As filed with the Securities and Exchange Commission on November 10, 2015

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________

FORM N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

| | Pre-Effective Amendment No. 3 | Post-Effective Amendment No. ___ | |

________________________________

AB BOND FUND, INC.

(Exact Name of Registrant as Specified in Charter)

1345 Avenue of the Americas, New York, New York 10105

(Address of Principal Executive Office) (Zip Code)

Registrant's Telephone Number, including Area Code:

(800) 221-5672

________________________________

EMILIE D. WRAPP

AllianceBernstein L.P.

1345 Avenue of the Americas

New York, New York 10105

(Name and address of agent for service)

Copies of communications to:

Kathleen K. Clarke

Seward & Kissel LLP

901 K Street, NW

Suite 800

Washington, DC 20001

Approximate Date of Proposed Public Offering: As soon as practicable after this Registration Statement becomes effective.

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to Section 8(a), may determine.

Title of Securities Being Registered: Advisor Class shares of beneficial interest, par value $.001 per share, of the following series of the Registrant: AB Income Fund.

No filing fee is required because an indefinite number of shares has previously been registered pursuant to Rule 24f-2 under the Investment Company Act of 1940, as amended.

ALLIANCEBERNSTEIN INCOME FUND, INC.

1345 Avenue of the Americas

New York, New York 10105

Toll Free (800) 221-5672

November 11, 2015

Dear Shareholders:

The Board of Directors (the "Directors") of AllianceBernstein Income Fund, Inc. (the "Fund"), a Maryland corporation and a closed-end management investment company, is asking the shareholders of the Fund to approve the acquisition of the assets and assumption of the liabilities of the Fund by AB Income Fund (the "Acquiring Fund"), a series of AB Bond Fund, Inc., a Maryland corporation and an open-end management investment company, pursuant to an Agreement and Plan of Acquisition and Dissolution (the "Plan"). For this purpose, the Directors have approved a Special Meeting of Shareholders of the Fund (the "Meeting") to be held on February 1, 2016.

The proposed acquisition is described in more detail in the attached Proxy Statement/Prospectus. You should review the Proxy Statement/Prospectus carefully and retain it for future reference. If the shareholders of the Fund approve the Plan providing for the acquisition by the Acquiring Fund at the Meeting, the acquisition is expected to be completed in the first quarter of 2016.

The Fund has the same investment objective as the Acquiring Fund. Like the Fund, the Acquiring Fund will normally invest at least 80% of its net assets in income-producing securities. The most significant difference between the Fund and the Acquiring Fund is that, while the Fund invests at least 65% of its total assets in securities issued by the U.S. government (and repurchase agreements relating to U.S. Government securities), the Acquiring Fund will invest at least 65% of its total assets in securities of U.S. and foreign governments (and repurchase agreements relating to U.S. Government securities). The Acquiring Fund will have an additional policy to invest at least 65% of its total assets in securities denominated in U.S. dollars, which will serve to reduce the currency risks associated with investments in foreign government securities. The Fund's investment adviser, AllianceBernstein L.P. (the "Adviser"), is the Adviser of the Acquiring Fund, and the day-to-day management of, and investment decisions for, the Fund and the Acquiring Fund are made by the same portfolio managers. The acquisition is expected to be tax-free to the shareholders of the Fund for federal income tax purposes.

The Acquiring Fund's gross expenses are expected to be significantly higher than the Fund's expenses, at least initially, because of substantial redemptions typically experienced by a closed-end fund after reorganizing into an open-end fund and the resulting decrease in Fund assets as shareholders take the opportunity to redeem shares received in the reorganization at their net asset value ("NAV"). Expenses are also expected to be higher due to the higher costs of operating an open-end fund (e.g., higher transfer agency and shareholder servicing costs). To address these higher expenses, the Adviser has agreed to waive fees and/or reimburse expenses of the Acquiring Fund for a two-year period beginning with the Fund's commencement of operations so that the net expenses of Advisor Class shares of the Acquiring Fund will be comparable to, but higher than (by approximately 7 basis points), the Fund's expenses as of August 31, 2015.

If the acquisition of the Fund by the Acquiring Fund is approved by the Fund's shareholders at the Meeting, each shareholder will receive Advisor Class shares of the Acquiring Fund. These shares of the Acquiring Fund will have an aggregate NAV equal to the aggregate NAV of the shareholder's holding in the Fund. The Fund would then be de-registered as a registered investment company, dissolved, and its shares delisted from the New York Stock Exchange. Shareholders of the Fund will not be assessed any sales charges or other individual shareholder fees in connection with the acquisition.

The Directors have given careful consideration to the proposed Plan and the acquisition and have concluded that the acquisition is in the best interests of the Fund. The Directors unanimously recommend that you vote "for" the proposed Plan and the acquisition of the Fund by the Acquiring Fund.

We welcome your attendance at the Meeting. If you are unable to attend, we encourage you to authorize proxies to vote your shares. Computershare Fund Services, a proxy solicitation firm, has been selected to assist in the proxy solicitation process. If we have not received your proxy as the date of the Meeting approaches, you may receive a telephone call from the Proxy Solicitor to remind you to authorize a proxy to vote your shares. No matter how many shares you own, your vote is important.

Sincerely,

Robert M. Keith

President

ALLIANCEBERNSTEIN INCOME FUND, INC.

1345 Avenue of the Americas

New York, New York 10105

Toll Free (800) 221-5672

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD FEBRUARY 1, 2016

To the Shareholders of AllianceBernstein Income Fund, Inc.:

NOTICE IS HEREBY GIVEN that a Special Meeting of Shareholders (the "Meeting") of AllianceBernstein Income Fund, Inc. (the "Acquired Fund"), a closed-end management investment company organized as a Maryland corporation, is to be held at 3:00 p.m. Eastern time at the offices of AllianceBernstein L.P., 1345 Avenue of the Americas, New York, New York l0105, on February 1, 2016.

