EXHIBIT 1

December 11, 2014

Dear Fellow Forward Shareholder,

I have been a shareholder and a member of the Board of Directors of Forward Industries, Inc. since 2012. I am also Forward’s largest shareholder; I hold approximately 19.6% of Forward’s common stock. In my time as a Forward shareholder and director, I have come to see the potential in Forward’s business and the value it could provide shareholders. However, I have also seen, firsthand, the harm being caused to Forward’s business by its current management and the destruction of shareholder value at the hands of Forward’s Chairman, Frank LaGrange Johnson. I therefore find myself compelled to appeal directly to you for your support in voting for the five highly qualified candidates, including myself, that I have nominated for election to the Forward Board of Directors. Forward needs a fresh perspective, independent thinking and analytical rigor – traits that I believe my director nominees possess in abundance and which I propose to harness in the service of all Forward’s shareholders.

Over the past year, Mr. Johnson and a dominant faction of Forward’s Board have authorized a number of questionable transactions that I believe have severely impacted the value of your investment in Forward. My efforts to engage with the Board to rectify the resulting fall in Forward’s share price, the apparent mismanagement of corporate funds and repeated instances of self-dealing have only resulted in my increasing marginalization by the other members of the Board. Instead of embracing the need for change at the top, Mr. Johnson and his cohorts are now seeking to consolidate their control of the Board by purging it of all voices of dissent.

As a result, I have lost all confidence in the ability of the current Board, under the leadership of Mr. Johnson and his hand-picked management, to effectively run Forward and reverse the evident destruction of shareholder value. Accordingly, I am compelled to bring my concerns directly to Forward’s shareholders by nominating a new slate of director nominees for election. In doing so, my aim is to establish an independent and balanced board that will represent the best interests of all shareholders and reclaim Forward’s future.

I urge you to vote on the GOLD proxy card for the five highly qualified individuals who are committed to increasing the value of your Forward investment. Please vote TODAY by telephone, over the Internet, or by signing, dating and returning the enclosed GOLD proxy card in the postage-paid envelope provided.

TERENCE BERNARD WISE

Committed to Improving the Value of Forward Industries, Inc.

Mr. Johnson and His Management Team Have

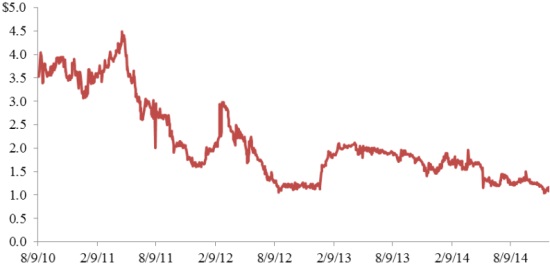

Presided Over a 67% DECLINE in Value for Shareholders

Forward’s stock today is worth 31% less than it was one year ago and 67% less than it was on August 9, 2010, the day prior to the Forward’s announcement of Mr. Johnson’s appointment as Chairman of the Board, the appointment of two of Mr. Johnson’s nominees as directors, and the replacement of Forward’s CEO with Mr. Johnson’s handpicked candidate. By way of contrast, the NASDAQ Composite Index has risen over 100% in that same time period.

During this time, Forward’s balance sheet has deteriorated significantly – with shareholders’ equity (i.e., total assets minus its total liabilities) dropping from over $22 million as at June 30, 2010 (the last reporting date prior to Mr. Johnson’s appointment as Chairman) to just over $10 million as at June 30, 2014 (a nearly 55% decline in four years). Over the same period, Forward has witnessed a significant decline in cash reserves. Forward’s reported cash and cash equivalents have dropped from nearly $20 million as at June 30, 2010 to just over $7 million as at June 30, 2014. This represents a reduction in cash and cash equivalents of $12,863,377, or a nearly 65% decline.

