Semiannual Report

Franklin Money Fund

Your Fund’s Goal and Main Investments: Franklin Money Fund seeks to provide as

high a level of current income as is consistent with preservation of shareholders’ capital and liquidity.

The Fund invests through The Money Market Portfolio (the Portfolio) mainly in high-quality, short-term

U.S. dollar denominated money market securities of domestic and foreign issuers. The Fund attempts

to maintain a stable $1.00 share price.

This semiannual report for Franklin Money Fund covers the period ended

December 31, 2011.

Performance Overview

In an effort to promote economic growth, the Federal Reserve Board (Fed)

held short-term interest rates at a historically low level during the six-month

period under review. As a result, the Fund’s seven-day effective yield was

unchanged at 0.00% from June 30, 2011, through December 31, 2011.

Economic and Market Overview

During the six months under review, Fed policymakers maintained historically

low interest rates while adopting a more restrained view of the economy

largely because of the European sovereign debt crisis and signs the U.S. eco-

nomic expansion lacked momentum. In September, the Fed announced plans

designed to boost the economy by driving down long-term interest rates. The

Fed intends to sell $400 billion in short-term securities over the next year and

purchase an equal amount of long-term securities. The Fed also anticipated it

would keep short-term rates near zero through mid-2013.

The economy grew more slowly than expected, and unemployment remained

high. Home foreclosures increased, but federal lawmakers made efforts to

strengthen the real estate market by removing some eligibility restrictions and

charges associated with refinancing. Manufacturing activity weakened during

the reporting period partly because of global supply-chain disruptions following

Japan’s natural disasters. Geopolitical instability in some oil-producing regions

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s

Statement of Investments (SOI). The SOI begins on page 9.

Semiannual Report | 3

and investor concerns over weak economic data contributed to volatility in

crude oil prices. After prices reached a period high of $103 per barrel on

November 16, they fell to $99 by period-end. Storms and droughts in several

states reduced crop yields, pushing up grain prices. As oil and food prices rose,

the pace of inflation accelerated during the period. Various U.S. economic gauges

began to show some improvement, leading some economists to become more

optimistic near year-end about the economy’s prospects.

Generally favorable economic improvements and positive corporate earnings

reports somewhat eased investor concerns. During the six months under review,

fixed income markets, as measured by the BC U.S. Aggregate Index, posted

modest returns, and U.S. stocks, as measured by the Standard & Poor’s® 500

Index, declined.1 Heightened volatility, however, roiled global financial markets

amid U.S. lawmakers’ protracted debate and eventual compromise on the debt

limit, independent credit rating agency Standard & Poor’s downgrade of the

long-term U.S. credit rating to AA+ from AAA, and fears of sovereign debt cri-

sis contagion in Europe. In November, the unemployment rate fell to its lowest

level in more than two years, which helped consumer confidence climb to its

highest level in more than eight years. Overall for the period under review, how-

ever, investors sought the perceived safety of U.S. Treasuries, which drove their

prices higher and yields lower.

Investment Strategy

Consistent with our strategy, we invest, through the Portfolio, mainly in high-

quality, short-term U.S. dollar denominated money market securities of

domestic and foreign issuers, including bank obligations, commercial paper,

repurchase agreements and U.S. government securities. We maintain a dollar-

weighted average portfolio maturity of 60 days or less and a dollar-weighted

average life of 120 days or less. We seek to provide shareholders with a high-

quality, conservative investment vehicle; thus, we do not invest the Fund’s

cash in derivatives or other relatively volatile securities that we believe involve

undue risk.

1. STANDARD & POOR’S®, S&P® and S&P 500® are registered trademarks of Standard & Poor’s Financial Services LLC.

Standard & Poor’s does not sponsor, endorse, sell or promote any S&P index-based product.

