2Q Earnings Review July 25, 2018

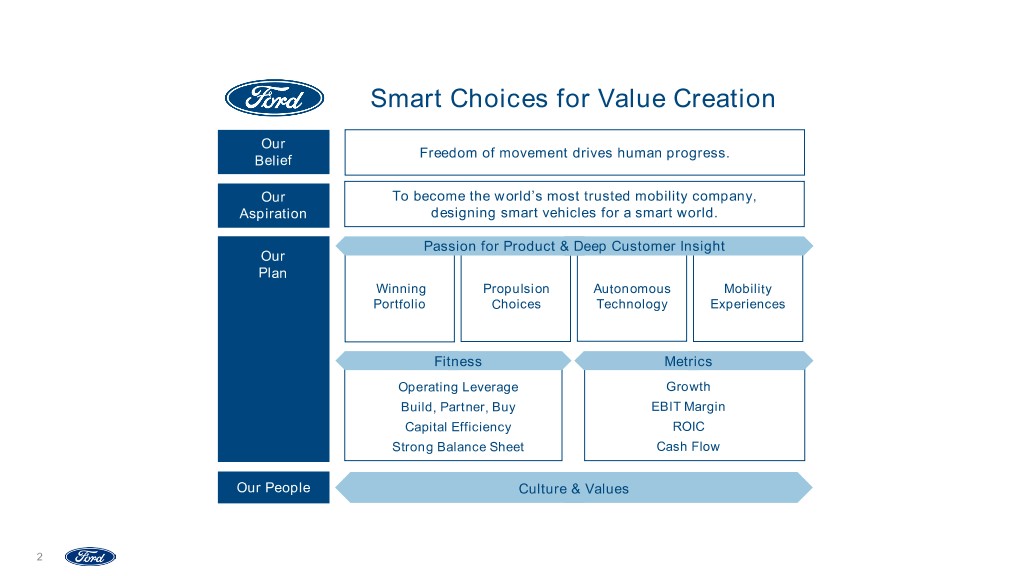

Smart Choices for Value Creation Our Freedom of movement drives human progress. Belief Our To become the world’s most trusted mobility company, Aspiration designing smart vehicles for a smart world. Passion for Product & Deep Customer Insight Our Plan Winning Propulsion Autonomous Mobility Portfolio Choices Technology Experiences Fitness Metrics Operating Leverage Growth Build, Partner, Buy EBIT Margin Capital Efficiency ROIC Strong Balance Sheet Cash Flow Our People Culture & Values 2

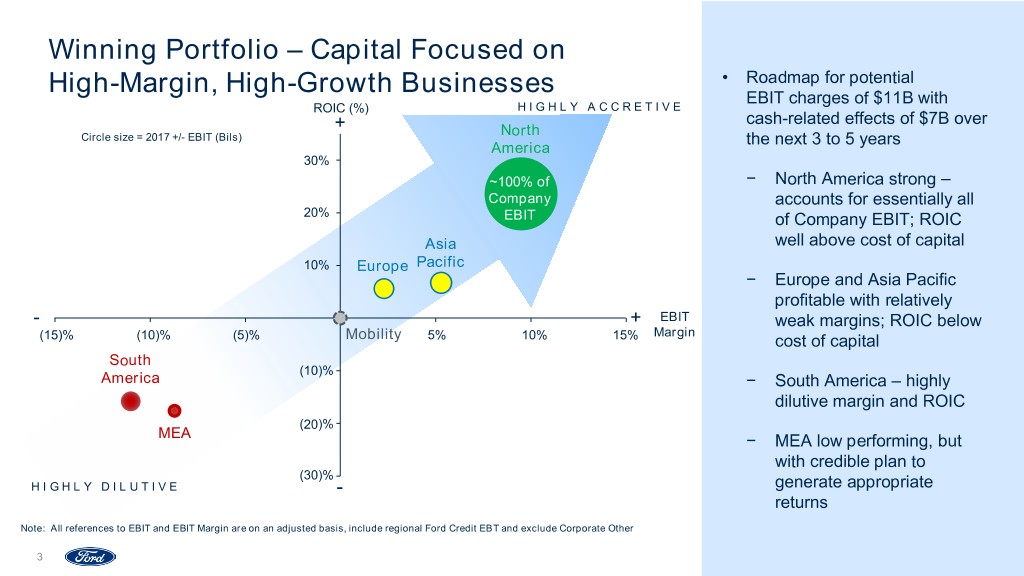

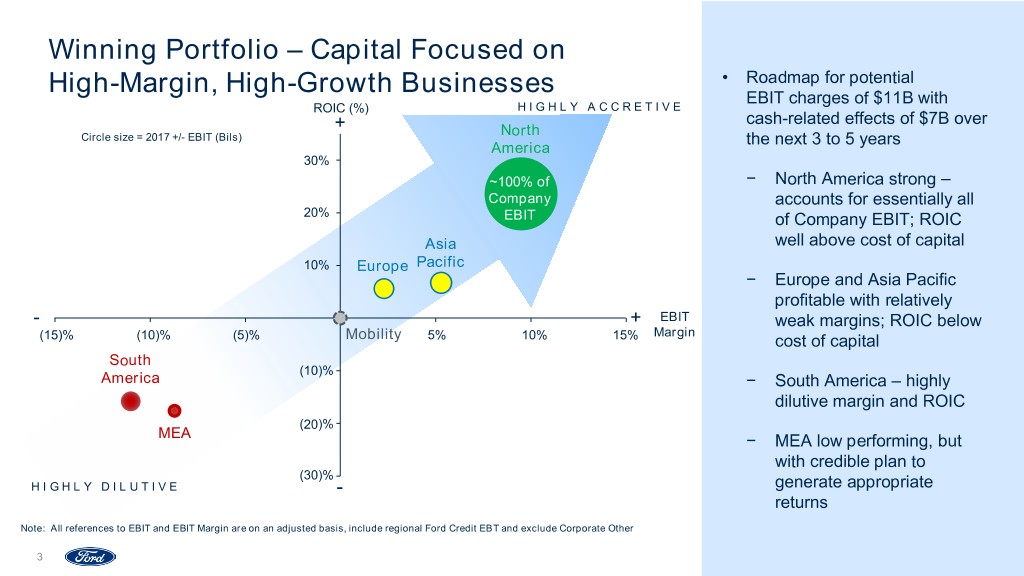

Winning Portfolio – Capital Focused on • Roadmap for potential High-Margin, High-Growth Businesses EBIT charges of $11B with ROIC (%) HIGHLY ACCRETIVE cash-related effects of $7B over + North Circle size = 2017 +/- EBIT (Bils) the next 3 to 5 years America 30% ~100% of − North America strong – Company accounts for essentially all 20% EBIT of Company EBIT; ROIC Asia well above cost of capital 10% Europe Pacific − Europe and Asia Pacific profitable with relatively - + EBIT weak margins; ROIC below Margin (15)% (10)% (5)% Mobility 5% 10% 15% cost of capital South (10)% America − South America – highly dilutive margin and ROIC (20)% MEA − MEA low performing, but with credible plan to (30)% HIGHLY DILUTIVE - generate appropriate returns Note: All references to EBIT and EBIT Margin are on an adjusted basis, include regional Ford Credit EBT and exclude Corporate Other 3

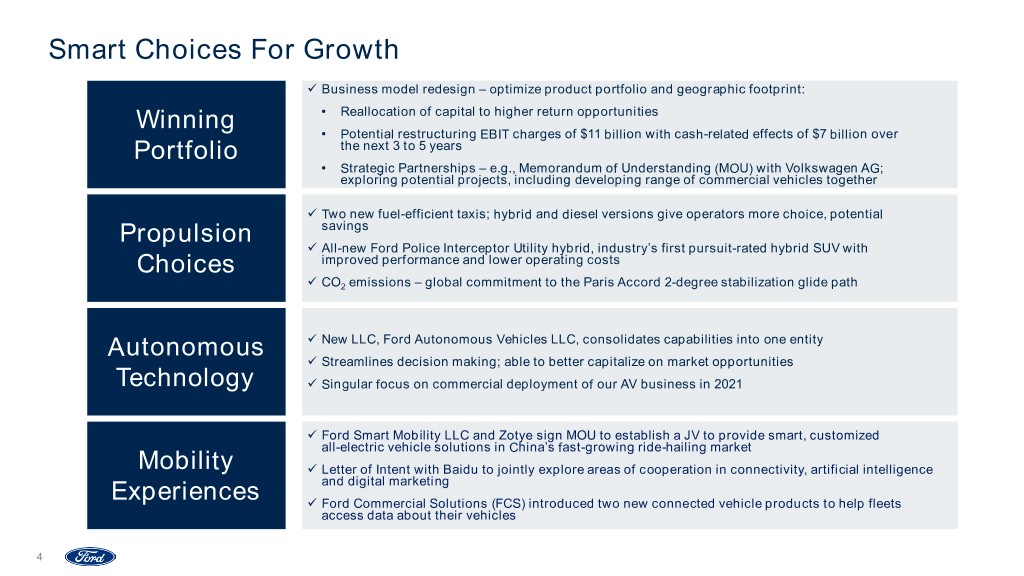

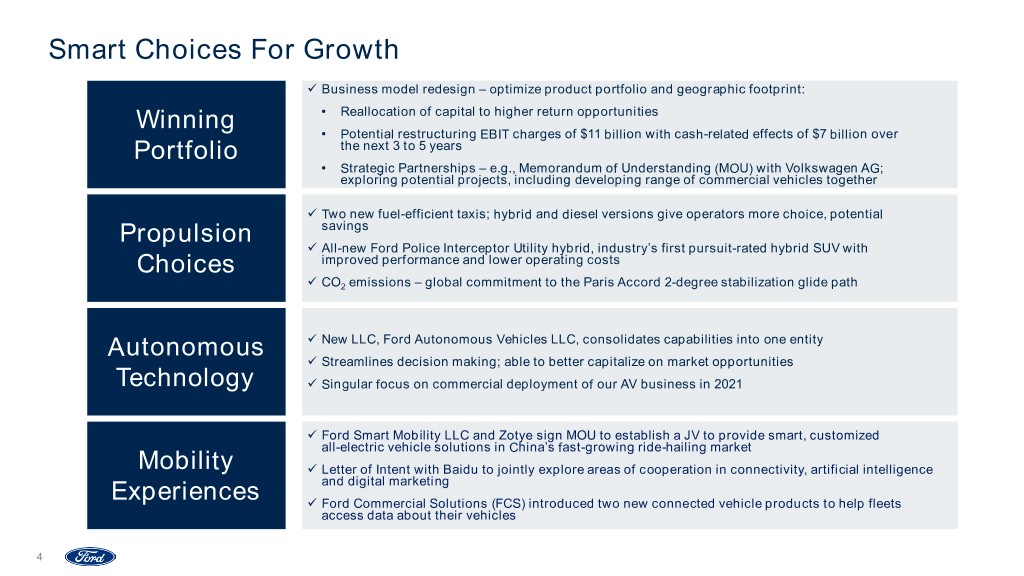

Smart Choices For Growth Business model redesign – optimize product portfolio and geographic footprint: • Reallocation of capital to higher return opportunities Winning • Potential restructuring EBIT charges of $11 billion with cash-related effects of $7 billion over Portfolio the next 3 to 5 years • Strategic Partnerships – e.g., Memorandum of Understanding (MOU) with Volkswagen AG; exploring potential projects, including developing range of commercial vehicles together Two new fuel-efficient taxis; hybrid and diesel versions give operators more choice, potential savings Propulsion All-new Ford Police Interceptor Utility hybrid, industry’s first pursuit-rated hybrid SUV with Choices improved performance and lower operating costs CO2 emissions – global commitment to the Paris Accord 2-degree stabilization glide path New LLC, Ford Autonomous Vehicles LLC, consolidates capabilities into one entity Autonomous Streamlines decision making; able to better capitalize on market opportunities Technology Singular focus on commercial deployment of our AV business in 2021 Ford Smart Mobility LLC and Zotye sign MOU to establish a JV to provide smart, customized all-electric vehicle solutions in China’s fast-growing ride-hailing market Mobility Letter of Intent with Baidu to jointly explore areas of cooperation in connectivity, artificial intelligence and digital marketing Experiences Ford Commercial Solutions (FCS) introduced two new connected vehicle products to help fleets access data about their vehicles 4

Ford Autonomous Vehicles LLC • Singular focus on commercial deployment of AV business in 2021 MOVING PEOPLE SELF-DRIVING & GOODS SYSTEM • Brings together teams that have DISPATCH & been focused on AV over the ROUTING last 18 months DATA FROM VEHICLE − Includes majority stake in VEHICLE AV LLC INTEGRATION Argo AI Research & Engineering Transportation-as-a-service Platform • Flexibility to monetize Business Development & PARTNER API capabilities and investments in Go-to-Market Strategy PLATFORM IN VEHICLE User Experience Design the future SERVICES • By 2023 will invest $4B in AV DATA & ANALYTICS business, including previously announced $1B in Argo AI BUSINESS FLEET SERVICES MANAGEMENT • Headcount dedicated to AV development of 700 5

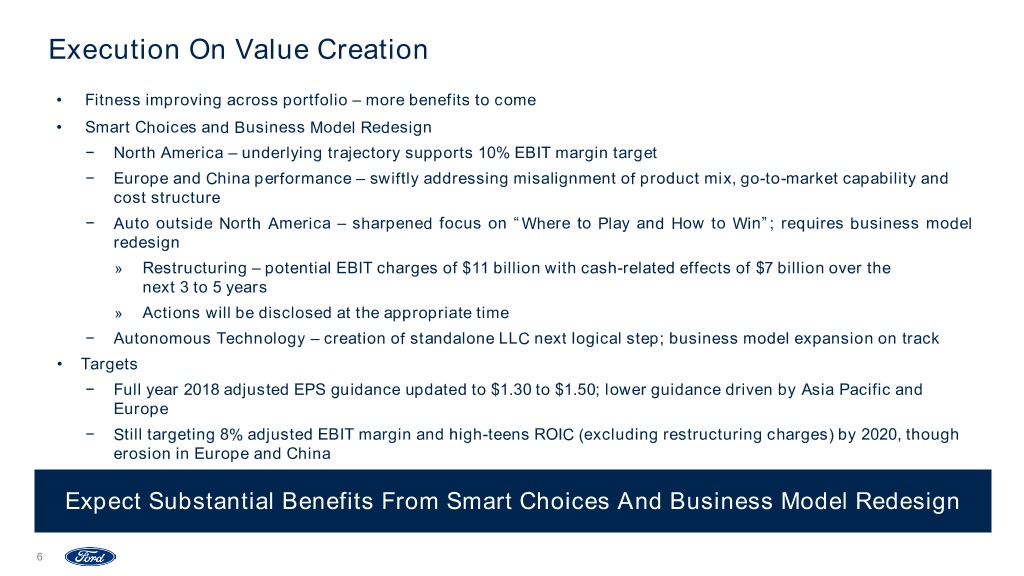

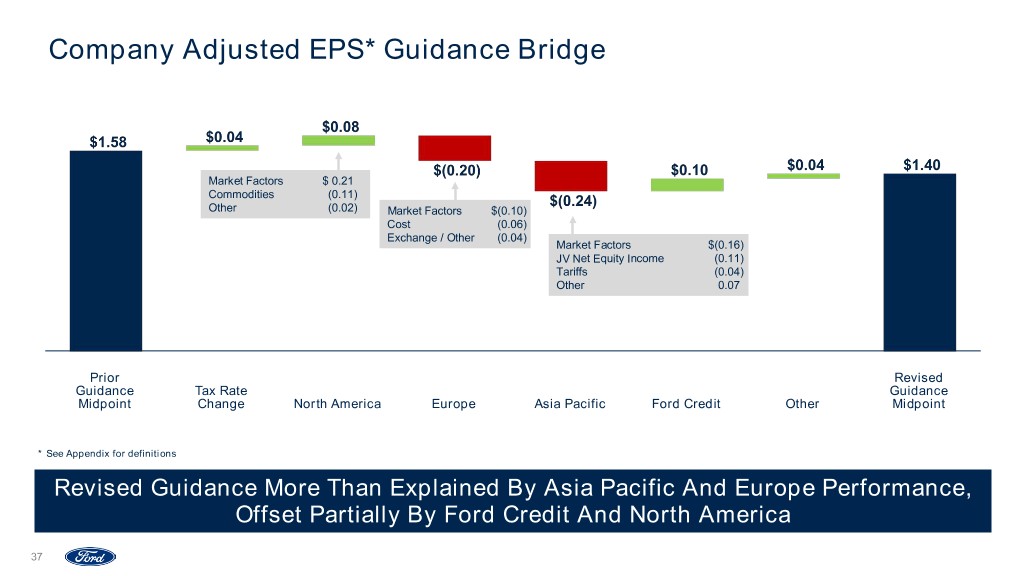

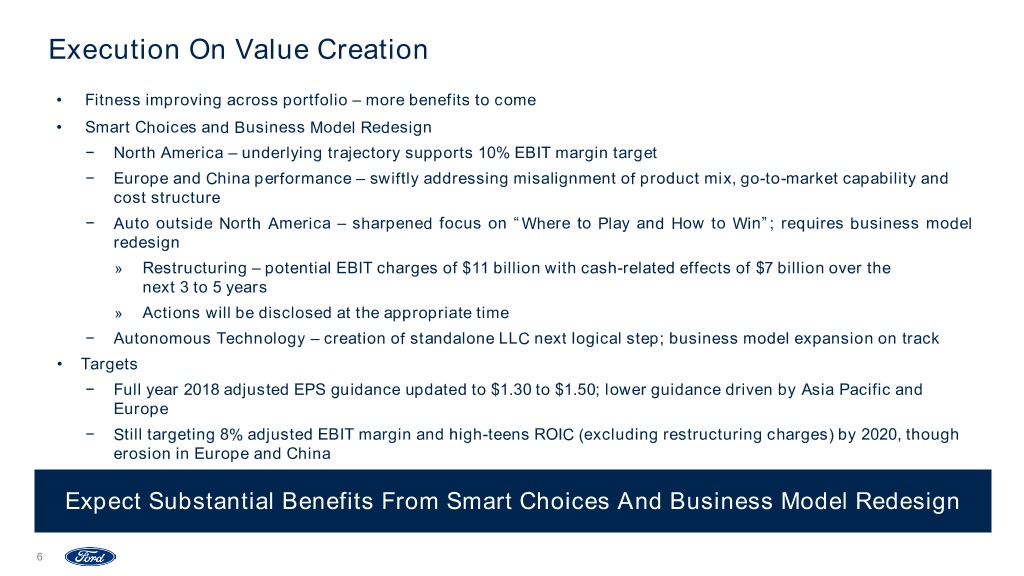

Execution On Value Creation • Fitness improving across portfolio – more benefits to come • Smart Choices and Business Model Redesign − North America – underlying trajectory supports 10% EBIT margin target − Europe and China performance – swiftly addressing misalignment of product mix, go-to-market capability and cost structure − Auto outside North America – sharpened focus on “Where to Play and How to Win”; requires business model redesign » Restructuring – potential EBIT charges of $11 billion with cash-related effects of $7 billion over the next 3 to 5 years » Actions will be disclosed at the appropriate time − Autonomous Technology – creation of standalone LLC next logical step; business model expansion on track • Targets − Full year 2018 adjusted EPS guidance updated to $1.30 to $1.50; lower guidance driven by Asia Pacific and Europe − Still targeting 8% adjusted EBIT margin and high-teens ROIC (excluding restructuring charges) by 2020, though erosion in Europe and China Expect Substantial Benefits From Smart Choices And Business Model Redesign 6

Bob Shanks Chief Financial Officer Financial Review

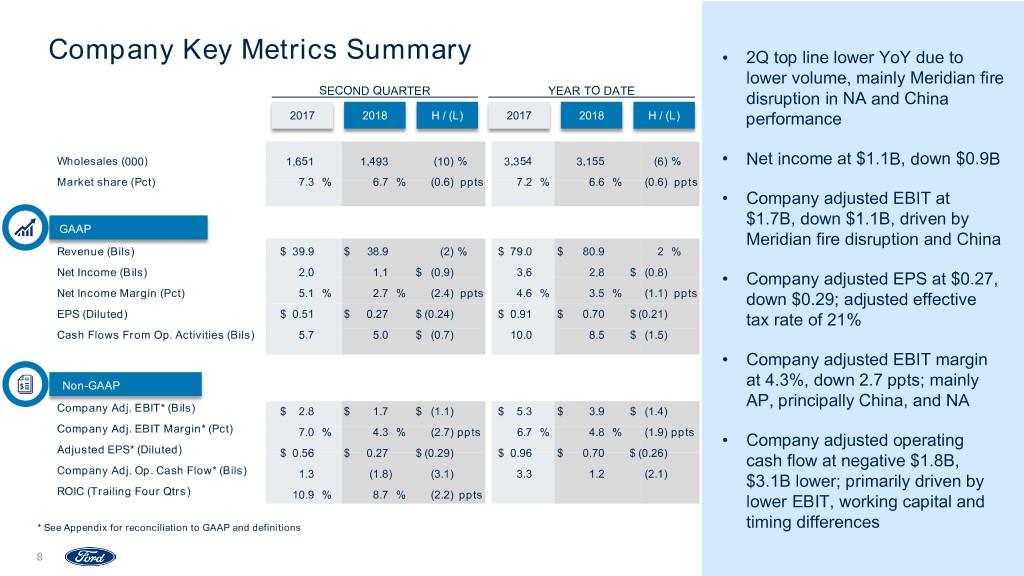

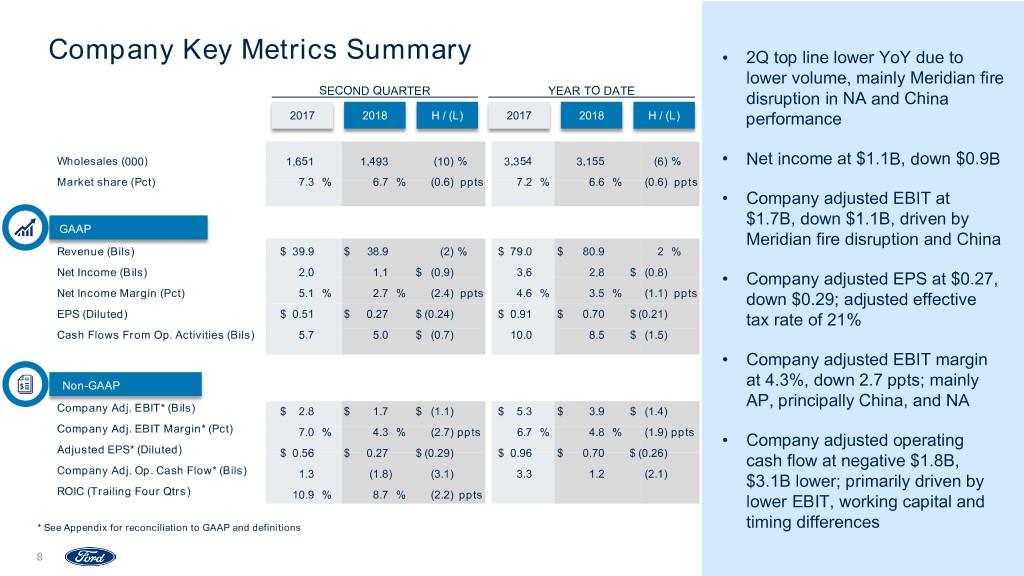

Company Key Metrics Summary • 2Q top line lower YoY due to lower volume, mainly Meridian fire SECOND QUARTER YEAR TO DATE disruption in NA and China 2017 2018 H / (L) 2017 2018 H / (L) performance Wholesales (000) 1,651 1,493 (10) % 3,354 3,155 (6) % • Net income at $1.1B, down $0.9B Market share (Pct) 7.3 % 6.7 % (0.6) ppts 7.2 % 6.6 % (0.6) ppts • Company adjusted EBIT at $1.7B, down $1.1B, driven by GAAP Meridian fire disruption and China Revenue (Bils) $ 39.9 $ 38.9 (2) % $ 79.0 $ 80.9 2 % Net Income (Bils) 2.0 1.1 $ (0.9) 3.6 2.8 $ (0.8) • Company adjusted EPS at $0.27, Net Income Margin (Pct) 5.1 % 2.7 % (2.4) ppts 4.6 % 3.5 % (1.1) ppts down $0.29; adjusted effective EPS (Diluted) $ 0.51 $ 0.27 $ (0.24) $ 0.91 $ 0.70 $ (0.21) tax rate of 21% Cash Flows From Op. Activities (Bils) 5.7 5.0 $ (0.7) 10.0 8.5 $ (1.5) • Company adjusted EBIT margin Non-GAAP at 4.3%, down 2.7 ppts; mainly AP, principally China, and NA Company Adj. EBIT* (Bils) $ 2.8 $ 1.7 $ (1.1) $ 5.3 $ 3.9 $ (1.4) Company Adj. EBIT Margin* (Pct) 7.0 % 4.3 % (2.7) ppts 6.7 % 4.8 % (1.9) ppts • Company adjusted operating Adjusted EPS* (Diluted) $ 0.56 $ 0.27 $ (0.29) $ 0.96 $ 0.70 $ (0.26) cash flow at negative $1.8B, Company Adj. Op. Cash Flow* (Bils) 1.3 (1.8) (3.1) 3.3 1.2 (2.1) $3.1B lower; primarily driven by ROIC (Trailing Four Qtrs) 10.9 % 8.7 % (2.2) ppts lower EBIT, working capital and * See Appendix for reconciliation to GAAP and definitions timing differences 8

