Exhibit 99.1

FMC Corporation

Bank of America Conference Call

November 12, 2004

Ted Butz

Vice President and Group Manager, Specialty Chemicals

Disclaimer

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995

These slides and the accompanying presentation contain “forward-looking statements” that represent management’s best judgment as of the date hereof based on information currently available. Actual results of the Company may differ materially from those contained in the forward-looking statements.

Additional information concerning factors that may cause results to differ materially from those in the forward-looking statements is contained in the Company’s periodic reports filed under the Securities Exchange Act of 1934, as amended.

The Company undertakes no obligation to update or revise these forward-looking statements to reflect new events or uncertainties.

1

Use of Non-GAAP Terms

These slides contain certain “non-GAAP financial terms” which are defined below and on FMC’s Investor Relations web site (http://ir.fmc.com) in the Glossary of Financial Terms section. In addition, at the end of this presentation, we have provided reconciliations of non-GAAP terms to the closest GAAP term.

EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) is the sum of Income (loss) from continuing operations before income taxes and cumulative effect of change in accounting principle and Depreciation and Amortization.

EBITDA Margin is the quotient of EBITDA (defined above) and Revenue.

Segment EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) for a segment is the sum of Income (loss) from continuing operations before income taxes and cumulative effect of change in accounting principle for that segment and Depreciation and Amortization for that segment.

Segment EBITDA Margin is the quotient of Segment EBITDA (defined above) and Revenue for that segment.

2

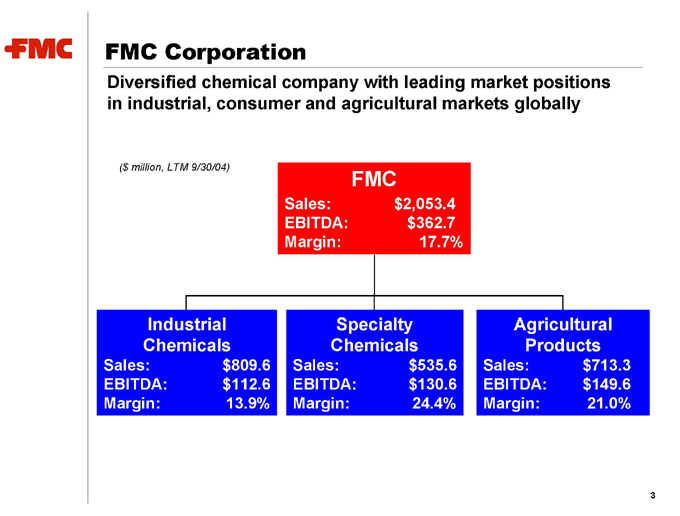

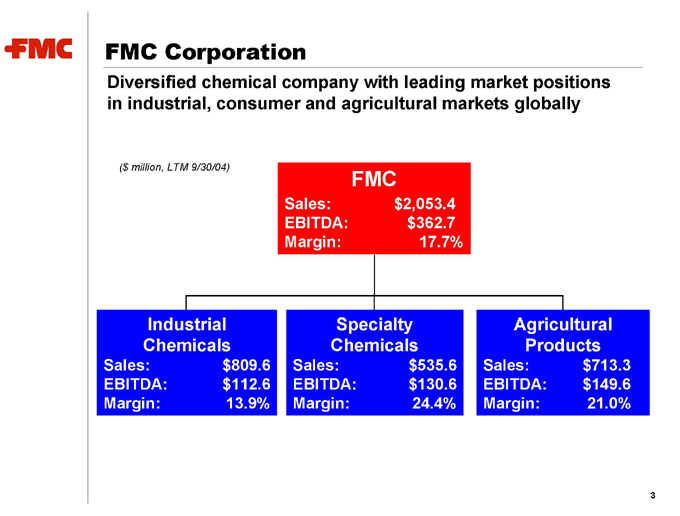

FMC Corporation

Diversified chemical company with leading market positions in industrial, consumer and agricultural markets globally

($ million, LTM 9/30/04)

