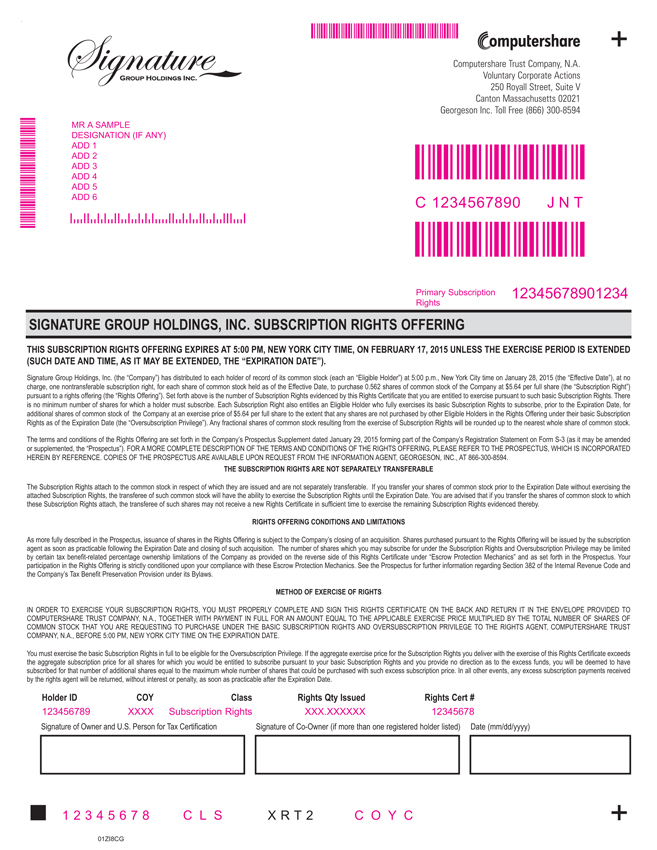

Exhibit 4.1

Computershare Trust Company, N.A. Voluntary Corporate Actions 250 Royall Street, Suite V

Canton Massachusetts 02021 Georgeson Inc. Toll Free (866) 300-8594

MR A SAMPLE DESIGNATION (IF ANY) ADD 1 ADD 2 ADD 3

ADD 4 NNNNNN

ADD 5

NNNNNNNNN ADD 6 C 1234567890 J N T

NNNNNN

Primary Subscription 12345678901234 Rights

SIGNATURE GROUP HOLDINGS, INC. SUBSCRIPTION RIGHTS OFFERING

THIS SUBSCRIPTION RIGHTS OFFERING EXPIRES AT 5:00 PM, NEW YORK CITY TIME, ON FEBRUARY 17, 2015 UNLESS THE EXERCISE PERIOD IS EXTENDED (SUCH DATE AND TIME, AS IT MAY BE EXTENDED, THE “EXPIRATION DATE”).

Signature Group Holdings, Inc. (the “Company”) has distributed to each holder of record of its common stock (each an “Eligible Holder”) at 5:00 p.m., New York City time on January 28, 2015 (the “Effective Date”), at no charge, one nontransferable subscription right, for each share of common stock held as of the Effective Date, to purchase 0.562 shares of common stock of the Company at $5.64 per full share (the “Subscription Right”) pursuant to a rights offering (the “Rights Offering”). Set forth above is the number of Subscription Rights evidenced by this Rights Certificate that you are entitled to exercise pursuant to such basic Subscription Rights. There is no minimum number of shares for which a holder must subscribe. Each Subscription Right also entitles an Eligible Holder who fully exercises its basic Subscription Rights to subscribe, prior to the Expiration Date, for additional shares of common stock of the Company at an exercise price of $5.64 per full share to the extent that any shares are not purchased by other Eligible Holders in the Rights Offering under their basic Subscription Rights as of the Expiration Date (the “Oversubscription Privilege”). Any fractional shares of common stock resulting from the exercise of Subscription Rights will be rounded up to the nearest whole share of common stock.

The terms and conditions of the Rights Offering are set forth in the Company’s Prospectus Supplement dated January 29, 2015 forming part of the Company’s Registration Statement on Form S-3 (as it may be amended or supplemented, the “Prospectus”). FOR A MORE COMPLETE DESCRIPTION OF THE TERMS AND CONDITIONS OF THE RIGHTS OFFERING, PLEASE REFER TO THE PROSPECTUS, WHICH IS INCORPORATED HEREIN BY REFERENCE. COPIES OF THE PROSPECTUS ARE AVAILABLE UPON REQUEST FROM THE INFORMATION AGENT, GEORGESON, INC., AT 866-300-8594.

THE SUBSCRIPTION RIGHTS ARE NOT SEPARATELY TRANSFERABLE

The Subscription Rights attach to the common stock in respect of which they are issued and are not separately transferable. If you transfer your shares of common stock prior to the Expiration Date without exercising the attached Subscription Rights, the transferee of such common stock will have the ability to exercise the Subscription Rights until the Expiration Date. You are advised that if you transfer the shares of common stock to which these Subscription Rights attach, the transferee of such shares may not receive a new Rights Certificate in sufficient time to exercise the remaining Subscription Rights evidenced thereby.

