2018 Shareholders Meeting Gregg Sengstack, Chairman and CEO | May 4, 2018

2 SAFE HARBOR STATEMENT: “Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995. Any forward‐looking statements contained herein, including those relating to market conditions or the Company’s financial results, costs, expenses or expense reductions, profit margins, inventory levels, foreign currency translation rates, liquidity expectations, business goals and sales growth, involve risks and uncertainties, including but not limited to, risks and uncertainties with respect to general economic and currency conditions, various conditions specific to the Company’s business and industry, weather conditions, new housing starts, market demand, competitive factors, changes in distribution channels, supply constraints, effect of price increases, raw material costs, technology factors, integration of acquisitions, litigation, government and regulatory actions, the Company’s accounting policies, future trends, and other risks which are detailed in the Company’s Securities and Exchange Commission filings, included in Item 1A of Part I of the Company’s Annual Report on Form 10‐K for the fiscal year ending December 31, 2017, Exhibit 99.1 attached thereto and in Item 1A of Part II of the Company’s Quarterly Reports on Form 10‐Q. These risks and uncertainties may cause actual results to differ materially from those indicated by the forward‐ looking statements. All forward‐looking statements made herein are based on information currently available, and the Company assumes no obligation to update any forward‐looking statements.

$1.68 $1.41 $1.50 $1.65 $1.86 $0.00 $0.50 $1.00 $1.50 $2.00 2013 2014 2015 2016 2017 0 21 Earnings Per Share REASONS FOR DECLINE: • Strong $ • Decline in oil price • Distribution reset • Weather 3*One time impact of U.S. tax law was $0.21/share. Future benefit approximately $0.16/share (1.3 year “payback”) $1.86 Impact of New Tax Law $1.65

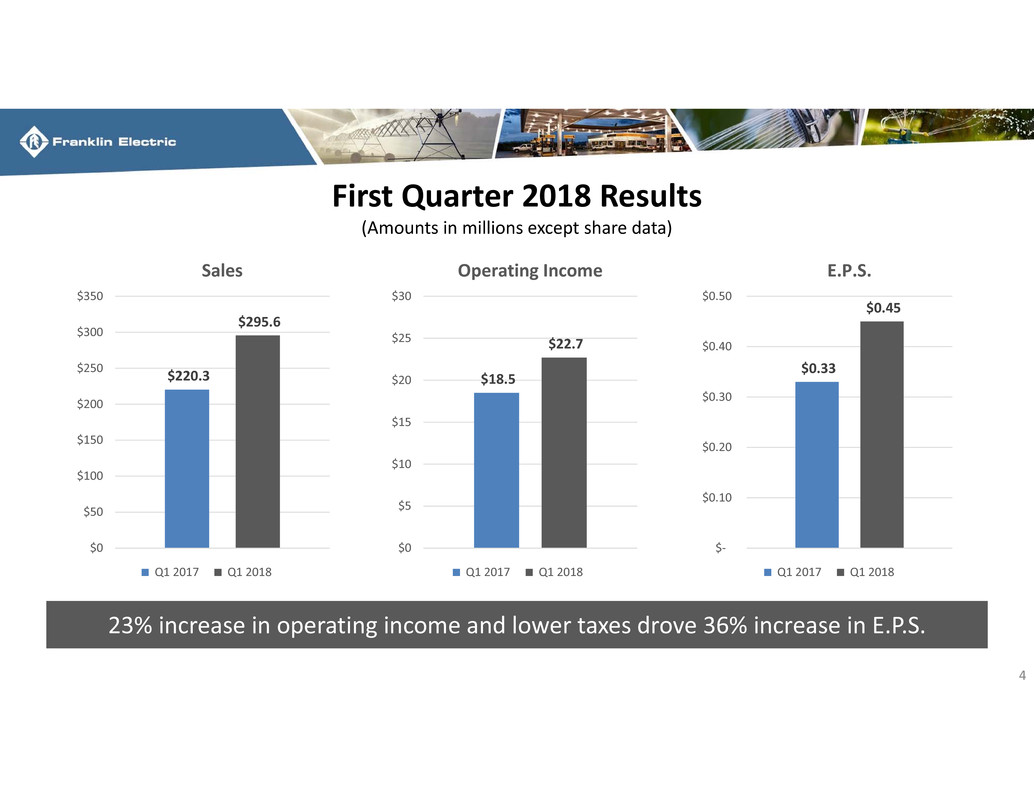

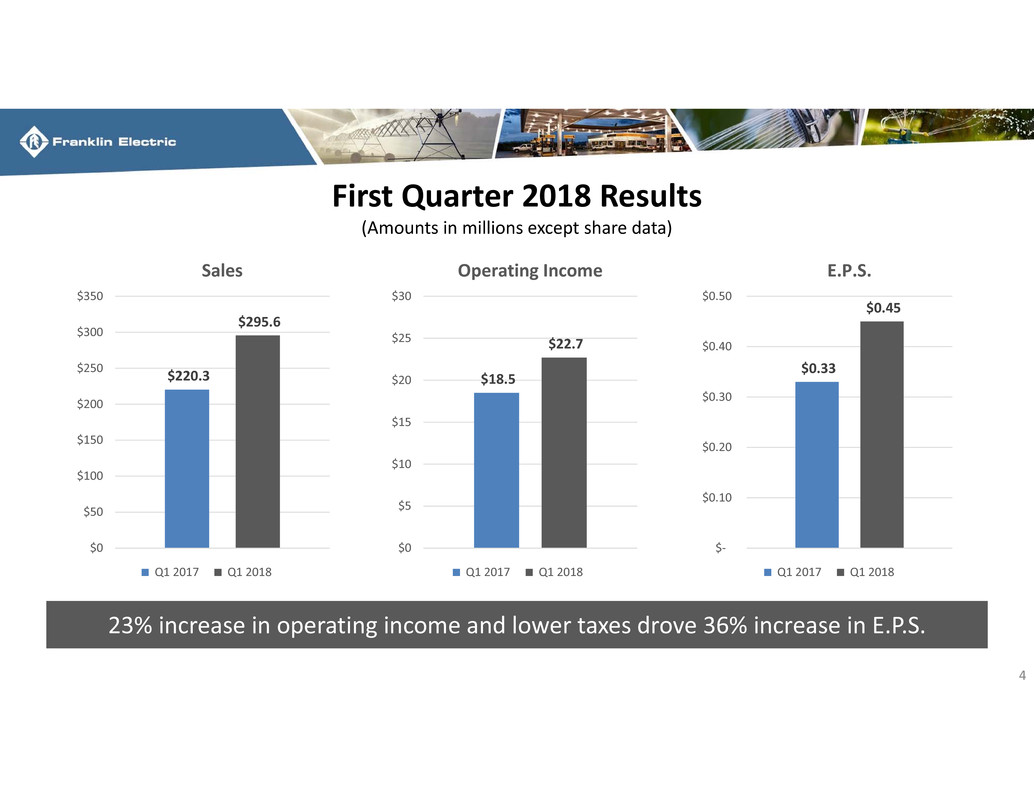

First Quarter 2018 Results (Amounts in millions except share data) 4 23% increase in operating income and lower taxes drove 36% increase in E.P.S. $220.3 $295.6 $0 $50 $100 $150 $200 $250 $300 $350 Sales Q1 2017 Q1 2018 $0.33 $0.45 $‐ $0.10 $0.20 $0.30 $0.40 $0.50 E.P.S. Q1 2017 Q1 2018 $18.5 $22.7 $0 $5 $10 $15 $20 $25 $30 Operating Income Q1 2017 Q1 2018