FMC

Sales: $2,053.4

EBITDA: $362.7

Margin: 17.7%

Industrial Chemicals

Sales: $809.6

EBITDA: $112.6

Margin: 13.9%

Agricultural Products

Sales: $713.3

EBITDA: $149.6

Margin: 21.0%

Specialty Chemicals

Sales: $535.6

EBITDA: $130.6

Margin: 24.4%

3

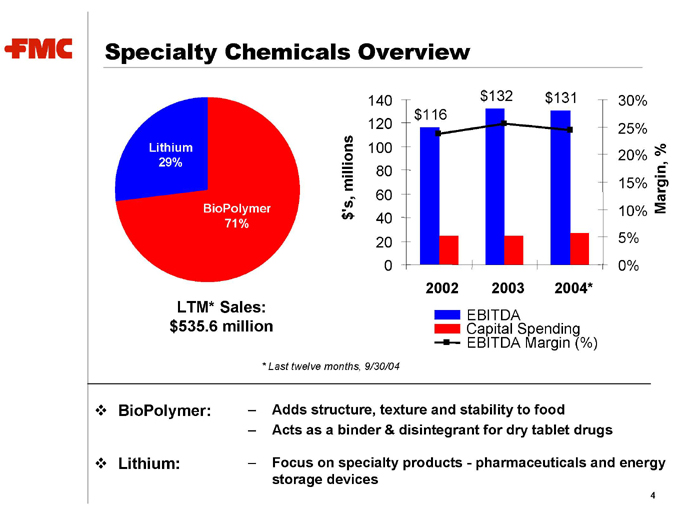

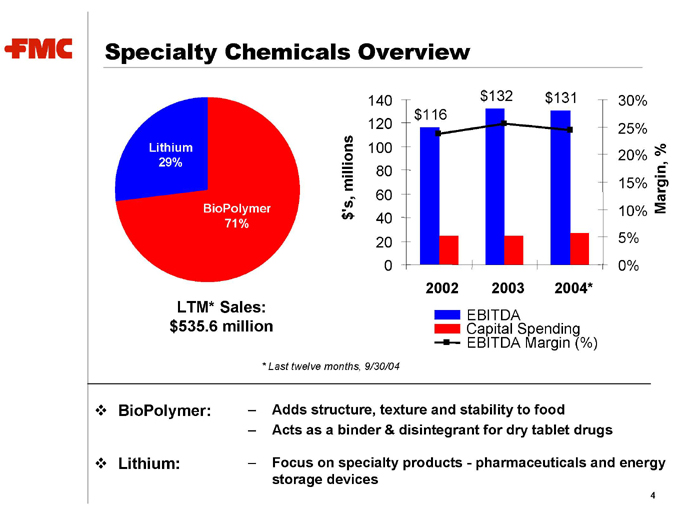

Specialty Chemicals Overview

LTM* Sales:

$535.6 million

2002

2003

2004*

$’s, millions

0%

5%

10%

15%

20%

25%

30%

Margin, %

EBITDA

Capital Spending

EBITDA Margin (%)

$116

$132

$131

0

20

40

60

80

100

120

140

BioPolymer

71%

Lithium

29%

* Last twelve months, 9/30/04

BioPolymer: — Adds structure, texture and stability to food

— Acts as a binder & disintegrant for dry tablet drugs

Lithium: — Focus on specialty products - pharmaceuticals and energy storage devices

