MARK FIELDS Executive Vice President, Ford Motor Company President, The Americas Bank of America Merrill Lynch 2012 New York Auto Summit April 4, 2012

SLIDE 2 • ONE Ford Plan Update • North America -- Including U.S. Industry Outlook • South America • Europe, Asia Pacific Africa, and Ford Credit • 2012 Planning Assumptions and Key Metrics • Closing Remarks • Q&A AGENDA

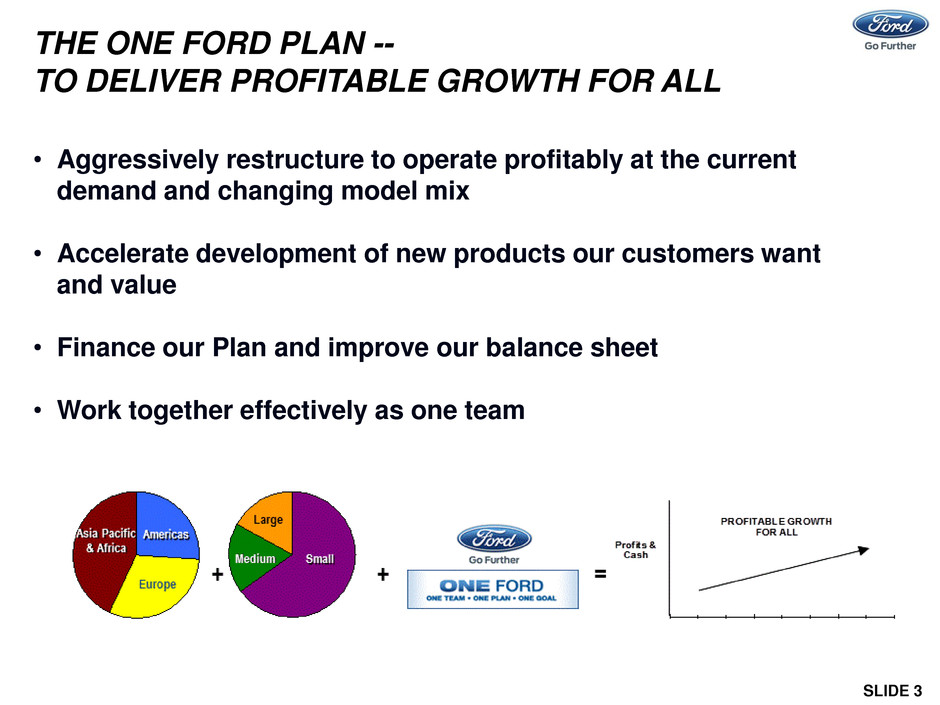

SLIDE 3 BLANK THE ONE FORD PLAN -- TO DELIVER PROFITABLE GROWTH FOR ALL • Aggressively restructure to operate profitably at the current demand and changing model mix • Accelerate development of new products our customers want and value • Finance our Plan and improve our balance sheet • Work together effectively as one team

SLIDE 4 THE PLAN • Great Products…Strong Business…Better World • Serve all major markets • Expand in BRIC markets • Focus on the Ford and Lincoln brands • Full line-up of vehicles – Small, Medium and Large…Cars, Utilities and Trucks – Electrification strategy -- “Power of Choice” – Commitment to product excellence • Best-in-class vehicles Drive quality. Drive green. Drive safe. Drive smart. Best Value

SLIDE 5 • Improve time to market • Freshest showroom • Enhance customer experience • Deliver the brand promise • Fully competitive revenue • Global platforms and scale • Flexible and efficient production • Fully competitive costs • Return to and maintain investment grade • Skilled and motivated team THE PLAN (CONT’D)

