UNITED STATES

SECURITIES & EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

Proxy Statement pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. ____)

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Under Rule 14a -12 |

FROZEN FOOD EXPRESS INDUSTRIES, INC.

(Name of Registrant as Specified in Its Charter)

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| ý | No fee required |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| | | |

| ¨ | Fee paid previously with preliminary materials. |

| | |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | |

| | (1) | Amount Previously Paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | (3) | Filing Party: |

| | | |

| | (4) | Date Filed: |

| | | |

FROZEN FOOD EXPRESS INDUSTRIES, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held May 5, 2005

TO THE SHAREHOLDERS OF

FROZEN FOOD EXPRESS INDUSTRIES, INC.:

Notice is hereby given that the Annual Meeting of Shareholders (the "Annual Meeting") of Frozen Food Express Industries, Inc. (the "Company"), a Texas corporation, will be held on Thursday, May 5, 2005, at 3:30 p.m., Dallas, Texas time, at The City Club, 901 Main Street, 69th Floor, Dallas, Texas 75202 for the following purposes:

| 1. | To elect two Class I directors for a three-year term, or until their respective successors are elected and qualified; |

| 2. | Considering and voting upon approval of the 2005 Non-Employee Director Restricted Stock Plan; |

| 3. | Considering and voting upon approval of the 2005 Executive Bonus and Restricted Stock Plan; |

| 4. | Considering and voting upon approval of the 2005 Stock Incentive Plan; |

| 5. | Transacting such other business as may properly be brought before the Annual Meeting or any adjournment thereof. |

You are encouraged to attend the Annual Meeting in person. Directions to the Annual Meeting are printed on the outside back cover of this Proxy Statement. Whether or not you plan to attend the Annual Meeting, please complete, date, sign and return the accompanying proxy at your earliest convenience. A reply envelope is provided for this purpose, which needs no postage if mailed in the United States. Your immediate attention is requested in order to save your Company additional solicitation expense.

Information regarding the matters to be acted upon at the Annual Meeting is contained in the Proxy Statement attached to this Notice.

Only shareholders of record at the close of business on March 24, 2005 (the “Record Date”) are entitled to notice of and to vote at the Annual Meeting or any adjournment thereof.

| | By Order of the Board of Directors |

| | |

| | /s/ Leonard W. Bartholomew |

| Dallas, Texas | LEONARD W. BARTHOLOMEW |

| April 8, 2005 | Secretary |

| | Page |

| 1 |

| 1 |

| 1 |

| 2 |

| 2 |

| 2 |

| 2 |

| 3 |

| 7 |

| 7 |

| 10 |

| 13 |

| 17 |

| 17 |

| 18 |

| 19 |

| 20 |

| 21 |

| 24 |

| 25 |

| 27 |

| 27 |

| A-1 |

| B-1 |

| C-1 |

| |

FROZEN FOOD EXPRESS INDUSTRIES, INC.

1145 Empire Central Place

Dallas, Texas 75247

Telephone: (214) 630-8090

PROXY STATEMENT FOR ANNUAL MEETING OF

SHAREHOLDERS TO BE HELD May 5, 2005

The accompanying proxy is solicited by the Board of Directors (the "Board") of Frozen Food Express Industries, Inc. (the "Company") for use at the Annual Meeting of Shareholders to be held at The City Club, 901 Main Street, 69th Floor, Dallas, Texas 75202, on the 5th day of May, 2005 at 3:30 p.m., Dallas, Texas time(the "Annual Meeting"), and at any adjournment thereof, for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders. Directions to the Annual Meeting are printed on the outside back cover of this Proxy. This Proxy Statement and accompanying proxy are being mailed or delivered to shareholders on or about April 8, 2005. Solicitations of proxies may be made by personal interview, mail, telephone, facsimile, electronic mail or telegram by directors, officers and regular employees of the Company. The Company may also request banking institutions, brokerage firms, custodians, trustees, nominees and fiduciaries to forward solicitation material to the beneficial owners of the Company's $1.50 par value Common Stock (the "Common Stock") held of record by such persons and may reimburse such forwarding expenses. All costs of preparing, printing, assembling and mailing the form of proxy and the material used in the solicitation thereof and all clerical and other expenses of solicitation will be borne by the Company.

The principal executive offices of the Company are located at 1145 Empire Central Place, Dallas, Texas 75247.

The Company's Annual Report on Form 10-K covering the fiscal year ended December 31, 2004, including audited financial statements (the "Annual Report"), is also being mailed to the shareholders entitled to notice of and vote at the Annual Meeting in the envelope containing this Proxy Statement. The Annual Report does not form any part of the material for solicitation of proxies.

If a shareholder is a corporation, the accompanying proxy should be signed in its full corporate name by the President or another authorized officer, who should indicate his title. If a shareholder is a partnership, the proxy should be signed in the partnership name by an authorized person. If stock is registered in the name of two or more trustees or other persons, the proxy should be signed by each of them. If stock is registered in the name of a decedent, the proxy should be signed by an executor or an administrator. The executor or administrator should attach to the proxy appropriate instruments showing his or her qualification and authority. Proxies signed by a person as agent, attorney, administrator, executor, guardian or trustee should indicate such person's full title following his or her signature.

All shares represented by a valid proxy will be voted. A proxy may be revoked at any time before it is voted by the giving of written notice to that effect to the Secretary of the Company, by executing and delivering a later-dated proxy to the Secretary of the Company or by attending the Annual Meeting and voting in person. New proxies or revocations should be submitted to the Secretary of the Company at 1145 Empire Central Place, Dallas, Texas 75247.

The presence, in person or by proxy, of the holders of a majority of the outstanding shares of Common Stock entitled to vote is necessary to constitute a quorum at the Annual Meeting. Abstentions and broker non-votes will be counted in determining the presence of a quorum. A "broker non-vote" occurs when a nominee holding shares for a beneficial owner has voted on certain matters at the Annual Meeting pursuant to discretionary authority or instructions from the beneficial owner but may not have received instructions or exercised discretionary voting power with respect to other matters.

Each shareholder will be entitled to one vote, in person or by proxy, for each share of Common Stock owned of record at the close of business on March 24, 2005 (the "Record Date"). A shareholder may, by checking the appropriate box on the proxy: (i) vote "FOR" all director nominees as a group; (ii) withhold authority to vote "FOR" all director nominees as a group; or (iii) vote "FOR" all director nominees as a group except those nominees identified by the shareholder in the appropriate area. With respect to the other proposals, a shareholder may, by checking the appropriate box on the proxy; (a) vote “FOR” the proposal; (b) vote “AGAINST” the proposal; or (c) “ABSTAIN” from voting on the proposal. Cumulative voting is not permitted.

The accompanying proxy, if properly executed and returned, will be voted, unless otherwise specified thereon, (i) FOR the election of the two nominees named under "Nominees for Directors" below, (ii) FOR the approval of the 2005 Non-Employee Director Restricted Stock Plan, (iii) FOR the approval of the 2005 Executive Bonus and Restricted Stock Plan, (iv) FOR the approval of the 2005 Stock Incentive Plan and(v)in the transaction of such other business as may properly come before the Annual Meeting or any adjournment thereof in accordance with the judgment of the proxies. The Board of the Company does not know of any such other matters or business. Should any nominee named herein for the office of director become unable or be unwilling to accept nomination for or election to such position, the persons acting under the proxy will vote for the election, in his stead, of such other persons as the Board of the Company may recommend. The Board of the Company has no reason to believe that any of the nominees will be unable or unwilling to serve if elected to office. To be elected, each director must receive the affirmative vote of the holders of a plurality of the issued and outstanding shares of Common stock represented in person or by proxy at the Annual Meeting. Approvals of Proposals Two, Three and Four will require the affirmative vote of the holders of a majority of the shares represented in person or by proxy at the Annual Meeting. Abstentions and broker non-votes will have no affect in the election of directors. Broker non-votes will have no affect on proposals Two, Three and Four, and abstentions will have the same affect as a vote against proposals Two, Three and Four.

