Exhibit 1.01

Ford Motor Company

Conflict Minerals Report

For The Year Ended December 31, 2020

Ford Motor Company is a global company based in Dearborn, Michigan. With about 186,000 employees worldwide as of December 31, 2020, the Company designs, manufactures, markets, and services a full line of Ford trucks, vans, utility vehicles, and cars – increasingly including electrified versions – and Lincoln luxury vehicles; provides financial services through Ford Motor Credit Company LLC (“Ford Credit”); and is pursuing leadership positions in electrification; mobility solutions, including self-driving services; and connected vehicle services. The principal products we sell are automobiles, automotive components, and service parts.

In this report, “Ford,” the “Company,” “we,” “our,” “us,” or similar references mean Ford Motor Company, our consolidated subsidiaries, and our consolidated variable interest entities of which we are the primary beneficiary, unless the context requires otherwise.

1. Overview

Since 2014, public companies in the United States have been required to conduct due diligence to determine the origin of conflict minerals in their products and to report annually with the Securities and Exchange Commission. The disclosure rules are intended to further the humanitarian goal of ending violent conflict in the Democratic Republic of the Congo (the “DRC”) and adjoining countries, collectively referred to as the “Covered Countries.” The rules consider tin, tungsten, tantalum, and gold to be “conflict minerals” regardless from where they are sourced. We use the term “3TG” when discussing these minerals. By increasing the transparency of 3TG sources, the expectation is that funds from the mineral trade will not directly or indirectly benefit armed groups in the Covered Countries. Instead, these funds will be redirected to responsible sources of 3TG both in the Covered Countries and other Conflict Affected and High-Risk Areas (“CAHRA”).

3TG is used in many automotive parts and components, from engine assemblies to radio components. We work to ensure that the 3TG used in our vehicles is responsibly sourced. Ford defines a responsible source of 3TG as a smelter or refiner that provides 3TG material and has been validated as conformant to (i.e., successfully completed) or is active in (i.e., currently participating) a 3rd party audit of its management systems and sourcing practices according to one of the following schemes: the Responsible Minerals Assurance Process (RMAP); the London Bullion Market Association (LBMA); or the Responsible Jewelry Council (RJC) audit protocols. We expect the use of responsibly sourced 3TG in our supply chain to support the development of a “DRC conflict free” 3TG mineral trade in the Covered Countries.

To help us achieve our sourcing goals and to comply with the relevant disclosure rules, we require our direct suppliers of components containing 3TG to conduct due diligence to understand the origins of 3TG in their components, source 3TG responsibly (as described above), and not knowingly provide us with 3TG parts that contribute to conflict. One of the best ways to provide transparency for the sources of 3TG is to disclose which 3TG smelters and refiners are reported by our supply chain. Smelters and refiners procure minerals that they process into usable metals. If our suppliers identify smelters or refiners that are not conformant to or active in a 3rd party responsible mineral sourcing validation program, Ford asks suppliers to encourage the smelters or refiners to participate in RMAP by contacting non-participating smelters or refiners directly or consider alternate sourcing arrangements.

Determination

Through our 2020 data collection and due diligence efforts described below, Ford has reason to believe some 3TG contained in our products may come from Covered Countries. Annex 1 to our report contains a list of confirmed smelters and refiners -- regardless of where they are located and regardless from where they sourced 3TG -- who were included in the reports submitted by our suppliers.

2. Reasonable Country of Origin Inquiry (“RCOI”)

We have instituted conflict minerals reporting requirements as part of our suppliers’ contractual obligations through our Supplier Social Responsibility and Anti-Corruption Requirements Web-Guide, and we request our suppliers to extend the same obligations to their suppliers. Since we are layers removed from the smelters and refiners in our supply chain, we rely on our direct suppliers to survey their suppliers who are expected to continue the cascade of reporting requirements until they identify all information concerning the origin of the 3TG contained in the products they supply to us. Our RCOI determination is based on smelter and refiner data received from our in-scope suppliers and compared to the Responsible Minerals Initiative (“RMI”) RCOI database, which contains aggregated data on the origins of 3TG from RMAP and LBMA conformant smelters and refiners. In some cases, information provided by our in-scope suppliers may be incomplete or over-inclusive, resulting in missing or additional RCOI data determination. Our in-scope suppliers are often unable to confirm 3TG country of origin information.

RCOI Approach

For reporting purposes, we required our in-scope direct suppliers to complete the conflict minerals reporting template (“CMRT”) developed by the RMI. Suppliers can submit their completed CMRT via email or by uploading it to a specific website.

To determine our in-scope suppliers, we performed a risk-based assessment of all suppliers of components or parts to our plants based on expected spend and 3TG content as reported through the International Material Data System (“IMDS”). In aggregate, our in-scope suppliers represent over 80% of our direct expenditures for components or parts. Through our analysis, we can confirm that over 60,000 parts in our vehicles contain some level of 3TG content. 3TG materials are found in parts from all of our major commodity groups including interior, exterior, electrical, chassis, and powertrain components. Of our in-scope parts, 99% contain tin, 12% contain tungsten, 18% contain tantalum, and 44% contain gold, with many parts containing more than one of the 3TG materials. All of our vehicles include components containing at least one 3TG material.

For the sixth year in a row, Ford received responses from 100% of the in-scope suppliers surveyed. We continue to work with our suppliers to improve the quality and completeness of their reports, and we provide direct feedback to suppliers if their reports are incomplete, inconsistent with information previously reported through IMDS, and/or their CMRT contained smelters or refiners that are not identified as conformant to or active in the RMAP, LBMA, or RJC responsible sourcing validation programs. The feedback to suppliers resulted in 60 suppliers significantly improving data quality on their CMRT by including smelter lists, increasing supplier response rates, and cross-checking the RMI smelter database for conformant smelter or refiner audit status. We also continued our efforts to determine country of origin by sending a direct inquiry to smelters and refiners reported in our supply chain that were not identified on the RMI RCOI list. Our RCOI dataset aggregates country of origin data provided by LBMA validated gold refiners. The data is not specific to an LBMA refiner and could refer to any or all LBMA-validated refiners.

3. Design of Due Diligence

Our due diligence measures have been designed to conform, in all material respects, with the 5-step framework in the Organisation for Economic Co-operation and Development Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas, Third Edition, 2016 (“OECD Guidance”) and the related supplements for 3TG.

4. Due Diligence Measures Performed

4.1 Management Systems

Our conflict minerals management system includes the following actions:

•Established an Executive Steering Team for conflict minerals compliance led by our Vice President, Global Commodities Purchasing and Supplier Technical Assistance. The team includes the following members:

◦Chief Government Relations Officer

◦General Counsel

◦Vice President, Chief Sustainability, Environment and Safety Officer

◦Chief Communications Officer

◦Vice President, Vehicle Embedded Software & Controls (“VESC”)

◦Controller

•Established a cross-functional working level team to manage conflict minerals compliance. The working level team meets biweekly and holds an annual meeting with the Executive Steering Team to review our conflict minerals compliance status, strategy, continuous improvement objectives, performance to metrics, and legislative updates

•Built supply base knowledge capacity by developing training modules to ensure our suppliers understand our reporting and due diligence requirements and to assist them in their continuous improvement efforts to increase reporting transparency and source from conformant smelters and refiners

•Integrated supplier report cards that communicate conflict mineral compliance with Ford’s due diligence requirements and survey response quality into cross-functional executive business unit reviews, including Purchasing and Product Development input

•Reported metrics including supplier survey response rate and quality of responses monthly to the Vice President, Global Commodities Purchasing and Supplier Technical Assistance and integrated metrics into our human rights program

•Established and communicated our conflict minerals sourcing policy on our public website available by clicking here or http://corporate.ford.com

•Our conflict minerals policy is:

To the extent tin, tungsten, tantalum, and gold are contained in our products, it is Ford’s goal to use DRC conflict free minerals while continuing to support responsible in-region mineral sourcing from the Democratic Republic of the Congo and adjoining

countries. As defined in Rule 13p-1 of the Securities Exchange Act of 1934 (the “Rule”), “DRC conflict free” means that a product does not contain conflict minerals

necessary to the functionality or production of that product that directly or indirectly finance or benefit armed groups in the Democratic Republic of the Congo or an adjoining country. Ford’s responsible materials and related due diligence practices address additional materials originating from Conflict-Affected and High-Risk Areas (CAHRAs), as defined by the Organization for Economic Co-operation and Development (“OECD”) Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High Risk Areas (“OECD Guidance”) and the related supplements for 3TG, including cobalt and mica. Our suppliers are required to conduct due diligence to understand the source of the conflict minerals and other requested raw materials used in Ford products, source responsibly, and not knowingly provide products containing minerals that contribute to conflict as described in the Rule. Suppliers are required to comply with Ford’s annual conflict minerals reporting requirements as published in our Social Responsibility and Anti-Corruption Requirements Web-Guide. Suppliers are required to use smelters and refiners that have been validated as conformant to a 3rd party responsible mineral sourcing validation program. Additionally, Ford encourages suppliers to extend responsible sourcing and due diligence to include CAHRAs.