I believe that these statistics, among many others, demonstrate the substantial erosion of Forward’s assets and resources that has occurred under Mr. Johnson’s tenure as Chairman. As a result, Forward is constrained in its ability to grow its core business and capitalize on favorable market dynamics. The devaluation of Forward’s equity has directly translated into a devaluation of Forward’s stock and shareholder value, evidencing the clear and compelling need for change in Forward’s direction and management.

Mr. Johnson Has Repeatedly Engaged in Questionable Self-Serving Transactions

Over the past year, Mr. Johnson has engaged in a number of transactions with Forward for his personal profit, several of which occurred without the approval of the full Board. I believe these related-party transactions are highly inappropriate given Forward’s financial circumstances and have significantly compromised Mr. Johnson’s ability to exercise independent judgment in carrying out his responsibilities as Chairman.

TERENCE BERNARD WISE

Committed to Improving the Value of Forward Industries, Inc.

| | · | Significant Corporate Funds Invested With Mr. Johnson’s Hedge Fund, Leading to Significant Losses. In April 2013, Forward entered into an agreement with Mr. Johnson’s hedge fund, LaGrange Capital Administration, L.L.C. (“LCA”), and subsequently authorized the investment of up to $2,000,000 with LCA, for which Mr. Johnson received both an advisory and compensation fee, totaling $25,000 to-date. My fellow directors and I initially voted in favor of this investment. However, despite the obvious risks associated with investing such a significant sum given Forward’s relatively small size, Mr. Johnson has been pursuing a volatile and risky strategy of short-term swing trading. This strategy resulted in a net loss of over $720,000 by July 2013 – almost half of the amount invested with LCA! Mr. Johnson’s investment strategy is so risky that he managed to lose over $250,000 in the month of September 2014 alone, bringing total reported loses to almost $1 million. This investment raises significant concerns about the ability of the current Board to serve as an effective check on Mr. Johnson’s self-dealing, despite my continued admonitions for Forward to prudently divest itself of this investment. We have incurred significant losses through an investment strategy that is fundamentally unrelated to our core business. That Mr. Johnson’s associates on the Board continue to permit Mr. Johnson’s trading unabated is simply unacceptable. |

| | · | New 6% Senior Convertible Preferred Stock Issued. In June 2013, a special committee of the Board, comprising Mr. Chiste and two former directors, Mr. King and Mr. Gordon, unilaterally determined to designate and issue a new series of convertible preferred stock. This private placement was made without any input or deliberation by the other uninterested directors on the Board. Moreover, the issuance was only offered to Forward insiders and their affiliates – the 12 subscribers include Mr. Johnson, Johnson appointee Mr. Gordon and new Board member Robert Neal. The designation and issuance of convertible preferred stock was a serious decision, with preferential dividend, governance and liquidation rights that materially impact the rights of Forward’s common stockholders. Importantly, the terms of the convertible preferred stock provide its holders with a 6% cumulative dividend, while prohibiting Forward from paying dividends on its common stock without the preferred stockholders’ consent. The terms also provide for a liquidation payment in the event of a change of control in the composition of the Board, which currently totals $1,275,000. To be clear, this issuance was explicitly designed to furnish Mr. Johnson with further control over Forward, to your detriment as a shareholder, while providing him with yet another revenue stream derived from corporate funds. |

| | · | Mr. Johnson Requests Lucrative Management Role with the Company. In February 2014, Mr. Johnson approached the Board seeking an executive position with Forward, purportedly to focus on sourcing and executing M&A opportunities for Forward, in addition to his current role as Chairman. In exchange for this bespoke executive position, Mr. Johnson requested additional compensation of $300,000 per annum. Mr. Johnson later withdrew this request in light of the opposition from several Board members. While an acquisition search process should undoubtedly be a complementary element to our existing business, the Chairman’s first and foremost priority must be Forward’s core business and delivering meaningful profit to our shareholders. The preoccupation of our Chairman with boosting his personal finances at the expense of Forward’s relatively limited financial resources, particularly during a period where shareholder returns have not been strong, raises serious questions as to Mr. Johnson’s judgment and competence. |

| | · | 400%+ Increase in Rent Payable to Mr. Johnson for a One-Man Office Space in NY. In May 2014, it came to light that Mr. Johnson was benefiting from yet another lucrative deal with Forward that was put in place without consideration by, or even notice to, the full Board. In February 2014, Forward’s CEO Robert |

TERENCE BERNARD WISE

Committed to Improving the Value of Forward Industries, Inc.

