1

2019 Shareholders Meeting Gregg Sengstack, Chairman and CEO | May 2019

SAFE HARBOR STATEMENT: “Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995. Any forward‐looking statements contained herein, including those relating to market conditions or the Company’s financial results, costs, expenses or expense reductions, profit margins, inventory levels, foreign currency translation rates, liquidity expectations, business goals and sales growth, involve risks and uncertainties, including but not limited to, risks and uncertainties with respect to general economic and currency conditions, various conditions specific to the Company’s business and industry, weather conditions, new housing starts, market demand, competitive factors, changes in distribution channels, supply constraints, effect of price increases, raw material costs, technology factors, integration of acquisitions, litigation, government and regulatory actions, the Company’s accounting policies, future trends, and other risks which are detailed in the Company’s Securities and Exchange Commission filings, included in Item 1A of Part I of the Company’s Annual Report on Form 10‐K for the fiscal year ending December 31, 2018, Exhibit 99.1 attached thereto and in Item 1A of Part II of the Company’s Quarterly Reports on Form 10‐Q. These risks and uncertainties may cause actual results to differ materially from those indicated by the forward‐looking statements. All forward‐looking statements made herein are based on information currently available, and the Company assumes no obligation to update any forward‐looking statements. 3

First Quarter 2019 Results (Amounts in millions except share data) Sales E.P.S. Operating Cash Flow (before restructuring) $300.0 $0.50 $‐ $295.6 $0.45 $290.7 $(5.0) $(2.9) $0.40 $(10.0) $0.30 $(15.0) $275.0 $0.21 $0.20 $(20.0) $0.10 $(25.0) $(30.0) $(27.2) $250.0 $‐ Q1 2018 Q1 2019 Q1 2018 Q1 2019 Q1 2018 Q1 2019 Weather driven earning decline. Substantial improvement in cash flow. Maintaining full year 2019 guidance of $2.37 to $2.47 4

STRATEGIC FOCUS: To grow as a global provider of water and fuel systems, through geographic expansion and product line extensions, leveraging our global platform and competency in system design. 5

