UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-02383

AB BOND FUND, INC.

(Exact name of registrant as specified in charter)

1345 Avenue of the Americas, New York, New York 10105

(Address of principal executive offices) (Zip code)

Stephen M. Woetzel

AllianceBernstein L.P.

1345 Avenue of the Americas

New York, New York 10105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 221-5672

Date of fiscal year end: October 31, 2023

Date of reporting period: October 31, 2023

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

OCT 10.31.23

ANNUAL REPORT

AB ALL MARKET REAL RETURN PORTFOLIO

| Investment Products Offered | • Are Not FDIC Insured • May Lose Value • Are Not Bank Guaranteed | |

Investors should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. For copies of our prospectus or summary prospectus, which contain this and other information, visit us online at www.abfunds.com or contact your AB representative. Please read the prospectus and/or summary prospectus carefully before investing.

This shareholder report must be preceded or accompanied by the Fund’s prospectus for individuals who are not current shareholders of the Fund.

You may obtain a description of the Fund’s proxy voting policies and procedures, and information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, without charge. Simply visit AB’s website at www.abfunds.com, or go to the Securities and Exchange Commission’s (the “Commission”) website at www.sec.gov, or call AB at (800) 227 4618.

The Fund files its complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT reports are available on the Commission’s website at www.sec.gov. AB publishes full portfolio holdings for the Fund monthly at www.abfunds.com.

AllianceBernstein Investments, Inc. (ABI) is the distributor of the AB family of mutual funds. ABI is a member of FINRA and is an affiliate of AllianceBernstein L.P., the Adviser of the funds.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

| FROM THE PRESIDENT |  |

Dear Shareholder,

We’re pleased to provide this report for the AB All Market Real Return Portfolio (the “Fund”). Please review the discussion of Fund performance, the market conditions during the reporting period and the Fund’s investment strategy.

At AB, we’re striving to help our clients achieve better outcomes by:

| + | Fostering diverse perspectives that give us a distinctive approach to navigating global capital markets |

| + | Applying differentiated investment insights through a connected global research network |

| + | Embracing innovation to design better ways to invest and leading-edge mutual-fund solutions |

Whether you’re an individual investor or a multibillion-dollar institution, we’re putting our knowledge and experience to work for you every day.

For more information about AB’s comprehensive range of products and shareholder resources, please log on to www.abfunds.com.

Thank you for your investment in AB mutual funds—and for placing your trust in our firm.

Sincerely,

Onur Erzan

President and Chief Executive Officer, AB Mutual Funds

| abfunds.com | AB ALL MARKET REAL RETURN PORTFOLIO | 1 | |

ANNUAL REPORT

December 11, 2023

This report provides management’s discussion of fund performance for the AB All Market Real Return Portfolio for the annual reporting period ended October 31, 2023.

The Fund’s investment objective is to maximize real return over inflation.

NAV RETURNS AS OF October 31, 2023 (unaudited)

| 6 Months | 12 Months | |||||||

| AB ALL MARKET REAL RETURN PORTFOLIO | ||||||||

| Class 1 Shares1 | -4.90% | -1.36% | ||||||

| Class 2 Shares1 | -4.76% | -1.04% | ||||||

| Class A Shares | -4.90% | -1.37% | ||||||

| Class C Shares | -5.36% | -2.15% | ||||||

| Advisor Class Shares2 | -4.80% | -1.25% | ||||||

| Class R Shares2 | -5.10% | -1.77% | ||||||

| Class K Shares2 | -4.97% | -1.52% | ||||||

| Class I Shares2 | -4.75% | -1.09% | ||||||

| Class Z Shares2 | -4.74% | -1.08% | ||||||

| MSCI AC World Commodity Producers Index (net) | -2.67% | 2.78% | ||||||

| 1 | Class 1 shares are only available to Bernstein Global Wealth Management private client accounts. Class 2 shares are only available to the Adviser’s institutional clients or through other limited arrangements. |

| 2 | Please note that these share classes are for investors purchasing shares through accounts established under certain fee-based programs sponsored and maintained by certain broker-dealers and financial intermediaries, institutional pension plans and/or investment advisory clients of, and certain other persons associated with, the Adviser and its affiliates or the Fund. |

INVESTMENT RESULTS

The table above shows the Fund’s performance compared with its benchmark, the Morgan Stanley Capital International All Country (“MSCI AC”) World Commodity Producers Index (net), for the six- and 12-month periods ended October 31, 2023.

All share classes of the Fund underperformed the benchmark for both periods before sales charges. For the 12-month period, the strategic allocation detracted overall relative to the benchmark, as real estate, infrastructure, future natural resources and commodity futures underperformed commodity producers. This underperformance was partially offset by our strategic allocation to inflation-sensitive equities, which contributed. Security selection within commodity equities and real estate was positive, while selection within inflation-sensitive equities was negative. The Fund’s tactical

2 | AB ALL MARKET REAL RETURN PORTFOLIO | abfunds.com | |

underweight to future natural resources and the tactical management of commodity futures contributed, while our modest underweight to commodity producers detracted.

During the six-month period, the strategic allocation detracted overall, as real estate, infrastructure, and future natural resource equities underperformed commodity producers. Security selection within real estate and inflation-sensitive equities contributed. With respect to tactical asset allocation decisions, the Fund’s underweight allocation to real estate and infrastructure, as well as the overweight allocation to inflation-sensitive equities have been additive. In contrast, the Fund’s tactical management of commodity futures detracted.

The Fund used derivatives for hedging and investment purposes in the form of futures and total return swaps, which detracted from absolute returns for both periods, while currency forwards and inflation swaps added for both periods.

MARKET REVIEW AND INVESTMENT STRATEGY

Over the 12-month period ended October 31, 2023, both US and international stocks have risen, while emerging-market stocks have declined. Aggressive central bank tightening, led by the US Federal Reserve, pressured global equity markets. However, stocks rallied amid signs of easing inflation and as central banks began to pause rate hikes. The collapse of select US regional banks, China’s faltering economic recovery, and concerns over a broadening United Auto Workers strike and a looming US government shutdown later in the year weighed on results. Stronger-than-expected third-quarter economic growth supported the Fed’s commitment to higher-for-longer rates, which triggered a rapid rise in bond yields, especially the 10-year US Treasury note, which briefly crossed the 5% threshold for the first time in 16 years. Headwinds from higher Treasury yields, conflict in the Middle East, and mixed third-quarter earnings weighed on investor sentiment globally. Over the six-month period, US stocks rose, while international and emerging-market stocks declined. Global markets experienced bouts of volatility as central banks, led by the US Federal Reserve, paused rate hikes. China’s faltering economic recovery, concern over a broadening United Auto Workers strike, and the looming risk of a US government shutdown later in the year weighed on results. As the period ended, equity markets rallied, led by a rebound in technology shares and earnings surprises across a range of sectors in the US. Within large-cap markets, growth stocks, supported by the technology sector and artificial intelligence optimism, rose and significantly outperformed value stocks, which declined. Large-cap stocks rose and outperformed small-cap stocks, which declined, by a wide margin.

Inflation assets were broadly negative over both periods ended October 31, 2023. Real estate, as measured by the FTSE EPRA NAREIT Global Index, fell over both periods, as a result of headwinds related to

| abfunds.com | AB ALL MARKET REAL RETURN PORTFOLIO | 3 | |

concerns regarding a slowdown in growth amid restrictive monetary policy. Infrastructure was negative over both periods. Commodity futures fell over the 12-month period and have been flat over the six-month period despite episodic gains from OECD supply announcements and rising geopolitical risk in the middle east. Natural resources, particularly future natural resource stocks, were negative over both horizons. Several prominent companies experienced idiosyncratic issues along with broad concerns related to rising interest rates. Inflation swaps, while positive over the 12-month period, modestly detracted over the six-month period.

The Fund’s Senior Investment Management Team continues to look for sources of value via asset allocation shifts, active security selection, risk overlay strategies and currency management. The Fund uses a blend of quantitative and fundamental research in order to determine overall portfolio risk, allocate risk across major real asset classes and identify idiosyncratic opportunities.

INVESTMENT POLICIES

The Fund seeks to maximize real return. Real return is the rate of return after adjusting for inflation. The Fund pursues an aggressive investment strategy involving a variety of asset classes. The Fund invests primarily in instruments that the Adviser expects to outperform broad equity indices during periods of rising inflation. Under normal circumstances, the Fund expects to invest its assets principally in the following instruments that, in the judgment of the Adviser, are affected directly or indirectly by the level and change in rate of inflation: inflation-indexed fixed-income securities, such as Treasury Inflation-Protected Securities (“TIPS”) and similar bonds issued by governments outside of the United States; commodities; commodity-related equity securities; real estate equity securities; inflation-sensitive equity securities, which the Fund defines as equity securities of companies that the Adviser believes have the ability to pass along increasing costs to consumers and maintain or grow margins in rising inflation environments, including equity securities of utilities and infrastructure-related companies (“inflation-sensitive equities”); securities and derivatives linked to the price of other assets (such as commodities, stock indices and real estate); and currencies. The Fund expects its investments in fixed-income securities to have a broad range of maturities and quality levels.

The Fund seeks inflation protection from investments around the globe, both in developed- and emerging-market countries. In selecting securities for purchase and sale, the Adviser utilizes its qualitative and quantitative resources to determine overall inflation sensitivity, asset allocation and security selection. The Adviser assesses the securities’

(continued on next page)

4 | AB ALL MARKET REAL RETURN PORTFOLIO | abfunds.com | |

risks and inflation sensitivity as well as the securities’ impact on the overall risks and inflation sensitivity of the Fund. When its analysis indicates that changes are necessary, the Adviser intends to implement them through a combination of changes to underlying positions and the use of inflation swaps and other types of derivatives, such as interest rate swaps.

The Fund anticipates that its targeted investment mix, other than its investments in inflation-indexed fixed-income securities, will focus on commodity-related equity securities, commodities and commodity derivatives, real estate equity securities and inflation-sensitive equities to provide a balance between expected return and inflation protection. The Fund may vary its investment allocations among these asset classes, at times significantly. Its commodities investments will include significant exposure to energy commodities, but will also include agricultural products, and industrial and precious metals, such as gold. The Fund’s investments in real estate equity securities will include real estate investment trusts and other real estate-related securities.

The Fund invests in both US and non-US dollar-denominated equity or fixed-income securities. The Fund may invest in currencies for hedging or investment purposes, both in the spot market and through long or short positions in currency-related derivatives. The Fund does not ordinarily expect to hedge its foreign currency exposure because it will be balanced by investments in US dollar-denominated securities, although it may hedge the exposure under certain circumstances.