4 | Semiannual Report

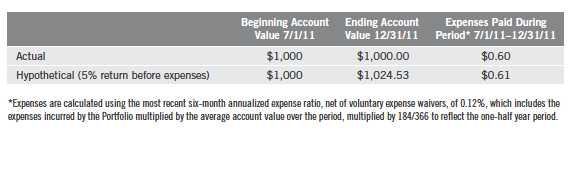

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) of the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. | |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) of the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the Fund’s actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the Fund’s actual expense ratio and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

6 | Semiannual Report

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect

any transaction costs, such as sales charges. Therefore, the second line of the table is useful in com-

paring ongoing costs only, and will not help you compare total costs of owning different funds. In

addition, if transaction costs were included, your total costs would have been higher. Please refer to

the Fund prospectus for additional information on operating expenses.

Semiannual Report | 7

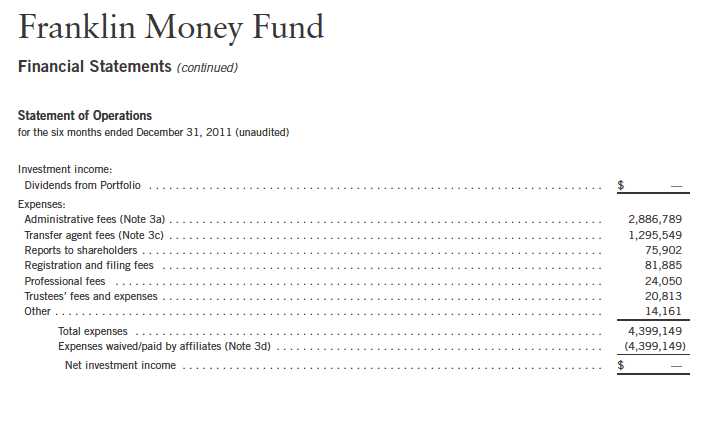

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 9

10 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 11

12 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

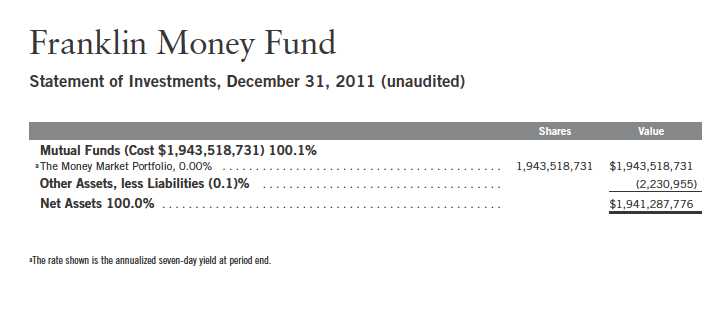

Franklin Money Fund

Notes to Financial Statements (unaudited)

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

Franklin Money Fund (Fund) is registered under the Investment Company Act of 1940, as amended, (1940 Act) as an open-end investment company.

The Fund invests substantially all of its assets in The Money Market Portfolio (Portfolio), which is registered under the 1940 Act as an open-end investment company. The accounting policies of the Portfolio, including the Portfolio’s security valuation policies, will directly affect the recorded value of the Fund’s investment in the Portfolio. The financial statements of the Portfolio, including the Statement of Investments, are included elsewhere in this report and should be read in conjunction with the Fund’s financial statements.

The following summarizes the Fund’s significant accounting policies.

a. Financial Instrument Valuation

The Fund holds Portfolio shares that are valued at the closing net asset value of the Portfolio. At December 31, 2011, the Fund owned 20.48% of the Portfolio.

b. Income Taxes

It is the Fund’s policy to qualify as a regulated investment company under the Internal Revenue Code. The Fund intends to distribute to shareholders substantially all of its taxable income and net realized gains to relieve it from federal income and excise taxes. As a result, no provision for U.S. federal income taxes is required.

