Fixed Income Investor Presentation February 6, 2019 Exhibit 99.1

2 Cautionary Statement Regarding Forward‐Looking Information and Non‐GAAP Financial Information Forward-Looking Statements This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, which contain F.N.B. Corporation’s (F.N.B.) expectations or predictions of future financial or business performance or conditions. Forward-looking statements are typically identified by words such as “believe,” “plan,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “will,” “should,” “project,” “goal,” and other similar words and expressions. These forward-looking statements involve certain risks and uncertainties. In addition to factors previously disclosed in F.N.B.’s reports filed with the SEC, the following factors among others, could cause actual results to differ materially from forward-looking statements or historical performance: changes in asset quality and credit risk; the inability to sustain revenue and earnings growth; changes in interest rates, deposit costs and capital markets; inflation; potential difficulties encountered in operating in new and remote geographic markets; customer borrowing, repayment, investment and deposit practices; customer disintermediation; the introduction, withdrawal, success and timing of business and technology initiatives; competitive conditions; the inability to realize cost savings or revenues or to implement integration plans and other consequences associated with acquisitions and divestitures; economic conditions; interruption in or breach of security of F.N.B.’s information systems; integrity and functioning of products, information systems and services provided by third party external vendors; changes in tax rules and regulations or interpretations including, but not limited to the recently enacted Tax Cuts and Jobs Act; changes in accounting policies, standards and interpretations; liquidity risk; changes in asset valuations; and the impact, extent and timing of technological changes, capital management activities, and other actions of the Office of the Comptroller of the Currency, the Board of Governors of the Federal Reserve System, the Consumer Financial Protection Bureau, the Federal Deposit Insurance Corporation and legislative and regulatory actions and reforms. Actual results may differ materially from those expressed or implied as a result of these risks and uncertainties. You are cautioned not to put undue reliance on any forward-looking statements, which are only meaningful on the date when such statements are made, and except as required by applicable law or the rules and regulations of the SEC, F.N.B. undertakes no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise. This presentation contains “snapshot” information about F.N.B. and is not intended as a full business or financial review and should be viewed in the context of all the information made available in F.N.B.’s SEC filings. Non-GAAP Financial Measures To supplement F.N.B.’s consolidated financial statements presented in accordance with Generally Accepted Accounting Principles (GAAP), F.N.B. provides additional measures of operating results, net income and earnings per share adjusted to exclude certain costs, expenses, and gains and losses. F.N.B. believes that these non-GAAP financial measures are appropriate to enhance understanding of F.N.B.’s past performance and facilitate comparisons with the performance of F.N.B.’s peers. The Appendix to this presentation contains a reconciliation of the non-GAAP financial measures used by F.N.B. to the most directly comparable GAAP financial measures. While F.N.B. believes that these non-GAAP financial measures are useful in evaluating results, the information should be considered supplemental in nature and not as a substitute for or superior to the relevant financial information prepared in accordance with GAAP. The non-GAAP financial measures used by F.N.B. may differ from the non-GAAP financial measures other financial institutions use to measure their results of operations. This information should be reviewed in conjunction with F.N.B.’s financial results disclosed on January 22, 2019, as well as F.N.B.'s Annual Report on Form 10-K for the year ended December 31, 2017, subsequent quarterly 2018 Form 10-Q filings and other subsequent filings with the SEC.

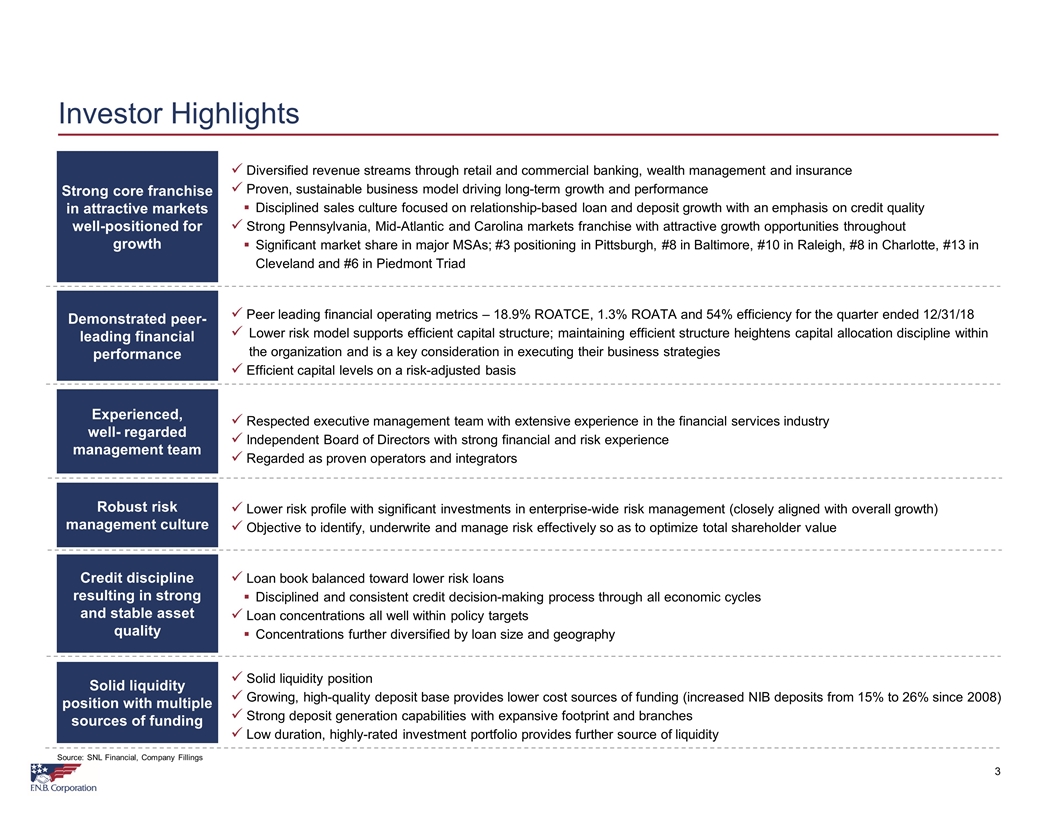

Diversified revenue streams through retail and commercial banking, wealth management and insurance Proven, sustainable business model driving long-term growth and performance Disciplined sales culture focused on relationship-based loan and deposit growth with an emphasis on credit quality Strong Pennsylvania, Mid-Atlantic and Carolina markets franchise with attractive growth opportunities throughout Significant market share in major MSAs; #3 positioning in Pittsburgh, #8 in Baltimore, #10 in Raleigh, #8 in Charlotte, #13 in Cleveland and #6 in Piedmont Triad Peer leading financial operating metrics – 18.9% ROATCE, 1.3% ROATA and 54% efficiency for the quarter ended 12/31/18 Lower risk model supports efficient capital structure; maintaining efficient structure heightens capital allocation discipline within the organization and is a key consideration in executing their business strategies Efficient capital levels on a risk-adjusted basis Respected executive management team with extensive experience in the financial services industry Independent Board of Directors with strong financial and risk experience Regarded as proven operators and integrators Lower risk profile with significant investments in enterprise-wide risk management (closely aligned with overall growth) Objective to identify, underwrite and manage risk effectively so as to optimize total shareholder value Loan book balanced toward lower risk loans Disciplined and consistent credit decision-making process through all economic cycles Loan concentrations all well within policy targets Concentrations further diversified by loan size and geography Solid liquidity position Growing, high-quality deposit base provides lower cost sources of funding (increased NIB deposits from 15% to 26% since 2008) Strong deposit generation capabilities with expansive footprint and branches Low duration, highly-rated investment portfolio provides further source of liquidity 3 Investor Highlights Experienced, well- regarded management team Solid liquidity position with multiple sources of funding Robust risk management culture Credit discipline resulting in strong and stable asset quality Demonstrated peer-leading financial performance Strong core franchise in attractive markets well-positioned for growth Source: SNL Financial, Company Fillings

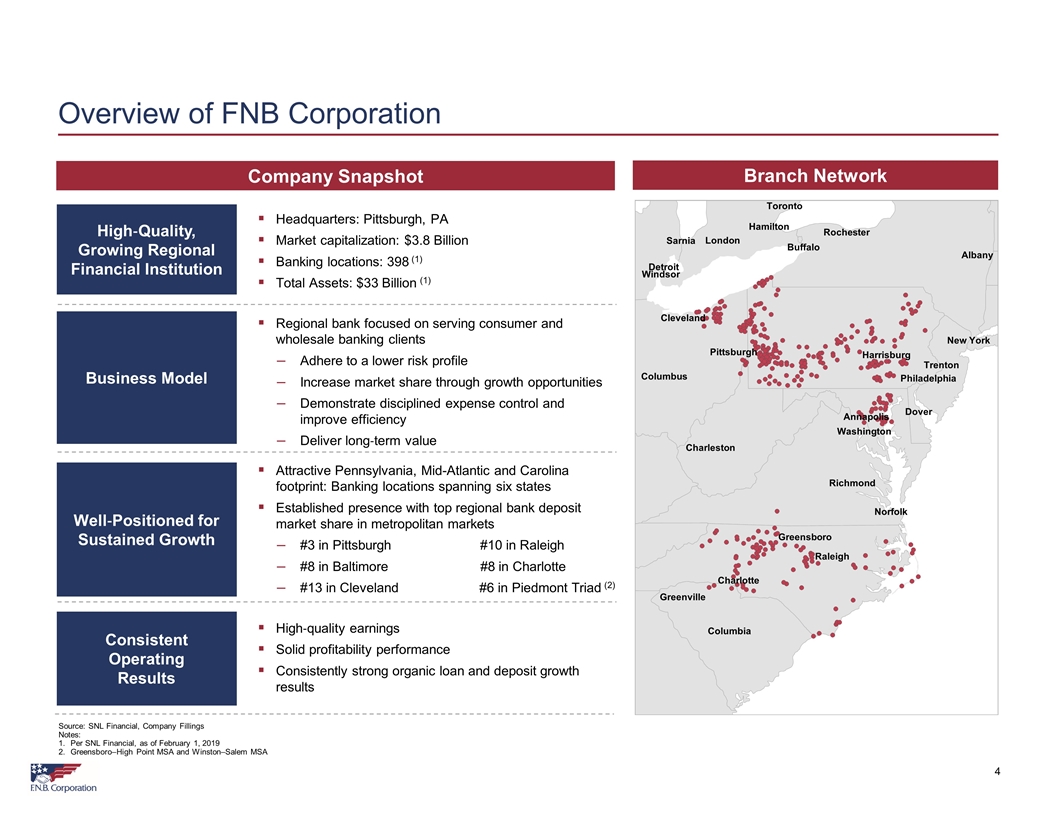

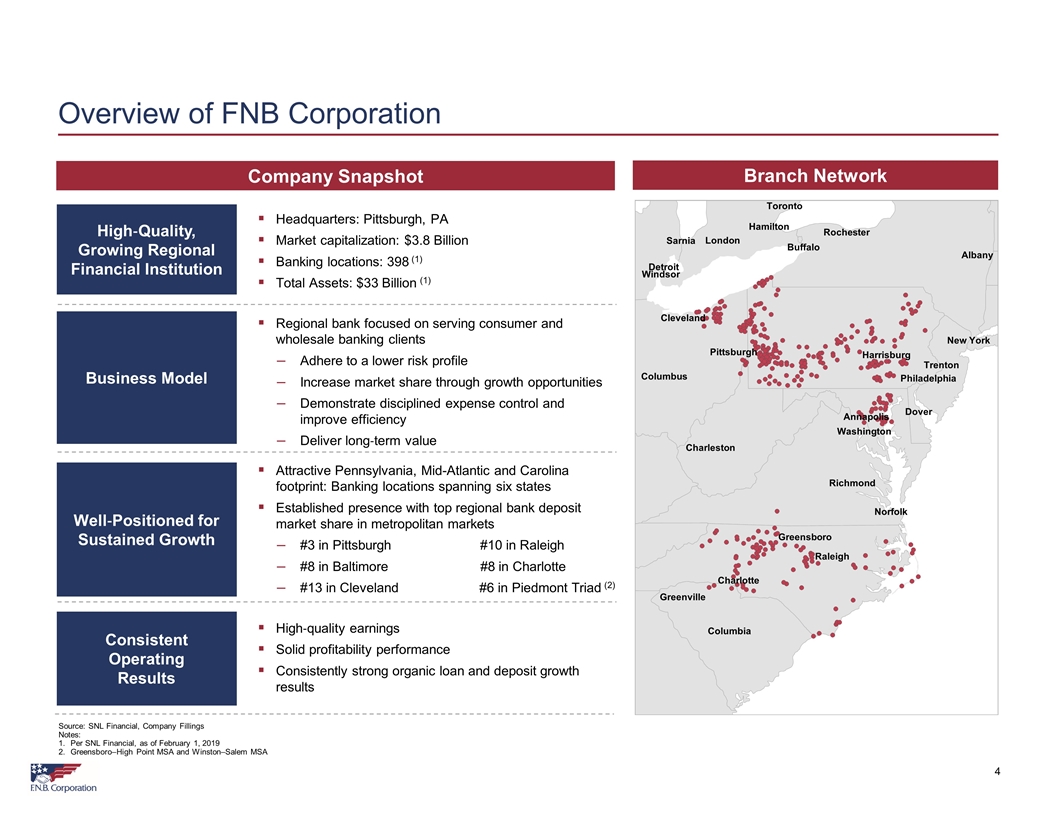

Source: SNL Financial, Company Fillings Notes: Per SNL Financial, as of February 1, 2019 Greensboro–High Point MSA and Winston–Salem MSA 4 Overview of FNB Corporation High‐Quality, Growing Regional Financial Institution Consistent Operating Results Business Model Well‐Positioned for Sustained Growth Headquarters: Pittsburgh, PA Market capitalization: $3.8 Billion Banking locations: 398 (1) Total Assets: $33 Billion (1) Regional bank focused on serving consumer and wholesale banking clients Adhere to a lower risk profile Increase market share through growth opportunities Demonstrate disciplined expense control and improve efficiency Deliver long‐term value Attractive Pennsylvania, Mid-Atlantic and Carolina footprint: Banking locations spanning six states Established presence with top regional bank deposit market share in metropolitan markets #3 in Pittsburgh #10 in Raleigh #8 in Baltimore #8 in Charlotte #13 in Cleveland #6 in Piedmont Triad (2) High‐quality earnings Solid profitability performance Consistently strong organic loan and deposit growth results Branch Network Company Snapshot Toronto Rochester Albany Buffalo Hamilton London Sarnia Detroit Windsor Trenton New York Philadelphia Dover Washington Charleston Columbus Richmond Norfolk Greenville Columbia Charlotte Annapolis Harrisburg Cleveland Pittsburgh Greensboro Raleigh

5 Experienced FNB Leadership Team Name Background Vincent Calabrese CFO 12 Years at FNB, 30+ Years of industry experience Calabrese has over 31 years of financial services experience. He joined F.N.B. Corporation in March 2007 as Senior Vice President and Corporate Controller. He was Senior Vice President and Controller at People’s Bank in Bridgeport, Connecticut, and a Supervising Senior Auditor for KPMG Peat Marwick in Stamford, Connecticut. A Certified Public Accountant, Calabrese earned a bachelor of science in accounting from the University of Bridgeport (CT) and an MBA from the University of Connecticut. Vincent Delie Chairman, President & CEO 14 Years at FNB, 30+ Years of industry experience After joining FNB in 2005, Delie became President of First National Bank in 2009. He was promoted to President of F.N.B. Corporation in 2011, was named Chief Executive Officer and elected to the Board of Directors in 2012, and was named Chairman of the Board of Directors of F.N.B. Corporation and First National Bank in 2017. He additionally chairs the Board’s executive committee. Delie has more than 30 years of extensive experience in the financial services industry, which has included executive roles at National City Bank and various positions held in capital markets and investment banking. Delie earned a degree in Business Administration and Finance from the Penn State Smeal College of Business. Gary Guerrieri Chief Credit Officer 17 Years at FNB, 30+ Years of industry experience Guerrieri joined F.N.B. Corporation as Regional Credit Officer through the merger with Promistar Bank in 2002 and was promoted to Chief Credit Officer in 2011. At Promistar, Guerrieri served as Executive Vice President of Commercial Banking in Johnstown, PA. Previously, he served as Executive Vice President and Community Banking Executive for Laurel Bank in Uniontown, PA. He holds a Bachelor of Science degree in Business Administration from California University and a Master of Business Administration from Waynesburg University, for whom he serves on the Board of Trustees. Combined 150+ Years of Experience Robert Moorehead Chief Wholesale Banking Officer 8 Years at FNB, 40+ Years of industry experience Robert Moorehead is Chief Wholesale Banking Officer for First National Bank. Moorehead provides oversight for lines of business and functional areas including Metropolitan and Community Commercial Banking, Investment Real Estate, Treasury Management and Wholesale Banking Solutions. Bringing more than 40 years of experience to his current role, Moorehead joined FNB in 2011 as President of its Pittsburgh Region. He previously served in a number of executive commercial banking and lending roles with well-known financial institutions in the Pittsburgh area, including First Niagara Bank and National City Bank. Barry Robinson Chief Consumer Banking Ofiicer 9 Years at FNB, 30+ Years of industry experience Barry Robinson is Chief Consumer Banking Officer for First National Bank, responsible for driving the consumer banking experience. Accordingly, he oversees Retail Sales and Distribution, Electronic Delivery, Small Business Banking, Mortgage Services, Consumer Banking Solutions and consumer product development. Robinson joined FNB in 2010 and most recently served as Executive Vice President of Consumer Banking. His 30 years of financial services experience includes executive wealth management and corporate banking roles with National City Bank as well as previous responsibility for leveraged lending. Robinson earned a Bachelor’s Degree from The Pennsylvania State University and a Master’s of Business Administration from Carnegie Mellon University. Source: Company Fillings

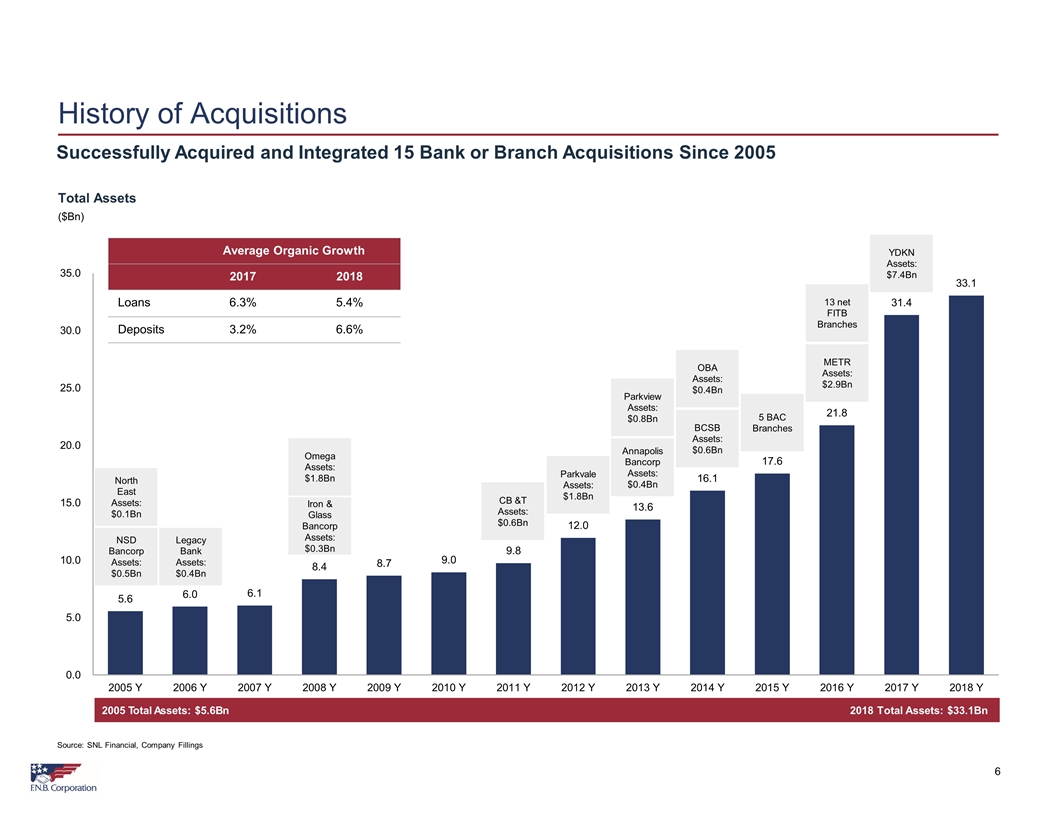

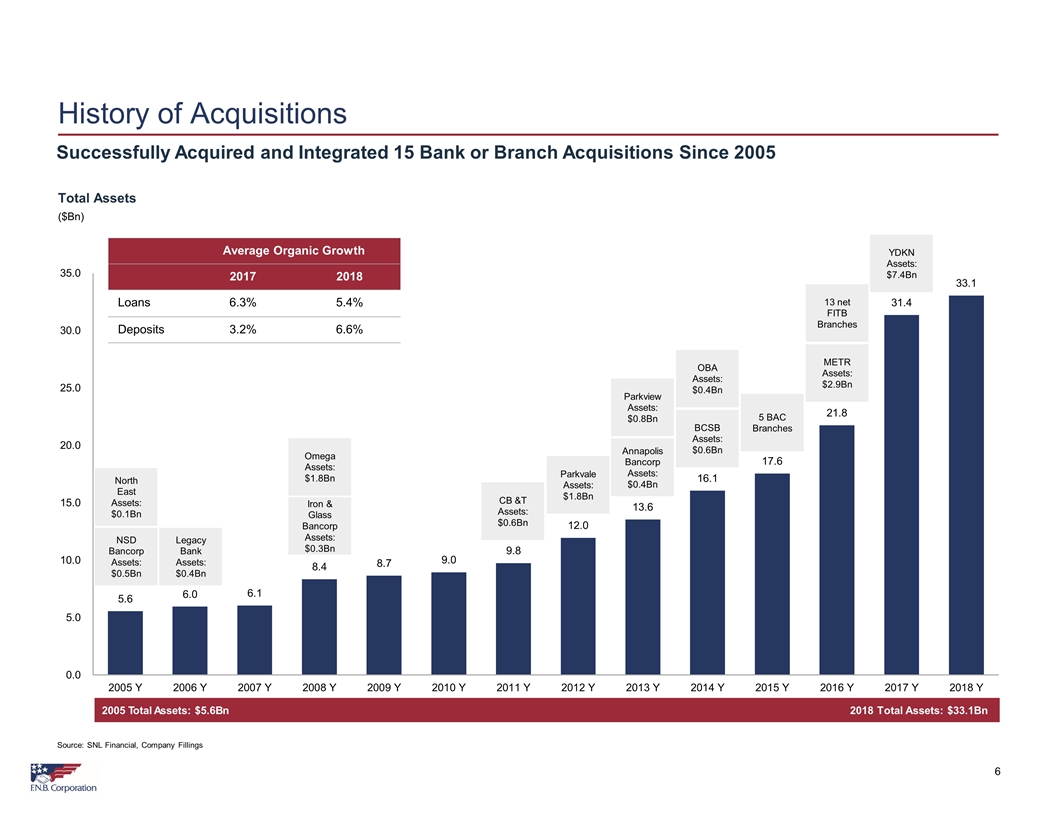

Source: Notes: 6 History of Acquisitions NSD Bancorp Assets: $0.5Bn North East Assets: $0.1Bn Legacy Bank Assets: $0.4Bn Iron & Glass Bancorp Assets: $0.3Bn Omega Assets: $1.8Bn CB &T Assets: $0.6Bn Parkvale Assets: $1.8Bn Annapolis Bancorp Assets: $0.4Bn Parkview Assets: $0.8Bn BCSB Assets: $0.6Bn OBA Assets: $0.4Bn 5 BAC Branches METR Assets: $2.9Bn 13 net FITB Branches YDKN Assets: $7.4Bn 2005 Total Assets: $5.6Bn 2018 Total Assets: $33.1Bn Source: SNL Financial, Company Fillings Successfully Acquired and Integrated 15 Bank or Branch Acquisitions Since 2005 Total Assets ($Bn) Average Organic Growth 2017 2018 Loans 6.3% 5.4% Deposits 3.2% 6.6%