The Fund may enter into derivatives, such as options, futures contracts, forwards, swaps or structured notes, to a significant extent, subject to the limits of applicable law. The Fund intends to use leverage for investment purposes through the use of cash made available by derivatives transactions to make other investments in accordance with its investment policies. In determining when and to what extent to employ leverage or enter into derivatives transactions, the Adviser considers factors such as the relative risks and returns expected of potential investments and the cost of such transactions. The Adviser considers the impact of derivatives in making its assessments of the Fund’s risks. The resulting exposures to markets, sectors, issuers or specific securities will be continuously monitored by the Adviser.

The Fund may seek to gain exposure to physical commodities traded in the commodities markets through use of a variety of derivative instruments, including investments in commodity index-linked notes. The Adviser expects that the Fund will seek to gain exposure to commodities and commodity-related instruments and derivatives primarily through investments in AllianceBernstein Cayman Inflation

(continued on next page)

| abfunds.com | AB ALL MARKET REAL RETURN PORTFOLIO | 5 | |

Strategy, Ltd., a wholly owned subsidiary of the Fund organized under the laws of the Cayman Islands (the “Subsidiary”). The Subsidiary is advised by the Adviser and has the same investment objective and substantially similar investment policies and restrictions as the Fund except that the Subsidiary, unlike the Fund, may invest, without limitation, in commodities and commodity-related instruments. The Fund is subject to the risks associated with the commodities, derivatives and other instruments in which the Subsidiary invests, to the extent of its investment in the Subsidiary. The Fund limits its investment in the Subsidiary to no more than 25% of its net assets. Investment in the Subsidiary is expected to provide the Fund with commodity exposure within the limitations of federal tax requirements that apply to the Fund.

The Fund is “non-diversified”, which means that it may concentrate its assets in a smaller number of issuers than a diversified fund.

6 | AB ALL MARKET REAL RETURN PORTFOLIO | abfunds.com | |

DISCLOSURES AND RISKS

Benchmark Disclosure

The MSCI AC World Commodity Producers Index is unmanaged and does not reflect fees and expenses associated with the active management of a mutual fund portfolio. The MSCI AC World Commodity Producers Index is a free float-adjusted, market capitalization index designed to track the performance of global listed commodity producers, including emerging markets. Commodities sectors include: energy, grains, industrial metals, petroleum, precious metals and softs. MSCI makes no express or implied warranties or representations, and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices, any securities or financial products. This report is not approved, reviewed or produced by MSCI. Net returns include the reinvestment of dividends after deduction of non-US withholding tax. An investor cannot invest directly in an index, and its results are not indicative of the performance for any specific investment, including the Fund.

A Word About Risk

Market Risk: The value of the Fund’s assets will fluctuate as the stock, commodity and bond markets fluctuate. The value of the Fund’s investments may decline, sometimes rapidly and unpredictably, simply because of economic changes or other events, including public health crises (including the occurrence of a contagious disease or illness) and regional and global conflicts, that affect large portions of the market.

Credit Risk: An issuer or guarantor of a fixed-income security, or the counterparty to a derivatives or other contract, may be unable or unwilling to make timely payments of interest or principal, or to otherwise honor its obligations. The issuer or guarantor may default, causing a loss of the full principal amount of a security and accrued interest. The degree of risk for a particular security may be reflected in its credit rating. There is the possibility that the credit rating of a fixed-income security may be downgraded after purchase, which may adversely affect the value of the security. Investments in fixed-income securities with lower ratings tend to have a higher probability that an issuer will default or fail to meet its payment obligations.

Interest-Rate Risk: Changes in interest rates will affect the value of investments in fixed-income securities. When interest rates rise, the value of existing investments in fixed-income securities tends to fall and this decrease in value may not be offset by higher income from new investments. Interest-rate risk is generally greater for fixed-income securities with longer maturities or durations. The Fund may be subject to a greater risk of rising interest rates than would normally be the case due to the recent end of a period of historically low rates and the effect of potential central bank monetary policy, and government fiscal policy, initiatives and resulting market reactions to those initiatives.

| abfunds.com | AB ALL MARKET REAL RETURN PORTFOLIO | 7 | |

DISCLOSURES AND RISKS (continued)

Commodity Risk: Investing in commodities and commodity-linked derivative instruments, either directly or through the Subsidiary, may subject the Fund to greater volatility than investments in traditional securities. The value of commodity-linked derivative instruments may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or factors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs and international economic, political and regulatory developments.

Derivatives Risk: Derivatives may be difficult to price or unwind and leveraged so that small changes may produce disproportionate losses for the Fund. A short position in a derivative instrument involves the risk of a theoretically unlimited increase in the value of the underlying asset, which could cause the Fund to suffer a potentially unlimited loss. Derivatives, especially over-the-counter derivatives, are also subject to counterparty risk, which is the risk that the counterparty (the party on the other side of the transaction) on a derivative transaction will be unable or unwilling to honor its contractual obligations to the Fund.

Leverage Risk: To the extent the Fund uses leveraging techniques, its net asset value (“NAV”) may be more volatile because leverage tends to exaggerate the effect of changes in interest rates and any increase or decrease in the value of the Fund’s investments.

Inflation Risk: This is the risk that the value of assets or income from investments will be less in the future as inflation decreases the value of money. As inflation increases, the value of the Fund’s assets can decline as can the value of the Fund’s distributions. This risk is significantly greater for fixed-income securities with longer maturities.

Illiquid Investments Risk: Illiquid investments risk exists when certain investments are or become difficult to purchase or sell. Difficulty in selling such investments may result in sales at disadvantageous prices affecting the value of your investment in the Fund. Causes of illiquid investments risk may include low trading volumes and large positions. Foreign fixed-income securities may have more illiquid investments risk because secondary trading markets for these securities may be smaller and less well-developed and the securities may trade less frequently. Illiquid investments risk may be higher in a rising interest-rate environment, when the value and liquidity of fixed-income securities generally go down.

Foreign (Non-US) Risk: Investments in securities of non-US issuers may involve more risk than those of US issuers. These securities may fluctuate more widely in price and may be more difficult to trade due to adverse market, economic, political, regulatory or other factors.

8 | AB ALL MARKET REAL RETURN PORTFOLIO | abfunds.com | |

DISCLOSURES AND RISKS (continued)

Currency Risk: Fluctuations in currency exchange rates may negatively affect the value of the Fund’s investments or reduce its returns.

Subsidiary Risk: By investing in the Subsidiary, the Fund is indirectly exposed to the risks associated with the Subsidiary’s investments. The derivatives and other investments held by the Subsidiary are generally similar to those that are permitted to be held by the Fund and are subject to the same risks that apply to similar investments if held directly by the Fund. The Subsidiary is not registered under the Investment Company Act of 1940, as amended (the “1940 Act”), and, unless otherwise noted in the Fund’s prospectus, is not subject to all of the investor protections of the 1940 Act. However, the Fund wholly owns and controls the Subsidiary, and the Fund and the Subsidiary are managed by the Adviser, making it unlikely the Subsidiary will take actions contrary to the interests of the Fund or its shareholders.

Real Estate Risk: The Fund’s investments in real estate securities have many of the same risks as direct ownership of real estate, including the risk that the value of real estate could decline due to a variety of factors that affect the real estate market generally. Investments in REITs may have additional risks. REITs are dependent on the capability of their managers, may have limited diversification, and could be significantly affected by changes in taxes.

Non-Diversification Risk: The Fund may have more risk because it is “non-diversified”, meaning that it can invest more of its assets in a smaller number of issuers. Accordingly, changes in the value of a single security may have a more significant effect, either negative or positive, on the Fund’s NAV.

Management Risk: The Fund is subject to management risk because it is an actively managed investment fund. The Adviser will apply its investment techniques and risk analyses in making investment decisions, but there is no guarantee that its techniques will produce the intended results. Some of these techniques may incorporate, or rely upon, quantitative models, but there is no guarantee that these models will generate accurate forecasts, reduce risk or otherwise perform as expected.

These risks are fully discussed in the Fund’s prospectus. As with all investments, you may lose money by investing in the Fund.

An Important Note About Historical Performance

The investment return and principal value of an investment in the Fund will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Performance shown in this report represents past performance and does not guarantee future

| abfunds.com | AB ALL MARKET REAL RETURN PORTFOLIO | 9 | |

DISCLOSURES AND RISKS (continued)

results. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by visiting www.abfunds.com. For Class 1 shares, go to www.bernstein.com and click on “Investments”, found in the footer, then “Mutual Fund Information—Mutual Fund Performance at a Glance.”

Investors should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. For copies of our prospectus or summary prospectus, which contain this and other information, visit us online at www.abfunds.com. For Class 1 shares, go to www.bernstein.com, click on “Investments”, found in the footer, then “Mutual Fund Information—Prospectuses, SAIs and Shareholder Reports.” Please read the prospectus and/or summary prospectus carefully before investing.

All fees and expenses related to the operation of the Fund have been deducted. NAV returns do not reflect sales charges; if sales charges were reflected, the Fund’s quoted performance would be lower. SEC returns reflect the applicable sales charges for each share class: a 4.25% maximum front-end sales charge for Class A shares and a 1% 1-year contingent deferred sales charge for Class C shares. Returns for the different share classes will vary due to different expenses associated with each class. Performance assumes reinvestment of distributions and does not account for taxes.

