Exhibit 99.1

FMC Corporation

Marketing Trip

Cleveland, Ohio

November 10, 2004

W. Kim Foster

SVP and Chief Financial Officer

Disclaimer

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995

These slides and the accompanying presentation contain “forward-looking statements” that represent management’s best judgment as of the date hereof based on information currently available. Actual results of the Company may differ materially from those contained in the forward-looking statements.

Additional information concerning factors that may cause results to differ materially from those in the forward-looking statements is contained in the Company’s periodic reports filed under the Securities Exchange Act of 1934, as amended.

The Company undertakes no obligation to update or revise these forward-looking statements to reflect new events or uncertainties.

1

Use of Non-GAAP Terms

These slides contain certain “non-GAAP financial terms” which are defined below and on FMC’s Investor Relations web site (http://ir.fmc.com) in the Glossary of Financial Terms section. In addition, in the Conference Calls and Presentations section of the web site, we have provided reconciliations of non-GAAP terms to the closest GAAP term. Lastly, these slides contain references to segment financial items which are presented in detail in Note 19 of FMC’s 2003 Form 10-K.

EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) is the sum of Income (loss) from continuing operations before income taxes and cumulative effect of change in accounting principle and Depreciation and Amortization.

EBITDA Margin is the quotient of EBITDA (defined above) and Revenue.

ROIC (Return on Invested Capital) is the sum of Earnings from continuing operations before restructuring and other charges (gains) and after-tax Interest expense divided by the sum of Short-term debt, Current portion of long-term debt, Long-term debt and Total shareholders’ equity.

Free Cash Flow is the sum of Cash provided (required) by operating activities and Cash required by discontinued operations less Cash required by investing activities.

2

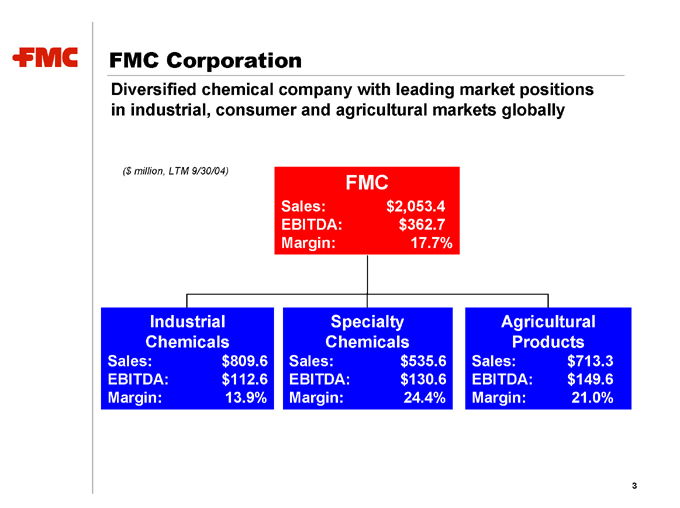

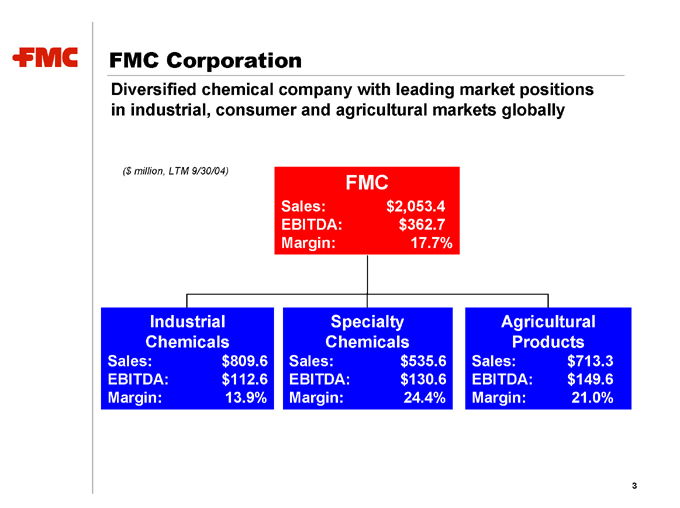

FMC Corporation

Diversified chemical company with leading market positions in industrial, consumer and agricultural markets globally

($ million, LTM 9/30/04)

