SCHEDULE 14AProxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. __)

Filed by the Registrant [ ]

Filed by a Party other than the Registrant [x]

Check the appropriate box:

| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [ ] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [X] | Soliciting Material Pursuant to § 240.14a-12 |

Forest Laboratories, Inc.

(Name of Registrant as Specified In Its Charter)

Icahn Partners LP

Icahn Partners Master Fund LP

Icahn Partners Master Fund II L.P.

Icahn Partners Master Fund III L.P.

High River Limited Partnership

Hopper Investments LLC

Barberry Corp.

Icahn Onshore LP

Icahn Offshore LP

Icahn Capital L.P.

IPH GP LLC

Icahn Enterprises Holdings L.P.

Icahn Enterprises G.P. Inc.

Beckton Corp.

Carl C. Icahn

Dr. Eric J. Ende

Pierre Legault

Andrew J. Fromkin

Daniel A. Ninivaggi

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (check the appropriate box):

| [ ] | Fee computed on table below per Exchange Act Rule 14a-6(i)(4) and 0-11. |

1) Title of each class of securities to which transaction applies:

2) Aggregate number of securities to which transaction applies:

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

4) Proposed maximum aggregate value of transaction:

5) Total fee paid:

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

1) Amount Previously Paid:

2) Form, Schedule or Registration Statement No.:

3) Filing Party:

4) Date Filed:

SECURITY HOLDERS ARE ADVISED TO READ THE PROXY STATEMENT AND OTHER DOCUMENTS RELATED TO THE SOLICITATION OF PROXIES BY CARL C. ICAHN AND HIS AFFILIATES FROM THE STOCKHOLDERS OF FOREST LABORATORIES, INC. FOR USE AT ITS 2012 ANNUAL MEETING WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION, INCLUDING INFORMATION RELATING TO THE PARTICIPANTS IN SUCH PROXY SOLICITATION. WHEN COMPLETED, A DEFINITIVE PROXY STATEMENT AND A FORM OF PROXY WILL BE MAILED TO STOCKHOLDERS OF FOREST LABORATORIES, INC. AND WILL ALSO BE AVAILABLE AT NO CHARGE AT THE SECURITIES AND EXCHANGE COMMISSION’S WEBSITE AT HTTP://WWW.SEC.GOV. INFORMATION RELATING TO THE PARTICIPANTS IN SUCH PROXY SOLICITATION IS CONTAINED IN THE AMENDED PRELIMINARY PROXY STATEMENT FILED BY MR. ICAHN AND HIS AFFILIATES ON JULY 11, 2012 (THE “PRELIMINARY PROXY”). EXCEPT AS OTHERWISE DISCLOSED HEREIN OR IN THE PRELIMINARY PROXY, THE PARTICIPANTS HAVE NO INTEREST IN FOREST LABORATORIES, INC. OTHER THAN THROUGH THE BENEFICIAL OWNERSHIP OF SHARES OF COMMON STOCK, PAR VALUE $0.10 PER SHARE, OF FOREST LABORATORIES, INC., AS DISCLOSED IN THE PRELIMINARY PROXY. THE PRELIMINARY PROXY IS AVAILABLE AT NO CHARGE AT THE SECURITIES AND EXCHANGE COMMISSION’S WEBSITE AT HTTP://WWW.SEC.GOV.

Disclaimer

Special note regarding this presentation

• This presentation includes information based on data found in filings with the SEC, independent industry publications and other

sources. Although we believe that the data is reliable, we do not guarantee the accuracy or completeness of this information and have

not independently verified any such information. We have not sought, nor have we received, permission from any third-party to

include their information in this presentation.

• Many of the statements in this presentation reflect our subjective belief. Although we have reviewed and analyzed the information

that has informed our opinions, we do not guarantee the accuracy of any such beliefs.

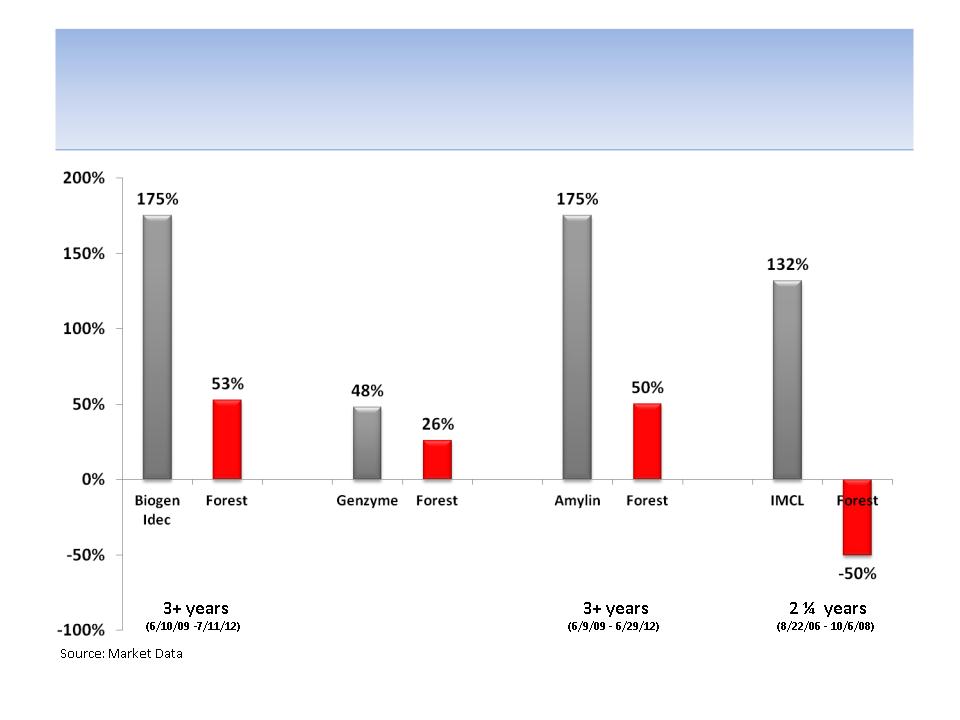

• Sections of this presentation refer to our track record of Board representation at Biogen Idec, ImClone Systems Inc., Genzyme

Corporation, and Amylin Pharmaceuticals. We believe our experience at these companies was a success and resulted in an increase in

shareholder value that benefited all shareholders. However, this success at these companies is not necessarily indicative of future

results at Forest Laboratories if our nominees were to be elected to the Forest Laboratories Board of Directors.

• SECURITY HOLDERS ARE ADVISED TO READ THE PROXY STATEMENT AND OTHER DOCUMENTS RELATED TO THE SOLICITATION OF

PROXIES BY CARL C. ICAHN AND HIS AFFILIATES FROM THE STOCKHOLDERS OF FOREST LABORATORIES, INC. FOR USE AT ITS 2012

ANNUAL MEETING WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION, INCLUDING

INFORMATION RELATING TO THE PARTICIPANTS IN SUCH PROXY SOLICITATION. WHEN COMPLETED, A DEFINITIVE PROXY STATEMENT

AND A FORM OF PROXY WILL BE MAILED TO STOCKHOLDERS OF FOREST LABORATORIES, INC. AND WILL ALSO BE AVAILABLE AT NO

CHARGE AT THE SECURITIES AND EXCHANGE COMMISSION’S WEBSITE AT HTTP://WWW.SEC.GOV. INFORMATION RELATING TO THE

PARTICIPANTS IN SUCH PROXY SOLICITATION IS CONTAINED IN THE AMENDED PRELIMINARY PROXY STATEMENT FILED BY MR. ICAHN

AND HIS AFFILIATES ON JULY 11, 2012 (THE “PRELIMINARY PROXY”). EXCEPT AS OTHERWISE DISCLOSED HEREIN OR IN THE

PRELIMINARY PROXY, THE PARTICIPANTS HAVE NO INTEREST IN FOREST LABORATORIES, INC. OTHER THAN THROUGH THE BENEFICIAL

OWNERSHIP OF SHARES OF COMMON STOCK, PAR VALUE $0.10 PER SHARE, OF FOREST LABORATORIES, INC., AS DISCLOSED IN THE

PRELIMINARY PROXY. THE PRELIMINARY PROXY IS AVAILABLE AT NO CHARGE AT THE SECURITIES AND EXCHANGE COMMISSION’S

WEBSITE AT HTTP://WWW.SEC.GOV.

2

Presentation Summary

• We believe Change is Needed as the Board has overseen:

– significant stock underperformance (p. 7 - 11) and massive destruction of value (p. 12)

– an inadequate and flawed company strategy (p. 15 - 28)

– significant corporate waste and cost structure inefficiency (p. 27 - 28)

– inefficient and ineffective deployment of capital (p. 29 - 31)

– corporate governance failures (p. 32)

• we believe that 50% of Board lacks independence (p.33)

• CEO Solomon’s Son, After Only 5 Years at Forest, Was Promoted and Given Significant Responsibility for Business Development

and Strategic Planning; We Believe He Is Significantly Responsible for the Company’s Current Predicament; Despite His

Failures, He Has Been Promoted to SVP Business Development and Strategic Planning and He Is Now a Candidate for CEO; How

Can a Board that Calls Itself “Strong & Independent” Be Responsible For This? (p. 39 - 40)

• We believe we Have a Viable Plan for Change (p. 44 - 51)

• We believe we Will Help Generate Change (p. 53 - 58) superior to existing Board based on:

– highly relevant experience in all aspects of biopharmaceuticals and related areas necessary for success in this new era of

reimbursement and cost effectiveness

– greater independence

– fresh perspectives from outside of Forest

– better alignment with shareholders; track record of outperformance in biopharma (p. 59 - 60)

– consistent accountability

4

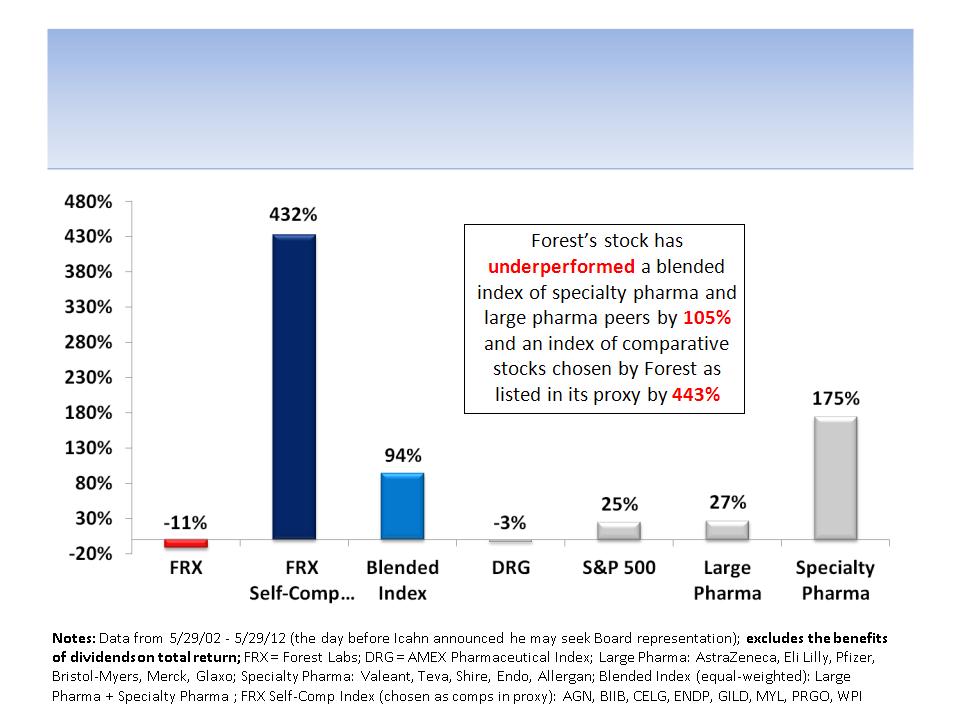

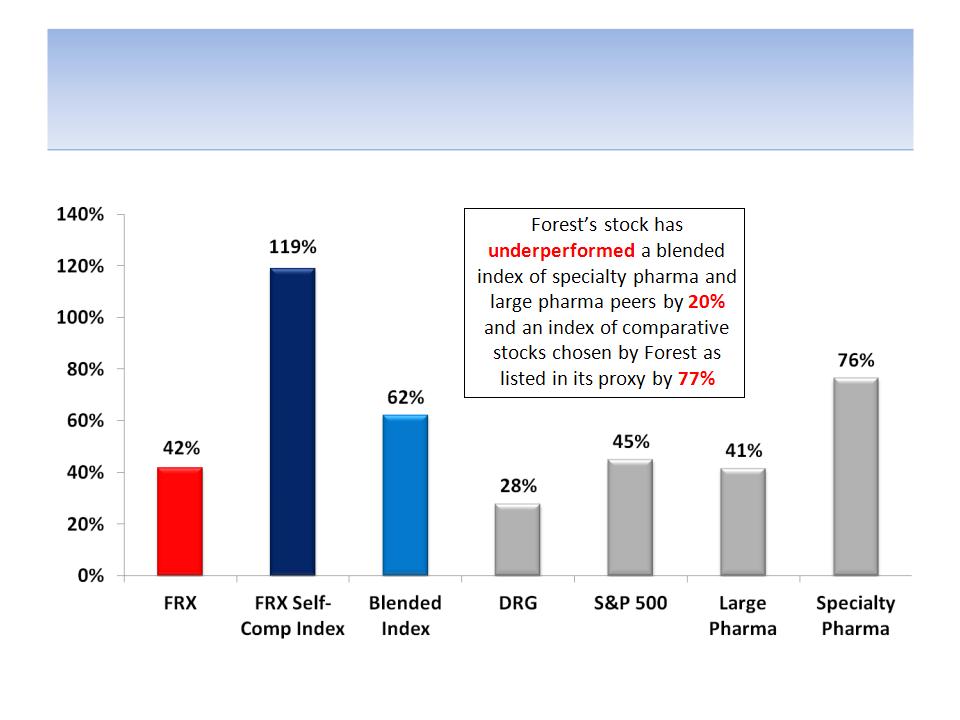

Forest’s Stock Has Underperformed

Against Most Measures For 3 Years

Notes: Data from 5/29/09 - 5/29/12 (the day before Icahn announced he may seek Board representation); excludes the benefits of

dividends on total return; FRX = Forest Labs; DRG = AMEX Pharmaceutical Index; Large Pharma: AstraZeneca, Eli Lilly, Pfizer, Bristol-