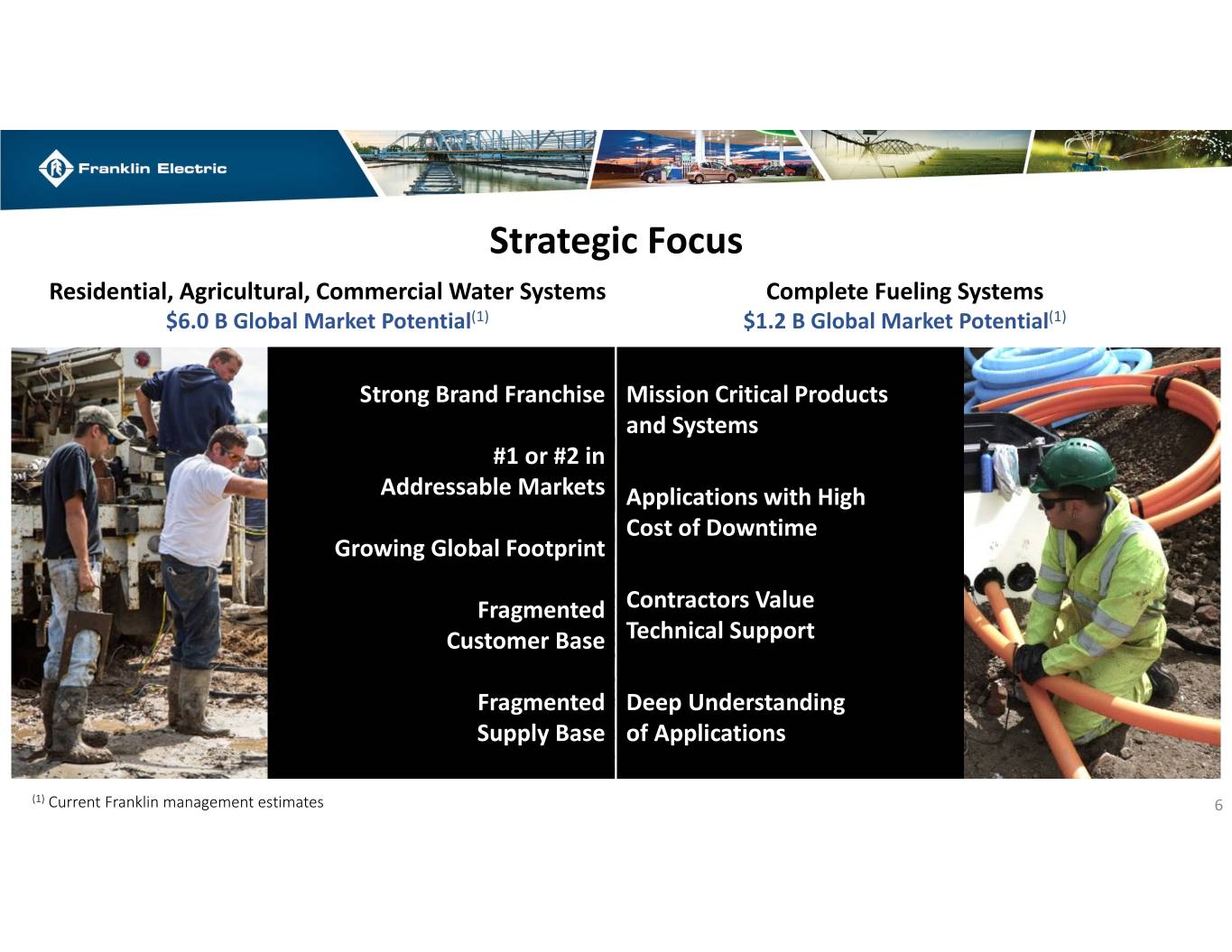

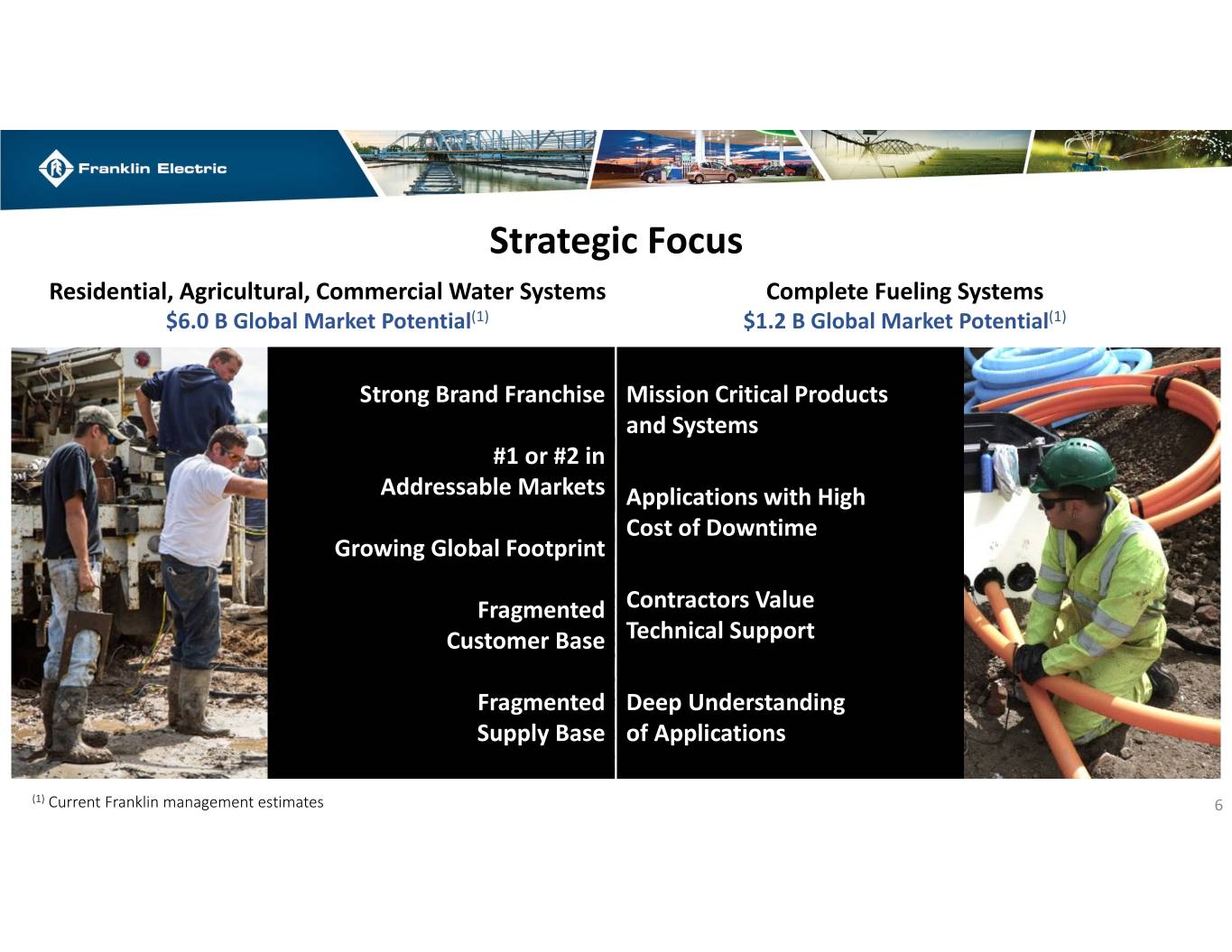

Strategic Focus Residential, Agricultural, Commercial Water Systems Complete Fueling Systems $6.0 B Global Market Potential(1) $1.2 B Global Market Potential(1) Strong Brand Franchise Mission Critical Products and Systems #1 or #2 in Addressable Markets Applications with High Cost of Downtime Growing Global Footprint Fragmented Contractors Value Customer Base Technical Support Fragmented Deep Understanding Supply Base of Applications (1) Current Franklin management estimates 6

