Second Quarter 2011 Investor Presentation Dated: September 13, 2011 Filed by F.N.B. Corporation (Commission File No. 001-31940) Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 of the Securities Exchange Act of 1934 Subject Company: Parkvale Financial Corporation (Commission File No. 0-17411) F.N.B. Corporation |

Forward-Looking Statements This presentation and the reports F.N.B. Corporation files with the Securities and Exchange Commission often contain “forward-looking statements” relating to present or future trends or factors affecting the banking industry and, specifically, the financial operations, markets and products of F.N.B. Corporation. These forward-looking statements involve certain risks and uncertainties. There are a number of important factors that could cause F.N.B. Corporation’s future results to differ materially from historical performance or projected performance. These factors include, but are not limited to: (1) a significant increase in competitive pressures among financial institutions; (2) changes in the interest rate environment that may reduce interest margins; (3) changes in prepayment speeds, loan sale volumes, charge-offs and loan loss provisions; (4) general economic conditions; (5) various monetary and fiscal policies and regulations of the U.S. government that may adversely affect the businesses in which F.N.B. Corporation is engaged; (6) technological issues which may adversely affect F.N.B. Corporation’s financial operations or customers; (7) changes in the securities markets; (8) risk factors mentioned in the reports and registration statements F.N.B. Corporation files with the Securities and Exchange Commission; (9) housing prices; (10) job market; (11) consumer confidence and spending habits; (12) estimates of fair value of certain F.N.B. Corporation assets and liabilities or (13) the effects of current, pending and future legislation, regulation and regulatory actions. F.N.B. Corporation undertakes no obligation to revise these forward-looking statements or to reflect events or circumstances after the date of this presentation. 2 |

Forward-Looking Statements 3 ADDITIONAL INFORMATION ABOUT THE MERGER F.N.B. Corporation and Parkvale Financial Corporation will file a proxy statement/prospectus and other relevant documents with the SEC in connection with the merger. SHAREHOLDERS OF PARKVALE FINANCIAL CORPORATION ARE ADVISED TO READ THE PROXY STATEMENT/PROSPECTUS WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. The proxy statement/prospectus and other relevant materials (when they become available), and any other documents F.N.B. Corporation has filed with the SEC, may be obtained free of charge at the SEC's website at www.sec.gov. In addition, investors and security holders may obtain free copies of the documents F.N.B. Corporation has filed with the SEC by contacting James Orie, Chief Legal Officer, F.N.B. Corporation, One F.N.B. Boulevard, Hermitage, PA 16148, telephone: (724) 983-3317 or Parkvale Financial Corporation by contacting Gilbert A. Riazzi, Chief Financial Officer, 4220 William Penn Highway, Monroeville, PA 15146, telephone: (412) 373-4804. Parkvale Financial Corporation and its directors, executive officers and other members of its management and employees may be deemed to be participants in the solicitation of proxies from its shareholders in connection with the proposed merger. Information concerning such participants' ownership of Parkvale Financial Corporation common stock will be set forth in the proxy statement/prospectus relating to the merger when it becomes available. This communication does not constitute an offer of any securities for sale. |

Non-GAAP Financial Information 4 To supplement its consolidated financial statements presented in accordance with Generally Accepted Accounting Principles (GAAP), the Corporation provides additional measures of operating results, net income and earnings per share (EPS) adjusted to exclude certain costs, expenses, and gains and losses. The Corporation believes that these non-GAAP financial measures are appropriate to enhance the understanding of its past performance as well as prospects for its future performance. In the event of such a disclosure or release, the Securities and Exchange Commission’s Regulation G requires: (i) the presentation of the most directly comparable financial measure calculated and presented in accordance with GAAP and (ii) a reconciliation of the differences between the non-GAAP financial measure presented and the most directly comparable financial measure calculated and presented in accordance with GAAP. The required presentations and reconciliations are contained herein and can be found at our website, www.fnbcorporation.com, under “Shareholder and Investor Relations” by clicking on “Non-GAAP Reconciliation.” The Appendix to this presentation contains non-GAAP financial measures used by the Corporation to provid information useful to investors in understanding the Corporation's operating performance and trends, and facilitate comparisons with the performance of the Corporation's peers. While the Corporation believes that these non-GAAP financial measures are useful in evaluating the Corporation, the information should be considered supplemental in nature and not as a substitute for or superior to the relevant financial information prepared in accordance with GAAP. The non-GAAP financial measures used by the Corporation may differ from the non-GAAP financial measures other financial institutions use to measure their results of operations. This information should be reviewed in conjunction with the Corporation’s financial results disclosed on July 25, 2011 and in its periodic filings with the Securities and Exchange Commission. |

F.N.B. Corporation Headquarters: Hermitage, PA Bank Charter: 1864 Assets: $9.9B (4th largest bank in PA) Market Capitalization: $1.1B at August 31, 2011 Current Locations 234 Banking: 223 (PA), 11 (OH) 65 Consumer Finance: 22 (PA), 19 (TN), 17 (OH), 7 (KY) Business Lines Banking Wealth Management Insurance Consumer Finance Merchant Banking 5 |

Experienced Management Team Name Position Years of Banking Experience Steve Gurgovits Chief Executive Officer 50 Vince Delie President CEO, First National Bank of PA 24 Brian Lilly Chief Operating Officer Vice Chairman 30 Vince Calabrese Chief Financial Officer 23 Gary Guerrieri Chief Credit Officer 24 6 |

Board Leadership Thirteen Independent Directors Seven Former Financial Services Executives Three Involved as Financial Services Investors 7 |

Manage our business for profitability and growth Operate in markets we know and understand Maintain a low-risk profile Drive growth through relationship banking Fund loan growth through deposits Target neutral asset / liability position to manage interest rate risk Build fee income sources Maintain rigid expense controls Operating Strategy 8 |

Market Characteristics Stable Markets Modest Growth #2 Ranking State College (1) #3 Ranking Pittsburgh (1) Regional Management Local Advisory Boards Marcellus Shale Exposure FNB Region Market Size Deposits FNB Deposit Ranking FNB Branches Pittsburgh $76.4B 3 rd 114 Northwest $25.5B 3 rd 54 Capital $45.8B 10 th 42 Central Mountain $11.8B 1 st 71 Source: SNL, company data; based on June 30, 2010 deposit data, excludes custodian bank, pro-forma ownership as of September 1, 2011. (1) MSA 9 |