Myers, Merck, Glaxo; Specialty Pharma: Valeant, Teva, Shire, Endo, Allergan; Blended Index (equal-weighted): Large Pharma +

Specialty Pharma; FRX Self-Comp Index (chosen as comps in proxy): AGN, BIIB, CELG, ENDP, GILD, MYL, PRGO, WPI, HSP, WCRX

9

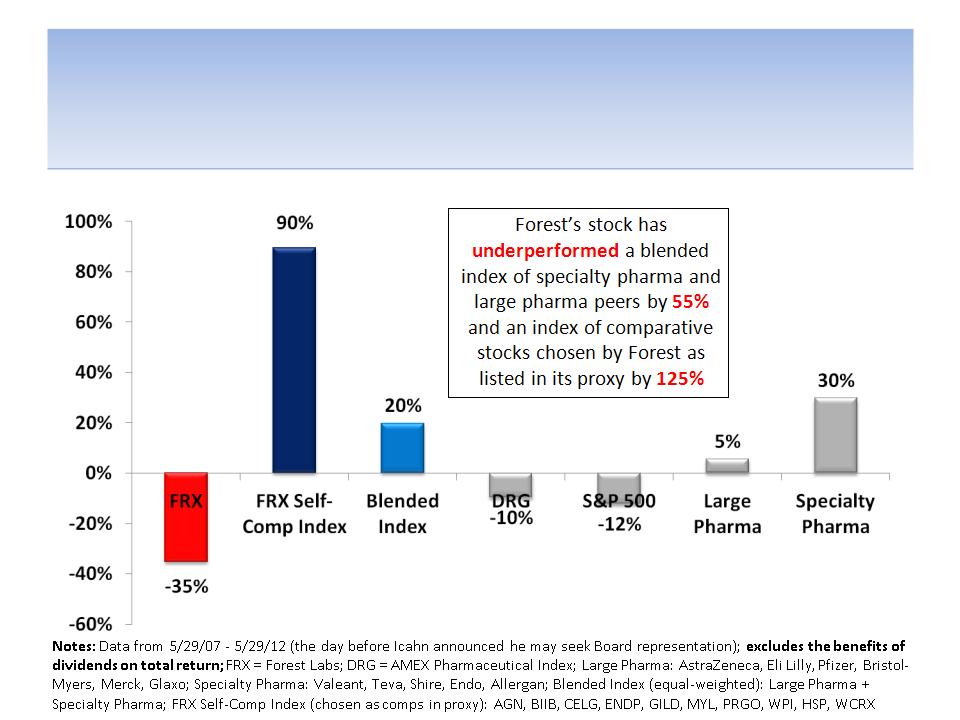

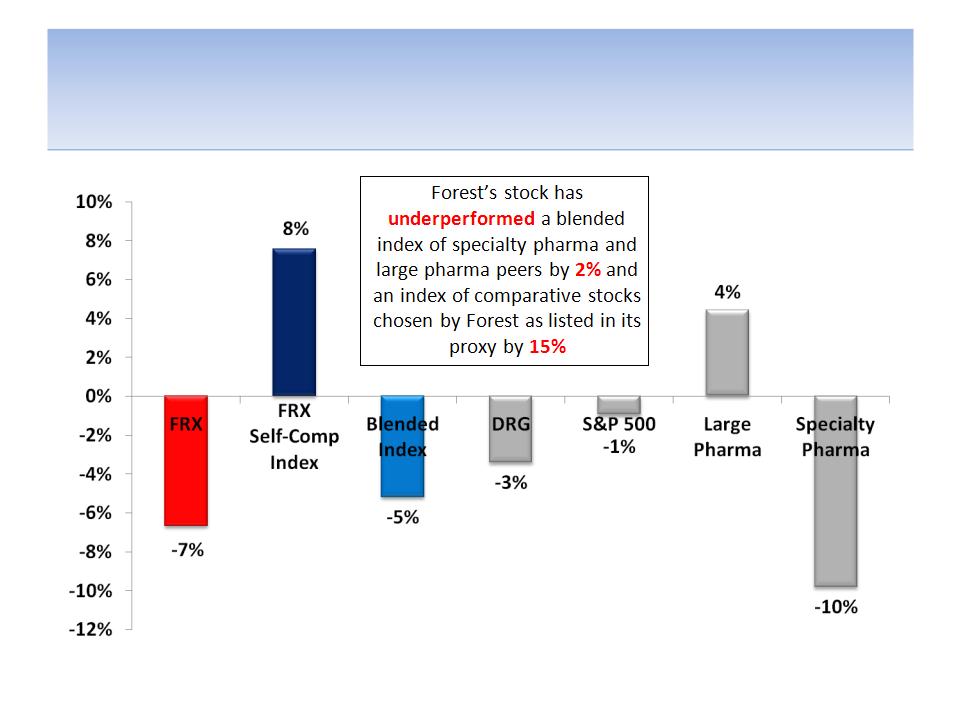

Forest’s Stock Has Underperformed

Against Most Measures For 1 Year

Notes: Data from 5/29/11 - 5/29/12 (the day before Icahn announced he may seek Board representation); excludes the benefits of

dividends on total return; FRX = Forest Labs; DRG = AMEX Pharmaceutical Index; Large Pharma: AstraZeneca, Eli Lilly, Pfizer, Bristol

-Myers, Merck, Glaxo; Specialty Pharma: Valeant, Teva, Shire, Endo, Allergan; Blended Index (equal-weighted): Large Pharma +

Specialty Pharma; FRX Self-Comp Index (chosen as comps in proxy): AGN, BIIB, CELG, ENDP, GILD, MYL, PRGO, WPI, HSP, WCRX