At the close of business on the Record Date, there were outstanding and entitled to be voted 17,876,874 shares of Common Stock. The following table sets forth certain information, as of the Record Date, with respect to each person known to the management of the Company to be a beneficial owner of more than five percent of the outstanding Common Stock. For information relating to the beneficial ownership of the Company's Common Stock by(a) each director and director nominee who is a stockholder of the Company; (b) each of the named executive officers who is a stockholder of the Company; and (c) all executive officers and Directors of the Company as a group, see "Nominees for Directors" contained herein.

Name and Address Of Beneficial Owner | | Amount and Nature of Beneficial Ownership(1) | | Percent of Class | |

| | | | | | |

| Frozen Food Express Industries, Inc. | | | 2,902,042 | | | 16.23 | % |

401(k) Savings Plan | | | | | | | |

ABN AMRO Trust Services Company | | | | | | | |

161 N Clark Street, 10th Floor | | | | | | | |

Chicago, IL 60601 | | | | | | | |

Stoney M. Stubbs, Jr.(2) | | | 1,633,524(3) | | | 8.85 | % |

158 Jellico Circle | | | | | | | |

Southlake, TX 76092 | | | | | | | |

Sarah M. Daniel(4) | | | 1,435,138 | | | 8.03 | % |

612 Linda | | | | | | | |

El Paso, TX 79922 | | | | | | | |

Lucile B. Fielder(4) | | | 1,324,972 | | | 7.41 | % |

104 South Commerce St. | | | | | | | |

Lockhart, TX 78644 | | | | | | | |

| Dimensional Fund Advisors, Inc. | | | 1,344,354(5) | ) | | 7.52 | % |

1299 Ocean Avenue, 11th Floor | | | | | | | |

Santa Monica, CA 90401 | | | | | | | |

________________________________

| (1) | Except as otherwise noted, each beneficial owner has sole voting and investment power with respect to all shares owned by him or her, and all shares are directly held by the person named. |

| (2) | Mr. Stubbs holds, and has held for the past twenty-five years, the offices of Chairman of the Board, President and Chief Executive Officer of the Company and FFE Transportation Services, Inc. (“FFE”). |

| (3) | Includes 576,326 shares issuable pursuant to options exercisable by Mr. Stubbs within 60 days, 209,058 shares allocated to his account in the Frozen Food Express Industries, Inc. 401(k) Savings Plan, 24,746 shares allocated to his account in the FFE Transportation Services, Inc. 401(k) Wrap Plan, and 578,925 shares held in family partnerships controlled by Mr. Stubbs. |

| (4) | Ms. Daniel has sole voting and dispositive power over 66,714 shares, joint voiting and dispositive power with her husband over 45,092 shares, and shared voitng and dispositive power with Ms. Fielder over 1,323,332 shares owned by Weller Investment, Ltd. Ms. Fielder has sole voting and dispositive power over 1,640 shares and shared voting and dispositive power with Ms. Daniel over 1,323,332 shares owned by Weller Investment Ltd. |

| (5) | Information concerning the number of shares owned by Dimensional Fund Advisors, Inc. is as of December 31, 2004 and was obtained from a Schedule 13G/A dated February 9, 2005. |

The Company is committed to having sound corporate governance principles. Having such principles is essential to running the Company’s business efficiently and maintaining integrity in the marketplace. The Company’s Code of Business Conduct and Ethics is available on the Internet website athttp://www.ffex.net under the “corporate governance” link.

Board Independence

The Company’s Board has determined that each of our five non-employee directors has no material relationship with the Company (either directly or as a partner, shareholder or officer of an organization that has a relationship with the Company) and is independent within the meaning of Nasdaq Stock Market, Inc. (“Nasdaq”) director independence standards. Such directors are hereinafter referred to as “Independent Directors” and are identified in the table set forth below.

Board Structure and Committee Composition

Our Board has five Independent Directors, an Audit Committee and a Compensation Committee. The membership during 2004 and the function of each of the committees are described below. During 2004, the Board held fivemeetings. Each director attended at least 92% of all Board and applicable committee meetings.

Name of Independent Director | Audit | Compensation |

| | | |

| Jerry T. Armstrong | X | |

| W. Mike Baggett | X | X |

| Brian R. Blackmarr | | Chair |

| Leroy Hallman | Chair | X |

| T. Michael O’Connor | X | |

| Number of Meetings in Fiscal 2004 | 8 | 2 |

| | | |

| X = Committee member | | |

Consideration of Director Nominees

Each Independent Director has the responsibility to periodically assess, develop and communicate with the full Board concerning the appropriate criteria for nominating and appointing directors, including the Board’s size and composition, applicable listing standards and laws, individual director performance, expertise, experience, willingness to serve actively, number of other public and private company boards on which a director candidate serves, consideration of director nominees timely proposed by shareholders in accordance with the Bylaws and other appropriate factors. Other specific duties and responsibilities of the Independent Directors as a group include but are not limited to: recommending to the Board the individuals to be nominated for election as directors at each annual meeting of shareholders, identifying and recommending to the Board the appointees to be selected by the Board for service on the committees of the Board, retaining and terminating any search firm used to identify director candidates, overseeing an annual review of the performance of the full Board and performing any other activities the Board considers appropriate.

Procedures for Nominations by Shareholders

The Company does not have a standing nominating committee or a committee performing similar functions. The Board believes that it is appropriate for the Company not to have such a committee because director nominees have historically been selected by the Board, a majority of which are considered independent under Nasdaq director independence standards. In accordance with Nasdaq Stock Market Marketplace Rules, a majority of the Company's Independent Directors will recommend director nominees for the Board's consideration. Because the Company does not maintain a standing nominating committee, there exists no written committee charter; however, the Company has adopted the nomination policy described in this section by Board resolution.

The Independent Directors have adopted policies concerning the process for the consideration of director candidates by shareholders. The Independent Directors will consider director candidates submitted by shareholders of the Company. Any shareholder wishing to submit a candidate for consideration should send the following information to the Secretary of the Company, Frozen Food Express Industries, Inc., 1145 Empire Central Place, Dallas, Texas 75247:

| · | The name and address of the shareholder submitting the candidate as it appears on the Company’s books and records; the number and class of shares owned beneficially and of record by such shareholder and the length of period held; and proof of ownership of such shares; |

| · | Name, age and address of the candidate; |

| · | A detailed resume describing, among other things, the candidate’s educational background, occupation, employment history, and material outside commitments (e.g., memberships on other boards and committees, charitable foundations, etc.); |

| · | Any information relating to such candidate that is required to be disclosed in solicitations of proxies for election of directors in an election contest, or is otherwise required, in each case pursuant to the Securities Exchange Act of 1934, as amended (the "Exchange Act") and rules adopted thereunder; |

| · | A description of any arrangements or understandings between the recommending shareholder and such candidate; |

| · | A supporting statement which describes the candidate’s reasons for seeking election to the Board, and documents his or her ability to satisfy the director qualifications; and |

| · | A signed statement from the candidate, confirming his or her willingness to serve on the Board. |

The Secretary will promptly forward such materials to the Independent Directors. The Secretary will also maintain copies of such materials for future reference by the Independent Directors when filling Board positions.

If a vacancy arises or the Board decides to expand its membership, the Independent Directors will seek recommendations of potential candidates from a variety of sources (which may include incumbent directors, shareholders, the Company’s management and third-party consultants). At that time, the Independent Directors also will consider potential candidates submitted by shareholders in accordance with the procedures described above. The Independent Directors will then evaluate each potential candidate’s educational background, employment history, outside commitments and other relevant factors to determine whether he or she is potentially qualified to serve on the Board. The Independent Directors seek to identify and recruit the best available candidates, and intend to evaluate qualified shareholder candidates on the same basis as those submitted by other sources.

After completing this process, the Independent Directors will determine whether one or more candidates are sufficiently qualified to warrant further investigation. If the process yields one or more desirable candidates, the Independent Directors will rank them by order of preference, depending on their respective qualifications and the Company’s needs. The Independent Directors will then contact the desired candidate(s) to evaluate their potential interest and to set up interviews with the Independent Directors. All such interviews will be held in person, and include only the candidate and the Independent Directors. Based upon interview results, the candidate’s qualifications and appropriate background checks, the Independent Directors will then decide whether they will recommend the candidate’s nomination to the full Board.