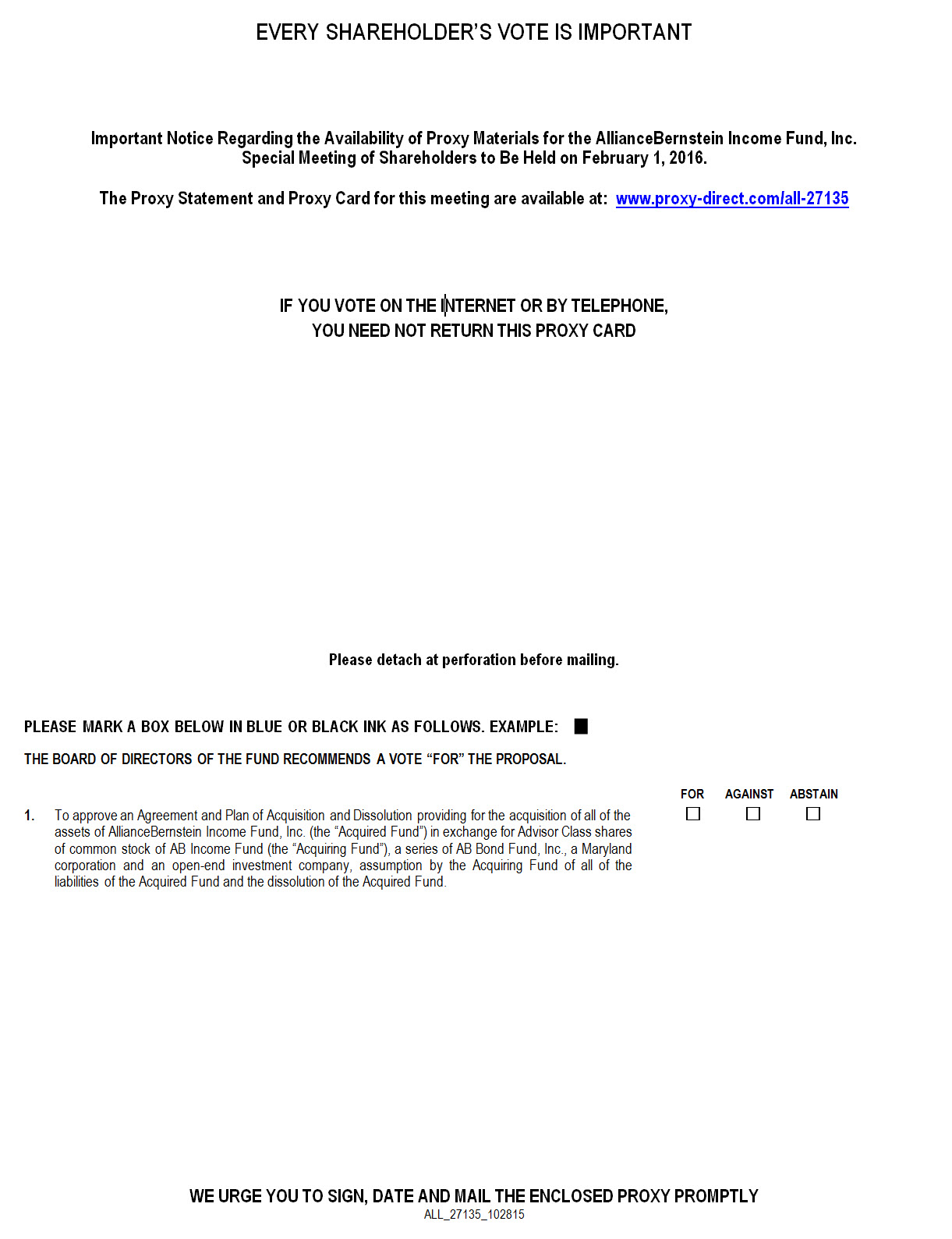

At the Meeting you will be asked to consider and approve a proposal to vote upon an Agreement and Plan of Acquisition and Dissolution (the "Plan") providing for the acquisition of all of the assets of the Acquired Fund in exchange for shares of common stock of AB Income Fund (the "Acquiring Fund"), a series of AB Bond Fund, Inc., a Maryland corporation and an open-end management investment company, the assumption by the Acquiring Fund of all of the liabilities of the Acquired Fund and the dissolution of the Acquired Fund.

Record owners of shares of the Acquired Fund as of the close of business on November 4, 2015, are entitled to vote at the Meeting or any adjournments or postponements thereof. If you attend the Meeting, you may vote your shares in person. If you do not attend the Meeting, you may authorize a proxy to vote your shares by completing, signing and returning the enclosed proxy card by mail in the envelope provided, or by following the instructions on the proxy card to authorize a proxy to vote your shares by telephone or the Internet.

Your vote is important. If you have any questions, please contact us toll-free at (877) 632-0901 for additional information.

| By order of the Board of Directors |

| |

| Sincerely, |

| |

| |

| | |

| Emilie Wrapp |

| Secretary |

| November 11, 2015 |

| IMPORTANT — We urge you to sign and date the enclosed proxy card and return it in the enclosed addressed envelope, which requires no postage and is intended for your convenience. You also may vote through the internet, by visiting the website address on your proxy card, or by telephone, by using the toll-free number on your proxy card. Your prompt vote may save AllianceBernstein Income Fund, Inc. the necessity of further solicitations to ensure a quorum at the Meeting. If you can attend the Meeting and wish to vote your shares in person at that time, you will be able to do so. |

ALLIANCEBERNSTEIN INCOME FUND, INC.

1345 Avenue of the Americas

New York, New York 10105

Toll Free: (800) 221-5672

QUESTIONS AND ANSWERS

The following questions and answers provide an overview of key features of the proposed acquisition and of the information contained in the attached Combined Proxy Statement and Prospectus ("Proxy Statement/ Prospectus"). Please review the full Proxy Statement/Prospectus before casting your vote or authorizing a proxy to vote your shares.

1. What is this document and why was it sent to you?

The attached Proxy Statement/Prospectus provides you with information about the proposed acquisition of the assets of AllianceBernstein Income Fund, Inc. (the "Acquired Fund"), a closed-end management investment company organized as a Maryland corporation, by AB Income Fund (the "Acquiring Fund," and, together with the Acquired Fund, the "Funds"), a series of AB Bond Fund, Inc. (the "Company"), an open-end management investment company organized as a Maryland corporation (the "Acquisition"). The purposes of the Proxy Statement/Prospectus are to (1) solicit votes from shareholders of the Acquired Fund to approve the proposed Acquisition, as described in the Agreement and Plan of Acquisition and Dissolution, between the Acquired Fund and the Company, on behalf of the Acquiring Fund (the "Plan"), and (2) provide information about the Acquiring Fund.

This Proxy Statement/Prospectus contains information that shareholders of the Acquired Fund should know before voting on the proposed Acquisition. The Proxy Statement/Prospectus should be retained for future reference.

2. How is this proxy different from the one I received in March 2015?

The proxy you received in March in connection with the Acquired Fund's annual meeting of shareholders held on April 16, 2015 (the "Annual Meeting") requested that, at the annual meeting, you vote to elect three Directors of the Acquired Fund and vote on a non-binding shareholder proposal (the "Non-Binding Shareholder Proposal"). The Non-Binding Shareholder Proposal, which requested that the Board of Directors of the Acquired Fund (the "Board" or the "Directors") consider authorizing a self-tender offer for all of the Fund's outstanding common shares and, if more than 50% of such shares are tendered, take steps to liquidate, merge or convert the Acquired Fund into an open-end mutual fund, was approved by the Acquired Fund's shareholders at the Annual Meeting. A description of the Non-Binding Shareholder Proposal and number of shares voted at the Annual Meeting are included in the semi-annual report to shareholders of the Acquired Fund for the six-month period ended June 30, 2015.

3. What is the purpose of the Acquisition?

As noted above, the Acquired Fund's shareholders recently approved the Non-Binding Shareholder Proposal, which requested, among other things, that the Directors consider authorizing a significant tender offer for the Acquired Fund's common shares. The Directors currently believe that authorizing such a significant tender offer would have adverse consequences for the Acquired Fund and its shareholders because it would reduce the Acquired Fund's size, force the Acquired Fund to liquidate a large portion of its portfolio securities to pay for tendered shares, and lead to a material increase in the Acquired Fund's expense ratio, while potentially having little or no long-term impact on the level of the discount. To avoid imposing such adverse consequences on the Acquired Fund, and recognizing that, based on the results of the Annual Meeting, there was significant support among shareholders of the Acquired Fund for merging the Fund with, or converting the Fund into, an open-end fund, AllianceBernstein L.P. (the "Adviser") recommended and the Board determined that it was in the best interests of the Acquired Fund to propose to the Acquired Fund's shareholders that the Fund be reorganized into the Acquiring Fund.

The purpose of the Acquisition is to transfer the assets and liabilities of the Acquired Fund to the Acquiring Fund, which was formed for purposes of the Acquisition. As discussed in the Proxy Statement/Prospectus, after carefully considering the recommendation of the Adviser, the Board approved the submission of the Plan to shareholders of the Acquired Fund for approval. In reaching this conclusion, the Directors considered, among other factors:

| · | that shareholders who receive Advisor Class shares of the Acquiring Fund in the Acquisition will be able to redeem their shares at their net asset value ("NAV") (subject to a 0.75% redemption fee during the three-month period following the closing of the Acquisition); |

| · | that, as an open-end fund, rather than a closed-end fund with a charter provision requiring submission to shareholders of an open-ending proposal when certain discount related conditions are met and shareholders representing at least 10% of the outstanding shares so request, the Acquiring Fund is not susceptible to the type of activities currently engaged in by activist shareholders of the Acquired Fund, which have been, and could continue to be, costly to the Acquired Fund; |

| · | the continuity of management, as the Acquiring Fund will have the same Adviser and the same portfolio managers, and will be overseen by the same Directors and be serviced by some of the same service providers as the Acquired Fund; |

| · | that the Acquiring Fund will have the same investment objective as the Acquired Fund, and the Acquiring Fund will normally invest at least 65% of its total assets in both U.S. and foreign government securities (and repurchase agreements relating to U.S. Government securities) unlike the Acquired Fund, which invests 65% of its total assets in U.S. government securities (and repurchase agreements relating to U.S. Government securities), exposing the Acquiring Fund to greater foreign securities risk and emerging market risk; |

| · | that the Acquiring Fund will invest at least 65% of its total assets in securities denominated in U.S. dollars and no more than 25% of its securities of issuers in any one country other than the U.S.; |

| · | the comparison of fees for the Funds, including that the investment advisory fees will be structured differently than the current advisory fee since the investment advisory fee will not be partly based on the Acquiring Fund's income and will be higher than the fee rate currently paid by the Acquired Fund in the current low interest rate environment, although it will be lower than the fee rate paid by the Acquired Fund in most prior periods, and that the gross expenses of the Acquiring Fund will be significantly higher, at least initially, but will be subject to a fee waiver and/or expense reimbursement by the Adviser for a two-year period beginning with the Acquiring Fund's commencement of operations, that will limit the Acquiring Fund's net operating expenses during such period for Advisor Class shares to an amount that, on an annual basis, is comparable to, but higher than, the Acquired Fund's total expense ratio; |

| · | that the Acquiring Fund, as an open-end rather than a closed-end fund, will be managed utilizing somewhat less leverage and with higher cash balances than the Acquired Fund; |

| · | the costs of the Acquisition and the allocation thereof; and |

| · | the expectation that the Acquired Fund and its shareholders will not recognize any gain or loss upon the Acquisition for federal income tax purposes, but that the Acquiring Fund may recognize gains that, upon distribution, are taxable to shareholders as a result of sales of portfolio securities after the Acquisition to satisfy expected redemption requests. |

The Acquisition will not occur unless it is approved by the affirmative vote of at least 2/3 of the votes entitled to be cast by the shareholders of the Acquired Fund. The Directors unanimously recommend that you vote "FOR" the Acquisition.

