Exhibit 99.1

Soda Ash and Hydrogen Peroxide Update

Michael Wilson

Vice President, Industrial Chemicals Group

Bank of America Conference Call March 11, 2005

Disclaimer

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995

These slides and the accompanying presentation contain “forward-looking statements” that represent management’s best judgment as of the date hereof based on information currently available. Actual results of the Company may differ materially from those contained in the forward-looking statements.

Additional information concerning factors that may cause results to differ materially from those in the forward-looking statements is contained in the Company’s periodic reports filed under the Securities Exchange Act of 1934, as amended.

The Company undertakes no obligation to update or revise these forward-looking statements to reflect new events or uncertainties.

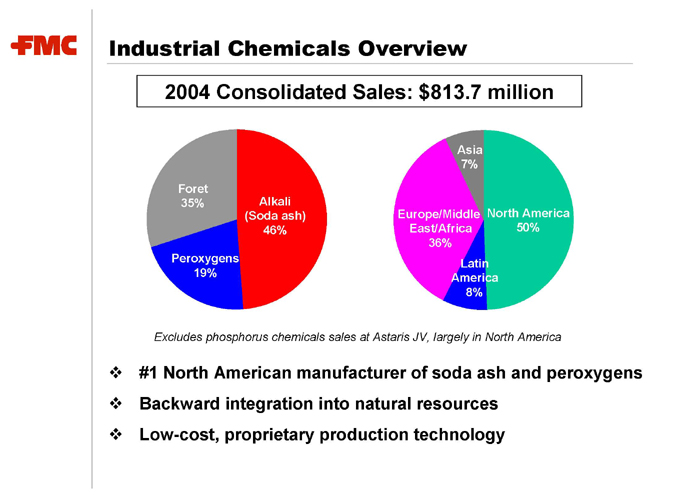

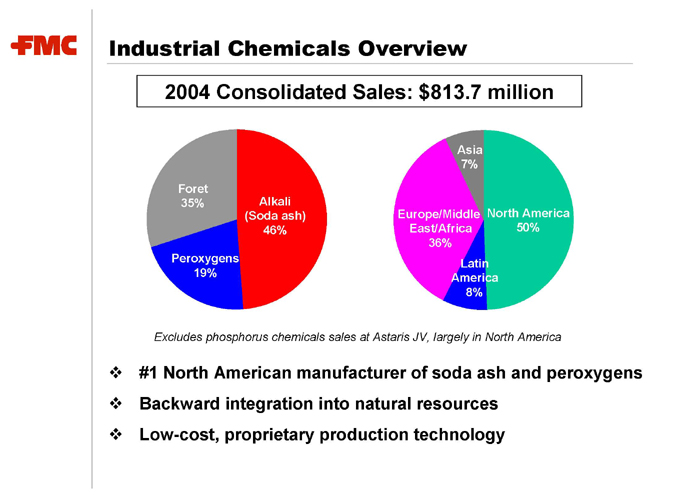

Industrial Chemicals Overview

2004 Consolidated Sales: $813.7 million

Foret 35%

Peroxygens 19%

Alkali (Soda ash) 46%

Asia 7%

Europe/Middle East/Africa 36%

Latin America 8%

North America 50%

Excludes phosphorus chemicals sales at Astaris JV, largely in North America

#1 North American manufacturer of soda ash and peroxygens Backward integration into natural resources