Shareholder Communications With the Board

The Board has adopted the following procedures for shareholders to send communications to the Board or individual directors of the Company:

Shareholders seeking to communicate with the Board of Directors should submit their written comments to the Secretary of the Company, Frozen Food Express Industries, Inc., 1145 Empire Central Place, Dallas, Texas 75247. The Secretary of the Company will forward all such communications (excluding routine advertisements and business solicitations and communications which the Secretary of the Company, in his or her discretion, deems to be a security risk or for harassment purposes) to each member of the Board, or if applicable, to the individual director(s) named in the correspondence. Subject to the following, the Chairman of the Board and the Independent Directors will receive copies of all shareholder communications, including those addressed to individual directors, unless such communications address allegations of misconduct or mismanagement on the part of the Chairman. In such an event, the Secretary of the Company will first consult with and receive the approval of the Independent Directors before disclosing or otherwise discussing the communication with the Chairman.

The Company reserves the right to screen materials sent to its directors for potential security risks and/or harassment purposes, and the Company also reserves the right to verify ownership status before forwarding shareholder communications to the Board.

The Secretary of the Company will determine the appropriate timing for forwarding shareholder communications to the directors. The Secretary will consider each communication to determine whether it should be forwarded promptly or compiled and sent with other communications and other Board materials in advance of the next scheduled Board meeting.

Shareholders also have an opportunity to communicate with the Board at the Company’s annual meetings of shareholders. Absent unusual circumstances, directors are expected to attend all annual meetings of shareholders. All directors attended the 2004 Annual Meeting of Shareholders.

Audit Committee

The Audit Committee was established in accordance with the Exchange Act. The Board has concluded that the Audit Committee is comprised only of Independent Directors who satisfy the Nasdaq listing standards financial literacy requirements and that Mr. Armstrong is the "audit committee financial expert" within the meaning of the Securities and Exchange Commission rules. The Audit Committee assists the Board in fulfilling its responsibilities for general oversight of the integrity of the Company’s financial statements, the qualifications of the Company’s Independent Registered Public Accounting Firm, the Company’s compliance with legal and regulatory requirements and the Company’s internal audit function and internal controls over financial reporting. The Audit Committee works closely with management as well as the Company’s Independent Registered Public Accounting Firm.

The report of the Audit Committee is included herein on page 24 of this proxy.

Compensation Committee

The Compensation Committee issues a report annually on executive compensation for inclusion in the proxy statement and provides a general overview of the Company’s compensation structure, including the Company’s equity compensation and certain employee benefit plans. Other specific duties and responsibilities include reviewing and approving objectives relevant to executive officer compensation, evaluating performance and determining the compensation of each executive officer in accordance with those objectives, approving and amending the Company’s incentive compensation and stock option program and recommending compensation arrangements for the directors. The current report of the Compensation Committee is included herein on page 13 of this proxy.

On May 12, 2004, upon the recommendation of the Compensation Committee following its review of twelve publicly traded peer companies and other consideration, the Board approved an increase in non-employee director’s compensation. For each Board meeting personally attended the fee was increased from $1,000 to $2,000 and each committee meeting personallyattended which is not on the same day as a Board meeting was increased from $500 to $1,000. An annual retainer of $3,000 for the Audit Committee Chairman, $1,500 for the Audit Committee Financial Expert and $1,500 for the Compensation Committee Chairman were initiated as a result of the review.

The 1995 Non-Employee Director Stock Option Plan (the "Director Plan") is intended to advance the interests of the Company and its shareholders by attracting and retaining experienced and able Independent Directors. Upon a non-employee director’s initial appointment or election to the Board, he or she is granted an option to purchase 9,375 shares of Common Stock. Reelected and continuing non-employee directors are granted an option to purchase 1,875 shares of Common Stock on the day of the annual shareholders meeting.

If an Independent Director has served for one or more years prior to the grant of an option, the option is immediately exercisable for one-seventh of the number of shares subject to the option for each full year such non-employee director has served. On each anniversary thereafter, one-seventh of the number of shares subject to the option become exercisable. Options expire if not exercised before the tenth anniversary of grant. Upon death, options become fully exercisable and may be exercised by the beneficiary under the option holder's will or the executor of such option holder's estate at any time prior to the second anniversary of his or her death. If an option holder ceases to be a director for any other reason, the vested options may be exercised at any time prior to the second anniversary of the date he or she ceases to be a director. In no event, however, shall the period during which options may be exercised extend beyond the tenth anniversary of an option’s grant. No shares from the exercise of the options may be sold by a director until the expiration of six months after the date of grant.

Per-share stock option exercise prices are the greater of $1.50 or fifty percent (50%) of the fair market value of the Common Stock at the close of business on the day prior to the date of a stock option’s grant. The exercise price may be paid in cash, check or shares of the Company's Common Stock. No option may be granted pursuant to the Director Plan after March 3, 2005. Grants are subject to adjustments to reflect certain changes in capitalization.

On April 29, 2004 each Independent Director was granted an option to purchase 1,875 shares with an exercise price of $3.59 per share.

(Proposal No. 1)

The Company’s Board of Directors currently consists of eight members and is divided into three classes. Each year, the directors in one of the three classes are elected to serve for a three-year term. At the 2005 Annual Meeting, two incumbent Class I directors are nominated for election to serve until the year 2008 Annual Meeting of Shareholders or until their successors are elected and qualified. Three Class II and three Class III incumbent directors will not be elected this year, because their current three-year terms do not expire until 2006 or beyond.

If you sign your proxy or voting instruction card but do not give instructions with respect to the voting of directors, your shares will be voted "For" the two persons recommended by the Board. If you wish to give specific instructions with respect to the voting of directors, you may do so by indicating your instructions on your proxy or voting instruction card.

If any nominee is unable or unwilling to accept nomination, the persons acting under the proxy will vote for the election, in his stead, of such other person as the Board of the Company may recommend. The Board of the Company has no reason to believe that either of the nominees will be unable or unwilling to serve if elected to office. To be elected, each directormust receive the affirmative vote of the holders of a plurality of the issued and outstanding shares of Common Stock represented in person or by proxy and voting at the Annual Meeting. Abstentions and broker non-votes will have no effect on the election of directors.

The Company’s Bylaws, as amended, provide that the Board of Directors shall consist of nine directors. Presently, there are eight directors. Management is attempting to identify a qualified candidate to fill the vacancy on the Board. Proxies cannot be voted for a greater number of persons than the number of nominees named.

The following table presents information regarding the name, age, occupation, term as a director of the Company and beneficial ownership of the Company’s Common Stock for each director including the two persons nominated for election to be a director at the Annual Meeting. Each director has served continuously since the date he first became a director.

Our Board recommends a vote FOR the election to the Board of both of the following nominees.

Name | Age | Principal Occupation During Past Five Years and Directorships | First Became a Director | Term Expiration Date | Class | Amount and Nature of Beneficial Ownership(1) | | Percent of Class |

| | | | | | | | | |

Nominees For Election | | | | | | | |

Jerry T. Armstrong(2) | 66 | Chairman and CEO of Wind Associates, Inc., a private investment and management company, since 1997. Mr. Armstrong has held executive positions and served on the Boards of a number of transportation companies and currently serves as a director of Landair Corporation. | 2003 | 2008 | I | 3,750(3) | | * |

| | | | | | | | | |

| Leroy Hallman | 89 | Attorney, Retired | 1975 | 2008 | I | 34,150(4) | | * |

| | | | | | | | | |

Continuing Directors | | | | | | | |

| | | | | | | | |

| Brian R. Blackmarr | 63 | CEO, RFID Systems, Inc., a software company, since June 2002, CEO, Fusion Laboratories, Inc., a software Company, from January 2001 until June 2002, and CEO, eBusLink, Inc., a technology consulting company from August 1999 until January 2001. | 1990 | 2006 | II | 33,750(4) | | * |

| | | | | | | | | |

| W. Mike Baggett | 58 | Chairman, President and CEO of Winstead Sechrest & Minick, P.C., a Dallas-based law firm, since 1992. | 1998 | 2006 | II | 18,094(6) | | * |

| | | | | | | | | |

F. Dixon McElwee, Jr.(7) | 58 | Chief Financial Officer and Senior Vice President of the Company and FFE since September 1999. | 1999 | 2006 | II | 157,404(6) | | |

| | | | | | | | | |

| T. Michael O'Connor | 50 | Partner T. J. O'Connor Cattle Co. since 1999. | 1992 | 2007 | III | 18,750(9) | | * |

| | | | | | | | | |

| Stoney M. Stubbs, Jr. | 68 | Chairman of the Board President and Chief Executive Officer of the Company and FFE since 1980. | 1977 | 2007 | III | 1,633,524(10) | | 8.85% |

| | | | | | | | | |

Charles G. Robertson (7) | 63 | Executive Vice President of the Company and Executive Vice President and Chief Operating Officer of FFE since 1987. | 1982 | 2007 | III | 839,151(11) | | 4.59% |