The Fund recognizes the tax benefits of uncertain tax positions only when the position is “more likely than not” to be sustained upon examination by the tax authorities based on the technical merits of the tax position. As of December 31, 2011, and for all open tax years, the Fund has determined that no liability for unrecognized tax benefits is required in the Fund’s financial statements related to uncertain tax positions taken on a tax return (or expected to be taken on future tax returns). Open tax years are those that remain subject to examination and are based on each tax jurisdiction statute of limitation.

c. Security Transactions, Investment Income, Expenses and Distributions

Security transactions are accounted for on trade date. Realized gains and losses on security transactions are determined on a specific identification basis. Income received from the Portfolio and estimated expenses are accrued daily. Dividends from net investment income are normally declared and distributed daily; these dividends may be reinvested or paid monthly to shareholders. Distributions to shareholders are determined according to income tax regulations (tax basis). Distributable earnings determined on a tax basis may differ from earnings recorded in accordance with accounting principles generally accepted in the United States of America. These differences may be permanent or temporary. Permanent differences are reclassified among capital accounts to reflect their tax character. These reclassifications have no impact on net assets or the results of operations. Temporary differences are not reclassified, as they may reverse in subsequent periods.

Semiannual Report | 13

Franklin Money Fund

Notes to Financial Statements (unaudited) (continued)

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| d. | Accounting Estimates |

The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

e. Guarantees and Indemnifications

Under the Fund’s organizational documents, its officers and directors are indemnified by the Fund against certain liabilities arising out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. Currently, the Fund expects the risk of loss to be remote.

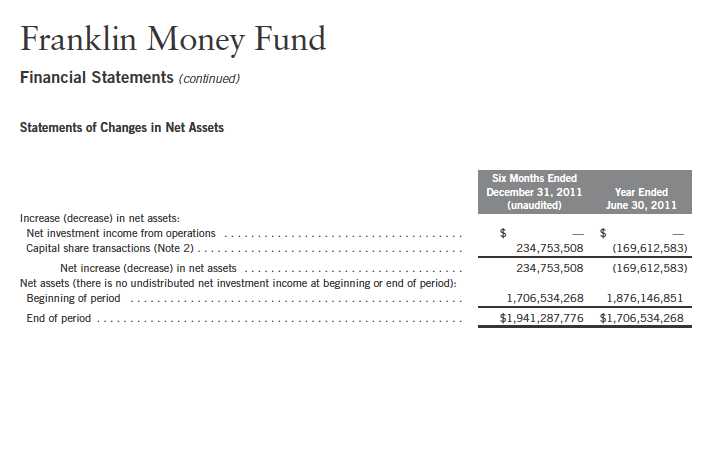

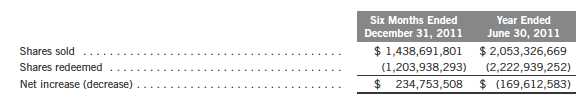

2. SHARES OF BENEFICIAL INTEREST

At December 31, 2011, there were an unlimited number of shares authorized (without par value).

Transactions in the Fund’s shares at $1.00 per share were as follows:

3. TRANSACTIONS WITH AFFILIATES

Franklin Resources, Inc. is the holding company for various subsidiaries that together are referred to as Franklin Templeton Investments. Certain officers and trustees of the Fund are also officers, directors, and/or trustees of the Portfolio and of the following subsidiaries:

| Subsidiary | Affiliation |

| Franklin Advisers, Inc. (Advisers) | Administrative manager |

| Franklin Templeton Distributors, Inc. (Distributors) | Principal underwriter |

| Franklin Templeton Investor Services, LLC (Investor Services) | Transfer agent |

14 | Semiannual Report

Franklin Money Fund

Notes to Financial Statements (unaudited) (continued)

5. FAIR VALUE MEASUREMENTS

The Fund follows a fair value hierarchy that distinguishes between market data obtained from independent sources (observable inputs) and the Fund’s own market assumptions (unobservable inputs). These inputs are used in determining the value of the Fund’s investments and are summarized in the following fair value hierarchy:

- Level 1 – quoted prices in active markets for identical securities

- Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speed, credit risk, etc.)

- Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

For movements between the levels within the fair value hierarchy, the Fund has adopted a policy of recognizing the transfers as of the date of the underlying event which caused the movement.