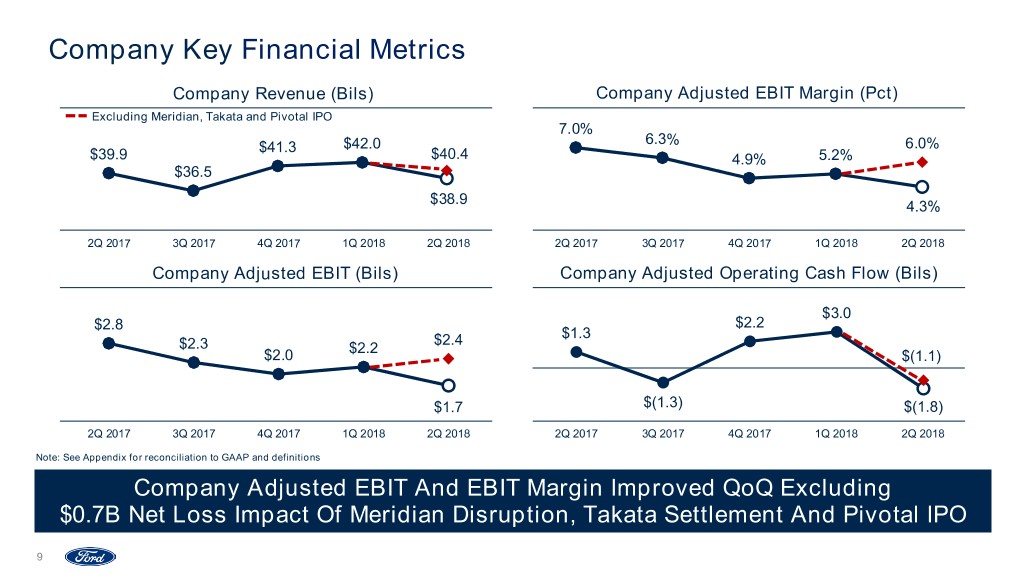

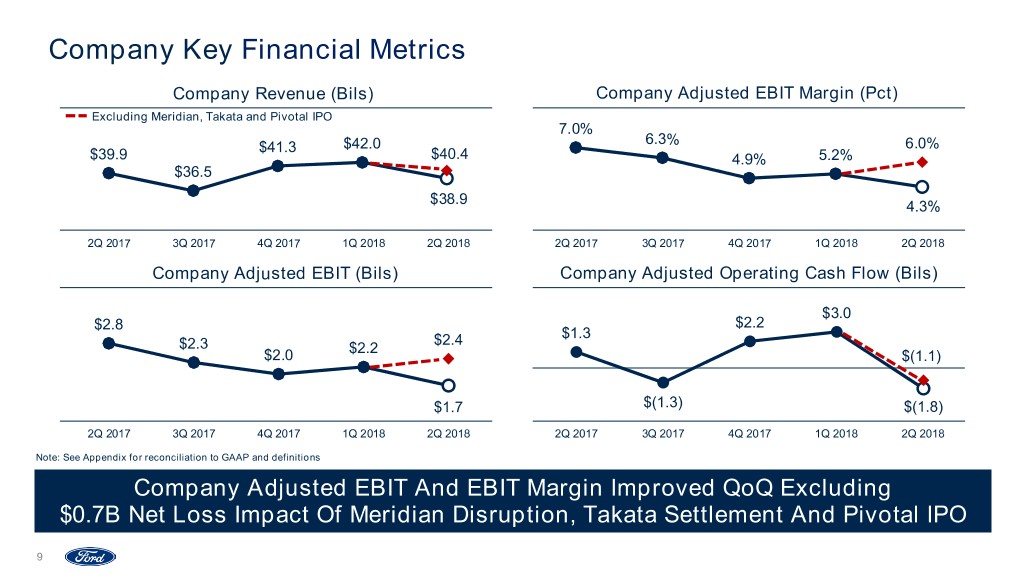

Company Key Financial Metrics Company Revenue (Bils) Company Adjusted EBIT Margin (Pct) Excluding Meridian, Takata and Pivotal IPO 7.0% 6.3% $41.3 $42.0 6.0% $39.9 $40.4 4.9% 5.2% $36.5 $38.9 4.3% 2Q 2017 3Q 2017 4Q 2017 1Q 2018 2Q 2018 2Q 2017 3Q 2017 4Q 2017 1Q 2018 2Q 2018 Company Adjusted EBIT (Bils) Company Adjusted Operating Cash Flow (Bils) $3.0 $2.8 $2.2 $2.4 $1.3 $2.3 $2.2 $2.0 $(1.1) $1.7 $(1.3) $(1.8) 2Q 2017 3Q 2017 4Q 2017 1Q 2018 2Q 2018 2Q 2017 3Q 2017 4Q 2017 1Q 2018 2Q 2018 Note: See Appendix for reconciliation to GAAP and definitions Company Adjusted EBIT And EBIT Margin Improved QoQ Excluding $0.7B Net Loss Impact Of Meridian Disruption, Takata Settlement And Pivotal IPO 9

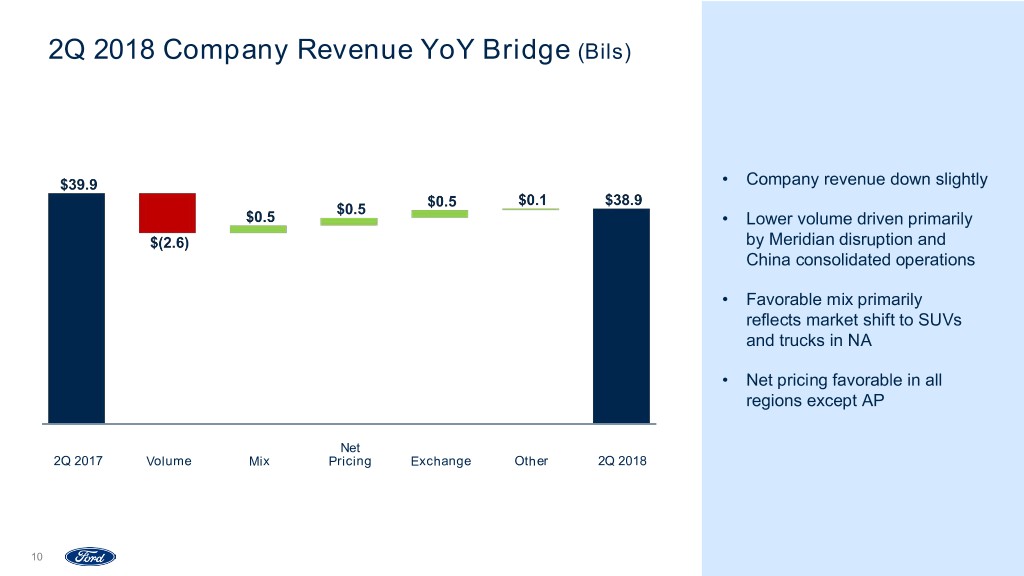

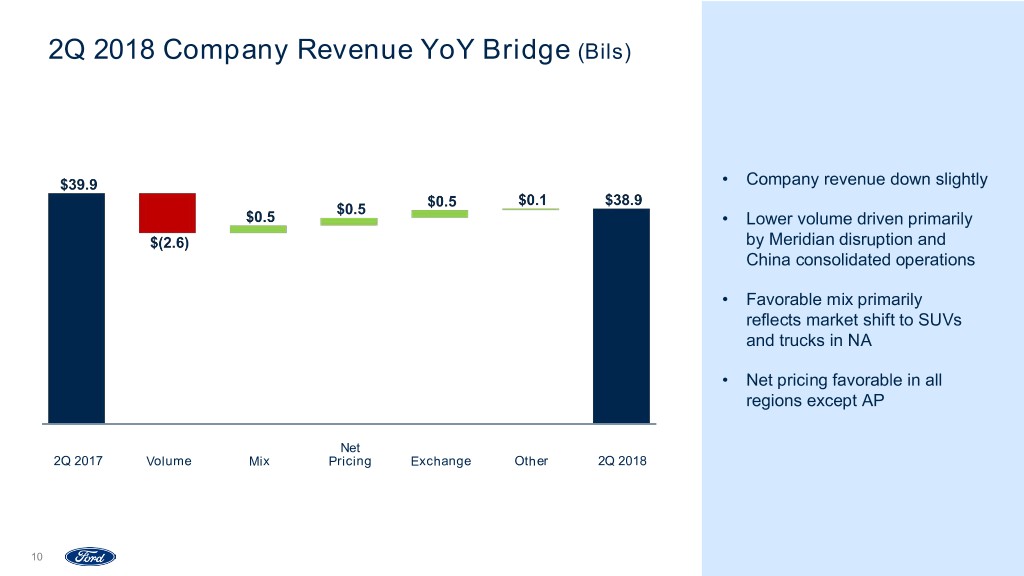

2Q 2018 Company Revenue YoY Bridge (Bils) • Company revenue down slightly • Lower volume driven primarily by Meridian disruption and China consolidated operations • Favorable mix primarily reflects market shift to SUVs and trucks in NA • Net pricing favorable in all regions except AP Net 2Q 2017 Volume Mix Pricing Exchange Other 2Q 2018 10

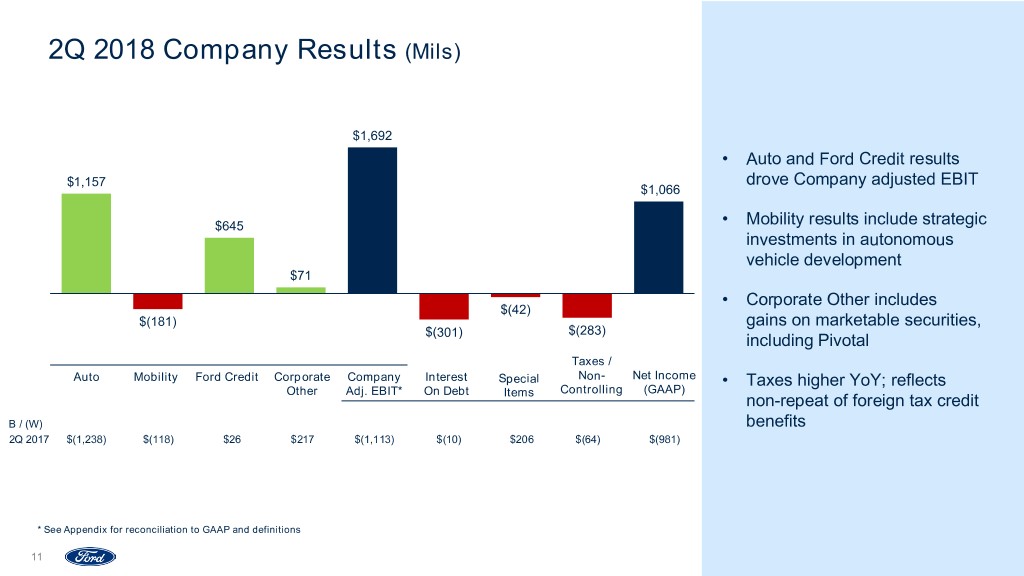

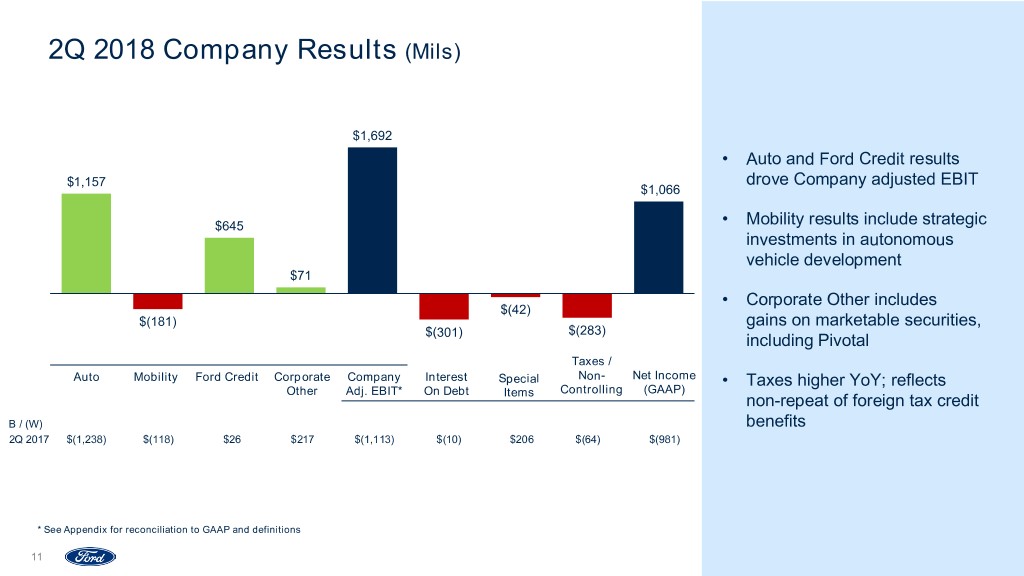

2Q 2018 Company Results (Mils) $1,692 • Auto and Ford Credit results $1,157 drove Company adjusted EBIT $1,066 $645 • Mobility results include strategic investments in autonomous vehicle development $71 • Corporate Other includes $(42) $(181) gains on marketable securities, $(283) $(301) including Pivotal Taxes / Auto Mobility Ford Credit Corporate Company Interest Special Non- Net Income • Taxes higher YoY; reflects Other Adj. EBIT* On Debt Controlling (GAAP) Items non-repeat of foreign tax credit B / (W) benefits 2Q 2017 $(1,238) $(118) $26 $217 $(1,113) $(10) $206 $(64) $(981) * See Appendix for reconciliation to GAAP and definitions 11

2Q 2018 Automotive EBIT By Region (Mils) $1,753 • Automotive EBIT driven by NA $1,157 • Operations outside NA at an EBIT loss in total, down $659M $(596) YoY, driven by AP (China) and Europe $49 • NA EBIT YoY decline caused $(73) $(178) by Meridian disruption $(394) • MEA delivers record 2Q EBIT North South Middle East Asia Automotive America America Europe & Africa Pacific B / (W) 2Q 2017 $(1,238) $(579) $(1) $(195) $98 $(561) 12

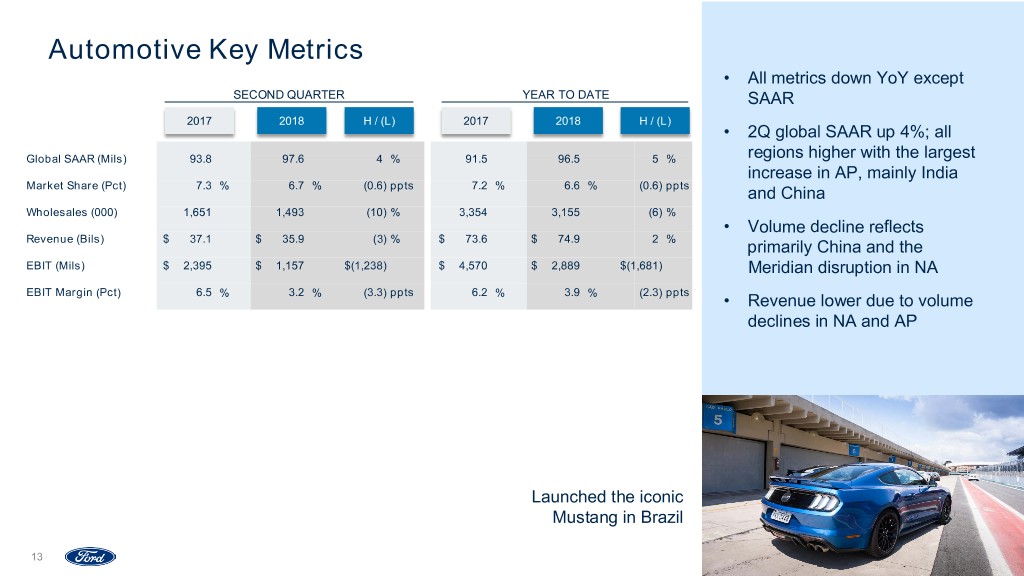

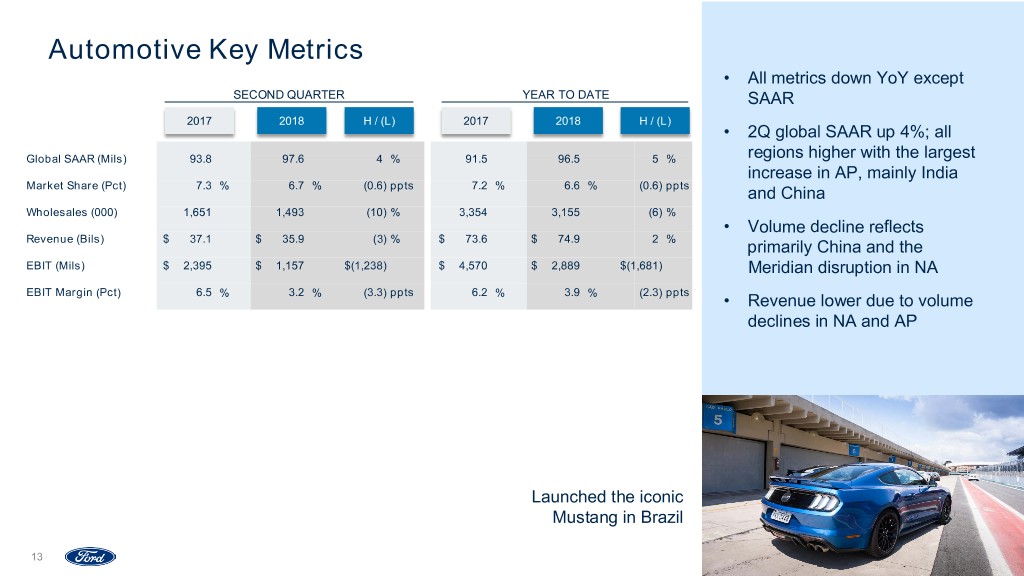

Automotive Key Metrics • All metrics down YoY except SECOND QUARTER YEAR TO DATE SAAR 2017 2018 H / (L) 2017 2018 H / (L) • 2Q global SAAR up 4%; all Global SAAR (Mils) 93.8 97.6 4 % 91.5 96.5 5 % regions higher with the largest increase in AP, mainly India Market Share (Pct) 7.3 % 6.7 % (0.6) ppts 7.2 % 6.6 % (0.6) ppts and China Wholesales (000) 1,651 1,493 (10) % 3,354 3,155 (6) % • Volume decline reflects Revenue (Bils) $ 37.1 $ 35.9 (3) % $ 73.6 $ 74.9 2 % primarily China and the EBIT (Mils) $ 2,395 $ 1,157 $(1,238) $ 4,570 $ 2,889 $(1,681) Meridian disruption in NA EBIT Margin (Pct) 6.5 % 3.2 % (3.3) ppts 6.2 % 3.9 % (2.3) ppts • Revenue lower due to volume declines in NA and AP Launched the iconic Mustang in Brazil 13

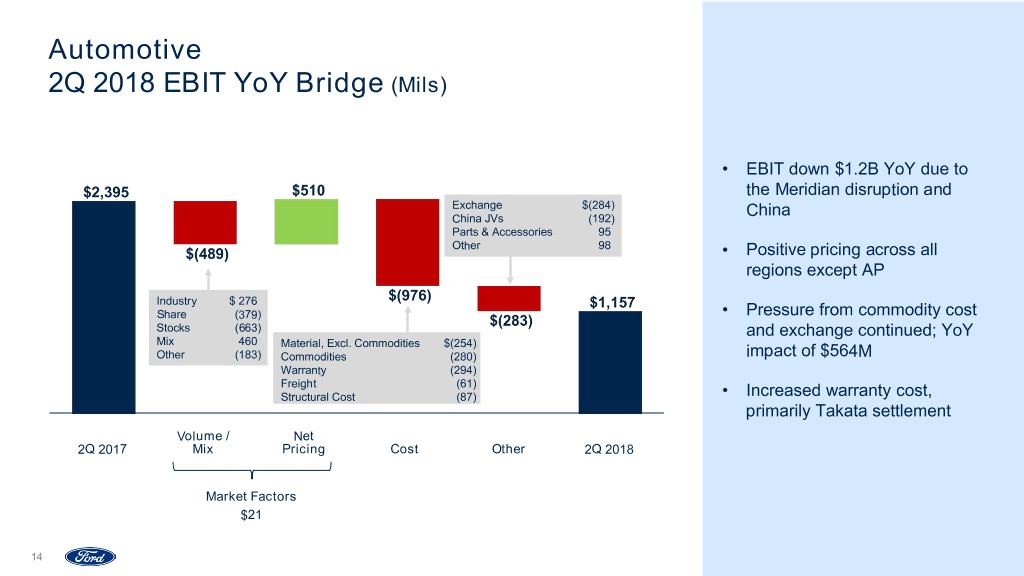

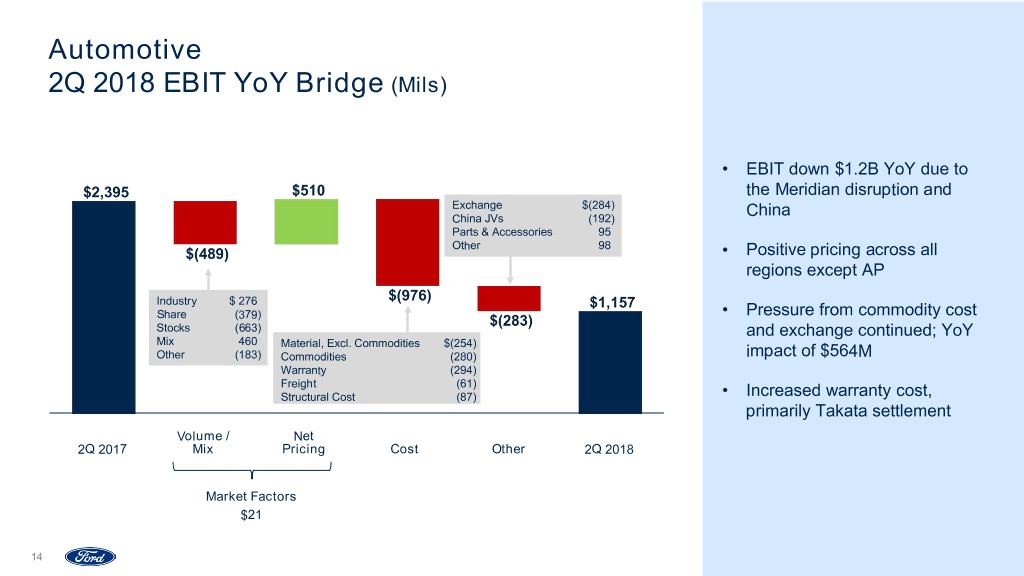

Automotive 2Q 2018 EBIT YoY Bridge (Mils) • EBIT down $1.2B YoY due to the Meridian disruption and Exchange $(284) China JVs (192) China Parts & Accessories 95 Other 98 • Positive pricing across all regions except AP Industry $ 276 Share (379) • Pressure from commodity cost Stocks (663) and exchange continued; YoY Mix 460 Material, Excl. Commodities $(254) Other (183) Commodities (280) impact of $564M Warranty (294) Freight (61) Structural Cost (87) • Increased warranty cost, primarily Takata settlement Volume / Net 2Q 2017 Mix Pricing Cost Other 2Q 2018 Market Factors $21 14

