- F Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Ford Motor Company 6.500% Notes (F) DEF 14ADefinitive proxy

Filed: 1 Apr 21, 9:02am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ý | ||

Filed by a Party other than the Registrant o | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material under §240.14a-12 | |

| Ford Motor Company | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

Notice of 2021 Virtual Annual Meeting

of Shareholders and Proxy Statement

Thursday, May 13, 2021 at 8:30 a.m., Eastern Daylight Saving Time

Virtual Annual Meeting of Shareholders

Online Meeting Only — No Physical Meeting Location

| Ford Motor Company One American Road Dearborn, Michigan 48126-2798 |

Dear Shareholders:

It is my pleasure to inform you that our 2021 Annual Meeting of Shareholders will be conducted online on Thursday, May 13, 2021, starting at 8:30 a.m. EDT. The virtual nature of the meeting will continue to enable increased shareholder accessibility, while improving meeting efficiency and reducing costs. Shareholders will be able to listen, submit questions, and vote from any remote location with Internet connectivity. Information on how to participate in this year's virtual meeting can be found on page 105.

Throughout Ford's nearly 118-year history, we have faced many challenges and crises, but COVID-19 was unique in the way that it upended and threatened the lives of people around the world. But in the face of adversity, our Ford family responded to a global emergency as we have done many times in the past, by finding significant ways to help. No other company and no other workforce did what we did, and that is a source of immense gratification and pride.

In spite of these challenges, we accomplished a lot, including the launches of some of our most important products. Our core mission of developing vehicles, technologies, and services that improve people's lives has never been more important. And, as humanity continues to face enormous challenges, we believe Ford has the values, the people, and the will to make a positive impact. As always, our Board of Directors, leadership team, and extended family of employees are determined to continue earning your confidence as we aspire to become the world's most trusted company.

Thank you for your support of our efforts.

April 1, 2021

/s/ William Clay Ford, Jr.

William Clay Ford, Jr.

Chairman of the Board

Notice of Virtual Annual Meeting of

Shareholders of Ford Motor Company

Thursday, May 13, 2021

8:30 a.m., Eastern Daylight Saving Time

This year's virtual annual meeting will begin promptly at 8:30 a.m., Eastern Daylight Saving Time. If you plan to participate in the virtual meeting, please see the instructions on page 105 of the Proxy Statement. Shareholders will be able to listen, vote, and submit questions from their home or from any remote location that has Internet connectivity. There will be no physical location for shareholders to attend. Shareholders may only participate online by logging in at www.virtualshareholdermeeting.com/FORD2021.

ITEMS OF BUSINESS:

If you were a shareholder at the close of business on March 17, 2021, you are eligible to vote at this year's annual meeting.

Please read these materials so that you will know which items of business we intend to cover during the meeting. Also, please either sign and return the accompanying proxy card in the postage-paid envelope or instruct us by telephone or online as to how you would like your shares voted. This will allow your shares to be voted as you instruct even if you cannot participate in the meeting. Instructions on how to vote your shares by telephone or online are on the proxy card enclosed with the Proxy Statement.

Please see Other Items and the Questions and Answers section beginning on page 101 for important information about the proxy materials, voting, the virtual annual meeting, Company documents, communications, and the deadline to submit shareholder proposals for the 2022 Annual Meeting of Shareholders.

Shareholders are being notified of the Proxy Statement and the form of proxy beginning April 1, 2021.

April 1, 2021

Dearborn, Michigan

/s/ Jonathan E. Osgood

Jonathan E. Osgood

Secretary

We urge each shareholder to promptly sign and return the enclosed proxy card or to use telephone or online voting. See our Questions and Answers beginning on page 102 for information about the virtual meeting and voting by telephone or online and how to revoke a proxy.

| | | | | | |

NOTICE OF VIRTUAL ANNUAL MEETING OF SHAREHOLDERS | | | | 2021 Proxy Statement | | i |

Proxy Summary | 1 | |

Corporate Governance | 11 | |

Corporate Governance Principles | 11 | |

Our Governance Practices | 11 | |

Leadership Structure | 12 | |

Board Meetings, Composition, and Committees | 12 | |

Board's Role in Risk Management | 15 | |

Independence of Directors and Relevant Facts and Circumstances | 19 | |

Codes of Ethics | 20 | |

Communications with the Board and Annual Meeting Attendance | 21 | |

Beneficial Stock Ownership | 21 | |

Delinquent Section 16(a) Reports | 24 | |

Certain Relationships and Related Party Transactions | 24 | |

Stakeholder Engagement | 26 | |

Government Relations Activities | 27 | |

Environmental, Social, and Governance | 27 | |

Proposal 1. Election of Directors | 28 | |

Director Compensation in 2020 | 36 | |

Proposal 2. Ratification of Independent Registered Public Accounting Firm | 38 | |

Audit Committee Report | 39 | |

Proposal 3. Approval of the Compensation of the Named Executives | 40 | |

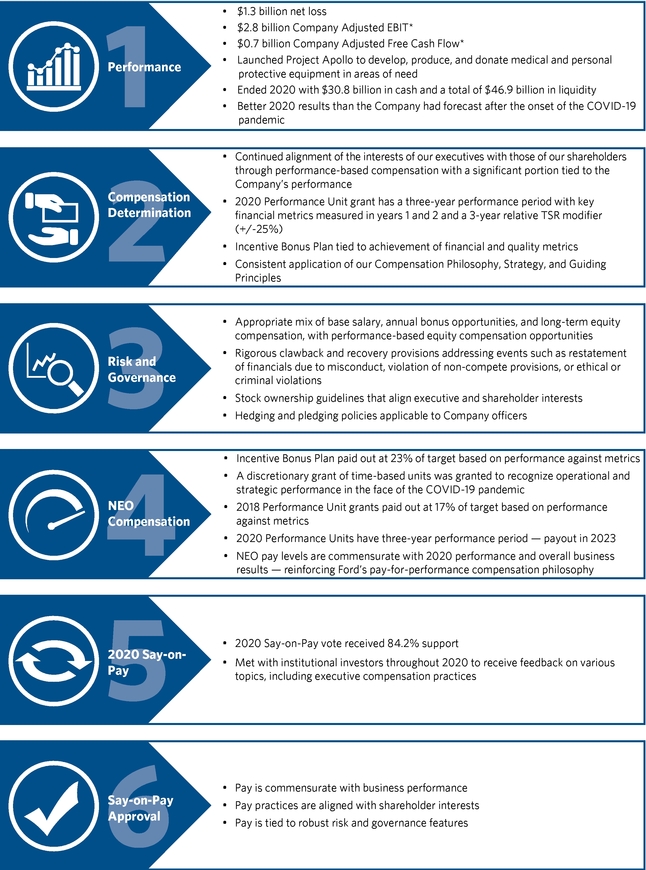

Compensation Discussion and Analysis (CD&A) Roadmap | 41 | |

Executive Compensation | 42 | |

COMPENSATION DISCUSSION AND ANALYSIS (CD&A) | 42 | |

COMPENSATION COMMITTEE REPORT | 79 | |

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION | 79 | |

COMPENSATION OF NAMED EXECUTIVES | 80 | |

Summary Compensation Table | 80 | |

Grants of Plan-Based Awards in 2020 | 83 | |

Outstanding Equity Awards at 2020 Fiscal Year-End | 84 | |

Option Exercises and Stock Vested in 2020 | 86 | |

Pension Benefits in 2020 | 86 | |

Nonqualified Deferred Compensation in 2020 | 88 | |

Potential Payments Upon Termination or Change-in-Control | 90 | |

Equity Compensation Plan Information | 94 | |

Pay Ratio | 95 | |

Shareholder Proposal | 98 | |

Proposal 4. Shareholder Proposal | 98 | |

Other Items | 101 | |

Questions and Answers About the Proxy Materials | 102 | |

Instructions for the Virtual Annual Meeting | 105 | |

Appendix I. Cautionary Note on Forward Looking Statements | I-1 |

| | | | | | |

ii | | TABLE OF CONTENTS | | | | 2021 Proxy Statement |

This summary highlights information contained in this Proxy Statement. It does not contain all of the information you should consider. You should read the entire Proxy Statement carefully before voting. Please see the Questions and Answers section beginning on page 102 for important information about proxy materials, voting, the virtual annual meeting, Company documents, and communications.

The Board of Directors is soliciting proxies to be used at the annual meeting of shareholders. This Proxy Statement and the enclosed proxy are being made available to shareholders beginning April 1, 2021.