Garrett concluded a lease agreement with Mr. Johnson’s hedge fund LCA for office space at a rate of $2,500 per month, or $30,000 per annum. As of April 1, 2014, however, Mr. Garrett increased the amount of rental charges payable to Mr. Johnson to $12,700 per month, or $152,400 per annum, with no explanation for the additional charges. Setting aside the obvious question of why Forward should be paying for an expensive one-man NY office, given that the rest of our executive team and head office is located in Florida, it is shocking that Mr. Garrett would obligate Forward to a 400% increase in rent payable to our Chairman without bringing the matter to the full Board – a sum that is almost twice the amount Forward spends on its head office in Florida ($6,500 per month, or $78,000 per annum). There is no evident reason for this increase or benefit to Forward in agreeing to it, other than lining Mr. Johnson’s pockets with corporate funds.

Mr. Johnson and His Management Team Are Seeking to

DEMOLISH Forward’s Capital Structure and Business Model

You should be aware that Mr. Johnson and his supporters on the Board have been attempting to take the following actions in advance of the 2014 Annual Meeting:

1) Significantly Dilute Your Shareholding in Forward by issuing a considerable amount of additional convertible preferred stock; and

2) Sell or Leverage Forward’s Existing Assets and use the proceeds and resulting public shell to invest in an entirely different industry.

Mr. Johnson’s Plan to Issue Additional Convertible Preferred Stock Would Have Significantly Diluted Your Shareholding in Forward – Court Enjoined It As “An Incumbent Board Entrenchment Tactic”

Mr. Johnson and his supporters on the Board have been seeking to issue a new series of convertible preferred stock to undisclosed investors. In July 2014, it came to light through various Board e-mail communications that Mr. Johnson and his affiliates had attempted to file a listing application with NASDAQ for the prospective issuance of preferred stock at a 10% discount to market value, without notifying the full Board or the CFO despite the fact that the CFO was required to have signed the application and was incorrectly represented as having done so. More recently, on December 5, 2014, Mr. Johnson sought and received approval from a majority of the Board for an issuance of preferred stock with preferential dividend and liquidation payment rights to undisclosed investors. The issuance would have been convertible into shares of common stock representing just under 20% of Forward’s current outstanding common stock – which is conveniently just under the NASDAQ threshold requiring a shareholder vote, thus depriving shareholders of their say on a massively dilutive transaction. If this issuance had been effected, a mere two days in advance of the Record Date for the Annual Meeting, your voting and economic interests in Forward would have been significantly diluted. On December 8, 2014, I succeeded in obtaining a preliminary injunction from the Supreme Court of the State of New York, New York County, enjoining this issuance, which the Court called “an incumbent board entrenchment tactic.” These repeated attempts at preferred stock issuances to undisclosed investors can only be considered part and parcel of Mr. Johnson and his supporters’ efforts to entrench themselves in office and further their own personal interests, rather than act in the best interests of Forward’s shareholders.

TERENCE BERNARD WISE

Committed to Improving the Value of Forward Industries, Inc.

The Scheme to Sell Forward’s Assets and Invest in a Completely Different Industry is Irresponsible and Will Harm the Value of Your Shares

I have become aware that the dilutive capital raise referenced above is also part of Mr. Johnson and his supporters’ broader and wildly reckless scheme to abandon Forward’s business and use the company as their own personal acquisition vehicle. It has come to light that Mr. Johnson and his supporters are seeking to strip Forward of its core business, by leveraging or selling off all or substantially all of Forward’s existing assets, with the intention of discontinuing this business and putting the proceeds towards acquiring and operating an entirely new line of business. Mr. Johnson and his affiliates have been courting private investors and pursuing various institutional lending streams in an effort to turn Forward into a highly-leveraged investment vehicle. Again, this scheme was conceived and put into motion without full Board and management notification or involvement. Such a self-interested plan would amount to a monumental and material change to Forward and its shareholders – it would essentially allow Mr. Johnson and his supporters to remain in control of a public company while depriving minority shareholders of an opportunity to receive a premium on their investment. This will render Forward shareholders investors in an entirely different company and has the potential to seriously harm the value of your investment. This is not what we as shareholders signed up for and we must act now to save our company.

