Exhibit 99.1

Forest City Enterprises, Inc.

Supplemental Package

Three and Six Months Ended July 31, 2012 and 2011

Forest City Enterprises, Inc. and Subsidiaries

Three and Six Months Ended July 31, 2012 and 2011

Supplemental Package

NYSE: FCEA, FCEB

Index

|

| |

| Corporate Overview | |

| | |

| Selected Financial Information | |

| Forest City Enterprises, Inc. | |

| Consolidated Balance Sheet Information | |

| Consolidated Earnings Information | |

| Net Asset Value Components | |

| | |

| Supplemental Operating Information | |

| Occupancy Data | |

| Retail Sales Data | |

| Leasing Summary | |

| Comparable Net Operating Income (NOI) | |

| Comparable NOI Detail | |

| NOI By Product Type | |

| NOI By Core Market | |

| Reconciliation of NOI to Net Earnings (Loss) | |

| Results of Operations Discussion | |

| Reconciliation of Operating FFO to FFO | |

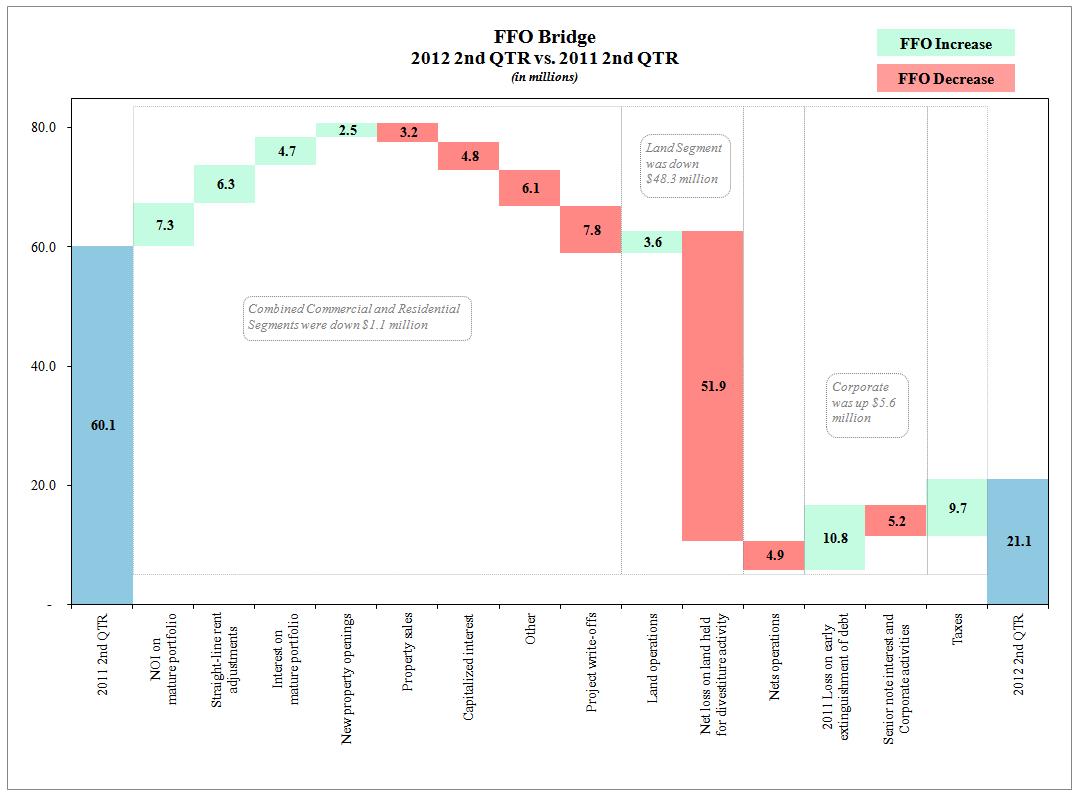

| FFO Bridge | |

| EBDT Discussion | |

| Reconciliation of FFO and EBDT to Net Earnings (Loss) | |

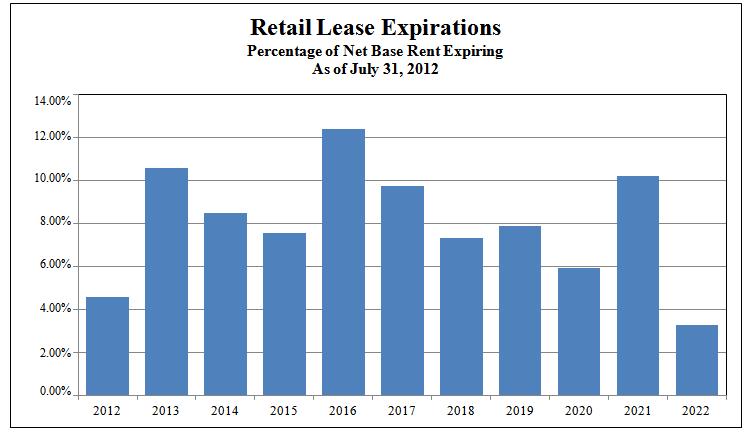

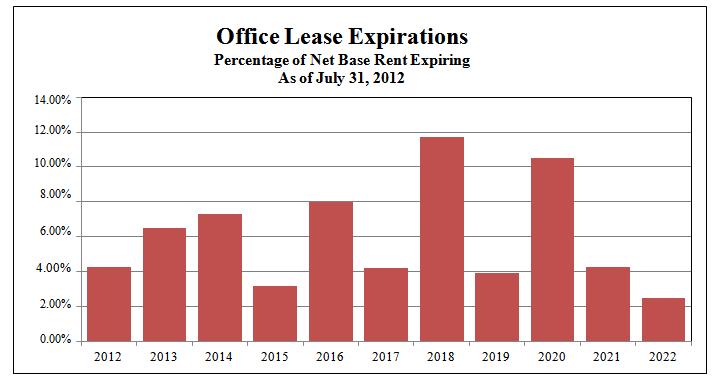

| Retail and Office Lease Expirations | |

| Retail and Office Significant Tenants | |

| Development Pipeline | |

| | |

| Supplemental Financial Information | |

| Common Stock Data/Covenants | |

| Projects under Construction and Development Debt and Nonrecourse Debt | |

| Scheduled Maturities Table | |

| Summary of FFO | |

This Supplemental Package, together with other statements and information publicly disseminated by us, contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements reflect management’s current views with respect to financial results related to future events and are based on assumptions and expectations that may not be realized and are inherently subject to risks and uncertainties, many of which cannot be predicted with accuracy and some of which might not even be anticipated. Future events and actual results, financial or otherwise, may differ from the results discussed in the forward-looking statements. Risk factors discussed in Item 1A of our Form 10-K for the year ended January 31, 2012 and other factors that might cause differences, some of which could be material, include, but are not limited to, the impact of current lending and capital market conditions on our liquidity, ability to finance or refinance projects and repay our debt, the impact of the current economic environment on the ownership, development and management of our real estate portfolio, general real estate investment and development risks, vacancies in our properties, the strategic decision to reposition or divest portions of our land business, further downturns in the housing market, competition, illiquidity of real estate investments, bankruptcy or defaults of tenants, anchor store consolidations or closings, international activities, the impact of terrorist acts, risks associated with an investment in a professional sports team, our substantial debt leverage and the ability to obtain and service debt, the impact of restrictions imposed by our credit facility and senior debt, exposure to hedging agreements, the level and volatility of interest rates, the continued availability of tax-exempt government financing, the impact of credit rating downgrades, effects of uninsured or underinsured losses, effects of a downgrade or failure of our insurance carriers, environmental liabilities, conflicts of interest, risks associated with the sale of tax credits, risks associated with developing and managing properties in partnership with others, the ability to maintain effective internal controls, compliance with governmental regulations, increased legislative and regulatory scrutiny of the financial services industry, volatility in the market price of our publicly traded securities, inflation risks, litigation risks, cybersecurity risks and cyber incidents, as well as other risks listed from time to time in our reports filed with the Securities and Exchange Commission. We have no obligation to revise or update any forward-looking statements, other than imposed by law, as a result of future events or new information. Readers are cautioned not to place undue reliance on such forward-looking statements.

Forest City Enterprises, Inc. and Subsidiaries

Supplemental Financial and Operating Information

Corporate Overview

We principally engage in the ownership, development, management and acquisition of commercial and residential real estate and land throughout the United States. We operate through three strategic business units and five reportable segments. The Commercial Group, our largest strategic business unit, owns, develops, acquires and operates regional malls, specialty/urban retail centers, office and life science buildings, hotels and mixed-use projects. The Residential Group owns, develops, acquires and operates residential rental properties, including upscale and middle-market apartments and adaptive re-use developments. Additionally, the Residential Group develops for-sale condominium projects and also owns interests in entities that develop and manage military family housing. The Land Development Group acquires and sells both land and developed lots to residential, commercial and industrial customers. It also owns and develops land into master-planned communities and mixed-use projects. On January 31, 2012, our Board of Directors approved a strategic decision by senior management to reposition or divest significant portions of our Land Development Group. During the six months ended July 31, 2012, we established and began executing on our land divestiture strategy. Real Estate Groups are the combined Commercial, Residential and Land Development Groups. Corporate Activities and the Nets, a member of the National Basketball Association (“NBA”) in which we account for our investment on the equity method of accounting, are other reportable segments of the Company.

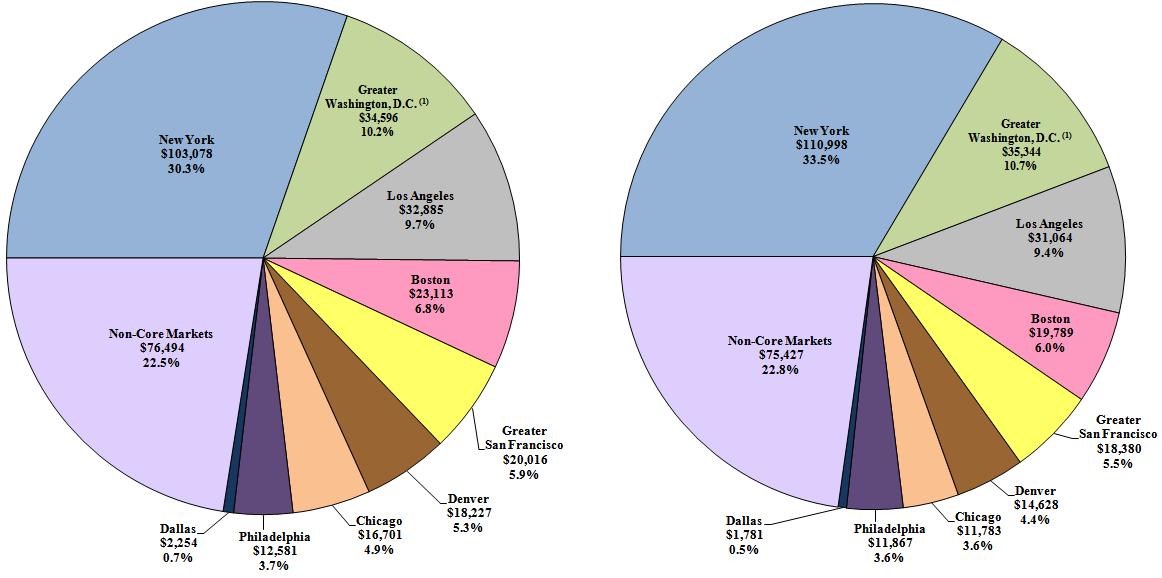

We have approximately $10.7 billion of assets in 27 states and the District of Columbia at July 31, 2012. Our core markets include Boston, Chicago, Dallas, Denver, Los Angeles, New York, Philadelphia, the Greater San Francisco metropolitan area and the Greater Washington D.C. metropolitan area. Our core markets account for approximately 78 percent of the cost of our real estate portfolio at July 31, 2012. We have offices in Albuquerque, Boston, Chicago, Dallas, Denver, London (England), Los Angeles, New York City, San Francisco, Washington, D.C. and our corporate headquarters in Cleveland, Ohio.