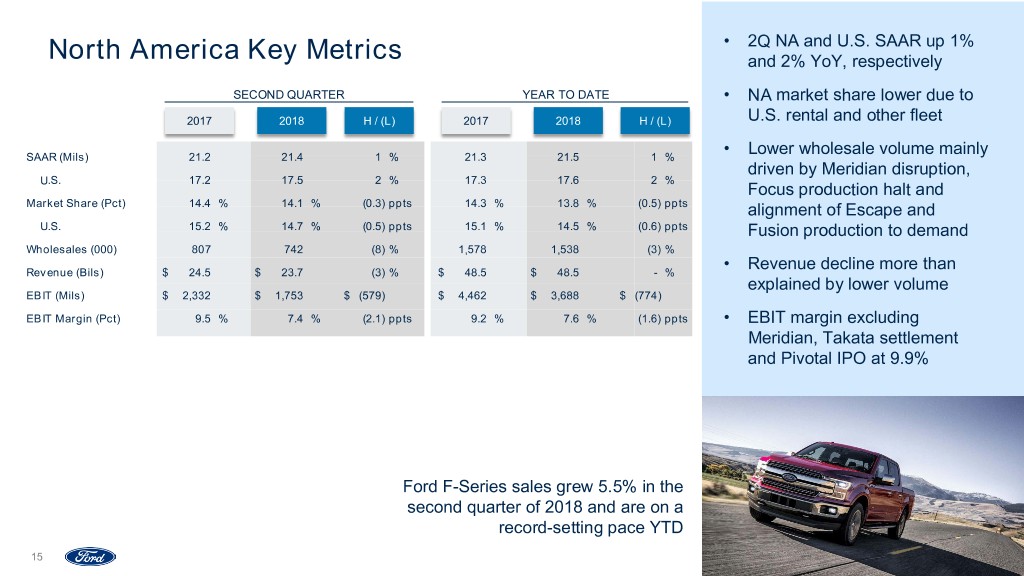

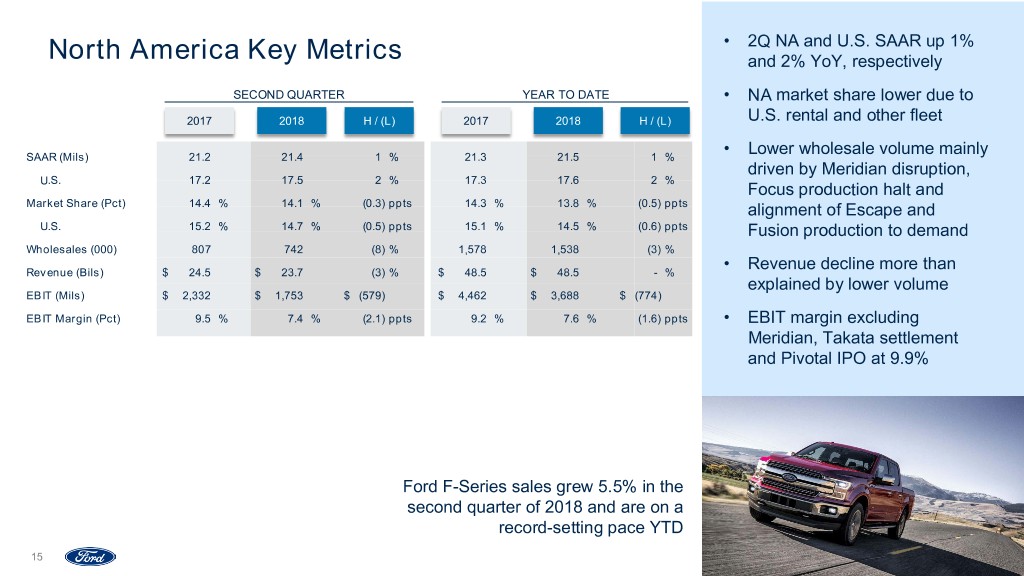

• 2Q NA and U.S. SAAR up 1% North America Key Metrics and 2% YoY, respectively SECOND QUARTER YEAR TO DATE • NA market share lower due to 2017 2018 H / (L) 2017 2018 H / (L) U.S. rental and other fleet SAAR (Mils) 21.2 21.4 1 % 21.3 21.5 1 % • Lower wholesale volume mainly driven by Meridian disruption, U.S. 17.2 17.5 2 % 17.3 17.6 2 % Focus production halt and Market Share (Pct) 14.4 % 14.1 % (0.3) ppts 14.3 % 13.8 % (0.5) ppts alignment of Escape and U.S. 15.2 % 14.7 % (0.5) ppts 15.1 % 14.5 % (0.6) ppts Fusion production to demand Wholesales (000) 807 742 (8) % 1,578 1,538 (3) % • Revenue decline more than Revenue (Bils) $ 24.5 $ 23.7 (3) % $ 48.5 $ 48.5 - % explained by lower volume EBIT (Mils) $ 2,332 $ 1,753 $ (579) $ 4,462 $ 3,688 $ (774) EBIT Margin (Pct) 9.5 % 7.4 % (2.1) ppts 9.2 % 7.6 % (1.6) ppts • EBIT margin excluding Meridian, Takata settlement and Pivotal IPO at 9.9% Ford F-Series sales grew 5.5% in the second quarter of 2018 and are on a record-setting pace YTD 15

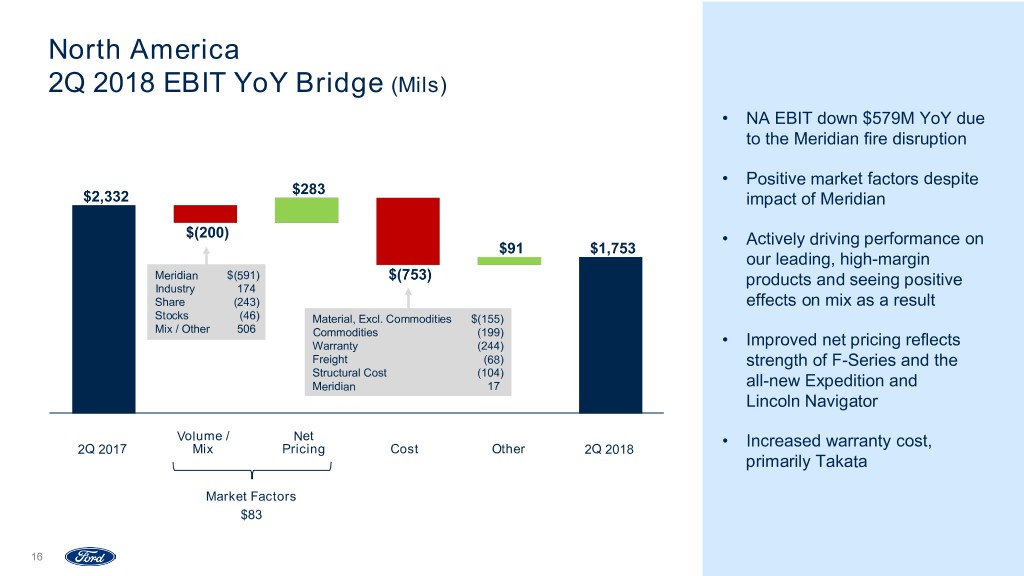

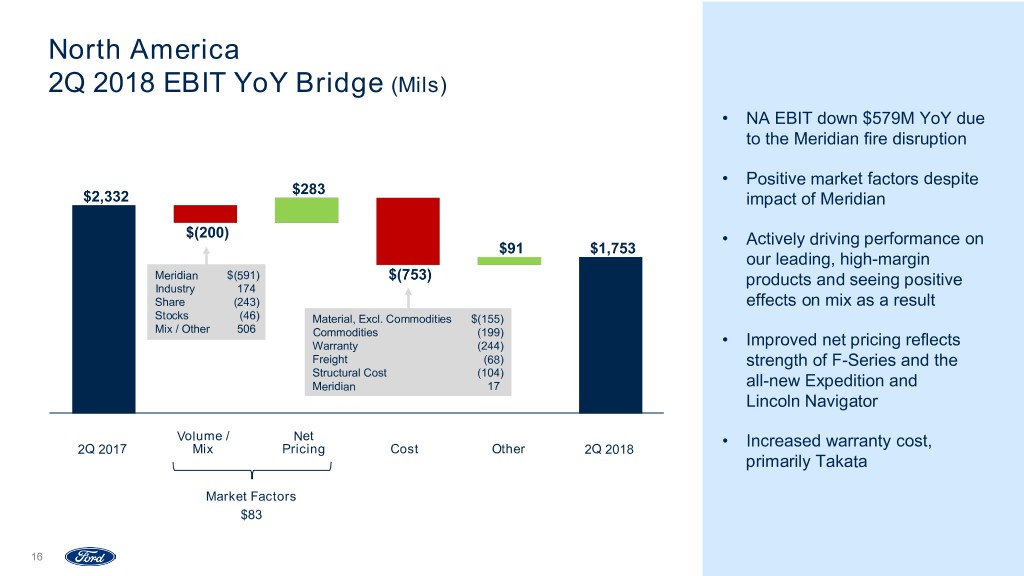

North America 2Q 2018 EBIT YoY Bridge (Mils) • NA EBIT down $579M YoY due to the Meridian fire disruption • Positive market factors despite impact of Meridian • Actively driving performance on our leading, high-margin Meridian $(591) Industry 174 products and seeing positive Share (243) effects on mix as a result Stocks (46) Material, Excl. Commodities $(155) Mix / Other 506 Commodities (199) Warranty (244) • Improved net pricing reflects Freight (68) strength of F-Series and the Structural Cost (104) Meridian 17 all-new Expedition and Lincoln Navigator Volume / Net 2Q 2017 Mix Pricing Cost Other 2Q 2018 • Increased warranty cost, primarily Takata Market Factors $83 16

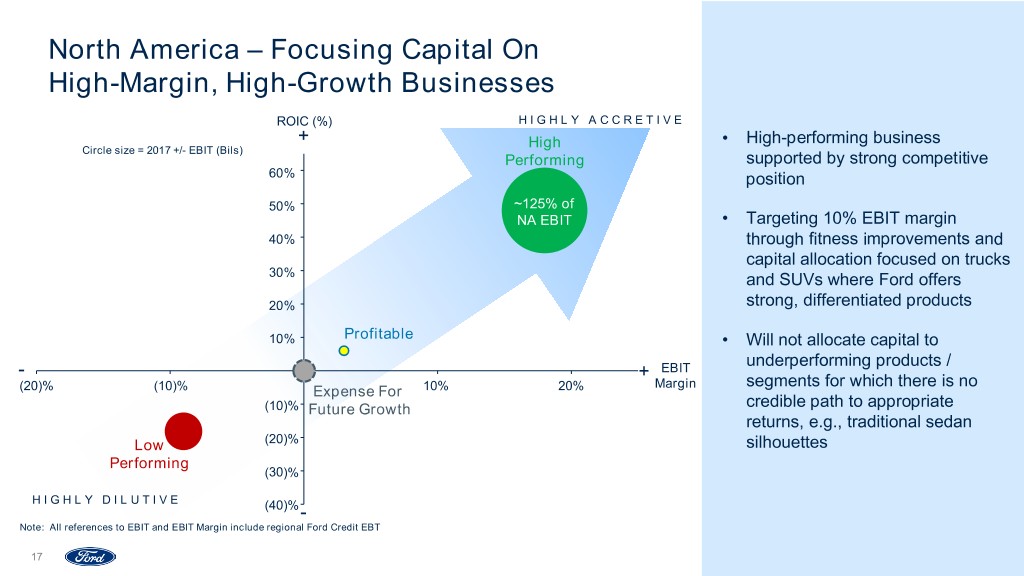

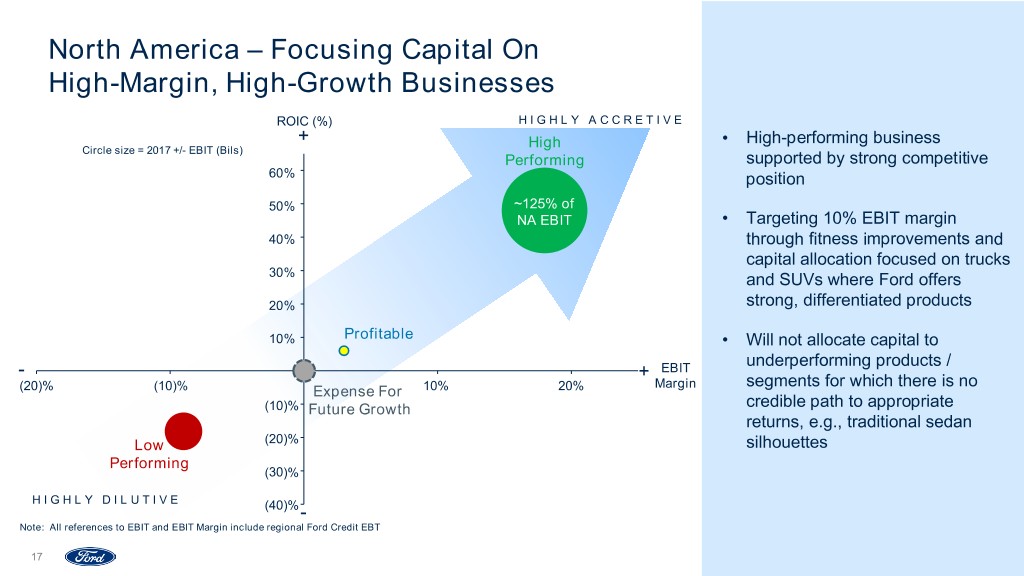

North America – Focusing Capital On High-Margin, High-Growth Businesses ROIC (%) HIGHLY ACCRETIVE + • High-performing business Circle size = 2017 +/- EBIT (Bils) High Performing supported by strong competitive 60% position 50% ~125% of NA EBIT • Targeting 10% EBIT margin 40% through fitness improvements and capital allocation focused on trucks 30% and SUVs where Ford offers 20% strong, differentiated products 10% Profitable • Will not allocate capital to underperforming products / - + EBIT Margin segments for which there is no (20)% (10)% Expense For 10% 20% credible path to appropriate (10)% Future Growth returns, e.g., traditional sedan Low (20)% silhouettes Performing (30)% HIGHLY DILUTIVE (40)%- Note: All references to EBIT and EBIT Margin include regional Ford Credit EBT 17

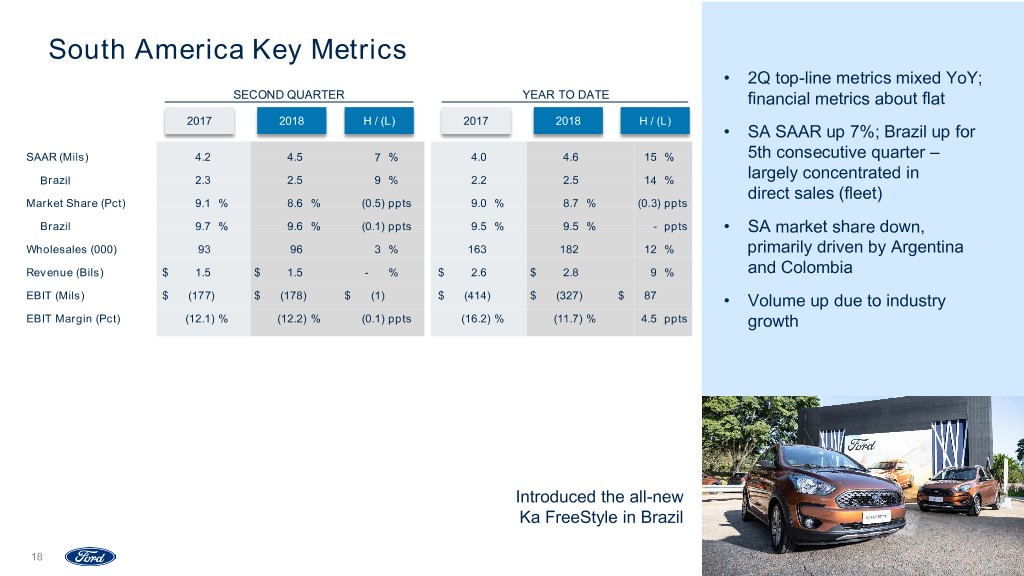

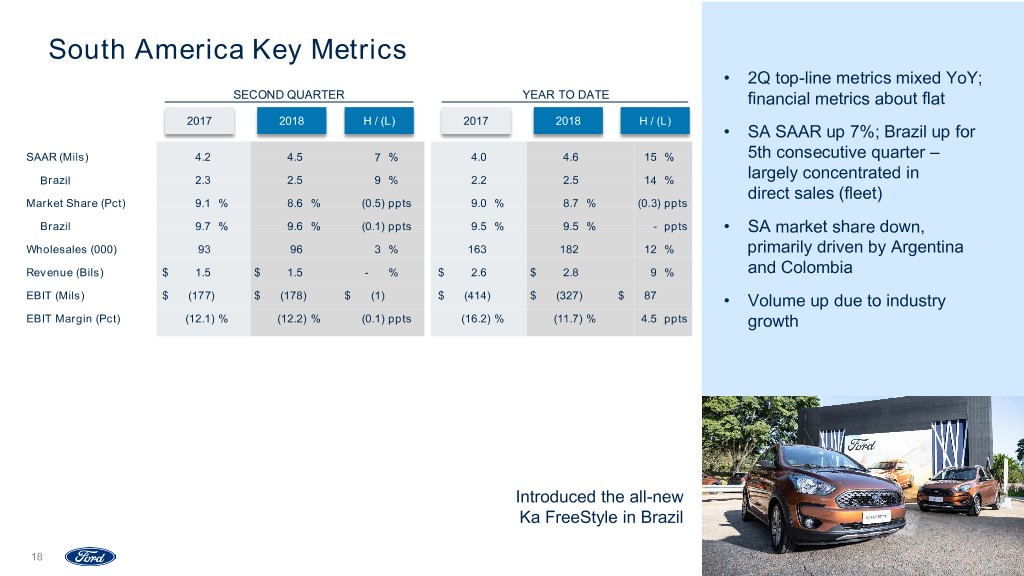

South America Key Metrics • 2Q top-line metrics mixed YoY; SECOND QUARTER YEAR TO DATE financial metrics about flat 2017 2018 H / (L) 2017 2018 H / (L) • SA SAAR up 7%; Brazil up for SAAR (Mils) 4.2 4.5 7 % 4.0 4.6 15 % 5th consecutive quarter – Brazil 2.3 2.5 9 % 2.2 2.5 14 % largely concentrated in direct sales (fleet) Market Share (Pct) 9.1 % 8.6 % (0.5) ppts 9.0 % 8.7 % (0.3) ppts Brazil 9.7 % 9.6 % (0.1) ppts 9.5 % 9.5 % - ppts • SA market share down, Wholesales (000) 93 96 3 % 163 182 12 % primarily driven by Argentina Revenue (Bils) $ 1.5 $ 1.5 - % $ 2.6 $ 2.8 9 % and Colombia EBIT (Mils) $ (177) $ (178) $ (1) $ (414) $ (327) $ 87 • Volume up due to industry EBIT Margin (Pct) (12.1) % (12.2) % (0.1) ppts (16.2) % (11.7) % 4.5 ppts growth Introduced the all-new Ka FreeStyle in Brazil 18

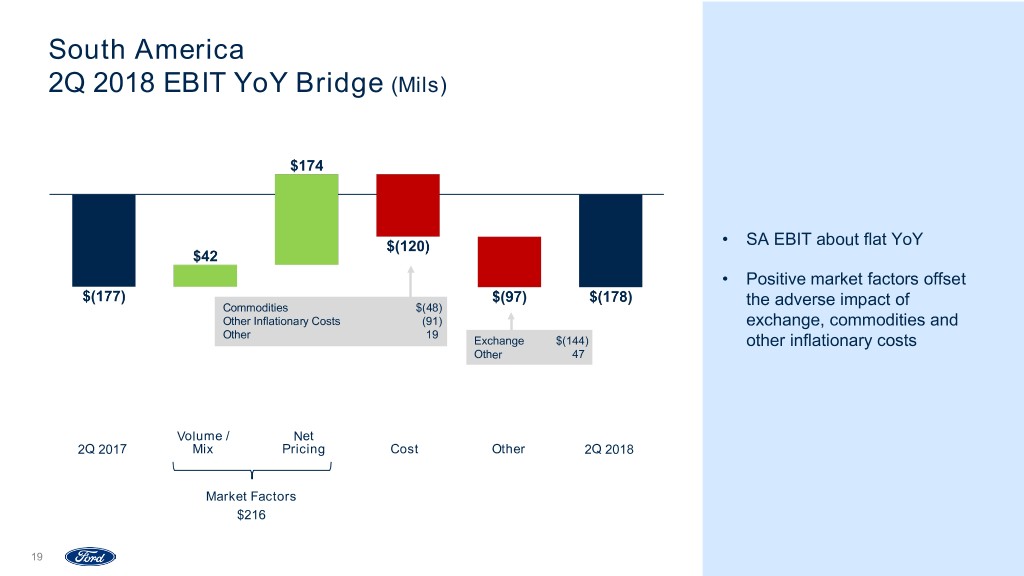

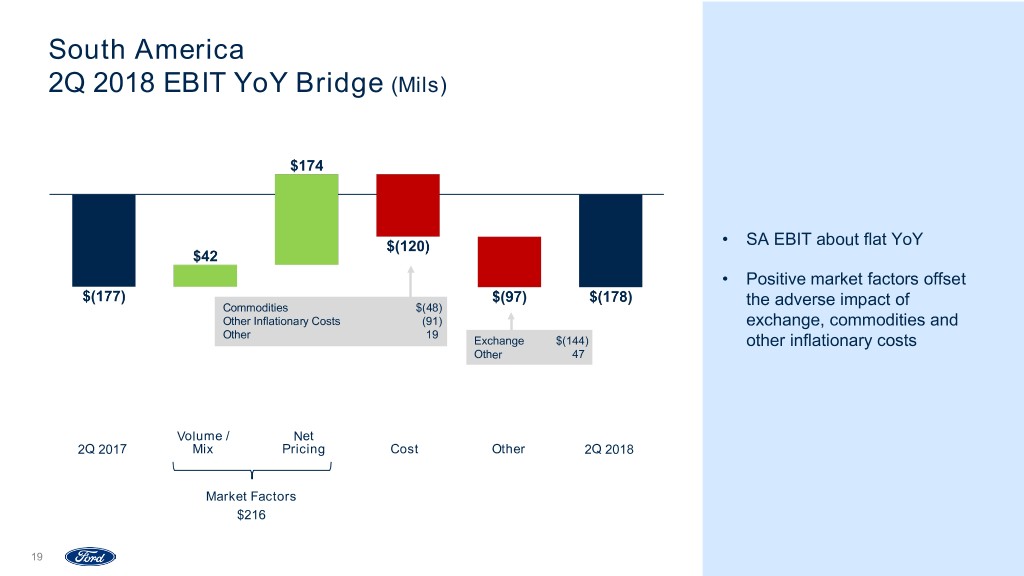

South America 2Q 2018 EBIT YoY Bridge (Mils) • SA EBIT about flat YoY • Positive market factors offset Commodities $(48) the adverse impact of Other Inflationary Costs (91) exchange, commodities and Other 19 Exchange $(144) other inflationary costs Other 47 Volume / Net 2Q 2017 Mix Pricing Cost Other 2Q 2018 Market Factors $216 19