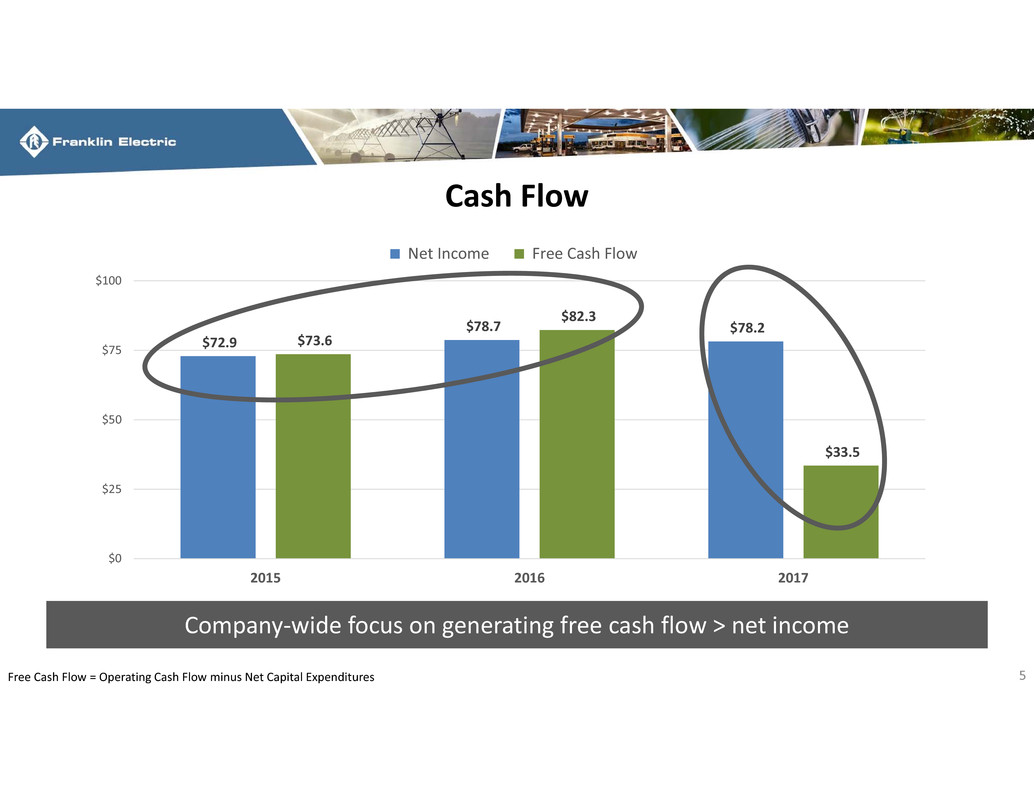

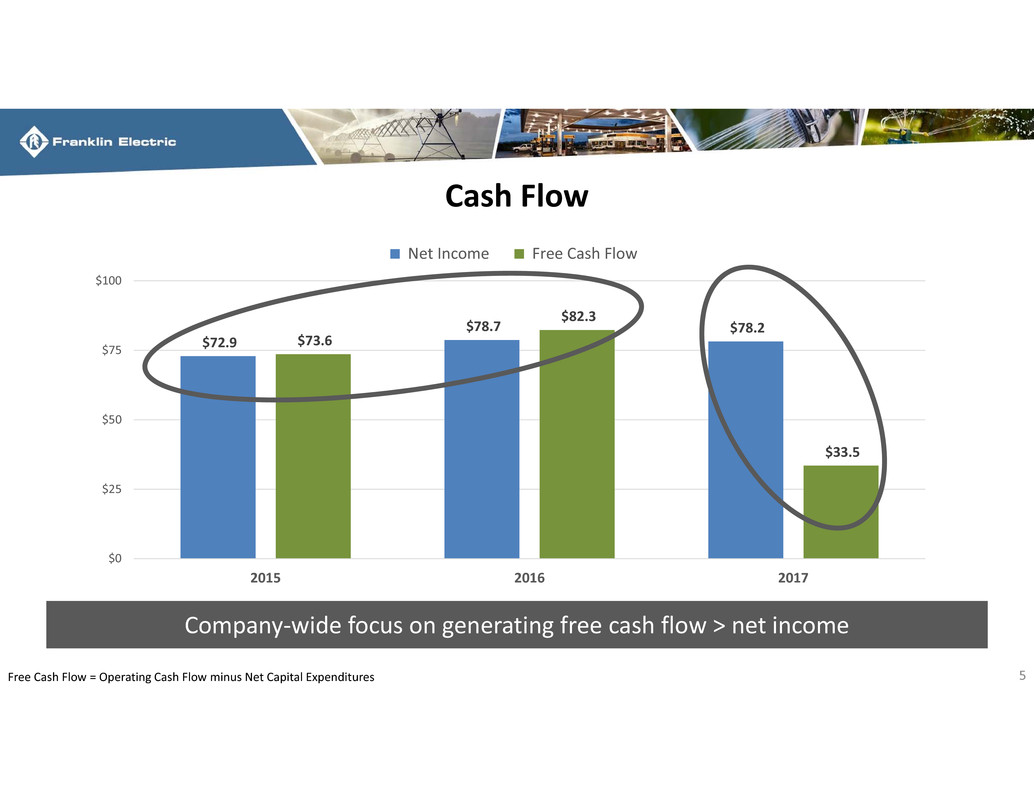

Cash Flow $72.9 $78.7 $78.2 $73.6 $82.3 $33.5 $0 $25 $50 $75 $100 2015 2016 2017 Net Income Free Cash Flow 5Free Cash Flow = Operating Cash Flow minus Net Capital Expenditures Company‐wide focus on generating free cash flow > net income

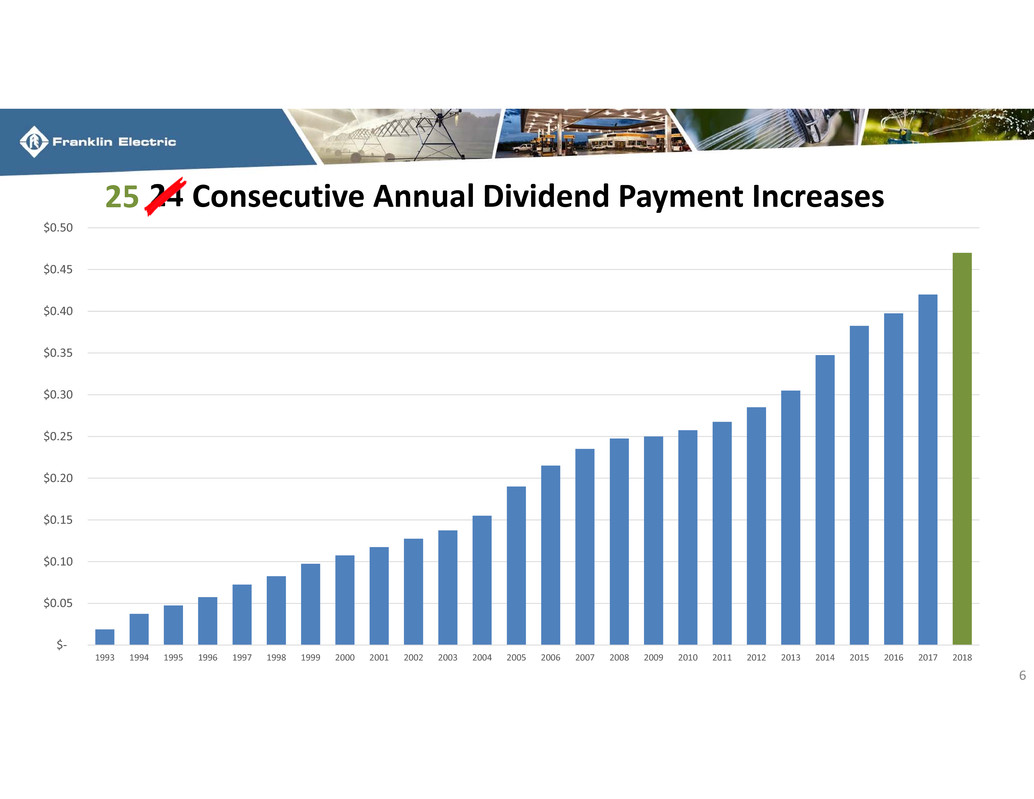

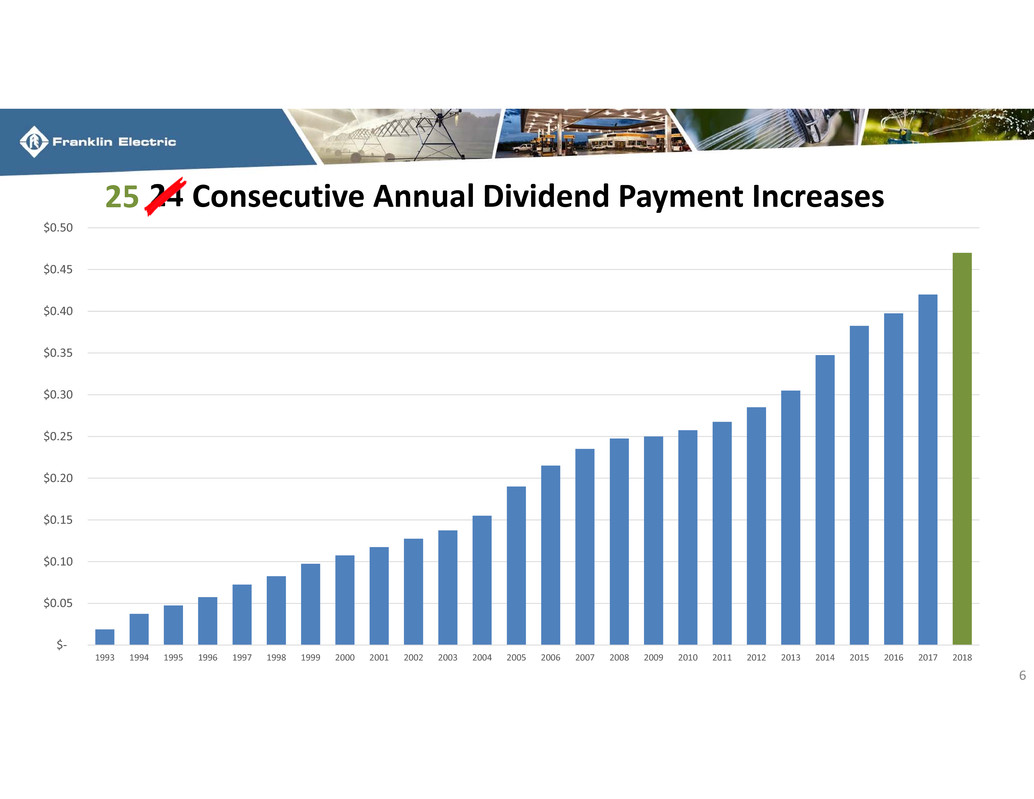

24 Consecutive Annual Dividend Payment Increases 6 $‐ $0.05 $0.10 $0.15 $0.20 $0.25 $0.30 $0.35 $0.40 $0.45 $0.50 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 25