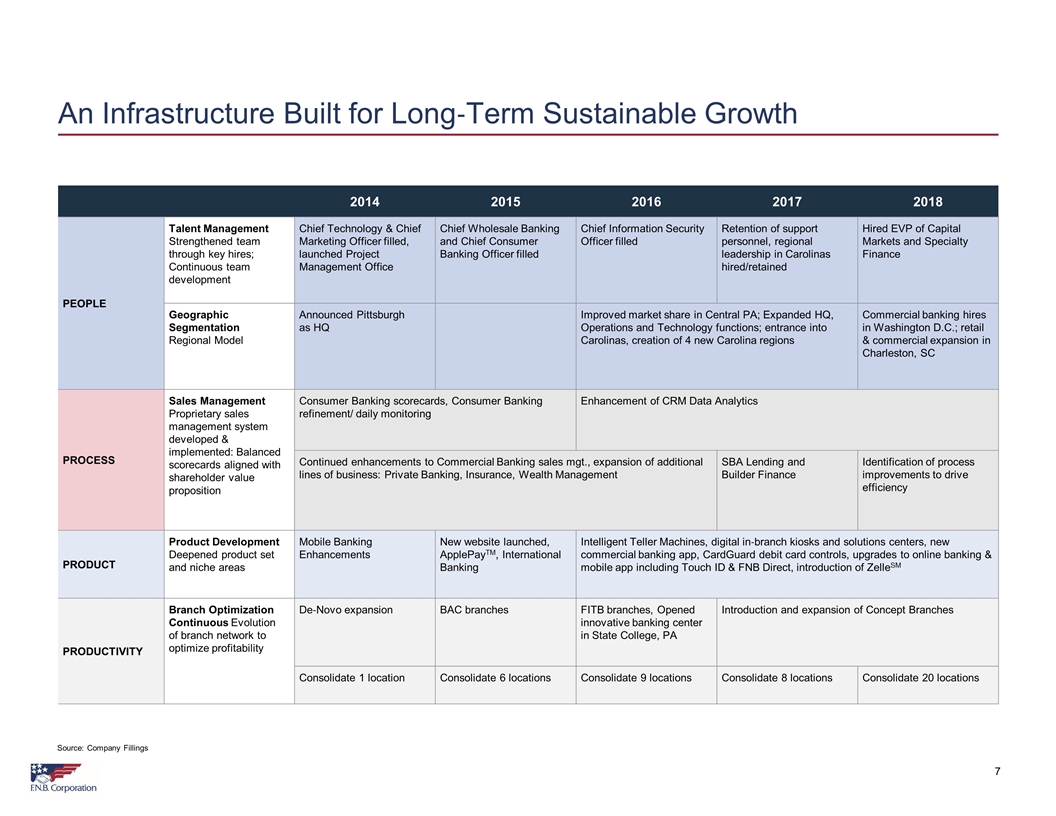

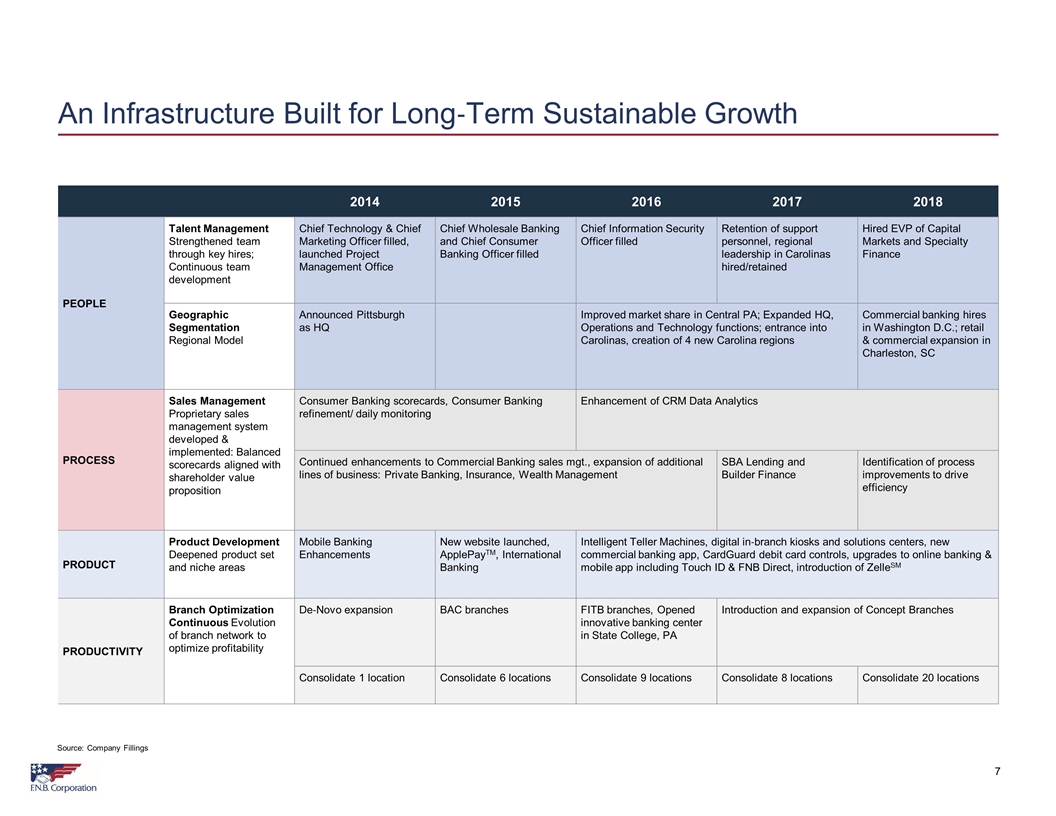

7 An Infrastructure Built for Long‐Term Sustainable Growth 2014 2015 2016 2017 2018 PEOPLE Talent Management Strengthened team through key hires; Continuous team development Chief Technology & Chief Marketing Officer filled, launched Project Management Office Chief Wholesale Banking and Chief Consumer Banking Officer filled Chief Information Security Officer filled Retention of support personnel, regional leadership in Carolinas hired/retained Hired EVP of Capital Markets and Specialty Finance Geographic Segmentation Regional Model Announced Pittsburgh as HQ Improved market share in Central PA; Expanded HQ, Operations and Technology functions; entrance into Carolinas, creation of 4 new Carolina regions Commercial banking hires in Washington D.C.; retail & commercial expansion in Charleston, SC PROCESS Sales Management Proprietary sales management system developed & implemented: Balanced scorecards aligned with shareholder value proposition Consumer Banking scorecards, Consumer Banking refinement/ daily monitoring Enhancement of CRM Data Analytics Continued enhancements to Commercial Banking sales mgt., expansion of additional lines of business: Private Banking, Insurance, Wealth Management SBA Lending and Builder Finance Identification of process improvements to drive efficiency PRODUCT Product Development Deepened product set and niche areas Mobile Banking Enhancements New website launched, ApplePayTM, International Banking Intelligent Teller Machines, digital in‐branch kiosks and solutions centers, new commercial banking app, CardGuard debit card controls, upgrades to online banking & mobile app including Touch ID & FNB Direct, introduction of ZelleSM PRODUCTIVITY Branch Optimization Continuous Evolution of branch network to optimize profitability De‐Novo expansion BAC branches FITB branches, Opened innovative banking center in State College, PA Introduction and expansion of Concept Branches Consolidate 1 location Consolidate 6 locations Consolidate 9 locations Consolidate 8 locations Consolidate 20 locations Source: Company Fillings

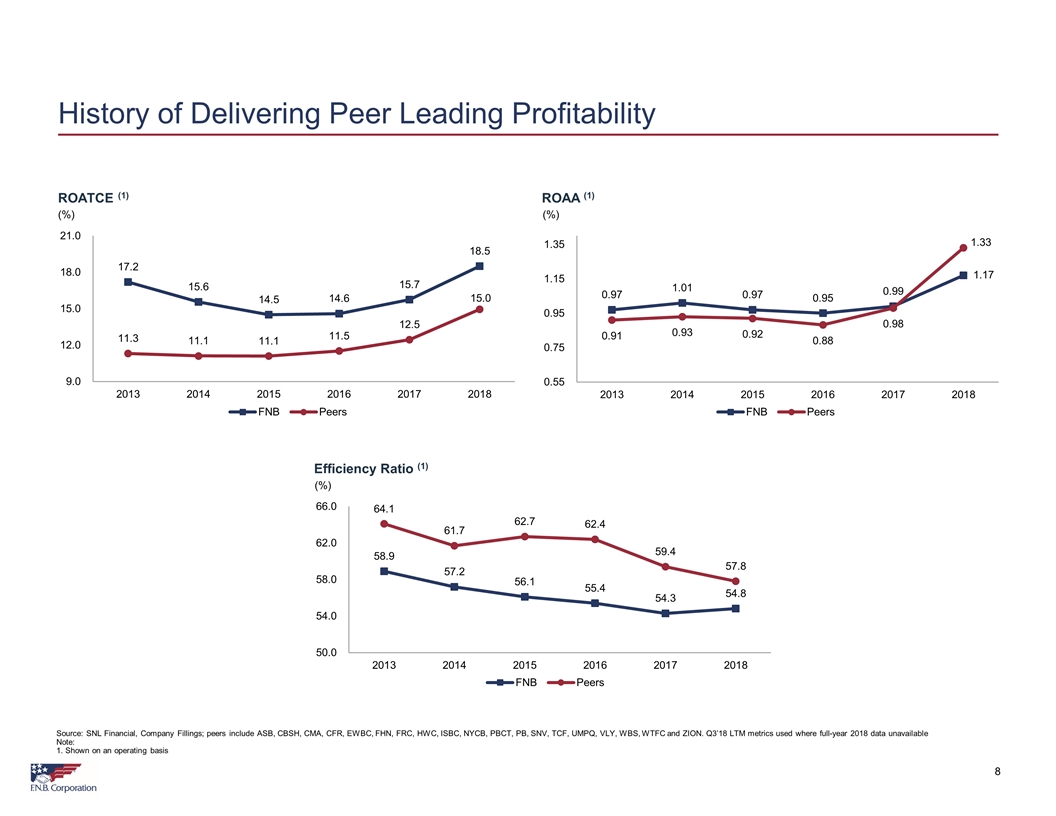

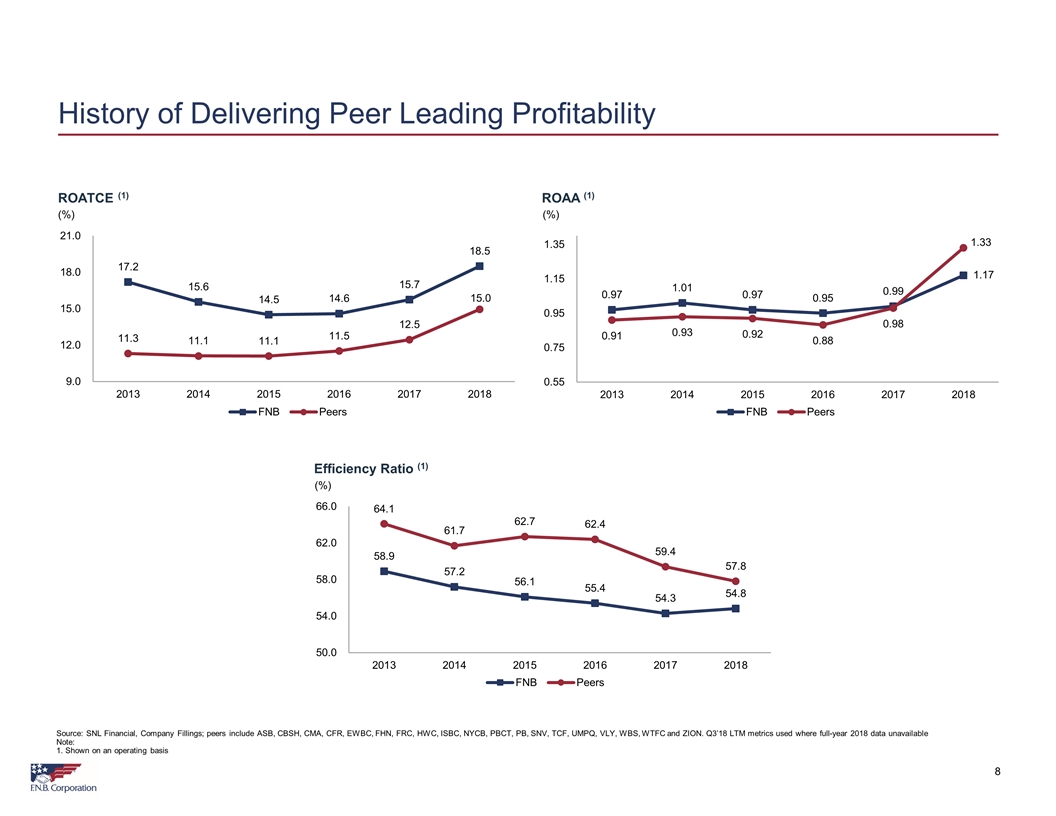

History of Delivering Peer Leading Profitability ROATCE (1) ROAA (1) Efficiency Ratio (1) 8 (%) (%) (%) Source: SNL Financial, Company Fillings; peers include ASB, CBSH, CMA, CFR, EWBC, FHN, FRC, HWC, ISBC, NYCB, PBCT, PB, SNV, TCF, UMPQ, VLY, WBS, WTFC and ZION. Q3’18 LTM metrics used where full-year 2018 data unavailable Note: 1. Shown on an operating basis

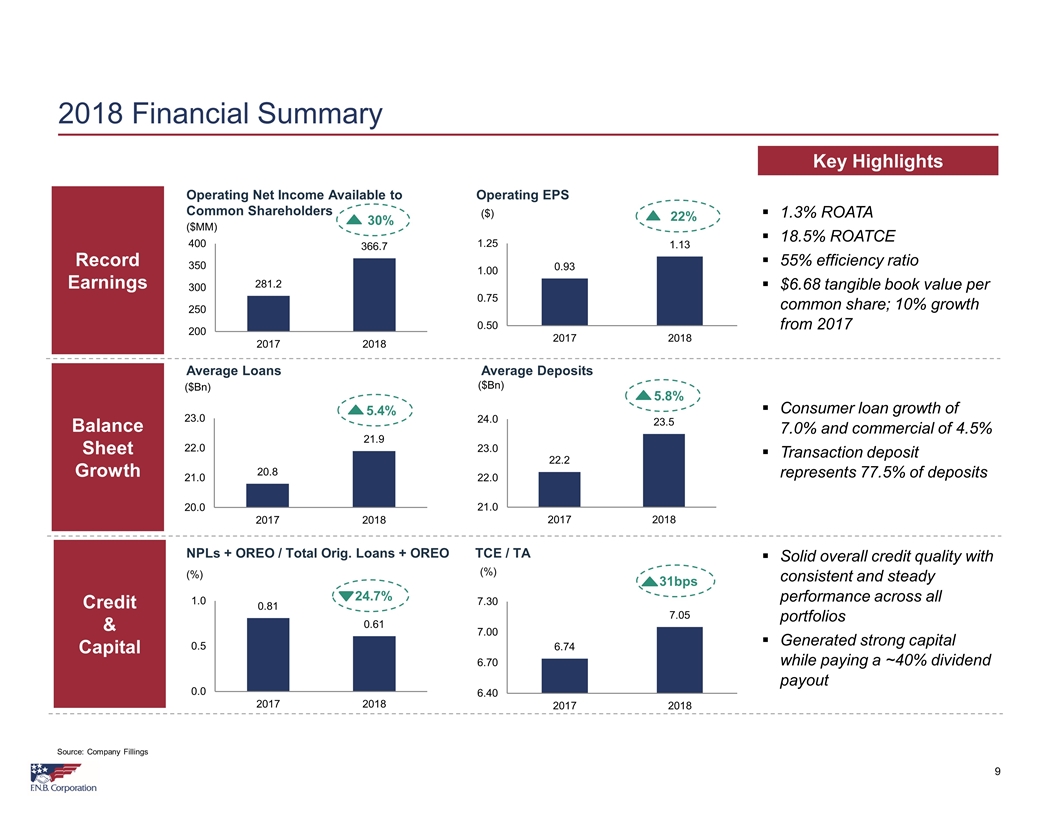

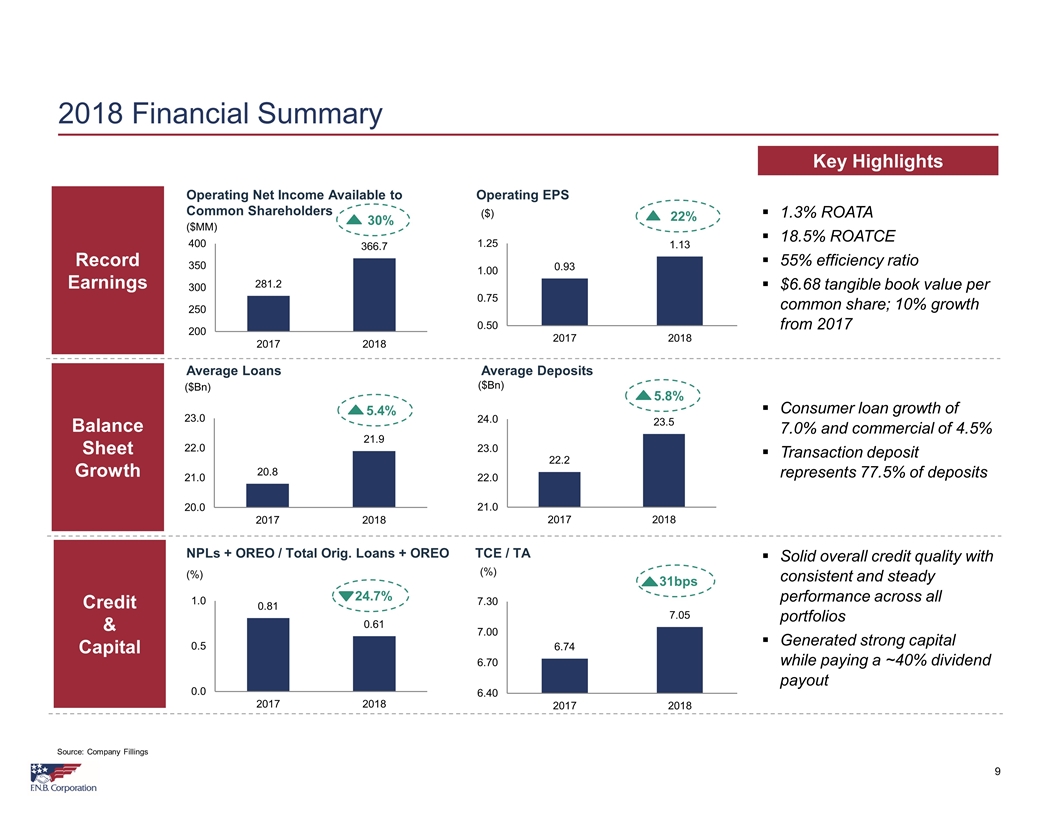

2018 Financial Summary 9 Key Highlights Record Earnings Balance Sheet Growth Credit & Capital 1.3% ROATA 18.5% ROATCE 55% efficiency ratio $6.68 tangible book value per common share; 10% growth from 2017 Consumer loan growth of 7.0% and commercial of 4.5% Transaction deposit represents 77.5% of deposits Solid overall credit quality with consistent and steady performance across all portfolios Generated strong capital while paying a ~40% dividend payout Operating Net Income Available to Common Shareholders ($MM) Operating EPS ($) Average Loans Average Deposits ($Bn) NPLs + OREO / Total Orig. Loans + OREO (%) TCE / TA (%) 30% 5.4% 24.7% 22% 5.8% 31bps ($Bn) Source: Company Fillings