TIME OF VIRTUAL ANNUAL MEETING

| Thursday, May 13, 2021 8:30 a.m., Eastern Daylight Saving Time We will hold a virtual annual meeting of shareholders. Shareholders may participate online by logging onto www.virtualshareholdermeeting.com/FORD2021. There will not be a physical meeting location. | Corporate Website: www.corporate.ford.com Annual Report: www.shareholder.ford.com |

| VOTING MATTERS | Board Recommendations | Pages | ||||

|---|---|---|---|---|---|---|

| | | | | | | |

Election of the 14 Director Nominees Named in the Proxy Statement | FOR | 28-37 | ||||

Ratification of Independent Registered Public Accounting Firm | FOR | 38-39 | ||||

Approval of the Compensation of the Named Executives | FOR | 40-97 | ||||

Shareholder Proposal — Give Each Share an Equal Vote | AGAINST | 98-100 | ||||

CORPORATE GOVERNANCE HIGHLIGHTS

| | | | | | |

PROXY SUMMARY | | | | 2021 Proxy Statement | | 1 |

| DIRECTOR NOMINEES |  |

| OF OUR 14 BOARD NOMINEES 4 ARE WOMEN 2 IDENTIFY THEMSELVES AS MEMBERS OF MINORITY GROUPS | | AGE DIRECTOR SINCE PRINCIPAL OCCUPATION | | | QUALIFICATIONS | | | COMMITTEES | | | OTHER BOARDS | |||||||||||||

| | ||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Kimberly A. Casiano Independent | 63 2003 President, Kimberly Casiano & Associates, San Juan, Puerto Rico | Audit Nominating & Governance Sustainability & Innovation | Mutual of America | |||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Anthony F. Earley, Jr. Lead Independent Director | 71 2009 Retired Executive Chairman of the Board of Directors, PG&E Corporation | Compensation (Chair) Nominating & Governance Sustainability & Innovation | Southern Company | |||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Alexandra Ford English | 33 New Nominee A Director of Corporate Strategy, Ford Motor Company | |||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| James D. Farley, Jr. | 58 2020 President and Chief Executive Officer, Ford Motor Company | |||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Henry Ford III | 40 New Nominee A Director of Investor Relations, Ford Motor Company | |||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| William Clay Ford, Jr. | 63 1988 Executive Chairman and Chairman of the Board of Directors, Ford Motor Company | Finance (Chair) Sustainability & Innovation | ||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| William W. Helman IV Independent | 62 2011 General Partner, Greylock Partners | Finance Nominating & Governance Sustainability & Innovation (Chair) | Vornado Realty Trust | |||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Jon M. Huntsman, Jr.* | 61 2020 Former Chairman, Atlantic Council and Former Chairman, Huntsman Cancer Foundation | Compensation Nominating & Governance Sustainability & Innovation | Chevron Corporation | |||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| William E. Kennard Independent | 64 2015 Chairman, Velocitas Partners LLC | Finance Nominating & Governance (Chair) Sustainability & Innovation | AT&T Inc. MetLife, Inc. | |||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Beth E. Mooney Independent | 66 July 2019 Retired Chairman and Chief Executive Officer, KeyCorp | Audit Nominating & Governance | AT&T Inc. KeyCorp | |||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| John L. Thornton Independent | 67 1996 Executive Chairman, Barrick Gold Corporation | Compensation Finance Nominating & Governance | Barrick Gold Corporation | |||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| John B. Veihmeyer Independent | 65 2017 Retired Chairman and Chief Executive Officer, KPMG, LLP and retired Chairman of KPMG International | Audit (Chair) Nominating & Governance | Zanite Acquisition Corp. | |||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Lynn M. Vojvodich Independent | 53 2017 Former Executive Vice President & Chief Marketing Officer, Salesforce | Audit Nominating & Governance Sustainability & Innovation | Booking Holdings Inc. Dell Technologies | |||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| John S. Weinberg Independent | 64 2016 Co-Chief Executive Officer and Co-Chairman of the Board of Directors, Evercore Partners Inc. | Compensation Finance Nominating & Governance Sustainability & Innovation | Evercore Partners Inc. | |||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

2 | | PROXY SUMMARY | | | | 2021 Proxy Statement |

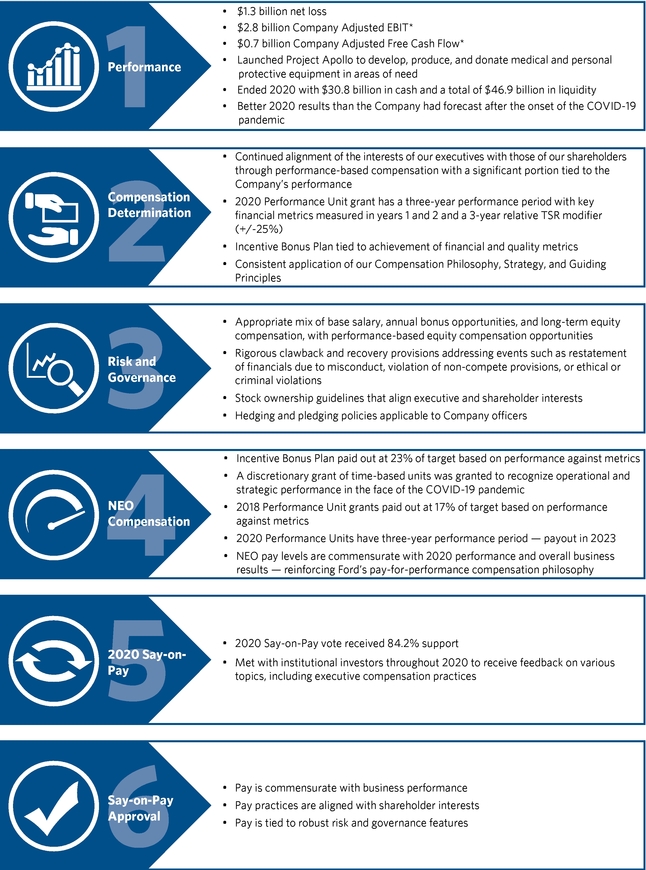

2020 — A YEAR OF TRANSITION AND RESILIENCY

The year 2020 was a year like no other as the COVID-19 pandemic brought unexpected challenges to our people, our customers, our business, and our partners, creating a global health crisis and causing a temporary shutdown of the automotive industry. For Ford, it was also a year of transition and resiliency. Through these challenging times, we proved our spirit and adaptability: we promoted the health and safety of our employees and communities without losing sight of the importance of strong operating execution.

As events associated with the pandemic unfolded, management took decisive action to respond to the disruption:

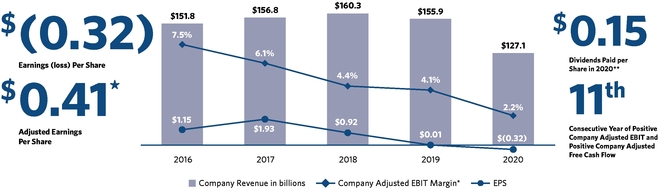

Management also took measures to bolster the Company's ongoing liquidity and financial stability through financing activities, cash preservation initiatives, capital expense reductions, and cost control measures, including deferring payment of a portion of the salaries of certain corporate officers, including our Named Executives (see p. 57), from May through October, when the Company successfully repaid more than $7 billion of its Automotive debt. These actions helped preserve and advance the Company's long-term performance and positioned the Company to achieve better results in 2020 than the Company had forecast after the onset of the COVID-19 pandemic. Although the unpredictable consequences of the COVID-19 pandemic had an adverse effect on our 2020 performance, we ended 2020 with $30.8 billion in cash and a total of $46.9 billion in liquidity, both significantly higher than year-end 2019.

In order to recognize the extraordinary efforts of employees, as well as strategic and operational performance in the face of the global COVID 19 pandemic, in February 2021, the Compensation Committee approved a Pandemic Response Award for Incentive Bonus Plan-eligible employees, which was paid in cash to employees other than corporate officers and paid in the form of Time Based Units with a one-year cliff vest for corporate officers, including Named Executives. See Compensation Discussion & Analysis — Pandemic Response Award on pp. 66-69.