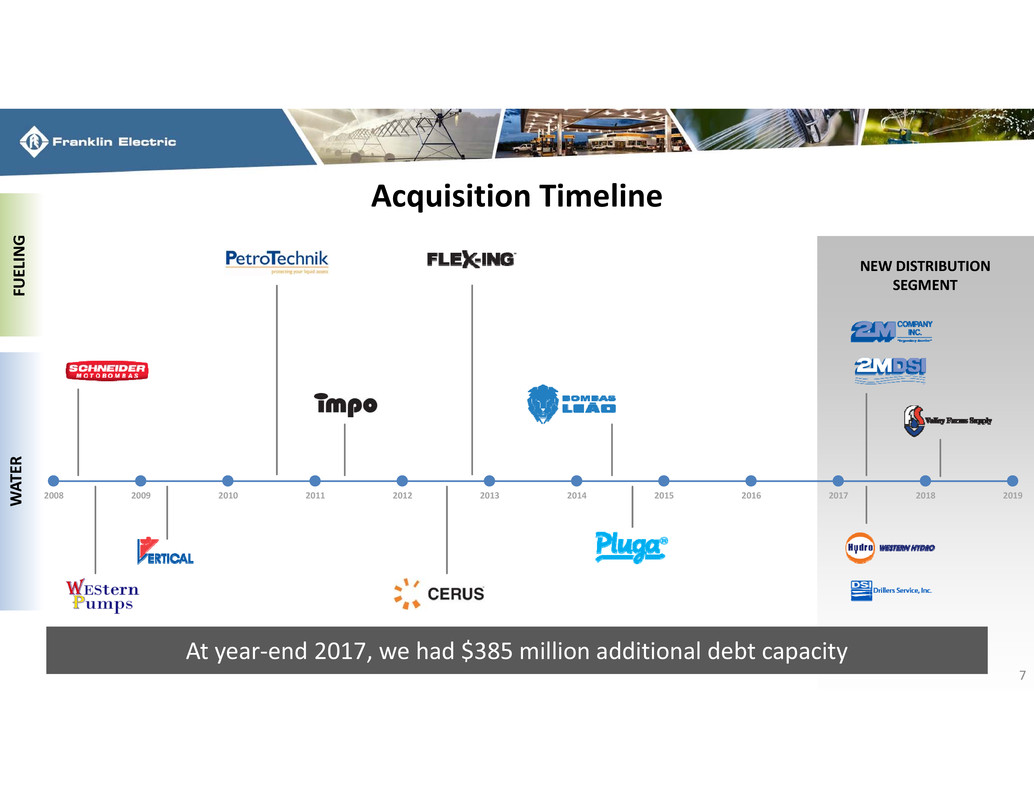

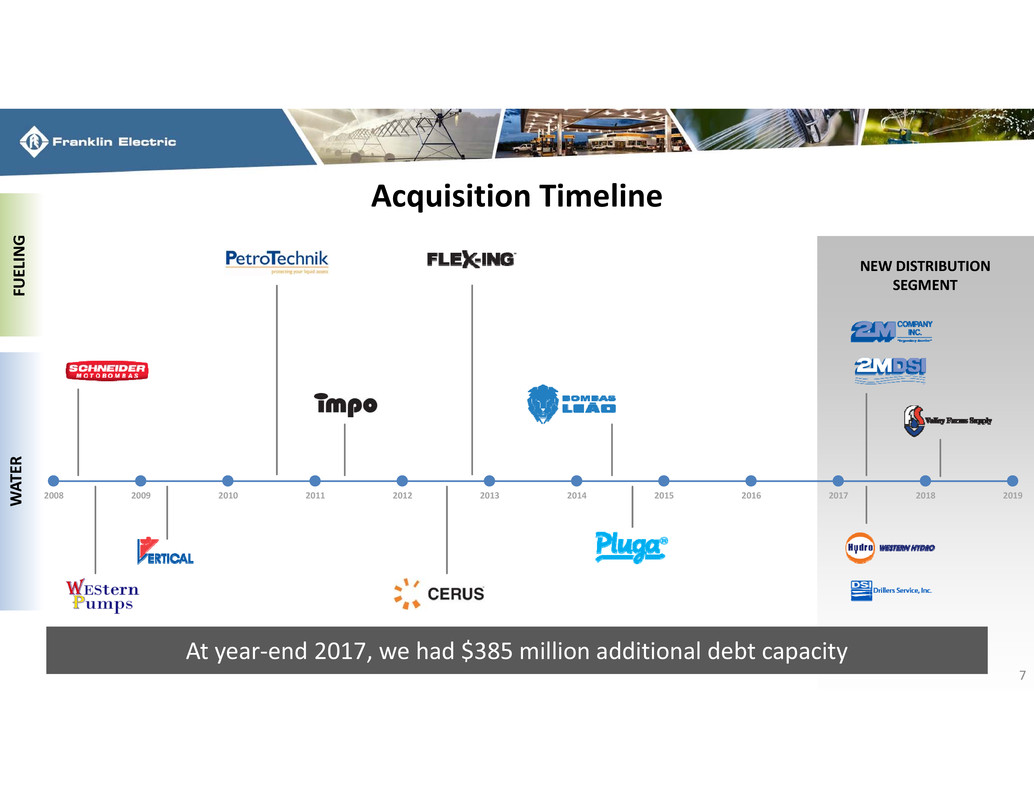

NEW DISTRIBUTION SEGMENT 7 20192009 2010 2011 2012 2013 2014 F U E L I N G 2015 20182016 W A T E R Acquisition Timeline 2008 2017 At year‐end 2017, we had $385 million additional debt capacity

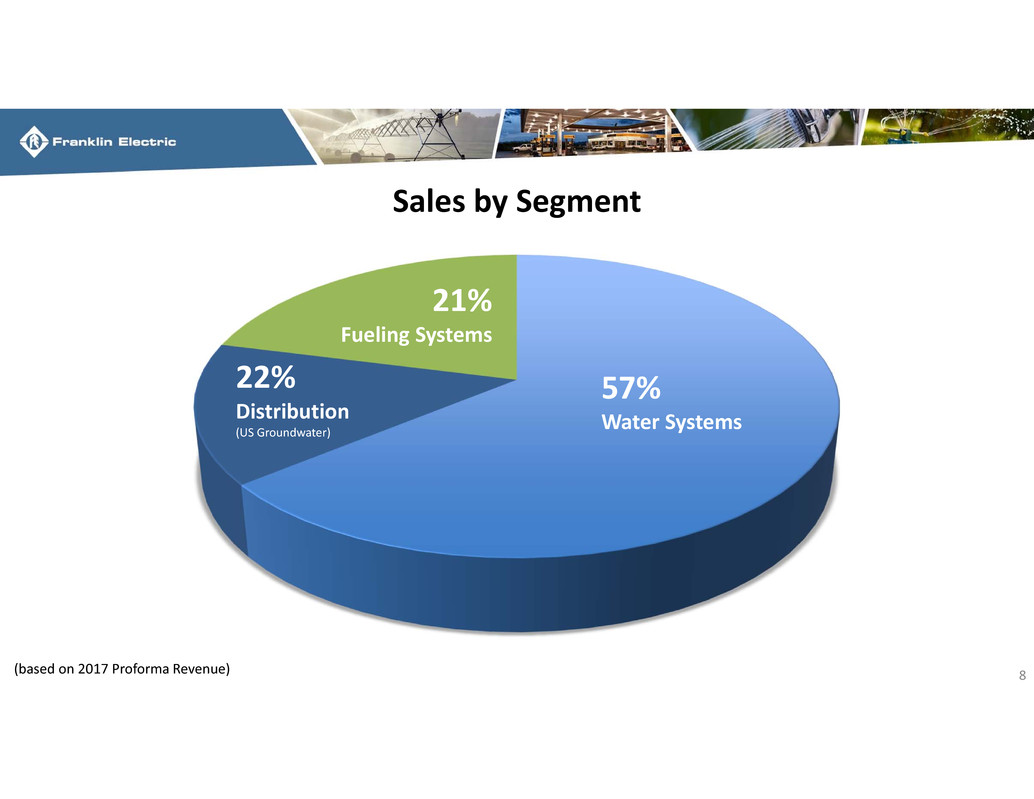

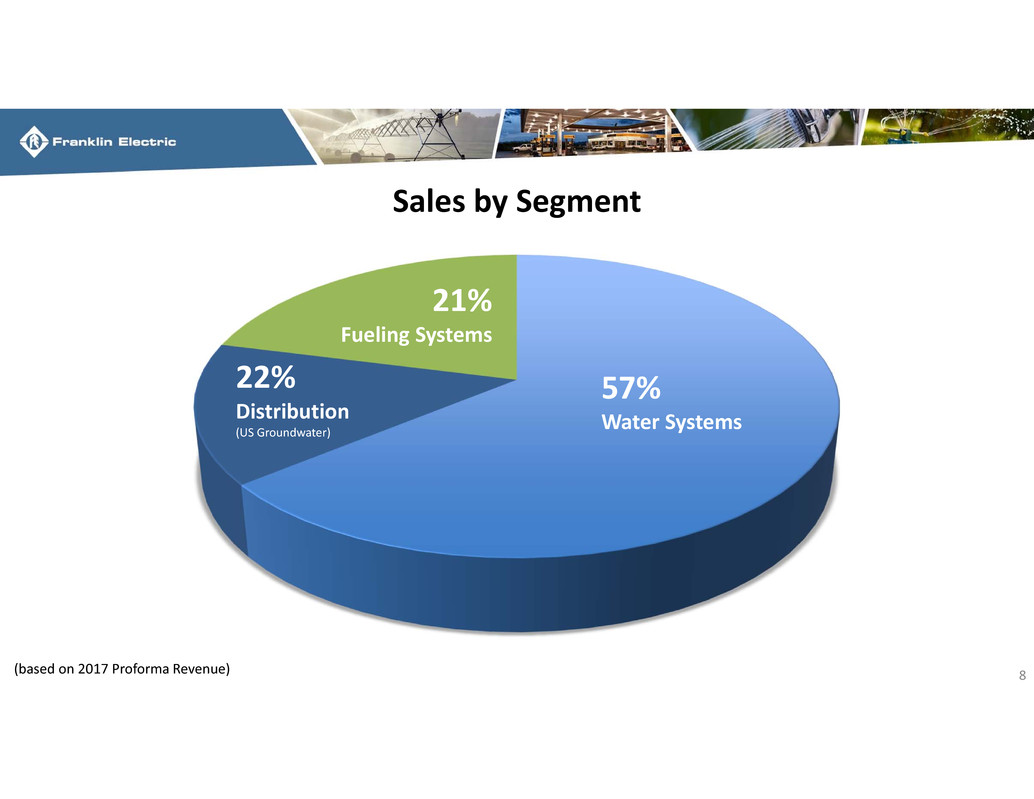

8 Sales by Segment 57% Water Systems 21% Fueling Systems (based on 2017 Proforma Revenue) 22% Distribution (US Groundwater)