4. How will the proposed Acquisition work?

Subject to the approval of the shareholders of the Acquired Fund, the Plan provides for:

| · | the transfer of all of the assets of the Acquired Fund in exchange for Advisor Class shares of the Acquiring Fund and the assumption by the Acquiring Fund of all of the liabilities of the Acquired Fund; |

| · | the distribution of the Advisor Class shares of the Acquiring Fund received by the Acquired Fund to shareholders of the Acquired Fund; and |

| · | the complete liquidation and dissolution of the Acquired Fund. |

Shareholders of the Acquired Fund at the time of the Acquisition will become Advisor Class shareholders of the Acquiring Fund. If the Plan is approved by the Acquired Fund's shareholders at the Special Meeting of Shareholders to be held on February 1, 2016 (the "Meeting"), the Acquisition is expected to occur during the first quarter of 2016.

5. Who is eligible to vote on the Acquisition?

Shareholders of record of the Acquired Fund at the close of business on November 4, 2015 (the "Record Date") are entitled to notice of, and to vote at, the Meeting or any adjournment or postponement thereof. If you held Acquired Fund shares on the Record Date, you have the right to vote even if you later sold your shares. Each share is entitled to one vote. Shares represented by properly executed proxies, unless the proxies are revoked before or at the Meeting, will be voted according to shareholders' instructions. If you date, sign and return a proxy but do not fill in a vote, your shares will be voted "FOR" the Acquisition. If any other business properly comes before the Meeting, your shares will be voted at the discretion of the persons named as proxies.

6. How will the Acquisition affect shareholders of the Acquired Fund?

Shareholders of the Acquired Fund, a Maryland corporation and a closed-end investment company whose shares trade on the New York Stock Exchange (the "NYSE"), will become Advisor Class shareholders of the Acquiring Fund, a Maryland corporation and an open-end investment company. The shares of the Acquiring Fund that an Acquired Fund shareholder receives will have a total NAV equal to the NAV of shares held by the shareholder in the Acquired Fund as of the Effective Time of the Acquisition. Shareholders of the Acquiring Fund will be able to redeem their Acquiring Fund shares at any time for such shares' then-current NAV after the Acquisition, except that, during the three-month period following the Acquisition, Advisor Class shares redeemed or exchanged for the Advisor Class shares of other AB mutual funds will be subject to a redemption fee of 0.75% to help the Acquiring Fund defray expected transaction costs incurred in response to redemption requests from former shareholders of the Acquired Fund. Shares of the Acquired Fund will be delisted from the NYSE following the Closing Date.

7. Who manages the Acquiring Fund?

The Adviser serves as investment adviser to the Acquiring Fund and the Acquired Fund. The Adviser manages assets totaling approximately $463 billion as of September 30, 2015, of which approximately $94 billion represented assets of registered investment companies sponsored by the Adviser. Currently, the Adviser advises 32 registered investment companies, comprising 140 separate investment portfolios.

The management of, and investment decisions for, the Acquiring Fund are made by Paul J. DeNoon, Gershon M. Distenfeld, Douglas J. Peebles and Matthew S. Sheridan, the same team responsible for managing the Acquired Fund.

The Acquiring Fund is overseen by the same Board of Directors as the Acquired Fund.

8. What are the differences between an open-end investment company and a closed-end investment company?

Closed-end funds, like the Acquired Fund, generally do not redeem their outstanding shares or engage in the continuous sale of new shares. As a result, shareholders of a closed-end fund wishing to buy or sell their shares generally must do so through a broker-dealer in securities markets and pay or receive the prevailing market price, which may be more (a premium) or less (a discount) than the NAV of the closed-end fund's shares. In addition, closed-end funds are able to use leverage to a greater extent than open-end funds. This is because closed-end funds are permitted by the Investment Company Act of 1940, as amended, (the "1940 Act") to issue preferred stock and debt securities, and have a relatively stable asset base, which makes it easier to establish and maintain leverage in accordance with the requirements of the 1940 Act, as well as other requirements.

Open-end funds issue, and continuously offer, shares that generally are sold and can be redeemed or sold back to the fund at the shares' NAV less any applicable sales charges. Because open-end funds must be able to satisfy redemption requests from their shareholders on a daily basis, they may not be as fully invested as closed-end funds, which may affect performance. In addition, open-end funds are generally unable to use leverage to the same extent as closed-end funds due to 1940 Act restrictions and a less stable asset base due to daily purchases and redemption requests. This, in turn, may affect an open-end fund's ability to generate the same yield as a closed-end fund with the same investment objective. Shareholders of an open-end fund may benefit from increases in assets of the fund through economies of scale whenever asset levels increase, but can be adversely affected from decreases in the assets of the fund. In addition, open-end funds are required to maintain a higher percentage of liquid assets than closed-end funds.

9. How will the Acquisition affect the advisory fees and expenses?

The advisory fee of the Acquiring Fund is structured differently than the current advisory fee of the Acquired Fund, since it is not partly based on the Acquiring Fund's income, and will be higher than the fee rate currently paid by the Acquired Fund in the current low interest rate environment, although it will be lower than the fee rate paid by the Acquired Fund in most prior periods. The Acquiring Fund's gross expenses are expected to be significantly higher, at least initially, than the Acquired Fund's expenses due to the higher costs of operating as an open-end fund (e.g., higher transfer agency and shareholder servicing costs) and the expected redemptions that typically occur after a closed-end fund is reorganized into an open-end fund, resulting in a decrease in the Acquiring Fund's assets. The Adviser has agreed to waive fees and/or reimburse the operating expenses of the Acquiring Fund for a two-year period beginning with the Acquiring Fund's commencement of operations, so that the net operating expenses of the Advisor Class shares of the Acquiring Fund after the Acquisition will be limited to an amount that, on an annual basis, is comparable to, but higher (by approximately 7 basis points) than, the operating expenses of the Acquired Fund as of August 31, 2015.

10. What happens if shareholders of the Acquired Fund do not approve the Plan?

If shareholders of the Acquired Fund do not approve the Plan, the Acquisition will not occur, the Acquired Fund will continue to operate as a closed-end fund and its shares would continue to trade on the NYSE. The Directors of the Acquired Fund may consider other alternatives for the Fund in such event.

11. Who is paying the expenses of the Acquisition?

The Acquired Fund will bear the costs and expenses of the Acquisition, which are estimated to be approximately $600,000. Costs and expenses of the Acquisition ("Acquisition Costs") do not include the fees and expenses of counsel to the independent Directors of the Acquired Fund and the Acquiring Fund, and are estimated to be approximately $540,000. Any Acquisition Costs that exceed $540,000 will be paid by the Adviser.

12. Who do I call if I have questions about the Meeting or the Acquisition?

If you have any questions about the Meeting or the Acquisition, please call AllianceBernstein Investor Services, Inc. toll-free at (800) 221-5672 from 9:00 a.m. to 5:00 p.m. Eastern time, or Computershare Fund Services, the Acquired Fund's proxy solicitor, at (877) 632-0901.

13. Where may I find additional information regarding the Acquired Fund and the Acquiring Fund?

Additional information relating to the Acquired Fund and the Acquiring Fund has been filed with the Securities and Exchange Commission ("SEC") and can be found in the following documents, which are incorporated into the Proxy Statement/Prospectus by reference:

| · | The Statement of Additional Information dated as of November 11, 2015 that has been filed with the SEC in connection with the Proxy Statement/Prospectus (the "Acquisition SAI"); |

| · | The audited financial statements and related independent registered public accounting firm's report for the Acquired Fund contained in its annual report for the fiscal year ended December 31, 2014; and |

| · | The unaudited financial statements for the six-month period ended June 30, 2015 contained in the Acquired Fund's semi-annual report. |

In addition, reports, proxy statements and other information concerning the Acquired Fund may be inspected at the NYSE.

Because the Acquiring Fund is a recently created fund that has not yet commenced operations, no shareholder reports for the Acquiring Fund are available.