10

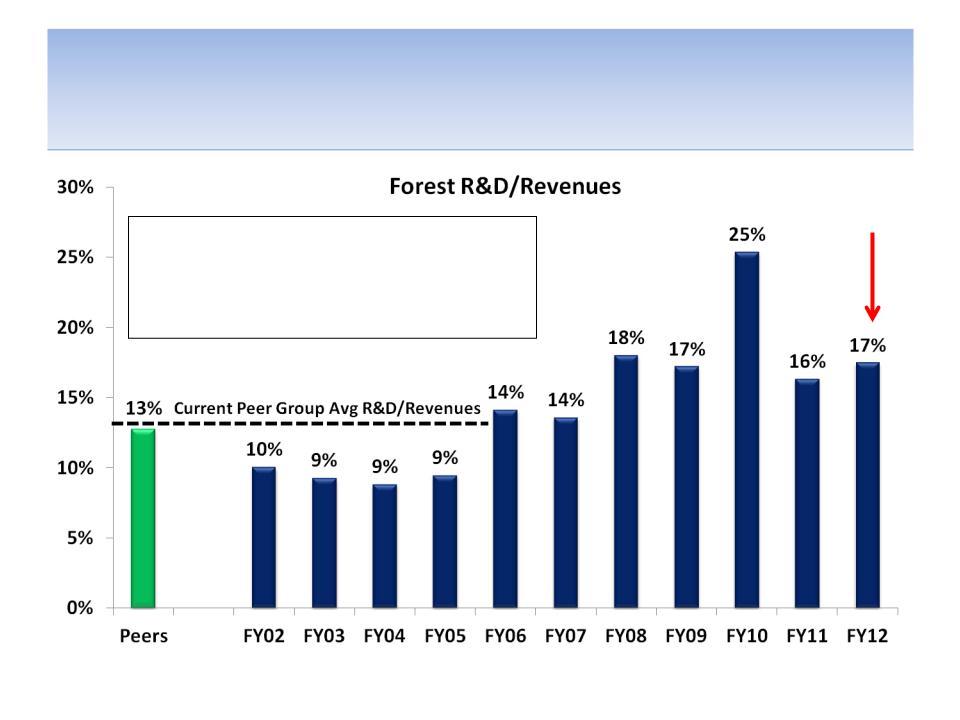

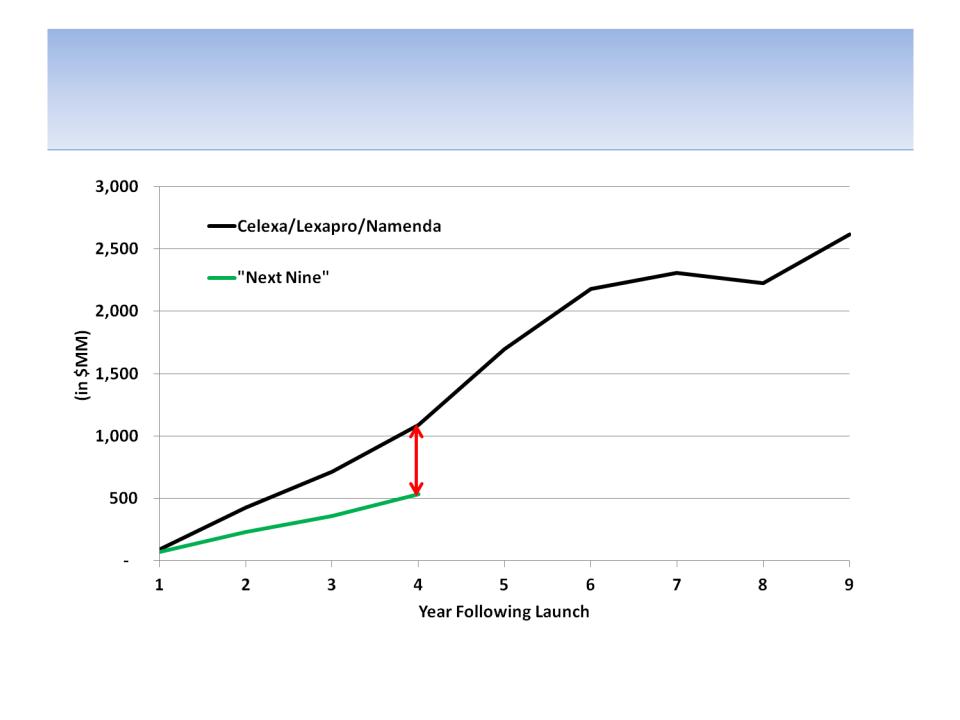

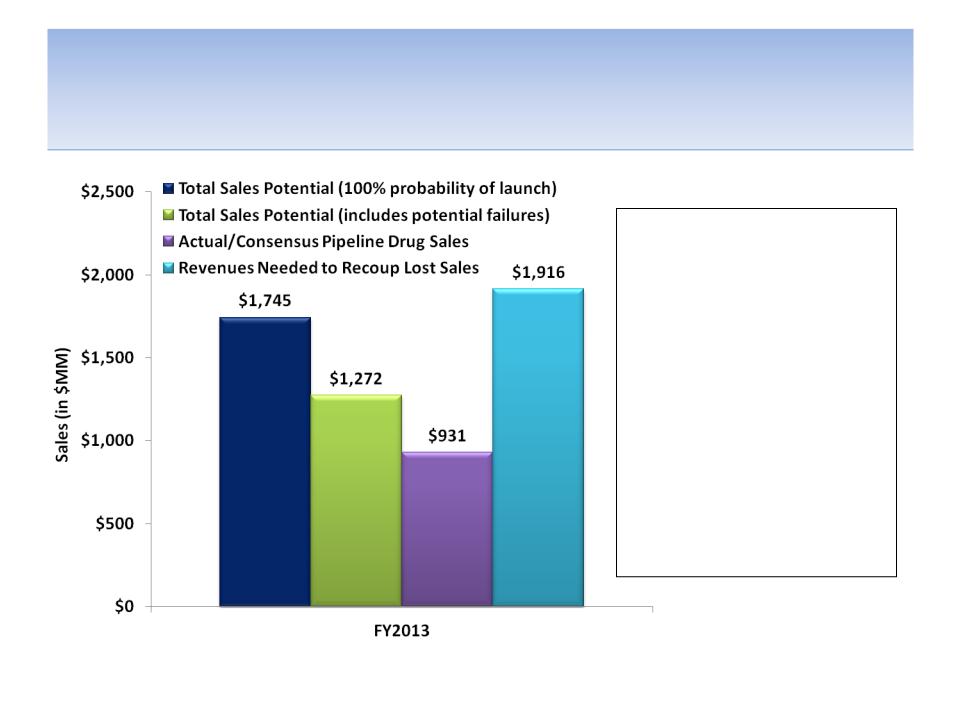

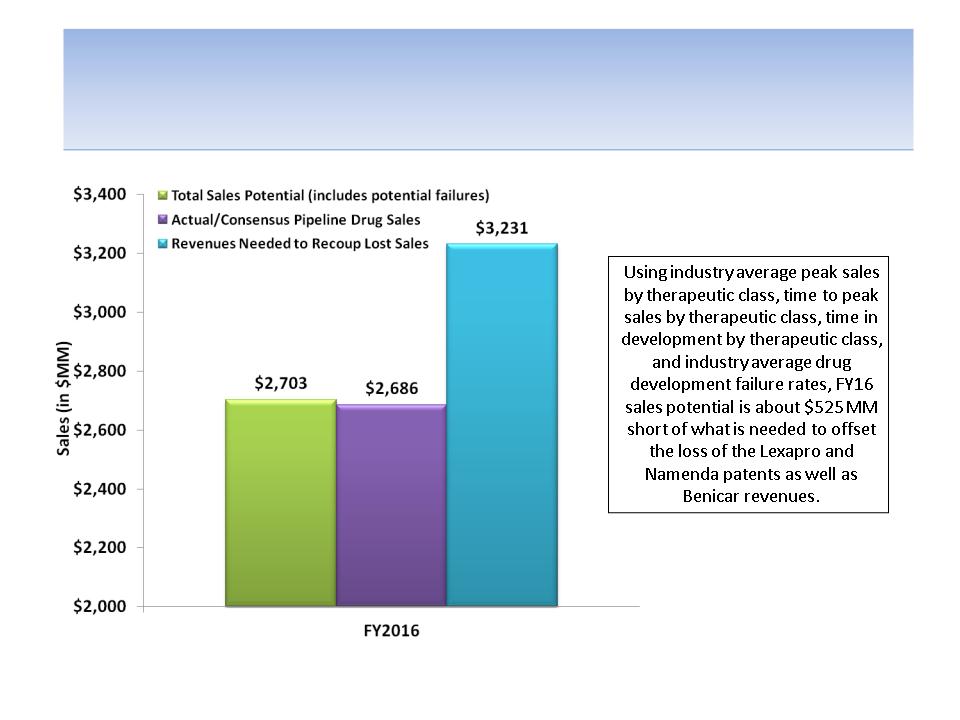

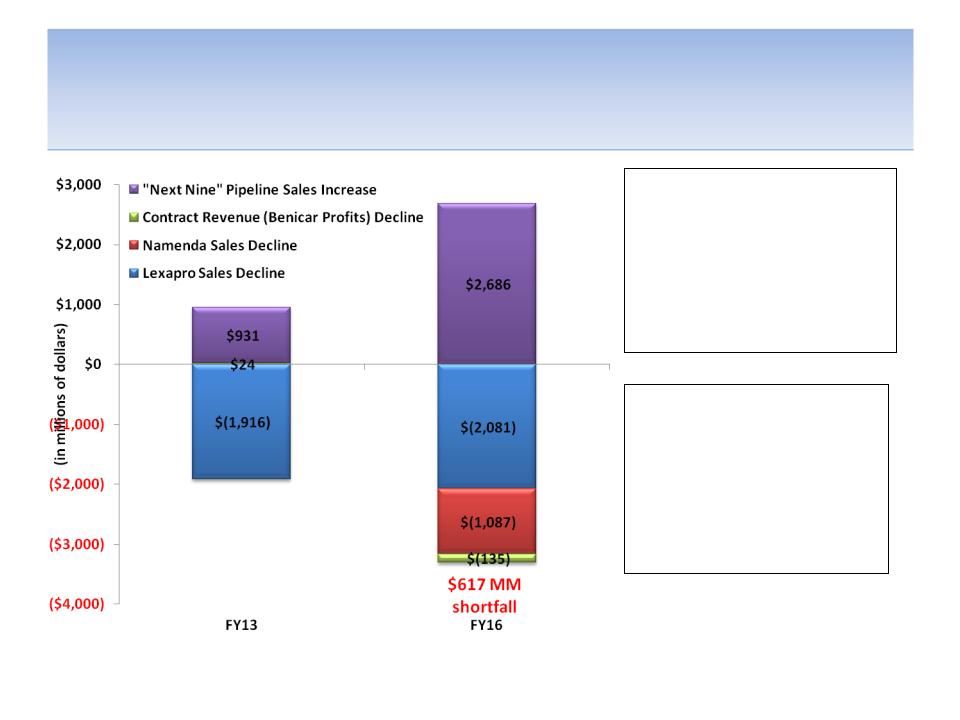

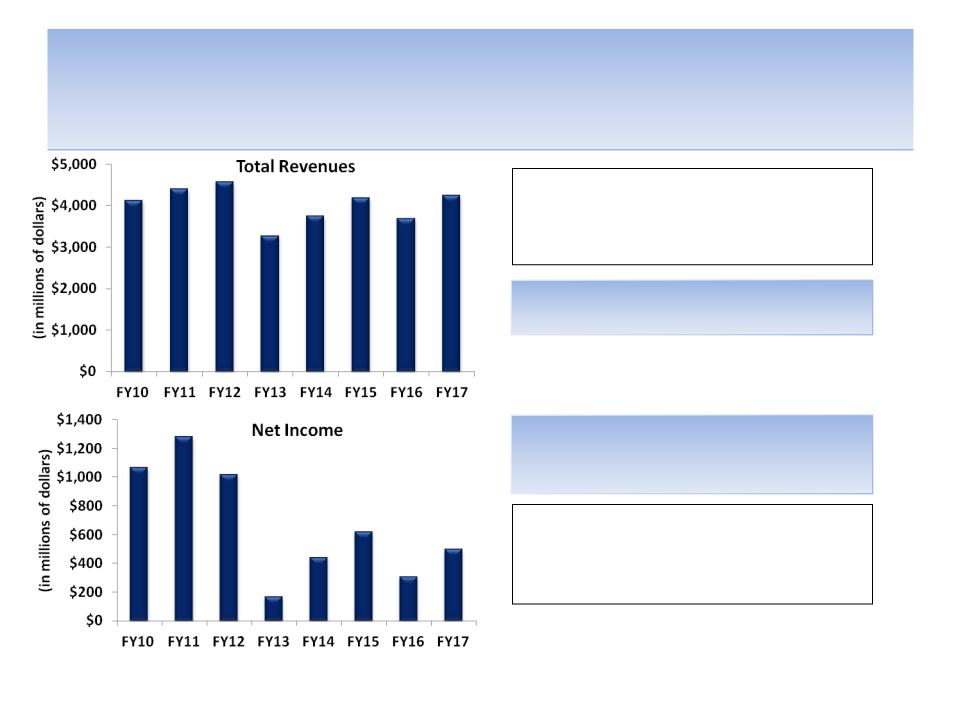

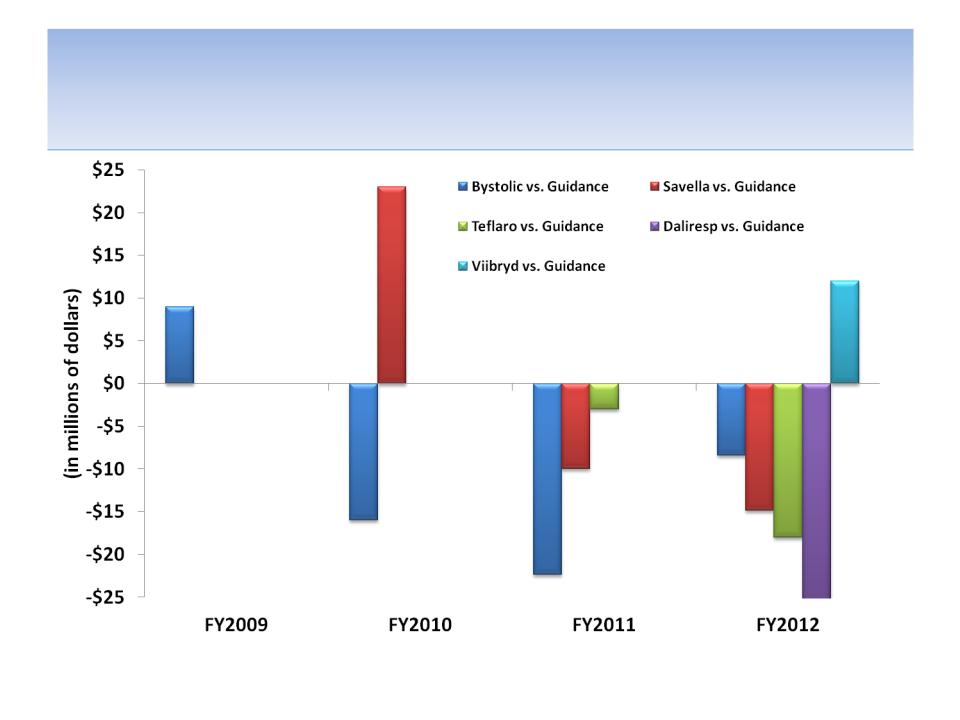

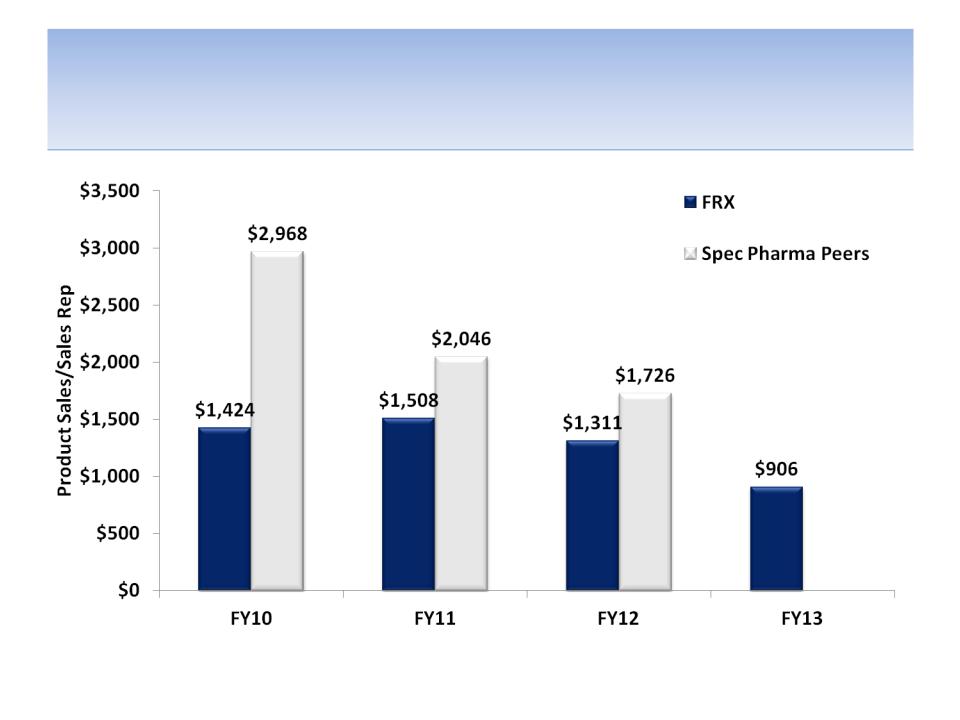

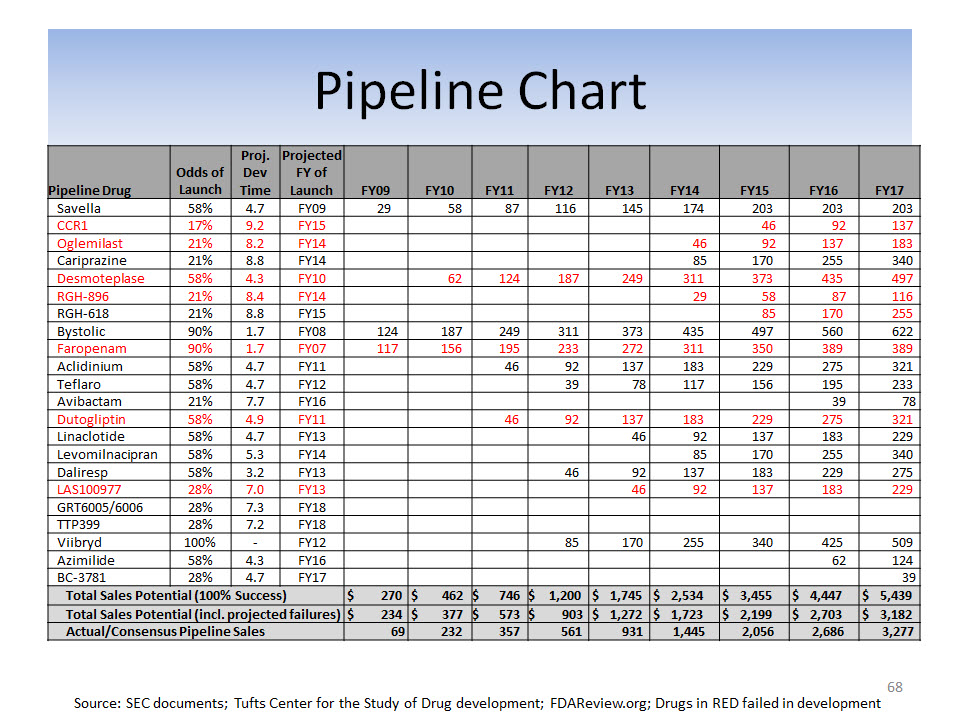

