Exhibit 99.1

FMC Corporation

California Investor Meetings March 30-31, 2006

William G. Walter Chairman, President and CEO

Disclaimer

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995

These slides and the accompanying presentation contain “forward-looking statements” that represent management’s best judgment as of the date hereof based on information currently available. Actual results of the Company may differ materially from those contained in the forward-looking statements.

Additional information concerning factors that may cause results to differ materially from those in the forward-looking statements is contained in the Company’s periodic reports filed under the Securities Exchange Act of 1934, as amended.

The Company undertakes no obligation to update or revise these forward-looking statements to reflect new events or uncertainties.

Non-GAAP Financial Terms

These slides contain certain “non-GAAP financial terms” which are defined in the appendix. In addition, we have provided reconciliations of non-GAAP terms to the closest GAAP term in the appendix.

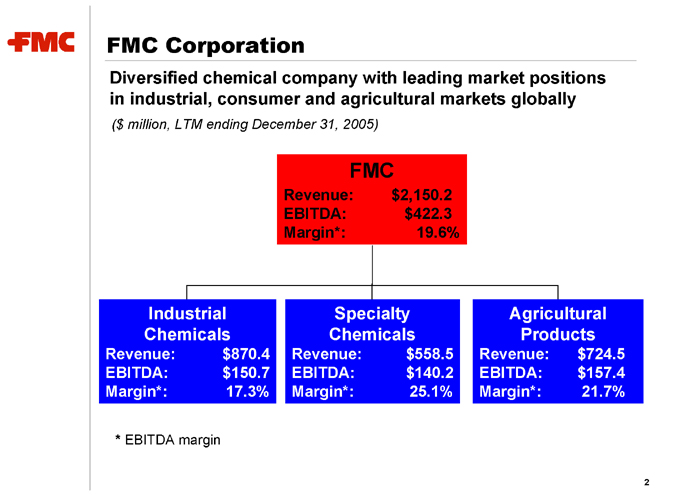

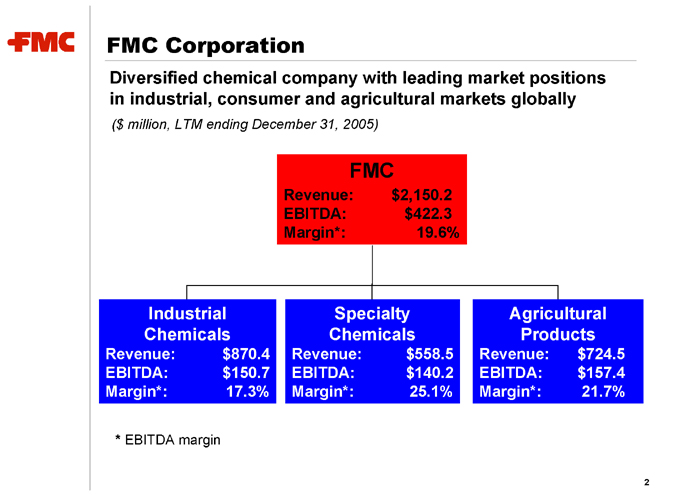

FMC Corporation

Diversified chemical company with leading market positions in industrial, consumer and agricultural markets globally

($ million, LTM ending December 31, 2005)

FMC

Industrial Chemicals

Specialty Chemicals

Agricultural Products

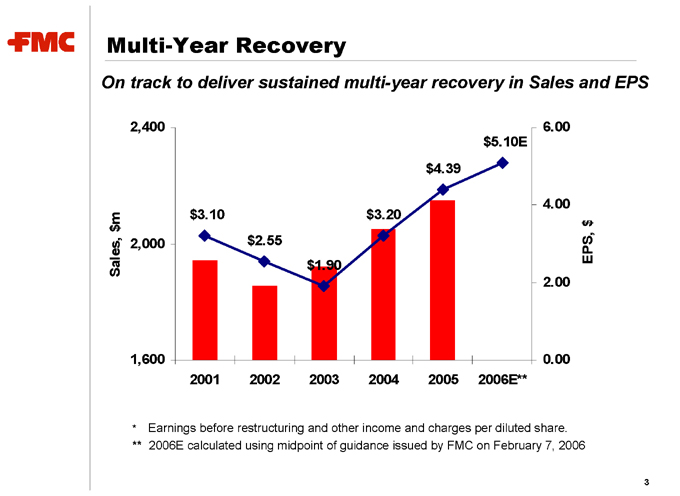

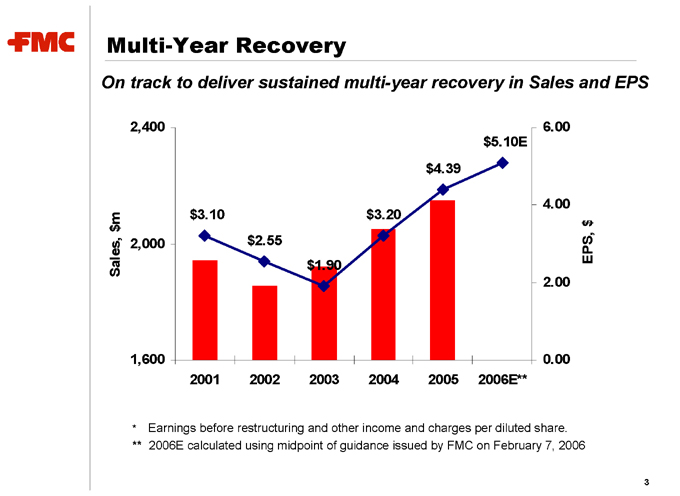

Multi-Year Recovery

On track to deliver sustained multi-year recovery in Sales and EPS

Sales, $m

2,400

2,000

1,600 $3.10 $2.55 $1.90 $3.20

$4.39 $5.10E

2001 2002 2003 2004 2005 2006E**

6.00

4.00

2.00

0.00

EPS, $

* | | Earnings before restructuring and other income and charges per diluted share. |