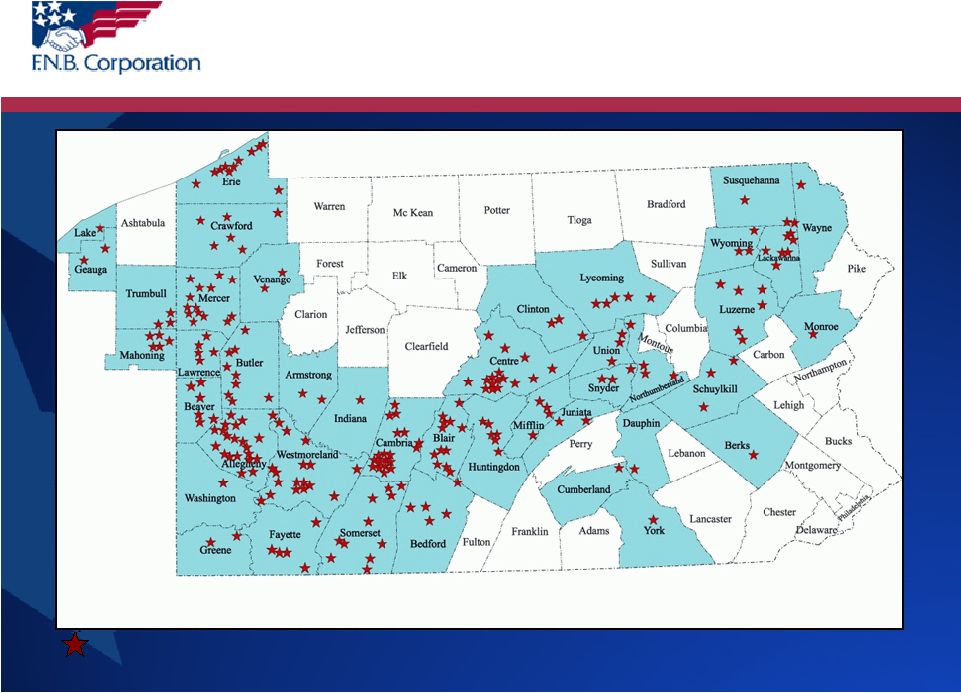

Banking Locations Current First National Bank Locations As of September 1, 2011 10 |

Organic Growth Opportunity Source: SNL Financial Deposit data as of June 30, 2010; excludes custodian bank, pro-forma ownership as of September 1, 2011. Attractive market rank of #3 for counties of operation 11 Rank Institution Branch Count Total Deposits in Market ($000) Total Market Share (%) 1 PNC Financial Services Group Inc. 347 45,417,165 29.71 2 Royal Bank of Scotland Group Plc 228 10,374,299 6.79 3 F.N.B. Corp. 281 8,639,847 5.65 4 M&T Bank Corp. 137 6,196,246 4.05 5 Huntington Bancshares Inc. 127 5,769,478 3.77 6 Wells Fargo & Co. 64 4,942,063 3.23 7 First Commonwealth Financial Corp. 101 4,164,090 2.72 8 Banco Santander SA 75 3,755,597 2.46 9 First Niagara Financial Group Inc. 70 3,562,975 2.33 10 Susquehanna Bancshares Inc. 85 3,387,912 2.22 Total (1-165) 2,863 152,854,759 100.00 Counties of Operation |

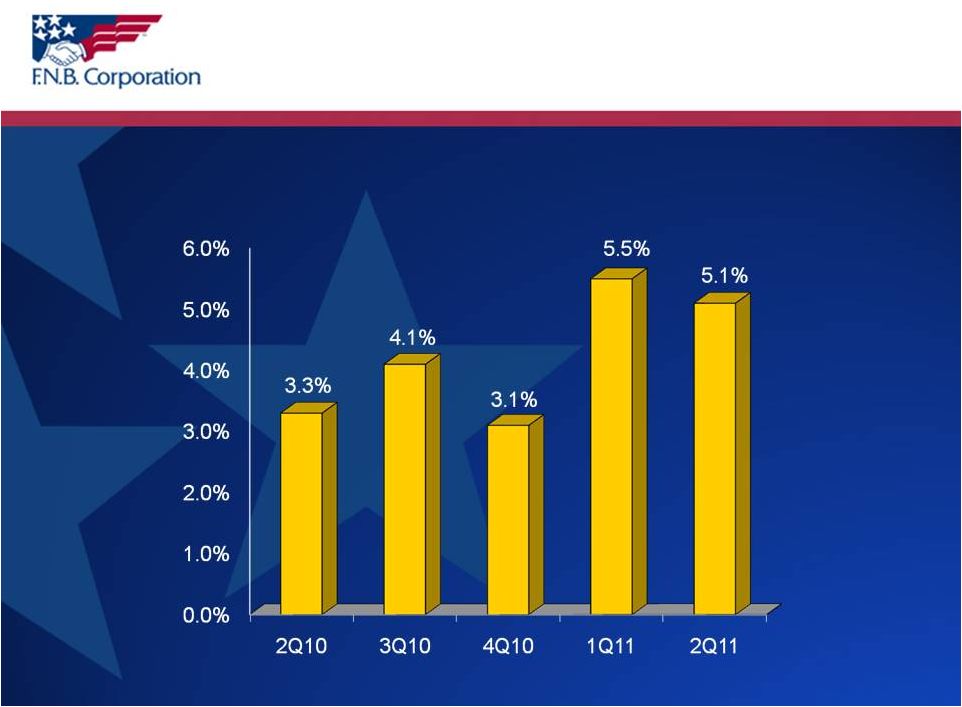

Winning Market Share Total Organic Loan Growth (1) Eighth Consecutive Quarter of Organic Growth (1) Based on average balances; percentage organic growth annualized and as compared to the prior quarter. 12 |

Winning Market Share Second Quarter 2011 Ninth consecutive linked- quarter organic growth for Pennsylvania commercial loans (2) Pennsylvania commercial loan organic growth of 8.7% (1) (2) Commercial line utilization rates remain historically low Commercial Organic Loan Growth (1) (1) Based on average balances; percentage organic growth annualized and as compared to the prior quarter. (2) Pennsylvania commercial portfolio organic loan growth, excludes Florida. 13 -2.0% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 2Q11 1Q11 4Q10 3Q10 2Q10 8.7% 10.7% 2.5% 0.6% 4.7% 7.4% 8.3% 0.1% -1.1% 3.6% Pennsylvania Commercial Growth Total Commercial Growth |

Winning Market Share Transaction Deposit and Customer Repurchase Agreements Organic Growth (1) (1) Based on average balances; percentage organic growth annualized and as compared to the prior quarter; transaction deposits includes DDA, Savings, NOW and MMDA. 14 |