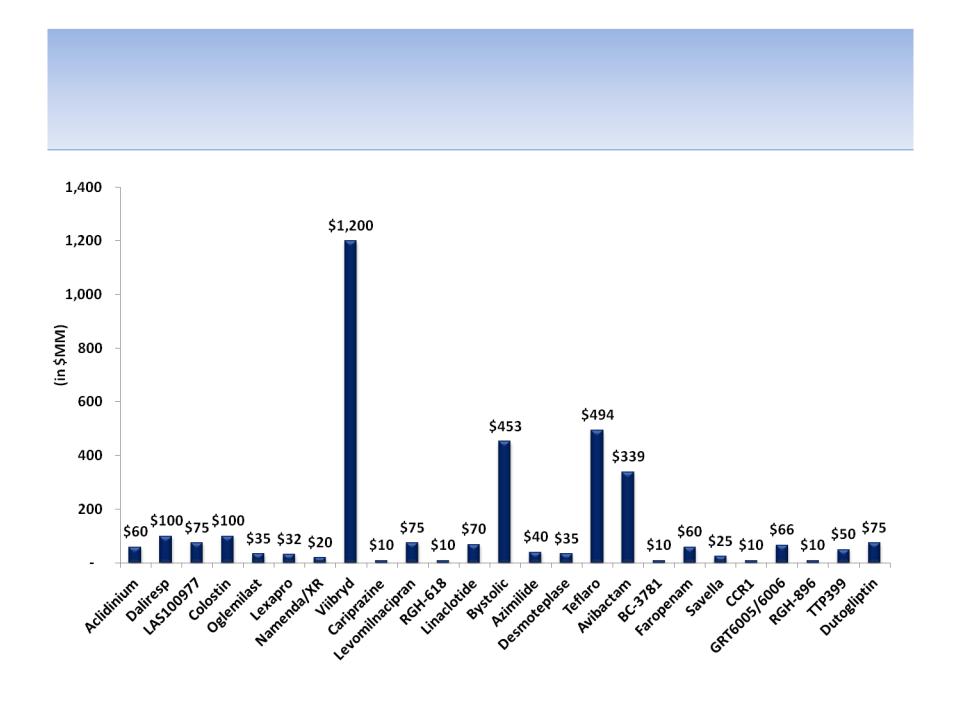

We Believe Forest Had an Inadequate & Flawed

Strategy That Destroyed Shareholder Value

• Inadequate Strategy: Management and the Board implemented a strategy that we

believe was inadequate to offset declining revenues and profits due to generic

competition for Lexapro and Namenda

– The strategy was implemented too late even though there was plenty of time to prepare