** 2006E calculated using midpoint of guidance issued by FMC on February 7, 2006

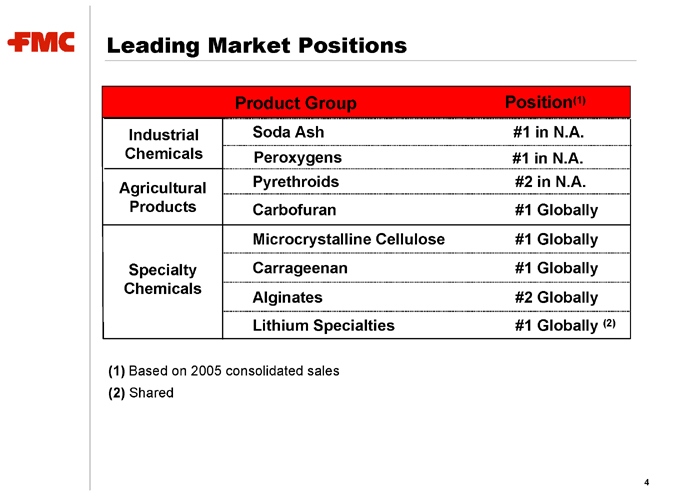

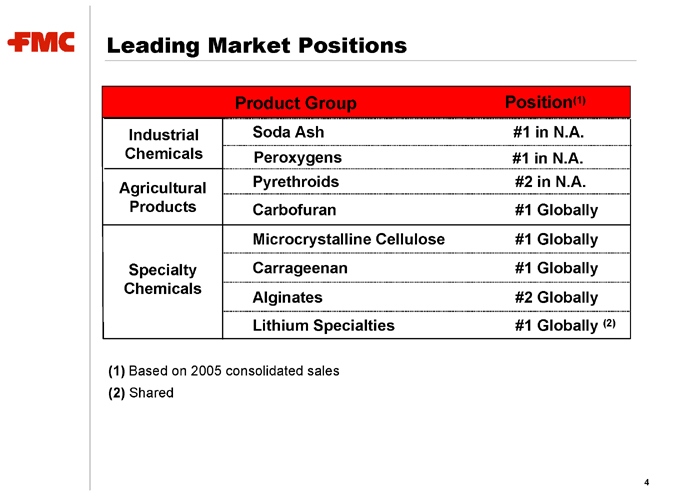

Leading Market Positions

Product | | Group Position(1) |

Industrial | | Soda Ash #1 in N.A. |

Chemicals | | Peroxygens #1 in N.A. |

Agricultural | | Pyrethroids #2 in N.A. |

Products | | Carbofuran #1 Globally |

Microcrystalline | | Cellulose #1 Globally |

Specialty | | Carrageenan #1 Globally |

Lithium | | Specialties #1 Globally (2) |

(1) | | Based on 2005 consolidated sales (2) Shared |

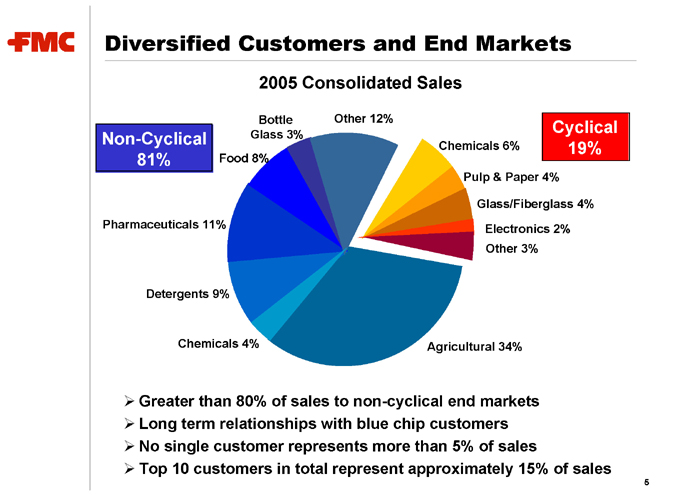

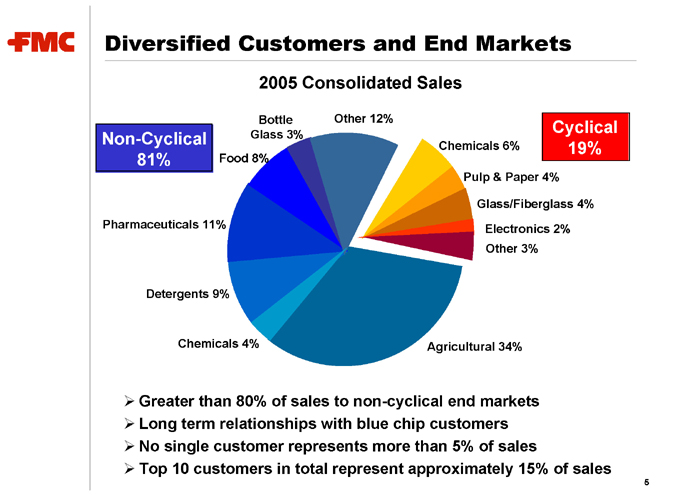

Diversified Customers and End Markets

2005 Consolidated Sales

Non-Cyclical 81%

Pharmaceuticals 11%

Food 8%

Bottle Glass 3%

Other 12%

Chemicals 6%

Pulp & Paper 4%

Glass/Fiberglass 4%

Electronics 2% Other 3%

Detergents 9%

Chemicals 4%

Agricultural 34%

Cyclical 19%

Greater than 80% of sales to non-cyclical end markets Long term relationships with blue chip customers No single customer represents more than 5% of sales