I am Proposing Independent Board Candidates That Are Well Qualified to

Oversee the Restoration of Value and Sound Governance at Forward

Forward requires a fresh perspective, independent thinking and analytical rigor – traits that I believe the Board as currently composed under Mr. Johnson’s leadership lacks. I have nominated five highly qualified candidates, including myself, whose experience should add immediate value to the Board. My nominees are:

N. Scott Fine. Mr. Fine has been an investment banker for over 35 years, having previously worked since 2007 for Scarsdale Equities LLC, a boutique investment banking firm, and formerly served as the Vice Chairman and Lead Director of Central European Distribution Corporation (“CEDC”), a multi-billion dollar alcohol beverage company domiciled in Delaware with the majority of its operations in Eastern Europe. Mr. Fine served as a director of CEDC for over a decade, during which time he co-managed its IPO and listing on NASDAQ, and led the CEDC Board’s successful efforts in 2013 to restructure the company through a pre-packaged Chapter 11 process whereby CEDC was acquired by the Russian Standard alcohol group. Mr. Fine has been involved in corporate finance for over 30 years and has considerable experience in the medical and medical device sectors, having served as an advisor for companies such as Research Medical, Derma Sciences, and Interleukin Genetics, among many others. Mr. Fine also acts as Vice Chairman and Lead Director of CTD Holdings, Inc., a specialty biopharmaceutical manufacturing and marketing company. Mr. Fine is the sole director of Better Place, Inc., an electric car company, where he was brought in to design, oversee and manage the orderly liquidation of the Delaware holding company of the Better Place group. He is also a director of Operation Respect, an anti-bullying education non-profit organization. Mr. Fine will bring crucially needed experience in corporate finance and restructuring and M&A strategy to the Board.

Michael Luetkemeyer. Mr. Luetkemeyer, has extensive executive experience in the medical device industry, Forward’s largest market, having served as the Chief Financial Officer of TranS1, Inc., a NASDAQ-listed medical device company from April 2007 through March 2010. He currently works as an independent consultant in the areas of strategic planning, financial management and infrastructure development. Prior to serving as CFO of TranS1, Mr. Luetkemeyer served as Senior Vice President and Chief Financial Officer of Micromuse, Inc., a NASDAQ-listed provider of network management software, from October 2001 to May 2006. He also served as a member of

TERENCE BERNARD WISE

Committed to Improving the Value of Forward Industries, Inc.

Micromuse’s board of directors from January 2003 through February 2005, and as its interim CEO during 2003. Prior to Micromuse, Mr. Luetkemeyer also served as Chief Financial Officer at NASDAQ-listed companies Rawlings Sporting Goods and Electronic Retailing Systems. Mr. Luetkemeyer has held a variety of senior finance positions throughout his career, including more than 10 years with General Electric, where he served with GE Aerospace, GE Semiconductor, and GE Plastics. Mr. Luetkemeyer will bring extensive financial and accounting experience to the Board.

Eric Freitag. Mr. Freitag currently acts as the Group Director of Product Innovation for R/GA, an international digital advertising agency, focusing on brand development and technology. Mr. Freitag specializes in the healthcare sector with extensive experience working with pharmaceutical, medical device and healthcare provider clients. Mr. Freitag has previously held leadership management positions at Smart Design, an innovation consulting firm, subsequent to a career in product development, having served as Global Director of its Healthcare Practice and Director of Engineering Services for nearly a decade. Mr. Freitag will bring crucially needed experience in product design and strategic innovation to the Board.

