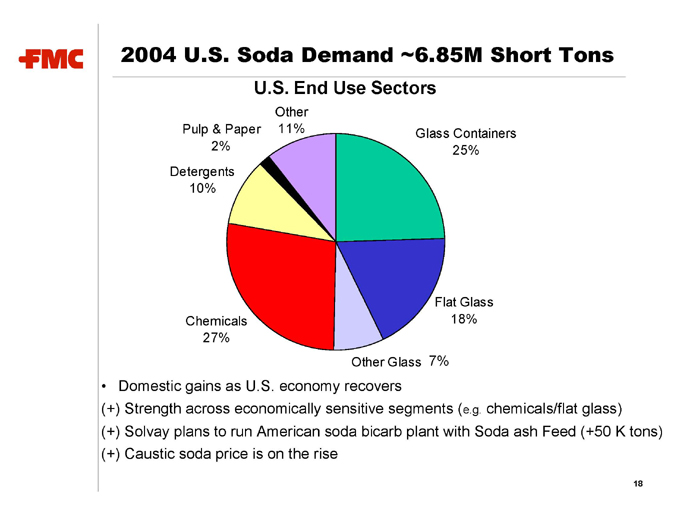

2004 U.S. Soda Demand ~6.85M Short Tons

U.S. End Use Sectors

Other Glass 7%

Pulp & Paper 2%

Other 11%

Glass Containers 25%

Detergents 10%

Chemicals 27%

Flat Glass 18%

Domestic gains as U.S. economy recovers

(+) Strength across economically sensitive segments (e.g. chemicals/flat glass) (+) Solvay plans to run American soda bicarb plant with Soda ash Feed (+50 K tons) (+) Caustic soda price is on the rise

18

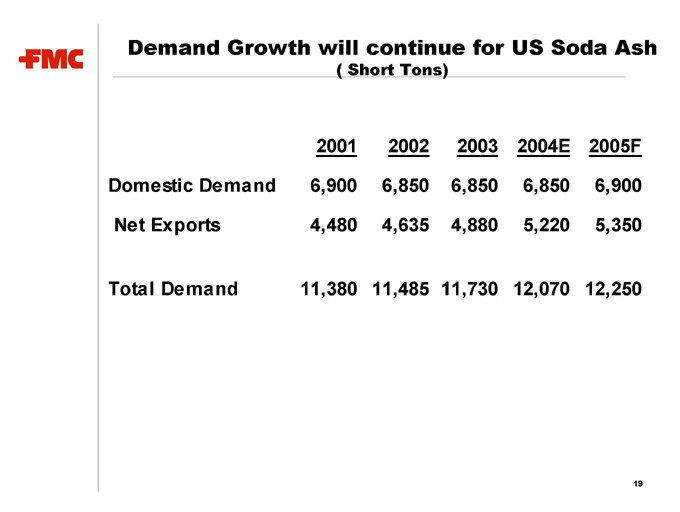

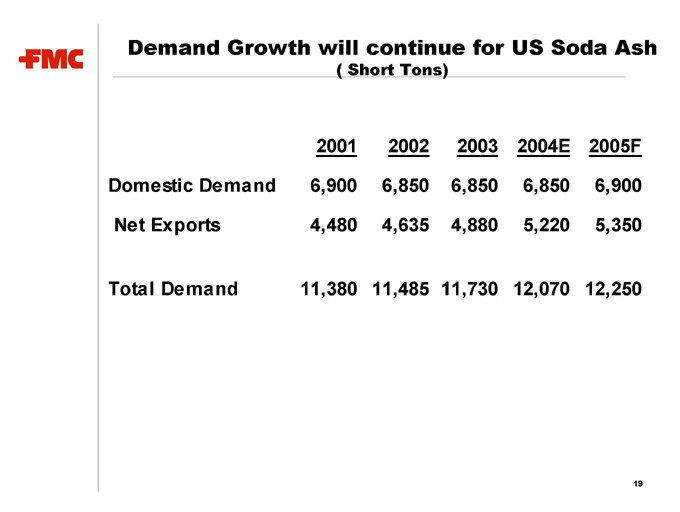

Demand Growth will continue for US Soda Ash

(Short Tons)

