DEFA14A

PROXY STATEMENT PURSUANT TO SECTION 14 (a)

OF THE SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant [X]

Filed by a Party other than the [_]

Registrant

Check the appropriate box:

[_] Preliminary Proxy Statement

[_] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[_ ] Definitive Proxy Statement

[X] Definitive Additional Materials

[_] Soliciting Materials under Rule 14a-12

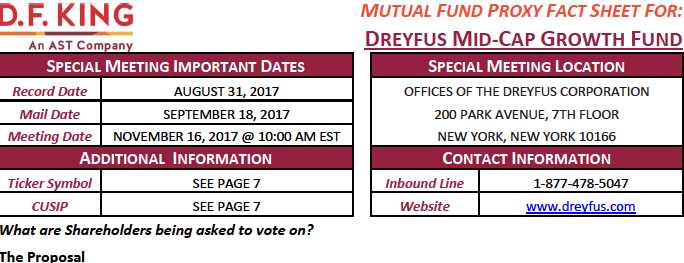

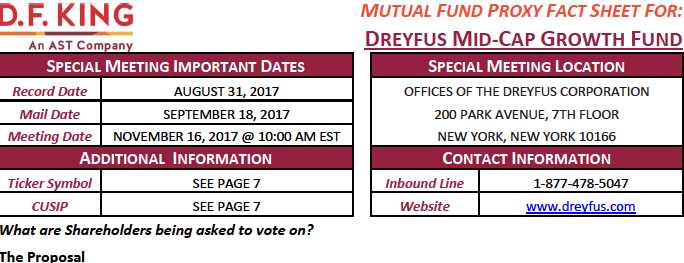

Dreyfus Funds, Inc.

- Dreyfus Mid-Cap Growth Fund

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (check the appropriate box):

[X] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11:

(4) Proposed maximum aggregate value of transaction:

(5) Total Fee Paid:

[_] Fee paid previously with preliminary materials.

[_] Check box if any part of the fee is offset as provided by Exchange Act Rule 0- 11(a)(2) and identify the filing for which the offsetting fee was paid previously.

Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

To approve an Agreement and Plan of Reorganization providing for the transfer of all of the assets of the Fund toDreyfus/The Boston Company Small/Mid Cap Growth Fund (the "Acquiring Fund"), in exchange solely for Class A, Class C, Class I and Class Z shares of the Acquiring Fund having an aggregate net asset value equal to the value of the Fund's net assets and the assumption by the Acquiring Fund of the Fund's stated liabilities (the "Reorganization"). Class A, Class C, Class I and Class Z shares of the Acquiring Fund received by the Fund in the Reorganization will be distributed by the Fund to its shareholders in liquidation of the Fund, after which the Fund will cease operations and will be terminated as a series of the Dreyfus Funds, Inc.(the “Company”). Holders of Class A, Class C or Class I shares of the Fund would receive Class A, Class C or Class I shares of the Acquiring Fund, respectively, and holders of Class F shares of the Fund would receive Class Z shares of the Acquiring Fund.

BOARD OF DIRECTORS UNANIMOUS RECOMMENDATION–FOR

How does the Fund’s Board recommend I vote?

After careful review, the Company’s Board of Directors has unanimously approved the proposedReorganization. The Company’s Board of Directors believes that theReorganization will permit Fund shareholders to pursue substantially similar investment goals in a much larger combined fund that has a lower total annual expense ratio and better performance record generally than the Fund. In approving the Reorganization, the Company’s Board of Directors determined that theReorganization is in the best interests ofthe Fund and that the interests of the Fund’s shareholders will not be diluted as a result ofthe Reorganization. The Company’s Board of Directors recommends that you read the enclosedmaterials carefully and then vote FOR the proposal.

How will shareholders benefit from the proposed Reorganization?