Copies of the annual and semi-annual reports to shareholders of the Acquired Fund are available, along with the Proxy Statement/Prospectus and Acquisition SAI, upon request, without charge, by writing to the address or calling the telephone number listed below.

| | |

| By mail: | c/o AllianceBernstein Investor Services, Inc. P.O. Box 786003 San Antonio, TX 78278-6003 |

| | |

| By phone: | (800) 221-5672 |

All of this additional information is also available in documents filed with the SEC. You may view or obtain these documents from the SEC:

| | |

| In person: | at the SEC's Public Reference Room in Washington, DC |

| | |

| By phone: | 1-202-551-8090 (for information on the operations of the Public Reference Room only) |

| | |

| By mail: | Public Reference Branch, Office of Consumer Affairs and Information Services, Securities and Exchange Commission, Washington, DC 20549 (copies may be obtained at prescribed rates) |

| | |

| | |

| | |

| On the Internet: | www.sec.gov |

Other Important Things to Note:

| · | You may lose money by investing in the Acquired Fund or the Acquiring Fund. |

| · | The SEC has not approved or disapproved these securities or passed upon the adequacy of the Proxy Statement/Prospectus. Any representation to the contrary is a criminal offense. |

PROXY STATEMENT/PROSPECTUS

November 11, 2015

FOR THE ACQUISITION OF

AllianceBernstein Income Fund, Inc.

1345 Avenue of the Americas

New York, New York 10105

BY

AB Income Fund

a series of AB Bond Fund, Inc.

1345 Avenue of the Americas

New York, New York l0105

(800) 221-5672

This Combined Proxy Statement and Prospectus (the "Proxy Statement/Prospectus") is being sent to you in connection with the solicitation of proxies by the Board of Directors of AllianceBernstein Income Fund, Inc., a Maryland corporation (the "Acquired Fund"), for use at a Special Meeting of Shareholders (the "Meeting") of the Acquired Fund at 3:00 p.m. Eastern time at the principal executive offices of AllianceBernstein, L.P., the investment adviser to the Acquired Fund (the "Adviser"), located at 1345 Avenue of the Americas, New York, New York l0105, on February 1, 2016.

At the Meeting you will be asked to consider and vote upon the following proposal:

To approve an Agreement and Plan of Acquisition and Dissolution (the "Plan") providing for the acquisition of all of the assets of the Acquired Fund in exchange for shares of common stock of AB Income Fund (the "Acquiring Fund"), a series of AB Bond Fund, Inc. (the "Company"), a Maryland corporation and an open-end investment company, assumption by the Acquiring Fund of all of the liabilities of the Acquired Fund (the "Acquisition") and the dissolution of the Acquired Fund.

The Acquired Fund is a closed-end management investment company whose shares trade on the New York Stock Exchange (the "NYSE"). The Acquiring Fund is a newly created series of the Company, an open-end management investment company. Each of the Acquired Fund and the Company is an investment company registered with the Securities and Exchange Commission (the "SEC") and is organized as a Maryland corporation.

This Proxy Statement/Prospectus sets forth the basic information you should know before voting on the proposal to approve the Plan (the "Proposal"). You should read it and keep it for future reference. If the Proposal is approved, the Acquisition will be accomplished through the transfer of all of the assets of the Acquired Fund to the Acquiring Fund in exchange for Advisor Class shares of the Acquiring Fund, which will be distributed to shareholders of the Acquired Fund, and the assumption by the Acquiring Fund of the Acquired Fund's liabilities. The shares of the Acquiring Fund that an Acquired Fund shareholder receives will have a total net asset value ("NAV") equal to the NAV of shares held by the shareholder in the Acquired Fund as of the time that the shares of the Acquired Fund and Acquiring Fund (each, a "Fund" and together, the "Funds") are valued for determining NAV for the Acquisition (4:00 p.m. Eastern time, on the day before the date of the closing of the Acquisition (the "Closing Date"), or such other date and time as may be agreed upon by the parties to the Plan (the "Valuation Time")). Because Acquired Fund shareholders will receive Acquiring Fund shares, this Prospectus/Proxy Statement also serves as a prospectus for the offering of Advisor Class shares of the Acquiring Fund in connection with the Acquisition. The Acquired Fund expects that this Proxy Statement/Prospectus will be mailed to shareholders on or about November 12, 2015.

Additional information relating to the Funds and this Proxy Statement/Prospectus is set forth in the Statement of Additional Information to this Proxy Statement/Prospectus dated November 11, 2015 (the "Acquisition SAI"), which is incorporated herein by reference. Additional information about the Funds has been filed with the SEC and is available upon request and without charge by writing to the applicable Fund or by calling (800) 221-5672. In addition, shares of the Acquired Fund are listed on the NYSE, and reports, proxy statements and other information concerning the Acquired Fund may be inspected at the NYSE.

Important Notice Regarding Availability of Proxy Materials for the Meeting to Be Held on February 1, 2016. The Proxy Statement is available on the Internet at www.abglobal.com/abfundsproxy.

| THE SECURITIES AND EXCHANGE COMMISSION ("SEC") HAS NOT APPROVED OR DISAPPROVED THESE SECURITIES NOR HAS IT PASSED ON THE ACCURACY OR ADEQUACY OF THIS PROXY STATEMENT/PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE. |

TABLE OF CONTENTS

| | Page |

| | |

PROPOSAL: APPROVAL OF AN AGREEMENT AND PLAN OF ACQUISITION AND DISSOLUTION | 5 |

| SUMMARY | 6 |

| COMPARISON OF INVESTMENT ADVISORY FEES | 6 |

| COMPARISON OF EXPENSES | 6 |

| COMPARISON OF INVESTMENT OBJECTIVES AND PRINCIPAL INVESTMENT STRATEGIES | 9 |

| RISKS RELATING TO DIFFERENCES IN PORTFOLIO MANAGEMENT | 10 |

| FEDERAL INCOME TAX CONSEQUENCES | 10 |

| COMPARISON OF FUND SHARES | 10 |

| COMPARISON OF PURCHASE AND REDEMPTION PROCEDURES | 10 |

| SERVICE PROVIDERS | 11 |

| COMPARISON OF BUSINESS STRUCTURES | 11 |

| PRINCIPAL RISKS | 11 |

| INFORMATION ABOUT THE ACQUISITION | 12 |

| INTRODUCTION | 12 |

| DESCRIPTION OF THE PLAN | 12 |

| REASONS FOR THE ACQUISITION | 13 |

| BOARD CONSIDERATION OF THE PLAN AND ACQUISITION | 14 |

| DESCRIPTION OF THE SECURITIES TO BE ISSUED | 17 |

| DIVIDENDS AND OTHER DISTRIBUTIONS | 17 |

| SHARE CERTIFICATES | 18 |

| FEDERAL INCOME TAX CONSEQUENCES | 18 |

| CAPITALIZATION INFORMATION | 18 |

| INFORMATION ABOUT THE FUNDS | 18 |

| MANAGEMENT OF THE FUNDS | 19 |

| ADVISORY AGREEMENTS AND FEES | 20 |

| ACQUIRING FUND DISTRIBUTION ARRANGEMENTS | 21 |

| ADMINISTRATIVE AND TRANSFER AGENCY ARRANGEMENTS | 21 |

| VOTING INFORMATION | 21 |

| LEGAL MATTERS | 22 |

| FINANCIAL HIGHLIGHTS | 22 |

| INFORMATION FILED WITH THE SEC | 23 |

| Appendix A: FORM OF AGREEMENT AND PLAN OF ACQUISITION AND DISSOLUTION | A-1 |

| Appendix B: FUND PERFORMANCE | B-1 |

| Appendix C: COMPARISON OF INVESTMENT OBJECTIVES AND POLICIES | C-1 |

Appendix D:CERTAIN INFORMATION APPLICABLE TO SHARES OF THE ACQUIRING FUND | D-1 |

Appendix E: COMPARISON OF BUSINESS STRUCTURE AND ORGANIZATION | E-1 |

Appendix F: CAPITALIZATION | F-1 |

Appendix G: SHARE OWNERSHIP INFORMATION | G-1 |

PROPOSAL

APPROVAL OF AN AGREEMENT AND PLAN OF ACQUISITION AND DISSOLUTION

The Board of Directors (the "Board" or the "Directors") of the Acquired Fund approved the Plan at a meeting of the Board held on August 4-5, 2015. Subject to the approval of the shareholders of the Acquired Fund, the Plan provides for:

| · | the transfer of all of the assets of the Acquired Fund to the Acquiring Fund in exchange for Advisor Class shares of the Acquiring Fund and the assumption by the Acquiring Fund of all of the liabilities of the Acquired Fund; |

| · | the distribution of Advisor Class shares of the Acquiring Fund to the shareholders of the Acquired Fund; and |

| · | the liquidation and dissolution of the Acquired Fund. |

Each shareholder of the Acquired Fund will become the owner of the number of full and fractional Advisor Class shares of the Acquiring Fund having an NAV equal to the aggregate NAV of the shareholder's Acquired Fund shares as of the Valuation Time. It is expected that shareholders of the Acquired Fund will recognize no gain or loss for federal income tax purposes in connection with the Acquisition. If approved by the shareholders of the Acquired Fund at the Meeting, the Acquisition is expected to occur in the first quarter of 2016.

