Exhibit 99.1

Exhibit 99.1

VISION 2015

THE RIGHT CHEMISTRY

VISION 2015

Pierre Brondeau, President, CEO and Chairman

Vision 2015

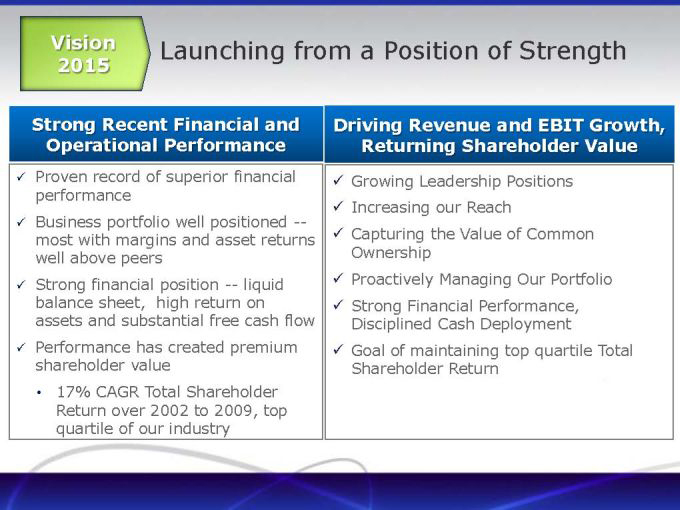

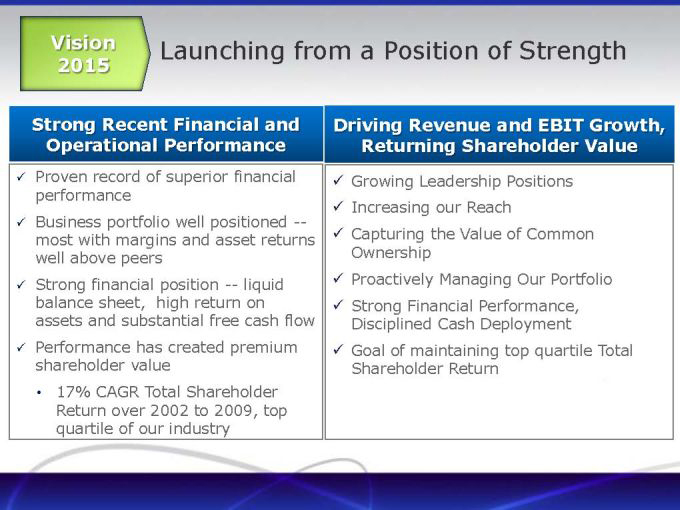

Launching from a Position of Strength

Strong Recent Financial and Operational Performance

Proven record of superior financial performance Business portfolio well positioned —most with margins and asset returns well above peers Strong financial position — liquid balance sheet, high return on assets and substantial free cash flow Performance has created premium shareholder value

17% CAGR Total Shareholder Return over 2002 to 2009, top quartile of our industry

Driving Revenue and EBIT Growth, Returning Shareholder Value

Growing Leadership Positions Increasing our Reach Capturing the Value of Common Ownership Proactively Managing Our Portfolio Strong Financial Performance, Disciplined Cash Deployment Goal of maintaining top quartile Total Shareholder Return

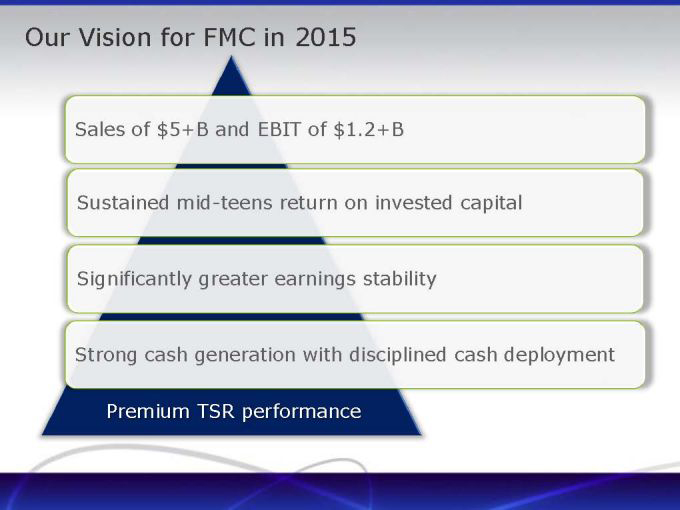

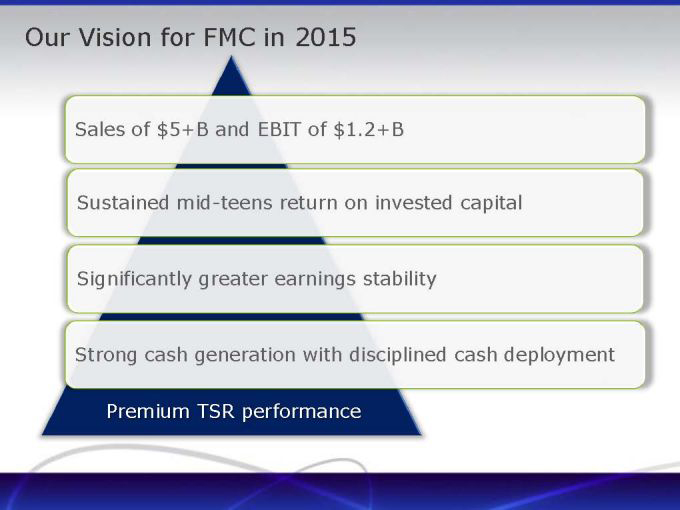

Our Vision for FMC in 2015

Sales of $5+B and EBIT of $1.2+B

Sustained mid-teens return on invested capital

Significantly greater earnings stability

Strong cash generation with disciplined cash deployment

Premium TSR performance

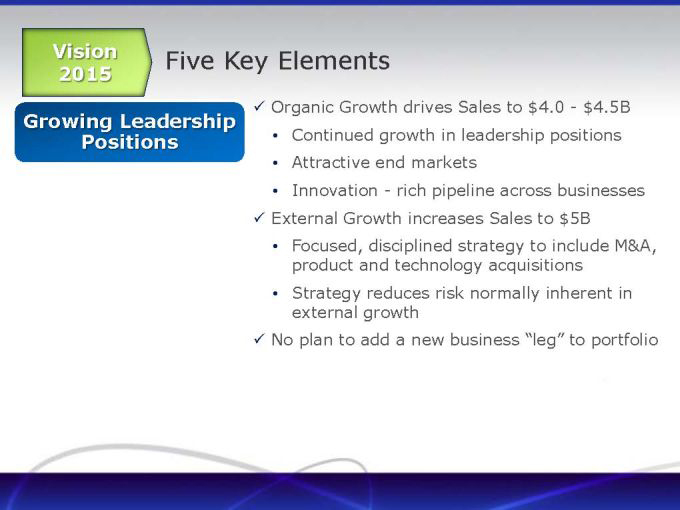

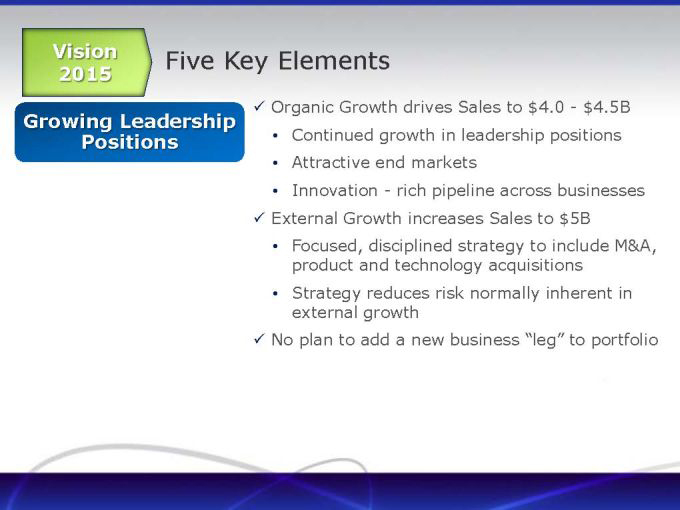

Vision Five Key Elements

2015

Growing Leadership Positions

Organic Growth drives Sales to $4.0—$4.5B

Continued growth in leadership positions

Attractive end markets

Innovation—rich pipeline across businesses

External Growth increases Sales to $5B

Focused, disciplined strategy to include M&A,

product and technology acquisitions

Strategy reduces risk normally inherent in

external growth

No plan to add a new business “leg” to portfolio

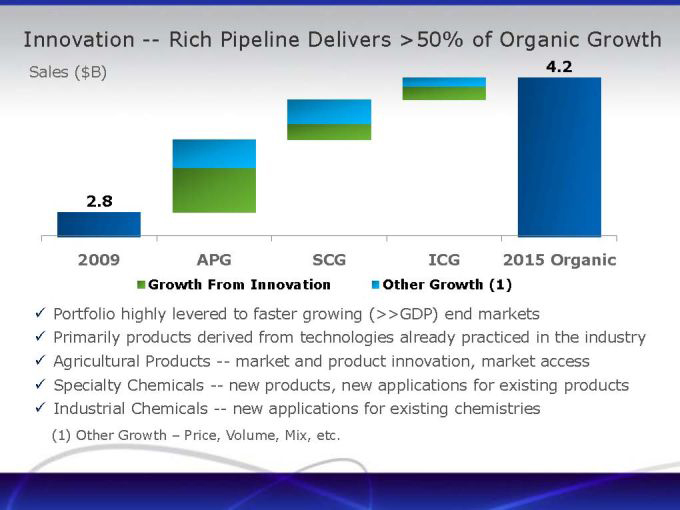

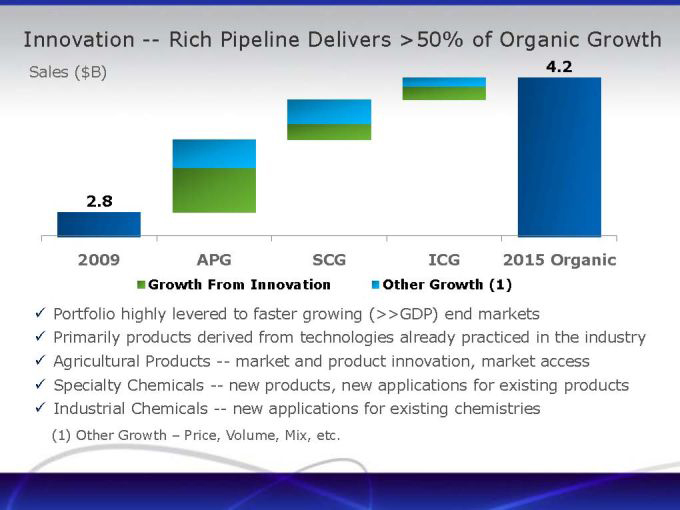

Innovation — Rich Pipeline Delivers >50% of Organic Growth

Sales ($B)

4.2

2.8

2009 APG SCG ICG 2015 Organic

Growth From Innovation

Other Growth (1)

Portfolio highly levered to faster growing (>>GDP) end markets

Primarily products derived from technologies already practiced in the industry Agricultural Products — market and product innovation, market access Specialty Chemicals — new products, new applications for existing products Industrial Chemicals — new applications for existing chemistries (1) Other Growth Price, Volume, Mix, etc.

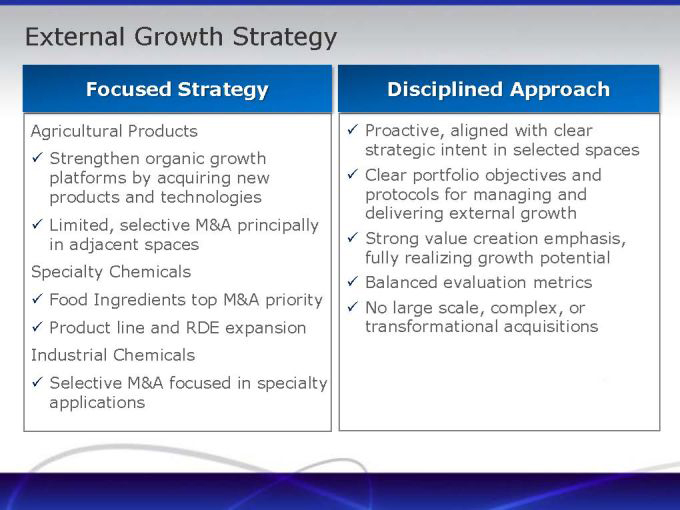

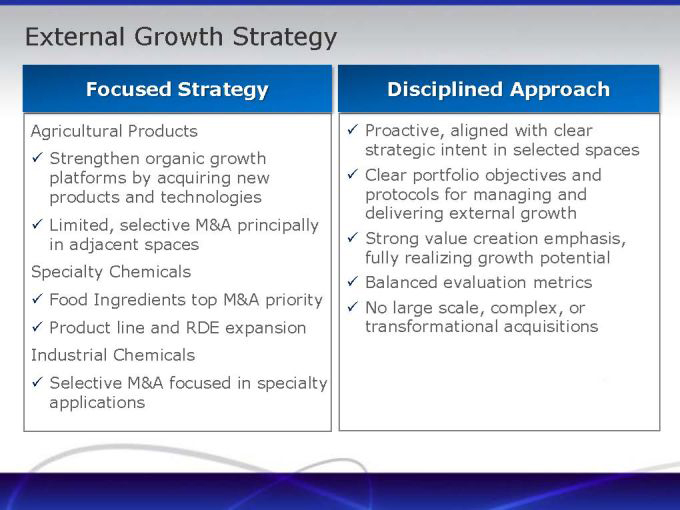

External Growth Strategy

Focused Strategy

Agricultural Products

Strengthen organic growth platforms by acquiring new products and technologies Limited, selective M&A principally in adjacent spaces Specialty Chemicals Food Ingredients top M&A priority Product line and RDE expansion Industrial Chemicals Selective M&A focused in specialty applications

Disciplined Approach

Proactive, aligned with clear strategic intent in selected spaces Clear portfolio objectives and protocols for managing and delivering external growth Strong value creation emphasis, fully realizing growth potential Balanced evaluation metrics No large scale, complex, or transformational acquisitions

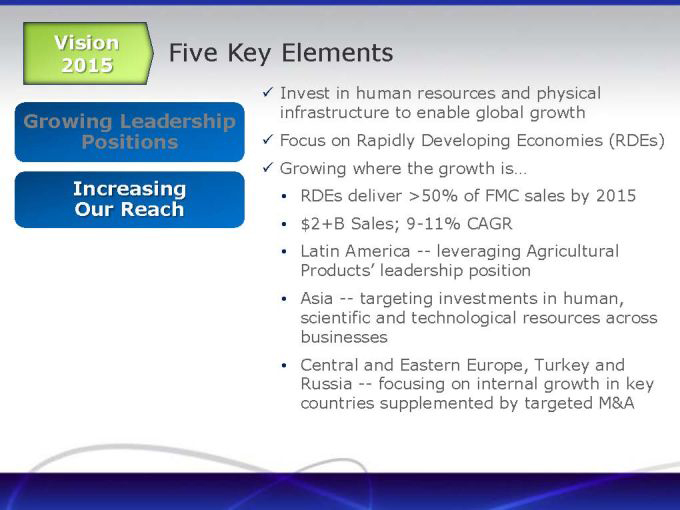

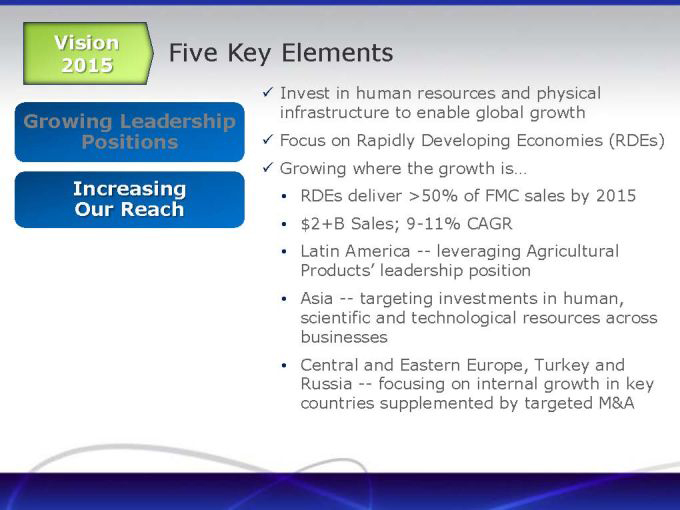

Vision Five Key Elements

2015

Growing Leadership Positions

Increasing Our Reach

Invest in human resources and physical infrastructure to enable global growth

Focus on Rapidly Developing Economies (RDEs)

Growing where the growth is…

RDEs deliver >50% of FMC sales by 2015 $2+B Sales; 9-11% CAGR

Latin America — leveraging Agricultural

Products’ leadership position

Asia — targeting investments in human, scientific and technological resources across businesses

Central and Eastern Europe, Turkey and Russia — focusing on internal growth in key countries supplemented by targeted M&A