Loan Composition Based on average balances for each period presented. 15 $0.0 $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 $3.5 $4.0 $4.5 $5.0 $5.5 $6.0 $6.5 $7.0 2007 2008 2009 2010 2Q11 Other Commercial Leases Regency Indirect Residential Mortgage Consumer Home Equity Commercial |

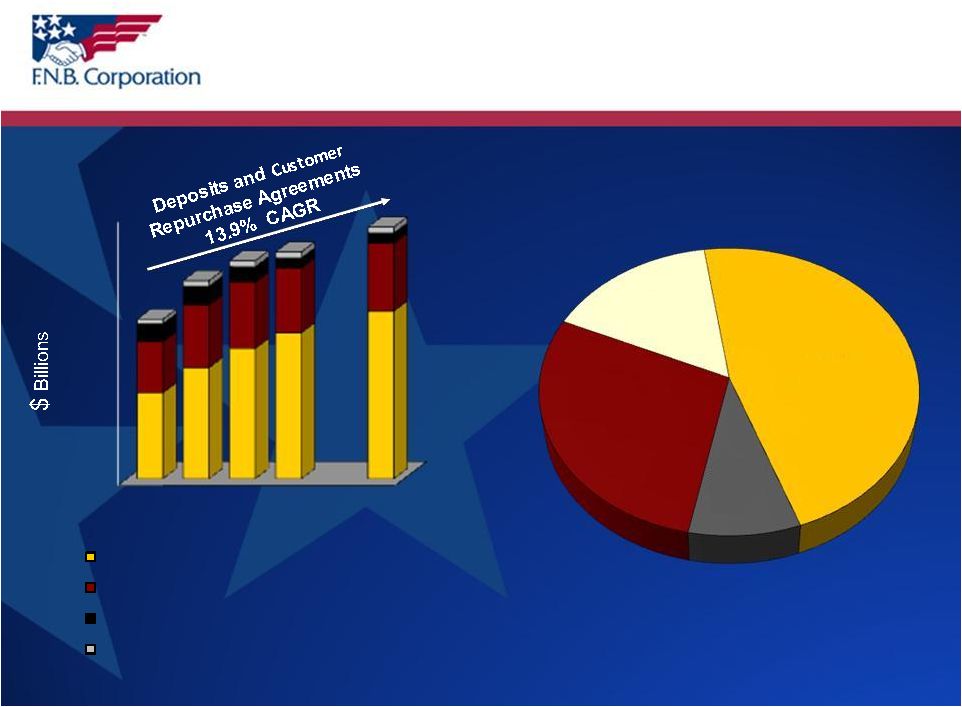

Funding Based on average balances for each period presented. Loans to deposits and customer repurchase agreements ratio of 84% Deposits and Customer Repurchase Agreements – $8.0 Billion at June 30, 2011 16 $0.0 $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 $7.0 $8.0 $9.0 2007 2008 2009 2010 2Q11 Transaction Deposits and Customer Repos Time Deposits Total Borrowings Trust Preferred Customer Repos 9% Time Deposits 28% DDA 16% Savings, NOW, MMDA 47% |

Proven Merger Integrator |

Proven Merger Integrator Proven significant acquisition and integration experience - since 2002, completed eight bank acquisitions ($6.1 billion in assets), four insurance acquisitions and one consumer finance acquisition. Pending - acquisition of Parkvale Financial ($1.8 billion in assets) announced June 15, 2011. Significant acquisition opportunities exist in Pennsylvania - currently over 50 Pennsylvania headquartered institutions with assets between $300 million and $3 billion (1) . Pre-2002 Presence Acquisition Related Expansion (1) Source: SNL: Includes all banks and thrifts headquartered in PA, excludes mutuals and MHCs. 18 |

Well Diversified Business F.N.B. F.N.B. Corporation Corporation Banking Banking Wealth Wealth Management Management Merchant Merchant Banking Banking Consumer Consumer Finance Finance Insurance Insurance |

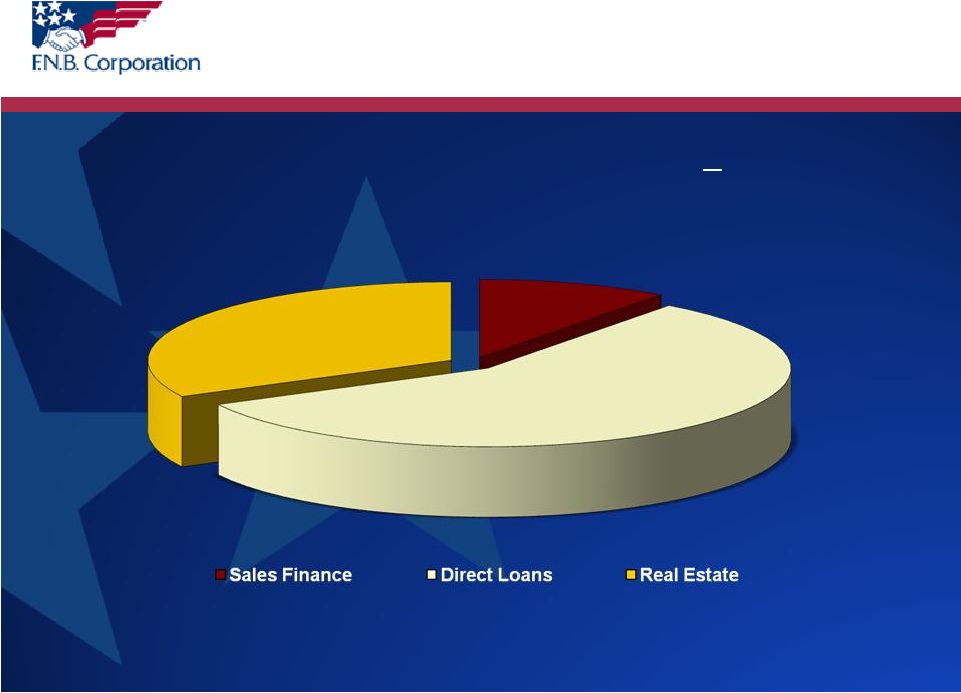

Regency Finance Company Over 80 years of consumer lending experience 65 Offices – 9 opened since October, 2010 High-Performing Affiliate • 2Q2011 YTD ROTCE 31.80% (1) • 2Q2011 YTD ROA 2.74% • 2Q2011 ROE 28.31% Consumer Finance (1) Return on average tangible common equity (ROTCE) is calculated by dividing net income less amortization of intangibles by average common equity less average intangibles. Pennsylvania Ohio Ohio Kentucky 20 Tennessee |