The shareholders of the Acquired Fund must approve the Proposal in order for the Acquisition to occur. Approval of the Proposal requires the affirmative vote of the holders of two-thirds of the votes entitled to be cast by the shareholders of the Acquired Fund. The Acquisition does not require approval of the shareholders of the Acquiring Fund.

A quorum for the transaction of business by shareholders of the Acquired Fund at the Meeting will consist of the presence in person or by proxy of the holders of a majority of the total outstanding shares of the Acquired Fund entitled to vote at the Meeting.

Based on its consideration of, among other factors, the benefits expected to be received by shareholders of the Acquired Fund in becoming shareholders of the Acquiring Fund, the Directors of the Acquired Fund concluded that the Acquisition is in the best interests of the Acquired Fund. In reaching this conclusion, the Directors considered that: the Acquired Fund's shareholders recently approved a shareholder proposal indicating significant support for providing shareholders with liquidity at NAV; the Acquiring Fund, as an open-end fund rather than a closed-end fund with a charter provision mandating submission to shareholders of an open-ending proposal when certain conditions are met, would not be subject to the tactics of activists that have been, and could continue to be, costly to the Acquired Fund; the investment objective of the Acquiring Fund is the same as that of the Acquired Fund; the most significant difference between the Acquired Fund and the Acquiring Fund is that the Acquiring Fund invests at least 65% of its total assets in U.S. and foreign government securities (and repurchase agreements relating to U.S. Government securities) whereas the Acquired Fund invests at least 65% of its total assets in U.S. government securities (and repurchase agreements relating to U.S. Government securities); the advisory fee arrangements differ, including that the advisory fee rate for the Acquiring Fund would be higher than the current fee rate for the Acquired Fund due to the current very low interest rate environment; for an initial two-year period beginning with the Acquiring Fund's commencement of operations, the expenses (after fee waiver and/or reimbursement) of Advisor Class shares of the Acquiring Fund will be comparable to but higher than those of the Acquired Fund; the similarities and differences between the investment policies and strategies of the Acquiring Fund and the Acquired Fund, and related risks; the different advisory fee arrangements of the Acquiring Fund and the Acquired Fund; and the Adviser and portfolio managers of the Acquired Fund are the same as those of the Acquiring Fund.

Shares of the Acquired Fund are listed on the NYSE and traded in the secondary market, and are bought and sold through financial intermediaries at prevailing market prices, which may be equal to, higher or lower than their NAV. In contrast, the Acquiring Fund issues and redeems Acquiring Fund shares at prices based on their NAV. The Acquiring Fund's NAV is calculated on any day the NYSE is open at the close of regular trading (ordinarily, 4:00 p.m., Eastern time, but sometimes earlier, as in the case of scheduled half-day trading or unscheduled suspensions of trading). To calculate the Acquiring Fund's NAV per share, the Acquiring Fund's assets are valued and totaled, liabilities are subtracted, and the balance, called net assets, is divided by the number of shares outstanding. The Acquiring Fund values its securities at their current market value determined on the basis of market quotations or, if market quotations are not readily available or are unreliable, at "fair value" as determined in accordance with procedures established by and under the general supervision of the Directors. When the Acquiring Fund uses fair value pricing, it may take into account any factors it deems appropriate. The Acquiring Fund may determine fair value based upon developments related to a specific security, current valuations of foreign stock indices (as reflected in U.S. futures markets) and/or U.S. sector or broader stock market indices.

The Directors unanimously recommend that shareholders of the Acquired Fund vote "FOR" the Plan.

For a more complete discussion of the factors considered by the Directors in approving the Acquisition, see "Information about the Acquisition - Reasons for the Acquisition."

SUMMARY

The following summary highlights differences between the Funds. This summary is not complete and does not contain all of the information that you should consider before voting on the Plan. This Summary is qualified in its entirety by reference to the additional information contained elsewhere in this Proxy Statement/Prospectus and the Plan, a form of which is attached to this Proxy Statement/Prospectus as Appendix A. Shareholders of the Acquired Fund should read this entire Proxy Statement/Prospectus carefully. For additional information about the Acquiring Fund, please read the prospectus of the Acquiring Fund. This Proxy Statement/Prospectus, the accompanying Notice of the Special Meeting of Shareholders and the enclosed Proxy Card are being mailed to shareholders of the Acquired Fund on or about November 12, 2015.

The Acquired Fund, a closed-end management investment company whose shares trade on the NYSE, is organized as a Maryland corporation. The Acquiring Fund is a newly created series of the Company, an open-end management investment company that is organized as a Maryland corporation. The investment objective of each of the Acquired Fund and the Acquiring Fund is high current income consistent with preservation of capital. Each of the Acquired Fund and the Acquiring Fund is a diversified investment company.

The Acquired Fund will be the accounting survivor of the Acquisition and the Acquiring Fund will carry over the performance record of the Acquired Fund. Performance information of the Acquired Fund is included in Appendix B.

Comparison of Investment Advisory Fees

The investment advisory fee of the Acquired Fund consists of a base fee of 0.30% of the first $250 million of the Fund's average weekly net assets and 0.25% of average weekly net assets in excess of $250 million plus an income component of 4.75% of the Fund's daily gross income (i.e., income other than gains from the sale of securities or gains realized from options, futures and swaps, less interest on money borrowed by the Fund). The Acquired Fund's advisory fee may not exceed 0.80% of the Acquired Fund's average weekly net assets during any month. The current advisory fee, as of August 31, 2015, is 0.49%, which, due to current low interest rates, is lower than the 10-year average effective rate of 0.58%. Because the Acquiring Fund is an open-end fund, instituting a similar income-based fee for the Acquiring Fund would present a marketing impediment for a number of the Adviser's distribution partners. The Acquiring Fund has instead an asset-based fee, typical for open-end funds, at the annualized rate of 0.60% of the first $2.5 billion of the Acquiring Fund's average daily net assets; 0.55% of the excess of $2.5 billion up to $5 billion; and 0.50% of the excess over $5 billion, which fee will accrue daily and be paid monthly. The advisory fee rate is higher than the advisory fee rate of the Acquired Fund due to the current historically low interest rate environment, although it is lower than the fee rate paid by the Acquired Fund in most prior periods. The Acquired Fund and the Acquiring Fund reimburse the Adviser for the costs of providing administrative and accounting services to the Funds.

Comparison of Expenses

The Acquiring Fund is expected to have, at least initially, significantly higher gross expenses than the Acquired Fund. At current net asset levels, the Acquiring Fund's gross expenses for Advisor Class shares are estimated to be 0.76% as compared to expenses of the Acquired Fund of 0.56% as of August 31, 2015 (both exclusive of interest expense). Gross expenses for the Acquiring Fund are estimated at 0.78% with a 25% reduction in net assets, 0.82% with a 50% reduction in assets; and 0.93% with a 75% reduction in net assets (in each case exclusive of interest expense, and calculated by reducing current net asset levels by 25%, 50% and 75%, respectively, and dividing these amounts by the applicable estimated expenses of the Acquiring Fund). The Acquisition is likely to result in an increase in the total expenses of the Fund because substantial redemptions typically accompany the reorganization of a closed-end fund into an open-end fund with a corresponding decrease in fund assets and increase in expenses, at least over the short-term. The Adviser expects these redemptions to be partially offset over the medium- to longer-term by increased sales of Acquiring Fund shares, although there can be no assurances that the Acquiring Fund will be successful in making sales sufficient to offset the expected redemptions. Higher expenses also result from the increased costs of operating an open-end fund. For example, open-end funds are typically subject to higher transfer agency and shareholder servicing costs and expenses than closed-end funds, and this would be the case for the Acquiring Fund. Higher expenses may result in the Acquiring Fund paying lower dividends than the Acquired Fund currently pays.

To address the anticipated higher expenses of the Acquiring Fund, the Adviser has agreed to implement fee waivers and/or expense reimbursements for the Acquiring Fund to the extent necessary to limit total fund operating expenses of Advisor Class shares, which shareholders of the Acquired Fund will receive in the Acquisition, to 0.63% of the Acquiring Fund's average daily net assets. This fee waiver/expense limitation agreement will continue in effect initially for two years beginning with the Acquiring Fund's commencement of operations. As a result of this undertaking, the net fund operating expenses for Advisor Class shares of the Acquiring Fund are expected to be approximately 7 basis points higher than the total fund operating expenses for shares of the Acquired Fund as of August 31, 2015, but materially lower than they would be without the expense limitation. The total fund operating expenses to which the fee waiver/expense limitation agreement applies do not include acquired fund fees and expenses (other than the advisory fees of any AB Mutual Funds in which the Acquiring Fund may invest), interest expense, taxes, extraordinary expenses, and brokerage commissions and other transaction costs ("excluded expenses"). The estimated difference between the net fund operating expenses of the Acquiring Fund and the Acquired Fund could be greater than 7 basis points (based on Acquired Fund expenses as of August 31, 2015) if such excluded expenses are higher than anticipated. More detailed information about the Funds' fees is included in the tables below.