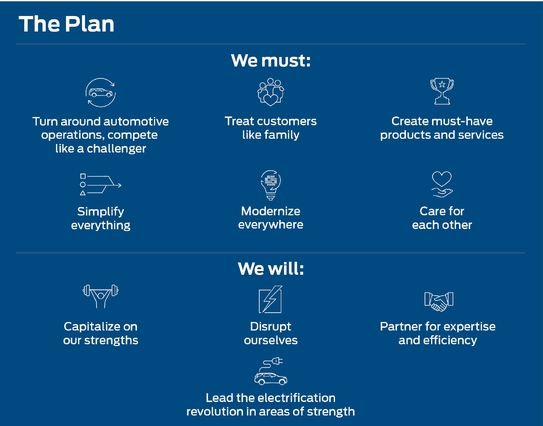

Amid our response to the global COVID-19 pandemic, the Company was planning and successfully executing a leadership transition. On August 4, 2020, the Company announced the election of James D. Farley, Jr., as President and Chief Executive Officer of the Company, effective October 1, 2020. Quickly following his accession to President and Chief Executive Officer, Mr. Farley unveiled The Plan: Ford's strategy to speed our transformation, improve execution, and drive growth. Under The Plan, we will turn our business around by modernizing how we operate, simplifying our processes, building on our strengths, exploring new opportunities, caring for each other and our customers, and leading the electrification revolution in areas of strength. Please refer to page 42 for more information about The Plan.

| | | | | | |

PROXY SUMMARY | | | | 2021 Proxy Statement | | 3 |

| * | See pages 69-72 of Ford's Annual Report on Form 10-K for the year ended December 31, 2020 for definitions and reconciliations to GAAP. | |||||

| | | | | | |

4 | | PROXY SUMMARY | | | | 2021 Proxy Statement |

| * | See pages 69-72 of Ford's Annual Report on Form 10-K for the year ended December 31, 2020 for definitions and reconciliations to GAAP. | |||||

CREATING VALUE

Set forth below are some of our 2020 achievements against certain elements of The Plan. We will continue to execute on The Plan as we strive to deliver superior shareholder returns through focused automotive, electrification, and high-growth mobility initiatives.

The Plan: Care for Each Other

The Plan: Care for Each Other

| | | | | | |

PROXY SUMMARY | | | | 2021 Proxy Statement | | 5 |

The Plan: Create Must Have Products and Services

The Plan: Create Must Have Products and Services

The Plan: Turn Around Operations; Compete like a Challenger

The Plan: Turn Around Operations; Compete like a Challenger

The Plan: Lead the Electrification Revolution in Areas of Strength

The Plan: Lead the Electrification Revolution in Areas of Strength

| | | | | | |

6 | | PROXY SUMMARY | | | | 2021 Proxy Statement |

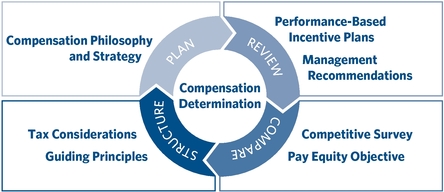

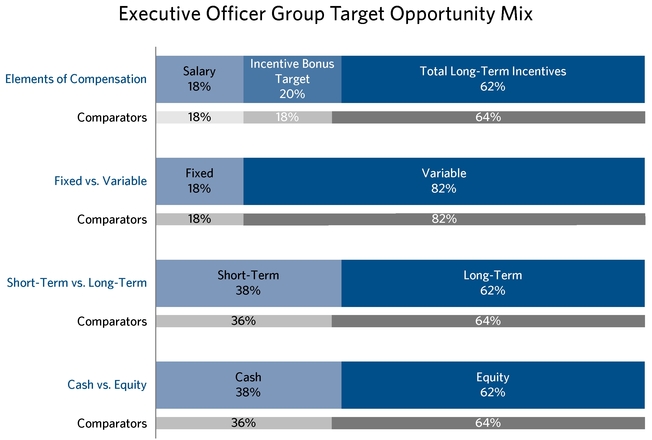

Underlying our compensation programs is an emphasis on sound governance practices. These practices include:

WE DO

| Perform annual say-on-pay advisory vote for shareholders | ||

| Pay for performance | ||

| Use appropriate peer group when establishing compensation | ||

| Balance short- and long-term incentives | ||

| Align executive compensation with stockholder returns through long-term incentives | ||

| Cap individual payouts in incentive plans | ||

| Include clawback provisions in our incentive grants (see Risk Assessment Regarding Compensation Policies and Practices on pp. 16-17) | ||

| Maintain robust stock ownership goals for Named Executives |

| Prohibit officers from hedging their exposure to Ford common stock and limit officers' pledging of Ford common stock (see Risk Assessment Regarding Compensation Policies and Practices on pp. 16-17) | ||

| Condition grants of long-term incentive awards on non-compete and non-disclosure restrictions | ||

| Mitigate undue risk taking in compensation programs | ||

| Retain a fully independent external compensation consultant whose independence is reviewed annually by the Compensation Committee (see Compensation Committee Operations on pp. 17-18) | ||

| Include a double-trigger change in control provision for equity grants |

| | | | | | |

PROXY SUMMARY | | | | 2021 Proxy Statement | | 7 |

WE DO NOT

| | Provide evergreen employment contracts | |

| | Pay out dividend equivalents on equity awards during vesting periods or performance periods | |

| | Maintain individual change in control agreements for Named Executives (other than the provisions included in Mr. Farley's employment agreement discussed on p. 59 and footnote 7 on p. 92) |

| | Reprice options | |

| | Allow officers to hedge their exposure to Ford common stock |

![]()

| Element | | BASE SALARY | | | ANNUAL CASH INCENTIVE AWARDS | | | LONG-TERM INCENTIVE AWARDS | | | BENEFITS AND PERQUISITES | | | RETIREMENT PLANS | ||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Purpose | Base Level of Compensation | Incentive to Drive Near-Term Performance | Incentive to Drive Long- Term Performance and Stock Price Growth | Enhance Productivity and Development | Income Certainty and Security | |||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Target | Fixed $ | Fixed % of Salary | Fixed $ Value Equity Opportunity | Variable | % of Salary | |||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Form of Delivery | Cash | Cash | Performance Units,* Time-Based Units* and Stock Options | Various | Cash | |||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Company | NA | 0-200% | Performance Units 0-200% | NA | NA | |||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

![]()

| | | | | | |

8 | | PROXY SUMMARY | | | | 2021 Proxy Statement |

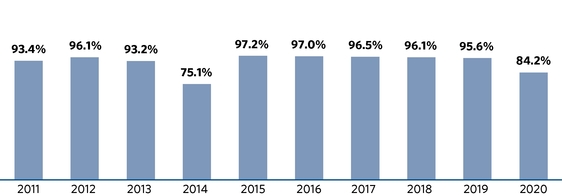

Our compensation practices have been consistently supported by shareholders, as evidenced by recent Say-on-Pay results.

We regularly meet with investors to discuss and receive feedback on various topics, including long-term strategy; financial and operating performance; risk management; environmental, social, and governance practices; and executive compensation practices. Based on these interactions, we believe investors were generally satisfied with our compensation programs in 2020 and we are pleased that investors support our compensation philosophy, policies, and programs.

![]()

| | | | | | |

PROXY SUMMARY | | | | 2021 Proxy Statement | | 9 |

| | | | | | |

10 | | PROXY SUMMARY | | | | 2021 Proxy Statement |

Corporate Governance

Corporate Governance Principles

The Nominating and Governance Committee developed and recommended to the Board a set of corporate governance principles, which the Board adopted. Ford's Corporate Governance Principles may be found on its website at www.corporate.ford.com. These principles include: a limitation on the number of boards on which a director may serve, qualifications for directors (including a requirement that directors be prepared to resign from the Board in the event of any significant

change in their personal circumstances that could affect the discharge of their responsibilities), director orientation and continuing education, and a requirement that the Board and each of its Committees perform an annual self-evaluation. Shareholders may obtain a printed copy of the Company's Corporate Governance Principles by writing to our Shareholder Relations Department at Ford Motor Company, Shareholder Relations, P.O. Box 6248, Dearborn, MI 48126.

Ford has a long history of operating under sound corporate governance practices, which is a critical element of creating the world's most trusted company. These practices include the following:

| Annual Election of All Directors. | ||

Majority Vote Standard. Each director must be elected by a majority of votes cast. | ||

Independent Board. 64% of the Director Nominees are independent. | ||

Lead Independent Director. Ensures management is adequately addressing the matters identified by the Board. | ||

Independent Board Committees. Each of the Audit, Compensation, and Nominating and Governance Committees is comprised entirely of independent directors. | ||

Committee Charters. Each standing committee operates under a written charter that has been approved by the Board and is reviewed annually. | ||

Independent Directors Meet Regularly Without Management and Non-Independent Directors. | ||

Regular Board and Committee Self-Evaluation Process. The Board and each committee evaluates its performance each year. |

| Mandatory Deferral of Compensation for Directors. In 2020, approximately 68% of annual director fees were mandatorily deferred into Ford restricted stock units, which strongly links the interests of the Board with those of shareholders. | ||

Separate Chairman of the Board and CEO. The Board of Directors has chosen to separate the roles of CEO and Chairman of the Board of Directors. | ||

Confidential Voting at Annual Meeting. | ||

Special Meetings. Shareholders have the right to call a special meeting. | ||

Shareholders May Take Action by Written Consent. | ||

Strong Codes of Ethics. Ford is committed to operating its business with the highest level of integrity and has adopted codes of ethics that apply to all directors and senior financial personnel, and a code of conduct that applies to all employees. | ||

Hedging and Pledging Policies. Officers are prohibited from hedging their exposure to, and limited in pledging, Ford common stock (see p. 17). |

| | | | | | |

CORPORATE GOVERNANCE | | | | 2021 Proxy Statement | | 11 |

Ford determines the most suitable leadership structure from time to time. At present, the Board of Directors has chosen to separate the roles of CEO and Chairman of the Board of Directors. James D. Farley, Jr., is our President and CEO, and William Clay Ford, Jr., is Chairman of the Board of Directors as well as our Executive Chairman. We believe this structure is optimal for Ford at this time because it allows Mr. Farley to focus on leading the organization while allowing Mr. Ford to focus on leading the Board of Directors. Furthermore, the Board has appointed Anthony F. Earley, Jr., as our Lead Independent Director. We believe having a Lead Independent Director is an important governance

practice given that the Chairman of the Board, Mr. Ford, is not an independent director under our Corporate Governance Principles. The duties of the Lead Independent Director include:

This structure optimizes the roles of CEO, Chairman, and Lead Independent Director and provides Ford with sound corporate governance in the management of its business.