2001 2002 2003 2004E 2005F

Domestic Demand 6,900 6,850 6,850 6,850 6,900

Net Exports 4,480 4,635 4,880 5,220 5,350

Total Demand 11,380 11,485 11,730 12,070 12,250

19

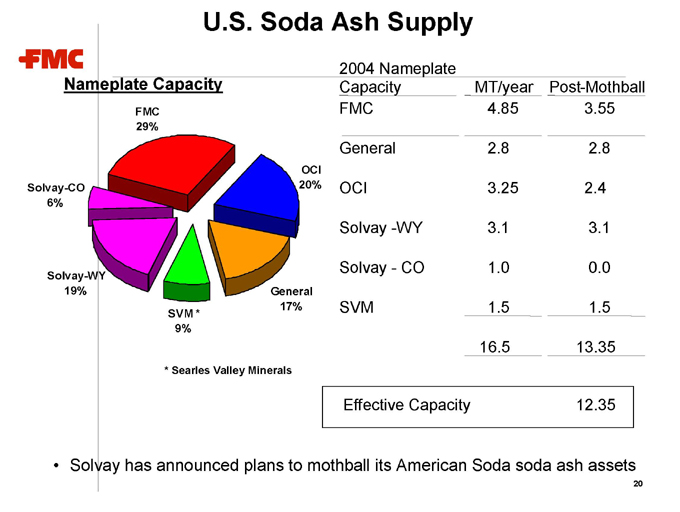

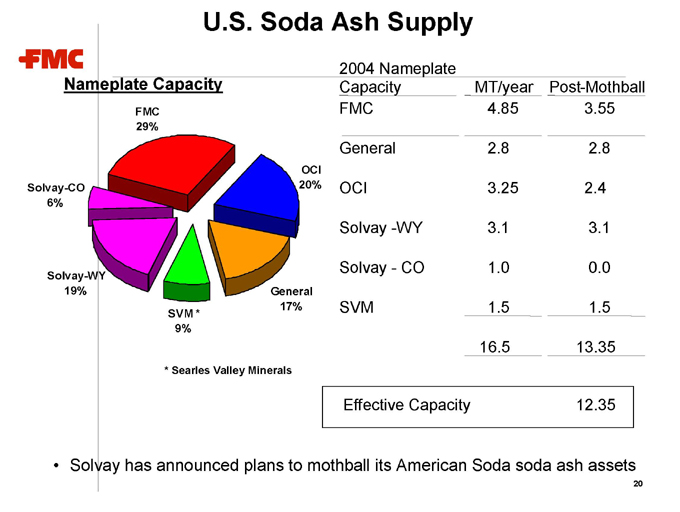

U.S. Soda Ash Supply

Nameplate Capacity

OCI 20%

FMC 29%

Solvay-CO

6%

Solvay-WY

19%

SVM * 9%

General 17%

* Searles Valley Minerals

2004 Nameplate

Capacity MT/year Post-Mothball

FMC 4.85 3.55

General 2.8 2.8

OCI 3.25 2.4

Solvay -WY 3.1 3.1

Solvay—CO 1.0 0.0

SVM 1.5 1.5

16.5 13.35

Effective Capacity 12.35

Solvay has announced plans to mothball its American Soda soda ash assets

20

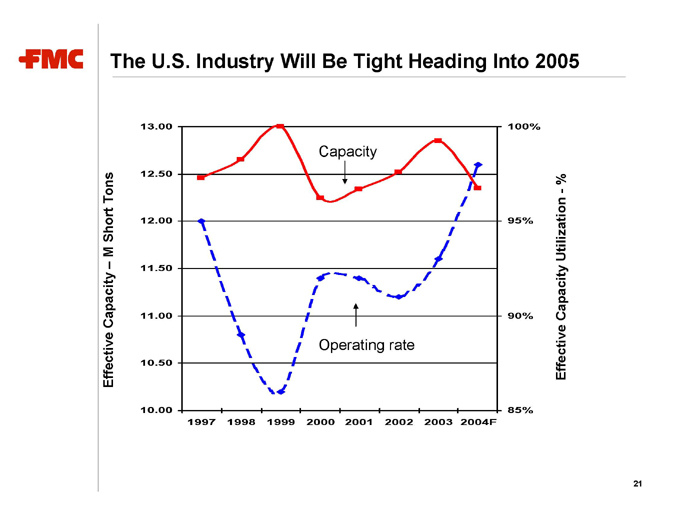