Low-cost, proprietary production technology

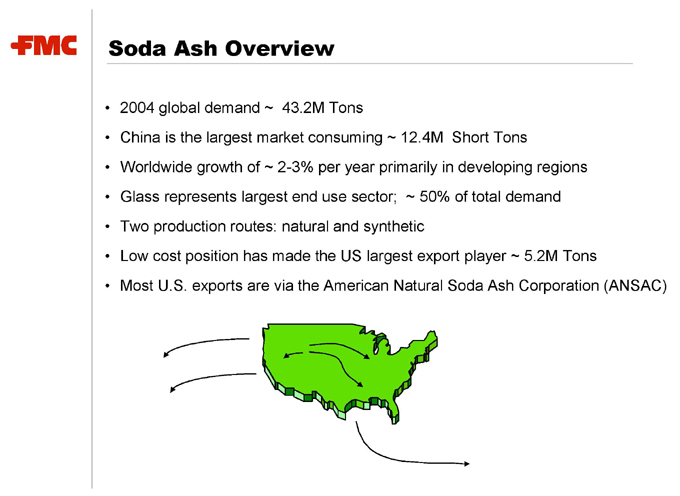

Soda Ash Overview

2004 global demand ~ 43.2M Tons

China is the largest market consuming ~ 12.4M Short Tons

Worldwide growth of ~ 2-3% per year primarily in developing regions

Glass represents largest end use sector; ~ 50% of total demand

Two production routes: natural and synthetic

Low cost position has made the US largest export player ~ 5.2M Tons

Most U.S. exports are via the American Natural Soda Ash Corporation (ANSAC)

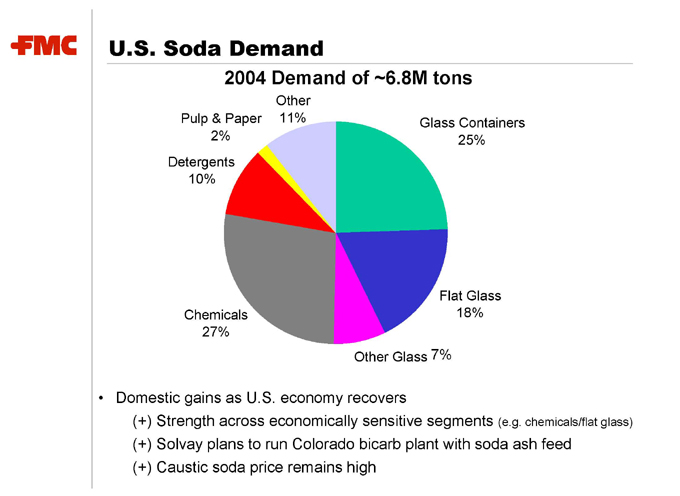

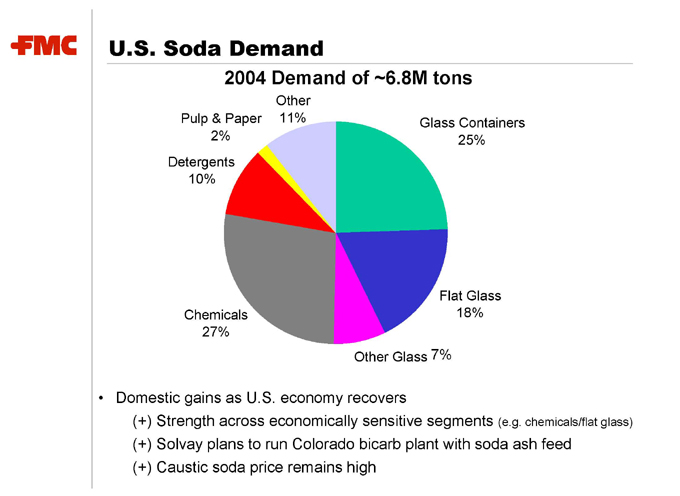

U.S. Soda Demand

2004 Demand of ~6.8M tons

Other 11%

Glass Containers 25%

Flat Glass 18%

Other Glass 7%

Chemicals 27%

Detergents 10%

Pulp & Paper 2%

Domestic gains as U.S. economy recovers

(+) Strength across economically sensitive segments (e.g. chemicals/flat glass) (+) Solvay plans to run Colorado bicarb plant with soda ash feed (+) Caustic soda price remains high