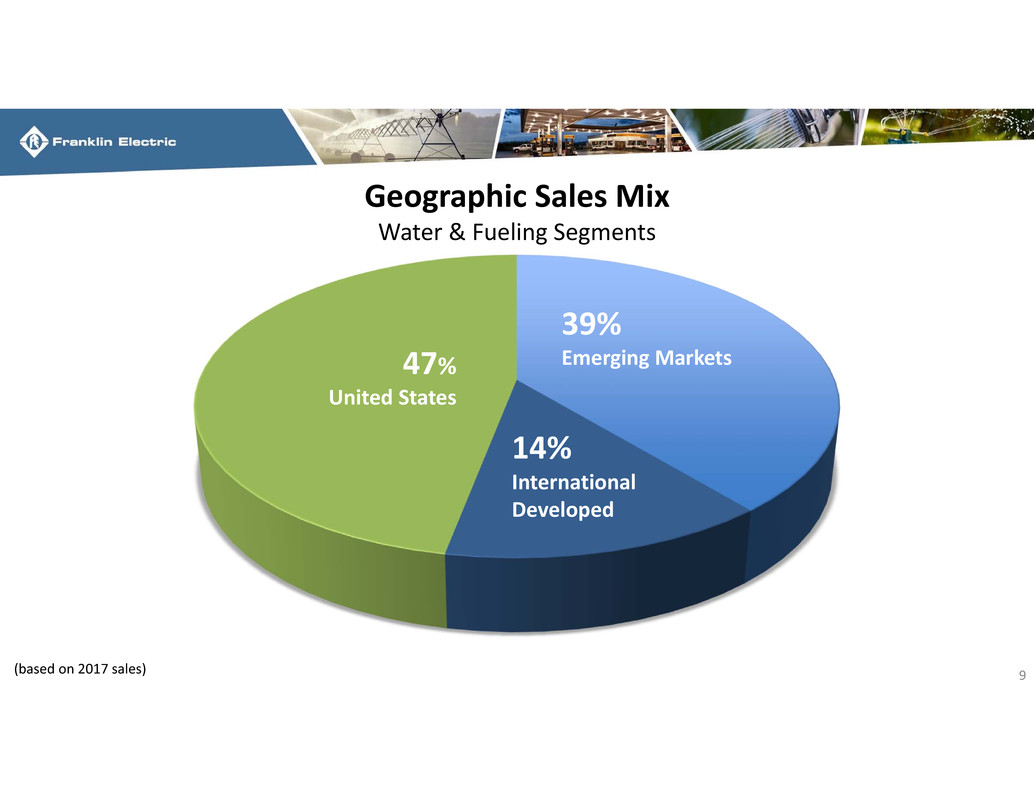

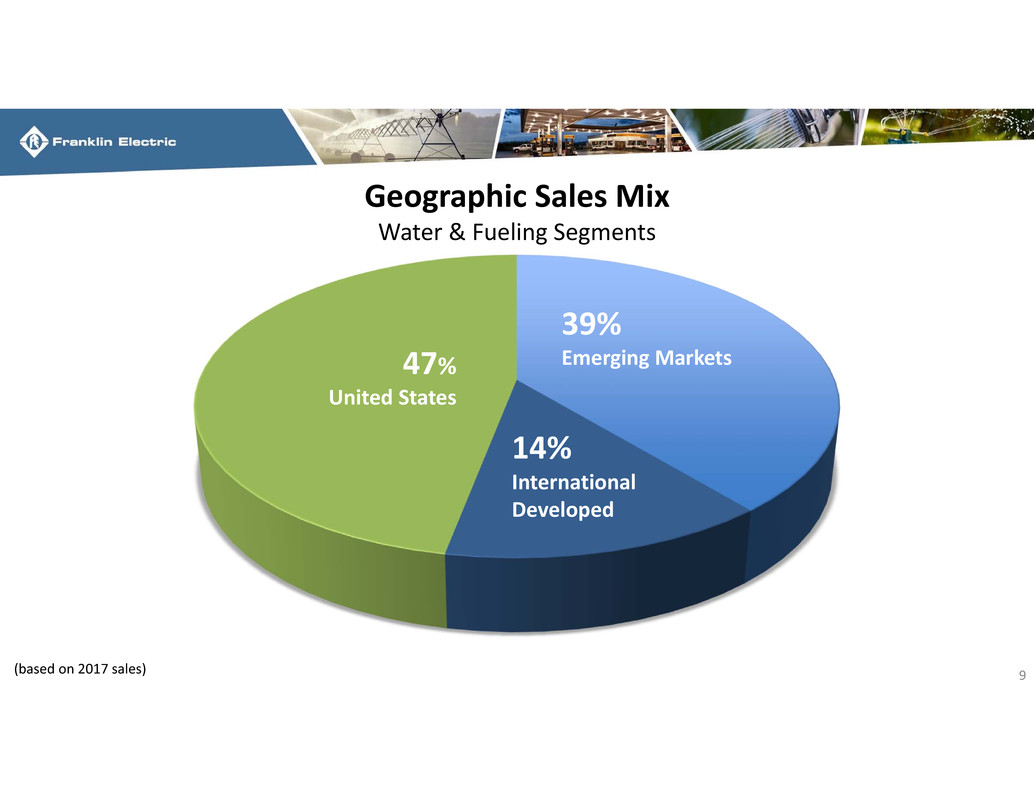

Geographic Sales Mix Water & Fueling Segments 9 47% United States 39% Emerging Markets 14% International Developed (based on 2017 sales)

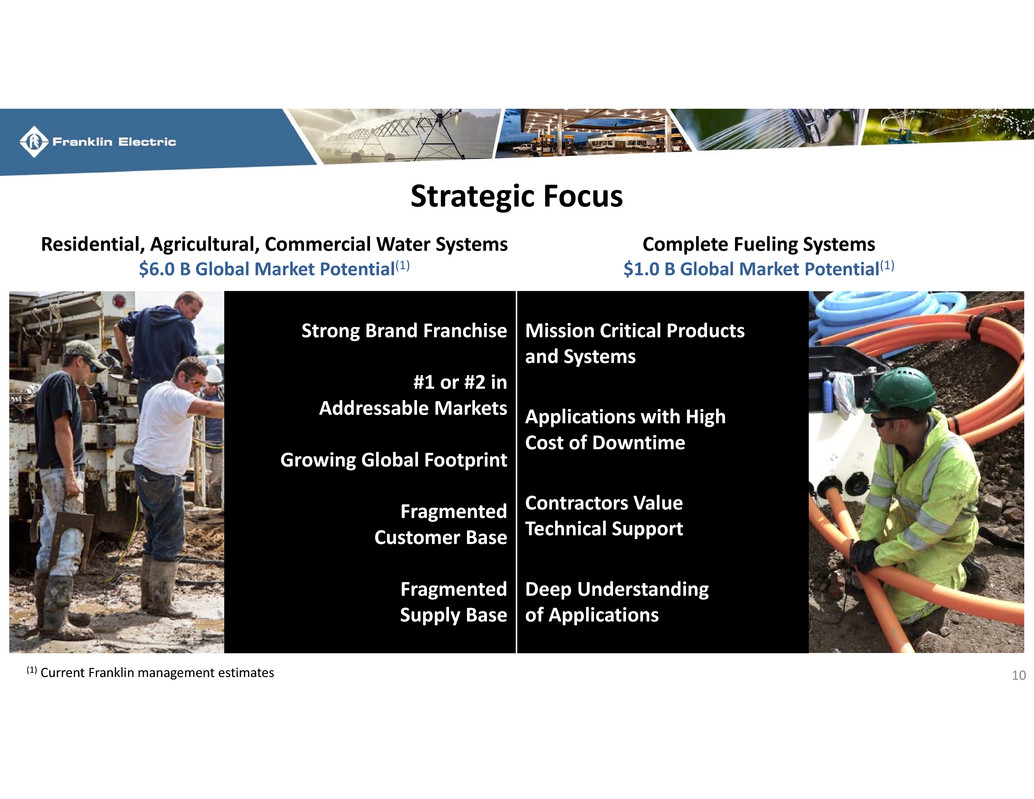

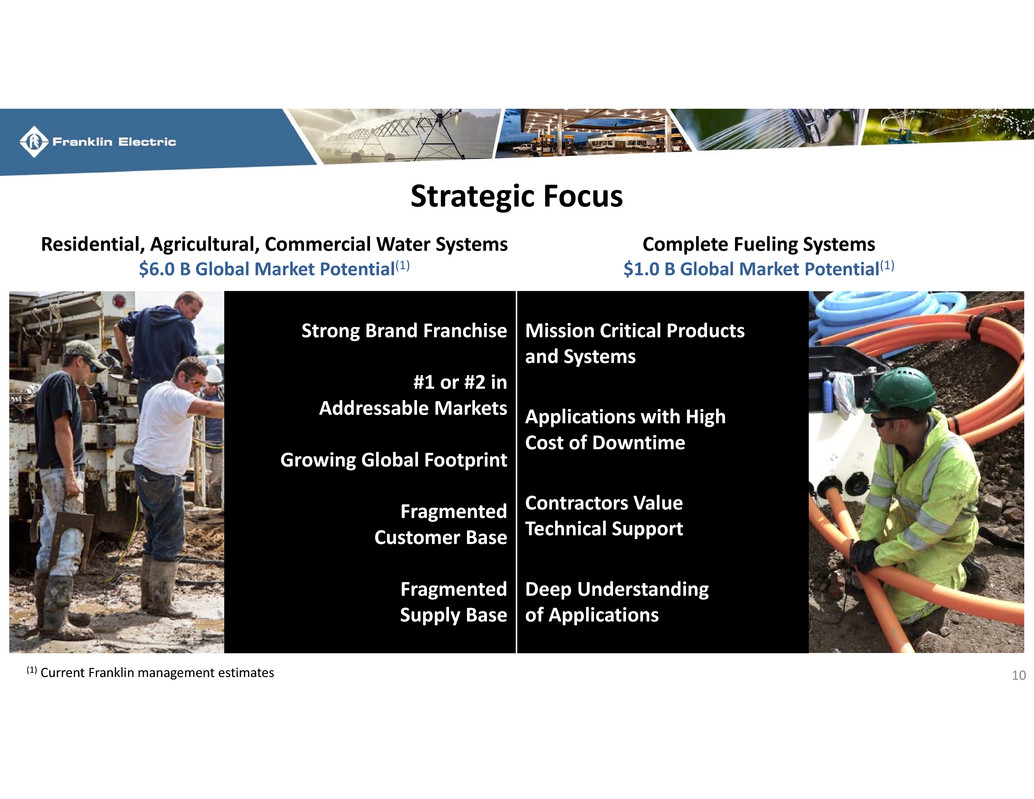

Strategic Focus 10 Residential, Agricultural, Commercial Water Systems $6.0 B Global Market Potential(1) Complete Fueling Systems $1.0 B Global Market Potential(1) (1) Current Franklin management estimates Strong Brand Franchise #1 or #2 in Addressable Markets Growing Global Footprint Fragmented Customer Base Fragmented Supply Base Mission Critical Products and Systems Applications with High Cost of Downtime Contractors Value Technical Support Deep Understanding of Applications

11 STRATEGIC FOCUS: To grow as a global provider of water and fuel systems, through geographic expansion and product line extensions, leveraging our global platform and competency in system design.