FMC

Sales: $2,053.4

EBITDA: $362.7

Margin: 17.7%

Industrial Chemicals Specialty Chemicals Agricultural Products

Sales: $809.6

Sales: $535.6

Sales: $713.3

EBITDA: $112.6

EBITDA: $130.6

EBITDA: $149.6

Margin: 13.9%

Margin: 24.4%

Margin: 21.0%

3

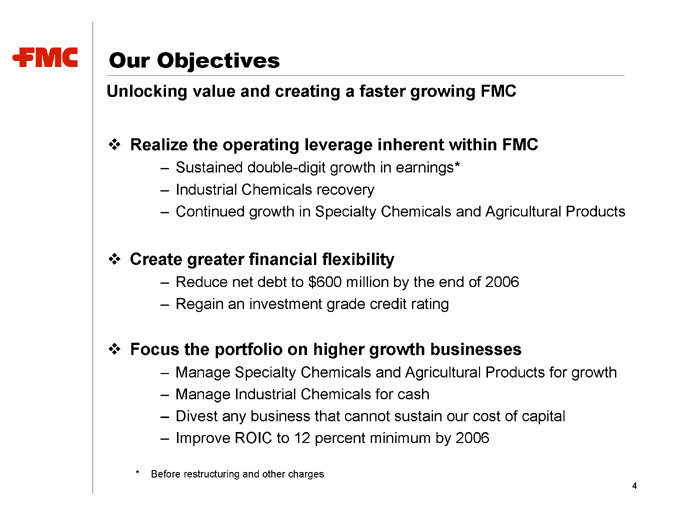

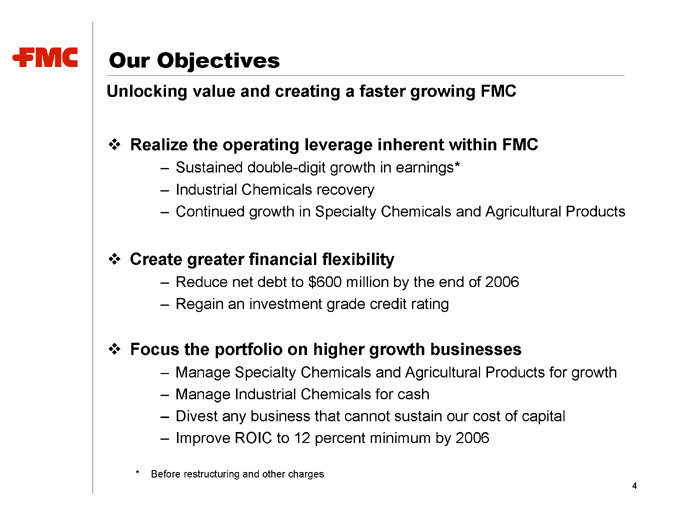

Our Objectives

Unlocking value and creating a faster growing FMC

Realize the operating leverage inherent within FMC

Sustained double-digit growth in earnings*

Industrial Chemicals recovery

Continued growth in Specialty Chemicals and Agricultural Products

Create greater financial flexibility

Reduce net debt to $600 million by the end of 2006

Regain an investment grade credit rating

Focus the portfolio on higher growth businesses

Manage Specialty Chemicals and Agricultural Products for growth

Manage Industrial Chemicals for cash

Divest any business that cannot sustain our cost of capital

Improve ROIC to 12 percent minimum by 2006