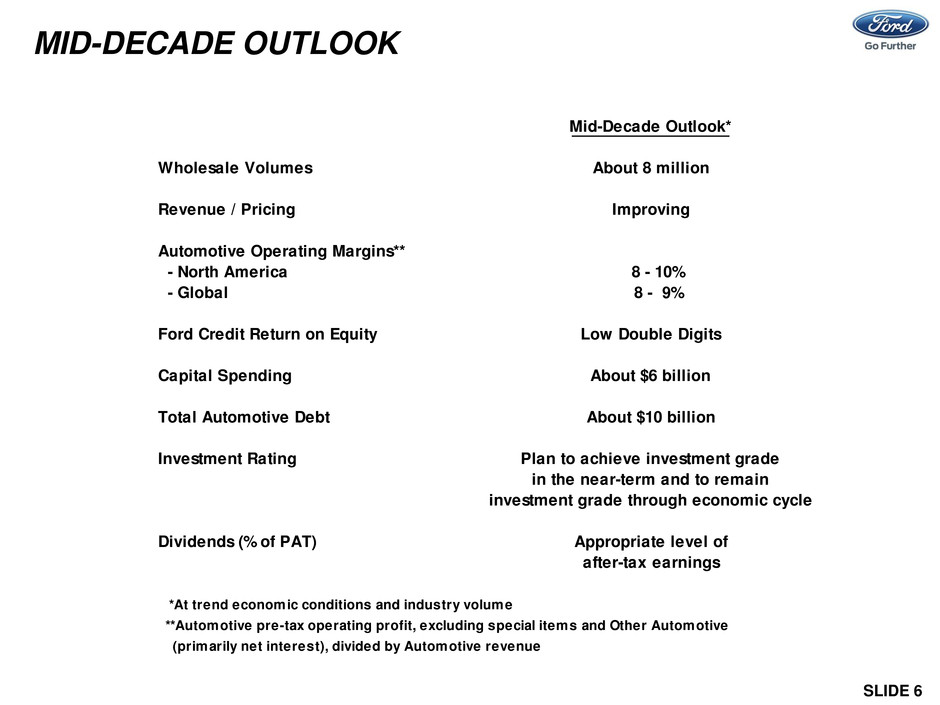

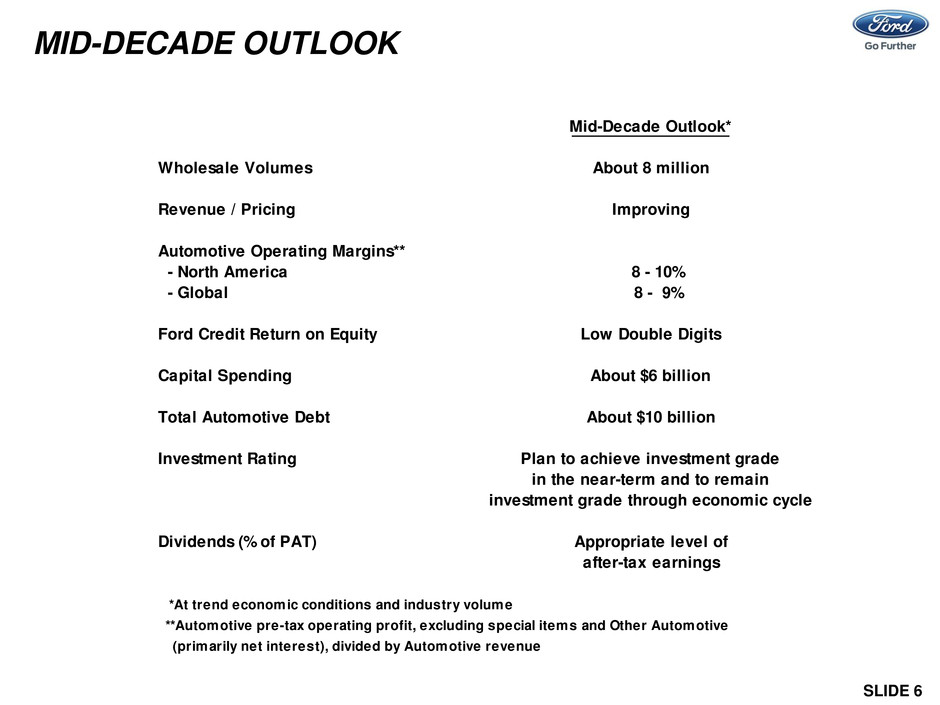

SLIDE 6 MID-DECADE OUTLOOK Mid-Decade Outlook* Wholesale Volumes About 8 million Revenue / Pricing Improving Automotive Operating Margins** - North America 8 - 10% - Global 8 - 9% Ford Credit Return on Equity Low Double Digits Capital Spending About $6 billion Total Automotive Debt About $10 billion Investment Rating Plan to achieve investment grade in the near-term and to remain investment grade through economic cycle Dividends (% of PAT) Appropriate level of after-tax earnings *At trend economic conditions and industry volume **Automotive pre-tax operating profit, excluding special items and Other Automotive (primarily net interest), divided by Automotive revenue

SLIDE 7 ‘FOUR PILLARS’ OF GLOBAL PRODUCT STRATEGY Drive quality. Drive green. Drive safe. Drive smart. Quality Leadership Fuel Economy Leadership Safety Leadership Infotainment Leadership Ford Continues To Advance Its Global Product Strategy

SLIDE 8 Mid-Decade Ongoing Annual Volume GLOBAL PRODUCT PLAN -- PLATFORM CONSOLIDATION & INCREASING SCALE Platform Consolidation Underway With Common Global Top Hats. By 2013, 85% Of Volume Is On 9 Core Platforms Segment Sample Vehicle B Segment C Segment CD Segment Compact Pickup Segment Commercial Van Segment Fiesta Focus Fusion / Mondeo Ranger E-Series / Transit > 2 million > 2 million 1 million > 275K > 475K