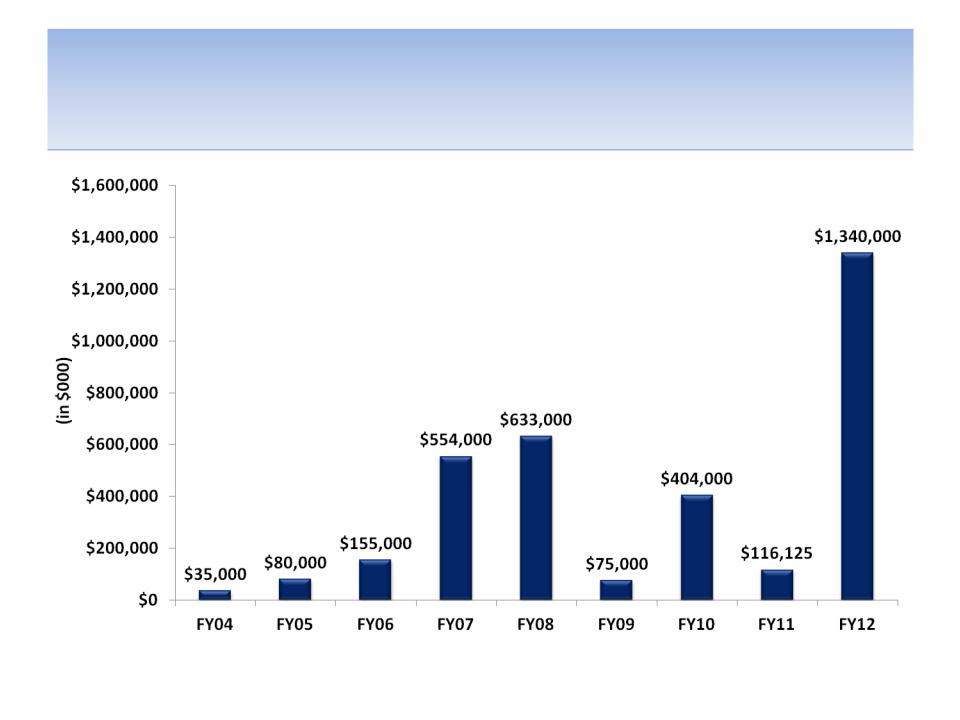

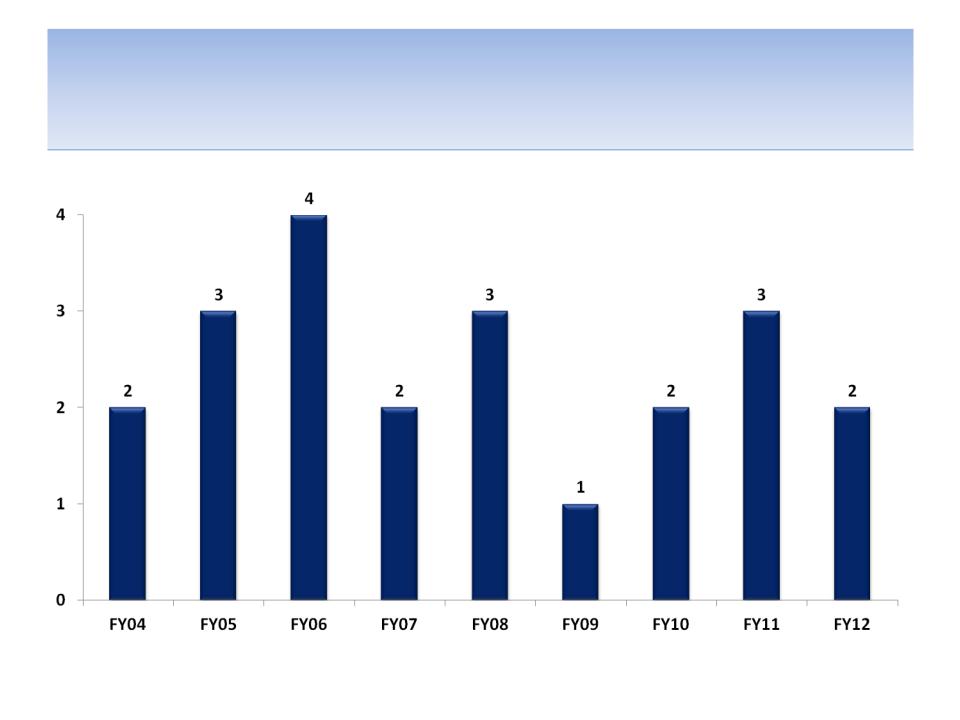

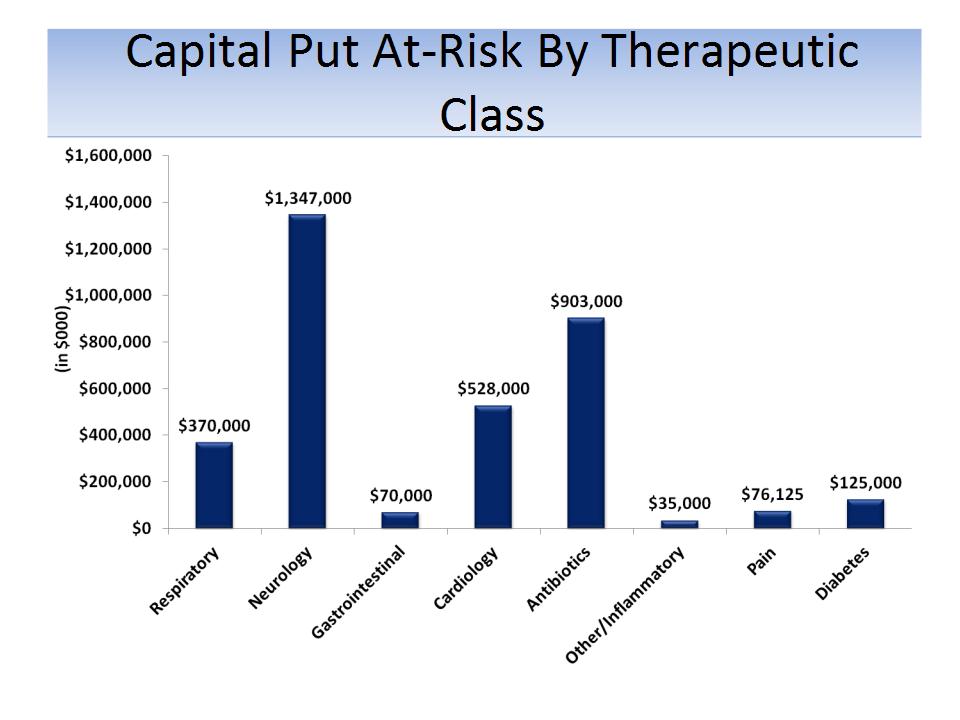

– An increasing amount of capital has had to be put at risk for each product

– In spite of all the capital used, a massive amount of value was destroyed

– Pipeline planning to offset lost revenues was insufficient

– Revenues from “Next Nine” drug launches have missed company guidance

– Revenues & profits are expected to remain depressed for the foreseeable future

• Flawed Strategy: We believe the “opportunistic” strategy has caused business

development & Forest’s pipeline to become highly unfocused

– Lack of company expertise and critical mass in specific areas

– Sales rep productivity has declined and is below specialty pharma peers

– Loss of cost synergies within sales and marketing, G&A as well as R&D

Source: Company documents; Analyst estimates

15

Management Had Plenty of Time to Prepare

For the Patent Cliff, But Started Too Late

Source: Company documents and analyst estimates

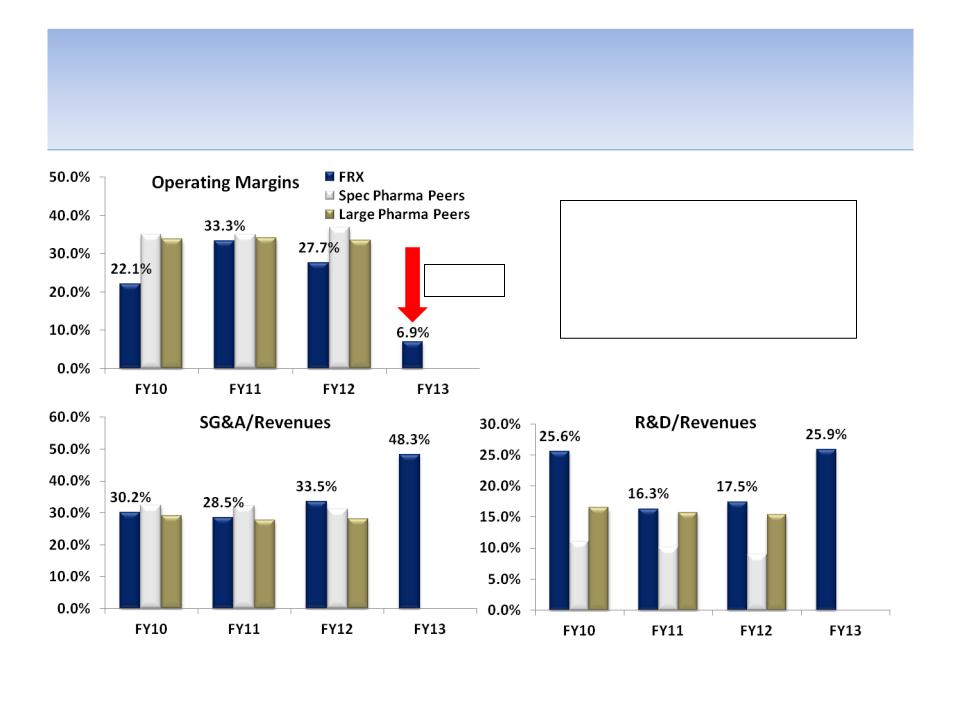

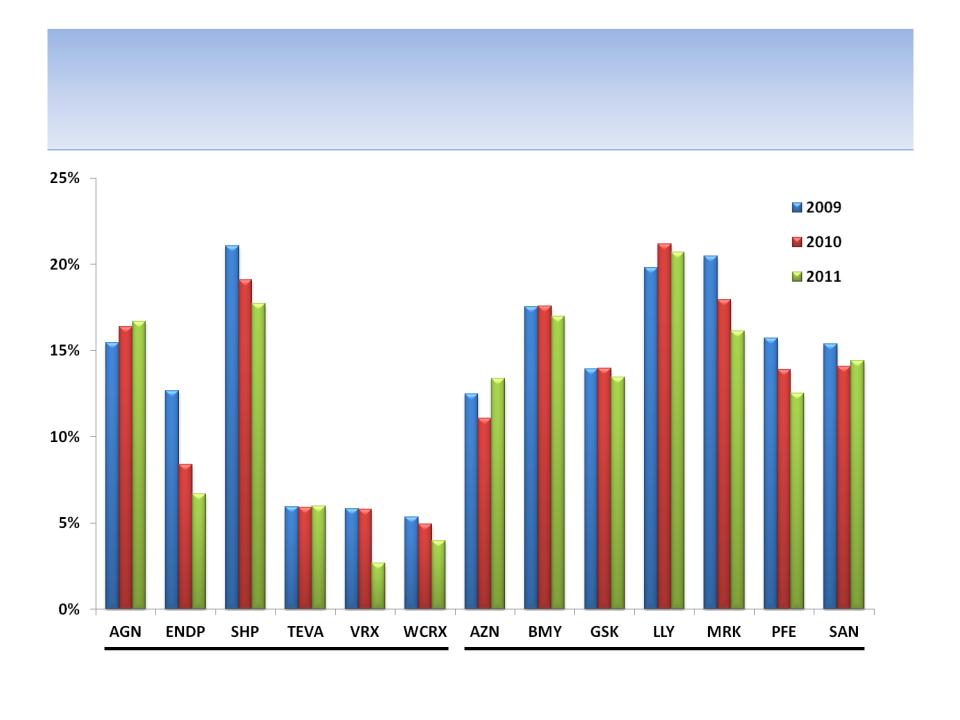

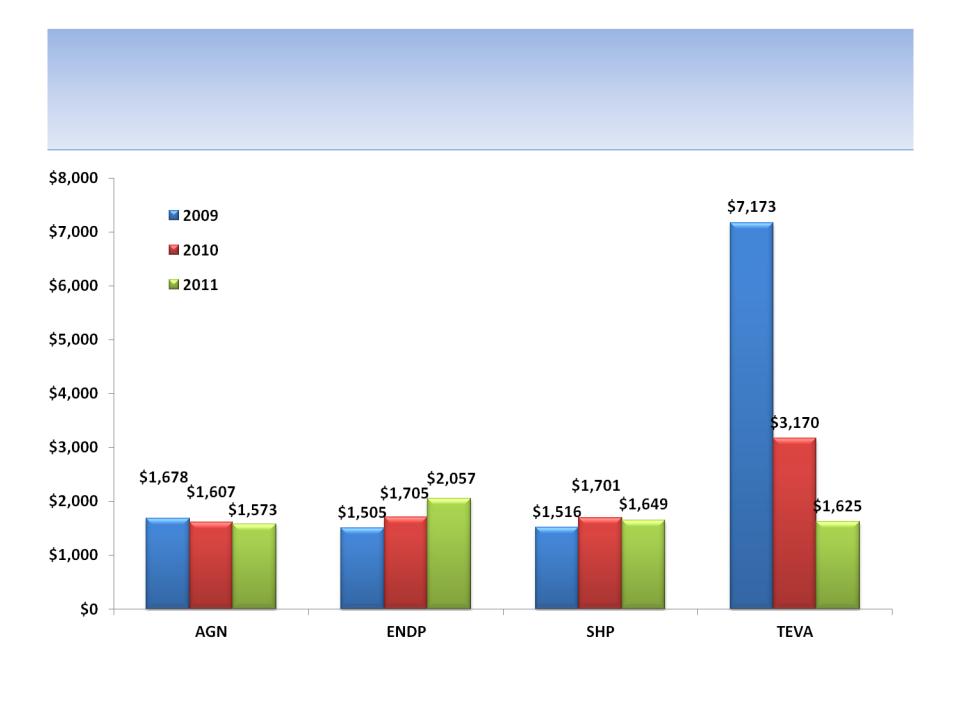

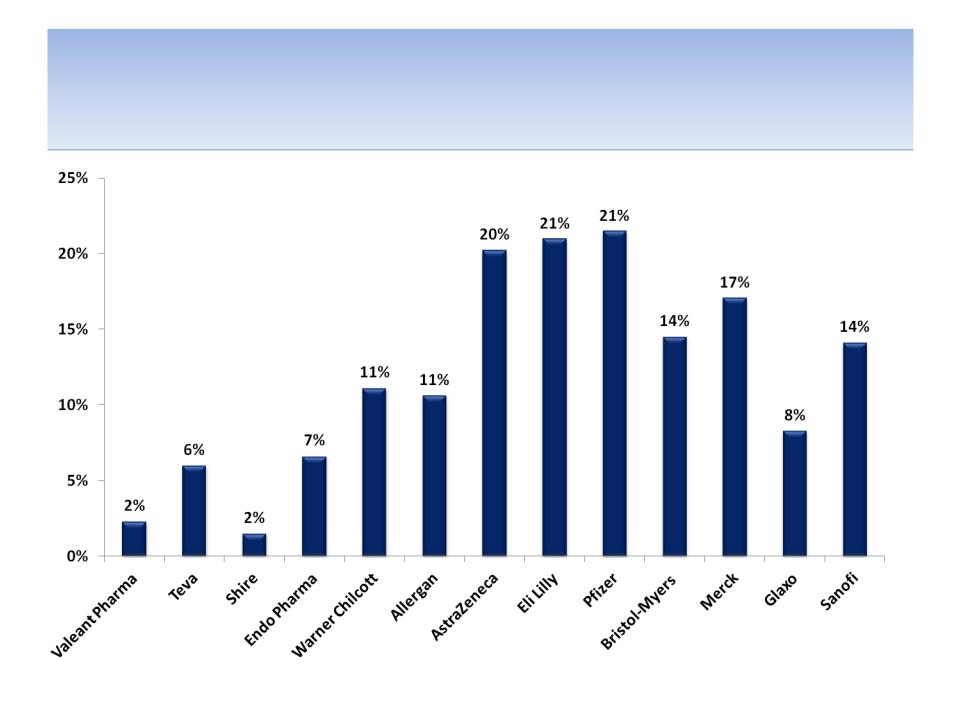

Note: Peer specialty pharmaceutical companies consist of Valeant, Teva, Shire, Endo, Warner Chilcott & Allergan ; Peer

large pharmaceutical companies consist of AstraZeneca, Eli Lilly, Pfizer, Bristol, Merck, Glaxo, Sanofi-Aventis

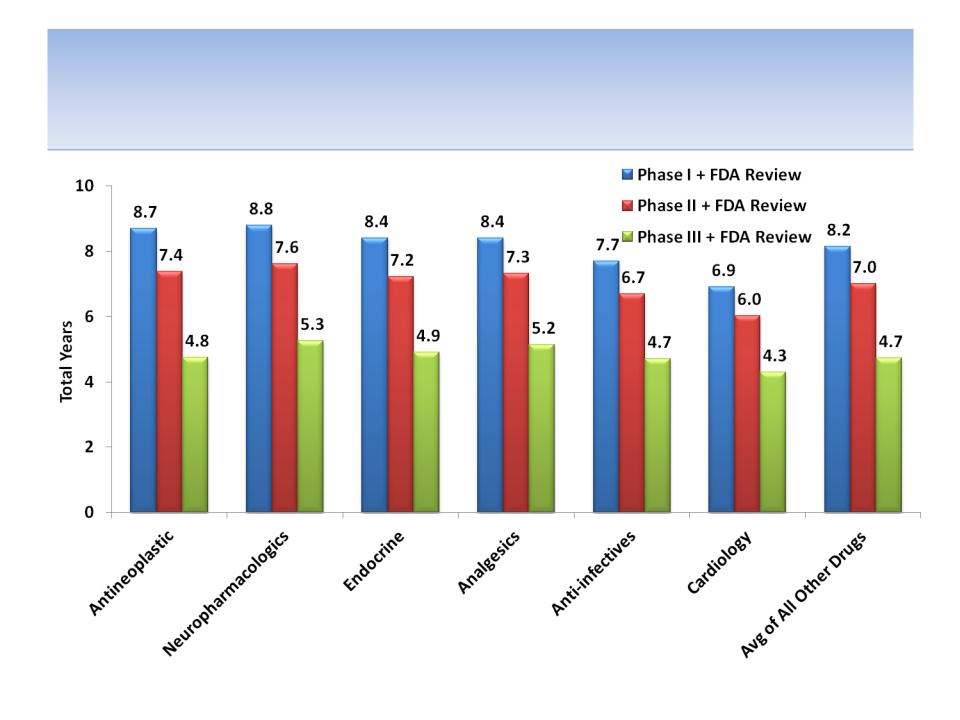

Management/Board underinvested in R&D for

several years forcing them to try to “catch up”

