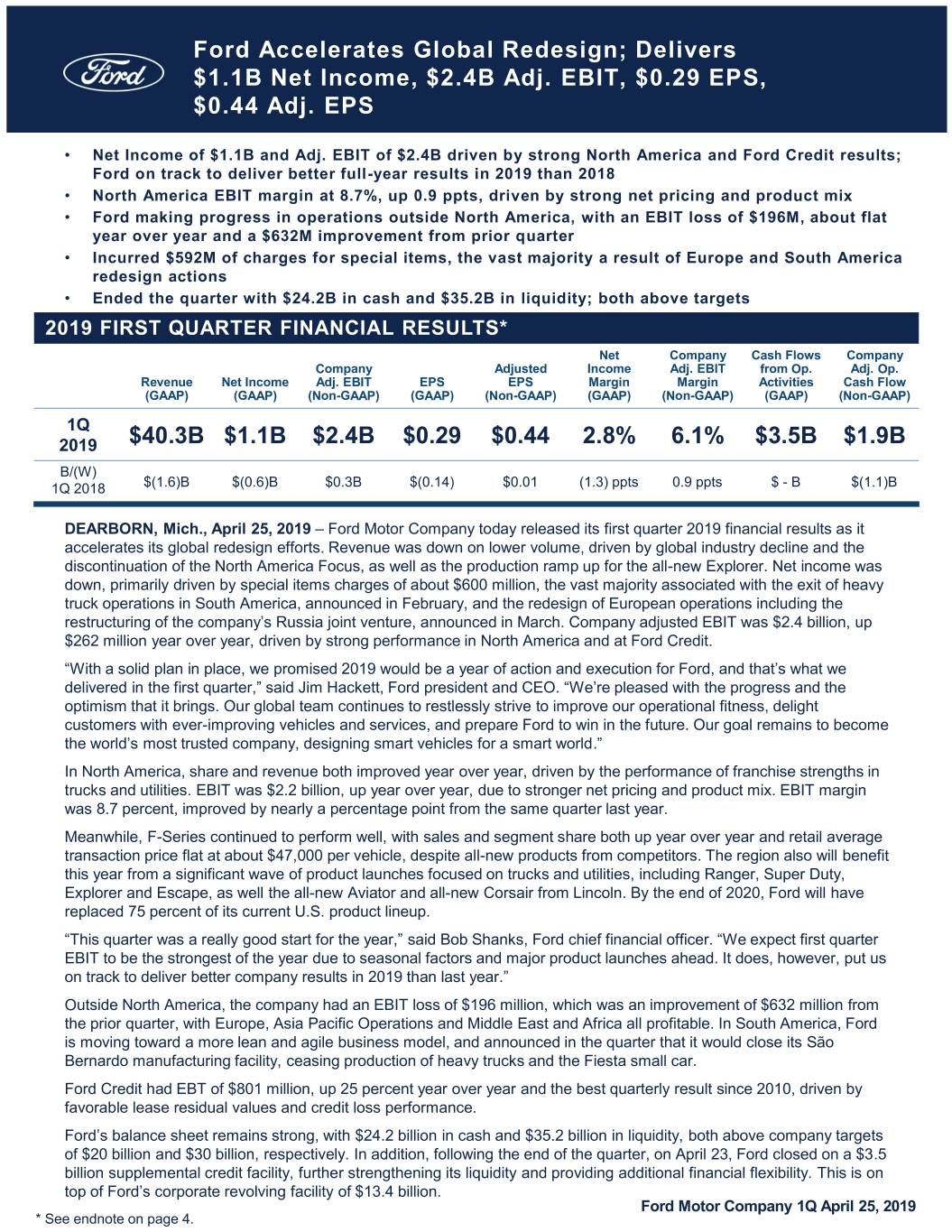

Ford Accelerates Global Redesign; Delivers $1.1B Net Income, $2.4B Adj. EBIT, $0.29 EPS, $0.44 Adj. EPS • Net Income of $1.1B and Adj. EBIT of $2.4B driven by strong North America and Ford Credit results; Ford on track to deliver better full-year results in 2019 than 2018 • North America EBIT margin at 8.7%, up 0.9 ppts, driven by strong net pricing and product mix • Ford making progress in operations outside North America, with an EBIT loss of $196M, about flat year over year and a $632M improvement from prior quarter • Incurred $592M of charges for special items, the vast majority a result of Europe and South America redesign actions • Ended the quarter with $24.2B in cash and $35.2B in liquidity; both above targets 2019 FIRST QUARTER FINANCIAL RESULTS* Net Company Cash Flows Company Company Adjusted Income Adj. EBIT from Op. Adj. Op. Revenue Net Income Adj. EBIT EPS EPS Margin Margin Activities Cash Flow (GAAP) (GAAP) (Non-GAAP) (GAAP) (Non-GAAP) (GAAP) (Non-GAAP) (GAAP) (Non-GAAP) 1Q 2019 $40.3B $1.1B $2.4B $0.29 $0.44 2.8% 6.1% $3.5B $1.9B B/(W) 1Q 2018 $(1.6)B $(0.6)B $0.3B $(0.14) $0.01 (1.3) ppts 0.9 ppts $ - B $(1.1)B DEARBORN, Mich., April 25, 2019 – Ford Motor Company today released its first quarter 2019 financial results as it accelerates its global redesign efforts. Revenue was down on lower volume, driven by global industry decline and the discontinuation of the North America Focus, as well as the production ramp up for the all-new Explorer. Net income was down, primarily driven by special items charges of about $600 million, the vast majority associated with the exit of heavy truck operations in South America, announced in February, and the redesign of European operations including the restructuring of the company’s Russia joint venture, announced in March. Company adjusted EBIT was $2.4 billion, up $262 million year over year, driven by strong performance in North America and at Ford Credit. “With a solid plan in place, we promised 2019 would be a year of action and execution for Ford, and that’s what we delivered in the first quarter,” said Jim Hackett, Ford president and CEO. “We’re pleased with the progress and the optimism that it brings. Our global team continues to restlessly strive to improve our operational fitness, delight customers with ever-improving vehicles and services, and prepare Ford to win in the future. Our goal remains to become the world’s most trusted company, designing smart vehicles for a smart world.” In North America, share and revenue both improved year over year, driven by the performance of franchise strengths in trucks and utilities. EBIT was $2.2 billion, up year over year, due to stronger net pricing and product mix. EBIT margin was 8.7 percent, improved by nearly a percentage point from the same quarter last year. Meanwhile, F-Series continued to perform well, with sales and segment share both up year over year and retail average transaction price flat at about $47,000 per vehicle, despite all-new products from competitors. The region also will benefit this year from a significant wave of product launches focused on trucks and utilities, including Ranger, Super Duty, Explorer and Escape, as well the all-new Aviator and all-new Corsair from Lincoln. By the end of 2020, Ford will have replaced 75 percent of its current U.S. product lineup. “This quarter was a really good start for the year,” said Bob Shanks, Ford chief financial officer. “We expect first quarter EBIT to be the strongest of the year due to seasonal factors and major product launches ahead. It does, however, put us on track to deliver better company results in 2019 than last year .” Outside North America, the company had an EBIT loss of $196 million, which was an improvement of $632 million from the prior quarter, with Europe, Asia Pacific Operations and Middle East and Africa all profitable. In South America, Ford is moving toward a more lean and agile business model, and announced in the quarter that it would close its São Bernardo manufacturing facility, ceasing production of heavy trucks and the Fiesta small car. Ford Credit had EBT of $801 million, up 25 percent year over year and the best quarterly result since 2010, driven by favorable lease residual values and credit loss performance. Ford’s balance sheet remains strong, with $24.2 billion in cash and $35.2 billion in liquidity, both above company targets of $20 billion and $30 billion, respectively. In addition, following the end of the quarter, on April 23, Ford closed on a $3.5 billion supplemental credit facility, further strengthening its liquidity and providing additional financial flexibility. This is on top of Ford’s corporate revolving facility of $13.4 billion. Ford Motor Company 1Q April 25, 2019 * See endnote on page 4.