At December 31, 2011, all of the Fund’s investments in securities carried at fair value were valued using Level 1 inputs.

6. NEW ACCOUNTING PRONOUNCEMENTS

In May 2011, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2011-04, Fair Value Measurement (Topic 820): Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs. The amendments in the ASU will improve the comparability of fair value measurements presented and disclosed in financial statements prepared in accordance with U.S. GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards) and include new guidance for certain fair value measurement principles and disclosure requirements. The ASU is effective for interim and annual periods beginning after December 15, 2011. The Fund believes the adoption of this ASU will not have a material impact on its financial statements.

7. SUBSEQUENT EVENTS

The Fund has evaluated subsequent events through the issuance of the financial statements and determined that no events have occurred that require disclosure.

16 | Semiannual Report

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 17

18 | Semiannual Report

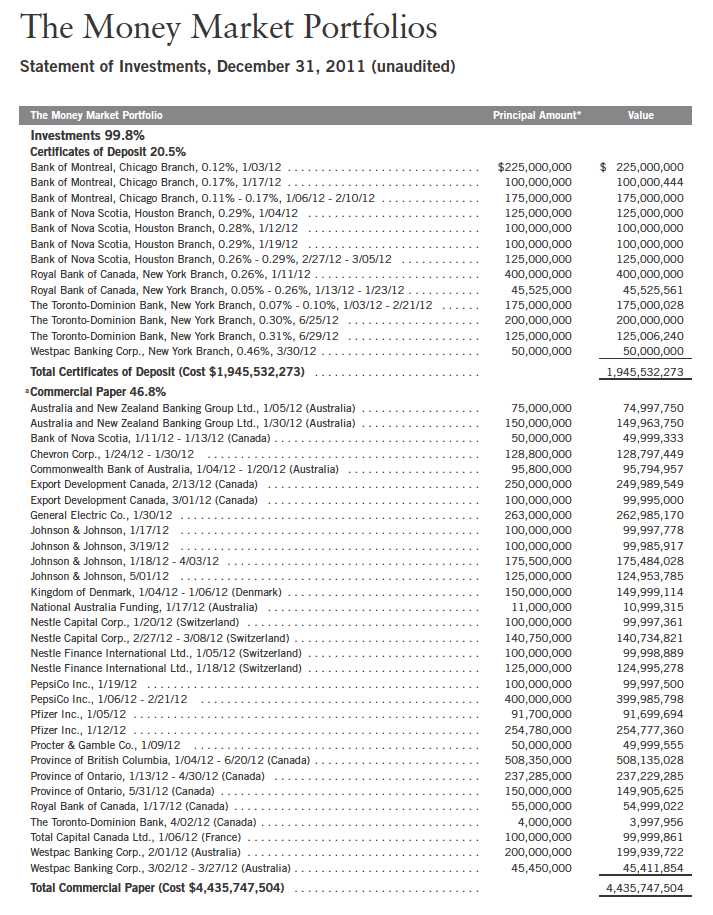

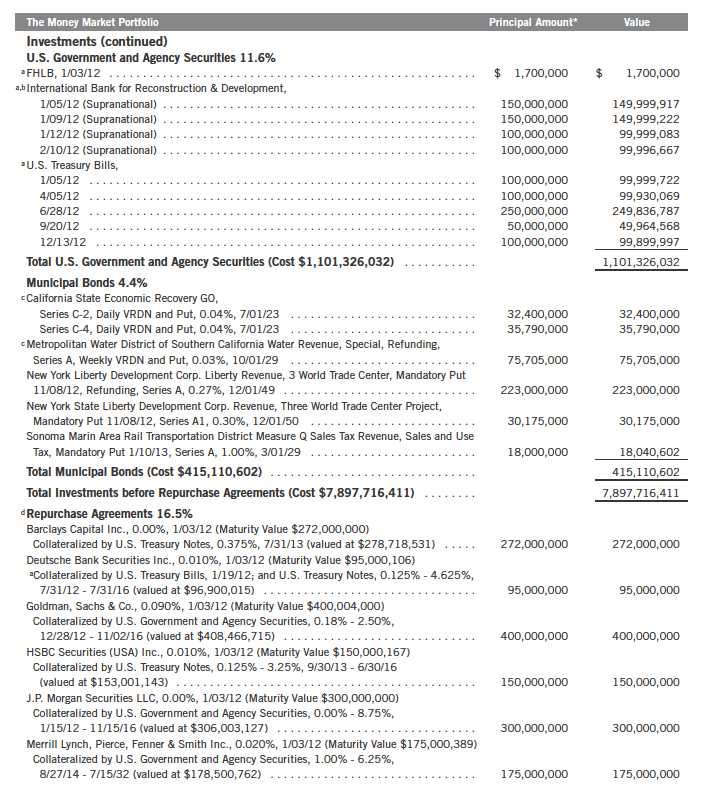

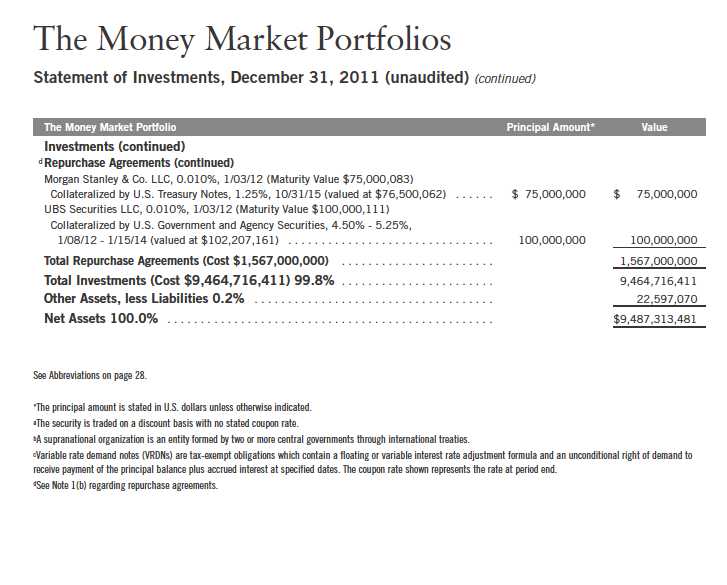

The Money Market Portfolios

Statement of Investments, December 31, 2011 (unaudited) (continued)

Semiannual Report | 19

20 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 21

22 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 23

The Money Market Portfolios

Notes to Financial Statements (unaudited)

The Money Market Portfolio

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