later. Depending on the stage of development

that a product is licensed, clinical development of

a single drug can take up to 10 years

Loss of

Lexapro

patent

16

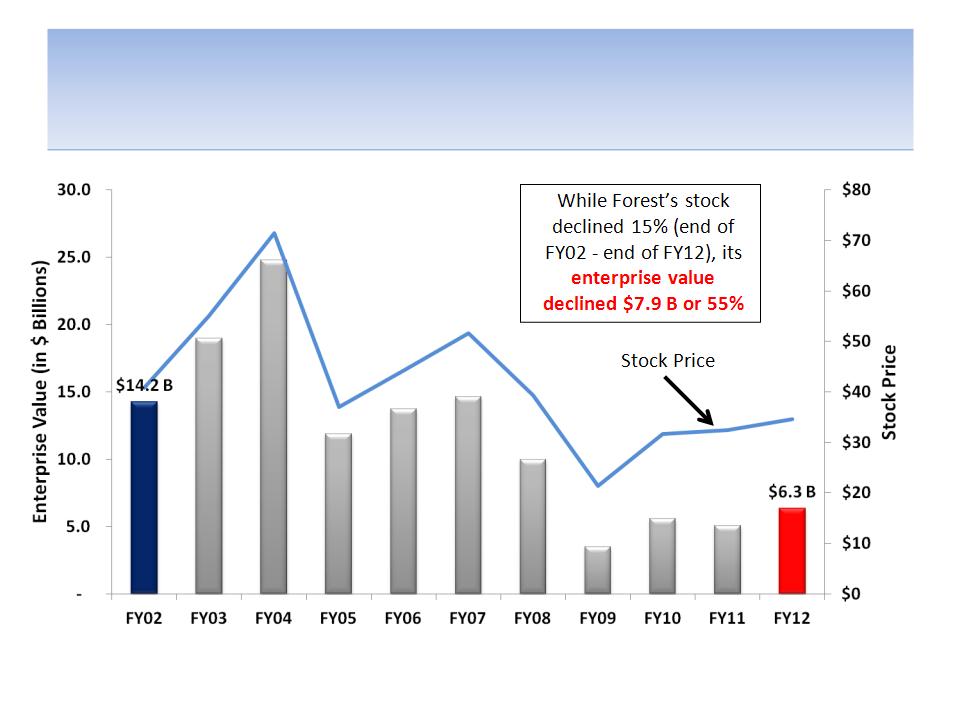

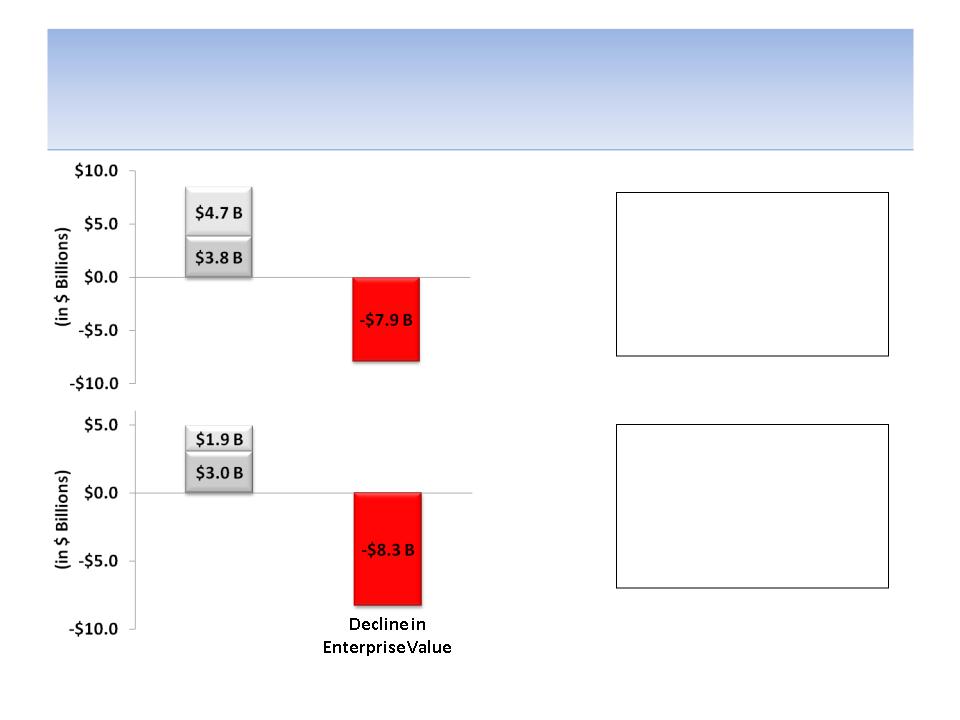

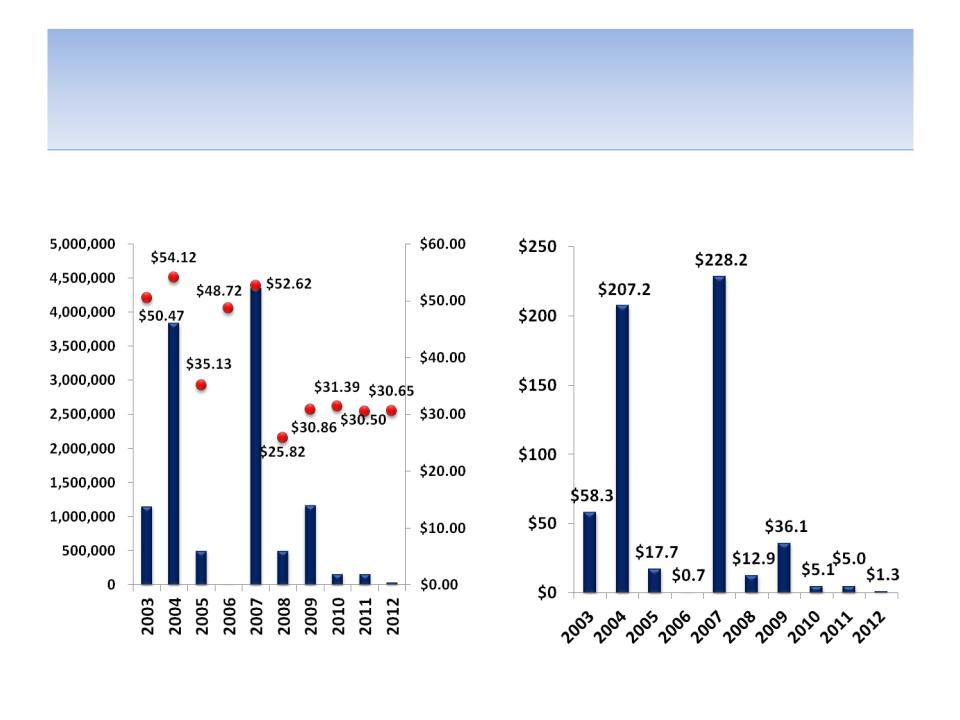

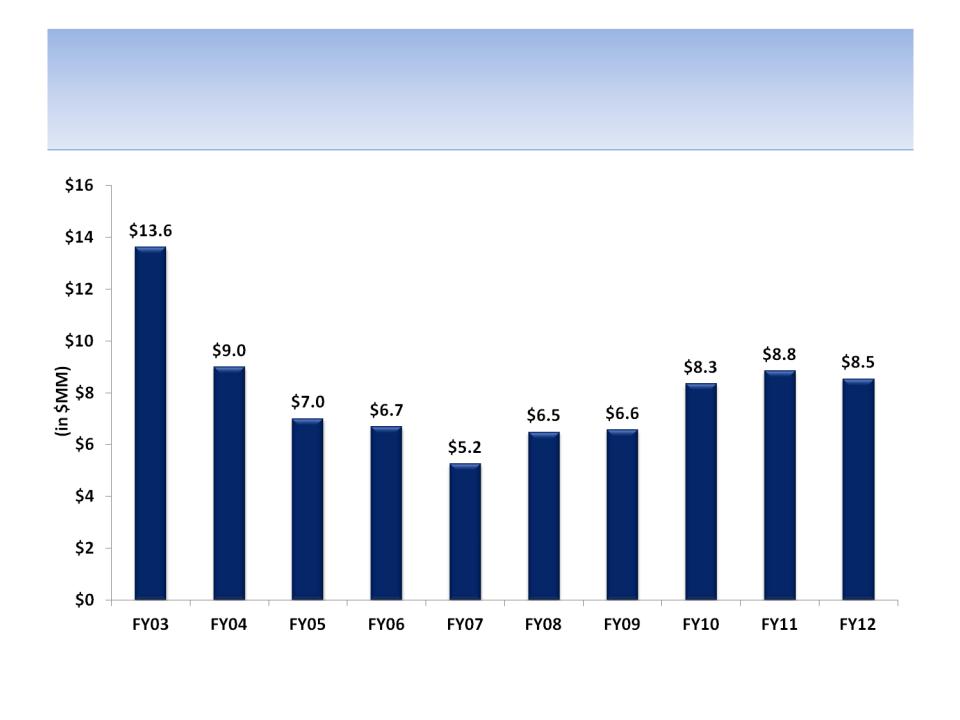

Despite All the Money Spent on Products,

Massive Value Has Been Destroyed

During the last 10 years,

Forest spent $8.3 B on R&D,

licensing/milestone payments

and product/rights

acquisitions. At the same

time, $7.9 B of Enterprise

Value was destroyed

During the last 5 years, Forest

spent more than $6.2 B on

R&D, licensing/rights

payments and product/rights

acquisitions. At the same

time, $8.3 B of Enterprise

Value was destroyed

Source: Company documents

Notes: Enterprise value is calculated from FY03 through FY12 (10 yrs) and from FY07 through FY12 (5 yrs)

Acquisitions of companies/product rights

Acquisitions of companies/product rights

R&D/licensing & milestones payments

R&D/licensing & milestones payments

18

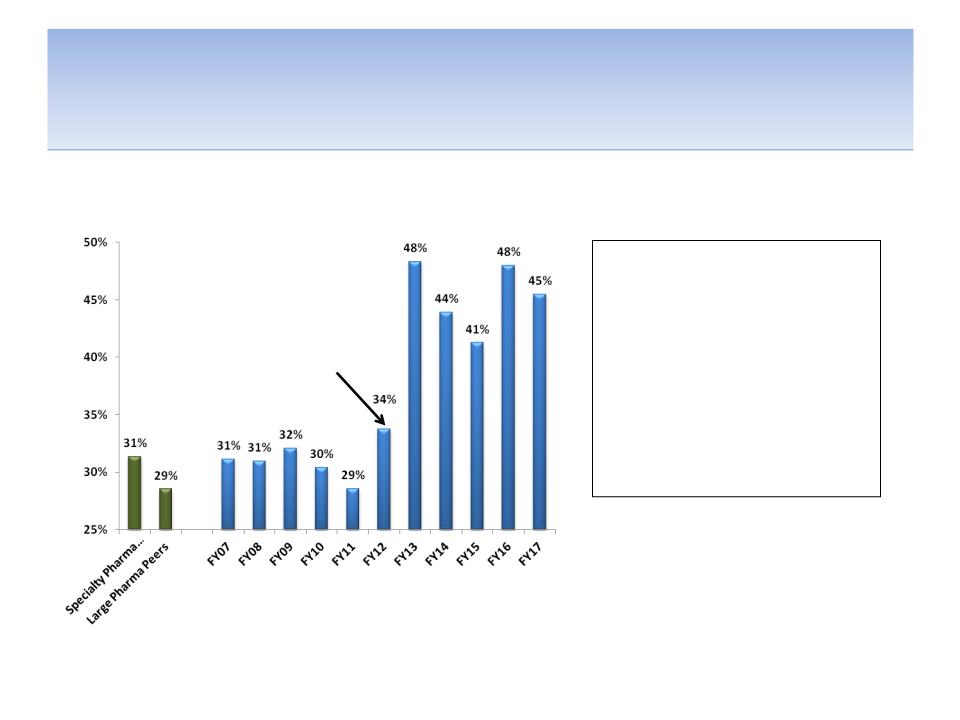

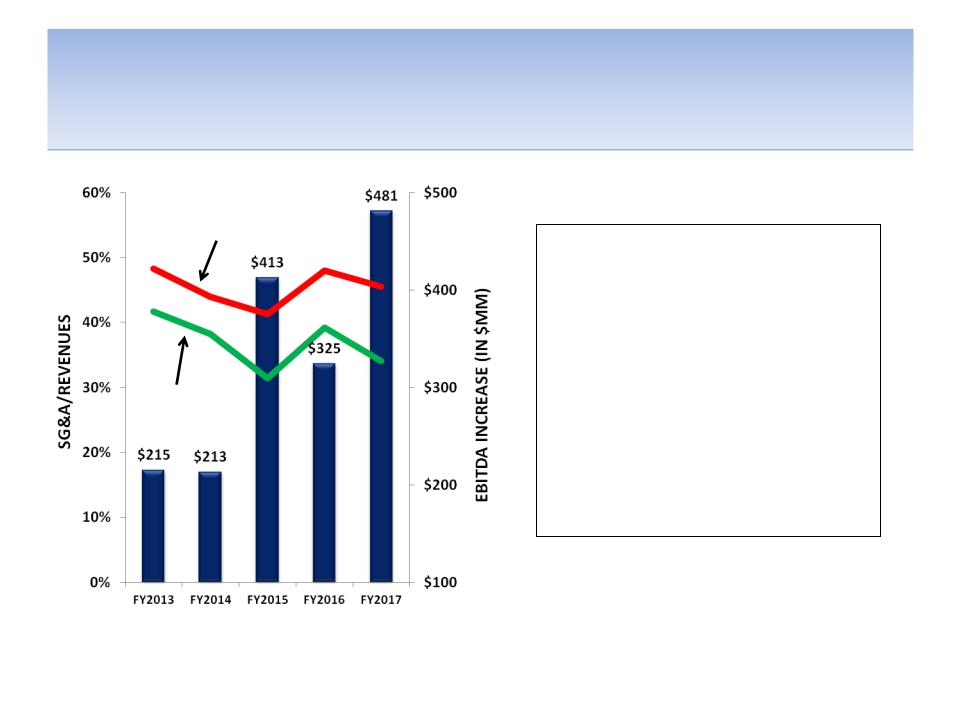

We Believe Loss of Lexapro Sales Has Further Exposed

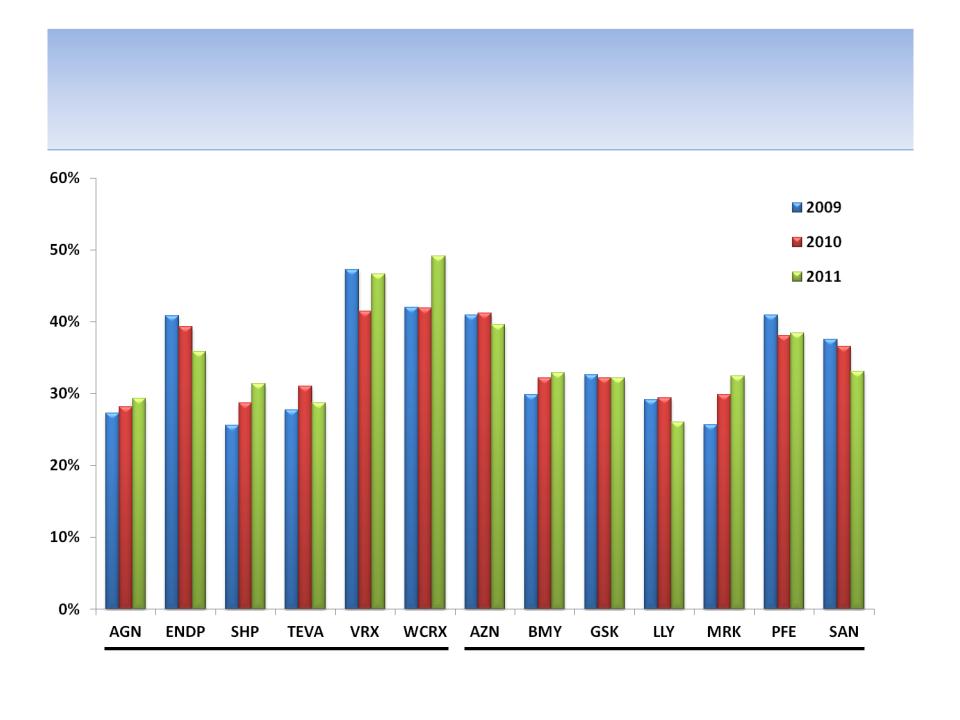

Massive Corporate Inefficiency & Lack of Cost Synergies

SG&A/Revenues (Forest vs. Peers)