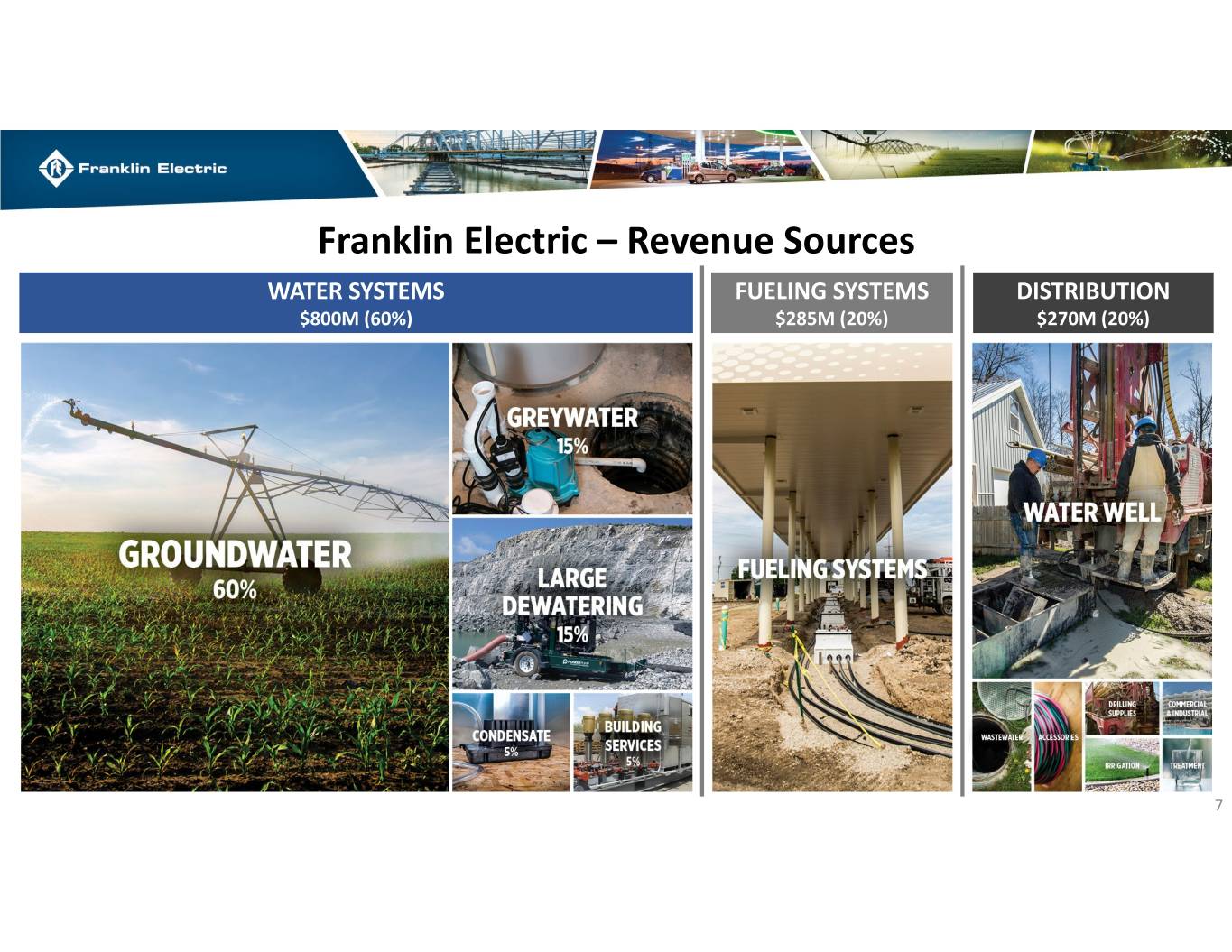

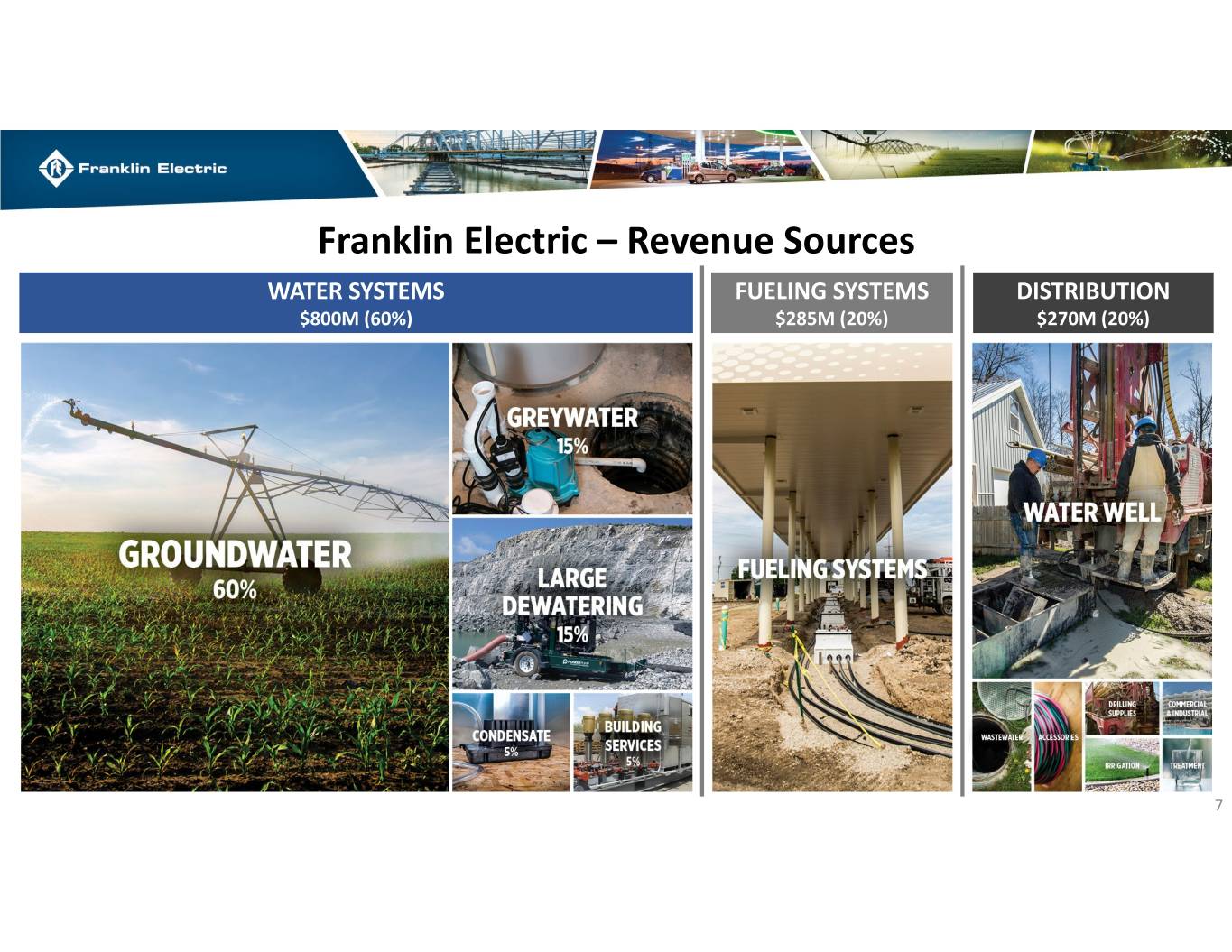

Franklin Electric – Revenue Sources WATER SYSTEMS FUELING SYSTEMS DISTRIBUTION $800M (60%) $285M (20%) $270M (20%) 7