* Before restructuring and other charges

4

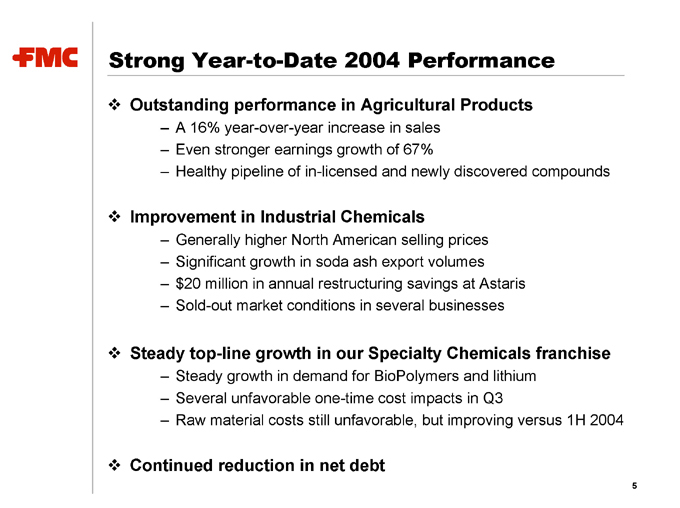

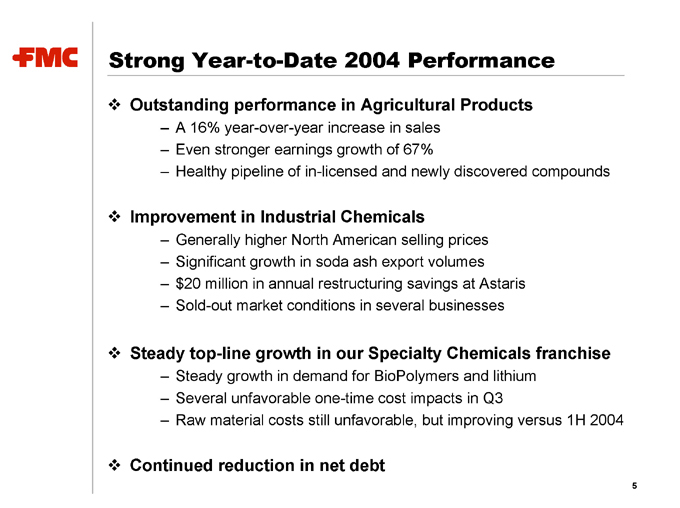

Strong Year-to-Date 2004 Performance

Outstanding performance in Agricultural Products

A 16% year-over-year increase in sales

Even stronger earnings growth of 67%

Healthy pipeline of in-licensed and newly discovered compounds

Improvement in Industrial Chemicals

Generally higher North American selling prices

Significant growth in soda ash export volumes

$20 million in annual restructuring savings at Astaris

Sold-out market conditions in several businesses

Steady top-line growth in our Specialty Chemicals franchise

Steady growth in demand for BioPolymers and lithium

Several unfavorable one-time cost impacts in Q3

Raw material costs still unfavorable, but improving versus 1H 2004

Continued reduction in net debt

5

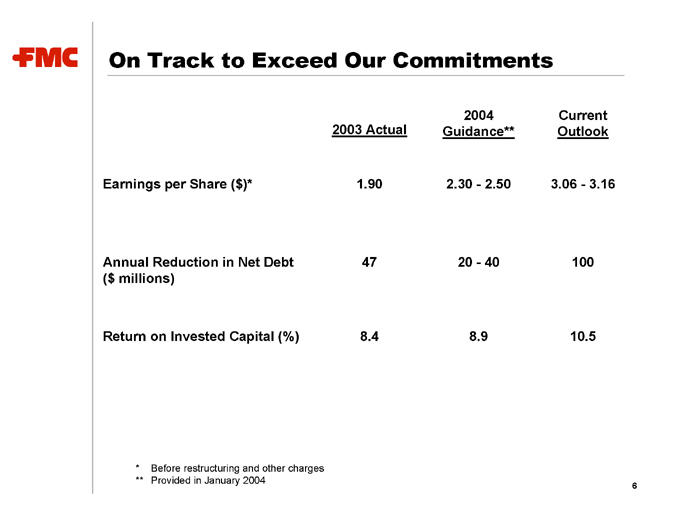

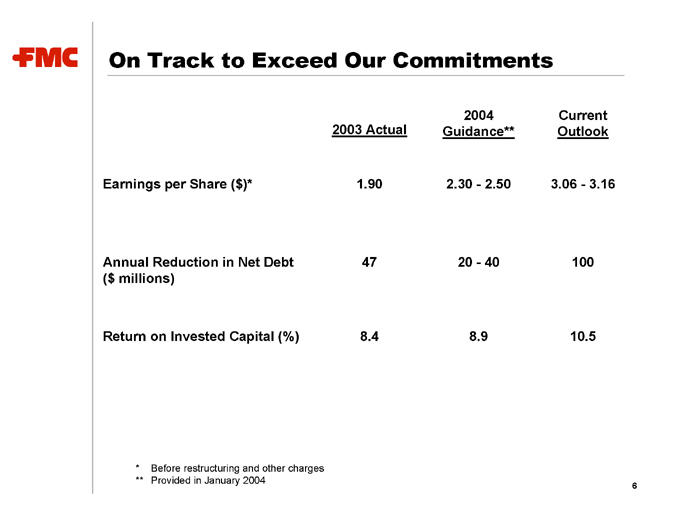