Top 10 customers in total represent approximately 15% of sales

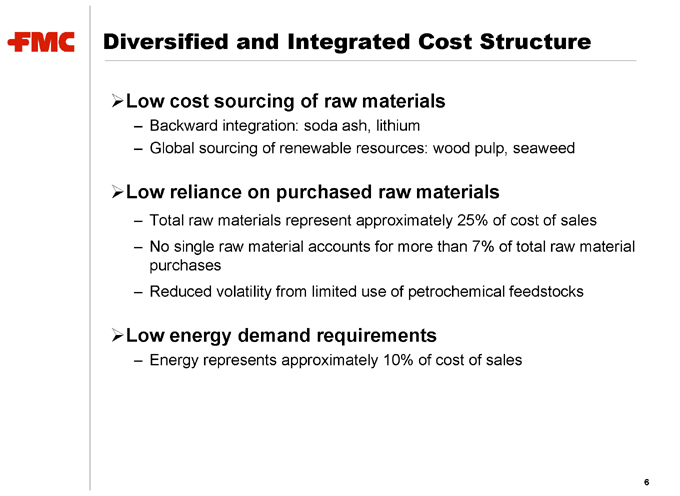

Diversified and Integrated Cost Structure

Low cost sourcing of raw materials

Backward integration: soda ash, lithium

Global sourcing of renewable resources: wood pulp, seaweed

Low reliance on purchased raw materials

Total raw materials represent approximately 25% of cost of sales No single raw material accounts for more than 7% of total raw material purchases Reduced volatility from limited use of petrochemical feedstocks

Low energy demand requirements

Energy represents approximately 10% of cost of sales

Disciplined Approach to Unlocking Value

Realizing the inherent operating leverage within FMC

Sustained earnings growth >10% per year(1) Industrial Chemicals recovery in mid-cycle in 2006

Continued growth in Specialty Chemicals and Agricultural Products

Maintaining financial strength and flexibility

Investment grade capital policies

Initiated quarterly cash dividend of $0.18 per share Announced $150 million share repurchase program

Focusing the portfolio on higher growth businesses

Manage Specialty Chemicals and Agricultural Products for growth Manage Industrial Chemicals for cash

(1) | | Earnings before restructuring and other income and charges |

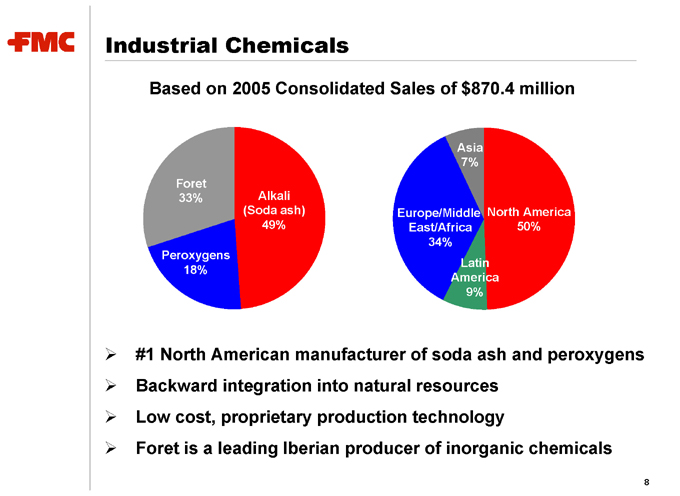

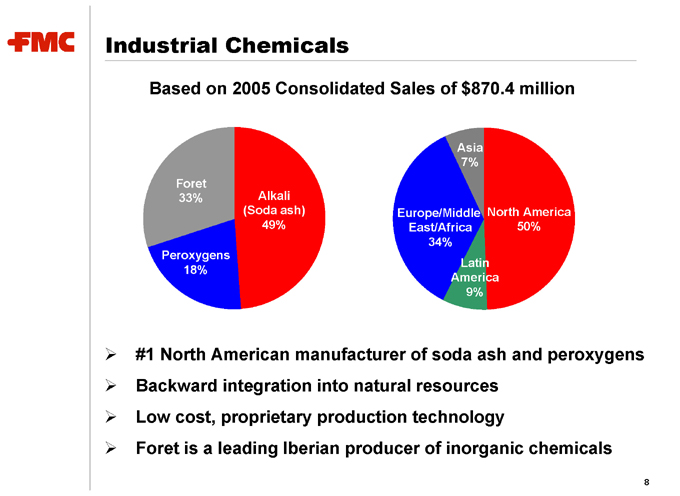

Industrial Chemicals

Based on 2005 Consolidated Sales of $870.4 million

Foret 33%

Peroxygens 18%

Alkali (Soda ash) 49%

Europe/Middle East/Africa 34%

Latin America 9%

Asia 7%

North America 50%

#1 North American manufacturer of soda ash and peroxygens Backward integration into natural resources Low cost, proprietary production technology Foret is a leading Iberian producer of inorganic chemicals