The Company’s Board of Directors believes that theReorganization will permit Fund shareholders to pursue substantially similar investment goals in a much larger combined fund. As of June 30, 2017, the Acquiring Fund had approximately $1.1 billion and the Fund had approximately $137.7 million in net assets. In addition,the Acquiring Fund’s Class A, Class C and Class I shares had lower total annual expense ratios than the Fund’s Class A, Class C and Class I shares, respectively, and the Acquiring Fund’sClass Z shares are estimated to have a lower total annual expense ratio than the Fund’s Class F shares, based on the expenses of each fund as of the fund’s most recent fiscal year end and as of August 31,

For Internal Distribution Only Page 1

2017. See “Will the ProposedReorganization Result in a Higher Management Fee or Higher Total FundExpenses?” below and “Summary—Comparison of the Acquiring Fund and the Fund—Fees andExpenses” in the Prospectus/Proxy Statement. The Acquiring Fund’s Class A, Class C and Class I sharesalso had a better performance record than the corresponding class of Fund shares for the one-, five- and ten-year periods ended December 31, 2016. See “Summary—Past Performance” in the Prospectus/ProxyStatement. Past performance is not available for Class Z shares, which are new and have beenauthorized by the Acquiring Fund’s Board to be issued to Fund shareholders in connection with the proposed Reorganization. Management believes that, as a result of becoming shareholders in a much larger combined fund, the Reorganization should enable Fund shareholders to benefit from the spreading of fixed costs across a larger asset base, which may result in a reduction of shareholder expenses. By combining the Fund with the Acquiring Fund, shareholders of the Fund also should benefit from more efficient portfolio management and certain operational efficiencies. The Reorganization should enable The DreyfusCorporation (“Dreyfus”), as the Acquiring Fund’s investment adviser, and The Boston Company Asset Management, LLC (“TBCAM”), as the Acquiring Fund’s sub-investment adviser, to more efficiently manage thelarger combined fund’s portfolio through various measures, including trade orders and executions, and permit the funds’ service providers—including Dreyfus, as the AcquiringFund’s administrator—to operate and service a single fund (and its shareholders), instead of having to operate and service both funds with similar shareholder bases. The potential benefits of the Reorganization are described in greater detail in the enclosed Prospectus/Proxy Statement.

If approved, what will happen to my shares as a result of the Reorganization?

You will become ashareholder of the Acquiring Fund,an open-end investment company managed byDreyfus, on or about January 19, 2018 (the “Closing Date”), and will no longer be a shareholder of Fund.You will receive Class A, Class C or Class I shares of the Acquiring Fund corresponding to your Class A, Class C or Class I shares of the Fund, respectively, with an aggregate net asset value equal to the aggregate net asset value of your investment in the Fund as of the Closing Date. If you hold Class F shares of the Fund, you will receive Class Z shares of the Acquiring Fund with an aggregate net asset value equal to the aggregate net asset value of your investment in the Fund as of the Closing Date. The Fund will then cease operations and will be terminated as a series of Dreyfus Funds, Inc. (the“Company”).

What are the principal differences between Class F shares of the Fund and Class Z shares of the Acquiring Fund?

If you hold Class F shares of the Fund, you will receive Class Z shares of the Acquiring Fund with a value equal to the value of your Class F shares as of the Closing Date. Class F shares of the Fund and Class Z shares of the Acquiring Fund are each subject to an annual Rule 12b-1 fee of up to 0.25% to reimbursethe Fund’s and Acquiring Fund’s distributor,MBSCSecurities Corporation (“MBSC”)for the sale and distribution of such shares and, in the case of Class Z, such fee includes reimbursement to MBSC for certain services provided to the holders of Class Z shares relating to shareholder accounts, such as answering shareholder inquiries regarding the Acquiring Fund and providing reports and other information, and services related to the maintenance of shareholder accounts. Class F shares of the Fund, unlike Class Z shares of the Acquiring Fund, pay MBSC a prorated monthly fee, pursuant to a Shareholder Services Agreement, for certain shareholder-related services equal on an annual basis to $24 for each Class F shareholder account of the Fund considered to be an open account at any time during the applicable month. The fee under the agreement also is payment for the provision of certain

For Internal Distribution Only Page 2

services rendered and facilities furnished by the Fund’s transfer agent in performing transfer agent services for holders of Class F shares. In addition, after the Reorganization, Class Z shares of the Acquiring Fund generally will be offered only to holders of shares of the Fund who received Class Z shares of the Acquiring Fund in exchange for their Fund Class F shares as a result of the Reorganization. To be eligible to purchase Class Z shares, such shareholders must purchase Class Z shares of the Acquiring Fund directly through MBSC and such purchase must be for Acquiring Fund accounts maintained with MBSC. Class Z shares of the Acquiring Fund also may be purchased on behalf of certain group retirement plans or wrap accounts or similar programs maintaining accounts with the Fund at the time of the Reorganization.