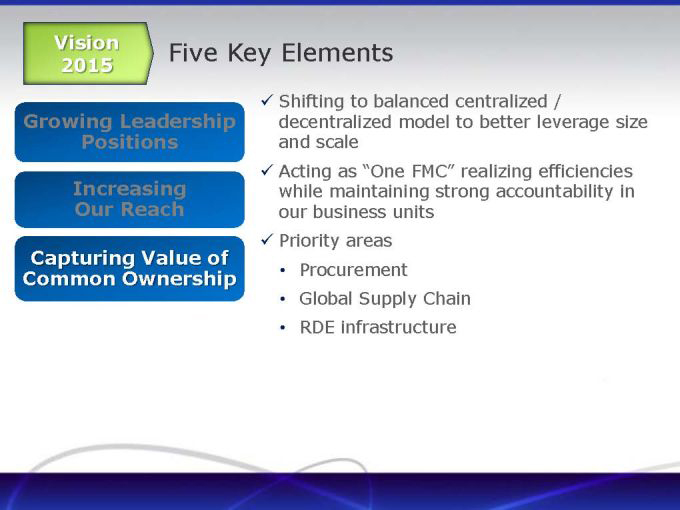

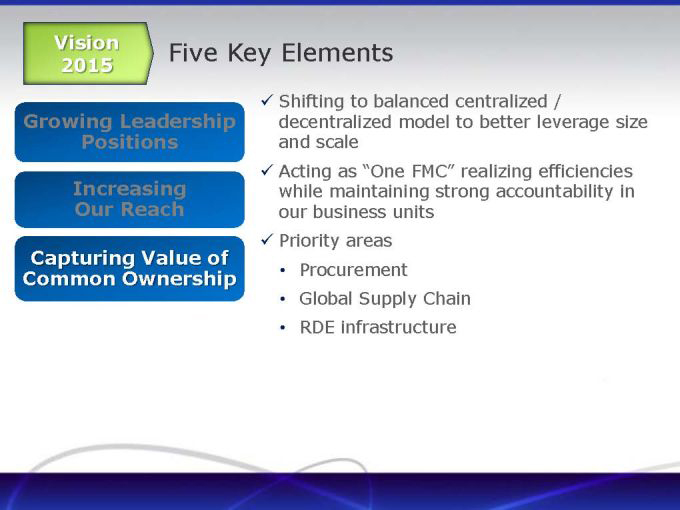

Vision Five Key Elements

2015

Growing Leadership Positions

Increasing Our Reach

Capturing Value of Common Ownership

Shifting to balanced centralized / decentralized model to better leverage size and scale

Acting as “One FMC” realizing efficiencies while maintaining strong accountability in our business units Priority areas

Procurement

Global Supply Chain

RDE infrastructure

Vision Five Key Elements

2015

Growing Leadership Positions

Increasing Our Reach

Capturing Value of Common Ownership

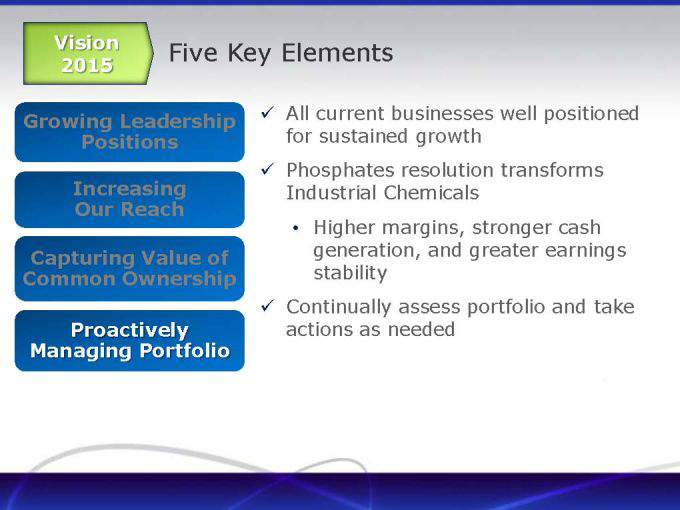

Proactively Managing Portfolio

All current businesses well positioned for sustained growth Phosphates resolution transforms Industrial Chemicals

Higher margins, stronger cash generation, and greater earnings stability Continually assess portfolio and take actions as needed

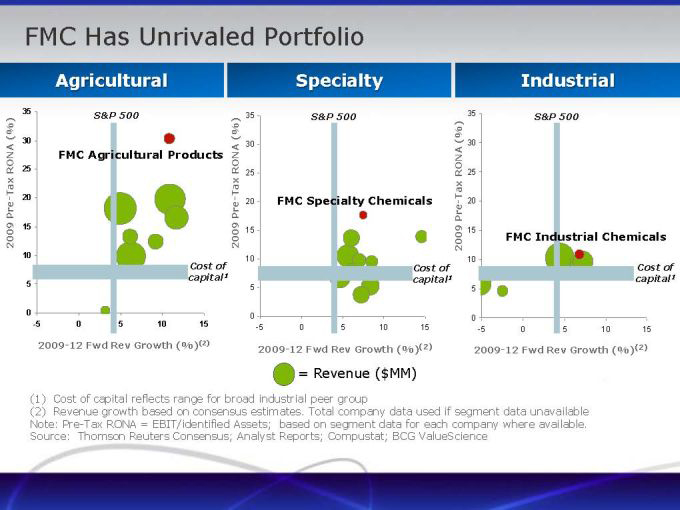

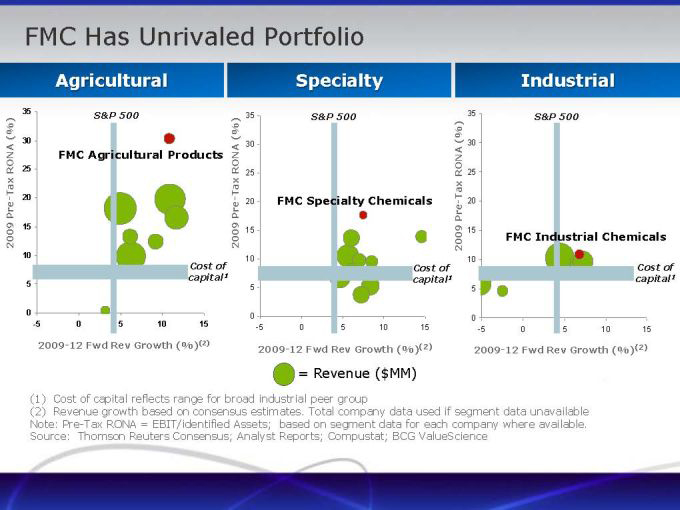

FMC Has Unrivaled Portfolio

Agricultural

35

(%) RONA 30

25

20

2009 Pre-Tax 15

10

0

-5 0 5 10 15

S&P 500

FMC Agricultural Products

Cost of capital1

2009-12 Fwd Rev Growth (%)(2)

Specialty

(%) 35 30

RONA

25

20

2009 Pre-Tax 15 10

0

-5 0 5 10 15

S&P 500

FMC Specialty Chemicals

Cost of capital1

2009-12 Fwd Rev Growth (%)(2)

Industrial

35

(%) 30 RONA

25

20

2009 Pre-Tax 15 10

0

-5 0 5 10 15

S&P 500

FMC Industrial Chemicals

Cost of capital1

2009-12 Fwd Rev Growth (%)(2)

= Revenue ($MM)

(1) | | Cost of capital reflects range for broad industrial peer group |

(2) Revenue growth based on consensus estimates. Total company data used if segment data unavailable Note: Pre-Tax RONA = EBIT/identified Assets; based on segment data for each company where available. Source: Thomson Reuters Consensus; Analyst Reports; Compustat; BCG ValueScience

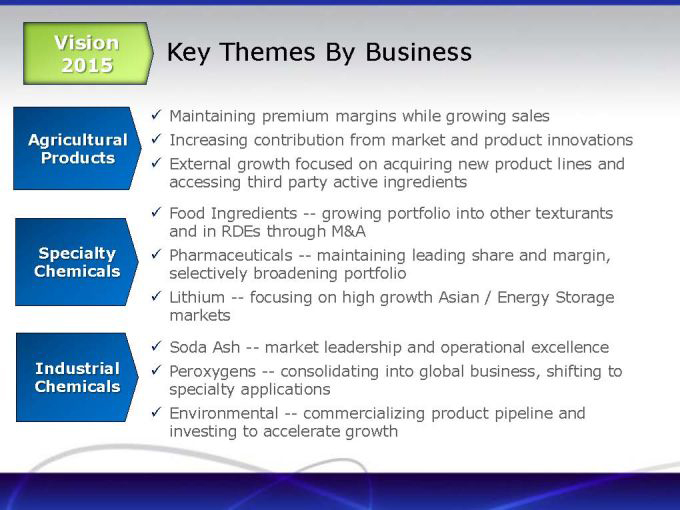

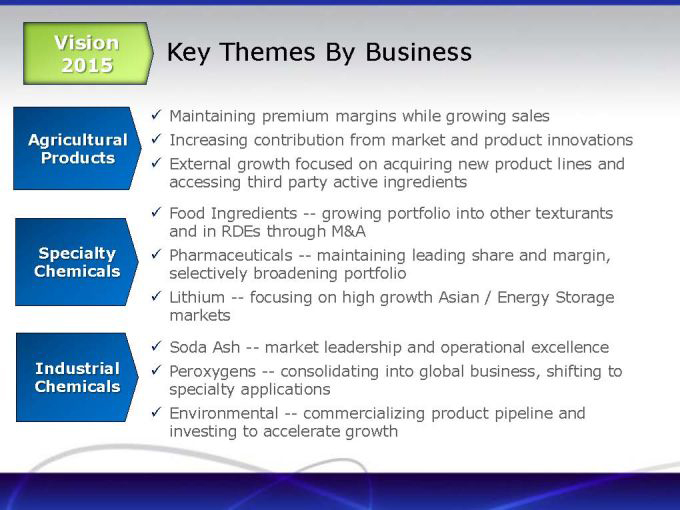

Vision Key Themes By Business

2015

Agricultural Products

Maintaining premium margins while growing sales

Increasing contribution from market and product innovations External growth focused on acquiring new product lines and accessing third party active ingredients

Specialty Chemicals

Food Ingredients — growing portfolio into other texturants and in RDEs through M&A

Pharmaceuticals — maintaining leading share and margin, selectively broadening portfolio Lithium — focusing on high growth Asian / Energy Storage markets

Industrial Chemicals

Soda Ash — market leadership and operational excellence Peroxygens — consolidating into global business, shifting to specialty applications Environmental — commercializing product pipeline and investing to accelerate growth

Vision Five Key Elements

2015

Growing Leadership Positions

Increasing Our Reach

Capturing Value of Common Ownership

Proactively Managing Portfolio

Disciplined Cash Deployment

Expect total of ~$3B in cash for deployment over 2010 2015

Cumulative free cash flow of ~$2B

~$1B additional debt capacity consistent with solid investment grade credit rating External growth strategy not expected to consume all cash available for deployment Expect to return meaningful amount of cash to shareholders over this period

Completed $100M share repurchase in 4th quarter 2010

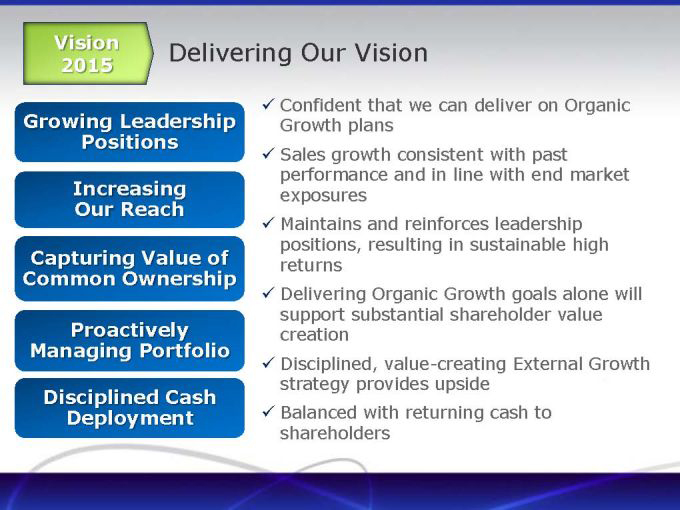

Vision Delivering Our Vision

2015

Growing Leadership Positions

Increasing Our Reach

Capturing Value of Common Ownership

Proactively Managing Portfolio

Disciplined Cash Deployment

Confident that we can deliver on Organic Growth plans Sales growth consistent with past performance and in line with end market exposures Maintains and reinforces leadership positions, resulting in sustainable high returns Delivering Organic Growth goals alone will support substantial shareholder value creation Disciplined, value-creating External Growth strategy provides upside Balanced with returning cash to shareholders

VISION 2015

THE RIGHT CHEMISTRY

Agricultural Products

Milton Steele, Vice President and General Manager, Agricultural Products

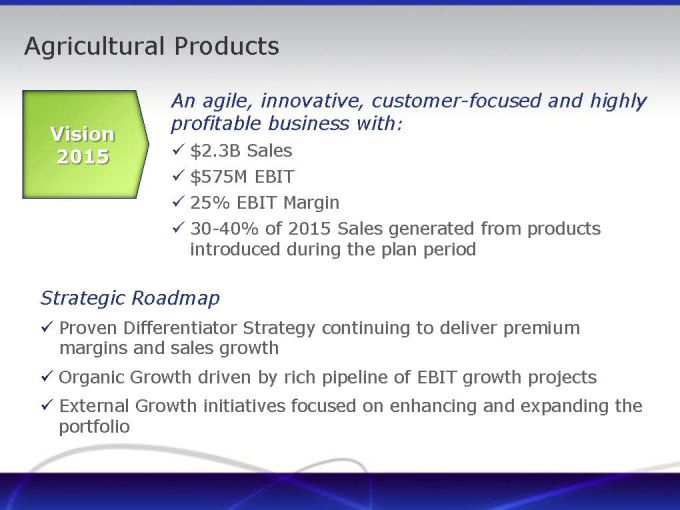

Agricultural Products

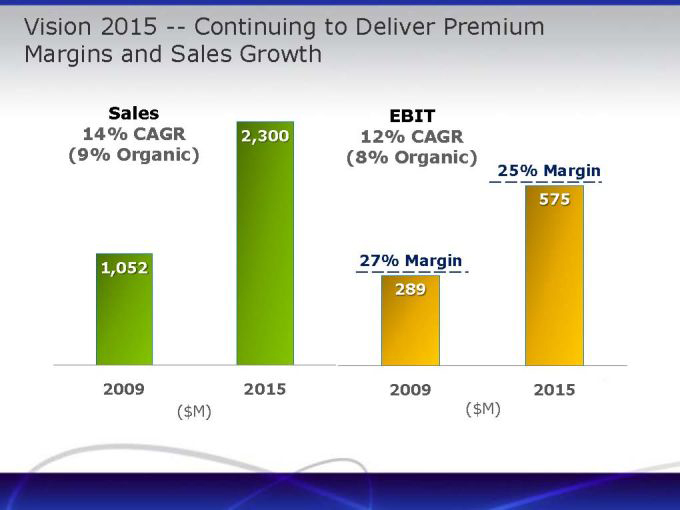

Vision 2015

An agile, innovative, customer-focused and highly profitable business with:

$2.3B Sales $575M EBIT 25% EBIT Margin

30-40% of 2015 Sales generated from products introduced during the plan period

Strategic Roadmap

Proven Differentiator Strategy continuing to deliver premium margins and sales growth Organic Growth driven by rich pipeline of EBIT growth projects External Growth initiatives focused on enhancing and expanding the portfolio

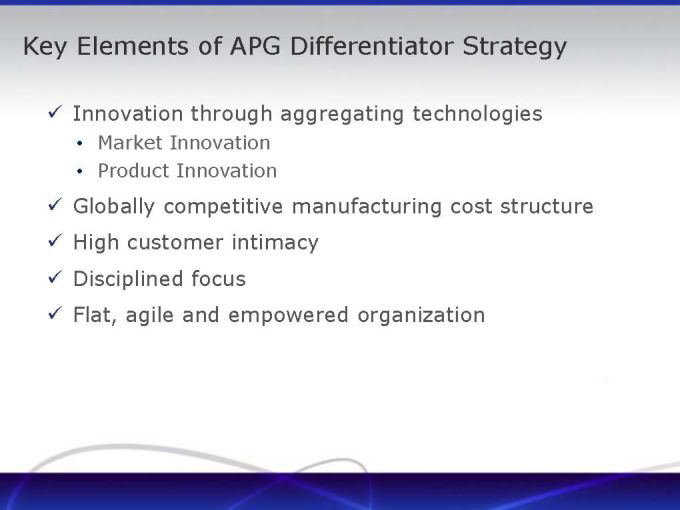

Key Elements of APG Differentiator Strategy

Innovation through aggregating technologies

Market Innovation

Product Innovation

Globally competitive manufacturing cost structure High customer intimacy Disciplined focus Flat, agile and empowered organization