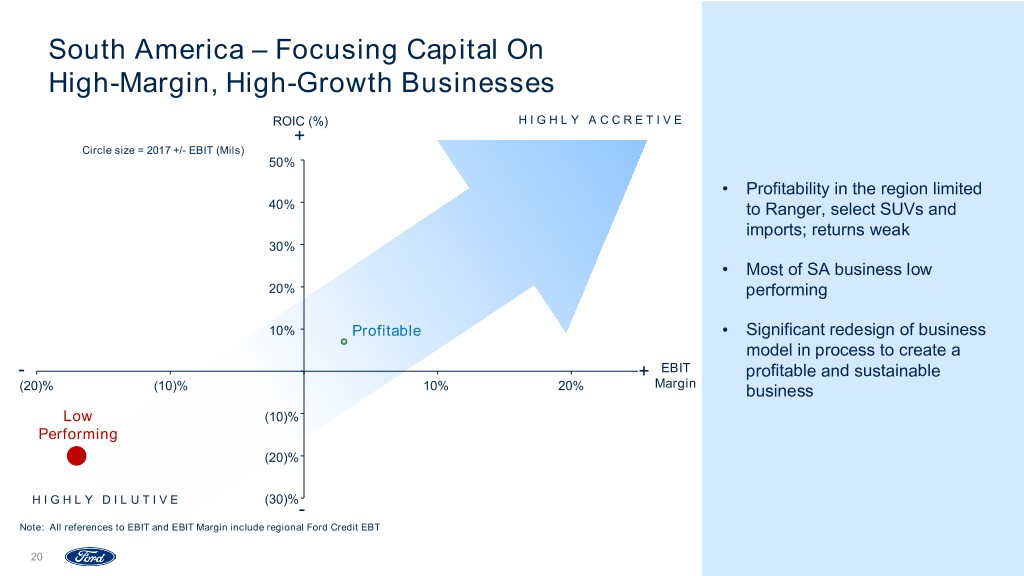

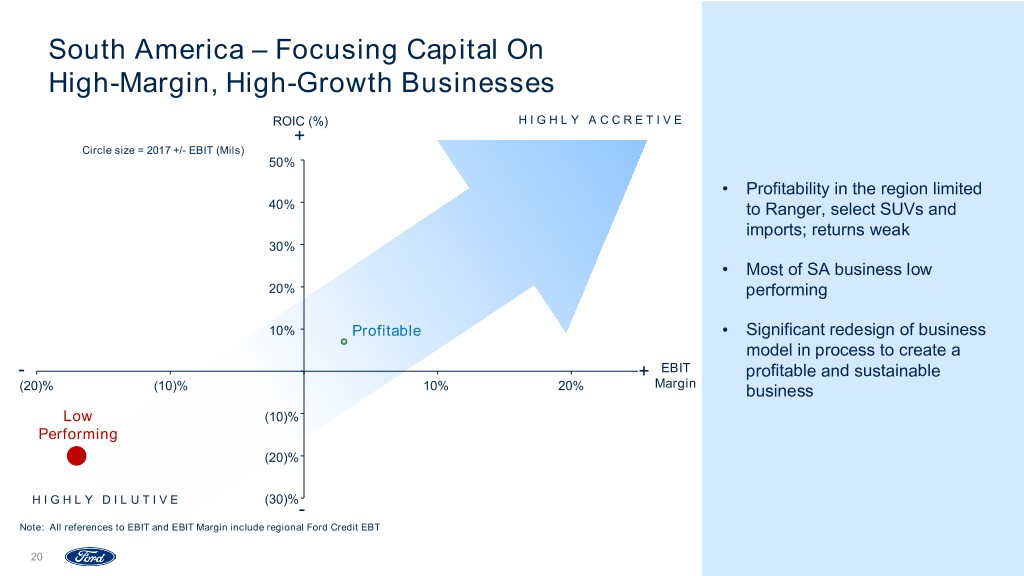

South America – Focusing Capital On High-Margin, High-Growth Businesses ROIC (%) HIGHLY ACCRETIVE + Circle size = 2017 +/- EBIT (Mils) 50% • Profitability in the region limited 40% to Ranger, select SUVs and imports; returns weak 30% • Most of SA business low 20% performing 10% Profitable • Significant redesign of business model in process to create a - + EBIT profitable and sustainable (20)% (10)% 10% 20% Margin business Low (10)% Performing (20)% HIGHLY DILUTIVE (30)% - Note: All references to EBIT and EBIT Margin include regional Ford Credit EBT 20

Europe Key Metrics • 2Q top-line metrics mixed YoY; SECOND QUARTER YEAR TO DATE financial metrics down 2017 2018 H / (L) 2017 2018 H / (L) • Europe SAAR up 4% SAAR (Mils) 20.7 21.6 4 % 20.6 21.6 5 % • Europe market share down Market Share (Pct) 7.2 % 7.0 % (0.2) ppts 7.6 % 7.3 % (0.3) ppts primarily due to discontinued B-MAX and sales slippage due Wholesales* (000) 375 367 (2) % 824 816 (1) % to late regulatory approvals Revenue (Bils) $ 7.1 $ 7.6 7 % $ 14.7 $ 16.5 12 % • Volume down 2%, driven by EBIT (Mils) $ 122 $ (73) $ (195) $ 331 $ 46 $ (285) Turkey EBIT Margin (Pct) 1.7 % (1.0) % (2.7) ppts 2.2 % 0.3 % (1.9) ppts • Revenue up 7% due to * Includes Ford brand vehicles produced and sold by our unconsolidated affiliate in Turkey (about 19,000 units in 2Q 2017 favorable exchange and 16,000 units in 2Q 2018). Revenue does not include these sales Ford’s new “Weather Factory” in Germany is Europe’s most advanced auto environmental test center 21

Europe 2Q 2018 EBIT YoY Bridge (Mils) Commodities $ (25) Other Contribution Cost (120) Structural Cost 6 • Europe EBIT down $195M YoY due to higher cost, primarily regulatory related, and Exchange $(106) unfavorable exchange, mainly Other 17 sterling $(139) • Favorable market factors more than explained by net pricing due to impact of refreshed products and industry pricing Volume / Net 2Q 2017 Mix Pricing Cost Other 2Q 2018 Market Factors $33 22

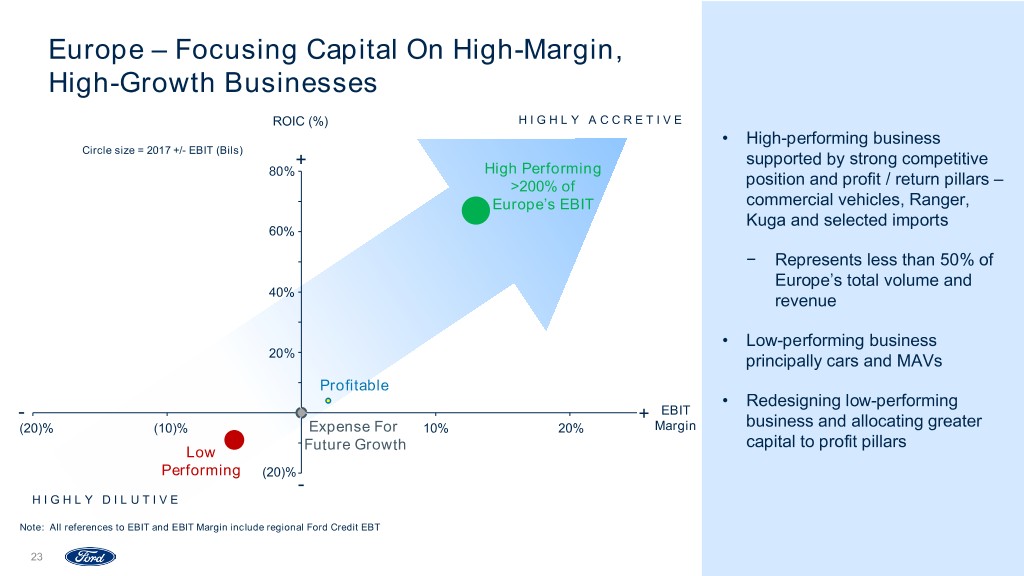

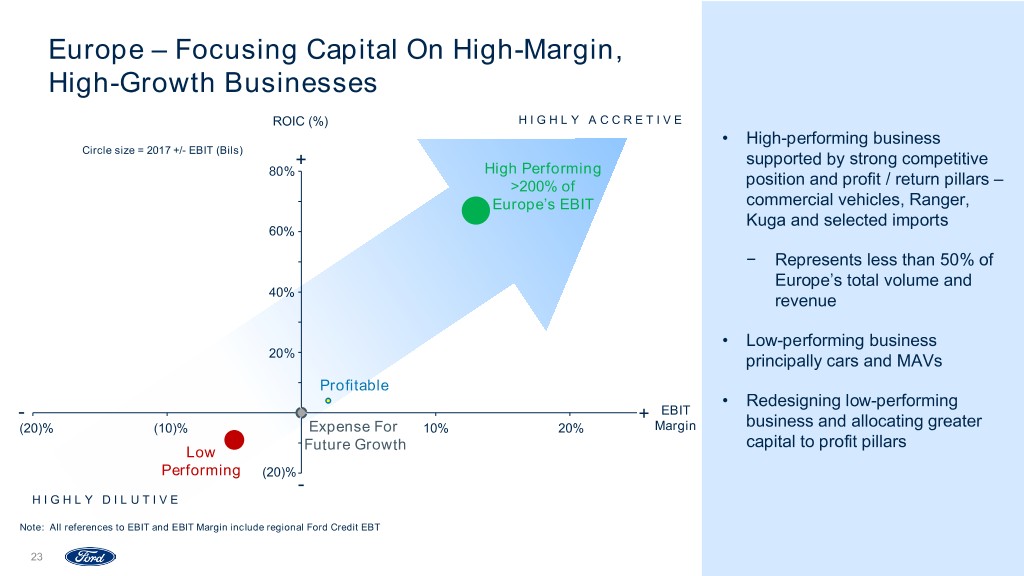

Europe – Focusing Capital On High-Margin, High-Growth Businesses ROIC (%) HIGHLY ACCRETIVE • High-performing business Circle size = 2017 +/- EBIT (Bils) + supported by strong competitive 80% High Performing >200% of position and profit / return pillars – Europe’s EBIT commercial vehicles, Ranger, Kuga and selected imports 60% − Represents less than 50% of Europe’s total volume and 40% revenue • Low-performing business 20% principally cars and MAVs Profitable • Redesigning low-performing - + EBIT (20)% (10)% Expense For 10% 20% Margin business and allocating greater Future Growth capital to profit pillars Low Performing (20)% - HIGHLY DILUTIVE Note: All references to EBIT and EBIT Margin include regional Ford Credit EBT 23

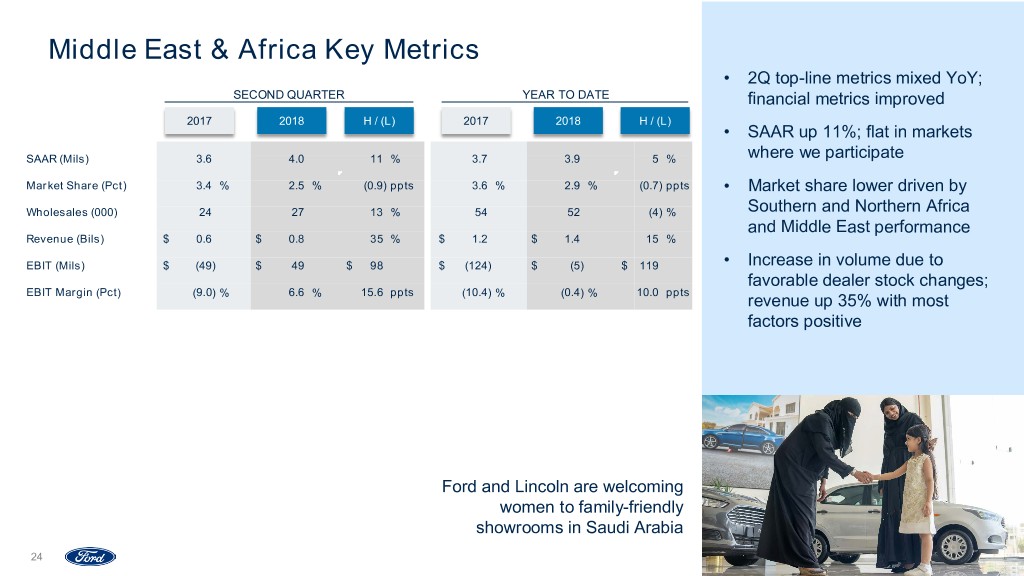

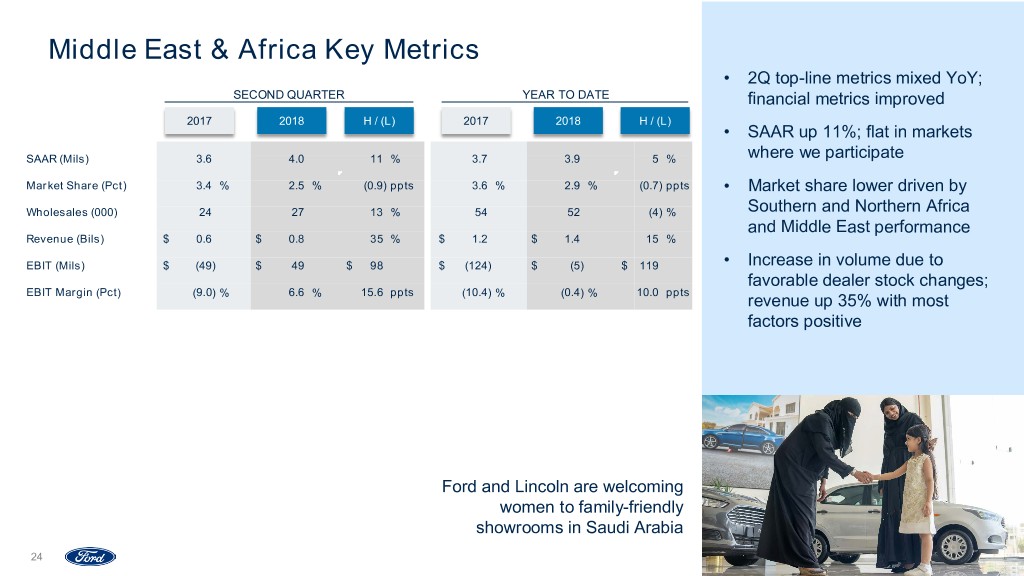

Middle East & Africa Key Metrics • 2Q top-line metrics mixed YoY; SECOND QUARTER YEAR TO DATE financial metrics improved 2017 2018 H / (L) 2017 2018 H / (L) • SAAR up 11%; flat in markets SAAR (Mils) 3.6 4.0 11 % 3.7 3.9 5 % where we participate Market Share (Pct) 3.4 % 2.5 % (0.9) ppts 3.6 % 2.9 % (0.7) ppts • Market share lower driven by Wholesales (000) 24 27 13 % 54 52 (4) % Southern and Northern Africa and Middle East performance Revenue (Bils) $ 0.6 $ 0.8 35 % $ 1.2 $ 1.4 15 % EBIT (Mils) $ (49) $ 49 $ 98 $ (124) $ (5) $ 119 • Increase in volume due to favorable dealer stock changes; EBIT Margin (Pct) (9.0) % 6.6 % 15.6 ppts (10.4) % (0.4) % 10.0 ppts revenue up 35% with most factors positive Ford and Lincoln are welcoming women to family-friendly showrooms in Saudi Arabia 24

Middle East & Africa 2Q 2018 EBIT YoY Bridge (Mils) • MEA EBIT a 2Q record • Favorable market factors and exchange drove the $98 million EBIT improvement Volume / Net 2Q 2017 Mix Pricing Cost Other 2Q 2018 Market Factors $74 25

Asia Pacific Key Metrics • All metrics lower YoY except SECOND QUARTER YEAR TO DATE SAAR; China the key driver 2017 2018 H / (L) 2017 2018 H / (L) • AP SAAR up 2.1M units; China SAAR (Mils) 44.1 46.2 5 % 41.7 45.0 8 % up 0.9M units China 27.6 28.5 3 % 25.4 27.5 8 % • AP market share lower due to Market Share (Pct) 3.7 % 2.7 % (1.0) ppts 3.5 % 2.7 % (0.8) ppts China performance, primarily China 4.5 % 3.2 % (1.3) ppts 4.5 % 3.2 % (1.3) ppts Focus and Escort Wholesales* (000) 352 261 (26) % 735 567 (23) % Revenue (Bils) $ 3.4 $ 2.3 (30) % $ 6.6 $ 5.7 (13) % • Key metrics for China JVs EBIT (Mils) $ 167 $ (394) $ (561) $ 315 $ (513) $ (828) down substantially with China EBIT Margin (Pct) 4.8 % (16.4) % (21.2) ppts 4.8 % (8.9) % (13.7) ppts JV net equity income about breakeven China Unconsolidated Affiliates Wholesales (000) 246 174 (29) % 524 369 (30) % Ford Equity Income (Mils) $ 195 $ 3 (98) % $ 469 $ 141 (70) % Net Income Margin (Pct) 10.7 % 0.6 % (10.1) ppts 11.9 % 5.5 % (6.4) ppts * Wholesales include Ford brand and Jiangling Motors Corporation (JMC) brand vehicles produced and sold in China by our unconsolidated affiliates. Revenue does not include these sales Revealed the all-new Ford Focus in China 26

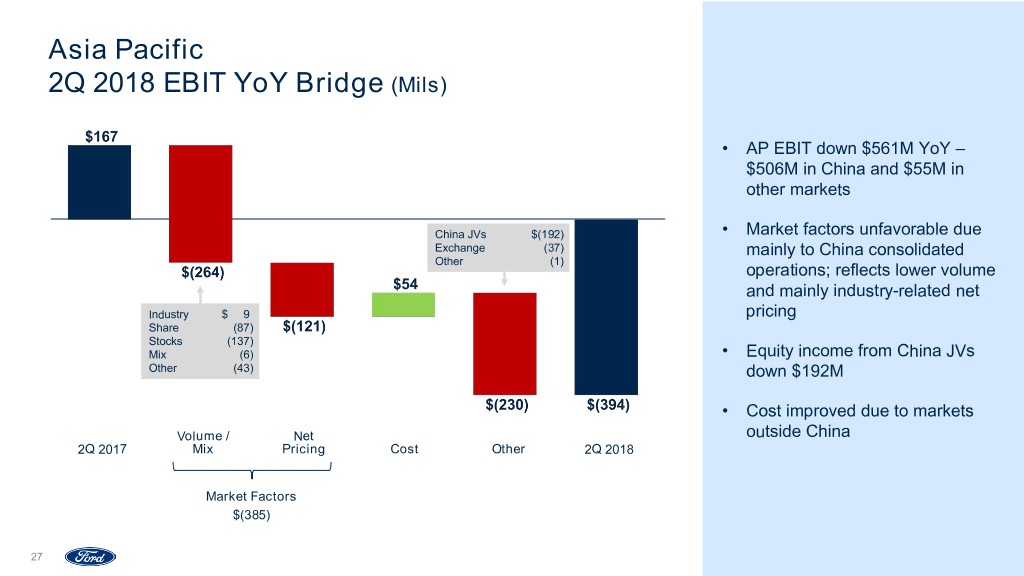

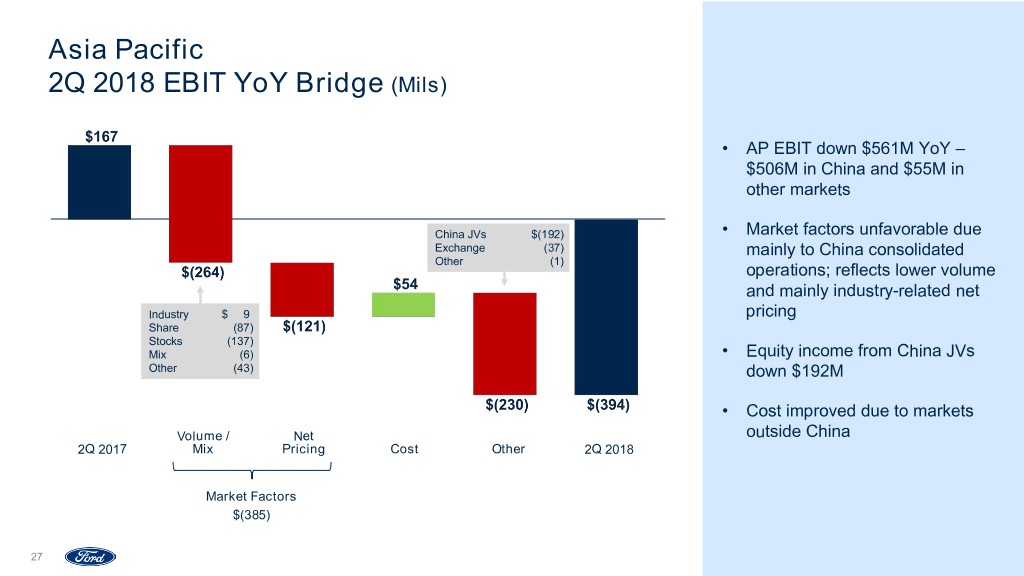

Asia Pacific 2Q 2018 EBIT YoY Bridge (Mils) • AP EBIT down $561M YoY – $506M in China and $55M in other markets China JVs $(192) • Market factors unfavorable due Exchange (37) mainly to China consolidated Other (1) operations; reflects lower volume and mainly industry-related net Industry $ 9 pricing Share (87) Stocks (137) Mix (6) • Equity income from China JVs Other (43) down $192M • Cost improved due to markets Volume / Net outside China 2Q 2017 Mix Pricing Cost Other 2Q 2018 Market Factors $(385) 27