Are the investment goals and strategies of each fund similar?

Yes. The Acquiring Fund and the Fund have a similar investment objective and similar investment management policies. However, the investment practices and limitations of each fund are not identical. The Acquiring Fund seeks long-term growth of capital. The Fund seeks capital appreciation by emphasizing investments in equity securities of mid-cap companies with favorable growth prospects.

To pursue its goal, the Acquiring Fund normally invests at least 80% of its net assets, plus any borrowings for investment purposes, in equity securities of small-cap and mid-cap U.S. companies. The Acquiring Fund currently considers small-cap and mid-cap companies to be those with total market capitalizations that are equal to or less than the total market capitalization of the largest company included in the Russell 2500TMGrowth Index, the Acquiring Fund’s benchmark index. To pursue its goal, the Fundnormally invests at least 80% of its net assets, plus any borrowings for investment purposes, in equity securities of companies with market capitalizations within the market capitalization range of companies comprising the Russell Midcap®Growth Index, the Fund’s benchmark index. Subject to the 80%limitation, the Fund also may invest in larger or smaller companies if they represent better prospects forcapital appreciation. The Acquiring Fund’s portfolio will have more exposure to companies with smaller market capitalizations than the Fund’s portfolio. As of June 30, 2017,the weighted average and medianmarket capitalizations were $5.710 billion and $4.588 billion for the Acquiring Fund’s portfolio, respectively, and $13.436 billion and $9.275 billion for the Fund’s portfolio, respectively.

The Acquiring Fund’s portfoliomanagers employ a growth-oriented investment style in managing theAcquiring Fund’s portfolio, which means the portfolio managers seek to identify those small-cap and mid-cap companies which are experiencing or are expected to experience rapid earnings or revenuegrowth. The Acquiring Fund’s portfolio managers focus on high quality companies, especially those with products or services that are believed to be leaders in their market niches. The Acquiring Fund’sportfolio managers focus on individual stock selection using fundamental research instead of trying topredict which industries or sectors will perform best. The Acquiring Fund’s investment strategy may leadit to emphasize certain sectors more than the Fund, such as technology, health care, business services and communications.

The Fund’s portfolio managers also use a “growth style” of investing, searching for companies whose fundamental strengths suggest the potential to provide superior earnings growth over time. The Fund’sportfolio managers use a consistent, bottom-up approach which emphasizes individual stock selection.The Fund’s portfolio managers go beyond Wall Street analysis and perform intensive qualitative andquantitative in-house research to determine whether companies meet the Fund’s investment criteria.

For Internal Distribution Only Page 3

Given that the Acquiring Fund and the Fund have a similar investment objective and similar investment management policies, the risks associated with an investment in the Acquiring Fund and the Fund are similar. The Acquiring Fund is non-diversified, which means that it may invest a relatively high percentage of its assets in a limited number of issuers. In addition, the Acquiring Fund may have exposure to companies with smaller market capitalizations than the Fund and may emphasize sectors, such as technology, healthcare, business services and communications, more than the Fund. The Acquiring Fund also may be subject to certain additional risks, to the extent it were to invest in fixed-income securities, preferred stocks, convertible securities, warrants or companies in emerging markets, that the Fund is not subject to, as described below, but which are not anticipated to be principal risks of investing in the Acquired Fund.

If approved, how will this affect the day-to-day management of the fund?