On Track to Exceed Our Commitments

2003 Actual 2004 Guidance** Current Outlook

Earnings per Share ($)* 1.90 2.30—2.50 3.06—3.16

Annual Reduction in Net Debt ($ millions) 47 20—40 100

Return on Invested Capital (%) 8.4 8.9 10.5

* Before restructuring and other charges

** Provided in January 2004

6

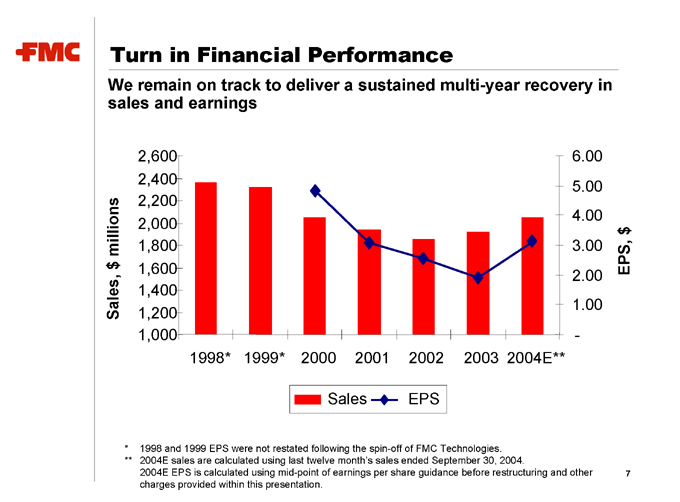

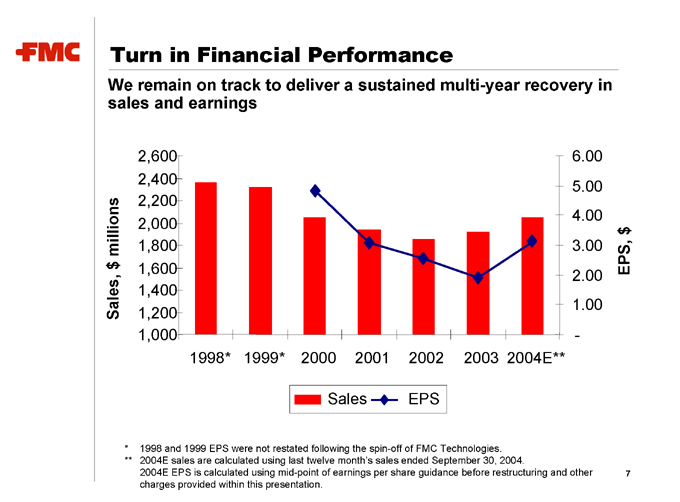

Turn in Financial Performance

We remain on track to deliver a sustained multi-year recovery in sales and earnings

Sales, $ millions

2,600 2,400 2,200 2,000 1,800 1,600 1,400 1,200 1,000

1998* 1999* 2000 2001 2002 2003 2004E**

6.00 5.00 4.00 3.00 2.00 1.00 -

EPS, $

Sales

EPS

* 1998 and 1999 EPS were not restated following the spin-off of FMC Technologies.

** 2004E sales are calculated using last twelve month’s sales ended September 30, 2004.

2004E EPS is calculated using mid-point of earnings per share guidance before restructuring and other charges provided within this presentation.