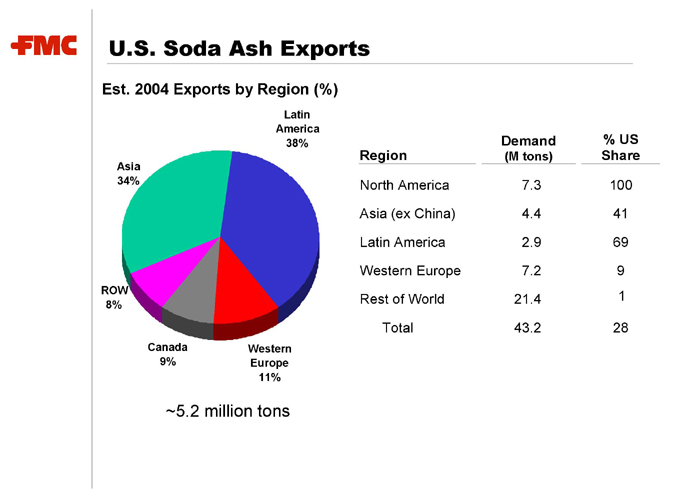

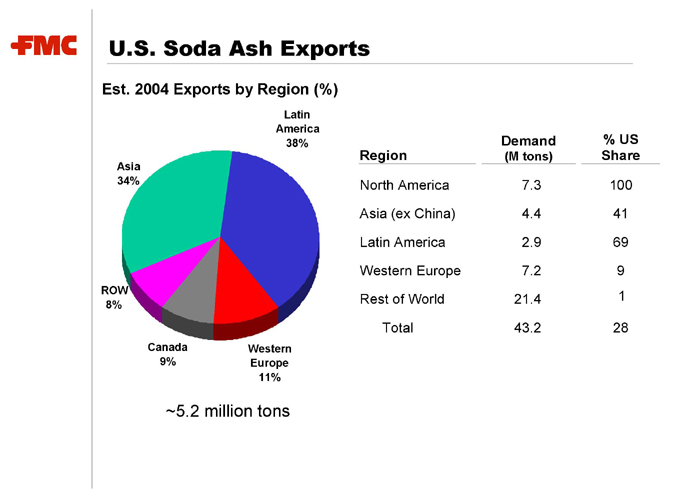

U.S. Soda Ash Exports

Est. 2004 Exports by Region (%)