Ford may reassess supplier relationships if suppliers fail to comply with minimum

requirements.

Effective Date: July 1, 2020

•Instituted and include conflict minerals reporting requirements as part of our suppliers’ contractual obligations through our Supplier Social Responsibility and Anti-Corruption Requirements Web-Guide

•Developed training materials for relevant employees outlining our supplier reporting requirements, reporting process, and timeline

•Employees can report violations directly to Human Resources or the Compliance, Ethics and Integrity Office as well as the Office of General Counsel or the General Auditor’s Office. Violations can also be reported using the SpeakUp reporting mechanism, telephone hotlines, websites, or email, some of which allow for anonymous reporting. External stakeholders may report by emailing SpeakUp@ford.com

•Added a link to our corporate Responsible Materials Sourcing website (http://corporate.ford.com/social-impact/sustainability/responsible-material-sourcing.html) for an online cross-industry platform called the Minerals Grievance Platform (“MGP”) for Ford to screen and address grievances linked to smelters and refiners present in its supply chains. RMI, LBMA, and RJC developed and maintain the MGP to establish a multi-stakeholder mechanism to record and communicate the identification, follow-up, and resolution of grievances for 3TG refiners and smelters related to OECD Annex II risks

4.2 Identify and Assess Risk in the Supply Chain

We reviewed in-scope supplier CMRTs for:

•Completion of all required reporting elements

•Consistency between the expected 3TG metals reported as being intentionally added to the supplier’s products and the metals reported in IMDS

•Presence of a smelter and refiner list that includes expected metals based on IMDS reporting

•Suppliers’ sub-tier response rate reported from each CMRT supplier survey

•Identification of smelters and refiners not participating in required 3rd party validation programs reported in suppliers’ supply chain

•Inclusion of conflict minerals policy that aligns to our conflict mineral expectations

We compared our suppliers’ smelter and refiner lists to the RMI smelter database, and for those smelters and refiners that appear on both lists, we were able to determine their audit status and gained visibility to assess potential risks in our supply chain. The RMAP, RJC, and LBMA use independent 3rd party risk-based approach audits to confirm that smelters and refiners have carried out all 5-steps of the OECD Guidance framework.

We utilized our internally developed database to aid in the analysis of supplier report data and to create tailored corrective actions to aid suppliers in improving the quality of their reports. We have dedicated resources and a cross-functional team managing our conflict mineral compliance and responsible sourcing efforts.

To strengthen our responsible sourcing expectations with our suppliers and increase risk awareness, Ford provided suppliers with a list of smelters and refiners reported in their CMRT that were not on the RMI public Conformant/Active list. Ford requested suppliers to complete additional due diligence, outreach, and/or consider alternate sourcing arrangements for those smelters and refiners.

Although cobalt is not included in the definition of “conflict minerals,” we conduct due diligence on cobalt, another mineral in Ford’s supply chain originating from CAHRAs as defined by the OECD Guidance. In 2020, we expanded our pool of surveyed in-scope cobalt suppliers to complete the Cobalt Reporting Template (“CRT”) and received an 83% response rate.

In 2019, Ford underwent an assessment of its cobalt due diligence management system for conformance with the requirements of the OECD Guidance. In 2020, Ford conducted a follow-up assessment and demonstrated significant performance improvements, increasing our audit score from 34.5% to 80% (out of 100%). All findings from the follow-up assessment are considered minor or areas of opportunity only. Based on these findings, we will work to improve continuously and optimize our mineral due diligence programs.

4.3 Design and Implement a Strategy to Respond to Identified Risk

We have established and utilize the following process to respond to identified risks in the supply base:

•Follow an escalation process to notify the Vice President, Global Commodities Purchasing and Supplier Technical Assistance of risks when identified

•Follow a procedure for risk mitigation including monitoring, tracking, and reporting progress to the Vice President, Global Commodities Purchasing and Supplier Technical Assistance

As part of our risk mitigation process, entities that are reported by our suppliers but that have not been confirmed as an “eligible” smelter or refiner are reported to RMI for validation and assessment. In 2020, if our suppliers’ lists contained smelters or refiners not identified on the RMI public “Conformant” or “Active” Smelter & Refiner RMAP lists, we immediately notified those suppliers. We also directed the suppliers where to find the RMI “Conformant” and “Active” Smelter & Refiner information, encouraged our suppliers to complete outreach to their reported smelters and refiners that are not yet identified as “Conformant” or “Active,” and/or consider alternate sourcing arrangements.

To further mitigate the risk in our supply chain of suppliers reporting or utilizing 3TG smelters and refiners that have not been validated as conformant to a 3rd party responsible mineral sourcing validation program , we have expanded our Purchasing team’s capacity on responsible sourcing practices through additional training sessions, updated our conflict mineral policy to require suppliers to use 3rd party validated smelters and refiners, and we encourage our suppliers to conduct due diligence for materials from CAHRAs.

Ford participates in cross-industry forums to prevent and mitigate supply chain risks. We are an active member of the RMI Smelter Disposition team in order to better understand requirements and processes of smelters and refiners, as well as support research on any new smelters and refiners reported globally so they can be properly identified and engaged to complete RMAP. While we cross-recognize LBMA and RJC audit status, we directly contact smelters and refiners to request their participation in RMAP.

We chair the Automotive Industry Action Group (“AIAG”) Smelter Engagement Team (“SET”) on behalf of the North American Automotive Industry to lead and complete coordinated outreach directly to smelters and refiners. The AIAG SET encourages non-participating RMAP smelters and refiners to become conformant to RMAP. The AIAG SET advocates for responsible sourcing by completing coordinated smelter and refiner outreach and completing pre-audit visits annually.

Gold refiners demonstrate a relatively lower rate of conformance to RMAP compared to tin, tungsten, and tantalum refiners, and many of these refiners are in areas that reportedly contribute to gold smuggling. Ford seeks to mitigate the risk of having refiners that have not been validated as conformant to a 3rd party responsible mineral sourcing validation program specific to the gold supply chain, through our participation as co-chair on the RMI Gold Team. The team directs outreach to gold refiners to engage in RMAP. In addition, in our eLearning curriculum, we have included RMI digital training for suppliers on Responsible Gold Sourcing.

Ford is a member of Drive Sustainability, a group coordinated by CSR Europe consisting of several automotive manufacturers who collaborate to enhance sustainability in their supply chains. Drive Sustainability aims to improve the social, ethical, and environmental performance

of automotive supply chains, including the responsible sourcing of raw materials. In 2020, Drive Sustainability represented its members through its continued engagement with the European Partnership for Responsible Minerals (“EPRM”).