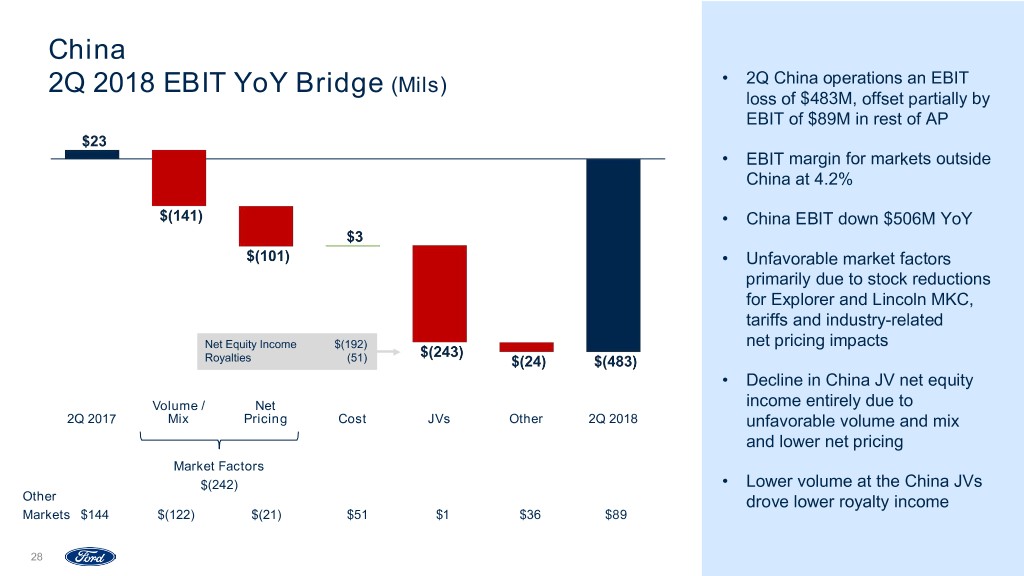

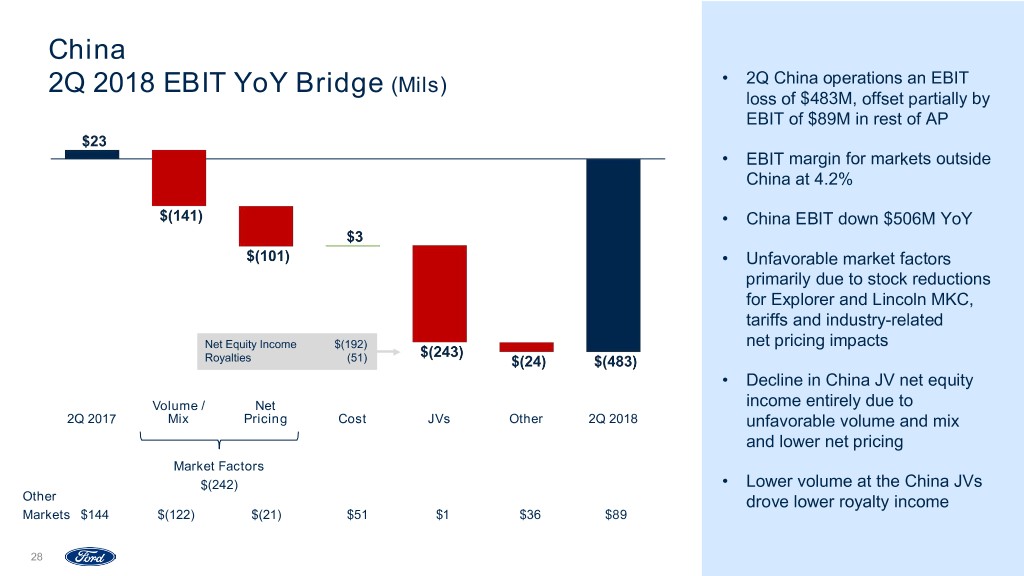

China (Mils) • 2Q China operations an EBIT 2Q 2018 EBIT YoY Bridge loss of $483M, offset partially by EBIT of $89M in rest of AP • EBIT margin for markets outside China at 4.2% • China EBIT down $506M YoY • Unfavorable market factors primarily due to stock reductions for Explorer and Lincoln MKC, tariffs and industry-related Net Equity Income $(192) net pricing impacts Royalties (51) • Decline in China JV net equity Volume / Net income entirely due to 2Q 2017 Mix Pricing Cost JVs Other 2Q 2018 unfavorable volume and mix and lower net pricing Market Factors $(242) • Lower volume at the China JVs Other drove lower royalty income Markets $144 $(122) $(21) $51 $1 $36 $89 28

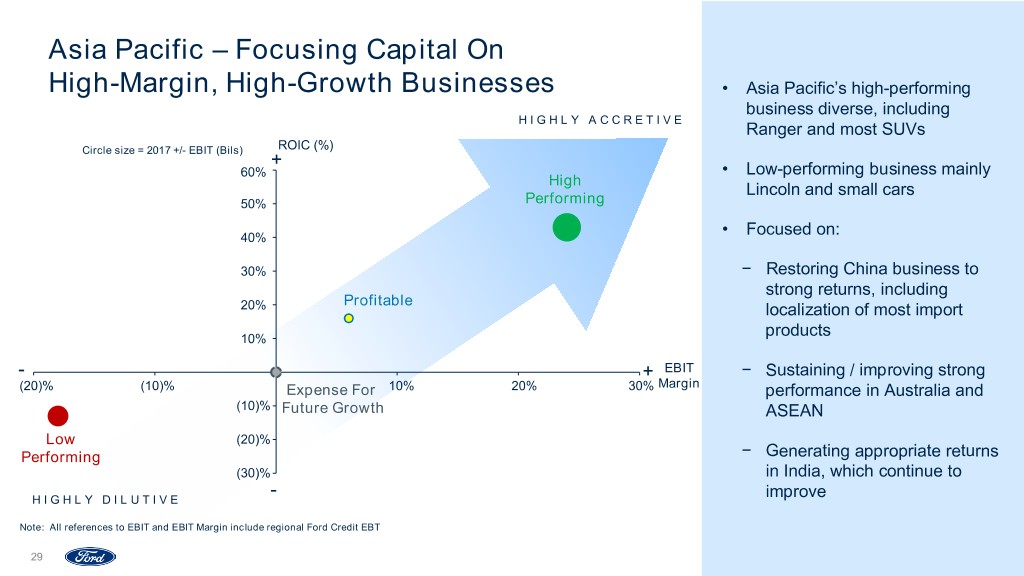

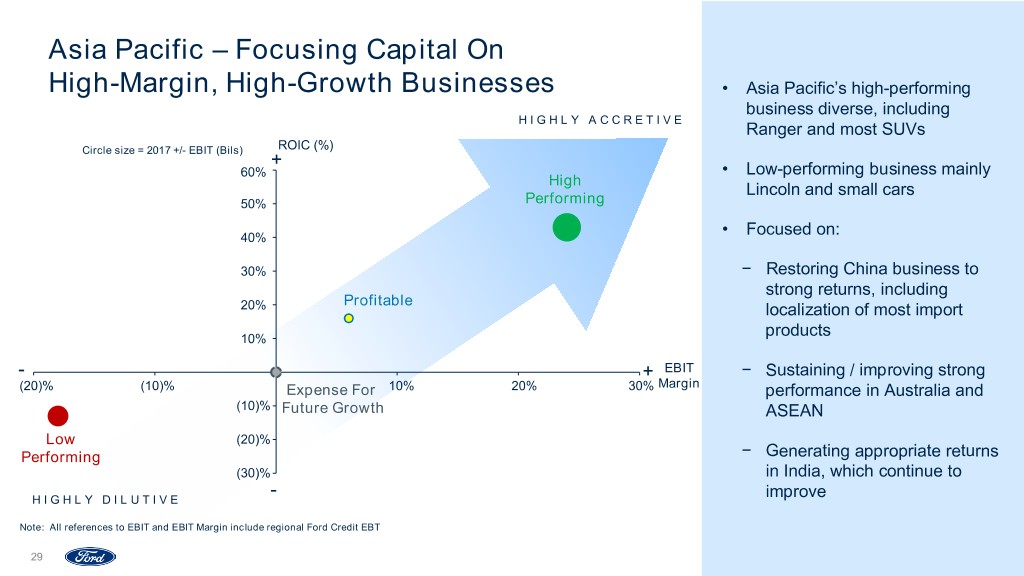

Asia Pacific – Focusing Capital On High-Margin, High-Growth Businesses • Asia Pacific’s high-performing business diverse, including HIGHLY ACCRETIVE Ranger and most SUVs Circle size = 2017 +/- EBIT (Bils) ROIC (%) + 60% • Low-performing business mainly High Lincoln and small cars 50% Performing • Focused on: 40% 30% − Restoring China business to strong returns, including Profitable 20% localization of most import products 10% - + EBIT − Sustaining / improving strong (20)% (10)% Expense For 10% 20% 30% Margin performance in Australia and (10)% Future Growth ASEAN Low (20)% Performing − Generating appropriate returns (30)% in India, which continue to - HIGHLY DILUTIVE improve Note: All references to EBIT and EBIT Margin include regional Ford Credit EBT 29

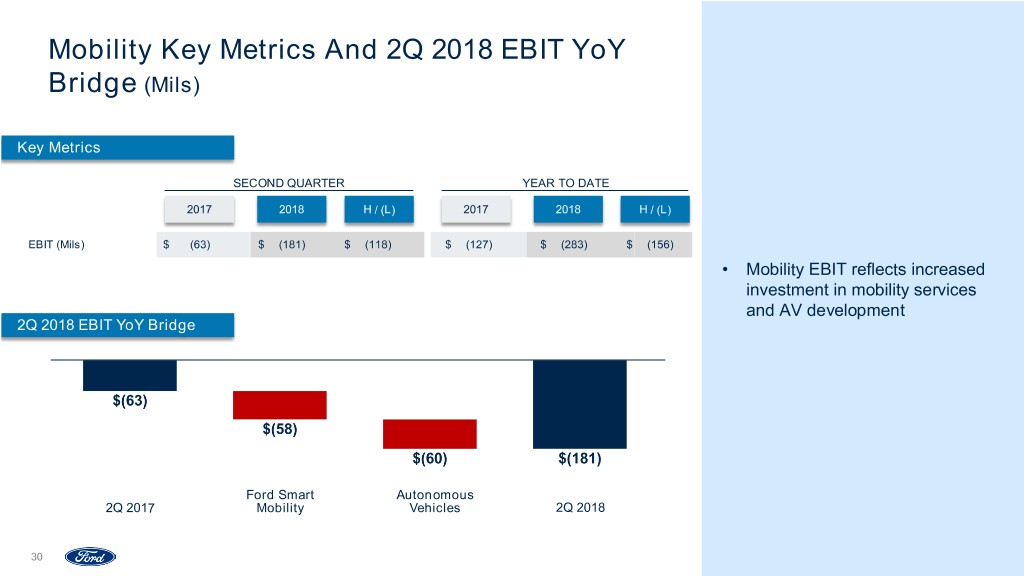

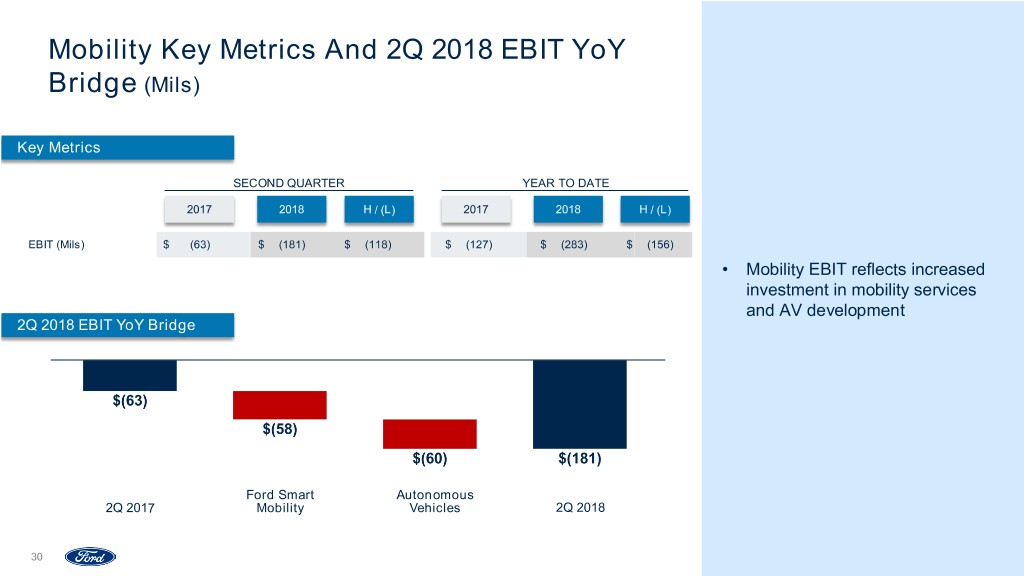

Mobility Key Metrics And 2Q 2018 EBIT YoY Bridge (Mils) Key Metrics SECOND QUARTER YEAR TO DATE 2017 2018 H / (L) 2017 2018 H / (L) EBIT (Mils) $ (63) $ (181) $ (118) $ (127) $ (283) $ (156) • Mobility EBIT reflects increased investment in mobility services and AV development 2Q 2018 EBIT YoY Bridge Ford Smart Autonomous 2Q 2017 Mobility Vehicles 2Q 2018 30

Ford Credit Key Metrics SECOND QUARTER YEAR TO DATE 2017 2018 H / (L) 2017 2018 H / (L) • Strong 2Q EBT Net Receivables (Bils) $ 135 $ 143 6 % $ 135 $ 143 6 % Managed Receivables* (Bils) $ 142 $ 151 7 % $ 142 $ 151 7 % • Receivables up globally YoY led Loss-to-Receivables** (LTR) 46 bps 36 bps (10) bps 50 bps 43 bps (7) bps by retail financing Auction Values*** $ 17,440 $ 18,190 4 % $ 17,285 $ 17,770 3 % EBT (Mils) $ 619 $ 645 $ 26 $ 1,100 $ 1,286 $ 186 • Continuing to maintain ROE (Pct) 13 % 12 % (1) ppts 12 % 15 % 3 ppts receivables around present Other Balance Sheet Metrics level and deliver strong distributions to Ford Debt (Bils) $ 129 $ 137 6 % Liquidity (Bils) $ 29 $ 27 (4.0) % • U.S. consumer credit metrics Financial Statement Leverage (to 1) 9.3 8.9 (0.4) healthy with improved LTR Managed Leverage* (to 1) 8.8 8.3 (0.5) • Balance sheet and liquidity strong; managed leverage within target range of 8:1 to 9:1 * See Appendix for reconciliation to GAAP and definitions ** U.S. retail and lease *** U.S. 36-month off-lease at 2Q 2018 mix 31

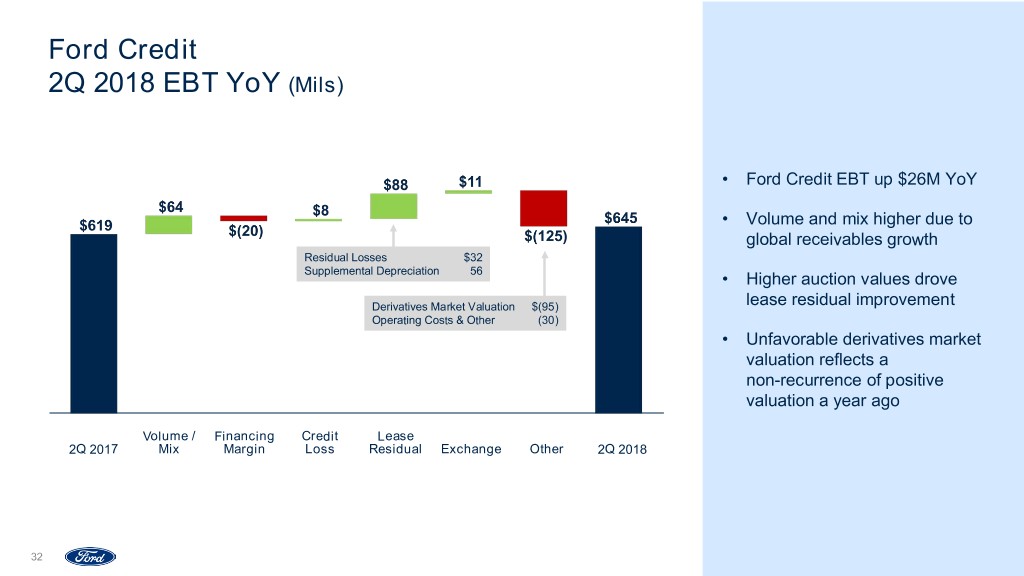

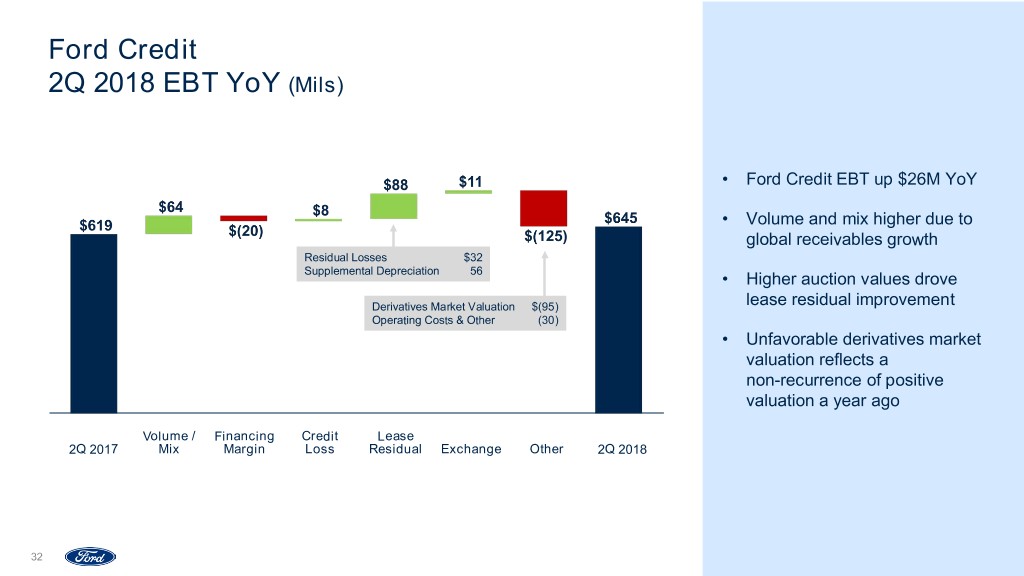

Ford Credit 2Q 2018 EBT YoY (Mils) • Ford Credit EBT up $26M YoY • Volume and mix higher due to global receivables growth Residual Losses $32 Supplemental Depreciation 56 • Higher auction values drove Derivatives Market Valuation $(95) lease residual improvement Operating Costs & Other (30) • Unfavorable derivatives market valuation reflects a non-recurrence of positive valuation a year ago Volume / Financing Credit Lease 2Q 2017 Mix Margin Loss Residual Exchange Other 2Q 2018 32

Ford Credit U.S. Automotive Financing Trends Lease Share of Retail Sales (Pct) Lease Return Vol. (000) and Auction Values** Ford Credit Industry* 36-Month Return Volume $18,190 $17,705 • 2Q lease share about the same $17,440 $17,385 $17,130 $17,350 31% 30% 31% 30% as prior year and below industry 28% 28% reflecting Ford sales mix 79 80 71 70 61 68 24% 22% 23% 23% • Auction values stronger than 19% 17% expected and up 4% YoY 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 • Now expect 2018 FY average Retail and Lease Repossession Ratio (Pct) Retail and Lease Charge-Offs (Mils) auction values to be 1% to 2% and Severity (000) and LTR Ratio (Pct) higher at constant mix Repo Ratio Severity LTR Charge-Offs 0.60% • Strong loss metrics reflect 1.22% 0.54% 0.46% 0.53% 0.51% 1.16% 1.12% 1.16% 0.36% 1.06% 1.00% healthy consumer credit $109 $10.6 $96 $95 $93 conditions $10.5 $10.2 $10.3 $82 $9.8 $10.0 $66 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 * Source: J.D. Power PIN ** At 2Q 2018 mix 33

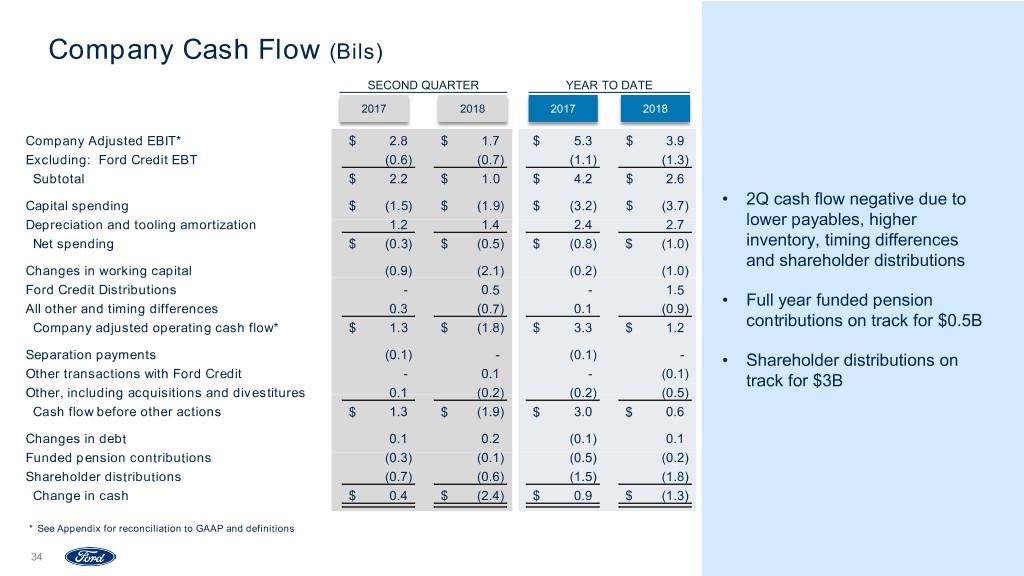

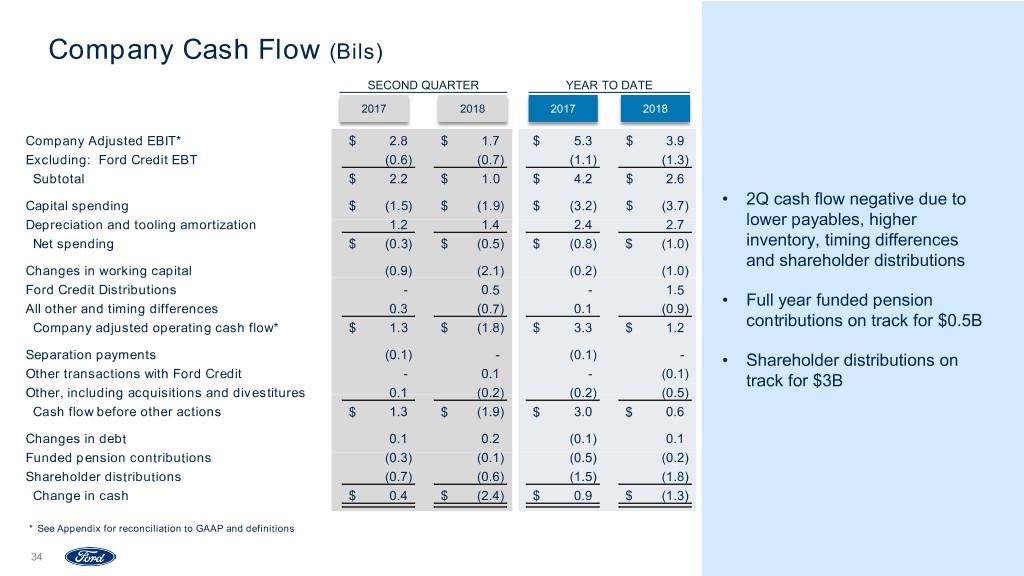

Company Cash Flow (Bils) SECOND QUARTER YEAR TO DATE 2017 2018 2017 2018 Company Adjusted EBIT* $ 2.8 $ 1.7 $ 5.3 $ 3.9 Excluding: Ford Credit EBT (0.6) (0.7) (1.1) (1.3) Subtotal $ 2.2 $ 1.0 $ 4.2 $ 2.6 Capital spending $ (1.5) $ (1.9) $ (3.2) $ (3.7) • 2Q cash flow negative due to Depreciation and tooling amortization 1.2 1.4 2.4 2.7 lower payables, higher Net spending $ (0.3) $ (0.5) $ (0.8) $ (1.0) inventory, timing differences and shareholder distributions Changes in working capital (0.9) (2.1) (0.2) (1.0) Ford Credit Distributions - 0.5 - 1.5 • Full year funded pension All other and timing differences 0.3 (0.7) 0.1 (0.9) Company adjusted operating cash flow* $ 1.3 $ (1.8) $ 3.3 $ 1.2 contributions on track for $0.5B Separation payments (0.1) - (0.1) - • Shareholder distributions on Other transactions with Ford Credit - 0.1 - (0.1) track for $3B Other, including acquisitions and divestitures 0.1 (0.2) (0.2) (0.5) Cash flow before other actions $ 1.3 $ (1.9) $ 3.0 $ 0.6 Changes in debt 0.1 0.2 (0.1) 0.1 Funded pension contributions (0.3) (0.1) (0.5) (0.2) Shareholder distributions (0.7) (0.6) (1.5) (1.8) Change in cash $ 0.4 $ (2.4) $ 0.9 $ (1.3) * See Appendix for reconciliation to GAAP and definitions 34