Regency Finance Company Loan Portfolio $163 Million 87% of Real Estate Loans are First Mortgages 12% 32% 56% As of June 30, 2011 Consumer Finance 21 |

Insurance Property, Casualty, Life and Employee Benefits Risk Management, Risk Transfer and Cost Containment Services Seven offices, located in Central and Western PA 80% Commercial; 20% Personal • 78% Property and Casualty • 22% Life and Benefits Annual premiums of $97 Million Wealth Management and Insurance Wealth Management Trust, Fiduciary and Institutional Investment Services • Over 70 Years Managing Wealth • $2.4 Billion Under Administration at June 30, 2011 Individual Investment Services • Brokerage, Mutual Funds and Annuities • Life and Long-Term Care Insurance Planning 22 |

Merchant Banking Junior capital provider offering flexible financing solutions •Mezzanine debt, subordinated notes, equity capital •Growth or expansion capital, buyouts and ownership transition financing •No early stage or real estate financing •Typical investment between $1 million and $7 million Total outstandings of $22 million as of June 30, 2011 Successfully harvested two relationships in 2010 contributing $2.3 million to fee revenue Founded in 2005 23 |

Parkvale Financial Corporation Transaction Highlights Announce Date: June 15, 2011 |

Strengthens FNB’s Leading Pittsburgh Position Solidifies FNB’s leading status in the Pittsburgh market – Pittsburgh MSA market rank moves significantly from #7 to #3 Significantly enhances distribution capabilities and scale One of few meaningful opportunities left in the market Low Execution Risk In-market transaction Leverages experienced Pittsburgh-market management team FNB is a proven merger integrator – completed eight bank acquisitions since 2002 ($6.1 billion in assets) Financially Attractive Effective deployment of capital – EPS accretion of 6% – IRR 20% Significant operating efficiencies – 35% cost savings Neutral to tangible book value per share, after recent capital raise – Accretive to March 31, 2011 tangible book value per share (pre-capital raise) Parkvale Financial Compelling Strategic Rationale 25 |

Leadership Position Pittsburgh MSA Strong # 3 pro forma market share position (FNB currently #7) (1) #1 community bank in the market Leverages existing strengths to build on momentum in market FNB/Parkvale branch overlap – 19 branches, or 40%, within 1 mile 26 Source: SNL Financial. (1) Excludes custodian banks. Pennsylvania Parkvale Financial (47 branches) F.N.B. (234 branches) Beaver Butler Westmoreland Armstrong Fayette Washington Allegheny • Parkvale Financial (40 branches) • F.N.B. (61 branches) Pittsburgh Pittsburgh MSA • • |

Total Foreclosures, First Quarter – 2011 Attractive Pittsburgh Market Source: PittsburghTODAY.org derived from Bureau of Labor Statistics, RealtyTrac and FHFA. 27 Source: SBA firms and employment by MSA 2008, Census.gov. 0 500 1,000 1,500 2,000 500+ Employees Middle Market and Corporate Pittsburgh MSA Pennsylvania MSA Average National MSA Average Pittsburgh Commercial Market – Continued Opportunity Pittsburgh MSA Economic Indicators Third Best % Job Growth % Change in Jobs, July 2010 – July 2011 Total Nonfarm #1 Housing Appreciation 1 Year Appreciation Rates 4th Quarter 2010 Second Lowest First Quarter 2011 Total Foreclosures 10,000 20,000 30,000 40,000 50,000 <20 Employees Small Businesses <500 Employees Businesses |

Transaction Overview Consideration: $22.48 (1) per Parkvale Financial share Fixed 2.178x exchange ratio 100% stock Deal Value: Approximately $130 million (1) Detailed Due Diligence: Completed Required Approvals: Customary regulatory and Parkvale shareholders Expected Closing: Early January 2012 TARP Repayment: Parkvale intends to redeem its $32 million of TARP prior to closing, subject to Treasury approval. Board Seats: Robert J. McCarthy, Jr. will join the Board of Directors of F.N.B. Corporation, and one Parkvale board member, as mutually agreed, will become a director of First National Bank of Pennsylvania. (1) Based on FNB stock price as of announcement date, Wednesday, June 15, 2011, $10.32. 28 |

Pennsylvania Marcellus Shale |

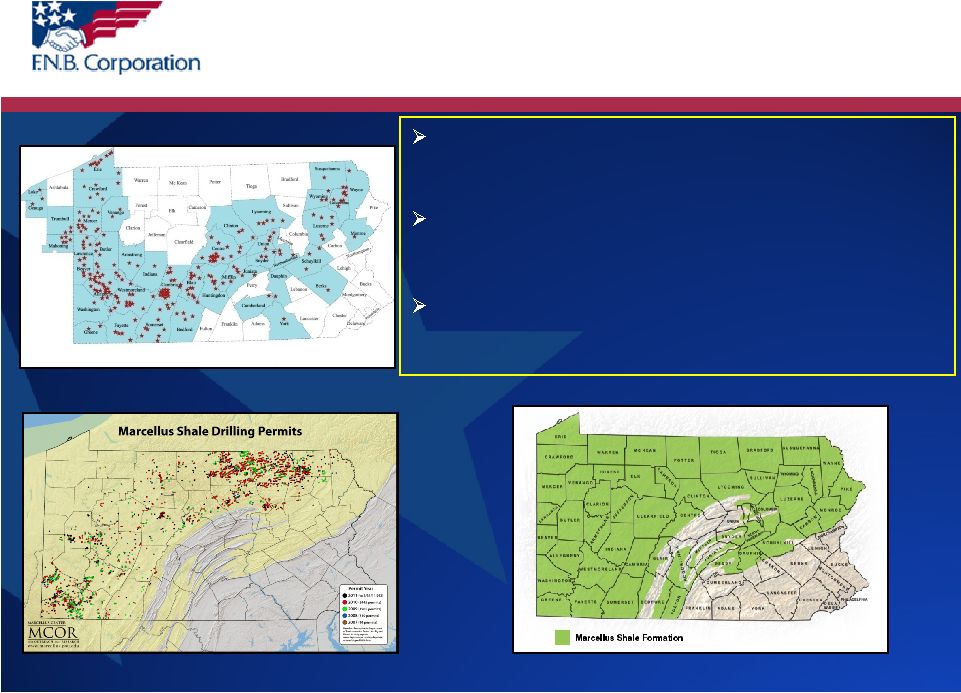

Pennsylvania Marcellus Shale PA Marcellus Shale Formation (3) Sources: (1) “The Pennsylvania Marcellus Natural Gas Industry: Status, Economic Impacts and Future Potential”, July 20, 2011, Penn State; (2) “Banking on the Marcellus”, June 7, 2010, Sterne Agee Industry Report; (3) MarcellusCoalition.org Fully developed - Marcellus Shale has potential to be the second largest natural gas field in the world. (1) Estimated/projected Pennsylvania jobs (1): • 2020, cumulative, respectively FNB screened as second best positioned in Pennsylvania based on overlap of market share, drilling permits issued and wells being dug. (2) PA Marcellus Drilling Permits F.N.B. Banking Locations 30 60,000, 157,000 and 256,000 - 2009, 2011 and |