For the eighth consecutive year, we are an active member of the Public Private Alliance for Responsible Minerals Trade (“PPA”). The PPA is a multi-sector initiative between leaders in civil society, industry, and the US government that supports projects to improve the due diligence and governance systems needed for ethical supply chains from the Covered Countries. In 2020, as a member of the PPA and its Projects and Resources Work Group, Ford’s engagement supported the following:

•Integrating human rights-specific language in PPA’s Results Framework to ensure future projects incorporate strategies to mitigate human rights risks in the supply chain

•Launching three grants focused on providing assistance to 3TG mining communities. The grants enabled:

◦A pilot providing financial services to artisanal mining communities

◦Funding to provide educational and livelihood opportunities for women and children in mining communities

◦A program supporting services to survivors of gender violence, including mental health therapy, leadership training, and literacy and vocational training

•Hosting a webinar on social and economic impacts of 3TG due diligence programs in the DRC

•Launching a member project collaboration tool called “Internet of the PPA” (“IoPPA”) designed to facilitate information sharing and coordination on member projects, as well as identify gaps and priorities across PPA members’ collective work

4.4 Carry Out Independent 3rd Party Audit of Smelter and Refiner Due Diligence Practices

Due to our position in the supply chain, we utilize the RMAP Cross-Recognition Program to determine if smelters and refiners reported by our suppliers are conformant with RMAP, LBMA, and RJC 3rd party audit protocols to validate responsible sourcing. These audit standards have been developed to assess if companies have management systems in place to support and implement due diligence and responsible sourcing practices. We are an active member of various RMI workgroups, and we contribute to the development of RMI tools and processes used to support our program. We use the RMI audit status database and RCOI information as key inputs to help us manage risk in our supply chain. In addition, we actively review and assess other information such as publicly available incident reports, NGO reports, and government published information to help us assess risk in the supply base.

4.5 Report Annually on Supply Chain Due Diligence

This is our eighth Conflict Minerals Report and we plan to continue reporting annually. Our conflict minerals policy is available by clicking here and both our policy and our report are available on our website at http://corporate.ford.com. We also provide information regarding our conflict mineral disclosure and reporting in our Integrated Sustainability and Financial Report at http://sustainability.ford.com.

5. Facilities Used to Process the Conflict Minerals in Products, if Known

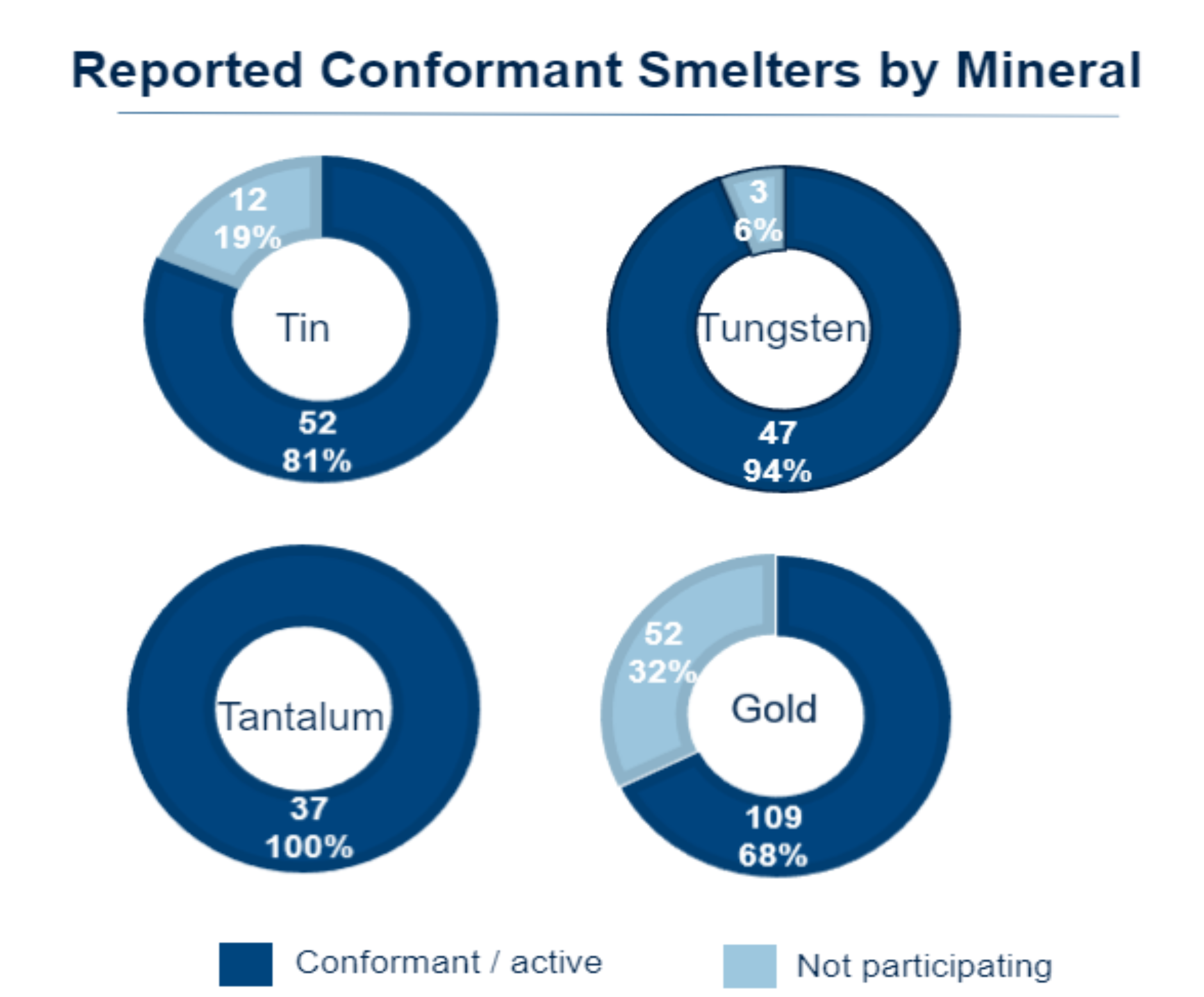

We have surveyed our in-scope suppliers to identify the facilities used to process the 3TG contained in our products. The majority of our in-scope suppliers, 64%, provided a company-level CMRT that does not identify the smelters or refiners used for a particular part, component, or business customer. In cases where suppliers provided a part-level report, the identification of the smelters and refiners that support our specific products could not be determined due to lower tier suppliers reporting on a company basis. Therefore, we are unable to identify with certainty the specific facilities used to process the 3TG in our products and whether the 3TG in our products is from recycled/scrap sources. By comparing our in-scope suppliers’ smelter and refiner lists to the RMI Smelter Database, 312 RMI eligible 3TG smelters/refiners were reported by our in-scope suppliers as shown in Annex 1. Overall, 79% of the 312 smelters and refiners are considered “responsible sources of 3TG.” This conformance rate is unchanged from 2019.

Ford monitors the performance of our risk prevention measures through our business process review. We track and escalate supplier response rate and the quality of the data suppliers provide us. These reports are presented to our executive leadership who engage in escalations when necessary. Our assessments demonstrate that supplier report quality has lingered around 80% for at least three years; therefore, our responsible material sourcing policy requires suppliers to use smelters and refiners that have been validated as conformant to a 3rd party responsible mineral sourcing validation program.

We worked with over 50 in-scope suppliers providing parts containing gold components to complete additional due diligence if a non-conformant gold refiner was reported on company and product level reports. Through engaging with suppliers and educating them on the process to inquire with their tiered suppliers about sources of gold, we helped raise awareness and increase due diligence actions related to non-conformant gold refiners reported in our supply chain. Many of our in-scope gold suppliers continued to submit company-level CMRTs; therefore, we are unable to confirm if several non-conformant gold refiners are in our supply chain or not.

The graphs below depict, by mineral, the number of smelters and refiners potentially in our supply chain that are participating (conformant/active) and are not participating in the RMAP, LBMA, or RJC audit protocol.

6. Country of Origin of the Conflict Minerals in Products, if Known

Through our leadership efforts as well as our due diligence actions, we have increased the transparency within our supply chain. In 2014, 41% of our in-scope suppliers provided a smelter and refiner list. In 2020, 69% of our in-scope suppliers provided a smelter and refiner list, allowing better determination of possible countries of origin and identification of facilities that process 3TG reported in our supply chain. We reviewed the RMI RCOI data against the 312 smelters and refiners reported by our supply chain to determine if any of our reported smelters and refiners sourced from the Covered Countries. We have reason to believe that 89 of the reported smelters and refiners might have sourced directly from the Covered Countries, and an additional 29 smelters and refiners might have indirectly sourced from the Covered Countries. All 118 of the smelters and refiners that have been identified as directly or indirectly sourcing from the Covered Countries were deemed conformant to the RMAP, LBMA, or RJC audit protocols as of December 31, 2020.