Dreyfus is the investment adviser to both the Acquiring Fund and the Fund. Dreyfus provides the day-today management of the Fund’s investments. Dreyfus has engaged its affiliate, TBCAM, to serve as the Acquiring Fund’s sub-investment adviser and provide the day-to-day management of the AcquiringFund’s investments. The Fund and the Acquiring Fund have the same portfolio managers, who areemployees of Dreyfus and TBCAM. The portfolio managers manage the Fund in their capacity as Dreyfus employees and the Acquiring Fund in their capacity as employees of TBCAM. Dreyfus also serves as the administrator to the Acquiring Fund and the Fund. MBSC, a wholly-owned subsidiary of Dreyfus, distributes the shares of the Acquiring Fund and the Fund. For additional information regarding the Acquiring Fund and the Fund, please refer to the enclosed Prospectus/Proxy Statement.

If the Reorganization is approved, will I continue to have the same shareholder privileges?

Yes. The Acquiring Fund will offer you the same shareholder privileges, such as the Fund Exchanges service, Dreyfus Auto-Exchange Privilege, Wire Redemption and Dreyfus TeleTransfer Privileges, Dreyfus Automatic Asset Builder®, Dreyfus Payroll Savings Plan, Dreyfus Government Direct Deposit, Dreyfus Dividend Sweep, Dreyfus Automatic Withdrawal Plan and Dreyfus Express®, that you currently have as a shareholder of the Fund. Except as provided below, the privileges you currently have on your Fund account will transfer automatically to your account with the Acquiring Fund. While you will continue to have the same privileges as a holder of Class A, Class C, Class I or Class Z shares of the Acquiring Fund as you previously did as a holder of Class A, Class C, Class I or Class F shares of the Fund, please note that if you participated in Dreyfus Government Direct Deposit or made incoming wire transactions or otherincoming Automated Clearing House (“ACH”) transactions to your Fund account, you will need to updateyour incoming ACH and/or wiring instructions with new information with respect to your shares of the Acquiring Fund in order to continue these services and avoid having these transactions rejected by the Acquiring Fund. To continue participating in Dreyfus Government Direct Deposit or to provide ACH and/or wiring instructions as a shareholder of the Acquiring Fund, please call your financial adviser, or call 1-800-DREYFUS, visit www.dreyfus.com or write to the Acquiring Fund at its offices located at 144 Glenn Curtiss Boulevard, Uniondale, New York 11556-0144.

If approved, will Fund fees and expenses increase as a result of the Reorganization?

No. Under its investment advisory agreement with Dreyfus, the Fund has agreed to pay Dreyfus an investment advisory fee at the annual rate of 1.00% of the value ofthe Fund’s average daily net assetsup to $30 million, 0.75% of the next $270 million of such assets, 0.70% of the next $200 million of suchassets and 0.65% of the Fund’s average daily net assets in excess of $500 million. For the past fiscal year,

For Internal Distribution Only Page 4

the Fund paid an investment advisory fee at the annual rate of 0.81% of the Fund’s average daily netassets. Under its investment advisory agreement with Dreyfus, the Acquiring Fund has agreed to pay Dreyfus an investment advisory fee at the annual rate of 0.60%of the value of the Acquiring Fund’saverage daily net assets, which the Acquiring Fund paid Dreyfus for the past fiscal year. Dreyfus, in turn, pays TBCAM for the provision of sub-investment advisory services to the Acquiring Fund. In addition, the Fund and the Acquiring Fund have each agreed to pay Dreyfus an administration fee at the annual rateof 0.06% of the value of the fund’s average daily net assets up to $500 million, 0.04% of the next $500 million of such assets and 0.02% of the fund’s average daily net assets in excess of $1 billion (but limitedto the amount of Dreyfus’ costs of providing administrative services to the respective fund). For the pastfiscal year, the Fund and the Acquiring Fund paid Dreyfus an administration fee at the annual rate of0.06% and 0.02%, respectively, of the Fund’s and the Acquiring Fund’s average daily net assets.