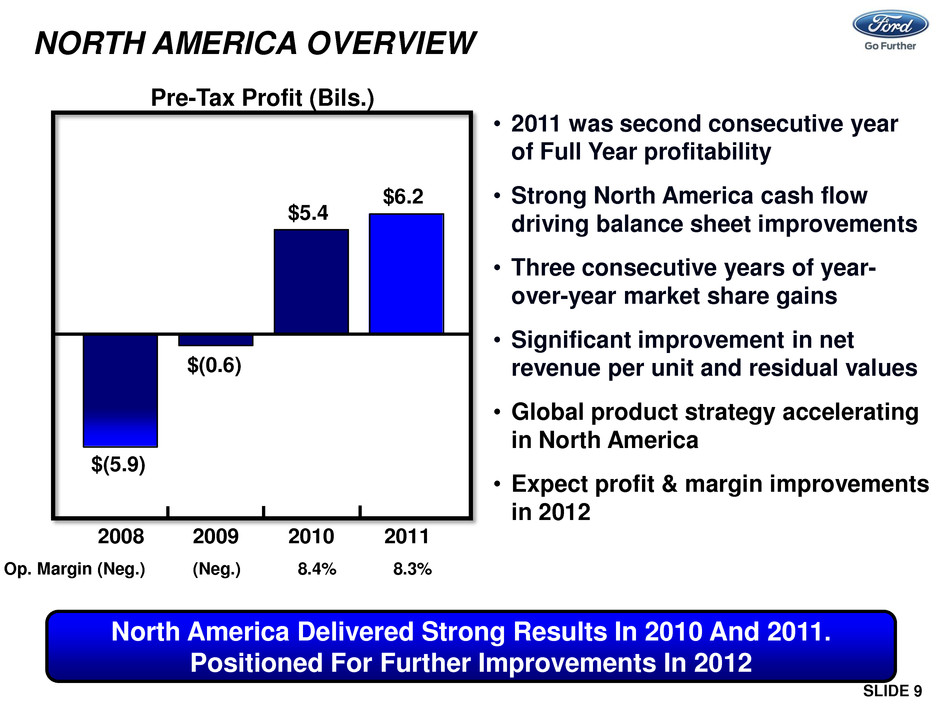

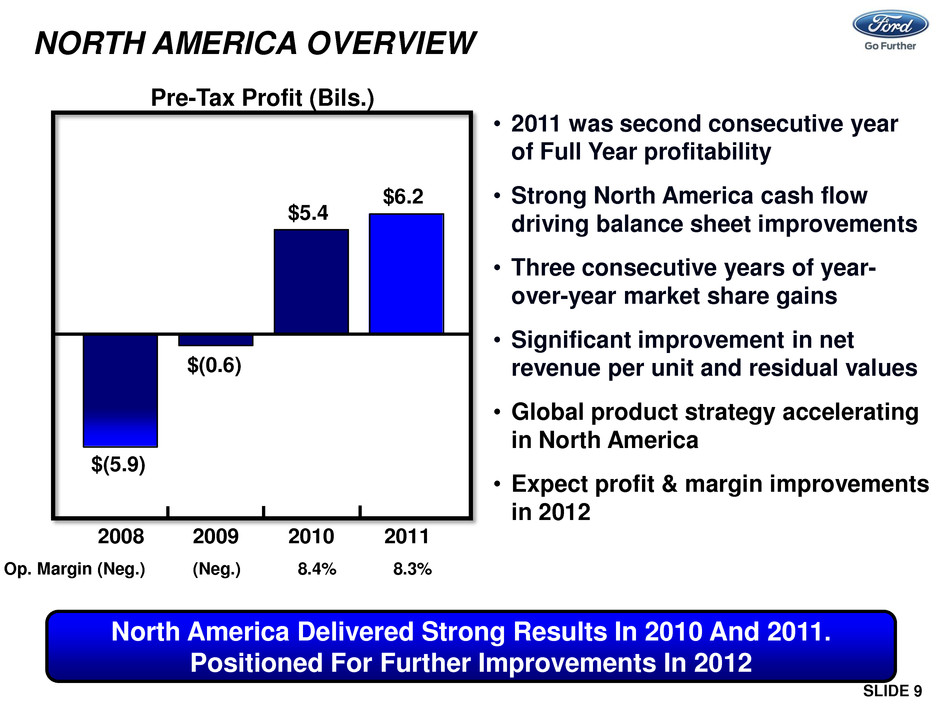

SLIDE 9 • 2011 was second consecutive year of Full Year profitability • Strong North America cash flow driving balance sheet improvements • Three consecutive years of year- over-year market share gains • Significant improvement in net revenue per unit and residual values • Global product strategy accelerating in North America • Expect profit & margin improvements in 2012 Pre-Tax Profit (Bils.) NORTH AMERICA OVERVIEW North America Delivered Strong Results In 2010 And 2011. Positioned For Further Improvements In 2012 $(5.9) $(0.6) $5.4 $6.2 2008 2009 2010 2011 Op. Margin (Neg.) (Neg.) 8.4% 8.3%

SLIDE 10 2012 PRODUCT INTRODUCTIONS -- FORD BRAND Taurus + SHO Mustang (V6,GT & Boss) Flex Focus Electric Mustang GT500 All-New Escape All-New C-MAX Hybrid All-New Fusion C-MAX ENERGI GLOBAL GLOBAL GLOBAL GLOBAL GLOBAL Super Duty GLOBAL First Half Second Half North America Aggressive Product Launch Cadence In North America In 2012 Police Interceptor Interceptor (Sedan) Interceptor (SUV) Fusion (Hybrid) GLOBAL Fusion (Energi) GLOBAL

SLIDE 11 MKS MKT Key Features Of The All-New MKZ • MKZ is a transformational product for the Lincoln brand • All-new exterior and interior created by the Lincoln Design Studio • Premium-grade materials create a luxurious and comfortable interior space • Leading technologies: – SYNC with MyLincoln Touch – Lincoln Drive Control – Lane Keeping System – Park Assist System • Three powerful and efficient powertrains expected to deliver Best-in-Class fuel economy GLOBAL First Half Second Half 2012 PRODUCT INTRODUCTIONS -- LINCOLN BRAND North America Lincoln Is Introducing 7 Products By 2015, And 50% Of Dealers In Top-130 Luxury Markets Committed To Capital Improvements All-New MKZ

SLIDE 12 NORTH AMERICA -- QUALITY TREND Ford North America Addressing 2011 Quality Issues Chrysler-Fiat GM Honda VW Hyn-Kia Better Toyota 2008 2009 2010 2011 Ford Things Gone Wrong* (TGW) *Ford Global Quality Research System (GQRS)

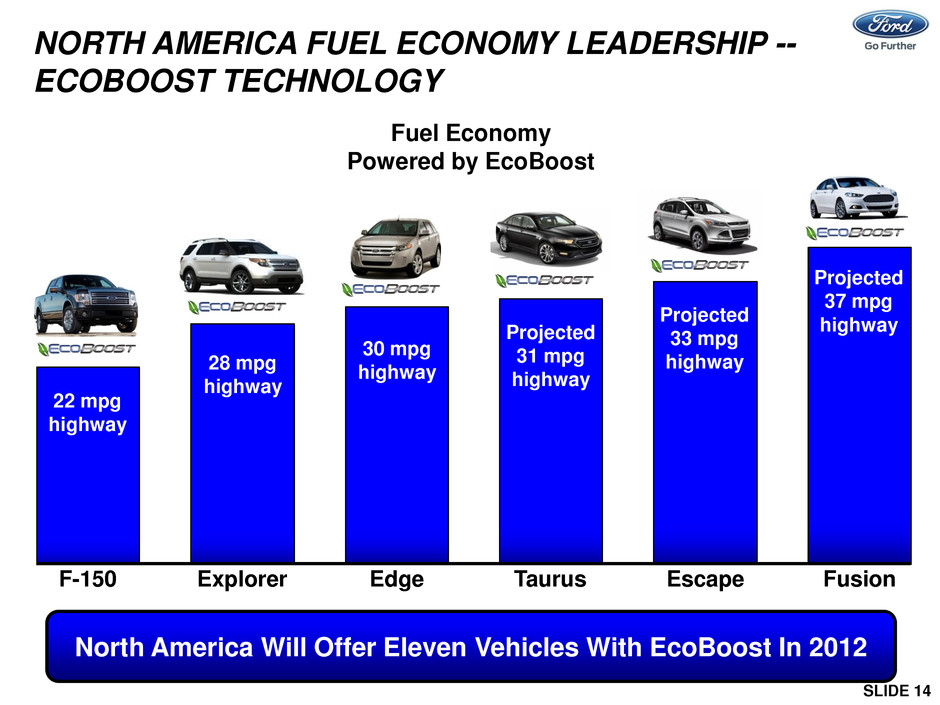

SLIDE 13 New Industry Leading Fuel-Efficient Products Ford is leveraging a portfolio of technologies – EcoBoost, HEV, PHEV, and BEV In 2012 North America will offer 11 vehicles with EcoBoost – many are fuel economy segment leaders Ford is the largest U.S. domestic hybrid seller Nearly one-third of Ford’s U.S. vehicle lines will offer a version with 40 MPG or more Focus Electric offers an EPA certified 110 MPGe city rating 2009 2012 NORTH AMERICA FUEL ECONOMY LEADERSHIP -- TECHNOLOGY AND INNOVATION U.S. Light-Duty Fleet Fuel Economy Model Year (Percent Improvement) Ford Is Significantly Improving Fuel Economy By Leveraging A Portfolio Of Technologies -- EcoBoost, HEV, PHEV, And BEV 25% Base 15% 2005 2015 Further Improvement