Based on the information provided by our suppliers as well as from the RMI RCOI data that includes aggregated country of origin for RMAP, LBMA, and RJC conformant processing facilities, we believe the countries of origin (“COO”) of 3TG contained in our products may include the following Covered Countries by mineral:

| | | | | | | | | | | | | | | | | | | | |

| Country of Origin | Gold | Recycled/ Scrap Gold | Tantalum | Tin | Recycled/ Scrap Tin | Tungsten |

| Burundi | | | x | x | | x |

| Congo, Democratic Republic of the | x | x | x | x | | x |

| Rwanda | x | | x | x | | x |

| Tanzania | x | x | | | x | |

| Uganda | x | | x | x | | x |

| Zambia | x | | | | | |

Using the same methodology, we believe the COO of 3TG contained in our products may also include the following countries. Additional due diligence was performed for gold. In that case, any country that we confirmed was not a source of gold in our products was excluded from the aggregated data below:

Angola; Argentina; Armenia; Australia; Austria; Azerbaijan; Bahamas; Bangladesh; Belarus; Belgium; Benin; Bolivia; Botswana; Brazil; Brunei; Bulgaria; Burkina Faso; Cameroon; Canada; Cayman Islands; Chile; China; Colombia; Croatia; Cyprus; Czech Republic; Czechia; Denmark; Dominican Republic; Ecuador; Egypt; El Salvador; Eritrea; Estonia; Ethiopia; Fiji; Finland; France; Gabon; The Gambia; Georgia; Germany; Ghana; Greece; Guatemala; Guinea; Guyana; Honduras; Hong Kong; Hungary; Iceland; India; Indonesia; Iran*; Ireland; Israel; Italy; Ivory Coast; Japan; Jordan; Kazakhstan; Kenya; Kuwait; Kyrgyzstan; Laos; Latvia; Lebanon; Liberia; Libya; Liechtenstein; Lithuania; Luxembourg; Macau; Madagascar; Malaysia; Mali; Malta; Mauritania; Mauritius; Mexico; Monaco; Mongolia; Morocco; Mozambique; Myanmar; Namibia; Netherlands; New Caledonia; New Zealand; Nicaragua; Niger; Nigeria; Norway; Pakistan; Panama; Papua New Guinea; Paraguay; Peru; Philippines; Poland; Portugal; Puerto Rico; Qatar; Romania; Russia; San Marino; Saudi Arabia; Senegal; Serbia; Sierra Leone; Singapore; Slovakia; Slovenia; Solomon Islands; Somaliland; South Africa; South Korea; Spain; St Vincent and Grenadines; Sudan; Suriname; Swaziland; Sweden; Switzerland; Taiwan; Tajikistan; Thailand; Togo; Trinidad and Tobago; Tunisia; Turkey; Ukraine; United Arab Emirates; United Kingdom; United States of America; Uruguay; Uzbekistan; Venezuela; Vietnam; Yemen; Zimbabwe

* Ford does not directly import 3TG from Iran. If any 3TG in products supplied to us was from Iran, it would have been substantially transformed prior to receipt and incorporation into our finished products.

7. Efforts to Determine the Mine or Location of Origin with the Greatest Possible Specificity

We have taken the following actions to determine the mine or location of origin of the 3TG in our products with the greatest possible specificity:

•Conducted RCOI for suppliers whose parts contain 3TG and surveyed those suppliers using a risk-based approach

•Analyzed completed CMRTs from our suppliers for consistency with the 3TG content reported by suppliers in IMDS

•Analyzed completed CMRTs from our suppliers for completeness, consistency, and for identification of smelters and refiners sourcing conflict minerals from the Covered Countries

•Compared reports from our suppliers with the expected responses and when the information was incomplete or inconsistent with our conflict minerals policy or data expectations, we directly contacted our suppliers to obtain additional or clarifying information

•Assessed the information provided by our suppliers with the RMI members-only smelter database to obtain country of origin information

•Requested COO information directly from smelters and refiners not participating in RMAP

8. Steps We Have Taken or Will Take, if Any, to Mitigate the Risk that Conflict Minerals in Our Products Benefit Armed Groups, Including Any Steps to Improve Our Due Diligence

Ford’s policy is to source responsibly. We recognize, however, that strict avoidance of a given mineral or mineral origin could have unintended consequences, including the loss of livelihood for a local population. Ford supports responsible sourcing from the Covered Countries.

We review suppliers’ conflict minerals policies for alignment with our expectations. When suppliers’ policies indicate a ban on materials from the Covered Countries, we contact them to inform them of our expectation and the potential negative consequences of banning material from the Covered Countries. Seven suppliers we contacted in 2019 updated policy language to establish a more inclusive view on conducting due diligence on material coming from Covered Countries rather than excluding these materials.

Our goal is to improve the transparency of mineral sourcing within our supply chain while improving the capacity of smelters and refiners globally to ensure that 3TG originating from the Covered Countries does not fund armed groups or conflict in the area. We aim to increase all smelter and refiner participation in RMAP, LBMA, or RJC 3rd party validation programs to ensure responsible sourcing from the Covered Countries. Specifically, we set goals to: (i) obtain a 100% response rate from in-scope suppliers, (ii) increase the number of suppliers that provide a smelter and refiner list, (iii) increase our suppliers’ use of only responsible sources of 3TG so we can better determine COO and ensure responsible sourcing, and (iv) continuously improve our due diligence efforts. We have taken the following actions in support of these goals:

•We made conflict minerals reporting a contractual requirement for our suppliers and we require our suppliers to use smelters and refiners that have been validated as conformant to a 3rd party responsible mineral sourcing validation program

•We achieved a supplier conflict minerals reporting response rate of 100% for the sixth year in a row. We continue to work with our suppliers to improve the quality and completeness of their reports

•In 2020, approximately 10% of suppliers reported only using conformant or active smelters and refiners. We analyzed the root cause for the rate's decline from 2019 and identified potential contributing factors, including a change in the makeup of our in-scope suppliers from 2019 and the reporting of certain smelters that were previously conformant but are now considered ineligible for RMAP

•Through RMI eLearning, we created a curriculum for suppliers to complete, allowing Ford to track supplier engagement and capacity building. Twelve percent of our suppliers completed the curriculum in 2020

•We held two global conflict mineral training webinars for over 100 suppliers. The webinars focused on sharing responsible sourcing best practices to improve conflict mineral due diligence reporting

•In 2020, we conducted five training sessions on mineral due diligence across Purchasing-- more than 400 participants attended. Moreover, Ford Conflict Minerals team members undergo annual RMI Smelter and Refiner Engagement training to understand RMAP requirements so they are equipped to interact meaningfully with smelters and refiners

•We completed a direct inquiry to 73 smelters and refiners whose sources of 3TG were not identified in RMI’s RCOI data. Ford requested COO of mined material, status of recycled scrap, and any due diligence validation information. Two gold refiners responded to our inquiry by stating they do not source materials from the DRC, Covered Countries, or CARHAs. One of these refiners indicated an interest in joining RJC due to the relevance to its customer base, and the other refiner reported that it does not source primary gold. A tin smelter currently considering RMAP confirmed it does not source materials from the DRC or Covered Countries. Ford does not consider these refiners to be responsible sources of 3TG. Additionally, two gold refiners that are now active with RMI for RMAP confirmed they do not source from the DRC or Covered Countries

•We are an active member of RMI (member ID FORD) and participate in cross-industry smelter and refiner outreach efforts to identify eligibility for the RMAP audit program. We also encouraged smelter and refiner participation in the RMAP. We directly contacted 50 3TG smelters and refiners and 22 cobalt smelters and refiners. In addition, through the AIAG SET, we led AIAG’s coordinated industry outreach efforts to encourage smelter and refiner participation in RMI’s audit program

•Ford sent outreach letters to 18 conformant smelters and refiners whose responsible sourcing audit dates were upcoming to ensure awareness of RMI resources available if COVID-19 impacted the smelters and refiners’ ability to remain in RMAP or participate in an upcoming assessment

•We actively participated in various RMI working groups, including Cobalt, Gold, SET, CMRT, Smelter disposition, Multi-stakeholder, Plenary, Due Diligence Practices, Mica, Artisanal/Small Mining Working Group, Cobalt Taskforce, Mineral Sensing, and Mining Engagement Team (“MET”)

•We continued to investigate the use of the RMI Risk Readiness Assessment (“RRA”) to improve understanding of the due diligence practices of mineral supply chain processors and their relevant risk management practices and performance. We met with RMI to review the tool and invited 5 gold refiners and mining sites to complete the RRA. One site completed and shared its Environmental, Governance, and Social (“ESG”) risk self-assessment.