All directors and executive officers, as a group (8 people) | 2,738,573(12) | | 14.36% |

-----------------------------------------------------------

-----------------------------------------------------------

* less than 1%

| (1) | Except as otherwise noted, all shares are held directly, and the owner has sole voting and investment power. |

| (2) | The Board of Directors has determined that Mr. Armstrong is an “audit committee financial expert” as such term is defined by regulations promulgated by the SEC. |

| (3) | Represents 3,750 shares issuable pursuant to options exercisable by Mr. Armstrong within 60 days. |

| (4) | Includes 13,125 shares issuable pursuant to options exercisable by Mr. Hallman within 60 days and 7,475 shares held by a trust of which Mr. Hallman is the Trustee. |

| (5) | Includes 18,750 shares issuable pursuant to options exercisable by Mr. Blackmarr within 60 days. |

| (6) | Includes 16,068 shares issuable pursuant to options exercisable by Mr. Baggett within 60 days. |

| (7) | Mr. Robertson is also a director of FFE. Mr. McElwee is also a director of FFE. |

| (8) | Includes 136,725 shares issuable pursuant to options exercisable by Mr. McElwee within 60 days, 7,738 shares allocated to Mr. McElwee's account in the Frozen Food Express Industries, Inc. 401(k) Savings Plan and 12,941 shares allocated to his account in the FFE Transportation Services, Inc. 401(k) Wrap Plan. |

| (9) | Represents 18,750 shares issuable pursuant to options exercisable by Mr. O’Connor within 60 days. |

| (10) | Includes 576,326 shares issuable pursuant to options exercisable by Mr. Stubbs within 60 days, 209,058 shares allocated to his account in the Frozen Food Express Industries, Inc. 401(k) Savings Plan, 24,746 shares allocated to his account in the FFE Transportation Services, Inc. 401(k) Wrap Plan, and 578,925 shares held in family partnerships controlled by Mr. Stubbs. |

| (11) | Includes 416,653 shares issuable pursuant to options exercisable by Mr. Robertson within 60 days, 140,192 shares allocated to his account in the Frozen Food Express Industries, Inc. 401(k) Savings Plan, 19,935 shares allocated to his account in the FFE Transportation Services, Inc. 401(k) Wrap Plan, and 192,236 shares held by a family partnership controlled by Mr. Robertson. |

| (12) | Includes 1,200,147 shares issuable pursuant to options exercisable within 60 days, 356,988 shares allocated to the accounts of executive officers pursuant to the Frozen Food Express Industries, Inc. 401(k) Savings Plan, 57,622 shares allocated to the accounts of executive officers pursuant to the FFE Transportation Services, Inc, 401(k) Wrap Plan and 771,161 shares held by family partnerships controlled by directors and executive officers, and 7,475 shares held by a trust of which a director is Trustee. |

Summary Compensation Table:

Set forth below is information with respect to the compensation paid by the Company for services rendered during 2004, 2003 and 2002, to each executive officer (collectively, the “Executive Officers”):

| | | | | | | Long-term Compensation Awards | | | |

| | | | | Annual Compensation | | Restricted Stock | | Securities Underlying Options/ | | All Other | |

Name and Principal Position | | Year | | Salary | | Bonus | | Total(1) | | Awards $(2) | | SARs #(3) | | Compensation(4) | |

| Stoney M. Stubbs, Jr. | | 2004 | | $ | 349,184 | | $ | 118,470 | | $ | 467,654 | | $ | 147,085 | | | 50,000 | | $ | 358,645 | |

Chairman of the Board | | 2003 | | $ | 317,613 | | | - | | $ | 317,613 | | $ | 41,613 | | | 90,000 | | $ | 307,435 | |

President and | | 2002 | | $ | 317,613 | | | - | | $ | 317,613 | | $ | 13,283 | | | 214,027 | | $ | 22,358 | |

Chief Executive Officerof the Company and FFE | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Charles G. Robertson | | 2004 | | $ | 274,099 | | $ | 87,369 | | $ | 361,468 | | $ | 115,416 | | | 50,000 | | $ | 215,444 | |

Executive Vice President | | 2003 | | $ | 247,595 | | | - | | $ | 247,595 | | $ | 25,591 | | | 65,000 | | $ | 192,623 | |

| of the Company and | | 2002 | | $ | 247,595 | | | - | | $ | 247,595 | | $ | 16,168 | | | 147,164 | | $ | 13,217 | |

ExecutiveVice President andChief OperatingOfficer of FFE | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| F. Dixon McElwee, Jr. | | 2004 | | $ | 201,821 | | $ | 60,546 | | $ | 262,367 | | $ | 106,750 | | | 50,000 | | $ | 8,313 | |

Chief Financial Officer and | | 2003 | | $ | 184,263 | | | - | | $ | 184,263 | | $ | 24,150 | | | 40,000 | | $ | 2,534 | |

SeniorVice President of theCompany and FFE | | 2002 | | $ | 184,263 | | | - | | $ | 184,263 | | $ | 11,129 | | | 22,500 | | $ | 2,744 | |

| | | | | | | | | | | | | | | | | | | | | | | |

(1) Personal benefits provided to each of the named individuals under various company programs do not exceed the disclosure thresholds established under SEC rules and are not included in this total.

(2) Includes restricted phantom stock units awarded pursuant to the FFE Transportation Services, Inc. 2000 Executive Bonus and Phantom Stock Plan (the “Executive Plan”) or in accordance with the Company’s Supplemental Executive Retirement Plan (the “SERP”) and Common Stock issued to a trust for the benefit of participants in the FFE Transportation Services, Inc. 401(k) Wrap Plan (the “Wrap Plan”). Phantom stock units generally will be adjusted to prevent dilution in the event of any cash and non-cash dividends, recapitalizations and similar transactions affecting the Common Stock. An officer may elect to cash out any number of the phantom stock units between December 1 and December 15 of any year. In that event an amount equal to the product of the greater of (i) the fair market value of a share of Common Stock as of the last business day of the calendar year in which such election is made and (ii) the average of the fair market values of a share of Common Stock as of the last business day of each calendar month of the calendar year in which such election is made multiplied by the number of units that the officer elected to cash out shall be paid to the officer. In the event of certain mergers, the sale of all or substantially all of the Company’s assets and certain similar transactions (a “Reorganization”) within six months after the date an officer has been paid for units and as a result of such Reorganization the holders of Common Stock receive cash for each share so held in an amount in excess of the amount paid to such officer for such units, then such excess shall be paid to the officer.

The following table sets forth the total number of phantom stock units and shares of restricted Common Stock issued to a trust awarded under the Executive Plan, the SERP and the Wrap Plan for 2004, 2003 and 2002, for the benefit of each Executive Officer of the Company:

| | 2004 | 2003 | 2002 |

| Mr. Stubbs | 11,402 | 6,267 | 5,129 |

| Mr. Robertson | 8,947 | 3,854 | 6,242 |

| Mr. McElwee | 8,275 | 3,637 | 4,283 |

During 2000, a "grantor" (or "rabbi") trust was established in connection with the Wrap Plan to hold Company assets to satisfy obligations under the Plan. As of December 31, 2004, the total number of phantom stock units and shares of Restricted Common Stock allocated to the accounts of Messrs. Stubbs, Robertson, and McElwee was 122,710, 82,331 and 17,500, respectively. The total value of such accounts, based upon the market price of a share of Common Stock on December 31, 2004 was $1,582,960, $1,062,068 and $225,753, respectively, for Messrs. Stubbs, Robertson, and McElwee.