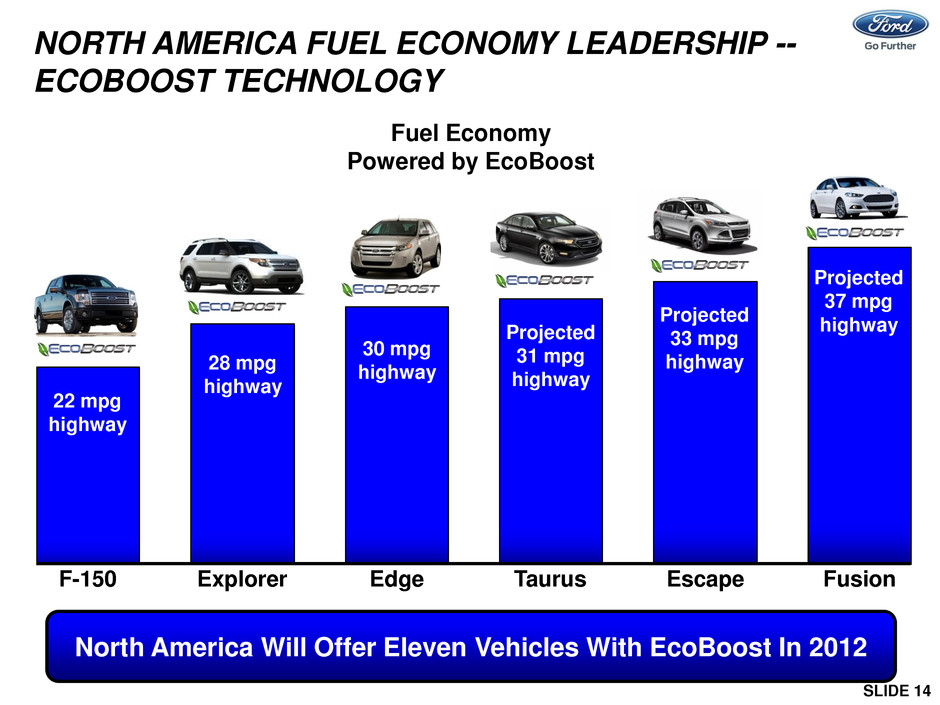

SLIDE 14 North America Will Offer Eleven Vehicles With EcoBoost In 2012 22 mpg highway 28 mpg highway 30 mpg highway Projected 31 mpg highway Projected 33 mpg highway Projected 37 mpg highway F-150 Explorer Edge Taurus Escape Fusion NORTH AMERICA FUEL ECONOMY LEADERSHIP -- ECOBOOST TECHNOLOGY Fuel Economy Powered by EcoBoost

SLIDE 15 POWER THE CHOICE OF Ford’s Strategy Is To Electrify Global Platforms With All 3 Electric Solutions; To Drive Choice Of Top Hats, Scale And Affordability 110 MPGe city NORTH AMERICA FUEL ECONOMY LEADERSHIP -- ELECTRIFICATION BY PLATFORM Focus Fusion 100+ MPGe city projected

SLIDE 16 U.S. ECONOMIC OUTLOOK • U.S. economy continues on a gradual recovery path – Consumer confidence rising, reflecting brighter job market prospects – Labor market gaining momentum with more significant employment increases in recent months – Housing market reached its trough with potential growth in the years ahead – Manufacturing Purchasing Managers’ Index signals continued expansion – Low interest rate environment remains favorable • Industry sales have progressively strengthened beginning in 2011 Second Quarter Continued Recovery In The U.S. Economic Environment Is Supporting Improved U.S. Industry Sales