Surveyors Real Estate Rocks and Quarries Utilities Oil and Gas (Direct Effect) Drilling, Extraction, Support Activities Indirect Impact (Supply Chain Effect) Heavy Equipment Commodity Traders Other Gas Distribution Iron and Steel Construction Pipelines Machinery Manufacturers Gas Processors Rig Parts Cement Induced Impact (Consumption Effect) Food and drink Utilities Travel Higher Education Housing Entertainment Attorneys Marcellus Shale Effect 31 |

2011 2015 2020 Economic Value: $12.8 Billion $17.2 Billion $20.2 Billion State/Local Taxes: $1.2 Billion $1.7 Billion $2.0 Billion Total Jobs: 156,695 215,979 256,420 Pennsylvania Marcellus Shale The Future: Economic Opportunity 2011 Status, Economic Impacts and Future Potential Source: “The Pennsylvania Marcellus Shale Natural Gas Industry: Status, Economic Impacts and Future Potential “, July 20, 2011, Penn State 32 |

LOAN COMPOSITION & CREDIT QUALITY |

Diversified Loan Portfolio $6.7 Billion Outstanding as of June 30, 2011 Shared National Credits • 3.6% of total loan portfolio • In-market customers and prospects Avoided subprime and Alt-A mortgages Construction and land development total only 3.4% and 0.7%, respectively, of FNB’s total loan portfolio 34 |

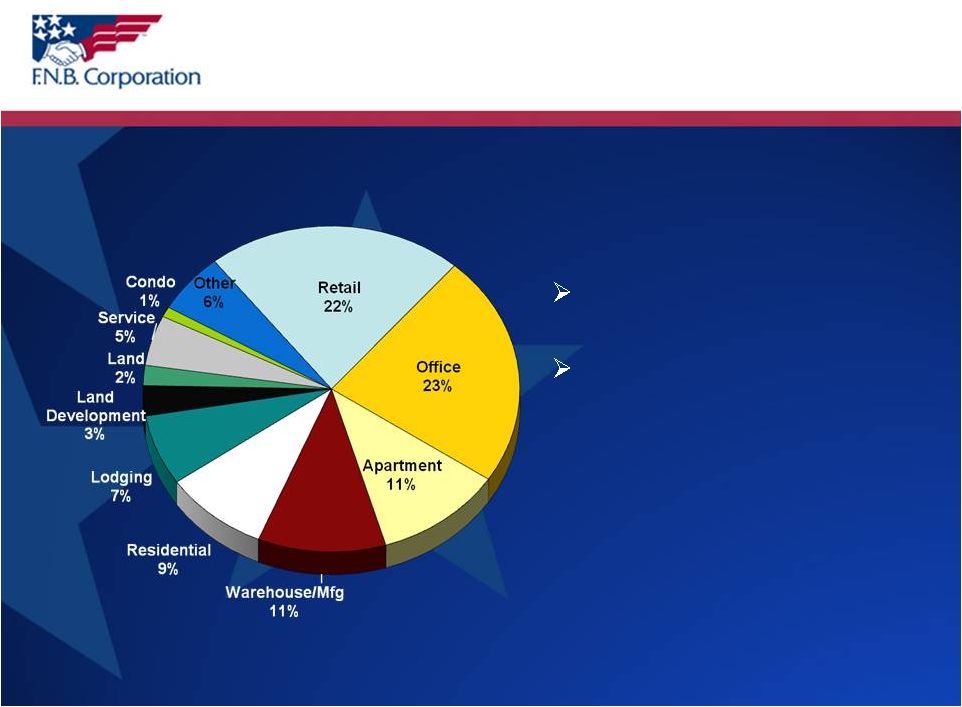

Commercial Real Estate Portfolio $1.2 Billion in CRE Non-Owner Occupied as of June 30, 2011 (excluding Florida) Diverse Portfolio Solid Credit Quality Results • 2.20% Total delinquency • 1.84% Non-performing loans + OREO/Total loans + OREO 35 |

