UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________

FORM 10-Q

(Mark One)

|

| | |

| R | Quarterly report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | |

| | For the quarterly period ended March 31, 2018 | |

or

|

| | |

| £ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | |

| | For the transition period from ____________________ to ____________________ | |

| | Commission file number 1-6368 | |

Ford Motor Credit Company LLC

(Exact name of registrant as specified in its charter)

|

| |

| Delaware | 38-1612444 |

| (State of organization) | (I.R.S. employer identification no.) |

| One American Road, Dearborn, Michigan | 48126 |

| (Address of principal executive offices) | (Zip code) |

(313) 322-3000

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. þ Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). þ Yes o No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

| | | |

Large accelerated filer o | Accelerated filer o | Non-accelerated filer þ | Smaller reporting company o |

Emerging growth company o | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

o Yes þ No

All of the limited liability company interests in the registrant (“Shares”) are held by an affiliate of the registrant. None of the Shares are publicly traded.

REDUCED DISCLOSURE FORMAT

The registrant meets the conditions set forth in General Instruction H(1)(a) and (b) of Form 10-Q and is therefore filing this Form with the reduced disclosure format.

FORD MOTOR CREDIT COMPANY LLC

QUARTERLY REPORT ON FORM 10-Q

For the Quarter Ended March 31, 2018

|

| | | |

| | | | |

| | Table of Contents | | Page |

| | | | |

| | Part I. Financial Information | | |

| | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | |

| | | |

| | Part II. Other Information | | |

| | | |

| | | |

| | | | |

PART I. FINANCIAL INFORMATION

ITEM 1. Financial Statements

FORD MOTOR CREDIT COMPANY LLC AND SUBSIDIARIES

CONSOLIDATED INCOME STATEMENT

(in millions)

|

| | | | | | | |

| | For the periods ended March 31, |

| | 2017 | | 2018 |

| | First Quarter |

| | (unaudited) |

| Financing revenue | | | |

| Operating leases | $ | 1,366 |

| | $ | 1,415 |

|

| Retail financing | 802 |

| | 948 |

|

| Dealer financing | 451 |

| | 536 |

|

| Other | 17 |

| | 22 |

|

| Total financing revenue | 2,636 |

| | 2,921 |

|

| Depreciation on vehicles subject to operating leases | (1,064 | ) | | (1,028 | ) |

| Interest expense | (729 | ) | | (912 | ) |

| Net financing margin | 843 |

| | 981 |

|

| Other revenue | |

| | |

|

| Insurance premiums earned | 40 |

| | 41 |

|

| Fee based revenue and other | 55 |

| | 58 |

|

| Total financing margin and other revenue | 938 |

| | 1,080 |

|

| Expenses | |

| | |

|

| Operating expenses | 304 |

| | 345 |

|

| Provision for credit losses (Note 6) | 152 |

| | 119 |

|

| Insurance expenses | 31 |

| | 12 |

|

| Total expenses | 487 |

| | 476 |

|

| | | | |

| Other income, net (Note 13) | 30 |

| | 37 |

|

| | | | |

| Income before income taxes | 481 |

| | 641 |

|

| Provision for / (Benefit from) income taxes | 148 |

| | (60 | ) |

| Net income | $ | 333 |

| | $ | 701 |

|

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

(in millions)

|

| | | | | | | |

| | For the periods ended March 31, |

| | 2017 | | 2018 |

| | First Quarter |

| | (unaudited) |

| Net income | $ | 333 |

| | $ | 701 |

|

| Other comprehensive income / (loss), net of tax (Note 12) | | | |

| Foreign currency translation | 90 |

| | 113 |

|

| Comprehensive income / (loss) | $ | 423 |

| | $ | 814 |

|

The accompanying notes are part of the financial statements.

Item 1. Financial Statements (Continued)

FORD MOTOR CREDIT COMPANY LLC AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEET

(in millions)

|

| | | | | | | |

| | December 31,

2017 | | March 31,

2018 |

| | (unaudited) |

| ASSETS | | | |

| Cash and cash equivalents (Note 3) | $ | 9,558 |

| | $ | 8,766 |

|

| Marketable securities (Note 3) | 2,881 |

| | 3,708 |

|

| Finance receivables, net (Note 4) | 116,003 |

| | 120,936 |

|

| Net investment in operating leases (Note 5) | 26,661 |

| | 26,715 |

|

| Notes and accounts receivable from affiliated companies | 1,076 |

| | 903 |

|

| Derivative financial instruments (Note 9) | 935 |

| | 754 |

|

| Other assets (Note 10) | 3,329 |

| | 3,301 |

|

| Total assets | $ | 160,443 |

| | $ | 165,083 |

|

| | | | |

| LIABILITIES | | | |

| Accounts payable | | | |

| Customer deposits, dealer reserves, and other | $ | 1,171 |

| | $ | 1,303 |

|

| Affiliated companies | 592 |

| | 922 |

|

| Total accounts payable | 1,763 |

| | 2,225 |

|

| Debt (Note 11) | 137,828 |

| | 141,974 |

|

| Deferred income taxes | 2,386 |

| | 2,251 |

|

| Derivative financial instruments (Note 9) | 310 |

| | 794 |

|

| Other liabilities and deferred income (Note 10) | 2,272 |

| | 2,154 |

|

| Total liabilities | 144,559 |

| | 149,398 |

|

| | | | |

| SHAREHOLDER’S INTEREST | | | |

| Shareholder’s interest | 5,227 |

| | 5,227 |

|

| Accumulated other comprehensive income / (loss) (Note 12) | (419 | ) | | (306 | ) |

| Retained earnings | 11,076 |

| | 10,764 |

|

| Total shareholder’s interest | 15,884 |

| | 15,685 |

|

| Total liabilities and shareholder’s interest | $ | 160,443 |

| | $ | 165,083 |

|

The following table includes assets to be used to settle the liabilities of the consolidated variable interest entities (“VIEs”). These assets and liabilities are included in the consolidated balance sheet above. See Notes 7 and 8 for additional information on our VIEs.

|

| | | | | | | |

| | December 31,

2017 | | March 31,

2018 |

| | (unaudited) |

| ASSETS | | | |

| Cash and cash equivalents | $ | 3,479 |

| | $ | 2,866 |

|

| Finance receivables, net | 56,250 |

| | 59,145 |

|

| Net investment in operating leases | 11,503 |

| | 11,984 |

|

| Derivative financial instruments | 64 |

| | 63 |

|

| | | | |

| LIABILITIES | | | |

| Debt | $ | 46,437 |

| | $ | 50,366 |

|

| Derivative financial instruments | 2 |

| | 5 |

|

The accompanying notes are part of the financial statements.

Item 1. Financial Statements (Continued)

FORD MOTOR CREDIT COMPANY LLC AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF SHAREHOLDER’S INTEREST

(in millions, unaudited)

|

| | | | | | | | | | | | | | | | |

| | | Shareholder’s Interest | | Accumulated Other Comprehensive Income / (Loss) (Note 12) | | Retained Earnings | | Total Shareholder’s Interest |

| Balance at December 31, 2016 | | $ | 5,227 |

| | $ | (890 | ) | | $ | 8,466 |

| | $ | 12,803 |

|

| Net income | | — |

| | — |

| | 333 |

| | 333 |

|

| Other comprehensive income / (loss), net of tax | | — |

| | 90 |

| | — |

| | 90 |

|

| Adoption of accounting standard (Note 2) | | — |

| | — |

| | 9 |

| | 9 |

|

| Distributions declared | | — |

| | — |

| | (28 | ) | | (28 | ) |

| Balance at March 31, 2017 | | $ | 5,227 |

| | $ | (800 | ) | | $ | 8,780 |

| | $ | 13,207 |

|

| | | | | | | | | |

| Balance at December 31, 2017 | | $ | 5,227 |

| | $ | (419 | ) | | $ | 11,076 |

| | $ | 15,884 |

|

| Net income | | — |

| | — |

| | 701 |

| | 701 |

|

| Other comprehensive income / (loss), net of tax | | — |

| | 113 |

| | — |

| | 113 |

|

| Distributions declared | | — |

| | — |

| | (1,013 | ) | | (1,013 | ) |

| Balance at March 31, 2018 | | $ | 5,227 |

| | $ | (306 | ) | | $ | 10,764 |

| | $ | 15,685 |

|

The accompanying notes are part of the financial statements.

Item 1. Financial Statements (Continued)

FORD MOTOR CREDIT COMPANY LLC AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF CASH FLOWS

(in millions)

|

| | | | | | | |

| | For the periods ended March 31, |

| | 2017 | | 2018 |

| | First Quarter |

| | (unaudited) |

| Cash flows from operating activities | | | |

| Net cash provided by / (used in) operating activities | $ | 1,460 |

| | $ | 2,009 |

|

| | | | |

| Cash flows from investing activities | | | |

| Purchases of finance receivables | (9,388 | ) | | (11,085 | ) |

| Principal collections of finance receivables | 8,880 |

| | 10,814 |

|

| Purchases of operating lease vehicles | (3,270 | ) | | (3,592 | ) |

| Proceeds from termination of operating lease vehicles | 2,166 |

| | 2,481 |

|

| Net change in wholesale receivables and other short-duration receivables | (1,510 | ) | | (3,668 | ) |

| Purchases of marketable securities | (1,883 | ) | | (2,287 | ) |

| Proceeds from sales and maturities of marketable securities | 1,479 |

| | 1,422 |

|

| Settlements of derivatives | 22 |

| | 100 |

|

| All other investing activities | (11 | ) | | 143 |

|

| Net cash provided by / (used in) investing activities | (3,515 | ) | | (5,672 | ) |

| | | | |

| Cash flows from financing activities | | | |

| Proceeds from issuances of long-term debt | 13,243 |

| | 16,779 |

|

| Principal payments on long-term debt | (11,731 | ) | | (12,156 | ) |

| Change in short-term debt, net | 722 |

| | (793 | ) |

| Cash distributions to parent | (28 | ) | | (1,013 | ) |

| All other financing activities | (37 | ) | | (28 | ) |

| Net cash provided by / (used in) financing activities | 2,169 |

| | 2,789 |

|

| | | | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | 58 |

| | 106 |

|

| | | | |

| Net increase / (decrease) in cash, cash equivalents and restricted cash | $ | 172 |

| | $ | (768 | ) |

| | | | |

| Cash, cash equivalents and restricted cash at January 1 | $ | 8,185 |

| | $ | 9,682 |

|

| Net increase / (decrease) in cash, cash equivalents and restricted cash | 172 |

| | (768 | ) |

| Cash, cash equivalents and restricted cash at March 31 | $ | 8,357 |

| | $ | 8,914 |

|

The accompanying notes are part of the financial statements.

Item 1. Financial Statements (Continued)

FORD MOTOR CREDIT COMPANY LLC AND SUBSIDIARIES

NOTES TO THE FINANCIAL STATEMENTS

Table of Contents

|

| | |

| Footnote | | Page |

| Presentation | |

| Accounting Policies | |

| Cash, Cash Equivalents, and Marketable Securities | |

| Finance Receivables | |

| Net Investment in Operating Leases | |

| Allowance for Credit Losses | |

| Transfers of Receivables | |

| Variable Interest Entities | |

| Derivative Financial Instruments and Hedging Activities | |

| Other Assets and Other Liabilities and Deferred Income | |

| Debt and Commitments | |

| Accumulated Other Comprehensive Income / (Loss) | |

| Other Income, Net | |

| Segment Information | |

| Commitments and Contingencies | |

Item 1. Financial Statements (Continued)

FORD MOTOR CREDIT COMPANY LLC AND SUBSIDIARIES

NOTES TO THE FINANCIAL STATEMENTS

NOTE 1. PRESENTATION

The consolidated financial statements have been prepared in conformity with generally accepted accounting principles in the United States of America (“GAAP”) for interim financial information, and instructions to the Quarterly Report on Form 10-Q and Rule 10-01 of Regulation S-X. In the opinion of management, these unaudited financial statements include all adjustments considered necessary for a fair statement of the results of operations and financial condition for interim periods for Ford Motor Credit Company LLC, its consolidated subsidiaries and consolidated VIEs in which Ford Motor Credit Company LLC is the primary beneficiary (collectively referred to herein as “Ford Credit,” “we,” “our,” or “us”). Results for interim periods should not be considered indicative of results for any other interim period or for the full year. Reference should be made to the financial statements contained in our Annual Report on Form 10-K for the year ended December 31, 2017 (“2017 Form 10-K Report”). We are an indirect, wholly owned subsidiary of Ford Motor Company (“Ford”).

We reclassified certain prior period amounts in our consolidated financial statements to conform to current year presentation.

NOTE 2. ACCOUNTING POLICIES

Provision for Income Taxes

For interim tax reporting we estimate one single effective tax rate, which is applied to the year-to-date ordinary income/(loss). Tax effects of significant unusual or infrequently occurring items are excluded from the estimated annual effective tax rate calculation and recognized in the interim period in which they occur.