Geographic Expansion 12

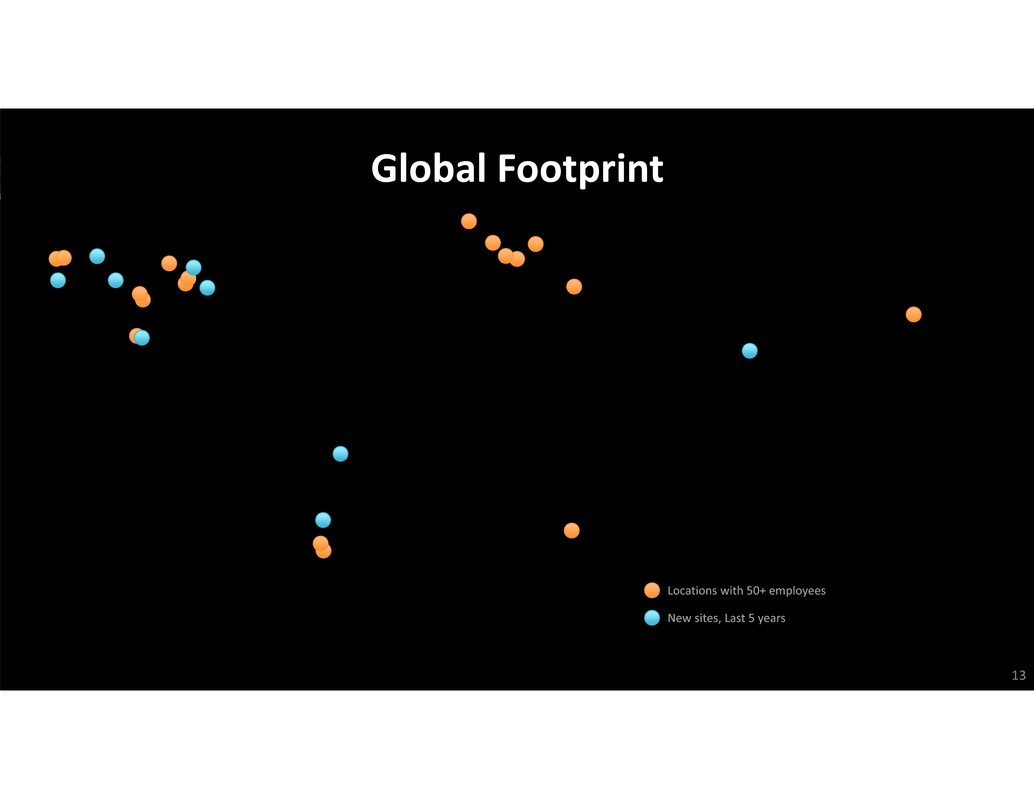

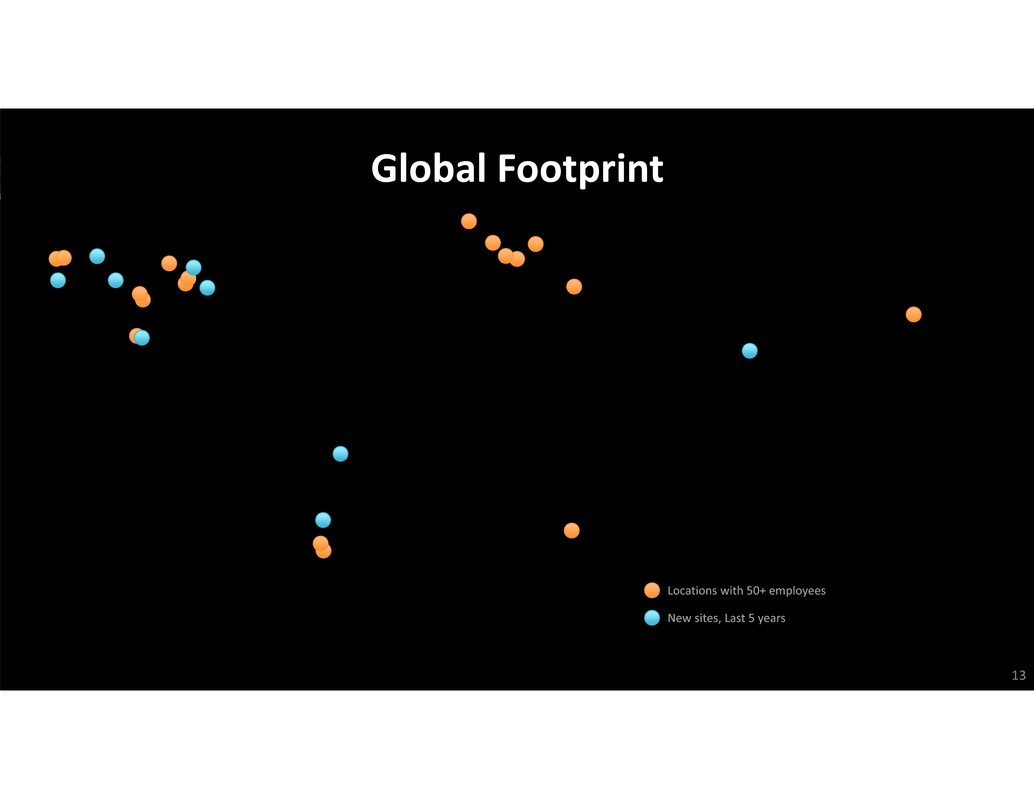

13 Global Footprint Locations with 50+ employees New sites, Last 5 years

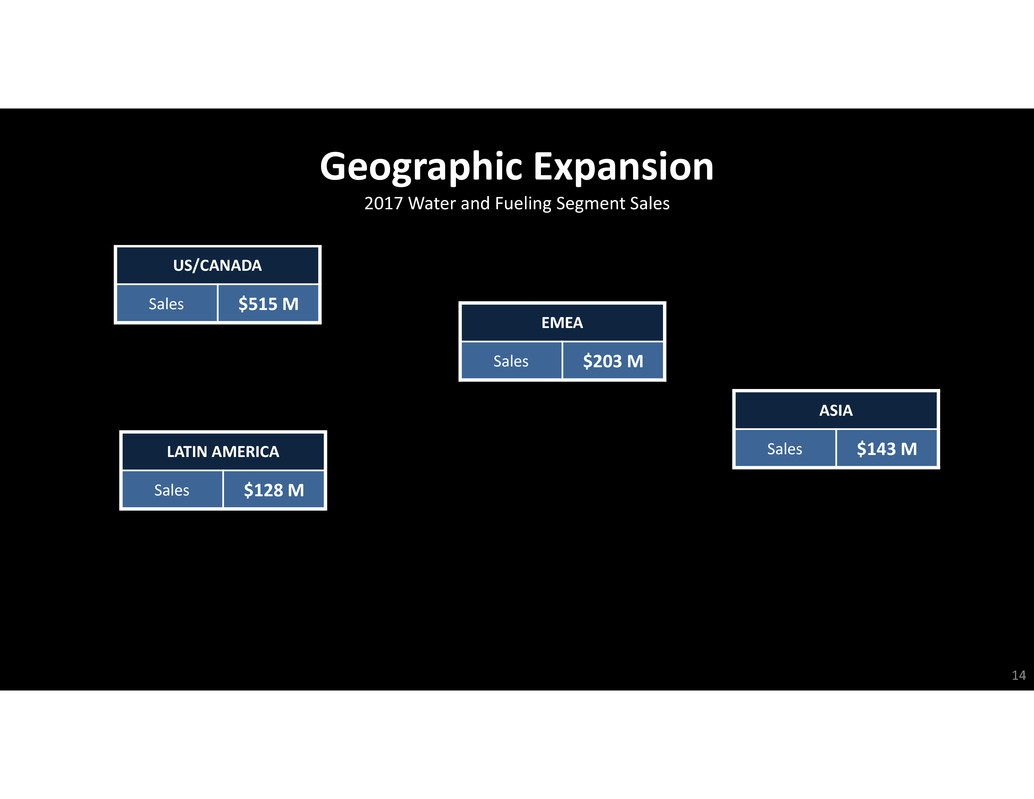

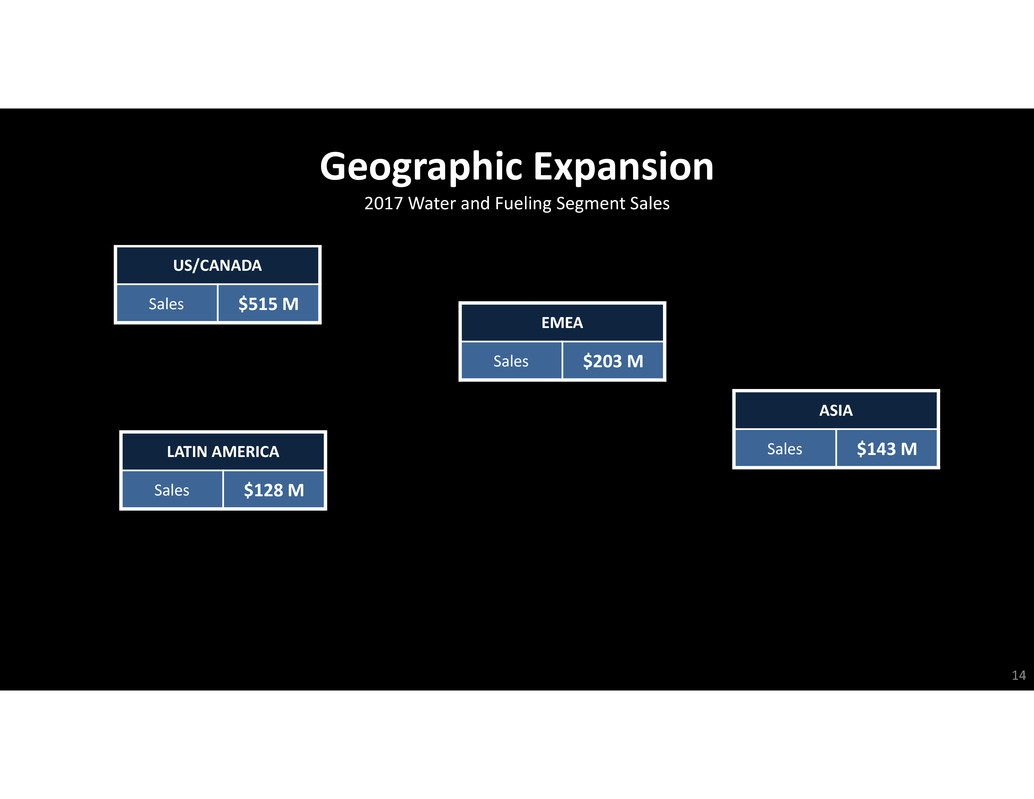

14 US/CANADA Sales $515 M LATIN AMERICA Sales $128 M EMEA Sales $203 M ASIA Sales $143 M Geographic Expansion 2017 Water and Fueling Segment Sales