•Explored integration of the RMI CAHRA tool into risk assessments for material prioritization study

•We participate in the AIAG Responsible Materials Working Group to help scope industry due diligence best practices

•Due to travel restrictions, AIAG was unable to send a representative to conduct a pre-audit visit at an eligible smelter or refiner to learn more about and prepare for a 3rd party responsible mineral sourcing validation program. In lieu of a pre-audit visit, AIAG donated to the RMAP Audit Fund, which covers the initial assessments for new RMAP auditees, financial assistance for participating auditees, and the publication of assessment results on RMI’s website. Additionally, Ford continued to represent AIAG, the RMI Gold team, and itself in two virtual events in 2020 to ensure continued progress and engagement for Indian gold refiners. Events included a Town Hall with the India National Stock Exchange, RMI, and India gold refiners, as well as an OECD, India Gold Policy Centre, and RMI webinar event. At both events, Ford expressed its expectations for refiners to participate in an accepted Independent 3rd Party Assessment Program to demonstrate alignment with OECD Due Diligence guidance.

•Through AIAG, Ford presented an International Material Data Sheet Briefing focused on educating automotive industry suppliers and original equipment manufacturers (“OEMs”) about responsibly sourced materials, including conflict mineral legislation and due diligence, material prioritization, and how to address ESG risks within mineral supply chains

•In 2020, Ford served on the PPA Projects and Resources (“PAR”) Work Group. We evaluated and prioritized recommended projects in the Covered Countries for PPA funding. One such project was a pilot providing financial services to artisanal mining communities, which grew from the PPA 2019 report by Sofala Partners and BetterChain on the roles of financial institutions in promoting responsible minerals trade. Additionally, the PAR recommended for PPA Governance Committee approval two programs that address gender-based violence and education for women and children in mining communities

•The responsible sourcing of raw materials (including 3TG) was identified as one of nine salient issues in our 2018 human rights saliency assessment conducted in line with the UN Guiding Principles Reporting Framework (“UNGPRF”). We will annually report progress to our actions through our Integrated and Sustainability Financial Report and the UN Guiding Principles Reporting Framework Index

•As members of the Responsible Business Alliance (“RBA”), we utilized the Validated Audit Process (“VAP”) for our 3rd party on-site supplier audits. These audits were conducted and validated by external parties and are used to assess suppliers’ performance to human rights, health and safety, and environmental expectations. These audits were conducted at the manufacturing site level and differ from the RMAP audit protocols used for smelters and refiners

•For the third consecutive year, we significantly increased our supplier outreach, issuing more than 1,200 supplier self-assessment questionnaires (“SAQs”) to our Tier 1 suppliers to aid us in assessing risk in our supply chain. Responses to the SAQs served as one of several inputs into our risk assessment used to determine candidates for further supply chain capacity building or additional due diligence. The SAQ included a conflict minerals

provision that can be used to assess suppliers’ Conflict Mineral policies and reporting who may not be in-scope for a particular Conflict Minerals Reporting Year

•As a founding member of the Responsible Sourcing Blockchain Network (“RSBN”), we partnered with IBM and cross-industry leaders on a pilot to develop a minimum viable product in 2019. RCS Global assessed and validated each cobalt supply chain participant against responsible sourcing requirements set by the OECD and relevant industry organization standards, such as the RMI blockchain guidelines. The RSBN aims to provide traceability and verification of responsible sourcing practices from mine to market. A governance board representing members across automotive and consumer electronics industries, including their supply chains and the mining sector, was formed to help ensure the network’s functionality and adherence to good practices

•We published a Responsible Material Sourcing website as an educational resource that reflects Ford’s mineral due diligence practices and engagements. We also included a link to the RMI Mineral Grievance Platform (“MGP”) to ensure external stakeholders have access to a publicly available mechanism to initiate investigations related to 3TG supply chain actors. The MGP allows Ford to assess the risk of smelters and refiners that have pending allegations and understand if risks identified with 3rd party validated smelters and refiners are properly resolved

Our Goals for 2021

Ford will continue its commitment to responsible 3TG sourcing by collaborating with industry groups and NGOs, engaging suppliers in continuous improvements to adopt best practices, and improving internal risk assessment and management systems. Our goals to achieve continuous improvement include:

•Continue engaging suppliers to increase use of only conformant or active RMAP, LBMA, RJC smelters and refiners

•Increase participation of suppliers in due diligence capacity building training, such as the RMI eLearning curriculum, by 10% year over year

•Continue employing and building participation with relevant suppliers in the RMI RRA tool. Implement invitations as a form of outreach to encourage smelters and refiners who may not be participating in RMAP to demonstrate certain responsible sourcing practices

•Integrate cross-industry resources into risk assessments specifically related to 3TG smelters and refiners that are not participating in a 3rd party validated responsible sourcing audit scheme

•Continue updating, developing, and cascading training materials for relevant employees outlining mineral due diligence and supplier responsible sourcing requirements and ensuring that all Purchasing departments receive relevant training

•Continue improving our cobalt due diligence according to the corrective action plan resulting from an assessment of our due diligence management systems against OECD requirements and guidance

•Provide in-kind support to the Scalable Trade in Artisanal Gold (“STAG”) project made possible by a grant from EPRM awarded to a multi-stakeholder collaboration. Ford partnered with the Artisanal Gold Council (“AGC”), AG SARL, RESOLVE, RMI, and ABB to create a replicable, regional sourcing system adapted to The Code of Risk mitigation for Artisanal and small-scale miners engaging in Formal Trade (“CRAFT”) to scale up trade in responsible artisanal gold in CAHRAs

•Launch our new Supplier Code of Conduct, which outlines our requirements for supplier relationships in areas related to human rights, the environment, responsible material sourcing, responsible and lawful business practices, and the associated implementation of these principles. We seek to identify and do business with organizations that adopt and enforce policies to protect people and the planet in their own operations and in their supply chain. We consider companies’ sustainable business practices as we make sourcing decisions, incorporating this Code into our Purchasing Global Terms & Conditions (GT&Cs) as of July 2021. The Code requires suppliers to support and cooperate with Ford’s efforts to secure full transparency and traceability of their raw materials supply chain and must engage sub-tier suppliers in their efforts to demonstrate transparency

Annex 1

| | | | | | | | | | | |

| Metal | Company Name | Smelter Country |

| Gold | 8853 S.p.A.* | ITALY |

| Gold | Abington Reldan Metals, LLC | UNITED STATES OF AMERICA |

| Gold | Advanced Chemical Company* | UNITED STATES OF AMERICA |

| Gold | African Gold Refinery | UGANDA |

| Gold | Aida Chemical Industries Co., Ltd.* | JAPAN |

| Gold | Al Etihad Gold Refinery DMCC* | UNITED ARAB EMIRATES |

| Gold | Allgemeine Gold-und Silberscheideanstalt A.G.* | GERMANY |

| Gold | Almalyk Mining and Metallurgical Complex (AMMC)* | UZBEKISTAN |

| Gold | AngloGold Ashanti Corrego do Sitio Mineracao* | BRAZIL |

| Gold | Argor-Heraeus S.A.* | SWITZERLAND |

| Gold | Asahi Pretec Corp.* | JAPAN |

| Gold | Asahi Refining Canada Ltd.* | CANADA |

| Gold | Asahi Refining USA Inc.* | UNITED STATES OF AMERICA |

| Gold | Asaka Riken Co., Ltd.* | JAPAN |

| Gold | Atasay Kuyumculuk Sanayi Ve Ticaret A.S. | TURKEY |

| Gold | AU Traders and Refiners* | SOUTH AFRICA |

| Gold | Augmont Enterprises Private Limited | INDIA | |

| Gold | Aurubis AG* | GERMANY |

| Gold | Bangalore Refinery* | INDIA |

| Gold | Bangko Sentral ng Pilipinas (Central Bank of the Philippines)* | PHILIPPINES |