AUTOMOTIVE SEGMENT RESULTS Wholesales Revenue Market Share EBIT EBIT Margin 1Q 2019 1,425K $37.2B 5.9% $2.0B 5.4% B/(W) 1Q 2018 (237)K $(1.8)B (0.6) ppts $0.3B 1.0 ppts Market EBIT Wholesales Revenue EBIT North America Share Margin § Higher U.S. market share reflects performance of franchise strengths – truck and SUV – and Lincoln, offset 1Q 2019 753K $25.4 B 13.6% $2.2B 8.7% largely by Focus and all-new Explorer launch B/(W) (43)K $0.6B 0.1 ppts $0.3B 0.9 ppts § Favorable market factors drove YoY EBIT gain, with partial 1Q 2018 offsets from higher warranty costs related to changes in accrual rates and coverages § F-Series, Ranger and Transit, along with decision to exit traditional sedans, drove EBIT gain South America § Continued favorable cost performance more than offset 1Q 2019 68K $0.9B 7.7% $(158)M (17.0)% by inflationary and adverse exchange effects and sharply lower Argentina industry B/(W) (18)K $(0.4)B (1.1) ppts $(9)M (5.8) ppts § São Bernardo plant closure announced; expect EBIT 1Q 2018 special items of about $460M, with $193M booked in the quarter. Anticipate about a 2-year payback from action Europe § Europe profitable and improved $256M from prior quarter 1Q 2019 391K $7.6 B 7.2% $57M 0.7% § Market share decline driven by cars; commercial B/(W) (58)K $(1.3)B (0.4) ppts $(62)M (0.6) ppts vehicle share higher, with Ford No. 1 commercial 1Q 2018 brand in the quarter § Lower structural costs year over year, reflect early benefits of business redesign efforts Middle East & Africa § EBIT up $68M year over year, driven by lower cost 1Q 2019 22K $0.6B 2.8% $14M 2.4% and favorable mix B/(W) 1Q 2018 (3)K $ - B (0.4) ppts $68M 10.9 ppts China § EBIT loss improved $22M year over year and $406M from prior quarter 1Q 2019 115K $0.9 B 2.1% $(128)M (14.9)% § Consolidated operations improved $201M driven by B/(W) (107)K $(0.4)B (1.1) ppts $22M (2.8) ppts cost reduction actions and favorable exchange, offset 1Q 2018 partially by lower volume § Net pricing flat despite continued negative pricing on an industry level § JV net equity income declined $179M due to lower volume, mainly lower market share and unfavorable stock changes Asia Pacific Operations § Business unit accounts for Asia Pacific markets, excluding China 1Q 2019 76K $1.8 B 1.7% $19M 1.0% § EBIT down year over year, as cost improvement was B/(W) (8)K $(0.3)B (0.1) ppts $(12)M (0.5) ppts more than offset by weaker Australian dollar and 1Q 2018 stronger euro 2 Ford Motor Company 1Q April 25, 2019