7

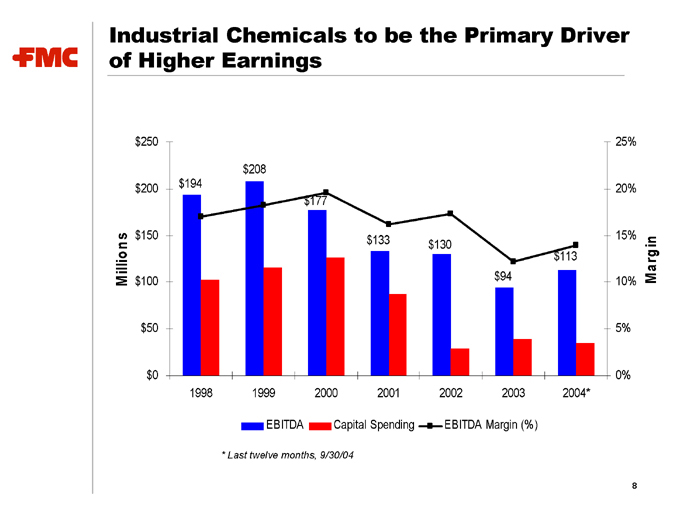

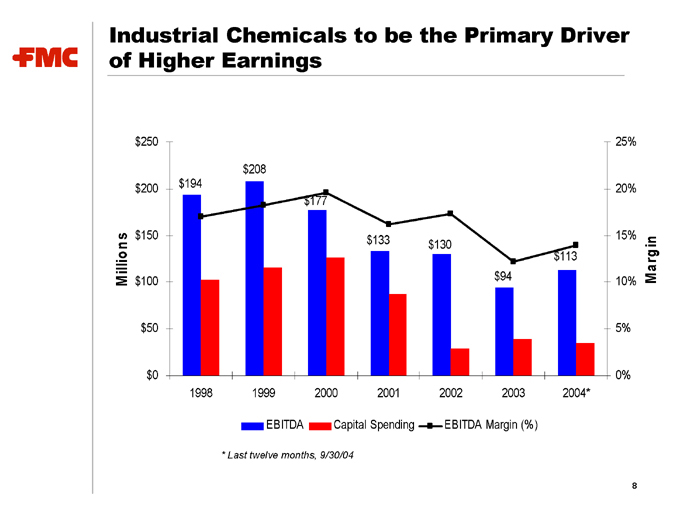

Industrial Chemicals to be the Primary Driver of Higher Earnings

Millions $250 $200 $150 $100 $50 $0

1998 1999 2000 2001 2002 2003 2004*

25% 20% 15% 10% 5% 0%

Margin

EBITDA Capital Spending EBITDA Margin (%)

* Last twelve months,

9/30/04 $194 $208 $177 $133 $130 $94 $113

8

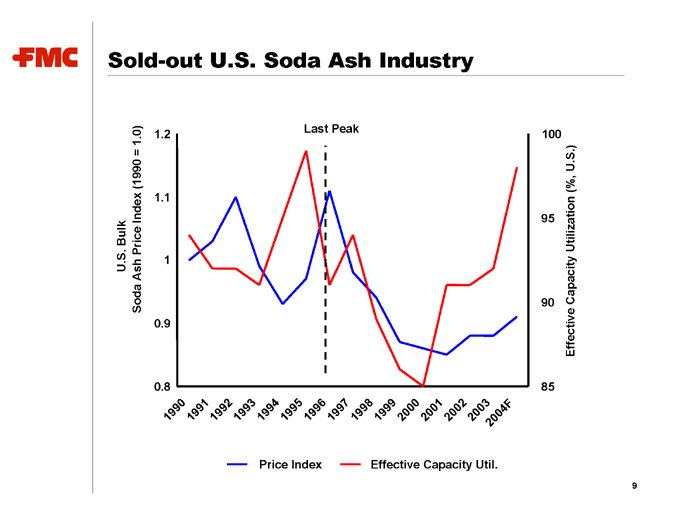

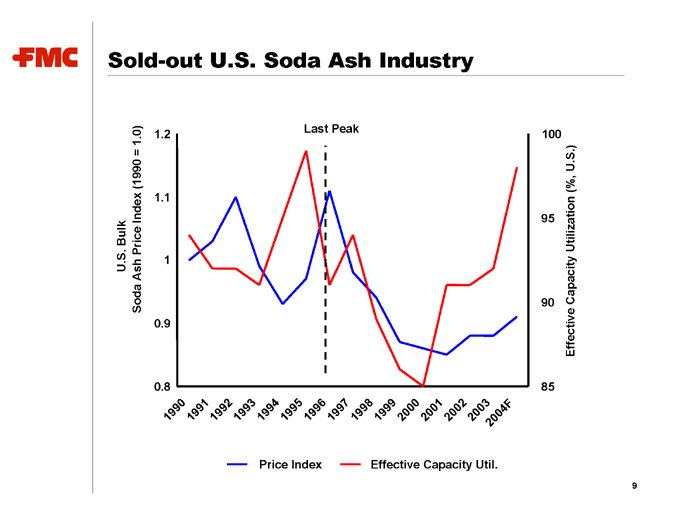

Sold-out U.S. Soda Ash Industry

U.S. Bulk

Soda Ash Price Index (1990 = 1.0)

1.2 1.1 1 0.9 0.8

Effective Capacity Utilization (%, U.S.)

100 95 90 85

1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004F

Price Index

Effective Capacity Util.