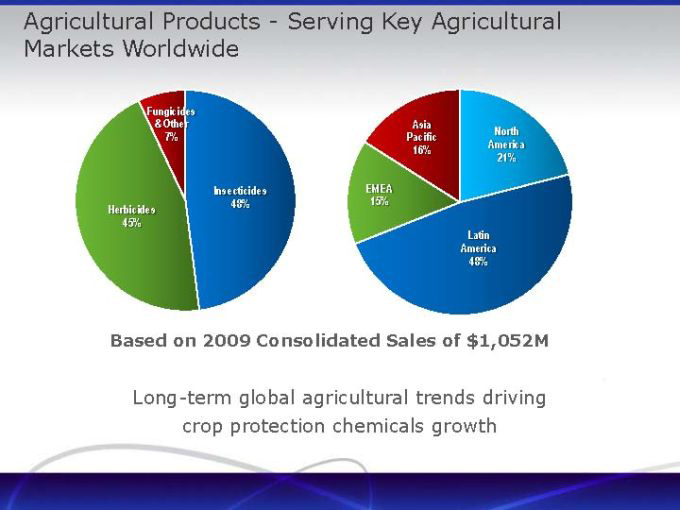

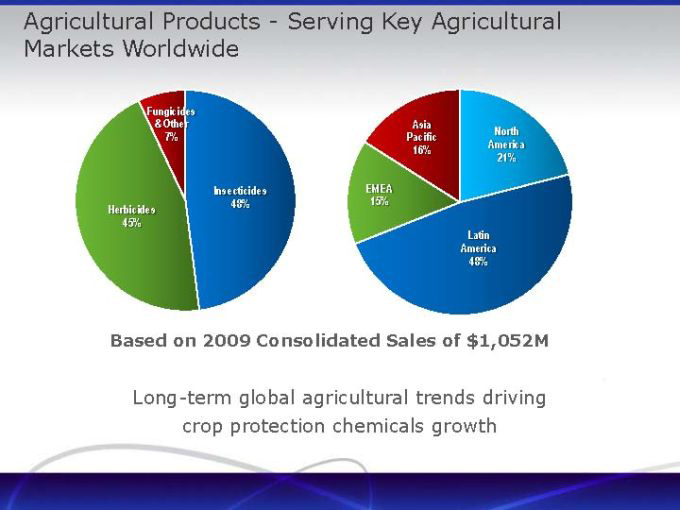

Agricultural Products—Serving Key Agricultural Markets Worldwide

Fungicides & Other 7%

Herbicides 45%

Insecticides 48%

Asia Pacific 16%

EMEA 15%

North America 21%

Latin America 48%

Based on 2009 Consolidated Sales of $1,052M

Long-term global agricultural trends driving crop protection chemicals growth

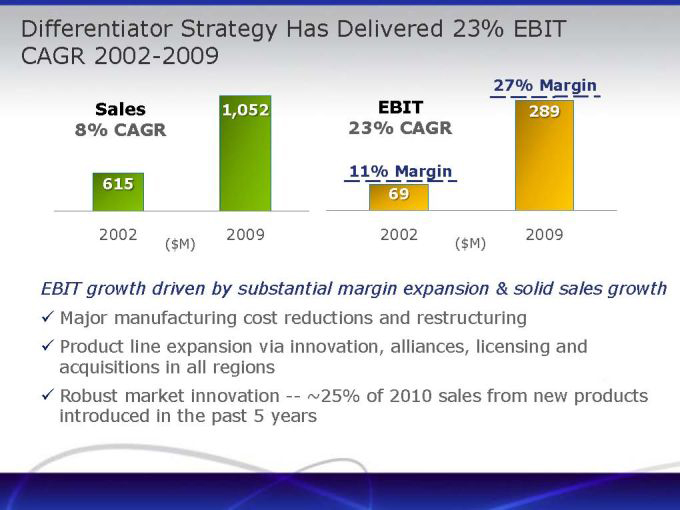

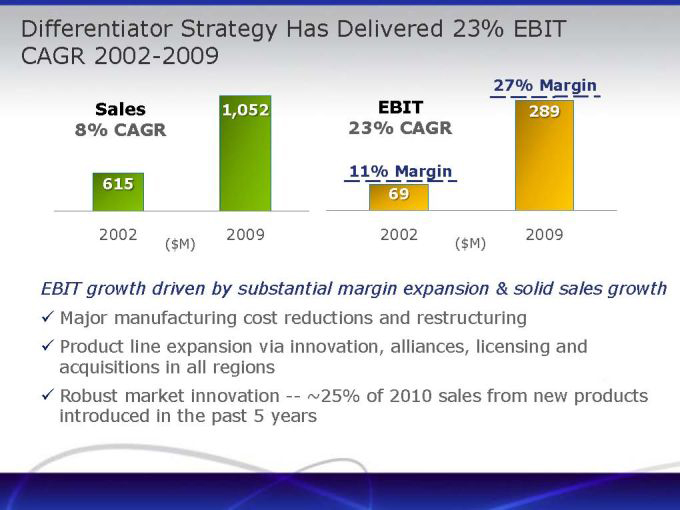

Differentiator Strategy Has Delivered 23% EBIT CAGR 2002-2009

Sales 8% CAGR

615

1,052

2002 2009 ($M)

EBIT 23% CAGR

11% Margin

69

2002

27% Margin

289

2009 ($M)

EBIT growth driven by substantial margin expansion & solid sales growth

Major manufacturing cost reductions and restructuring Product line expansion via innovation, alliances, licensing and acquisitions in all regions Robust market innovation — ~25% of 2010 sales from new products introduced in the past 5 years

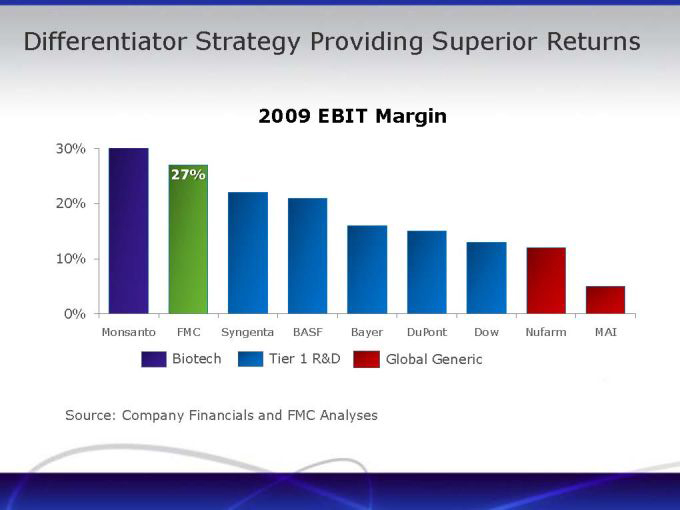

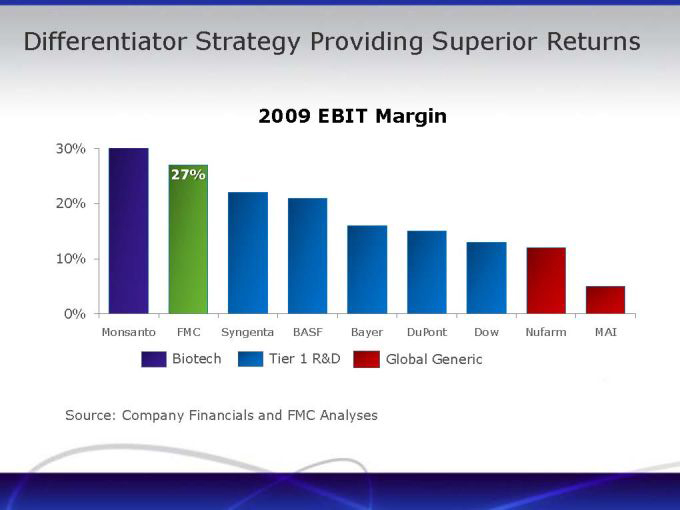

Differentiator Strategy Providing Superior Returns

2009 EBIT Margin

30% 20% 10% 0%

27%

Monsanto FMC Syngenta BASF Bayer DuPont Dow Nufarm MAI

Biotech

Tier 1 R&D

Global Generic

Source: Company Financials and FMC Analyses

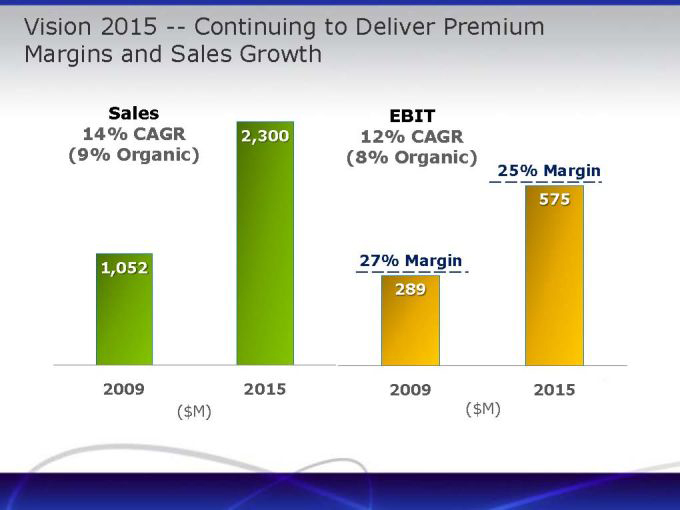

Vision 2015 — Continuing to Deliver Premium Margins and Sales Growth

Sales 14% CAGR

(9% Organic)

1,052

2009

(

( millions) $M)

2,300

2015

EBIT 12% CAGR

(8% Organic)

27% Margin

289

2009

($M)

25% Margin 575

2015

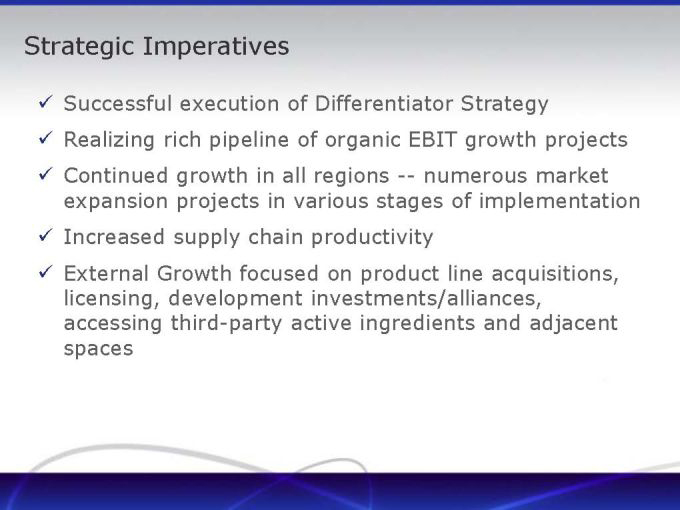

Strategic Imperatives

Successful execution of Differentiator Strategy Realizing rich pipeline of organic EBIT growth projects Continued growth in all regions — numerous market expansion projects in various stages of implementation Increased supply chain productivity External Growth focused on product line acquisitions, licensing, development investments/alliances, accessing third-party active ingredients and adjacent spaces

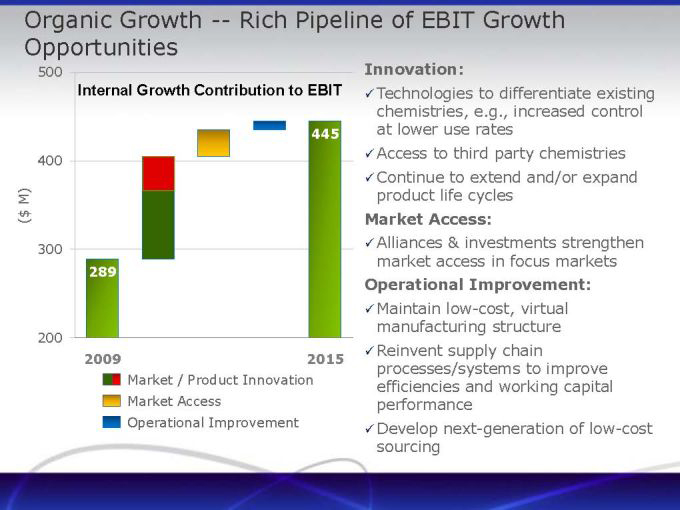

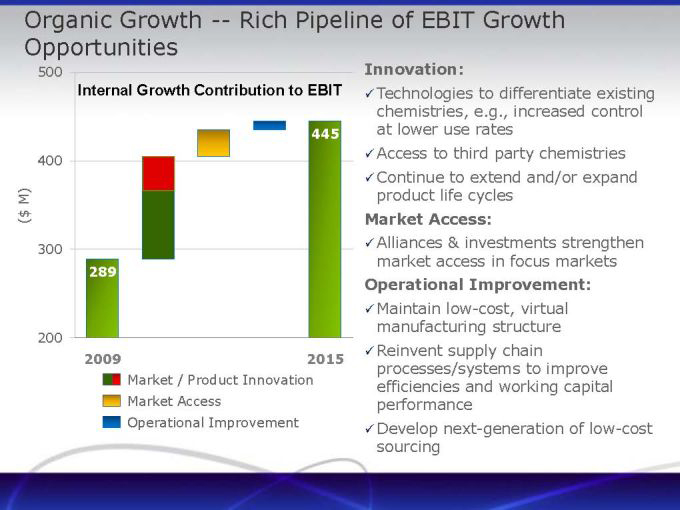

Organic Growth — Rich Pipeline of EBIT Growth Opportunities

500

400

($ M) 300

200

Internal Growth Contribution to EBIT

289

445

2009

2015

Market / Product Innovation Market Access Operational Improvement

Innovation:

Technologies to differentiate existing chemistries, e.g., increased control at lower use rates Access to third party chemistries Continue to extend and/or expand product life cycles

Market Access:

Alliances & investments strengthen market access in focus markets

Operational Improvement:

Maintain low-cost, virtual manufacturing structure Reinvent supply chain processes/systems to improve efficiencies and working capital performance Develop next-generation of low-cost sourcing

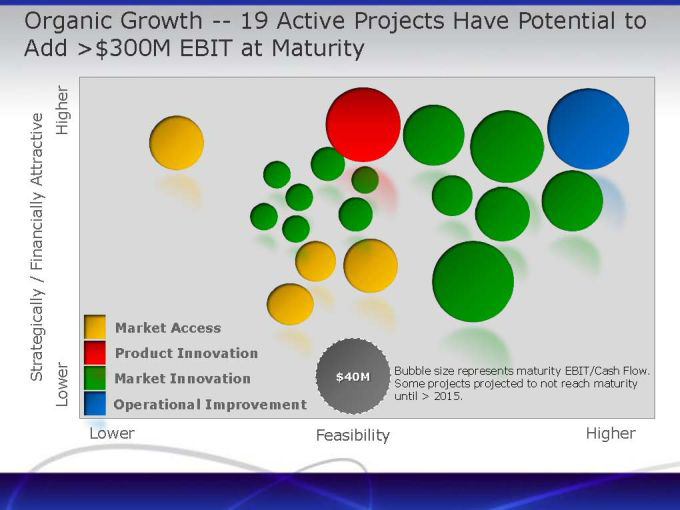

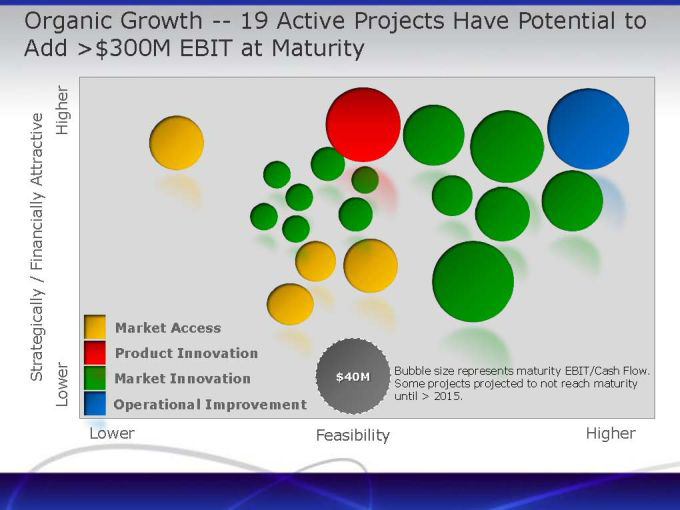

Organic Growth — 19 Active Projects Have Potential to Add >$300M EBIT at Maturity

Higher Attractive

Financially

Strategically /

Lower

Market Access Product Innovation Market Innovation Operational Improvement

$40M

Bubble size represents maturity EBIT/Cash Flow. Some projects projected to not reach maturity until > 2015.

Lower Feasibility Higher

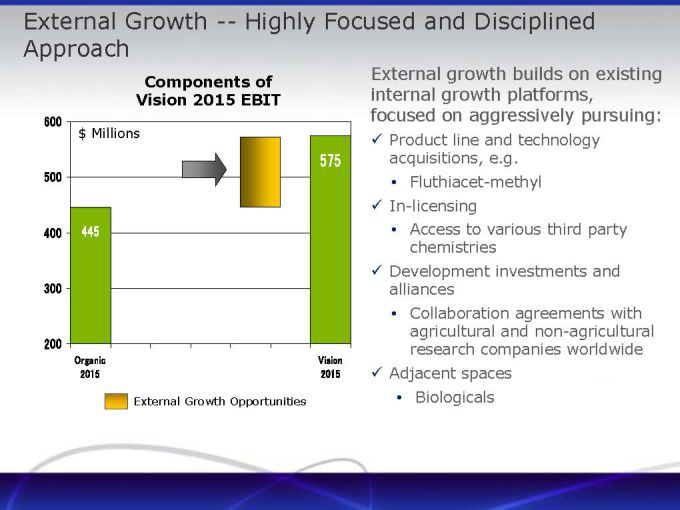

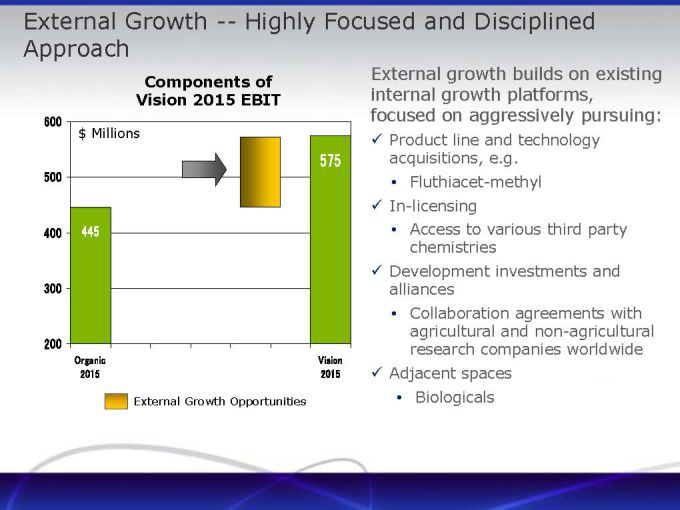

External Growth — Highly Focused and Disciplined Approach

Components of

Vision 2015 EBIT

600 500 400 300 200

Organic 2015

445

$ Millions

575

Vision 2015

External Growth Opportunities

External growth builds on existing internal growth platforms, focused on aggressively pursuing:

Product line and technology acquisitions, e.g.