(3) Options to acquire shares of the Company’s Common Stock.

(4) Amounts shown in this column include the following benefits associated with split dollar arrangements and supplemental medical:

Split Dollar Bonus and Base Salary Increase

The Company had previously entered into Split Dollar Agreements with each of The Stubbs Irrevocable 1995 Trust and The Robertson Irrevocable 1995 Trust for the benefit of Stoney M. Stubbs, Jr. (“Stubbs”) and Charles G. Robertson (“Robertson”). Under the agreements the Company agreed to pay certain premium payments under split dollar life insurance policies, and the trusts agreed to repay such premiums to the Company on the earlier of surrender or cancellation of each policy for its cash value or upon payment of death benefits. Due to changes in the law and other pertinent factors during 2003, the Board terminated such obligation to pay premiums with respect to each policy and agreed to compensate Stubbs and Robertson for the loss by (i) paying cash bonuses to each of Stubbs and Robertson of $296,276 and $185,414, respectively, which amounts equal one-half of the total premiums still payable under each of their respective policies and (ii) increasing the base salary by $45,717 and $17,132 for Stubbs and Robertson, respectively, effective November 12, 2003 to offset adverse federal tax consequences resulting from their revised arrangements.

Split Dollar Life Valuation

The value of benefits, as determined under a methodology required by the U.S. generally accepted accounting principles, ascribed to Split Dollar life insurance policies whose premiums were paid by the Company.

Supplemental Medical Benefits

The Company maintains an Exec-U-Care Medical Reimbursement Plan which provides additional health insurance protection for certain key employees of the Company and its subsidiaries, in addition to the group health and life insurance policies provided to all employees.

| | | | | Split Dollar | | | | | |

| | | | | | | Base Salary | | | | Supplemental | | | |

| | | | | Bonus | | Increase | | Valuations | | Medical | | Total | |

| Stoney M. Stubbs, Jr. | | | 2004 | | $ | 296,276 | | $ | 45,717 | | | - | | $ | 16,652 | | $ | 358,645 | |

| | | | 2003 | | $ | 296,276 | | $ | 6,506 | | $ | 120 | | $ | 4,533 | | $ | 307,435 | |

| | | | 2002 | | | - | | | - | | $ | 19,172 | | $ | 3,186 | | $ | 22,358 | |

| | | | | | | | | | | | | | | | | | | | |

| Charles G. Robertson | | | 2004 | | $ | 185,414 | | $ | 17,132 | | | - | | $ | 12,898 | | $ | 215,444 | |

| | | | 2003 | | $ | 185,414 | | $ | 2,438 | | $ | 27 | | $ | 4,744 | | $ | 192,623 | |

| | | | 2002 | | | - | | | - | | $ | 9,949 | | $ | 3,268 | | $ | 13,217 | |

| | | | | | | | | | | | | | | | | | | | |

| F. Dixon McElwee, Jr. | | | 2004 | | | - | | | - | | | - | | $ | 8,313 | | $ | 8,313 | |

| | | | 2003 | | | - | | | - | | | - | | $ | 2,534 | | $ | 2,534 | |

| | | | 2002 | | | - | | | - | | | - | | $ | 2,744 | | $ | 2,744 | |

Option/SAR Grants in Last Fiscal Year

Following is information concerning the grant of stock options to the Executive Officers in 2004 under the Company’s option plans:

| | | | | Individual Grants | | | |

Name | | Number of Securities Underlying Options/SARs Granted(2) | | % of Total Options/SARS Granted to Employees In Fiscal Year | | Exercise or Base Price (#/Sh) | | Expiration Date | | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation For Option Term(1) | |

| | | | | | | | | | | 5% | | 10% | |

| Mr. Stubbs | | | 50,000 | | | 8.9 | % | $ | 6.71 | | | 05/12/2014 | | $ | 210,994 | | $ | 534,701 | |

| Mr. Robertson | | | 50,000 | | | 8.9 | % | $ | 6.71 | | | 05/12/2014 | | $ | 210,994 | | $ | 534,701 | |

| Mr. McElwee | | | 50,000 | | | 8.9 | % | $ | 6.71 | | | 05/12/2014 | | $ | 210,994 | | $ | 534,701 | |

| (1) | Represents assumed rates of appreciation only. Actual gains depend on the future performance of the Common Stock and overall stock market conditions. There can be no assurance that the amounts reflected in this table will be achieved. |

| (2) | All options granted were granted on May 12, 2004, under the 2002 Incentive and Nonstatutory Stock Option Plan, are exercisable one year from the date of grant, expire ten years from the date of grant, and were granted with an exercise price equal to the market price of the Common Stock on the date of grant. |

Aggregated Option/SAR Exercises in Last Fiscal Year and Fiscal Year-End Option/SAR Values

The following table provides information, with respect to each Executive Officer, concerning the exercise of options during the last fiscal year and the number of unexercised options segregated by those that were exercisable and those that were unexercisable at December 31, 2004 and the value of in-the-money options segregated by those that were exercisable and those that were unexercisable at December 31, 2004:

Name | Shares Acquired On Exercise (#) | Value Realized | Number of Securities Underlying Unexercised Options/SARs at Fiscal Year-End (#) Exercisable/Unexercisable | Value of Unexercised In-the-Money Options/SARs at Fiscal Year-end ($)(1) ($) Exercisable/Unexercisable |

| | | | | |

| Mr. Stubbs | | $ - | 526,326/50,000 | $5,503,769/$309,500 |

| Mr. Robertson | | $ - | 366,653/50,000 | $3,833,608/$309,500 |

| Mr. McElwee | | $ - | 86,725/50,000 | $ 907,880/$309,500 |

| (1) | The closing price for the Company's Common Stock as reported by Nasdaq on December 31, 2004, was $12.90. Value is calculated on the basis of the difference between $12.90 and the optionexercise price of an "in-the-money" option multiplied by the number of shares of Common Stock underlying the option. |

Change in Control Agreements

The Company has entered into Change in Control Agreements ("Agreements") with each Executive Officer, pursuant to which each Executive Officer is entitled to severance benefits in the event of a "change in control" of the Company during the term of his employment.

Under the terms of the Agreements, if an Executive Officer (i) is terminated by the Company without cause during the six month period following a change in control ("Transition Period"), (ii) resigns for "good reason" (as defined in the Agreements) during the Transition Period, or (iii) resigns for any reason during the ten day period following a change in control or during the thirty day period following the Transition Period, then the Company is required to provide the Executive Officer with certain payments and benefits. Such payments and benefits include (a) payment of accrued and unpaid base salary, car allowance, plus accrued and unpaid bonus, if any, for the prior fiscal year plus a pro-rated bonus (as defined in the Agreements) for the year during which such Executive Officer's employment is terminated; (b) payment of a lump sum amount equal to the sum of 2.9 times the Executive Officer's annual pay (as defined in the Agreement); (c) payment of the unvested account balance under the Company's 401(k) Savings Plan and 401(k) Wrap Plan; (d) continued participation, at the same premium rate charged when actively employed, in the Company's employee welfare plans, until the expiration of two years following the change in control or cash equivalent; (e) vesting of all stock options on change of control; and (f) "gross-up" payments, if applicable, in the amount necessary to satisfy any excise tax imposed on the Executive Officer by the Internal Revenue Code of 1986, as amended (the ("Code")).

This report has been prepared by Messrs. Brian R. Blackmarr, Chairman, W. Mike Baggett and Leroy Hallman, serving as the Company's Compensation Committee during 2004. Each member is an Independent Director. We are responsible for overseeing the development and administration of all compensation policies and programs for executive officers of the Company.

We seek to design compensation programs that align the interests of such officers with the Company's shareholders. We have implemented compensation programs we believe will enhance the profitability of the Company, and reward such officers for efforts to achieve enhanced profitability. We believe the compensation programs allow the Company to attract, motivate, and retain the services of its executive officers.

The executive compensation package is designed to retain senior management by providing total compensation comparable to the Company's competitors. To align the interests of the Company's executives with the interests of shareholders, a substantial portion of each executive's compensation is provided through annual and long-term incentive plans. Such plans place a substantial portion of the executives' compensation packages at risk and serve as an integral component of the Company's executive compensation philosophy. We believe the executives' attentions are better balanced between achieving short-term business goals and increasing the long-term value of the Company with a "pay-at-risk" policy. The programs reward executive officers for successful leadership when certain levels of Company performance are achieved. The Company's executive officer compensation program also provides base salary, supplemental retirement benefits and other benefits, including medical and retirement plans generally available to all Company employees.