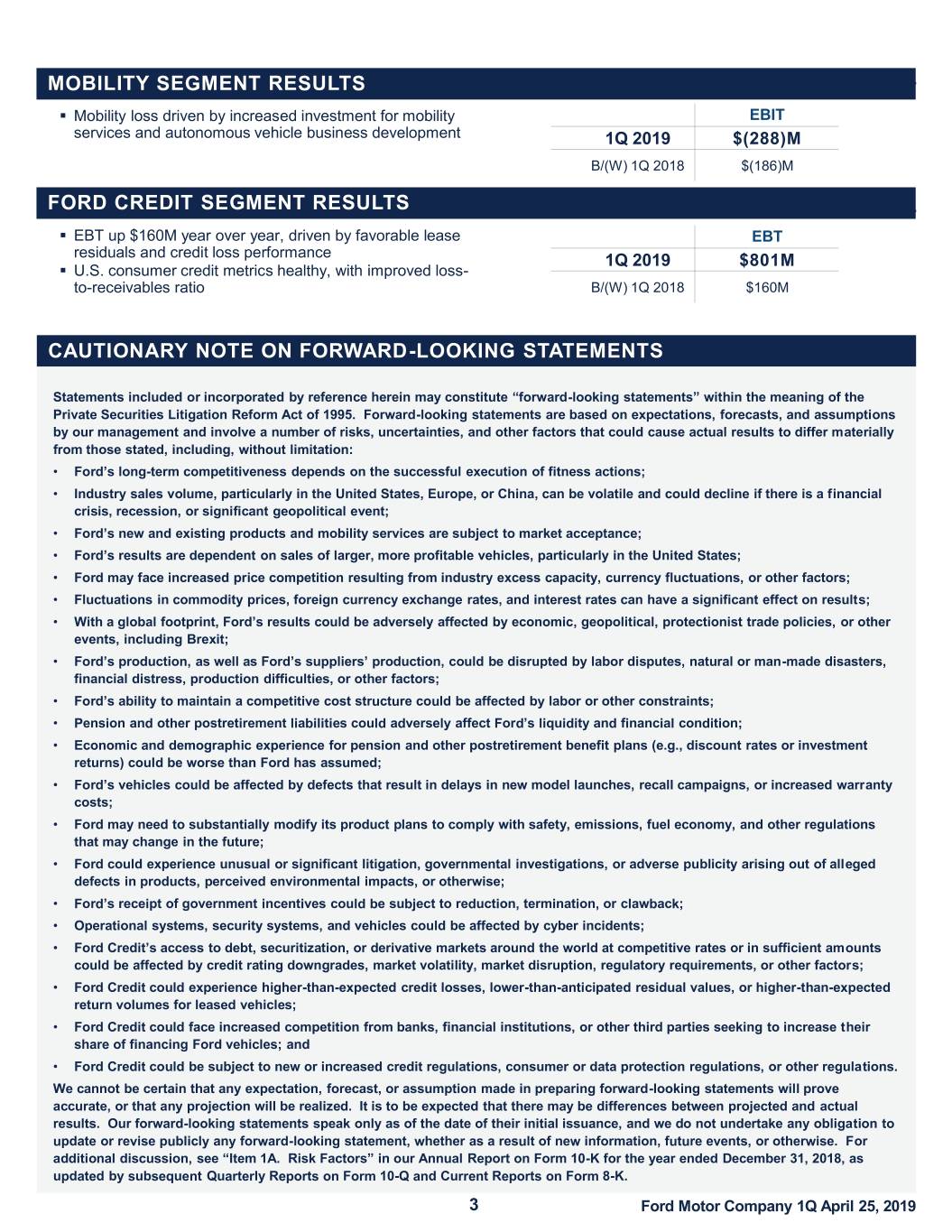

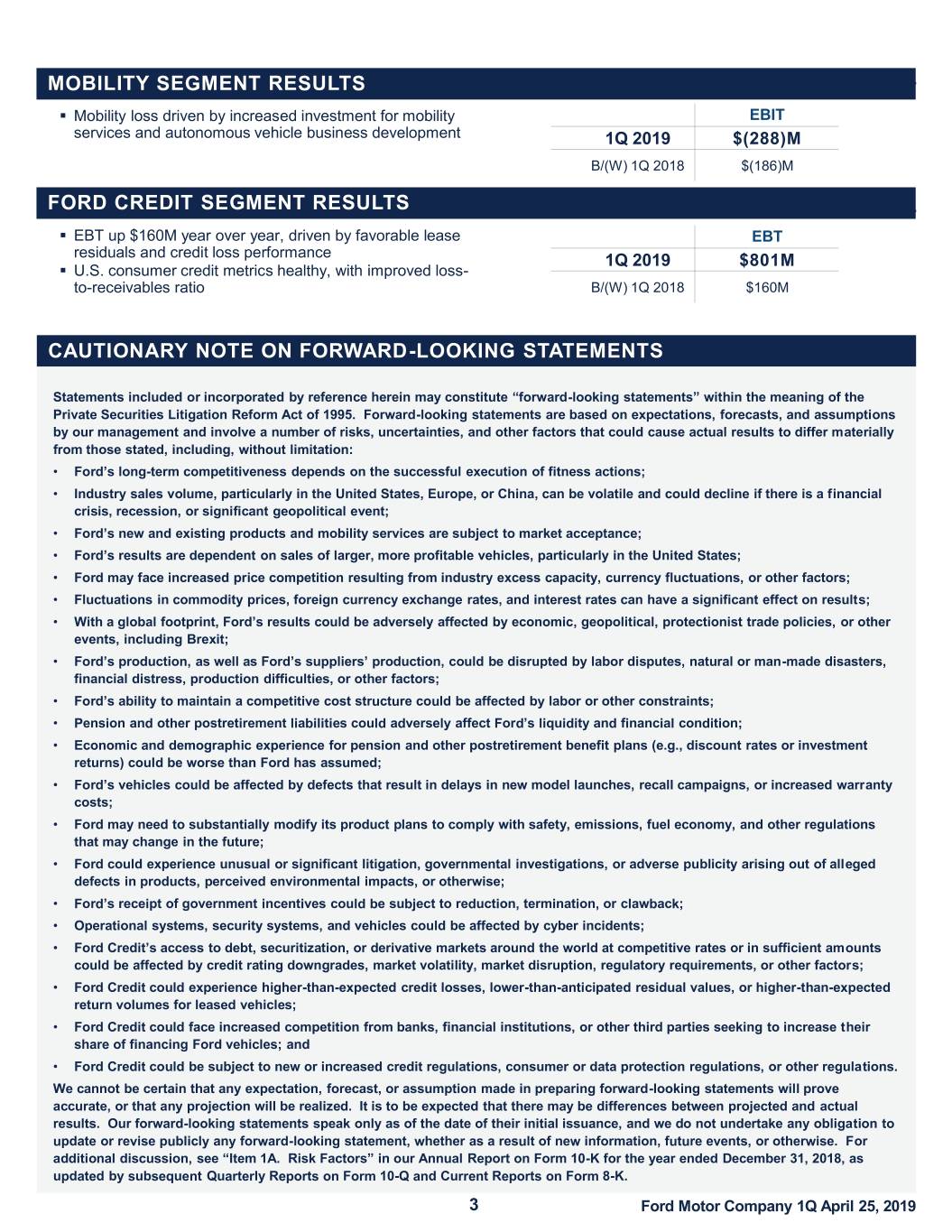

MOBILITYMobility SegmentSEGMENT Results RESULTS § Mobility loss driven by increased investment for mobility EBIT services and autonomous vehicle business development 1Q 2019 $(288)M B/(W) 1Q 2018 $(186)M FORDFord CreditCREDIT Segment SEGMENT Results RESULTS § EBT up $160M year over year, driven by favorable lease EBT residuals and credit loss performance 1Q 2019 $801M § U.S. consumer credit metrics healthy, with improved loss- to-receivables ratio B/(W) 1Q 2018 $160M CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS Statements included or incorporated by reference herein may constitute “forward -looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on expectations, forecasts, and assumptions by our management and involve a number of risks, uncertainties, and other factors that could cause actual results to differ materially from those stated, including, without limitation: • Ford’s long -term competitiveness depends on the successful execution of fitness actions; • Industry sales volume, particularly in the United States, Europe, or China, can be volatile and could decline if there is a financial crisis, recession, or significant geopolitical event; • Ford’s new and existing products and mobility services are subject to market acceptance; • Ford’s results are dependent on sales of larger, more profitable vehicles, particularly in the United States; • Ford may face increased price competition resulting from industry excess capacity, currency fluctuations, or other factors; • Fluctuations in commodity prices, foreign currency exchange rates, and interest rates can have a significant effect on results; • With a global footprint, Ford’s results could be adversely affected by economic, geopolitical, protectionist trade policies, or other events, including Brexit; • Ford’s production, as well as Ford’s suppliers’ production, could be disrupted by labor disputes, natural or man -made disasters, financial distress, production difficulties, or other factors; • Ford’s ability to maintain a competitive cost structure could be affected by labor or other constraints; • Pension and other postretirement liabilities could adversely affect Ford’s liquidity and financial condition; • Economic and demographic experience for pension and other postretirement benefit plans (e.g., discount rates or investment returns) could be worse than Ford has assumed; • Ford’s vehicles could be affected by defects that result in delays in new model launches, recall campaigns, or increased warr anty costs; • Ford may need to substantially modify its product plans to comply with safety, emissions, fuel economy, and other regulations that may change in the future; • Ford could experience unusual or significant litigation, governmental investigations, or adverse publicity arising out of alleged defects in products, perceived environmental impacts, or otherwise; • Ford’s receipt of government incentives could be subject to reduction, termination, or clawback; • Operational systems, security systems, and vehicles could be affected by cyber incidents; • Ford Credit’s access to debt, securitization, or derivative markets around the world at competitive rates or in sufficient am ounts could be affected by credit rating downgrades, market volatility, market disruption, regulatory requirements, or other factors; • Ford Credit could experience higher-than-expected credit losses, lower-than-anticipated residual values, or higher-than-expected return volumes for leased vehicles; • Ford Credit could face increased competition from banks, financial institutions, or other third parties seeking to increase their share of financing Ford vehicles; and • Ford Credit could be subject to new or increased credit regulations, consumer or data protection regulations, or other regulations. We cannot be certain that any expectation, forecast, or assumption made in preparing forward-looking statements will prove accurate, or that any projection will be realized. It is to be expected that there may be differences between projected and actual results. Our forward-looking statements speak only as of the date of their initial issuance, and we do not undertake any obligation to update or revise publicly any forward-looking statement, whether as a result of new information, future events, or otherwise. For additional discussion, see “Item 1A. Risk Factors” in our Annual Report on Form 10 -K for the year ended December 31, 2018, as updated by subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. 3 Ford Motor Company 1Q April 25, 2019

CONFERENCE CALL DETAILS Ford Motor Company [NYSE:F] and Ford Motor Credit Company release their 2019 first quarter financial results at 4:15 p.m. ET today. Following the release, Jim Hackett, Ford president and chief executive officer, and Bob Shanks, Ford chief financial officer, and members of Ford’s senior management team will host a conference call at 5:30 p.m. ET to discuss the results. The presentation and supporting materials are available at www.shareholder.ford.com . Representatives of the investment community and the news media will have the opportunity to ask questions on the call. Access Information – Thursday, April 25, 2019 Ford Earnings Call: 5:30 p.m. ET Toll-Free: 1.877.870.8664 International: 1.970.297.2423 Passcode: Ford Earnings Web: www.shareholder.ford.com REPLAY (Available after 9:30 p.m. ET the day of the event through May 2, 2019) Web: www.shareholder.ford.com Toll-Free: 1.855.859.2056 International: 1.404.537.3406 Replay Passcode: 6640339 About Ford Motor Company Ford Motor Company is a global company based in Dearborn, Michigan. The company designs, manufactures, markets and services a full line of Ford cars, trucks, SUVs, electrified vehicles and Lincoln luxury vehicles, provides financial services through Ford Motor Credit Company and is pursuing leadership positions in electrification, autonomous vehicles and mobility solutions. Ford employs approximately 196,000 people worldwide. For more information regarding Ford, its products and Ford Motor Credit Company, please visit www.corporate.ford.com . * The following applies to the information throughout this release: § See tables later in this release for the nature and amount of special items, and reconciliations of the non-GAAP financial measures designated as “adjusted” to the most comparable financial measures calculated in accordance with U.S. generally accepted accounting principles (“GAAP”). § Wholesale unit sales and production volumes include Ford brand and Jiangling Motors Corporation (“JMC”) brand vehicles produced and sold in China by our unconsolidated affiliates; revenue does not include these sales. See materials supporting the April 25, 2019 conference call at www.shareholder.ford.com for further discussion of wholesale unit volumes. 4 Ford Motor Company 1Q April 25, 2019

CONSOLIDATED INCOME STATEMENT FORD MOTOR COMPANY AND SUBSIDIARIES CONSOLIDATED INCOME STATEMENT (in millions, except per share amounts) For the periods ended March 31, 2018 2019 First Quarter (unaudited) Revenues Automotive $ 39,012 $ 37,239 Ford Credit 2,943 3,097 Mobility 4 6 Total revenues 41,959 40,342 Costs and expenses Cost of sales 35,753 33,942 Selling, administrative, and other expenses 2,747 2,843 Ford Credit interest, operating, and other expenses 2,338 2,355 Total costs and expenses 40,838 39,140 Interest expense on Automotive debt 275 231 Interest expense on Other debt 14 14 Other income/(loss), net 863 628 Equity in net income of affiliated companies 224 25 Income before income taxes 1,919 1,610 Provision for/(Benefit from) income taxes 174 427 Net income 1,745 1,183 Less: Income/(Loss) attributable to noncontrolling interests 9 37 Net income attributable to Ford Motor Company $ 1,736 $ 1,146 EARNINGS PER SHARE ATTRIBUTABLE TO FORD MOTOR COMPANY C OMMON AND CLASS B STOCK Basic income $ 0.44 $ 0.29 Diluted income 0.43 0.29 5 Ford Motor Company 1Q April 25, 2019