10 | AB ALL MARKET REAL RETURN PORTFOLIO | abfunds.com | |

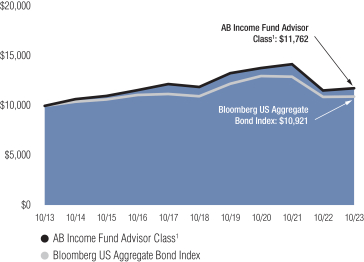

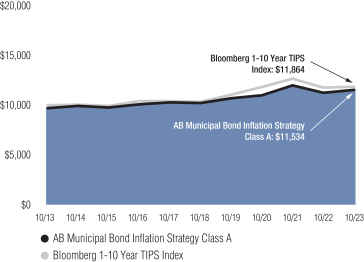

HISTORICAL PERFORMANCE

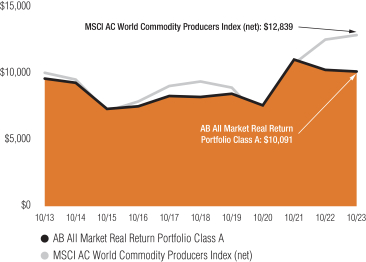

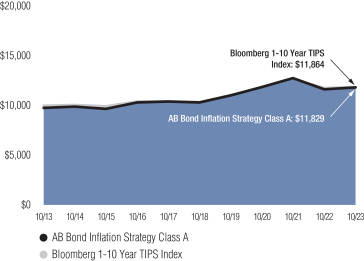

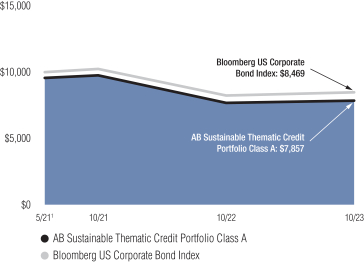

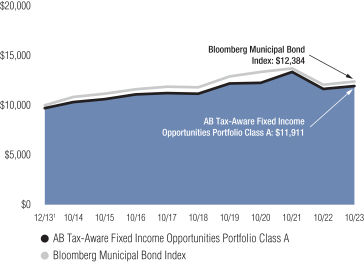

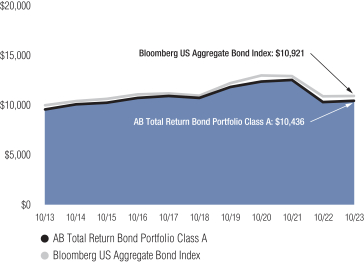

GROWTH OF A $10,000 INVESTMENT IN THE FUND (unaudited)

10/31/2013 TO 10/31/2023

This chart illustrates the total value of an assumed $10,000 investment in AB All Market Real Return Portfolio Class A shares (from 10/31/20123 to 10/31/2023) as compared to the performance of its benchmark. The chart reflects the deduction of the maximum 4.25% sales charge from the initial $10,000 investment in the Fund and assumes the reinvestment of dividends and capital gains distributions.

| abfunds.com | AB ALL MARKET REAL RETURN PORTFOLIO | 11 | |

HISTORICAL PERFORMANCE (continued)

AVERAGE ANNUAL RETURNS AS OF OCTOBER 31, 2023 (unaudited)

| NAV Returns | SEC Returns sales charges) | |||||||

| CLASS 1 SHARES1 | ||||||||

| 1 Year | -1.36% | -1.36% | ||||||

| 5 Years | 4.45% | 4.45% | ||||||

| 10 Years | 0.68% | 0.68% | ||||||

| CLASS 2 SHARES1 | ||||||||

| 1 Year | -1.04% | -1.04% | ||||||

| 5 Years | 4.75% | 4.75% | ||||||

| 10 Years | 0.94% | 0.94% | ||||||

| CLASS A SHARES | ||||||||

| 1 Year | -1.37% | -5.60% | ||||||

| 5 Years | 4.29% | 3.38% | ||||||

| 10 Years | 0.53% | 0.09% | ||||||

| CLASS C SHARES | ||||||||

| 1 Year | -2.15% | -3.06% | ||||||

| 5 Years | 3.50% | 3.50% | ||||||

| 10 Years2 | -0.21% | -0.21% | ||||||

| ADVISOR CLASS SHARES3 | ||||||||

| 1 Year | -1.25% | -1.25% | ||||||

| 5 Years | 4.55% | 4.55% | ||||||

| 10 Years | 0.78% | 0.78% | ||||||

| CLASS R SHARES3 | ||||||||

| 1 Year | -1.77% | -1.77% | ||||||

| 5 Years | 3.97% | 3.97% | ||||||

| 10 Years | 0.25% | 0.25% | ||||||

| CLASS K SHARES3 | ||||||||

| 1 Year | -1.52% | -1.52% | ||||||

| 5 Years | 4.27% | 4.27% | ||||||

| 10 Years | 0.52% | 0.52% | ||||||

| CLASS I SHARES3 | ||||||||

| 1 Year | -1.09% | -1.09% | ||||||

| 5 Years | 4.69% | 4.69% | ||||||

| 10 Years | 0.92% | 0.92% | ||||||

| CLASS Z SHARES3 | ||||||||

| 1 Year | -1.08% | -1.08% | ||||||

| 5 Years | 4.72% | 4.72% | ||||||

| Since Inception4 | 1.29% | 1.29% | ||||||

(footnotes continued on next page)

12 | AB ALL MARKET REAL RETURN PORTFOLIO | abfunds.com | |

HISTORICAL PERFORMANCE (continued)

The Fund’s prospectus fee table shows the Fund’s total annual operating expense ratios as 1.13%, 0.86%, 1.21%, 1.99%, 0.96%, 1.62%, 1.31%, 0.91% and 0.88% for Class 1, Class 2, Class A, Class C, Advisor Class, Class R, Class K, Class I and Class Z shares, respectively, gross of any fee waivers or expense reimbursements. Contractual fee waivers and/or expense reimbursements reduced the Fund’s total annual operating expense ratio (excluding extraordinary expenses, interest expense, and acquired fund fees and expenses other than the advisory fees of any AB mutual funds in which the Fund may invest) to 1.55% and 1.30% for Class R and Class K shares, respectively. These waivers/reimbursements may not be terminated before January 31, 2024, and may be extended by the Adviser for additional one-year terms. Absent reimbursements or waivers, performance would have been lower. The Financial Highlights section of this report sets forth expense ratio data for the current reporting period; the expense ratios shown above may differ from the expense ratios in the Financial Highlights section since they are based on different time periods.

| 1 | Class 1 shares are only available to Bernstein Global Wealth Management private client accounts. Class 2 shares are only available to the Adviser’s institutional clients or through other limited arrangements. These share classes do not carry front-end sales charges; therefore, their respective NAV and SEC returns are the same. |

| 2 | Assumes conversion of Class C shares into Class A shares after eight years. |

| 3 | These share classes are offered at NAV to eligible investors and their SEC returns are the same as their NAV returns. Please note that these share classes are for investors purchasing shares through accounts established under certain fee-based programs sponsored and maintained by certain broker-dealers and financial intermediaries, institutional pension plans and/or investment advisory clients of, and certain other persons associated with, the Adviser and its affiliates or the Fund. |

| 4 | Inception date: 1/31/2014. |

| abfunds.com | AB ALL MARKET REAL RETURN PORTFOLIO | 13 | |

HISTORICAL PERFORMANCE (continued)

SEC AVERAGE ANNUAL RETURNS

AS OF THE MOST RECENT CALENDAR QUARTER-END

SEPTEMBER 30, 2023 (unaudited)

SEC Returns sales charges) | ||||

| CLASS 1 SHARES1 | ||||

| 1 Year | 6.55% | |||

| 5 Years | 3.80% | |||

| 10 Years | 1.11% | |||

| CLASS 2 SHARES1 | ||||

| 1 Year | 6.77% | |||

| 5 Years | 4.06% | |||

| 10 Years | 1.38% | |||

| CLASS A SHARES | ||||

| 1 Year | 1.79% | |||

| 5 Years | 2.73% | |||

| 10 Years | 0.52% | |||

| CLASS C SHARES | ||||

| 1 Year | 4.62% | |||

| 5 Years | 2.85% | |||

| 10 Years2 | 0.21% | |||

| ADVISOR CLASS SHARES3 | ||||

| 1 Year | 6.61% | |||

| 5 Years | 3.88% | |||

| 10 Years | 1.22% | |||

| CLASS R SHARES3 | ||||

| 1 Year | 6.02% | |||

| 5 Years | 3.31% | |||

| 10 Years | 0.69% | |||

| CLASS K SHARES3 | ||||

| 1 Year | 6.30% | |||

| 5 Years | 3.60% | |||

| 10 Years | 0.95% | |||

| CLASS I SHARES3 | ||||

| 1 Year | 6.75% | |||

| 5 Years | 4.05% | |||

| 10 Years | 1.35% | |||

| CLASS Z SHARES3 | ||||

| 1 Year | 6.88% | |||

| 5 Years | 4.07% | |||

| Since Inception4 | 1.58% | |||

(footnotes continued on next page)

14 | AB ALL MARKET REAL RETURN PORTFOLIO | abfunds.com | |

HISTORICAL PERFORMANCE (continued)

| 1 | Class 1 shares are only available to Bernstein Global Wealth Management private client accounts. Class 2 shares are only available to the Adviser’s institutional clients or through other limited arrangements. |

| 2 | Assumes conversion of Class C shares into Class A shares after eight years. |

| 3 | Please note that these share classes are for investors purchasing shares through accounts established under certain fee-based programs sponsored and maintained by certain broker-dealers and financial intermediaries, institutional pension plans and/or investment advisory clients of, and certain other persons associated with, the Adviser and its affiliates or the Fund. |

| 4 | Inception date: 1/31/2014. |

| abfunds.com | AB ALL MARKET REAL RETURN PORTFOLIO | 15 | |

EXPENSE EXAMPLE

(unaudited)

As a shareholder of a mutual fund, you may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, contingent deferred sales charges on redemptions and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses

The table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), or contingent deferred sales charges on redemptions. Therefore, the hypothetical example is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

16 | AB ALL MARKET REAL RETURN PORTFOLIO | abfunds.com | |

EXPENSE EXAMPLE (continued)

| Beginning Account Value May 1, 2023 | Ending Account Value October 31, 2023 | Expenses Paid During Period* | Annualized Expense Ratio* | Total Expenses Paid During Period+ | Total Annualized Expense Ratio+ | |||||||||||||||||||

| Class A | ||||||||||||||||||||||||

Actual | $ | 1,000 | $ | 951.00 | $ | 5.75 | 1.17 | % | $ | 6.10 | 1.24 | % | ||||||||||||

Hypothetical** | $ | 1,000 | $ | 1,019.31 | $ | 5.96 | 1.17 | % | $ | 6.31 | 1.24 | % | ||||||||||||

| Class C | ||||||||||||||||||||||||

Actual | $ | 1,000 | $ | 946.40 | $ | 9.42 | 1.92 | % | $ | 9.76 | 1.99 | % | ||||||||||||

Hypothetical** | $ | 1,000 | $ | 1,015.53 | $ | 9.75 | 1.92 | % | $ | 10.11 | 1.99 | % | ||||||||||||

| Advisor Class | ||||||||||||||||||||||||

Actual | $ | 1,000 | $ | 952.00 | $ | 4.53 | 0.92 | % | $ | 4.87 | 0.99 | % | ||||||||||||

Hypothetical** | $ | 1,000 | $ | 1,020.57 | $ | 4.69 | 0.92 | % | $ | 5.04 | 0.99 | % | ||||||||||||

| Class R | ||||||||||||||||||||||||

Actual | $ | 1,000 | $ | 949.00 | $ | 7.42 | 1.51 | % | $ | 7.76 | 1.58 | % | ||||||||||||