Lack of Critical Mass

Source: Company documents and analyst estimates

Note: Peer specialty pharmaceutical companies include Valeant, Teva, Shire, Endo, Warner Chilcott & Allergan ; Peer large

pharmaceutical companies include AstraZeneca, Eli Lilly, Pfizer, Bristol, Merck, Glaxo, Sanofi-Aventis

Loss of

Lexapro

patent

27

• With the loss of Lexapro sales

due to generic competition, it

has become very clear to us

that SG&A is too high

• Without critical mass within

specific therapeutic areas, the

significant fixed costs

associated with the addition

of incremental sales reps

creates cost inefficiency

We Believe Management & Board Have a

Poor Track Record of Allocating Capital

Cash used for share repurchases

Cash used for licensing or acquiring products

Source: Company documents; 10 year values measured from YE 2002 through YE 2012; 5 Year

values measured from YE07 through YE12; Enterprise Value = Market Cap + Debt - Cash

Cash used for share repurchases

Cash used for licensing or acquiring products

During the past 10 years as

$8.5 B of capital was

deployed for obtaining

products and repurchasing

shares, there was a decline

in enterprise value of $7.9 B

During the past 5 years as

$4.9 B of capital was

deployed for obtaining

products and repurchasing

shares, there was a decline

in enterprise value of $8.3 B

29

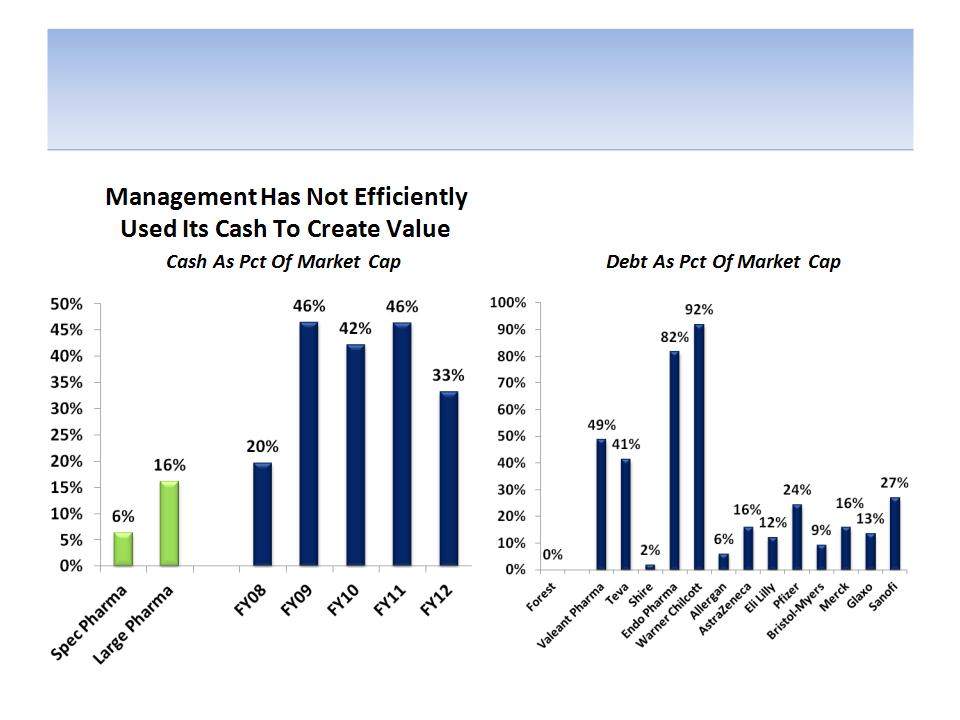

We Are Concerned About How Management

May Use the Cash Given Its Track Record

• Given its history of destroying significant value during the last 10

years, we are very concerned about how management may choose

to use the company’s $3.2 B of cash

• Because of the current & projected revenue shortfalls from generic

competition, we believe management may “swing for the fences”

• Analysts do not believe what they have in the pipeline is enough

and therefore may need to do acquisitions:

– “The pipeline, as currently constituted, is not nearly enough to replace

the lost revenue from losing Lexapro and Namenda to generics.” --

David Amsellem of Piper Jaffray

– “I don’t think what they have in their pipeline is enough . At some

point, you’re going to see them use that balance sheet” - Gary

Nachman of Susquehanna

31

Source: Company documents; SEC filings; quotes from Bloomberg article from July 6, 2012