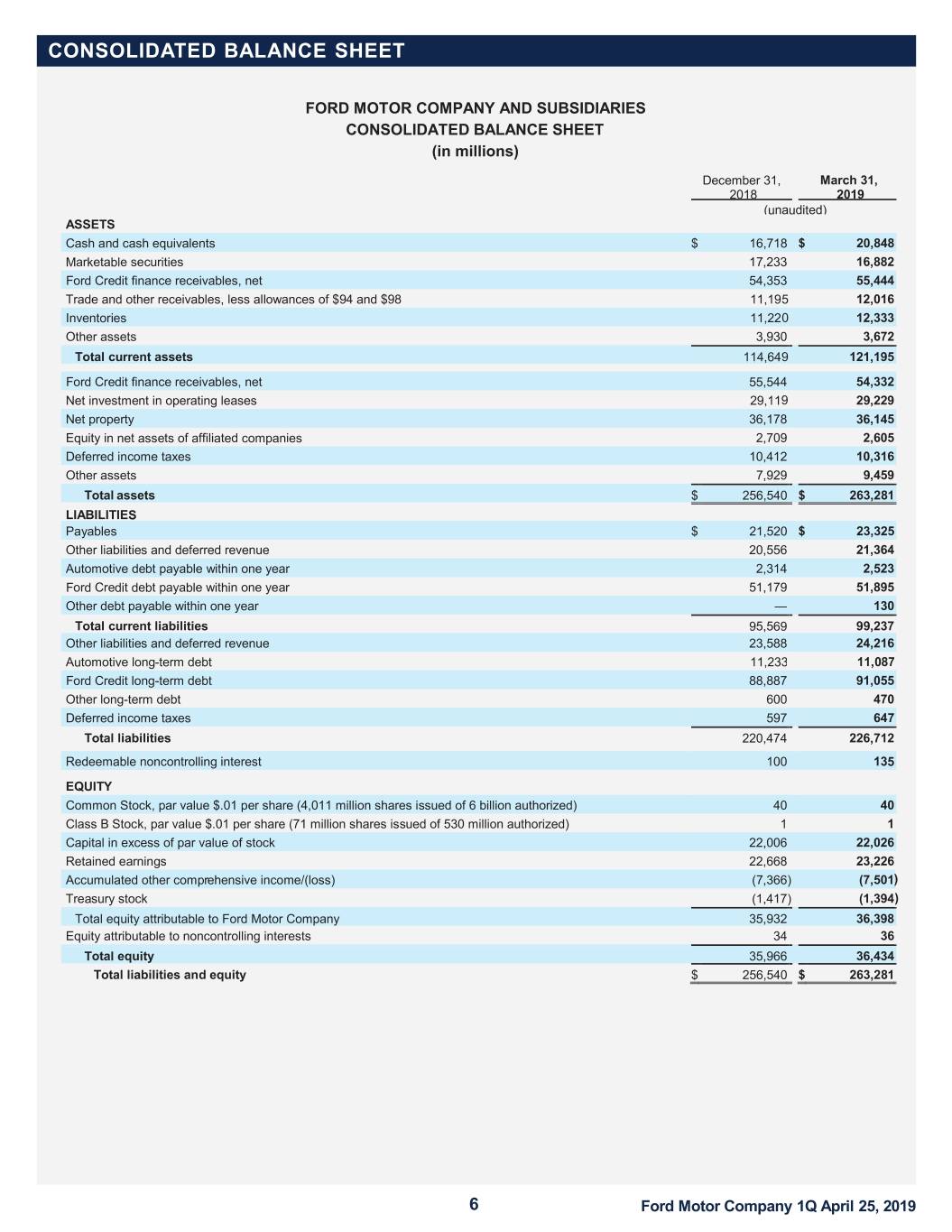

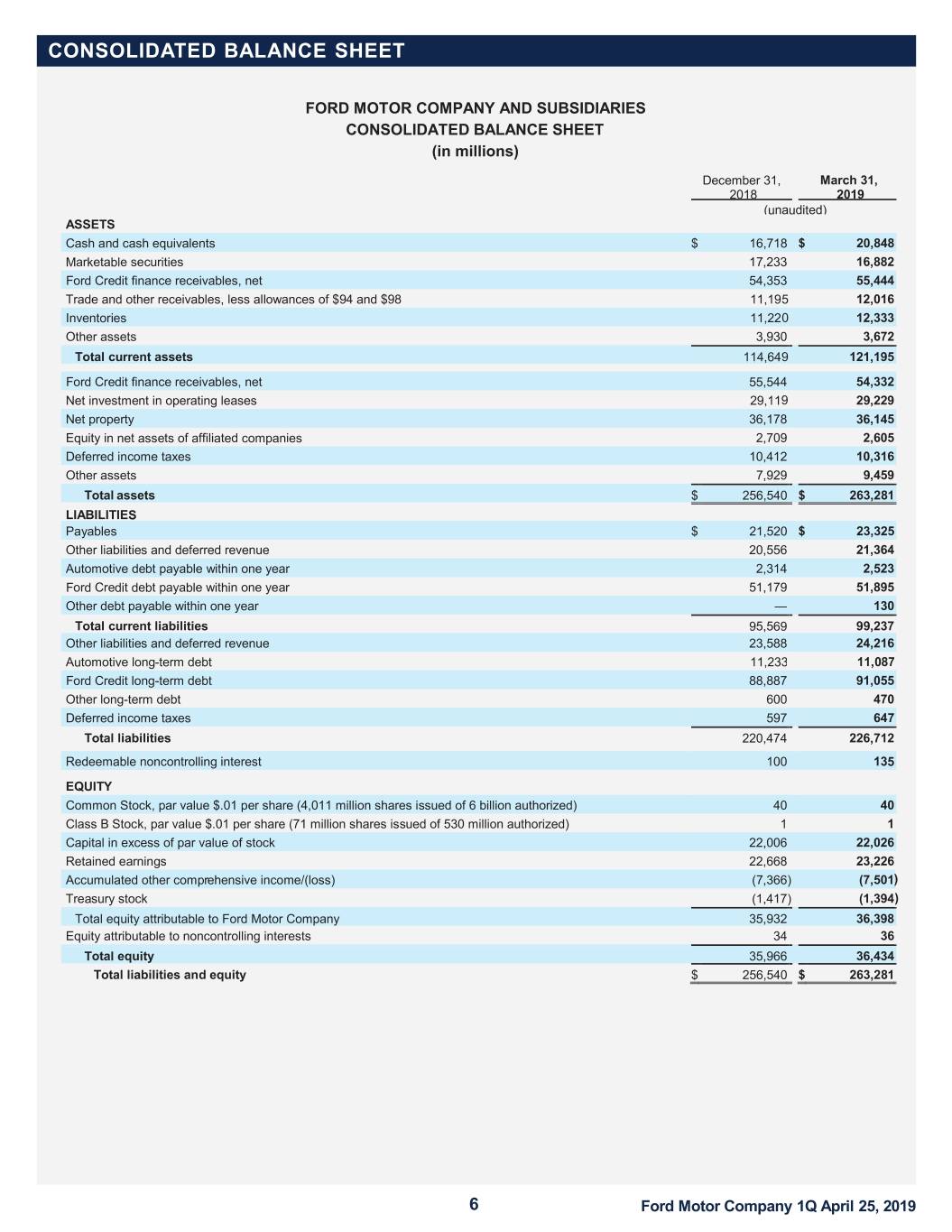

CONSOLIDATED BALANCE SHEET FORD MOTOR COMPANY AND SUBSIDIARIES CONSOLIDATED BALANCE SHEET (in millions) December 31, March 31, 2018 2019 (unaudited) ASSETS Ca sh and cash equivalents $ 16,718 $ 20,848 Marketable securities 17,233 16,882 Ford Credit f inance receivables, net 54,353 55,444 Trade and other receivables, less allowances of $94 and $98 11,1955 12,016 Inventories 11,2200 12,333 Other assets 3,930 3,672 Total current assets 114,6499 121,195 Ford Credit f inance receivables, net 55,544 54,332 Net investme nt in operating leases 29,1199 29,229 Net property 36,178 36,145 Equity in net assets of affiliated companies 2,709 2,605 Deferred income taxes 10,412 10,316 Other assets 7,929 9,459 Total assets $ 256,540 $ 263,281 LIABILITIES Payables $ 21,520 $ 23,325 Other liabilitie s and deferred revenue 20,556 21,364 Automotive de bt payable within one year 2,314 2,523 Ford Credit debt p ayable within one year 51,179 51,895 Other debt p ayable within one year — 130 Total current liabilities 95,569 99,237 Other liabilitie s and deferred revenue 23,588 24,216 Aut omotive long -term debt 11,233 11,087 Ford Credit long -term debt 88,887 91,055 Other long -term debt 600 470 Deferred income taxes 597 647 Total liabilities 220,474 226,712 Redeemable noncontrolling interest 100 135 EQUITY Common Stock, par value $.01 per share (4,011 million shares issued of 6 billion authorized) 40 40 Class B Stock, par value $.01 per share (71 million shares issued of 530 million authorized) 1 1 Capital in excess of par value of stock 22,006 22,026 Retained earnings 22,668 23,226 Accumulated other compr ehensive income/(loss) (7,366 ) (7,501 ) Treasury stock (1,417 ) (1,394 ) Total equity attributable to Ford Motor Company 35,932 36,398 Equity attributable to noncontrolling interests 34 36 Total equity 35,966 36,434 Total liabilities and equity $ 256,540 $ 263,281 6 Ford Motor Company 1Q April 25, 2019

CONSOLIDATED STATEMENT OF CASH FLOWS FORD MOTOR COMPANY AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS (in millions) For the periods ended March 31, 2018 2019 First Quarter (unaudited) Cash flows from operating activities Net cash provided by/(used in) operating activities $ 3,514 $ 3,544 Cash flows from investing activities Capital spending (1,779 ) (1,633 ) Acquisitions of finance receivables and operating leases (15,683 ) (12,595 ) Collections of finance receivables and operating leases 12,956 12,336 Purchases of marketable and other securities (7,867 ) (3,923 ) Sales and maturities of marketable and other securities 6,040 4,441 Settlements of derivatives (61 ) (14 ) Other (150 ) 54 Net cash provided by/(used in) investing activities (6,544 ) (1,334 ) Cash flows from financing activities Cash payments for dividends and dividend equivalents (1,1133 )) (597 ) Purchases of common stock (89 ) — Net changes in short -term debt (909 ) 420 Proceeds from issuance of long -term debt 16,953 15,411 Principal payments on long -term debt (12,360 ) (13,277 ) Other (68 ) (84 ) Net cash provided by/(used in) financing activities 2,414 1,873 Effect of exchange rate changes on cash, cash equivalents, and restricted cash 1155 29 Net increase/(decrease) in cash, cash equivalents, and restricted cash $ (501 ) $ 4,1122 Cash, cash equivalents, and restri cted cash at January 1 $ 18,638 $ 16,907 Net increase/(decrease) in cash, cash equivalents, and restricted cash (501 ) 4,112 Cash, cash equivalents, and restr icted cash at March 31 $ 18,137 $ 21,019 7 Ford Motor Company 1Q April 25, 2019