Supplemental Financial and Operating Information

We recommend this supplemental package be read in conjunction with our Form 10-Q for the three and six months ended July 31, 2012. This supplemental package contains certain measures prepared in accordance with generally accepted accounting principles (“GAAP”) under the full consolidation accounting method and certain measures prepared under the pro-rata consolidation method, a non-GAAP measure. Along with net earnings, we have historically reported an additional measure, Earnings Before Depreciation, Amortization and Deferred Taxes (“EBDT”), to report operating results. EBDT is a non-GAAP measure and may not be directly comparable to similarly-titled measures reported by other companies. In the three months ended April 30, 2012, we began presenting Funds From Operations (“FFO”), which is also a non-GAAP measure. In the three months ended July 31, 2012, we began presenting Operating FFO, which is also a non-GAAP measure. The non-GAAP financial measures presented under the pro-rata consolidation method, comparable net operating income (“NOI”), EBDT, FFO and Operating FFO provide supplemental information about our operations. Although these measures are not presented in accordance with GAAP, we believe they are necessary to understand our business and operating results, along with net earnings and other GAAP measures. Our investors can use these non-GAAP measures as supplementary information to evaluate our business. Our non-GAAP measures are not intended to be performance measures that should be regarded as alternatives to, or more meaningful than, our GAAP measures.

Revision of Prior Period Financial Statements

Historically, we have recorded an allowance for projects under development (the “Allowance”) that have not been abandoned at each balance sheet date. During the three months ended January 31, 2012, we determined that the recording of the Allowance was not in accordance with ASC 970-360-40. The impact of this error (the “Allowance Revision”) was an overstatement of operating expenses of $2,000,000 ($1,224,000 after tax) for the three months ended July 31, 2011. We assessed the materiality of this error on prior periods’ financial statements in accordance with ASC 250-10 (SEC’s Staff Accounting Bulletin No. 99, Materiality), and concluded that the error was not material to any prior annual or interim periods but would be material if the entire correction was recorded during the year ended January 31, 2012. Accordingly, the financial statements for the three months ended July 31, 2011 which are presented herein, have been revised. The error had no effect on the financial statements for the six months ended July 31, 2011.

Consolidation Methods

We present certain financial amounts under the pro-rata consolidation method because we believe this information is useful to investors as this method reflects the manner in which we operate our business. In line with industry practice, we have made a large number of investments in which our economic ownership is less than 100% as a means of procuring opportunities and sharing risk. Under the pro-rata consolidation method, we generally present our investments proportionate to our economic share of ownership. Under GAAP, the full consolidation method is used to report partnership assets and liabilities consolidated at 100% if deemed to be under our control or if we are deemed to be the primary beneficiary of the variable interest entity (“VIE”), even if our ownership is not 100%. We provide reconciliations from the full consolidation method to the pro-rata consolidation method throughout our supplemental package. Please refer to our property listing for the detail of our consolidated and unconsolidated properties in our supplemental package for the year ended January 31, 2012.

Forest City Enterprises, Inc. and Subsidiaries

Supplemental Financial and Operating Information

EBDT

We believe that EBDT, along with net earnings, provides additional information about our core operations. While property dispositions, acquisitions or other factors can affect net earnings in the short-term, we believe EBDT presents a more consistent view of the overall financial performance of our business from period-to-period. EBDT has been used by the chief operating decision maker and management to assess performance and resource allocations by strategic business unit and on a consolidated basis. EBDT is similar, but not identical, to FFO, a measure of performance used by publicly traded Real Estate Investment Trusts (“REITs”).

FFO

The majority of our peers in the publically traded real estate industry are REITs and report operations using FFO as defined by the National Association of Real Estate Investment Trusts (“NAREIT”). Although we are not a REIT, we feel it is important to publish this measure to allow for easier comparison of our performance to our peers. The major difference between us and our REIT peers is that we are a taxable entity and any taxable income we generate could result in payment of federal or state income taxes. Our REIT peers typically are not subject to federal or state income taxes, but must pay out a portion of their taxable income to shareholders. Due to our effective tax management policies, we have not historically been a significant payer of income taxes. This has allowed us to retain our internally generated cash flows but has also resulted in large expenses for deferred taxes as required by GAAP. The treatment of deferred taxes is the single biggest difference between EBDT and FFO. We intend to continue to report both EBDT and FFO during the fiscal year ending January 31, 2013. Effective February 1, 2013, we will only report FFO to be more comparable to our industry peers.

Supplemental Operating Information

The operating information contained in this document includes: occupancy data, retail sales data, leasing summaries, comparable NOI, NOI by product type and core market, reconciliation of NOI to net earnings, results of operations discussion, FFO bridge, reconciliation of Operating FFO to FFO, reconciliation of net earnings to FFO and EBDT, retail and office lease expirations, significant retail and office tenants, and our development pipeline. We believe this information will give interested parties a better understanding and more information about our operating performance. The term “comparable,” which is used throughout this document, is generally defined as including properties that were open and operated in both the three and six months ended July 31, 2012 and 2011.

We believe occupancy rates, retail and office lease expirations, base rent, significant retail and office tenant listings, mall sales per square foot, leasing spreads on retail and office properties, and other rental rate information on multi-family properties represent meaningful operating statistics about us.

Comparable NOI is useful because it measures the performance of the same properties on a period-to-period basis and is used to assess operating performance and resource allocation of the operating properties within our strategic business units. While property dispositions, acquisitions or other factors can impact net earnings in the short term, we believe comparable NOI gives a more consistent view of the overall performance of our operating portfolio from quarter-to-quarter and year-to-year. A reconciliation of NOI to net earnings, the most comparable financial measure calculated in accordance with GAAP, a reconciliation of NOI to net earnings for each strategic business unit and a reconciliation from NOI to comparable NOI are included in this supplemental package.

Forest City Enterprises, Inc. and Subsidiaries

Supplemental Financial and Operating Information

Corporate Headquarters

Forest City Enterprises, Inc.

Terminal Tower

50 Public Square, Suite 1100

Cleveland, Ohio 44113

Annual Report on Form 10-K

A copy of the Annual Report on Form 10-K as filed with the Securities and Exchange Commission for the fiscal year ended January 31, 2012 can be found on our website under SEC Filings or may be obtained without charge upon written request to:

Jeffrey B. Linton

Senior Vice President, Corporate Communication

jefflinton@forestcity.net

Website

www.forestcity.net

The information contained on this website is not incorporated herein by reference and does not constitute a part of this supplemental package.

Investor Relations

Robert G. O’Brien

Executive Vice President and Chief Financial Officer

Transfer Agent and Registrar

Wells Fargo

Shareowner Services

P.O. Box 64854

St. Paul, MN 55164-9440

(800) 468-9716

www.shareowneronline.com

Common Stock Exchange Listing

NYSE: FCEA and FCEB

Dividend Reinvestment and Stock Purchase Plan

We offer our shareholders the opportunity to purchase additional shares of common stock through the Forest City Enterprises, Inc. Dividend Reinvestment and Stock Purchase Plan (the “Plan”) at 97% of current market value. You may obtain a copy of the Plan prospectus and an enrollment card by contacting Wells Fargo Shareowner Services at (800) 468-9716 or by visiting www.shareowneronline.com.

Forest City Enterprises, Inc. and Subsidiaries

Selected Financial Information

Consolidated Balance Sheet Information – July 31, 2012 (Unaudited)

|

| | | | | | | | | | | | | | | |

| | Full Consolidation (GAAP) | Less Noncontrolling Interest | Plus Unconsolidated Investments at Pro-Rata | Plus Discontinued Operations | Pro-Rata Consolidation (Non-GAAP) |

| | (in thousands) |

| Assets | | | | | |

| Real Estate | | | | | |

| Completed rental properties | | | | | |

| Residential | $ | 1,584,458 |

| $ | 35,185 |

| $ | 1,338,153 |

| $ | 24,210 |

| $ | 2,911,636 |

|

| Commercial | | | | | |

| Retail centers | 2,925,904 |

| 71,424 |

| 1,141,309 |

| — |

| 3,995,789 |

|

| Office and other buildings | 3,028,576 |

| 103,265 |

| 351,703 |

| — |

| 3,277,014 |

|

| Corporate and other equipment | 10,820 |

| — |

| — |

| — |

| 10,820 |

|

| Total completed rental properties | 7,549,758 |

| 209,874 |

| 2,831,165 |

| 24,210 |

| 10,195,259 |

|

| Projects under construction | | | | | |

| Residential | 67,151 |

| 1,059 |

| 24,417 |

| — |

| 90,509 |

|

| Commercial | | | | | |

| Retail centers | 343,393 |

| — |

| 4,150 |

| — |

| 347,543 |

|

| Office and other buildings | 811,526 |

| 495,417 |

| — |

| — |

| 316,109 |

|

| Total projects under construction | 1,222,070 |

| 496,476 |

| 28,567 |

| — |

| 754,161 |

|

| Projects under development | | | | | |

| Residential | 845,947 |

| 186,339 |

| 6,178 |

| — |

| 665,786 |

|

| Commercial | | | | | |

| Retail centers | 33,478 |

| 109 |

| — |

| — |

| 33,369 |

|

| Office and other buildings | 260,105 |

| 25,714 |

| 6,259 |

| — |

| 240,650 |

|

| Total projects under development | 1,139,530 |

| 212,162 |

| 12,437 |

| — |

| 939,805 |

|

| Total projects under construction and development | 2,361,600 |

| 708,638 |

| 41,004 |

| — |

| 1,693,966 |

|

| Land held for development and sale | 77,175 |

| 7,432 |

| — |

| — |

| 69,743 |

|

| Total Real Estate | 9,988,533 |

| 925,944 |

| 2,872,169 |

| 24,210 |

| 11,958,968 |

|

| Less accumulated depreciation | (1,602,423 | ) | (51,135 | ) | (581,822 | ) | (5,732 | ) | (2,138,842 | ) |