Hypothetical** | $ | 1,000 | $ | 1,017.59 | $ | 7.68 | 1.51 | % | $ | 8.03 | 1.58 | % | ||||||||||||

| Class K | ||||||||||||||||||||||||

Actual | $ | 1,000 | $ | 950.30 | $ | 6.24 | 1.27 | % | $ | 6.59 | 1.34 | % | ||||||||||||

Hypothetical** | $ | 1,000 | $ | 1,018.80 | $ | 6.46 | 1.27 | % | $ | 6.82 | 1.34 | % | ||||||||||||

| Class I | ||||||||||||||||||||||||

Actual | $ | 1,000 | $ | 952.50 | $ | 4.13 | 0.84 | % | $ | 4.48 | 0.91 | % | ||||||||||||

Hypothetical** | $ | 1,000 | $ | 1,020.97 | $ | 4.28 | 0.84 | % | $ | 4.63 | 0.91 | % | ||||||||||||

| Class 1 | ||||||||||||||||||||||||

Actual | $ | 1,000 | $ | 951.00 | $ | 5.36 | 1.09 | % | $ | 5.70 | 1.16 | % | ||||||||||||

Hypothetical** | $ | 1,000 | $ | 1,019.71 | $ | 5.55 | 1.09 | % | $ | 5.90 | 1.16 | % | ||||||||||||

| Class 2 | ||||||||||||||||||||||||

Actual | $ | 1,000 | $ | 952.40 | $ | 3.79 | 0.77 | % | $ | 4.13 | 0.84 | % | ||||||||||||

Hypothetical** | $ | 1,000 | $ | 1,021.32 | $ | 3.92 | 0.77 | % | $ | 4.28 | 0.84 | % | ||||||||||||

| Class Z | ||||||||||||||||||||||||

Actual | $ | 1,000 | $ | 952.60 | $ | 4.23 | 0.86 | % | $ | 4.58 | 0.93 | % | ||||||||||||

Hypothetical** | $ | 1,000 | $ | 1,020.87 | $ | 4.38 | 0.86 | % | $ | 4.74 | 0.93 | % | ||||||||||||

| * | Expenses are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

| ** | Assumes 5% annual return before expenses. |

| + | In connection with the Fund’s investments in affiliated/unaffiliated underlying portfolios, the Fund incurs no direct expenses, but bears proportionate shares of the fees and expenses (i.e., operating, administrative and investment advisory fees) of the affiliated/unaffiliated underlying portfolios. The Adviser has contractually agreed to waive its fees from the Fund in an amount equal to the Fund’s pro rata share of certain acquired fund fees and expenses of the affiliated underlying portfolios. The Fund’s total expenses are equal to the classes’ annualized expense ratio plus the Fund’s pro rata share of the weighted average expense ratio of the affiliated/unaffiliated underlying portfolios in which it invests, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

| abfunds.com | AB ALL MARKET REAL RETURN PORTFOLIO | 17 | |

PORTFOLIO SUMMARY

October 31, 2023 (unaudited)

PORTFOLIO STATISTICS

Net Assets ($mil): $782.2

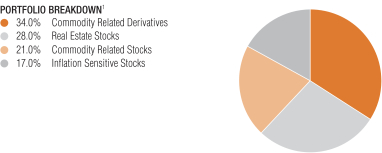

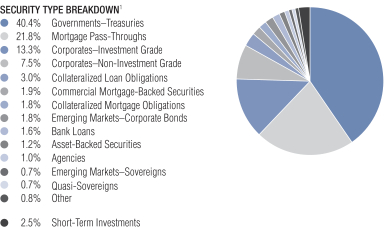

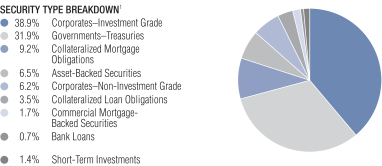

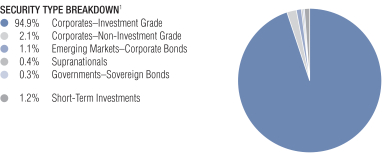

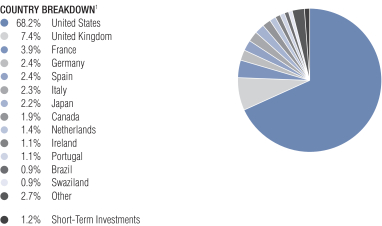

| 1 | The portfolio breakdown is expressed as an approximate percentage of the Fund’s net assets inclusive of derivative exposure, based on the Adviser’s internal classification guidelines. |

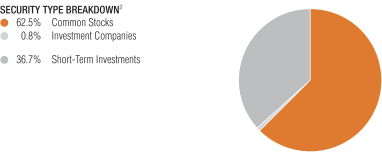

| 2 | The Fund’s security type breakdown is expressed as a percentage of total investments (excluding security lending collateral) and may vary over time. The Fund also enters into derivative transactions, which may be used for hedging or investment purposes (see “Consolidated Portfolio of Investments” section of the report for additional details). |

18 | AB ALL MARKET REAL RETURN PORTFOLIO | abfunds.com | |

PORTFOLIO SUMMARY (continued)

October 31, 2023 (unaudited)

TEN LARGEST HOLDINGS2

| Company | U.S. $ Value | Percent of Net Assets | ||||||

| Prologis, Inc. | $ | 15,536,758 | 2.0 | % | ||||

| Shell PLC | 14,317,315 | 1.8 | ||||||

| Exxon Mobil Corp. | 13,758,912 | 1.8 | ||||||

| Equinix, Inc. | 12,447,659 | 1.6 | ||||||

| Digital Realty Trust, Inc. | 7,068,622 | 0.9 | ||||||

| Welltower, Inc. | 6,821,740 | 0.9 | ||||||

| Mitsui Fudosan Co., Ltd. | 6,422,260 | 0.8 | ||||||

| iShares MSCI Global Metals & Mining Producers ETF | 6,353,625 | 0.8 | ||||||

| ConocoPhillips | 6,300,796 | 0.8 | ||||||

| TotalEnergies SE | 6,155,369 | 0.8 | ||||||

| $ | 95,183,056 | 12.2 | % | |||||

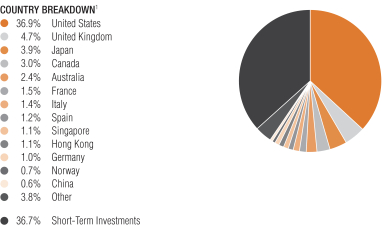

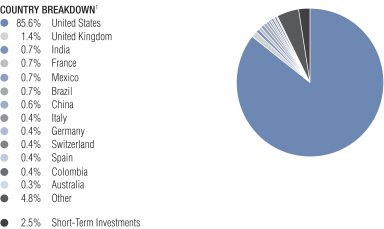

| 1 | The Fund’s country breakdown is expressed as a percentage of total investments (excluding security lending collateral) and may vary over time. The Fund also enters into derivative transactions, which may be used for hedging or investment purposes (see “Portfolio of Investments” section of the report for additional details). “Other” country weightings represent 0.6% or less in the following: Austria, Belgium, Brazil, Chile, Denmark, Finland, Ireland, Luxembourg, Mexico, Netherlands, New Zealand, Russia, South Africa, South Korea, Sweden and Switzerland. |

| 2 | Long-term investments. |

| abfunds.com | AB ALL MARKET REAL RETURN PORTFOLIO | 19 | |

CONSOLIDATED PORTFOLIO OF INVESTMENTS

October 31, 2023

| Company | Shares | U.S. $ Value | ||||||

| ||||||||

COMMON STOCKS – 60.8% | ||||||||

Equity Real Estate Investment Trusts (REITs) – 22.8% | ||||||||

Data Center REITs – 2.5% | ||||||||

Digital Realty Trust, Inc. | 56,840 | $ | 7,068,622 | |||||

Equinix, Inc. | 17,060 | 12,447,659 | ||||||

|

| |||||||

| 19,516,281 | ||||||||

|

| |||||||

Diversified REITs – 1.2% | ||||||||

Alexander & Baldwin, Inc. | 74,700 | 1,180,260 | ||||||

Essential Properties Realty Trust, Inc. | 117,430 | 2,577,588 | ||||||

Land Securities Group PLC | 177,190 | 1,228,228 | ||||||

LXI REIT PLC | 407,020 | 424,216 | ||||||

Merlin Properties Socimi SA | 160,970 | 1,342,133 | ||||||

Stockland | 863,220 | 1,948,237 | ||||||

United Urban Investment Corp. | 926 | 933,564 | ||||||

|

| |||||||

| 9,634,226 | ||||||||

|

| |||||||

Health Care REITs – 1.8% | ||||||||

Cofinimmo SA | 10,030 | 623,720 | ||||||

Medical Properties Trust, Inc.(a) | 196,870 | 941,039 | ||||||

Physicians Realty Trust | 56,900 | 617,934 | ||||||

Ventas, Inc. | 123,160 | 5,229,373 | ||||||

Welltower, Inc. | 81,590 | 6,821,740 | ||||||

|

| |||||||

| 14,233,806 | ||||||||

|

| |||||||

Hotel & Resort REITs – 0.9% | ||||||||

Invincible Investment Corp.(a) | 1,020 | 392,292 | ||||||

Japan Hotel REIT Investment Corp. | 3,828 | 1,740,337 | ||||||

Park Hotels & Resorts, Inc. | 155,060 | 1,787,842 | ||||||

RLJ Lodging Trust | 162,530 | 1,527,782 | ||||||

Ryman Hospitality Properties, Inc. | 16,560 | 1,417,536 | ||||||

|

| |||||||

| 6,865,789 | ||||||||

|

| |||||||

Industrial REITs – 4.7% | ||||||||

CapitaLand Ascendas REIT | 1,154,700 | 2,193,981 | ||||||

Centuria Industrial REIT(a) | 710,700 | 1,286,251 | ||||||

Dream Industrial Real Estate Investment Trust | 216,884 | 1,831,413 | ||||||

GLP J-Reit(b) | 2,156 | 1,931,036 | ||||||

LondonMetric Property PLC | 862,990 | 1,739,052 | ||||||

Mapletree Logistics Trust | 1,507,218 | 1,618,524 | ||||||

Mitsui Fudosan Logistics Park, Inc.(b) | 530 | 1,602,312 | ||||||

Plymouth Industrial REIT, Inc. | 54,566 | 1,088,046 | ||||||

Prologis, Inc. | 154,211 | 15,536,758 | ||||||

Rexford Industrial Realty, Inc. | 67,380 | 2,913,511 | ||||||

STAG Industrial, Inc. | 100,740 | 3,346,583 | ||||||

Tritax Big Box REIT PLC | 1,109,610 | 1,847,409 | ||||||

|

| |||||||

| 36,934,876 | ||||||||

|

| |||||||

Multi-Family Residential REITs – 2.2% | ||||||||

Apartment Income REIT Corp. | 94,570 | 2,762,390 | ||||||

20 | AB ALL MARKET REAL RETURN PORTFOLIO | abfunds.com | |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| Company | Shares | U.S. $ Value | ||||||