RIGHTS OFFERING CONDITIONS AND LIMITATIONS

As more fully described in the Prospectus, issuance of shares in the Rights Offering is subject to the Company’s closing of an acquisition. Shares purchased pursuant to the Rights Offering will be issued by the subscription agent as soon as practicable following the Expiration Date and closing of such acquisition. The number of shares which you may subscribe for under the Subscription Rights and Oversubscription Privilege may be limited by certain tax benefit-related percentage ownership limitations of the Company as provided on the reverse side of this Rights Certificate under “Escrow Protection Mechanics” and as set forth in the Prospectus. Your participation in the Rights Offering is strictly conditioned upon your compliance with these Escrow Protection Mechanics. See the Prospectus for further information regarding Section 382 of the Internal Revenue Code and the Company’s Tax Benefit Preservation Provision under its Bylaws.

METHOD OF EXERCISE OF RIGHTS

IN ORDER TO EXERCISE YOUR SUBSCRIPTION RIGHTS, YOU MUST PROPERLY COMPLETE AND SIGN THIS RIGHTS CERTIFICATE ON THE BACK AND RETURN IT IN THE ENVELOPE PROVIDED TO COMPUTERSHARE TRUST COMPANY, N.A., TOGETHER WITH PAYMENT IN FULL FOR AN AMOUNT EQUAL TO THE APPLICABLE EXERCISE

PRICE MULTIPLIED BY THE TOTAL NUMBER OF SHARES OF COMMON STOCK THAT YOU ARE REQUESTING TO PURCHASE UNDER THE BASIC SUBSCRIPTION RIGHTS AND OVERSUBSCRIPTION PRIVILEGE TO THE RIGHTS AGENT, COMPUTERSHARE TRUST COMPANY, N.A., BEFORE 5:00 PM, NEW YORK CITY TIME ON THE EXPIRATION DATE.

You must exercise the basic Subscription Rights in full to be eligible for the Oversubscription Privilege. If the aggregate exercise price for the Subscription Rights you deliver with the exercise of this Rights Certificate exceeds the aggregate subscription price for all shares for which you would be entitled to subscribe pursuant to your basic Subscription Rights and you provide no direction as to the excess funds, you will be deemed to have subscribed for that number of additional shares equal to the maximum whole number of shares that could be purchased with such excess subscription price. In all other events, any excess subscription payments received by the rights agent will be returned, without interest or penalty, as soon as practicable after the Expiration Date.

Holder ID COY Class Rights Qty Issued Rights Cert #

123456789 XXXX Subscription Rights XXX.XXXXXX 12345678

Signature of Owner and U.S. Person for Tax Certification Signature of Co-Owner (if more than one registered holder listed) Date (mm/dd/yyyy)