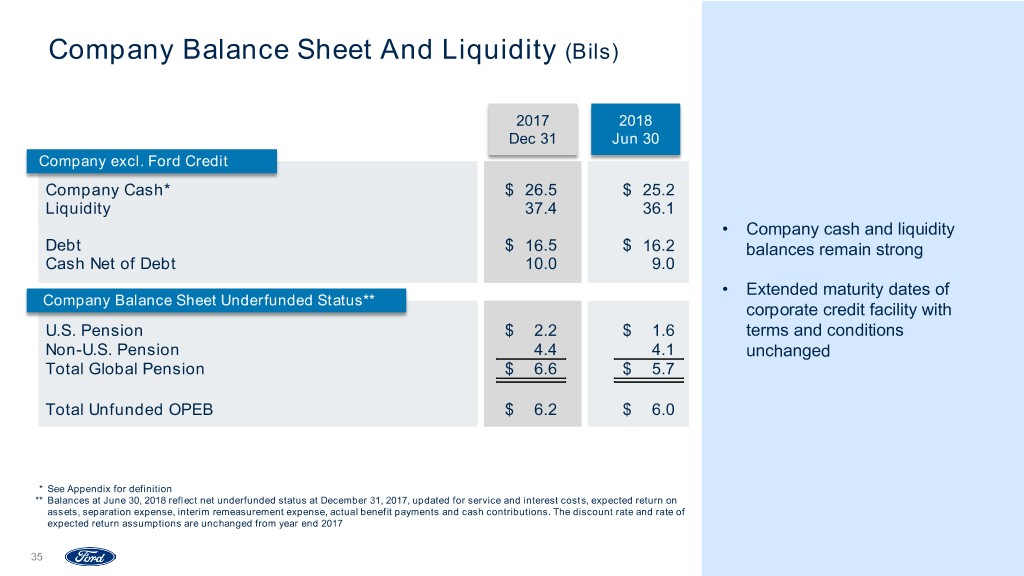

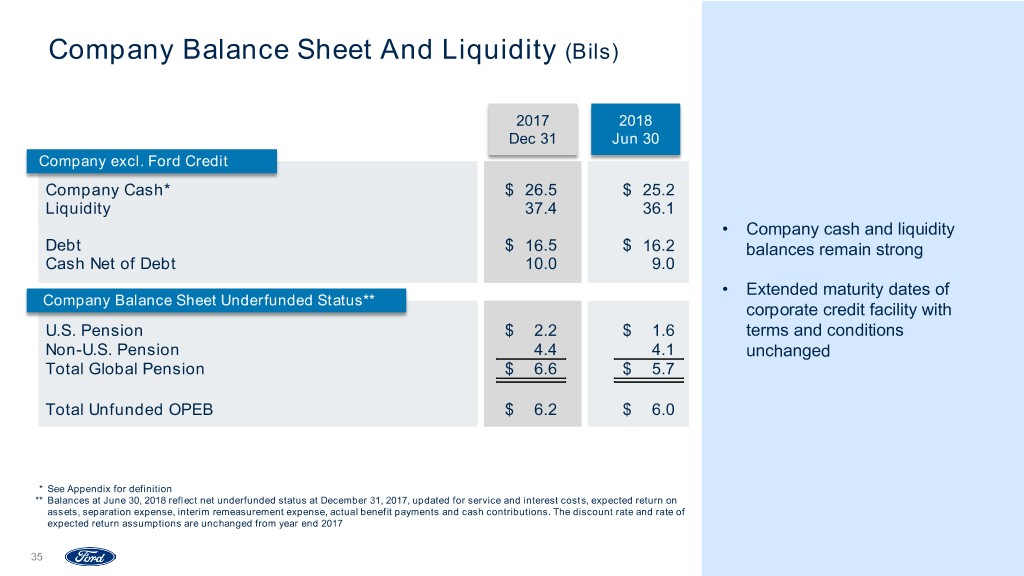

Company Balance Sheet And Liquidity (Bils) 2017 2018 Dec 31 Jun 30 Company excl. Ford Credit Company Cash* $ 26.5 $ 25.2 Liquidity 37.4 36.1 • Company cash and liquidity Debt $ 16.5 $ 16.2 balances remain strong Cash Net of Debt 10.0 9.0 • Extended maturity dates of Company Balance Sheet Underfunded Status** corporate credit facility with U.S. Pension $ 2.2 $ 1.6 terms and conditions Non-U.S. Pension 4.4 4.1 unchanged Total Global Pension $ 6.6 $ 5.7 Total Unfunded OPEB $ 6.2 $ 6.0 * See Appendix for definition ** Balances at June 30, 2018 reflect net underfunded status at December 31, 2017, updated for service and interest costs, expected return on assets, separation expense, interim remeasurement expense, actual benefit payments and cash contributions. The discount rate and rate of expected return assumptions are unchanged from year end 2017 35

2018 FY Outlook Company Business Units Key Metric 2018 Guidance Region / Segment 2018 EBIT Guidance Modestly higher than Revenue Automotive Lower than 2017 due to Asia Pacific and Europe 2017 North America Lower than 2017 Adjusted EPS* $1.30 - $1.50** South America Improved from 2017 Adj. Operating Cash Lower than 2017** Flow* Europe A loss** Pension Contributions About $500M Middle East & Africa Improved from 2017 (about breakeven) Asia Pacific A significant loss** Capital Spending About $7.5B Mobility Larger loss than 2017 Adj. Effective Tax Rate* About 13%** Ford Credit (EBT) Improved from 2017** * See Appendix for definitions ** Revised guidance 36

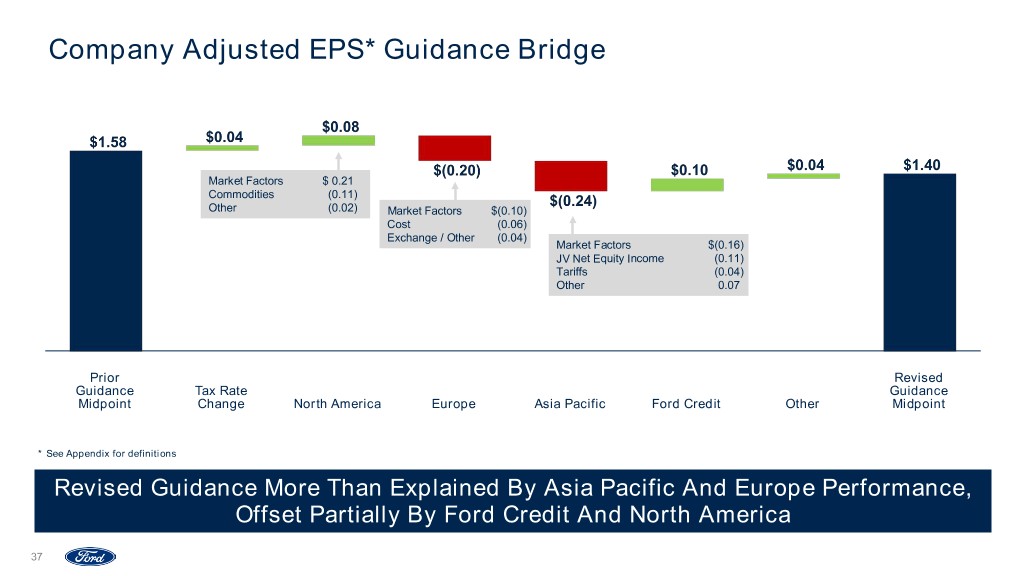

Company Adjusted EPS* Guidance Bridge Market Factors $ 0.21 Commodities (0.11) Other (0.02) Market Factors $(0.10) Cost (0.06) Exchange / Other (0.04) Market Factors $(0.16) JV Net Equity Income (0.11) Tariffs (0.04) Other 0.07 Prior Revised Guidance Tax Rate Guidance Midpoint Change North America Europe Asia Pacific Ford Credit Other Midpoint * See Appendix for definitions Revised Guidance More Than Explained By Asia Pacific And Europe Performance, Offset Partially By Ford Credit And North America 37

North America Highlights MERIDIAN FIRE RESPONSE QUALITY UNITED STATES J.D. POWER INITIAL QUALITY STUDY Ford led as America’s best-selling brand of combined trucks and SUVs Ford achieved best-ever score in 2018 F-Series sales topped 236,000 units in 2Q and are 5th straight year of improvement on a record-setting pace YTD Ford received more awards than any other Ford brand SUV sales reached a 2Q record of manufacturer in the J.D. Power 2018 Initial Quality Study 216,000 units Combined first half Expedition / Navigator retail sales up 55% compared with 2017 Industry-leading commercial business led by F-Series and Transit EXPANDED HYBRID PORTFOLIO 2018 FORD EXPEDITION & Ford executed a world-class recovery plan, 2018 LINCOLN NAVIGATOR Introduced all-new Ford Police Interceptor which ensured safe retrieval and relocation of Utility, industry’s first pursuit-rated hybrid SUV tools, quickly restoring production for our Five-star rating in National Highway Traffic Safety customers New Fuel Efficient Taxis Administration’s New Car Assessment Program 2019 Transit Connect and Fusion Hybrid DEPLOYED 2 CREATIVE SOLUTIONS TO RESTORE SUPPLY AND REOPEN PLANTS IN JUST 8DAYS 38

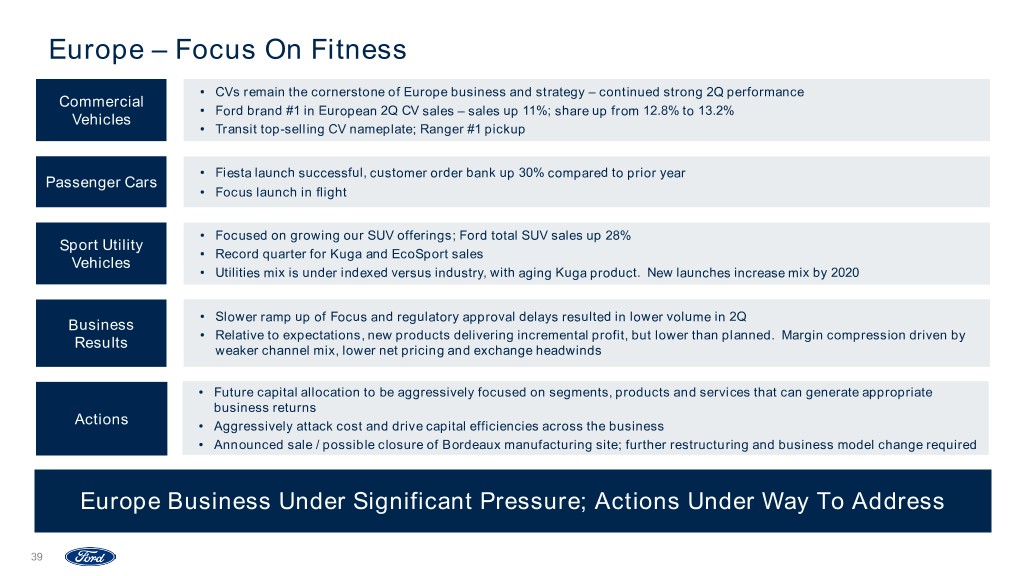

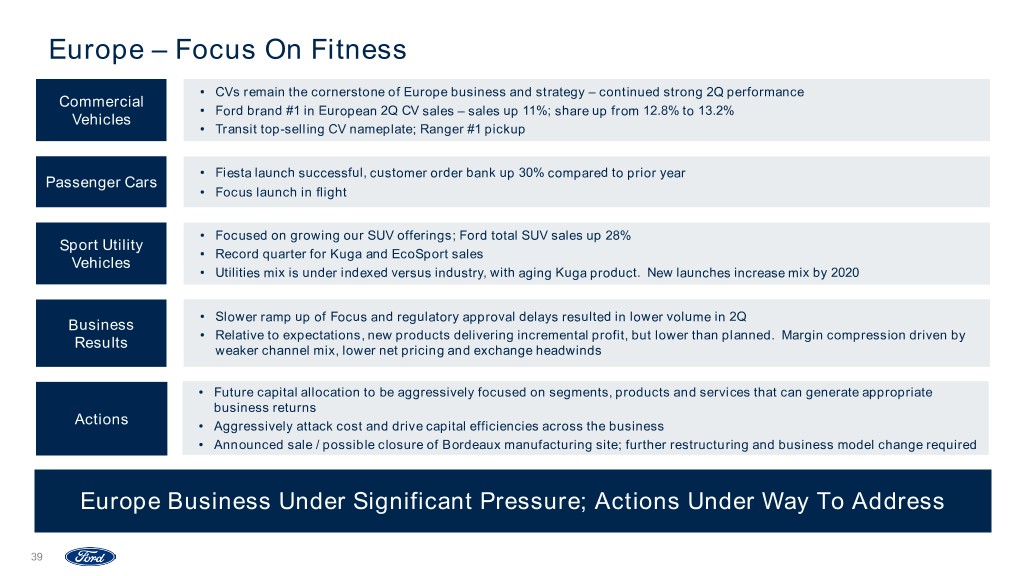

Europe – Focus On Fitness • CVs remain the cornerstone of Europe business and strategy – continued strong 2Q performance Commercial • Ford brand #1 in European 2Q CV sales – sales up 11%; share up from 12.8% to 13.2% Vehicles • Transit top-selling CV nameplate; Ranger #1 pickup • Fiesta launch successful, customer order bank up 30% compared to prior year Passenger Cars • Focus launch in flight • Focused on growing our SUV offerings; Ford total SUV sales up 28% Sport Utility • Record quarter for Kuga and EcoSport sales Vehicles • Utilities mix is under indexed versus industry, with aging Kuga product. New launches increase mix by 2020 • Slower ramp up of Focus and regulatory approval delays resulted in lower volume in 2Q Business • Relative to expectations, new products delivering incremental profit, but lower than planned. Margin compression driven by Results weaker channel mix, lower net pricing and exchange headwinds • Future capital allocation to be aggressively focused on segments, products and services that can generate appropriate business returns Actions • Aggressively attack cost and drive capital efficiencies across the business • Announced sale / possible closure of Bordeaux manufacturing site; further restructuring and business model change required Europe Business Under Significant Pressure; Actions Under Way To Address 39

China Deep Dive – Structural And Go-To-Market Issues Dealers • Actions to improve dealer support and profitability executed end 2Q Disengaged • High dealer stock levels being addressed aggressively Uncompetitive • Localize assembly of Explorer and Lincoln (starting with new Small Utility early 2020) Cost • Integrate Ford Marketing / Sales and Purchasing operations into JVs to remove duplication and optimize costs Structure • Fitness actions to be implemented Product Ageing • 60% of product line-up to be refreshed or new in 2019 And Not • New Ford utility showroom (replacements and additions) launched 2019 through 2021; 50 new vehicles in total by 2025 Aligned With including 8 new SUVs and 15 or more electrified vehicles Customer • New Advanced Product Creation Process at Nanjing Research and Engineering Centre and increased use of ‘in JV’ Demand product creation Go-To-Market • New single authentic and trusted Ford brand voice through Distribution Division to address consistency and differentiation Capability Gaps • New China Futuring group to be established to improve local consumer insights Exposed • Recruiting additional local talent to key management positions Success In China Imperative – World’s Largest Market; Reaches 2X U.S. Volume By 2025 40

Questions & Answers

Smart Choices for Value Creation Our Freedom of movement drives human progress. Belief Our To become the world’s most trusted mobility company, Aspiration designing smart vehicles for a smart world. Passion for Product & Deep Customer Insight Our Plan Winning Propulsion Autonomous Mobility Portfolio Choices Technology Experiences Fitness Metrics Operating Leverage Growth Build, Partner, Buy EBIT Margin Capital Efficiency ROIC Strong Balance Sheet Cash Flow Our People Culture & Values 42

Cautionary Note On Forward-Looking Statements Statements included or incorporated by reference herein may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on expectations, forecasts, and assumptions by our management and involve a number of risks, uncertainties, and other factors that could cause actual results to differ materially from those stated, including, without limitation: • Ford’s long-term competitiveness depends on the successful execution of fitness actions; • Industry sales volume, particularly in the United States, Europe, or China, could decline if there is a financial crisis, recession, or significant geopolitical event; • Ford’s new and existing products and mobility services are subject to market acceptance; • Ford’s results are dependent on sales of larger, more profitable vehicles, particularly in the United States; • Ford may face increased price competition resulting from industry excess capacity, currency fluctuations, or other factors; • Fluctuations in commodity prices, foreign currency exchange rates, and interest rates can have a significant effect on results; • With a global footprint, Ford’s results could be adversely affected by economic, geopolitical, protectionist trade policies, or other events; • Ford’s production, as well as Ford’s suppliers’ production, could be disrupted by labor disputes, natural or man-made disasters, financial distress, production difficulties, or other factors; • Ford’s ability to maintain a competitive cost structure could be affected by labor or other constraints; • Pension and other postretirement liabilities could adversely affect Ford’s liquidity and financial condition; • Economic and demographic experience for pension and other postretirement benefit plans (e.g., discount rates or investment returns) could be worse than Ford has assumed; • Ford’s vehicles could be affected by defects that result in delays in new model launches, recall campaigns, or increased warranty costs; • Safety, emissions, fuel economy, and other regulations affecting Ford may become more stringent; • Ford could experience unusual or significant litigation, governmental investigations, or adverse publicity arising out of alleged defects in products, perceived environmental impacts, or otherwise; • Ford’s receipt of government incentives could be subject to reduction, termination, or clawback; • Operational systems, security systems, and vehicles could be affected by cyber incidents; • Ford Credit’s access to debt, securitization, or derivative markets around the world at competitive rates or in sufficient amounts could be affected by credit rating downgrades, market volatility, market disruption, regulatory requirements, or other factors; • Ford Credit could experience higher-than-expected credit losses, lower-than-anticipated residual values, or higher-than-expected return volumes for leased vehicles; • Ford Credit could face increased competition from banks, financial institutions, or other third parties seeking to increase their share of financing Ford vehicles; and • Ford Credit could be subject to new or increased credit regulations, consumer or data protection regulations, or other regulations. We cannot be certain that any expectation, forecast, or assumption made in preparing forward-looking statements will prove accurate, or that any projection will be realized. It is to be expected that there may be differences between projected and actual results. Our forward-looking statements speak only as of the date of their initial issuance, and we do not undertake any obligation to update or revise publicly any forward-looking statement, whether as a result of new information, future events, or otherwise. For additional discussion, see “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2017, as updated by subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. 43

APPENDIX SUPPLEMENTAL DATA Shareholder Distributions A1 Return on Invested Capital A2 Special Items A3 U.S. Transaction Prices, Incentives and Days Supply A4 Revised Reporting – 2017 A5 Revised Reporting – ROIC A6 1Q China YoY EBIT Bridge A7 RECONCILIATIONS TO GAAP Adjusted EBIT A8 Adjusted EBIT 2018 A9 Adjusted Earnings Per Share A10 Adjusted Effective Tax Rate A11 Adjusted Operating Cash Flow A12 Adjusted Operating Cash Flow Trailing 5 Quarters A13 Managed Receivables A14 Managed Leverage A15 OTHER Non-GAAP Financial Measures A16 - A17 Definitions and Calculations A18

Shareholder Distributions (Bils) Supplemental Dividend $18.3 Anti-Dilutive Share Repurchases Regular Dividends $1.7 $2.8 • 2018 planned distributions of $3B for a total of $18.3B for 2012 - 2018 • Paid a second quarter regular dividend of 15¢ per share $13.8 $3.5 $2.7 $3.0 $2.3 $1.0 $0.6 $2.4 $1.7 $2.4 $2.4 Average 2016 2017 2018 2012 - 2018 2012 - 2015 A145

Return On Invested Capital Calculation (Bils) Four Quarters Four Quarters Ending 2Q 2017 Ending 2Q 2018 Net Operating Profit After Tax (NOPAT) (Bils.) (Bils.) Net income attributable to Ford $ 3.8 $ 6.9 Add: Non-controlling interest 0.0 0.0 Less: Income tax (0.9) 0.0 Add: Cash taxes (0.7) (0.6) Less: Interest on debt (1.1) (1.2) Less: Total pension / OPEB income / (Cost) (2.6) 0.7 Add: Pension / OPEB service costs (1.1) (1.2) Net operating profit after tax $6.7 $5.6 Invested Capital Equity $ 32.8 $ 36.5 Redeemable non-controlling interest 0.1 0.1 Automotive and other debt 16.8 16.2 Net pension and OPEB liability 14.2 11.7 Invested capital (end of period) $ 63.9 $ 64.5 Four quarter average invested capital $ 60.9 $ 64.7 ROIC* 10.9% 8.7% * Calculated as the sum of Net Operating Profit After Tax from the last four quarters, divided by the average Invested Capital over the last four quarters A246

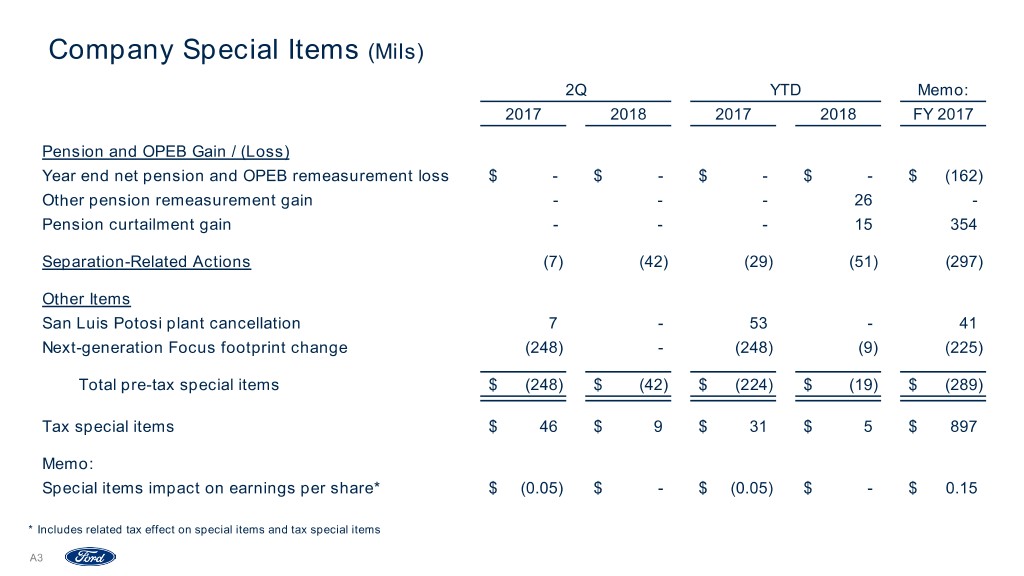

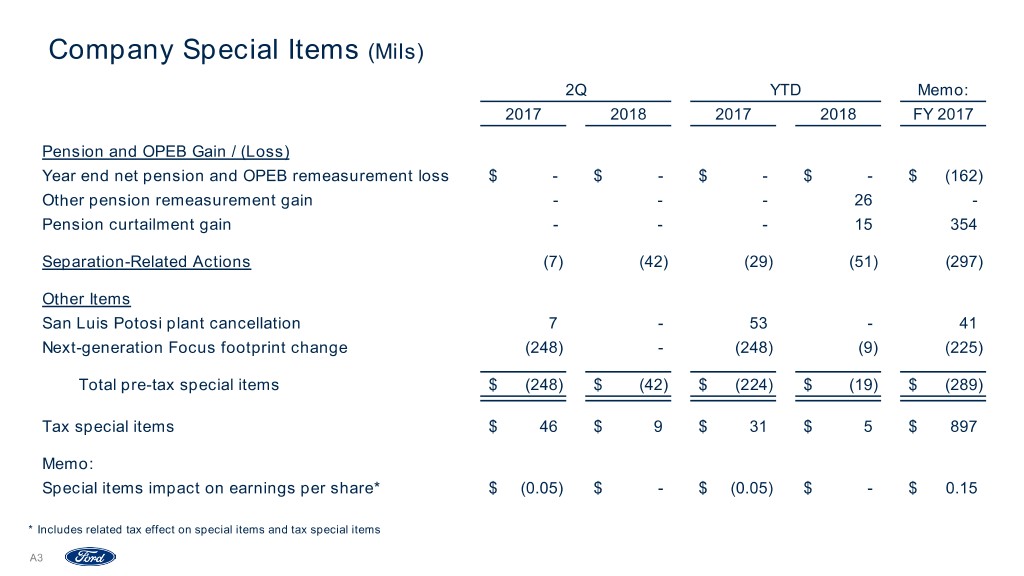

Company Special Items (Mils) 2Q YTD Memo: 2017 2018 2017 2018 FY 2017 Pension and OPEB Gain / (Loss) Year end net pension and OPEB remeasurement loss $ - $ - $ - $ - $ (162) Other pension remeasurement gain - - - 26 - Pension curtailment gain - - - 15 354 Separation-Related Actions (7) (42) (29) (51) (297) Other Items San Luis Potosi plant cancellation 7 - 53 - 41 Next-generation Focus footprint change (248) - (248) (9) (225) Total pre-tax special items $ (248) $ (42) $ (224) $ (19) $ (289) Tax special items $ 46 $ 9 $ 31 $ 5 $ 897 Memo: Special items impact on earnings per share* $ (0.05) $ - $ (0.05) $ - $ 0.15 * Includes related tax effect on special items and tax special items A347