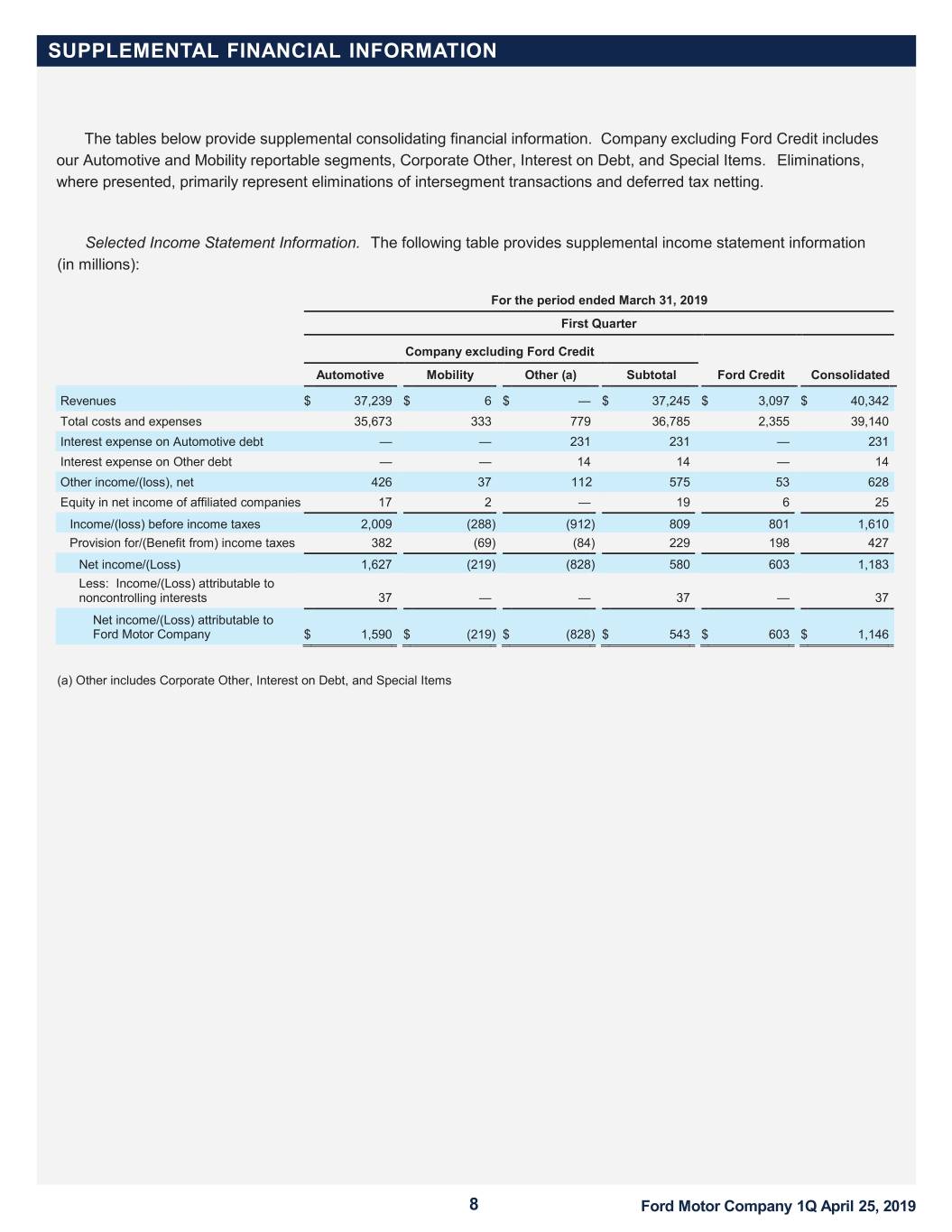

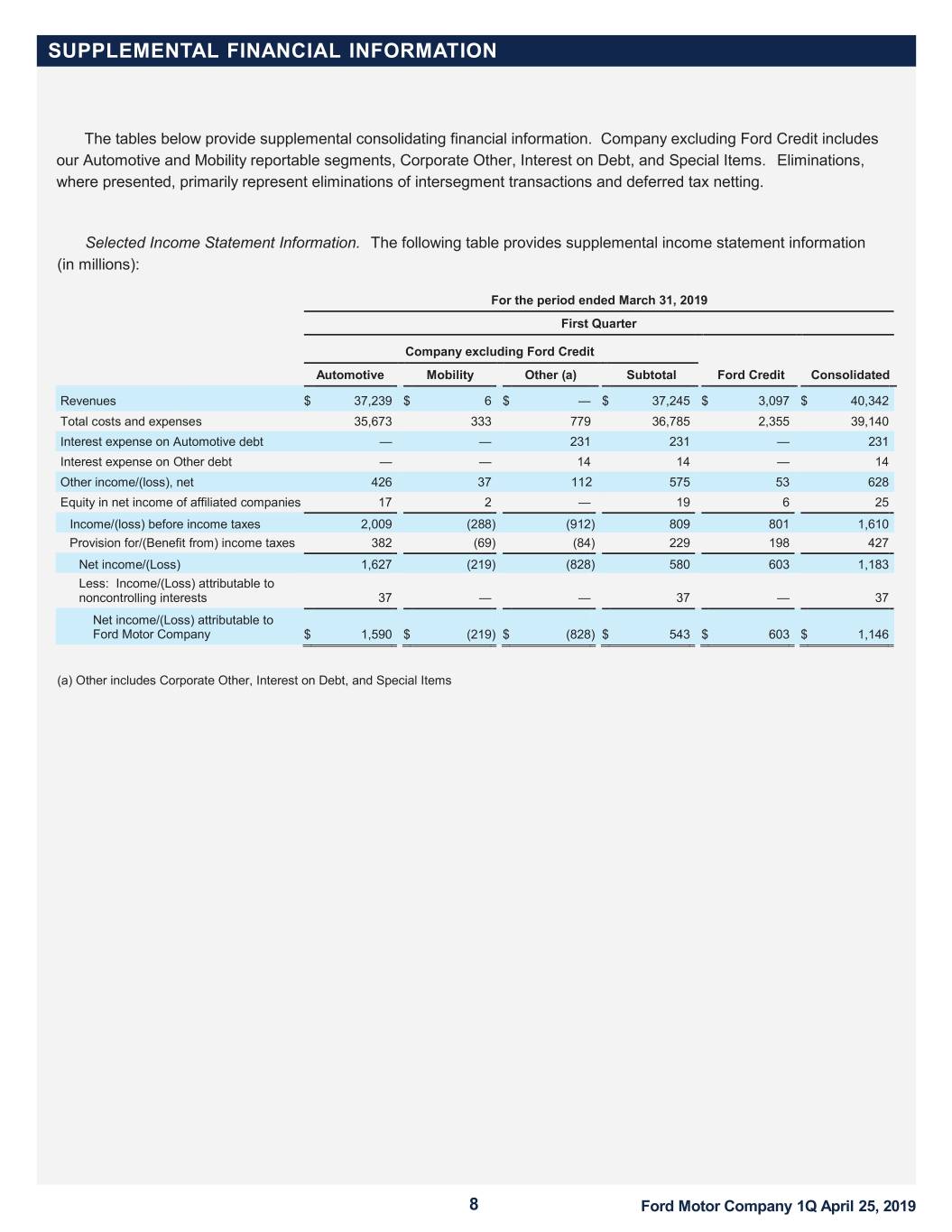

SUPPLEMENTAL FINANCIAL INFORMATION The tables below provide supplemental consolidating financial information. Company excluding Ford Credit includes our Automotive and Mobility reportable segments, Corporate Other, Interest on Debt, and Special Items. Eliminations, where presented, primarily represent eliminations of intersegment transactions and deferred tax netting. Selected Income Statement Information. The following table provides supplemental income statement information (in millions): For the period ended March 31, 2019 First Quarter Company excluding Ford Credit Automotive Mobility Other (a) Subtotal Ford Credit Consolidated Revenues $ 37,239 $ 6 $ — $ 37,245 $ 3,097 $ 40,342 Total costs and expenses 35,673 333 779 36,785 2,355 39,140 Interest expense on Automotive debt — — 231 231 — 231 Interest expense on Other debt — — 14 14 — 14 Other income/(loss), net 426 37 1122 575 53 628 Equity in net income of affiliated companies 17 2 — 19 6 25 Income/(loss) before income taxes 2,009 (288 ) (912 ) 809 801 1,610 Provision for/(Benefit from) income taxes 382 (69 ) (84 ) 229 198 427 Net income/(Loss) 1,627 (219 ) (828 ) 580 603 1,183 Less: Income/(Loss) attributable to noncontrolling interests 37 — — 37 — 37 Net income/(Loss) attributable to Ford Motor Company $ 1,590 $ (219 ) $ (828 ) $ 543 $ 603 $ 1,146 (a) Other includ es Corporate Other, Interest on Debt, and Special Items 8 Ford Motor Company 1Q April 25, 2019

SUPPLEMENTAL FINANCIAL INFORMATION Selected Balance Sheet Information. The following tables provide supplemental balance sheet information (in millions): March 31, 2019 Company excluding Assets Ford Credit Ford Credit Eliminations Consolidated Cash and cash equivalents $ 9,1155 $ 11,7333 $ — $ 20,848 Marketable securities 15,036 1,846 — 16,882 Ford Credit finance receivables, net — 55,444 — 55,444 Trade and other receivables, less allowances 3,837 8,179 — 12,016 Inventories 12,333 — — 12,333 Other assets 2,499 1,173 — 3,672 Receivable from other segments 94 1,944 (2,038 ) — Total current assets 42,914 80,319 (2,038 ) 121,195 Ford Credit finance receivables, net — 54,332 — 54,332 Net investment in operating leases 1,656 27,573 — 29,229 Net property 35,945 200 — 36,145 Equity in net assets of affiliated companies 2,487 118 — 2,605 Deferred income taxes 12,233 200 (2,117 ) 10,316 Other assets 7,822 1,637 — 9,459 Receivable from other segments 5 30 (35 ) — Total assets $ 103,062 $ 164,409 $ (4,190 ) $ 263,281 Company excluding Liabilities Ford Credit Ford Credit Eliminations Consolidated Payables $ 22,197 $ 1,128 $ — $ 23,325 Other liabilities and deferred revenue 19,782 1,582 — 21,364 Automotive debt payable within one year 2,523 — — 2,523 Ford Credit debt payable within one year — 51,895 — 51,895 Other debt payable within one year 130 — — 130 Payable to other segments 2,038 — (2,038 ) — Total current liabilities 46,670 54,605 (2,038 ) 99,237 Other liabilities and deferred revenue 23,069 1,147 — 24,216 Automotive long -term debt 11,087 — — 11,087 Ford Credit long -term debt — 91,055 — 91,055 Other long -term debt 470 — — 470 Deferred income taxes 84 2,680 (2,117 ) 647 Payable to other segments 35 — (35 ) — Total liabilities $ 81,415 $ 149,487 $ (4,190 ) $ 226,712 9 Ford Motor Company 1Q April 25, 2019