Fluthiacet-methyl In-licensing

Access to various third party chemistries Development investments and alliances

Collaboration agreements with agricultural and non-agricultural research companies worldwide Adjacent spaces

Biologicals

Agricultural Products

Vision 2015

An agile, innovative, customer-focused and highly profitable business with:

$2.3B Sales $575M EBIT 25% EBIT Margin

Sustainable Premium Margins

Innovation creating differentiated products Sales growth in all regions

Supply chain efficiencies driving global competitiveness

Focused and disciplined external growth initiatives complementing strategic focus and customer intimacy initiatives

VISION 2015

THE RIGHT CHEMISTRY

FMC

Specialty Chemicals

Theodore Butz, Vice President and General Manager, Specialty Chemicals

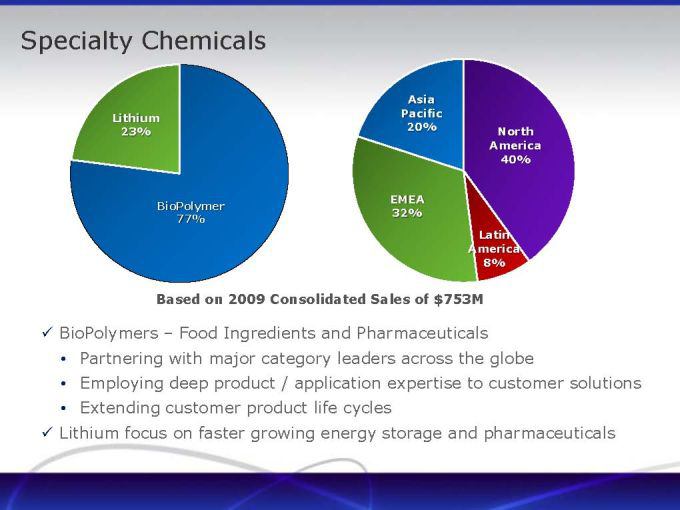

Specialty Chemicals

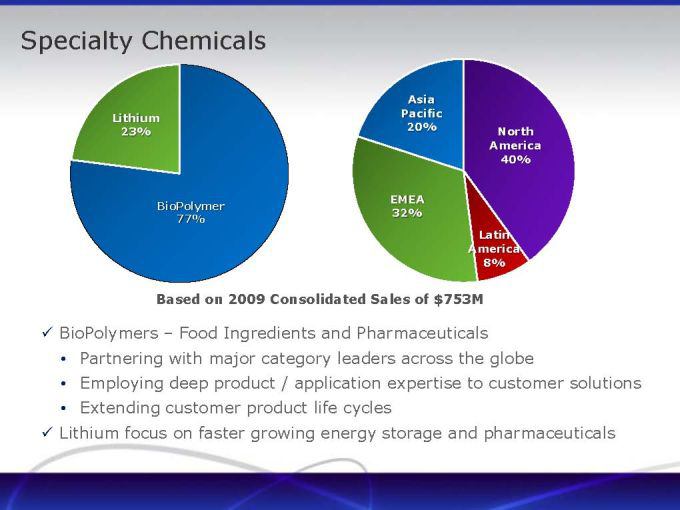

Lithium 23%

BioPolymer 77%

Asia Pacific 20%

North America 40%

EMEA 32%

Latin America 8%

Based on 2009 Consolidated Sales of $753M

BioPolymers Food Ingredients and Pharmaceuticals

Partnering with major category leaders across the globe

Employing deep product / application expertise to customer solutions

Extending customer product life cycles

Lithium focus on faster growing energy storage and pharmaceuticals

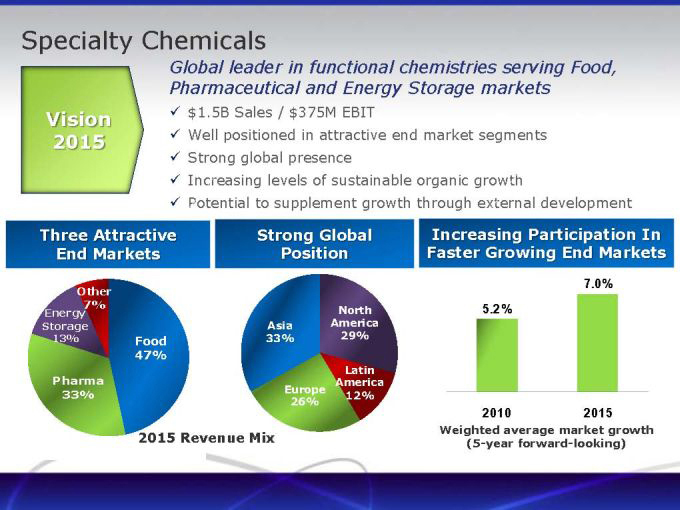

Specialty Chemicals

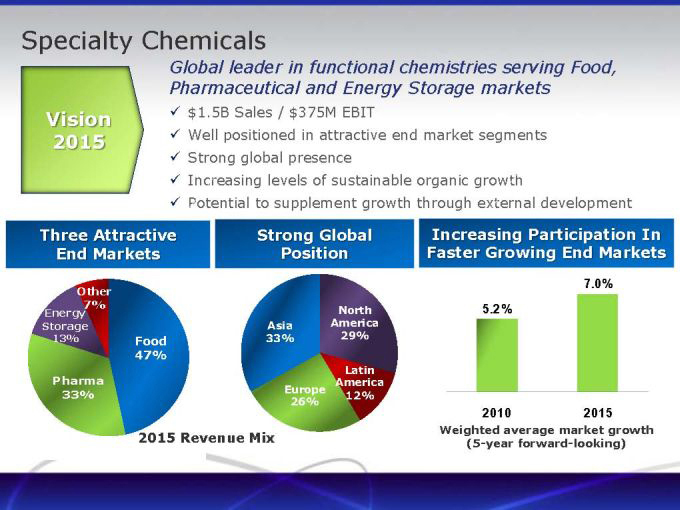

Vision 2015

Global leader in functional chemistries serving Food, Pharmaceutical and Energy Storage markets

$1.5B Sales / $375M EBIT

Well positioned in attractive end market segments Strong global presence Increasing levels of sustainable organic growth

Potential to supplement growth through external development

Three Attractive End Markets

Other 7% Energy Storage

13% Food 47% Pharma 33%

2015 Revenue Mix

Strong Global Position

North Asia America 33% 29%

Latin America Europe 12% 26%

Increasing Participation In Faster Growing End Markets

7.0% 5.2%

2010 2015

Weighted average market growth (5-year forward-looking)

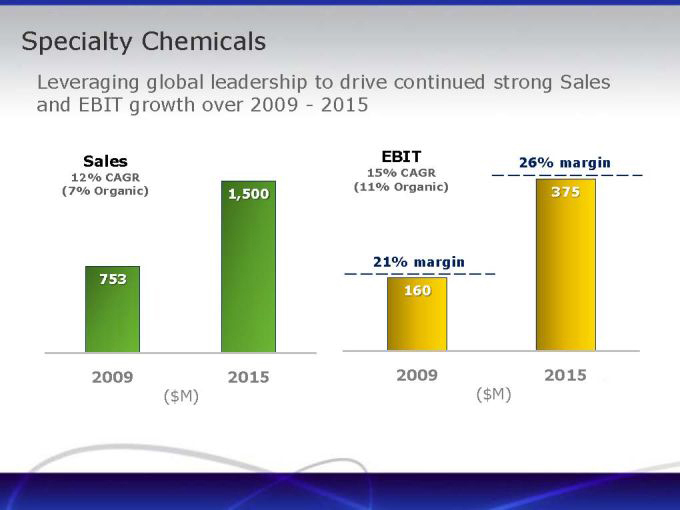

Specialty Chemicals

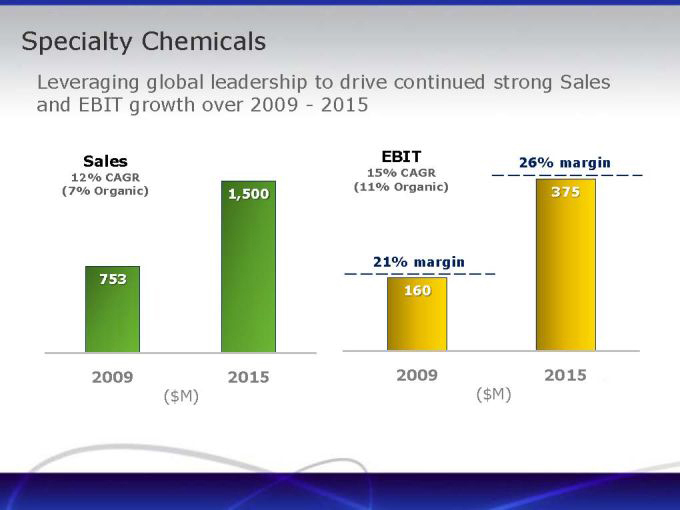

Leveraging global leadership to drive continued strong Sales and EBIT growth over 2009—2015

Sales

12% CAGR (7% Organic)

753

2009

($M)

1,500

2015

EBIT

15% CAGR (11% Organic)

21% margin 160

2009

(

$M)

26% margin 375

2015

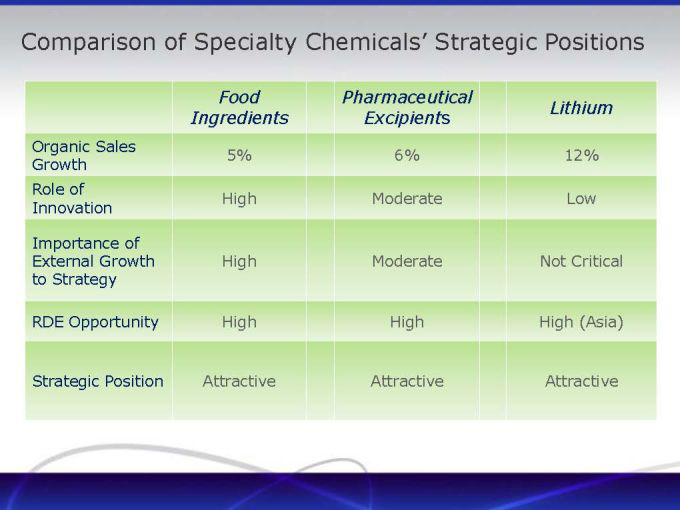

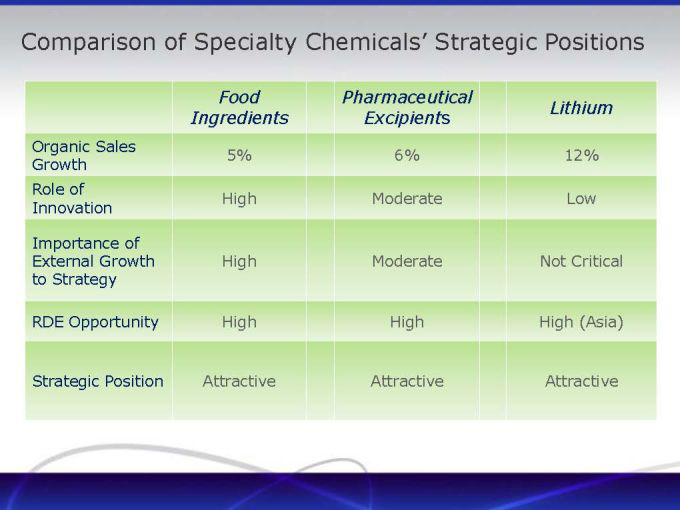

Comparison of Specialty Chemicals’ Strategic Positions

Food Pharmaceutical

Lithium Ingredients Excipients

Organic Sales

5% 6% 12% Growth

Role of

High Moderate Low Innovation

Importance of

External Growth High Moderate Not Critical to Strategy

RDE Opportunity High High High (Asia)

Strategic Position Attractive Attractive Attractive

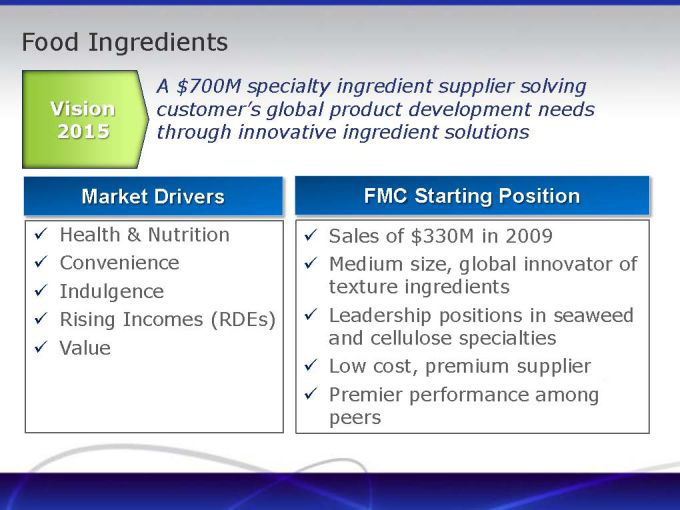

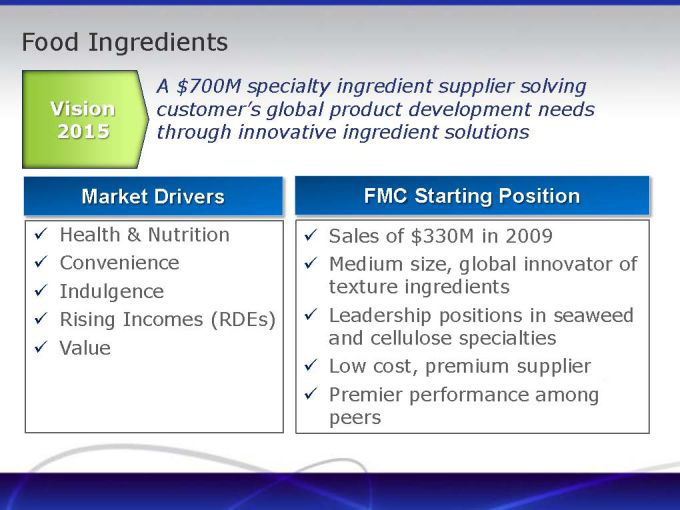

Food Ingredients

Vision 2015

A $700M specialty ingredient supplier solving

customer’s global product development needs

through innovative ingredient solutions

Market Drivers

Health & Nutrition Convenience Indulgence Rising Incomes (RDEs) Value

FMC Starting Position

Sales of $330M in 2009

Medium size, global innovator of texture ingredients Leadership positions in seaweed and cellulose specialties Low cost, premium supplier Premier performance among peers

Food Ingredients — Strategic Imperatives

Invest in core products to strengthen leadership position

Leverage customer relationships by broadening texture portfolio

Increase participation in higher growth, high value-added ingredients

Expand RDE position by investing in growth markets

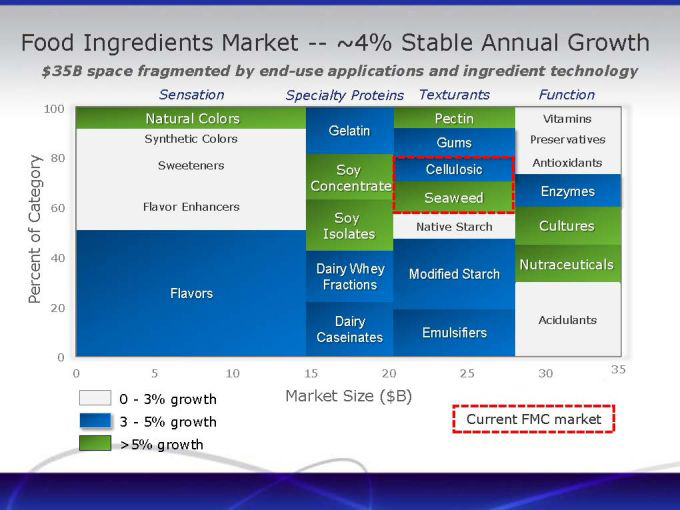

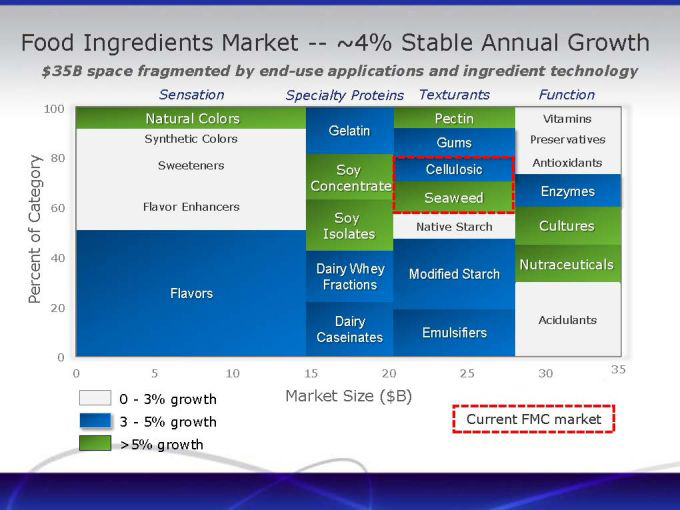

Food Ingredients Market — ~4% Stable Annual Growth

$35B space fragmented by end-use applications and ingredient technology

Sensation Specialty Proteins Texturants Function

100

Natural Colors Pectin Vitamins

Gelatin

Synthetic Colors Gums Preservatives Category 80 Antioxidants Sweeteners Soy Cellulosic

Concentrate Enzymes Seaweed

60 Flavor Enhancers

Soy

Native Starch Cultures

of Isolates Percent 40

Dairy Whey Nutraceuticals

Modified Starch Fractions Flavors

20

Dairy Acidulants

Caseinates Emulsifiers

0 35

0 5 10 15 20 25 30

0—3% growth Market Size ($B)