Board Meetings, Composition, and Committees

COMPOSITION OF BOARD OF DIRECTORS / NOMINEES

The Nominating and Governance Committee recommends the nominees for all directorships. The Committee also reviews and makes recommendations to the Board on matters such as the size and composition of the Board in order to ensure the Board has the requisite expertise and its membership consists of persons with sufficiently diverse and independent backgrounds. Between annual shareholder meetings, the Board may elect directors to the Board to serve until the next annual meeting. In 2018, we implemented a more robust peer and Board and Committee self-assessment process. In 2020, we engaged an outside party to communicate with each director concerning Board dynamics and effectiveness and provide feedback to the Board on areas of strengths, weaknesses, and opportunities for improvement. We also instituted an evaluation process whereby every five years each director's skills and qualifications are analyzed as to whether such skills and qualifications remain relevant in light of changing business conditions.

For many years we have maintained a mandatory retirement age of 72 for directors. In 2019, the Board

adopted a policy for new independent directors whereby it is expected that an independent director may serve up to 15 one-year terms, unless unique circumstances warrant additional terms. We will continue to maintain the mandatory retirement age of 72 so that for new independent directors it is expected that they will not be re-nominated when they reach the earlier of having served for 15 terms or age 72, absent a waiver from the Board for unique circumstances.

In October 2020, the Committee recommended that the size of the Board be increased to 14 and re-elected Jon M. Huntsman, Jr., to the Board. Gov. Huntsman previously served on the Board from 2012-2017, when he resigned to serve as the U.S. Ambassador to Russia. Edsel B. Ford II is not standing for re-election this year having reached our mandatory retirement age. John C. Lechleiter is also not standing for re-election this year due to personal reasons and not due to any disagreement on any matter relating to the Company's operations, policies, or practices. In March 2021, the Committee recommended that the size of the Board remain at 14 at the time of the 2021 Annual Meeting and nominated Alexandra Ford English and Henry Ford III to stand for election at the 2021 Annual Meeting.

The Board believes that, with the addition of its new nominees, it will have an appropriate mix of short- and medium-tenured directors as well as long-tenured directors which provide a balance that enables the Board to benefit from fresh insights and historical perspectives during its deliberations and inform Board succession planning.

| | | | | | |

12 | | CORPORATE GOVERNANCE | | | | 2021 Proxy Statement |

In addition, having a Ford family member, William Clay Ford, Jr., as our Executive Chairman brings a unique and historical long-term perspective to Board deliberations. Our new nominees, Alexandra Ford English and Henry Ford III, will provide fresh perspectives and valuable insights while continuing the Ford family's nearly 118 years of active involvement with and stewardship of the Company. Alexandra Ford English is the daughter of William Clay Ford, Jr. and Henry Ford III is the son of our retiring director Edsel B. Ford II. William Clay Ford, Jr. and Edsel B. Ford II are first cousins.

The Board proposes to you a slate of nominees for election to the Board at the annual meeting. You may propose nominees (other than self-nominations) for consideration by the Committee by submitting the names, qualifications, and other supporting information to: Secretary, Ford Motor Company, One American Road, Dearborn, MI 48126. Properly submitted recommendations must be received no later than December 2, 2021, to be considered by the Committee for inclusion in the following year's nominations for election to the Board. Your properly submitted candidates are evaluated in the same manner as those candidates recommended by other sources. All candidates are considered in light of the needs of the Board with due consideration given to the qualifications described on p. 28 under Election of Directors.

EXECUTIVE SESSIONS OF NON-EMPLOYEE DIRECTORS

Non-employee directors ordinarily meet in executive session without management present at most regularly scheduled Board meetings and may meet at other times at the discretion of the Lead Independent Director or at the request of any non-employee director. Additionally, all of the independent directors meet periodically (at least annually) without management or non-independent directors present.

BOARD COMMITTEES

Only independent directors serve on the Audit, Compensation, and Nominating and Governance Committees, in accordance with the independence standards of the New York Stock Exchange LLC ("NYSE") Listed Company and Securities and Exchange Commission ("SEC") rules and the Company's Corporate Governance Principles. Under these standards members of the Audit Committee also satisfy the heightened SEC independence standards for audit committees and the members of the Compensation Committee satisfy the additional NYSE independence standards for compensation committees. Each member of the Audit Committee also meets the financial literacy requirements of the NYSE Listed Company rules. The Board, and each committee of the Board, has the authority to engage independent consultants and advisors at the Company's expense.

The Company has published on its website (www.corporate.ford.com) the charter of each of the Audit, Compensation, Finance, Nominating and Governance, and Sustainability and Innovation Committees of the Board. Printed copies of each of the committee charters are available by writing to our Shareholder Relations Department at Ford Motor Company, Shareholder Relations, P.O. Box 6248, Dearborn, MI 48126.

BOARD COMMITTEE FUNCTIONS

Audit Committee: Selects the independent registered public accounting firm, subject to shareholder ratification, and determines the compensation of the independent registered public accounting firm.

At least annually, reviews a report by the independent registered public accounting firm describing: internal quality control procedures, any issues raised by an internal or peer quality control review, any issues raised by a governmental or professional authority investigation in the past five years and any steps taken to deal with such issues, and (to assess the independence of the independent registered public accounting firm) all relationships between the independent registered public accounting firm and the Company.

Consults with the independent registered public accounting firm, reviews and approves the scope of their audit, and reviews their independence and performance. Also, annually approves categories of services to be performed by the independent registered public accounting firm and reviews and, if appropriate, approves in advance any new proposed engagement greater than $250,000.

Reviews internal controls, accounting practices, and financial reporting, including the results of the annual audit and the review of the interim financial statements with management and the independent registered public accounting firm.

Reviews activities, organization structure, and qualifications of the General Auditor's Office, and participates in the appointment, dismissal, evaluation, and determination of the compensation of the General Auditor.

Discusses earnings releases and guidance provided to the public and rating agencies.

Reviews, at least annually, policies with respect to risk assessment and risk management.

Exercises reasonable oversight with respect to the implementation and effectiveness of the Company's compliance and ethics program, including being knowledgeable about the content and operation of the compliance and ethics program.

Reviews, with the Office of the General Counsel, any legal or regulatory matter that could have a significant impact on the financial statements.

| | | | �� | | |

CORPORATE GOVERNANCE | | | | 2021 Proxy Statement | | 13 |

As appropriate, obtains advice and assistance from outside legal, accounting, or other advisors.

Prepares an annual report of the Audit Committee to be included in the Company's proxy statement.

Reviews our cyber security practices periodically, at least twice each year.

Assesses annually the adequacy of the Audit Committee Charter.

Reports to the Board of Directors about these matters.

Compensation Committee: Establishes and reviews the overall executive compensation philosophy and strategy of the Company.

Reviews and discusses key people-related business strategies, including leadership succession planning, culture, diversity and inclusion, and talent development programs.

Reviews and approves Company goals and objectives related to the Executive Chairman, the President and CEO, and other executive officers' compensation, including annual performance objectives.

Evaluates the performance of the Executive Chairman, the President and CEO, and other executive officers in light of established goals and objectives and, based on such evaluation, reviews and approves the annual salary, bonus, stock options, Performance Units, other stock-based awards, other incentive awards, and other benefits, direct and indirect, of the Executive Chairman, the President and CEO, and other executive officers.

Conducts a risk assessment of the Company's compensation policies and practices.

Considers and makes recommendations on Ford's executive compensation plans and programs.

Reviews the Compensation Discussion and Analysis to be included in the Company's proxy statement.