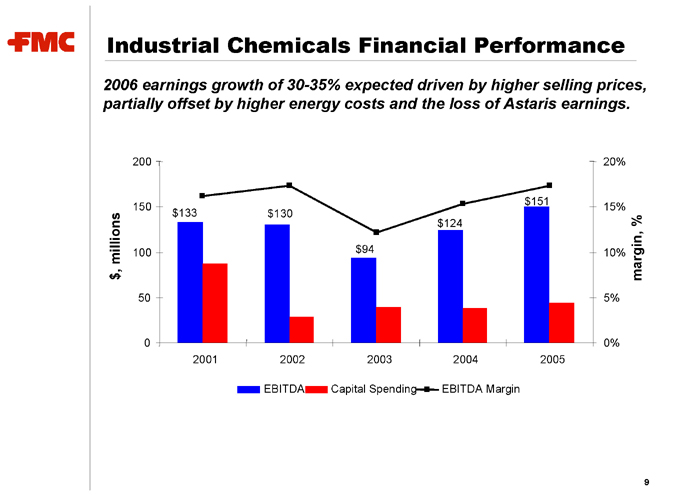

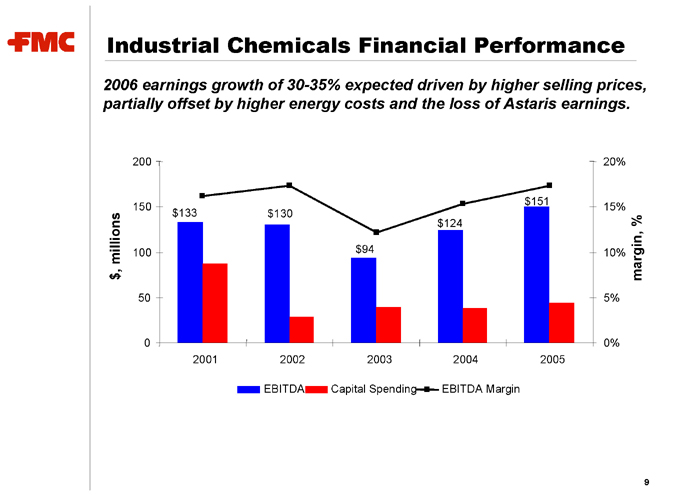

Industrial Chemicals Financial Performance

2006 earnings growth of 30-35% expected driven by higher selling prices, partially offset by higher energy costs and the loss of Astaris earnings.

$, millions

200 150 100 50 0 $133 $130 $94 $124 $151

2001 2002 2003 2004 2005

20% 15% 10% 5% 0% margin, %

EBITDA

Capital Spending

EBITDA Margin

9

Industrial Chemicals’ Focus

Managing for cash generation

Near-term sales growth

Higher soda ash selling prices

Considering re-commissioning another increment of soda ash capacity at Granger to support export demand growth Additional peroxide price increases in North America and Europe.

Margin expansion

Working to offset rising energy, raw material and transportation costs

10

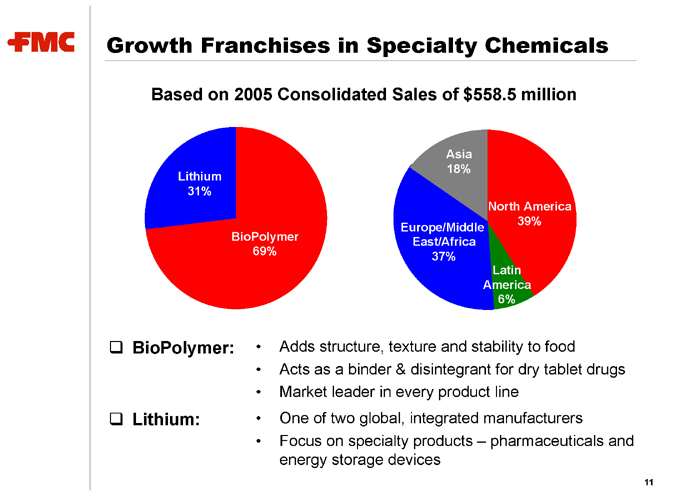

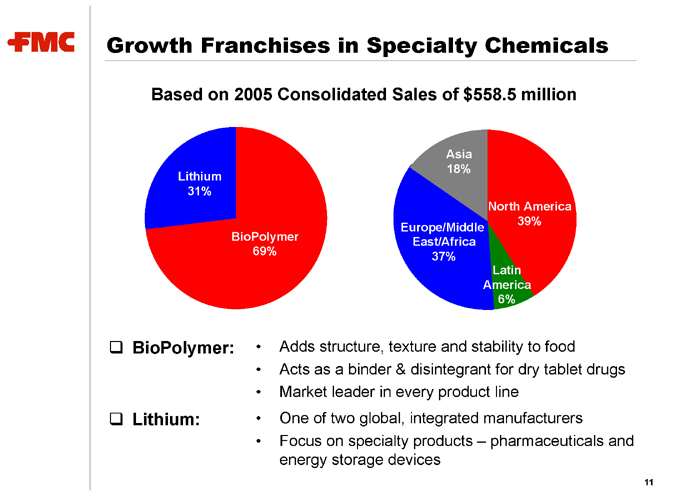

Growth Franchises in Specialty Chemicals

Based on 2005 Consolidated Sales of $558.5 million

Lithium 31%

BioPolymer 69%

Asia 18%

Europe/Middle East/Africa 37%

North America 39%

Latin America 6%

BioPolymer:

Lithium:

Adds structure, texture and stability to food Acts as a binder & disintegrant for dry tablet drugs Market leader in every product line One of two global, integrated manufacturers Focus on specialty products – pharmaceuticals and energy storage devices