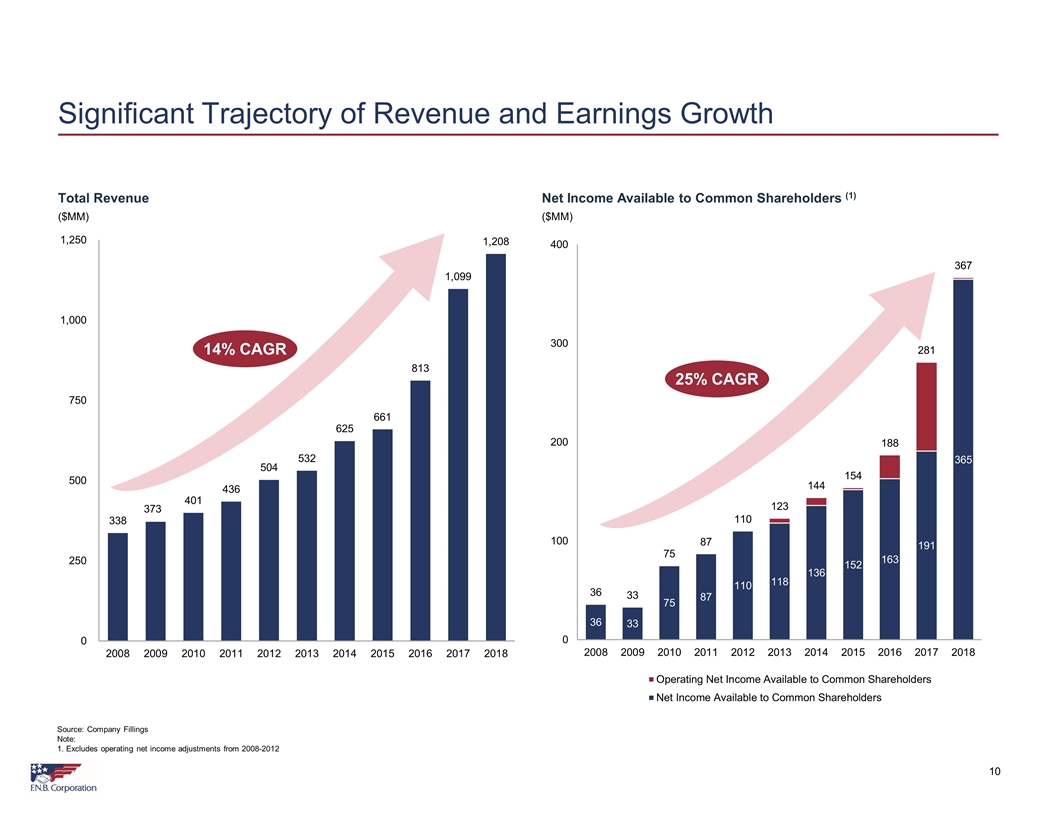

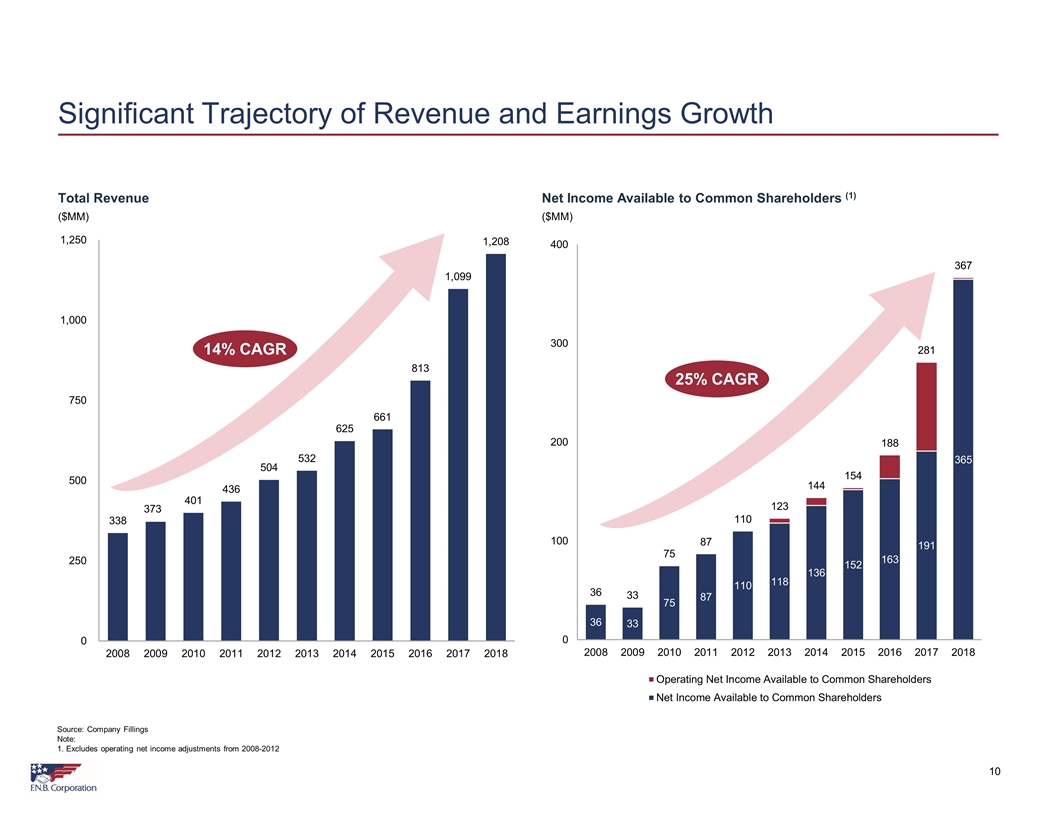

Total Revenue ($MM) Net Income Available to Common Shareholders (1) ($MM) 10 Significant Trajectory of Revenue and Earnings Growth Source: Company Fillings Note: 1. Excludes operating net income adjustments from 2008-2012 14% CAGR 25% CAGR

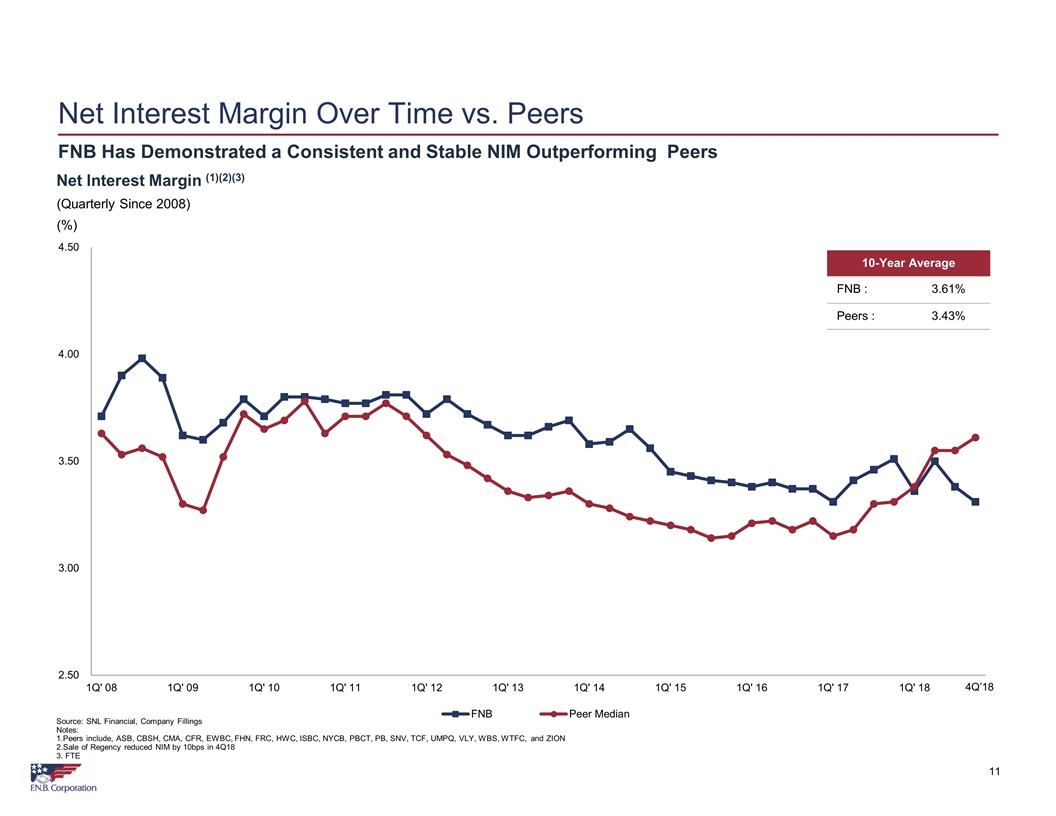

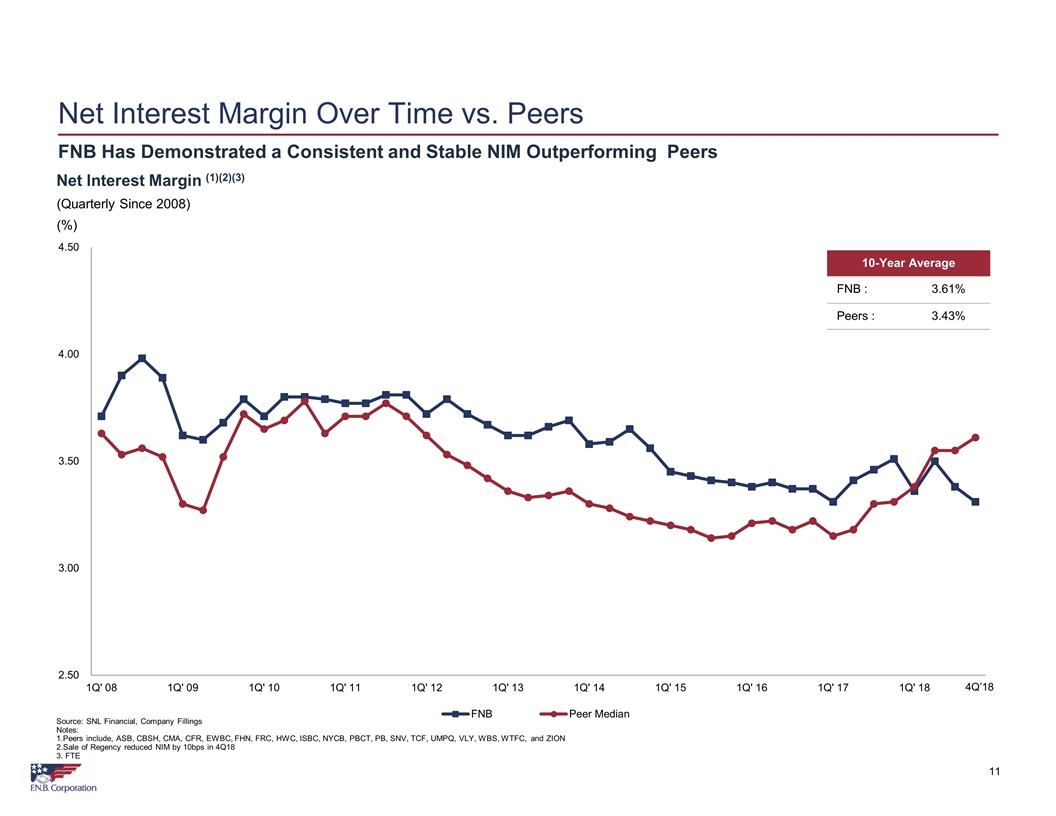

FNB Has Demonstrated a Consistent and Stable NIM Outperforming Peers 11 Net Interest Margin Over Time vs. Peers Net Interest Margin (1)(2)(3) (Quarterly Since 2008) (%) Source: SNL Financial, Company Fillings Notes: 1.Peers include, ASB, CBSH, CMA, CFR, EWBC, FHN, FRC, HWC, ISBC, NYCB, PBCT, PB, SNV, TCF, UMPQ, VLY, WBS, WTFC, and ZION 2.Sale of Regency reduced NIM by 10bps in 4Q18 3. FTE 10-Year Average FNB : 3.61% Peers : 3.43% 4Q’18

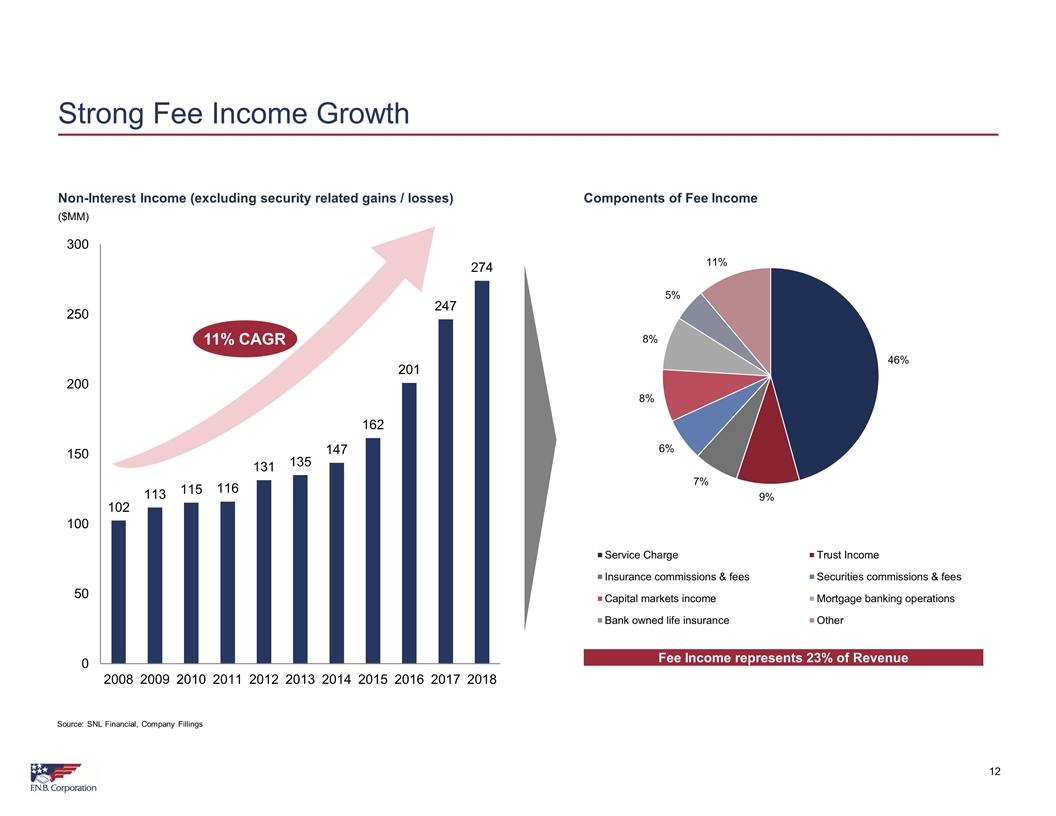

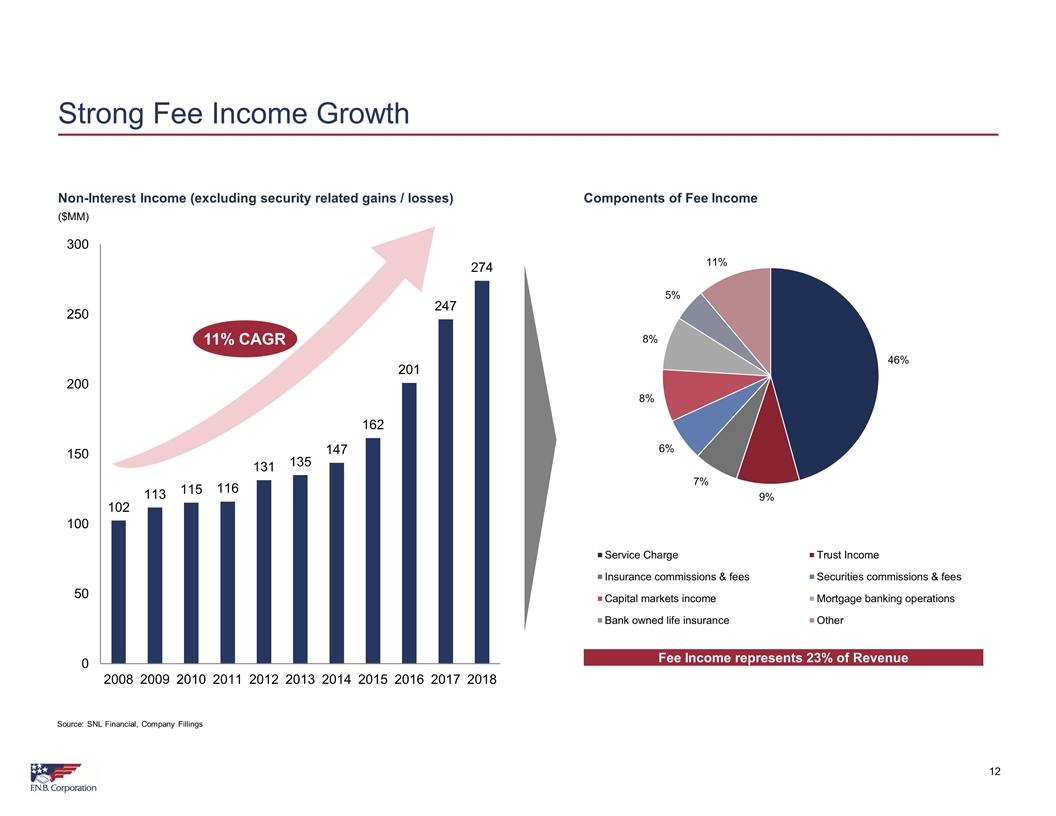

Non-Interest Income (excluding security related gains / losses) ($MM) Components of Fee Income 12 Strong Fee Income Growth Fee Income represents 23% of Revenue Source: SNL Financial, Company Fillings 11% CAGR