Fee Table

The purpose of the tables below is to assist an investor in understanding the various costs and expenses that a shareholder bears directly and indirectly from an investment in the Funds. The tables allow you to compare any sales charges and expenses of the Acquired Fund and (pro forma) estimates for the Acquiring Fund in its first year following the Acquisition. Under the Plan, shares of beneficial interest in the Acquired Fund will be reorganized into Advisor Class shares of the Acquiring Fund. The tables also include Annual Fund Operating Expenses and Expense Examples on a pro forma combined basis.

The Annual Fund Operating Expenses and Expense Example tables shown below are based on expenses as of the period ended December 31, 2014, for the Acquired Fund, and estimated expenses for the fiscal year ending October 31, 2016, for the Acquiring Fund. Pro forma numbers assume a 50% reduction in assets for the Acquiring Fund. Pro forma numbers are estimated in good faith and are hypothetical.

| Shareholder Fees (fees paid directly from your investment) |

| | Acquired Fund | Acquiring Fund – Advisor Class Shares |

| Maximum Sales Charge (Load) Imposed on Purchases |

N/A

| None |

| Maximum Deferred Sales Charge (Load) | N/A | None |

| Redemption fee if redeemed or exchanged within 90 days as of purchase (as a percentage of amount redeemed) |

N/A

| 0.75%* |

| Exchange Fee | N/A | None |

* In connection with the proposed Acquisition, Advisor Class shares issued to current Acquired Fund shareholders will be subject to a 0.75% redemption fee for the three-month period following the Closing Date.

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

| | | Acquired Fund | | | Acquiring Fund – Advisor Class (pro forma) | |

| Management Fees | | | 0.52 | % | | | 0.60 | %* |

| Distribution and/or Service (12b-1) Fees | | | N/A | | | None | |

| | | | | | | | | |

| Other Expenses: | | | | | | | | |

| Transfer Agent | | | 0.01 | % | | | 0.10 | % |

| Interest Expenses | | | 0.06 | % | | | 0.11 | % |

Other Expenses(a) | | | 0.08 | % | | | 0.12 | % |

| Total Other Expenses | | | 0.15 | % | | | 0.33 | % |

| Total Annual Fund Operating Expenses (Including Interest Expense) Before Waiver, If Applicable | | | 0.67 | % | | | 0.93 | % |

| Fee Waiver and/or Expense Reimbursement | | | N/A | | | | (0.19 | )%(b) |

Total Annual Fund Operating Expenses (Including Interest Expense) After Fee Waiver and/or Expense Reimbursement, If Applicable(c) | | | 0.67 | % | | | 0.74 | % |

| * | The advisory fee of the Acquiring Fund is equal to an annualized rate of 0.60% of the first $2.5 billion of the Acquiring Fund's average daily net assets; 0.55% of the excess of $2.5 billion up to $5 billion; and 0.50% of the excess over $5 billion. |

| (a) | Other expenses do not include the projected costs and expenses of the Acquisition. The basis point impact of such costs and expenses is approximately 3 basis points. |

| (b) | The Adviser has contractually agreed to waive its investment advisory fees and/or to bear expenses of the Acquiring Fund for a two-year period beginning with the Acquiring Fund's commencement of operations to the extent necessary to prevent total operating expenses (excluding acquired fund fees and expenses other than the advisory fees of any AB Mutual Funds in which the Fund may invest, interest expense, taxes, extraordinary expenses, and brokerage commissions and other transaction costs), on an annual basis, from exceeding 0.63% of the average daily net assets for Advisor Class shares. Any fees waived and expenses borne by the Adviser may be reimbursed by the Fund until the end of the third fiscal year after the fiscal period in which the fee was waived or the expense was borne, provided that no reimbursement payment will be made that would cause the Fund's Total Annual Fund Operating Expenses to exceed the expense reimbursement. After the initial two-year term, the expense limitation agreement may continue in effect from year-to-year unless terminated by the Adviser 60 days prior to the end of its then-current term. |

| (c) | If interest expenses were excluded for the Acquired Fund and the Acquiring Fund, net expenses would be 0.61% and 0.63%, respectively. |

Examples

The following examples are intended to help you compare the costs of investing in each of the Acquired Fund and the Acquiring Fund. The examples assume that you invest $10,000 in each of the Acquired Fund and the Acquiring Fund after the Acquisition for the time periods indicated. The examples also assume that your investment has a 5% return each year, that all distributions are reinvested and that each Fund's operating expenses remain the same. The examples reflect the contractual fee waivers through the end of their respective terms. Your actual costs may be higher or lower.

| | | 1 Year | | | 3 Years | | | 5 Years | | | 10 Years | |

| Acquired Fund | | $ | 68 | | | $ | 214 | | | $ | 373 | | | $ | 835 | |

| Acquiring Fund – Advisor Class (pro forma) | | $ | 76 | | | $ | 257 | | | $ | 476 | | | $ | 1,105 | |

Portfolio Turnover

Each Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the examples, affect the Fund's performance. During its most recent fiscal year ended December 31, 2014, the Acquired Fund's portfolio turnover rate was 32% of the average value of its portfolio.

Comparison of Investment Objectives and Principal Investment Strategies

The Acquired Fund has the same investment objective as the Acquiring Fund. Like the Acquired Fund, the Acquiring Fund will normally invest at least 80% of its net assets in income-producing securities. The most significant difference between the Acquired Fund and the Acquiring Fund is that, while the Acquired Fund invests at least 65% of its total assets in securities issued by the U.S. government (and repurchase agreements relating to U.S. Government securities), the Acquiring Fund will invest at least 65% of its total assets in securities of U.S. and foreign governments (and repurchase agreements relating to U.S. Government securities). The Acquiring Fund will have an additional policy to invest at least 65% of its total assets in securities denominated in U.S. dollars.

The following table shows the investment objective and principal investment strategies of each Fund:

| | | AllianceBernstein Income Fund, Inc. (Acquired Fund) | | AB Income Fund (Acquiring Fund) |

| Investment Objective | | The investment objective of the Acquired Fund is high current income consistent with preservation of capital. | | The investment objective of the Acquiring Fund is high current income consistent with preservation of capital. |

| | | | | |

| | | | | |

| Principal Investment Strategies | | The Acquired Fund normally invests at least 80% of its net assets in income-producing securities. | | The Acquiring Fund invests, under normal circumstances, at least 80% of its net assets in income-producing securities. |

| | | The Acquired Fund normally invests at least 65% of its total assets in securities issued or guaranteed by the U.S. government, its agencies or instrumentalities ("U.S. Government Securities") (and repurchase agreements relating to U.S. Government securities). The Acquired Fund may also invest in other debt securities, including those of foreign governmental issuers. The Acquired Fund may invest up to 35% of its total assets in obligations issued or guaranteed by a foreign government or any of its political subdivisions, authorities, agencies, or instrumentalities ("Foreign Government Securities") of issuers considered stable by the Adviser. | | The Acquiring Fund normally invests at least 65% of its total assets in securities of U.S. and foreign governments, their agencies or instrumentalities (and repurchase agreements relating to U.S. Government Securities). The Acquiring Fund's investments in foreign securities may include investments in securities of emerging markets countries or issuers in emerging markets. The Acquiring Fund invests at least 65% of its total assets in U.S. dollar denominated securities. |

| | | The Fund may also invest up to 35% of its total assets in other fixed-income securities, corporate debt securities, certificates of deposit, bankers' acceptances and interest bearing savings deposits of banks and commercial paper. | | The Acquiring Fund may also invest up to 35% of its total assets in non-government fixed-income securities, including corporate debt securities, non-government mortgage-backed and other asset-backed securities, certificates of deposit and commercial paper. |

| | | The Acquired Fund may invest up to 35% of its net assets in securities rated below Baa by Moody's Investor Service, Inc. ("Moody's") or below BBB by S&P Rating Services ("S&P") or, if not rated, of comparable investment quality as determined by the Adviser. | | The Acquiring Fund may invest up to 35% of its net assets in below investment grade securities (commonly known as "junk bonds"). |

| | | The Acquired Fund will not invest 25% or more of its total assets in the Foreign Government Securities of any one country. | | The Acquiring Fund will not invest more than 25% of its total assets in securities of issuers in any one country outside of the U.S. |

| | | The Acquired Fund utilizes certain other investment techniques, including options, futures, forwards and swaps, intended to enhance income and reduce market risk. | | In an effort to enhance income and reduce market risk, the Acquiring Fund expects to invest in derivatives, such as options, futures contracts, forwards and swaps. The Acquiring Fund may also enter into transactions, such as reverse repurchase agreements, that are similar to borrowings for investment purposes. |

Additional information about the Funds' investment objectives, strategies and policies is contained in Appendix C.