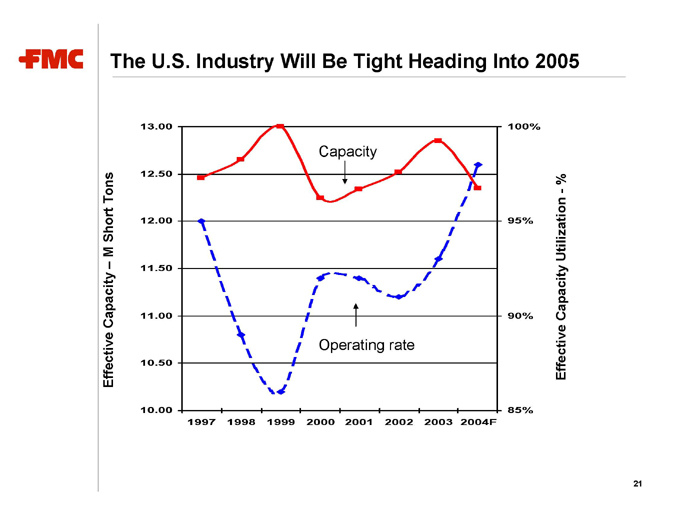

The U.S. Industry Will Be Tight Heading Into 2005

Effective Capacity – M Short Tons

13.00 12.50 12.00 11.50 11.00 10.50 10.00

1997 1998 1999 2000 2001 2002 2003 2004F

100% 95% 90% 85%

Effective Capacity Utilization—%

Capacity

Operating rate

21

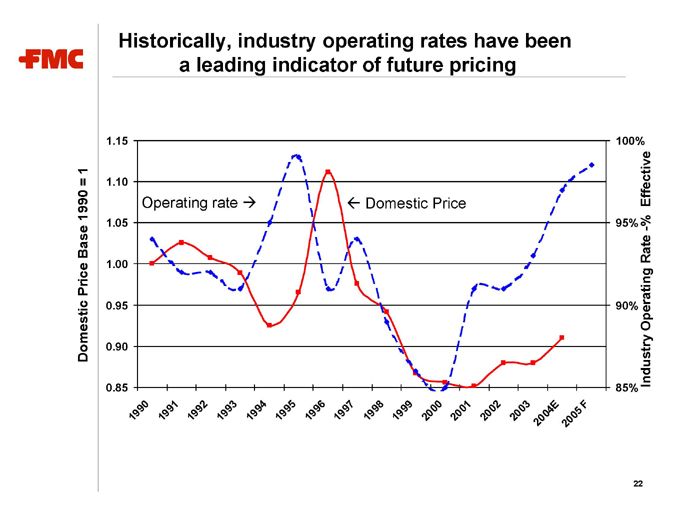

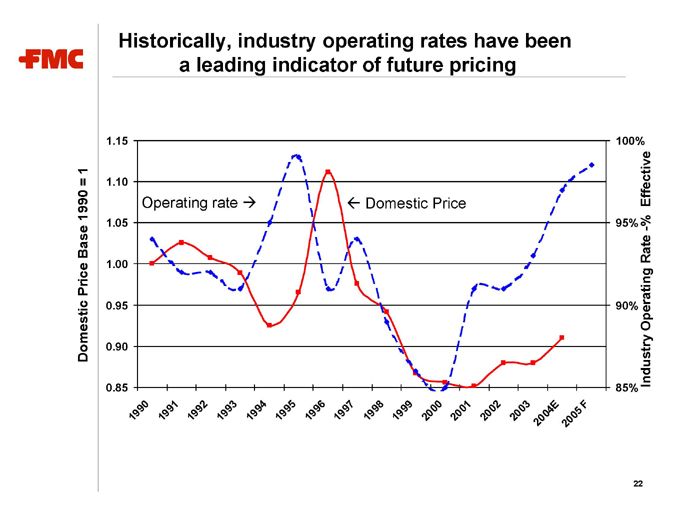

Historically, industry operating rates have been a leading indicator of future pricing

Domestic Price Base 1990 = 1

1.15 1.10 1.05 1.00 0.95 0.90 0.85

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004E

2005F

100%

95%

90%

85%

Industry Operating Rate -% Effective

Operating rate

Domestic Price

22

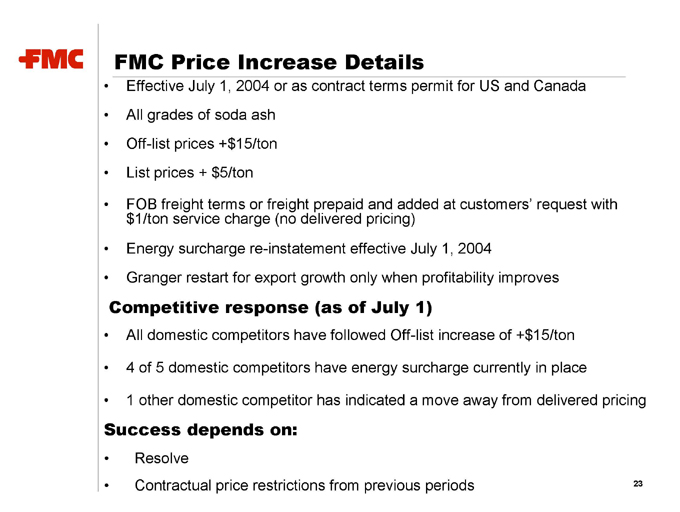