Class A, Class C and Class I shares of the Acquiring Fund had lower total annual expense ratios than Class A, Class C and Class I shares of the Fund, respectively, and Class Z shares of the Acquiring Fund are estimated to have a lower total expense ratio than Class F shares of the Fund, based on the expenses ofeach fund as of the fund’s most recent fiscal year end and as of August 31, 2017. Annual fund operating expenses for the Fund and the Acquiring Fund as of the last fiscal year end (December 31, 2016 for the Fund and September 30, 2016 for the Acquiring Fund) were 1.37% and 1.04% for Class A, 2.14% and 1.83% for Class C, 1.14% and 0.79% for Class I, and 1.16% for Class F and are estimated to be 0.86% for Class Z, respectively. As of August 31, 2017, Class A, Class C and Class I shares of the Acquiring Fund continued to have lower total annual expense ratios than Class A, Class C and Class I shares of the Fund, respectively, and Class Z shares of the Acquiring Fund continued to be estimated to have a lower total expense ratio than Class F shares of the Fund. Annual fund operating expenses for the Fund and the Acquiring Fund as of August 31, 2017 were 1.37% and 1.03% for Class A, 2.15% and 1.79% for Class C, 1.14% and 0.74% for Class I, and 1.16% for Class F and are estimated to be 0.86% for Class Z, respectively.

What are the expected tax consequences of the Reorganization?

The Reorganization will not be a taxable event for federal income tax purposes. Shareholders will not recognize any capital gain or loss as a direct result of the Reorganization. A shareholder’s tax basis in Fund shares will carry over to the shareholder’s Acquiring Fund shares, and the holding period for suchAcquiring Fund shares will include the holding period for the shareholder’s Fund shares. As a conditionto the closing of the Reorganization, the Fund and the Acquiring Fund will receive an opinion of counsel to the effect that, for federal income tax purposes, the Reorganization will qualify as a tax-free Reorganizationand, thus, no gain or loss will be recognized by the Fund, the Fund’s shareholders, or theAcquiring Fund as a result of the Reorganization.

The Fund will distribute any undistributed net investment income and net realized capital gains (after reduction for any capital loss carryforwards) prior to the Reorganization, which distribution will be taxable to shareholders. Management currently estimates thatapproximately 37% of the Fund’sportfolio securities may be sold by the Fund before consummation of the Reorganization, and that the Fund would recognize approximately $9.3 million in capital gains (approximately $0.64 per share) as a result of the sale of such portfolio securities. Management estimates that brokerage commissions and other transaction costs associated with such portfolio sales will be approximately $23,150, such cost to be borne by the Fund. Certain tax attributes of the Fund will carry over to the Acquiring Fund, includingthe ability of the Acquiring Fund to utilize the Fund’s capital loss carryforwards, if any; however, the

For Internal Distribution Only Page 5

ability of the Acquiring Fund to utilize the Fund’s capital loss carryforwards, if any, will be subject tolimitations.

Will I be charged a sales charge, redemption fee or contingent deferred sales charge (“CDSC”) at thetime of the Reorganization?

No. No sales charge, redemption fee or CDSC will be imposed at the time of the Reorganization. Any redemption of Class C shares (or Class A shares subject to a CDSC) received in the Reorganization will be subject to the same CDSC as the redemption of Class C shares (or Class A shares subject to a CDSC) of the Fund (calculated from the date of original purchase of Fund shares). Any shares of the Acquiring Fund acquired after the Reorganization will be subject to any applicable sales charges and CDSCs.

Who will pay the costs of the proposed Reorganization?

Because of the expected benefits to shareholders of the Fund as a result of the Reorganization (e.g., permitting Fund shareholders to pursue substantially similar investment goals in a much larger combined fund that had a lower total annual expense ratio, based on the expenses of each fund as of the fund’s most recent fiscal year end and as of August 31, 2017, and a better performance recordgenerally), expenses relating to the Reorganization will be borne by the Fund, whether or not the Reorganization is consummated. Such expenses are expected to total approximately $260,000 orapproximately 0.20% of the Fund’s net assets as of June 30, 2017. It is estimated that holders of the Fund’s Class A, Class C, Class I and Class F shares would start to realize the Acquiring Fund’s lower totalannual expense ratio approximately 7 months, 8 months, 7 months and 8 months, respectively, after the Reorganization occurs based on the current estimate of the expenses of the Reorganization and eachClass’s pro rata share of those expenses. The Acquiring Fund will notbear any expenses relating to the proposed Reorganization.