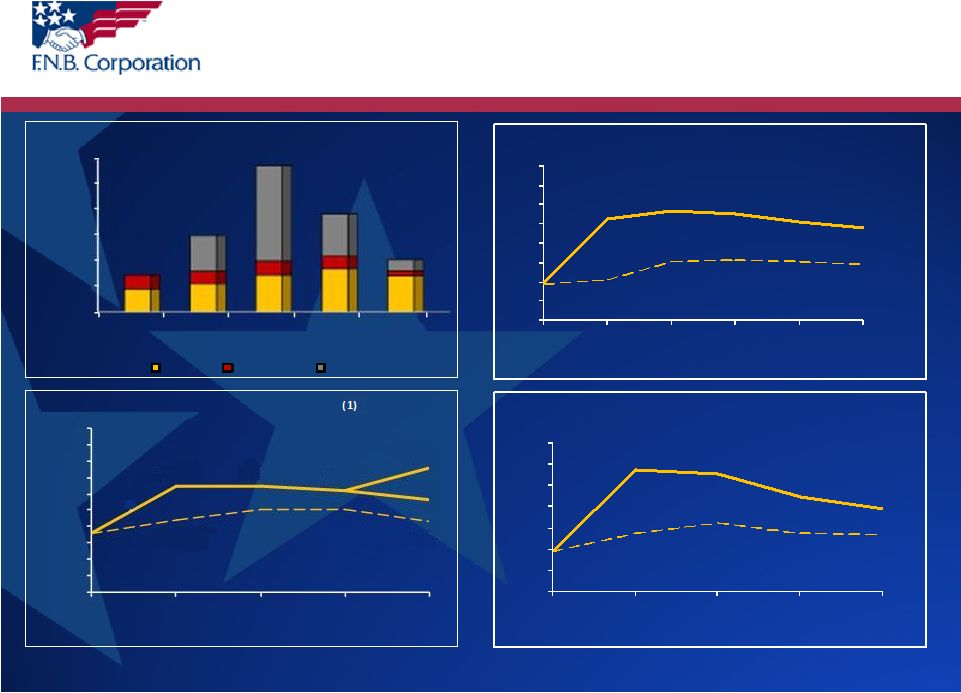

Credit Quality (1) 2.02% when including credit mark in both reserve for loan losses and total loans, refer to non-GAAP reconciliation in Appendix 2.62% 2.84% 2.74% 2.54% 2.42% 0.94% 1.06% 1.51% 1.56% 1.51% 1.44% 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 2007 2008 2009 2010 1Q11 2Q11 Dashed Line Excludes Florida NPL's and OREO % of Total Loans and OREO 3.38% 3.28% 2.76% 2.46% 1.47% 1.87% 2.14% 1.87% 1.84% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 2007 2008 2009 2010 2Q11 Dashed Line Excludes Florida Total Past Due & Non-Accrual Loans % of Total Loans 36 1.22% 1.80% 1.79% 1.74% 1.63% 1.38% 1.51% 1.50% 1.37% 2.02% 0.5% 0.7% 0.9% 1.1% 1.3% 1.5% 1.7% 1.9% 2.1% 2.3% 2.5% 2007 2008 2009 2010 2Q11 Dashed Line Excludes Florida Reserves % of Total Loans 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 2007 2008 2009 2010 2Q11 YTD NCO's % of Total Average Loans Bank Regency Florida |

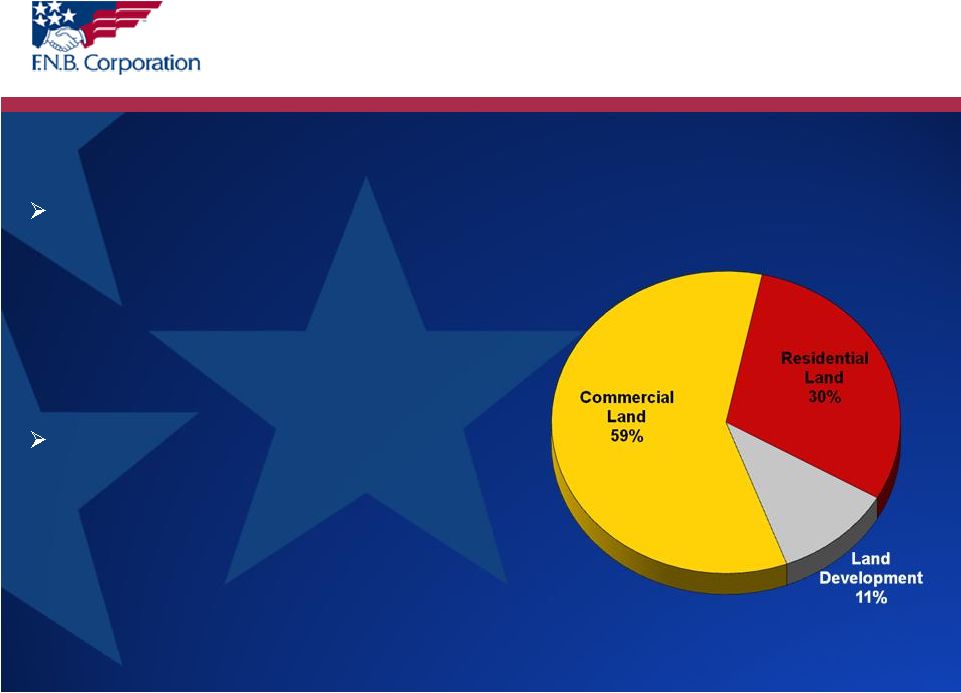

Florida Focus: Land-Related Exposure Florida Land-Related Exposure • Loans of $53 million represent under 1% of total loan portfolio • OREO of $21 million • Year-over-year exposure reduction of $24 million, or 25% Total Florida Portfolio • Loans of $180 million represent only 2.7% of total loan portfolio • Year-over-year exposure reduction of $39 million, or 16% Florida Land-Related Exposure Composition (1) Exposure refers to period-end loans plus OREO 37 $74 Million in Florida Land-Related Exposure as of June 30, 2011 (1) |

FINANCIALS |

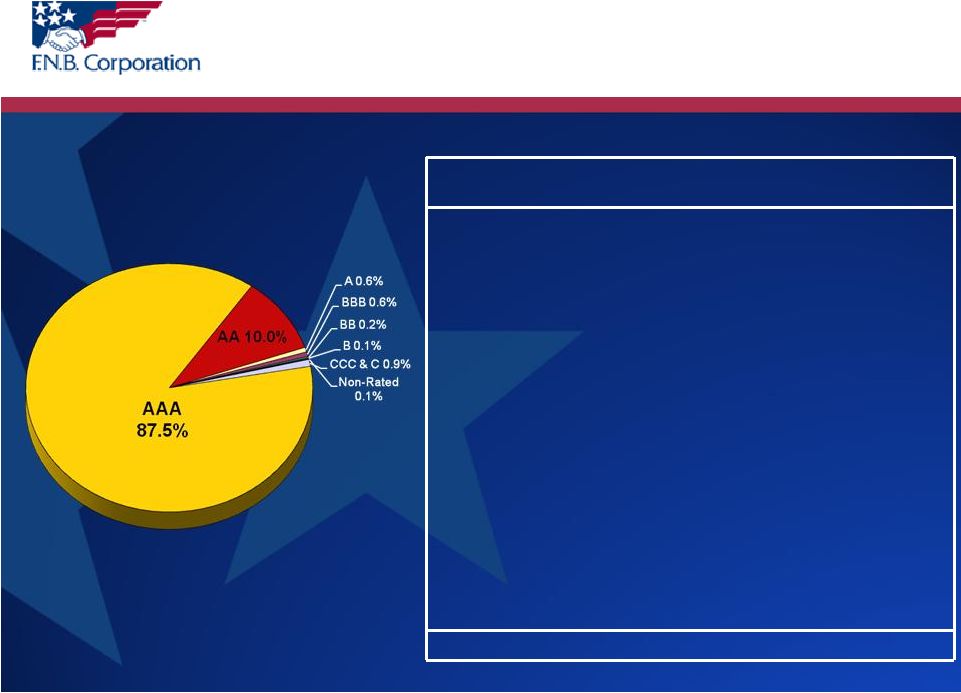

Investment Ratings By Investment - % Amount (1) (in $ millions) Agency – MBS AAA $999 Agency - Senior Notes AAA $338 CMO – Agency AAA $250 Municipals AAA – 2% AA – 93% A – 5% $198 CMO – Private Label AAA – 30% AA – 9% A - 4% BBB – 20% CCC – 36% $28 Short-Term AAA $17 Trust Preferred (2) BBB – 26% BB – 22% B – 12% C – 40% $17 Bank Stocks Non-Rated $2 Total $1,849 % of Total $1.8 Billion Portfolio Earning Assets - Investments (1) Amounts shown reflect GAAP (2) Original cost of $48 million; adjusted cost of $30 million; fair value of $16 million Investment Portfolio Ratings as of June 30, 2011 39 |