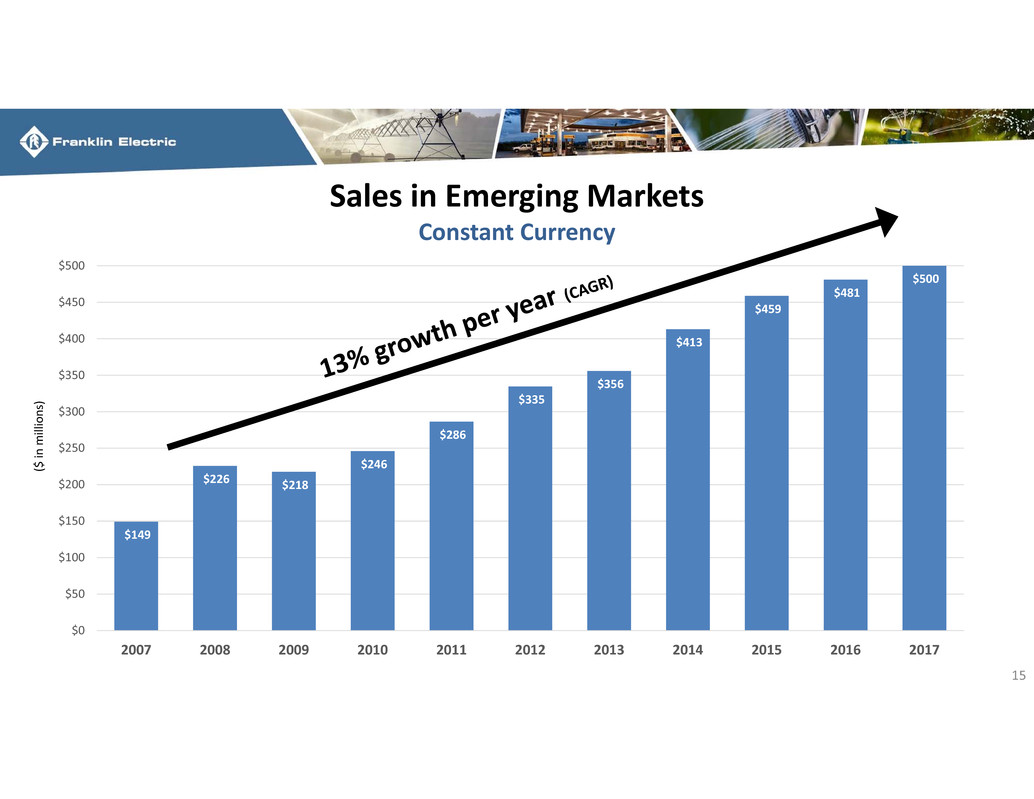

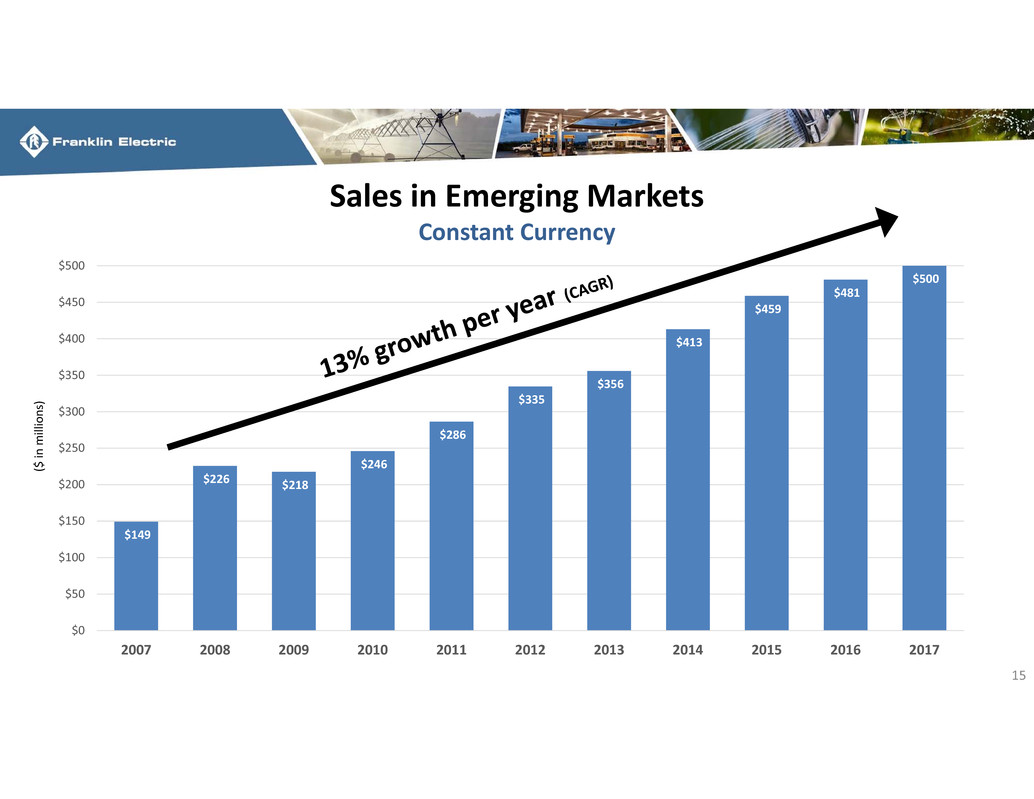

Sales in Emerging Markets $149 $226 $218 $246 $286 $335 $356 $413 $459 $481 $500 $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 $500 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 ( $ i n m i l l i o n s ) 15 Constant Currency

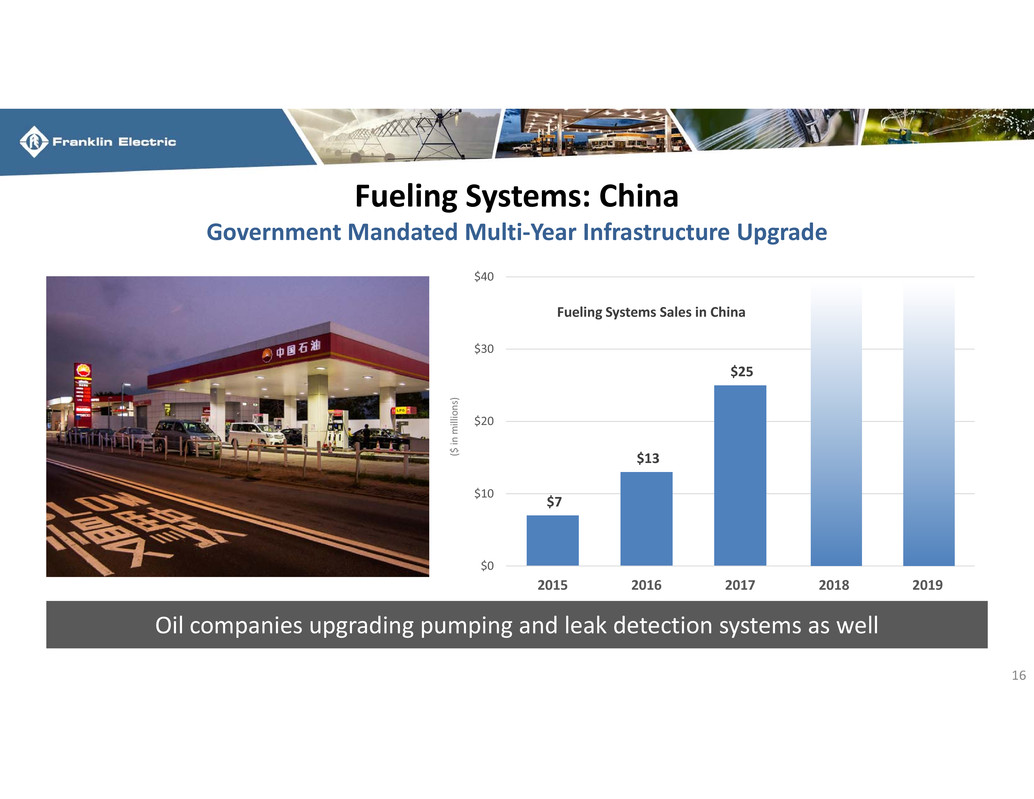

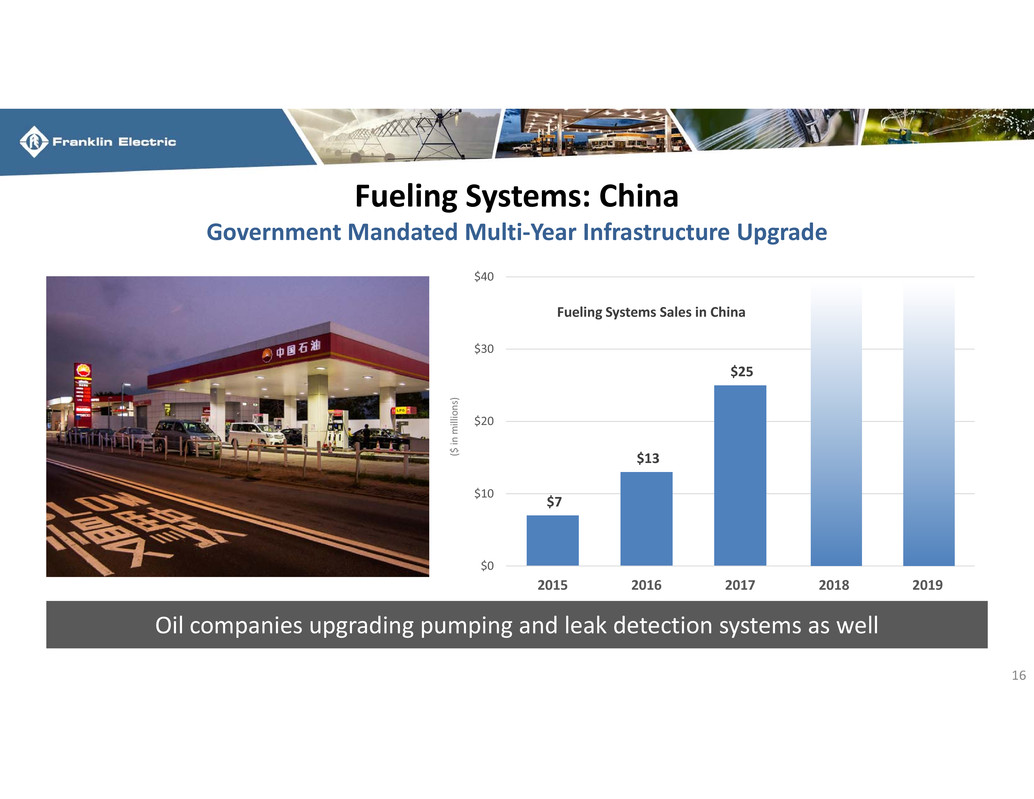

Fueling Systems: China $7 $13 $25 $0 $10 $20 $30 $40 2015 2016 2017 2018 2019 ( $ i n m i l l i o n s ) 16 Oil companies upgrading pumping and leak detection systems as well Government Mandated Multi‐Year Infrastructure Upgrade Fueling Systems Sales in China