Prepares an annual report of the Compensation Committee to be included in the Company's proxy statement.

Assesses the independence of the Committee's consultant. Assesses annually the adequacy of the Compensation Committee Charter.

Reports to the Board of Directors about these matters.

Finance Committee: Reviews all aspects of the Company's policies and practices that relate to the management of the Company's financial affairs, consistent with law and specific instructions given by the Board of Directors.

Reviews capital allocation priorities, policies, and guidelines, including the Company's cash flow, minimum cash requirements, and liquidity targets.

Reviews the Company's capital appropriations financial performance against targets by conducting interim reviews and an annual review of previously approved capital programs and periodic review of acquisitions and new business investments.

Reviews with management, at least annually, the annual report from the Treasurer of the Company's cash and funding plans and other Treasury matters.

Reviews the strategy and performance of the Company's pension and other retirement and savings plans.

Performs such other functions and exercises such other powers as may be delegated to it by the Board of Directors from time to time.

Reviews, at least annually, policies with respect to financial risk assessment and financial risk management.

Assesses annually the adequacy of the Finance Committee Charter.

Reports to the Board of Directors about these matters.

Nominating and Governance Committee: Reviews and makes recommendations on: (i) the nominations or election of directors and (ii) the size, diversity, composition, and compensation of the Board.

Establishes criteria for selecting new directors and the evaluation of the Board, including whether current members and candidates possess skills and qualifications that support the Company's strategy.

Develops and recommends to the Board corporate governance principles and guidelines.

Reviews the charter and composition of each committee of the Board and makes recommendations to the Board for the adoption of or revisions to the committee charters, the creation of additional committees, or the elimination of committees.

Considers the adequacy of the By-Laws and the Restated Certificate of Incorporation of the Company and recommends to the Board, as appropriate, that the Board: (i) adopt amendments to the By-Laws and (ii) propose, for consideration by the shareholders, amendments to the Restated Certificate of Incorporation.

Considers shareholder suggestions for director nominees (other than self-nominations). See Composition of Board of Directors/Nominees on pp. 12-13.

Assesses annually the adequacy of the Nominating and Governance Committee Charter.

Reports to the Board of Directors about these matters.

| | | | | | |

14 | | CORPORATE GOVERNANCE | | | | 2021 Proxy Statement |

Sustainability and Innovation Committee: Evaluates and advises on the Company's pursuit of innovative practices and technologies that improve environmental and social sustainability, enrich our customers' experiences, and increase shareholder value.

Discusses and advises on the innovation strategies and practices used to develop and commercialize technologies.

Annually reviews the Company's Sustainability Report Summary and initiatives related to innovation.

Assesses annually the adequacy of the Sustainability and Innovation Committee Charter.

Reports to the Board of Directors about these matters.

Board's Role in Risk Management

The oversight responsibility of the Board and its committees is supported by Company management and the risk management processes that are currently in place. Ford has extensive and effective risk management processes, relating specifically to compliance, reporting, operating, and strategic risks.

Compliance Risk encompasses matters such as legal and regulatory compliance (e.g., Foreign Corrupt Practices Act, environmental, OSHA/safety, etc.).

Reporting Risk covers Sarbanes-Oxley compliance, disclosure controls and procedures, and accounting compliance.

Operating Risk addresses the myriad of matters related to the operation of a complex company such as Ford (e.g., quality, supply chain, sales and service, financing and liquidity, product development and engineering, labor, etc.).

Strategic Risk encompasses somewhat broader and longer-term matters, including, but not limited to, technology development, environmental and social sustainability, capital allocation, management development, retention and compensation, competitive developments, and geopolitical developments.

We believe that key success factors in the risk management at Ford include a strong risk analysis tone set by the Board and senior management, which is shown through their commitment to effective top-down and bottom-up communication (including communication between management and the Board and Committees), and active cross-functional participation among the Business Units and Functional Skill Teams. We have institutionalized a regular Operations Flash and Special Attention Review process where the senior leadership of the Company reviews the status of the business, the risks and opportunities presented to the business (in the areas of compliance, reporting, operating, and strategic risks), and, utilizing the principles of design thinking and critical thinking, develops specific plans to address those risks and opportunities.

The Enterprise Risk Management process adopted by the Company identifies the top 12 critical enterprise risks identified through a survey process of senior management and the Board of Directors. Once identified, each of the top 12 risks is assigned an executive risk owner who is responsible to oversee risk assessment, develop mitigation plans, and provide regular updates. The process includes that Business Units and Skill Teams will follow the same process for local risk identification and management. Risks at all levels are shared and aligned for a top-down and bottom-up view and management of risk. The Audit Committee and Board annually review the process to update the list of critical risks and monitor risk movement and emerging trends.

As noted above, the full Board of Directors has overall responsibility for the oversight of risk management at Ford and oversees operating risk management with reviews at each of its regular Board meetings. The Board of Directors has delegated responsibility for the oversight of specific areas of risk management to certain committees of the Board, with each Board committee reporting to the full Board following each committee meeting. The Audit Committee assists the Board of Directors in overseeing compliance and reporting risk. The Sustainability and Innovation Committee assists the Board of Directors in overseeing environmental and social sustainability risks, while the Compensation Committee assists the Board of Directors in overseeing risks related to compensation and people-related business strategies, including leadership succession and culture, diversity, and inclusion. The Board and the appropriate committees also periodically review other policies related to personnel matters, including those related to sexual harassment and anti-retaliation policies related to whistleblowers. The Board, the Sustainability and Innovation Committee, the Compensation Committee, and the Finance Committee all play a role in overseeing strategic risk management.

The scope and severity of risks presented by cyber threats have increased dramatically, and constant vigilance is required to protect against intrusions. We take cyber threats very seriously and regularly audit our cyber security capabilities. These audits are a useful tool for ensuring that we maintain a robust cyber security program to protect our investors, customers,

| | | | | | |

CORPORATE GOVERNANCE | | | | 2021 Proxy Statement | | 15 |

employees, and intellectual property. The Audit Committee reviews our cyber security practices regularly with report outs to the Board as appropriate.

We also maintain an industry-leading cyber security insurance program with many of the world's largest and most respected insurance companies. Additionally, we are a founding member of the Board of the Automotive Information Sharing and Analysis Center. Our current seat on that board ensures that we preserve

relationships that help to protect ourselves against both enterprise and in-vehicle security risks.

Please refer to our Integrated Sustainability and Financial Report (www.shareholder.ford.com) for additional information about how we identify and address environmental and social sustainability risks.

| OVERSIGHT OF RISK MANAGEMENT | ||||

COMPLIANCE & REPORTING | OPERATING & STRATEGIC | |||

| | | | | |

| FORD BOARD Oversight | Audit Committee | Sustainability & Innovation Committee Compensation Committee Finance Committee | ||

| | | | | |

| FORD MANAGEMENT Day-to-Day | Compliance Reviews Sarbanes-Oxley Compliance Internal Controls Disclosure Committee | Business Units & Skill Teams Operations Flash Special Attention Review Product, Strategy, and People Forums | ||

AUDIT COMMITTEE FINANCIAL EXPERT AND AUDITOR ROTATION

The Charter of the Audit Committee provides that a member of the Audit Committee generally may not serve on the audit committee of more than two other public companies. The Board has designated John B. Veihmeyer as an Audit Committee financial expert. Mr. Veihmeyer meets the independence standards for audit committee members under the NYSE Listed Company and SEC rules. Mr. Veihmeyer is also the chair of the Audit Committee. The lead partner of the Company's independent registered public accounting firm is rotated at least every five years.

RISK ASSESSMENT REGARDING COMPENSATION POLICIES AND PRACTICES

In 2020, we conducted an annual assessment of our compensation policies and practices, including our executive compensation programs, to evaluate the potential risks associated with these policies and practices. We reviewed and discussed the findings of the assessment with the Compensation Committee and concluded that our compensation programs are designed with an appropriate balance of risk and reward and do not encourage excessive or unnecessary risk-taking behavior. As a result, we do not believe that risks relating to our compensation policies and practices for our employees are reasonably likely to have a material adverse effect on the Company.

In conducting this review, we considered the following attributes of our programs:

| | | | | | |

16 | | CORPORATE GOVERNANCE | | | | 2021 Proxy Statement |

short-term results without regard to longer-term consequences.

Recoupment Policy. The Committee maintains a policy of recoupment of compensation in certain circumstances. The purpose of this policy is to help ensure executives act in the best interests of the Company. The policy requires any Company officer to repay or return cash bonuses and equity awards in the event: (i) the Company issues a material restatement of its financial statements, and the restatement was caused by such officer's intentional misconduct; (ii) such officer was found to be in violation of non-compete provisions of any plan or agreement; or (iii) such officer has committed ethical or criminal violations. The Committee will consider all relevant factors and exercise business judgment in determining any appropriate amounts to recoup up to 100% of any awards.