Global Footprint Locations with 50+ employees 8

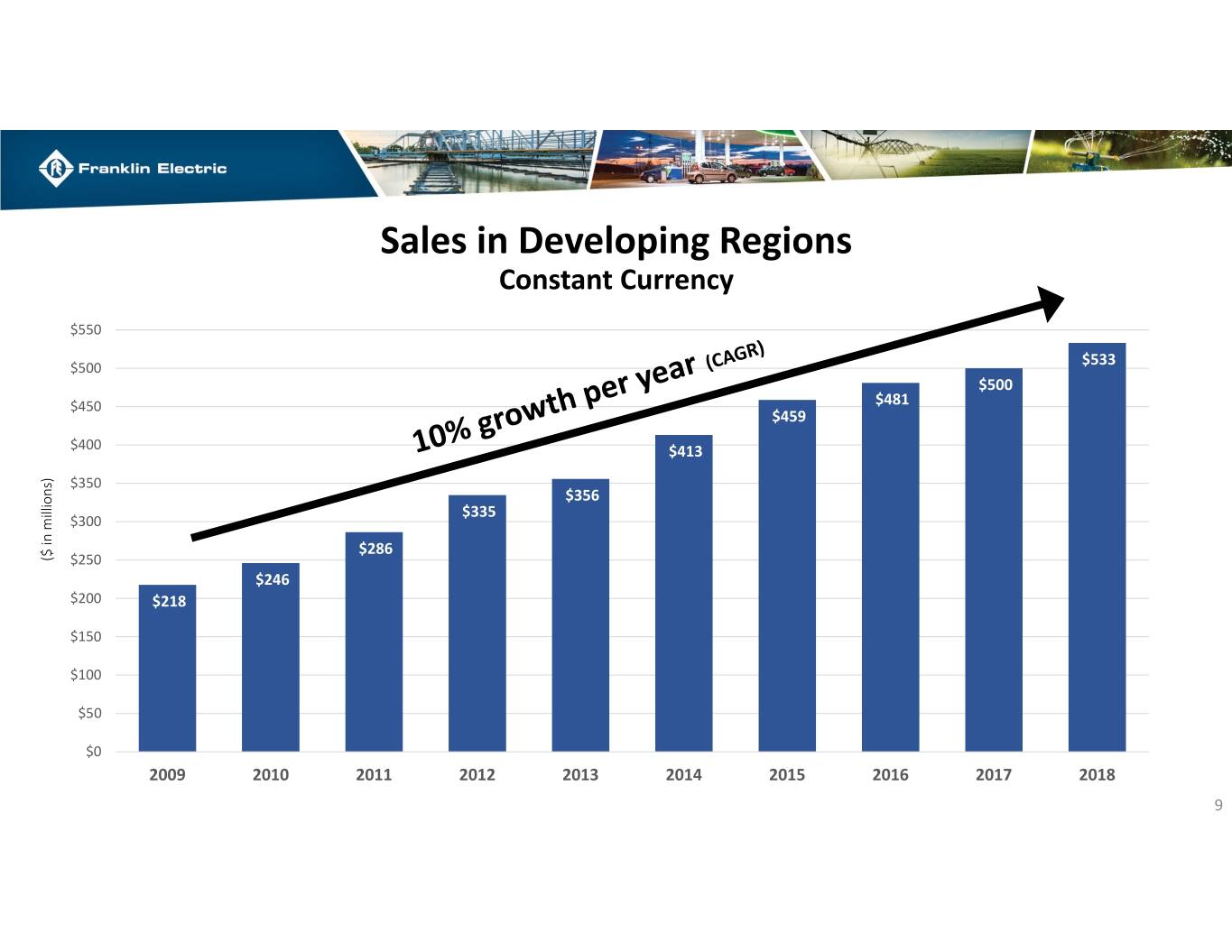

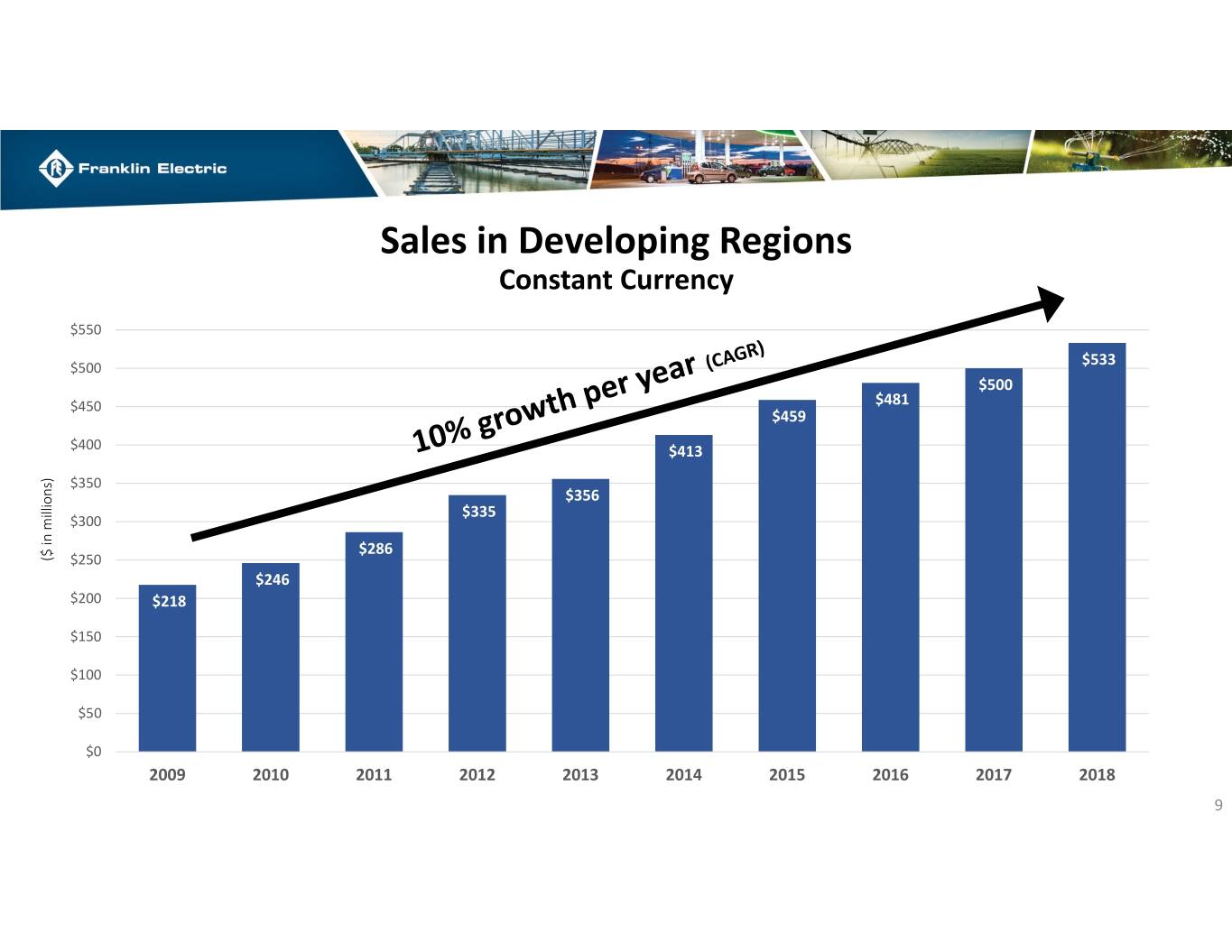

Sales in Developing Regions Constant Currency $550 $533 $500 $500 $450 $481 $459 $400 $413 $350 $356 $335 $300 $286 ($ in millions) $250 $246 $200 $218 $150 $100 $50 $0 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 9

Headwater Companies • Extend our position in groundwater • Move closer to contractor • Optimize supply chain • Opportunities to move into adjacencies: • Filtration • Treatment • Irrigation • Commercial 10