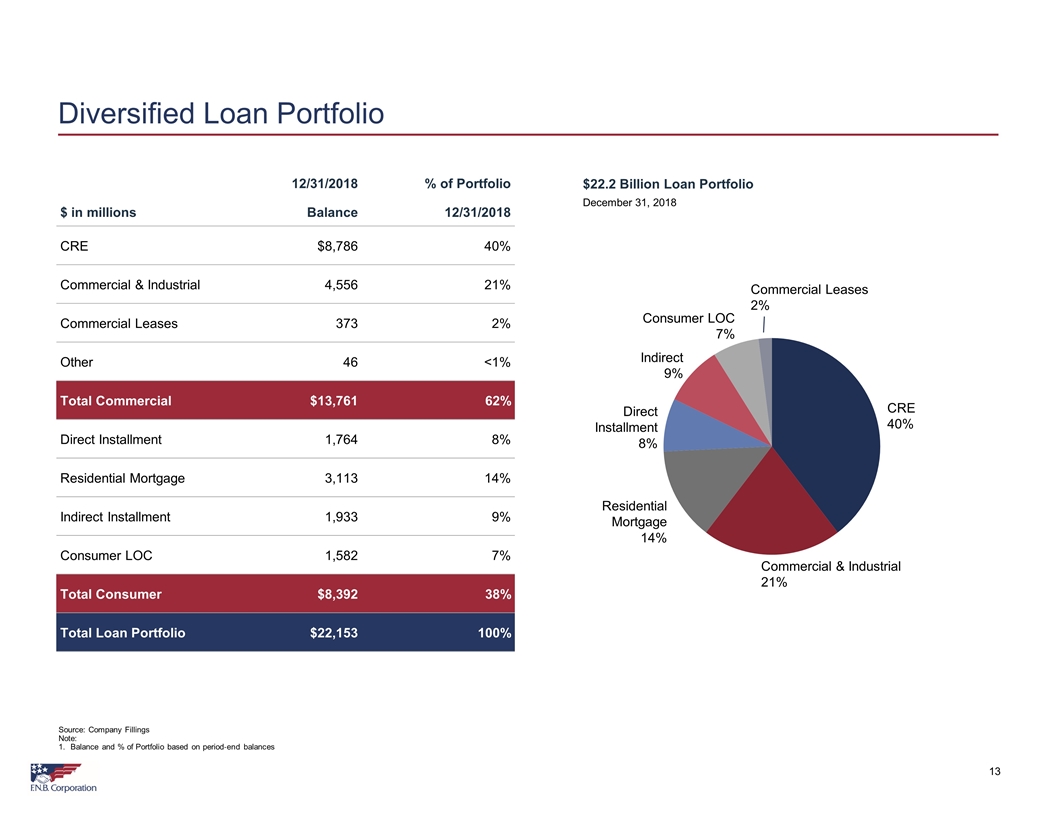

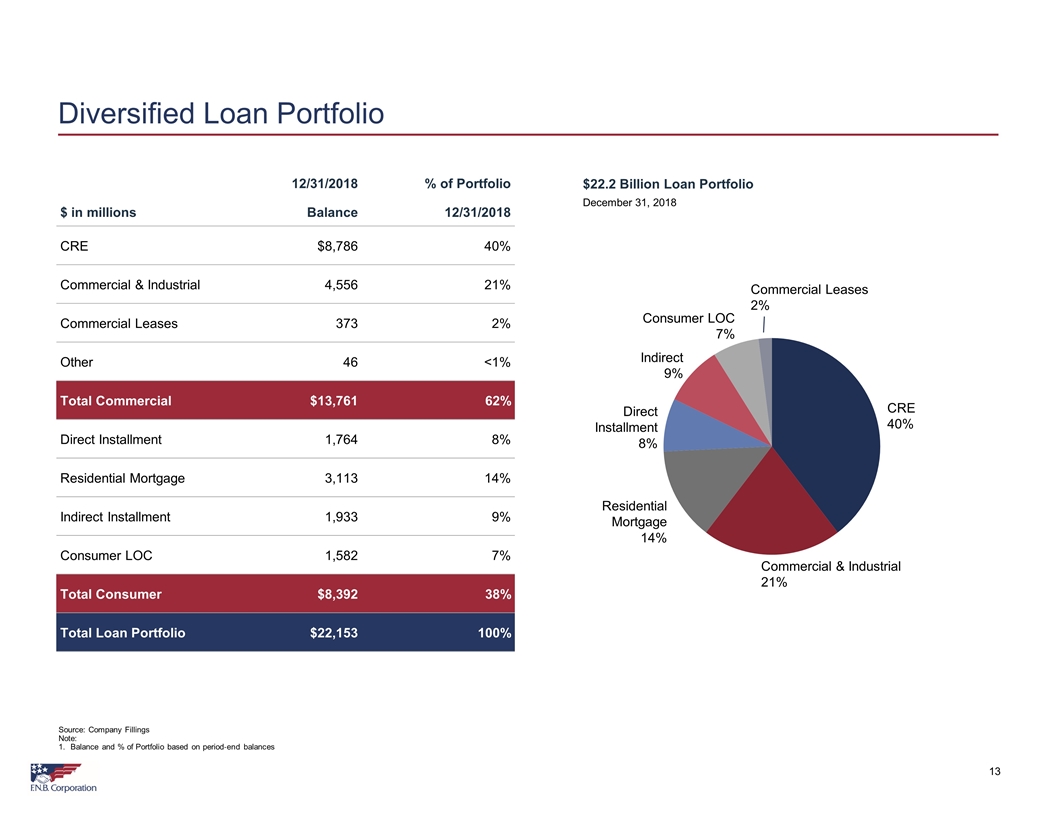

12/31/2018 % of Portfolio $ in millions Balance 12/31/2018 CRE $8,786 40% Commercial & Industrial 4,556 21% Commercial Leases 373 2% Other 46 <1% Total Commercial $13,761 62% Direct Installment 1,764 8% Residential Mortgage 3,113 14% Indirect Installment 1,933 9% Consumer LOC 1,582 7% Total Consumer $8,392 38% Total Loan Portfolio $22,153 100% $22.2 Billion Loan Portfolio December 31, 2018 Source: Company Fillings Note: Balance and % of Portfolio based on period‐end balances Diversified Loan Portfolio 13

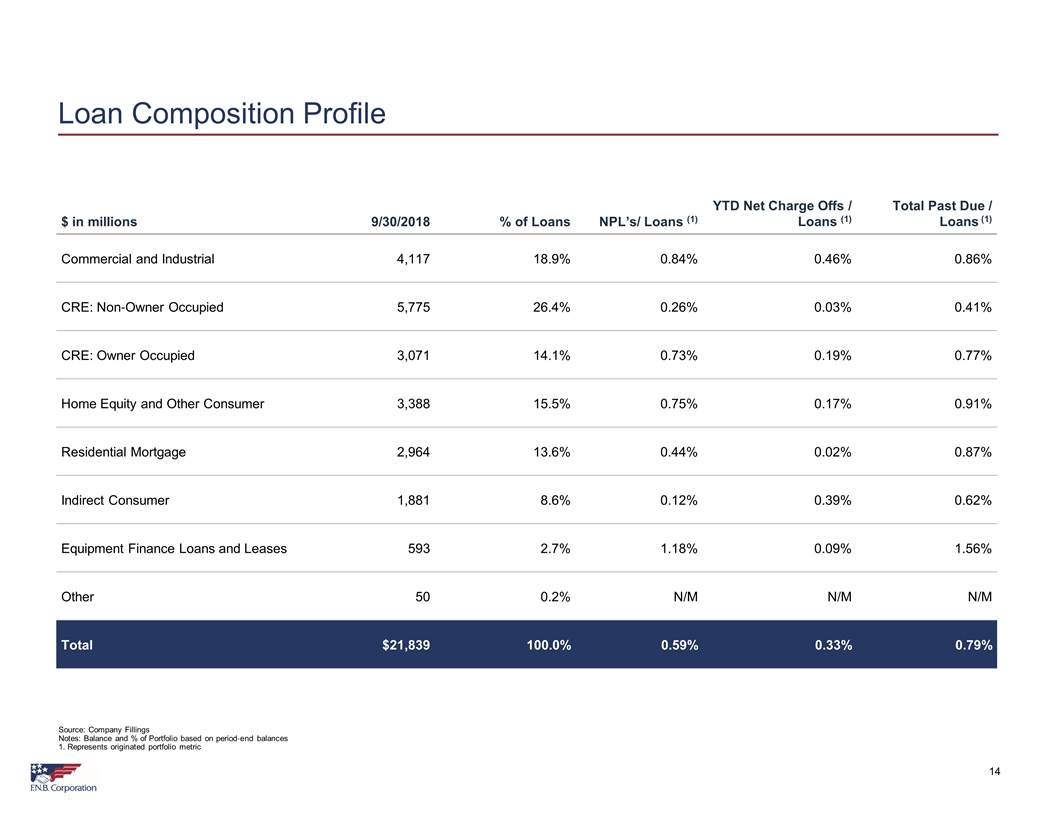

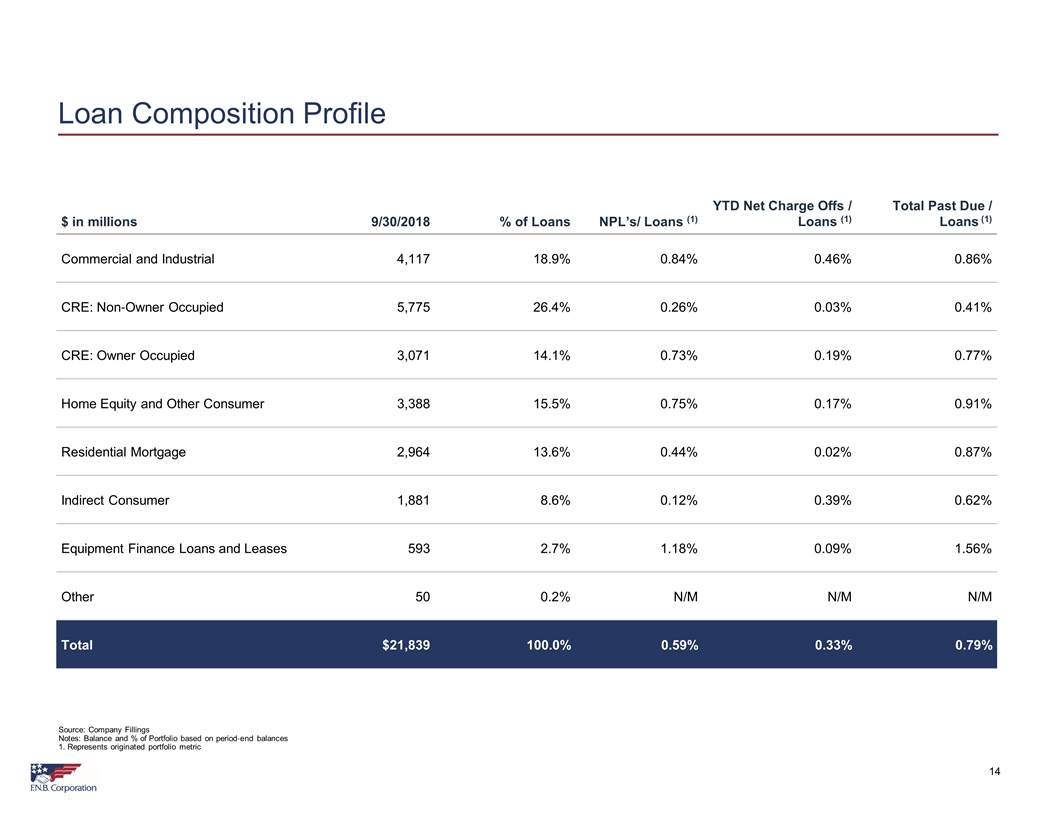

Loan Composition Profile $ in millions 9/30/2018 % of Loans NPL’s/ Loans (1) YTD Net Charge Offs / Loans (1) Total Past Due / Loans (1) Commercial and Industrial 4,117 18.9% 0.84% 0.46% 0.86% CRE: Non‐Owner Occupied 5,775 26.4% 0.26% 0.03% 0.41% CRE: Owner Occupied 3,071 14.1% 0.73% 0.19% 0.77% Home Equity and Other Consumer 3,388 15.5% 0.75% 0.17% 0.91% Residential Mortgage 2,964 13.6% 0.44% 0.02% 0.87% Indirect Consumer 1,881 8.6% 0.12% 0.39% 0.62% Equipment Finance Loans and Leases 593 2.7% 1.18% 0.09% 1.56% Other 50 0.2% N/M N/M N/M Total $21,839 100.0% 0.59% 0.33% 0.79% Source: Company Fillings Notes: Balance and % of Portfolio based on period‐end balances 1. Represents originated portfolio metric 14

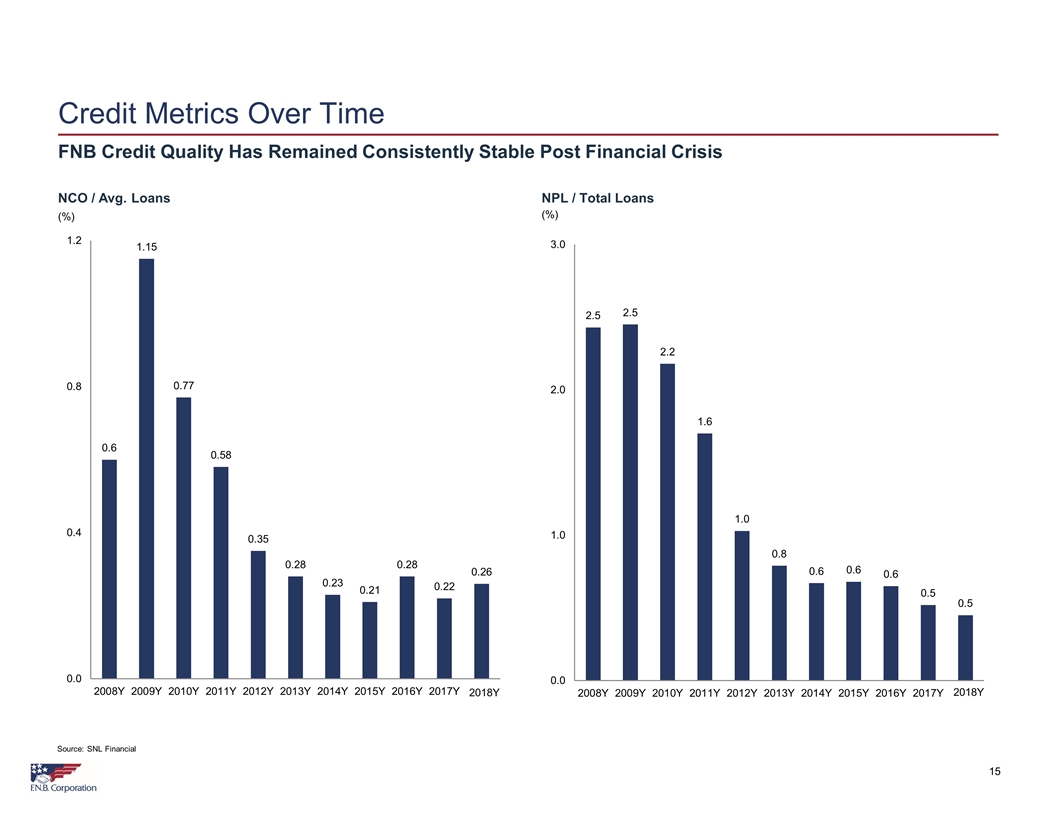

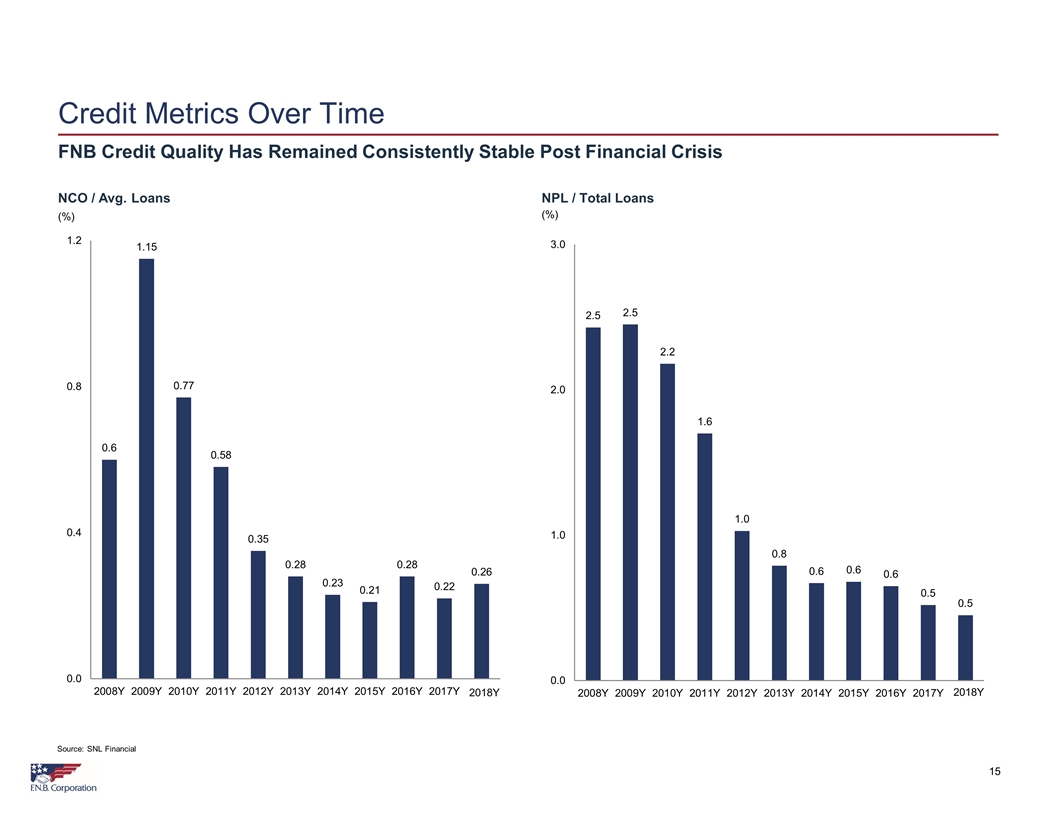

Credit Metrics Over Time NCO / Avg. Loans NPL / Total Loans 15 Source: SNL Financial 2018Y FNB Credit Quality Has Remained Consistently Stable Post Financial Crisis (%) (%) 2018Y

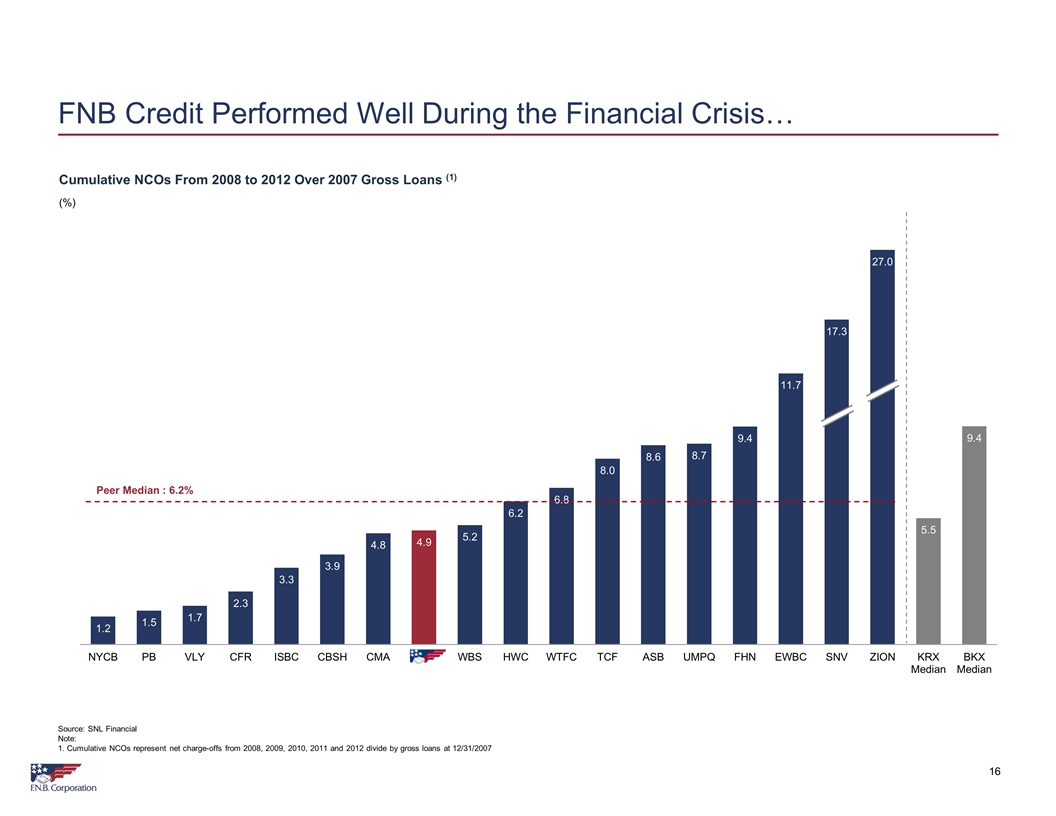

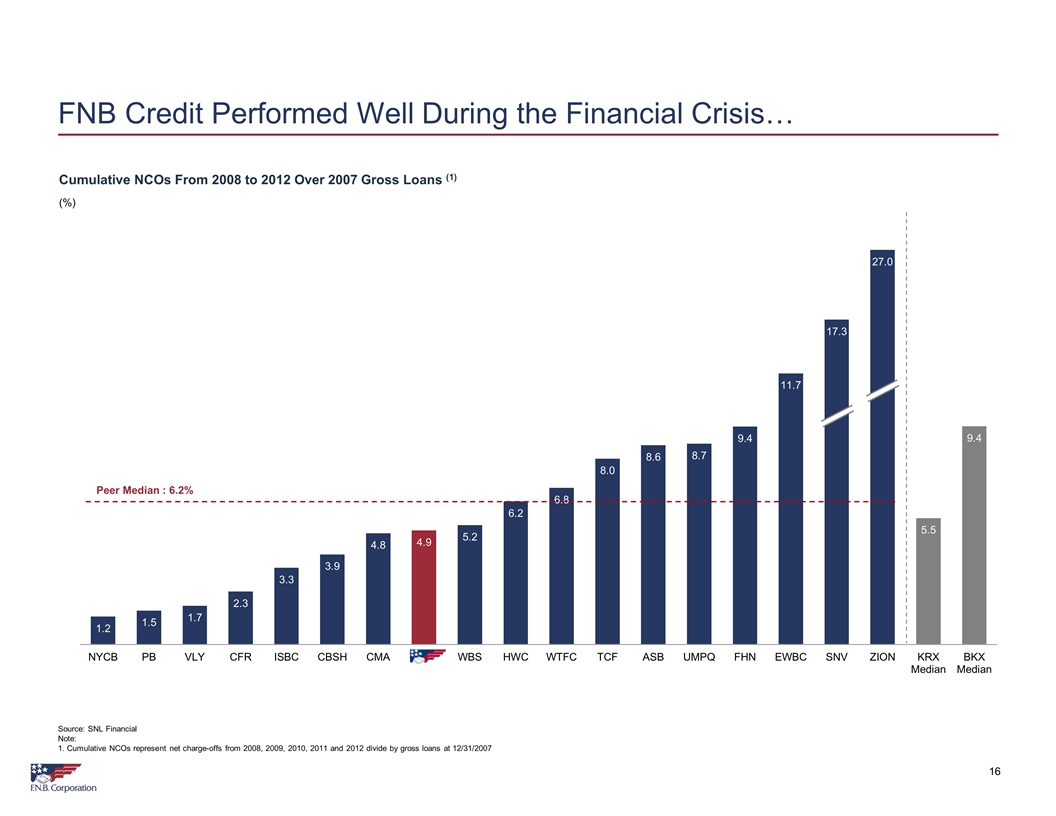

Cumulative NCOs From 2008 to 2012 Over 2007 Gross Loans (1) (%) Source: SNL Financial Note: 1. Cumulative NCOs represent net charge-offs from 2008, 2009, 2010, 2011 and 2012 divide by gross loans at 12/31/2007 16 FNB Credit Performed Well During the Financial Crisis… Peer Median : 6.2%