THE BOARD OF DIRECTORS UNANIMOUSLYRECOMMENDS A VOTE “FOR”PROPOSAL 1

Proxy Materials Are Available Online At:

https://im.bnymellon.com/us/en/individual/resources/proxy-materials.jsp

For Internal Distribution Only Page 6

| | |

| CLASS | CUSIP | TICKER |

| A | 262001795 | FRSDX |

| C | 262001688 | FRSCX |

| I | 262001555 | FRSRX |

| F | 262001498 | FRSPX |

For Internal Distribution Only Page 7

Good (morning, afternoon, evening), my name is(AGENT’S FULL NAME).

May I please speak with(SHAREHOLDER’S FULL NAME)?(Re-Greet If Necessary)

I am calling on a recorded line from D.F. King and Co. regarding your current investment with Dreyfus Mid-Cap

Growth Fund. You were recently sent proxy materials along with a proxy card or voting instruction form to

cast your vote at the Special Meeting of Shareholders scheduled to take place on November 16, 2017.

1.Have you received this information?(Pause for response)

If “Yes” or positive responseto receiving information:

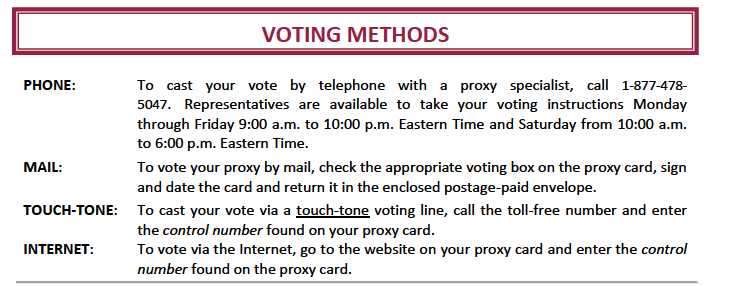

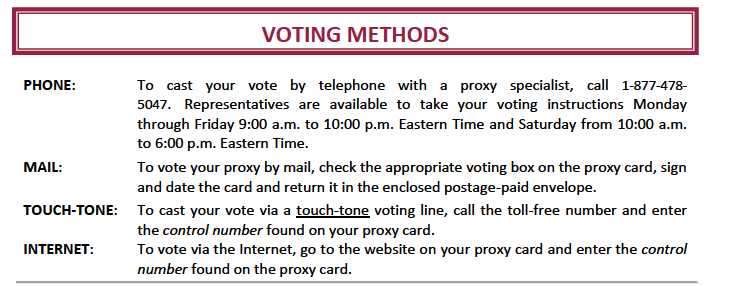

If you’re not able to attend the meeting, I can record your voting instructions by phone.TheFund’s

Board hasapproved the proposal and is recommending a vote “In Favor”(proceed to #2).

If “No” or negative response to receiving information:

We would be happy to resend the information to you. For verification purposes, please state your mailing

address.

(If address is incorrect, go to“Shareholder states a different address during confirmation”)

(If still incorrect, go to“Wrong address given by investor”.)

Would you prefer mail or e-mail?(Pause For Response)

E-mail:I would be happy to e-mail you the information and, if you’d like, you can reply to the e-mail with your

voting instructions and we can process your vote accordingly. You can also e-mail us back with any questions

you have, or feel free to contact us at 1-877-478-5047 Monday through Friday between 9:00 AM and 10:00

PM Eastern Time and Saturday between 10:00 AM and 6:00 PM Eastern Time. May I please have your e-mail

address?(Pause & record e-mail, read e-mail back to shareholder to confirm)

Please allow 24 hours to receive the materials. The e-mail will come from D.F. King and Co. Please check your

spam folder if you don’t see our e-mail in your inbox. Once you receive your prospectus/proxy statement and

other materials, if you have any questions, or would like us to take your vote by phone, feel free to contact us

at 1-877-478-5047 Monday through Friday between 9:00 AM and 10:00 PM Eastern Time and Saturday

between 10:00 AM and 6:00 PM Eastern Time. Thank you for your time and have a good(morning, afternoon,

evening).

Mail:We will send the materials to you by mail. Please allow 5 to 7 business days for delivery. Once you

receive your prospectus/proxy statement and other materials, if you have any questions, or would like us to

take your vote by phone, feel free to contact us at 1-877-478-5047 Monday through Friday between 9:00 AM

and 10:00 PM Eastern Time and Saturday between 10:00 AM and 6:00 PM Eastern Time. Thank you for your

time and have a good(morning, afternoon, evening).