| Gold | Boliden AB* | SWEDEN |

| Gold | C. Hafner GmbH + Co. KG* | GERMANY |

| Gold | C.I Metales Procesados Industriales SAS** | COLOMBIA |

| Gold | Caridad | MEXICO |

| Gold | CCR Refinery - Glencore Canada Corporation* | CANADA |

| Gold | Cendres + Metaux S.A.* | SWITZERLAND |

| Gold | CGR Metalloys Pvt Ltd. | INDIA |

| Gold | Chimet S.p.A.* | ITALY |

| Gold | Chugai Mining* | JAPAN |

| Gold | Daye Non-Ferrous Metals Mining Ltd. | CHINA |

| Gold | Degussa Sonne / Mond Goldhandel GmbH | GERMANY |

| Gold | Dijllah Gold Refinery FZC | UNITED ARAB EMIRATES |

| Gold | DODUCO Contacts and Refining GmbH* | GERMANY |

| Gold | Dowa* | JAPAN |

| Gold | DSC (Do Sung Corporation)* | KOREA, REPUBLIC OF |

| Gold | Eco-System Recycling Co., Ltd. East Plant* | JAPAN |

| Gold | Eco-System Recycling Co., Ltd. North Plant* | JAPAN |

| Gold | Eco-System Recycling Co., Ltd. West Plant* | JAPAN |

| Gold | Emirates Gold DMCC* | UNITED ARAB EMIRATES |

| Gold | Fidelity Printers and Refiners Ltd. | ZIMBABWE |

| Gold | Fujairah Gold FZC | UNITED ARAB EMIRATES |

| Gold | GCC Gujrat Gold Centre Pvt. Ltd. | INDIA |

| Gold | Geib Refining Corporation* | UNITED STATES OF AMERICA |

| Gold | Gold Coast Refinery | GHANA |

| | | | | | | | | | | |

| Gold | Gold Refinery of Zijin Mining Group Co., Ltd.* | CHINA |

| Gold | Great Wall Precious Metals Co., Ltd. of CBPM | CHINA |

| Gold | Guangdong Jinding Gold Limited | CHINA |

| Gold | Guoda Safina High-Tech Environmental Refinery Co., Ltd. | CHINA |

| Gold | Hangzhou Fuchunjiang Smelting Co., Ltd. | CHINA |

| Gold | Heimerle + Meule GmbH* | GERMANY |

| Gold | Heraeus Germany GmbH Co. KG** | GERMANY | |

| Gold | Heraeus Metals Hong Kong Ltd.* | CHINA |

| Gold | Hunan Chenzhou Mining Co., Ltd. | CHINA |

| Gold | Hunan Guiyang yinxing Nonferrous Smelting Co., Ltd. | CHINA |

| Gold | HwaSeong CJ CO., LTD. | KOREA, REPUBLIC OF |

| Gold | Inner Mongolia Qiankun Gold and Silver Refinery Share Co., Ltd.* | CHINA |

| Gold | International Precious Metal Refiners | UNITED ARAB EMIRATES |

| Gold | Ishifuku Metal Industry Co., Ltd.* | JAPAN |

| Gold | Istanbul Gold Refinery* | TURKEY |

| Gold | Italpreziosi* | ITALY |

| Gold | JALAN & Company | INDIA |

| Gold | Japan Mint* | JAPAN |

| Gold | Jiangxi Copper Co., Ltd.* | CHINA |

| Gold | JSC Ekaterinburg Non-Ferrous Metal Processing Plant*** | RUSSIAN FEDERATION | |

| Gold | JSC Novosibirsk Refinery* | RUSSIAN FEDERATION | |

| Gold | JSC Uralelectromed* | RUSSIAN FEDERATION |

| Gold | JX Nippon Mining & Metals Co., Ltd.* | JAPAN |

| Gold | K.A. Rasmussen | NORWAY | |

| Gold | Kaloti Precious Metals | UNITED ARAB EMIRATES |

| Gold | Kazakhmys Smelting LLC | KAZAKHSTAN |

| Gold | Kazzinc* | KAZAKHSTAN |

| Gold | Kennecott Utah Copper LLC* | UNITED STATES OF AMERICA |

| Gold | KGHM Polska Miedz Spolka Akcyjna* | POLAND |

| Gold | Kojima Chemicals Co., Ltd.* | JAPAN |

| Gold | Korea Zinc Co., Ltd.* | KOREA, REPUBLIC OF |

| Gold | Kundan Care Products Ltd. | INDIA | |

| Gold | Kyrgyzaltyn JSC* | KYRGYZSTAN |

| Gold | Kyshtym Copper-Electrolytic Plant ZAO | RUSSIAN FEDERATION |

| Gold | L'azurde Company For Jewelry | SAUDI ARABIA |

| Gold | Lingbao Gold Co., Ltd. | CHINA |

| Gold | Lingbao Jinyuan Tonghui Refinery Co., Ltd. | CHINA |

| Gold | L'Orfebre S.A.* | ANDORRA |

| Gold | LS-NIKKO Copper Inc.* | KOREA, REPUBLIC OF |

| Gold | LT Metal Ltd.* | KOREA, REPUBLIC OF |

| Gold | Luoyang Zijin Yinhui Gold Refinery Co., Ltd. | CHINA |

| Gold | Marsam Metals* | BRAZIL |

| Gold | Materion* | UNITED STATES OF AMERICA |

| Gold | Matsuda Sangyo Co., Ltd.* | JAPAN |

| Gold | Metalor Technologies (Hong Kong) Ltd.* | CHINA |

| Gold | Metalor Technologies (Singapore) Pte., Ltd.* | SINGAPORE |

| | | | | | | | | | | |

| Gold | Metalor Technologies (Suzhou) Ltd.* | CHINA |

| Gold | Metalor Technologies S.A.* | SWITZERLAND |

| Gold | Metalor USA Refining Corporation* | UNITED STATES OF AMERICA |

| Gold | Metalurgica Met-Mex Penoles S.A. De C.V.* | MEXICO |

| Gold | Mitsubishi Materials Corporation* | JAPAN |

| Gold | Mitsui Mining and Smelting Co., Ltd.* | JAPAN |

| Gold | MMTC-PAMP India Pvt., Ltd.* | INDIA |

| Gold | Modeltech Sdn Bhd | MALAYSIA |

| Gold | Morris and Watson | NEW ZEALAND |

| Gold | Moscow Special Alloys Processing Plant* | RUSSIAN FEDERATION |

| Gold | Nadir Metal Rafineri San. Ve Tic. A.S.* | TURKEY |

| Gold | Navoi Mining and Metallurgical Combinat* | UZBEKISTAN |

| Gold | NH Recytech Company | KOREA, REPUBLIC OF |

| Gold | Nihon Material Co., Ltd.* | JAPAN |

| Gold | Ogussa Osterreichische Gold- und Silber-Scheideanstalt GmbH* | AUSTRIA |

| Gold | Ohura Precious Metal Industry Co., Ltd.* | JAPAN |

| Gold | OJSC "The Gulidov Krasnoyarsk Non-Ferrous Metals Plant" (OJSC Krastsvetmet)* | RUSSIAN FEDERATION |

| Gold | PAMP S.A.* | SWITZERLAND |

| Gold | Pease & Curren | UNITED STATES OF AMERICA |

| Gold | Penglai Penggang Gold Industry Co., Ltd. | CHINA |

| Gold | Planta Recuperadora de Metales SpA* | CHILE |

| Gold | Prioksky Plant of Non-Ferrous Metals* | RUSSIAN FEDERATION |

| Gold | PT Aneka Tambang (Persero) Tbk* | INDONESIA |

| Gold | PX Precinox S.A.* | SWITZERLAND |

| Gold | QG Refining, LLC | UNITED STATES OF AMERICA |

| Gold | Rand Refinery (Pty) Ltd.* | SOUTH AFRICA |

| Gold | Refinery of Seemine Gold Co., Ltd. | CHINA |

| Gold | REMONDIS PMR B.V.* | NETHERLANDS |

| Gold | Royal Canadian Mint* | CANADA |

| Gold | SAAMP* | FRANCE |

| Gold | Sabin Metal Corp. | UNITED STATES OF AMERICA |

| Gold | Safimet S.p.A* | ITALY |

| Gold | SAFINA A.S.* | CZECHIA |

| Gold | Sai Refinery | INDIA |

| Gold | Samduck Precious Metals* | KOREA, REPUBLIC OF |

| Gold | Samwon Metals Corp. | KOREA, REPUBLIC OF |

| Gold | SAXONIA Edelmetalle GmbH* | GERMANY |

| Gold | SEMPSA Joyeria Plateria S.A.* | SPAIN |

| Gold | Shandong Gold Smelting Co., Ltd.* | CHINA | |

| Gold | Shandong Humon Smelting Co., Ltd. | CHINA |

| Gold | Shandong Tiancheng Biological Gold Industrial Co., Ltd. | CHINA |

| Gold | Shandong Zhaojin Gold & Silver Refinery Co., Ltd.* | CHINA |

| Gold | Shenzhen Zhonghenglong Real Industry Co., Ltd. | China | |

| Gold | Shirpur Gold Refinery Ltd. | INDIA | |

| Gold | Sichuan Tianze Precious Metals Co., Ltd.* | CHINA |

| Gold | Singway Technology Co., Ltd.* | TAIWAN, PROVINCE OF CHINA |

| Gold | SOE Shyolkovsky Factory of Secondary Precious Metals* | RUSSIAN FEDERATION |