17

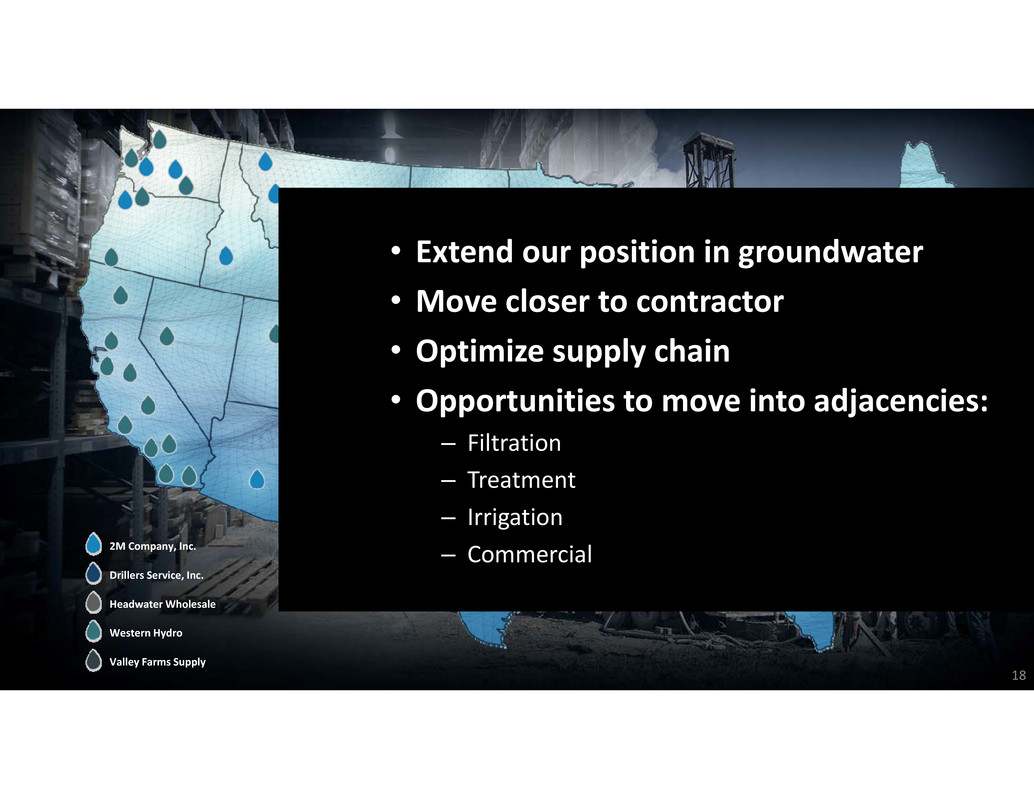

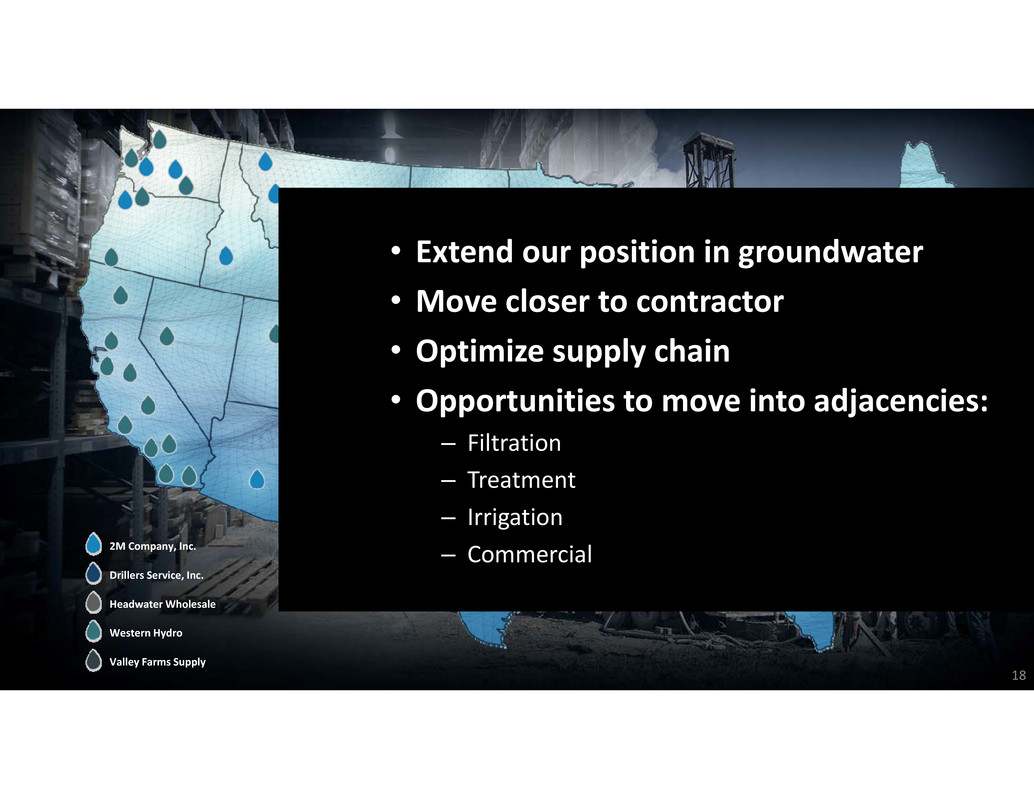

18 2M Company, Inc. Drillers Service, Inc. Headwater Wholesale Western Hydro Valley Farms Supply • Extend our position in groundwater • Move closer to contractor • Optimize supply chain • Opportunities to move into adjacencies: – Filtration – Treatment – Irrigation – Commercial