Our Compensation Committee considered compensation risk implications during its deliberations on the design of our executive compensation programs with the goal of appropriately balancing short-term incentives and long-term performance.

Hedging and Pledging Policies. The Committee maintains the following policy related to hedging exposure to common stock:

Certain forms of hedging or monetization transactions, such as forward sale contracts, allow a person to lock in much of the value of his or her stock holdings, often in exchange for all or part of the potential for upside appreciation in the stock. These transactions allow an officer to continue to own Ford common stock, but without the full risks and rewards of ownership. When that occurs, the officer may no longer have the same incentives or objectives as the Company's other shareholders. Consequently, officers are prohibited from engaging in hedging their exposure to directly or indirectly owned Ford common stock, whether obtained through compensation, open-market purchases, or otherwise. For purposes of this policy, "hedging" includes the purchase of financial instruments (including prepaid variable forward contracts, equity swaps, collars, and exchange funds), or otherwise engaging in transactions that hedge or offset, or are designed to hedge or offset, any decrease in the market value of Ford common stock. Any hedges of Ford common stock in existence at the time a person becomes subject to this policy are grandfathered, but are prohibited from being renewed or extended.

In addition, the Committee maintains the following policy related to the pledging of common stock:

Pledges of Ford common stock by an officer can result in the sale of shares without the consent of the officer if the obligation secured by the shares is in default, and if this occurs during a blackout period it could result in an insider trading violation by that officer. Pledges of Ford common stock in a brokerage margin account (where shares are pledged to secure a loan to buy other securities) present significant insider trading risk because the shares can be sold automatically with a decline in the stock price. In addition, the reputation of the Company, as well as officers' personal reputations, can be adversely affected if Ford common stock is sold pursuant to a defaulted obligation. Consequently, officers are prohibited from engaging in pledging directly or indirectly owned Ford common stock to secure obligations of a brokerage margin account as described above. Officers may pledge shares of Ford common stock other than in brokerage margin accounts as long as the following conditions are met: (i) only shares that exceed applicable stock ownership guidelines may be pledged and (ii) any such pledge receives the prior approval of the Chief Executive Officer and Office of the General Counsel. Any pledges of Ford common stock in existence at the time a person becomes subject to this policy are grandfathered, but are prohibited from being renewed or extended, unless such renewal or extension complies with this policy.

Regarding directors, the 2014 Stock Plan for Non-Employee Directors prohibits the hedging and pledging of common stock received pursuant to that plan.

COMPENSATION COMMITTEE OPERATIONS

The Compensation Committee establishes and reviews our executive compensation philosophy and strategy and oversees our various executive compensation programs. The Committee is responsible for evaluating the performance of and determining the compensation for our Executive Chairman, the President and CEO, and other executive officers and approving the compensation structure for senior management, including officers. The Committee is currently comprised of five directors who are considered independent under the NYSE Listed Company rules and our Corporate Governance Principles. The Committee's membership is determined by our Board of Directors. The Committee operates under a written charter adopted by our Board of Directors. The Committee annually reviews the charter. A copy of the charter may be found on our website at www.corporate.ford.com.

| | | | | | |

CORPORATE GOVERNANCE | | | | 2021 Proxy Statement | | 17 |

The Committee makes decisions regarding the compensation of our executive officers, including the Named Executives. The Committee has delegated authority, within prescribed share limits, to a Long-Term Incentive Compensation Award Committee (comprised of our Chairman and our President and CEO) to approve grants of options, Performance Units, Time-Based Units, and other stock-based awards, and to the Annual Incentive Compensation Award Committee (also comprised of our Chairman and our President and CEO) to determine bonuses for other employees. The Committee also delegated authority to the Office of the Chairman and Chief Executive (also comprised of our Chairman and our President and CEO) to determine the compensation of non-executive officers. The Committee regularly reviews such determinations.

The Board of Directors makes decisions relating to non-employee director compensation. Any proposed changes are reviewed in advance and recommended to the Board by the Nominating and Governance Committee (see Director Compensation in 2020 on pp. 36-37).

The Compensation Committee considers recommendations from the Chairman, the President and CEO, and the Chief People and Employee Experience Officer in developing compensation plans and evaluating performance of other executive officers. The Committee's consultant also provides advice and analysis on the structure and level of executive compensation. Final decisions on any major element of compensation, however, as well as total compensation for executive officers, are made by the Compensation Committee.

As in prior years, in 2020, the Committee engaged Semler Brossy Consulting Group, LLC, an independent compensation consulting firm, to advise the Committee on executive compensation and benefits matters. Semler Brossy is retained directly by the Committee, which has the sole authority to review and approve the budget of the independent consultant. Semler Brossy does not advise our management and receives no other compensation from us. The same Semler Brossy principal attended ten of the eleven Committee meetings in 2020.

The Committee has analyzed whether the work of Semler Brossy as a compensation consultant has raised any conflict of interest, taking into consideration the following factors: (i) the provision of any other services to the Company by Semler Brossy; (ii) the amount of

fees the Company paid to Semler Brossy as a percentage of the firm's total revenue; (iii) Semler Brossy's policies and procedures that are designed to prevent conflicts of interest; (iv) any business or personal relationship of Semler Brossy or the individual compensation advisor employed by the firm with an executive officer of the Company; (v) any business or personal relationship of the individual compensation advisor with any member of the Committee; and (vi) any stock of the Company owned by Semler Brossy or the individual compensation advisor employed by the firm. The Committee has determined, based on its analysis of the above factors, that the work of Semler Brossy and the individual compensation advisor employed by Semler Brossy as compensation consultant to the Committee has not created any conflict of interest.

In addition, the Committee reviewed survey data provided by the Willis Towers Watson Executive Compensation Database (see Competitive Survey on pp. 52-53). Willis Towers Watson does not make recommendations to, nor does it assist, the Committee in determining compensation of executive officers. Willis Towers Watson is retained by Ford management, not the Committee.

Committee meetings typically occur prior to the meetings of the full Board of Directors. Incentive Bonus targets and awards, Performance Unit grants, Time-Based Units, stock options, if any, and cash awards typically are decided at the February or March Committee meeting (see Timing of Equity Awards on pp. 54-55). Officer salaries are reviewed in February or March each year.

See the Compensation Discussion and Analysis on pp. 42-78 for more detail on the factors considered by the Committee in making executive compensation decisions. The Committee reviews our talent and executive development program with senior management. These reviews are conducted periodically and focus on executive development and succession planning throughout the organization, at the Leadership Level 1 officer level and above.

Our policy, approved by the Compensation Committee, to limit outside board participation by our officers, is:

| | | | | | |

18 | | CORPORATE GOVERNANCE | | | | 2021 Proxy Statement |

DIRECTOR INDEPENDENCE

A majority of the directors must be independent directors under applicable SEC and NYSE Listed Company rules. These rules provide that no director can qualify as independent unless the Board affirmatively determines that the director has no material relationship with the listed company. The Board has adopted the following standards in determining whether or not a director has a material relationship with the Company. These standards are contained in Ford's Corporate Governance Principles and may be found at the Company's website, www.corporate.ford.com.

Other Relationships. The following commercial, charitable, and educational relationships will not be

considered to be material relationships that would impair a director's independence:

Based on these independence standards and all of the relevant facts and circumstances, the Board determined that none of the following directors had any material relationship with the Company and, thus, are independent: Kimberly A. Casiano, Anthony F. Earley, Jr., William W. Helman IV, Jon M. Huntsman, Jr., William E. Kennard, John C. Lechleiter, Beth E. Mooney, John L. Thornton, John B. Veihmeyer, Lynn M. Vojvodich, and John S. Weinberg. Additionally, the Board

| | | | | | |

CORPORATE GOVERNANCE | | | | 2021 Proxy Statement | | 19 |

determined that each of Kimberly A. Casiano, Beth E. Mooney, John B. Veihmeyer, and Lynn M. Vojvodich is independent under the heightened SEC independence standards for audit committees and that each of Anthony F. Earley, Jr., Jon M. Huntsman, Jr., John C. Lechleiter, John L. Thornton, and John S. Weinberg is independent under the additional NYSE independence standards for compensation committees. Additionally, the Board determined that Stephen G. Butler, who did not stand for election at the 2020 Annual Meeting, had no material relationship with the Company during the time of his service and, thus, was independent, and that he was independent under the heightened SEC independence standards for audit committees.