3—5% | | growth Current FMC market >5% growth |

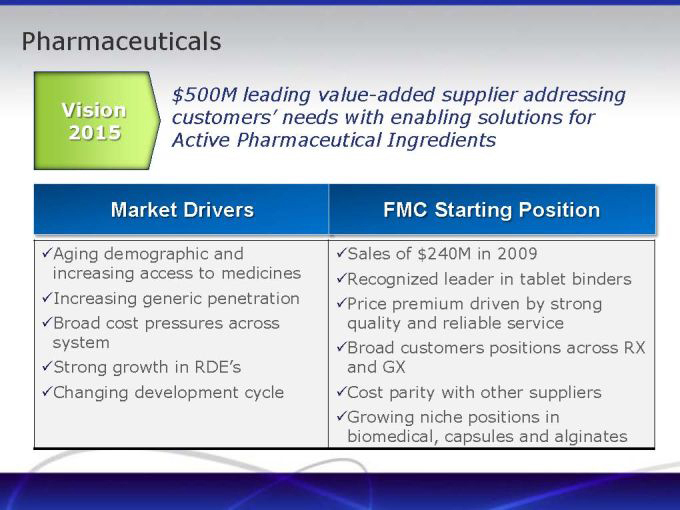

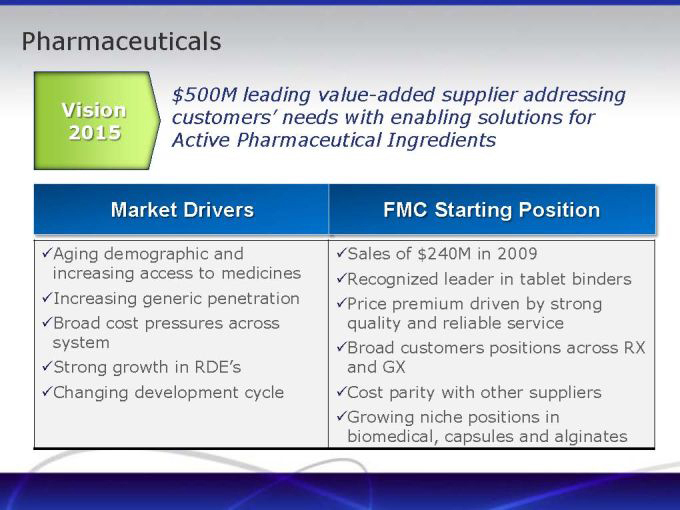

Pharmaceuticals

Vision 2015

$500M leading value-added supplier addressing customers’ needs with enabling solutions for Active Pharmaceutical Ingredients

Market Drivers

Aging demographic and increasing access to medicines Increasing generic penetration Broad cost pressures across system

Strong growth in

Changing development cycle

FMC Starting Position

Sales of $240M in 2009

Recognized leader in tablet binders Price premium driven by strong quality and reliable service Broad customers positions across RX RDE’s and GX Cost parity with other suppliers Growing niche positions in biomedical, capsules and alginates

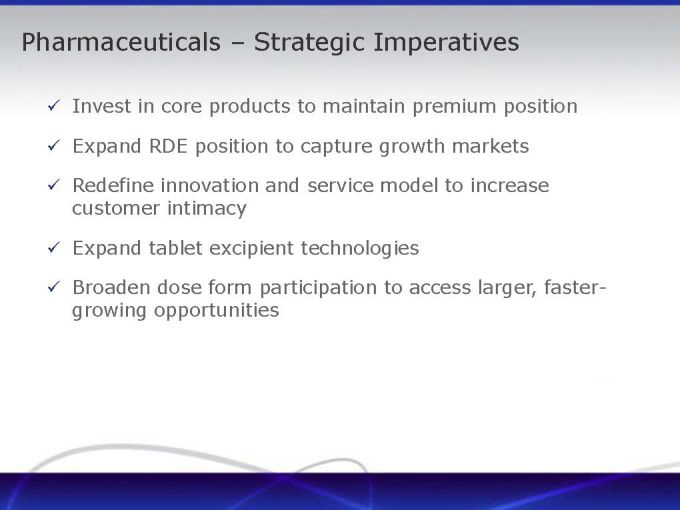

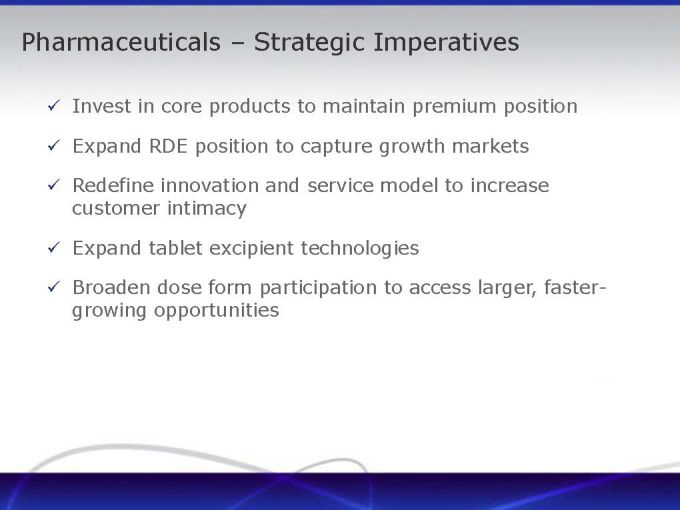

Pharmaceuticals Strategic Imperatives

Invest in core products to maintain premium position Expand RDE position to capture growth markets Redefine innovation and service model to increase customer intimacy Expand tablet excipient technologies Broaden dose form participation to access larger, faster-growing opportunities

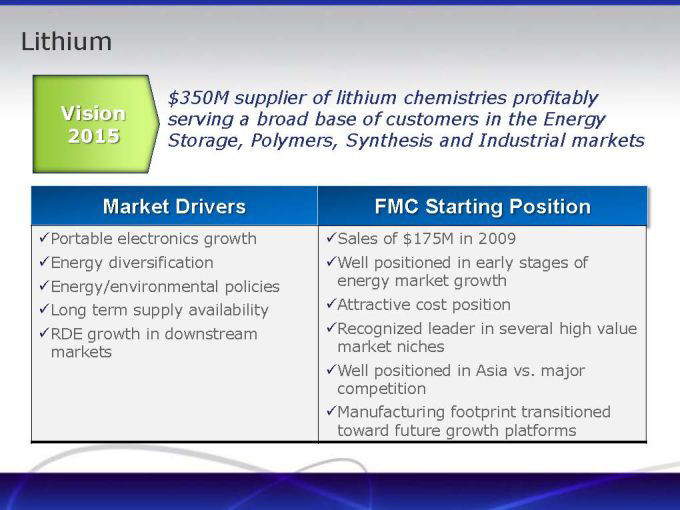

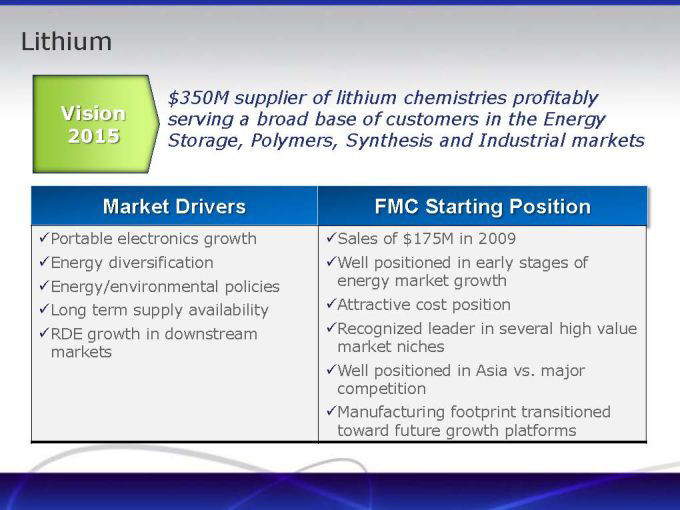

Lithium

$350M supplier of lithium chemistries profitably Vision serving a broad base of customers in the Energy 2015 Storage, Polymers, Synthesis and Industrial markets

Market Drivers

Portable electronics growth Energy diversification Energy/environmental policies Long term supply availability RDE growth in downstream markets

FMC Starting Position

Sales of $175M in 2009

Well positioned in early stages of energy market growth Attractive cost position Recognized leader in several high value market niches Well positioned in Asia vs. major competition Manufacturing footprint transitioned toward future growth platforms

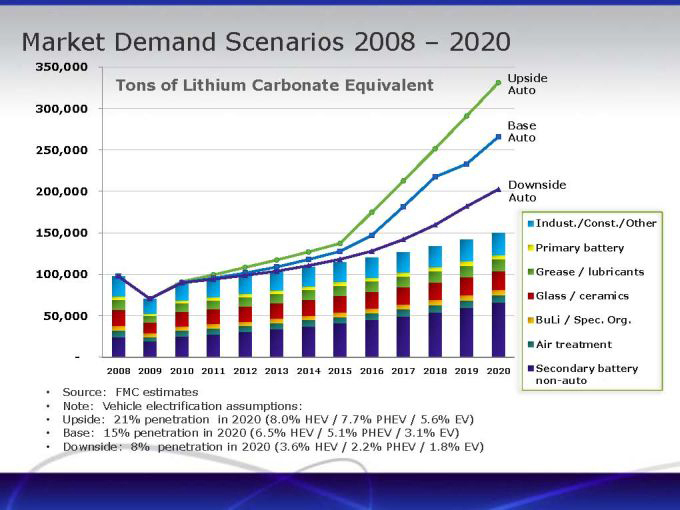

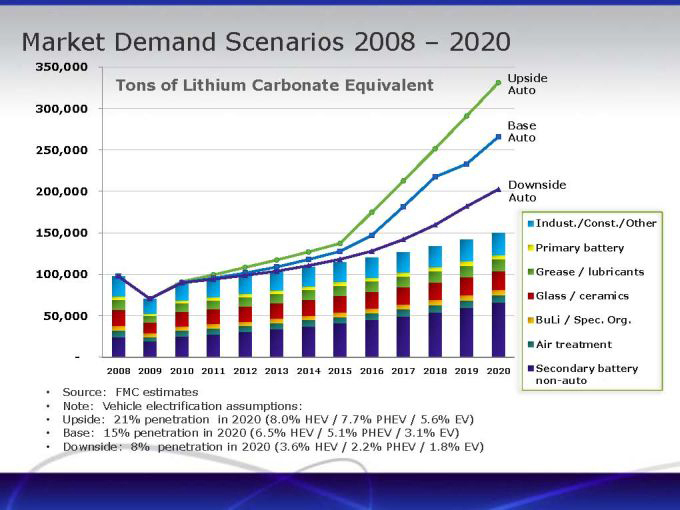

Market Demand Scenarios 2008 2020

350,000 Upside

Tons of Lithium Carbonate Equivalent Auto

300,000

Base Auto 250,000

Downside 200,000 Auto

Indust./Const./Other 150,000 Primary battery

100,000 Grease / lubricants Glass / ceramics 50,000 BuLi / Spec. Org.

Air treatment -

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Secondary battery non-auto

Source: FMC estimates

Note: Vehicle electrification assumptions:

Upside: 21% penetration in 2020 (8.0% HEV / 7.7% PHEV / 5.6% EV)

Base: 15% penetration in 2020 (6.5% HEV / 5.1% PHEV / 3.1% EV)

Downside: 8% penetration in 2020 (3.6% HEV / 2.2% PHEV / 1.8% EV)

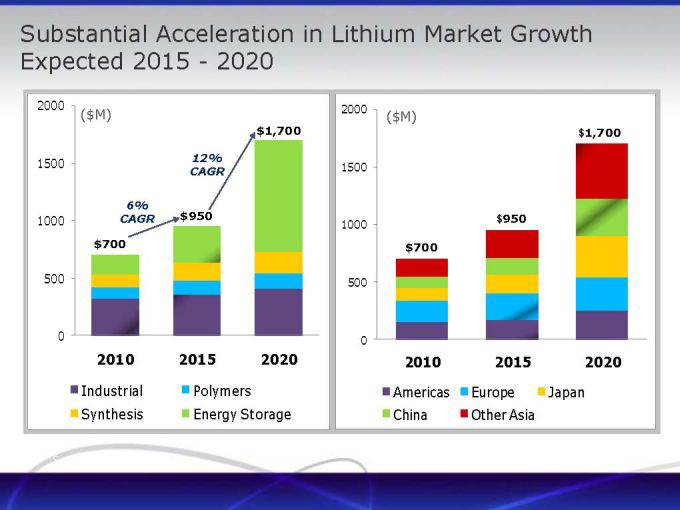

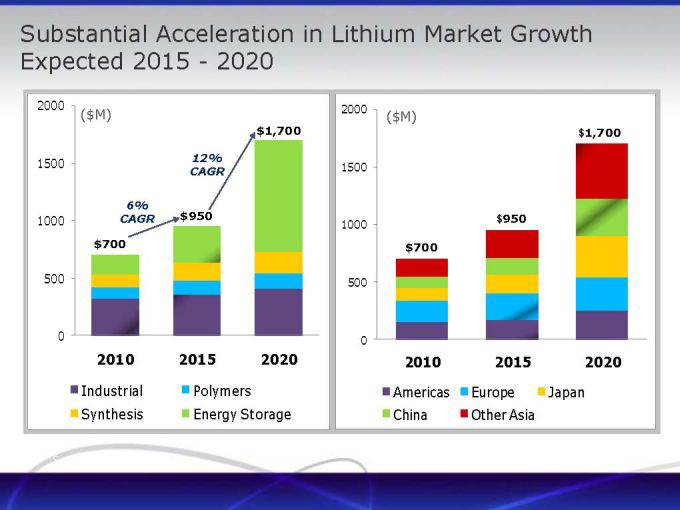

Substantial Acceleration in Lithium Market Growth Expected 2015—2020

2000 2000

($M) ($M)

$1,700 $1,700

1500 12%

CAGR 1500

6% $950

1000 CAGR 1000 $950 $700 $700

500 500

0 0

2010 2015 2020 2010 2015 2020

Industrial Polymers Americas Europe Japan Synthesis Energy Storage China Other Asia

Lithium—Strategic Imperatives

Expand position in energy storage segment Strengthen downstream business Additional capacity expansion decision in 2012

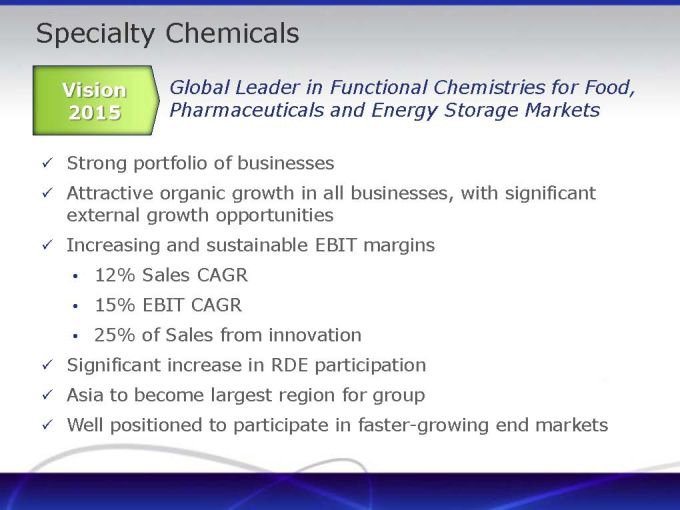

Specialty Chemicals

Vision Global Leader in Functional Chemistries for Food, 2015 Pharmaceuticals and Energy Storage Markets

Strong portfolio of businesses

Attractive organic growth in all businesses, with significant external growth opportunities Increasing and sustainable EBIT margins

12% Sales CAGR

15% EBIT CAGR

25% of Sales from innovation

Significant increase in RDE participation Asia to become largest region for group

Well positioned to participate in faster-growing end markets

VISION 2015

THE RIGHT CHEMISTRY

[Graphic Appears Here]

Industrial Chemicals

D. Michael Wilson, Vice President and General Manager, Industrial Chemicals

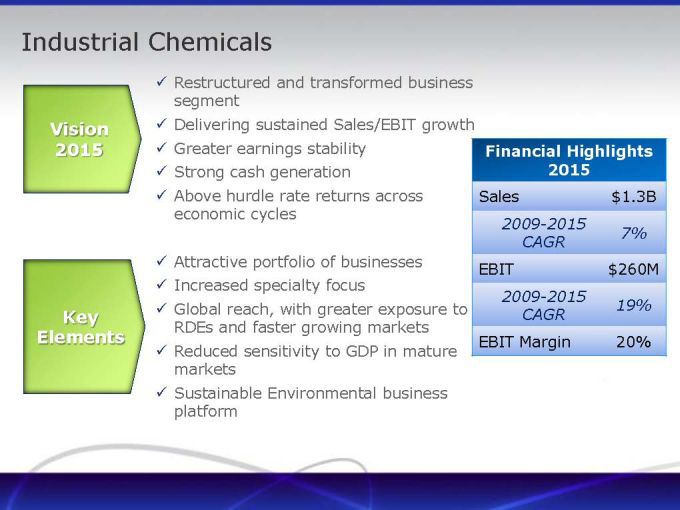

Industrial Chemicals

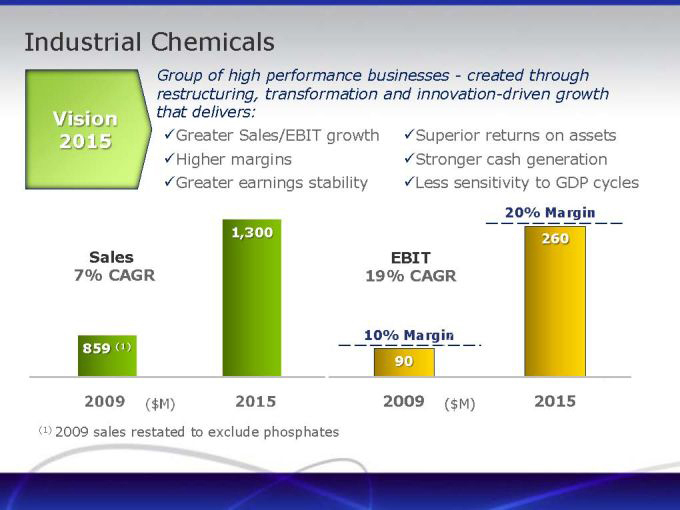

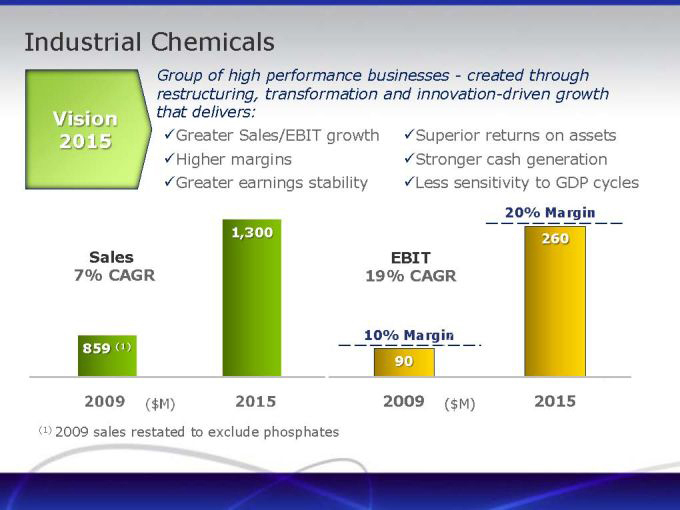

Group of high performance businesses—created through restructuring, transformation and innovation-driven growth Vision that delivers:

2015 Greater Sales/EBIT growth Superior returns on assets Higher margins Stronger cash generation Greater earnings stability Less sensitivity to GDP cycles

20% Margin 1,300 260 Sales EBIT

7% CAGR 19% CAGR

859 (1) 10% Margin 90

2009 2015 2009 ($M) 2015

(1) | | 2009 sales restated to exclude phosphates |

Industrial Chemicals

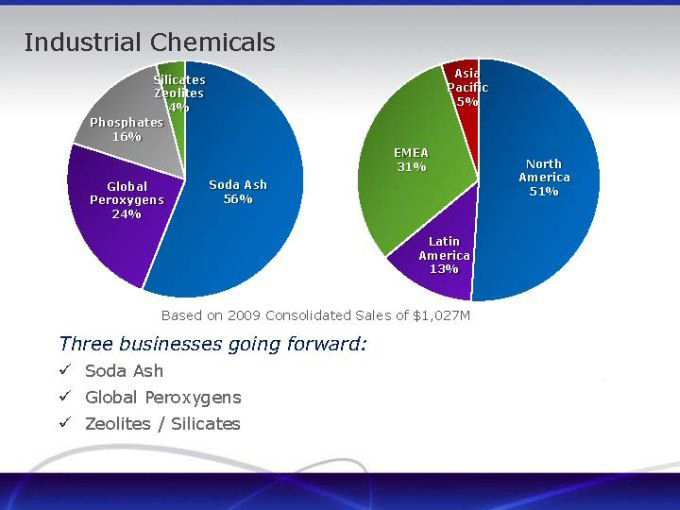

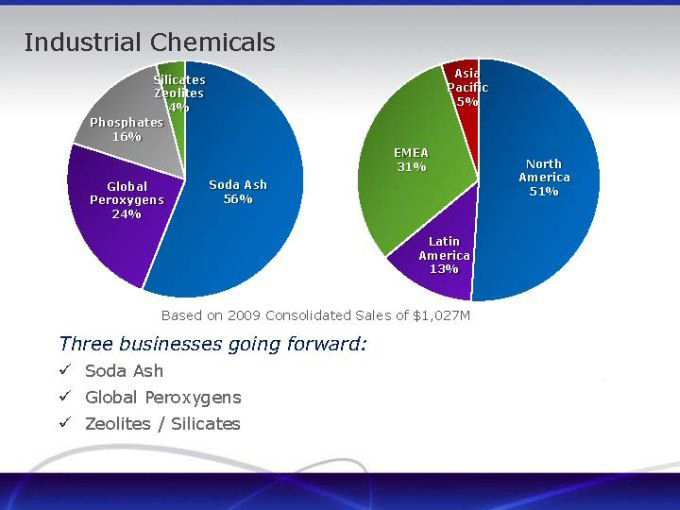

Silicates Zeolites 4% Phosphates 16%

Global Soda Ash Peroxygens 56% 24%

Asia Pacific 5%

EMEA North 31% America 51%

Latin America 13%

Based on 2009 Consolidated Sales of $1,027M

Three businesses going forward:

Soda Ash

Global Peroxygens Zeolites / Silicates

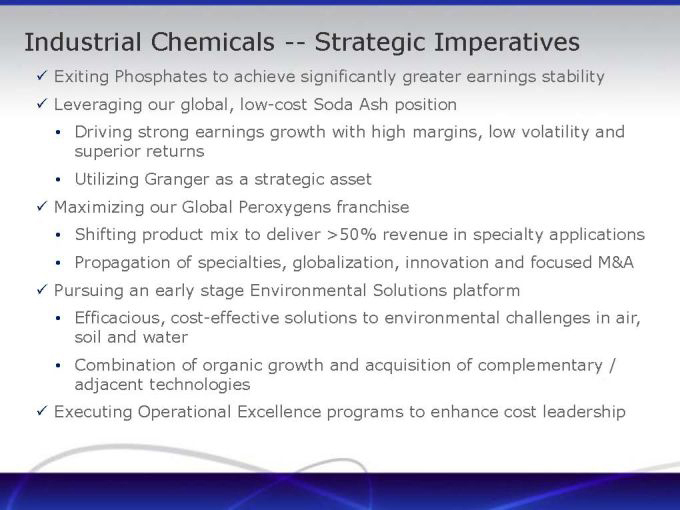

Industrial Chemicals — Strategic Imperatives

Exiting Phosphates to achieve significantly greater earnings stability Leveraging our global, low-cost Soda Ash position

Driving strong earnings growth with high margins, low volatility and superior returns

Utilizing Granger as a strategic asset Maximizing our Global Peroxygens franchise

Shifting product mix to deliver >50% revenue in specialty applications

Propagation of specialties, globalization, innovation and focused M&A

Pursuing an early stage Environmental Solutions platform

Efficacious, cost-effective solutions to environmental challenges in air, soil and water

Combination of organic growth and acquisition of complementary / adjacent technologies Executing Operational Excellence programs to enhance cost leadership

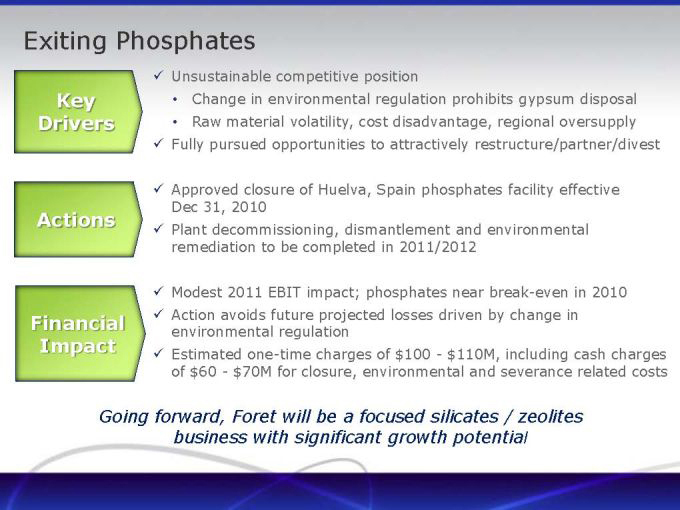

Exiting Phosphates

Key Drivers

Unsustainable competitive position

Change in environmental regulation prohibits gypsum disposal

Raw material volatility, cost disadvantage, regional oversupply Fully pursued opportunities to attractively restructure/partner/divest

Actions

Approved closure of Huelva, Spain phosphates facility effective Dec 31, 2010 Plant decommissioning, dismantlement and environmental remediation to be completed in 2011/2012

Financial Impact

Modest 2011 EBIT impact; phosphates near break-even in 2010 Action avoids future projected losses driven by change in environmental regulation Estimated one-time charges of $100—$110M, including cash charges of $60—$70M for closure, environmental and severance related costs

Going forward, Foret will be a focused silicates / zeolites business with significant growth potential

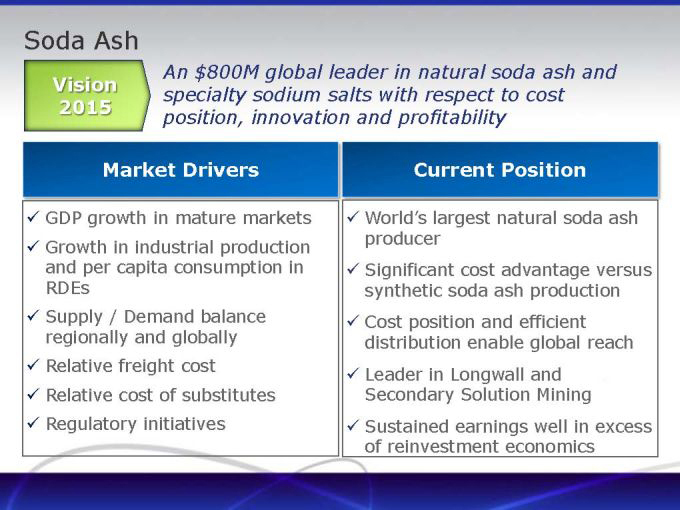

Soda Ash

An $800M global leader in natural soda ash and

Vision specialty sodium salts with respect to cost

2015 position, innovation and profitability

Market Drivers

GDP growth in mature markets Growth in industrial production and per capita consumption in RDEs Supply / Demand balance regionally and globally Relative freight cost Relative cost of substitutes Regulatory initiatives

Current Position

World’s largest natural soda ash producer Significant cost advantage versus synthetic soda ash production Cost position and efficient distribution enable global reach Leader in Longwall and Secondary Solution Mining Sustained earnings well in excess of reinvestment economics

Industry Structure and Competitive Position Make Soda Ash an Attractive Business for FMC

Limited access to key raw material

Favorable U.S. industry structure

FMC has scale, proprietary process technology and low-cost position

Supply-driven cycle, steady global demand growth

Global supply cost curve is not flat due to natural vs. synthetic production

ANSAC as a highly efficient sales and distribution channel

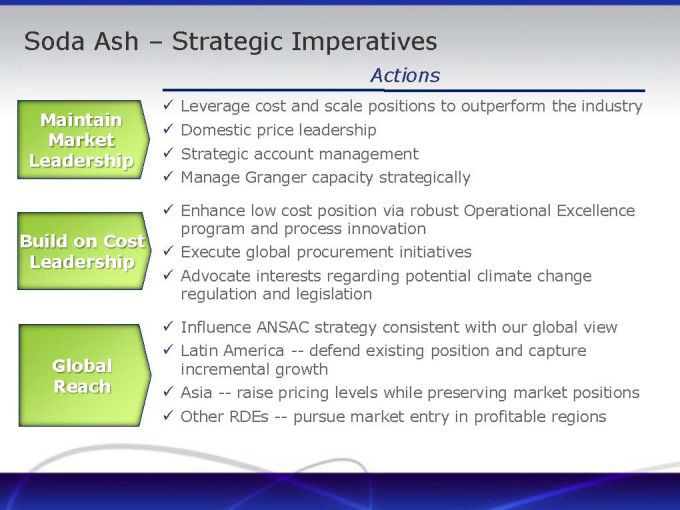

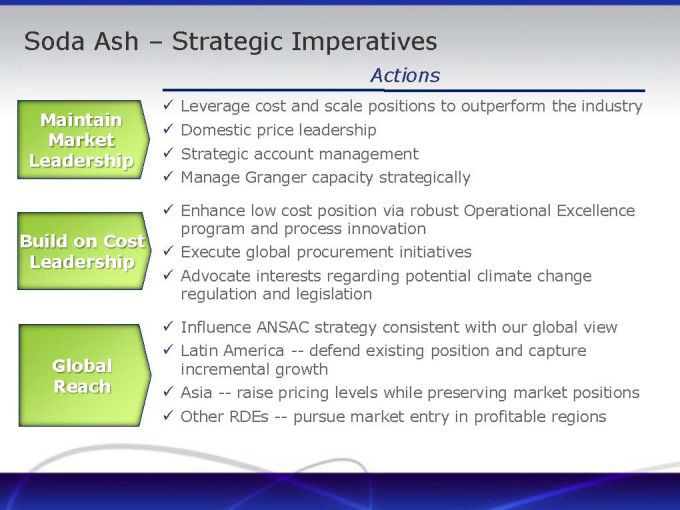

Soda Ash Strategic Imperatives

Actions

Maintain Market Leadership

Build on Cost Leadership

Global Reach

Leverage cost and scale positions to outperform the industry Domestic price leadership Strategic account management Manage Granger capacity strategically Enhance low cost position via robust Operational Excellence program and process innovation Execute global procurement initiatives Advocate interests regarding potential climate change regulation and legislation Influence ANSAC strategy consistent with our global view Latin America — defend existing position and capture incremental growth Asia — raise pricing levels while preserving market positions Other RDEs — pursue market entry in profitable regions

Global Peroxygens

A $375M leading global supplier of oxidation solutions to Vision environmental, anti-microbial, and other specialty 2015 markets building on our peroxygens chemistries and adjacent technologies

Market Drivers

Growth of core demand in North America and Western Europe with economic recovery Greater regulation of environmental and food safety standards

Sustainability and

RDE adoption of Western standards Core markets growing faster in RDEs

Current Position

North America leader in attractive and growing specialty peroxygens applications Opportunity to drive specialty transition in Europe “green Significant opportunity to enhance chemistry” growth via more rapid globalization

Peroxygens Targeting Three Sets of Applications

Environmental

Technologies employed to reduce, eliminate or remediate pollutants contained in or emitted into air, water, and soil.

Cost Growth

Globalization Core Anti-Microbial Innovation

All traditionally All served areas in served markets which our oxidants such as pulp/paper, are principally polymer, cosmetic, employed to kill pharmaceuticals, bacteria, pathogens distribution, and or other microbes. electronics.

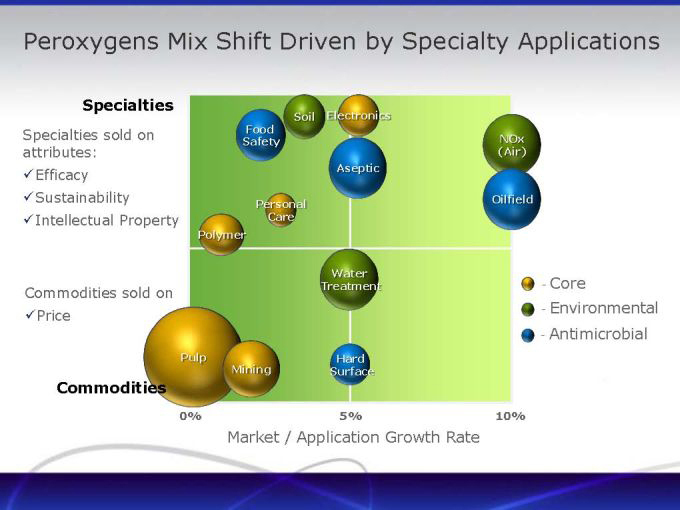

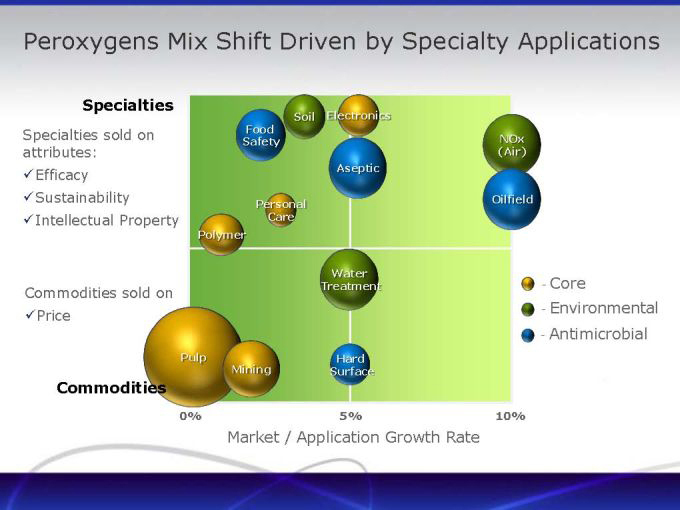

Peroxygens Mix Shift Driven by Specialty Applications

Specialties

Soil Electronics

Specialties sold on Food

Safety NOx

attributes: (Air)

Aseptic

Efficacy

Sustainability Oilfield

Personal

Intellectual Property Care

Polymer

Water

Treatment—Core

Commodities sold on

- Environmental Price

- Antimicrobial

Pulp Hard Mining Surface

Commodities

0% 5% 10%

Market / Application Growth Rate

Global Peroxygens Strategic Imperatives

Actions

Cost

Propagate Specialties

Global Reach

Innovation

Enhance competitive cost position via process redesign and ongoing cost reduction initiatives Continue to enhance profitability and reduce cyclicality while growing globally Globalize specialty franchises in environmental, electronics, food safety and water treatment Leverage specialty opportunities via integration of Western European peroxygens Capture growth in RDEs Establish sustainable competitive advantages in new geographies Ensure long-term sales and earning growth Pipeline of new applications and continued process enhancements Protect technology with intellectual property