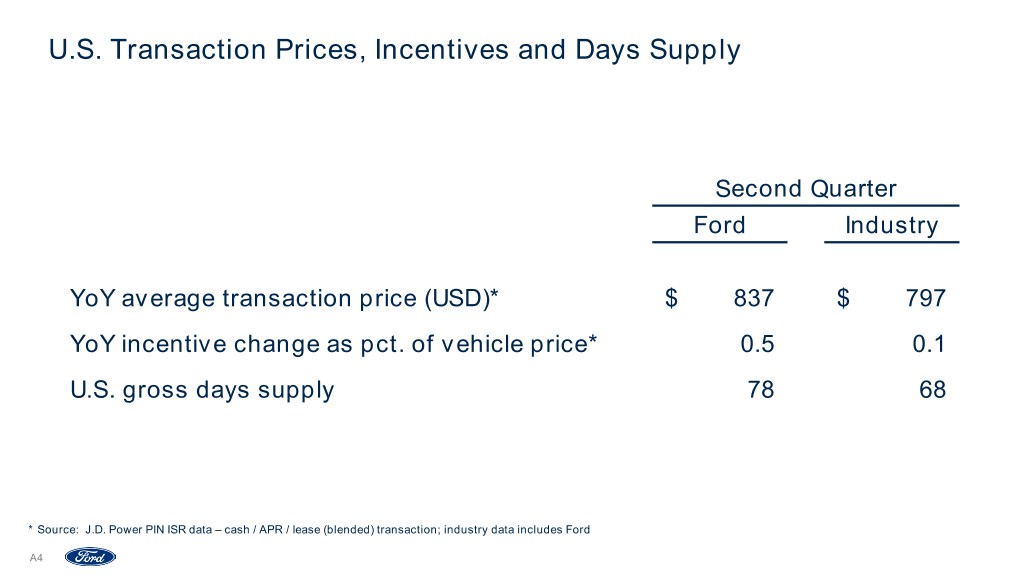

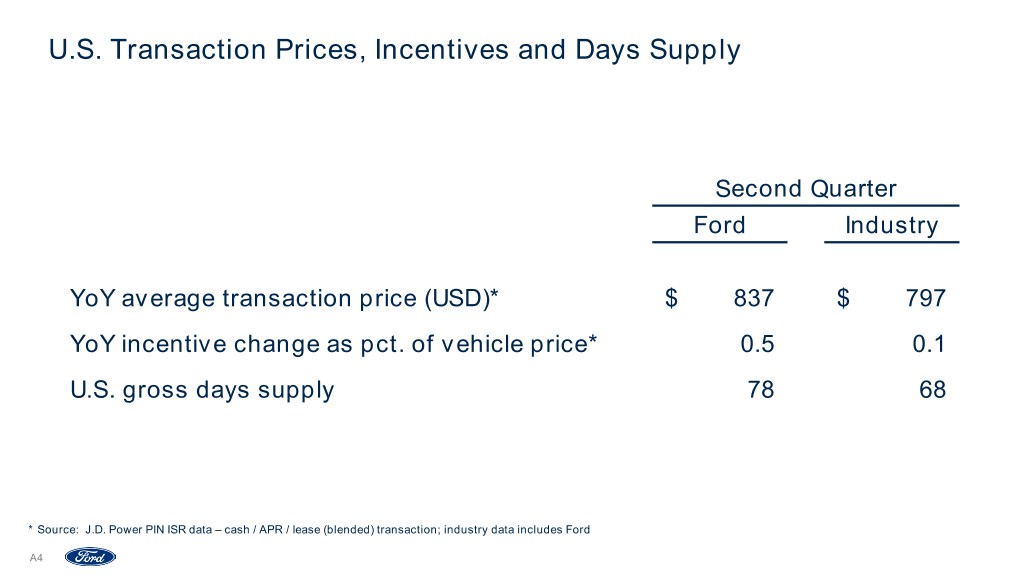

U.S. Transaction Prices, Incentives and Days Supply Second Quarter Ford Industry YoY average transaction price (USD)* $ 837 $ 797 YoY incentive change as pct. of vehicle price* 0.5 0.1 U.S. gross days supply 78 68 * Source: J.D. Power PIN ISR data – cash / APR / lease (blended) transaction; industry data includes Ford A448

Revised Reporting – 2017 (Mils) 2017 1Q 2Q 3Q 4Q Full Year North America $ 2,130 $ 2,332 $ 1,824 $ 1,771 $ 8,057 South America (237) (177) (150) (189) (753) Europe 209 122 (53) 89 367 Middle East & Africa (75) (49) (56) (66) (246) Asia Pacific 148 167 314 30 659 Automotive $ 2,175 $ 2,395 $ 1,879 $ 1,635 $ 8,084 Mobility (64) (63) (72) (100) (299) Ford Credit 481 619 600 610 2,310 Corporate Other (72) (146) (122) (117) (457) Adjusted EBIT $ 2,520 $ 2,805 $ 2,285 $ 2,028 $ 9,638 Interest on Debt (293) (291) (298) (308) (1,190) Special Items Pre-Tax 24 (248) (217) 152 (289) Taxes (652) (211) (191) 652 (402) Less: Non-Controlling Interests 7 8 7 4 26 Net Income Attributable to Ford $ 1,592 $ 2,047 $ 1,572 $ 2,520 $ 7,731 Company Adjusted Operating Cash Flow (Bils) $ 2.0 $ 1.3 $ (1.3) $ 2.2 $ 4.2 Revenue (Bils) 39.1 39.9 36.5 41.3 156.8 Automotive EBIT Margin (Pct) 6.0% 6.5% 5.6% 4.3% 5.6% Company Adjusted EBIT Margin (Pct) 6.4 7.0 6.3 4.9 6.1 Net Income Margin (Pct) 4.1 5.1 4.3 6.1 4.6 Adjusted EPS – Diluted $ 0.40 $ 0.56 $ 0.44 $ 0.39 $ 1.78 EPS (GAAP) – Diluted 0.40 0.51 0.39 0.63 1.93 China EBIT (Mils) $ 47 $ 23 $ 102 $ (20) $ 152 A549

Revised Reporting – ROIC (Bils) 2013 2014 2015 2016 2017 Net Operating Profit After Tax (NOPAT) Net income attributable to Ford $ 11.9 $ 1.3 $ 7.3 $ 4.6 $ 7.7 Add: Non-controlling interest (0.0) (0.0) (0.0) 0.0 0.0 Less: Income tax (2.4) (0.0) (2.9) (2.2) (0.4) Add: Cash taxes (0.5) (0.5) (0.6) (0.7) (0.6) Less: Interest on debt (1.0) (0.9) (0.8) (1.0) (1.2) Less: Total pension / OPEB income / (Cost) 4.9 (4.4) (0.5) (2.7) 0.6 Add: Pension / OPEB service costs (1.1) (1.0) (1.2) (1.0) (1.1) Net operating profit after tax $ 8.7 $ 5.1 $ 9.8 $ 8.6 $ 7.0 Invested Capital Equity $ 26.8 $ 25.1 $ 29.2 $ 29.7 $ 35.6 Redeemable non-controlling interest 0.3 0.3 0.1 0.1 0.1 Automotive and other debt 16.3 14.5 13.4 16.5 16.5 Net pension and OPEB liability 14.9 16.2 13.9 14.7 12.8 Invested capital (end of period) $ 58.3 $ 56.1 $ 56.6 $ 61.1 $ 65.0 Four quarter average invested capital $ 58.6 $ 57.2 $ 55.6 $ 58.5 $ 63.4 ROIC* 14.9% 8.9% 17.6% 14.7% 11.0% * Calculated as the sum of Net Operating Profit After Tax from the last four quarters, divided by the average Invested Capital over the last four quarters A650

China 1Q 2018 EBIT YoY Bridge (Mils) Net Equity Income $(136) Royalties (43) Volume / Net 1Q 2017 Mix Pricing Cost JVs Other 1Q 2018 Market Factors $(75) Other Markets $101 $(21) $(21) $15 $31 $(74) $31 A751

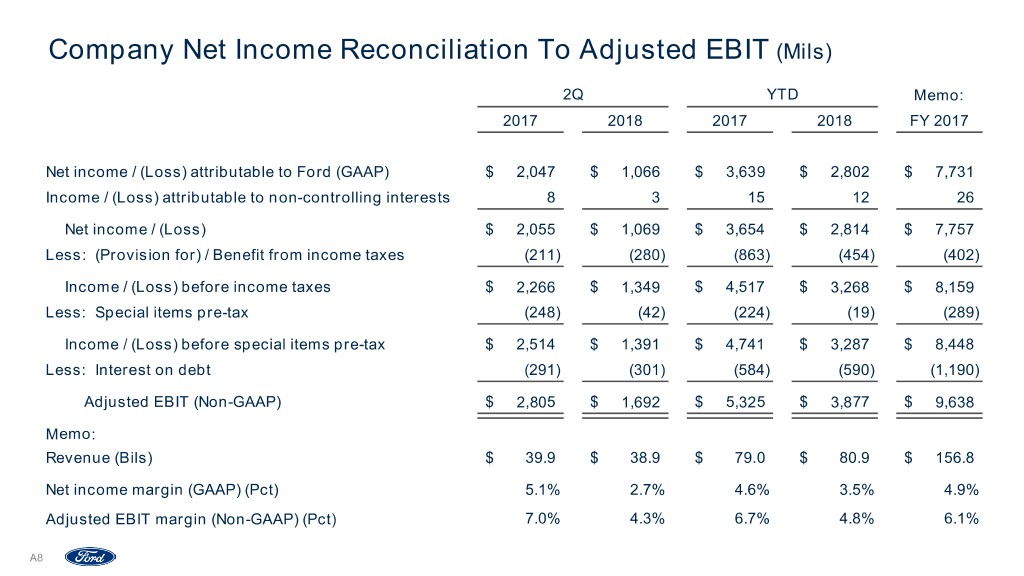

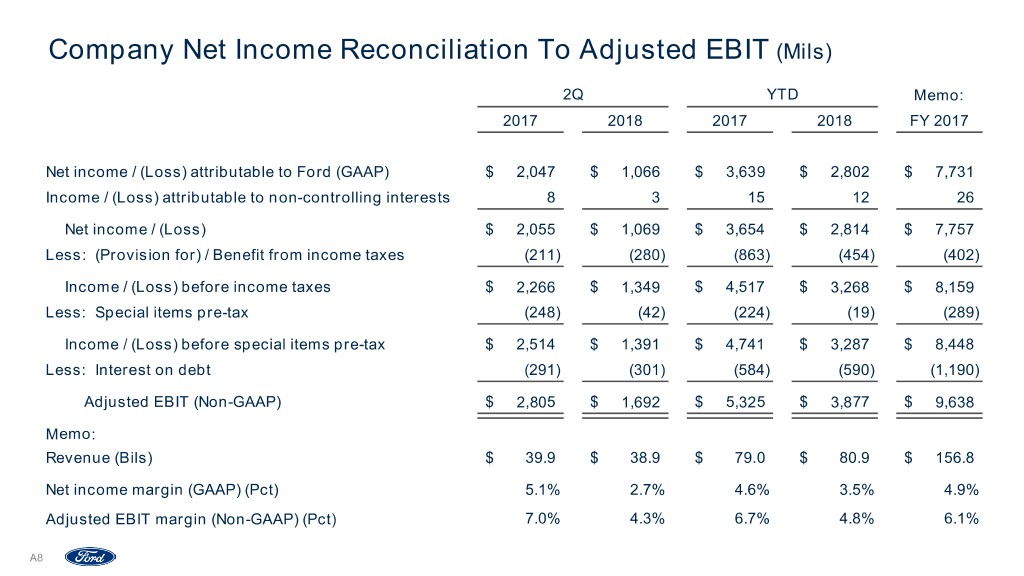

Company Net Income Reconciliation To Adjusted EBIT (Mils) 2Q YTD Memo: 2017 2018 2017 2018 FY 2017 Net income / (Loss) attributable to Ford (GAAP) $ 2,047 $ 1,066 $ 3,639 $ 2,802 $ 7,731 Income / (Loss) attributable to non-controlling interests 8 3 15 12 26 Net income / (Loss) $ 2,055 $ 1,069 $ 3,654 $ 2,814 $ 7,757 Less: (Provision for) / Benefit from income taxes (211) (280) (863) (454) (402) Income / (Loss) before income taxes $ 2,266 $ 1,349 $ 4,517 $ 3,268 $ 8,159 Less: Special items pre-tax (248) (42) (224) (19) (289) Income / (Loss) before special items pre-tax $ 2,514 $ 1,391 $ 4,741 $ 3,287 $ 8,448 Less: Interest on debt (291) (301) (584) (590) (1,190) Adjusted EBIT (Non-GAAP) $ 2,805 $ 1,692 $ 5,325 $ 3,877 $ 9,638 Memo: Revenue (Bils) $ 39.9 $ 38.9 $ 79.0 $ 80.9 $ 156.8 Net income margin (GAAP) (Pct) 5.1% 2.7% 4.6% 3.5% 4.9% Adjusted EBIT margin (Non-GAAP) (Pct) 7.0% 4.3% 6.7% 4.8% 6.1% A852

Company 2018 Net Income Reconciliation To Adjusted EBIT (Mils) 2018 1Q 2Q Net income / (Loss) attributable to Ford (GAAP) $ 1,736 $ 1,066 Income / (Loss) attributable to non-controlling interests 9 3 Net income / (Loss) $ 1,745 $ 1,069 Less: (Provision for) / Benefit from income taxes (174) (280) Income / (Loss) before income taxes $ 1,919 $ 1,349 Less: Special items pre-tax 23 (42) Income / (Loss) before special items pre-tax $ 1,896 $ 1,391 Less: Interest on debt (289) (301) Adjusted EBIT (Non-GAAP) $ 2,185 $ 1,692 Memo: Revenue (Bils) $ 42.0 $ 38.9 Net income margin (GAAP) (Pct) 5.2% 2.7% Adjusted EBIT margin (Non-GAAP) (Pct) 7.0% 4.3% Revenue excluding Meridian, Takata and Pivotal IPO (Bils) $ 42.0 $ 40.4 Adjusted EBIT excluding Meridian, Takata and Pivotal IPO (Mils) $ 2,185 $ 2,425 Adjusted EBIT Margin excluding Meridian, Takata and Pivotal IPO (Pct) 5.2% 6.0% Note: Meridian, Takata and Pivotal IPO collectively reduced revenue and EBIT in North America by $1.5 billion and $733 million, respectively, in the second quarter of 2018 A953

Company Earnings Per Share Reconciliation To Adjusted Earnings Per Share 2Q YTD 2017 2018 2017 2018 Diluted After-Tax Results (Mils) Diluted after-tax results (GAAP) $ 2,047 $ 1,066 $ 3,639 $ 2,802 Less: Impact of pre-tax and tax special items (202) (33) (193) (14) Adjusted net income – diluted (Non-GAAP) $ 2,249 $ 1,099 $ 3,832 $ 2,816 Basic and Diluted Shares (Mils) Basic shares (average shares outstanding) 3,977 3,977 3,977 3,976 Net dilutive options and unvested restricted stock units 19 22 21 23 Diluted shares 3,996 3,999 3,998 3,998 Earnings per share – diluted (GAAP) $ 0.51 $ 0.27 $ 0.91 $ 0.70 Less: Net impact of adjustments (0.05) - (0.05) - Adjusted earnings per share – diluted (Non-GAAP) $ 0.56 $ 0.27 $ 0.96 $ 0.70 A1054

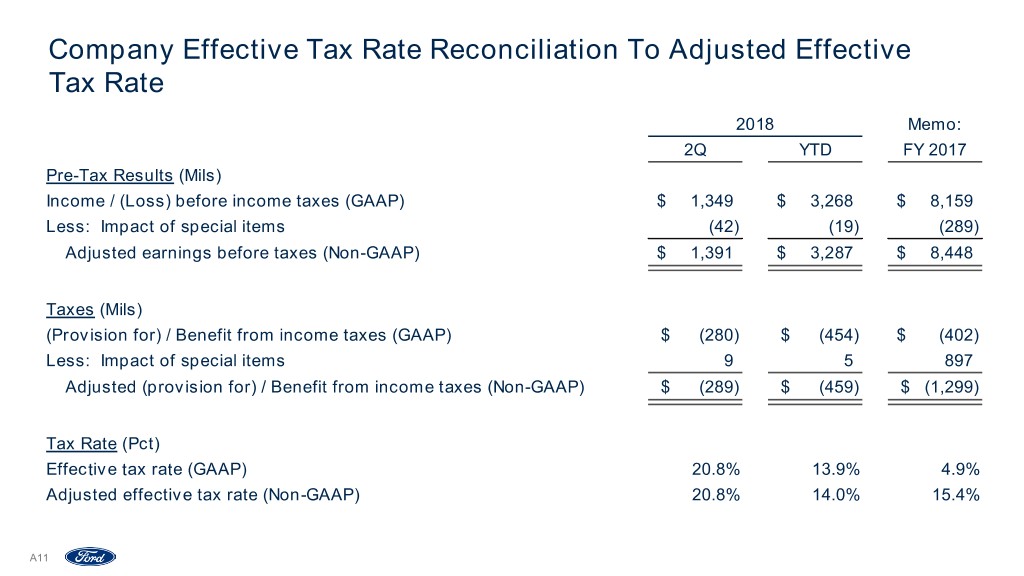

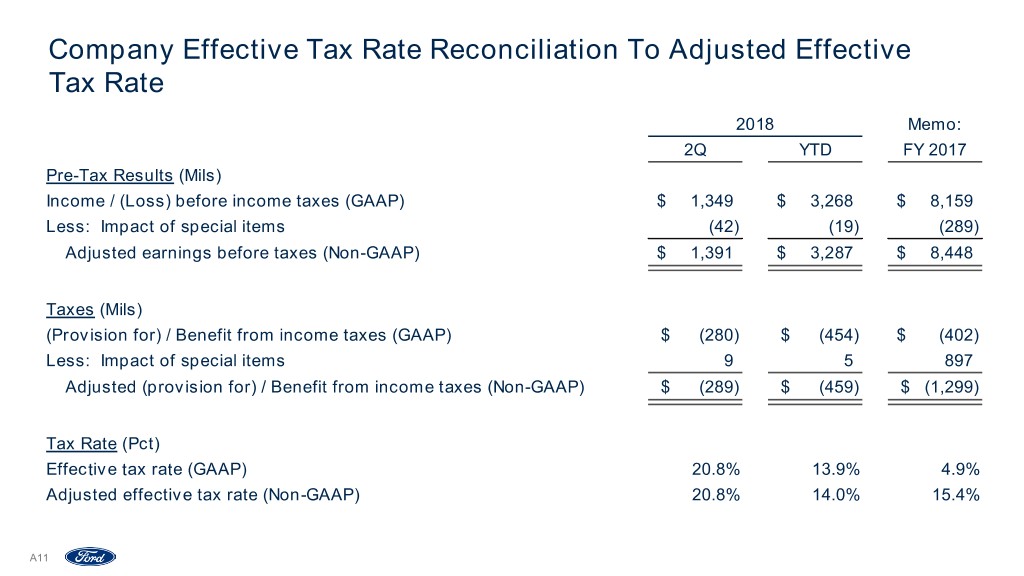

Company Effective Tax Rate Reconciliation To Adjusted Effective Tax Rate 2018 Memo: 2Q YTD FY 2017 Pre-Tax Results (Mils) Income / (Loss) before income taxes (GAAP) $ 1,349 $ 3,268 $ 8,159 Less: Impact of special items (42) (19) (289) Adjusted earnings before taxes (Non-GAAP) $ 1,391 $ 3,287 $ 8,448 Taxes (Mils) (Provision for) / Benefit from income taxes (GAAP) $ (280) $ (454) $ (402) Less: Impact of special items 9 5 897 Adjusted (provision for) / Benefit from income taxes (Non-GAAP) $ (289) $ (459) $ (1,299) Tax Rate (Pct) Effective tax rate (GAAP) 20.8% 13.9% 4.9% Adjusted effective tax rate (Non-GAAP) 20.8% 14.0% 15.4% A1155

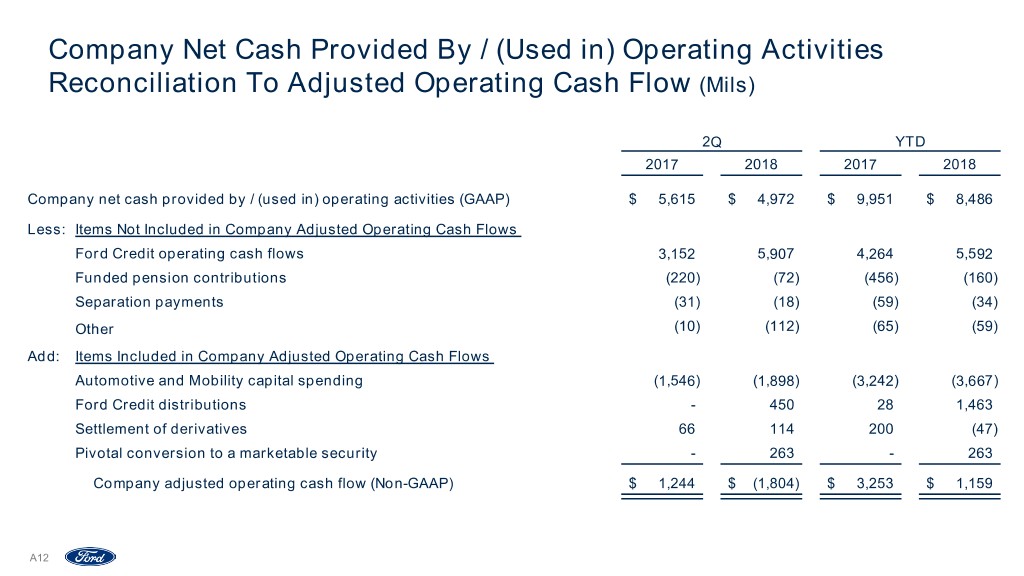

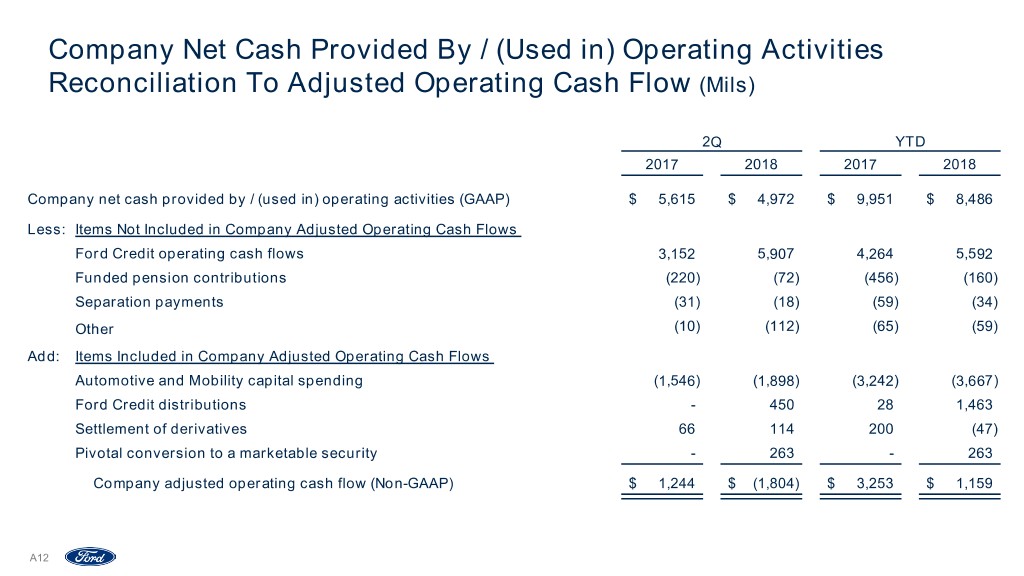

Company Net Cash Provided By / (Used in) Operating Activities Reconciliation To Adjusted Operating Cash Flow (Mils) 2Q YTD 2017 2018 2017 2018 Company net cash provided by / (used in) operating activities (GAAP) $ 5,615 $ 4,972 $ 9,951 $ 8,486 Less: Items Not Included in Company Adjusted Operating Cash Flows Ford Credit operating cash flows 3,152 5,907 4,264 5,592 Funded pension contributions (220) (72) (456) (160) Separation payments (31) (18) (59) (34) Other (10) (112) (65) (59) Add: Items Included in Company Adjusted Operating Cash Flows Automotive and Mobility capital spending (1,546) (1,898) (3,242) (3,667) Ford Credit distributions - 450 28 1,463 Settlement of derivatives 66 114 200 (47) Pivotal conversion to a marketable security - 263 - 263 Company adjusted operating cash flow (Non-GAAP) $ 1,244 $ (1,804) $ 3,253 $ 1,159 A12A1056