| Real Estate, net | 8,386,110 |

| 874,809 |

| 2,290,347 |

| 18,478 |

| 9,820,126 |

|

| Cash and equivalents | 240,866 |

| 22,157 |

| 61,776 |

| — |

| 280,485 |

|

| Restricted cash and escrowed funds | 351,645 |

| 59,320 |

| 95,227 |

| — |

| 387,552 |

|

| Escrowed funds for 2015 senior note redemption | 125,000 |

| — |

| — |

| — |

| 125,000 |

|

| Notes and accounts receivable, net | 399,964 |

| 22,721 |

| 29,064 |

| — |

| 406,307 |

|

| Investments in and advances to unconsolidated entities | 572,230 |

| (132,907 | ) | (503,613 | ) | — |

| 201,524 |

|

| Lease and mortgage procurement costs, net | 268,961 |

| 8,920 |

| 52,528 |

| — |

| 312,569 |

|

| Prepaid expenses and other deferred costs, net | 243,281 |

| 33,969 |

| 18,055 |

| 356 |

| 227,723 |

|

| Intangible assets, net | 102,545 |

| 3 |

| 10,842 |

| — |

| 113,384 |

|

| Land held for divestiture | 23,417 |

| 1,925 |

| 27,330 |

| — |

| 48,822 |

|

| Operating property assets held for sale | 18,834 |

| — |

| — |

| (18,834 | ) | — |

|

| Total Assets | $ | 10,732,853 |

| $ | 890,917 |

| $ | 2,081,556 |

| $ | — |

| $ | 11,923,492 |

|

Forest City Enterprises, Inc. and Subsidiaries

Selected Financial Information

Consolidated Balance Sheet Information – July 31, 2012 (Unaudited)

|

| | | | | | | | | | | | | | | |

| | Full Consolidation (GAAP) | Less Noncontrolling Interest | Plus Unconsolidated Investments at Pro-Rata | Plus Discontinued Operations | Pro-Rata Consolidation (Non-GAAP) |

| | (in thousands) |

| Liabilities and Equity | | | | | |

| Liabilities | | | | | |

| Mortgage debt and notes payable, nonrecourse | | | | | |

| Completed rental properties | | | | | |

| Residential | $ | 975,015 |

| $ | 26,246 |

| $ | 999,492 |

| $ | 14,914 |

| $ | 1,963,175 |

|

| Commercial | | | | | |

| Retail centers | 1,860,600 |

| 64,673 |

| 886,280 |

| — |

| 2,682,207 |

|

| Office and other buildings | 2,105,386 |

| 79,561 |

| 270,714 |

| — |

| 2,296,539 |

|

| Total completed rental properties | 4,941,001 |

| 170,480 |

| 2,156,486 |

| 14,914 |

| 6,941,921 |

|

| Projects under construction | | | | | |

| Residential | 25,995 |

| 460 |

| 6,271 |

| — |

| 31,806 |

|

| Commercial | | | | | |

| Retail centers | 178,863 |

| — |

| — |

| — |

| 178,863 |

|

| Office and other buildings | 352,226 |

| 224,425 |

| — |

| — |

| 127,801 |

|

| Total projects under construction | 557,084 |

| 224,885 |

| 6,271 |

| — |

| 338,470 |

|

| Projects under development | | | | | |

| Residential | 247,340 |

| 59,538 |

| — |

| — |

| 187,802 |

|

| Commercial | | | | | |

| Retail centers | — |

| — |

| — |

| — |

| — |

|

| Office and other buildings | — |

| — |

| 2,738 |

| — |

| 2,738 |

|

| Total projects under development | 247,340 |

| 59,538 |

| 2,738 |

| — |

| 190,540 |

|

| Total projects under construction and development | 804,424 |

| 284,423 |

| 9,009 |

| — |

| 529,010 |

|

| Land held for development and sale | 9,448 |

| 946 |

| — |

| — |

| 8,502 |

|

| Total Mortgage debt and notes payable, nonrecourse | 5,754,873 |

| 455,849 |

| 2,165,495 |

| 14,914 |

| 7,479,433 |

|

| Bank revolving credit facility | — |

| — |

| — |

| — |

| — |

|

| Senior and subordinated debt | 1,157,666 |

| — |

| — |

| — |

| 1,157,666 |

|

| Construction payables | 193,754 |

| 65,182 |

| 12,775 |

| — |

| 141,347 |

|

| Operating accounts payable and accrued expenses | 603,860 |

| 58,894 |

| 150,694 |

| 178 |

| 695,838 |

|

| Accrued derivative liability | 174,113 |

| 164 |

| 18,975 |

| — |

| 192,924 |

|

| Deferred profit on NY retail joint venture transaction | 114,465 |

| — |

| — |

| — |

| 114,465 |

|

| Total Accounts payable, accrued expenses and other liabilities | 1,086,192 |

| 124,240 |

| 182,444 |

| 178 |

| 1,144,574 |

|

| Cash distributions and losses in excess of investments in unconsolidated entities | 292,700 |

| (13,051 | ) | (287,037 | ) | — |

| 18,714 |

|

| Deferred income taxes | 458,825 |

| — |

| — |

| — |

| 458,825 |

|

| Mortgage debt and notes payable, nonrecourse on land held for divestiture | 19,571 |

| 1,721 |

| 20,654 |

| — |

| 38,504 |

|

| Liabilities of operating property held for sale | 15,092 |

| — |

| — |

| (15,092 | ) | — |

|

| Total Liabilities | 8,784,919 |

| 568,759 |

| 2,081,556 |

| — |

| 10,297,716 |

|

| Redeemable Noncontrolling Interest | 232,107 |

| 232,107 |

| — |

| — |

| — |

|

| Equity | | | | | |

| Shareholders’ Equity | | | | | |

| Shareholders’ equity before accumulated other comprehensive loss | 1,556,884 |

| — |

| — |

| — |

| 1,556,884 |

|

| Accumulated other comprehensive loss | (117,129 | ) | — |

| — |

| — |

| (117,129 | ) |

| Total Shareholders’ Equity | 1,439,755 |

| — |

| — |

| — |

| 1,439,755 |

|

| Noncontrolling interest | 276,072 |

| 90,051 |

| — |

| — |

| 186,021 |

|

| Total Equity | 1,715,827 |

| 90,051 |

| — |

| — |

| 1,625,776 |

|

| Total Liabilities and Equity | $ | 10,732,853 |

| $ | 890,917 |

| $ | 2,081,556 |

| $ | — |

| $ | 11,923,492 |

|

Forest City Enterprises, Inc. and Subsidiaries

Selected Financial Information

Consolidated Balance Sheet Information – January 31, 2012 (Unaudited)

|

| | | | | | | | | | | | |

| | Full Consolidation (GAAP) | Less Noncontrolling Interest | Plus Unconsolidated Investments at Pro-Rata | Pro-Rata Consolidation (Non-GAAP) |

| | (in thousands) |

| Assets | | | | |

| Real Estate | | | | |

| Completed rental properties | | | | |

| Residential | $ | 1,584,403 |

| $ | 27,003 |

| $ | 1,229,109 |

| $ | 2,786,509 |

|

| Commercial | | | | |

| Retail centers | 2,638,954 |

| 74,012 |

| 1,203,459 |

| 3,768,401 |

|

| Office and other buildings | 2,949,699 |

| 94,310 |

| 387,543 |

| 3,242,932 |

|

| Corporate and other equipment | 10,392 |

| — |

| — |

| 10,392 |

|

| Total completed rental properties | 7,183,448 |

| 195,325 |

| 2,820,111 |

| 9,808,234 |

|

| Projects under construction | | | | |

| Residential | 56,496 |

| 988 |

| 95,404 |

| 150,912 |

|

| Commercial | | | | |

| Retail centers | 595,011 |

| 309 |

| 7,945 |

| 602,647 |

|

| Office and other buildings | 606,304 |

| 370,626 |

| 2,302 |

| 237,980 |

|

| Total projects under construction | 1,257,811 |

| 371,923 |

| 105,651 |

| 991,539 |

|

| Projects under development | | | | |

| Residential | 776,817 |

| 170,423 |

| 17,693 |

| 624,087 |

|

| Commercial | | | | |

| Retail centers | 39,495 |

| 99 |

| 10,481 |

| 49,877 |

|

| Office and other buildings | 254,856 |

| 25,712 |

| 2,670 |

| 231,814 |

|

| Total projects under development | 1,071,168 |

| 196,234 |

| 30,844 |

| 905,778 |

|

| Total projects under construction and development | 2,328,979 |

| 568,157 |

| 136,495 |

| 1,897,317 |

|

| Land held for development and sale | 77,298 |

| 7,451 |

| 24,851 |

| 94,698 |

|

| Total Real Estate | 9,589,725 |

| 770,933 |

| 2,981,457 |

| 11,800,249 |

|

| Less accumulated depreciation | (1,526,503 | ) | (46,085 | ) | (557,613 | ) | (2,038,031 | ) |

| Real Estate, net | 8,063,222 |

| 724,848 |

| 2,423,844 |

| 9,762,218 |

|

| Cash and equivalents | 217,486 |

| 9,324 |

| 60,689 |

| 268,851 |

|

| Restricted cash and escrowed funds | 542,566 |

| 98,001 |

| 109,282 |

| 553,847 |

|

| Notes and accounts receivable, net | 406,244 |

| 19,542 |

| 36,684 |

| 423,386 |

|

| Investments in and advances to unconsolidated entities | 609,079 |

| (160,470 | ) | (542,772 | ) | 226,777 |

|

| Lease and mortgage procurement costs, net | 273,995 |

| 8,760 |

| 58,512 |

| 323,747 |

|

| Prepaid expenses and other deferred costs, net | 227,354 |

| 34,626 |

| 20,708 |

| 213,436 |

|

| Intangible assets, net | 107,192 |

| 3 |

| 11,076 |

| 118,265 |

|

| Land held for divestiture | 57,145 |

| 14,141 |

| 45,257 |

| 88,261 |

|

| Total Assets | $ | 10,504,283 |

| $ | 748,775 |

| $ | 2,223,280 |

| $ | 11,978,788 |

|

Forest City Enterprises, Inc. and Subsidiaries

Selected Financial Information

Consolidated Balance Sheet Information – January 31, 2012 (Unaudited)

|

| | | | | | | | | | | | |

| | Full Consolidation (GAAP) | Less Noncontrolling Interest | Plus Unconsolidated Investments at Pro-Rata | Pro-Rata Consolidation (Non-GAAP) |