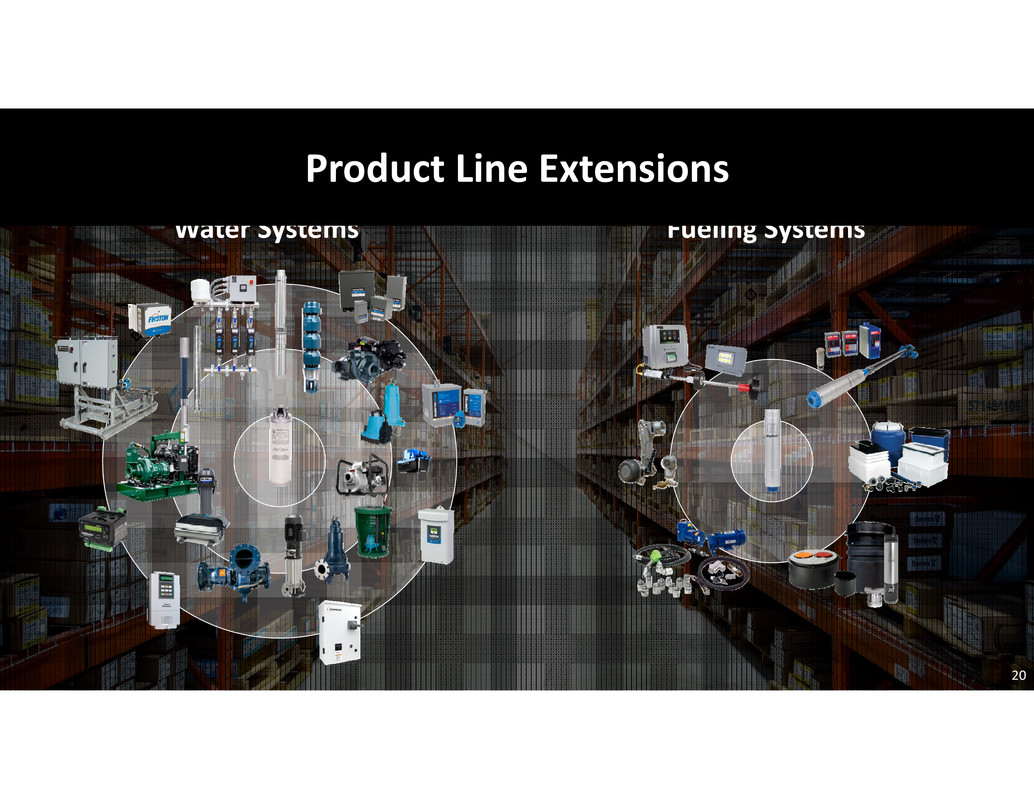

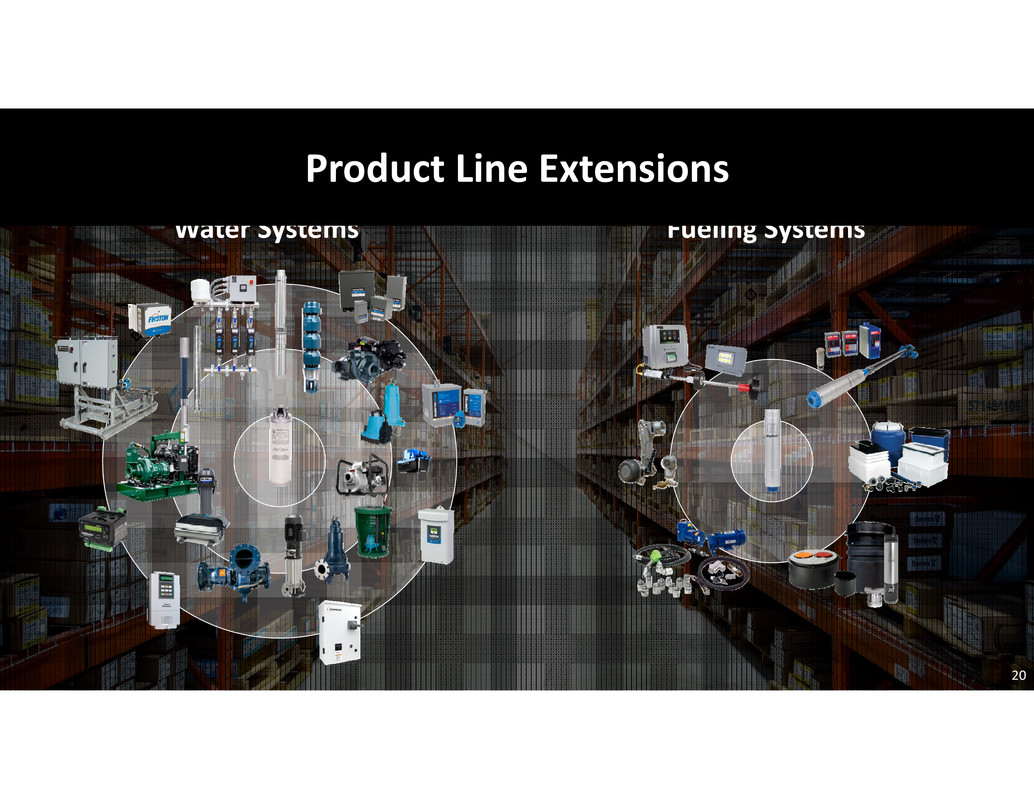

Product Line Extensions 19

20 Water Systems Fueling Systems Product Line Extensions

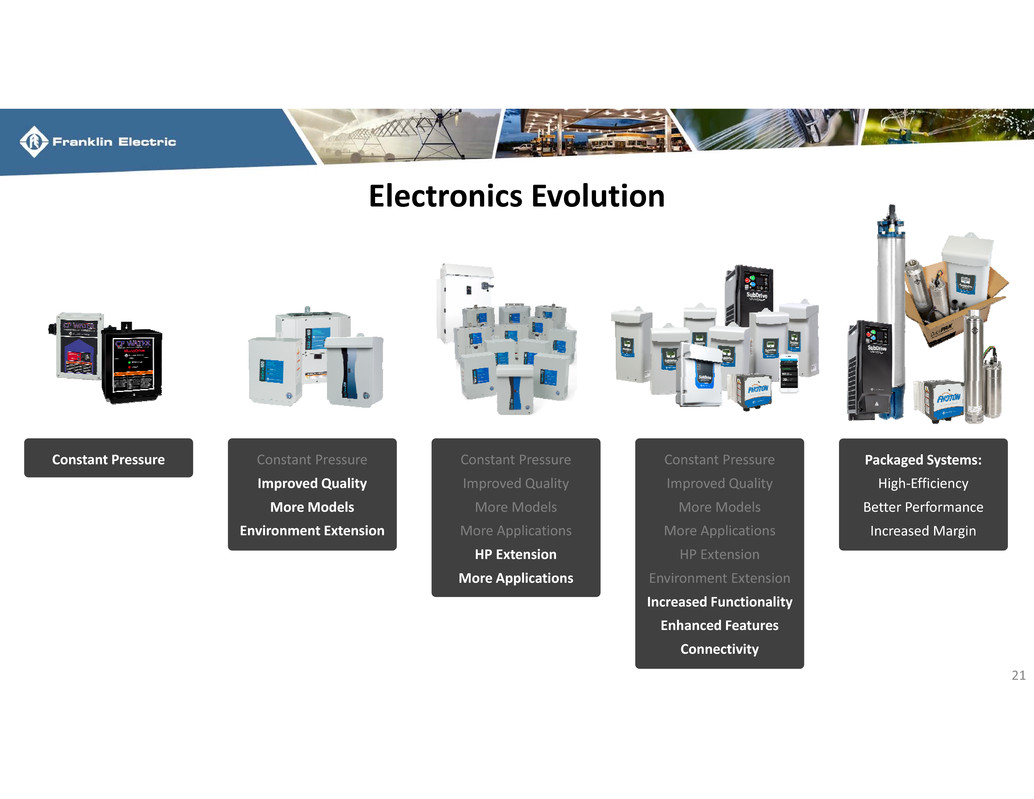

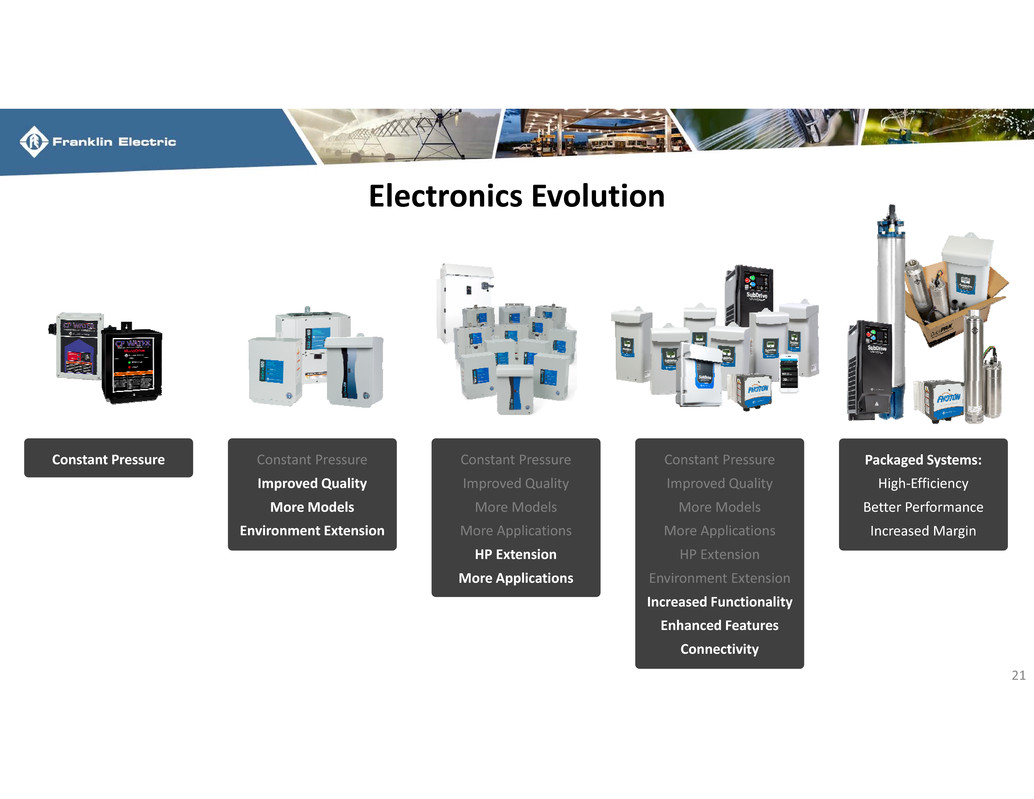

Electronics Evolution 21 Constant Pressure Constant Pressure Improved Quality More Models Environment Extension Constant Pressure Improved Quality More Models More Applications HP Extension More Applications Constant Pressure Improved Quality More Models More Applications HP Extension Environment Extension Increased Functionality Enhanced Features Connectivity Packaged Systems: High‐Efficiency Better Performance Increased Margin

22 Fueling – Total System Solutions FUEL MANAGEMENT SYSTEMS DISPENSING SYSTEMS PIPE & CONTAINMENT SYSTEMS SUBMERSIBLE PUMPING SYSTEMS SERVICE STATION HARDWARE

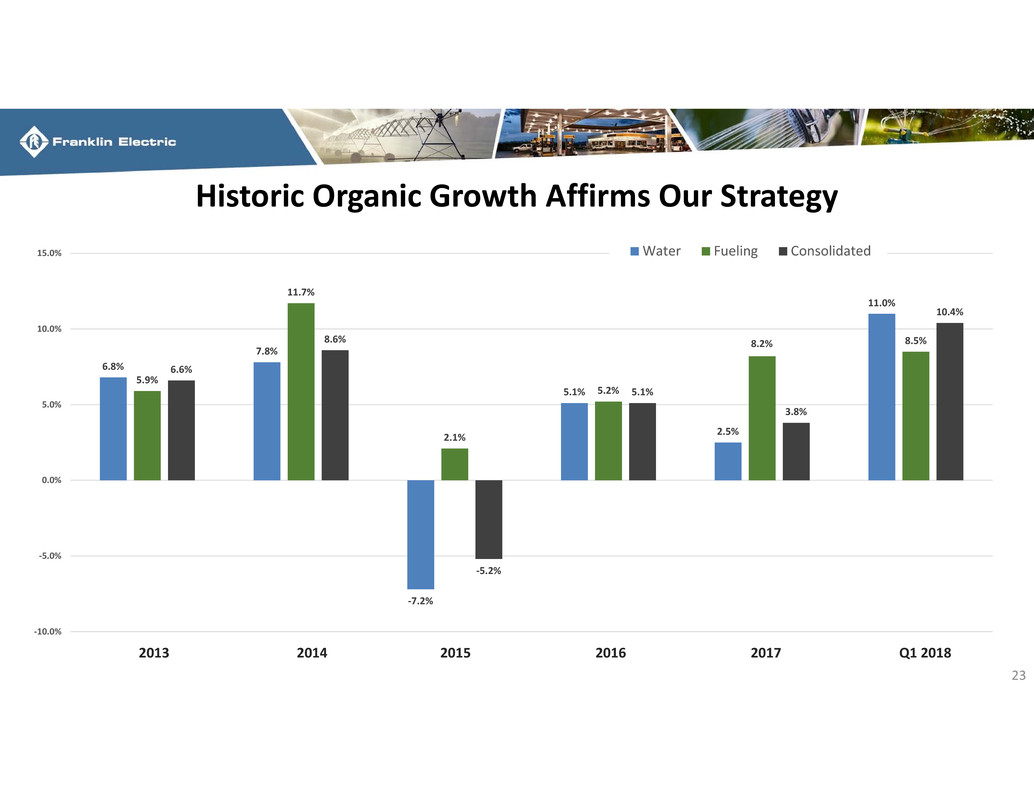

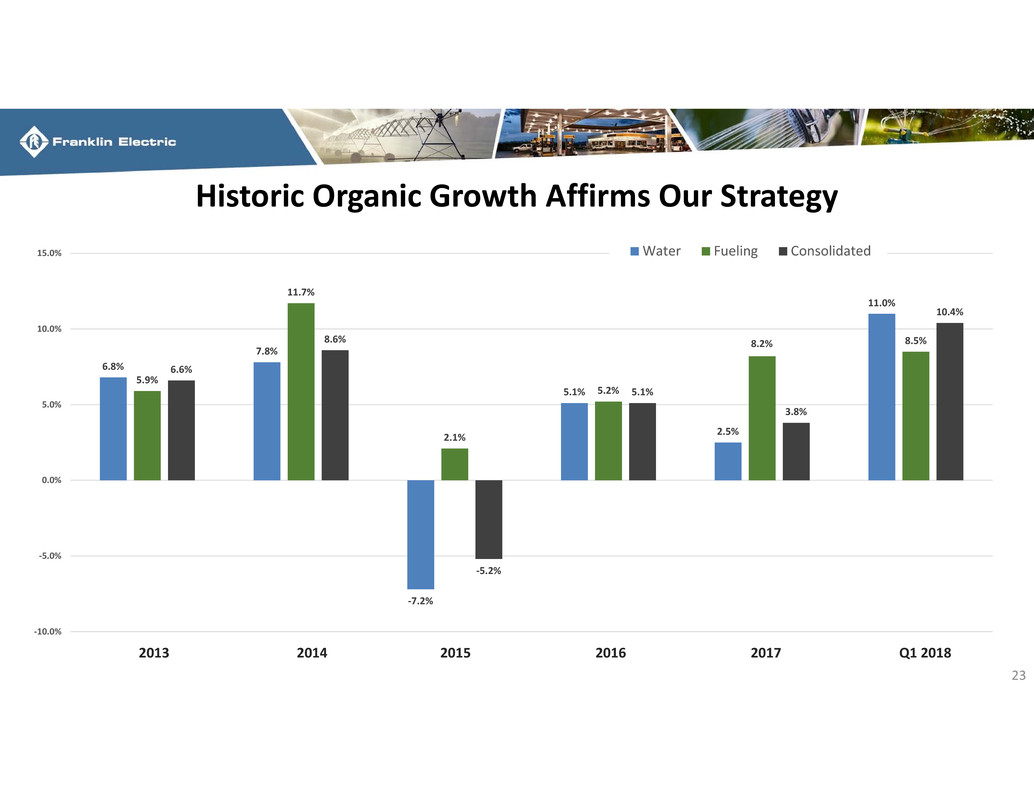

Historic Organic Growth Affirms Our Strategy 6.8% 7.8% ‐7.2% 5.1% 2.5% 11.0% 5.9% 11.7% 2.1% 5.2% 8.2% 8.5% 6.6% 8.6% ‐5.2% 5.1% 3.8% 10.4% ‐10.0% ‐5.0% 0.0% 5.0% 10.0% 15.0% Water Fueling Consolidated 2013 2014 2015 2016 2017 Q1 2018 23

2018 Shareholders Meeting Gregg Sengstack, Chairman and CEO | May 4, 2018

2017 Efforts: – 5 installations spanning 3 different countries • South Africa • Zimbabwe • Uganda – Benefiting the lives of nearly 18,000 people – Leveraged our solar pumping technology 25