| ||||||||

Equity Residential | 110,160 | $ | 6,095,153 | |||||

Kenedix Residential Next Investment Corp.(b)(c)(d) | 620 | 855,356 | ||||||

Killam Apartment Real Estate Investment Trust | 210,150 | 2,374,653 | ||||||

UDR, Inc. | 110,470 | 3,514,051 | ||||||

UNITE Group PLC (The) | 176,590 | 1,868,766 | ||||||

|

| |||||||

| 17,470,369 | ||||||||

|

| |||||||

Office REITs – 1.9% | ||||||||

Alexandria Real Estate Equities, Inc. | 34,630 | 3,225,092 | ||||||

Boston Properties, Inc. | 78,006 | 4,178,782 | ||||||

COPT Defense Properties | 62,690 | 1,429,332 | ||||||

Daiwa Office Investment Corp. | 301 | 1,316,713 | ||||||

Dexus | 279,730 | 1,155,337 | ||||||

Japan Real Estate Investment Corp. | 206 | 765,150 | ||||||

Kenedix Office Investment Corp.(a) | 1,068 | 1,113,911 | ||||||

Nippon Building Fund, Inc. | 404 | 1,623,245 | ||||||

|

| |||||||

| 14,807,562 | ||||||||

|

| |||||||

Other Specialized REITs – 0.7% | ||||||||

VICI Properties, Inc. | 186,090 | 5,191,911 | ||||||

|

| |||||||

Retail REITs – 4.3% | ||||||||

Acadia Realty Trust | 76,190 | 1,091,041 | ||||||

AEON REIT Investment Corp. | 824 | 784,442 | ||||||

Brixmor Property Group, Inc. | 156,800 | 3,259,872 | ||||||

CapitaLand Integrated Commercial Trust | 1,095,760 | 1,408,292 | ||||||

Crombie Real Estate Investment Trust | 104,210 | 915,290 | ||||||

Frasers Centrepoint Trust | 687,500 | 1,040,019 | ||||||

Japan Metropolitan Fund Invest | 1,059 | 683,422 | ||||||

Kite Realty Group Trust | 122,310 | 2,607,649 | ||||||

Klepierre SA | 83,990 | 2,039,595 | ||||||

Link REIT | 774,060 | 3,552,269 | ||||||

NETSTREIT Corp. | 124,816 | 1,778,628 | ||||||

Phillips Edison & Co., Inc. | 83,250 | 2,939,557 | ||||||

Realty Income Corp. | 37,410 | 1,772,486 | ||||||

Simon Property Group, Inc. | 42,496 | 4,669,885 | ||||||

Spirit Realty Capital, Inc. | 77,970 | 2,806,140 | ||||||

Vicinity Ltd. | 2,020,920 | 2,188,921 | ||||||

|

| |||||||

| 33,537,508 | ||||||||

|

| |||||||

Self-Storage REITs – 1.2% | ||||||||

Extra Space Storage, Inc. | 38,890 | 4,028,615 | ||||||

Public Storage | 22,970 | 5,483,169 | ||||||

|

| |||||||

| 9,511,784 | ||||||||

|

| |||||||

Single-Family Residential REITs – 1.3% | ||||||||

American Homes 4 Rent – Class A | 63,540 | 2,080,300 | ||||||

Equity LifeStyle Properties, Inc. | 38,930 | 2,561,594 | ||||||

Invitation Homes, Inc. | 97,860 | 2,905,463 | ||||||

| abfunds.com | AB ALL MARKET REAL RETURN PORTFOLIO | 21 | |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| Company | Shares | U.S. $ Value | ||||||

| ||||||||

Sun Communities, Inc. | 21,617 | $ | 2,404,675 | |||||

|

| |||||||

| 9,952,032 | ||||||||

|

| |||||||

Timber REITs – 0.1% | ||||||||

Weyerhaeuser Co. | 32,681 | 937,618 | ||||||

|

| |||||||

| 178,593,762 | ||||||||

|

| |||||||

Energy – 9.9% | ||||||||

Coal & Consumable Fuels – 0.2% | ||||||||

Cameco Corp. | 32,028 | 1,310,266 | ||||||

|

| |||||||

Integrated Oil & Gas – 6.7% | ||||||||

BP PLC | 618,868 | 3,778,816 | ||||||

Chevron Corp. | 28,797 | 4,196,587 | ||||||

Eni SpA | 223,915 | 3,660,487 | ||||||

Equinor ASA | 78,268 | 2,623,793 | ||||||

Exxon Mobil Corp. | 129,985 | 13,758,912 | ||||||

Gazprom PJSC(b)(c)(d) | 818,956 | 0 | ||||||

Imperial Oil Ltd. | 17,764 | 1,012,359 | ||||||

LUKOIL PJSC(c)(d)(e) | 20,541 | 0 | ||||||

Repsol SA | 225,974 | 3,308,745 | ||||||

Shell PLC | 444,267 | 14,317,315 | ||||||

TotalEnergies SE | 92,067 | 6,155,369 | ||||||

|

| |||||||

| 52,812,383 | ||||||||

|

| |||||||

Oil & Gas Exploration & Production – 2.5% | ||||||||

ConocoPhillips | 53,037 | 6,300,796 | ||||||

Coterra Energy, Inc. | 44,841 | 1,233,127 | ||||||

Enerplus Corp. | 68,040 | 1,150,559 | ||||||

EOG Resources, Inc. | 44,921 | 5,671,276 | ||||||

Hess Corp. | 24,130 | 3,484,372 | ||||||

Woodside Energy Group Ltd. | 77,105 | 1,679,331 | ||||||

|

| |||||||

| 19,519,461 | ||||||||

|

| |||||||

Oil & Gas Refining & Marketing – 0.5% | ||||||||

Ampol Ltd. | 12,413 | 251,708 | ||||||

Marathon Petroleum Corp. | 7,927 | 1,198,959 | ||||||

Neste Oyj | 6,712 | 225,576 | ||||||

Parkland Corp.(a) | 35,897 | 1,086,423 | ||||||

Valero Energy Corp. | 8,847 | 1,123,569 | ||||||

|

| |||||||

| 3,886,235 | ||||||||

|

| |||||||

| 77,528,345 | ||||||||

|

| |||||||

Materials – 5.9% | ||||||||

Aluminum – 0.2% | ||||||||

Norsk Hydro ASA | 239,747 | 1,367,207 | ||||||

|

| |||||||

Commodity Chemicals – 0.4% | ||||||||

Beijing Haixin Energy Technology Co., Ltd. – Class A(b) | 955,485 | 457,794 | ||||||

Corteva, Inc. | 38,407 | 1,848,913 | ||||||

Ecopro Co., Ltd. | 333 | 153,871 | ||||||

22 | AB ALL MARKET REAL RETURN PORTFOLIO | abfunds.com | |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| Company | Shares | U.S. $ Value | ||||||

| ||||||||

LG Chem Ltd. | 746 | $ | 244,495 | |||||

Mitsubishi Chemical Group Corp.(a) | 85,900 | 486,074 | ||||||

W-Scope Corp.(a)(b) | 39,300 | 227,411 | ||||||

|

| |||||||

| 3,418,558 | ||||||||

|

| |||||||

Construction Materials – 0.2% | ||||||||

CRH PLC (London) | 10,202 | 547,509 | ||||||

GCC SAB de CV | 122,907 | 1,096,612 | ||||||

Heidelberg Materials AG | 4,740 | 344,092 | ||||||

|

| |||||||

| 1,988,213 | ||||||||

|

| |||||||

Copper – 0.1% | ||||||||

Capstone Mining Corp.(a)(b) | 196,054 | 667,297 | ||||||

Lundin Mining Corp. | 32,710 | 204,268 | ||||||

|

| |||||||

| 871,565 | ||||||||

|

| |||||||

Diversified Chemicals – 0.1% |

| |||||||

Sumitomo Chemical Co., Ltd. | 203,400 | 516,994 | ||||||

|

| |||||||

Diversified Metals & Mining – 1.8% | ||||||||

Anglo American PLC | 67,148 | 1,710,903 | ||||||

BHP Group Ltd. | 73,113 | 2,069,644 | ||||||

CMOC Group Ltd. – Class H | 378,000 | 225,443 | ||||||

Glencore PLC | 622,026 | 3,294,762 | ||||||

MMC Norilsk Nickel PJSC (ADR)(b)(c)(d) | 66,074 | 0 | ||||||

Rio Tinto PLC | 76,907 | 4,906,702 | ||||||

Teck Resources Ltd. – Class B | 42,083 | 1,487,213 | ||||||

Zhejiang Huayou Cobalt Co., Ltd. – Class A | 54,470 | 274,138 | ||||||

|

| |||||||

| 13,968,805 | ||||||||

|

| |||||||

Fertilizers & Agricultural Chemicals – 0.4% | ||||||||

CF Industries Holdings, Inc. | 21,703 | 1,731,466 | ||||||

Nutrien Ltd. | 25,266 | 1,356,784 | ||||||

|

| |||||||

| 3,088,250 | ||||||||

|

| |||||||

Gold – 1.0% | ||||||||

Agnico Eagle Mines Ltd. | 49,163 | 2,305,795 | ||||||

Barrick Gold Corp. | 142,782 | 2,281,657 | ||||||

Endeavour Mining PLC | 131,413 | 2,711,329 | ||||||

Regis Resources Ltd.(b) | 526,643 | 570,119 | ||||||

|

| |||||||

| 7,868,900 | ||||||||

|

| |||||||

Industrial Gases – 0.1% | ||||||||

Air Liquide SA | 1,452 | 248,803 | ||||||

Air Products and Chemicals, Inc. | 857 | 242,051 | ||||||

Linde PLC | 612 | 233,882 | ||||||

|

| |||||||

| 724,736 | ||||||||

|

| |||||||

Specialty Chemicals – 0.5% | ||||||||

Albemarle Corp. | 2,231 | 282,846 | ||||||

Danimer Scientific, Inc.(a)(b) | 197,479 | 282,395 | ||||||

Ecolab, Inc. | 1,342 | 225,107 | ||||||

Evonik Industries AG | 20,367 | 374,852 | ||||||

| abfunds.com | AB ALL MARKET REAL RETURN PORTFOLIO | 23 | |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| Company | Shares | U.S. $ Value | ||||||

| ||||||||

Ganfeng Lithium Group Co., Ltd – Class A | 48,680 | $ | 294,935 | |||||

IMCD NV | 2,010 | 241,995 | ||||||

Johnson Matthey PLC | 15,989 | 290,667 | ||||||

Livent Corp.(b) | 21,973 | 320,586 | ||||||

Shanghai Putailai New Energy Technology Co., Ltd. – Class A | 51,919 | 177,600 | ||||||