| | (in thousands) |

| Liabilities and Equity | | | | |

| Liabilities | | | | |

| Mortgage debt and notes payable, nonrecourse | | | | |

| Completed rental properties | | | | |

| Residential | $ | 1,008,576 |

| $ | 18,844 |

| $ | 949,015 |

| $ | 1,938,747 |

|

| Commercial | | | | |

| Retail centers | 1,735,148 |

| 67,371 |

| 971,035 |

| 2,638,812 |

|

| Office and other buildings | 2,064,588 |

| 73,056 |

| 301,910 |

| 2,293,442 |

|

| Total completed rental properties | 4,808,312 |

| 159,271 |

| 2,221,960 |

| 6,871,001 |

|

| Projects under construction | | | | |

| Residential | 6,596 |

| — |

| 56,737 |

| 63,333 |

|

| Commercial | | | | |

| Retail centers | 330,533 |

| — |

| — |

| 330,533 |

|

| Office and other buildings | 207,028 |

| 127,685 |

| — |

| 79,343 |

|

| Total projects under construction | 544,157 |

| 127,685 |

| 56,737 |

| 473,209 |

|

| Projects under development | | | | |

| Residential | 272,195 |

| 66,027 |

| — |

| 206,168 |

|

| Commercial | | | | |

| Retail centers | — |

| — |

| — |

| — |

|

| Office and other buildings | — |

| — |

| 2,887 |

| 2,887 |

|

| Total projects under development | 272,195 |

| 66,027 |

| 2,887 |

| 209,055 |

|

| Total projects under construction and development | 816,352 |

| 193,712 |

| 59,624 |

| 682,264 |

|

| Land held for development and sale | 15,775 |

| 1,578 |

| 12,655 |

| 26,852 |

|

| Total Mortgage debt and notes payable, nonrecourse | 5,640,439 |

| 354,561 |

| 2,294,239 |

| 7,580,117 |

|

| Bank revolving credit facility | — |

| — |

| — |

| — |

|

| Senior and subordinated debt | 1,038,529 |

| — |

| — |

| 1,038,529 |

|

| Construction payables | 202,395 |

| 61,564 |

| 18,564 |

| 159,395 |

|

| Operating accounts payable and accrued expenses | 621,582 |

| 27,798 |

| 161,323 |

| 755,107 |

|

| Accrued derivative liability | 174,020 |

| — |

| 19,033 |

| 193,053 |

|

| Deferred profit on NY retail joint venture transaction | 114,465 |

| — |

| — |

| 114,465 |

|

| Total Accounts payable, accrued expenses and other liabilities | 1,112,462 |

| 89,362 |

| 198,920 |

| 1,222,020 |

|

| Cash distributions and losses in excess of investments in unconsolidated entities | 279,708 |

| (24,803 | ) | (282,105 | ) | 22,406 |

|

| Deferred income taxes | 433,040 |

| — |

| — |

| 433,040 |

|

| Mortgage debt and notes payable, nonrecourse on land held for divestiture | 19,084 |

| 1,721 |

| 12,226 |

| 29,589 |

|

| Total Liabilities | 8,523,262 |

| 420,841 |

| 2,223,280 |

| 10,325,701 |

|

| Redeemable Noncontrolling Interest | 229,149 |

| 229,149 |

| — |

| — |

|

| Equity | | | | |

| Shareholders’ Equity | | | | |

| Shareholders’ equity before accumulated other comprehensive loss | 1,587,526 |

| — |

| — |

| 1,587,526 |

|

| Accumulated other comprehensive loss | (120,460 | ) | — |

| — |

| (120,460 | ) |

| Total Shareholders’ Equity | 1,467,066 |

| — |

| — |

| 1,467,066 |

|

| Noncontrolling interest | 284,806 |

| 98,785 |

| — |

| 186,021 |

|

| Total Equity | 1,751,872 |

| 98,785 |

| — |

| 1,653,087 |

|

| Total Liabilities and Equity | $ | 10,504,283 |

| $ | 748,775 |

| $ | 2,223,280 |

| $ | 11,978,788 |

|

Forest City Enterprises, Inc. and Subsidiaries

Selected Financial Information

Consolidated Earnings Information – Three Months Ended July 31, 2012 (Unaudited)

|

| | | | | | | | | | | | | | | |

| | Full Consolidation (GAAP) | Less Noncontrolling Interest | Plus Unconsolidated Investments at Pro-Rata | Plus Discontinued Operations | Pro-Rata Consolidation (Non-GAAP) |

| | (in thousands) |

| Revenues from real estate operations | $ | 261,373 |

| $ | 11,191 |

| $ | 93,930 |

| $ | 848 |

| $ | 344,960 |

|

| Expenses | | | | | |

| Operating expenses | 173,292 |

| 8,360 |

| 42,304 |

| 316 |

| 207,552 |

|

| Depreciation and amortization | 54,231 |

| 1,039 |

| 19,686 |

| 191 |

| 73,069 |

|

| Impairment of real estate | 2,908 |

| — |

| 390 |

| 261 |

| 3,559 |

|

| | 230,431 |

| 9,399 |

| 62,380 |

| 768 |

| 284,180 |

|

| Interest expense | (62,725 | ) | (2,677 | ) | (23,966 | ) | (256 | ) | (84,270 | ) |

| Amortization of mortgage procurement costs | (3,682 | ) | (146 | ) | (813 | ) | (4 | ) | (4,353 | ) |

| Loss on early extinguishment of debt | — |

| — |

| (1,313 | ) | — |

| (1,313 | ) |

| Interest and other income | 13,678 |

| 489 |

| 288 |

| — |

| 13,477 |

|

| Net gain (loss) on land held for divestiture activity | (6,458 | ) | 3,507 |

| (41,887 | ) | — |

| (51,852 | ) |

| Net gain on disposition of rental properties | — |

| — |

| 16,107 |

| — |

| 16,107 |

|

| Earnings (loss) before income taxes | (28,245 | ) | 2,965 |

| (20,034 | ) | (180 | ) | (51,424 | ) |

| Income tax expense (benefit) | | | | | |

| Current | (25,839 | ) | — |

| — |

| 5,019 |

| (20,820 | ) |

| Deferred | 16,797 |

| — |

| — |

| (5,367 | ) | 11,430 |

|

| | (9,042 | ) | — |

| — |

| (348 | ) | (9,390 | ) |

| Net gain on change in control of interests | 6,766 |

| 2,702 |

| — |

| — |

| 4,064 |

|

| Equity in earnings (loss) of unconsolidated entities, including impairment | 16,275 |

| 169 |

| (21,853 | ) | — |

| (5,747 | ) |

| Net loss on land held for divestiture activity of unconsolidated entities | (41,887 | ) | — |

| 41,887 |

| — |

| — |

|

| | (25,612 | ) | 169 |

| 20,034 |

| — |

| (5,747 | ) |

| Earnings (loss) from continuing operations | (38,049 | ) | 5,836 |

| — |

| 168 |

| (43,717 | ) |

| Discontinued operations, net of tax: | | | | | |

| Operating earnings (loss) from rental properties | 325 |

| (3 | ) | — |

| (328 | ) | — |

|

| Impairment of real estate | (160 | ) | — |

| — |

| 160 |

| — |

|

| | 165 |

| (3 | ) | — |

| (168 | ) | — |

|

| Net earnings (loss) | (37,884 | ) | 5,833 |

| — |

| — |

| (43,717 | ) |

| Noncontrolling interests | | | | | |

| Earnings from continuing operations attributable to noncontrolling interests | (5,836 | ) | (5,836 | ) | — |

| — |

| — |

|

| Loss from discontinued operations attributable to noncontrolling interests | 3 |

| 3 |

| — |

| — |

| — |

|

| | (5,833 | ) | (5,833 | ) | — |

| — |

| — |

|

| Net loss attributable to Forest City Enterprises, Inc. | $ | (43,717 | ) | $ | — |

| $ | — |

| $ | — |

| $ | (43,717 | ) |

| Preferred dividends | (3,850 | ) | — |

| — |

| — |

| (3,850 | ) |

| Net loss attributable to Forest City Enterprises, Inc. common shareholders | $ | (47,567 | ) | $ | — |

| $ | — |

| $ | — |

| $ | (47,567 | ) |

Forest City Enterprises, Inc. and Subsidiaries

Selected Financial Information

Consolidated Earnings Information – Six Months Ended July 31, 2012 (Unaudited)

|

| | | | | | | | | | | | | | | |

| | Full Consolidation (GAAP) | Less Noncontrolling Interest | Plus Unconsolidated Investments at Pro-Rata | Plus Discontinued Operations | Pro-Rata Consolidation (Non-GAAP) |

| | (in thousands) |

| Revenues from real estate operations | $ | 557,162 |

| $ | 23,752 |

| $ | 195,494 |

| $ | 2,003 |

| $ | 730,907 |

|

| Expenses | | | | | |

| Operating expenses | 339,838 |

| 17,417 |

| 87,488 |

| 762 |

| 410,671 |

|

| Depreciation and amortization | 106,860 |

| 1,996 |

| 38,847 |

| 395 |

| 144,106 |

|

| Impairment of real estate | 4,289 |

| — |

| 390 |

| 261 |

| 4,940 |

|

| | 450,987 |

| 19,413 |

| 126,725 |

| 1,418 |

| 559,717 |

|

| Interest expense | (120,969 | ) | (5,401 | ) | (50,298 | ) | (625 | ) | (166,491 | ) |

| Amortization of mortgage procurement costs | (6,547 | ) | (229 | ) | (1,650 | ) | (8 | ) | (7,976 | ) |

| Loss on early extinguishment of debt | (719 | ) | (188 | ) | (1,313 | ) | — |

| (1,844 | ) |

| Interest and other income | 24,357 |

| 955 |

| 498 |

| — |

| 23,900 |

|

| Net gain (loss) on land held for divestiture activity | (6,458 | ) | 3,507 |

| (41,887 | ) | — |

| (51,852 | ) |

| Net gain on disposition of rental properties | — |

| — |

| 16,107 |

| 7,914 |

| 24,021 |

|

| Earnings (loss) before income taxes | (4,161 | ) | 2,983 |

| (9,774 | ) | 7,866 |

| (9,052 | ) |

| Income tax expense (benefit) | | | | | |

| Current | (24,772 | ) | — |

| — |

| 5,592 |

| (19,180 | ) |

| Deferred | 25,273 |

| — |

| — |

| (2,380 | ) | 22,893 |

|

| | 501 |

| — |

| — |

| 3,212 |

| 3,713 |

|

| Net gain on change in control of interests | 6,766 |

| 2,702 |

| — |

| — |

| 4,064 |

|

| Equity in earnings (loss) of unconsolidated entities, including impairment | 20,048 |

| 199 |

| (32,113 | ) | — |

| (12,264 | ) |

| Net loss on land held for divestiture activity of unconsolidated entities | (41,887 | ) | — |

| 41,887 |

| — |

| — |

|

| | (21,839 | ) | 199 |

| 9,774 |

| — |

| (12,264 | ) |

| Earnings (loss) from continuing operations | (19,735 | ) | 5,884 |

| — |

| 4,654 |

| (20,965 | ) |

| Discontinued operations, net of tax: | | | | | |

| Operating earnings from rental properties | 414 |

| 5 |

| — |

| (409 | ) | — |

|

| Impairment of real estate | (160 | ) | — |

| — |

| 160 |

| — |

|

| Gain on disposition of rental properties | 5,370 |

| 965 |

| — |

| (4,405 | ) | — |

|

| | 5,624 |

| 970 |

| — |

| (4,654 | ) | — |

|

| Net earnings (loss) | (14,111 | ) | 6,854 |

| — |

| — |

| (20,965 | ) |

| Noncontrolling interests | | | | | |

| Earnings from continuing operations attributable to noncontrolling interests | (5,884 | ) | (5,884 | ) | — |