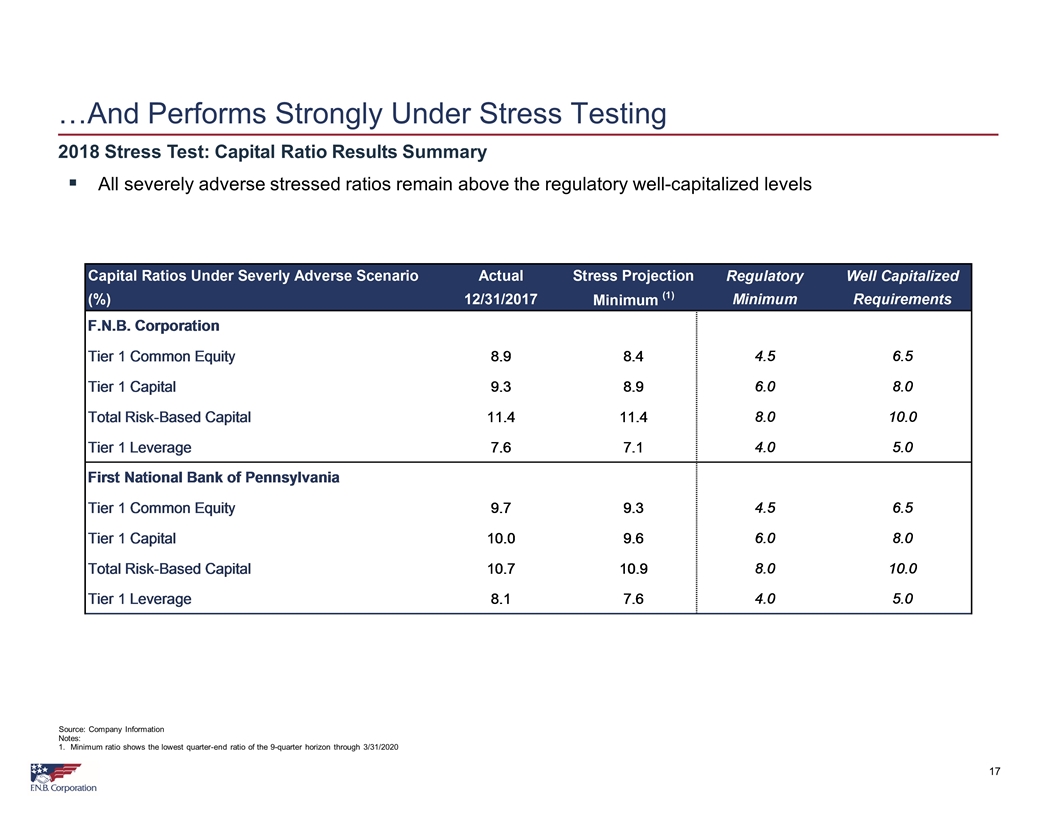

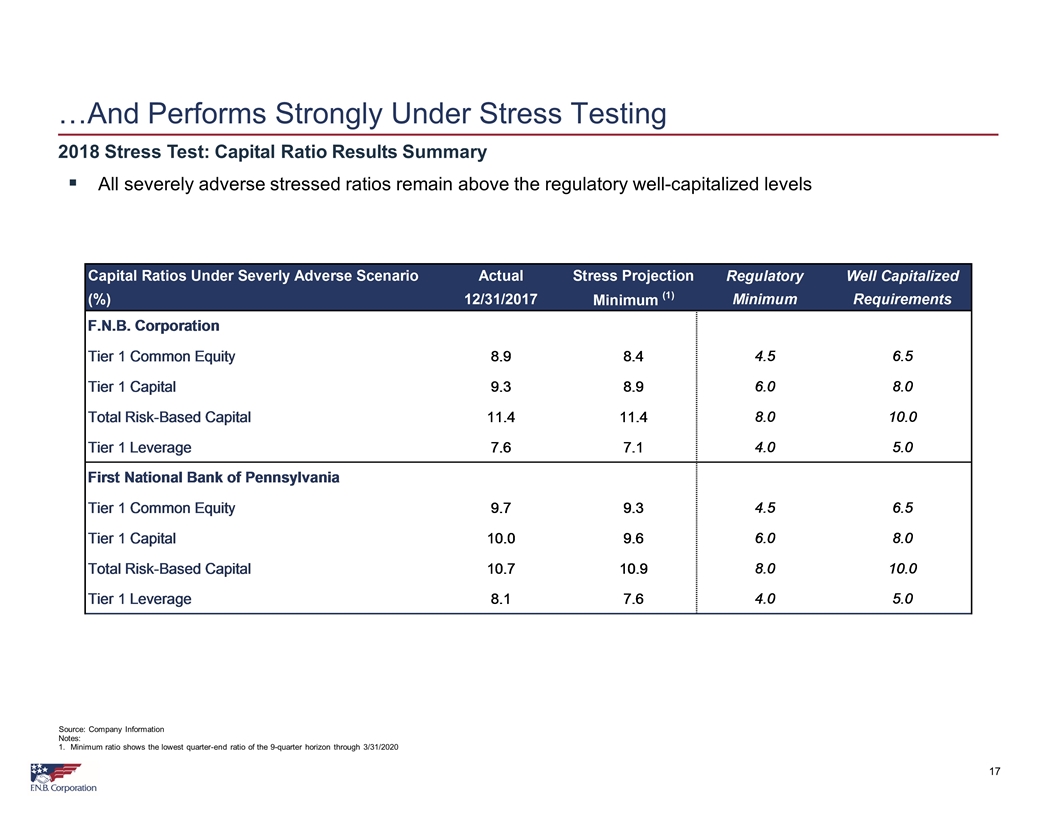

2018 Stress Test: Capital Ratio Results Summary Notes: Minimum ratio shows the lowest quarter-end ratio of the 9-quarter horizon through 3/31/2020 17 …And Performs Strongly Under Stress Testing All severely adverse stressed ratios remain above the regulatory well-capitalized levels Source: Company Information

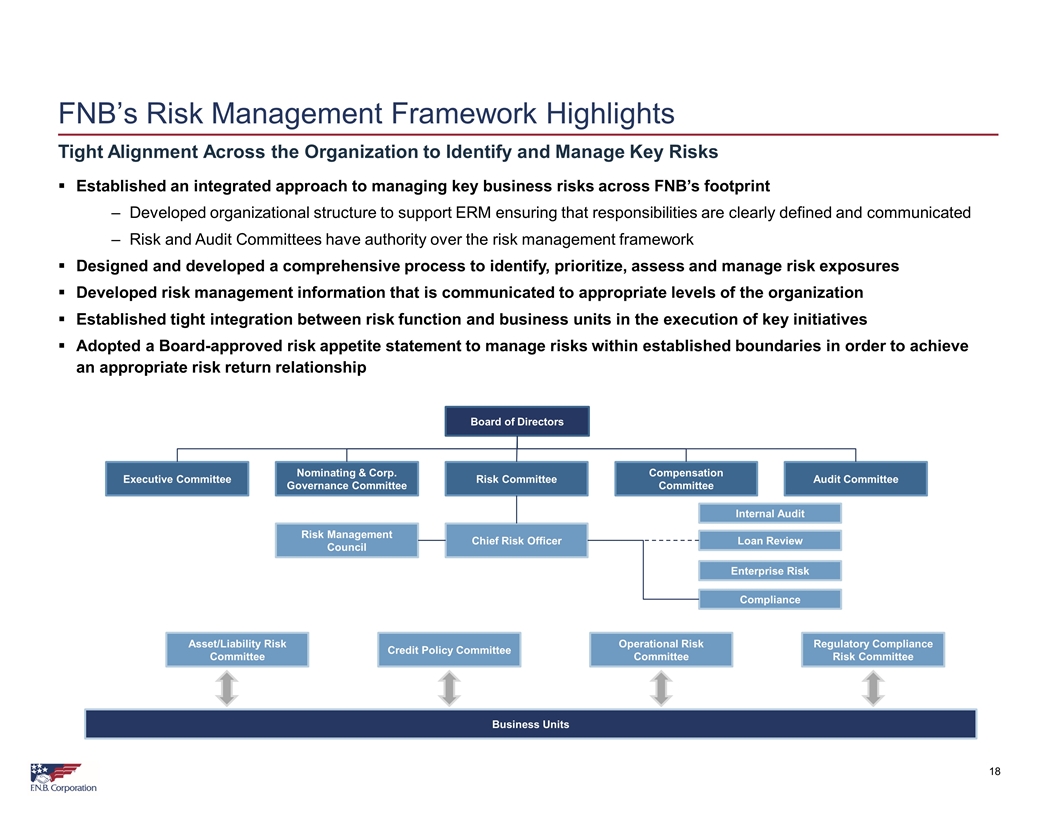

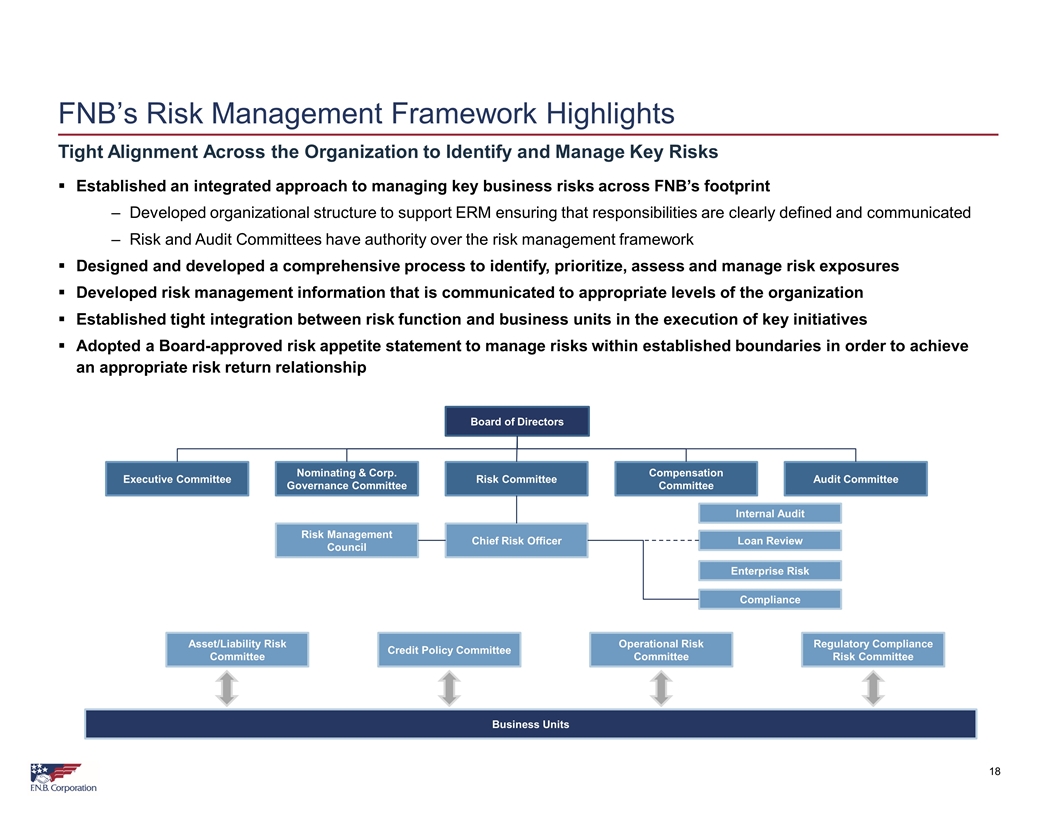

Tight Alignment Across the Organization to Identify and Manage Key Risks 18 FNB’s Risk Management Framework Highlights Board of Directors Risk Committee Nominating & Corp. Governance Committee Executive Committee Compensation Committee Audit Committee Risk Management Council Chief Risk Officer Internal Audit Loan Review Enterprise Risk Compliance Asset/Liability Risk Committee Credit Policy Committee Operational Risk Committee Regulatory Compliance Risk Committee Business Units Established an integrated approach to managing key business risks across FNB’s footprint Developed organizational structure to support ERM ensuring that responsibilities are clearly defined and communicated Risk and Audit Committees have authority over the risk management framework Designed and developed a comprehensive process to identify, prioritize, assess and manage risk exposures Developed risk management information that is communicated to appropriate levels of the organization Established tight integration between risk function and business units in the execution of key initiatives Adopted a Board-approved risk appetite statement to manage risks within established boundaries in order to achieve an appropriate risk return relationship

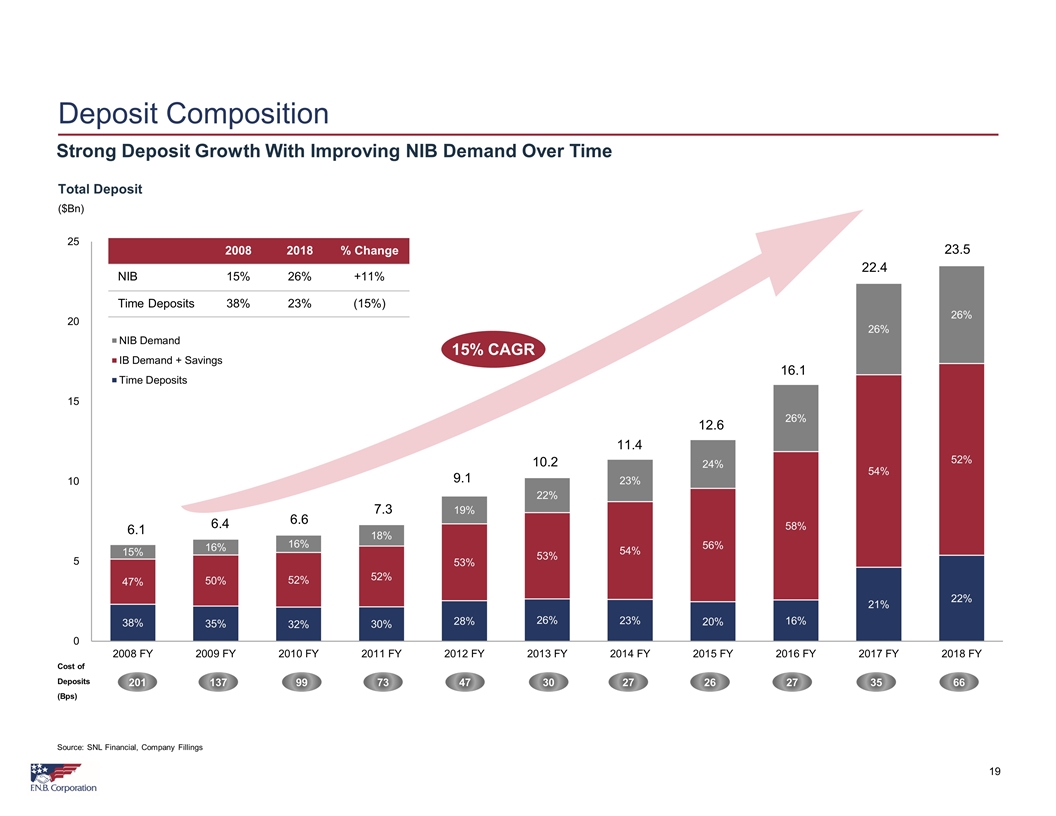

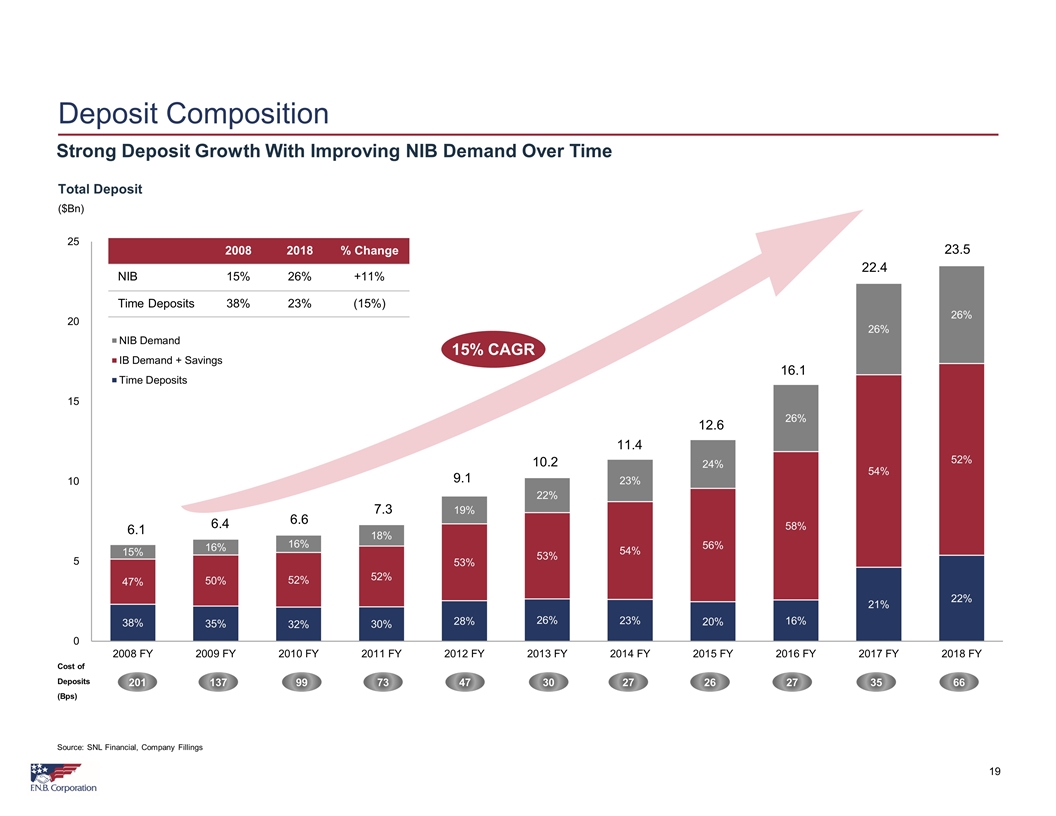

Deposit Composition Total Deposit ($Bn) 19 6.1 6.4 6.6 7.3 9.1 10.2 11.4 12.6 16.1 22.4 23.5 Source: SNL Financial, Company Fillings 15% CAGR 2008 2018 % Change NIB 15% 26% +11% Time Deposits 38% 23% (15%) Strong Deposit Growth With Improving NIB Demand Over Time 201 73 47 30 27 26 27 35 66 137 99 Cost of Deposits (Bps)