SUPPLEMENTAL FINANCIAL INFORMATION Selected Cash Flow Information. The following tables provide supplemental cash flow information (in millions): For the period ended March 31, 2019 First Quarter Company excluding Cash flows from operating activities Ford Credit Ford Credit Eliminations Consolidated Net cash provided by/(used in) operating activities $ 2,426 $ 1,1188 $ — $ 3,544 Company excluding Cash flows from investing activities Ford Credit Ford Credit Eliminations Consolidated Capital spending $ (1,620 ) $ (13 ) $ — $ (1,633 ) Acquisitions of finance receivables and operating leases — (12,595 ) — (12,595 ) Collections of finance receivables and operating leases — 12,336 — 12,336 Purchases of marketable and other securities (3,120 ) (803 ) — (3,923 ) Sales and maturities of marketable and other securities 4,167 274 — 4,441 Settlements of derivatives (26 ) 12 — (14 ) Other 54 — — 54 Investing activity (to)/from other segments 754 — (754 ) — Net cash provided by/(used in) investing activities $ 209 $ (789 ) $ (754 ) $ (1,334 ) Company excluding Cash flows from financing activities Ford Credit Ford Credit Eliminations Consolidated Cash payments for dividends and dividend equivalents $ (597 ) $ — $ — $ (597 ) Purchases of common stock — — — — Net changes in short -term debt 616 (196 ) — 420 Proceeds from issuance of long -term debt — 15,411 — 15,411 Principal payments on long -term debt (594 ) (12,683 ) — (13,277 ) Other (46 ) (38 ) — (84 ) Financing activity to/(from) other segments — (754 ) 754 — Net cash provided by/(used in) financing activities $ (621 ) $ 1,740 $ 754 $ 1,873 Effect of exchange rate changes on cash, cash equivalents, and restricted cash $ (9 ) $ 38 $ — $ 29 10 Ford Motor Company 1Q April 25, 2019

NON-GAAP FINANCIAL MEASURES THAT SUPPLEMENT GAAP MEASURES We use both GAAP and non-GAAP financial measures for operational and financial decision making, and to assess Company and segment business performance. The non-GAAP measures listed below are intended to be considered by users as supplemental information to their equivalent GAAP measures, to aid investors in better understanding our financial results. We believe that these non-GAAP measures provide useful perspective on underlying business results and trends, and a means to assess our period-over-period results. These non-GAAP measures should not be considered as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP. These non-GAAP measures may not be the same as similarly titled measures used by other companies due to possible differences in method and in items or events being adjusted. • Company Adjusted EBIT (Most Comparable GAAP Measure: Net income attributable to Ford) – Earnings before interest and taxes (EBIT) excludes interest on debt (excl. Ford Credit Debt), taxes and pre-tax special items. This non-GAAP measure is useful to management and investors because it allows users to evaluate our operating results aligned with industry reporting. Pre-tax special items consist of (i) pension and OPEB remeasurement gains and losses, (ii) significant personnel and dealer-related costs stemming from our efforts to match production capacity and cost structure to market demand and changing model mix, and (iii) other items that we do not necessarily consider to be indicative of earnings from ongoing operating activities. When we provide guidance for adjusted EBIT, we do not provide guidance on a net income basis because the GAAP measure will include potentially significant special items that have not yet occurred and are difficult to predict with reasonable certainty prior to year-end, including pension and OPEB remeasurement gains and losses. • Company Adjusted EBIT Margin (Most Comparable GAAP Measure: Company Net Income Margin) – Company Adjusted EBIT margin is Company adjusted EBIT divided by Company revenue. This non-GAAP measure is useful to management and investors because it allows users to evaluate our operating results aligned with industry reporting. • Adjusted Earnings Per Share (Most Comparable GAAP Measure: Earnings Per Share) – Measure of Company’s diluted net earnings per share adjusted for impact of pre -tax special items (described above), tax special items and restructuring impacts in non-controlling interests. The measure provides investors with useful information to evaluate performance of our business excluding items not indicative of underlying run rate of our business. When we provide guidance for adjusted earnings per share, we do not provide guidance on an earnings per share basis because the GAAP measure will include potentially significant special items that have not yet occurred and are difficult to predict with reasonable certainty prior to year-end, including pension and OPEB remeasurement gains and losses. • Company Adjusted Operating Cash Flow (Most Comparable GAAP Measure: Net Cash Provided By / (Used In) Operating Activities) – Measure of Company’s operating cash flow excluding Ford Credit’s operating cash flows. The measure contains elements management considers operating activities, including Automotive and Mobility capital spending, Ford Credit distributions to its parent, and settlement of derivatives. The measure excludes cash outflows for funded pension contributions, separation payments, and other items that are considered operating cash outflows under U.S. GAAP. This measure is useful to management and investors because it is consistent with management’s assessment of the Company’s operating cash flow performance. When we provide guidance for Company adjusted operating cash flow, we do not provide guidance for net cash provided by/(used in) operating activities because the GAAP measure will include items that are difficult to quantify or predict with reasonable certainty, including cash flows related to the Company's exposures to foreign currency exchange rates and certain commodity prices (separate from any related hedges), Ford Credit's operating cash flows, and cash flows related to special items, including separation payments, each of which individually or in the aggregate could have a significant impact to our net cash provided by/(used in) our operating activities. Note: Calculated results may not sum due to rounding 11 Ford Motor Company 1Q April 25, 2019