11

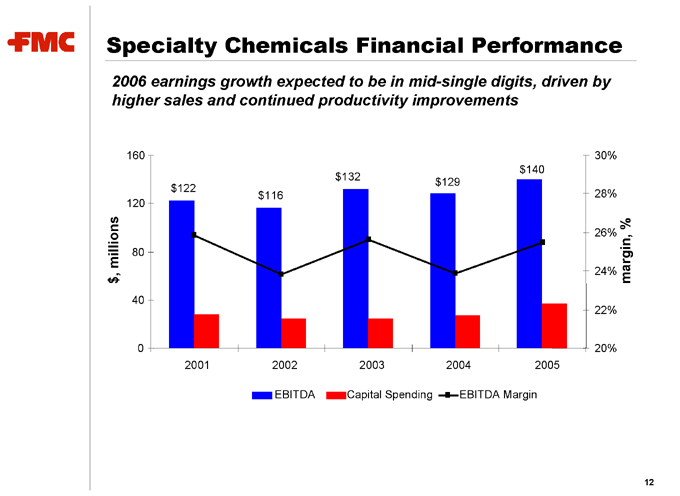

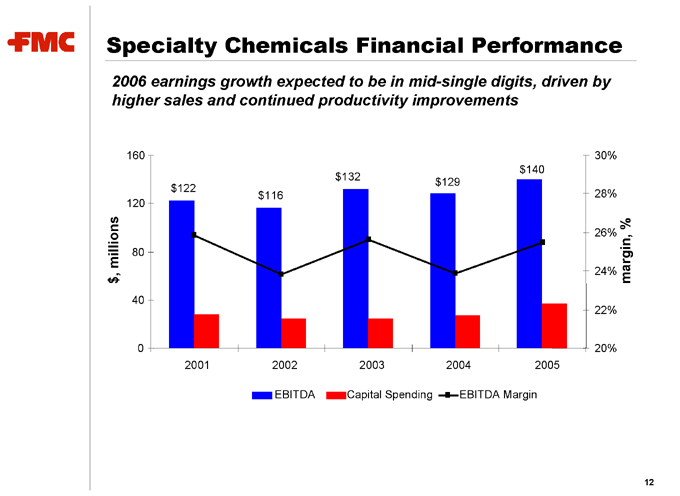

Specialty Chemicals Financial Performance

2006 earnings growth expected to be in mid-single digits, driven by higher sales and continued productivity improvements $, millions

160 120 80 40 0 $122 $116 $132 $129 $140

2001 2002 2003 2004 2005

30% 28% 26% 24% 22% 20% margin, %

EBITDA

Capital Spending

EBITDA Margin

12

Specialty Chemicals Focus

Growing existing core business

Maintaining key positions with category leading customers Shifting resources toward faster growing segments Expanding presence in rapidly growing emerging markets

Commercializing new technology platforms

Managing maturing segments for improved earnings and cash

Identifying financially attractive bolt-on acquisition opportunities to further expand our franchises

13

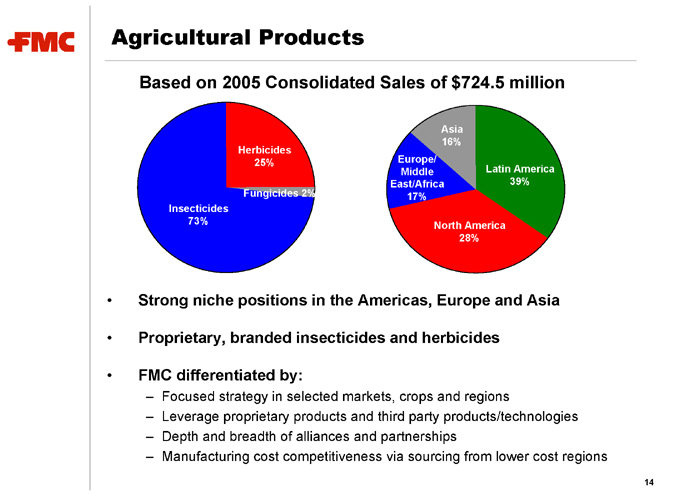

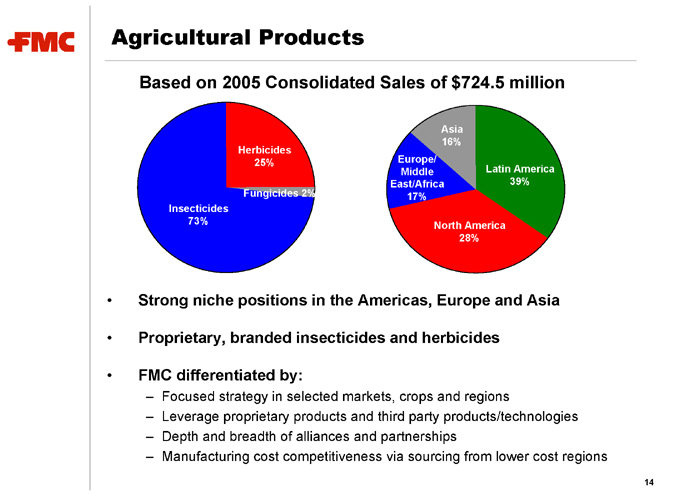

Agricultural Products

Based on 2005 Consolidated Sales of $724.5 million

Herbicides 25%

Insecticides 73%

Fungicides 2%

Europe/ Middle East/Africa 17%

Asia 16%

Latin America 39%

North America 28%

Strong niche positions in the Americas, Europe and Asia Proprietary, branded insecticides and herbicides FMC differentiated by:

Focused strategy in selected markets, crops and regions

Leverage proprietary products and third party products/technologies Depth and breadth of alliances and partnerships Manufacturing cost competitiveness via sourcing from lower cost regions