Product Line Extensions Water Systems Fueling Systems 11

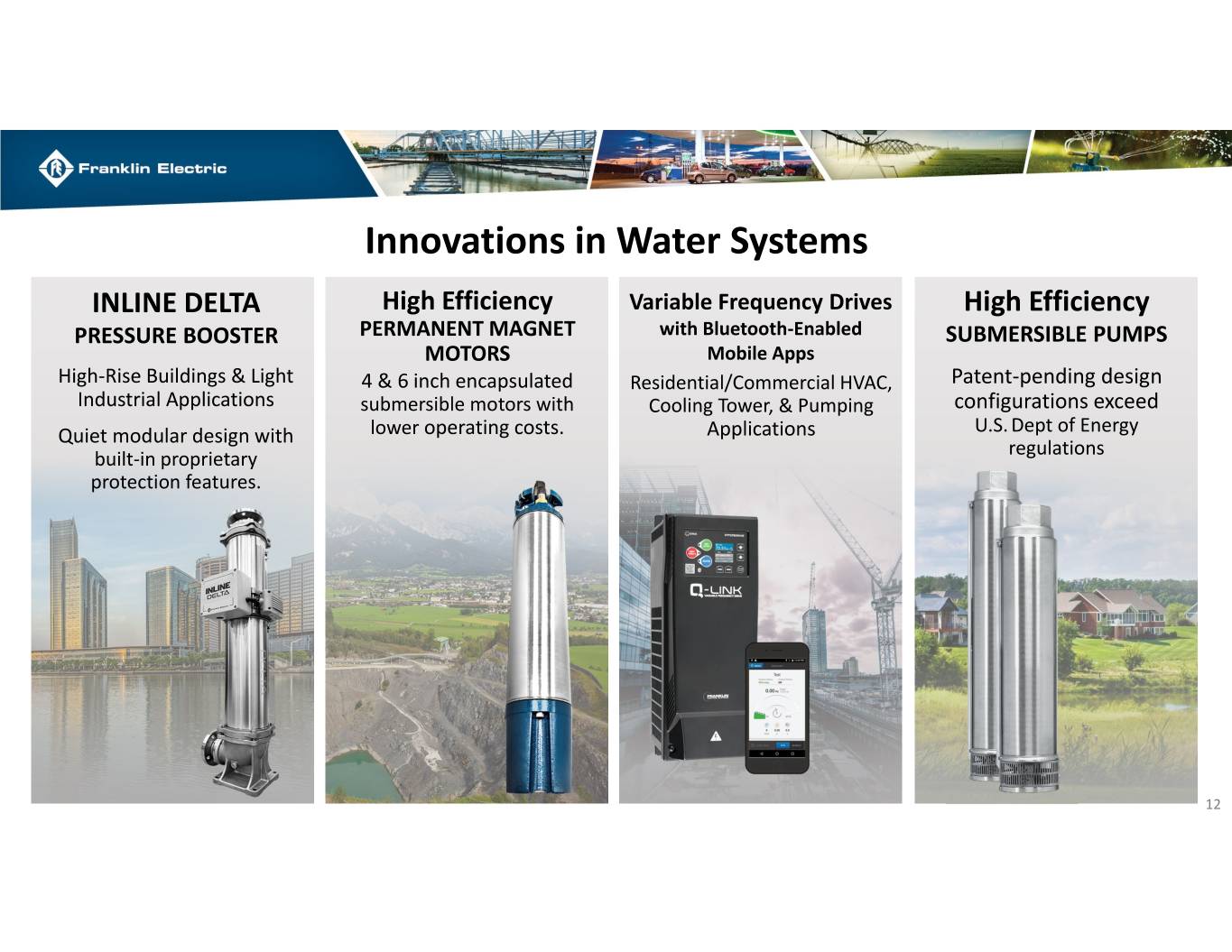

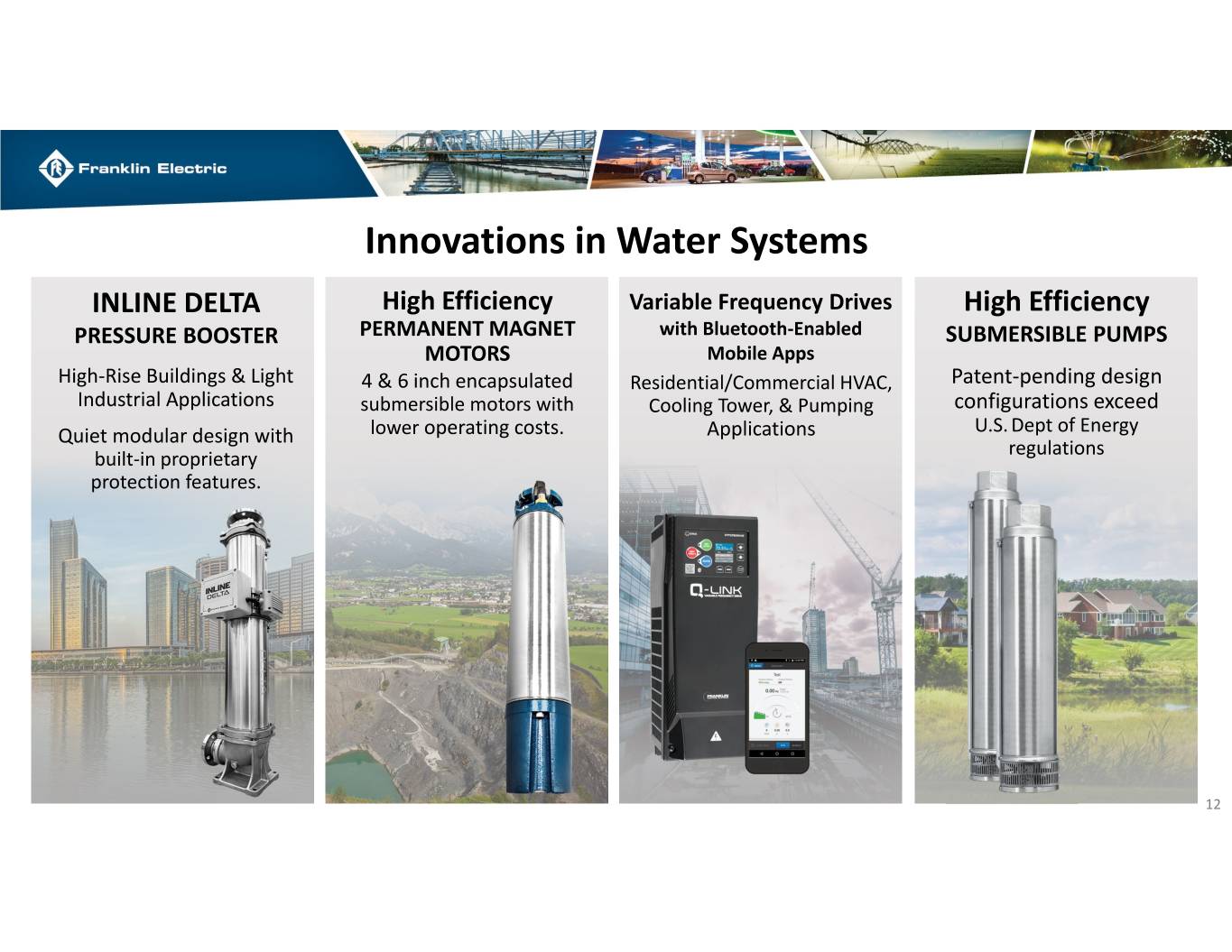

Innovations in Water Systems INLINE DELTA High Efficiency Variable Frequency Drives High Efficiency PRESSURE BOOSTER PERMANENT MAGNET with Bluetooth‐Enabled SUBMERSIBLE PUMPS MOTORS Mobile Apps High‐Rise Buildings & Light 4 & 6 inch encapsulated Residential/Commercial HVAC, Patent‐pending design Industrial Applications submersible motors with Cooling Tower, & Pumping configurations exceed Quiet modular design with lower operating costs. Applications U.S. Dept of Energy regulations built‐in proprietary protection features. 12

Innovations in Fueling Systems EVO 200/400 FFS PRO Verify Corrosion Control FUEL MANAGEMENT Installation Quality Assurance In‐tank & In‐Sump Corrosion Control 2018 Sales of $4 Million Cloud service that provides Mitigates corrosion and remote installation quality protects sites from its 2019 Sales of $2 Million YTD and safety assurance. potentially costly effects. 13

Organic Sales Growth(a) 20.0% 15.0% 15.0% 11.7% 9.8% 10.0% 8.6% 7.8% 8.2% 8.1% 5.1% 5.2% 5.1% 5.0% 3.8% 2.1% 2.5% 0.0% 2014 2015 2016 2017 2018 ‐5.0% ‐5.2% ‐7.2% ‐10.0% Water Fueling Consolidated (a) Organic sales growth for FE Water and Fueling Systems segments only. Excludes acquisitions for one year and impact of Foreign Currency translation. 14

Sales & EPS Consolidated Sales EPS (before restructuring) $1,400 $2.50 $1,298 $2.26 $1,200 $1,125 $1,048 $2.00 $1.92 $1,000 $950 $925 $1.65 $1.64 $1.54 $1.50 $800 ($ in millions) $600 $1.00 $400 $0.50 $200 $‐ $‐ 2014 2015 2016 2017 2018 2014 2015 2016 2017* 2018 *2017: EPS (Before Restructuring and the US Tax law changes) 15