Last Peak

9

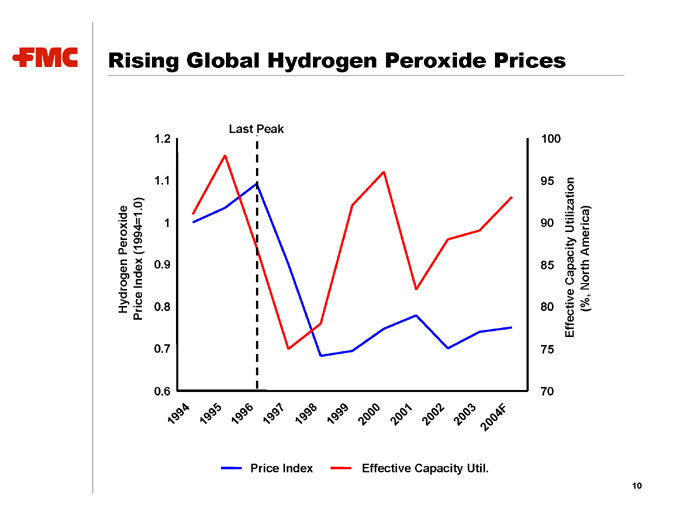

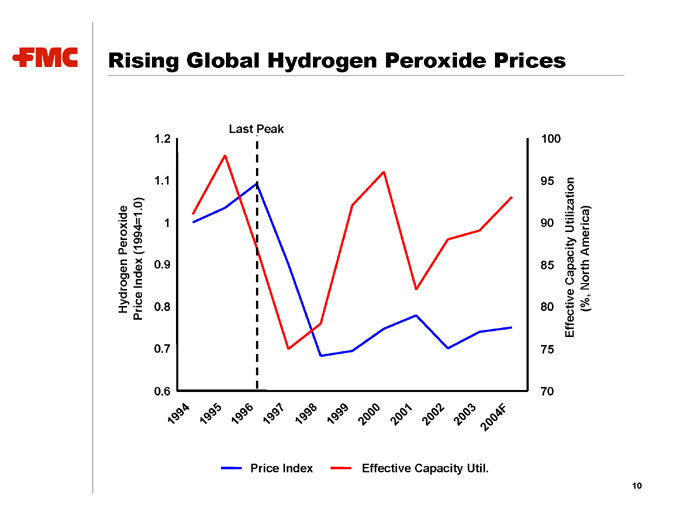

Rising Global Hydrogen Peroxide Prices

Hydrogen Peroxide Price Index (1994=1.0)

1.2 1.1 1 0.9 0.8 0.7 0.6

Last Peak

Effective Capacity Utilization (%, North America)

100 95 90 85 80 75 70

1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004F

Price Index

Effective Capacity Util.

10

Turnaround In Phosphorus Chemicals

Domestic improvement resulting from Astaris restructuring

Annualized savings of $40 million are in place (a $20 million benefit to FMC’s operating profit)

Astaris capacity reductions have tightened domestic supply

Price increases of 4-7 percent are expected for 2005, which will be partially offset by higher input costs