4

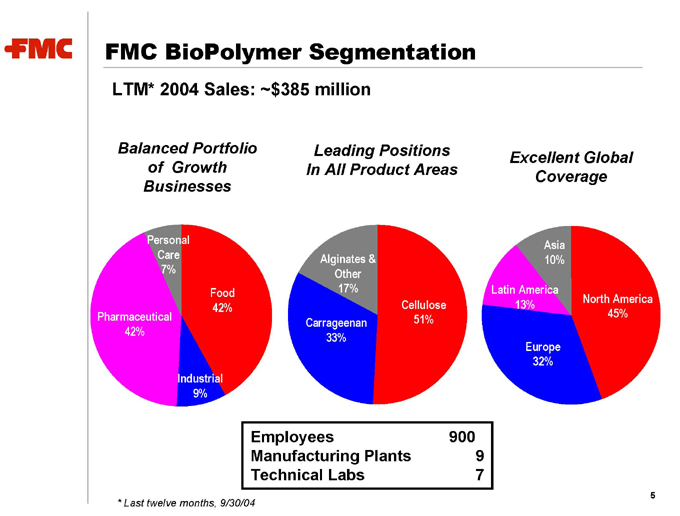

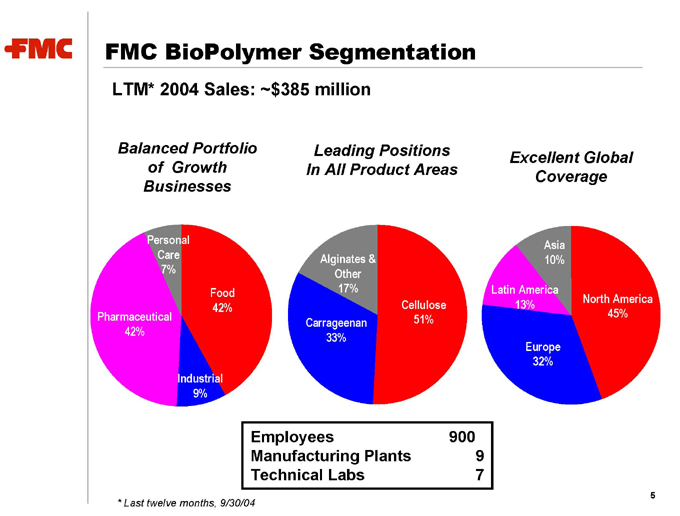

FMC BioPolymer Segmentation

LTM* 2004 Sales: ~$385 million

Balanced Portfolio of Growth Businesses

Personal Care

7%

Food

42%

Industrial

9%

Pharmaceutical

42%

Leading Positions In All Product Areas

Alginates & Other

17%

Carrageenan

33%

Cellulose

51%

Excellent Global Coverage

North America

45%

Europe

32%

Latin America

13%

Asia

10%

Employees 900

Manufacturing Plants 9

Technical Labs 7

* Last twelve months, 9/30/04

5

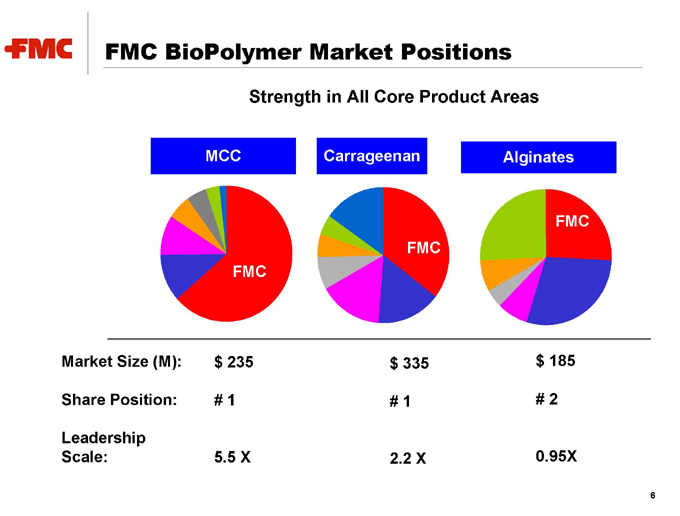

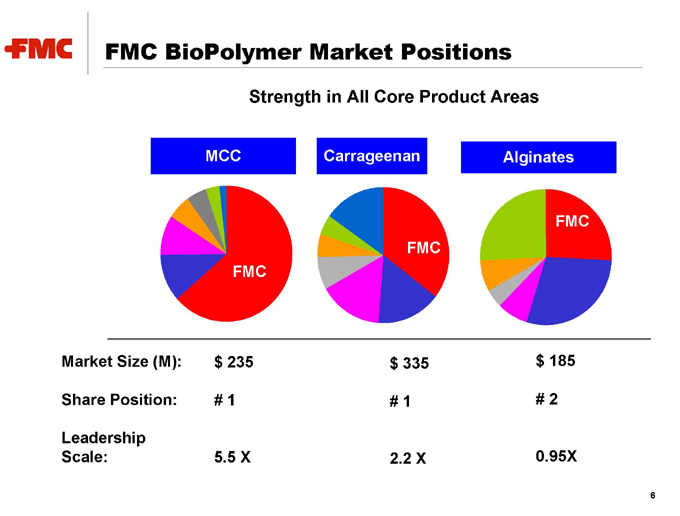

FMC BioPolymer Market Positions

Strength in All Core Product Areas

MCC

FMC

Carrageenan

FMC

Alginates

FMC

Market Size (M): $235 $335 $185

Share Position: # 1 # 1 # 2

Leadership Scale: 5.5 X 2.2 X 0.95X

6

FMC BioPolymer’s Outlook is Positive

Serving attractive end markets

Strong position with industry-driving customers

Leading product positions

Coordinated global capabilities

Proven track record of performance

7

FMC Corporation

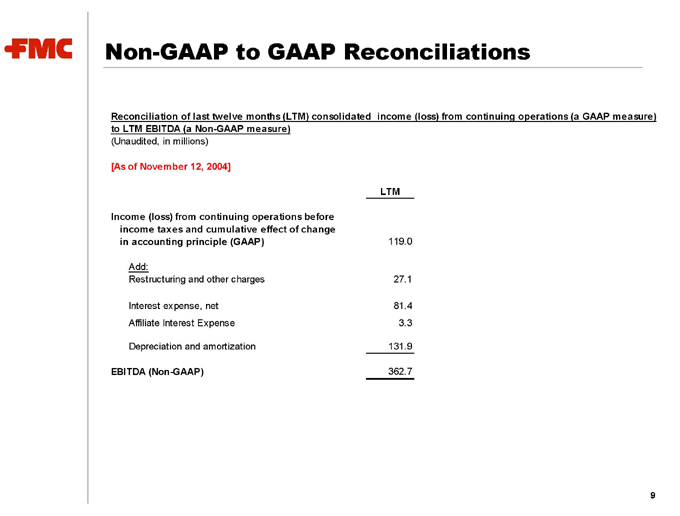