2.Would you like to vote along with the Board’s Recommendation?(Pause For Response)

Voting with Board’s Recommendation:(Proceed to Confirmation)

If not voting with Board’srecommendation or unsure how to vote:

Use appropriate Rebuttal and/or explanation from Fact Sheet and follow up with:

Based on this information,would you like to vote “In Favor” along with the Board’s recommendation?

(Pause For Response)

CONFIRMATION:If we identify any additional accounts you hold in the Dreyfus Mid-Cap Growth Fund before

the meeting takes place, would you like us to vote those accounts in the same manner as well?(Pause For

Response)

I am recording your(Recap Voting Instructions). For confirmation purposes:

Please state your full name.(Pause–refer to rebuttal if neglects to state middle initial)

To ensure that we have the correct address for the written confirmation, please state your full streetaddress.(Pause)(If Wrong address is stated, go to“Shareholder states a different address during confirmation”)(If still incorrect, go to“Wrong address given by investor”)

Thank you. You will receive written confirmation of this vote within 3 to 5 business days. Upon receipt, please

review and retain for your records. If you should have any questions, please call the toll free number listed on

this confirmation. Mr. /Ms.(SHAREHOLDER’S LAST NAME), your vote is important and your time is greatly

appreciated. Thank you and have a good(morning, afternoon, evening.)

FOR INTERNAL DISTRIBUTION ONLY Updated 9-25-2017

Shareholder states a different address during confirmation:

Our records indicate a different address. Is it possible the account has been registered at a different address?

Wrong address given by investor:

Mr./Mrs./Ms.(SHAREHOLDER’S LAST NAME)I apologize but the addressthat you just recited for me doesn’t

match our records and, therefore, I can’t take your vote by telephone. Instead, I urge you to complete, sign,

date and return your proxy card or voting instruction form at your earliest convenience, or vote your shares by

touch-tone telephone or on the Internet by following the instructions provided on your proxy card or voting

instruction form. Thank you for your time and have a good(morning, afternoon, evening).

S/h neglects to state middle initial/name suffix/street direction/apartment during confirmation.

Our records also show a(middle initial/name suffix/street direction/apartment).Can you please confirm that

as well?

“Why do I need to vote?” or “Why is it so important that I vote?”

We want to ensure that your shares are represented at the upcoming special meeting of shareholders. If there

is a lack of shareholder participation,the meeting might be delayed or adjourned, which may create additional

solicitation costs. The Board has approved and is recommendinga vote “In Favor”. May I record your vote at

this time?

Shareholder refuses to vote or give address:

I understand you don’t wish to vote at this time, please remember your vote is very important and your time is

appreciated. If you change your mind and would like us to assist you in voting by telephone, please call us back

toll-free at 1-877-478-5047 Monday through Friday between 9:00 AM and 10:00 PM Eastern Time and

Saturday between 10:00 AM and 6:00 PM Eastern Time. You can vote at any time by completing, signing,

dating and returning your proxy card or voting instruction form using the postage-paid envelope provided, or

by touch-tone telephone or on the Internet by following the instructions provided on your proxy card or

voting instruction form. Thank you for your time and have a good(morning, afternoon, evening).

ANSWERING MACHINE SCRIPT:

Hello. My name is [AGENT’S FULL NAME] and I am calling from D.F. King & Co. regarding your investment in

the Dreyfus Mid-Cap Growth Fund. You should have recently received proxy materials in the mail concerning

the Fund’s Special Meeting of Shareholders to be held onNovember 16, 2017. Your vote is important. Please

sign, date and promptly mail your proxy card or voting instruction form in the postage-paid envelope

provided. Internet or touch-tone telephone voting also is available. Please follow the instructions provided on

your proxy card or voting instruction form. If you have any questions, would like to vote or need new proxy

materials, please call D.F. King, which is your Fund’s proxy solicitor, at 1-877-478-5047. Thank you.

FOR INTERNAL DISTRIBUTION ONLY Updated 9-25-2017