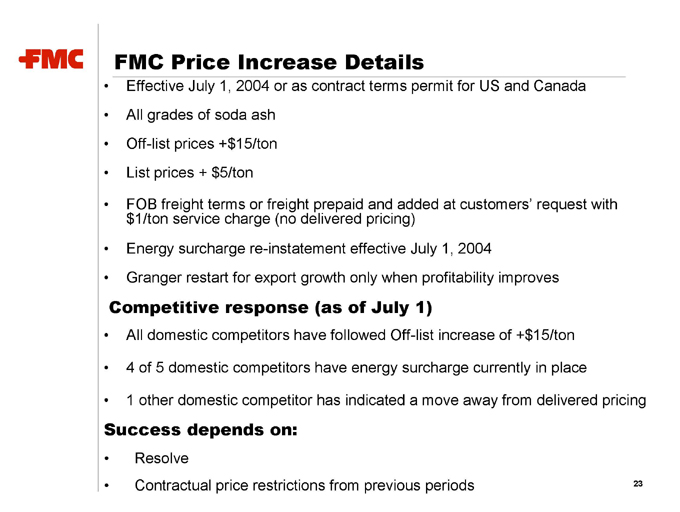

FMC Price Increase Details

Effective July 1, 2004 or as contract terms permit for US and Canada

All grades of soda ash

Off-list prices +$15/ton

List prices + $5/ton

FOB freight terms or freight prepaid and added at customers’ request with $1/ton service charge (no delivered pricing)

Energy surcharge re-instatement effective July 1, 2004

Granger restart for export growth only when profitability improves

Competitive response (as of July 1)

All domestic competitors have followed Off-list increase of +$15/ton 4 of 5 domestic competitors have energy surcharge currently in place 1 other domestic competitor has indicated a move away from delivered pricing