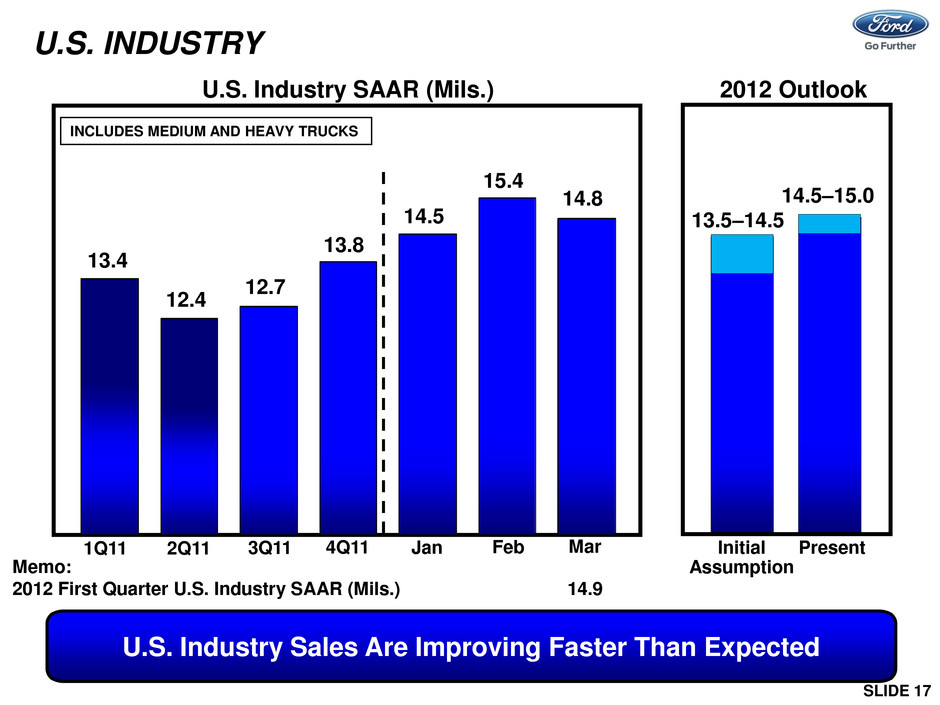

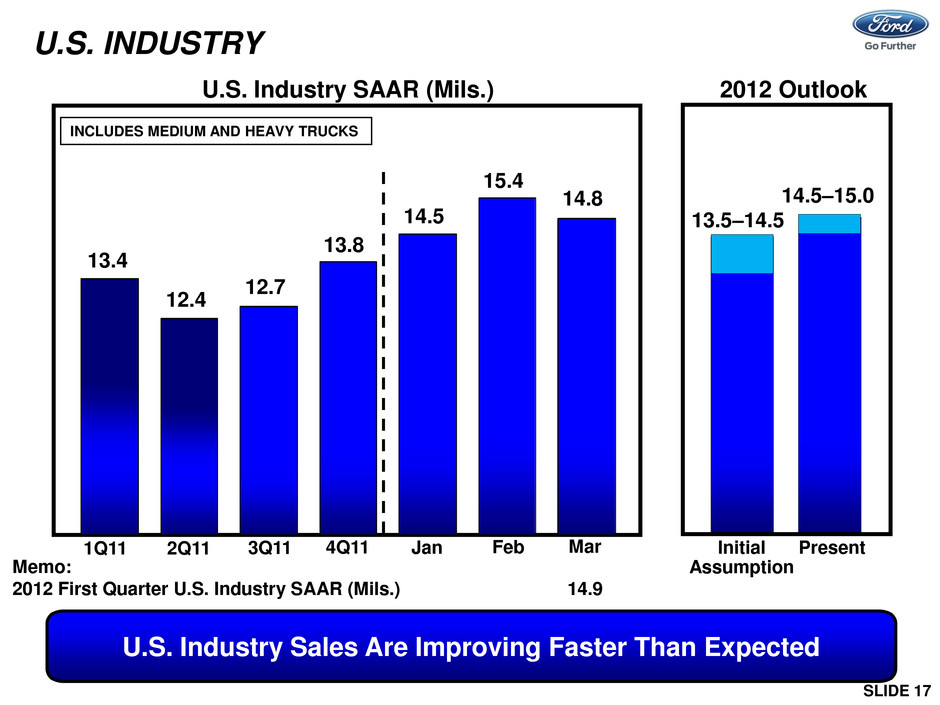

SLIDE 17 U.S. INDUSTRY U.S. Industry SAAR (Mils.) 1Q11 2Q11 3Q11 4Q11 U.S. Industry Sales Are Improving Faster Than Expected Initial Assumption Jan Feb Mar 13.4 12.4 12.7 13.8 14.5 15.4 14.8 13.5–14.5 14.5–15.0 2012 Outlook Present INCLUDES MEDIUM AND HEAVY TRUCKS Memo: 2012 First Quarter U.S. Industry SAAR (Mils.) 14.9

SLIDE 18 First Quarter Total Share Down And Share Of Retail Industry Up From 2011. Continuing To Manage The Business To Maximize Profitability • Ford’s First Quarter sales were up 9% from a year ago, retail sales were up 13% from a year ago • Ford’s First Quarter total share was 15.2%, down 0.8 points from a year ago • Ford’s retail share of retail industry for First Quarter was 13.8%, up 0.3 points from a year ago • Ford’s First Quarter daily rental volume down from 2011, while overall industry sales to daily rental companies were up • New products performing very well – Focus First Quarter retail share highest since 2002, and best March sales results ever – Explorer continues to perform at top of segment and is fastest turning vehicle in Ford showroom – F-Series continues to dominate segment, with transaction prices and mix that are unrivaled • Selling down previous model of Escape and Fusion before launch of new products 2012 FIRST QUARTER -- U.S. SALES & SHARE HIGHLIGHTS