The Money Market Portfolios (Trust) is registered under the Investment Company Act of 1940, as amended, (1940 Act) as an open-end investment company, consisting of one portfolio, The Money Market Portfolio (Portfolio). The shares of the Portfolio are issued in private placements and are exempt from registration under the Securities Act of 1933.

The following summarizes the Portfolio’s significant accounting policies.

a. Financial Instrument Valuation

Securities are valued at amortized cost, which approximates market value. Amortized cost is an income-based approach which involves valuing an instrument at its cost and thereafter assuming a constant amortization to maturity of any discount or premium.

b. Repurchase Agreements

The Portfolio enters into repurchase agreements, which are accounted for as a loan by the Portfolio to the seller, collateralized by securities which are delivered to the Portfolio’s custodian. The market value, including accrued interest, of the initial collateralization is required to be at least 102% of the dollar amount invested by the Portfolio, with the value of the underlying securities marked to market daily to maintain coverage of at least 100%. All repurchase agreements held by the Portfolio at period end had been entered into on December 30, 2011.

c. Income Taxes

It is the Portfolio’s policy to qualify as a regulated investment company under the Internal Revenue Code. The Portfolio intends to distribute to shareholders substantially all of its taxable income and net realized gains to relieve it from federal income and excise taxes. As a result, no provision for U.S. federal income taxes is required.