Fundamental and Non-Fundamental Policies. Fundamental policies are policies that, under the Investment Company Act of 1940, as amended (the "1940 Act"), may not be changed without a shareholder vote. The Acquired Fund's investment objective is a fundamental policy that may not be changed without a shareholder vote, while the Acquiring Fund's investment objective is not a fundamental policy. The Acquired Fund's policy to invest at least 65% of its total assets in U.S. Government Securities (and repurchase agreements relating to U.S. Government Securities) is a fundamental policy, whereas the Acquiring Fund's policy to invest at least 65% of its total assets in U.S. or foreign government securities (and repurchase agreements relating to U.S. Government Securities) is not a fundamental policy. Classifying the Acquiring Fund's investment objective and policy as non-fundamental will give the Directors more flexibility to respond to changed market conditions or other circumstances in a timely manner without the delay and expense of obtaining a shareholder vote.

Please refer to Appendix C for additional information about the fundamental and non-fundamental policies of the Acquired Fund and the Acquiring Fund.

Risks Relating to Differences in Portfolio Management

As described above, although the Funds' respective investment objectives are the same, the Acquiring Fund will be managed differently than the Acquired Fund is currently managed. These differences could have a potentially adverse impact on the yield and performance of the Acquiring Fund as compared to the Acquired Fund. For example, the Acquiring Fund will not be able to employ leverage to the same extent as the Acquired Fund, and the use of leverage has historically contributed positively to the Acquired Fund's net income per share. Limitations on the use of leverage could cause the Acquiring Fund's yield to be lower than the Acquired Fund's current yield. In addition, as an open-end fund, the Acquiring Fund will normally be required to maintain a larger cash position than the Acquired Fund currently maintains in order to meet potential redemptions expected to occur after the Acquisition and on an ongoing basis and, in the event cash on hand is insufficient to satisfy redemption requests, the Acquiring Fund may be required to liquidate securities in order to meet such requests. While the Acquiring Fund's positions in securities of U.S. and foreign governments will typically be liquid, liquidating certain of its other positions within a short period of time could pose challenges. Liquidating portfolio positions, particularly less liquid securities, at inopportune times could have significant adverse effects, depressing the prices received by the Acquiring Fund and the value of its remaining positions.

Federal Income Tax Consequences

The Funds expect that the Acquisition will constitute a "reorganization" within the meaning of Section 368 of the Internal Revenue Code of 1986, as amended (the "Code"), with substantially the following results: No gain or loss will be recognized by the Acquired Fund or its shareholders as a result of the Acquisition. The aggregate tax basis of the shares of the Acquiring Fund received by a shareholder of the Acquired Fund (including any fractional shares to which the shareholder may be entitled) will be the same as the aggregate tax basis of the shareholder's shares of the Acquired Fund. The holding period of the shares of the Acquiring Fund received by a shareholder of the Acquired Fund (including any fractional share to which the shareholder may be entitled) will include the holding period of the shares of the Acquired Fund held by the shareholder, provided that such shares are held as capital assets by the shareholder of the Acquired Fund at the time of the Acquisition. The holding period and tax basis of each asset of the Acquired Fund in the hands of the Acquiring Fund as a result of the Acquisition will generally be the same as the holding period and tax basis of each such asset in the hands of the Acquired Fund prior to the Acquisition. It is a condition to the closing of the Acquisition that both the Acquired Fund and Acquiring Fund receive an opinion of Seward & Kissel LLP confirming these consequences, as further discussed below under "Information About the Acquisition—Federal Income Tax Consequences." An opinion of counsel is not binding on the Internal Revenue Service.

Federal income tax law permits a regulated investment company to carry forward net capital losses that arose in tax years that began on or before December 22, 2010 ("Pre-2011 Losses") for a period of up to eight taxable years. Net capital losses that arise in tax years beginning after December 22, 2010 ("Post-2010 Losses") may generally be carried forward without limit and such carryforwards must be fully utilized before the regulated investment company is permitted to utilize carryforwards of Pre-2011 Losses. The Acquired Fund has no carryforwards of Pre-2011 Losses, and has $(16,955,334) of net short-term Post-2010 Loss carryforwards from the Fund's last fiscal year ended December 31, 2014. The Acquisition is not expected to affect the Acquiring Fund's ability to use capital loss carryforwards. The ability of the Acquiring Fund to use capital losses to offset gains (even in the absence of the Acquisition) also depends on factors other than loss limitations, such as the future realization of capital losses or gains.

Additional tax considerations are discussed under the section on "Federal Income Tax Consequences" in Information about the Acquisition.

Comparison of Fund Shares

The Acquired Fund offers one class of shares. In contrast, the Acquiring Fund will offer multiple share classes, which, in addition to Advisor Class shares, will include Class A and Class C shares (such other classes collectively, the "Additional Share Classes"). Information regarding the Additional Share Classes, including the expenses of the Additional Share Classes, is available in the Acquiring Fund's prospectus.

Comparison of Purchase and Redemption Procedures

As a result of the Acquisition, holders of Acquired Fund shares will receive Advisor Class shares of the Acquiring Fund. Because the Acquired Fund is a closed-end fund whose shares trade on the NYSE and the Acquiring Fund is an open-end fund, the distribution and purchase procedures of the Acquired Fund and the Advisor Class shares of the Acquiring Fund are different.

Buying and Redeeming Shares. The Acquired Fund does not redeem its outstanding shares or engage in the continuous sale of new securities. Rather, shares of the Acquired Fund are listed on the NYSE and traded in the secondary market, and are bought and sold through financial intermediaries at prevailing market prices, which may be equal to, higher or lower than their NAV. In contrast, the Acquiring Fund issues and redeems Acquiring Fund shares at prices based on their NAV (less any contingent deferred sales charge, and a 0.75% redemption fee on Advisor Class shares for the three-month period following the Closing Date) on each business day (i.e., any day on which the NYSE is open for trading), as described in the Acquiring Fund's prospectus. The Acquiring Fund has no minimum initial investment amount for Advisor Class shares.

Exchanging Shares. Shares of the Acquired Fund do not have any exchange rights. Acquiring Fund shareholders are entitled to exchange their Advisor Class shares for Advisor Class shares of other AB mutual funds of equivalent NAV (less a 0.75% redemption fee on Advisor Class shares of the Acquiring Fund exchanged during the three-month period following the Closing Date) without sales or service charges.

Redemption Fee. Closed-end funds that reorganize into open-end funds are typically subject to substantial redemptions, and temporary redemption fees may be imposed in such situations. Advisor Class shares redeemed or exchanged for the Advisor Class shares of other AB mutual funds will be subject to a redemption fee of 0.75% for the three-month period following the Closing Date. The imposition of the redemption fee is intended to help the Acquiring Fund defray the transaction costs it might incur in response to redemption requests. It is expected that the redemption fee would serve to, among other things, offset some of the direct and indirect costs associated with the Acquisition, including any costs of liquidating portfolio positions, and as an anti-dilution measure to benefit remaining shareholders.

More information on distribution, purchase and redemption procedures of the Acquiring Fund is provided in Appendix D.

Service Providers

The Funds are serviced by many of the same service providers. The Adviser is the investment adviser to each Fund, State Street Bank and Trust Company is the custodian for each Fund and Ernst & Young LLP is the independent registered public accounting firm for each Fund. However, there are some differences in service providers, in part due to the fact that the Acquired Fund is a NYSE-listed closed-end fund and the Acquiring Fund is an open-end fund. Computershare Trust Company, N.A. ("Computershare") is the dividend paying agent, transfer agent and registrar for the Acquired Fund, and AllianceBernstein Investor Services, Inc. ("ABIS"), which is an affiliate of the Adviser, is the transfer agent for the Acquiring Fund and receives a fee for providing shareholder services to the Acquiring Fund. ABIS currently provides phone inquiry services to the Acquired Fund pursuant to a Shareholder Inquiry Agency Agreement between ABIS and the Acquired Fund. In addition, AllianceBernstein Investments, Inc. ("ABI" or the "Distributor"), the Company's principal underwriter, is the distributor of the Acquiring Fund's shares.

Comparison of Business Structures

As described above, the Acquired Fund is a closed-end management investment company organized as a Maryland corporation governed by its Charter, Bylaws and Maryland law. The Acquiring Fund is a newly created series of the Company, an open-end management investment company organized as a Maryland corporation, which is governed by its Charter, Bylaws and Maryland law. For more information on the comparison of the business structures of the Funds, see Appendix E.