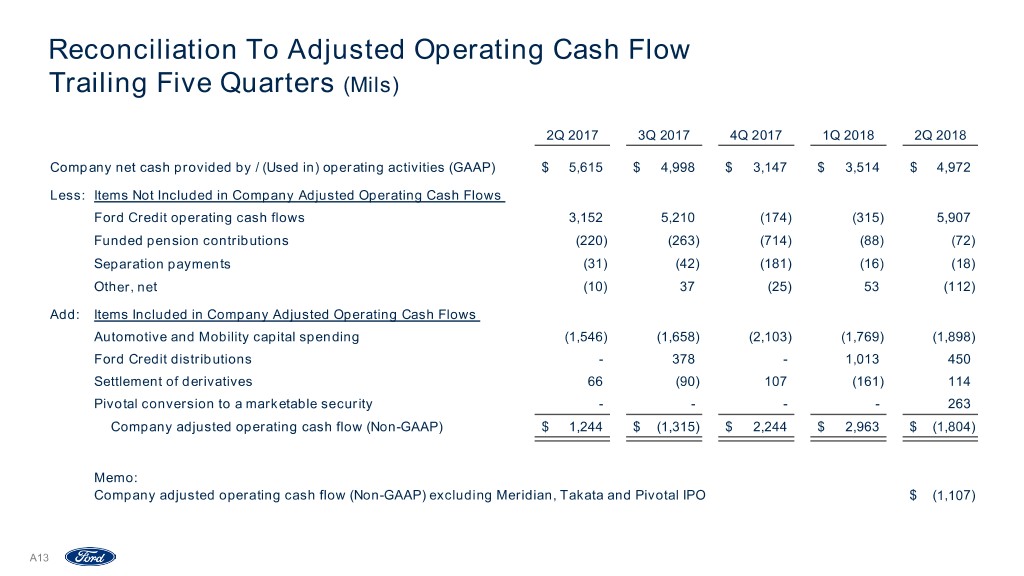

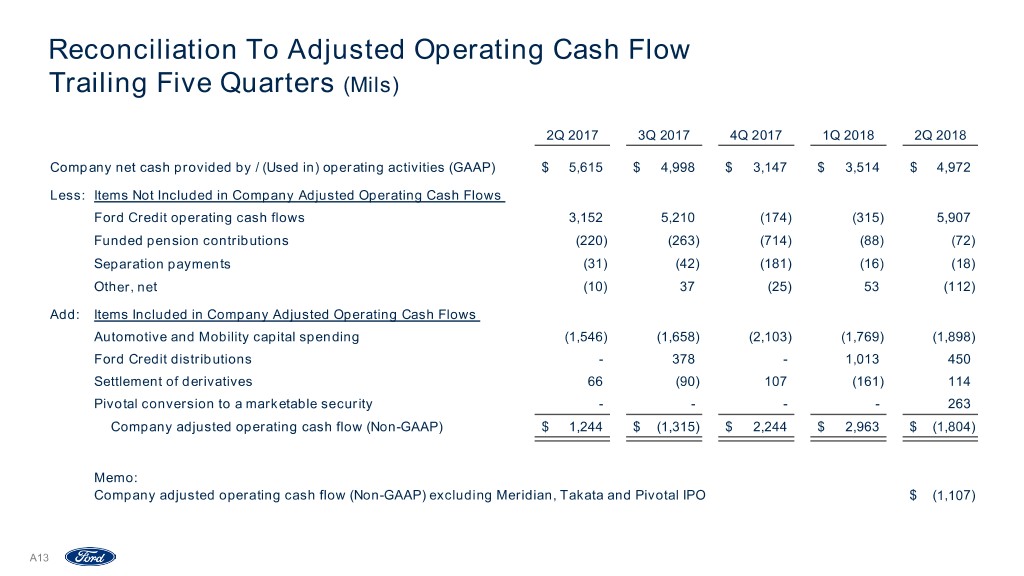

Reconciliation To Adjusted Operating Cash Flow Trailing Five Quarters (Mils) 2Q 2017 3Q 2017 4Q 2017 1Q 2018 2Q 2018 Company net cash provided by / (Used in) operating activities (GAAP) $ 5,615 $ 4,998 $ 3,147 $ 3,514 $ 4,972 Less: Items Not Included in Company Adjusted Operating Cash Flows Ford Credit operating cash flows 3,152 5,210 (174) (315) 5,907 Funded pension contributions (220) (263) (714) (88) (72) Separation payments (31) (42) (181) (16) (18) Other, net (10) 37 (25) 53 (112) Add: Items Included in Company Adjusted Operating Cash Flows Automotive and Mobility capital spending (1,546) (1,658) (2,103) (1,769) (1,898) Ford Credit distributions - 378 - 1,013 450 Settlement of derivatives 66 (90) 107 (161) 114 Pivotal conversion to a marketable security - - - - 263 Company adjusted operating cash flow (Non-GAAP) $ 1,244 $ (1,315) $ 2,244 $ 2,963 $ (1,804) Memo: Company adjusted operating cash flow (Non-GAAP) excluding Meridian, Takata and Pivotal IPO $ (1,107) A13A1057

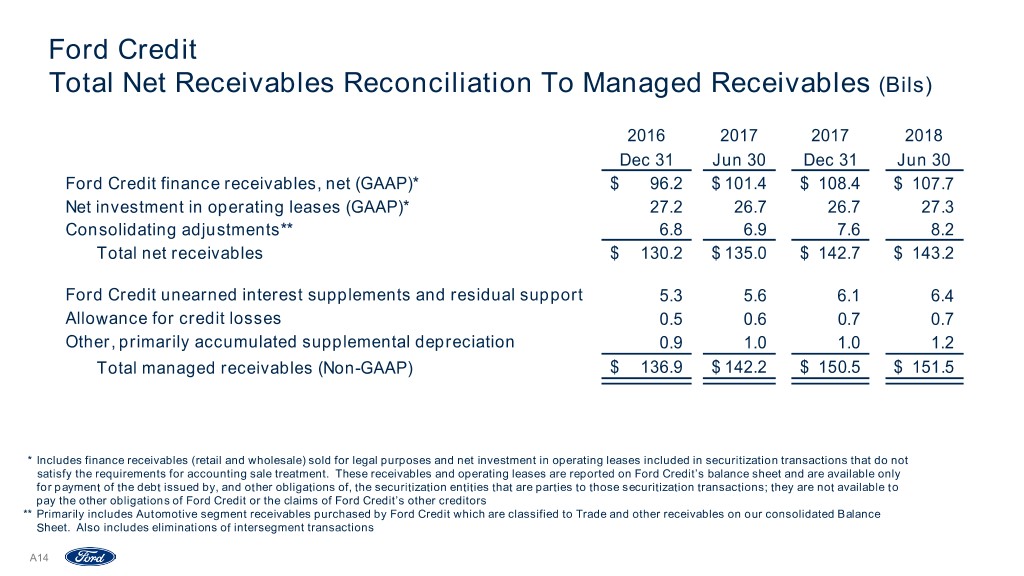

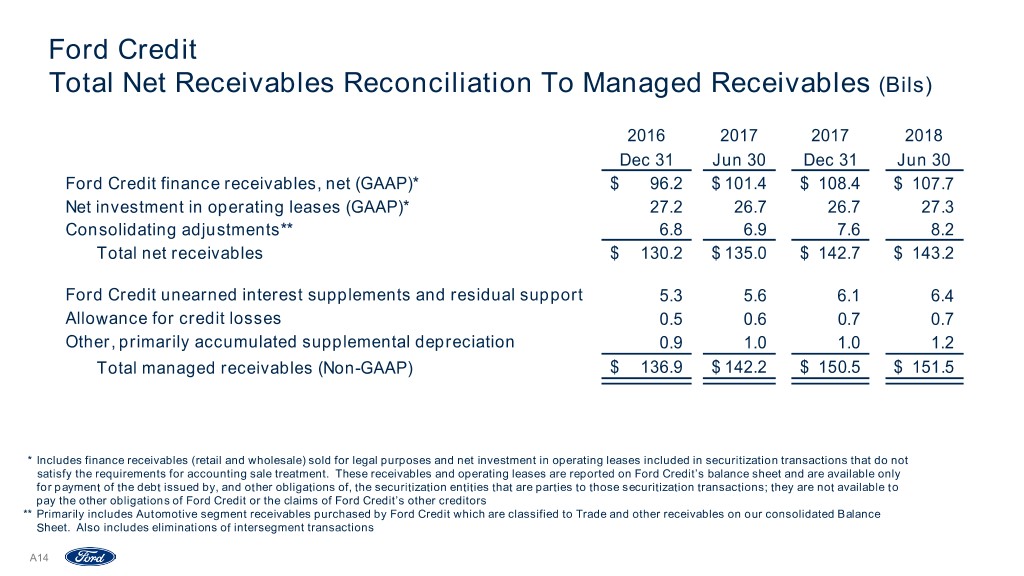

Ford Credit Total Net Receivables Reconciliation To Managed Receivables (Bils) 2016 2017 2017 2018 Dec 31 Jun 30 Dec 31 Jun 30 Ford Credit finance receivables, net (GAAP)* $ 96.2 $ 101.4 $ 108.4 $ 107.7 Net investment in operating leases (GAAP)* 27.2 26.7 26.7 27.3 Consolidating adjustments** 6.8 6.9 7.6 8.2 Total net receivables $ 130.2 $ 135.0 $ 142.7 $ 143.2 Ford Credit unearned interest supplements and residual support 5.3 5.6 6.1 6.4 Allowance for credit losses 0.5 0.6 0.7 0.7 Other, primarily accumulated supplemental depreciation 0.9 1.0 1.0 1.2 Total managed receivables (Non-GAAP) $ 136.9 $ 142.2 $ 150.5 $ 151.5 * Includes finance receivables (retail and wholesale) sold for legal purposes and net investment in operating leases included in securitization transactions that do not satisfy the requirements for accounting sale treatment. These receivables and operating leases are reported on Ford Credit’s balance sheet and are available only for payment of the debt issued by, and other obligations of, the securitization entities that are parties to those securitization transactions; they are not available to pay the other obligations of Ford Credit or the claims of Ford Credit’s other creditors ** Primarily includes Automotive segment receivables purchased by Ford Credit which are classified to Trade and other receivables on our consolidated Balance Sheet. Also includes eliminations of intersegment transactions A1458

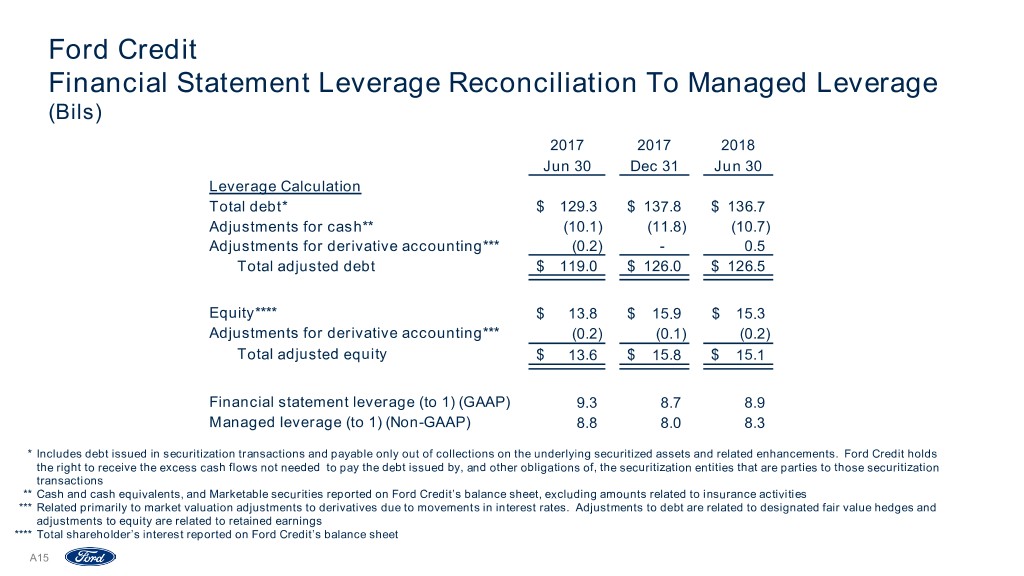

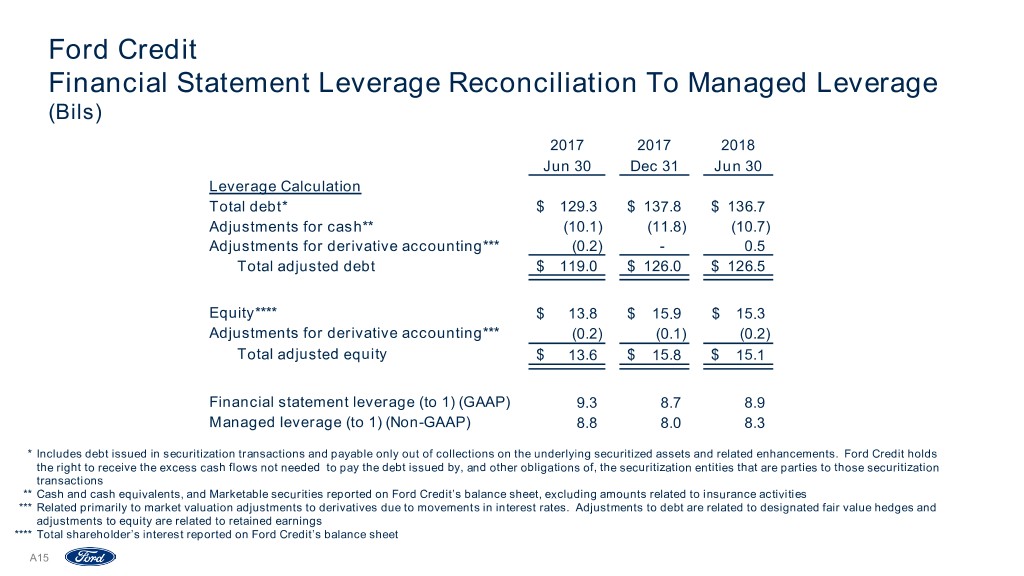

Ford Credit Financial Statement Leverage Reconciliation To Managed Leverage (Bils) 2017 2017 2018 Jun 30 Dec 31 Jun 30 Leverage Calculation Total debt* $ 129.3 $ 137.8 $ 136.7 Adjustments for cash** (10.1) (11.8) (10.7) Adjustments for derivative accounting*** (0.2) - 0.5 Total adjusted debt $ 119.0 $ 126.0 $ 126.5 Equity**** $ 13.8 $ 15.9 $ 15.3 Adjustments for derivative accounting*** (0.2) (0.1) (0.2) Total adjusted equity $ 13.6 $ 15.8 $ 15.1 Financial statement leverage (to 1) (GAAP) 9.3 8.7 8.9 Managed leverage (to 1) (Non-GAAP) 8.8 8.0 8.3 * Includes debt issued in securitization transactions and payable only out of collections on the underlying securitized assets and related enhancements. Ford Credit holds the right to receive the excess cash flows not needed to pay the debt issued by, and other obligations of, the securitization entities that are parties to those securitization transactions ** Cash and cash equivalents, and Marketable securities reported on Ford Credit’s balance sheet, excluding amounts related to insurance activities *** Related primarily to market valuation adjustments to derivatives due to movements in interest rates. Adjustments to debt are related to designated fair value hedges and adjustments to equity are related to retained earnings **** Total shareholder’s interest reported on Ford Credit’s balance sheet A1559

Non-GAAP Financial Measures That Supplement GAAP Measures We use both GAAP and non-GAAP financial measures for operational and financial decision making, and to assess Company and segment business performance. The non-GAAP measures listed below are intended to be considered by users as supplemental information to their equivalent GAAP measures, to aid investors in better understanding our financial results. We believe that these non-GAAP measures provide useful perspective on underlying business results and trends, and a means to assess our period-over-period results. These non-GAAP measures should not be considered as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP. These non-GAAP measures may not be the same as similarly titled measures used by other companies due to possible differences in method and in items or events being adjusted. • Company Adjusted EBIT (Most Comparable GAAP Measure: Net income attributable to Ford) – Earnings before interest and taxes (EBIT) includes non-controlling interests and excludes interest on debt (excl. Ford Credit Debt), taxes and pre-tax special items. This non-GAAP measure is useful to management and investors because it allows users to evaluate our operating results aligned with industry reporting. Pre-tax special items consist of (i) pension and OPEB remeasurement gains and losses, (ii) significant restructuring actions related to our efforts to match production capacity and cost structure to market demand and changing model mix, and (iii) other items that we do not necessarily consider to be indicative of earnings from ongoing operating activities. When we provide guidance for adjusted EBIT, we do not provide guidance on a net income basis because the GAAP measure will include potentially significant special items that have not yet occurred and are difficult to predict with reasonable certainty prior to year- end, including pension and OPEB remeasurement gains and losses. • Company Adjusted EBIT Margin (Most Comparable GAAP Measure: Company Net Income Margin) – Company Adjusted EBIT margin is Company adjusted EBIT divided by Company revenue. This non-GAAP measure is useful to management and investors because it allows users to evaluate our operating results aligned with industry reporting. • Adjusted Earnings Per Share (Most Comparable GAAP Measure: Earnings Per Share) – Measure of Company’s diluted net earnings per share adjusted for impact of pre-tax special items (described above), and tax special items. The measure provides investors with useful information to evaluate performance of our business excluding items not indicative of underlying run rate of our business. When we provide guidance for adjusted earnings per share, we do not provide guidance on an earnings per share basis because the GAAP measure will include potentially significant special items that have not yet occurred and are difficult to predict with reasonable certainty prior to year-end, including pension and OPEB remeasurement gains and losses. • Adjusted Effective Tax Rate (Most Comparable GAAP Measure: Effective Tax Rate) – Measure of Company’s tax rate excluding pre-tax special items (described above) and tax special items. The measure provides an ongoing effective rate which investors find useful for historical comparisons and for forecasting. When we provide guidance for adjusted effective tax rate, we do not provide guidance on an effective tax rate basis because the GAAP measure will include potentially significant special items that have not yet occurred and are difficult to predict with reasonable certainty prior to year-end, including pension and OPEB remeasurement gains and losses. A1660

Non-GAAP Financial Measures That Supplement GAAP Measures • Company Adjusted Operating Cash Flow (Most Comparable GAAP Measure: Net Cash Provided By / (Used In) Operating Activities) – Measure of Company’s operating cash flow excluding Ford Credit’s operating cash flows. The measure contains elements management considers operating activities, including Automotive and Mobility capital spending, Ford Credit distributions to its parent, and settlement of derivatives. The measure excludes cash outflows for funded pension contributions, separation payments, and other items that are considered operating cash outflows under U.S. GAAP. This measure is useful to management and investors because it is consistent with management’s assessment of the Company’s operating cash flow performance. When we provide guidance for Company adjusted operating cash flow, we do not provide guidance for net cash provided by/(used in) operating activities because the GAAP measure will include items that are difficult to quantify or predict with reasonable certainty, including cash flows related to the Company's exposures to foreign currency exchange rates and certain commodity prices (separate from any related hedges), Ford Credit's operating cash flows, and cash flows related to special items, including separation payments, each of which individually or in the aggregate could have a significant impact to our net cash provided by/(used in) our operating activities. • Ford Credit Managed Receivables – (Most Comparable GAAP Measure: Net Finance Receivables plus Net Investment in Operating Leases) – Measure of Ford Credit’s Total net receivables, excluding unearned interest supplements and residual support, allowance for credit losses, and other (primarily accumulated supplemental depreciation). The measure is useful to management and investors as it closely approximates the customer’s outstanding balance on the receivables, which is the basis for earning revenue. • Ford Credit Managed Leverage (Most Comparable GAAP Measure: Financial Statement Leverage) – Ford Credit’s debt-to-equity ratio adjusted (i) to exclude cash, cash equivalents, and marketable securities (other than amounts related to insurance activities), and (ii) for derivative accounting. The measure is useful to investors because it reflects the way Ford Credit manages its business. Cash, cash equivalents, and marketable securities are deducted because they generally correspond to excess debt beyond the amount required to support operations and on-balance sheet securitization transactions. Derivative accounting adjustments are made to asset, debt, and equity positions to reflect the impact of interest rate instruments used with Ford Credit’s term-debt issuances and securitization transactions. Ford Credit generally repays its debt obligations as they mature, so the interim effects of changes in market interest rates are excluded in the calculation of managed leverage. A1761

Definitions And Calculations Automotive Records • References to Automotive records for EBIT margin and business units are since at least 2009 Wholesales and Revenue • Wholesale unit volumes include all Ford and Lincoln badged units (whether produced by Ford or by an unconsolidated affiliate) that are sold to dealerships, units manufactured by Ford that are sold to other manufacturers, units distributed by Ford for other manufacturers, and local brand units produced by our China joint venture, Jiangling Motors Corporation, Ltd. (“JMC”), that are sold to dealerships. Vehicles sold to daily rental car companies that are subject to a guaranteed repurchase option (i.e., rental repurchase), as well as other sales of finished vehicles for which the recognition of revenue is deferred (e.g., consignments), also are included in wholesale unit volumes. Revenue from certain vehicles in wholesale unit volumes (specifically, Ford badged vehicles produced and distributed by our unconsolidated affiliates, as well as JMC brand vehicles) are not included in our revenue Industry Volume and Market Share • Industry volume and market share are based, in part, on estimated vehicle registrations; includes medium and heavy duty trucks SAAR • SAAR means seasonally adjusted annual rate Company Cash • Company cash includes cash, cash equivalents, marketable securities and restricted cash; excludes Ford Credit’s cash, cash equivalents, marketable securities and restricted cash Market Factors • Volume and Mix – primarily measures EBIT variance from changes in wholesale volumes (at prior-year average contribution margin per unit) driven by changes in industry volume, market share, and dealer stocks, as well as the EBIT variance resulting from changes in product mix, including mix among vehicle lines and mix of trim levels and options within a vehicle line • Net Pricing – primarily measures EBIT variance driven by changes in wholesale prices to dealers and marketing incentive programs such as rebate programs, low-rate financing offers, special lease offers and stock accrual adjustments on dealer inventory • Market Factors exclude the impact of unconsolidated affiliate wholesales ROE • Reflects an annualized return on equity. This metric is calculated by taking net income for the period divided by average equity for the period and annualizing the result by dividing by the number of days in the quarter and multiplying by 365. Earnings Before Taxes (EBT) • Reflects Income before income taxes A1862