| — |

| — |

|

| Earnings from discontinued operations attributable to noncontrolling interests | (970 | ) | (970 | ) | — |

| — |

| — |

|

| | (6,854 | ) | (6,854 | ) | — |

| — |

| — |

|

| Net loss attributable to Forest City Enterprises, Inc. | $ | (20,965 | ) | $ | — |

| $ | — |

| $ | — |

| $ | (20,965 | ) |

| Preferred dividends | (7,700 | ) | — |

| — |

| — |

| (7,700 | ) |

| Net loss attributable to Forest City Enterprises, Inc. common shareholders | $ | (28,665 | ) | $ | — |

| $ | — |

| $ | — |

| $ | (28,665 | ) |

Forest City Enterprises, Inc. and Subsidiaries

Selected Financial Information

Consolidated Earnings Information – Three Months Ended July 31, 2011 (Unaudited)

|

| | | | | | | | | | | | | | | |

| | Full Consolidation (GAAP) | Less Noncontrolling Interest | Plus Unconsolidated Investments at Pro-Rata | Plus Discontinued Operations | Pro-Rata Consolidation (Non-GAAP) |

| | (in thousands) |

| Revenues from real estate operations | $ | 244,706 |

| $ | 12,179 |

| $ | 94,643 |

| $ | 9,893 |

| $ | 337,063 |

|

| Expenses | | | | | |

| Operating expenses | 152,756 |

| 7,855 |

| 45,037 |

| 5,413 |

| 195,351 |

|

| Depreciation and amortization | 53,434 |

| 1,150 |

| 16,010 |

| 1,321 |

| 69,615 |

|

| Impairment of real estate | 235 |

| — |

| — |

| — |

| 235 |

|

| | 206,425 |

| 9,005 |

| 61,047 |

| 6,734 |

| 265,201 |

|

| Interest expense | (62,995 | ) | (3,523 | ) | (25,183 | ) | (1,214 | ) | (85,869 | ) |

| Amortization of mortgage procurement costs | (2,711 | ) | (129 | ) | (734 | ) | (99 | ) | (3,415 | ) |

| Loss on early extinguishment of debt | (5,471 | ) | — |

| (2,355 | ) | — |

| (7,826 | ) |

| Interest and other income | 15,315 |

| 534 |

| 268 |

| — |

| 15,049 |

|

| Net gain on disposition of rental properties | — |

| — |

| — |

| 29,899 |

| 29,899 |

|

| Earnings (loss) before income taxes | (17,581 | ) | 56 |

| 5,592 |

| 31,745 |

| 19,700 |

|

| Income tax expense (benefit) | | | | | |

| Current | (2,138 | ) | — |

| — |

| 2,002 |

| (136 | ) |

| Deferred | (3,761 | ) | — |

| — |

| 10,890 |

| 7,129 |

|

| | (5,899 | ) | — |

| — |

| 12,892 |

| 6,993 |

|

| Equity in earnings (loss) of unconsolidated entities | 2,385 |

| 142 |

| (5,592 | ) | — |

| (3,349 | ) |

| Earnings (loss) from continuing operations | (9,297 | ) | 198 |

| — |

| 18,853 |

| 9,358 |

|

| Discontinued operations, net of tax: | | | | | |

| Operating earnings from rental properties | 1,791 |

| 660 |

| — |

| (1,131 | ) | — |

|

| Gain on disposition of rental properties | 99,087 |

| 81,365 |

| — |

| (17,722 | ) | — |

|

| | 100,878 |

| 82,025 |

| — |

| (18,853 | ) | — |

|

| Net earnings | 91,581 |

| 82,223 |

| — |

| — |

| 9,358 |

|

| Noncontrolling interests | | | | | |

| Earnings from continuing operations attributable to noncontrolling interests | (198 | ) | (198 | ) | — |

| — |

| — |

|

| Earnings from discontinued operations attributable to noncontrolling interests | (82,025 | ) | (82,025 | ) | — |

| — |

| — |

|

| | (82,223 | ) | (82,223 | ) | — |

| — |

| — |

|

| Net earnings attributable to Forest City Enterprises, Inc. | $ | 9,358 |

| $ | — |

| $ | — |

| $ | — |

| $ | 9,358 |

|

| Preferred dividends | (3,850 | ) | — |

| — |

| — |

| (3,850 | ) |

| Net earnings attributable to Forest City Enterprises, Inc. common shareholders | $ | 5,508 |

| $ | — |

| $ | — |

| $ | — |

| $ | 5,508 |

|

Forest City Enterprises, Inc. and Subsidiaries

Selected Financial Information

Consolidated Earnings Information – Six Months Ended July 31, 2011 (Unaudited)

|

| | | | | | | | | | | | | | | |

| | Full Consolidation (GAAP) | Less Noncontrolling Interest | Plus Unconsolidated Investments at Pro-Rata | Plus Discontinued Operations | Pro-Rata Consolidation (Non-GAAP) |

| | (in thousands) |

| Revenues from real estate operations | $ | 548,043 |

| $ | 24,677 |

| $ | 177,357 |

| $ | 19,988 |

| $ | 720,711 |

|

| Expenses | | | | | |

| Operating expenses | 313,113 |

| 15,255 |

| 82,721 |

| 12,424 |

| 393,003 |

|

| Depreciation and amortization | 109,081 |

| 2,788 |

| 29,700 |

| 3,153 |

| 139,146 |

|

| Impairment of real estate | 5,070 |

| — |

| — |

| — |

| 5,070 |

|

| | 427,264 |

| 18,043 |

| 112,421 |

| 15,577 |

| 537,219 |

|

| Interest expense | (128,900 | ) | (7,355 | ) | (48,290 | ) | (2,726 | ) | (172,561 | ) |

| Amortization of mortgage procurement costs | (5,589 | ) | (259 | ) | (1,352 | ) | (365 | ) | (7,047 | ) |

| Loss on early extinguishment of debt | (5,767 | ) | (4 | ) | (2,355 | ) | — |

| (8,118 | ) |

| Interest and other income | 30,822 |

| 394 |

| 385 |

| — |

| 30,813 |

|

| Net gain on disposition of rental properties and partial interests in rental properties | 9,561 |

| — |

| 12,567 |

| 39,937 |

| 62,065 |

|

| Earnings (loss) before income taxes | 20,906 |

| (590 | ) | 25,891 |

| 41,257 |

| 88,644 |

|

| Income tax expense (benefit) | | | | | |

| Current | 15,460 |

| — |

| — |

| 2,615 |

| 18,075 |

|

| Deferred | (3,619 | ) | — |

| — |

| 14,785 |

| 11,166 |

|

| | 11,841 |

| — |

| — |

| 17,400 |

| 29,241 |

|

| Equity in earnings (loss) of unconsolidated entities | 22,379 |

| 190 |

| (25,891 | ) | — |

| (3,702 | ) |

| Earnings (loss) from continuing operations | 31,444 |

| (400 | ) | — |

| 23,857 |

| 55,701 |

|

| Discontinued operations, net of tax: | | | | | |

| Operating earnings from rental properties | 2,804 |

| 1,995 |

| — |

| (809 | ) | — |

|

| Gain on disposition of rental properties | 104,806 |

| 81,758 |

| — |

| (23,048 | ) | — |

|

| | 107,610 |

| 83,753 |

| — |

| (23,857 | ) | — |

|

| Net earnings | 139,054 |

| 83,353 |

| — |

| — |

| 55,701 |

|

| Noncontrolling interests | | | | | |

| Loss from continuing operations attributable to noncontrolling interests | 400 |

| 400 |

| — |

| — |

| — |

|

| Earnings from discontinued operations attributable to noncontrolling interests | (83,753 | ) | (83,753 | ) | — |

| — |

| — |

|

| | (83,353 | ) | (83,353 | ) | — |

| — |

| — |

|

| Net earnings attributable to Forest City Enterprises, Inc. | $ | 55,701 |

| $ | — |

| $ | — |

| $ | — |

| $ | 55,701 |

|

| Preferred dividends | (7,700 | ) | — |

| — |

| — |

| (7,700 | ) |

| Net earnings attributable to Forest City Enterprises, Inc. common shareholders | $ | 48,001 |

| $ | — |

| $ | — |

| $ | — |

| $ | 48,001 |

|

Forest City Enterprises, Inc. and Subsidiaries

Selected Financial Information

Net Asset Value Components – July 31, 2012

The “Net Asset Value Components” table below represents components of our business relevant to calculate Net Asset Value (“NAV”), a non-GAAP measure. There is no directly comparable GAAP financial measure to NAV. We consider NAV to be a useful supplemental measure which assists both management and investors to estimate the fair value of our Company. The calculation of the net asset value involves significant estimates and can be calculated using various methods. Each individual investor must determine the specific methodology, assumptions and estimates to use to arrive at an estimated NAV of the Company.

The components of NAV do not consider the potential changes in rental and fee income streams, or development platform. The components include non-GAAP financial measures, such as NOI and information related to our rental properties business prepared using the pro-rata consolidation method. Although these measures are not presented in accordance with GAAP, investors can use these non-GAAP measures as supplementary information to evaluate our business. The non-GAAP measures presented are not intended to be performance measures that should be regarded as alternatives to, or more meaningful than, our GAAP measures.

|

| | | | | | | | | | | | | | | | | | | |

| Net Asset Value Components - July 31, 2012 |

| Completed Rental Properties (“CRP”) |

| | Q2 2012 | | Annualized | | Net Stabilized | | Annualized | | Nonrecourse |

| (Dollars in millions at pro-rata) | NOI (1) | | NOI (2) | | Adjustments (3) | | Stabilized NOI | | Debt (4) |

| | | | A | | B | | =A+B | | |

| Commercial Real Estate | | | | | | | | | |

| Retail | $ | 58.8 |

| | $ | 235.2 |

| | $ | (4.6 | ) | | $ | 230.6 |

| | (2,682.2 | ) |

| Office | 63.6 |

| | 254.4 |

| | 0.2 |

| | 254.6 |

| | (2,296.5 | ) |

| Other | (4.3 | ) | | (17.2 | ) | | 15.1 |

| | (2.1 | ) | | |

| Total Commercial Real Estate | $ | 118.1 |

| | $ | 472.4 |

| | $ | 10.7 |

| | $ | 483.1 |

| | (4,978.7 | ) |

| Residential Real Estate | | | | | | | | | |

| Apartments | $ | 35.5 |

| | $ | 142.0 |

| | $ | 6.9 |

| | $ | 148.9 |

| | (1,963.2 | ) |

Subsidized Senior Housing (5) | 4.5 |

| | 18.0 |

| | — |

| | 18.0 |

| | |

| Military Housing | 7.1 |

| | 28.4 |

| | (13.4 | ) | | 15.0 |

| | |

| Other | (3.1 | ) | | (12.4 | ) | | — |

| | (12.4 | ) | | |

| Total Residential Real Estate | $ | 44.0 |

| | $ | 176.0 |

| | $ | (6.5 | ) | | $ | 169.5 |

| | (1,963.2 | ) |

| Total Rental Properties | $ | 162.1 |

| | $ | 648.4 |

| | $ | 4.2 |

| | $ | 652.6 |

| | (6,941.9 | ) |

Development Pipeline Debt Adj. NET (6) | | | | | | | | | 596.0 |

|

| Adjusted Total Rental Properties | $ | 162.1 |

| | $ | 648.4 |

| | $ | 4.2 |

| | $ | 652.6 |

| | (6,345.9 | ) |

| Development Pipeline |

| | | | | | | | Book Value | | Nonrecourse Debt |

Westchester's Ridge Hill (Adjusted for amounts included in CRP) (6) | | | | | | $ | 586.3 |