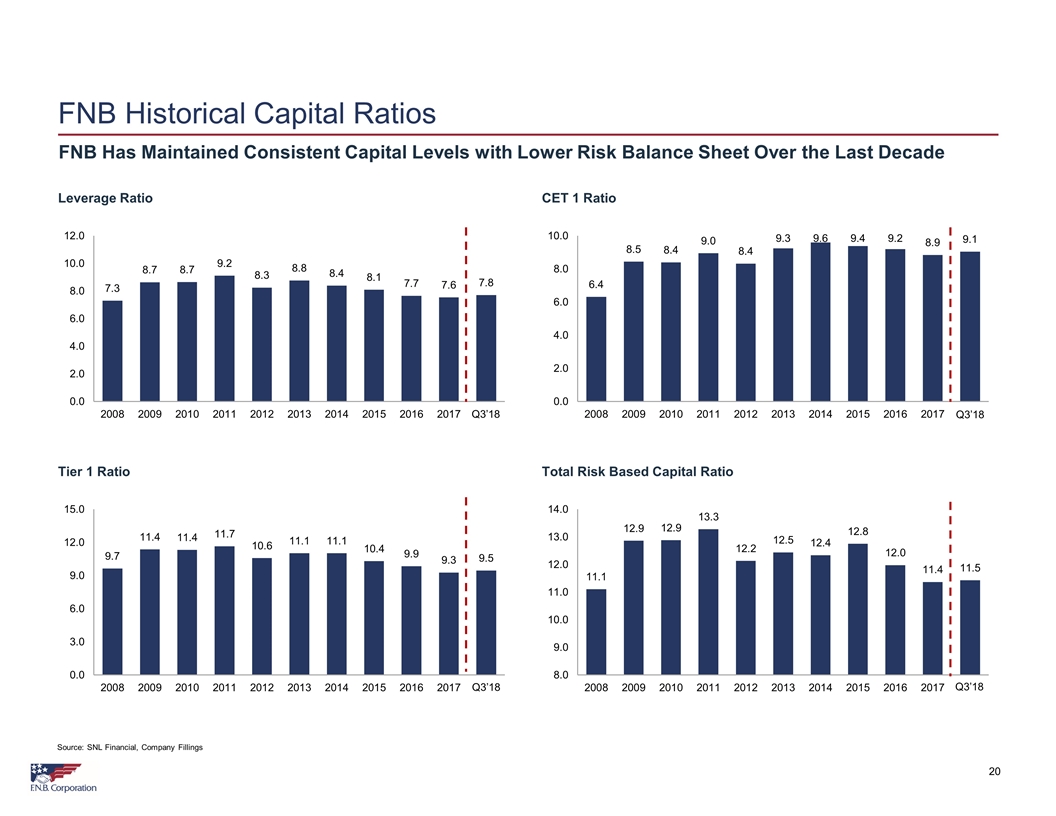

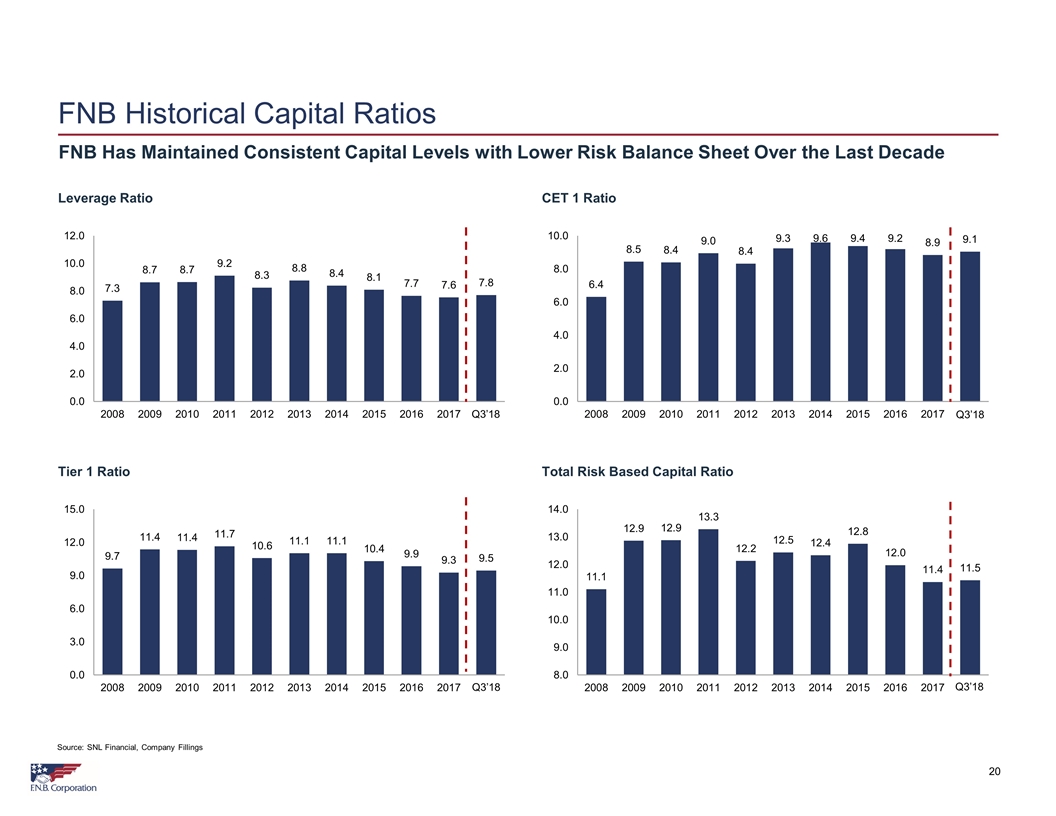

Leverage Ratio CET 1 Ratio Tier 1 Ratio Total Risk Based Capital Ratio 20 FNB Historical Capital Ratios FNB Has Maintained Consistent Capital Levels with Lower Risk Balance Sheet Over the Last Decade Q3’18 Q3’18 Q3’18 Q3’18 Source: SNL Financial, Company Fillings

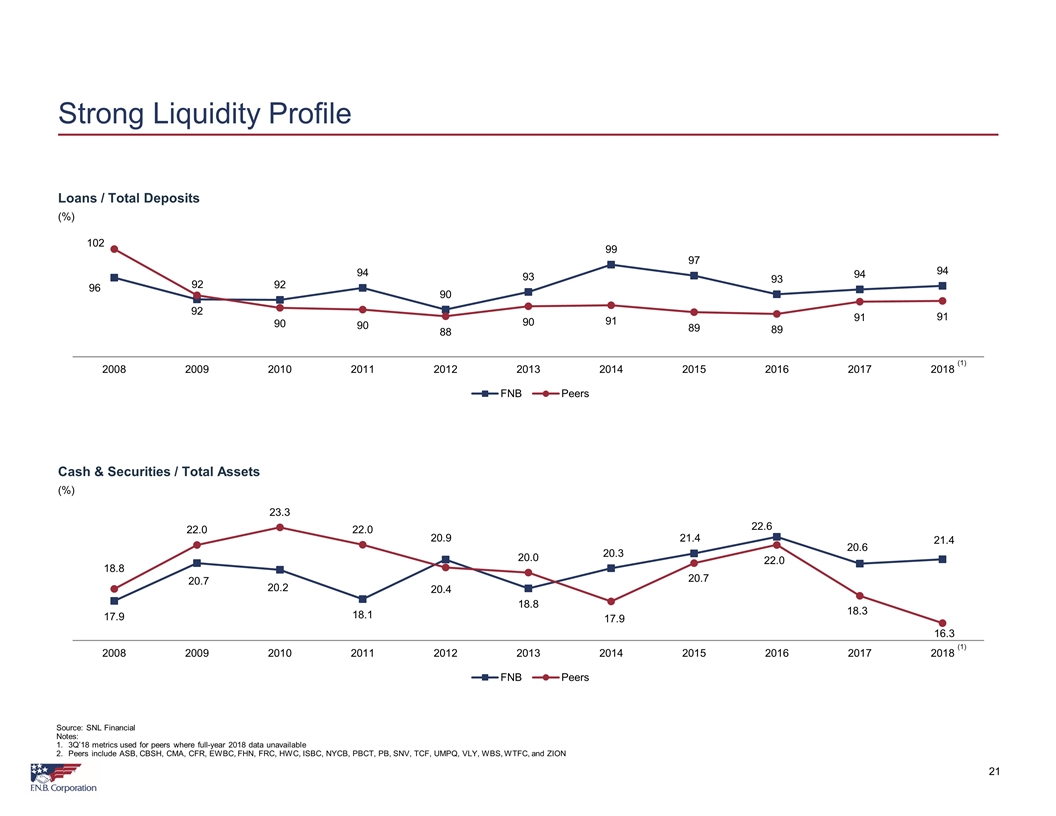

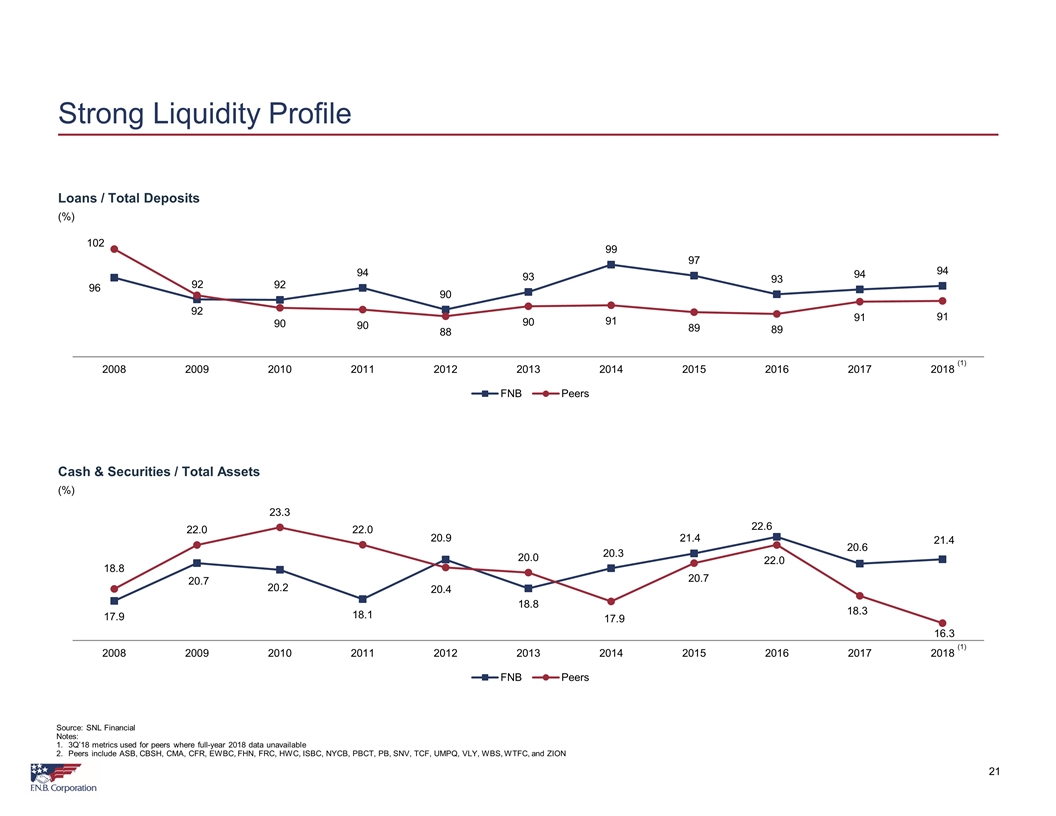

Loans / Total Deposits (%) Cash & Securities / Total Assets (%) 21 Strong Liquidity Profile Source: SNL Financial Notes: 3Q’18 metrics used for peers where full-year 2018 data unavailable Peers include ASB, CBSH, CMA, CFR, EWBC, FHN, FRC, HWC, ISBC, NYCB, PBCT, PB, SNV, TCF, UMPQ, VLY, WBS, WTFC, and ZION (1) (1)

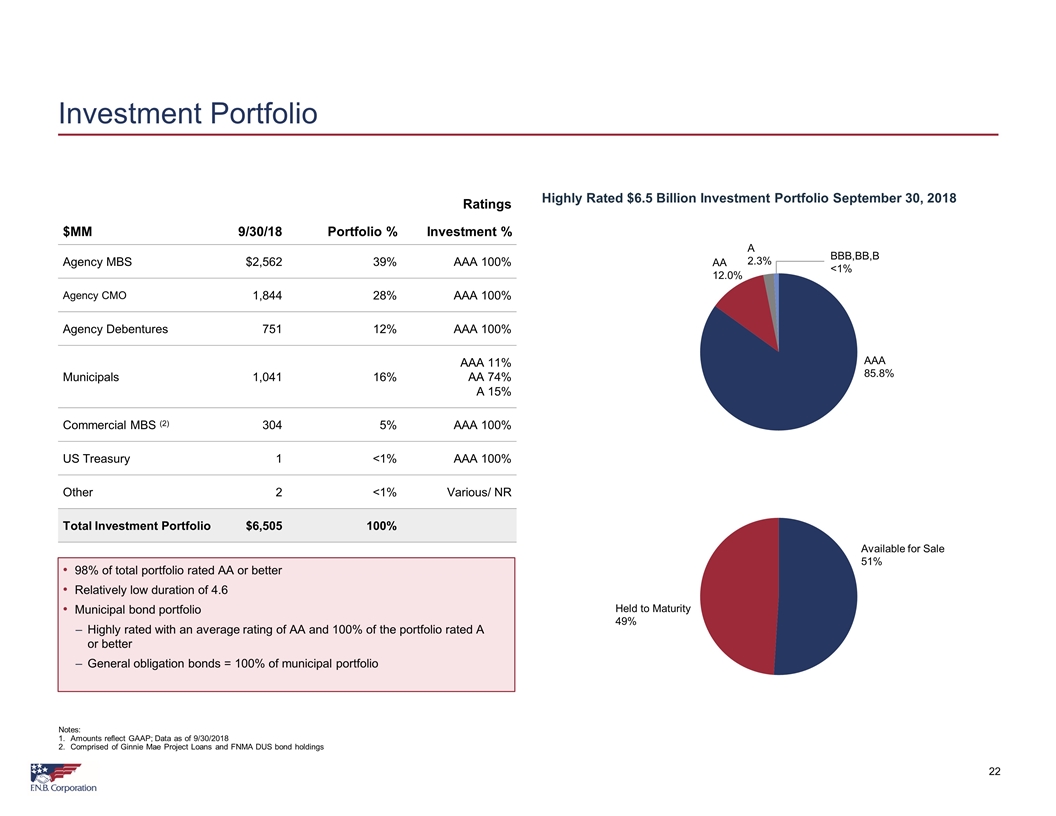

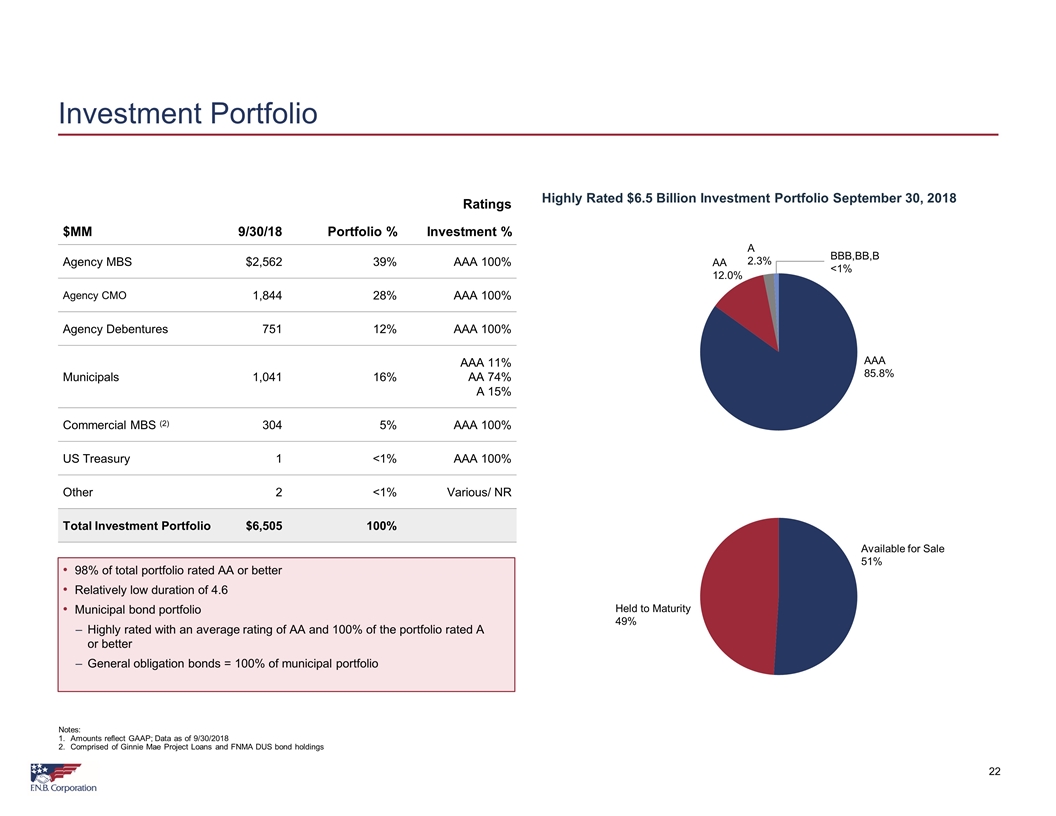

22 Highly Rated $6.5 Billion Investment Portfolio September 30, 2018 98% of total portfolio rated AA or better Relatively low duration of 4.6 Municipal bond portfolio Highly rated with an average rating of AA and 100% of the portfolio rated A or better General obligation bonds = 100% of municipal portfolio Investment Portfolio Ratings $MM 9/30/18 Portfolio % Investment % Agency MBS $2,562 39% AAA 100% Agency CMO 1,844 28% AAA 100% Agency Debentures 751 12% AAA 100% Municipals 1,041 16% AAA 11% AA 74% A 15% Commercial MBS (2) 304 5% AAA 100% US Treasury 1 <1% AAA 100% Other 2 <1% Various/ NR Total Investment Portfolio $6,505 100% Notes: Amounts reflect GAAP; Data as of 9/30/2018 Comprised of Ginnie Mae Project Loans and FNMA DUS bond holdings

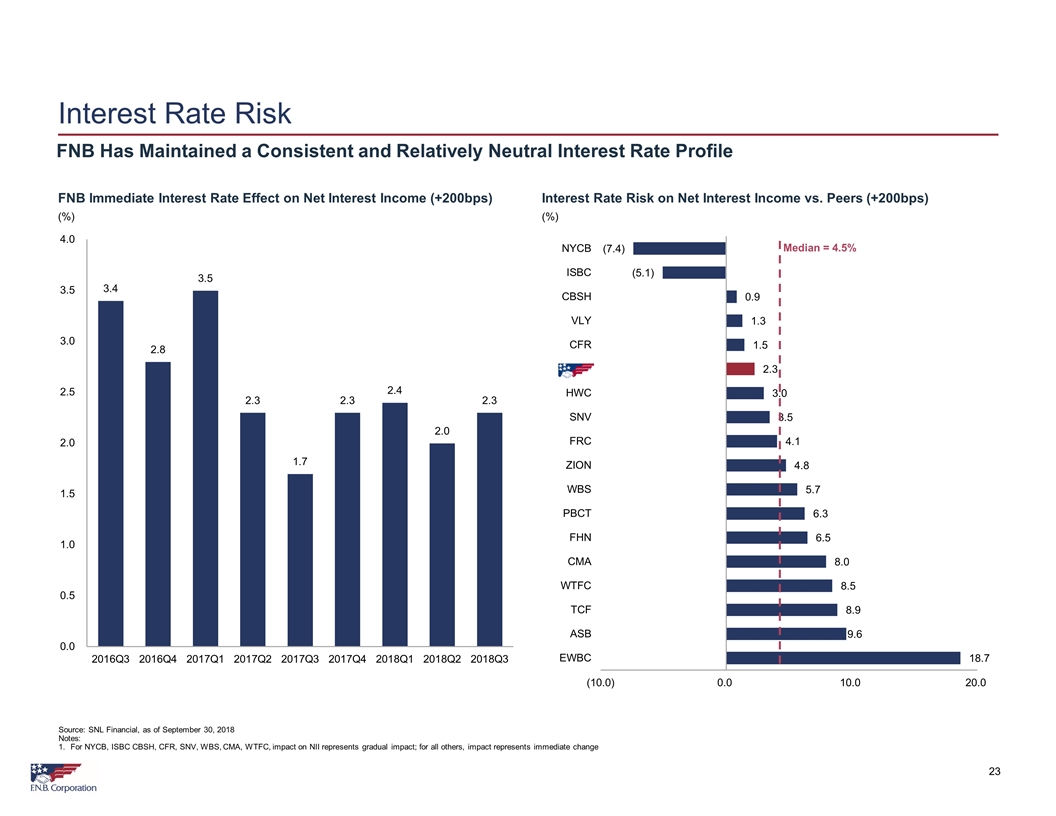

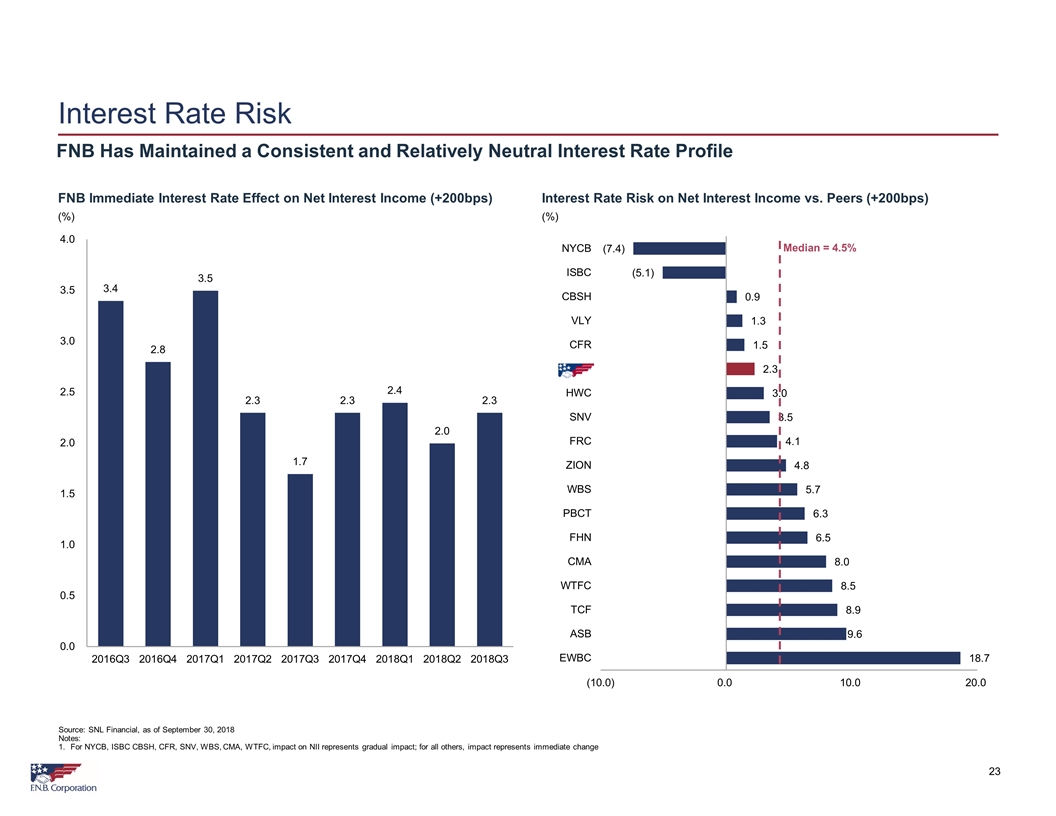

FNB Immediate Interest Rate Effect on Net Interest Income (+200bps) (%) Interest Rate Risk on Net Interest Income vs. Peers (+200bps) (%) Source: SNL Financial, as of September 30, 2018 Notes: For NYCB, ISBC CBSH, CFR, SNV, WBS, CMA, WTFC, impact on NII represents gradual impact; for all others, impact represents immediate change 23 Interest Rate Risk Median = 4.5% FNB Has Maintained a Consistent and Relatively Neutral Interest Rate Profile