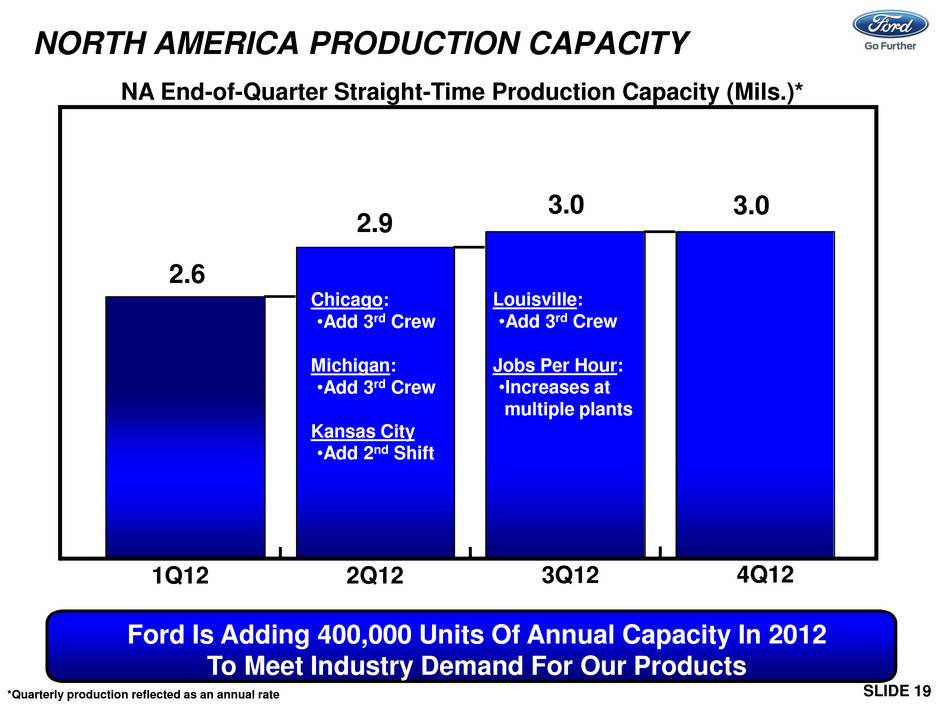

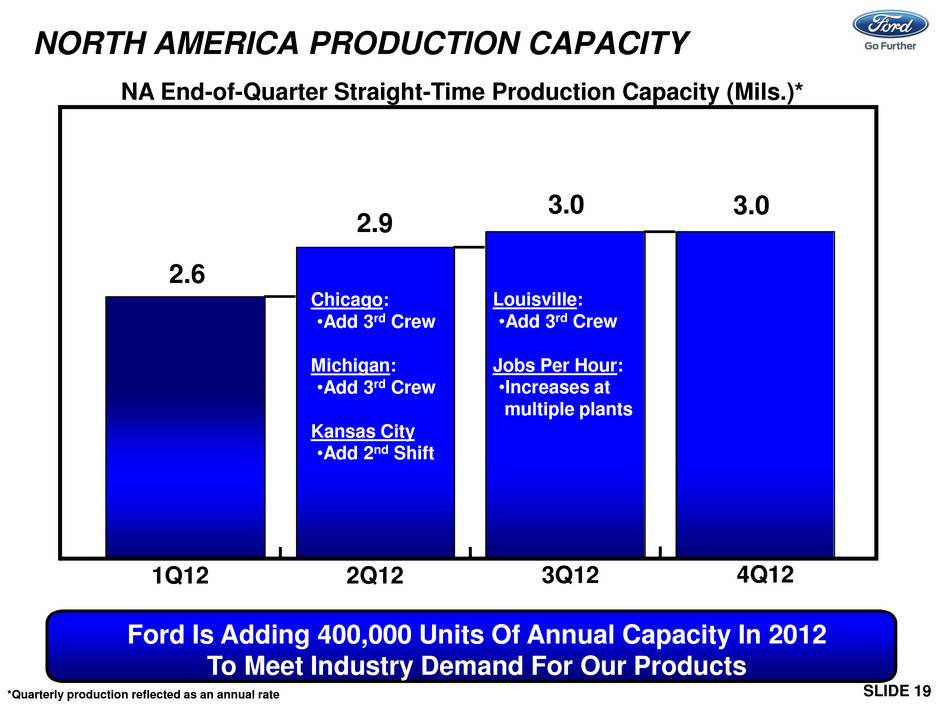

SLIDE 19 NORTH AMERICA PRODUCTION CAPACITY * Excludes special items Ford Is Adding 400,000 Units Of Annual Capacity In 2012 To Meet Industry Demand For Our Products NA End-of-Quarter Straight-Time Production Capacity (Mils.)* 1Q12 2Q12 3Q12 4Q12 Chicago: •Add 3rd Crew Michigan: •Add 3rd Crew Kansas City •Add 2nd Shift 2.6 2.9 3.0 3.0 Louisville: •Add 3rd Crew Jobs Per Hour: •Increases at multiple plants *Quarterly production reflected as an annual rate

SLIDE 20 • South America continues to deliver positive operating performance • Quality and brand health improving • New entrants and added capacity have created a more competitive market environment • Weak exchange and regional trade tensions will also pressure 2012 results • Transition to global products accelerating in Second Half 2012 • First and Second Quarter pre-tax profits each will be lower than our Fourth Quarter 2011 pre-tax profit • Second Half pre-tax profits expected to be up from 2011 Pre-Tax Profit (Bils.) SOUTH AMERICA OVERVIEW South America Delivering Positive Results, But 2012 Will Be Lower Than 2011. Transition From Legacy Products To Global Products Begins Later This Year $1.2 $0.8 $1.0 $0.9 2008 2009 2010 2011 Op. Margin 14.1% 9.7% 10.2% 7.8%

SLIDE 21 SOUTH AMERICA BUSINESS ENVIRONMENT • GDP growth of 3-4% across the region is supporting steady growth in industry sales • The market environment, especially in Brazil, is becoming increasingly competitive – New importers, including the Koreans and Chinese, are entering the market with new products and aggressive pricing – Installed capacity in the region is projected to increase substantially over the next 5 years, leading to excess capacity • Trade balance issues are escalating -- recent Brazil and Mexico quota agreements will likely impact Fiesta from Mexico • Political environments in Brazil and Argentina are relatively stable, but Venezuela remains unpredictable, with uncertainty surrounding this year’s presidential election Increasing Competitive Environment, Inflation, Weakening Currency And Trade Restrictions Are Pressuring Margins