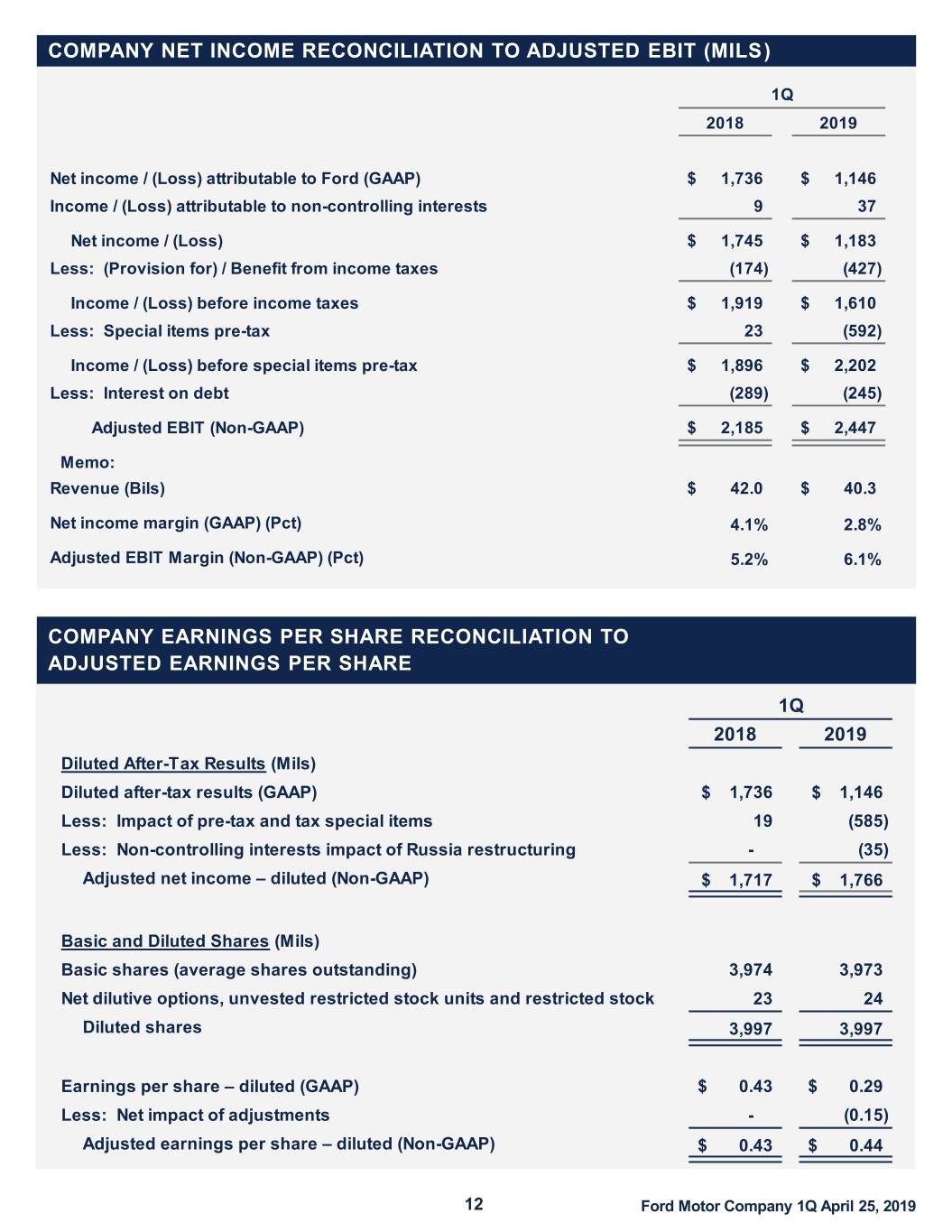

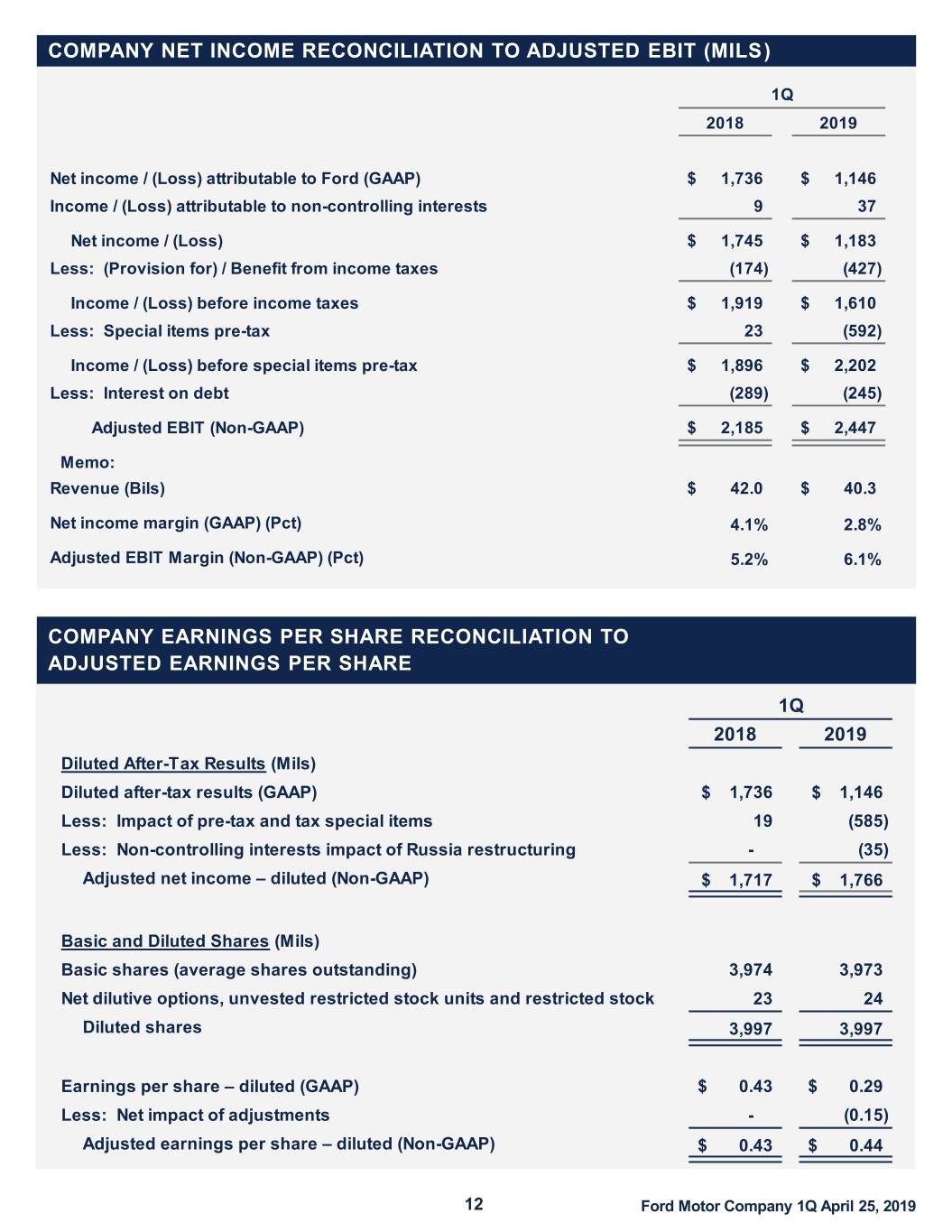

COMPANY NET INCOME RECONCILIATION TO ADJUSTED EBIT (MILS) 1Q 2018 2019 Net income / (Loss) attributable to Ford (GAAP) $ 1,736 $ 1,146 Income / (Loss) attributable to non-controlling interests 9 37 Net income / (Loss) $ 1,745 $ 1,183 Less: (Provision for) / Benefit from income taxes (174) (427) Income / (Loss) before income taxes $ 1,919 $ 1,610 Less: Special items pre-tax 23 (592) Income / (Loss) before special items pre-tax $ 1,896 $ 2,202 Less: Interest on debt (289) (245) Adjusted EBIT (Non-GAAP) $ 2,185 $ 2,447 Memo: Revenue (Bils) $ 42.0 $ 40.3 Net income margin (GAAP) (Pct) 4.1% 2.8% Adjusted EBIT Margin (Non-GAAP) (Pct) 5.2% 6.1% COMPANY EARNINGS PER SHARE RECONCILIATION TO ADJUSTED EARNINGS PER SHARE 1Q 2018 2019 Diluted After-Tax Results (Mils) Diluted after-tax results (GAAP) $ 1,736 $ 1,146 Less: Impact of pre-tax and tax special items 19 (585) Less: Non-controlling interests impact of Russia restructuring - (35) Adjusted net income – diluted (Non-GAAP) $ 1,717 $ 1,766 Basic and Diluted Shares (Mils) Basic shares (average shares outstanding) 3,974 3,973 Net dilutive options, unvested restricted stock units and restricted stock 23 24 Diluted shares 3,997 3,997 Earnings per share – diluted (GAAP) $ 0.43 $ 0.29 Less: Net impact of adjustments - (0.15) Adjusted earnings per share – diluted (Non-GAAP) $ 0.43 $ 0.44 12 Ford Motor Company 1Q April 25, 2019

COMPANY SPECIAL ITEMS (MILS) 1Q 2018 2019 Global Redesign South America São Bernardo closure $ - $ (193) Other South America (9) (8) Russia - (174) Other Europe - (115) Separations (not included above) - (24) Subtotal Global Redesign $ (9) $ (514) Other Items Focus cancellation $ (9) $ (67) Chariot closure - (11) Subtotal Other Items $ (9) $ (78) Pension and OPEB Gain / (Loss) Other pension remeasurement $ 26 $ - Pension curtailment 15 - Subtotal Pension and OPEB Gain / (Loss) $ 41 $ - Total EBIT Special Items $ 23 $ (592) Cash effect of Redesign (incl. separations) $ (15) $ (136) COMPANY NET CASH PROVIDED BY / (USED IN) OPERATING ACTIVITIES RECONCILIATION TO ADJUSTED OPERATING CASH FLOW (MILS) 1Q 2018 2019 Net cash provided by / (used in) operating activities (GAAP)$ 3,514 $ 3,544 Less: Items not included in Company Adjusted Operating Cash Flows Ford Credit operating cash flows (315) 1,118 Funded pension contributions (88) (294) Restructuring (including separations) (16) (146) Other, net 53 (12) Add: Items included in Company Adjusted Operating Cash Flows Automotive and Mobility capital spending (1,769) (1,620) Ford Credit distributions 1,013 675 Settlement of derivatives (161) (26) Company adjusted operating cash flow (Non-GAAP)$ 2,963 $ 1,907 13 Ford Motor Company 1Q April 25, 2019

CONSOLIDATED INCOME STATEMENT – FORD CREDIT FORD MOTOR CREDIT COMPANY LLC AND SUBSIDIARIES CONSOLIDATED INCOME STATEMENT (in millions) For the periods ended March 31, 2018 2019 First Quarter (unaudited) Financing revenue Operating leases $ 1,415 $ 1,477 Retail financing 948 984 Dealer financing 536 608 Other financing 22 24 Total financing revenue 2,921 3,093 Depreciation on vehicles subject to operating leases (1,053 ) (924 ) Interest expense (912 ) (1,121 ) Net financing margin 956 1,048 Other revenue Insurance premiums earned 41 47 Fee based revenue and other 58 54 Total financing margin and other revenue 1,055 1,149 Expenses Operating expenses 345 364 Provision for credit losses 94 33 Insurance expenses 12 10 Total expenses 451 407 Other income, net (Note 13) 37 59 Income before income taxes 641 801 Provision for / (Benefit from) income taxes (60 ) 198 Net income $ 701 $ 603 14 Ford Motor Company 1Q April 25, 2019