Howard Morgan. Mr. Morgan has served as an independent director of Forward since February 2012. Mr. Morgan has been the Managing Director of The Justwise Group Limited, a consumer durable products company, since 1997, having previously been employed by Justwise in various senior executive roles since 1989. Mr. Morgan has also served as a Director of Eurofresh, a wholesale distribution company of fresh produce, since March 2013. Mr. Morgan brings significant business management and operational skills and experience to the Board.

Terence Bernard Wise. Mr. Wise has served as a director of Forward since February 2012 and has over 30 years of experience in the furniture, plastics, luggage and accessories industries. Mr. Wise serves as principal and Chairman of The Justwise Group Limited, which he founded in 1977, a company that specializes in the procurement of consumer durable products from Asia and is an established supplier to a list of major UK multi-channel retailers. Mr. Wise also serves as a principal of Forward Industries Asia-Pacific Corporation (f/k/a Seaton Global Corporation) (“Forward China”) and has significant shareholdings in two manufacturing plants in China. In addition to his business management skills, Mr. Wise brings extensive experience in Asian markets to the Board.

**********

I believe Mr. Johnson and his supporters will stop at nothing to preserve their control of the Board, even at the expense of significantly impairing shareholder value. Mr. Johnson's self-serving motions and arguments have now been rejected by three different courts that have seen his repeated self-serving actions for the entrenchment tactics they are, aimed only at preventing you from exercising your right to vote on alternative director candidates. These obstructive tactics are unacceptable. I am urging all shareholders to consider the prospective harm these repeated actions may cause Forward.

I look forward to further engaging with you in advance of the 2014 Annual Meeting and welcome any feedback you may have. I believe my candidates possess the skills necessary to get Forward back on track and, more importantly, to independently represent your best interests. Please do not hesitate to contact Innisfree M&A Incorporated, the firm that will be assisting me in the solicitation of proxies, at (212) 750-5833 with any concerns or questions you may have. If we work collaboratively, I am certain we can reclaim Forward’s future together.

TERENCE BERNARD WISE

Committed to Improving the Value of Forward Industries, Inc.

Sincerely,

Terence Bernard Wise

YOUR VOTE IS IMPORTANT! To ensure that your instructions are received timely, we urge you to vote by telephone or Internet by following the easy instructions on the enclosed GOLD proxy card. If you have questions or need assistance in voting your shares, please contact our proxy solicitor: INNISFREE M&A INCORPORATED Stockholders call toll-free: (877) 800-5187 Banks and Brokers call collect: (212) 750-5833 |

ADDITIONAL INFORMATION:

Terence Bernard Wise, together with the other participants named below, has filed a definitive proxy statement and accompanying GOLD proxy card with the Securities and Exchange Commission (the “SEC”) to be used to solicit votes for the election of his director nominees at the 2014 annual meeting of stockholders of Forward Industries, Inc. (“Forward”), a New York corporation.

FORWARD STOCKHOLDERS ARE STRONGLY ADVISED TO READ THE PROXY STATEMENT, AS IT CONTAINS IMPORTANT INFORMATION. SUCH PROXY STATEMENT AND OTHER PROXY MATERIALS ARE AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION, THE PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE, UPON REQUEST. REQUESTS FOR COPIES SHOULD BE DIRECTED TO INNISFREE M&A INCORPORATED TOLL-FREE AT (888) 750-5834 (BANKS AND BROKERS MAY CALL COLLECT AT (212) 750-5833).

The participants in the proxy solicitation are Terence Bernard Wise, Howard Morgan, Michael Luetkemeyer, Eric Freitag, Sangita Shah, N. Scott Fine and Darryl Keys (collectively, the “Participants”).

As of the date hereof, Mr. Wise beneficially owns 1,608,541 shares of the Company’s common stock, constituting approximately 19.6% of the class. As of the date hereof, Mr. Morgan beneficially owns 25,000 shares of the Company’s common stock.

Contact:

Innisfree M&A Incorporated

Scott Winter, 212-750-5833