14

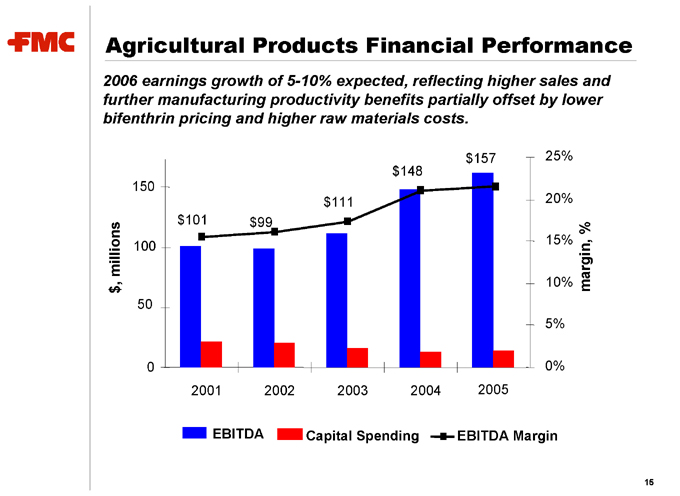

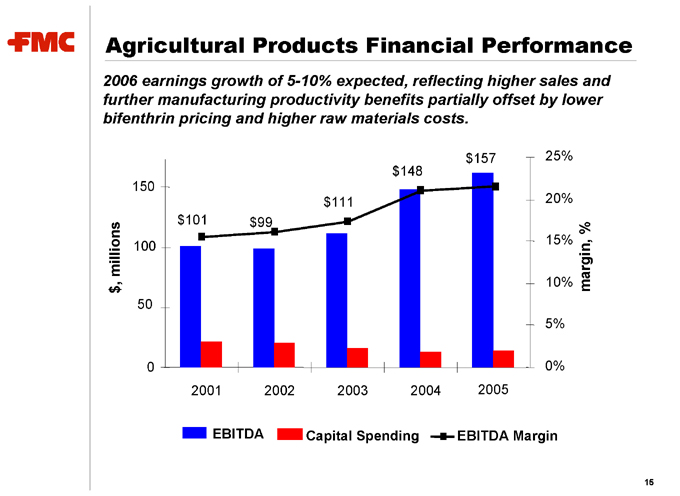

Agricultural Products Financial Performance

2006 earnings growth of 5-10% expected, reflecting higher sales and further manufacturing productivity benefits partially offset by lower bifenthrin pricing and higher raw materials costs.

$, millions

150 100 50 0 $101 $99 $111 $148 $157

2001 2002 2003 2004 2005

25% 20% 15% 10% 5% 0% margin, %

EBITDA

Capital Spending

EBITDA Margin

15

Agricultural Products’ Focus

Creating competitive advantage through innovation

Investing 10% of sales in R&D

In-licensing products & technologies that complement segment strategies

Driving near-term sales growth

Label expansions and new formulations in crop and non-crop segments In-licensed products, e.g., flonicamid and acetamiprid with maturity sales of ~$50-90 million

Strengthening Market Access

Distribution joint ventures & alliances Third party products

Reducing global supply chain and overhead costs

Sourcing initiatives should produce additional manufacturing savings Further redesign of global supply network Market access strategies/alliances drive SG&A reductions

16

FMC in Summary

Great businesses, each with EBITDA of at least $140 million

Double digit earnings growth

Earnings leverage in Industrial Chemicals

Continued growth in Specialty Chemicals and Ag Products

Strong financial position

Robust and growing EBITDA

Substantial decline in unusual demands on cash flow Recent balance sheet de-leveraging Low capex requirements

Strategic and financial flexibility

17

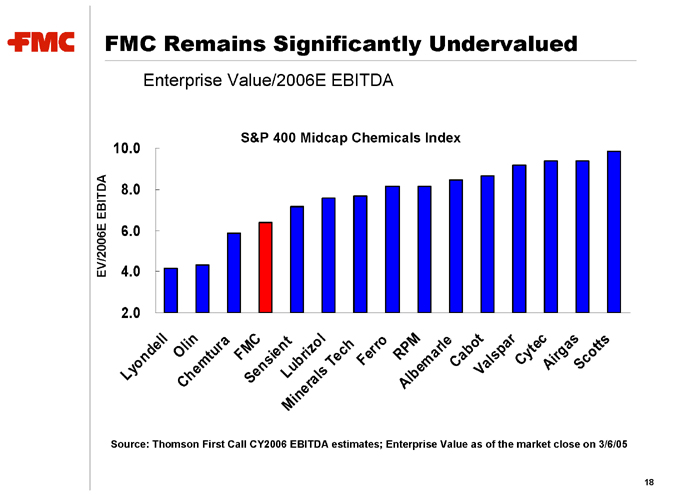

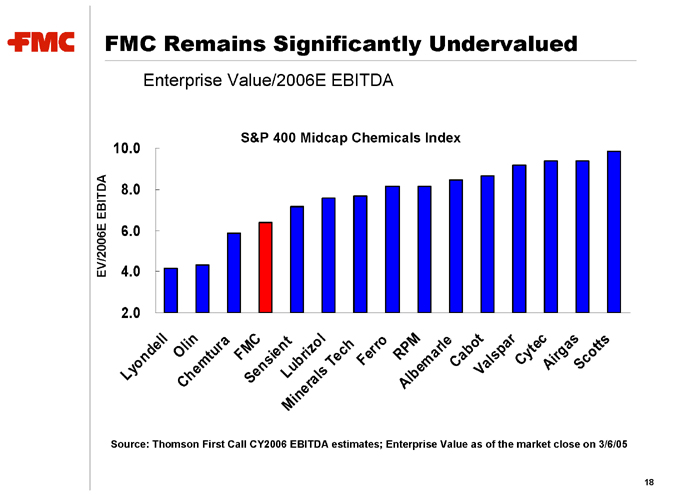

FMC Remains Significantly Undervalued

Enterprise Value/2006E EBITDA

S&P 400 Midcap Chemicals Index

EV/2006E EBITDA

10.0 8.0 6.0 4.0 2.0

Lyondell

Olin

Chemtura

FMC

Sensient

Lubrizol

Minerals Tech

Ferro

RPM

Albemarle Cabot

Valspar Cytec

Airgas

Scotts

Source: Thomson First Call CY2006 EBITDA estimates; Enterprise Value as of the market close on 3/6/05