Sold-out European STPP market

Driven by capacity closures and decreased Chinese imports

Prices at Foret have risen over 10 percent versus the prior year

Astaris deleveraging to impact cash flow favorably

Astaris is debt free, and keepwell payments are no longer anticipated

Refinancing of Astaris in late 2004 or 2005

Possible dividend of cash back to FMC post an Astaris refinancing

11

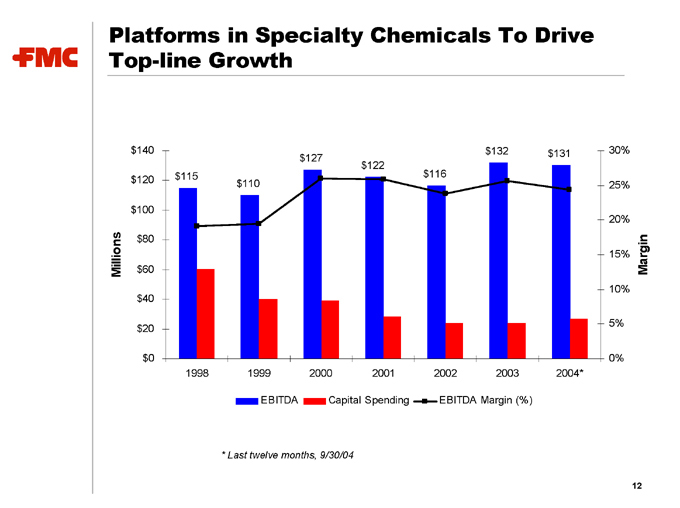

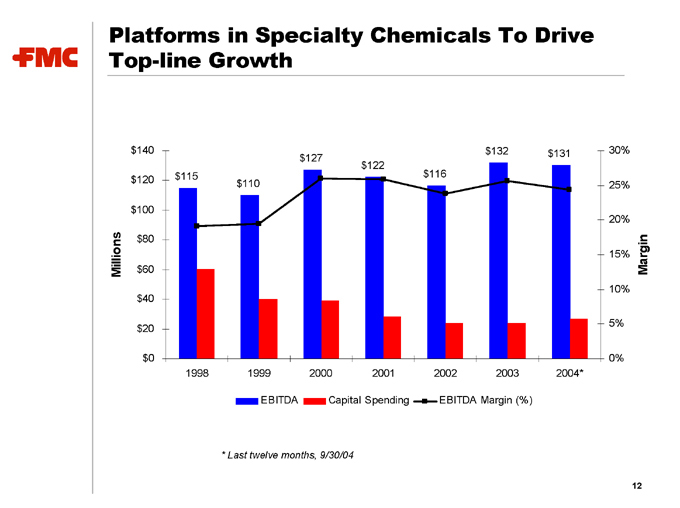

Platforms in Specialty Chemicals To Drive Top-line Growth

Millions $140 $120 $100 $80 $60 $40 $20 $0

1998 1999 2000 2001 2002 2003 2004*

Margin

30% 25% 20% 15% 10% 5% 0%

$115 $110 $127 $122 $116 $132 $131

EBITDA

Capital Spending

EBITDA Margin (%)

* Last twelve months, 9/30/04

12

Strong Market Positions In Growing Markets

Leading biopolymers supplier

Strong franchises in food ingredients and pharmaceutical formulation markets

End-market growth of 3-6 percent per year

Global leader in all three product lines

Leading lithium producer in high value markets

Specialty polymers: 27% of sales growing at 3-6%

Pharmaceutical synthesis: 25% of sales growing at 7-9%

Energy storage: 17% of sales growing at rates over 10%

13

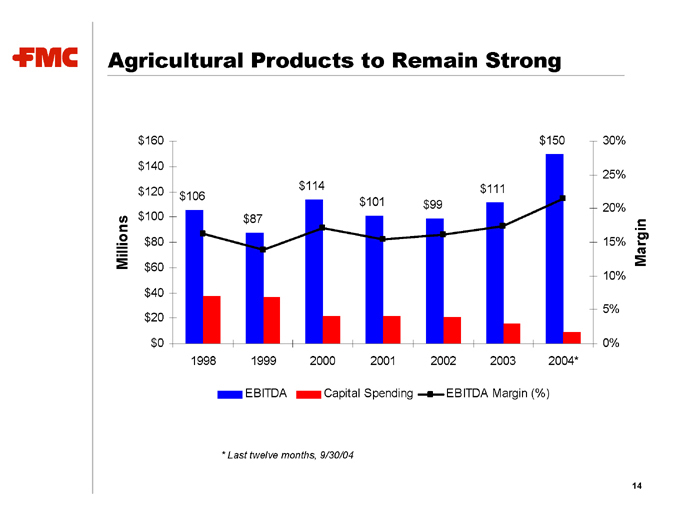

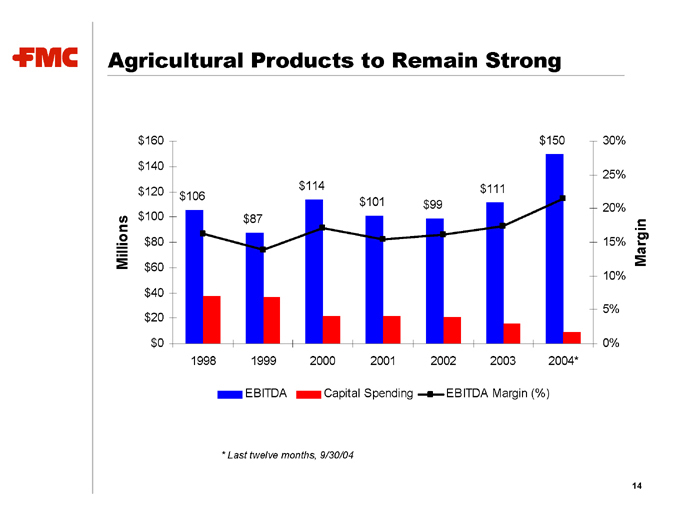

Agricultural Products to Remain Strong

Millions

$160 $140 $120 $100 $80 $60 $40 $20 $0

1998 1999 2000 2001 2002 2003 2004*

Margin

30% 25% 20% 15% 10% 5% 0%

$106 $87 $114 $101 $99 $111 $150

EBITDA

Capital Spending

EBITDA Margin (%)