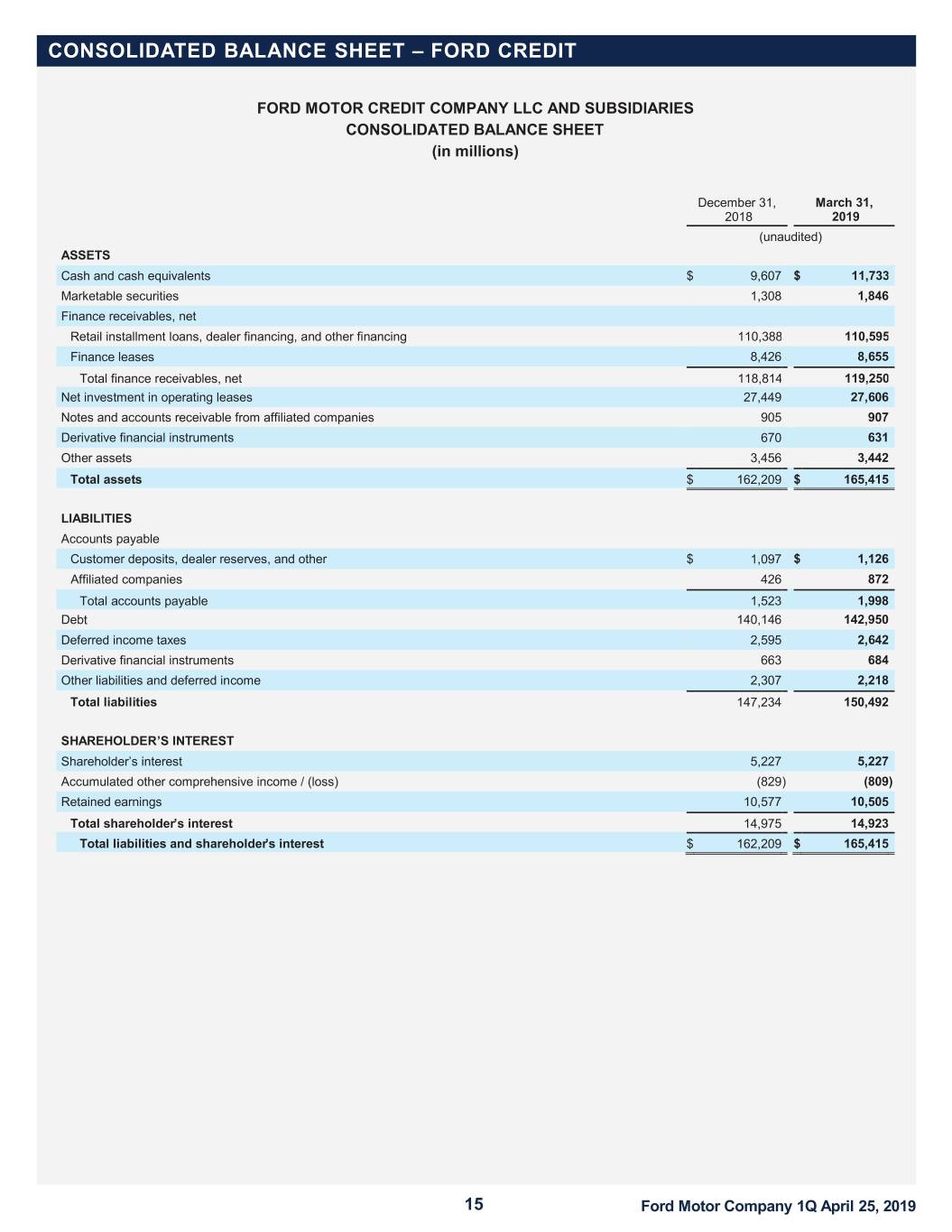

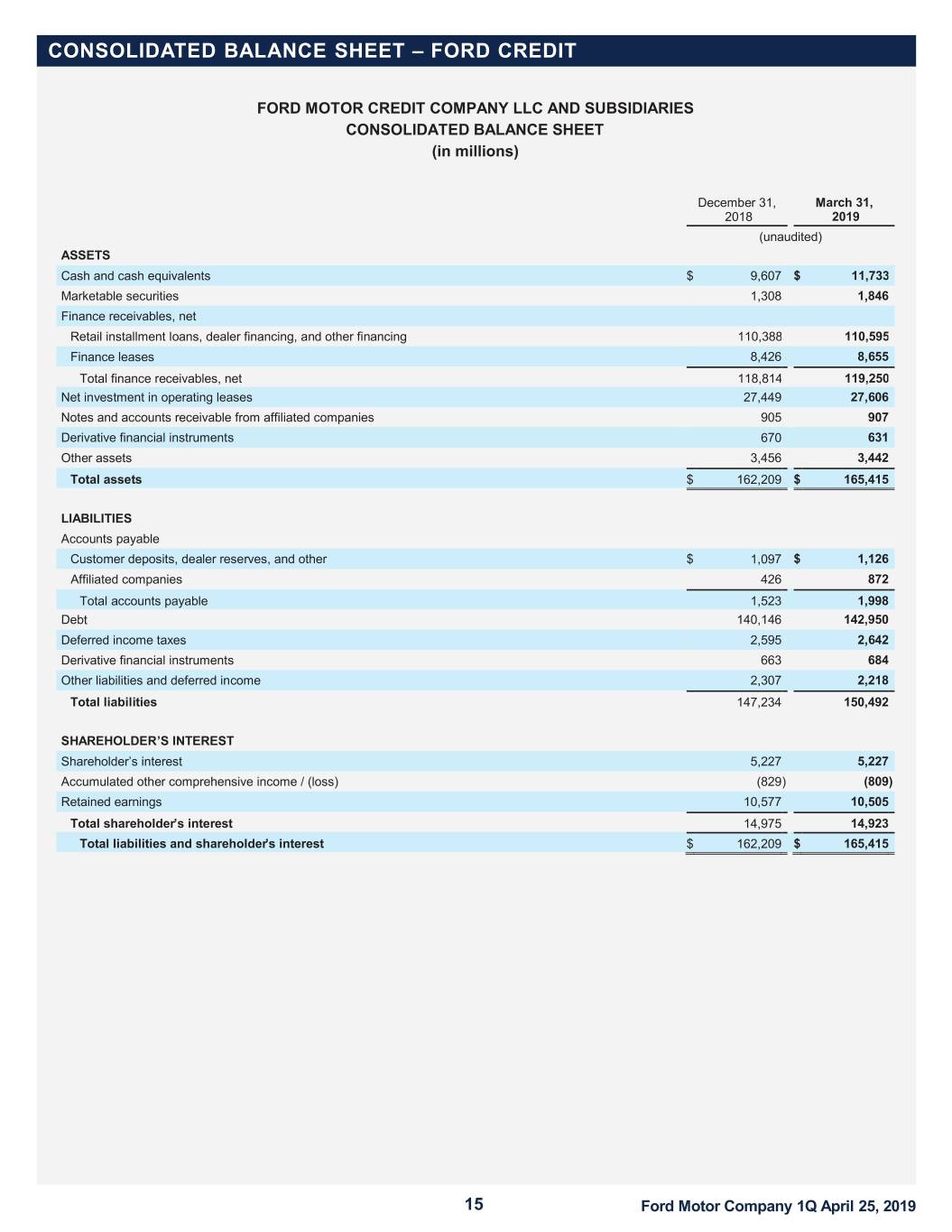

CONSOLIDATED BALANCE SHEET – FORD CREDIT FORD MOTOR CREDIT COMPANY LLC AND SUBSIDIARIES CONSOLIDATED BALANCE SHEET (in millions) December 31, March 31, 2018 2019 (unaudited) ASSETS Cash and cash equivalents $ 9,607 $ 11,733 Marketable securities 1,308 1,846 Finance receivables, net Retail installment loans, dealer financing, and other financing 110,388 110,595 Finance leases 8,426 8,655 Total finance receivables, net 118,814 119,250 Net investment in operating leases 27,449 27,606 Notes and accounts receivable from affiliated companies 905 907 Derivative financial instruments 670 631 Other assets 3,456 3,442 Total assets $ 162,209 $ 165,415 LIABILITIES Accounts payable Customer deposits, dealer reserves, and other $ 1,097 $ 1,126 Affiliated companies 426 872 Total accounts payable 1,523 1,998 Debt 140,146 142,950 Deferred income taxes 2,595 2,642 Derivative financial instruments 663 684 Other liabilities and deferred income 2,307 2,218 Total liabilities 147,234 150,492 SHAREHOLDER ’S INTEREST Shareholder ’s interest 5,227 5,227 Accumulated other comprehensive income / (loss) (829 ) (809 ) Retained earnings 10,577 10,505 Total shareholder ’s interest 14,975 14,923 Total liabilities and shareholder ’s interest $ 162,209 $ 165,415 15 Ford Motor Company 1Q April 25, 2019

CONSOLIDATED STATEMENT OF CASH FLOWS – FORD CREDIT FORD MOTOR CREDIT COMPANY LLC AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS (in millions) For the periods ended March 31, 2018 2019 First Three Months (unaudited) Cash flows from operating activities Net cash provided by / (used in) operating activities $ 2,009 $ 1,692 Cash flows from investing activities Purchases of finance receivables (11,085 ) (8,542 ) Principal collections of finance receivables 10,814 10,432 Purchases of operating lease vehicles (3,592 ) (3,184 ) Proceeds from termination of operating lease vehicles 2,481 2,306 Net change in wholesale receivables and other short-duration receivables (3,668 ) (1,844 ) Purchases of marketable securities (2,287 ) (803 ) Proceeds from sales and maturities of marketable securities 1,422 274 Settlements of derivatives 100 12 All other investing activities 143 (14 ) Net cash provided by / (used in) investing activities (5,672 ) (1,363 ) Cash flows from financing activities Proceeds from issuances of long -term debt 16,779 15,411 Principal payments on long -term debt (12,156 ) (12,683 ) Change in short -term debt, net (793 ) (276 ) Cash distributions to parent (1,013 ) (675 ) All other financing activities (28 ) (37 ) Net cash provided by / (used in) financing activities 2,789 1,740 Effect of exchange rate changes on cash, cash equivalents and restricted cash 106 38 Net increase / (decrease) in cash, cash equivalents and restricted cash $ (768 ) $ 2,107 Cash, cash equivalents and restricted cash at January 1 $ 9,682 $ 9,747 Net increase / (decrease) in cash, cash equivalents and restricted cash (768 ) 2,107 Cash, cash equivalents and restricted cash at March 31 $ 8,914 $ 11,854 16 Ford Motor Company 1Q April 25, 2019