We Remain Concerned About Corporate

Governance Issues

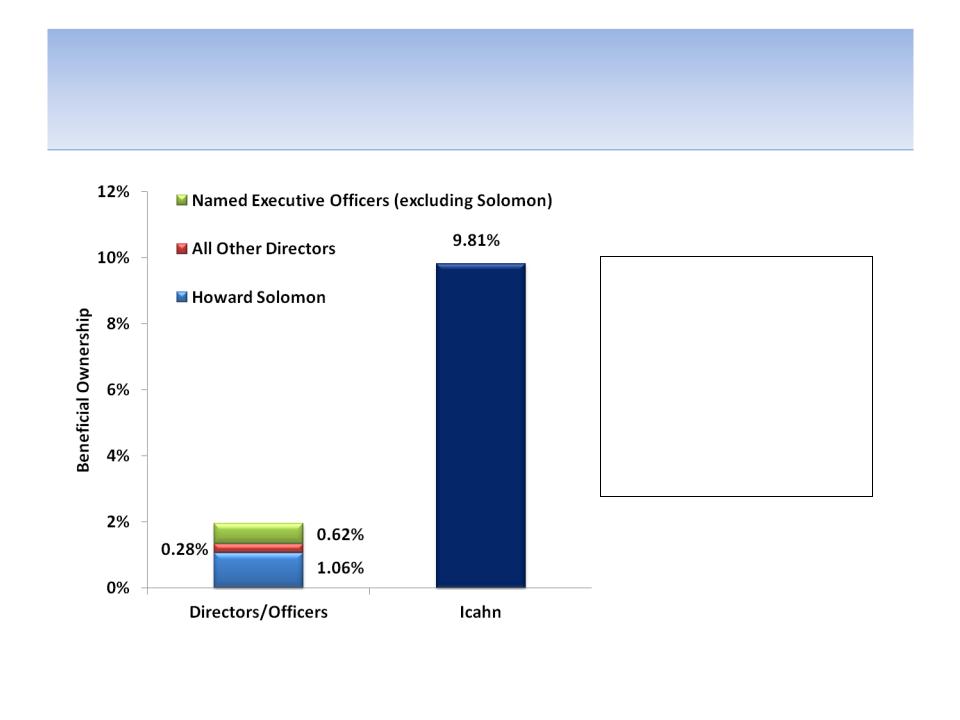

• At least 50% of the Board continues to lack true independence, in our

opinion

– The Presiding “Independent” Director (Kenneth Goodman) lacks true independence

yet he still remains in this important role

– The Chair of the Compensation Committee (Dan Goldwasser) who oversaw seriously

flawed compensation policies inexplicably remains in place

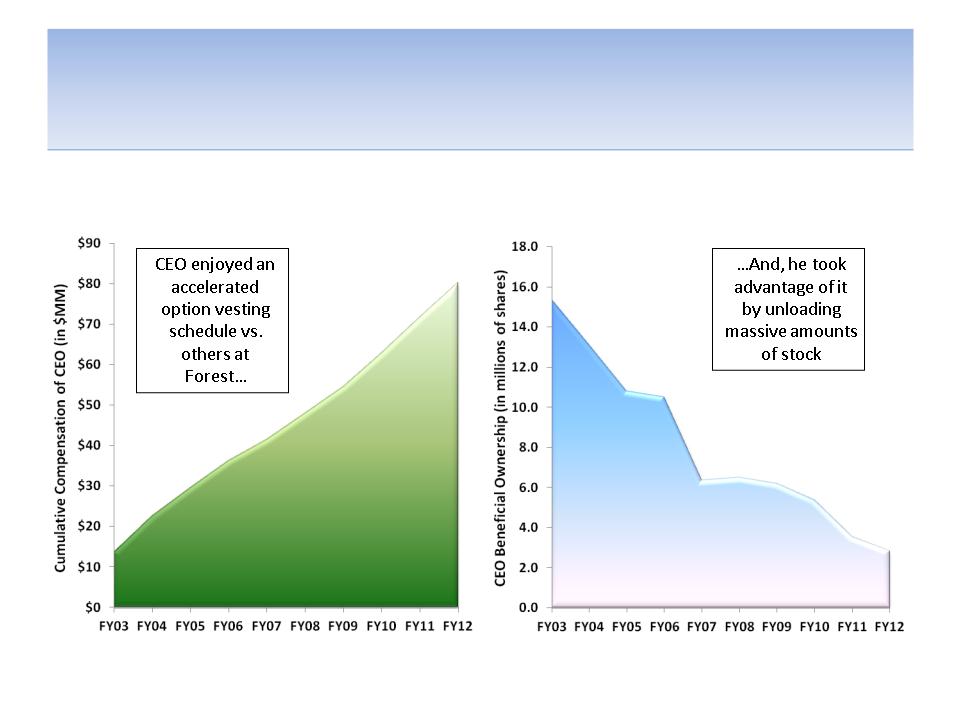

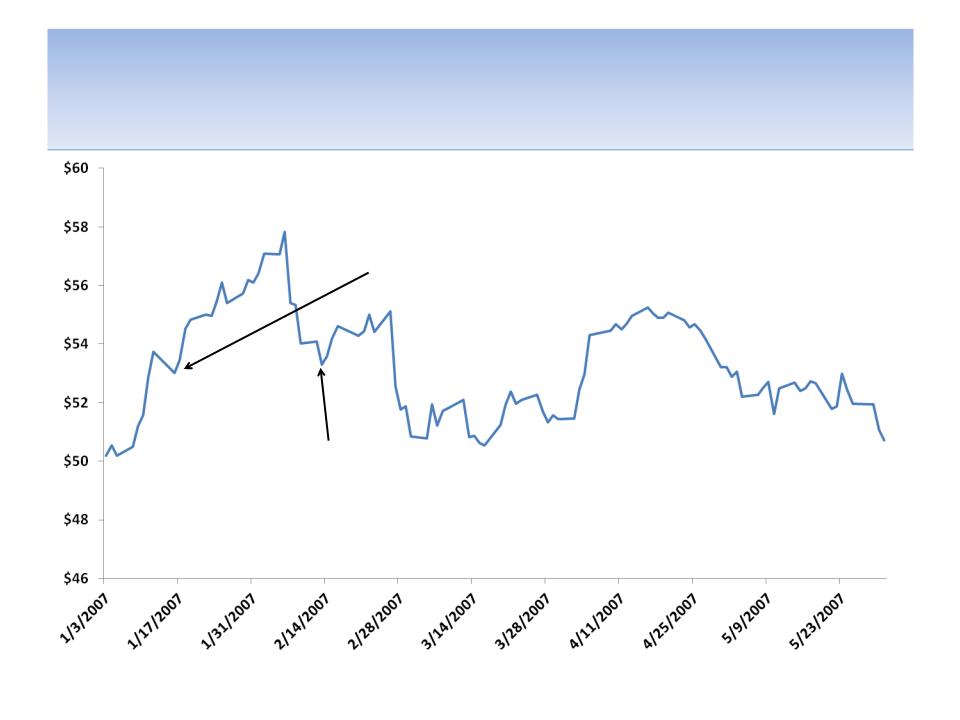

• The CEO (Howard Solomon) has had extremely fortunate timing on

large sales of stock

• The CEO succession plan seems to include the CEO’s son but doesn’t

appear to us to equitably include external candidates

• Promotion of CEO’s son to crucial role as head of Strategic Planning

despite relative inexperience in the area

• The Company has had $423 MM of legal settlements including a guilty

plea to a felony charge of obstruction of justice

32

Source: Company documents; SEC filings

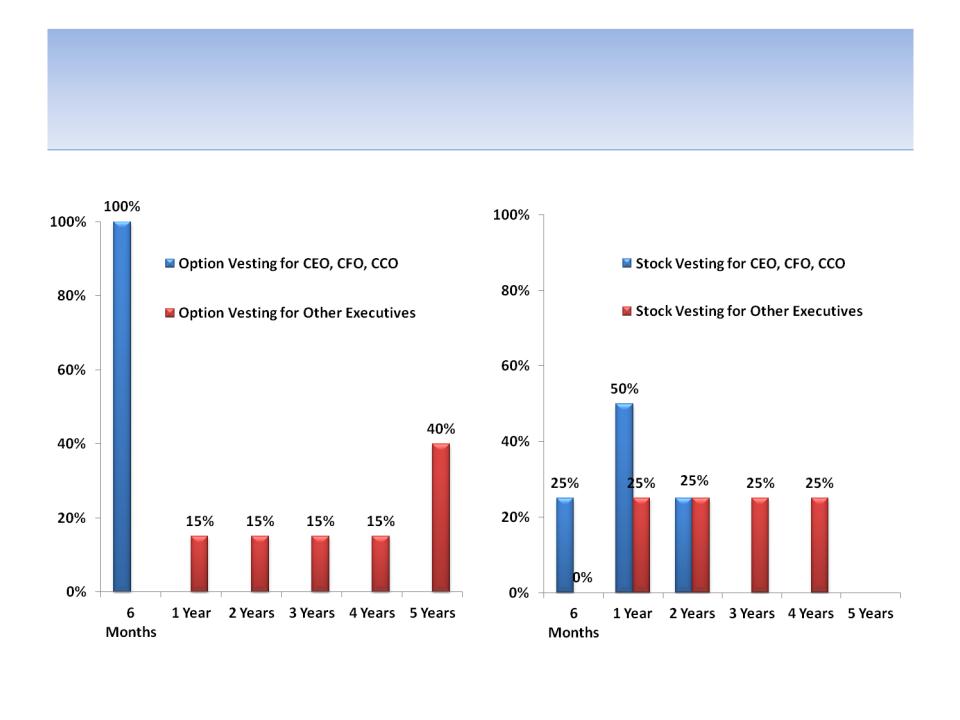

Compensation Policies Have Been

Flawed But Chairman Remains at Helm

• Chair of Compensation Committee (Dan Goldwasser - Board member for 35

years) presided over serious problems related to compensation policy

• Policy changes during the last year confirm these problems

– Vesting schedules of equity awards were too short, not linked to performance

and favored the CEO

– The Compensation Committee had not previously engaged an independent

compensation consultant

– The Chair of the Committee chose the peer group for comparison purposes

– The Chair circulated a report of factors he believed were relevant to

determining compensation including a report prepared directly by management

– Compensation was not linked to pre-determined performance measures

– There were no stock ownership requirements

• Then, why is Dan Goldwasser still Chair of the Compensation

Committee given these problems with compensation policy?

Source: Company documents

34

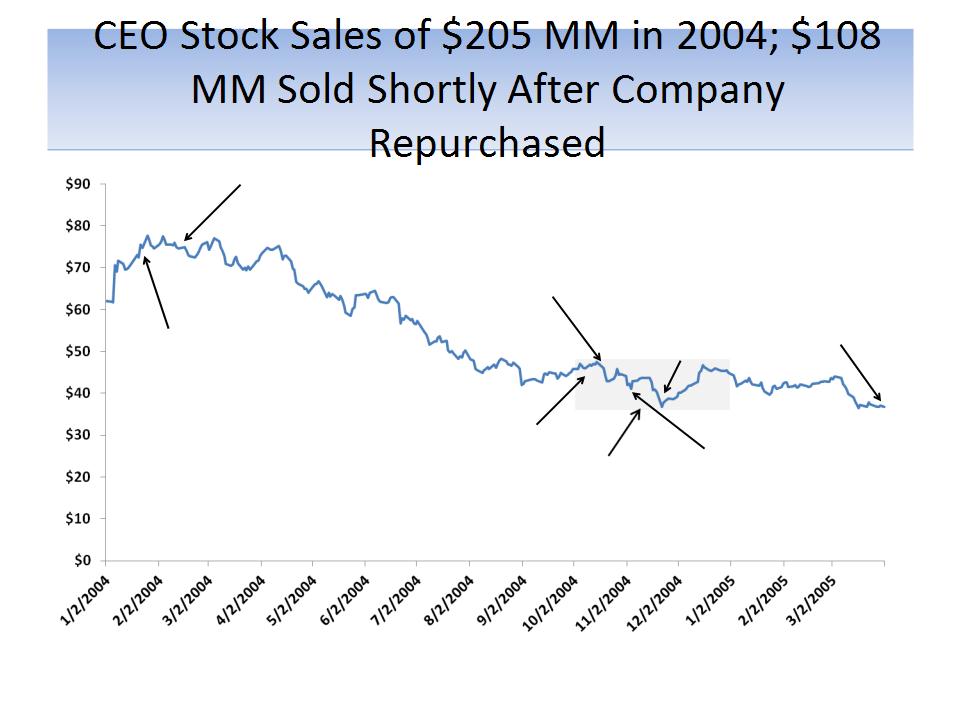

“Our financial performance for

the remainder of the fiscal year

ending March 31, 2004 should

result in earnings per share for

the year at the high end of our

previously issued guidance

[$1.92]. Regarding fiscal 2005

EPS, we continue to project a

range of $2.30 - $2.50.” - Jan 20,

2004

CEO Howard Solomon sells 1.3

MM shares at $74.85 for

proceeds of $97.3 MM from

2/11/04 - 2/17/04

“Forest Laboratories

to Exceed Fiscal 2005

Second And Third

Quarter Mean

earnings Per Share

Estimates” - Oct. 4,

2004

“All of our principal promoted

brands exhibited strong

growth…and we expect this

performance to continue in the

future…Given the underlying

strength…we are increasing our

projected EPS for the fiscal year

ending March 31, 2005 to at least

$2.70.” - Oct 18, 2004

“Forest Laboratories …has

revised its guidance for

diluted earnings per share

for the fiscal year ending

March 31, 2005 [to]

approximately $2.50.” - Nov

1, 2004

Fiscal Year ending

March 31, 2005 EPS

of $2.25

CEO Howard Solomon sells

2.5 MM shares at $43.26 for

proceeds of $108 MM from

11/8/04 - 11/17/04

Forest repurchases 13.8

MM shares during the 4th

quarter of 2004; it bought

2.3 MM in Nov. at an avg.

price of $37.64

Source: SEC filings; company press releases; Direct quotes from Howard Solomon

37

We Believe CEO Succession Is Long Overdue &

Should Equitably Include External Candidates

• Howard Solomon is currently 84 years old, has been CEO for 35 years and the

government considered excluding Solomon from government contracts as recently as 1

year ago so succession planning is long overdue

• Instead of preparing for succession by reducing his responsibilities, CEO Solomon took

on a larger role as President after COO Olanoff retired in 2010 and hasn’t yet

relinquished the role

• David Solomon, CEO Howard Solomon’s son and still independent movie producer, has

been promoted as an apparent contender for CEO, which we believe represents a

significant conflict and may be setting the stage for the creation of a dynasty

• Other recent promotions of Hochberg, Taglietti, and Perier collectively oversaw the

inadequate execution of the company ‘s flawed strategy, in our opinion

• Given potential conflicts, a lack of execution by internal candidates and the need for a

fresh perspective, it is crucial for external candidates to be evaluated as well, in our

opinion

Source: Company documents, company comments, press releases and analyst comments

39

CEOs Son Promoted to Key Role of

Strategic Planning

• Business development and strategic planning involve building the

company’s pipeline for future growth

• In Forest’s case, because of the huge revenue holes being generated by

the patent expirations of Lexapro and Namenda, which represent 80% of

revenues, the role has outsized importance

• David Solomon, the CEOs son with a background as a movie producer and

entertainment lawyer, was promoted into this crucial area just 5 years

after joining Forest. And, he was promoted to become the Head of the

division just 4 years later

• Because the company has not adequately offset the revenue shortfalls

due to the patent cliffs, we believe he has failed in this role

• Therefore, we believe strategic failure of the company rests on his

shoulders and the irresponsible actions of the Board and management

which lead to his promotion

40

Poor Risk Management & Compliance Has

Resulted in $423 MM in Legal Settlements

• We do not see how Lester Salans, a Clinical Professor and physician, as

Chair of the Compliance Committee has any qualifications as a compliance

expert

• These payments may be representative of a lax culture and complacency

at the Board level

• $313 MM related to doctor kickbacks, off-label promotion for children and

obstructing an agency proceeding

• $65 MM related to making false and misleading statements with respect

to anti-depression drugs

• $25 MM for securities claims against Forest and certain officers

• $20 MM for a patent infringement suit related to Lexapro

• $100 MM gender discrimination class action filed recently

Source: Company documents

41

Icahn Recommendations

How to Get the Forest Growing Again

• Independently evaluate current business development strategy, which we

believe is unfocused

• Develop a clear strategy focused on creating shareholder value

• Assess potential divestiture of non-core assets

• Evaluate ways to reduce SG&A spending

• Evaluate development programs for potential rationalization

• Identify ways to improve revenue growth with modernized sales &

marketing effort

• Increase efficiency & effectiveness of capital allocation decisions

• Improve corporate governance

• Review current management team as well as culture and implement any

necessary changes

44

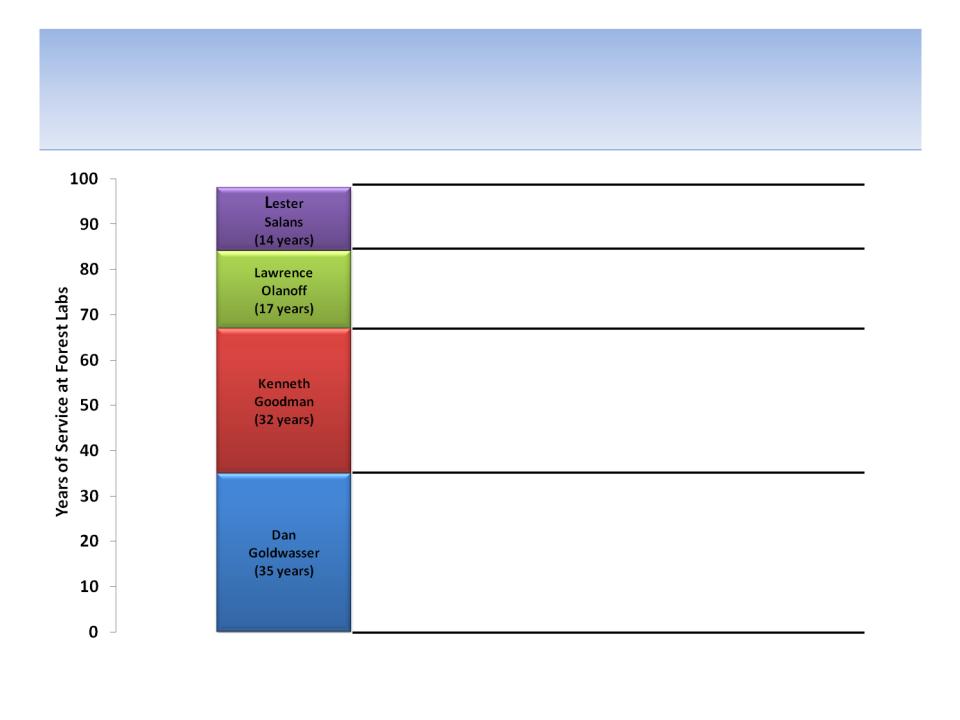

Four Directors That We Believe Have

Trouble “Seeing the FOREST For the Trees”

Source: Company documents

51

• Potential lack of independence due to length of Board tenure

• Need for fresh perspective after 35 years on the Board

• Lack of any biopharma experience outside of Forest

• Oversaw flawed compensation policy as Chair of Compensation Committee

• No other recent public Board experience

• Potential lack of independence due to length of tenure

• Lack of recent relevant operational experience

• No other recent public Board experience

• Lacks independence due to long tenure at Forest and continued compensation as consultant

• One of three former or current Forest executives on Board; Direct report to Solomon

• Need for fresh perspectives from outside of Forest; Employed by Forest for 15 years

• Presided over implementation of, in our belief, inadequate and flawed business strategy

• Potential lack of independence due to long tenure at Forest and direct report to Solomon

• One of three former or current Forest executives on Board

• Need for fresh perspectives from outside of Forest; Employed by Forest for 26 years

• Presided over implementation of, in our belief, inadequate and flawed business strategy

• No other recent public Board experience

98 Years

We Believe the Collective Experience of Icahn

Slate Will Help Create Shareholder Value

• A history of helping create shareholder value & stock price appreciation

• Value-enhancing capital allocation & efficient use of balance sheet

• Successful turnarounds of underperforming business operations

• Implemented sales force modernization policies

• Cost structure optimization and right-sizing of organizations

• Public Boards of other biopharmaceutical companies

• Highly efficient clinical development of new drugs with “first-pass” FDA

regulatory approval

• Multiple successful product launches

• Product licensing focused on creating shareholder value

• Integration of acquisitions and sale of existing businesses

• Effective management of payer relationships and global alliances

53