| | $ | (327.4 | ) |

8 Spruce Street (Adjusted for amounts included in CRP) (6) | | | | | | | 451.7 |

| | (268.6 | ) |

| Total development pipeline adjustments | | | | | | | 1,038.0 |

| | (596.0 | ) |

Projects under construction (4) | | | | | | | 754.2 |

| | (338.5 | ) |

| Adjusted projects under construction | | | | | | | $ | 1,792.2 |

| | $ | (934.5 | ) |

Projects under development (4) | | | | | | | $ | 939.8 |

| | $ | (190.5 | ) |

Land held for development and sale (4) | | | | | | | $ | 69.7 |

| | $ | (8.5 | ) |

| Other Tangible Assets |

| | | | | | | | Book Value (4) | | Nonrecourse |

| | | | | | | | | Debt (4) |

| Cash and equivalents | | | | | | | $ | 280.5 |

| | |

| Restricted cash and escrowed funds | | | | | | | $ | 387.6 |

| | |

Notes and accounts receivable, net (7) | | | | | | | $ | 406.3 |

| | |

| Net investments and advances to unconsolidated entities | | | | | | | $ | 182.8 |

| | |

| Prepaid expenses and other deferred costs, net | | | | | | | $ | 227.7 |

| | |

| Land held for divestiture | | | | | | | $ | 48.8 |

| | $ | (38.5 | ) |

| Recourse Debt and Other Liabilities |

| | | | | | | | Book Value (4) | | |

| Bank revolving credit facility | | | | | | | $ | — |

| | |

| Senior and subordinated debt | | | | | | | $ | (1,157.7 | ) | | |

| Less: convertible debt | | | | | | | $ | 599.3 |

| | |

| Less: escrowed funds for 2015 senior note redemption | | | | | | | $ | 125.0 |

| | |

| Construction payables | | | | | | | $ | (141.3 | ) | | |

Operating accounts payable and accrued expenses (8) | | | | | | $ | (695.8 | ) | | |

| Weighted Average Shares Outstanding - Diluted |

Number of shares for the three months ended July 31, 2012 (In millions) | | 221.9 |

| | |

Forest City Enterprises, Inc. and Subsidiaries

Selected Financial Information

Net Asset Value Components – July 31, 2012 (continued)

| |

| (1) | Pro-rata Q2 2012 NOI is reconciled to NOI at full consolidation by Product Group for the three months ended July 31, 2012 in the Supplemental Operating Information section of this supplemental package. Write-offs of abandoned development projects of $12.9 million and tax credit income of $8.0 million have been excluded from the appropriate real estate groups from total NOI used in the Net Asset Value Component schedule. |

| |

| (2) | Pro-rata annualized NOI is calculated by taking the Q2 2012 NOI times a multiple of four. |

| |

| (3) | The net stabilized adjustments column represents net adjustments required to arrive at a fully stabilized NOI for those properties currently in initial lease up periods, net of the removal of partial period NOI for recently sold properties. For those properties currently in initial lease up periods we have included stabilization adjustments as follows: |

| |

| a) | NOI for The Aster Town Center is reflected at 5% of the pro-rata cost disclosed in our Development Pipeline disclosure. This assumption does not reflect Forest City’s anticipated NOI, but rather is used in order to establish a hypothetical basis for valuation of lease up properties. See note 6, which describes the treatment of Westchester’s Ridge Hill and 8 Spruce Street. |

| |

| b) | At the conclusion of the initial development period at each of our military housing communities, we estimate the ongoing property management fees, net of operating expenses, to be $15.0 million. |

The net stabilized adjustments are not comparable to any GAAP measure and therefore do not have a reconciliation to the nearest comparable GAAP measure.

| |

| (4) | Amounts are derived from the respective pro-rata balance sheet line item as of July 31, 2012 and are reconciled to their GAAP equivalents in the Selected Financial Information section of this supplemental package. |

| |

| (5) | Represents limited-distribution subsidized senior housing properties. |

| |

| (6) | Westchester’s Ridge Hill and 8 Spruce Street have their assets shown in the Development Pipeline section of the model. Westchester’s Ridge Hill, as of July 31, 2012, had $586.3 million of costs incurred at pro-rata consolidation and $327.4 million of mortgage debt at pro-rata consolidation which were transferred to CRP. 8 Spruce Street, as of July 31, 2012, had $451.7 million of costs incurred at pro-rata consolidation and $268.6 million of mortgage debt at pro-rata consolidation which were transferred to CRP. In order to account for the phased openings of Westchester’s Ridge Hill and 8 Spruce Street as NAV components we have made the following adjustments: |

| |

| a) | All costs and associated debt for Westchester’s Ridge Hill and 8 Spruce Street for purposes exclusive to this disclosure are accounted for as a component of “Adjusted Projects Under Construction” in the Development Pipeline section of this schedule. Accordingly, all NOI, through the net stabilized adjustments column for the appropriate product types, and debt have been removed from the CRP section of the NAV schedule. The debt amounts removed from CRP and added to the Development Pipeline represent only the amounts recorded in CRP based on the proportion open and ready for occupancy and do not reflect the total debt outstanding for these projects, some of which is already included in the Development Pipeline. |

| |

| (7) | Includes $161.7 million of straight-line rent receivable (net of $15.7 million of allowance for doubtful accounts). |

| |

| (8) | Includes $36.3 million of straight-line rent payable. |

Forest City Enterprises, Inc. and Subsidiaries

Supplemental Operating Information

Occupancy Data - July 31, 2012 and 2011

Retail and office occupancy is based on square feet leased at the end of the fiscal quarter. Average Occupancy Year-to-Date for retail and office is calculated by dividing the sum of leased square feet at the beginning and end of the period by two. Residential occupancy represents total units occupied divided by total units available. Average Occupancy for residential is calculated by dividing gross potential rent less vacancy by gross potential rent.

We analyze our occupancy percentages by each of our major product lines as follows:

|

| | | | | | | | | | |

| | Occupancy

As of

July 31, 2012 | | Average

Occupancy

Year-to-Date

July 31, 2012 | Occupancy

As of

July 31, 2011 | | Average

Occupancy

Year-to-Date

July 31, 2011 |

| Retail | | | | | | |

| Comparable | 91.6 | % | | 91.4 | % | 91.2 | % | | 91.4 | % |

| Total | 89.3 | % | | 89.1 | % | 90.4 | % | | 90.8 | % |

| Office | | | | | | |

| Comparable | 91.4 | % | | 91.0 | % | 91.1 | % | | 90.3 | % |

| Total | 90.1 | % | | 89.6 | % | 88.8 | % | | 88.3 | % |

Residential (1) | | | | | | |

| Comparable | 94.2 | % | | 94.8 | % | 93.6 | % | | 94.5 | % |

| Total | 93.9 | % | | 94.5 | % | 93.0 | % | | 91.7 | % |

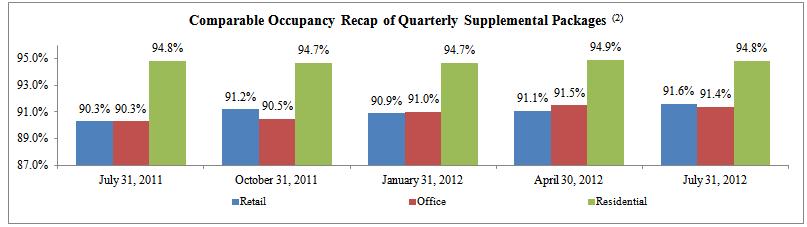

The graph below provides comparable occupancy as reported in previous quarters. These amounts may differ from above because the properties that qualify as comparable change from period to period.

(1)Excludes military and limited-distribution subsidized senior housing units.

(2)Represents Comparable Occupancy for Retail and Office as of the applicable date and Comparable Average Occupancy Year-to-Date for Residential.

Forest City Enterprises, Inc. and Subsidiaries

Supplemental Financial Information

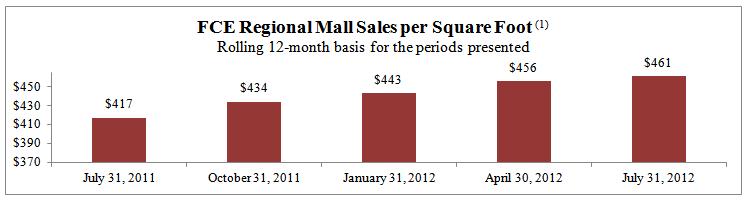

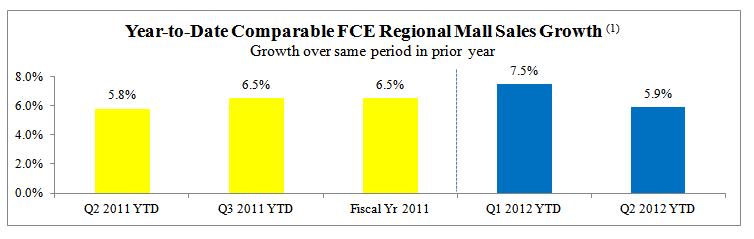

Retail Sales Data

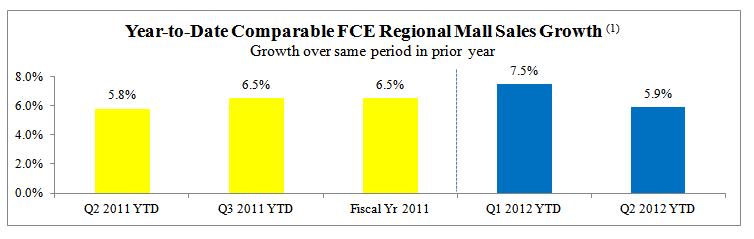

The following graphs provide current and historical retail sales for small shop inline tenants at our regional malls. We believe this data allows investors to better understand the productivity of our tenants.

The graph below represents regional mall sales for tenants that are open and operating for the duration of each rolling 12-month period presented. Those tenants that have begun and/or ceased operations in the periods shown are not included.

The graph below represents regional mall sales for all tenants that are open and operating for the duration of each comparable period presented. Those tenants that have begun and/or ceased operations in the periods shown are not included.

| |

| (1) | All sales data is derived from schedules provided by our tenants and is not subject to the same internal control and verification procedures that are applied to the other data supplied in the Company’s supplemental package. In addition, the data is presented on a one-month lag to be consistent with the calendar year end of our tenants.  |

Forest City Enterprises, Inc. and Subsidiaries

Supplemental Operating Information

Leasing Summary

Retail Centers

The following tables represent those new leases and gross leasable area (“GLA”) signed on the same space in which there was a former tenant and existing tenant renewals.