Latin America 38%

Asia 34%

ROW 8%

Canada 9%

Western Europe 11%

~5.2 million tons

U.S. Regional Share

Region Demand (M tons)% US Share

North America 7.3 100

Asia (ex China) 4.4 41

Latin America 2.9 69

Western Europe 7.2 9

Rest of World 21.4 1

Total 43.2 28

U.S. Soda Ash Supply

FMC 29%

OCI 20%

General 17%

SVM * 9%

Solvay-WY

19%

Solvay-CO

6%

* Searles Valley Minerals

2005 Capacity M Tons Nameplate Post Mothball

FMC 4.9 3.8 **

General 2.8 2.8

OCI 3.3 2.4

Solvay—WY 3.1 3.1

Solvay—CO 1.0 0.0

SVM 1.5 1.5

16.5 13.4

Estimated Effective Capacity 12.2

** Granger @ 250 K tons per year

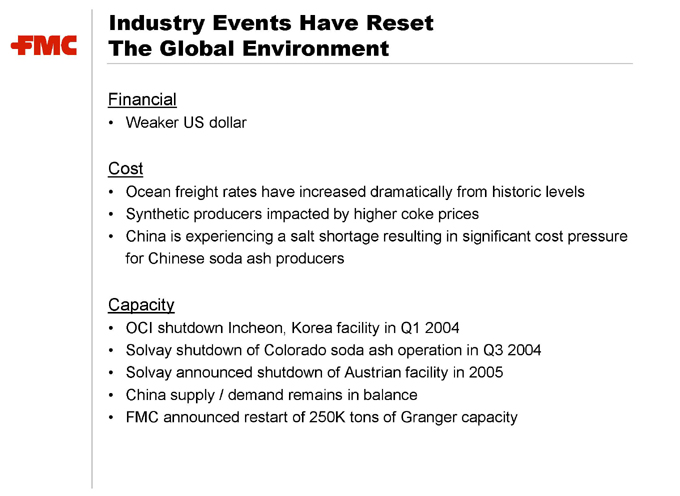

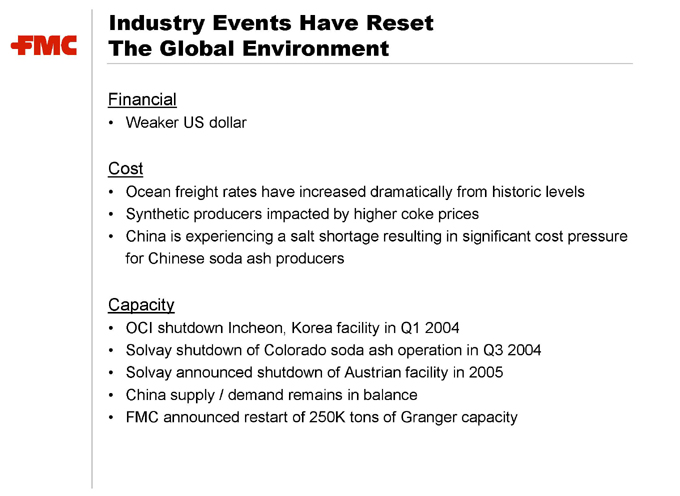

Industry Events Have Reset The Global Environment

Financial

Weaker US dollar

Cost

Ocean freight rates have increased dramatically from historic levels

Synthetic producers impacted by higher coke prices

China is experiencing a salt shortage resulting in significant cost pressure for Chinese soda ash producers

Capacity

OCI shutdown Incheon, Korea facility in Q1 2004

Solvay shutdown of Colorado soda ash operation in Q3 2004

Solvay announced shutdown of Austrian facility in 2005

China supply / demand remains in balance

FMC announced restart of 250K tons of Granger capacity

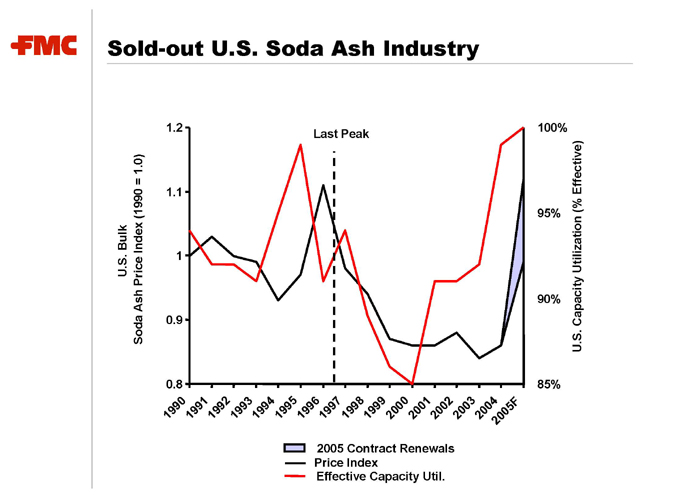

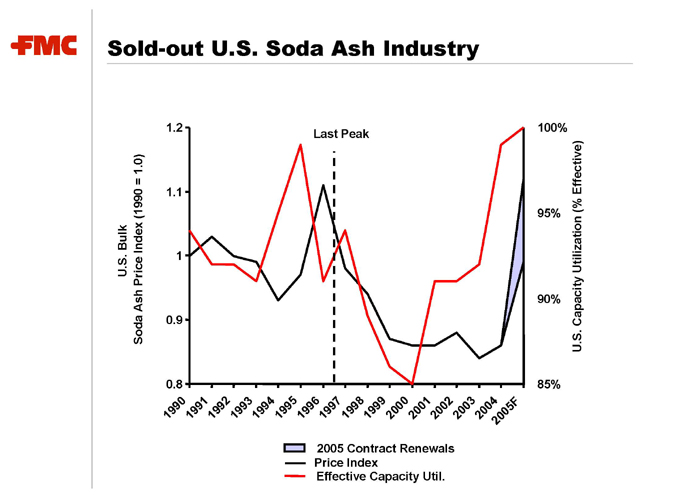

Sold-out U.S. Soda Ash Industry

U.S. Bulk

Soda Ash Price Index (1990 = 1.0)

1.2 1.1 1 0.9 0.8

Last Peak

100% 95% 90% 85%

U.S. Capacity Utilization (% Effective)