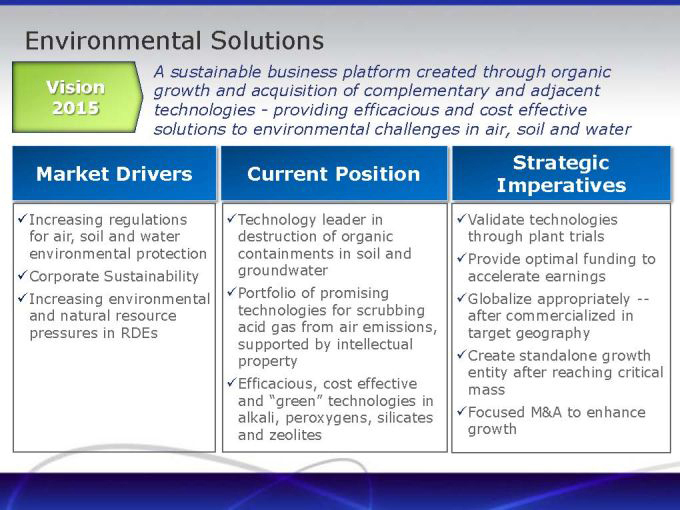

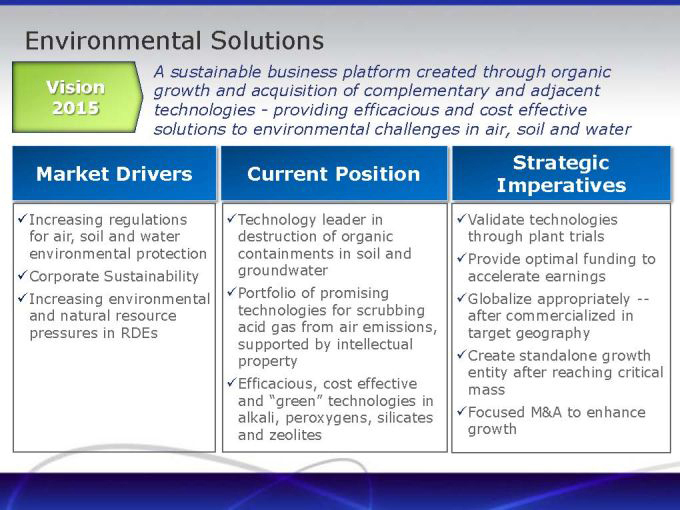

Environmental Solutions

A sustainable business platform created through organic Vision growth and acquisition of complementary and adjacent 2015 technologies—providing efficacious and cost effective solutions to environmental challenges in air, soil and water

Market Drivers

Increasing regulations for air, soil and water environmental protection Corporate Sustainability Increasing environmental and natural resource pressures in RDEs

Current Position

Technology leader in destruction of organic containments in soil and groundwater Portfolio of promising technologies for scrubbing acid gas from air emissions, supported by intellectual property Efficacious, cost effective and “green” technologies in alkali, peroxygens, silicates and zeolites

Strategic Imperatives

Validate technologies through plant trials Provide optimal funding to accelerate earnings Globalize appropriately —after commercialized in target geography Create standalone growth entity after reaching critical mass Focused M&A to enhance growth

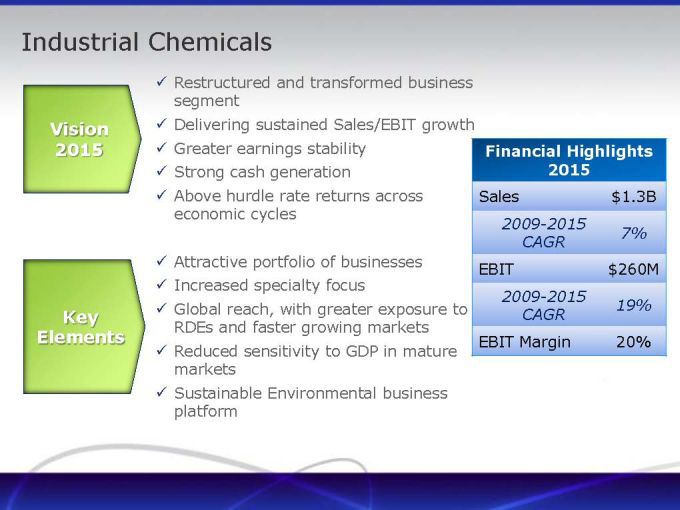

Industrial Chemicals

Vision 2015

Restructured and transformed business segment Delivering sustained Sales/EBIT growth Greater earnings stability Strong cash generation Above hurdle rate returns across economic cycles

Key Elements

Attractive portfolio of businesses Increased specialty focus Global reach, with greater exposure to RDEs and faster growing markets Reduced sensitivity to GDP in mature markets Sustainable Environmental business platform

Financial Highlights 2015

Sales $1.3B

2009-2015

7% CAGR

EBIT $260M

2009-2015

19% CAGR

EBIT Margin 20%

VISION 2015

THE RIGHT CHEMISTRY

[Graphic Appears Here]

Rapidly Developing Economies (RDEs) and Procurement

Mark Douglas, Vice President

Global Services and International Development

Dynamic Global Growth Trends Driving RDE Opportunities

Central / Eastern Europe, Turkey, Russia

Asia Middle East & Africa Latin America

Population Growth

Urbanization

Industrial Capital Investment

Growing Middle Class Consumerism

Rapidly Developing Economies (RDEs)

RDEs to deliver 50% or more of FMC’s total sales by

2015

Vision Sales of $2+B

2015

CAGR of 9-11% over 2009-2015

Strong local leadership with developed bench

Strategic Roadmap

People — recruitment, retention and development of local workforce and leadership Technology — local development of product offerings tailored for local markets Asset Placements — supporting resources for business growth, e.g.

Shanghai Innovation Center

BioPolymer labs in Turkey, Singapore, India

Enabling Actions to Capitalize on RDE Opportunities

Locally tailored products required for local markets Talent acquisition — increasing need now driven by both MNCs and local companies Continued rapid development of logistical / industrial infrastructure Shifting cost competitiveness Government support for growth — incentives, subsidies Increasing environmental legislation

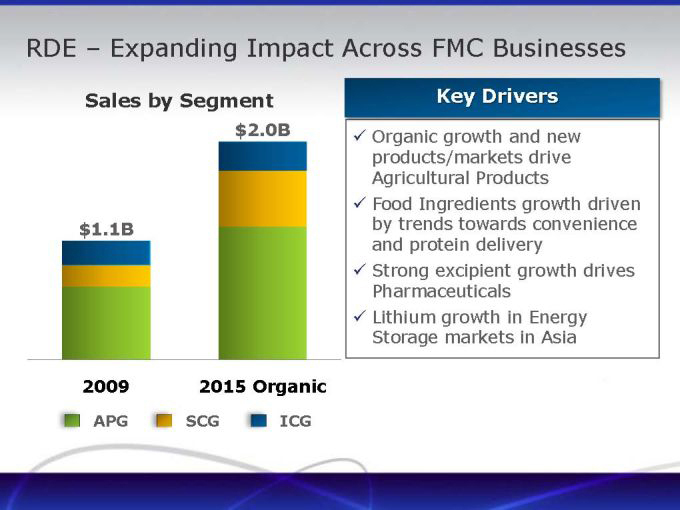

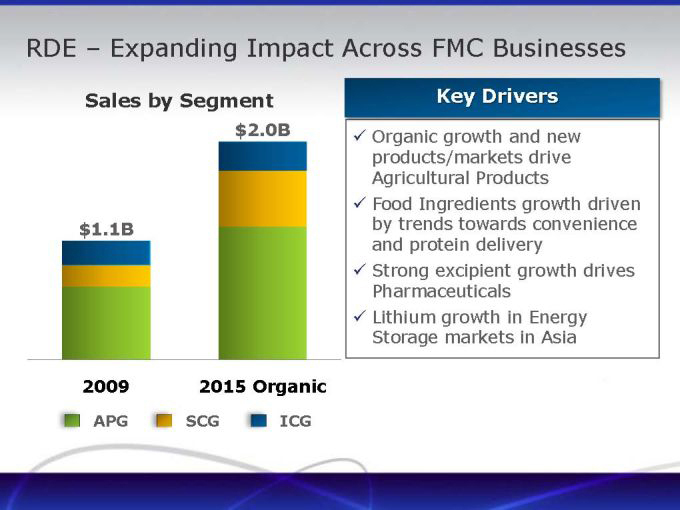

RDE Expanding Impact Across FMC Businesses

Sales by Segment

$2.0B

$1.1B

2009 2015 Organic

APG SCG ICG

Key Drivers

Organic growth and new products/markets drive Agricultural Products Food Ingredients growth driven by trends towards convenience and protein delivery Strong excipient growth drives Pharmaceuticals Lithium growth in Energy Storage markets in Asia

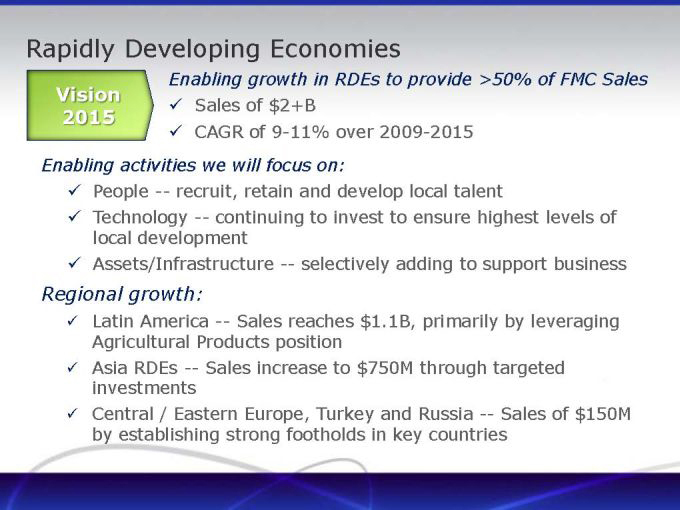

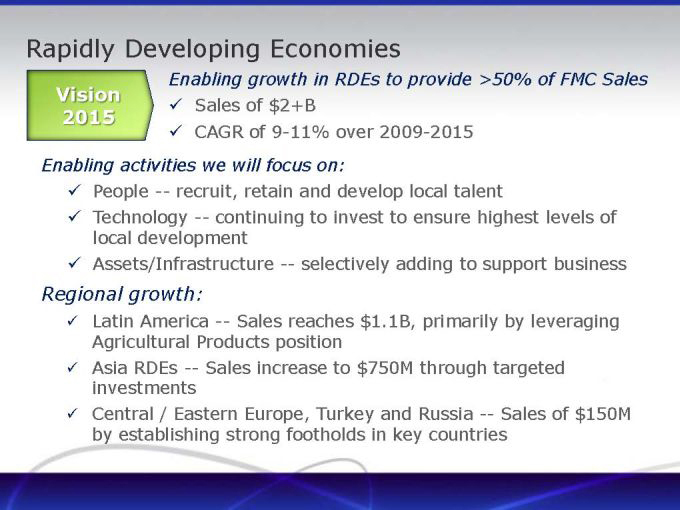

Rapidly Developing Economies

Enabling growth in RDEs to provide >50% of FMC Sales

Vision

Sales of $2+B

2015

CAGR of 9-11% over 2009-2015

Enabling activities we will focus on:

People — recruit, retain and develop local talent

Technology — continuing to invest to ensure highest levels of local development Assets/Infrastructure — selectively adding to support business

Regional growth:

Latin America — Sales reaches $1.1B, primarily by leveraging Agricultural Products position Asia RDEs — Sales increase to $750M through targeted investments Central / Eastern Europe, Turkey and Russia — Sales of $150M by establishing strong footholds in key countries

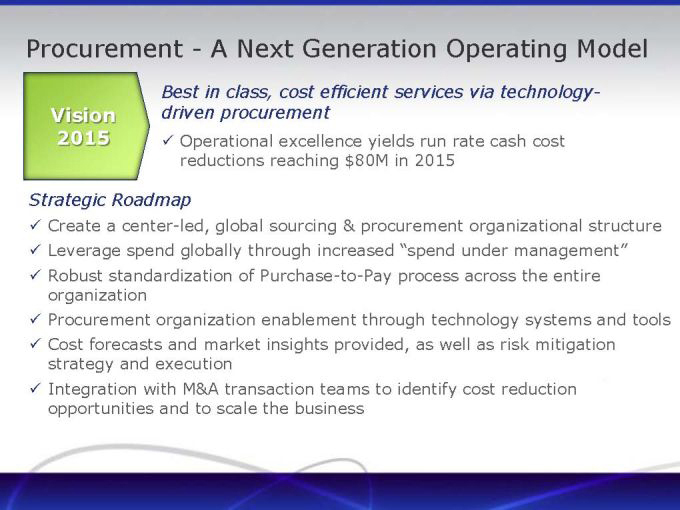

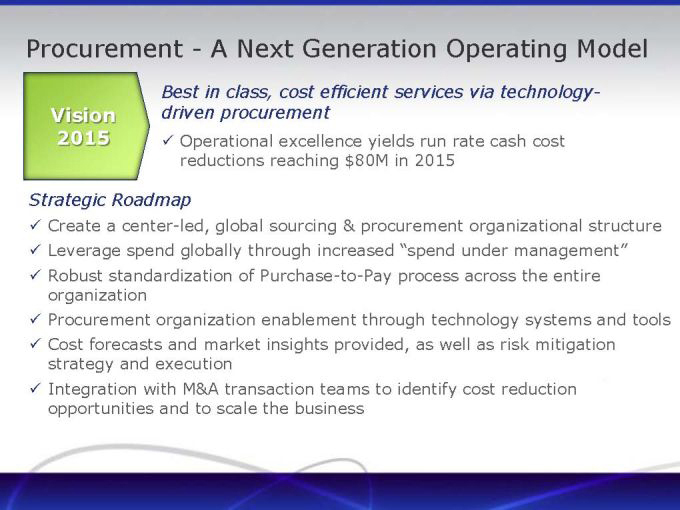

Procurement—A Next Generation Operating Model

Best in class, cost efficient services via technology-Vision driven procurement

2015 Operational excellence yields run rate cash cost reductions reaching $80M in 2015

Strategic Roadmap

Create a center-led, global sourcing & procurement organizational structure

Leverage spend globally through increased “spend under management”

Robust standardization of Purchase-to-Pay process across the entire organization

Procurement organization enablement through technology systems and tools Cost forecasts and market insights provided, as well as risk mitigation strategy and execution Integration with M&A transaction teams to identify cost reduction opportunities and to scale the business

Our Path to Operational Excellence

Operations 2010 2011 2012 2013 2014 2015 Organization Sourcing

Center of Excellence

Process

Spend Management Purchase-to-Process Pay Process

Accounts Broad organizational engagement supported by Payable external expertise E- Early wins identified and captured