Regional Malls

|

| | | | | | | | | | | | | | | | | |

| Quarter | Number of Leases Signed | | GLA Signed | | Contractual Rent Per Square Foot (1)(2) | | Prior Rent Per Square Foot (1)(2) | | Cash Basis % Change over Prior Rent | |

| 3rd Quarter 2011 | 48 |

| | 162,170 |

| | $ | 49.53 |

| | $ | 45.43 |

| | 9.0 | % | |

| 4th Quarter 2011 | 59 |

| | 149,030 |

| | $ | 60.95 |

| | $ | 55.35 |

| | 10.1 | % | |

| 1st Quarter 2012 | 38 |

| | 88,993 |

| | $ | 58.67 |

| | $ | 53.37 |

| | 9.9 | % | |

| 2nd Quarter 2012 | 28 |

| | 81,774 |

| | $ | 53.36 |

| | $ | 48.96 |

| | 9.0 | % | |

| Total | 173 |

| | 481,967 |

| | $ | 55.37 |

| | $ | 50.56 |

| | 9.5 | % | |

| | | | | | | | | | | |

Specialty Retail Centers

|

| | | | | | | | | | | | | | | | | |

| Quarter | Number of Leases Signed | | GLA Signed | | Contractual Rent Per Square Foot (1)(2) | | Prior Rent Per Square Foot (1)(2) | | Cash Basis % Change over Prior Rent | |

| 3rd Quarter 2011 | 10 |

| | 34,385 |

| | $ | 62.29 |

| | $ | 56.11 |

| | 11.0 | % | |

| 4th Quarter 2011 | 9 |

| | 83,671 |

| | $ | 31.12 |

| | $ | 27.86 |

| | 11.7 | % | |

| 1st Quarter 2012 | 7 |

| | 29,117 |

| | $ | 41.95 |

| | $ | 41.56 |

| | 0.9 | % | |

| 2nd Quarter 2012 | 8 |

| | 35,234 |

| | $ | 21.40 |

| | $ | 21.77 |

| | (1.7 | )% | |

| Total | 34 |

| | 182,407 |

| | $ | 36.85 |

| | $ | 34.20 |

| | 7.7 | % | |

| | | | | | | | | | | |

Office Buildings

The following table represents all new leases compared to terms of all expired leases in our office portfolio over the past 12 months.

Office Buildings

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | Number of Leases Signed | | Number of Leases Expired | | GLA Signed | | GLA Expired | | Contractual Rent Per Square Foot (2) | | Expiring Rent Per Square Foot (2) | | Cash Basis % Change over Prior Rent | |

| 3rd Quarter 2011 | 33 |

| | 27 |

| | 178,838 |

| | 178,598 |

| | $ | 26.20 |

| | $ | 29.22 |

| | (10.3 | )% | |

| 4th Quarter 2011 | 46 |

| | 33 |

| | 703,488 |

| | 683,121 |

| | $ | 30.13 |

| | $ | 27.86 |

| | 8.1 | % | |

| 1st Quarter 2012 | 38 |

| | 28 |

| | 340,382 |

| | 239,112 |

| | $ | 27.40 |

| | $ | 28.01 |

| | (2.2 | )% | |

| 2nd Quarter 2012 | 28 |

| | 20 |

| | 132,835 |

| | 96,046 |

| | $ | 20.13 |

| | $ | 18.66 |

| | 7.9 | % | |

| Total | 145 |

| | 108 |

| | 1,355,543 |

| | 1,196,877 |

| | $ | 27.95 |

| | $ | 27.36 |

| | 2.2 | % | |

| | | | | | | | | | | | | | | |

Office Buildings by Product in Core and Non-Core Markets

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | Number of Leases Signed | | Number of Leases Expired | | GLA Signed | | GLA Expired | | Contractual Rent Per Square Foot (2) | | Expiring Rent Per Square Foot (2) | | Cash Basis % Change over Prior Rent | |

| Products: | | | | | | | | | | | | |

|

| |

| Life Science Office | 22 |

| | 14 |

| | 278,037 |

| | 267,384 |

| | $ | 47.64 |

| | $ | 46.00 |

| | 3.6 | % | |

| Other Office | 61 |

| | 47 |

| | 381,798 |

| | 277,009 |

| | $ | 27.40 |

| | $ | 27.51 |

| | (0.4 | )% | |

| Total Office in Core Markets | 83 |

| | 61 |

| | 659,835 |

| | 544,393 |

| | $ | 35.93 |

| | $ | 36.59 |

| | (1.8 | )% | |

| Office in Non-Core Markets | 62 |

| | 47 |

| | 695,708 |

| | 652,484 |

| | $ | 20.37 |

| | $ | 19.66 |

| | 3.6 | % | |

| Total | 145 |

| | 108 |

| | 1,355,543 |

| | 1,196,877 |

| | $ | 27.95 |

| | $ | 27.36 |

| | 2.2 | % | |

| | | | | | | | | | | | | | | |

| |

| (1) | Retail contractual rent per square foot includes base rent and fixed additional charges for marketing/promotional charges and common area maintenance. |

| |

| (2) | For all new leases, contractual rent per square foot is the new base rate as of rental commencement. For all expiring leases, contractual rent per square foot is the base rate at the time of expiration, plus any applicable escalations. |

Forest City Enterprises, Inc. and Subsidiaries

Supplemental Operating Information

Apartment Communities

The following tables present leasing information of our Apartment Communities for the various periods presented.

|

| | | | | | | | | | | | | | | | | | |

| Quarterly Comparison | | | Monthly Average Residential Rental Rates (2) | | Average Residential Occupancy |

| | Leasable Units at | | Three Months Ended July 31, | | | Quarter-to-Date July 31, | |

Comparable Apartment Communities (1) | Pro-Rata % | | 2012 | 2011 | % Change | | 2012 | 2011 | % Change |

| Core Markets | 8,009 |

| | $ | 1,563 |

| $ | 1,481 |

| 5.5 | % | | 95.2 | % | 94.4 | % | 0.8 | % |

| Non-Core Markets | 9,103 |

| | $ | 869 |

| $ | 839 |

| 3.6 | % | | 94.0 | % | 94.3 | % | (0.3 | )% |

| Total Comparable Apartments | 17,112 |

| | $ | 1,194 |

| $ | 1,139 |

| 4.8 | % | | 94.7 | % | 94.4 | % | 0.3 | % |

|

| | | | | | | | | | | | | | | | | | |

| Year-to-Date Comparison | | | Monthly Average Residential Rental Rates (2) | | Average Residential Occupancy |

| | Leasable Units at | | Six Months Ended July 31, | | | Year-to-Date July 31, | |

Comparable Apartment Communities (1) | Pro-Rata % | | 2012 | 2011 | % Change | | 2012 | 2011 | % Change |

| Core Markets | 8,009 |

| | $ | 1,551 |

| $ | 1,469 |

| 5.6 | % | | 95.4 | % | 94.7 | % | 0.7 | % |

| Non-Core Markets | 9,103 |

| | $ | 865 |

| $ | 833 |

| 3.8 | % | | 93.7 | % | 94.3 | % | (0.6 | )% |

| Total Comparable Apartments | 17,112 |

| | $ | 1,186 |

| $ | 1,131 |

| 4.9 | % | | 94.8 | % | 94.5 | % | 0.3 | % |

|

| | | | | | | | | | | | | | | | | | |

| Sequential Quarter Comparison | | | Monthly Average Residential Rental Rates (2) | | Average Residential Occupancy |

| | Leasable | | Three Months Ended | | | Quarter-to-Date | |

| | Units | | July 31, | April 30, | | | July 31, | April 30, | |

Comparable Apartment Communities (1) | Pro-Rata % | | 2012 | 2012 (3) | % Change | | 2012 | 2012 (3) | % Change |

| Core Markets | 8,170 |

| | $ | 1,597 |

| $ | 1,568 |

| 1.8 | % | | 95.2 | % | 95.3 | % | (0.1 | )% |

| Non-Core Markets | 9,425 |

| | $ | 963 |

| $ | 959 |

| 0.4 | % | | 93.8 | % | 93.0 | % | 0.8 | % |

| Total Comparable Apartments | 17,595 |

| | $ | 1,257 |

| $ | 1,242 |

| 1.2 | % | | 94.6 | % | 94.4 | % | 0.2 | % |

| |

| (1) | Includes apartment communities completely opened and operated in the periods presented. Excludes all military and limited-distribution subsidized senior housing units. These apartment communities include units leased at affordable apartment rates which provide a discount from average market rental rates. For the three and six months ended July 31, 2012, 22.5% of leasable units in core markets and 1.7% of leasable units in non-core markets were deemed affordable housing. |

| |

| (2) | Represents gross potential rent less concessions. |

| |

| (3) | These amounts may differ from data as reported in previous quarter because the properties that qualify as comparable change from period to period. |

(THIS PAGE INTENTIONALLY LEFT BLANK)

Forest City Enterprises, Inc. and Subsidiaries

Supplemental Operating Information

Comparable NOI is defined as NOI from properties opened and operated in the three and six months ended July 31, 2012 and 2011. The schedules below present Pro-Rata Comparable NOI for the three and six months ended July 31, 2012 and 2011.

Comparable Net Operating Income (% change over same period prior year)

|

| | | | | |

| | Three Months Ended | | Six Months Ended |

| | July 31, 2012 | | July 31, 2012 |

| Retail | 1.3 | % | | 1.9 | % |

| Office | 5.4 | % | | 4.7 | % |

| Residential | 10.3 | % | | 10.3 | % |

| Total | 5.0 | % | | 4.8 | % |

The tables below provide the percentage change of Comparable NOI as reported in previous quarters. GAAP reconciliations for previous quarters can be found in prior supplemental packages.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarterly Historical Trends | | | | | Annual Historical Trends | | |

| | | | | | | |

| | Three Months Ended | | | | Years Ended | |

| | July 31, 2012 | | April 30, 2012 | | January 31, 2012 | | October 31, 2011 | | July 31, 2011 | | | | January 31, 2012 | | January 31, 2011 | | January 31, 2010 | |

| Retail | 1.3 | % | | 3.0 | % | | 4.7 | % | | (1.5 | )% | | 1.6 | % | | | Retail | 2.6 | % | | 2.2 | % | | (3.9 | )% | |

| Office | 5.4 | % | | 3.2 | % | | 0.5 | % | | (7.6 | )% | | 3.1 | % | | | Office | (2.6 | )% | | 2.1 | % | | 5.4 | % | |

| Residential | 10.3 | % | | 11.0 | % | | 11.9 | % | | 12.0 | % | | 3.1 | % | | | Residential | 7.3 | % | | 4.3 | % | | (3.9 | )% | |

| Total | 5.0 | % | | 4.8 | % | | 4.6 | % | | (1.4 | )% | | 2.6 | % | | | Total | 1.4 | % | | 2.5 | % | | (0.7 | )% | |