For the first quarter of 2018, our effective tax rate benefit was 9.3%. During the first quarter of 2018, we recognized $235 million of benefit for non-U.S. capital loss carryforwards expected to be realized in the foreseeable future.

Adoption of New Accounting Standards

ASU 2017-12, Derivatives and Hedging. On January 1, 2018, we adopted the amendments to accounting standard codification (“ASC”) 815 which aligns hedge accounting with risk management activities and simplifies the requirements to qualify for hedge accounting. Adoption did not have a material impact on our financial statements. We continue to assess opportunities enabled by the new standard to expand our risk management strategies.

ASU 2016-01, Financial Instruments - Recognition and Measurement of Financial Assets and Financial Liabilities. On January 1, 2018, we adopted ASU 2016-01 and the related amendments. This standard amends various aspects of the recognition, measurement, presentation, and disclosure of financial instruments. We adopted the measurement alternative for equity investments without readily determinable fair values (often referred to as cost method investments) on a prospective basis. As a result, these investments will be revalued upon occurrence of an observable price change for similar investments and for impairments. We anticipate adoption may increase the volatility on our consolidated income statement.

We also adopted the following standards during 2018, none of which had a material impact to our financial statements or financial statement disclosures:

|

| | | |

| Standard | | | Effective Date |

| 2017-08 | Nonrefundable Fees and Other Costs - Premium Amortization on Purchased Callable Debt Securities | | January 1, 2018 |

| 2016-18 | Statement of Cash Flows - Restricted Cash | | January 1, 2018 |

| 2016-16 | Income Taxes - Intra-Entity Transfers of Assets Other Than Inventory | | January 1, 2018 |

| 2016-15 | Statement of Cash Flows - Classification of Certain Cash Receipts and Cash Payments | | January 1, 2018 |

Item 1. Financial Statements (Continued)

FORD MOTOR CREDIT COMPANY LLC AND SUBSIDIARIES

NOTES TO THE FINANCIAL STATEMENTS

NOTE 2. ACCOUNTING POLICIES (Continued)

Accounting Standards Issued But Not Yet Adopted

The following represent the standards that will, or are expected to, result in a significant change in practice and / or have a significant financial impact to Ford Credit.

ASU 2016-13, Credit Losses - Measurement of Credit Losses on Financial Instruments. In June 2016, the Financial Accounting Standards Board (“FASB”) issued a new accounting standard which replaces the current incurred loss impairment method with a method that reflects expected credit losses. The new standard is effective as of January 1, 2020, and early adoption is permitted as of January 1, 2019. We will adopt the new credit loss guidance by recognizing the cumulative effect of initially applying the new standard as an adjustment to the opening balance of Retained earnings. We anticipate adoption will increase the amount of expected credit losses reported in Finance receivables, net on our consolidated balance sheet and do not expect a material impact to our income statement.

ASU 2016-02, Leases. In February 2016, the FASB issued a new accounting standard which provides guidance on the recognition, measurement, presentation, and disclosure of leases. The new standard supersedes the present U.S. GAAP standard on leases and requires substantially all leases to be reported on the balance sheet as right-of-use assets and lease obligations. We plan to adopt the standard at its effective date of January 1, 2019. We anticipate adoption of the standard will add about $100 million of right-of-use assets and lease obligations to our balance sheet and will not significantly impact pre-tax profit. We plan to elect the practical expedients upon transition that will retain the lease classification and initial direct costs for any leases that exist prior to adoption of the standard. We will not reassess whether any contracts entered into prior to adoption are leases. We are in the process of cataloging our existing lease contracts and implementing changes to our systems.

Item 1. Financial Statements (Continued)

FORD MOTOR CREDIT COMPANY LLC AND SUBSIDIARIES

NOTES TO THE FINANCIAL STATEMENTS

NOTE 3. CASH, CASH EQUIVALENTS, AND MARKETABLE SECURITIES

The following table categorizes the fair values of cash, cash equivalents, and marketable securities measured at fair value on a recurring basis on our balance sheet (in millions):

|

| | | | | | | | | |

| | Fair Value Level | | December 31, 2017 | | March 31, 2018 |

| Cash and cash equivalents | | | | | |

| U.S. government | 1 | | $ | — |

| | $ | 44 |

|

| U.S. government and agencies | 2 | | 300 |

| | 50 |

|

| Non-U.S. government and agencies | 2 | | 703 |

| | 556 |

|

| Corporate debt | 2 | | 25 |

| | 274 |

|

| Total marketable securities classified as cash equivalents | | | 1,028 |

| | 924 |

|

| Cash, time deposits and money market funds | | | 8,530 |

| | 7,842 |

|

| Total cash and cash equivalents | | | $ | 9,558 |

| | $ | 8,766 |

|

| | | | | | |

| Marketable Securities | | | | | |

| U.S. government | 1 | | $ | 966 |

| | $ | 1,116 |

|

| U.S. government and agencies | 2 | | 384 |

| | 265 |

|

| Non-U.S. government and agencies | 2 | | 660 |

| | 1,517 |

|

| Corporate debt | 2 | | 848 |

| | 680 |

|

| Other marketable securities | 2 | | 23 |

| | 130 |

|

| Total marketable securities | | | $ | 2,881 |

| | $ | 3,708 |

|

Cash, Cash Equivalents, and Restricted Cash

Cash, cash equivalents, and restricted cash as reported in the statement of cash flows are presented separately on our consolidated balance sheet as follows (in millions):

|

| | | | | | | |

| | December 31, 2017 | | March 31, 2018 |

| Cash and cash equivalents | $ | 9,558 |

| | $ | 8,766 |

|

| Restricted cash included in other assets | 124 |

| | 148 |

|

| Total cash, cash equivalents, and restricted cash | $ | 9,682 |

| | $ | 8,914 |

|

Item 1. Financial Statements (Continued)

FORD MOTOR CREDIT COMPANY LLC AND SUBSIDIARIES

NOTES TO THE FINANCIAL STATEMENTS

NOTE 4. FINANCE RECEIVABLES

We manage finance receivables as “consumer” and “non-consumer” portfolios. The receivables are generally secured by the vehicles, inventory, or other property being financed.

Finance receivables, net were as follows (in millions):

|

| | | | | | | |

| | December 31, 2017 | | March 31, 2018 |

| Consumer | | | |

| Retail financing, gross | $ | 78,467 |

| | $ | 79,627 |

|

| Unearned interest supplements from Ford and affiliated companies | (3,280 | ) | | (3,258 | ) |

| Consumer finance receivables | 75,187 |

| | 76,369 |

|

| | | | |

| Non-Consumer | | | |

| Dealer financing | 39,241 |

| | 43,230 |

|

| Other financing | 2,172 |

| | 1,937 |

|

| Non-Consumer finance receivables | 41,413 |

| | 45,167 |

|

| Total recorded investment | $ | 116,600 |

| | $ | 121,536 |

|

| | | | |

| Recorded investment in finance receivables | $ | 116,600 |

| | $ | 121,536 |

|

| Allowance for credit losses | (597 | ) | | (600 | ) |

| Finance receivables, net | $ | 116,003 |

| | $ | 120,936 |

|

| | | | |

| Net finance receivables subject to fair value (a) | $ | 112,717 |

| | $ | 117,432 |

|

| Fair value | 112,133 |

| | 116,785 |

|

__________

| |

| (a) | At December 31, 2017 and March 31, 2018, Finance receivables, net includes $3.3 billion and $3.5 billion, respectively, of direct financing leases that are not subject to fair value disclosure requirements. The fair value of finance receivables is categorized within Level 3 of the fair value hierarchy. |

Excluded from finance receivables at December 31, 2017 and March 31, 2018 was $241 million and $244 million, respectively, of accrued uncollected interest, which we report in Other assets on our balance sheet.

Included in recorded investment in finance receivables at December 31, 2017 and March 31, 2018, were consumer receivables of $38.9 billion and $39.3 billion, respectively, and non-consumer receivables of $24.5 billion and $26.6 billion, respectively, that have been sold for legal purposes in securitization transactions but continue to be reported in our consolidated financial statements. The receivables are available only for payment of the debt issued by, and other obligations of, the securitization entities that are parties to those securitization transactions; they are not available to pay the other obligations or the claims of Ford Credit’s other creditors. Ford Credit holds the right to receive the excess cash flows not needed to pay the debt issued by, and other obligations of, the securitization entities that are parties to those securitization transactions (see Note 7 for additional information).

Item 1. Financial Statements (Continued)

FORD MOTOR CREDIT COMPANY LLC AND SUBSIDIARIES

NOTES TO THE FINANCIAL STATEMENTS

NOTE 4. FINANCE RECEIVABLES (Continued)

Aging

For all finance receivables, we define “past due” as any payment, including principal and interest, that is at least 31 days past the contractual due date. The recorded investment of consumer receivables greater than 90 days past due and still accruing interest was $24 million and $23 million at December 31, 2017 and March 31, 2018, respectively. The recorded investment of non-consumer receivables greater than 90 days past due and still accruing interest was $1 million and de minimus at December 31, 2017 and March 31, 2018, respectively.

The aging analysis of finance receivables balances was as follows (in millions):

|

| | | | | | | |

| | December 31, 2017 | | March 31,

2018 |

| Consumer | | | |

| 31-60 days past due | $ | 748 |

| | $ | 667 |

|

| 61-90 days past due | 113 |

| | 85 |

|

| 91-120 days past due | 36 |

| | 33 |

|

| Greater than 120 days past due | 37 |

| | 41 |

|

| Total past due | 934 |

| | 826 |

|

| Current | 74,253 |

| | 75,543 |

|

| Consumer finance receivables | 75,187 |

| | 76,369 |

|

| | | | |

| Non-Consumer | | | |

| Total past due | 122 |

| | 95 |

|

| Current | 41,291 |

| | 45,072 |

|

| Non-Consumer finance receivables | 41,413 |

| | 45,167 |

|

| Total recorded investment | $ | 116,600 |

| | $ | 121,536 |

|

Credit Quality

Consumer Portfolio.

Credit quality ratings for consumer receivables are based on our aging analysis. Refer to the aging table above.

Consumer receivables credit quality ratings are as follows:

| |

| • | Pass – current to 60 days past due; |

| |

| • | Special Mention – 61 to 120 days past due and in intensified collection status; and |

| |

| • | Substandard – greater than 120 days past due and for which the uncollectible portion of the receivables has already been charged off, as measured using the fair value of collateral less costs to sell. |

Non-Consumer Portfolio.

Dealers are assigned to one of four groups according to risk ratings as follows:

| |

| • | Group I – strong to superior financial metrics; |

| |

| • | Group II – fair to favorable financial metrics; |

| |

| • | Group III – marginal to weak financial metrics; and |

| |

| • | Group IV – poor financial metrics, including dealers classified as uncollectible. |

Item 1. Financial Statements (Continued)

FORD MOTOR CREDIT COMPANY LLC AND SUBSIDIARIES

NOTES TO THE FINANCIAL STATEMENTS

NOTE 4. FINANCE RECEIVABLES (Continued)

The credit quality analysis of our dealer financing receivables was as follows (in millions):

|

| | | | | | | |

| | December 31, 2017 | | March 31,

2018 |

| Dealer financing | | | |

| Group I | $ | 31,551 |

| | $ | 34,584 |

|

| Group II | 5,912 |

| | 6,694 |

|

| Group III | 1,640 |

| | 1,844 |

|

| Group IV | 138 |

| | 108 |

|

| Total recorded investment | $ | 39,241 |

| | $ | 43,230 |

|

Impaired Receivables

Impaired consumer receivables include accounts that have been rewritten or modified in reorganization proceedings pursuant to the U.S. Bankruptcy Code that are considered to be Troubled Debt Restructurings (“TDRs”), as well as all accounts greater than 120 days past due. Impaired non-consumer receivables represent accounts with dealers that have weak or poor financial metrics or dealer financing that has been modified in TDRs. The recorded investment of consumer receivables that were impaired at December 31, 2017 and March 31, 2018 was $386 million, or 0.5% of consumer receivables, and $380 million, or 0.5% of consumer receivables, respectively. The recorded investment of non-consumer receivables that were impaired at December 31, 2017 and March 31, 2018 was $138 million, or 0.3% of non-consumer receivables, and $108 million, or 0.2% of non-consumer receivables, respectively. Impaired finance receivables are evaluated both collectively and specifically.

The accrual of revenue is discontinued at the time a receivable is determined to be uncollectible. Accounts may be restored to accrual status only when a customer settles all past-due deficiency balances and future payments are reasonably assured. For receivables in non-accrual status, subsequent financing revenue is recognized only to the extent a payment is received. Payments are generally applied first to outstanding interest and then to the unpaid principal balance.