The Portfolio recognizes the tax benefits of uncertain tax positions only when the position is “more likely than not” to be sustained upon examination by the tax authorities based on the technical merits of the tax position. As of December 31, 2011, and for all open tax years, the Portfolio has determined that no liability for unrecognized tax benefits is required in the Portfolio’s financial statements related to uncertain tax positions taken on a tax return (or expected to be taken on future tax returns). Open tax years are those that remain subject to examination and are based on each tax jurisdiction statute of limitation.

d. Security Transactions, Investment Income, Expenses and Distributions

Security transactions are accounted for on trade date. Realized gains and losses on security transactions are determined on a specific identification basis. Interest income and estimated expenses are accrued daily. Amortization of premium and accretion of discount on debt securities are

24 | Semiannual Report

The Money Market Portfolios

Notes to Financial Statements (unaudited) (continued)

The Money Market Portfolio

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| d. | Security Transactions, Investment Income, Expenses and Distributions (continued) |

included in interest income. Dividends from net investment income are normally declared daily; these dividends may be reinvested or paid monthly to shareholders. Distributions to shareholders are determined according to income tax regulations (tax basis). Distributable earnings determined on a tax basis may differ from earnings recorded in accordance with accounting principles generally accepted in the United States of America. These differences may be permanent or temporary. Permanent differences are reclassified among capital accounts to reflect their tax character. These reclassifications have no impact on net assets or the results of operations. Temporary differences are not reclassified, as they may reverse in subsequent periods.

e. Accounting Estimates

The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

f. Guarantees and Indemnifications

Under the Trust’s organizational documents, its officers and trustees are indemnified by the Trust against certain liabilities arising out of the performance of their duties to the Trust. Additionally, in the normal course of business, the Trust, on behalf of the Portfolio, enters into contracts with service providers that contain general indemnification clauses. The Trust’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Trust that have not yet occurred. Currently, the Trust expects the risk of loss to be remote.

2. SHARES OF BENEFICIAL INTEREST

At December 31, 2011, there were an unlimited number of shares authorized (without par value). Transactions in the Portfolio’s shares at $1.00 per share were as follows:

Semiannual Report | 25

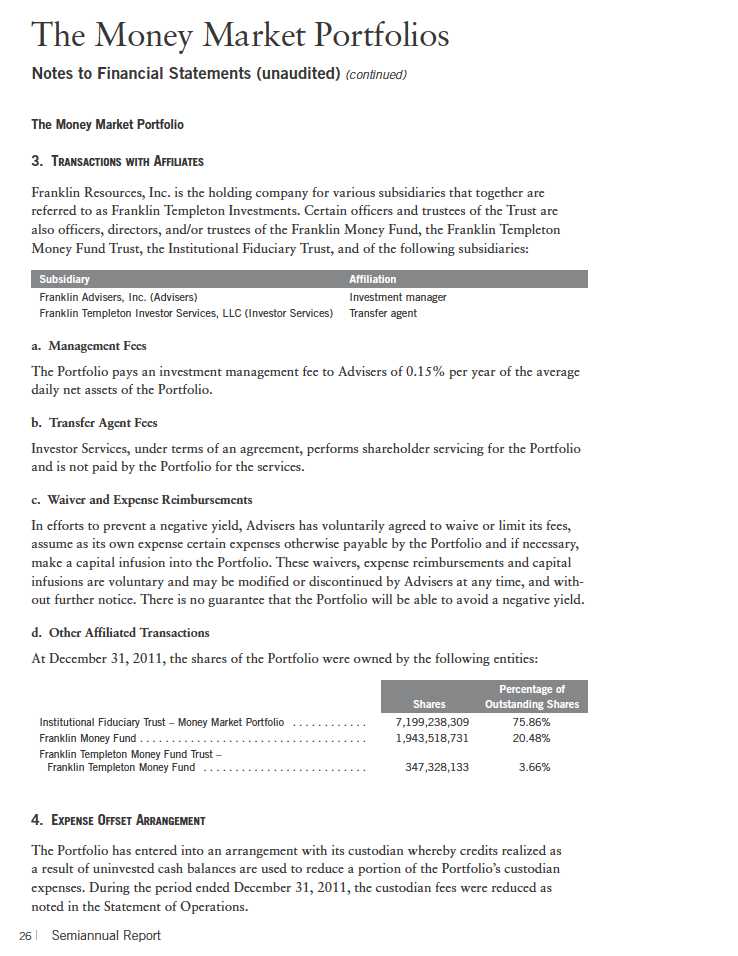

The Money Market Portfolios

Notes to Financial Statements (unaudited) (continued)