Forest City Enterprises, Inc. and Subsidiaries

Supplemental Financial Information

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Net Operating Income (dollars in thousands) |

| | Three Months Ended July 31, 2012 | | Three Months Ended July 31, 2011 | % Change |

| | Full Consolidation (GAAP) | Less Noncontrolling Interest | Plus Discontinued Operations | Pro-Rata Consolidation (Non-GAAP) | | Full Consolidation (GAAP) | Less Noncontrolling Interest | Plus Discontinued Operations | Pro-Rata Consolidation (Non-GAAP) | Full Consolidation (GAAP) | Pro-Rata Consolidation (Non-GAAP) |

| Commercial Group | | | | | | | | | | | |

| Retail | | | | | | | | | | | |

| Comparable | $ | 57,334 |

| $ | 1,668 |

| $ | — |

| $ | 55,666 |

| | $ | 56,582 |

| $ | 1,641 |

| $ | — |

| $ | 54,941 |

| 1.3 | % | 1.3 | % |

| Total | 60,846 |

| 2,079 |

| 54 |

| 58,821 |

| | 59,486 |

| 2,450 |

| 488 |

| 57,524 |

| | |

| Office Buildings | | | | | | | | | | | |

| Comparable | 65,003 |

| 2,078 |

| — |

| 62,925 |

| | 60,840 |

| 1,167 |

| — |

| 59,673 |

| 6.8 | % | 5.4 | % |

| Total | 65,600 |

| 2,024 |

| — |

| 63,576 |

| | 67,676 |

| 1,646 |

| 738 |

| 66,768 |

| | |

| Hotels | 3,712 |

| — |

| — |

| 3,712 |

| | 3,671 |

| — |

| 2,589 |

| 6,260 |

| | |

| Land Sales | 14 |

| — |

| — |

| 14 |

| | 773 |

| — |

| — |

| 773 |

| | |

Other (1) | (17,442 | ) | (2,476 | ) | — |

| (14,966 | ) | | (2,959 | ) | (533 | ) | — |

| (2,426 | ) | | |

| Total Commercial Group | | | | | | | | | | | |

| Comparable | 122,337 |

| 3,746 |

| — |

| 118,591 |

| | 117,422 |

| 2,808 |

| — |

| 114,614 |

| 4.2 | % | 3.5 | % |

| Total | 112,730 |

| 1,627 |

| 54 |

| 111,157 |

| | 128,647 |

| 3,563 |

| 3,815 |

| 128,899 |

| | |

| Residential Group | | | | | | | | | | | |

| Apartments | | | | | | | | | | | |

| Comparable | 36,115 |

| 718 |

| — |

| 35,397 |

| | 32,611 |

| 521 |

| — |

| 32,090 |

| 10.7 | % | 10.3 | % |

| Total | 35,788 |

| 791 |

| 478 |

| 35,475 |

| | 31,553 |

| 753 |

| 449 |

| 31,249 |

| | |

| Subsidized Senior Housing | 4,712 |

| 165 |

| — |

| 4,547 |

| | 4,017 |

| 154 |

| — |

| 3,863 |

| | |

| Military Housing | 7,121 |

| 49 |

| — |

| 7,072 |

| | 5,199 |

| 238 |

| — |

| 4,961 |

| | |

Other (1) | (881 | ) | 142 |

| — |

| (1,023 | ) | | (28 | ) | 134 |

| — |

| (162 | ) | | |

| Total Residential Group | | | | | | | | | | | |

| Comparable | 36,115 |

| 718 |

| — |

| 35,397 |

| | 32,611 |

| 521 |

| — |

| 32,090 |

| 10.7 | % | 10.3 | % |

| Total | 46,740 |

| 1,147 |

| 478 |

| 46,071 |

| | 40,741 |

| 1,279 |

| 449 |

| 39,911 |

| | |

| Total Rental Properties | | | | | | | | | | | |

| Comparable | 158,452 |

| 4,464 |

| — |

| 153,988 |

| | 150,033 |

| 3,329 |

| — |

| 146,704 |

| 5.6 | % | 5.0 | % |

| Total | 159,470 |

| 2,774 |

| 532 |

| 157,228 |

| | 169,388 |

| 4,842 |

| 4,264 |

| 168,810 |

| | |

| Land Development Group | 6,394 |

| 715 |

| — |

| 5,679 |

| | 643 |

| 158 |

| — |

| 485 |

| | |

| The Nets | (8,272 | ) | — |

| — |

| (8,272 | ) | | (3,382 | ) | — |

| — |

| (3,382 | ) | | |

| Corporate Activities | (13,848 | ) | — |

| — |

| (13,848 | ) | | (10,104 | ) | — |

| — |

| (10,104 | ) | | |

| Grand Total | $ | 143,744 |

| $ | 3,489 |

| $ | 532 |

| $ | 140,787 |

| | $ | 156,545 |

| $ | 5,000 |

| $ | 4,264 |

| $ | 155,809 |

| | |

| |

| (1) | Includes write-offs of abandoned development projects, non-capitalizable development costs and unallocated management and service company overhead, net of tax credit income. Additionally, non-capitalizable marketing/promotional costs associated with Barclays Center are included in the Commercial Group. |

Forest City Enterprises, Inc. and Subsidiaries

Supplemental Financial Information

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Net Operating Income (dollars in thousands) |

| | Six Months Ended July 31, 2012 | | Six Months Ended July 31, 2011 | % Change |

| | Full Consolidation (GAAP) | Less Noncontrolling Interest | Plus Discontinued Operations | Pro-Rata Consolidation (Non-GAAP) | | Full Consolidation (GAAP) | Less Noncontrolling Interest | Plus Discontinued Operations | Pro-Rata Consolidation (Non-GAAP) | Full Consolidation (GAAP) | Pro-Rata Consolidation (Non-GAAP) |

| Commercial Group | | | | | | | | | | | |

| Retail | | | | | | | | | | | |

| Comparable | $ | 115,735 |

| $ | 3,442 |

| $ | — |

| $ | 112,293 |

| | $ | 113,600 |

| $ | 3,364 |

| $ | — |

| $ | 110,236 |

| 1.9 | % | 1.9 | % |

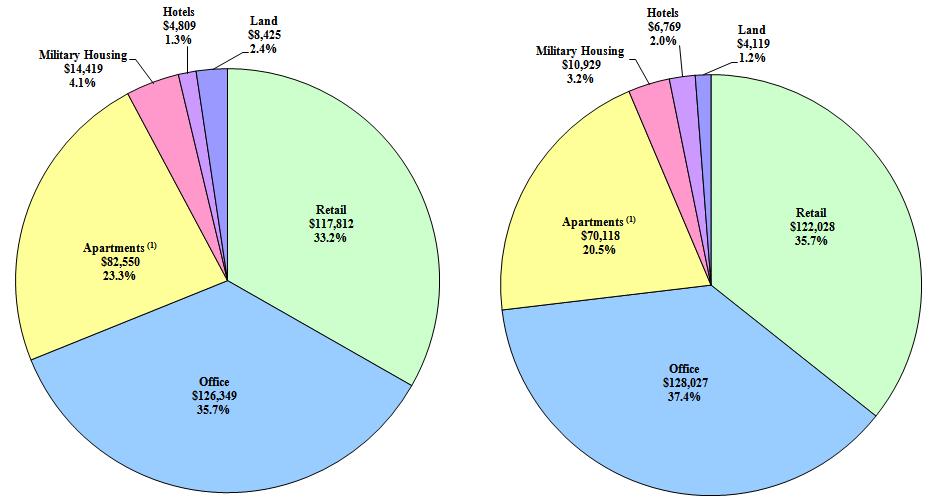

| Total | 121,673 |

| 4,155 |

| 294 |

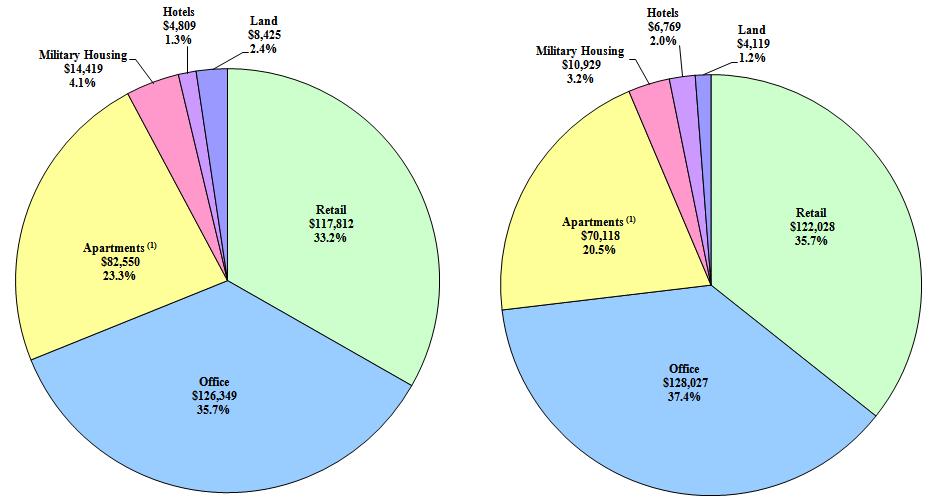

| 117,812 |

| | 126,187 |

| 5,289 |

| 1,130 |

| 122,028 |

| | |

| Office Buildings | | | | | | | | | | | |

| Comparable | 129,309 |

| 4,333 |

| — |

| 124,976 |

| | 122,630 |

| 3,219 |

| — |

| 119,411 |

| 5.4 | % | 4.7 | % |

| Total | 130,780 |

| 4,431 |

| — |

| 126,349 |

| | 128,823 |

| 3,669 |

| 2,873 |

| 128,027 |

| | |

| Hotels | 4,809 |

| — |

| — |

| 4,809 |

| | 4,627 |

| — |

| 2,142 |

| 6,769 |

| | |

Land Sales (1) | 36,498 |

| — |

| — |

| 36,498 |

| | 43,357 |

| (782 | ) | — |

| 44,139 |

| | |

Other (2) | (26,811 | ) | (4,486 | ) | — |

| (22,325 | ) | | (1,391 | ) | (583 | ) | — |

| (808 | ) | | |

| Total Commercial Group | | | | | | | | | | | |

| Comparable | 245,044 |

| 7,775 |

| — |

| 237,269 |

| | 236,230 |

| 6,583 |

| — |

| 229,647 |

| 3.7 | % | 3.3 | % |

| Total | 266,949 |

| 4,100 |

| 294 |

| 263,143 |

| | 301,603 |

| 7,593 |

| 6,145 |

| 300,155 |

| | |

| Residential Group | | | | | | | | | | | |

| Apartments | | | | | | | | | | | |

| Comparable | 71,375 |

| 1,353 |

| — |

| 70,022 |

| | 64,645 |

| 1,157 |

| — |

| 63,488 |

| 10.4 | % | 10.3 | % |

| Total | 74,297 |

| 1,598 |

| 944 |

| 73,643 |

| | 62,716 |

| 1,197 |

| 867 |

| 62,386 |

| | |