1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004

2005F

2005 Contract Renewals Price Index Effective Capacity Util.

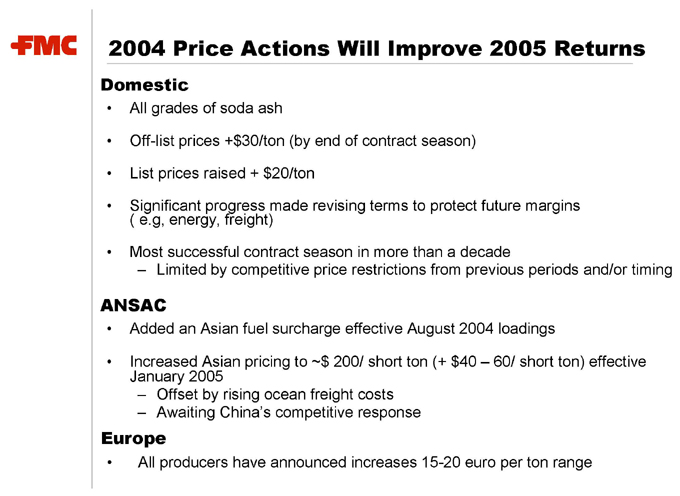

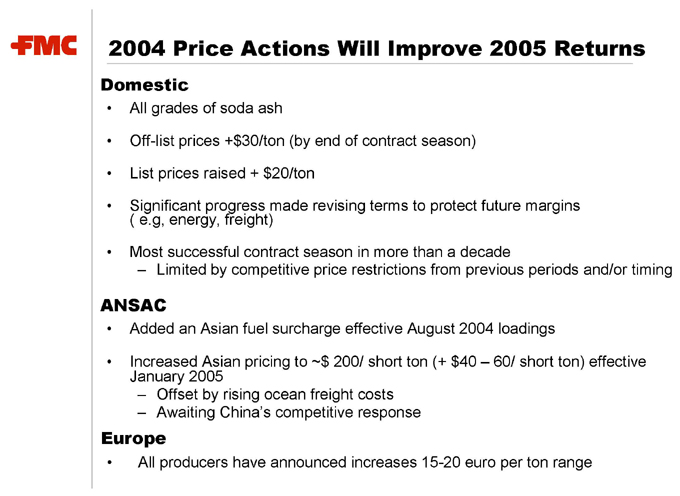

2004 Price Actions Will Improve 2005 Returns

Domestic

All grades of soda ash

Off-list prices +$30/ton (by end of contract season)

List prices raised + $20/ton

Significant progress made revising terms to protect future margins ( e.g, energy, freight)

Most successful contract season in more than a decade

Limited by competitive price restrictions from previous periods and/or timing

ANSAC

Added an Asian fuel surcharge effective August 2004 loadings

Increased Asian pricing to ~$ 200/ short ton (+ $40 – 60/ short ton) effective January 2005

Offset by rising ocean freight costs

Awaiting China’s competitive response

Europe

All producers have announced increases 15-20 euro per ton range

Soda Ash Summary

U.S. industry operating at full effective capacity

7% growth in U.S. export demand in 2004

History shows operating rate is a leading indicator for price

Financial pressure worldwide has lead to a rising price environment

Raw material and energy costs

Freight (rail and/or ocean)

Chinese governmental influence (e.g. credit, VAT duty drawback)

Global utilization – the world is sold out

FMC is positioned for higher soda ash profitability

Lowest cost producer

Domestic and export price recovery

Incremental capacity options exist at FMC Granger

Hydrogen Peroxide Overview

North American demand for hydrogen peroxide was 1.45 billion lbs. in 2004

Hydrogen gas is the primary raw material

Energy and hydrogen gas represent 50% of the cost of sales

Hydrogen peroxide is shipped dilute in water, resulting in a fairly regional market with few imports or exports

Pulp and paper is the largest end-market

Specialty peroxide derivatives are used in numerous high value applications including electronics, polymers and detergents