18

FMC Corporation

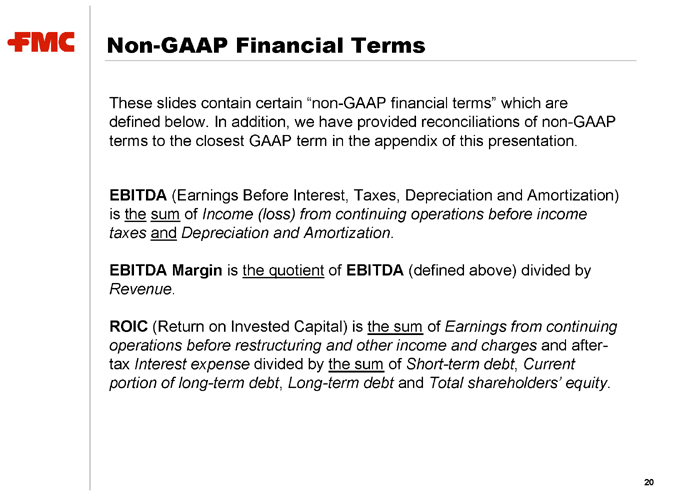

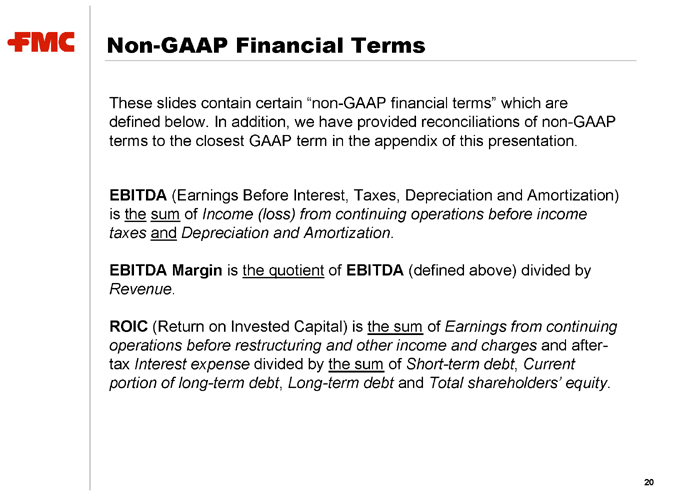

Non-GAAP Financial Terms

These slides contain certain “non-GAAP financial terms” which are defined below. In addition, we have provided reconciliations of non-GAAP terms to the closest GAAP term in the appendix of this presentation.

EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) is the sum of Income (loss) from continuing operations before income taxes and Depreciation and Amortization.

EBITDA Margin is the quotient of EBITDA (defined above) divided by

Revenue.

ROIC (Return on Invested Capital) is the sum of Earnings from continuing operations before restructuring and other income and charges and after-tax Interest expense divided by the sum of Short-term debt, Current portion of long-term debt, Long-term debt and Total shareholders’ equity.

20

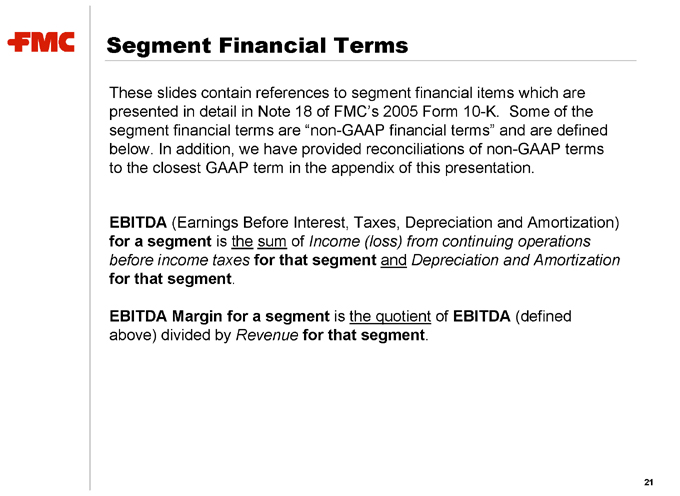

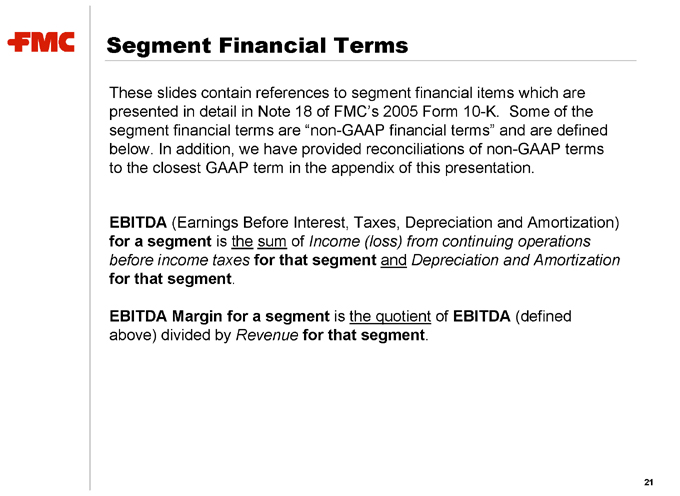

Segment Financial Terms

These slides contain references to segment financial items which are presented in detail in Note 18 of FMC’s 2005 Form 10-K. Some of the segment financial terms are “non-GAAP financial terms” and are defined below. In addition, we have provided reconciliations of non-GAAP terms to the closest GAAP term in the appendix of this presentation.

EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) for a segment is the sum of Income (loss) from continuing operations before income taxes for that segment and Depreciation and Amortization for that segment.

EBITDA Margin for a segment is the quotient of EBITDA (defined above) divided by Revenue for that segment.