| | | | | | | | | | | |

| Gold | Solar Applied Materials Technology Corp.* | TAIWAN, PROVINCE OF CHINA |

| Gold | Sovereign Metals | INDIA |

| Gold | State Research Institute Center for Physical Sciences and Technology | LITHUANIA |

| Gold | Sudan Gold Refinery | SUDAN |

| Gold | Sumitomo Metal Mining Co., Ltd.* | JAPAN |

| Gold | SungEel HiMetal Co., Ltd.* | KOREA, REPUBLIC OF |

| Gold | T.C.A S.p.A* | ITALY |

| Gold | Tanaka Kikinzoku Kogyo K.K.* | JAPAN |

| Gold | Tokuriki Honten Co., Ltd.* | JAPAN |

| Gold | Tongling Nonferrous Metals Group Co., Ltd. | CHINA |

| Gold | TOO Tau-Ken-Altyn* | KAZAKHSTAN |

| Gold | Torecom* | KOREA, REPUBLIC OF |

| Gold | TSK Pretech* | KOREA, REPUBLIC OF |

| Gold | Umicore Precious Metals Thailand* | THAILAND |

| Gold | Umicore S.A. Business Unit Precious Metals Refining* | BELGIUM |

| Gold | United Precious Metal Refining, Inc.* | UNITED STATES OF AMERICA |

| Gold | Valcambi S.A.* | SWITZERLAND |

| Gold | Value Trading | BELGIUM | |

| Gold | Western Australian Mint (T/a The Perth Mint)* | AUSTRALIA |

| Gold | WIELAND Edelmetalle GmbH* | GERMANY |

| Gold | Yamakin Co., Ltd.* | JAPAN |

| Gold | Yokohama Metal Co., Ltd.* | JAPAN |

| Gold | Yunnan Copper Industry Co., Ltd. | CHINA |

| Gold | Zhongyuan Gold Smelter of Zhongjin Gold Corporation* | CHINA |

| Tantalum | Asaka Riken Co., Ltd.* | JAPAN |

| Tantalum | Changsha South Tantalum Niobium Co., Ltd.* | CHINA |

| Tantalum | D Block Metals, LLC* | UNITED STATES OF AMERICA |

| Tantalum | Exotech Inc.* | UNITED STATES OF AMERICA |

| Tantalum | F&X Electro-Materials Ltd.* | CHINA |

| Tantalum | FIR Metals & Resource Ltd.* | CHINA |

| Tantalum | Global Advanced Metals Aizu* | JAPAN |

| Tantalum | Global Advanced Metals Boyertown* | UNITED STATES OF AMERICA |

| Tantalum | H.C. Starck Hermsdorf GmbH* | GERMANY |

| Tantalum | H.C. Starck Inc.* | UNITED STATES OF AMERICA |

| Tantalum | Hengyang King Xing Lifeng New Materials Co., Ltd.* | CHINA |

| Tantalum | Jiangxi Dinghai Tantalum & Niobium Co., Ltd.* | CHINA |

| Tantalum | Jiangxi Tuohong New Raw Material* | CHINA |

| Tantalum | JiuJiang JinXin Nonferrous Metals Co., Ltd.* | CHINA |

| Tantalum | Jiujiang Tanbre Co., Ltd.* | CHINA |

| Tantalum | Jiujiang Zhongao Tantalum & Niobium Co., Ltd.* | CHINA |

| Tantalum | KEMET de Mexico* | MEXICO |

| Tantalum | LSM Brasil S.A.* | BRAZIL |

| Tantalum | Meta Materials* | NORTH MACEDONIA | |

| Tantalum | Metallurgical Products India Pvt., Ltd.* | INDIA |

| Tantalum | Mineracao Taboca S.A.* | BRAZIL |

| Tantalum | Mitsui Mining and Smelting Co., Ltd.* | JAPAN |

| Tantalum | Ningxia Orient Tantalum Industry Co., Ltd.* | CHINA |

| | | | | | | | | | | |

| Tantalum | NPM Silmet AS* | ESTONIA |

| Tantalum | QuantumClean* | UNITED STATES OF AMERICA |

| Tantalum | Resind Industria e Comercio Ltda.* | BRAZIL |

| Tantalum | Solikamsk Magnesium Works OAO* | RUSSIAN FEDERATION |

| Tantalum | Taki Chemical Co., Ltd.* | JAPAN |

| Tantalum | TANIOBIS Co., Ltd.* | THAILAND | |

| Tantalum | TANIOBIS GmbH* | GERMANY | |

| Tantalum | TANIOBIS Japan Co., Ltd.* | JAPAN | |

| Tantalum | TANIOBIS Smelting GmbH & Co. KG* | GERMANY | |

| Tantalum | Telex Metals* | UNITED STATES OF AMERICA |

| Tantalum | Ulba Metallurgical Plant JSC* | KAZAKHSTAN |

| Tantalum | XIMEI RESOURCES (GUANGDONG) LIMITED* | CHINA | |

| Tantalum | XinXing HaoRong Electronic Material Co., Ltd.* | CHINA |

| Tantalum | Yanling Jincheng Tantalum & Niobium Co., Ltd.* | CHINA |

| Tin | Alpha* | UNITED STATES OF AMERICA |

| Tin | An Vinh Joint Stock Mineral Processing Company | VIET NAM |

| Tin | Chenzhou Yunxiang Mining and Metallurgy Co., Ltd.* | CHINA |

| Tin | Chifeng Dajingzi Tin Industry Co., Ltd.* | CHINA |

| Tin | China Tin Group Co., Ltd.* | CHINA |

| Tin | CRM Synergies** | SPAIN | |

| Tin | Dongguan CiEXPO Environmental Engineering Co., Ltd. | CHINA |

| Tin | Dowa* | JAPAN |

| Tin | Electro-Mechanical Facility of the Cao Bang Minerals & Metallurgy Joint Stock Company | VIET NAM |