We periodically retain the services of an outside consulting firm to review the Company's executive compensation practices. Such a review of basesalary, short-term bonus and long-term incentives was completed in February of 2004. These reviews also cover retirement benefits for the Company's executive officers as measured against the competitive pay practices of a peer group of publicly-traded trucking companies. The major components of executive compensation are detailed below.

Base Salary

As part of the review performed by outside consultants, base salary levels of the executives are reviewed to ensure comparability with other publicly-traded trucking companies. Base salary levels of executive officers have been set below the market median of the amounts paid to such peer group executives in the past. We directed our outside consultants to compare compensation practices with a peer group of twelve publicly traded companies with operations most similar to the Company's. Based on this study and our recommendations, the Board approved a 10% increase in Mr. Stubbs base salary effective January 1, 2004.

Annual Incentive/Bonus Compensation

The Company's shareholders reapproved the incentive compensation program in 1999. The program is designed to reward key employees for the Company's performance based on the achievement of performance goals established prior to the particular year. Components of annual incentive compensation include an Incentive Bonus Plan (the "Incentive Plan") covering all full-time FFE employees (including executive officers) and the FFE Transportation Services, Inc. 1999 Executive Bonus and Phantom Stock Plan (the "Executive Plan"), which covers only the key employees. Both plans focus on operational efficiencies. An executive officer's total cash compensation rises above the peer group market median as the Company's performance rises above the median performance of the Company's peer group. For the 2004 fiscal year, reflecting Company performance, total cash bonuses averaged approximately 30% of each executive officer’s base salary. No cash bonuses were awarded in 2003 and 2002.

Other Compensation

The Company has previously entered into Split-Dollar Agreements with each of the Stubbs Irrevocable 1995 Trust and the Robertson Irrevocable 1995 Trust for the benefit of Stoney M. Stubbs, Jr. and Charles G. Robertson. Under the Agreements, the Company agreed to pay certain premium payments under split-dollar life insurance policies, and the Trusts agreed to repay such premiums to the Company on the earlier of surrender or cancellation of each policy for its cash value or upon payment of death benefits. Due to changes in the law and other pertinent factors, the Board terminated such obligation to pay premiums. Awards to offset adverse consequences resulting from the revised arrangement for fiscal years 2004 and 2003 are disclosed in the “Summary Compensation Table”.

Long-Term Incentive Compensation

The Company's long-term incentive compensation is comprised of stock options and phantom equity programs. These serve to align the interests of the executive officers and other key employees with shareholder interests by linking executive pay with shareholder return. These programs also act as a counter-balance to the short-term goals and responsibilities of the Incentive Plan and Executive Plan.

The 2002 Incentive and Nonstatutory Option Plan (the "2002 Plan") as approved by shareholders, provides that the exercise price for incentive stock options may not be less than the fair market value of the Common Stock on the date of grant. We determine the exercise price of nonstatutory stock options under the 2002 Plan. The exercise price may not be less than 50% of the fair market value of a share of the Common Stock on the date of grant. Options granted under the 2002 Plan may not be outstanding for more than ten years. On May 12, 2004, Mr. Stubbs was granted an option to purchase 50,000 shares of Common stock under the 2002 Plan.

Supplemental Executive Retirement and 401(k) Wrap Plans

To provide supplemental retirement benefits to executive officers and other key members of management, the Company maintains the Supplemental Executive Retirement Plan (the "SERP") and 401(k) Wrap Plan, respectively. The SERP provides benefits limited by the Internal Revenue Code of 1986, as amended (the "Code"), by awarding phantom stock units. The 401(k) Wrap Plan supplements the Company's 401(k) Plan by allowing benefits supplemental to those limited by the Code.

Both the SERP and the 401(k) Wrap Plan are unfunded deferred compensation arrangements not subject to the annual reporting and disclosure requirements of the Employee Retirement Income Security Act of 1974. Awards under both the SERP and the 401(k) Wrap Plan for fiscal year 2004 are disclosed in the “Summary Compensation Table”.

Compensation for the Chief Executive Officer

During 2004, Mr. Stubbs served as the Chairman of the Board, President and Chief Executive Officer of the Company. For 2004, the Committee adjusted Mr. Stubbs’ base salary to $349,000, as compared to $318,000 for 2003 and 2002. For 2004, Mr. Stubbs received $118,470 under the Company's Executive Plan for performance measured against pre-established criteria. As disclosed in the “Summary Compensation Table”, Mr. Stubbs received approximately $358,645 in other compensation, $296,000 of which relates to an award to offset a portion of the adverse consequences associated with the revised Split-Dollar Agreement referred to above.

We evaluate Mr. Stubbs' performance by the same criteria established for all Company executives. We made an assessment of Mr. Stubbs' contributions to enhancing the Company's performance, his individual performance, and the compensation paid to chief executive officers of the Company's peer group to determine Mr. Stubbs' total compensation.

Deductibility of Executive Compensation

The Company has entered into Change in Control Agreements ("Agreements") with each of the Executive Officers whereby such individuals will be entitled to receive payments if they are terminated without cause or resign with good reason within specified periods following the occurrence of certain events deemed to involve a change in control of the Company. See "Change in Control Agreements".Under Section 162(m) of the Code, the federal income tax deduction for certain types of compensation paid to the Chief executive officer and up to four of the other most highly compensated executive officers of publicly-held companies is limited to $1 million per officer per fiscal year unless such compensation meets certain requirements. In determining the amount of compensation paid to the chief executive officer or the four other most highly compensated executive officers, “performance-based compensation" under Section 162(m) of the Code is disregarded. Additionally, Section 280G of the Code disallows a deduction for certain compensation paid upon a change in control of the Company. We are aware of the limitations of Section 162(m) and 280G of the Code and believe that no compensation paid by the Company will exceed these limitations, except possibly a portion of the sums payable pursuant to the Agreements in the event of a change in control of the Company, if paid.

The undersigned members of the Compensation Committee have submitted this Report to the Board of Directors.

/s/Brian R. Blackmarr, Chair

/s/W. Mike Baggett

/s/Leroy Hallman

The following table provides information concerning all of our stock-based compensation plans as of December 31, 2004. Specifically, the number of shares of Common Stock subject to outstanding options, warrants and rights and the exercise price thereof, as well as the number of shares of Common Stock available for issuance under all of our equity compensation plans.

Plan Category | | Number of securities to be issued upon exercise of outstanding options, warrants and rights | | Weighted-average exercise price of outstanding options, warrants and rights | | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a) | |

| Equity compensation | | | | | | | | | | |

| plans approved | | | | | | | | | | |

| by security holders | | | 2,251,432 | | $ | 3.82 | | | 702,125 | |

| Equity compensation | | | | | | | | | | |

| plans not approved | | | | | | | | | | |

| by security holders | | | 778,260 | | $ | 8.88 | | | - | |

| Total | | | 3,029,692 | | $ | 5.12 | | | 702,125 | |

Pursuant to our Employee Stock Option Plan (the "Plan") we issued non-qualified stock options to substantially all of our employees (except officers) in 1997, 1998 and 1999. All grants under the Plan were at market value on the date of the grant and generally do not vest for five years following the grant at which time they are 60% vested and are 100% vested after seven years. As of December 31, 2004, there were 778,260 options outstanding under the Plan of which 651,000 were exercisable. Because our officers did not participate in the Plan, no shareholder notification of the Plan was required. As of December 31, 2004, the weighted average exercise price of options outstanding under the Plan was $8.88. The Plan terminated on July 1, 2001 and no additional grants are permitted under the Plan.