21

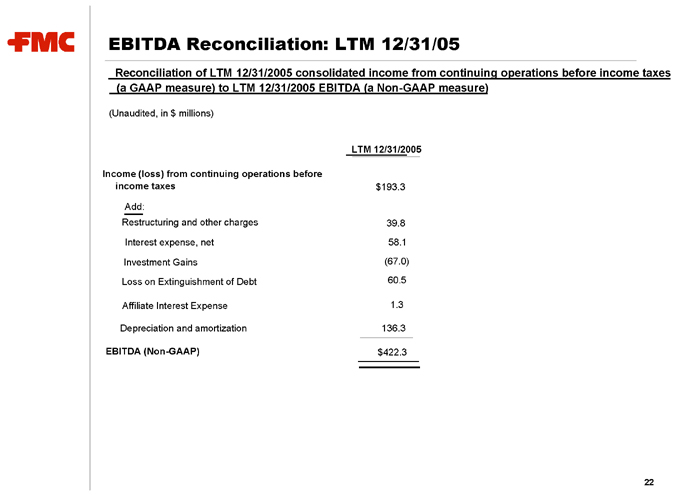

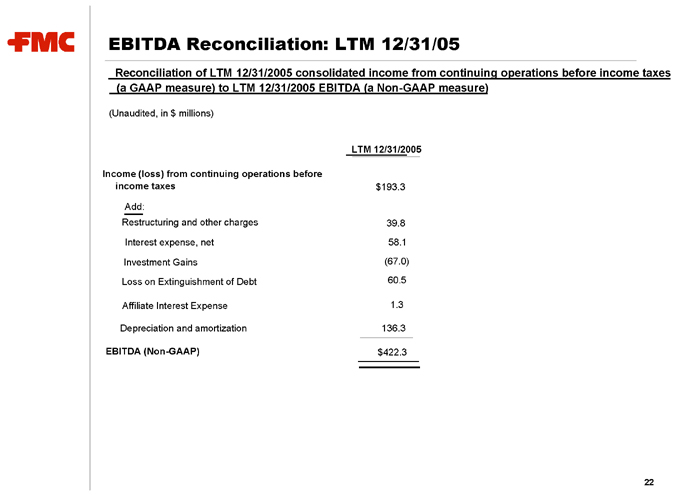

EBITDA Reconciliation: LTM 12/31/05

Reconciliation of LTM 12/31/2005 consolidated income from continuing operations before income taxes (a GAAP measure) to LTM 12/31/2005 EBITDA (a Non-GAAP measure)

(Unaudited, in $ millions)

LTM 12/31/2005

Income | | (loss) from continuing operations before |

Restructuring | | and other charges 39.8 |

Interest | | expense, net 58.1 |

Loss | | on Extinguishment of Debt 60.5 |

Affiliate | | Interest Expense 1.3 |

Depreciation | | and amortization 136.3 |

EBITDA | | (Non-GAAP) $ 422.3 |

22

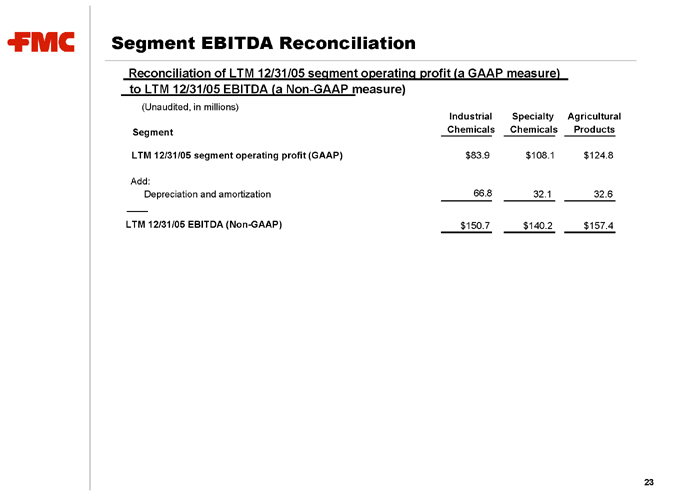

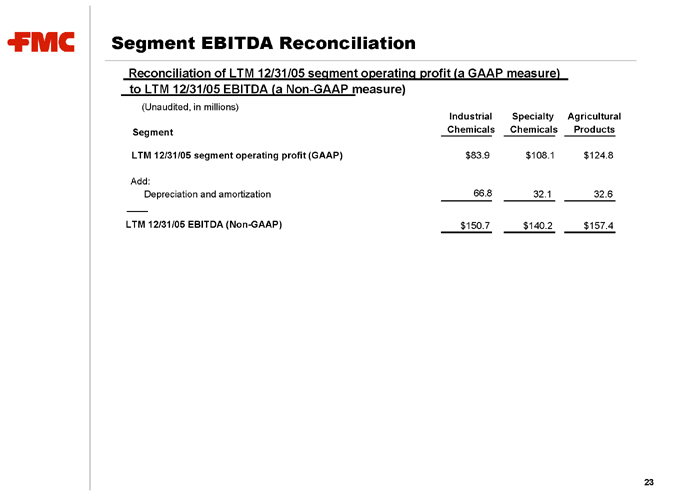

Segment EBITDA Reconciliation

Reconciliation of LTM 12/31/05 segment operating profit (a GAAP measure) to LTM 12/31/05 EBITDA (a Non-GAAP measure)

Industrial | | Specialty Agricultural |

Segment | | Chemicals Chemicals Products |

LTM | | 12/31/05 segment operating profit (GAAP) $ 83.9 $ 108.1 $ 124.8 |

Depreciation | | and amortization 66.8 32.1 32.6 |

LTM | | 12/31/05 EBITDA (Non-GAAP) $ 150.7 $ 140.2 $ 157.4 |

23