Procurement

Adoption Iterative process

Master Data

Technology New leadership in place

Roll-out

Process & Technology Development

Evole Operating Model

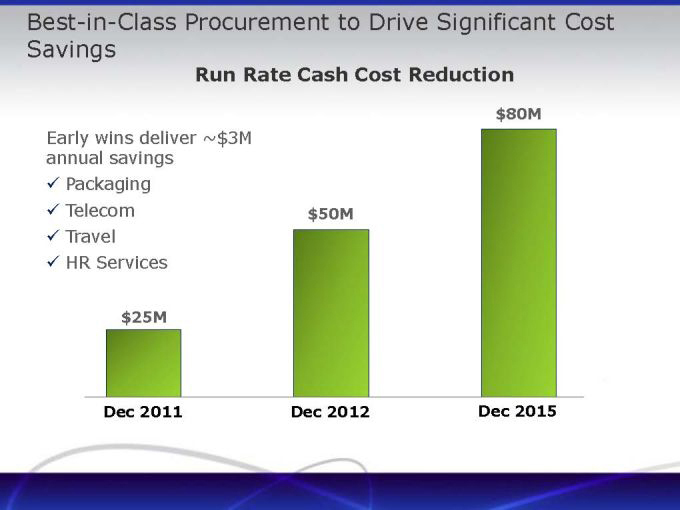

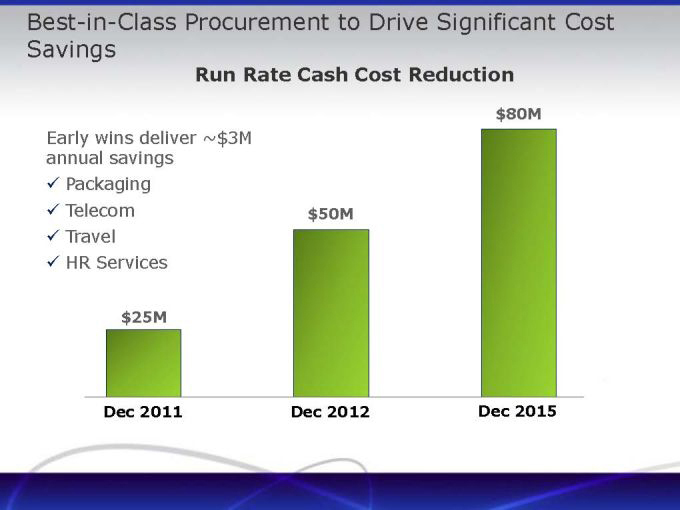

Best-in-Class Procurement to Drive Significant Cost Savings

Run Rate Cash Cost Reduction

$80M

Early wins deliver ~$3M annual savings Packaging

Telecom $50M Travel HR Services

$25M 20

Dec 2011 Dec 2012 Dec 2015

VISION 2015

THE RIGHT CHEMISTRY

Financial Strength Enables Achievement of Vision 2015

W. Kim Foster, Senior Vice President and Chief Financial Officer

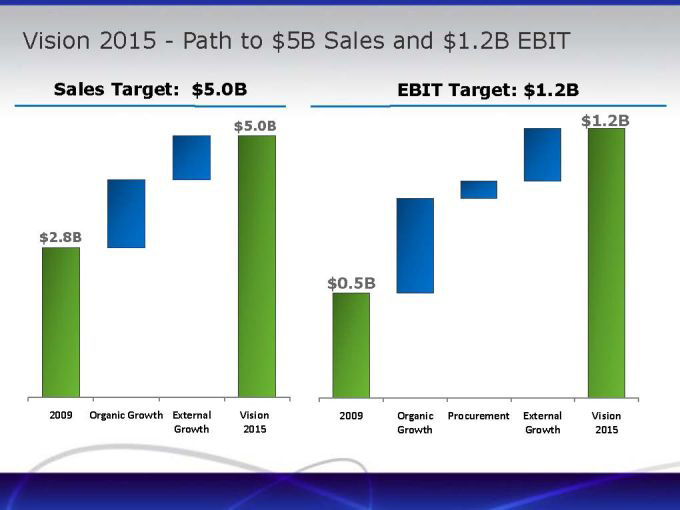

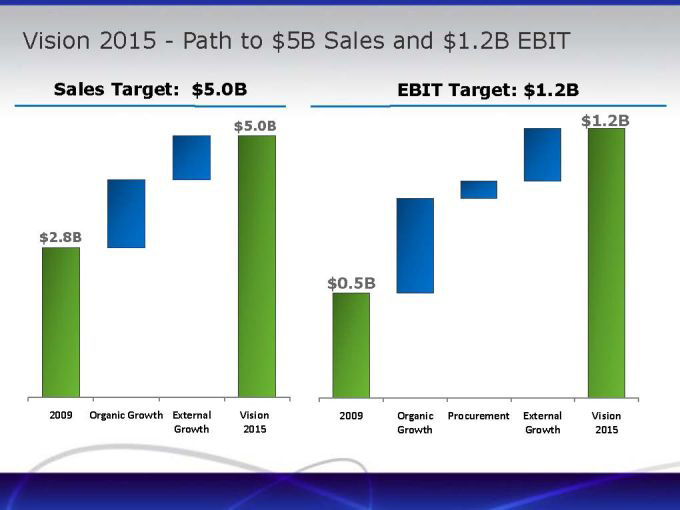

Vision 2015—Path to $5B Sales and $1.2B EBIT

Sales Target: $5.0B EBIT Target: $1.2B

$5.0B $1.2B

$2.8B

$0.5B

2009 Organic Growth External Vision 2009 Organic Procurement External Vision

Growth 2015 Growth Growth 2015

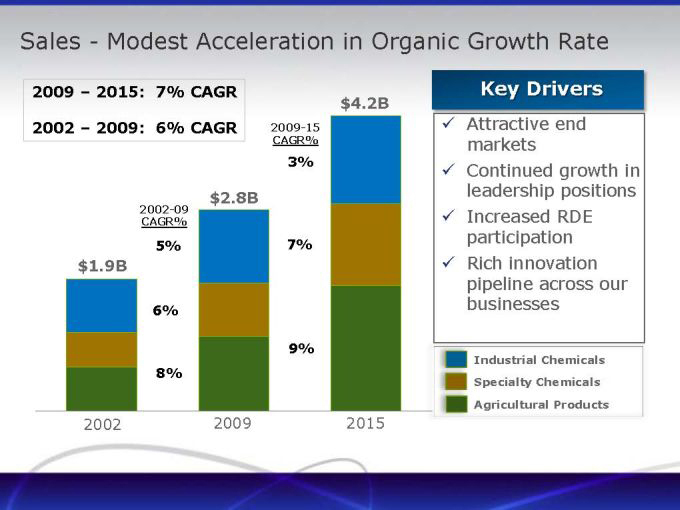

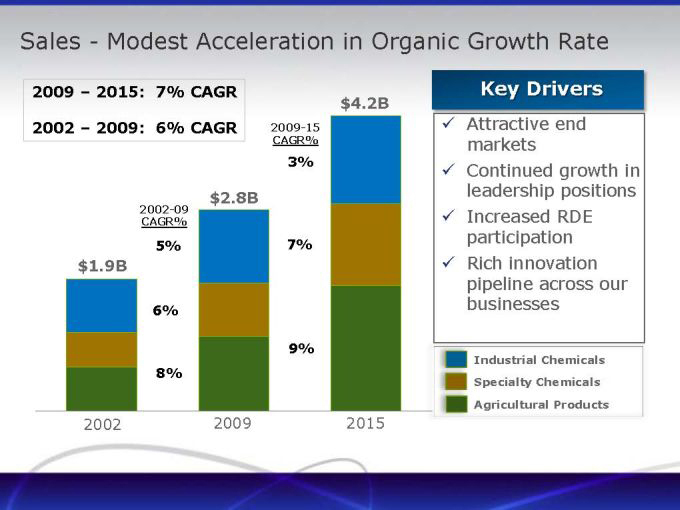

Sales—Modest Acceleration in Organic Growth Rate

2009 2015: 7% CAGR Key Drivers $4.2B

2002 2009: 6% CAGR 2009-15 Attractive end

CAGR% markets

3% Continued growth in $2.8B leadership positions 2002-09 Increased RDE

CAGR%

7% participation

5%

$1.9B Rich innovation pipeline across our 6% businesses

9%

Industrial Chemicals

8%

Specialty Chemicals Agricultural Products

2002 2009 2015

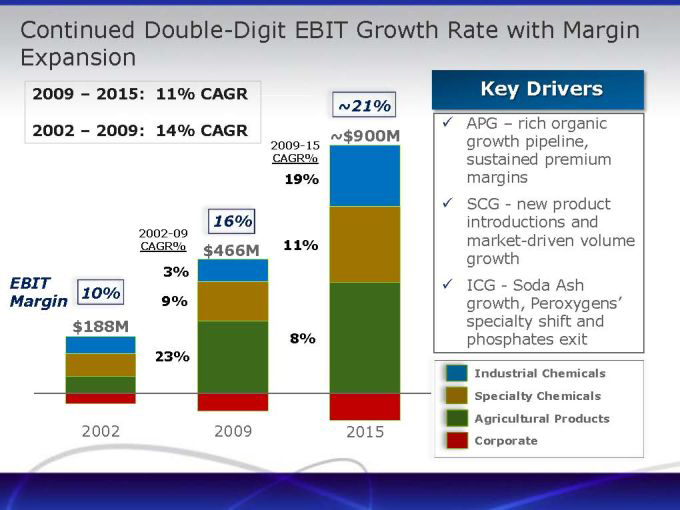

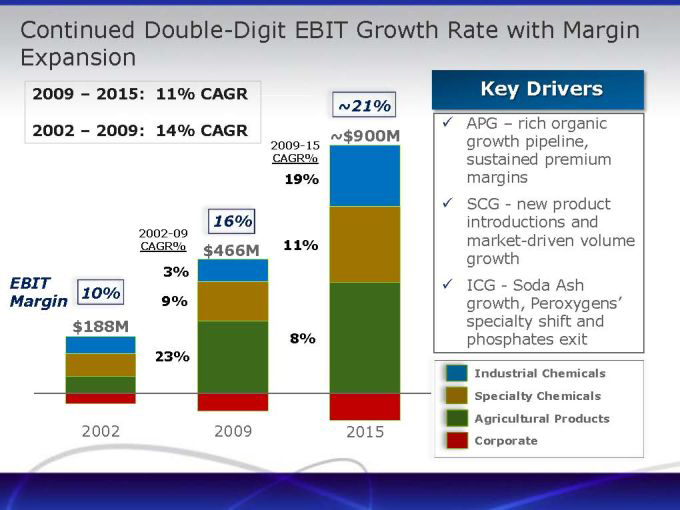

Continued Double-Digit EBIT Growth Rate with Margin Expansion

2009 2015: 11% CAGR Key Drivers

~21%

2002 2009: 14% CAGR APG rich organic

~$900M growth pipeline,

2009-15

CAGR% sustained premium 19% margins SCG—new product 2002-09 16% introductions and CAGR% 11% market-driven volume $466M growth

3%

EBIT ICG—Soda Ash

10%

Margin 9% growth, Peroxygens’ $188M specialty shift and

8% phosphates exit

23%

Industrial Chemicals Specialty Chemicals Agricultural Products

2002 2009 2015

Corporate

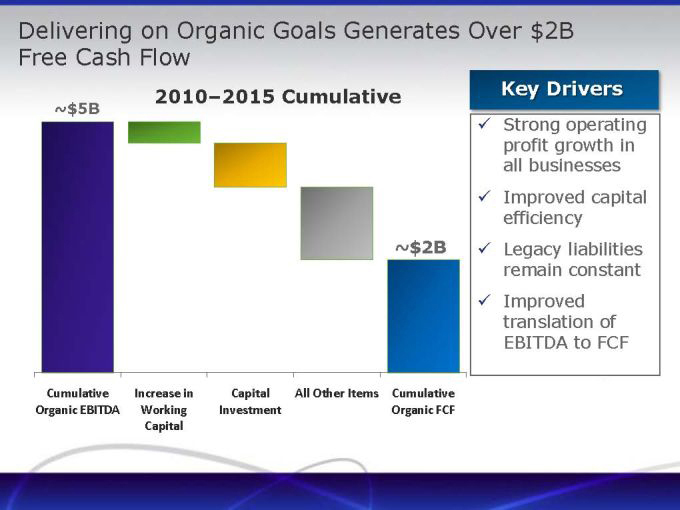

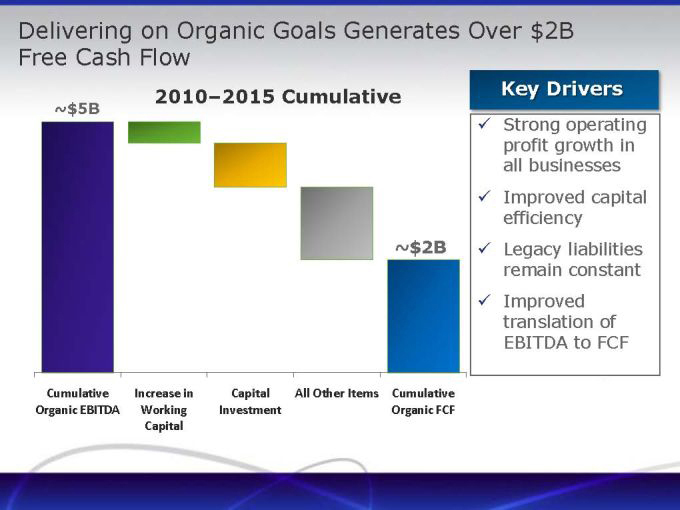

Delivering on Organic Goals Generates Over $2B Free Cash Flow

2010 2015 Cumulative Key Drivers

~$5B Strong operating profit growth in all businesses Improved capital efficiency ~$2B Legacy liabilities remain constant Improved translation of EBITDA to FCF

Cumulative Increase in Capital All Other Items Cumulative Organic EBITDA Working Investment Organic FCF

Capital

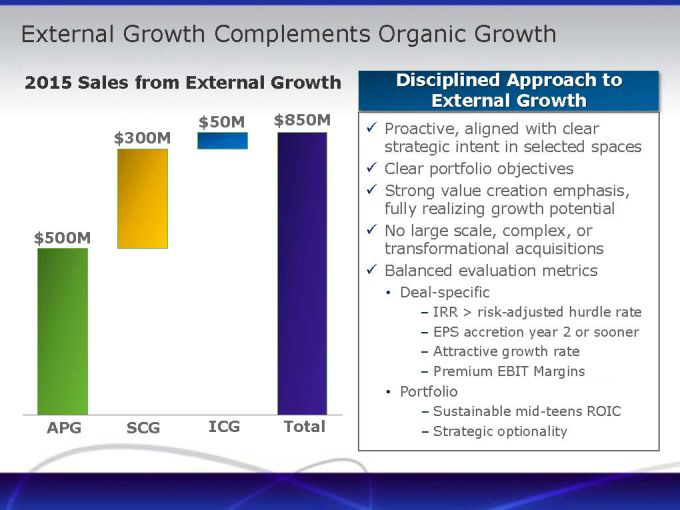

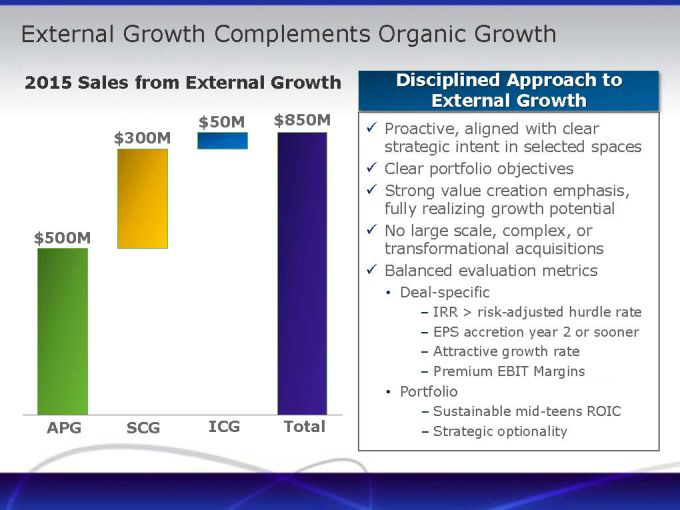

External Growth Complements Organic Growth

2015 Sales from External Growth Disciplined Approach to External Growth

$50M $850M

Proactive, aligned with clear $300M strategic intent in selected spaces Clear portfolio objectives Strong value creation emphasis, fully realizing growth potential $500M No large scale, complex, or transformational acquisitions Balanced evaluation metrics

Deal-specific

IRR > risk-adjusted hurdle rate

EPS accretion year 2 or sooner

Attractive growth rate

Premium EBIT Margins

Portfolio

Sustainable mid-teens ROIC

APG SCG ICG Total Strategic optionality

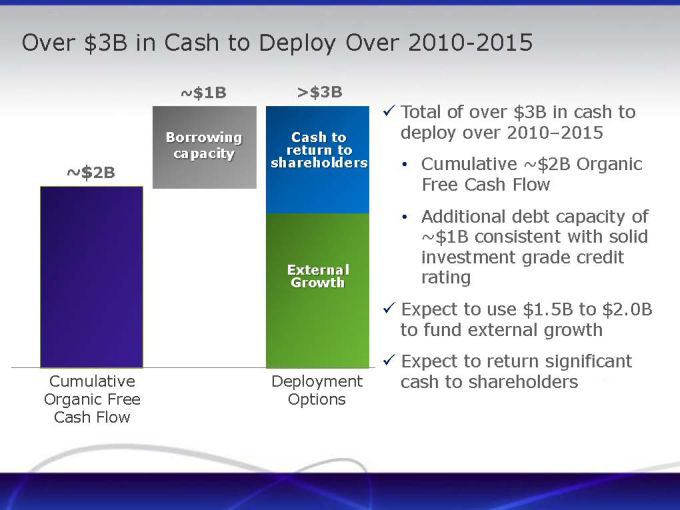

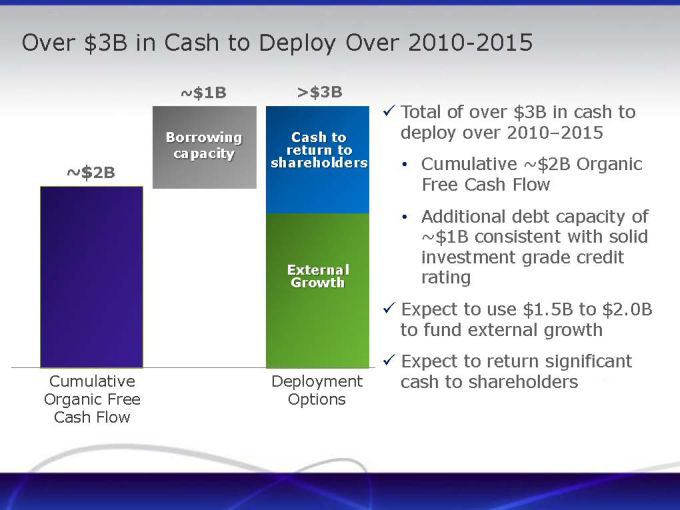

Over $3B in Cash to Deploy Over 2010-2015

~$1B >$3B

Total of over $3B in cash to Borrowing Cash to deploy over 2010 2015

capacity return to

shareholders Cumulative ~$2B Organic

~$ 2.2B

Free Cash Flow

Additional debt capacity of ~$1B consistent with solid investment grade credit

External rating Growth

Expect to use $1.5B to $2.0B to fund external growth Expect to return significant

Cumulative Deployment cash to shareholders Organic Free Options Cash Flow

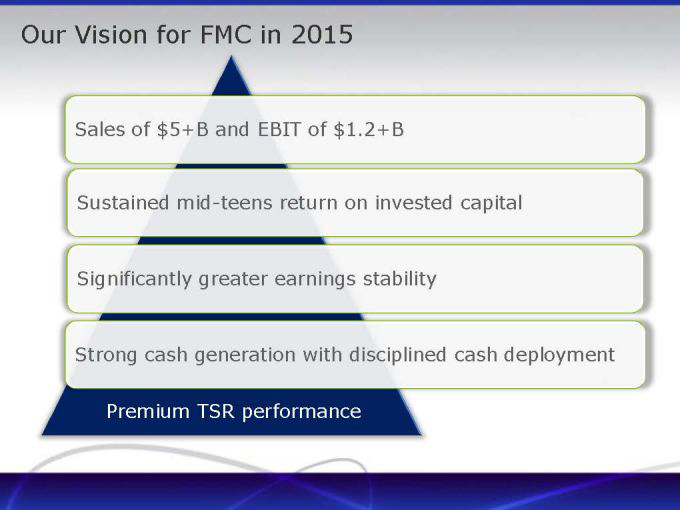

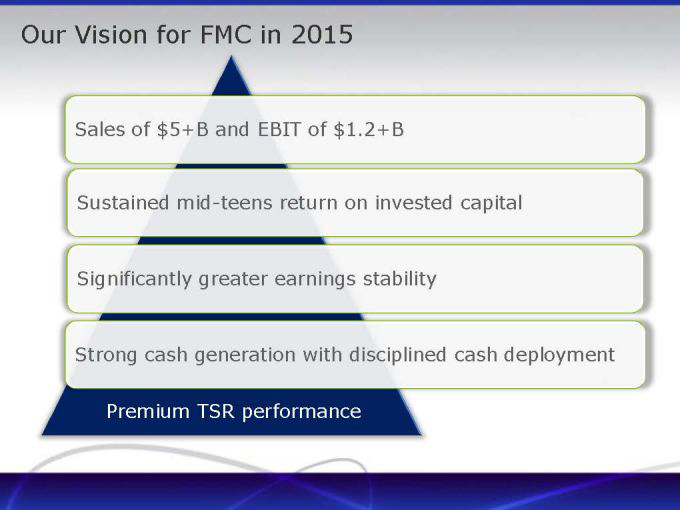

Our Vision for FMC in 2015

Sales of $5+B and EBIT of $1.2+B

Sustained mid-teens return on invested capital

Significantly greater earnings stability

Strong cash generation with disciplined cash deployment

Premium TSR performance

VISION 2015

THE RIGHT CHEMISTRY

VISION 2015

THE RIGHT CHEMISTRY