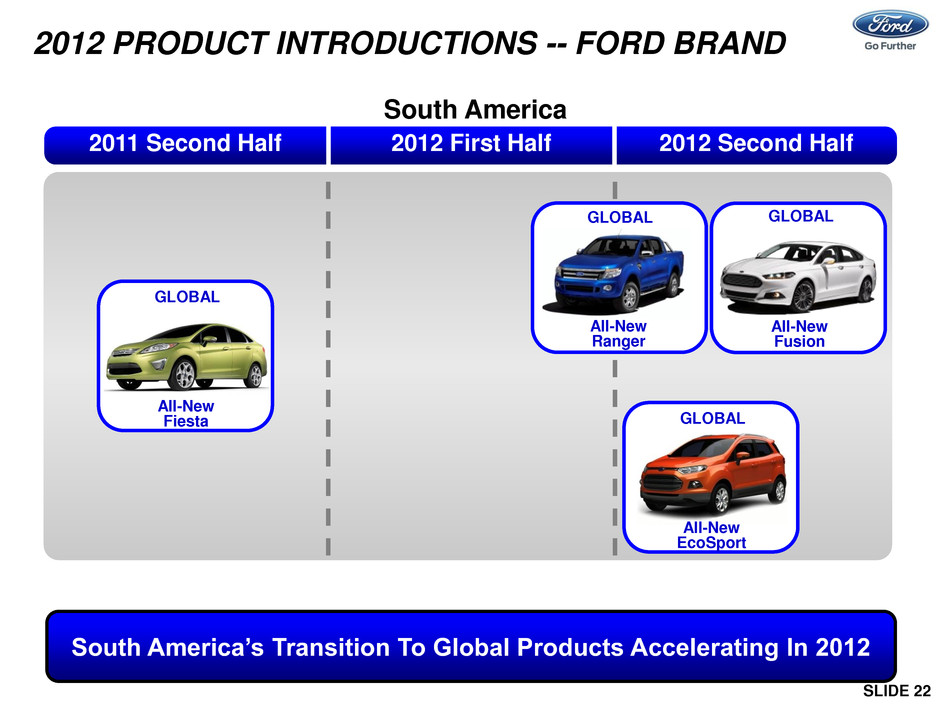

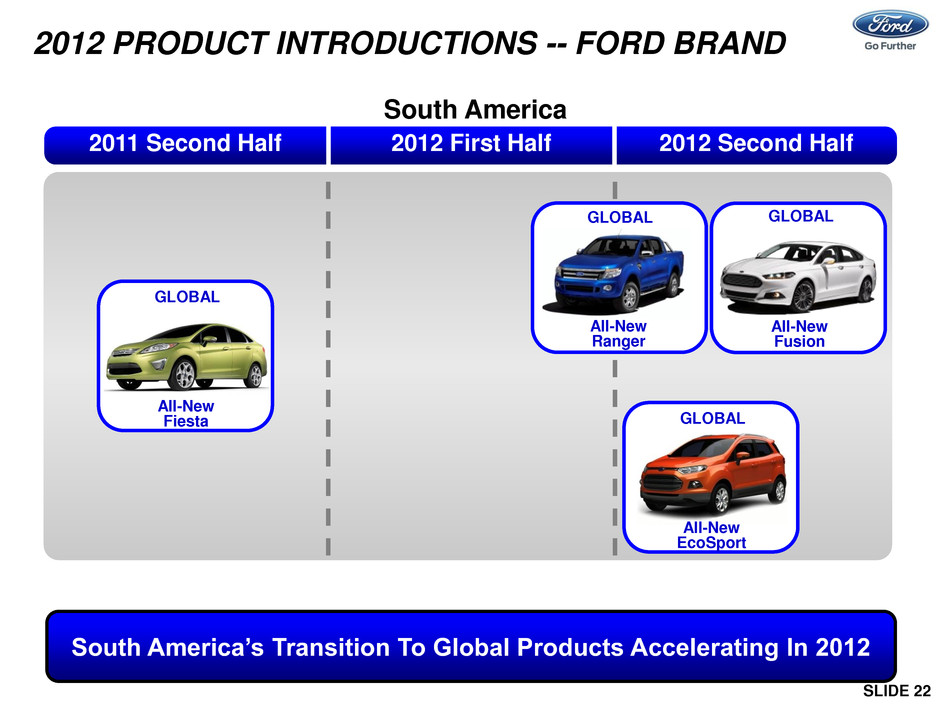

SLIDE 22 All-New Fusion GLOBAL 2012 Second Half All-New Ranger GLOBAL All-New EcoSport 2012 PRODUCT INTRODUCTIONS -- FORD BRAND South America South America’s Transition To Global Products Accelerating In 2012 GLOBAL 2012 First Half 2011 Second Half GLOBAL All-New Fiesta

SLIDE 23 EUROPE, ASIA PACIFIC AFRICA, AND FORD CREDIT OUTLOOK • European external environment is uncertain and the automotive industry remains under pressure – Full Year 2012 industry volume for the 19 markets we track is expected to be about 14 million units – Full Year 2012 results for Ford Europe are expected to be a loss of about $500 million to $600 million, and First Quarter 2012 results about the same as or somewhat worse than Fourth Quarter 2011 • Asia Pacific Africa (APA) – several key markets including China and India have entered cycles of policy easing to support economic growth – Ford APA is expected to grow volume and be profitable for Full Year 2012, but First Quarter 2012 results are expected to be a small loss, as we continue to invest in growth while launching the global Ranger and Focus • We expect Ford Credit to be solidly profitable for Full Year 2012 but at a lower level than 2011