Sherwin-Williams Co. (The) | 3,288 | 783,234 | ||||||

Sika AG (REG) | 822 | 196,712 | ||||||

Umicore SA | 13,658 | 324,963 | ||||||

Wacker Chemie AG | 2,252 | 276,373 | ||||||

|

| |||||||

| 4,072,265 | ||||||||

|

| |||||||

Steel – 1.1% | ||||||||

APERAM SA(a) | 39,327 | 1,089,760 | ||||||

ArcelorMittal SA | 128,084 | 2,834,146 | ||||||

BlueScope Steel Ltd. | 80,278 | 962,329 | ||||||

Commercial Metals Co. | 7,210 | 304,911 | ||||||

JFE Holdings, Inc. | 20,100 | 280,050 | ||||||

Steel Dynamics, Inc. | 12,692 | 1,351,825 | ||||||

Vale SA (Sponsored ADR) | 104,736 | 1,435,931 | ||||||

|

| |||||||

| 8,258,952 | ||||||||

|

| |||||||

| 46,144,445 | ||||||||

|

| |||||||

Real Estate Management & Development – 3.8% | ||||||||

Diversified Real Estate Activities – 1.2% | ||||||||

City Developments Ltd. | 117,000 | 540,050 | ||||||

Daito Trust Construction Co., Ltd. | 6,300 | 675,778 | ||||||

Mitsui Fudosan Co., Ltd. | 296,300 | 6,422,260 | ||||||

Sumitomo Realty & Development Co., Ltd. | 86,200 | 2,163,097 | ||||||

|

| |||||||

| 9,801,185 | ||||||||

|

| |||||||

Real Estate Development – 0.6% | ||||||||

CK Asset Holdings Ltd. | 646,000 | 3,228,917 | ||||||

Sino Land Co., Ltd. | 1,482,000 | 1,479,522 | ||||||

|

| |||||||

| 4,708,439 | ||||||||

|

| |||||||

Real Estate Operating Companies – 1.8% | ||||||||

CA Immobilien Anlagen AG | 35,749 | 1,208,788 | ||||||

Capitaland Investment Ltd./Singapore(a) | 446,100 | 957,858 | ||||||

Castellum AB | 138,750 | 1,329,747 | ||||||

CTP NV(f) | 145,089 | 2,115,303 | ||||||

LEG Immobilien SE(b) | 19,430 | 1,214,601 | ||||||

PSP Swiss Property AG (REG) | 19,840 | 2,441,098 | ||||||

Shurgard Self Storage Ltd. | 28,490 | 1,066,230 | ||||||

TAG Immobilien AG(b) | 119,600 | 1,307,705 | ||||||

Vonovia SE | 59,814 | 1,377,043 | ||||||

Wihlborgs Fastigheter AB | 161,710 | 1,048,211 | ||||||

|

| |||||||

| 14,066,584 | ||||||||

|

| |||||||

24 | AB ALL MARKET REAL RETURN PORTFOLIO | abfunds.com | |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| Company | Shares | U.S. $ Value | ||||||

| ||||||||

Real Estate Services – 0.2% | ||||||||

Unibail-Rodamco-Westfield(b) | 28,610 | $ | 1,417,602 | |||||

|

| |||||||

| 29,993,810 | ||||||||

|

| |||||||

Capital Goods – 3.0% | ||||||||

Aerospace & Defense – 0.3% | ||||||||

BAE Systems PLC | 50,618 | 680,628 | ||||||

Hexcel Corp. | 4,598 | 284,708 | ||||||

Rheinmetall AG | 3,855 | 1,106,745 | ||||||

|

| |||||||

| 2,072,081 | ||||||||

|

| |||||||

Agricultural & Farm Machinery – 0.2% | ||||||||

AGCO Corp. | 3,679 | 421,834 | ||||||

Deere & Co. | 734 | 268,174 | ||||||

Lindsay Corp. | 2,818 | 352,025 | ||||||

Toro Co. (The) | 3,225 | 260,709 | ||||||

|

| |||||||

| 1,302,742 | ||||||||

|

| |||||||

Building Products – 0.6% | ||||||||

A O Smith Corp. | 4,363 | 304,363 | ||||||

Builders FirstSource, Inc.(b) | 9,285 | 1,007,608 | ||||||

Carrier Global Corp. | 4,783 | 227,958 | ||||||

Cie de Saint-Gobain SA | 11,811 | 642,922 | ||||||

Kingspan Group PLC | 3,923 | 264,013 | ||||||

Lennox International, Inc. | 475 | 176,006 | ||||||

Nibe Industrier AB – Class B(a) | 36,463 | 210,004 | ||||||

Owens Corning | 11,184 | 1,267,930 | ||||||

Zurn Elkay Water Solutions Corp. | 10,241 | 270,977 | ||||||

|

| |||||||

| 4,371,781 | ||||||||

|

| |||||||

Construction & Engineering – 0.0% | ||||||||

Arcosa, Inc. | 5,617 | 387,966 | ||||||

|

| |||||||

Construction Machinery & Heavy Transportation Equipment – 0.3% | ||||||||

Caterpillar, Inc. | 4,992 | 1,128,442 | ||||||

Cummins, Inc. | 1,648 | 356,462 | ||||||

Volvo AB – Class B | 53,578 | 1,061,658 | ||||||

|

| |||||||

| 2,546,562 | ||||||||

|

| |||||||

Electrical Components & Equipment – 0.8% | ||||||||

Acuity Brands, Inc. | 5,944 | 962,750 | ||||||

Advent Technologies Holdings, Inc.(a)(b) | 202,190 | 72,586 | ||||||

Ballard Power Systems, Inc.(a)(b) | 83,062 | 277,322 | ||||||

Beijing Easpring Material Technology Co., Ltd. – Class A | 59,369 | 357,967 | ||||||

Blink Charging Co.(a)(b) | 89,881 | 213,917 | ||||||

Camel Group Co., Ltd. – Class A | 336,700 | 379,058 | ||||||

Contemporary Amperex Technology Co., Ltd. – Class A | 8,660 | 219,893 | ||||||

EnerSys | 4,312 | 369,021 | ||||||

| abfunds.com | AB ALL MARKET REAL RETURN PORTFOLIO | 25 | |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| Company | Shares | U.S. $ Value | ||||||

| ||||||||

FuelCell Energy, Inc.(b) | 247,097 | $ | 269,336 | |||||

Gotion High-tech Co., Ltd. – Class A(b) | 100,300 | 312,252 | ||||||

Hubbell, Inc. | 1,602 | 432,700 | ||||||

Legrand SA | 3,155 | 272,928 | ||||||

nVent Electric PLC | 5,423 | 261,009 | ||||||

Plug Power, Inc.(a)(b) | 39,173 | 230,729 | ||||||

Prysmian SpA | 8,038 | 300,999 | ||||||

Signify NV(f) | 19,197 | 497,640 | ||||||

SunPower Corp.(a)(b) | 43,969 | 187,748 | ||||||

Sunrun, Inc.(b) | 30,566 | 294,962 | ||||||

|

| |||||||

| 5,912,817 | ||||||||

|

| |||||||

Heavy Electrical Equipment – 0.3% | ||||||||

Bloom Energy Corp. – Class A(a)(b) | 18,300 | 190,320 | ||||||

CS Wind Corp. | 6,103 | 207,088 | ||||||

ITM Power PLC(a)(b) | 275,347 | 216,264 | ||||||

Ming Yang Smart Energy Group Ltd. – Class A | 190,396 | 363,958 | ||||||

NARI Technology Co., Ltd. – Class A | 62,570 | 193,186 | ||||||

NEL ASA(b) | 235,923 | 155,134 | ||||||

Nordex SE(b) | 20,783 | 219,250 | ||||||

Siemens Energy AG(b) | 32,303 | 287,204 | ||||||

TPI Composites, Inc.(a)(b) | 92,694 | 214,123 | ||||||

Vestas Wind Systems A/S(b) | 9,349 | 202,637 | ||||||

|

| |||||||

| 2,249,164 | ||||||||

|

| |||||||

Industrial Conglomerates – 0.0% | ||||||||

General Electric Co. | 2,366 | 257,019 | ||||||

|

| |||||||

Industrial Machinery & Supplies & Components – 0.4% | ||||||||

Chart Industries, Inc.(a)(b) | 2,051 | 238,388 | ||||||

Energy Recovery, Inc.(b) | 8,141 | 123,743 | ||||||

John Bean Technologies Corp. | 2,599 | 270,348 | ||||||

McPhy Energy SA(b) | 25,437 | 93,092 | ||||||

Mueller Industries, Inc. | 10,947 | 412,811 | ||||||

NGK Insulators Ltd. | 27,500 | 336,002 | ||||||

Pentair PLC | 4,006 | 232,829 | ||||||

Snap-on, Inc. | 903 | 232,920 | ||||||

SPX Technologies, Inc.(b) | 4,545 | 364,145 | ||||||

Watts Water Technologies, Inc. – Class A | 1,581 | 273,529 | ||||||

Xylem, Inc./NY | 3,099 | 289,881 | ||||||

|

| |||||||

| 2,867,688 | ||||||||

|

| |||||||

Trading Companies & Distributors – 0.1% | ||||||||

Fastenal Co. | 19,084 | 1,113,361 | ||||||

|

| |||||||

| 23,081,181 | ||||||||

|

| |||||||

Utilities – 2.1% | ||||||||

Electric Utilities – 0.7% |

| |||||||

Avangrid, Inc. | 17,079 | 510,150 | ||||||

Endesa SA | 52,779 | 993,020 | ||||||

26 | AB ALL MARKET REAL RETURN PORTFOLIO | abfunds.com | |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| Company | Shares | U.S. $ Value | ||||||