* Last twelve months, 9/30/04

14

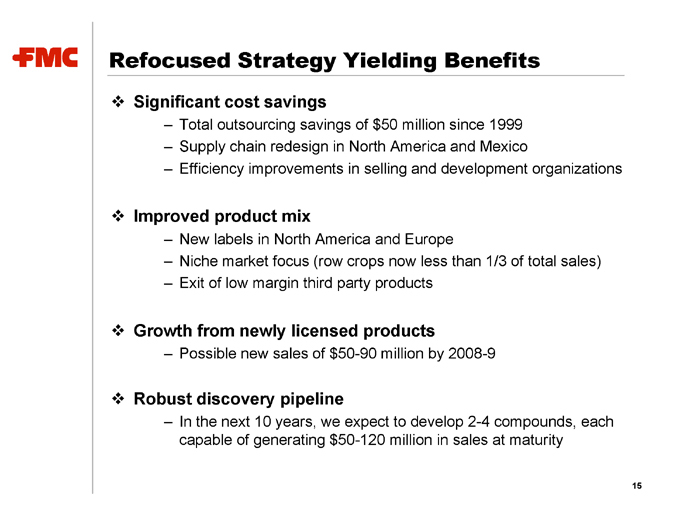

Refocused Strategy Yielding Benefits

Significant cost savings

Total outsourcing savings of $50 million since 1999

Supply chain redesign in North America and Mexico

Efficiency improvements in selling and development organizations

Improved product mix

New labels in North America and Europe

Niche market focus (row crops now less than 1/3 of total sales)

Exit of low margin third party products

Growth from newly licensed products

Possible new sales of $50-90 million by 2008-9

Robust discovery pipeline

In the next 10 years, we expect to develop 2-4 compounds, each capable of generating $50-120 million in sales at maturity

15

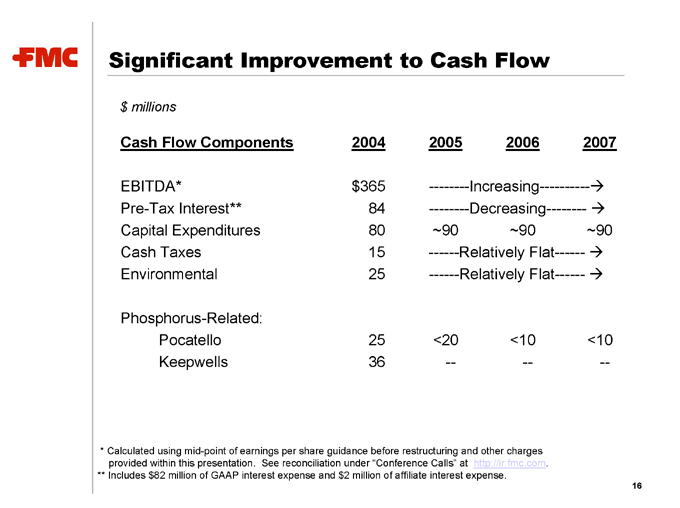

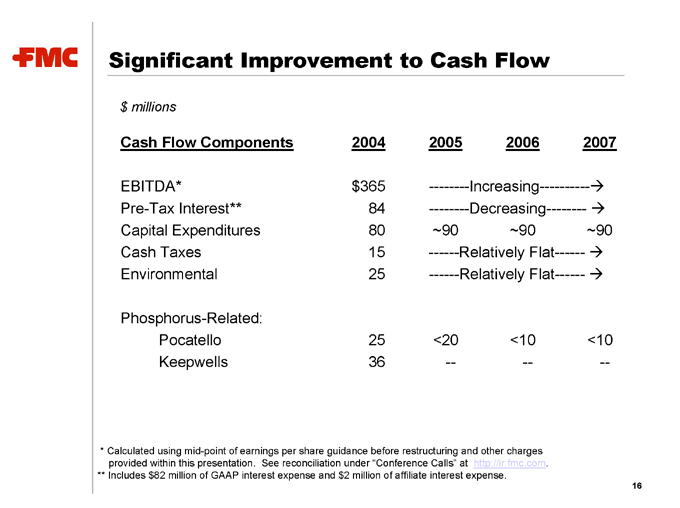

Significant Improvement to Cash Flow $ millions

Cash Flow Components 2004 2005 2006 2007

EBITDA* $365 Increasing

Pre-Tax Interest** 84 Decreasing

Capital Expenditures 80 ~90 ~90 ~90

Cash Taxes 15 Relatively Flat

Environmental 25 Relatively Flat

Phosphorus-Related:

Pocatello 25 <20 <10 <10

Keepwells 36 — — —

* Calculated using mid-point of earnings per share guidance before restructuring and other charges provided within this presentation. See reconciliation under “Conference Calls” at http://ir.fmc.com. ** Includes $82 million of GAAP interest expense and $2 million of affiliate interest expense.

16

In Summary

Great businesses, each generating EBITDA of over $100 million

Industrial Chemicals earnings are currently $50 million below mid-cycle and $100 million below peak

Steady growth in the balance of the portfolio

Low capital expenditure requirements Significantly improving free cash flow

17

FMC Corporation