We are in discussions with Gov. Huntsman regarding expanding his role advising on policy-related matters and government relations. In connection with entering into this expanded role, the Board may determine that Gov. Huntsman will cease to be an independent director under the rules of the New York Stock Exchange. If Gov. Huntsman takes on this expanded role, he would remain on the Board and on the Sustainability and Innovation Committee, but he would step down from the Compensation and the Nominating and Governance Committees. We believe that Gov. Huntsman's vast government experience, as a governor, ambassador and trade representative; his public company experience, as a board member and senior executive; and his knowledge of our company make him a critical member of our Board. If Gov. Huntsman is determined to be no longer independent, 64% of our director nominees

would be independent. Our Audit, Compensation and Nominating and Governance Committees would remain fully independent.

DISCLOSURE OF RELEVANT FACTS AND CIRCUMSTANCES

With respect to the independent directors listed above, the Board considered the following relevant facts and circumstances in making the independence determinations:

From time to time during the past three years, Ford purchased goods and services from, sold goods and services to, or financing arrangements were provided by, various companies with which certain directors were or are affiliated either as a member of such company's board of directors or, in the case of Ms. Mooney and Messrs. Thornton and Weinberg, as an officer of such a company or, in the case of Gov. Huntsman, where an immediate family member serves as an officer of such a company. In addition to Ms. Mooney, Gov. Huntsman, and Messrs. Thornton and Weinberg, these directors included Messrs. Earley, Kennard, and Veihmeyer, and Ms. Vojvodich. The Company also made donations to certain institutions with which certain directors are affiliated. These included Messrs. Earley, Thornton, and Veihmeyer, Dr. Lechleiter, and Mss. Casiano and Mooney. In addition, the Company made a charitable donation on behalf of the Board in lieu of holiday gifts. None of the relationships described above was material under the independence standards contained in our Corporate Governance Principles.

The Company has published on its website (www.corporate.ford.com) its code of conduct handbook, which applies to all officers and employees, a code of ethics for directors, and a code of ethics for the Company's chief executive officer as well as senior financial and accounting personnel. Any waiver of, or amendments to, the codes of ethics for directors or executive officers, including the chief executive officer,

the chief financial officer, and the principal accounting officer, must be approved by the Nominating and Governance Committee, and any such waivers or amendments will be disclosed promptly by the Company by posting such waivers or amendments to its website. Both the Audit Committee and the Nominating and Governance Committee review management's monitoring of compliance with the Company's Code of Conduct. Printed copies of each of the codes of ethics referred to above are also available by writing to our Shareholder Relations Department at Ford Motor Company, Shareholder Relations, P.O. Box 6248, Dearborn, MI 48126.

| | | | | | |

20 | | CORPORATE GOVERNANCE | | | | 2021 Proxy Statement |

Communications with the Board and Annual Meeting Attendance

The Board has established a process by which you may send communications to the Board as a whole, the non-employee Directors as a group, or the Lead Independent Director. You may send communications to our Directors, including any concerns regarding Ford's accounting, internal controls, auditing, or other matters, to the following address: Board of Directors (or Lead Independent Director or non-employee Directors as a group, as appropriate), Ford Motor Company, P.O. Box 685, Dearborn, MI 48126-0685. You may submit your concern anonymously or confidentially. You may also indicate whether you are a shareholder, customer, supplier, or other interested party.

Communications relating to the Company's accounting, internal controls, or auditing matters will be relayed to the Audit Committee. Communications relating to governance will be relayed to the Nominating and Governance Committee. All other communications will be referred to other areas of the Company for handling as appropriate under the facts and circumstances outlined in the communications. Responses will be sent to those that include a return address, as appropriate.

You can also find a description of the manner in which you can send communications to the Board on the Company's website (www.corporate.ford.com).

All members of the Board are expected to participate in the annual meeting, unless unusual circumstances would prevent such participation. Last year, of the thirteen then current members of the Board, thirteen attended the virtual annual meeting.

FIVE PERCENT BENEFICIAL OWNERS OF COMMON STOCK

Pursuant to SEC filings, the Company was notified that as of December 31, 2020, the entities included in the table below had more than a 5% ownership interest of Ford common stock, or owned securities convertible into more than 5% ownership of Ford common stock, or owned a combination of Ford common stock and securities convertible into Ford common stock that could result in more than 5% ownership of Ford common stock.

| | | | | | | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | |

| | Name of Beneficial Owner | Address of Beneficial Owner | Ford Common Stock | Percent of Outstanding Ford Common Stock | | |||||

| | | | | | | | | | | |

State Street Corporation and certain of its affiliates* | State Street Financial Center One Lincoln Street Boston, MA 02111 | 347,337,522 | 8.89% | |||||||

| | | | | | | | | | | |

The Vanguard Group and certain of its affiliates | The Vanguard Group 100 Vanguard Blvd. Malvern, PA 19355 | 288,820,844 | 7.39% | |||||||

| | | | | | | | | | | |

BlackRock, Inc. and certain of its affiliates | BlackRock, Inc. 55 East 52nd Street New York, NY 10055 | 271,606,151 | 7.0% | |||||||

| | | | | | | | | | | |

| | | | | | |

CORPORATE GOVERNANCE | | | | 2021 Proxy Statement | | 21 |

FIVE PERCENT BENEFICIAL OWNERS OF CLASS B STOCK

As of February 1, 2021, the persons included in the table below beneficially owned more than 5% of the outstanding Class B Stock.

| | | | | | | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | |

| | Name of Beneficial Owner | Address of Beneficial Owner | Ford Class B Stock | Percent of Outstanding Ford Class B Stock | | |||||

| | | | | | | | | | | |

| Lynn F. Alandt* | Ford Estates, 2000 Brush, Detroit, MI 48226 | 10,086,236 | 14.24% | |||||||

| David P. Larsen, as trustee of various trusts** | Ford Estates, 2000 Brush, Detroit, MI 48226 | 11,328,959 | 15.99% | |||||||

| Voting Trust*** | Ford Estates, 2000 Brush, Detroit, MI 48226 | 70,778,212 | 99.90% |

BENEFICIAL STOCK OWNERSHIP

The following table shows how much Ford stock each current director, nominee, and Named Executive beneficially owned as of February 1, 2021. No director, nominee, or executive officer, including Named Executives, beneficially owned more than 0.10% of Ford's total outstanding common stock nor did any such person beneficially own more than 0.01% of Ford common stock units as of February 1, 2021. Executive officers held options exercisable on or within 60 days after February 1, 2021 to buy 2,497,736 shares of Ford common stock.

| | | | | | | | | |

Name | Ford Common Stock 1,2 | Ford Common Stock Units 3 | ||||||

| | | | | | | | | |

Kimberly A. Casiano* | 153,950 | 159,751 | ||||||

Anthony F. Earley, Jr.* | 208,544 | 71,885 | ||||||

James D. Farley, Jr.* | 1,886,212 | 0 | ||||||

Ashwani ("Kumar") Galhotra | 639,630 | 0 | ||||||

James P. Hackett | 1,184,437 | 0 | ||||||

William W. Helman IV* | 162,029 | 42,641 | ||||||

Jon M. Huntsman, Jr.* | 6,927 | 0 | ||||||

William E. Kennard* | 132,481 | 0 | ||||||

John T. Lawler | 632,711 | 65 |

| | | | | | | | | |

Name | Ford Common Stock 1,2 | Ford Common Stock Units 3 | ||||||

| | | | | | | | | |

John C. Lechleiter** | 336,994 | 5,760 | ||||||

Beth E. Mooney* | 50,538 | 0 | ||||||

Tim Stone | 702,007 | 0 | ||||||

Hau Thai-Tang | 1,379,942 | 100 | ||||||

John L. Thornton* | 245,398 | 330,397 | ||||||

John B. Veihmeyer* | 108,107 | 0 | ||||||

Lynn M. Vojvodich* | 98,941 | 0 | ||||||

John S. Weinberg* | 155,391 | 0 |

Name | Ford Common Stock 1,2 | Ford Common Stock Units 3 | Ford Class B Stock | Percent of Outstanding Ford Class B Stock | ||||||||

| | | | | | | | | | | | | |

Alexandra Ford English* | 10,944 | 0 | 105,810 | 0.15% | ||||||||

Edsel B. Ford II** | 1,347,906 | 174,720 | 4,837,573 | 6.83% | ||||||||

Henry Ford III* | 435,155 | 0 | 1,235,369 | 1.74% | ||||||||

William Clay Ford, Jr.* | 4,353,279 | 201,552 | 15,721,009 | 22.19% | ||||||||

| | | | | | | | | | | | | |

All Directors and Executive Officers as a group | ||||||||||||

22 persons beneficially owned 0.34% of Ford common stock or securities convertible into Ford common stock as of February 1, 2021 | ||||||||||||

| | | | | | | | | | | | | |

| | | | | | |

22 | | CORPORATE GOVERNANCE | | | | 2021 Proxy Statement |

In addition, amounts shown include Restricted Stock Units issued under the LTI Plans as follows: 510,362 units for Mr. Farley; 451,981 units for William Clay Ford, Jr.; 291,253 units for Mr. Galhotra; 570,460 units for Mr. Hackett; 392,545 for Mr. Lawler; 482,914 for Mr. Stone; and 612,774 for Mr. Thai-Tang.