| ||||||||

Enel SpA | 462,915 | $ | 2,938,390 | |||||

Exelon Corp. | 7,781 | 302,992 | ||||||

Iberdrola SA | 20,672 | 229,914 | ||||||

NextEra Energy, Inc. | 2,381 | 138,812 | ||||||

Orsted AS(f) | 4,815 | 232,657 | ||||||

SSE PLC | 15,865 | 315,294 | ||||||

|

| |||||||

| 5,661,229 | ||||||||

|

| |||||||

Gas Utilities – 0.2% |

| |||||||

APA Group | 224,100 | 1,174,719 | ||||||

|

| |||||||

Independent Power Producers & Energy Traders – 0.7% | ||||||||

AES Corp. (The) | 20,022 | 298,328 | ||||||

Atlantica Sustainable Infrastructure PLC | 17,426 | 315,585 | ||||||

Boralex, Inc. – Class A | 11,272 | 209,793 | ||||||

Brookfield Renewable Corp. – Class A | 14,168 | 322,337 | ||||||

China Longyuan Power Group Corp., Ltd. – Class H | 307,000 | 259,884 | ||||||

Clearway Energy, Inc. – Class A | 11,693 | 238,186 | ||||||

Drax Group PLC | 67,734 | 347,915 | ||||||

EDP Renovaveis SA(a) | 16,952 | 272,706 | ||||||

ERG SpA(a) | 10,906 | 267,969 | ||||||

Guangxi Guiguan Electric Power Co., Ltd. – Class A | 305,100 | 228,620 | ||||||

Innergex Renewable Energy, Inc. | 39,154 | 241,121 | ||||||

NextEra Energy Partners LP | 6,865 | 185,835 | ||||||

Northland Power, Inc.(a) | 19,169 | 269,410 | ||||||

Ormat Technologies, Inc. | 3,959 | 243,637 | ||||||

RWE AG | 12,215 | 467,412 | ||||||

Solaria Energia y Medio Ambiente SA(a)(b) | 18,266 | 274,001 | ||||||

Vistra Corp. | 33,155 | 1,084,831 | ||||||

Xinyi Energy Holdings Ltd.(a) | 1,220,000 | 213,709 | ||||||

|

| |||||||

| 5,741,279 | ||||||||

|

| |||||||

Multi-Utilities – 0.3% | ||||||||

Algonquin Power & Utilities Corp.(a) | 56,035 | 282,044 | ||||||

E.ON SE | 20,464 | 243,483 | ||||||

Public Service Enterprise Group, Inc. | 18,562 | 1,144,347 | ||||||

Sembcorp Industries Ltd. | 77,400 | 259,670 | ||||||

|

| |||||||

| 1,929,544 | ||||||||

|

| |||||||

Water Utilities – 0.2% |

| |||||||

American States Water Co. | 3,376 | 263,497 | ||||||

American Water Works Co., Inc. | 1,679 | 197,534 | ||||||

Beijing Enterprises Water Group Ltd. | 1,472,000 | 310,600 | ||||||

California Water Service Group | 7,639 | 371,866 | ||||||

Middlesex Water Co. | 2,795 | 177,566 | ||||||

SJW Group | 5,108 | 319,148 | ||||||

|

| |||||||

| 1,640,211 | ||||||||

|

| |||||||

| 16,146,982 | ||||||||

|

| |||||||

| abfunds.com | AB ALL MARKET REAL RETURN PORTFOLIO | 27 | |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| Company | Shares | U.S. $ Value | ||||||

| ||||||||

Software & Services – 1.7% | ||||||||

Application Software – 0.6% |

| |||||||

Autodesk, Inc.(b) | 5,532 | $ | 1,093,289 | |||||

Cadence Design Systems, Inc.(b) | 4,913 | 1,178,383 | ||||||

Constellation Software, Inc./Canada(a) | 99 | 198,465 | ||||||

Dropbox, Inc. – Class A(b) | 40,572 | 1,067,044 | ||||||

Manhattan Associates, Inc.(b) | 5,383 | 1,049,577 | ||||||

Roper Technologies, Inc. | 608 | 297,051 | ||||||

|

| |||||||

| 4,883,809 | ||||||||

|

| |||||||

Internet Services & Infrastructure – 0.1% |

| |||||||

VeriSign, Inc.(b) | 5,193 | 1,036,834 | ||||||

|

| |||||||

IT Consulting & Other Services – 0.1% |

| |||||||

CGI, Inc.(b) | 5,630 | 543,533 | ||||||

|

| |||||||

Systems Software – 0.9% |

| |||||||

Microsoft Corp. | 15,219 | 5,145,696 | ||||||

Palo Alto Networks, Inc.(b) | 2,589 | 629,179 | ||||||

ServiceNow, Inc.(b) | 2,308 | 1,342,910 | ||||||

|

| |||||||

| 7,117,785 | ||||||||

|

| |||||||

| 13,581,961 | ||||||||

|

| |||||||

Pharmaceuticals & Biotechnology – 1.2% | ||||||||

Biotechnology – 0.5% |

| |||||||

AbbVie, Inc. | 6,968 | 983,742 | ||||||

Amgen, Inc. | 2,833 | 724,398 | ||||||

Incyte Corp.(b) | 8,662 | 467,142 | ||||||

Neurocrine Biosciences, Inc.(b) | 4,339 | 481,369 | ||||||

United Therapeutics Corp.(b) | 2,024 | 451,069 | ||||||

Vertex Pharmaceuticals, Inc.(b) | 1,821 | 659,402 | ||||||

|

| |||||||

| 3,767,122 | ||||||||

|

| |||||||

Life Sciences Tools & Services – 0.1% |

| |||||||

Danaher Corp. | 1,378 | 264,603 | ||||||

Eurofins Scientific SE | 7,473 | 379,148 | ||||||

Waters Corp.(b) | 1,205 | 287,429 | ||||||

|

| |||||||

| 931,180 | ||||||||

|

| |||||||

Pharmaceuticals – 0.6% |

| |||||||

Bayer AG (REG) | 9,202 | 397,605 | ||||||

Elanco Animal Health, Inc.(b) | 41,893 | 369,078 | ||||||

Eli Lilly & Co. | 3,510 | 1,944,294 | ||||||

Jazz Pharmaceuticals PLC(b) | 2,207 | 280,333 | ||||||

Novo Nordisk A/S – Class B | 17,484 | 1,686,790 | ||||||

Zoetis, Inc. | 1,012 | 158,884 | ||||||

|

| |||||||

| 4,836,984 | ||||||||

|

| |||||||

| 9,535,286 | ||||||||

|

| |||||||

28 | AB ALL MARKET REAL RETURN PORTFOLIO | abfunds.com | |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| Company | Shares | U.S. $ Value | ||||||

| ||||||||

Technology Hardware & Equipment – 1.1% | ||||||||

Electronic Components – 0.0% |

| |||||||

Samsung SDI Co., Ltd. | 550 | $ | 174,149 | |||||

|

| |||||||

Electronic Equipment & Instruments – 0.1% | ||||||||

Itron, Inc.(b) | 4,700 | 269,216 | ||||||

Landis+Gyr Group AG(b) | 6,312 | 468,300 | ||||||

|

| |||||||

| 737,516 | ||||||||

|

| |||||||

Technology Hardware, Storage & Peripherals – 1.0% | ||||||||

Apple, Inc. | 35,861 | 6,123,983 | ||||||

NetApp, Inc. | 14,314 | 1,041,773 | ||||||

Ricoh Co., Ltd. | 89,300 | 723,786 | ||||||

|

| |||||||

| 7,889,542 | ||||||||

|

| |||||||

| 8,801,207 | ||||||||

|

| |||||||

Food Beverage & Tobacco – 1.1% | ||||||||

Agricultural Products & Services – 0.3% | ||||||||

Archer-Daniels-Midland Co. | 4,401 | 314,980 | ||||||

Bunge Ltd. | 10,604 | 1,123,812 | ||||||

Darling Ingredients, Inc.(b) | 18,805 | 832,873 | ||||||

|

| |||||||

| 2,271,665 | ||||||||

|

| |||||||

Brewers – 0.1% |

| |||||||

Heineken Holding NV | 12,376 | 941,609 | ||||||

|

| |||||||

Packaged Foods & Meats – 0.7% | ||||||||

Danone SA | 4,351 | 258,843 | ||||||

Hormel Foods Corp. | 9,467 | 308,151 | ||||||

JBS SA | 107,900 | 428,668 | ||||||

Lamb Weston Holdings, Inc. | 12,787 | 1,148,273 | ||||||

Maple Leaf Foods, Inc. | 43,588 | 867,831 | ||||||

Marfrig Global Foods SA | 224,400 | 287,524 | ||||||

Mowi ASA | 46,390 | 753,822 | ||||||

Pilgrim’s Pride Corp.(b) | 16,549 | 421,999 | ||||||

Sao Martinho SA | 42,900 | 301,642 | ||||||

Tyson Foods, Inc. – Class A | 6,494 | 300,997 | ||||||

|

| |||||||

| 5,077,750 | ||||||||

|

| |||||||

Soft Drinks & Non-alcoholic Beverages – 0.0% | ||||||||

Coca-Cola Europacific Partners PLC | 2,810 | 164,413 | ||||||

|

| |||||||

| 8,455,437 | ||||||||

|

| |||||||

| abfunds.com | AB ALL MARKET REAL RETURN PORTFOLIO | 29 | |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| Company | Shares | U.S. $ Value | ||||||

| ||||||||

Financial Services – 0.9% | ||||||||

Asset Management & Custody Banks – 0.2% | ||||||||

Ameriprise Financial, Inc. | 3,364 | $ | 1,058,213 | |||||

Ares Management Corp. – Class A | 807 | 79,562 | ||||||

|

| |||||||

| 1,137,775 | ||||||||

|

| |||||||

Consumer Finance – 0.1% | ||||||||

Synchrony Financial | 14,675 | 411,634 | ||||||

|

| |||||||

Diversified Capital Markets – 0.1% |

| |||||||

UBS Group AG (REG)(b) | 45,963 | 1,079,966 | ||||||

|

| |||||||

Financial Exchanges & Data – 0.1% |

| |||||||

Moody’s Corp. | 2,842 | 875,336 | ||||||

TMX Group Ltd. | 12,157 | 253,178 | ||||||

|

| |||||||

| 1,128,514 | ||||||||

|

| |||||||

Mortgage REITs – 0.0% |

| |||||||

Hannon Armstrong Sustainable Infrastructure Capital, Inc.(a) | 13,219 | 226,574 | ||||||