Solid Financial Results EPS of $0.18 per diluted share Seventh consecutive quarter of revenue growth Eighth consecutive quarter of total loan growth Continued strong transaction deposits and customer repo growth Continued good credit quality results Parkvale Financial Announcement Effective deployment of capital – EPS accretion of 6% – IRR 20% Solidifies FNB’s leading status in the Pittsburgh market Completed Common Stock Offering $63 million net proceeds Attractive price of $10.70 Completed in conjunction with FNB inclusion in the S&P 600 Second Quarter Highlights 40 |

Second Quarter Results (1) Calculated by dividing net income less amortization of intangibles by average common equity less average intangibles. (2) Calculated by dividing net income less amortization of intangibles by average assets less average intangibles. (3) Annualized linked-quarter organic growth data, based on average balances. 41 * 1Q11 amounts adjusted for one-time merger costs, refer to non-GAAP reconciliation included in Appendix 2Q11 1Q11 2Q10 Profitability Earnings per Common Share* 0.18 $ 0.16 $ 0.16 $ Return on Tangible Equity (1) * 16.77% 15.97% 15.65% Return on Tangible Assets (2) * 1.02% 0.94% 0.92% Operating Loan Growth (3) 5.1% 5.5% 3.3% Total Deposit and Customer Repurchase Agreements Growth (3) 6.3% 1.0% 9.2% Transaction Deposits and Customer Repurchase Agreements Growth (3) 10.7% 4.3% 13.7% Net Interest Margin 3.78% 3.81% 3.81% Efficiency Ratio 60.54% 63.72% 60.45% |

Stable Net Interest Margin Source: SNL Financial Regional peers include: CBCR, CBCYB, CBSH, CBU, CHFC, CRBC, CSE, FCF, FFBC, FINN, FMBI, FMER, FRME, FULT, MBFI, NBTB, NPBC, ONB, PRK, PVTB, SBNY, SRCE, STBA, SUSQ, TAYC, TCB, UBSI, UMBF, VLY, WSBC, and WTFC 42 |

Fee Income Excludes securities gains. 43 -$20 -$10 $0 $10 $20 $30 $40 $50 $60 $70 $80 $90 $100 $110 $120 2007 2008 2009 2010 2Q10 YTD 2Q11 YTD Gain-Sale of Residential Mtg Loans Bank-Owned Life Insurance Securities Commissions and Fees Other Trust Fees Insurance Commissions and Fees Service Charges OTTI Charges 2Q11 YTD Fee Income as Percentage of Operating Revenue -- 27% |

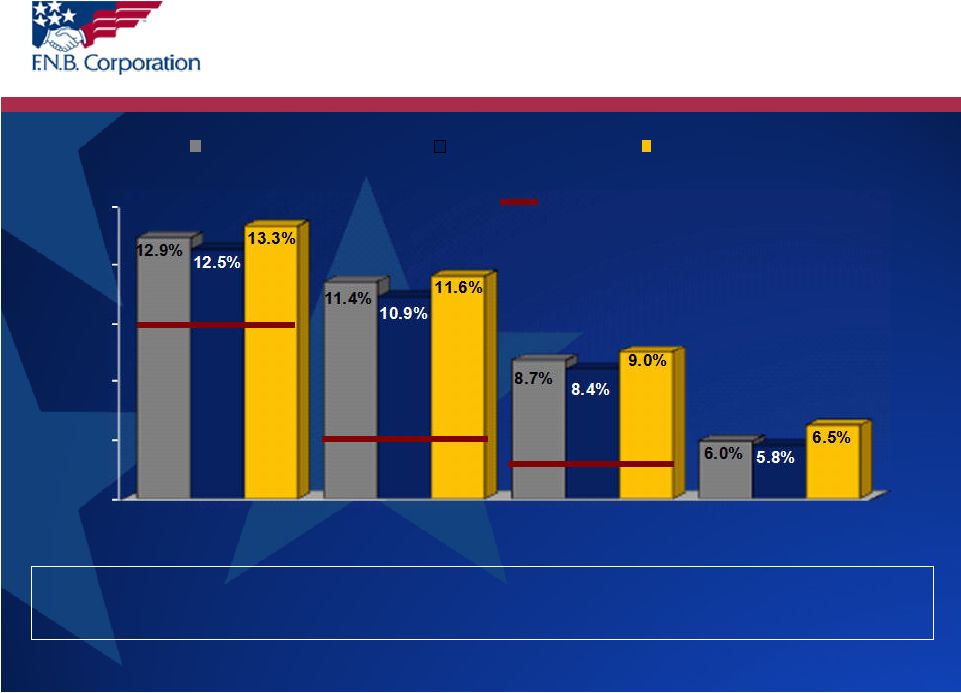

Well Capitalized Capital ratios at June 30, 2011 reflect the offering completed May 18, 2011 of 6.0 million shares of common stock with net proceeds of $63 million. 44 4% 6% 8% 10% 12% 14% Total Risk-Based Tier One Leverage Tangible Common Equity December 31, 2010 March 31, 2011 June 30, 2011 Regulatory “Well Capitalized” Threshold |

INVESTMENT THESIS |

Long-Term Investment Thesis Targeted EPS Growth 5-6% Expected Dividend Yield (Payout Ratio 60-70%) 4-6% = Total Shareholder Return 9-12% 46 |

(1) Based on August 31, 2011 closing prices (F.N.B.=$8.97) (2) Represents total common equity less intangibles Relative Valuation Multiples 47 F.N.B. Corporation Regional Banks National Banks Price (1) /Earnings Ratio FY11 Consensus EPS (F.N.B.=$0.69) 13.00x 14.03x 13.81x FY12 Consensus EPS (F.N.B.=$0.85) 10.55x 11.37x 11.40x Price (1) -to-Tangible Common Book Value (2) 1.90x 1.28x 1.26x Dividend Yield (1) 5.35% 2.01% 1.96% Peer Median |

Summary Leading market share among community banks in Central and Western PA Executing organic growth strategy and capitalizing on opportunities presented in markets of operation Experienced management team with proven ability to integrate acquisitions Diversified revenue stream 48 |