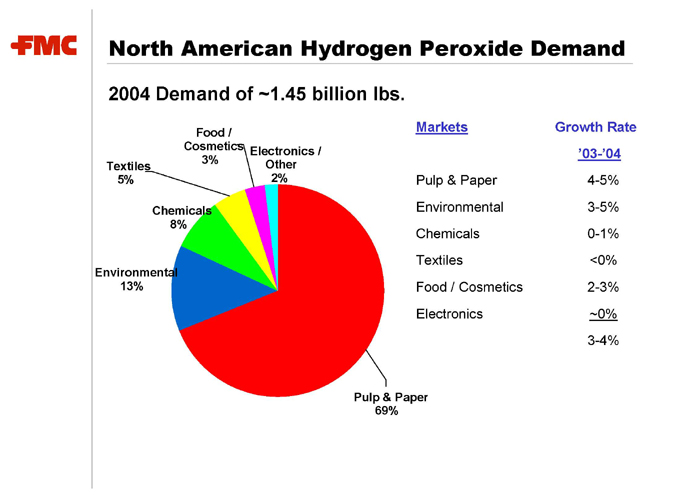

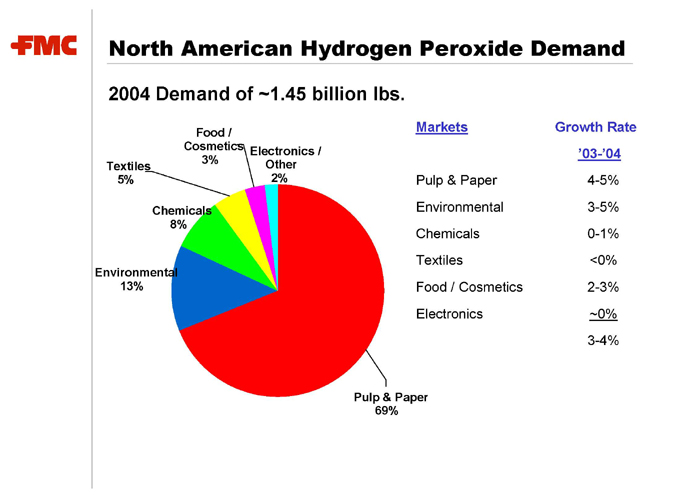

North American Hydrogen Peroxide Demand

2004 Demand of ~1.45 billion lbs.

Food/Cosmetics 3%

Electronics/Other 2%

Textiles 5%

Chemicals 8%

Environmental 13%

Pulp & Paper 69%

Markets Growth Rate ‘03-’04

Pulp & Paper 4-5%

Environmental 3-5%

Chemicals 0-1%

Textiles <0%

Food / Cosmetics 2-3%

Electronics 0%

3-4%

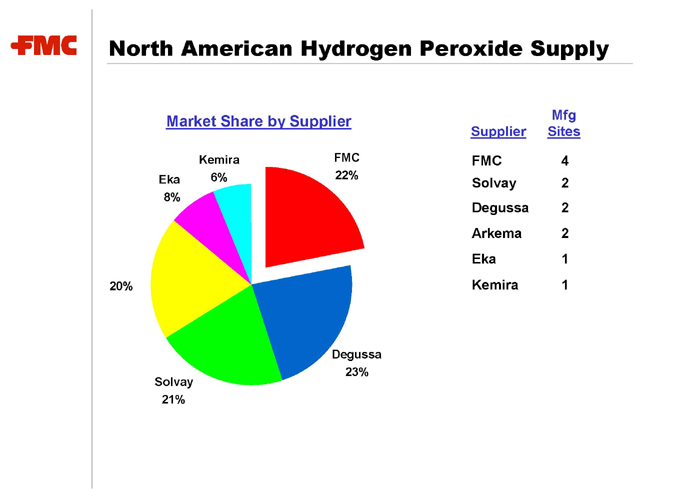

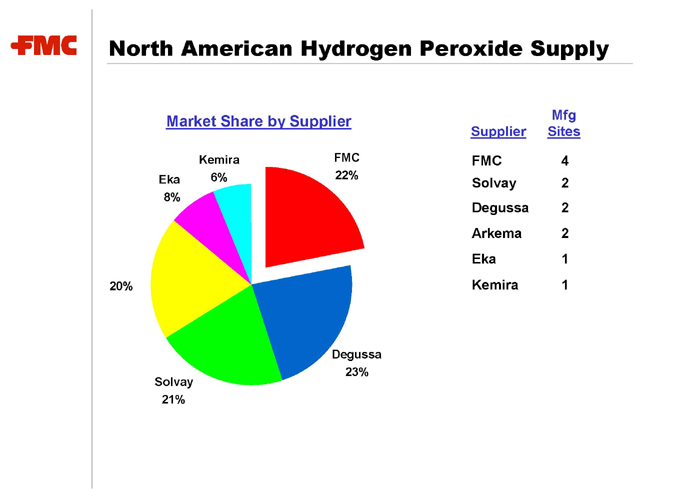

North American Hydrogen Peroxide Supply

Market Share by Supplier

Kemira 6%

FMC 22%

Eka 8%

20%

Solvay 21%

Degussa 23%

Supplier Mfg Sites

FMC 4

Solvay 2

Degussa 2

Arkema 2

Eka 1

Kemira 1

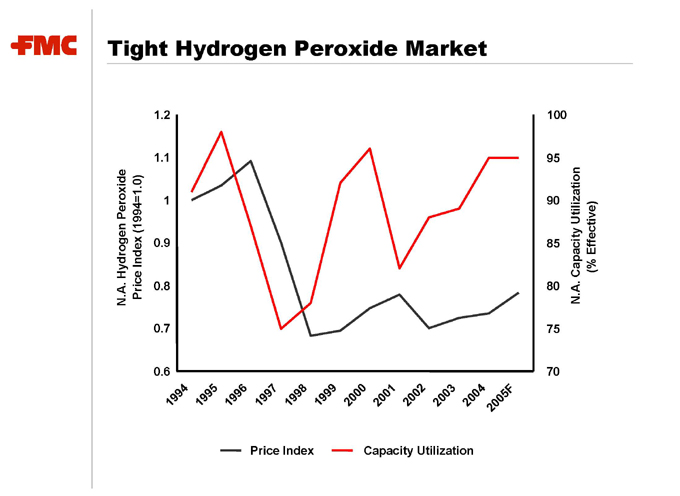

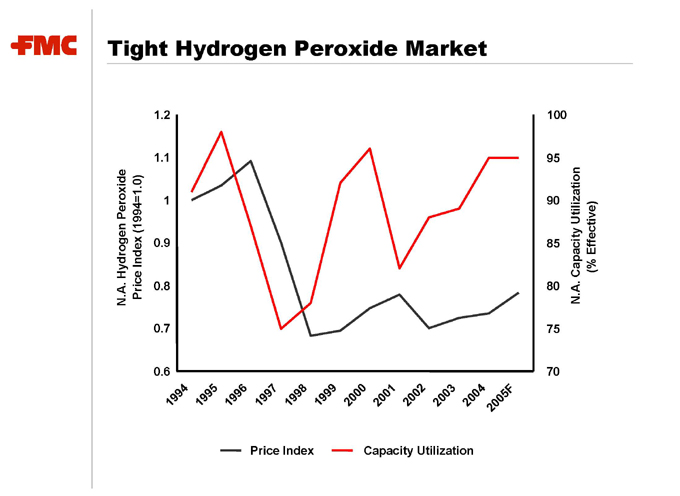

Tight Hydrogen Peroxide Market

N.A. Hydrogen Peroxide Price Index (1994=1.0)

1.2 1.1 1 0.9 0.8 0.7 0.6

100 95 90 85 80 75 70

N.A. Capacity Utilization

(% Effective)

1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004

2005F

Price Index Capacity Utilization

Hydrogen Peroxide Summary

Tight operating conditions expected to continue

Capacity utilization now in the mid 90’s

Solvay capacity addition to come on in second half of 2005

Solvay increment (~4% increase to industry capacity) is expected to be absorbed by continued demand growth

Steadily rising prices

Prices started to improve in 2003 as capacity utilization rose above 90%

Higher energy costs drive need for higher prices

Prices are expected to increase a couple cents on average in 2005

FMC is positioned for higher profitability

Low cost producer

Broadest geographic coverage

Higher value mix

FMC Corporation