A restructuring of debt constitutes a TDR if we grant a concession to a debtor for economic or legal reasons related to the debtor’s financial difficulties that we otherwise would not consider. Consumer and non-consumer receivables that have a modified interest rate below market rate or that were modified in reorganization proceedings pursuant to the U.S. Bankruptcy Code, except non-consumer receivables that are current with minimal risk of loss, are considered to be TDRs. We do not grant concessions on the principal balance of our receivables. If a receivable is modified in a reorganization proceeding, all payment requirements of the reorganization plan need to be met before remaining balances are forgiven. Finance receivables involved in TDRs are specifically assessed for impairment.

Item 1. Financial Statements (Continued)

FORD MOTOR CREDIT COMPANY LLC AND SUBSIDIARIES

NOTES TO THE FINANCIAL STATEMENTS

NOTE 5. NET INVESTMENT IN OPERATING LEASES

Net investment in operating leases consist primarily of lease contracts for vehicles with retail customers, daily rental companies, and fleet customers with terms of 60 months or less.

Net investment in operating leases were as follows (in millions): |

| | | | | | | |

| | December 31,

2017 | | March 31,

2018 |

| Vehicles, at cost (a) | $ | 32,659 |

| | $ | 32,821 |

|

| Accumulated depreciation | (5,927 | ) | | (6,035 | ) |

| Net investment in operating leases before allowance for credit losses | 26,732 |

| | 26,786 |

|

| Allowance for credit losses | (71 | ) | | (71 | ) |

| Net investment in operating leases | $ | 26,661 |

| | $ | 26,715 |

|

__________

| |

| (a) | Includes interest supplements and residual support payments we receive on certain leasing transactions under agreements with Ford and affiliated companies, and other vehicle acquisition costs. |

At December 31, 2017 and March 31, 2018, net investment in operating leases before allowance for credit losses includes $11.5 billion and $12.0 billion, respectively, of net investment in operating leases that have been included in securitization transactions but continue to be reported in our consolidated financial statements. These net investments in operating leases are available only for payment of the debt issued by, and other obligations of, the securitization entities that are parties to those securitization transactions; they are not available to pay our other obligations or the claims of our other creditors. We hold the right to receive the excess cash flows not needed to pay the debt issued by, and other obligations of, the securitization entities that are parties to those securitization transactions (see Note 7 for additional information).

Item 1. Financial Statements (Continued)

FORD MOTOR CREDIT COMPANY LLC AND SUBSIDIARIES

NOTES TO THE FINANCIAL STATEMENTS

NOTE 6. ALLOWANCE FOR CREDIT LOSSES

An analysis of the allowance for credit losses related to finance receivables and net investment in operating leases for the periods ended March 31 was as follows (in millions):

|

| | | | | | | | | | | | | | | | | | | |

| | First Quarter 2017 |

| | Finance Receivables | | Net Investment in Operating Leases | | Total Allowance |

| | Consumer | | Non-Consumer | | Total | | |

| Allowance for credit losses | | | | | | | | | |

| Beginning balance | $ | 469 |

| | $ | 15 |

| | $ | 484 |

| | $ | 64 |

| | $ | 548 |

|

| Charge-offs | (123 | ) | | (2 | ) | | (125 | ) | | (52 | ) | | (177 | ) |

| Recoveries | 34 |

| | — |

| | 34 |

| | 24 |

| | 58 |

|

| Provision for credit losses | 121 |

| | — |

| | 121 |

| | 31 |

| | 152 |

|

| Other (a) | 3 |

| | — |

| | 3 |

| | — |

| | 3 |

|

| Ending balance | $ | 504 |

| | $ | 13 |

| | $ | 517 |

| | $ | 67 |

| | $ | 584 |

|

| | | | | | | | | | |

| Analysis of ending balance of allowance for credit losses | | | | | | | | | |

| Collective impairment allowance | $ | 483 |

| | $ | 13 |

| | $ | 496 |

| | $ | 67 |

| | $ | 563 |

|

| Specific impairment allowance | 21 |

| | — |

| | 21 |

| | — |

| | 21 |

|

| Ending balance | 504 |

| | 13 |

| | 517 |

| | 67 |

| | $ | 584 |

|

| | | | | | | | | | |

| Analysis of ending balance of finance receivables and net investment in operating leases | | | | | | | | | |

| Collectively evaluated for impairment | 66,075 |

| | 40,468 |

| | 106,543 |

| | 26,495 |

| | |

| Specifically evaluated for impairment | 385 |

| | 164 |

| | 549 |

| | — |

| | |

| Recorded investment | 66,460 |

| | 40,632 |

| | 107,092 |

| | 26,495 |

| | |

| | | | | | | | | | |

| Ending balance, net of allowance for credit losses | $ | 65,956 |

| | $ | 40,619 |

| | $ | 106,575 |

| | $ | 26,428 |

| | |

__________

| |

| (a) | Primarily represents amounts related to translation adjustments. |

|

| | | | | | | | | | | | | | | | | | | |

| | First Quarter 2018 |

| | Finance Receivables | | Net Investment in Operating Leases | | Total Allowance |

| | Consumer | | Non-Consumer | | Total | | |

| Allowance for credit losses | | | | | | | | | |

| Beginning balance | $ | 582 |

| | $ | 15 |

| | $ | 597 |

| | $ | 71 |

| | $ | 668 |

|

| Charge-offs | (131 | ) | | (2 | ) | | (133 | ) | | (51 | ) | | (184 | ) |

| Recoveries | 39 |

| | 1 |

| | 40 |

| | 26 |

| | 66 |

|

| Provision for credit losses | 92 |

| | 2 |

| | 94 |

| | 25 |

| | 119 |

|

| Other (a) | 2 |

| | — |

| | 2 |

| | — |

| | 2 |

|

| Ending balance | $ | 584 |

| | $ | 16 |

| | $ | 600 |

| | $ | 71 |

| | $ | 671 |

|

| | | | | | | | | | |

| Analysis of ending balance of allowance for credit losses | | | | | | | | | |

| Collective impairment allowance | $ | 563 |

| | $ | 15 |

| | $ | 578 |

| | $ | 71 |

| | $ | 649 |

|

| Specific impairment allowance | 21 |

| | 1 |

| | 22 |

| | — |

| | 22 |

|

| Ending balance | 584 |

| | 16 |

| | 600 |

| | 71 |

| | $ | 671 |

|

| | | | | | | | | | |

| Analysis of ending balance of finance receivables and net investment in operating leases | | | | | | | | | |

| Collectively evaluated for impairment | 75,989 |

| | 45,059 |

| | 121,048 |

| | 26,786 |

| | |

| Specifically evaluated for impairment | 380 |

| | 108 |

| | 488 |

| | — |

| | |

| Recorded investment | 76,369 |

| | 45,167 |

| | 121,536 |

| | 26,786 |

| | |

| | | | | | | | | | |

| Ending balance, net of allowance for credit losses | $ | 75,785 |

| | $ | 45,151 |

| | $ | 120,936 |

| | $ | 26,715 |

| | |

__________

| |

| (a) | Primarily represents amounts related to translation adjustments. |

Item 1. Financial Statements (Continued)

FORD MOTOR CREDIT COMPANY LLC AND SUBSIDIARIES

NOTES TO THE FINANCIAL STATEMENTS

NOTE 7. TRANSFERS OF RECEIVABLES

We securitize finance receivables and net investment in operating leases through a variety of programs using amortizing, variable funding, and revolving structures. We also sell finance receivables in structured financing transactions. Due to the similarities between securitization and structured financing, we refer to structured financings as securitization transactions. Our securitization programs are targeted to institutional investors in both public and private transactions in capital markets including the United States, Canada, several European countries, Mexico, and China.

We engage in securitization transactions to fund operations and to maintain liquidity. Our securitization transactions are recorded as asset-backed debt and the associated assets are not derecognized and continue to be included in our financial statements.

The finance receivables sold for legal purposes and net investment in operating leases included in securitization transactions are available only for payment of the debt issued by, and other obligations of, the securitization entities that are parties to those securitization transactions. They are not available to pay our other obligations or the claims of our other creditors. We hold the right to receive the excess cash flows not needed to pay the debt issued by, and other obligations of, the securitization entities that are parties to those securitization transactions. The debt is the obligation of our consolidated securitization entities and not the obligation of Ford Credit or our other subsidiaries.

Most of these securitization transactions utilize VIEs. See Note 8 for additional information concerning VIEs. The following tables show the assets and debt related to our securitization transactions that were included in our financial statements (in billions):

|

| | | | | | | | | | | | | | | | | | | |

| | December 31, 2017 |

| | Cash and Cash Equivalents | | Finance Receivables and Net Investment in Operating Leases (a) | | Related Debt (c) |

| | Before Allowance

for Credit Losses | | Allowance for

Credit Losses | | After Allowance

for Credit Losses | |

| VIE (b) | | | | | | | | | |

| Retail financing | $ | 1.8 |

| | $ | 32.6 |

| | $ | 0.2 |

| | $ | 32.4 |

| | $ | 27.7 |

|

| Wholesale financing | 1.2 |

| | 23.9 |

| | — |

| | 23.9 |

| | 11.5 |

|

| Finance receivables | 3.0 |

| | 56.5 |

| | 0.2 |

| | 56.3 |

| | 39.2 |

|

| Net investment in operating leases | 0.5 |

| | 11.5 |

| | — |

| | 11.5 |

| | 7.2 |

|

| Total VIE | $ | 3.5 |

| | $ | 68.0 |

| | $ | 0.2 |

| | $ | 67.8 |

| | $ | 46.4 |

|

| | | | | | | | | | |

| Non-VIE | | | | | | | | | |

| Retail financing | $ | 0.3 |

| | $ | 6.3 |

| | $ | — |

| | $ | 6.3 |

| | $ | 5.7 |

|

| Wholesale financing | — |

| | 0.6 |

| | — |

| | 0.6 |

| | 0.5 |

|

| Finance receivables | 0.3 |

| | 6.9 |

| | — |

| | 6.9 |

| | 6.2 |

|

| Net investment in operating leases | — |

| | — |

| | — |

| | — |

| | — |

|

| Total Non-VIE | $ | 0.3 |

| | $ | 6.9 |

| | $ | — |

| | $ | 6.9 |

| | $ | 6.2 |

|

| | | | | | | | | | |

| Total securitization transactions | | | | | | | | | |

| Retail financing | $ | 2.1 |

| | $ | 38.9 |

| | $ | 0.2 |

| | $ | 38.7 |

| | $ | 33.4 |

|

| Wholesale financing | 1.2 |

| | 24.5 |

| | — |

| | 24.5 |

| | 12.0 |

|

| Finance receivables | 3.3 |

| | 63.4 |

| | 0.2 |

| | 63.2 |

| | 45.4 |

|

| Net investment in operating leases | 0.5 |

| | 11.5 |

| | — |

| | 11.5 |

| | 7.2 |

|

| Total securitization transactions | $ | 3.8 |

| | $ | 74.9 |

| | $ | 0.2 |

| | $ | 74.7 |

| | $ | 52.6 |

|

__________

| |

| (a) | Unearned interest supplements and residual support are excluded from securitization transactions. |

| |

| (b) | Includes assets to be used to settle the liabilities of the consolidated VIEs. |

| |

| (c) | Includes unamortized discount and debt issuance costs. |

Item 1. Financial Statements (Continued)