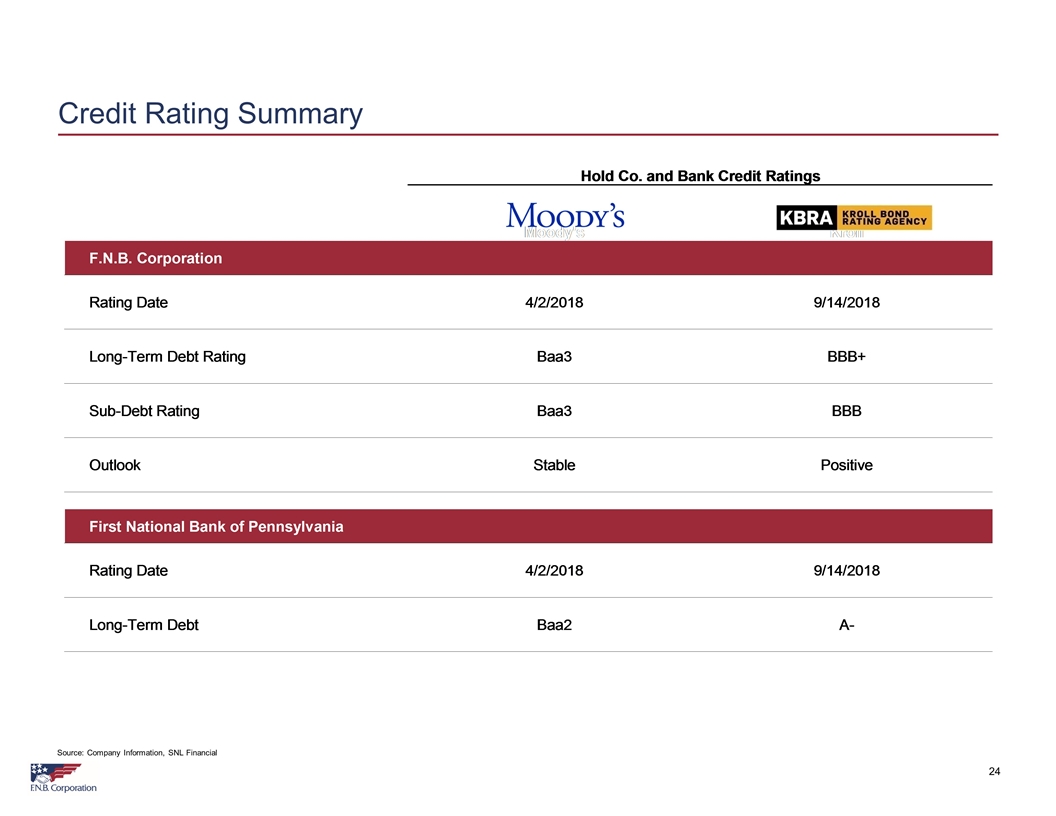

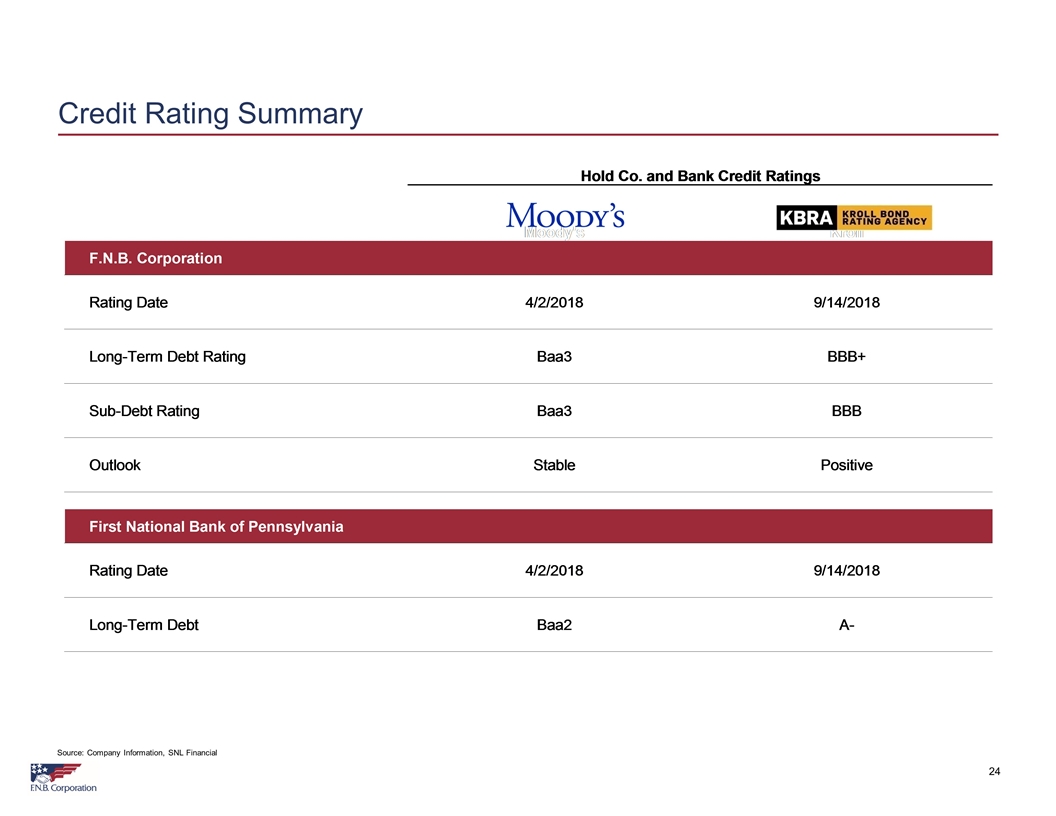

24 Credit Rating Summary Source: Company Information, SNL Financial

Strong core franchise in attractive markets well-positioned for growth Demonstrated peer-leading financial performance Experienced, well-regarded management team Robust risk management driven culture Credit discipline resulting in strong and stable asset quality Solid liquidity position with multiple sources of funding 25 Conclusion