| Tin | EM Vinto* | BOLIVIA (PLURINATIONAL STATE OF) |

| Tin | Estanho de Rondonia S.A. | BRAZIL |

| Tin | Fenix Metals* | POLAND |

| Tin | Gejiu City Fuxiang Industry and Trade Co., Ltd. | CHINA |

| Tin | Gejiu Kai Meng Industry and Trade LLC* | CHINA |

| Tin | Gejiu Non-Ferrous Metal Processing Co., Ltd.* | CHINA |

| Tin | Gejiu Yunxin Nonferrous Electrolysis Co., Ltd.* | CHINA |

| Tin | Gejiu Zili Mining And Metallurgy Co., Ltd.* | CHINA |

| Tin | Guangdong Hanhe Non-Ferrous Metal Co., Ltd.* | CHINA |

| Tin | HuiChang Hill Tin Industry Co., Ltd.* | CHINA |

| Tin | Jiangxi New Nanshan Technology Ltd.* | CHINA |

| Tin | Luna Smelter, Ltd.* | RWANDA |

| Tin | Ma'anshan Weitai Tin Co., Ltd.* | CHINA |

| Tin | Magnu's Minerais Metais e Ligas Ltda.* | BRAZIL |

| Tin | Malaysia Smelting Corporation (MSC)* | MALAYSIA |

| Tin | Melt Metais e Ligas S.A.* | BRAZIL |

| Tin | Metallic Resources, Inc.* | UNITED STATES OF AMERICA |

| Tin | Metallo Belgium N.V.* | BELGIUM |

| Tin | Metallo Spain S.L.U.* | SPAIN |

| Tin | Mineracao Taboca S.A.* | BRAZIL |

| Tin | Minsur* | PERU |

| Tin | Mitsubishi Materials Corporation* | JAPAN |

| Tin | Modeltech Sdn Bhd | MALAYSIA |

| Tin | Nghe Tinh Non-Ferrous Metals Joint Stock Company | VIET NAM |

| | | | | | | | | | | |

| Tin | Novosibirsk Processing Plant Ltd.** | RUSSIAN FEDERATION | |

| Tin | O.M. Manufacturing (Thailand) Co., Ltd.* | THAILAND |

| Tin | O.M. Manufacturing Philippines, Inc.* | PHILIPPINES |

| Tin | Operaciones Metalurgicas S.A.* | BOLIVIA (PLURINATIONAL STATE OF) |

| Tin | Pongpipat Company Limited | MYANMAR |

| Tin | Precious Minerals and Smelting Limited | INDIA |

| Tin | PT Artha Cipta Langgeng* | INDONESIA |

| Tin | PT ATD Makmur Mandiri Jaya* | INDONESIA | |

| Tin | PT Babel Surya Alam Lestari* | INDONESIA | |

| Tin | PT Bangka Serumpun* | INDONESIA | |

| Tin | PT Menara Cipta Mulia* | INDONESIA | |

| Tin | PT Mitra Stania Prima* | INDONESIA |

| Tin | PT Mitra Sukses Globalindo | INDONESIA | |

| Tin | PT Prima Timah Utama* | INDONESIA | |

| Tin | PT Rajawali Rimba Perkasa* | INDONESIA | |

| Tin | PT Rajehan Ariq* | INDONESIA | |

| Tin | PT Refined Bangka Tin* | INDONESIA |

| Tin | PT Timah Tbk Kundur* | INDONESIA |

| Tin | PT Timah Tbk Mentok* | INDONESIA |

| Tin | Resind Industria e Comercio Ltda.* | BRAZIL |

| Tin | Rui Da Hung* | TAIWAN, PROVINCE OF CHINA |

| Tin | Soft Metais Ltda.* | BRAZIL |

| Tin | Super Ligas | BRAZIL |

| Tin | Thai Nguyen Mining and Metallurgy Co., Ltd.* | VIET NAM |

| Tin | Thaisarco* | THAILAND |

| Tin | Tin Technology & Refining* | UNITED STATES OF AMERICA |

| Tin | Tuyen Quang Non-Ferrous Metals Joint Stock Company | VIET NAM |

| Tin | White Solder Metalurgia e Mineracao Ltda.* | BRAZIL |

| Tin | Yunnan Chengfeng Non-ferrous Metals Co., Ltd.* | CHINA |

| Tin | Yunnan Tin Company Limited* | CHINA |

| Tin | Yunnan Yunfan Non-ferrous Metals Co., Ltd.* | CHINA |

| Tungsten | A.L.M.T. Corp.* | JAPAN |

| Tungsten | ACL Metais Eireli* | BRAZIL |

| Tungsten | Albasteel Industria e Comercio de Ligas Para Fundicao Ltd.** | BRAZIL |

| Tungsten | Asia Tungsten Products Vietnam Ltd.* | VIET NAM |

| Tungsten | Chenzhou Diamond Tungsten Products Co., Ltd.* | CHINA |

| Tungsten | China Molybdenum Tungsten Co., Ltd.** | CHINA |

| Tungsten | Chongyi Zhangyuan Tungsten Co., Ltd.* | CHINA |

| Tungsten | CNMC (Guangxi) PGMA Co., Ltd. | CHINA |

| Tungsten | Cronimet Brasil Ltda** | BRAZIL |

| Tungsten | Fujian Ganmin RareMetal Co., Ltd.* | CHINA |

| Tungsten | Fujian Jinxin Tungsten Co., Ltd.* | CHINA |

| Tungsten | Ganzhou Haichuang Tungsten Co., Ltd.* | CHINA |

| Tungsten | Ganzhou Huaxing Tungsten Products Co., Ltd.* | CHINA |

| Tungsten | Ganzhou Jiangwu Ferrotungsten Co., Ltd.* | CHINA |

| Tungsten | Ganzhou Seadragon W & Mo Co., Ltd.* | CHINA |

| | | | | | | | | | | |

| Tungsten | GEM Co., Ltd. | CHINA | |

| Tungsten | Global Tungsten & Powders Corp.* | UNITED STATES OF AMERICA |

| Tungsten | Guangdong Xianglu Tungsten Co., Ltd.* | CHINA |

| Tungsten | H.C. Starck Tungsten GmbH* | GERMANY |

| Tungsten | Hunan Chenzhou Mining Co., Ltd.* | CHINA |

| Tungsten | Hunan Chuangda Vanadium Tungsten Co., Ltd. Wuji* | CHINA |

| Tungsten | Hunan Chunchang Nonferrous Metals Co., Ltd.* | CHINA |

| Tungsten | Hunan Litian Tungsten Industry Co., Ltd.* | CHINA |

| Tungsten | Hydrometallurg, JSC* | RUSSIAN FEDERATION |

| Tungsten | Japan New Metals Co., Ltd.* | JAPAN |

| Tungsten | Jiangwu H.C. Starck Tungsten Products Co., Ltd.* | CHINA |

| Tungsten | Jiangxi Gan Bei Tungsten Co., Ltd.* | CHINA |

| Tungsten | Jiangxi Minmetals Gao'an Non-ferrous Metals Co., Ltd. | CHINA |

| Tungsten | Jiangxi Tonggu Non-ferrous Metallurgical & Chemical Co., Ltd.* | CHINA |

| Tungsten | Jiangxi Xinsheng Tungsten Industry Co., Ltd.* | CHINA |

| Tungsten | Jiangxi Yaosheng Tungsten Co., Ltd.* | CHINA |

| Tungsten | JSC "Kirovgrad Hard Alloys Plant"** | RUSSIAN FEDERATION |

| Tungsten | Kennametal Fallon* | UNITED STATES OF AMERICA |

| Tungsten | Kennametal Huntsville* | UNITED STATES OF AMERICA |

| Tungsten | KGETS Co., Ltd.* | KOREA, REPUBLIC OF |

| Tungsten | Lianyou Metals Co., Ltd.* | TAIWAN, PROVINCE OF CHINA |

| Tungsten | Malipo Haiyu Tungsten Co., Ltd.* | CHINA |

| Tungsten | Masan High-Tech Materials* | VIET NAM |

| Tungsten | Moliren Ltd.* | RUSSIAN FEDERATION |

| Tungsten | Niagara Refining LLC* | UNITED STATES OF AMERICA |

| Tungsten | NPP Tyazhmetprom LLC** | RUSSIAN FEDERATION | |

| Tungsten | Philippine Chuangxin Industrial Co., Inc.* | PHILIPPINES |

| Tungsten | TANIOBIS Smelting GmbH & Co. KG* | GERMANY | |

| Tungsten | Tejing (Vietnam) Tungsten Co., Ltd.* | VIET NAM |

| Tungsten | Unecha Refractory metals plant* | RUSSIAN FEDERATION |

| Tungsten | Wolfram Bergbau und Hutten AG* | AUSTRIA |

| Tungsten | Woltech Korea Co., Ltd.* | KOREA, REPUBLIC OF |

| Tungsten | Xiamen Tungsten (H.C.) Co., Ltd.* | CHINA |

| Tungsten | Xiamen Tungsten Co., Ltd.* | CHINA |

| Tungsten | Xinfeng Huarui Tungsten & Molybdenum New Material Co., Ltd.* | CHINA |

| | |

* “Conformant” indicates conformant to a 3rd Party Responsible Sourcing Validation Program (RMAP, LBMA, RJC) based on information provided to RMI member companies as of December 31, 2020. |

** “Active” indicates actively participating in a 3rd Party Responsible Sourcing Validation Program (RMAP, LBMA, RJC) based on information provided to RMI member companies as of December 31, 2020. |

*** Ford does not have reason to believe JSC Ekaterinburg Non-Ferrous Metal Processing Plant ("JSC", CID000927) was present in Ford's supply chain during the first quarter of calendar year 2020. |