The Money Market Portfolio

5. INCOME TAXES

For tax purposes, capital losses may be carried over to offset future capital gains, if any. At June 30, 2011, the Portfolio had capital loss carryforwards of $2,771,692 expiring in 2017.

Under the Regulated Investment Company Modernization Act of 2010, the Portfolio will be permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 for an unlimited period. Post-enactment capital loss carryforwards will retain their character as either short-term or long-term capital losses rather than being considered short-term as under previous law. Any post-enactment capital losses generated will be required to be utilized prior to the losses incurred in pre-enactment tax years.

At December 31, 2011, the cost of investments for book and income tax purposes was the same.

6. FAIR VALUE MEASUREMENTS

The Portfolio follows a fair value hierarchy that distinguishes between market data obtained from independent sources (observable inputs) and the Portfolio’s own market assumptions (unobservable inputs). These inputs are used in determining the value of the Portfolio’s investments and are summarized in the following fair value hierarchy:

- Level 1 – quoted prices in active markets for identical securities

- Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speed, credit risk, etc.)

- Level 3 – significant unobservable inputs (including the Portfolio’s own assumptions in determining the fair value of investments)

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities. Money market securities may be valued using amortized cost, in accordance with the 1940 Act. Generally, amortized cost reflects the current fair value of a security, but since the value is not obtained from a quoted price in an active market, such securities are reflected as Level 2 inputs.

For movements between the levels within the fair value hierarchy, the Portfolio has adopted a policy of recognizing the transfers as of the date of the underlying event which caused the movement.

At December 31, 2011, all of the Portfolio’s investments in securities carried at fair value were valued using Level 2 inputs.

Semiannual Report | 27

The Money Market Portfolios

Notes to Financial Statements (unaudited) (continued)

The Money Market Portfolio

7. NEW ACCOUNTING PRONOUNCEMENTS

In May 2011, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2011-04, Fair Value Measurement (Topic 820): Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs. The amendments in the ASU will improve the comparability of fair value measurements presented and disclosed in financial statements prepared in accordance with U.S. GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards) and include new guidance for certain fair value measurement principles and disclosure requirements. The ASU is effective for interim and annual periods beginning after December 15, 2011. The Portfolio believes the adoption of this ASU will not have a material impact on its financial statements.

8. SUBSEQUENT EVENTS

The Portfolio has evaluated subsequent events through the issuance of the financial statements and determined that no events have occurred that require disclosure.

ABBREVIATIONS

Selected Portfolio

FHLB - Federal Home Loan Bank

GO - General Obligation

28 | Semiannual Report

Franklin Money Fund

Shareholder Information

Proxy Voting Policies and Procedures

The Trust’s investment manager has established Proxy Voting Policies and Procedures (Policies) that the Trust uses to determine how to vote proxies relating to portfolio securities. Shareholders may view the Trust’s complete Policies online at franklintempleton.com. Alternatively, shareholders may request copies of the Policies free of charge by calling the Proxy Group collect at (954) 527-7678 or by sending a written request to: Franklin Templeton Companies, LLC, 300 S.E. 2nd Street, Fort Lauderdale, FL 33301, Attention: Proxy Group. Copies of the Trust’s proxy voting records are also made available online at franklintempleton.com and posted on the U.S. Securities and Exchange Commission’s website at sec.gov and reflect the most recent 12-month period ended June 30.