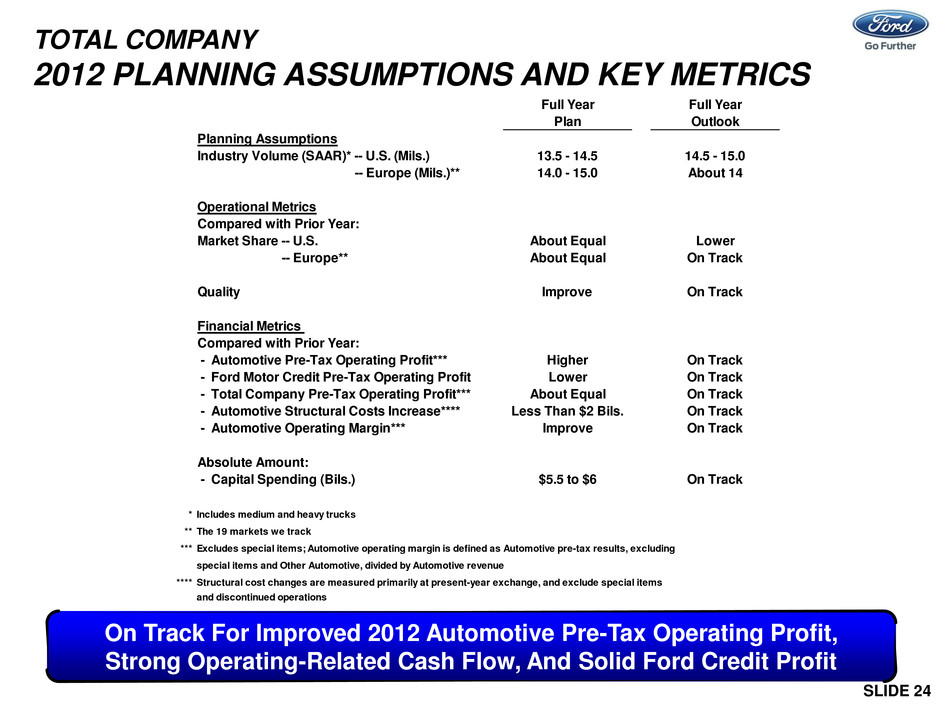

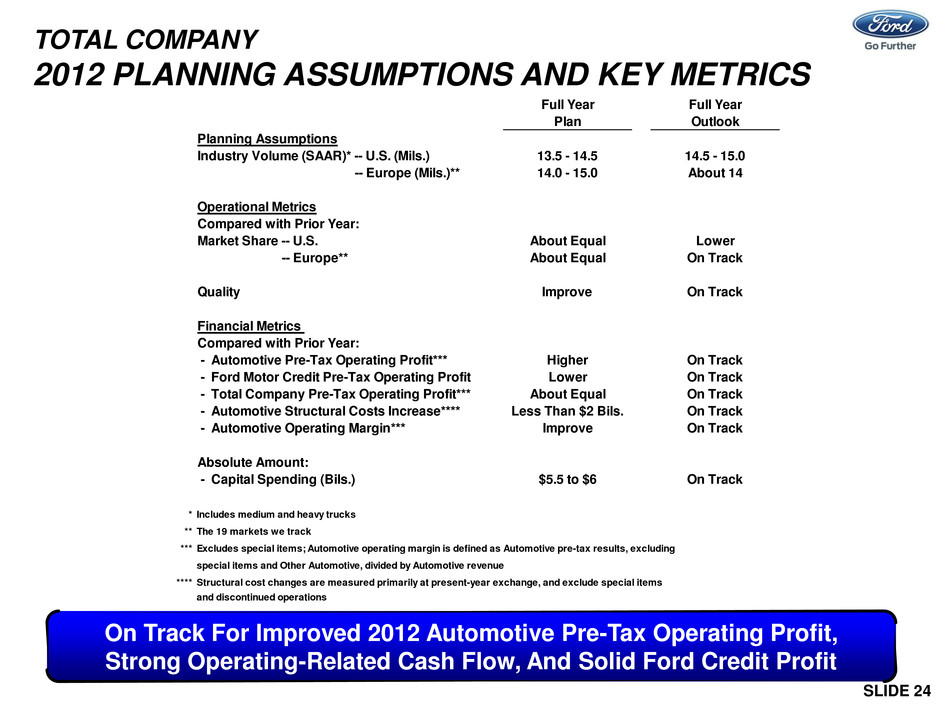

SLIDE 24 On Track For Improved 2012 Automotive Pre-Tax Operating Profit, Strong Operating-Related Cash Flow, And Solid Ford Credit Profit TOTAL COMPANY 2012 PLANNING ASSUMPTIONS AND KEY METRICS Full Year Full Year Plan Outlook Planning Assumptions Industry Volume (SAAR)* -- U.S. (Mils.) 13.5 - 14.5 14.5 - 15.0 Industry Volume (SAAR)* -- Europe (Mils.)** 14.0 - 15.0 About 14 Operational Metrics Compared with Prior Year: Market Share -- U.S. About Equal Lower Market Share -- Europe** About Equal On Track Quality Improve On Track Financial Metrics Compared with Prior Year: - Automotive Pre-Tax Operating Profit*** Higher On Track - Ford Motor Credit Pre-Tax Operating Profit Lower On Track - Total Company Pre-Tax Operating Profit*** About Equal On Track - Automotive Structural Costs Increase**** Less Than $2 Bils. On Track - Automotive Operating Margin*** Improve On Track Absolute Amount: - Capital Spending (Bils.) $5.5 to $6 On Track * Includes medium and heavy trucks ** The 19 markets we track *** Excludes special items; Automotive operating margin is defined as Automotive pre-tax results, excluding special items and Other Automotive, divided by Automotive revenue **** Structural cost changes are measured primarily at present-year exchange, and exclude special items and discontinued operations

SLIDE 25 • The ONE Ford Plan continues to deliver profitable growth • The Americas will drive improving Automotive profitability for Ford in 2012 • European business environment will remain difficult and uncertain, and Asia Pacific Africa continues to invest for the future • Execution of our product plan and migration to global platforms are accelerating • Ford is committed to offering a flexible and fuel-efficient line-up that offers customers great fuel economy and the “Power of Choice” CLOSING REMARKS

QUESTIONS?

SLIDE 27 SAFE HARBOR Statements included herein may constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on expectations, forecasts, and assumptions by our management and involve a number of risks, uncertainties, and other factors that could cause actual results to differ materially from those stated, including, without limitation: • Decline in industry sales volume, particularly in the United States or Europe, due to financial crisis, recession, geopolitical events, or other factors; • Decline in market share or failure to achieve growth; • Lower-than-anticipated market acceptance of new or existing products; • Market shift away from sales of larger, more profitable vehicles beyond our current planning assumption, particularly in the United States; • An increase in fuel prices, continued volatility of fuel prices, or reduced availability of fuel; • Continued or increased price competition resulting from industry excess capacity, currency fluctuations, or other factors; • Fluctuations in foreign currency exchange rates, commodity prices, and interest rates; • Adverse effects on our operations resulting from economic, geopolitical, or other events; • Economic distress of suppliers that may require us to provide substantial financial support or take other measures to ensure supplies of components or materials and could increase our costs, affect our liquidity, or cause production constraints or disruptions; • Work stoppages at Ford or supplier facilities or other limitations on production (whether as a result of labor disputes, natural or man-made disasters, tight credit markets or other financial distress, information technology issues, production constraints or difficulties, or other factors); • Single-source supply of components or materials; • Labor or other constraints on our ability to maintain competitive cost structure; • Substantial pension and postretirement health care and life insurance liabilities impairing our liquidity or financial condition; • Worse-than-assumed economic and demographic experience for our postretirement benefit plans (e.g., discount rates or investment returns); • Restriction on use of tax attributes from tax law "ownership change;" • The discovery of defects in vehicles resulting in delays in new model launches, recall campaigns, reputational damage, or increased warranty costs; • Increased safety, emissions, fuel economy, or other regulations resulting in higher costs, cash expenditures, and/or sales restrictions; • Unusual or significant litigation, governmental investigations or adverse publicity arising out of alleged defects in our products, perceived environmental impacts, or otherwise; • A change in our requirements where we have long-term supply arrangements committing us to purchase minimum or fixed quantities of certain parts, or to pay a minimum amount to the seller ("take-or-pay" contracts); • Adverse effects on our results from a decrease in or cessation or clawback of government incentives related to investments; • Inherent limitations of internal controls impacting financial statements and safeguarding of assets; • Cybersecurity risks to operational systems, security systems, or infrastructure owned by us or a third-party vendor, or at a supplier facility; • Failure of financial institutions to fulfill commitments under committed credit facilities; • Inability of Ford Credit to access debt, securitization, or derivative markets around the world at competitive rates or in sufficient amounts, due to credit rating downgrades, market volatility, market disruption, regulatory requirements, or other factors; • Higher-than-expected credit losses, lower-than-anticipated residual values or higher-than-expected return volumes for leased vehicles; • Increased competition from banks or other financial institutions seeking to increase their share of financing Ford vehicles; and • New or increased credit, consumer, or data protection or other regulations resulting in higher costs and/or additional financing restrictions. We cannot be certain that any expectation, forecast, or assumption made in preparing forward-looking statements will prove accurate, or that any projection will be realized. It is to be expected that there may be differences between projected and actual results. Our forward-looking statements speak only as of the date of initial issuance, and we do not undertake any obligation to update or revise publicly any forward-looking statement, whether as a result of new information, future events or otherwise. For additional discussion, see "Item 1A. Risk Factors" in our Annual Report on Form 10-K for the year ended December 31, 2011.