In addition, amounts shown include Restricted Stock Units issued under the 2014 Stock Plan for Non-Employee Directors of Ford Motor Company ("2014 Plan") as follows: 145,787 units for Ms. Casiano; 141,988 units for Mr. Earley; 6,927 units for Gov. Huntsman; 132,481 units for Mr. Kennard; 216,994 units for Dr. Lechleiter; 50,538 units for Ms. Mooney; 108,107 units for Mr. Veihmeyer; 98,941 units for Ms. Vojvodich; and 155,391 units for Mr. Weinberg.

Included in the stock ownership shown in the table above: Edsel B. Ford II has disclaimed beneficial ownership of 393,285 shares of common stock and 969,317 shares of Class B Stock that are either held directly by his immediate family or by charitable funds which he controls. William Clay Ford, Jr., has disclaimed beneficial ownership of 719,553 shares of Class B Stock that are either held directly by members of his immediate family or indirectly by members of his immediate family in trusts in which Mr. Ford has no interest, including 76,033 shares of Class B Stock that are also beneficially owned by Alexandra Ford English and included in the amounts shown in the table above for each of William Clay Ford, Jr. and Alexandra Ford English. Present directors and executive officers as a group have disclaimed beneficial ownership of a total of 393,285 shares of common stock and 1,688,870 shares of Class B Stock. Alexandra Ford English has disclaimed beneficial ownership of 29,777 shares of Class B Stock that are held indirectly by members of her immediate family in trusts in which Ms. English has no interest. Henry Ford III has disclaimed beneficial ownership of 7,100 shares of common stock and 51,692 shares of Class B Stock that are held indirectly by members of his immediate family in trusts in which Mr. Ford III has no interest.

No director or executive officer had pledged shares of common stock as security or hedged their exposure to common stock.

| | | | | ||||

|---|---|---|---|---|---|---|---|

| | | | | | | | |

Person | Number of Shares | ||||||

| | | | | | | | |

James D. Farley, Jr. | 272,017 | ||||||

John T. Lawler | 82,366 | ||||||

William Clay Ford, Jr. | 1,642,300 | ||||||

Hau Thai-Tang | 154,710 |

| | | | | |||

|---|---|---|---|---|---|---|

| | | | | | | |

Person | Number of Shares | |||||

| | | | | | | |

Kumar Galhotra | 103,792 | |||||

James P. Hackett | 0 | |||||

Tim Stone | 0 |

| | | | | | |

CORPORATE GOVERNANCE | | | | 2021 Proxy Statement | | 23 |

Delinquent Section 16(a) Reports

Based on Company records and other information, Ford believes that all SEC filing requirements applicable to its directors and executive officers were complied with for 2020 and prior years.

Certain Relationships and Related Party Transactions

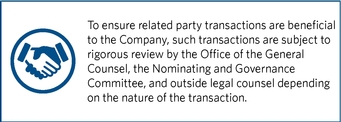

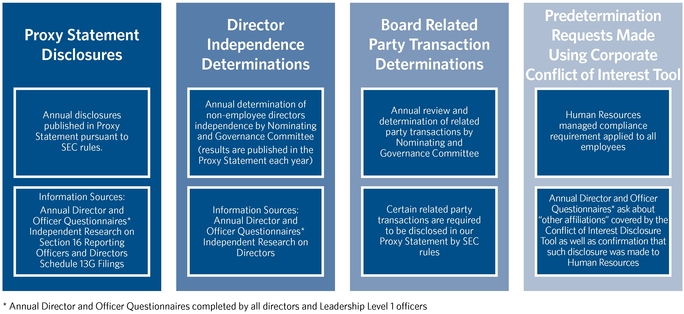

POLICY AND PROCEDURE FOR REVIEW AND APPROVAL OF RELATED PARTY TRANSACTIONS

Business transactions between Ford and its officers or directors, including companies in which a director or officer (or an immediate family member) has a substantial ownership interest or a company where such director or officer (or an immediate family member) serves as an executive officer ("related party transactions") are not prohibited. In fact, certain related party transactions can be beneficial to the Company and its shareholders.

It is important, however, to ensure that any related party transactions are beneficial to the Company. Accordingly, any related party transaction, regardless of amount, is submitted to the Nominating and Governance Committee in advance for review and approval. All existing related party transactions are reviewed at least annually by the Nominating and Governance Committee. The Office of the General Counsel reviews all such related party transactions, existing or proposed, prior to submission to the Nominating and Governance Committee, and our General Counsel opines on the appropriateness of each related party transaction. The Nominating and Governance Committee may, at its discretion, consult with outside legal counsel.

Any director or officer with an interest in a related party transaction is expected to recuse himself or herself from any consideration of the matter.

The Nominating and Governance Committee's approval of a related party transaction may encompass a series of subsequent transactions contemplated by the original approval, i.e., transactions contemplated by an ongoing business relationship occurring over a period of time. Examples include transactions in the normal course of business between the Company and a dealership owned by a director or an executive officer (or an immediate family member thereof), transactions in the normal

course of business between the Company and financial institutions with which a director or officer may be associated, and the ongoing issuances of purchase orders or releases against a blanket purchase order made in the normal course of business by the Company to a business with which a director or officer may be associated. In such instances, any such approval shall require that the Company make all decisions with respect to such ongoing business relationship in accordance with existing policies and procedures applicable to non-related party transactions (e.g., Company purchasing policies governing awards of business to suppliers, etc.).

In all cases, a director or officer with an interest in a related party transaction may not attempt to influence Company personnel in making any decision with respect to the transaction.

RELATED PARTY TRANSACTIONS

In February 2002, Ford entered into a Stadium Naming and License Agreement with The Detroit Lions, Inc. (the "Lions"), pursuant to which we acquired for $50 million, paid by us in 2002, the naming rights to a new domed stadium located in downtown Detroit at which the Lions began playing their home games during the 2002 National Football League season. We named the stadium "Ford Field." The term of the naming rights agreement is 25 years, which commenced with the 2002 National Football League season. Benefits to Ford under the naming rights agreement include exclusive exterior entrance signage and predominant interior promotional signage. Beginning in 2005, the Company also agreed to provide to the Lions, at no cost, eight new model year Ford, Lincoln or Mercury brand vehicles manufactured by Ford in North America for use by the management and staff of Ford Field and the Lions and to replace such vehicles in each second successive year, for the remainder of the naming rights agreement. The cost incurred during 2020 was $66,670. William Clay Ford, Jr., and his family own a minority equity interest in the Lions and Mr. Ford is a director and officer of the Lions.

In 2014, Ford entered into a Sponsorship Agreement with a wholly owned subsidiary of the Lions to be the exclusive title sponsor of an NCAA sanctioned, men's college football "Bowl" game to be played in each of the 2014-2016 seasons at Ford Field. We named the Bowl the "Quick Lane Bowl" for our Quick Lane Tire &

| | | | | | |

24 | | CORPORATE GOVERNANCE | | | | 2021 Proxy Statement |

Auto Center brand and acquired several broadcast television messages, event signage, and other advertising in exchange for a sponsorship fee. In 2016, the Company extended its sponsorship of the Quick Lane Bowl for another three years to cover the 2017-2019 seasons. In 2020, the Company extended its sponsorship through 2022. The cost incurred in 2020 was $715,000. Due to the COVID-19 pandemic, the Quick Lane Bowl did not occur in 2020, and, in 2021, the Company extended its sponsorship of the Quick Lane Bowl through 2023 as follows: 2021: $0 (2020 payment applies toward 2021); 2022: $736,500; 2023: $758,600.

Paul Alandt, Lynn F. Alandt's husband, is a minority owner of two Ford franchised dealerships and a Lincoln franchised dealership. In 2020, Ford charged the dealerships about $164.8 million for products and services in the ordinary course of business. In turn, Ford paid the dealerships about $33.1 million for services in the ordinary course of business. Also in 2020, Ford Motor Credit Company LLC, a wholly owned entity of Ford, provided about $281.8 million of financing to dealerships owned by Mr. Alandt and paid about $1.5 million to them in the ordinary course of business. The dealerships paid Ford Credit about $288.5 million in the ordinary course of business. Additionally, in 2020, Ford Credit purchased retail installment sales contracts and Red Carpet Leases from the dealerships in amounts of about $20.2 million and $117.9 million, respectively.