Quarterly Statement of Investments

The Trust files a complete statement of investments with the U.S. Securities and Exchange Commission for the first and third quarters for each fiscal year on Form N-Q. Shareholders may view the filed Form N-Q by visiting the Commission’s website at sec.gov. The filed form may also be viewed and copied at the Commission’s Public Reference Room in Washington, DC. Information regarding the operations of the Public Reference Room may be obtained by calling (800) SEC-0330.

Semiannual Report | 29

This page intentionally left blank.

Item 2. Code of Ethics.

(a) The Registrant has adopted a code of ethics that applies to its principal executive officers and principal financial and accounting officer.

| (c) | N/A |

| (d) | N/A |

| (f) | Pursuant to Item 12(a)(1), the Registrant is attaching as an |

exhibit a copy of its code of ethics that applies to its principal executive officers and principal financial and accounting officer.

Item 3. Audit Committee Financial Expert.

(a)(1) The Registrant has an audit committee financial expert serving on its audit committee.

(2) The audit committee financial expert is John B. Wilson, and he is “independent” as defined under the relevant Securities and Exchange Commission Rules and Releases.

Item 4. Principal Accountant Fees and Services. N/A

Item 5. Audit Committee of Listed Registrants. N/A

Item 6. Schedule of Investments. N/A

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies. N/A

Item 8. Portfolio Managers of Closed-End Management Investment Companies. N/A

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers. N/A

Item 10. Submission of Matters to a Vote of Security Holders.

There have been no changes to the procedures by which shareholders may recommend nominees to the Registrant's Board of Trustees that would require disclosure herein.

Item 11. Controls and Procedures.

(a) Evaluation of Disclosure Controls and Procedures. The Registrant maintains disclosure controls and procedures that are designed to ensure that information required to be disclosed in the Registrant’s filings under the Securities Exchange Act of 1934 and the Investment Company Act of 1940 is recorded, processed, summarized and reported within the periods specified in the rules and forms of the Securities and Exchange Commission. Such information is accumulated and communicated to the Registrant’s management, including its principal executive officer and principal financial officer, as appropriate, to allow timely decisions regarding required disclosure. The Registrant’s management, including the principal executive officer and the principal financial officer, recognizes that any set of controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving the desired control objectives.

Within 90 days prior to the filing date of this Shareholder Report on Form N-CSR, the Registrant had carried out an evaluation, under the supervision and with the participation of the Registrant’s management, including the Registrant’s principal executive officer and the Registrant’s principal financial officer, of the effectiveness of the design and operation of the Registrant’s disclosure controls and procedures. Based on such evaluation, the Registrant’s principal executive officer and principal financial officer concluded that the Registrant’s disclosure controls and procedures are effective.

(b) Changes in Internal Controls. There have been no significant changes in the Registrant’s internal controls or in other factors that could significantly affect the internal controls subsequent to the date of their evaluation in connection with the preparation of this Shareholder Report on Form N-CSR.

Item 12. Exhibits.

(a)(1) Code of Ethics

(a)(2) Certifications pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 of Laura F. Fergerson, Chief Executive Officer - Finance and Administration, and Gaston Gardey, Chief Financial Officer and Chief Accounting Officer

(b) Certifications pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 of Laura F. Fergerson, Chief Executive Officer - Finance and Administration, and Gaston Gardey, Chief Financial Officer and Chief Accounting Officer

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

FRANKLIN MONEY FUND

By /s/LAURA F. FERGERSON

Laura F. Fergerson

Chief Executive Officer - Finance and Administration

Date February 24 2012

Pursuant to the requirements of the Securities Exchange Act of 1934 and

the Investment Company Act of 1940, this report has been signed below

by the following persons on behalf of the registrant and in the

capacities and on the dates indicated.

By /s/LAURA F. FERGERSON

Laura F. Fergerson

Chief Executive Officer - Finance and Administration

Date February 24 2012

By /s/GASTON GARDEY

Gaston Gardey

Chief Financial Officer and Chief Accounting Officer

Date February 24 2012