APPENDIX Loan Risk Profile Established Board of Directors GAAP to Non-GAAP Reconciliations Second Quarter 2011 Earnings Release (July 25, 2011) |

Loan Risk Profile Appendix Balance (1) % of Loans YTD Net Charge- Offs/Loans (2) Total Past Due / Loans NPL/Loans CRE Owner Occupied 1,294,489 19% 0.18% 3.03% 2.13% CRE Non-Owner Occupied 1,189,744 18% 0.38% 2.20% 1.48% Commercial & Industrial 1,111,311 17% 0.37% 0.99% 0.78% Home Equity & Other Consumer 1,486,879 22% 0.31% 0.90% 0.79% Residential Mortgage 623,926 9% 0.02% 2.56% 1.39% Indirect Consumer 519,550 8% 0.42% 1.00% 0.17% Florida 180,232 3% 1.44% 24.92% 24.91% Regency Finance 163,150 2% 3.76% 3.62% 3.95% Other 133,314 2% 0.88% 1.65% 0.56% Total 6,702,595 100.0% 0.42% 2.46% 1.90% (1) Period end balances, in $ millions (2) Annualized Loan Risk Profile as of June 30, 2011 |

Director Name Age Since Biography Stephen J. Gurgovits 68 1981 President and Chief Executive Officer William B. Campbell 73 1975 Chairman of the Board Henry M. Ekker 72 1994 Partner with Ekker, Kuster, McConnell & Epstein, LLP Philip E. Gingerich 74 2008 Director of Omega from 1994 to 2008; Retired Real Estate Appraiser and Consultant Robert B. Goldstein 71 2003 Principal of CapGen Financial Advisors LLC since 2007; Former Chairman of Bay View Capital Dawne S. Hickton 53 2006 Vice Chairman and CEO of RTI International Metals, Inc. since 2007 David J. Malone 57 2005 President and CEO of Gateway Financial since 2004 D. Stephen Martz 69 2008 Former Director, President and COO of Omega Harry F. Radcliffe 60 2002 Investment Manager Arthur J. Rooney II 58 2006 President, Pittsburgh Steelers Sports, Inc.; of Counsel with Buchanan, Ingersoll & Rooney LLP John W. Rose 62 2003 Principal of CapGen Financial Advisors LLC since 2007; President of McAllen Capital Partners, Inc. since 1991 Stanton R. Sheetz 56 2008 CEO and Director of Sheetz, Inc.; Director of Omega from 1994 to 2008; Director of Quaker Steak and Lube Restaurant, Inc William J. Strimbu 50 1995 President of Nick Strimbu, Inc. since 1994 Earl K. Wahl, Jr. 70 2002 Owner, J.E.D. Corporation Appendix Established Board of Directors |

GAAP to Non-GAAP Reconciliation Appendix 2011 2010 Second First Second Quarter Quarter Quarter Return on average tangible equity (1): Net income (annualized) $89,695 $69,653 $71,886 Amortization of intangibles, net of tax (annualized) 4,707 4,734 4,376 94,402 74,387 76,262 Average total shareholders' equity 1,166,305 1,129,622 1,052,569 Less: Average intangibles (603,552) (595,436) (565,294) 562,753 534,186 487,275 Return on average tangible equity (1) 16.77% 13.93% 15.65% Return on average tangible assets (2): Net income (annualized) $89,695 $69,653 $71,886 Amortization of intangibles, net of tax (annualized) 4,707 4,734 4,376 94,402 74,387 76,262 Average total assets 9,866,025 9,695,015 8,874,430 Less: Average intangibles (603,552) (595,436) (565,294) 9,262,473 9,099,579 8,309,136 Return on average tangible assets (2) 1.02% 0.82% 0.92% |

GAAP to Non-GAAP Reconciliation Appendix 2011 2010 Second First Second Quarter Quarter Quarter Tangible book value per share: Total shareholders' equity $1,203,150 $1,128,414 $1,058,004 Less: intangibles (601,958) (601,475) (564,495) 601,192 526,939 493,509 Ending shares outstanding 127,024,899 120,871,383 114,532,890 Tangible book value per share $4.73 $4.36 $4.31 Tangible equity / tangible assets (period end): Total shareholders' equity $1,203,150 $1,128,414 $1,058,004 Less: intangibles (601,958) (601,475) (564,495) 601,192 526,939 493,509 Total assets 9,857,163 9,755,281 8,833,060 Less: intangibles (601,958) (601,475) (564,495) 9,255,205 9,153,806 8,268,565 Tangible equity / tangible assets (period end) 6.50% 5.76% 5.97% |

GAAP to Non-GAAP Reconciliation Appendix 2011 Second First Quarter Quarter Allowance for loan losses + credit marks / total loans + credit marks: Allowance for loan losses $109,224 $107,612 Credit marks 26,622 26,919 135,846 134,531 Total loans 6,702,595 6,559,952 Credit marks 26,622 26,919 6,729,217 6,586,871 Allowance for loan losses + credit marks / total loans + credit marks 2.02% 2.04% (1) Return on average tangible equity is calculated by dividing net income less amortization of intangibles by average equity less average intangibles. (2) Return on average tangible assets is calculated by dividing net income less amortization of intangibles by average assets less average intangibles. |

GAAP to Non-GAAP Reconciliation Appendix 2011 2011 First First Quarter Quarter Adjusted net income: Adjusted return on average tangible equity (1): Net income $17,175 Adjusted net income (annualized) $80,582 Merger-related costs, net of tax 2,695 Amortization of intangibles, net of tax (annualized) 4,734 Less: Pension credit, net of tax 0 85,317 Adjusted net income $19,870 Average total shareholders' equity 1,129,622 Adjusted diluted earnings per share: Less: Average intangibles (595,436) Diluted earnings per share $0.14 534,186 Effect of merger-related costs, net of tax 0.02 Adjusted return on average tangible equity (1) 15.97% Less: Effect of pension credit, net of tax 0.00 Adjusted diluted earnings per share $0.16 Adjusted return on average tangible assets (2): Adjusted net income (annualized) $80,582 Amortization of intangibles, net of tax (annualized) 4,734 85,317 Average total assets 9,695,015 Less: Average intangibles (595,436) 9,099,579 Adjusted return on average tangible assets (2) 0.94% (1) Return on average tangible equity is calculated by dividing net income less amortization of intangibles by average equity less average intangibles. (2) Return on average tangible assets is calculated by dividing net income less amortization of intangibles by average assets less average intangibles. |