12345678 CLS XR T2 COYC

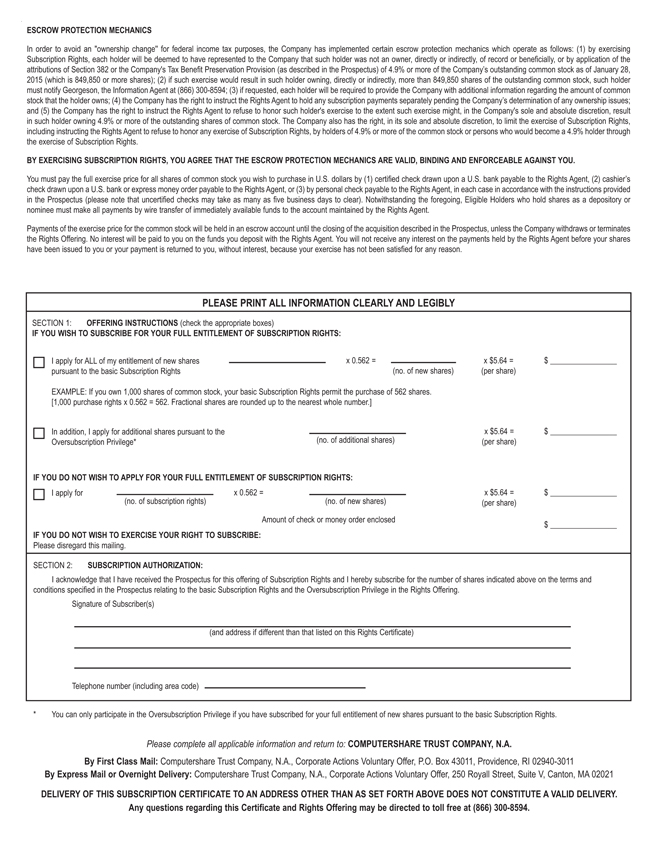

ESCROW PROTECTION MECHANICS

In order to avoid an “ownership change’’ for federal income tax purposes, the Company has implemented certain escrow protection mechanics which operate as follows: (1) by Subscription Rights, each holder will be deemed to have represented to the Company that such holder was not an owner, directly or indirectly, of record or beneficially, or by application of attributions of Section 382 or the Company’s Tax Benefit Preservation Provision (as described in the Prospectus) of 4.9% or more of the Company’s outstanding common stock as of January 2015 (which is 849,850 or more shares); (2) if such exercise would result in such holder owning, directly or indirectly, more than 849,850 shares of the outstanding common stock, such must notify Georgeson, the Information Agent at (866) 300-8594; (3) if requested, each holder will be required to provide the Company with additional information regarding the amount of stock that the holder owns; (4) the Company has the right to instruct the Rights Agent to hold any subscription payments separately pending the Company’s determination of any ownership and (5) the Company has the right to instruct the Rights Agent to refuse to honor such holder’s exercise to the extent such exercise might, in the Company’s sole and absolute discretion, in such holder owning 4.9% or more of the outstanding shares of common stock. The Company also has the right, in its sole and absolute discretion, to limit the exercise of Subscription including instructing the Rights Agent to refuse to honor any exercise of Subscription Rights, by holders of 4.9% or more of the common stock or persons who would become a 4.9% holder the exercise of Subscription Rights.

BY EXERCISING SUBSCRIPTION RIGHTS, YOU AGREE THAT THE ESCROW PROTECTION MECHANICS ARE VALID, BINDING AND ENFORCEABLE AGAINST YOU.

You must pay the full exercise price for all shares of common stock you wish to purchase in U.S. dollars by (1) certified check drawn upon a U.S. bank payable to the Rights Agent, (2) check drawn upon a U.S. bank or express money order payable to the Rights Agent, or (3) by personal check payable to the Rights Agent, in each case in accordance with the instructions in the Prospectus (please note that uncertified checks may take as many as five business days to clear). Notwithstanding the foregoing, Eligible Holders who hold shares as a depository nominee must make all payments by wire transfer of immediately available funds to the account maintained by the Rights Agent.

Payments of the exercise price for the common stock will be held in an escrow account until the closing of the acquisition described in the Prospectus, unless the Company withdraws or the Rights Offering. No interest will be paid to you on the funds you deposit with the Rights Agent. You will not receive any interest on the payments held by the Rights Agent before your have been issued to you or your payment is returned to you, without interest, because your exercise has not been satisfied for any reason.

PLEASE PRINT ALL INFORMATION CLEARLY AND LEGIBLY

SECTION 1: OFFERING INSTRUCTIONS (check the appropriate boxes)

IF YOU WISH TO SUBSCRIBE FOR YOUR FULL ENTITLEMENT OF SUBSCRIPTION RIGHTS:

I apply for ALL of my entitlement of new shares x 0.562 = x $5.64 = $ pursuant to the basic Subscription Rights (no. of new shares) (per share)

EXAMPLE: If you own 1,000 shares of common stock, your basic Subscription Rights permit the purchase of 562 shares. [1,000 purchase rights x 0.562 = 562. Fractional shares are rounded up to the nearest whole number.]

In addition, I apply for additional shares pursuant to the x $5.64 = $ Oversubscription Privilege* (no. of additional shares) (per share)

IF YOU DO NOT WISH TO APPLY FOR YOUR FULL ENTITLEMENT OF SUBSCRIPTION RIGHTS:

I apply for x 0.562 = x $5.64 = $ (no. of subscription rights) (no. of new shares) (per share)

Amount of check or money order enclosed $

IF YOU DO NOT WISH TO EXERCISE YOUR RIGHT TO SUBSCRIBE:

Please disregard this mailing.

SECTION 2: SUBSCRIPTION AUTHORIZATION:

I acknowledge that I have received the Prospectus for this offering of Subscription Rights and I hereby subscribe for the number of shares indicated above on the terms and conditions specified in the Prospectus relating to the basic Subscription Rights and the Oversubscription Privilege in the Rights Offering.

Signature of Subscriber(s)

(and address if different than that listed on this Rights Certificate)

Telephone number (including area code)

* You can only participate in the Oversubscription Privilege if you have subscribed for your full entitlement of new shares pursuant to the basic Subscription Rights.

Please complete all applicable information and return to: COMPUTERSHARE TRUST COMPANY, N.A.

By First Class Mail: Computershare Trust Company, N.A., Corporate Actions Voluntary Offer, P.O. Box 43011, Providence, RI 02940-3011

By Express Mail or Overnight Delivery: Computershare Trust Company, N.A., Corporate Actions Voluntary Offer, 250 Royall Street, Suite V, Canton, MA 02021

DELIVERY OF THIS SUBSCRIPTION CERTIFICATE TO AN ADDRESS OTHER THAN AS SET FORTH ABOVE DOES NOT CONSTITUTE A VALID DELIVERY. Any questions regarding this Certificate and Rights Offering may be directed to toll free at (866) 300-8594.