Success depends on:

Resolve

Contractual price restrictions from previous periods

23

Alkali Chemicals Division Key Product Offerings

High Volume

High Value (i.e. niche)

Other

Soda Ash

Sodium Sesquicarbonate Sodium Bicarbonate Light Density Soda Ash

Chemical Caustic Soda

24

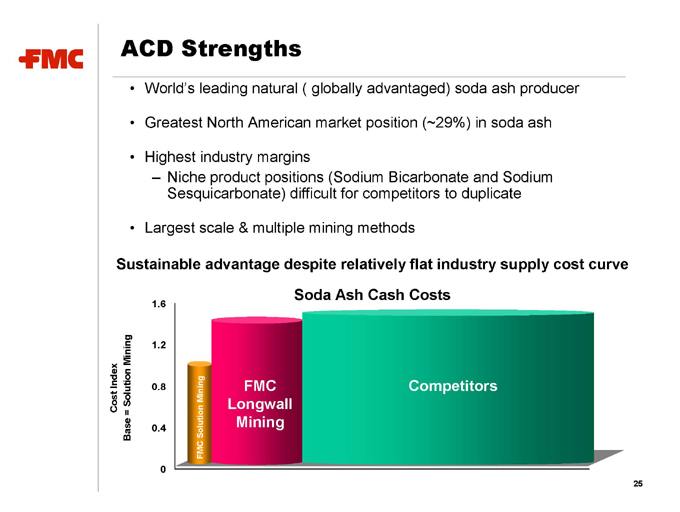

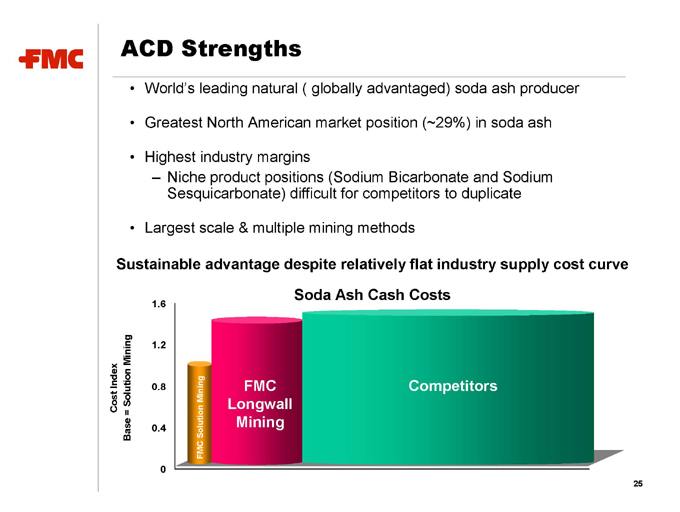

ACD Strengths

World’s leading natural ( globally advantaged) soda ash producer

Greatest North American market position (~29%) in soda ash

Highest industry margins

Niche product positions (Sodium Bicarbonate and Sodium Sesquicarbonate) difficult for competitors to duplicate

Largest scale & multiple mining methods

Sustainable advantage despite relatively flat industry supply cost curve

Soda Ash Cash Costs

Cost Index

Base = Solution Mining

1.6 1.2 0.8 0.4 0

FMC Solution Mining

FMC Longwall Mining

Competitors

25

Alkali Chemicals Division—Summary

U.S. industry operating at full effective capacity

7% growth in U.S. export demand

History shows operating rate is a leading indicator for price

Financial pressure worldwide is leading to a rising price environment

Raw material and energy costs

Freight (rail and/or ocean)

Chinese governmental influence (e.g. credit, VAT)

Global Utilization is rising

FMC is positioned to lead the industry to higher profitability

Low cost US producer

Domestic price increase

Export price recovery

Incremental capacity option exists at FMC Granger

Lowest cost, coal based, solution mined capacity expansion

Capacity variable for export growth

26