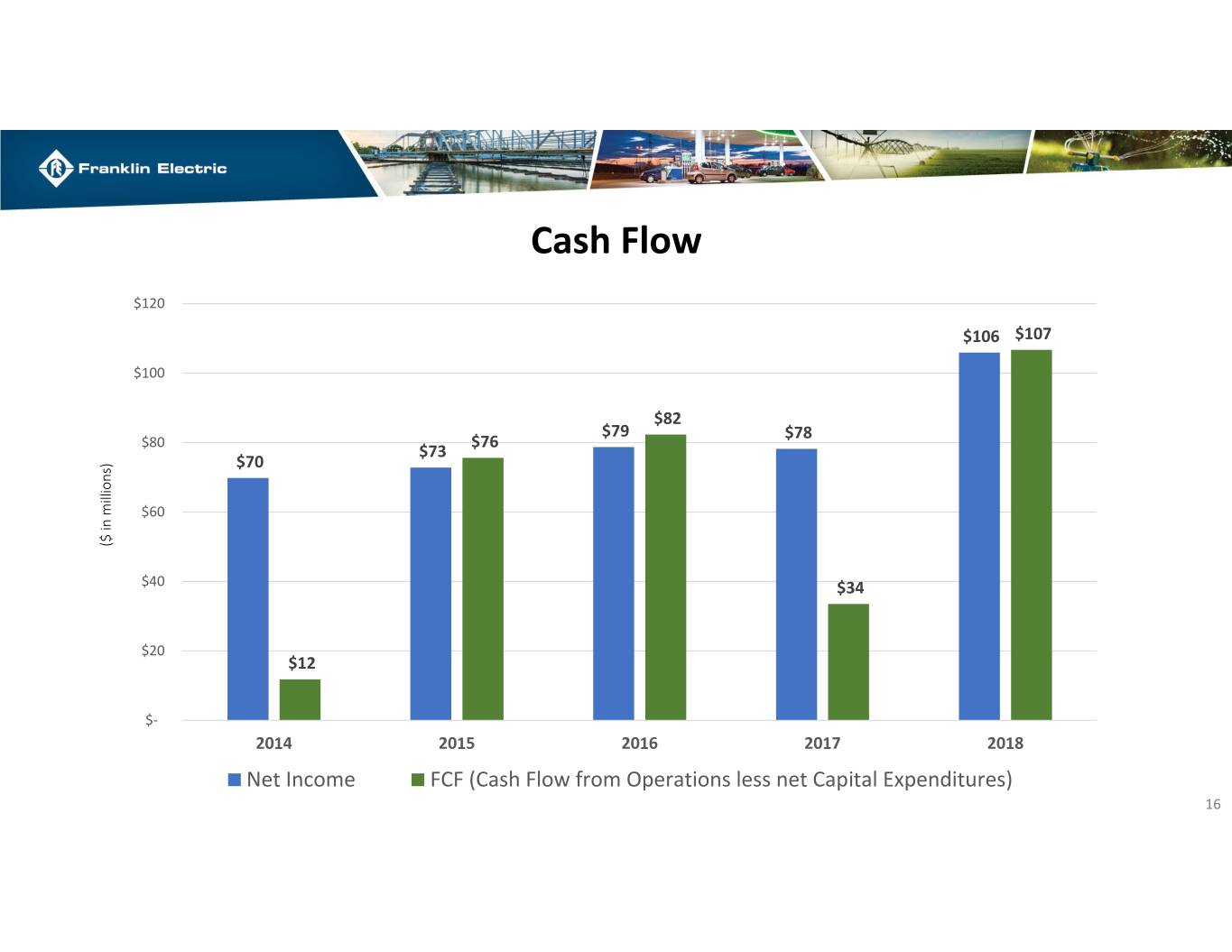

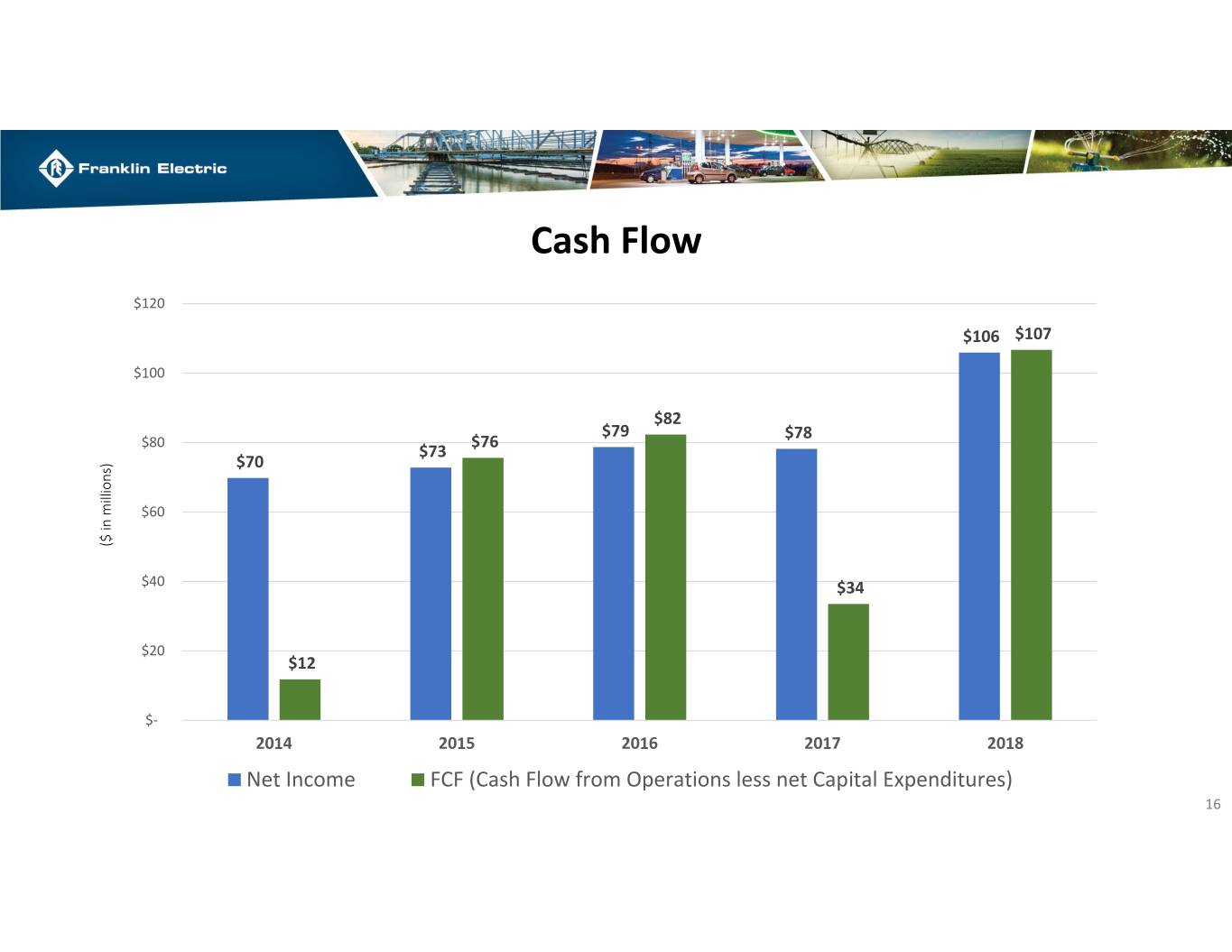

Cash Flow $120 $106 $107 $100 $82 $79 $78 $80 $76 $73 $70 $60 ($ in millions) $40 $34 $20 $12 $‐ 2014 2015 2016 2017 2018 Net Income FCF (Cash Flow from Operations less net Capital Expenditures) 16

ROIC & Dividends ROIC(a) Dividends ($ per Share) 16.5% $0.50 16.0% 16.0% $0.45 $0.40 15.5% 15.0% $0.35 15.0% 14.7% 14.5% $0.30 14.5% $0.25 14.0% $0.20 13.5% 13.5% $0.15 13.0% $0.10 12.5% $0.05 12.0% $‐ 2014 2015 2016 2017 2018 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 (a) ROIC = Operating Income before restructuring charges divided by Net Debt plus Equity 17

2019 Shareholders Meeting Gregg Sengstack, Chairman and CEO | May 2019