PRINCIPAL RISKS

The principal risks of the Acquiring Fund are similar to those of the Acquired Fund. Risks include market risk, credit risk, interest rate risk, foreign (non-U.S.) risk, emerging market risk, derivatives risk, leveraging risk, currency risk, duration risk, mortgage-backed and/or other asset-backed securities risk, below investment grade securities risk, liquidity risk and management risk. As noted above, the Acquired Fund normally invests at least 65% of its total assets in U.S. Government Securities (and repurchase agreements relating to U.S. Government Securities), whereas the Acquiring Fund normally invests at least 65% of its total assets in securities of both U.S. and foreign governments (and repurchase agreements relating to U.S. Government Securities). To the extent that the Acquiring Fund invests more of its assets in the securities of foreign governments and issuers in emerging markets, as it is expected to do, it will be subject to, among other risks associated with such investments, greater foreign (non-U.S.) securities risk and emerging market risk than those of securities of developed markets issuers. To limit these risks, the Acquiring Fund will be limited to investing at least 65% of its total assets in securities denominated in U.S. dollars. Such securities have historically tended to be of better quality and liquidity than securities denominated in most non-U.S. currencies. In addition, securities denominated in U.S. dollars do not have the currency risk associated with securities denominated in non-U.S. currencies.

The principal risks of investing in the Acquired Fund and the Acquiring Fund are described below. Each of the Acquired Fund and the Acquiring Fund could become subject to additional risks because the types of investments made by each Fund can change over time.

Principal Risks of both the Acquired Fund and Acquiring Fund

Interest Rate Risk. Interest rate risk is the risk that changes in interest rates will affect the value of the Fund's investments in fixed income securities. Increases in interest rates may cause the value of the Fund's investments to decline.

Foreign (Non-U.S.) Risk. Foreign risk is the risk that investments in issuers located in foreign countries may have greater price volatility and less liquidity. Foreign markets can be more volatile than the U.S. market due to increased risks of adverse issuer, political, regulatory, market or economic developments. The Acquiring Fund may be subject to greater foreign risk than the Acquired Fund, as the Acquiring Fund is permitted to invest a greater percentage of its total assets in the securities of foreign governments, their agencies and instrumentalities than the Acquired Fund.

Emerging Market Risk. Investment in emerging market securities involves a greater degree of risk than investment in securities of issuers based in developed countries. Among other things, emerging market securities investments may carry the risks of less publicly available information, more volatile markets, less strict securities market regulation, less favorable tax provisions, and a greater likelihood of severe inflation, unstable currency, war and expropriation of personal property than investments in securities of issuers based in developed countries.

Credit Risk. Credit risk is the risk that the issuer or the guarantor of a debt security or the counterparty to a derivatives contract will be unable or unwilling to make timely payments of interest or principal or to otherwise honor its obligations.

Market Risk. Market risk is the risk that the value of the Fund's investments will fluctuate as the bond markets fluctuate and that prices overall will decline over shorter or longer-term periods.

Derivatives Risk. Derivatives may be illiquid, difficult to price, and leveraged so that small changes may produce disproportionate losses for the Fund, and may be subject to counterparty risk to a greater degree than more traditional investments.

Leveraging Risk. Because the Fund may use derivative strategies and other leveraging techniques speculatively to enhance returns, it is subject to greater risk and its returns may be more volatile than other funds, particularly in periods of market declines.

Currency Risk. Currency risk is the risk that fluctuations in the exchange rates between the U.S. dollar and foreign currencies could negatively affect the value of the Fund's investments.

Below Investment Grade Risk. Investments in fixed-income securities with lower ratings (often referred to as "junk bonds") are subject to a higher probability that an issuer will default or fail to meet its payment obligations. These securities may be subject to greater price volatility, due to such factors as specific corporate developments, negative perception of the junk bond market generally and less secondary market liquidity.

Duration Risk. Duration is a measure that relates the expected price volatility of a fixed-income security to changes in interest rates. The duration of a fixed-income security may be shorter than or equal to full maturity of a fixed-income security. Fixed-income securities with longer durations have more risk and will decrease in price as interest rates rise.

Liquidity Risk. Liquidity risk exists when particular investments are difficult to purchase or sell, possibly preventing the Fund from selling out of these illiquid securities at an advantageous price. The Fund may be subject to liquidity risk because derivatives and securities involving substantial interest rate and credit risk tend to involve greater liquidity risk.

Mortgage-Backed and/or Other Asset-Backed Securities Risk. Investments in mortgage-backed and other asset-backed securities are subject to certain additional risks. The value of these securities may be particularly sensitive to changes in interest rates. These risks include "extension risk", which is the risk that, in periods of rising interest rates, issuers may delay the payment of principal, and "prepayment risk", which is the risk that in periods of falling interest rates, issuers may pay principal sooner than expected, exposing the Fund to a lower rate of return upon reinvestment of principal. Mortgage-backed securities offered by non-governmental issuers and other asset-backed securities may be subject to other risks, such as higher rates of default in the mortgages or assets backing the securities or risks associated with the nature and servicing of mortgages or assets backing the securities.

Management Risk. The Fund is subject to management risk because it is an actively managed investment fund. There can be no guarantee that the Adviser's investment decisions will produce desired results.

Additional Principal Risks of the Acquired Fund

Trading Discount. The shares of the Acquired Fund, a closed-end management investment company, trade at a discount to NAV (i.e., the market price per share is less than the NAV per share).

Additional Principal Risks of the Acquiring Fund

Inflation Risk. This is the risk that the value of assets or income from investments will be less in the future as inflation decreases the value of money. As inflation increases, the value of the Fund's assets can decline as can the value of the Fund's distributions. This risk is significantly greater for fixed-income securities with longer maturities.

INFORMATION ABOUT THE ACQUISITION

Introduction

This Proxy Statement/Prospectus is provided to you to solicit your proxy for exercise at the Meeting to approve the Acquisition. The Meeting will be held at 1345 Avenue of the Americas, New York, New York 10105 at 3:00 p.m., Eastern time, on February 1, 2016. This Proxy Statement/Prospectus, the accompanying Notice of Special Meeting of Shareholders and the enclosed Proxy Card are being mailed to shareholders of the Acquired Fund on or about November 12, 2015.

Description of the Plan

As provided in the Plan, the Acquired Fund will transfer all of its assets to the Acquiring Fund, and in exchange, the Acquiring Fund will assume all the liabilities of the Acquired Fund and deliver to the Acquired Fund a number of Advisor Class shares of the Acquiring Fund having an aggregate NAV equal to the value of the assets of the Acquired Fund, less the value of the liabilities of the Acquired Fund assumed by the Acquiring Fund. The assets and liabilities of the Acquired Fund will be valued as of the Valuation Time. The Advisor Class shares of the Acquiring Fund will be delivered to the Acquired Fund on the next full business day following the Valuation Time (the "Exchange Date"). Immediately following the delivery of the Advisor Class shares to the Acquired Fund on the Exchange Date, the Acquired Fund will distribute pro rata to its shareholders of record as of the Valuation Time the Advisor Class shares received from the Acquiring Fund. The Advisor Class shares of the Acquiring Fund that an Acquired Fund shareholder receives will have a total NAV equal to the NAV of shares held by the shareholder in the Acquired Fund as of the Exchange Date.

The distribution of Advisor Class shares to Acquired Fund shareholders will be accomplished by the establishment of accounts on the share records of the Acquiring Fund in the name of such Acquired Fund shareholders, each account representing the respective number of Advisor Class shares due the respective shareholder. Certificates for Advisor Class shares will not be issued.

Following the distribution of Advisor Class shares of the Acquiring Fund in full liquidation of the Acquired Fund, the Acquired Fund will wind up its affairs, cease operations and dissolve as soon as is reasonably practicable after the Acquisition. If the shareholders do not approve the Plan, the Acquisition will not occur. The Adviser will continue as investment adviser to the Acquired Fund and the current service providers will continue to provide services to the Acquired Fund. The Directors of the Acquired Fund will consider options for the Acquired Fund, including continuing its operations as a closed-end investment company.

The Acquired Fund will bear the costs and expenses of the Acquisition (primarily legal, accounting, printing and proxy solicitation expenses, including the cost of the Proxy Solicitor's solicitation services), which are estimated to be approximately $600,000. Costs and expenses of the Acquisition ("Acquisition Costs") do not include the fees and expenses of counsel to the Directors who are not "interested persons" of the Acquired Fund or the Acquiring Fund ("Independent Directors"), and are estimated to be approximately $540,000. Any Acquisition Costs that exceed $540,000 will be paid by the Adviser.

Completion of the Acquisition is subject to certain conditions set forth in the Plan, including approval of the Acquisition by shareholders of the Acquired Fund. Assuming satisfaction of the conditions in the Plan, the Acquisition will be completed on the Closing Date, which is expected to be in the first quarter of 2016. However, any shareholder of the Acquired Fund may sell his or her shares prior to the Acquisition.