A subsidiary of the Company leases certain tractors from Mr. Stubbs, Mr. Robertson, and a family partnership controlled by Mr. Stubbs (“Related-Party Lessors”). Because the terms of the leases are more flexible than those involving tractors leased from unaffiliated lessors, the subsidiary pays on average an 8.5% premium or approximately $150,000 a year more for these leases. Tractor rental payments during 2004 were as follows: Mr. Stubbs and the family partnership - $1,205,000 and Mr. Robertson - $623,000. The subsidiary has an option to purchase the tractors at the end of the lease term. During 2004, the subsidiary purchased (for market value) tractors valued at $735,000 from Mr. Stubbs and the family partnership and $351,000 from Mr. Robertson. The subsidiary sold these tractors to unrelated third parties and did not incur a gain or loss.

The subsidiary also rents certain trailers from related-party lessors on a month-to-month basis. Trailer rental payments during 2004 were as follows: Mr. Stubbs and the family partnership - $245,000 and Mr. Robertson - $146,000. The subsidiary has short-term leases for similar trailers with unaffiliated lessors for approximately 50% of the officers month-to-month rental payments.

During 2004, the subsidiary exchanged forty-eight 1994 refrigerated trailers, which were rented on a month-to-month basis from the officers for ninety-six 1996 dry trailers owned by the subsidiary. The fair market value of trailers exchanged was $238,000 for Mr. Stubbs and the family partnership and $171,000 for Mr. Robertson. The subsidiary sold these trailers to unrelated third parties and did not realize a gain or incur a loss.

The Company’s Audit Committee has approved all tractor and trailer transactions between the subsidiary and the Related-Party Lessors.

The Company and the Related-Party Lessors have agreed, should the month-to-month leases be terminated within twelve months following a change in control that the Company is required to pay to the lessors a lump sum payment in cash equal to 24 times the most recent monthly rental.

The aggregate future minimum rentals under officer tractor non-cancelable operating leases at December 31, 2004 were:

| | | Mr. Stubbs and family partnership | | Mr. Robertson | | Total | |

2005 | | $ | 1,250,000 | | $ | 654,000 | | $ | 1,904,000 | |

2006 | | | 1,250,000 | | | 580,000 | | | 1,830,000 | |

2007 | | | 1,064,000 | | | 483,000 | | | 1,547,000 | |

2008 | | | 809,000 | | | 404,000 | | | 1,213,000 | |

2009 | | | 302,000 | | | 163,000 | | | 465,000 | |

Total | | $ | 4,675,000 | | $ | 2,284,000 | | $ | 6,959,000 | |

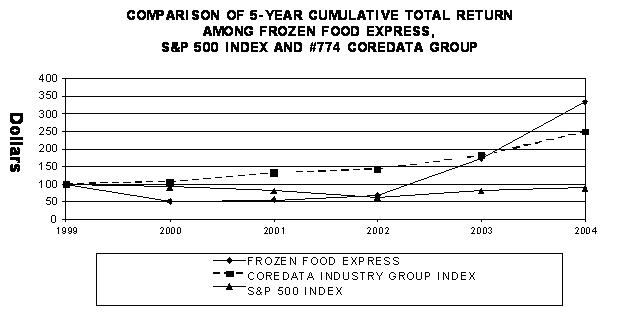

The following graph compares the cumulative total shareholder return on the Company’s Common Stock for the last five years to the S&P 500 Index and the CoreData Industry Group Index #774 - Trucking Companies (assuming the investment of $100 in the Company’s Common Stock, the S&P 500 Index and the CoreData Index on December 31, 1999 and reinvestment of all dividends).

| | December 31, |

| | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 |

| FROZEN FOOD EXPRESS | $100 | $ 51 | $ 55 | $ 67 | $171 | $333 |

COREDATA INDUSTRY GROUP INDEX #774-TRUCKING COMPANIES | 100 | 105 | 132 | 142 | 182 | 249 |

| S&P 500 INDEX | 100 | 91 | 80 | 62 | 80 | 89 |

The Compensation Committee Report, the Audit Committee Report, references to the independence of directors, and the Stock Performance Graph are not deemed to be "soliciting material" or "filed" with the Securities and Exchange Commission, are not subject to the liabilities of Section 18 of the Exchange Act, and shall not be deemed incorporated by reference into any of the filings previously made or in the future by our company under the Exchange Act or the Securities Act of 1933, as amended (except to the extent the Company specifically incorporates any such information into a document that is filed).

(Proposal No. 2)

The Company previously adopted the 2002 Non-Employee Director Stock Option Plan (the "2002 Plan"), which provided for formula grants of options to non-employee directors of the Company upon their initial appointment or election to the Board, and upon reelection. The 2002 Plan was previously approved by the shareholders of the Company. The 2002 Plan has terminated by its terms on March 3, 2005. The Board, following recommendation by the Compensation Committee, proposes that the Company adopt, subject to shareholder approval at the Annual Meeting, the 2005 Non-Employee Director Restricted Stock Plan (the “2005 Director Plan”). The purposes of the 2005 Director Plan are (i) to authorize the award of up to 50,000 shares of restricted stock to non-employee directors, upon their initial election or appointment to the Board, and upon reelection; (ii) to provide incentives for the recruitment and retention of well-qualified individuals to serve as non-employee members of the Board; and (iii) to align the interests of the non-employee directors with those of the Company’s shareholders.

The Company is seeking shareholder approval for the 2005 Director Plan. Shareholder approval is required under the requirements of the Nasdaq Stock Exchange which are applicable to the Company.

A copy of the 2005 Director Plan, as adopted by the Board, is attached to this Proxy Statement as Exhibit A, The principal features of the 2005 Director Plan are described below, but such description is qualified in its entirety by reference to the complete text of the 2005 Director Plan.

Description of the 2005 Director Plan. The 2005 Director Plan was adopted by the Board in February 2005, but its effective date will be the date of its approval by the Company’s shareholders. The 2005 Director Plan has a term of ten years, unless terminated sooner by the Board. A total of 50,000 shares of Common stock have been reserved for issuance under the 2005 Director Plan.

Eligibility under the 2005 Director Plan will be limited to non-employee directors of the Company. There are currently five directors who would be eligible to participate. Upon initial election or appointment to the Board, and thereafter, annually upon the date of the annual shareholder’s meeting, each non-employee Director will be awarded shares of Restricted stock which will vest over a period of three years, one-third on each anniversary of the Date of Grant, provided that the Non-Employee Director continues to serve as such as at each vesting date. The Board will determine in its discretion the number of shares of restricted stock to be awarded under the 2005 Director Plan. All shares of restricted stock will vest in full if the director should die while serving as such. As of April 1, 2005, the closing price of the Common Stock was $11.12.

New Plan Benefits. Awards to be received by non-employee directors are not determinable because the Board determines the number of shares of restricted stock awarded under the 2005 Director Plan in its sole discretion at the time of grant. As a result, the benefits that might be received by non-employee directors receiving discretionary grants under the 2005 Director Plan are not

determinable. For similar reasons, the Company cannot determine the awards that would have been granted to non-employee directors during the 2004 fiscal year under the 2005 Director Plan, if it had been in place during that year. No awards have yet been granted to non-employee directors under the 2005 Director Plan.

The Board recommends that shareholders vote FOR the approval of the 2005 Non-Employee Director Restricted Stock Plan.

RESTRICTED STOCK PLAN

(Proposal No. 3)

The Company currently has in place the 1999 Executive Bonus and Phantom Stock Plan (the “1999 Bonus Plan”), which provides for officers of the Company to receive an incentive bonus under a formula based on operating targets, payable partially in cash and partially in phantom stock awards. The 1999 Bonus Plan was previously approved by the shareholders of the Company. The Board, following recommendation by the Compensation Committee, proposes to replace, subject to shareholder approval at the Annual Meeting, the 1999 Bonus Plan with the 2005 Executive Bonus and Restricted Stock Plan (the “2005 Bonus Plan”), effective for the Company’s 2005 fiscal year. The purpose of the 2005 Bonus Plan is to align the financial interests of key officers of the Company with its shareholders through the use of awards, payable in the Common Stock of the Company, upon the attainment of predetermined performance goals.

The Company is seeking the shareholders’ approval for the 2005 Bonus Plan. Shareholder approval is required under Nasdaq listing requirements which are applicable to the Company and is also required to qualify the restricted stock awards for the performance-based compensation exception of Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”).

A copy of the 2005 Bonus Plan, as adopted by the Board, is attached to this Proxy Statement as Exhibit A. The principal features of the 2005 Bonus Plan are described below, but such description is qualified in its entirety by reference to the complete text of the 2005 Bonus Plan.