FORD MOTOR CREDIT COMPANY LLC AND SUBSIDIARIES

NOTES TO THE FINANCIAL STATEMENTS

NOTE 7. TRANSFERS OF RECEIVABLES (Continued)

|

| | | | | | | | | | | | | | | | | | | |

| | March 31, 2018 |

| | Cash and Cash Equivalents | | Finance Receivables and Net Investment in Operating Leases (a) | | Related Debt (c) |

| | Before Allowance for Credit Losses | | Allowance for Credit Losses | | After Allowance for Credit Losses | |

| VIE (b) | | | | | | | | | |

| Retail financing | $ | 2.0 |

| | $ | 33.4 |

| | $ | 0.2 |

| | $ | 33.2 |

| | $ | 29.1 |

|

| Wholesale financing | 0.3 |

| | 25.9 |

| | — |

| | 25.9 |

| | 13.8 |

|

| Finance receivables | 2.3 |

| | 59.3 |

| | 0.2 |

| | 59.1 |

| | 42.9 |

|

| Net investment in operating leases | 0.6 |

| | 12.0 |

| | — |

| | 12.0 |

| | 7.5 |

|

| Total VIE | $ | 2.9 |

| | $ | 71.3 |

| | $ | 0.2 |

| | $ | 71.1 |

| | $ | 50.4 |

|

| | | | | | | | | | |

| Non-VIE | | | | | | | | | |

| Retail financing | $ | 0.3 |

| | $ | 5.9 |

| | $ | — |

| | $ | 5.9 |

| | $ | 5.2 |

|

| Wholesale financing | — |

| | 0.7 |

| | — |

| | 0.7 |

| | 0.7 |

|

| Finance receivables | 0.3 |

| | 6.6 |

| | — |

| | 6.6 |

| | 5.9 |

|

| Net investment in operating leases | — |

| | — |

| | — |

| | — |

| | — |

|

| Total Non-VIE | $ | 0.3 |

| | $ | 6.6 |

| | $ | — |

| | $ | 6.6 |

| | $ | 5.9 |

|

| | | | | | | | | | |

| Total securitization transactions | | | | | | | | | |

| Retail financing | $ | 2.3 |

| | $ | 39.3 |

| | $ | 0.2 |

| | $ | 39.1 |

| | $ | 34.3 |

|

| Wholesale financing | 0.3 |

| | 26.6 |

| | — |

| | 26.6 |

| | 14.5 |

|

| Finance receivables | 2.6 |

| | 65.9 |

| | 0.2 |

| | 65.7 |

| | 48.8 |

|

| Net investment in operating leases | 0.6 |

| | 12.0 |

| | — |

| | 12.0 |

| | 7.5 |

|

| Total securitization transactions | $ | 3.2 |

| | $ | 77.9 |

| | $ | 0.2 |

| | $ | 77.7 |

| | $ | 56.3 |

|

__________

| |

| (a) | Unearned interest supplements and residual support are excluded from securitization transactions. |

| |

| (b) | Includes assets to be used to settle the liabilities of the consolidated VIEs. |

| |

| (c) | Includes unamortized discount and debt issuance cost. |

Item 1. Financial Statements (Continued)

FORD MOTOR CREDIT COMPANY LLC AND SUBSIDIARIES

NOTES TO THE FINANCIAL STATEMENTS

NOTE 8. VARIABLE INTEREST ENTITIES

We use special purpose entities to issue asset-backed securities in transactions to public and private investors. We have deemed most of these special purpose entities to be VIEs of which we are the primary beneficiary. The asset-backed securities are backed by finance receivables and interests in net investments in operating leases. The assets continue to be consolidated by us. We retain interests in our securitization VIEs, including subordinated securities issued by the VIEs, rights to cash held for the benefit of the securitization investors, and rights to receive the excess cash flows not needed to pay the debt issued by, and other obligations of, the securitization entities that are parties to those securitization transactions.

We have no obligation to repurchase or replace any securitized asset that subsequently becomes delinquent in payment or otherwise is in default, except when representations and warranties about the eligibility of the securitized assets are breached, or when certain changes are made to the underlying asset contracts. Securitization investors have no recourse to us or our other assets and have no right to require us to repurchase the investments. We generally have no obligation to provide liquidity or contribute cash or additional assets to the VIEs and do not guarantee any asset-backed securities. We may be required to support the performance of certain securitization transactions, however, by increasing cash reserves.

See Note 7 for additional information on the financial position and financial performance of our VIEs and Note 9 for additional information regarding derivatives.

NOTE 9. DERIVATIVE FINANCIAL INSTRUMENTS AND HEDGING ACTIVITIES

In the normal course of business, our operations are exposed to global market risks, including the effect of changes in interest rates and foreign currency exchange rates. To manage these risks, we enter into highly effective derivative contracts. We have elected to apply hedge accounting to certain derivatives. Derivatives that are designated in hedging relationships are evaluated for effectiveness using regression analysis at the time they are designated and throughout the hedge period. Some derivatives do not qualify for hedge accounting; for others, we elect not to apply hedge accounting.

Income Effect of Derivative Financial Instruments

The gains / (losses), by hedge designation, recorded in income for the periods ended March 31 were as follows (in millions):

|

| | | | | | | |

| | First Quarter |

| | 2017 | | 2018 |

| Fair value hedges | | | |

| Interest rate contracts | | | |

| Net interest settlements and accruals on hedging instruments | $ | 70 |

| | $ | 26 |

|

| Fair value changes on hedging instruments (a) | (89 | ) | | (339 | ) |

| Fair value changes on hedged debt (a) | 85 |

| | 329 |

|

| Derivatives not designated as hedging instruments | | | |

| Interest rate contracts | 7 |

| | (17 | ) |

| Foreign currency exchange contracts (b) | (29 | ) | | (12 | ) |

| Cross-currency interest rate swap contracts | 58 |

| | (58 | ) |

| Total | $ | 102 |

| | $ | (71 | ) |

__________

| |

| (a) | For the first quarter of 2017, the fair value changes on hedging instruments and on hedged debt were reported in Other income, net; effective first quarter 2018, these amounts were reported in Interest expense. |

| |

| (b) | Reflects forward contracts between Ford Credit and an affiliated company. |

Item 1. Financial Statements (Continued)

FORD MOTOR CREDIT COMPANY LLC AND SUBSIDIARIES

NOTES TO THE FINANCIAL STATEMENTS

NOTE 9. DERIVATIVE FINANCIAL INSTRUMENTS AND HEDGING ACTIVITIES (Continued)

Balance Sheet Effect of Derivative Financial Instruments

Derivative assets and liabilities are recorded on the balance sheet at fair value and are presented on a gross basis. The notional amounts of the derivative instruments do not necessarily represent amounts exchanged by the parties and are not a direct measure of our financial exposure. We also enter into master agreements with counterparties that may allow for netting of exposure in the event of default or breach of the counterparty agreement. Collateral represents cash received or paid under reciprocal arrangements that we have entered into with our derivative counterparties which we do not use to offset our derivative assets and liabilities.

The fair value of our derivative instruments and the associated notional amounts, presented gross, were as follows (in millions): |

| | | | | | | | | | | | | | | | | | | | | | | |

| | December 31, 2017 | | March 31, 2018 |

| | Notional | | Fair Value of Assets | | Fair Value of Liabilities | | Notional | | Fair Value of Assets | | Fair Value of Liabilities |

| Fair value hedges | | | | | | | | | | | |

| Interest rate contracts | $ | 28,008 |

| | $ | 248 |

| | $ | 135 |

| | $ | 30,250 |

| | $ | 139 |

| | $ | 516 |

|

| Derivatives not designated as hedging instruments | | | | | | | | | | | |

| Interest rate contracts | 60,504 |

| | 276 |

| | 137 |

| | 60,453 |

| | 282 |

| | 184 |

|

| Foreign currency exchange contracts | 2,406 |

| | 3 |

| | 10 |

| | 2,885 |

| | 28 |

| | 34 |

|

| Cross-currency interest rate swap contracts | 4,006 |

| | 408 |

| | 28 |

| | 5,712 |

| | 305 |

| | 60 |

|

| Total derivative financial instruments, gross (a) (b) | $ | 94,924 |

| | $ | 935 |

| | $ | 310 |

| | $ | 99,300 |

| | $ | 754 |

| | $ | 794 |

|

__________

| |

| (a) | At December 31, 2017 and March 31, 2018, we held collateral of $15 million and $22 million, respectively, and we posted collateral of $38 million and $55 million, respectively. |

| |

| (b) | At December 31, 2017 and March 31, 2018, the fair value of assets and liabilities available for counterparty netting was $162 million and $231 million, respectively. All derivatives are categorized within Level 2 of the fair value hierarchy. |

Fair Value Hedges

The carrying value of and fair value adjustments to our hedged debt were as follows (in millions):

|

| | | | | | | | | | | | | | | |

| | December 31, 2017 | | March 31, 2018 |

| | Carrying Value | | Fair Value Adjustments (a) | | Carrying Value | | Fair Value Adjustments (a) |

| Debt | $ | 38,976 |

| | $ | (21 | ) | | $ | 39,733 |

| | $ | (360 | ) |

__________

| |

| (a) | At December 31, 2017 and March 31, 2018, the balance includes unfavorable adjustments of $77 million and $66 million, respectively, related to discontinued hedging relationships. |

Item 1. Financial Statements (Continued)

FORD MOTOR CREDIT COMPANY LLC AND SUBSIDIARIES

NOTES TO THE FINANCIAL STATEMENTS

NOTE 10. OTHER ASSETS AND OTHER LIABILITIES AND DEFERRED INCOME

Other assets and other liabilities and deferred income consist of various balance sheet items that are combined for financial statement presentation due to their respective materiality compared with other individual asset and liability items.

Other assets were as follows (in millions):

|

| | | | | | | |

| | December 31,

2017 | | March 31,

2018 |

| Accrued interest and other non-finance receivables | $ | 1,117 |

| | $ | 1,059 |

|

| Collateral held for resale, at net realizable value, and other inventory | 780 |

| | 755 |

|

| Prepaid reinsurance premiums and other reinsurance recoverables | 611 |

| | 624 |

|

| Deferred charges – income taxes | 247 |

| | 239 |

|

| Property and equipment, net of accumulated depreciation (a) | 177 |

| | 181 |

|

| Restricted cash (b) | 124 |

| | 148 |

|

| Deferred charges | 127 |

| | 126 |

|

| Investment in non-consolidated affiliates | 107 |

| | 126 |

|

| Other | 39 |

| | 43 |

|

| Total other assets | $ | 3,329 |

| | $ | 3,301 |

|

__________

| |

| (a) | Accumulated depreciation was $354 million and $363 million at December 31, 2017 and March 31, 2018, respectively. |

| |

| (b) | Restricted cash primarily includes cash held to meet certain local governmental and regulatory reserve requirements and cash held under the terms of certain contractual agreements. Restricted cash does not include required minimum balances or cash securing debt issued through securitization transactions. |

Other liabilities and deferred income were as follows (in millions):

|

| | | | | | | |

| | December 31,

2017 | | March 31,

2018 |

| Unearned insurance premiums and fees | $ | 723 |

| | $ | 736 |

|

| Interest payable | 722 |

| | 608 |

|

| Income tax and related interest (a) | 301 |

| | 297 |

|

| Deferred revenue | 148 |

| | 150 |

|

| Payroll and employee benefits | 68 |

| | 45 |

|

| Other | 310 |

| | 318 |

|

| Total other liabilities and deferred income | $ | 2,272 |

| | $ | 2,154 |

|

__________

(a) Includes tax and interest payable to affiliated companies of $99 million and $103 million at December 31, 2017 and March 31, 2018, respectively.

We have investments in entities for which we do not have the ability to exercise significant influence and fair values are not readily available. We have elected to record these investments at cost (less impairment, if any), adjusted for changes resulting from observable price changes in orderly transactions for the identical or a similar investment of the same issuer. We report the carrying value of these investments in Other assets in our consolidated balance sheet. These investments were $7 million and $9 million at December 31, 2017 and March 31, 2018, respectively. There were no material adjustments to the fair values of these investments during the period ending March 31, 2018.

Deferred revenue balances presented above include amounts from contracts with customers primarily related to admission fee revenue on group financing products available in Argentina and were $124 million at both December 31, 2017, and March 31, 2018.

Admission fee revenue on group financing products is generally recognized evenly over the term of the agreement, which is up to 84 months. Increases in the admission fee deferred revenue balance are the result of payments due during the current period in advance of satisfying our performance under the contract and decreases are a result of revenue recognized during the current period that was previously deferred.

