office of the Trustee at Rodney Square North, 1100 North Market Street, Wilmington, Delaware 19890, Attn: F.N.B. Corporation Administrator; provided, however, that payment of interest may be made at the option of the Corporation by check mailed to the Person entitled thereto at such address as shall appear in the Security Register or by wire transfer to an account appropriately designated by the Person entitled to payment; provided that the paying agent shall have received written notice of such account designation at least five Business Days prior to the date of such payment (subject to surrender of the relevant Note in the case of a payment of interest on the Stated Maturity).

The Corporation hereby appoints the Trustee to act as Security Registrar and Paying Agent for the Notes.

The Notes will be issuable and may be transferred only in minimum denominations of $1,000 or any amount in excess thereof that is an integral multiple of $1,000. The specified currency of the Notes shall be U.S. Dollars.

Notwithstanding any other provisions of this Supplemental Indenture or the Base Indenture, (i) all payments on Global Notes may be made pursuant to the Applicable Procedures and (ii) any notice required to be given to Holders under this Supplemental Indenture or the Base Indenture shall be sufficiently given if given to the Depositary for a Global Note (or its designee), pursuant to the Applicable Procedures, not later than the latest date (if any), and not earlier than the earliest date (if any), prescribed for the giving of such notice.

2.04 Global Note. The Notes shall be issued initially in the form of one or more fully registered global notes (each such global note, a “Global Note”) deposited with DTC or its designated custodian or such other Depositary as any officer of the Corporation may from time to time designate. Unless and until a Global Note is exchanged for Notes in certificated form, such Global Note may be transferred, in whole but not in part, and any payments on the Notes shall be made, only to DTC or a nominee of DTC, or to a successor Depositary selected or approved by the Corporation or to a nominee of such successor Depositary.

2.05 Interest.

Interest on the Notes will accrue from, and including, December 11, 2024 (the “Issue Date”) to, but excluding, the first Interest Payment Date and then from, and including, the immediately preceding Interest Payment Date to which interest has been paid or duly provided for to, but excluding, the next Interest Payment Date (or if this Note is redeemed during the period, to, but excluding, the Redemption Date) (individually referred to as an “Interest Payment Date” and collectively as the “Interest Payment Dates”) or the Stated Maturity, as the case may be. Each of these periods is referred to as an “Interest Period.”

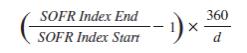

During the period from, and including, December 11, 2024, to, but excluding, December 11, 2029 (the “Fixed Rate Period”), this Note will bear interest at the rate of 5.722% per annum. Such interest will be payable semi-annually in arrears on June 11 and December 11 of each year, beginning on June 11, 2025 and ending on December 11, 2029 (each such date, a “Fixed Interest Payment Date”). During the period from, and including, December 11, 2029, to, but excluding, December 11, 2030 (the “Floating Rate Period”), this Note will bear interest at a floating rate per

4