Description of the 2005 Bonus Plan. The Company’s officers are eligible to participate in the 2005 Bonus Plan. There are currently three individuals who are participating in the 1999 Bonus Plan. Under the 2005 Bonus Plan, officers are eligible to receive an incentive bonus if certain operating targets are met. The bonus, if earned, is paid in cash, and the officer also receives an award of shares of restricted Common Stock of the Company under the Company’s 2005 Stock Incentive Plan (described in Proposal No. 4 below). The number of restricted shares of Common Stock awarded equals 50% of the officer’s bonus for that fiscal year divided by the applicable Share Value. The applicable Share Value is the amount that is the lower of (i) the fair market value of a share of Common Stock as of the last business day of the fiscal year immediately preceding the fiscal year for which the bonus was awarded and (ii) the average of the fair market values of a share of Common Stock as of the last business day of each calendar month of the fiscal year for which the bonus was awarded. The restricted shares will vest over a period of three years, one-third per year, provided that the officer remains employed on the vesting dates.

New Plan Benefits: The following table summarizes the awards that would have been granted under the 2005 Bonus Plan in fiscal year 2004 if the 2005 Bonus Plan had been in effect with the performance goal described above.

| | 2005 Executive Bonus andRestricted Stock Plan |

Name and Position | | CashBonus | Restricted Share Bonus |

Stoney M. Stubbs, Jr Chairman of the Board, President and Chief Executive Officer of the Company and FFE | $ | 118,470 | 8,921 |

Charles G. Robertson Executive Vice President of the Company and Executive Vice President and Chief Operating Officer of FFE | $ | 87,369 | 6,579 |

F. Dixon McElwee, Jr. Chief Financial Officer and Senior Vice President of the Company and FFE | $ | 60,546 | 4,559 |

| All Current Executive Officers as a Group | $ | 226,385 | 20,059 |

| All Directors who are not Executive Officers | $ | 0 | 0 |

| All Employees, including all officers who are not Executive Officers, as a group | $ | 0 | 0 |

The 2005 Bonus Plan differs from the 1999 Bonus Plan in that, if an officer earns an incentive bonus for a fiscal year under the 2005 Bonus Plan, he is issued shares of Restricted stock that vest over three years. Under the 1999 Bonus Plan, an officer who earned a bonus would be awarded vested phantom shares, which would not represent actual shares of Company Common stock and would not carry with them any rights to vote the shares. Under the 1999 Bonus Plan, the value of the phantom shares would be paid to the officer in cash after one year, unless the officer elected to defer payment for the phantom shares until his death, termination of employment, or a change in control of the Company.

The Board retains the discretion to amend or terminate the 2005 Bonus Plan in any manner and at any time.

The Board recommends that the shareholders vote FOR the approval of the 2005 Executive Bonus and Restricted Stock Plan.

(Proposal No. 4)

The Board, following recommendation by the Compensation Committee, of the Company has approved and adopted, and proposes that the shareholders approve at the Annual Meeting, the amendment and restatement of the Frozen Food Express Industries, Inc. 2002 Incentive and Nonstatutory Option Plan (the “2002 Plan”). As amended and restated, the 2002 Plan will become the 2005 Stock Incentive Plan (the “2005 Plan”). The 2002 Plan has previously been approved by the shareholders of the Company. The purpose of the amendment and restatement is to authorize the award of shares of restricted stock, stock appreciation rights, stock units and performance shares, in addition to stock options, under the 2005 Plan. The 2002 Plan only authorizes the award of stock options. The 2005 Plan will not increase the total number of shares of Common Stock currently authorized to be awarded under the 2002 Plan, which is 1.7 million shares of which 1 million shares of Common Stock have previously been granted as stock options.

A copy of the 2005 Plan, as adopted by the Board, is attached to this Proxy Statement as Exhibit C. The principal features of the 2005 Plan are described below, but such description is qualified in its entirety by reference to the complete text of the 2005 Plan.

Description of the 2005 Plan. Awards granted under the 2005 Plan will consist of the Company’s authorized Common Stock, par value $1.50 per share. The fair market value of the Company’s Common Stock as of April 1, 2005 was$11.12 per share. The 2005 Plan will provide for the grant of incentive stock options, nonstatutory options, shares of restricted stock, stock appreciation rights, stock units and performance share awards. Awards under the 2005 Plan may be made to key employees, including officers and directors who may be employees, and non-employee consultants or advisors. There are currently 125 employees of the Company who may be eligible to receive awards under the 2005 Plan, and there are 10 consultants or advisors who may be eligible to receive awards under the 2005 Plan. An aggregate of 1.7 million shares of Common Stock has been reserved for issuance under the Plan; provided, that no more than 500,000 shares of Common Stock may be awarded under the 2005 Plan in the form of shares of restricted stock, stock units, or performance shares. No eligible individual may be granted options under the 2005 Plan in any single fiscal year of the Company, the total number of shares subject to which exceed 100,000 shares.

The 2005 Plan will be administered by the Board or by the Compensation Committee (referred to herein as the “Committee”). The Committee has full authority, subject to the terms of the 2005 Plan, to determine the individuals to whom awards are made, the number of shares of Common Stock represented by each award, the time or times at which options are granted and exercisable, the exercise price of options, and the time or times at which shares of Restricted Stock, stock units or performance shares will be issued, vested or exercisable.

The 2005 Plan may be amended by the Board. However, the 2005 Plan may not be amended without the consent of the holders of a majority of the shares of stock then outstanding to (a) increase materially the aggregate number of shares of Common Stock that may be issued under the 2005 Plan or the maximum number of shares subject to options that may be granted to any eligible individual in any single fiscal year of the Company, (b) increase materially the benefits accruing to eligible individuals under the 2005 Plan, or (c) modify materially the requirements of eligibility for participation in the 2005 Plan; provided, that such amendments may be made without the consent of the shareholders if changes occur in law or other legal requirements (including Rule 16b-3) that would permit otherwise.

Description of Restricted Stock. Restricted stock awards are grants of Common Stock subject to a required period of employment or service following the award, referred to as the restricted period, and any other conditions established by the Committee. A recipient of a restricted stock award will become the holder of shares of restricted stock free of all restrictions if he or she completes the restricted period and satisfies any other conditions; otherwise, the shares will be forfeited. Under the 2005 Plan, the restricted period may not be more than ten years. The recipient of the restricted stock will have the right to vote the shares of restricted stock and, unless the Committee determines otherwise, will have the right to receive dividends on the shares during the restricted period. The recipient of the restricted stock may not sell, pledge or otherwise encumber or dispose of restricted stock until the conditions imposed by the Committee have been satisfied. The Committee may accelerate the termination of the restricted period or waive any other conditions with respect to any restricted stock.

Description of Options and Rights under the 2005 Plan. The 2005 Plan authorizes the award of both incentive stock options, for which option holders may receive favorable tax treatment under the Code, and nonstatutory options, for which option holders do not receive special tax treatment. For further information regarding the tax treatment of options granted under the 2005 Plan, see “Tax Treatment” below.

Incentive stock options may be granted only to employees. Non-qualified stock options may be granted to employees, consultants and advisors. The exercise price of each option shall be determined by the Committee, and may

be equal to or greater than the fair market value of the stock on the date of grant of the option; provided that the exercise price of an incentive stock option granted to an employee who owns more than 10% of the Company’s Common stock may not be less than 110% of the fair market value of the underlying shares of Common Stock on the date of grant.

The optionee may pay the exercise price:

| (ii) | with the approval of the Committee, by delivering or attesting to the ownership of shares of Common Stock having a fair market value on the date of exercise equal to the exercise price of the option; or |

| (iii) | by such other method as the Committee shall approve, including payment through a broker in accordance with cashless exercise procedures permitted by Regulation T of the Federal Reserve Board. |

Options vest according to the terms and conditions determined by the Committee and specified in the option agreement. The Committee will determine the term of each option up to a maximum of ten years from the date of grant; provided that the term of an incentive stock option granted to an employee who owns more than 10% of the Common Stock may not exceed five years from the date of grant. The Committee may accelerate the exercisability of any or all outstanding options at any time for any reason.