Appendix 26

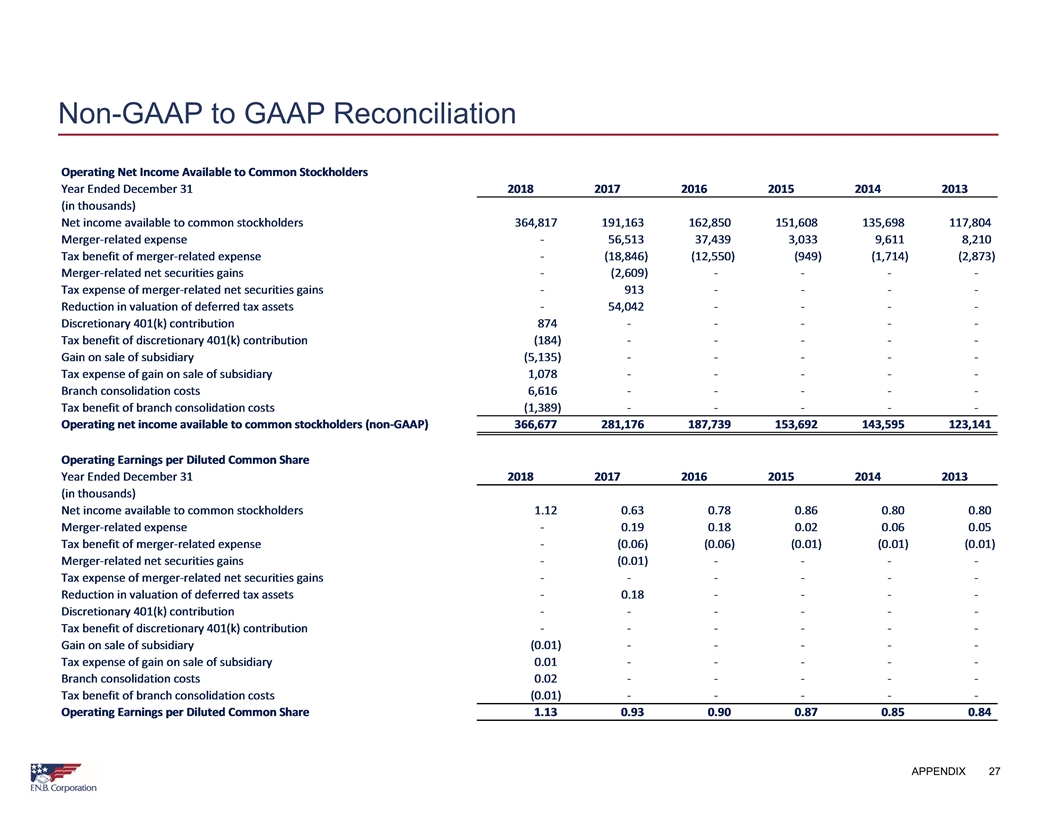

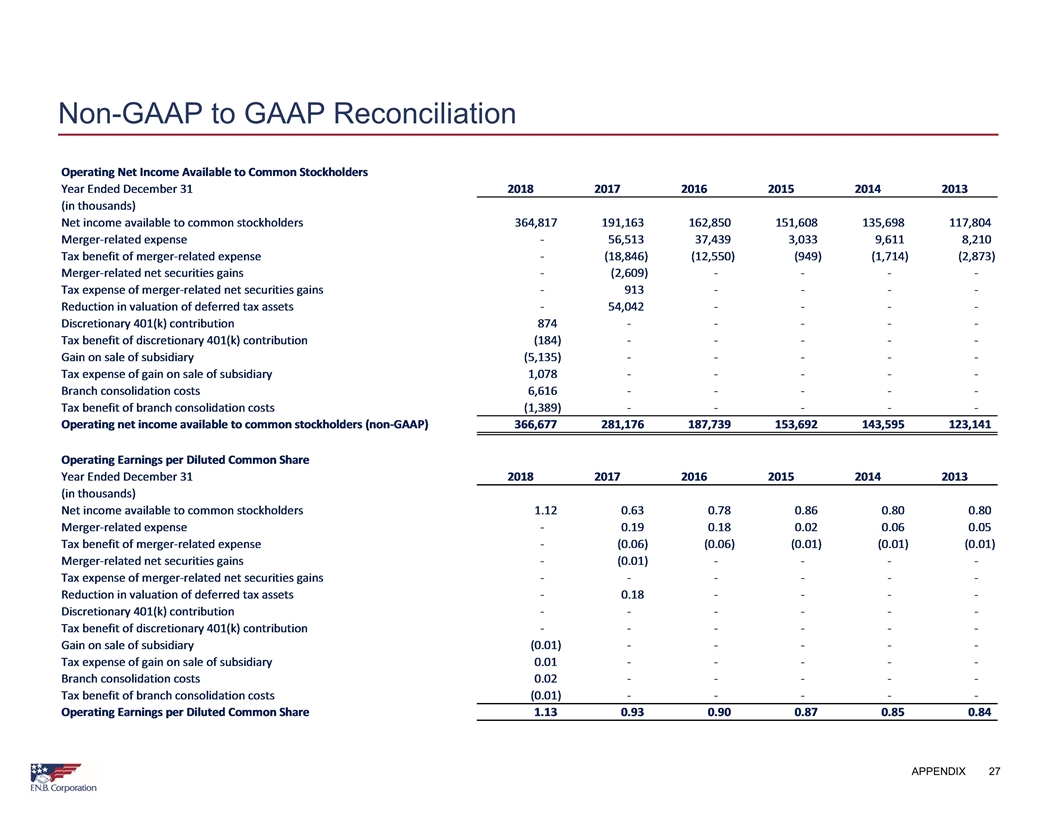

Appendix 27 Non-GAAP to GAAP Reconciliation

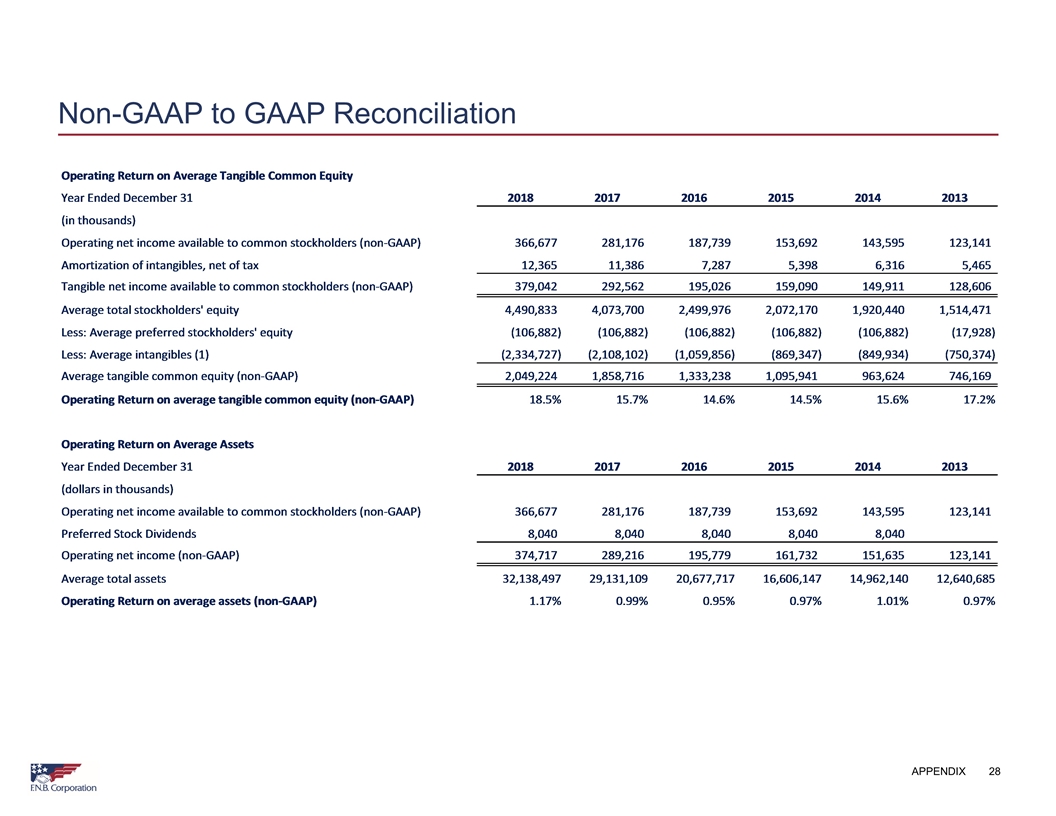

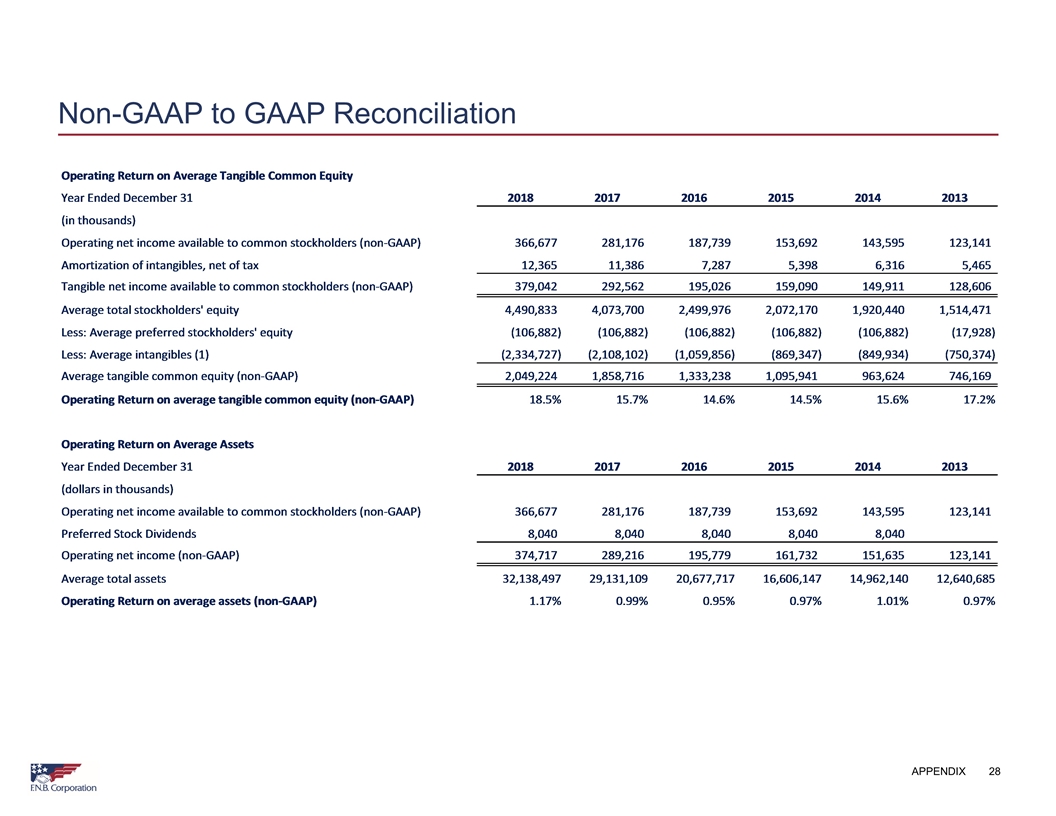

Appendix 28 Non-GAAP to GAAP Reconciliation

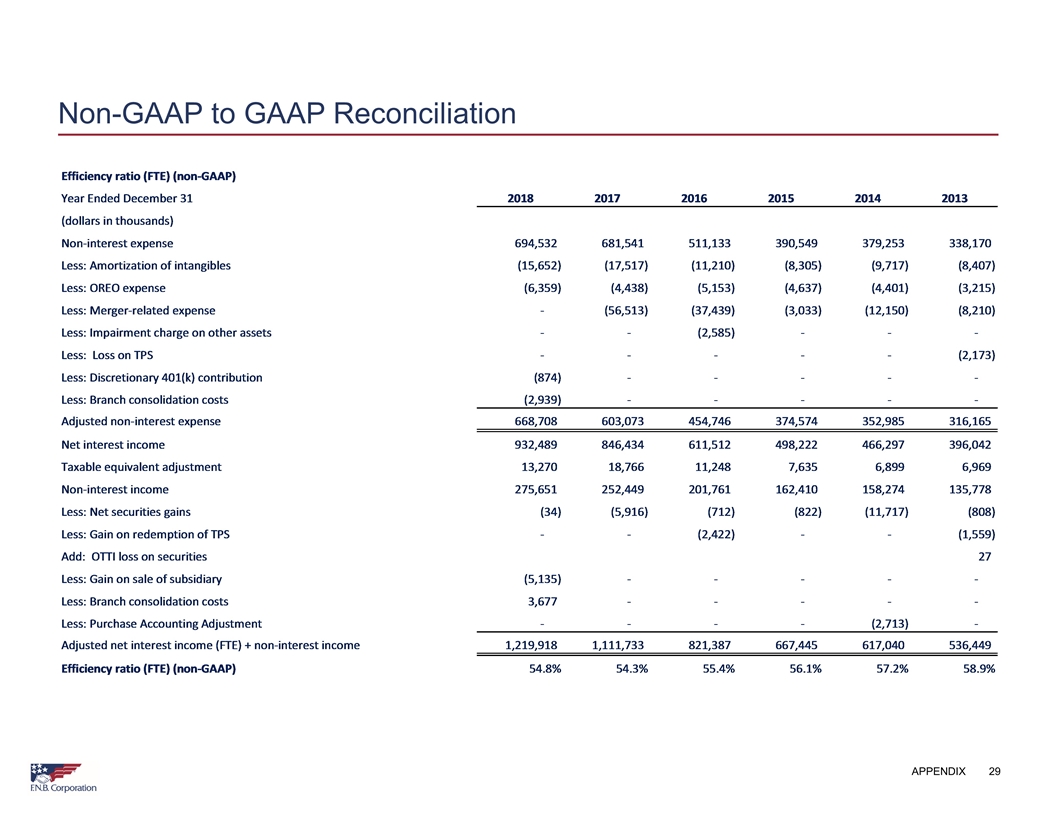

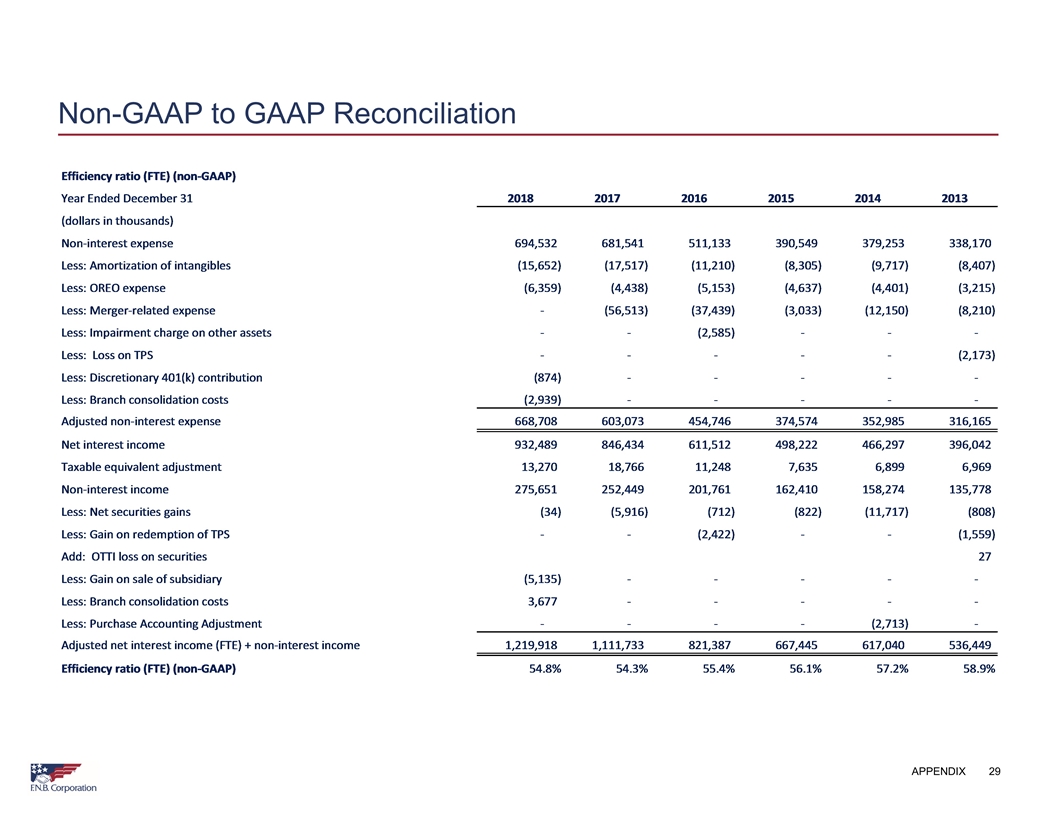

Appendix 29 Non-GAAP to GAAP Reconciliation

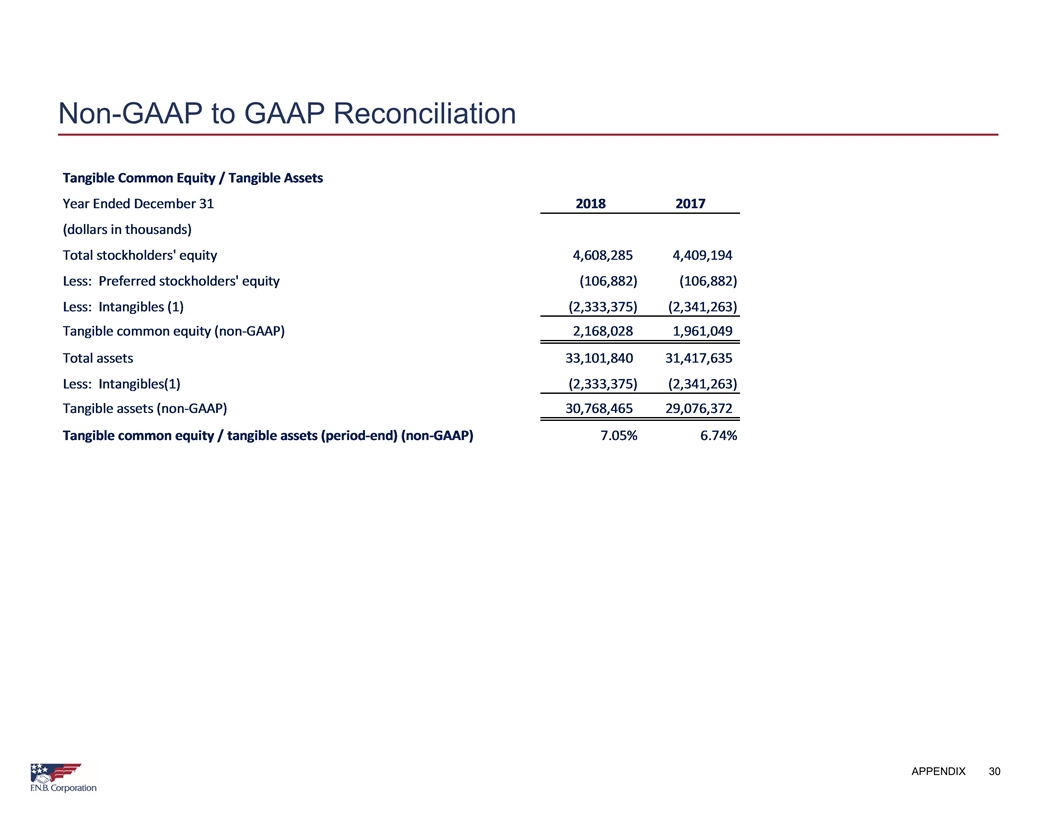

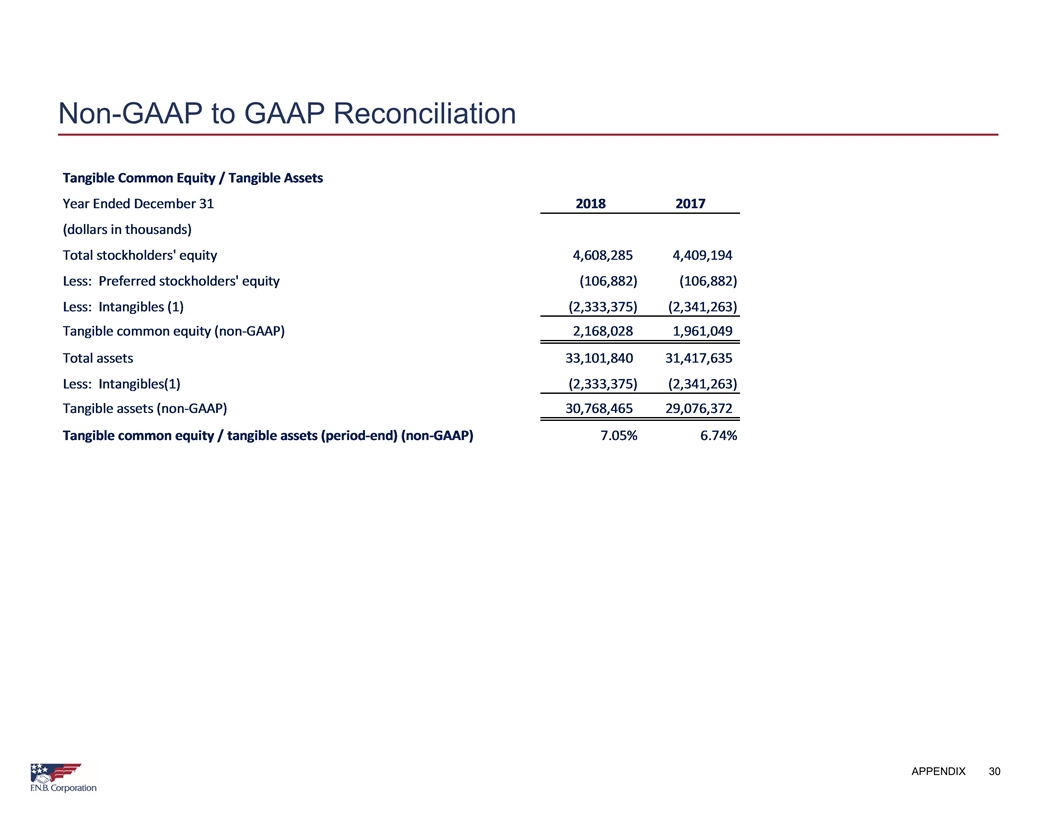

Appendix 30 Non-GAAP to GAAP Reconciliation

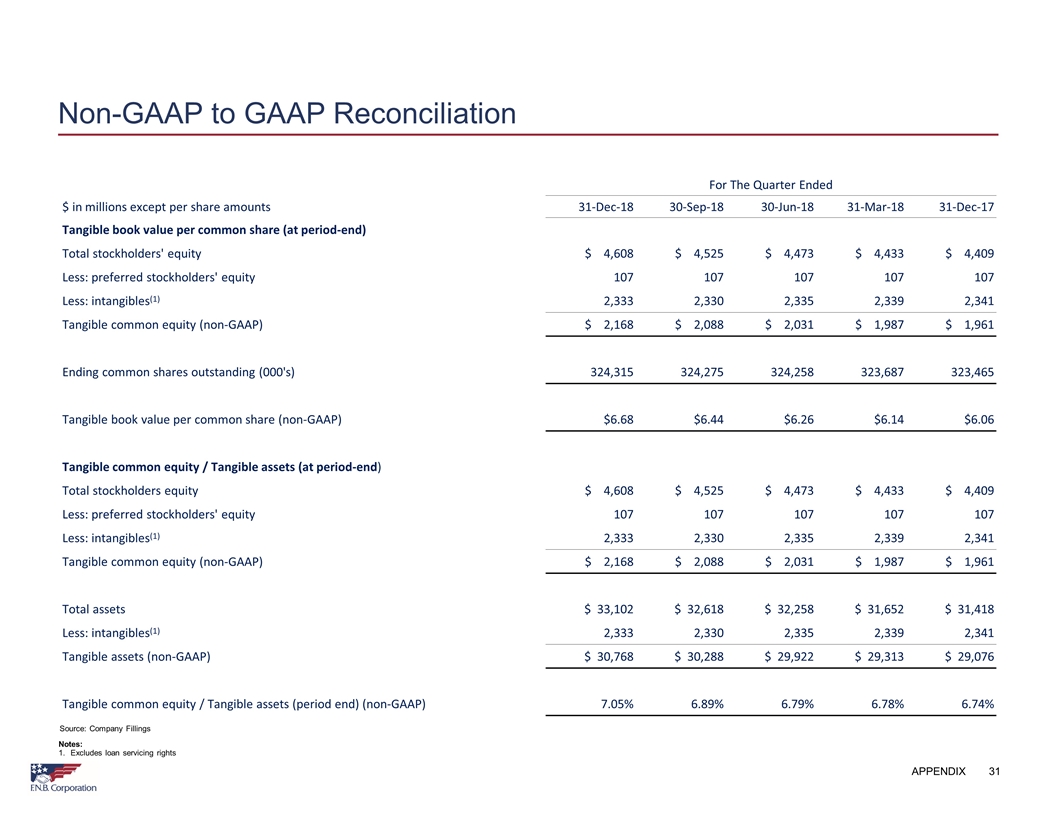

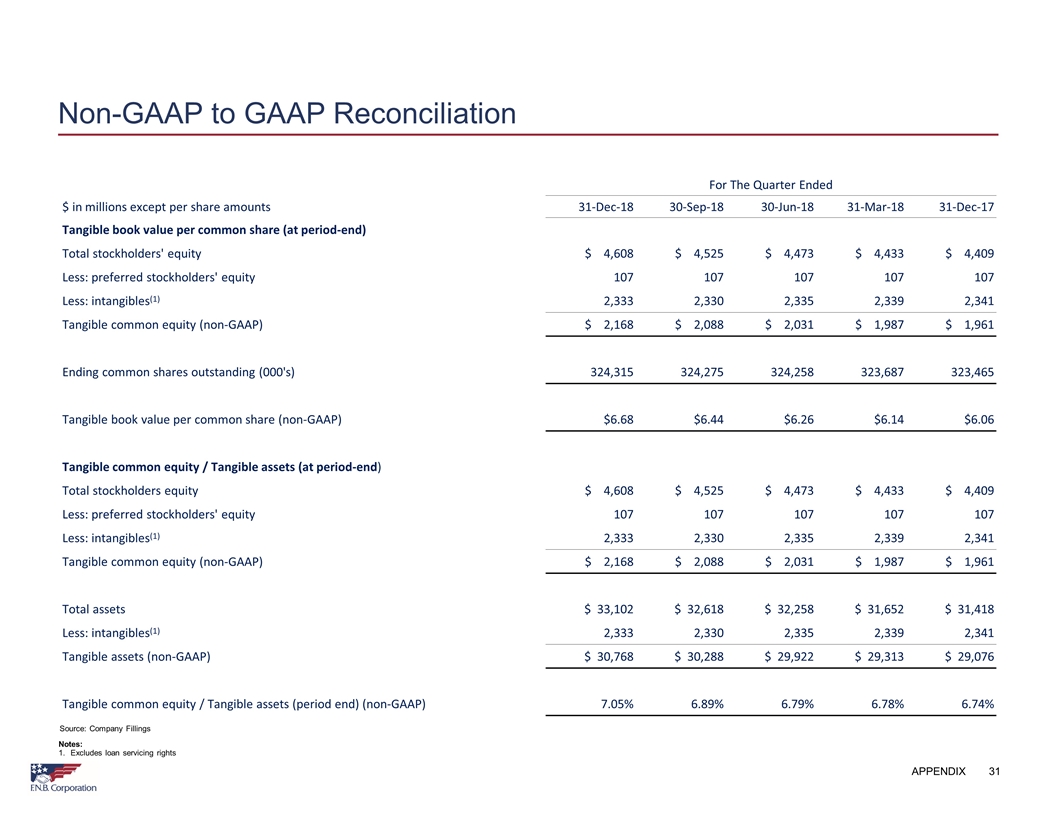

Appendix 31 Non-GAAP to GAAP Reconciliation For The Quarter Ended $ in millions except per share amounts 31-Dec-18 30-Sep-18 30-Jun-18 31-Mar-18 31-Dec-17 Tangible book value per common share (at period-end) Total stockholders' equity $ 4,608 $ 4,525 $ 4,473 $ 4,433 $ 4,409 Less: preferred stockholders' equity 107 107 107 107 107 Less: intangibles(1) 2,333 2,330 2,335 2,339 2,341 Tangible common equity (non-GAAP) $ 2,168 $ 2,088 $ 2,031 $ 1,987 $ 1,961 Ending common shares outstanding (000's) 324,315 324,275 324,258 323,687 323,465 Tangible book value per common share (non-GAAP) $6.68 $6.44 $6.26 $6.14 $6.06 Tangible common equity / Tangible assets (at period-end) Total stockholders equity $ 4,608 $ 4,525 $ 4,473 $ 4,433 $ 4,409 Less: preferred stockholders' equity 107 107 107 107 107 Less: intangibles(1) 2,333 2,330 2,335 2,339 2,341 Tangible common equity (non-GAAP) $ 2,168 $ 2,088 $ 2,031 $ 1,987 $ 1,961 Total assets $ 33,102 $ 32,618 $ 32,258 $ 31,652 $ 31,418 Less: intangibles(1) 2,333 2,330 2,335 2,339 2,341 Tangible assets (non-GAAP) $ 30,768 $ 30,288 $ 29,922 $ 29,313 $ 29,076 Tangible common equity / Tangible assets (period end) (non-GAAP) 7.05% 6.89% 6.79% 6.78% 6.74% Source: Company Fillings Notes: Excludes loan servicing rights

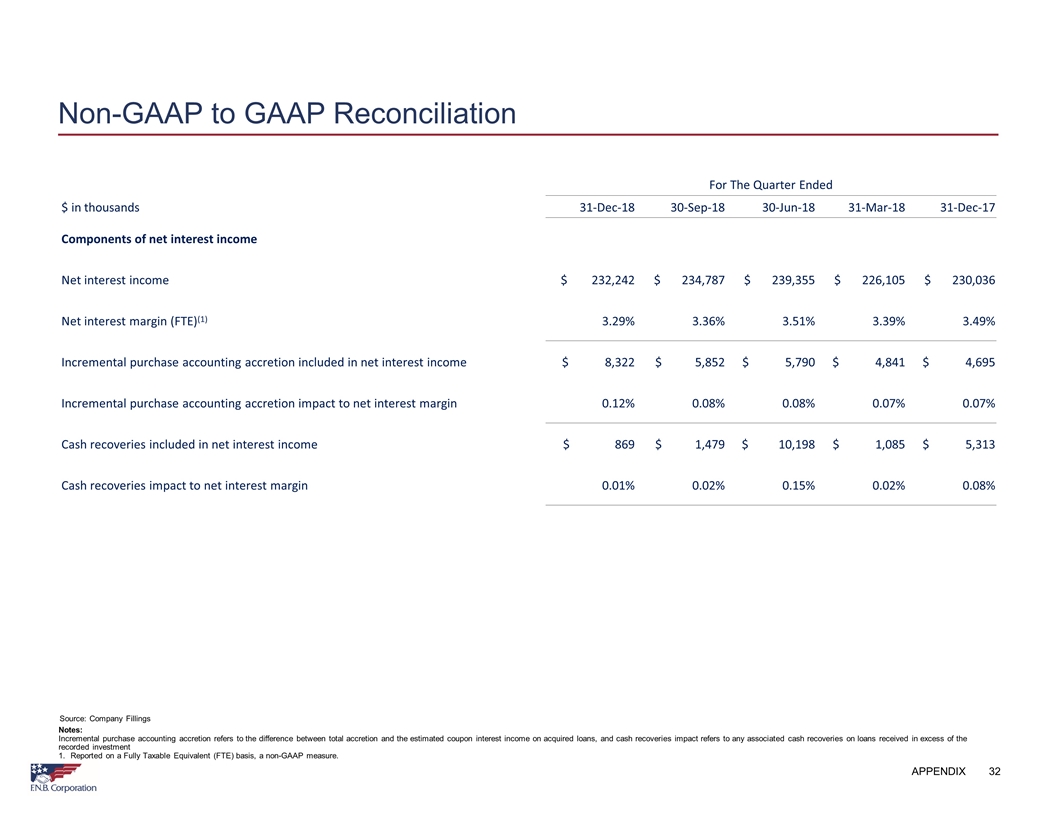

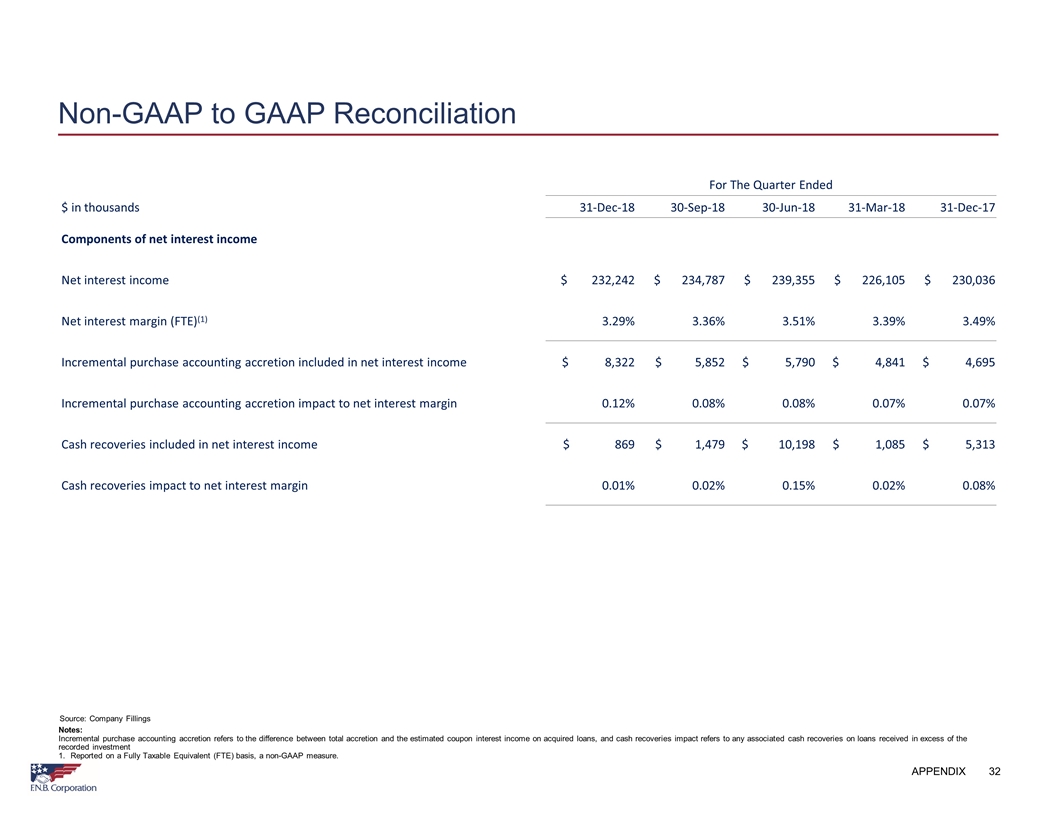

Appendix 32 Non-GAAP to GAAP Reconciliation For The Quarter Ended $ in thousands 31-Dec-18 30-Sep-18 30-Jun-18 31-Mar-18 31-Dec-17 Components of net interest income Net interest income $ 232,242 $ 234,787 $ 239,355 $ 226,105 $ 230,036 Net interest margin (FTE)(1) 3.29% 3.36% 3.51% 3.39% 3.49% Incremental purchase accounting accretion included in net interest income $ 8,322 $ 5,852 $ 5,790 $ 4,841 $ 4,695 Incremental purchase accounting accretion impact to net interest margin 0.12% 0.08% 0.08% 0.07% 0.07% Cash recoveries included in net interest income $ 869 $ 1,479 $ 10,198 $ 1,085 $ 5,313 Cash recoveries impact to net interest margin 0.01% 0.02% 0.15% 0.02% 0.08% Notes: Incremental purchase accounting accretion refers to the difference between total accretion and the estimated coupon interest income on acquired loans, and cash recoveries impact refers to any associated cash recoveries on loans received in excess of the recorded investment Reported on a Fully Taxable Equivalent (FTE) basis, a non-GAAP measure. Source: Company Fillings