Item 1. Financial Statements (Continued)

FORD MOTOR CREDIT COMPANY LLC AND SUBSIDIARIES

NOTES TO THE FINANCIAL STATEMENTS

NOTE 11. DEBT AND COMMITMENTS

Debt outstanding and interest rates were as follows (in millions):

|

| | | | | | | | | | | | | | | | | | | |

| | | | | | Interest Rates |

| | Debt | | Average Contractual | | Average Effective |

| | December 31,

2017 | | March 31,

2018 | | 2017 | | 2018 | | 2017 | | 2018 |

| Short-term debt | | | | | | | | | | | |

| Unsecured debt | | | | | | | | | | | |

| Floating rate demand notes | $ | 5,660 |

| | $ | 5,735 |

| | | | | | | | |

| Commercial paper | 4,889 |

| | 4,758 |

| | | | | | | | |

| Other short-term debt | 5,890 |

| | 5,034 |

| | | | | | | | |

| Asset-backed debt | 786 |

| | 1,138 |

| | | | | | | | |

| Total short-term debt | 17,225 |

| | 16,665 |

| | 3.0 | % | | 2.9 | % | | 3.0 | % | | 2.9 | % |

| Long-term debt | | | | | | | | | | | |

| Unsecured debt | | | | | | | | | | | |

| Notes payable within one year | 13,298 |

| | 14,195 |

| | | | | | | | |

| Notes payable after one year | 55,687 |

| | 56,504 |

| | | | | | | | |

| Asset-backed debt (a) | | | | | | | | | | | |

| Notes payable within one year | 17,817 |

| | 18,461 |

| | | | | | | | |

| Notes payable after one year | 34,051 |

| | 36,744 |

| | | | | | | | |

| Unamortized discount | (1 | ) | | 1 |

| | | | | | | | |

| Unamortized issuance costs | (228 | ) | | (236 | ) | | | | | | | | |

| Fair value adjustments (b) | (21 | ) | | (360 | ) | | | | | | | | |

| Total long-term debt | 120,603 |

| | 125,309 |

| | 2.5 | % | | 2.6 | % | | 2.6 | % | | 2.6 | % |

| Total debt | $ | 137,828 |

| | $ | 141,974 |

| | 2.6 | % | | 2.6 | % | | 2.6 | % | | 2.7 | % |

| | | | | | | | | | | | |

| Fair value of debt (c) | $ | 139,677 |

| | $ | 142,952 |

| | | | | | | | |

__________

| |

| (a) | Asset-backed debt issued in securitizations is the obligation of the consolidated securitization entity that issued the debt and is payable only out of collections on the underlying securitized assets and related enhancements. This asset-backed debt is not the obligation of Ford Credit or our other subsidiaries. |

| |

| (b) | Adjustments related to designated fair value hedges of unsecured debt. |

| |

| (c) | The fair value of debt includes $16.4 billion and $15.5 billion of short-term debt at December 31, 2017 and March 31, 2018, respectively, carried at cost, which approximates fair value. All other debt is categorized within Level 2 of the fair value hierarchy. |

NOTE 12. ACCUMULATED OTHER COMPREHENSIVE INCOME / (LOSS)

The changes in the balance of Accumulated Other Comprehensive Income / (Loss) (“AOCI”) attributable to Ford Credit for the periods ended March 31 were as follows (in millions):

|

| | | | | | | |

| | First Quarter |

| | 2017 | | 2018 |

| Beginning AOCI balance | $ | (890 | ) | | $ | (419 | ) |

| Net gain / (loss) on foreign currency translation | 90 |

| | 113 |

|

| Ending AOCI balance | $ | (800 | ) | | $ | (306 | ) |

Item 1. Financial Statements (Continued)

FORD MOTOR CREDIT COMPANY LLC AND SUBSIDIARIES

NOTES TO THE FINANCIAL STATEMENTS

NOTE 13. OTHER INCOME, NET

Other income consists of various line items that are combined on the income statement due to their respective materiality compared with other individual income and expense items.

The amounts included in Other income, net for the periods ended March 31 were as follows (in millions):

|

| | | | | | | |

| | First Quarter |

| | 2017 | | 2018 |

| Gains / (Losses) on derivatives | $ | 32 |

| | $ | (87 | ) |

| Currency revaluation gains / (losses) | (34 | ) | | 62 |

|

| Interest and investment income | 23 |

| | 42 |

|

| Other | 9 |

| | 20 |

|

| Total other income, net | $ | 30 |

| | $ | 37 |

|

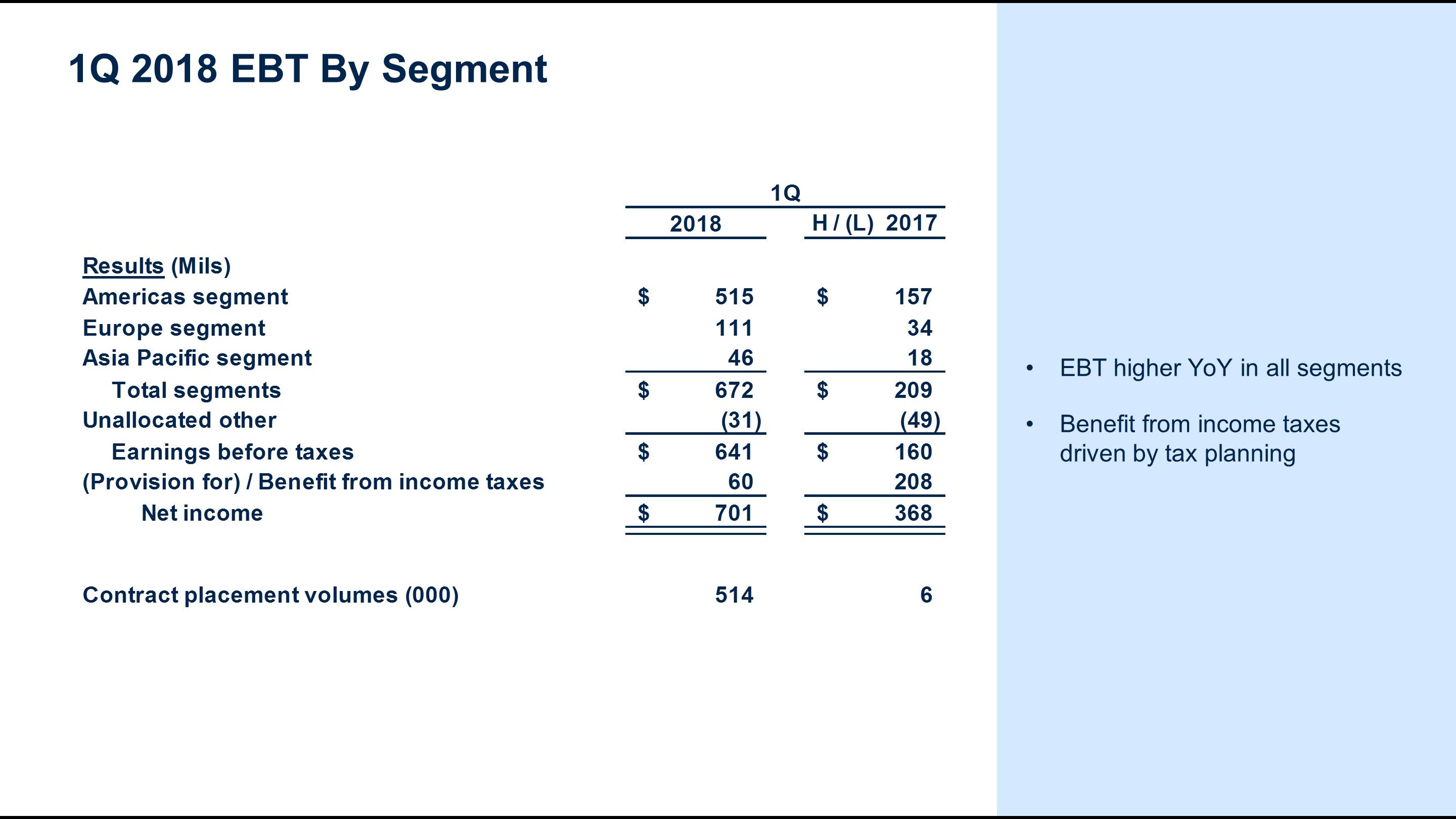

NOTE 14. SEGMENT INFORMATION

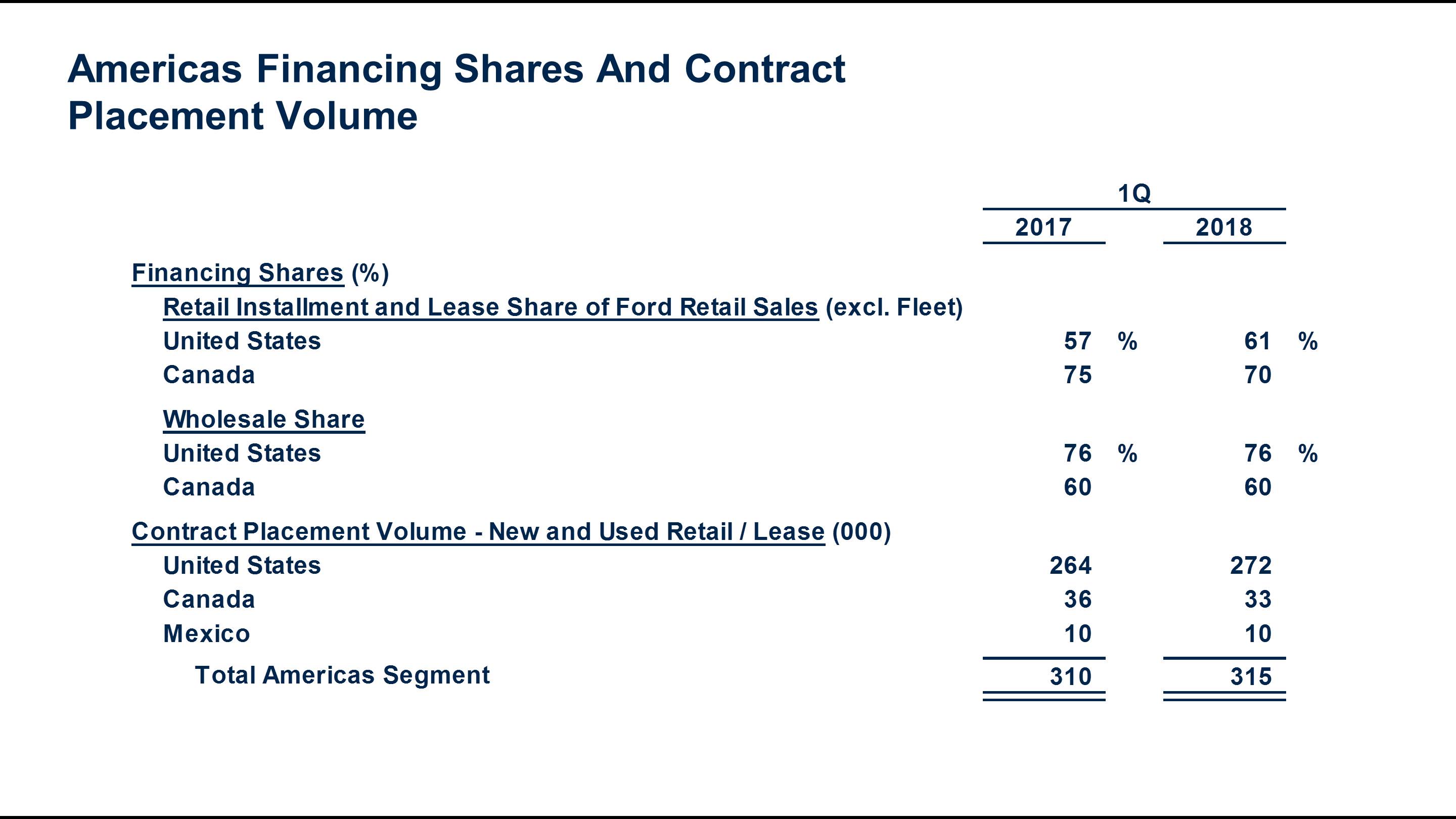

We conduct our financing operations directly and indirectly through our subsidiaries and affiliates. We offer substantially similar products and services throughout many different regions, subject to local legal restrictions and market conditions. We segment our business based on geographic regions: the Americas, Europe, and Asia Pacific. Items excluded in assessing segment performance because they are managed at the corporate level, including market valuation adjustments to derivatives and exchange-rate fluctuations on foreign currency-denominated transactions, are reflected in Unallocated Other. The following is a brief description of our segments:

• Americas Segment – United States, Canada, Mexico, Brazil, and Argentina

• Europe Segment – European region and South Africa

• Asia Pacific Segment – China and India

Item 1. Financial Statements (Continued)

FORD MOTOR CREDIT COMPANY LLC AND SUBSIDIARIES

NOTES TO THE FINANCIAL STATEMENTS

NOTE 14. SEGMENT INFORMATION (Continued)

Key financial information for our business segments for the periods ended or at March 31 were as follows (in millions):

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | Americas | | Europe | | Asia Pacific | | Total Segments | | Unallocated Other (a) | | Total |

| First Quarter 2017 | | | | | | | | | | | |

| Total revenue | $ | 2,405 |

| | $ | 228 |

| | $ | 98 |

| | $ | 2,731 |

| | $ | — |

| | $ | 2,731 |

|

| Income before income taxes | 358 |

| | 77 |

| | 28 |

| | 463 |

| | 18 |

| | 481 |

|

| Other disclosures: | | | | | | | | | | | |

| Depreciation on vehicles subject to operating leases | 1,053 |

| | 11 |

| | — |

| | 1,064 |

| | — |

| | 1,064 |

|

| Interest expense | 617 |

| | 61 |

| | 51 |

| | 729 |

| | — |

| | 729 |

|

| Provision for credit losses | 144 |

| | 6 |

| | 2 |

| | 152 |

| | — |

| | 152 |

|

| Net finance receivables and net investment in operating leases | 114,171 |

| | 20,840 |

| | 4,947 |

| | 139,958 |

| | (6,955 | ) | | 133,003 |

|

| Total assets | 119,990 |

| | 23,906 |

| | 5,636 |

| | 149,532 |

| | — |

| | 149,532 |

|

| | | | | | | | | | | | |

| First Quarter 2018 | | | | | | | | | | | |

| Total revenue | $ | 2,581 |

| | $ | 295 |

| | $ | 144 |

| | $ | 3,020 |

| | $ | — |

| | $ | 3,020 |

|

| Income before income taxes | 515 |

| | 111 |

| | 46 |

| | 672 |

| | (31 | ) | | 641 |

|

| Other disclosures: | | | | | | | | | | | |

| Depreciation on vehicles subject to operating leases | 1,023 |

| | 5 |

| | — |

| | 1,028 |

| | — |

| | 1,028 |

|

| Interest expense | 752 |

| | 72 |

| | 91 |

| | 915 |

| | (3 | ) | | 912 |

|

| Provision for credit losses | 111 |

| | 5 |

| | 3 |

| | 119 |

| | — |

| | 119 |

|

| Net finance receivables and net investment in operating leases | 120,392 |

| | 27,702 |

| | 7,574 |

| | 155,668 |

| | (8,017 | ) | | 147,651 |

|

| Total assets | 127,013 |

| | 30,109 |

| | 7,961 |

| | 165,083 |

| | — |

| | 165,083 |

|

__________

| |

| (a) | Net finance receivables and Net investment in operating leases include unearned interest supplements and residual support, allowance for credit losses, and other (primarily accumulated supplemental depreciation). |

NOTE 15. COMMITMENTS AND CONTINGENCIES

Commitments and contingencies primarily consist of lease commitments, guarantees and indemnifications, and litigation and claims.