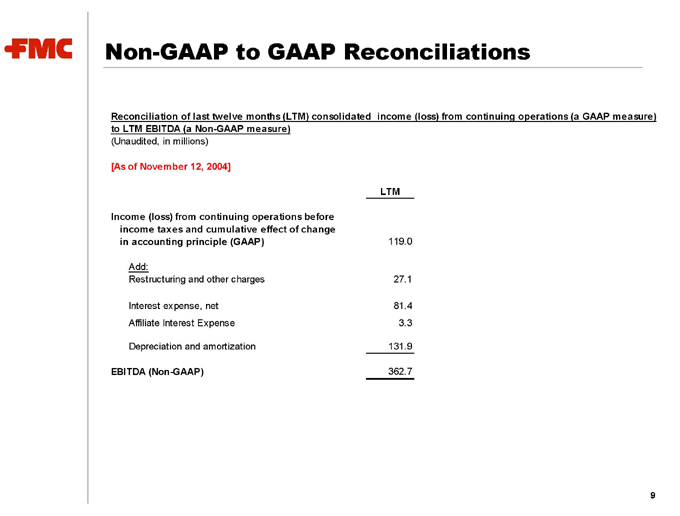

Non-GAAP to GAAP Reconciliations

Reconciliation of last twelve months (LTM) consolidated income (loss) from continuing operations (a GAAP measure) to LTM EBITDA (a Non-GAAP measure)

(Unaudited, in millions)

[As of November 12, 2004]

LTM

Income (loss) from continuing operations before income taxes and cumulative effect of change in accounting principle (GAAP) 119.0

Add:

Restructuring and other charges 27.1

Interest expense, net 81.4

Affiliate Interest Expense 3.3

Depreciation and amortization 131.9

EBITDA (Non-GAAP) 362.7

9

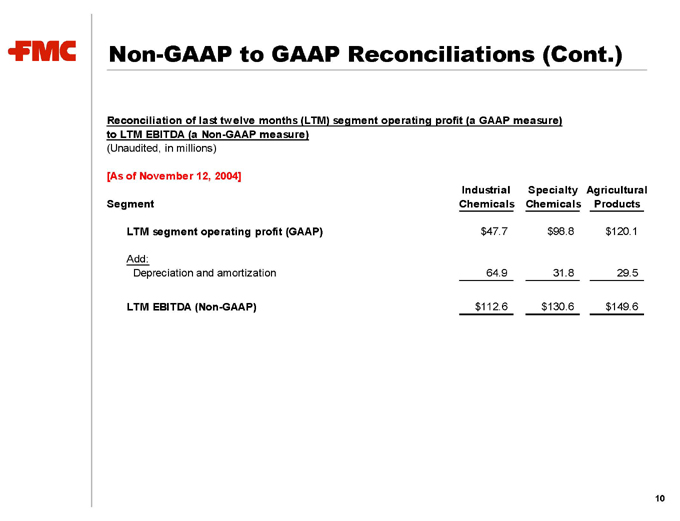

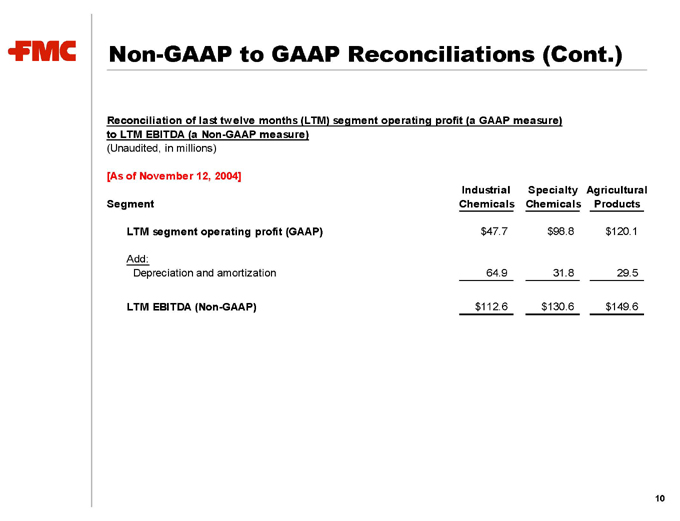

Non-GAAP to GAAP Reconciliations (Cont.)

Reconciliation of last twelve months (LTM) segment operating profit (a GAAP measure) to LTM EBITDA (a Non-GAAP measure)

(Unaudited, in millions)

[As of November 12, 2004]

Segment Industrial Chemicals Specialty Chemicals Agricultural Products

LTM segment operating profit (GAAP) $47.7 $98.8 $120.1

Add:

Depreciation and amortization 64.9 31.8 29.5

LTM EBITDA (Non-GAAP) $112.6 $130.6 $149.6

10