|

| |||||||

Multi-Sector Holdings – 0.0% |

| |||||||

EXOR NV | 2,707 | 232,339 | ||||||

|

| |||||||

Transaction & Payment Processing Services – 0.4% | ||||||||

Mastercard, Inc. – Class A | 4,463 | 1,679,650 | ||||||

Visa, Inc. – Class A | 5,398 | 1,269,070 | ||||||

|

| |||||||

| 2,948,720 | ||||||||

|

| |||||||

| 7,165,522 | ||||||||

|

| |||||||

Media & Entertainment – 0.9% | ||||||||

Broadcasting – 0.1% |

| |||||||

Fox Corp. – Class B | 34,476 | 962,225 | ||||||

|

| |||||||

Interactive Home Entertainment – 0.1% |

| |||||||

Electronic Arts, Inc. | 8,727 | 1,080,315 | ||||||

|

| |||||||

Interactive Media & Services – 0.6% |

| |||||||

Alphabet, Inc. – Class A(b) | 12,469 | 1,547,154 | ||||||

Alphabet, Inc. – Class C(b) | 11,056 | 1,385,317 | ||||||

Meta Platforms, Inc. – Class A(b) | 4,619 | 1,391,566 | ||||||

|

| |||||||

REA Group Ltd. | 4,151 | 381,081 | ||||||

|

| |||||||

| 4,705,118 | ||||||||

|

| |||||||

Movies & Entertainment – 0.1% |

| |||||||

Live Nation Entertainment, Inc.(b) | 3,975 | 318,080 | ||||||

|

| |||||||

| 7,065,738 | ||||||||

|

| |||||||

30 | AB ALL MARKET REAL RETURN PORTFOLIO | abfunds.com | |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| Company | Shares | U.S. $ Value | ||||||

| ||||||||

Semiconductors & Semiconductor Equipment – 0.9% | ||||||||

Semiconductor Materials & Equipment – 0.4% | ||||||||

Applied Materials, Inc. | 9,594 | $ | 1,269,766 | |||||

Enphase Energy, Inc.(b) | 2,168 | 172,530 | ||||||

KLA Corp. | 2,354 | 1,105,674 | ||||||

SolarEdge Technologies, Inc.(b) | 1,956 | 148,558 | ||||||

Xinyi Solar Holdings Ltd. | 350,000 | 205,978 | ||||||

|

| |||||||

| 2,902,506 | ||||||||

|

| |||||||

Semiconductors – 0.5% |

| |||||||

Canadian Solar, Inc.(a)(b) | 13,755 | 274,825 | ||||||

First Solar, Inc.(b) | 2,038 | 290,313 | ||||||

Lattice Semiconductor Corp.(b) | 4,505 | 250,523 | ||||||

LONGi Green Energy Technology Co., Ltd. – Class A | 87,232 | 287,924 | ||||||

NVIDIA Corp. | 6,170 | 2,516,126 | ||||||

Wolfspeed, Inc.(a)(b) | 4,780 | 161,755 | ||||||

|

| |||||||

| 3,781,466 | ||||||||

|

| |||||||

| 6,683,972 | ||||||||

|

| |||||||

Consumer Discretionary Distribution & Retail – 0.8% | ||||||||

Apparel Retail – 0.2% |

| |||||||

Industria de Diseno Textil SA(a) | 31,600 | 1,090,768 | ||||||

TJX Cos., Inc. (The) | 5,026 | 442,640 | ||||||

|

| |||||||

| 1,533,408 | ||||||||

|

| |||||||

Broadline Retail – 0.3% |

| |||||||

Amazon.com, Inc.(b) | 19,915 | 2,650,487 | ||||||

Next PLC | 1,444 | 121,069 | ||||||

|

| |||||||

| 2,771,556 | ||||||||

|

| |||||||

Broadline Retail – 0.1% |

| |||||||

MercadoLibre, Inc.(b) | 414 | 513,666 | ||||||

|

| |||||||

Home Improvement Retail – 0.2% |

| |||||||

Home Depot, Inc. (The) | 5,742 | 1,634,690 | ||||||

|

| |||||||

| 6,453,320 | ||||||||

|

| |||||||

Commercial & Professional Services – 0.8% | ||||||||

Commercial Printing – 0.2% |

| |||||||

TOPPAN Holdings, Inc. | 48,100 | 1,109,372 | ||||||

|

| |||||||

Diversified Support Services – 0.0% |

| |||||||

Brambles Ltd. | 18,884 | 157,601 | ||||||

|

| |||||||

Environmental & Facilities Services – 0.2% | ||||||||

Aker Carbon Capture ASA(b) | 124,875 | 118,718 | ||||||

| abfunds.com | AB ALL MARKET REAL RETURN PORTFOLIO | 31 | |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| Company | Shares | U.S. $ Value | ||||||

| ||||||||

Casella Waste Systems, Inc. – Class A(b) | 4,121 | $ | 310,929 | |||||

Clean Harbors, Inc.(b) | 2,095 | 321,939 | ||||||

Republic Services, Inc. | 1,969 | 292,377 | ||||||

Tetra Tech, Inc. | 1,799 | 271,487 | ||||||

Veralto Corp.(b) | 460 | 31,740 | ||||||

Waste Management, Inc. | 1,424 | 234,006 | ||||||

|

| |||||||

| 1,581,196 | ||||||||

|

| |||||||

Human Resource & Employment Services – 0.3% | ||||||||

Automatic Data Processing, Inc. | 219 | 47,790 | ||||||

Paychex, Inc. | 9,640 | 1,070,522 | ||||||

Robert Half, Inc. | 14,119 | 1,055,678 | ||||||

|

| |||||||

| 2,173,990 | ||||||||

|

| |||||||

Research & Consulting Services – 0.1% |

| |||||||

Verisk Analytics, Inc. | 4,391 | 998,338 | ||||||

|

| |||||||

| 6,020,497 | ||||||||

|

| |||||||

Health Care Equipment & Services – 0.7% | ||||||||

Health Care Distributors – 0.3% |

| |||||||

Cardinal Health, Inc. | 12,172 | 1,107,652 | ||||||

Cencora, Inc. | 6,046 | 1,119,417 | ||||||

McKesson Corp. | 774 | 352,449 | ||||||

|

| |||||||

| 2,579,518 | ||||||||

|

| |||||||

Health Care Equipment – 0.2% |

| |||||||

GE Healthcare, Inc. | 10,183 | 677,882 | ||||||

IDEXX Laboratories, Inc.(b) | 2,134 | 852,469 | ||||||

|

| |||||||

| 1,530,351 | ||||||||

|

| |||||||

Health Care Services – 0.0% |

| |||||||

ABIOMED, Inc.(b)(c)(d) | 1,321 | – 0 | – | |||||

|

| |||||||

Managed Health Care – 0.2% |

| |||||||

Humana, Inc. | 925 | 484,413 | ||||||

Molina Healthcare, Inc.(b) | 1,716 | 571,342 | ||||||

|

| |||||||

| 1,055,755 | ||||||||

|

| |||||||

| 5,165,624 | ||||||||

|

| |||||||

Banks – 0.6% | ||||||||

Diversified Banks – 0.6% |

| |||||||

Banco Bilbao Vizcaya Argentaria SA | 143,805 | 1,131,347 | ||||||

Barclays PLC | 122,973 | 197,377 | ||||||

First Citizens BancShares, Inc./NC – Class A | 791 | 1,092,165 | ||||||

NatWest Group PLC | 180,989 | 393,799 | ||||||

Standard Chartered PLC | 120,611 | 924,765 | ||||||

UniCredit SpA | 48,686 | 1,220,539 | ||||||

|

| |||||||

| 4,959,992 | ||||||||

|

| |||||||

Insurance – 0.6% | ||||||||

Life & Health Insurance – 0.4% |

| |||||||

iA Financial Corp., Inc. | 15,703 | 913,701 | ||||||

32 | AB ALL MARKET REAL RETURN PORTFOLIO | abfunds.com | |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| Company | Shares | U.S. $ Value | ||||||

| ||||||||

Japan Post Insurance Co., Ltd. | 60,400 | $ | 1,163,067 | |||||

Manulife Financial Corp. | 35,192 | 612,609 | ||||||

Medibank Pvt Ltd. | 75,017 | 163,708 | ||||||

Poste Italiane SpA(f) | 36,643 | 362,774 | ||||||

|

| |||||||

| 3,215,859 | ||||||||

|

| |||||||

Multi-line Insurance – 0.2% | ||||||||

American International Group, Inc. | 8,200 | 502,742 | ||||||

Assicurazioni Generali SpA | 54,257 | 1,077,741 | ||||||

|

| |||||||

| 1,580,483 | ||||||||

|

| |||||||

| 4,796,342 | ||||||||

|

| |||||||

Consumer Services – 0.5% | ||||||||

Casinos & Gaming – 0.1% | ||||||||

La Francaise des Jeux SAEM(f) | 16,096 | 519,208 | ||||||

|

| |||||||

Hotels, Resorts & Cruise Lines – 0.4% | ||||||||

Airbnb, Inc. – Class A(b) | 9,410 | 1,113,109 | ||||||

Booking Holdings, Inc.(b) | 434 | 1,210,669 | ||||||

Hyatt Hotels Corp. – Class A(a) | 10,400 | 1,065,376 | ||||||

|

| |||||||

| 3,389,154 | ||||||||

|

| |||||||

Specialized Consumer Services – 0.0% | ||||||||

WW International, Inc.(b) | 21,737 | 169,983 | ||||||

|

| |||||||

| 4,078,345 | ||||||||

|

| |||||||

Consumer Durables & Apparel – 0.5% | ||||||||

Apparel, Accessories & Luxury Goods – 0.2% | ||||||||

Pandora A/S | 9,328 | 1,057,987 | ||||||

|

| |||||||

Consumer Electronics – 0.0% | ||||||||

Panasonic Holdings Corp. | 27,900 | 244,780 | ||||||

|

| |||||||

Homebuilding – 0.3% | ||||||||

Desarrolladora Homex SAB de CV(b) | 1,590 | 1 | ||||||

Installed Building Products, Inc. | 1,324 | 147,851 | ||||||

NVR, Inc.(b) | 181 | 979,684 | ||||||

PulteGroup, Inc. | 16,590 | 1,220,858 | ||||||

Urbi Desarrollos Urbanos SAB de CV(b) | 9 | 4 | ||||||

|

| |||||||

| 2,348,398 | ||||||||

|

| |||||||

| 3,651,165 | ||||||||

|

| |||||||

Automobiles & Components – 0.3% | ||||||||

Automobile Manufacturers – 0.3% | ||||||||

Nissan Motor Co., Ltd. | 261,100 | 1,004,708 | ||||||

Tesla, Inc.(b) | 6,039 | 1,212,873 | ||||||

|

| |||||||

| 2,217,581 | ||||||||

|

| |||||||

| abfunds.com | AB ALL MARKET REAL RETURN PORTFOLIO | 33 | |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| Company | Shares | U.S. $ Value | ||||||

| ||||||||

Telecommunication Services – 0.3% | ||||||||

Integrated Telecommunication Services – 0.2% | ||||||||