Guarantees and Indemnifications

Guarantees and indemnifications are recorded at fair value at their inception. We regularly review our performance risk under these arrangements, and in the event it becomes probable we will be required to perform under a guarantee or indemnity, the amount of probable payment is recorded.

In some cases, we have guaranteed debt and other financial obligations of outside third parties and unconsolidated affiliates, including Ford. Expiration dates vary, and guarantees will terminate on payment and/or cancellation of the underlying obligation. A payment by us would be triggered by failure of the guaranteed party to fulfill its obligation covered by the guarantee. In some circumstances, we are entitled to recover from a third party amounts paid by us under the guarantee. However, our ability to enforce these rights is sometimes stayed until the guaranteed party is paid in full, and may be limited in the event of insolvency of the third party or other circumstances.

Item 1. Financial Statements (Continued)

FORD MOTOR CREDIT COMPANY LLC AND SUBSIDIARIES

NOTES TO THE FINANCIAL STATEMENTS

NOTE 15. COMMITMENTS AND CONTINGENCIES (Continued)

In the ordinary course of business, we execute contracts involving indemnifications standard in the industry and indemnifications specific to a transaction. These indemnifications might include and are not limited to claims relating to any of the following: environmental, tax, and shareholder matters; intellectual property rights; governmental regulations and employment-related matters; dealer and other commercial contractual relationships; and financial matters, such as securitizations. Performance under these indemnities generally would be triggered by a breach of terms of the contract or by a third-party claim. While some of these indemnifications are limited in nature, many of them do not limit potential payment. Therefore, we are unable to estimate a maximum amount of future payments that could result from claims made under these unlimited indemnities.

The maximum potential payments under these guarantees and limited indemnities totaled $52 million and $54 million at December 31, 2017 and March 31, 2018, respectively. Of these values, $44 million and $46 million at December 31, 2017 and March 31, 2018, respectively, were counter-guaranteed by Ford to us. There were no recorded liabilities related to guarantees and limited indemnities at December 31, 2017 and March 31, 2018.

Litigation and Claims

Various legal actions, proceedings, and claims (generally, “matters”) are pending or may be instituted or asserted against us. These include but are not limited to matters arising out of governmental regulations; tax matters; alleged illegal acts resulting in fines or penalties; financial services; employment-related matters; dealer and other contractual relationships; personal injury matters; investor matters; and financial reporting matters. Certain of the pending legal actions are, or purport to be, class actions. Some of the matters involve or may involve claims for compensatory, punitive, or antitrust or other treble damages in very large amounts, sanctions, assessments, or other relief, which, if granted, would require very large expenditures.

The extent of our financial exposure to these matters is difficult to estimate. Many matters do not specify a dollar amount for damages, and many others specify only a jurisdictional minimum. To the extent an amount is asserted, our historical experience suggests that in most instances the amount asserted is not a reliable indicator of the ultimate outcome.

We accrue for matters when losses are deemed probable and reasonably estimable. In evaluating matters for accrual and disclosure purposes, we take into consideration factors such as our historical experience with matters of a similar nature, the specific facts and circumstances asserted, the likelihood that we will prevail, and the severity of any potential loss. We reevaluate and update our accruals as matters progress over time.

For nearly all of our matters, where our historical experience with similar matters is of limited value (i.e., “non-pattern matters”), we evaluate the matters primarily based on the individual facts and circumstances. For non-pattern matters, we evaluate whether there is a reasonable possibility of a material loss in excess of any accrual that can be estimated. It is reasonably possible that some of the matters for which accruals have not been established could be decided unfavorably and could require us to pay damages or make other expenditures. We do not reasonably expect, based on our analysis, that such matters would have a material effect on future financial statements for a particular year, although such an outcome is possible.

As noted, the litigation process is subject to many uncertainties, and the outcome of individual matters is not predictable with assurance. Our assessments are based on our knowledge and experience, but the ultimate outcome of any matter could require payment substantially in excess of the amount that we have accrued and/or disclosed.

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Shareholder of

Ford Motor Credit Company LLC:

Results of Review of Financial Statements

We have reviewed the accompanying consolidated balance sheet of Ford Motor Credit Company LLC and its subsidiaries (the “Company”) as of March 31, 2018, and the related consolidated statements of income, comprehensive income, and shareholder’s interest for the three-month periods ended March 31, 2018 and 2017 and the condensed consolidated statement of cash flows for the three-month periods ended March 31, 2018 and 2017, including the related notes (collectively referred to as the “interim financial statements”). Based on our reviews, we are not aware of any material modifications that should be made to the accompanying interim financial statements for them to be in conformity with accounting principles generally accepted in the United States of America.

We have previously audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States) (“PCAOB”), the consolidated balance sheet of the Company as of December 31, 2017, and the related consolidated statements of income, comprehensive income, shareholder’s interest, and of cash flows for the year then ended (not presented herein), and in our report dated February 8, 2018, we expressed an unqualified opinion on those consolidated financial statements. In our opinion, the information set forth in the accompanying consolidated balance sheet information as of December 31, 2017, is fairly stated, in all material respects, in relation to the consolidated balance sheet from which it has been derived.

Basis for Review Results

These interim financial statements are the responsibility of the Company’s management. We are a public accounting firm registered with the PCAOB and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB. We conducted our review in accordance with the standards of the PCAOB. A review of interim financial information consists principally of applying analytical procedures and making inquiries of persons responsible for financial and accounting matters. It is substantially less in scope than an audit conducted in accordance with the standards of the PCAOB, the objective of which is the expression of an opinion regarding the financial statements taken as a whole. Accordingly, we do not express such an opinion.

/s/ PricewaterhouseCoopers LLP

Detroit, Michigan

April 25, 2018

ITEM 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Results of Operations

Overview

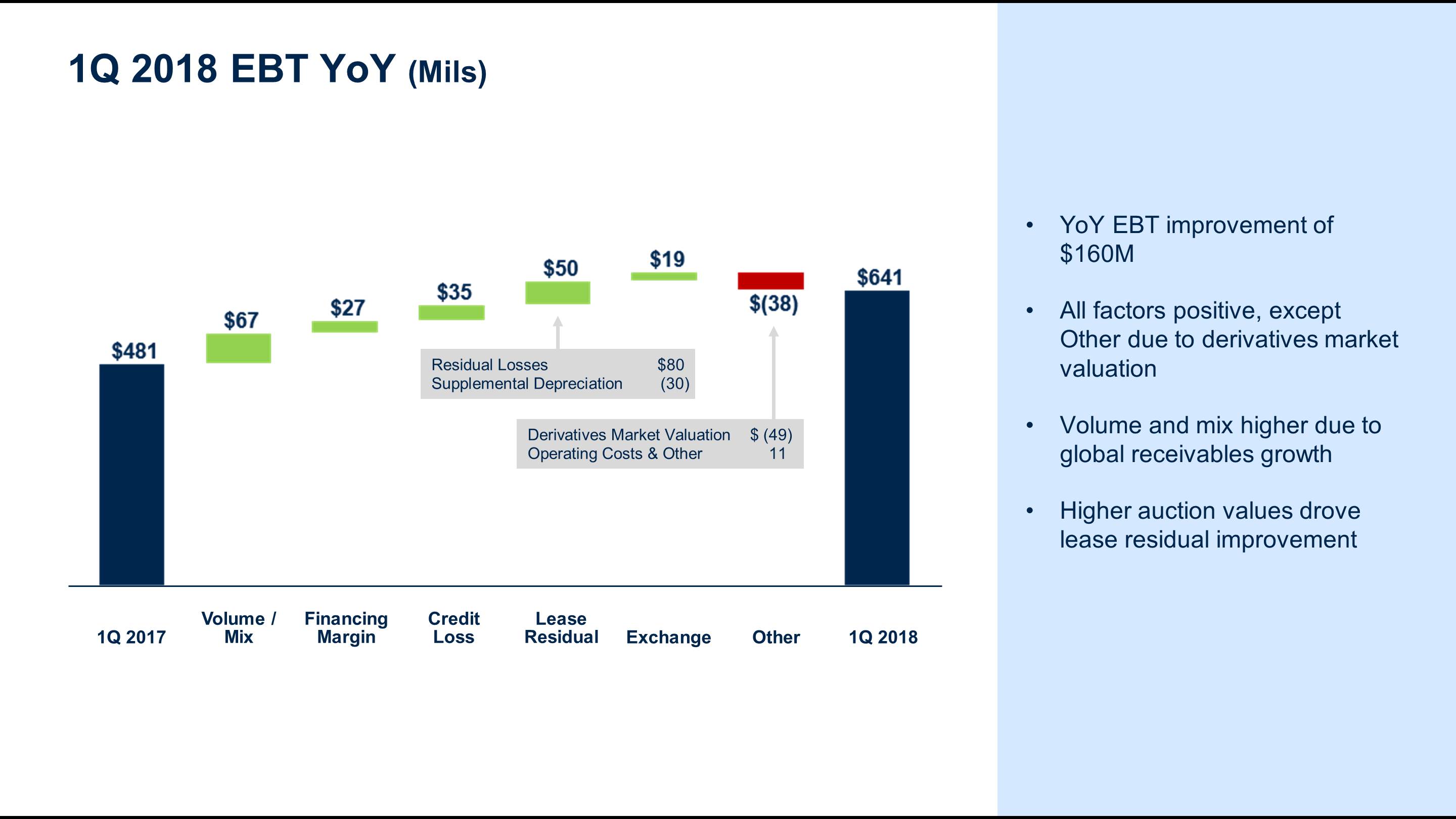

In general, we measure period-to-period changes in pre-tax results using the causal factors listed below:

| |

| • | Volume and Mix – Volume and Mix are primarily reflected within Net financing margin on the income statement. |

| |

| ◦ | Volume primarily measures changes in net financing margin driven by changes in average managed receivables at prior period financing margin yield (defined below in financing margin) at prior period exchange rates. Volume changes are primarily driven by the volume of new and used vehicle sales and leases, the extent to which we purchase retail installment sale and lease contracts, the extent to which we provide wholesale financing, the sales price of the vehicles financed, the level of dealer inventories, Ford-sponsored special financing programs available exclusively through us, and the availability of cost-effective funding for the purchase of retail installment sale and lease contracts and to provide wholesale financing. |

| |

| ◦ | Mix primarily measures changes in net financing margin driven by period over period changes in the composition of our average managed receivables by product and by country or region. |

| |

| • | Financing Margin – Financing Margin is reflected within Net financing margin on the income statement. |

| |

| ◦ | Financing margin variance is the period-to-period change in financing margin yield multiplied by the present period average managed receivables at prior period exchange rates. This calculation is performed at the product and country level and then aggregated. Financing margin yield equals revenue, less interest expense and scheduled depreciation for the period, divided by average managed receivables for the same period. |

| |

| ◦ | Financing margin changes are driven by changes in revenue and interest expense. Changes in revenue are primarily driven by the level of market interest rates, cost assumptions in pricing, mix of business, and competitive environment. Changes in interest expense are primarily driven by the level of market interest rates, borrowing spreads, and asset-liability management. |

| |

| • | Credit Loss – Credit Loss is reflected within the Provision for credit losses on the income statement. |

| |

| ◦ | Credit loss is the change in the provision for credit losses at prior period exchange rates. For analysis purposes, management splits the provision for credit losses into net charge-offs and the change in the allowance for credit losses. |

| |

| ◦ | Net charge-off changes are primarily driven by the number of repossessions, severity per repossession, and recoveries. Changes in the allowance for credit losses are primarily driven by changes in historical trends in credit losses and recoveries, changes in the composition and size of our present portfolio, changes in trends in historical used vehicle values, and changes in economic conditions. For additional information, refer to the “Critical Accounting Estimates – Allowance for Credit Losses” section of Item 7 of Part II to our 2017 Form 10-K Report. |

| |

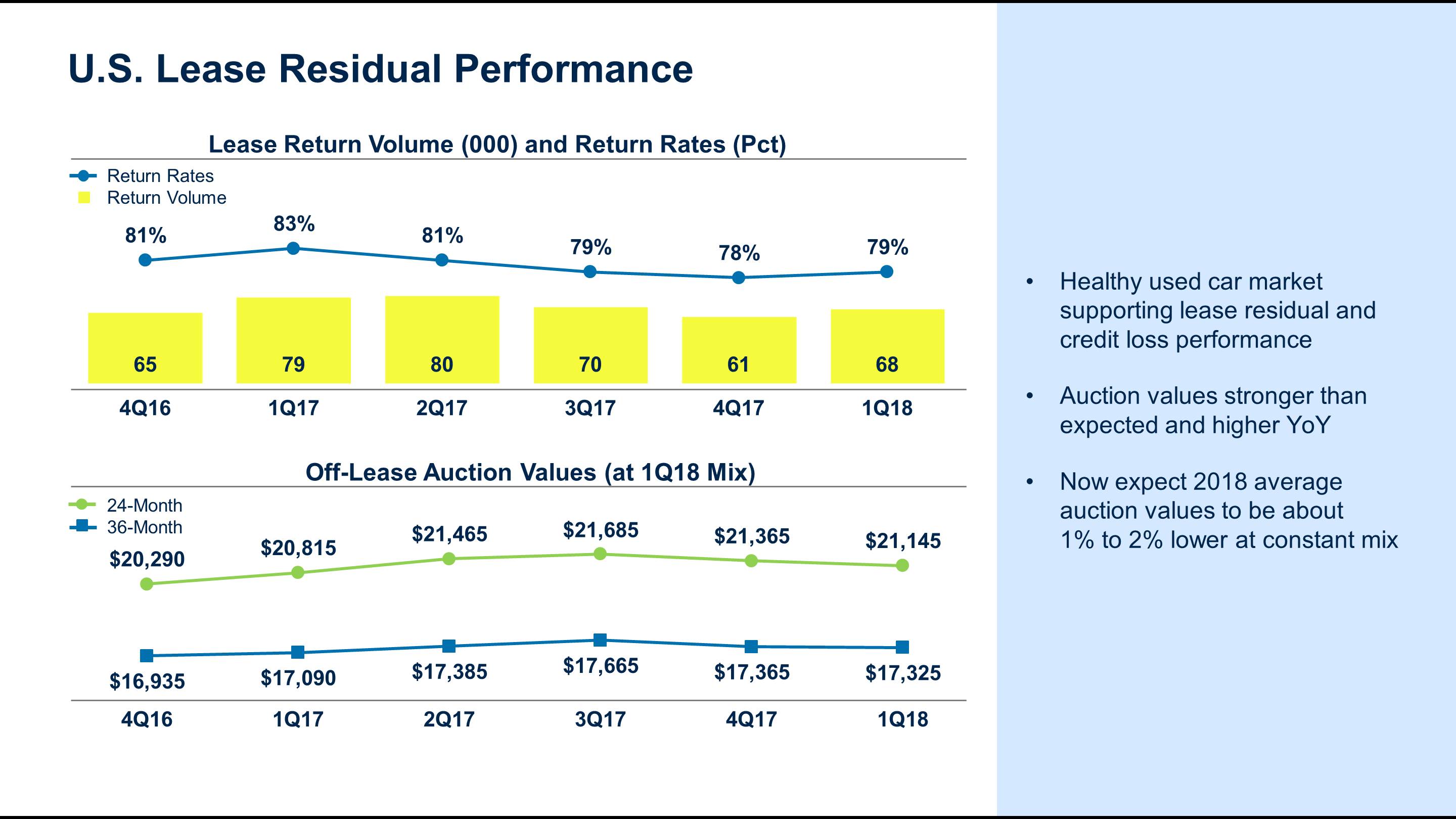

| • | Lease Residual – Lease Residual is reflected within Depreciation on vehicles subject to operating leases on the income statement. |

| |

| ◦ | Lease residual measures changes to residual performance at prior period exchange rates. For analysis purposes, management splits residual performance primarily into residual gains and losses, and the change in accumulated supplemental depreciation. |

| |

| ◦ | Residual gain and loss changes are primarily driven by the number of vehicles returned to us and sold, and the difference between the auction value and the depreciated value (which includes both base and accumulated supplemental depreciation) of the vehicles sold. Changes in accumulated supplemental depreciation are primarily driven by changes in our estimate of the expected auction value at the end of the lease term, and changes in our estimate of the number of vehicles that will be returned to us and sold. For additional information, refer to the “Critical Accounting Estimates” section of Item 7 of Part II to our 2017 Form 10-K Report. |

| |

| • | Exchange – Reflects changes in pre-tax results driven by the effects of converting functional currency income to U.S. dollars. |

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations (Continued)

| |

| • | Other – Primarily includes Operating expenses, Other revenue, and Insurance expenses on the income statement at prior period exchange rates. |

| |

| ◦ | Changes in operating expenses are primarily driven by salaried personnel costs, facilities costs, and costs associated with the origination and servicing of customer contracts. |

| |

| ◦ | In general, other revenue changes are primarily driven by changes in earnings related to market valuation adjustments to derivatives (primarily related to movements in interest rates), which are included in unallocated risk management, and other miscellaneous items. |

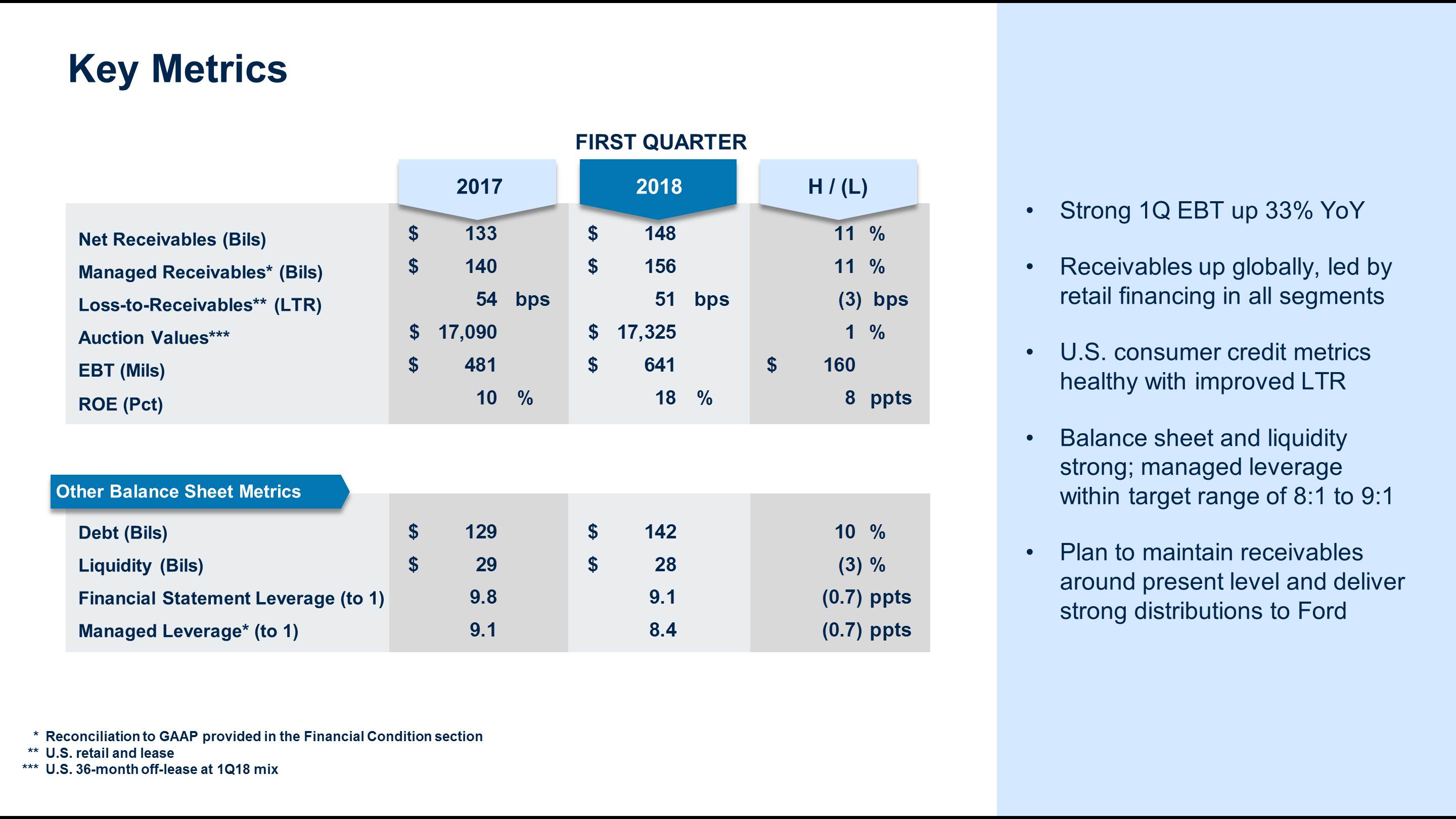

In addition, the following definitions and calculations apply to the charts contained in Item 2 of this report:

| |

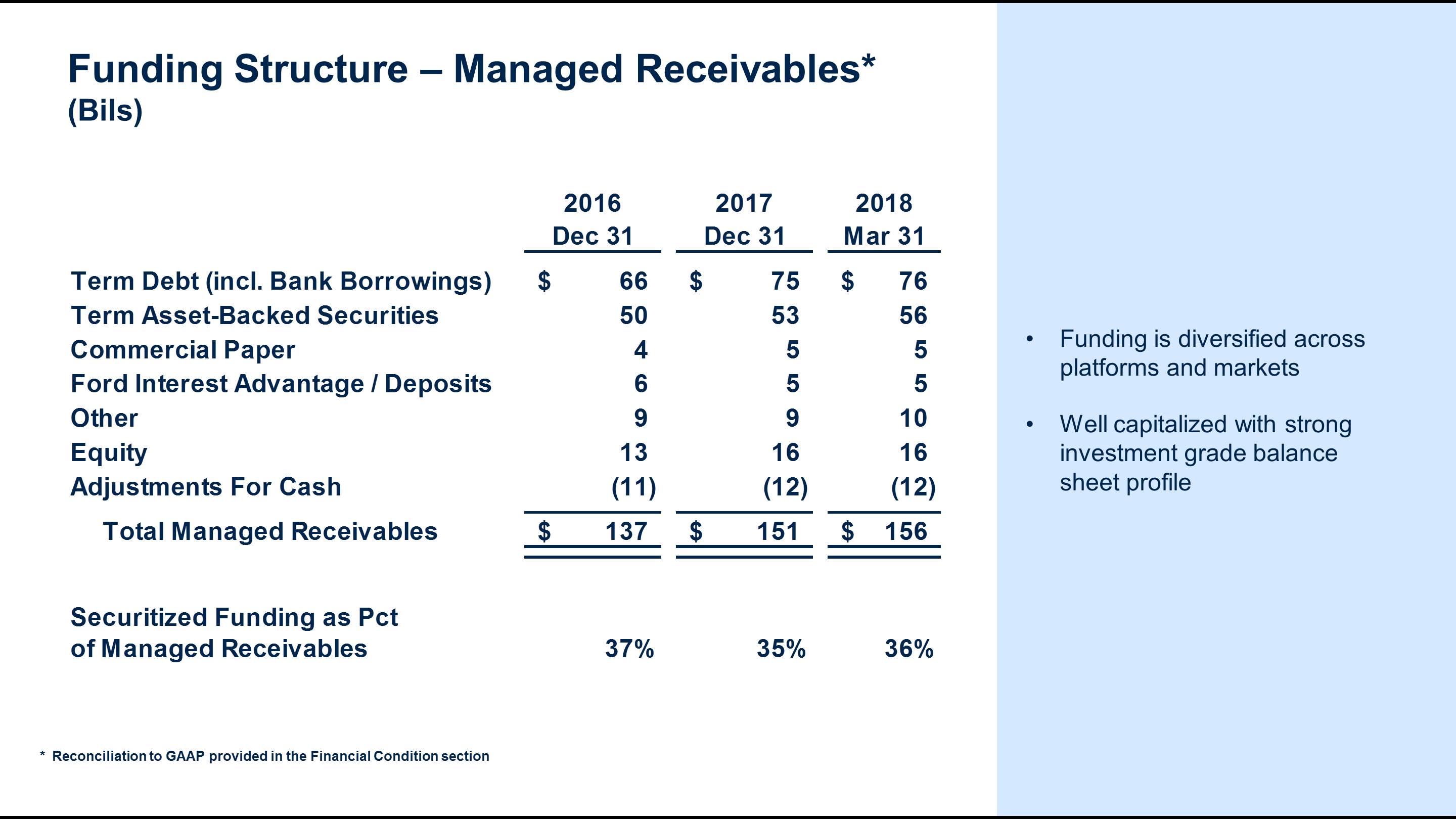

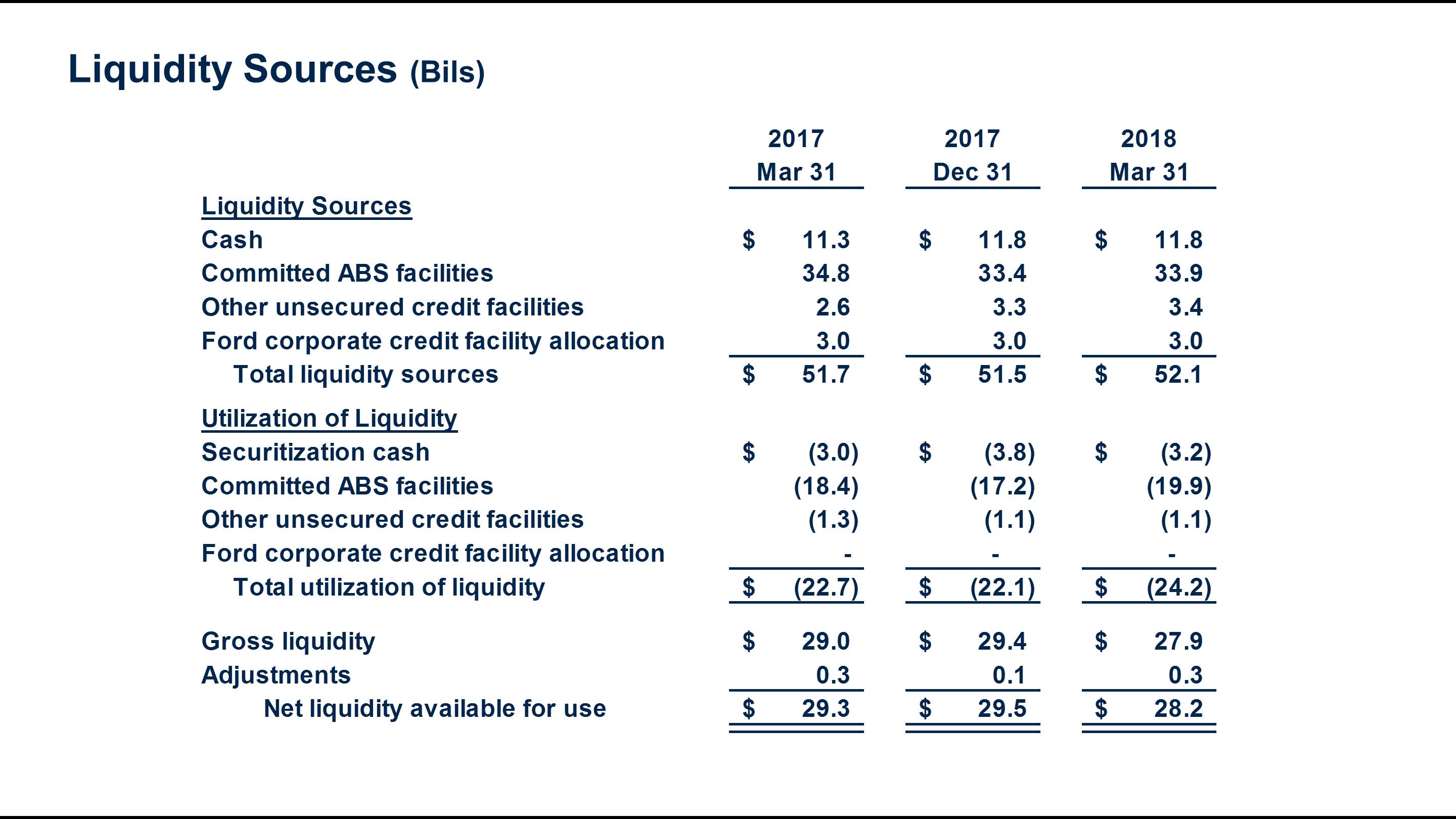

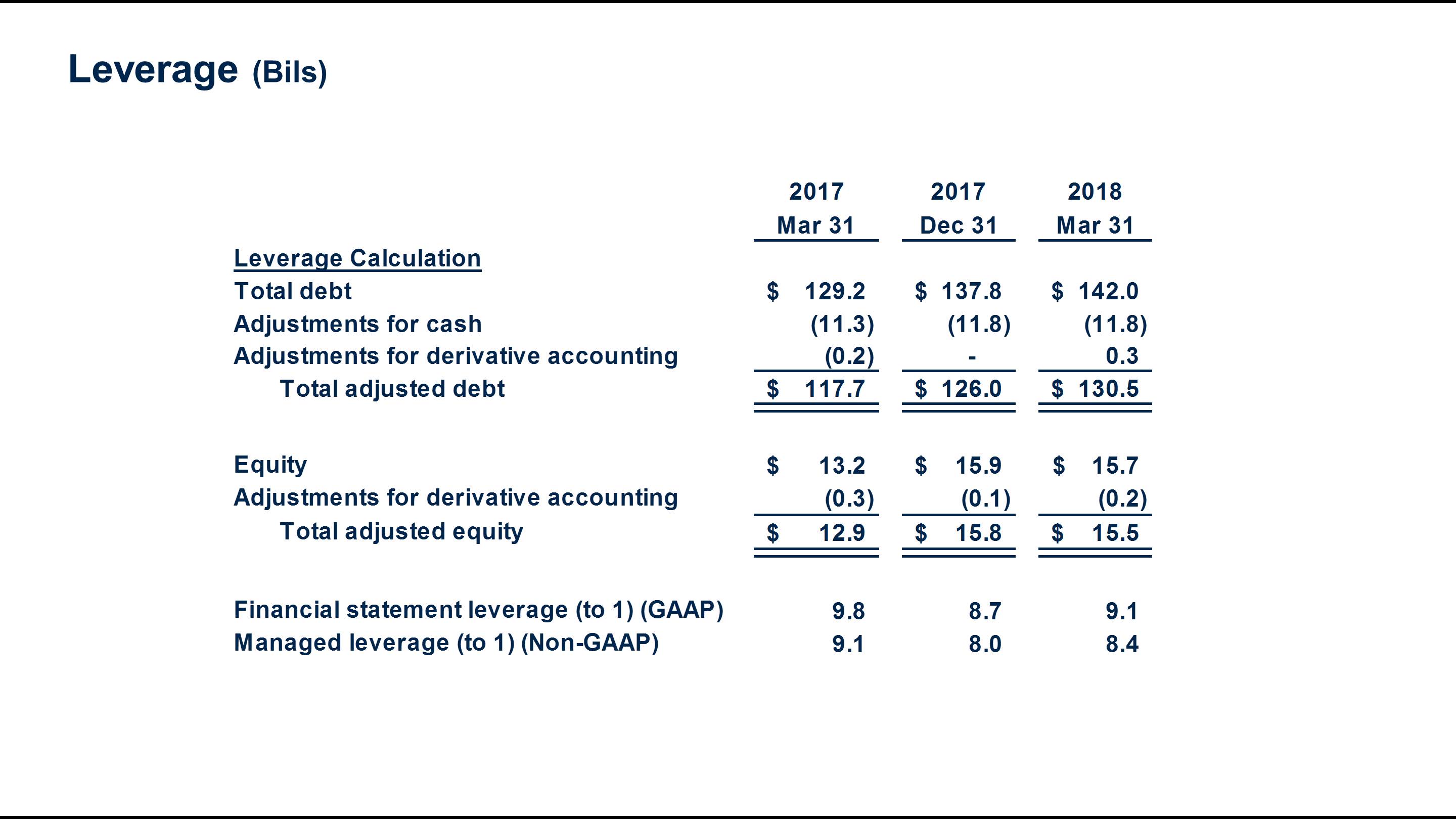

| • | Cash (as shown on the Funding Structure, Liquidity Sources, and Leverage charts) – Cash and cash equivalents and Marketable securities reported on Ford Credit’s balance sheet, excluding amounts related to insurance activities |

| |

| • | Earnings Before Taxes (EBT) – Reflects Income before income taxes as reported on Ford Credit’s income statement |

| |

| • | Return on Equity (ROE) (as shown on the Key Metrics chart) – Reflects return on equity calculated by annualizing net income for the period and dividing by monthly average equity for the period |

| |

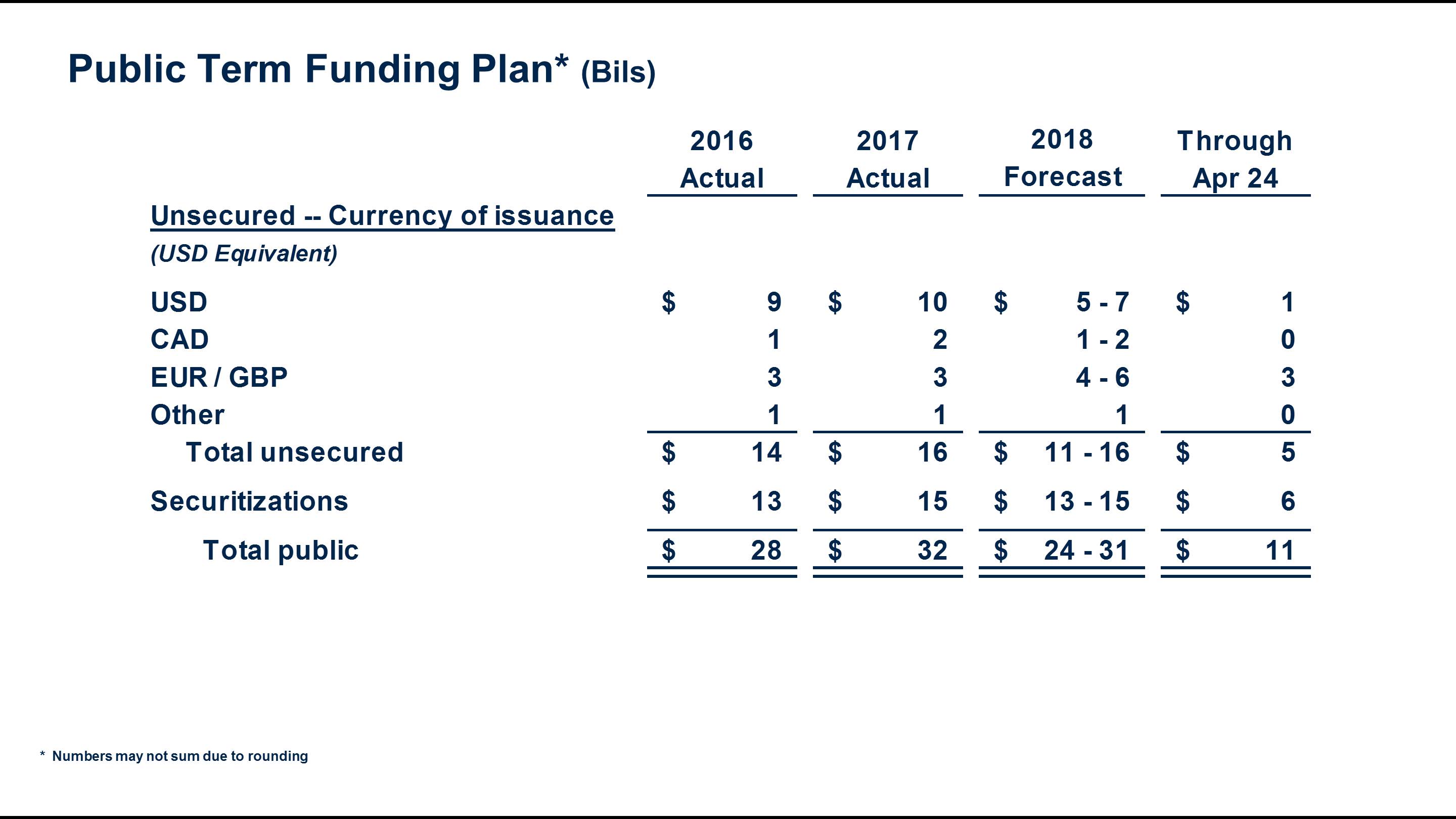

| • | Securitizations (as shown on the Public Term Funding Plan chart) – Public securitization transactions, Rule 144A offerings sponsored by Ford Credit, and widely distributed offerings by Ford Credit Canada |

| |

| • | Term Asset-Backed Securities (as shown on the Funding Structure chart) – Obligations issued in securitization transactions that are payable only out of collections on the underlying securitized assets and related enhancements |

| |