UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report:

(Date of earliest event reported)

August 15, 2006

FROZEN FOOD EXPRESS INDUSTRIES, INC.

(Exact Name of Registrant as Specified in its Charter)

Texas (State or Other Jurisdiction of Incorporation) | 1-10006 COMMISSION FILE NUMBER | 75-1301831 (IRS Employer Identification No.) |

1145 Empire Central Place Dallas, Texas 75247-4309 (Address of Principal Executive Offices) | | (214) 630-8090 (Registrant's telephone number, including area code) |

| | Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

| r | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| r | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| r | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| r | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

ITEM 7.01. | REGULATION FD DISCLOSURE |

| | Attached hereto as Exhibit 99.1, which is incorporated herein by reference, is a copy of certain slides used by the Company in making a presentation to the CJS Securities, Inc. Conference on August 15, 2006. This information furnished herewith, but is not “filed” pursuant to the Securities Exchange Act and is not incorporated by reference into any Securities Act registration statements. Additionally, the submission of this report on Form 8-K is not an admission as to the materiality of any information in this report that is required to be disclosed solely by Regulation FD. Any information in this report supersedes inconsistent or outdated information contained in earlier Regulation FD disclosures. |

ITEM 9.01. | FINANCIAL STATEMENTS AND EXHIBITS |

| (c) EXHIBITS | The following are furnished as exhibits to this report: |

| 99.1 | Presentation materials dated August 15, 2006. |

| | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | FROZEN FOOD EXPRESS INDUSTRIES, INC. |

| | | | |

| | | | |

Dated: August 15, 2006 | By: | /s/ Stoney M. Stubbs, Jr. | |

| | | Stoney M. Stubbs, Jr. Chairman and Chief Executive Officer | |

EXHIBIT INDEX | |

| | |

| Exhibit No. | Exhibit Title |

| 99.1 | Presentation materials dated August15, 2006. |

| | |

Frozen Food Express

Industries, Inc.

This document contains information and forward-looking statements that are based onmanagement's current beliefs and expectations and assumptions which are based upon information currently available. Forward-looking statements include statements relating to plans, strategies, objectives, expectations, intentions, and adequacy of resources, and may

be identified by words such as "will", "could", "should", "believe", "expect", intend", "plan", "schedule", "estimate", "project" and similar expressions. These statements are based on current expectations and are subject to uncertainty and change.

Although management believes that the expectations reflected in such forward-lookingstatements are reasonable, there can be no assurance that such expectations will be realized. Should one or more of the risks or uncertainties underlying such expectations not materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those expected.

Among the key factors that are not within management's control and that may have abearing on operating results are demand for the company's services and products, and its ability to meet that demand, which may be affected by, among other things, competition, weather conditions and the general economy, the availability and cost of labor, the ability to

negotiate favorably with lenders and lessors, the effects of terrorism and war, the availability and cost of equipment, fuel and supplies, the market for previously-owned equipment, the impact of changes in the tax and regulatory environment in which the company operates, operational risks and insurance, risks associated with the technologies and systems used and the other risks and uncertainties described in the company's filings with the Securities and Exchange Commission.

* Truck count based on average number of trucks throughout 2005

p

Leading publicly traded refrigerated trucking company in

the U.S.

p

Headquartered in Dallas, Texas

p

Traded on Nasdaq Global Market (FFEX)

p

2005 freight revenue of $514 Million

p

70/30 company-owned/owner-operator

p

LTL – Less-than-truckload

p

One-stop solution with refrigerated TL (39%), refrigerated LTL

(30%), dry van TL (17%), and dedicated services (7%)

n

Only National Carrier able to utilize TL fleets to pull LTL freight

n

New regulation on HOS impacts OTR driver productivity causing

customers to shift to LTL service offerings for multiple stops

p

Only national refrigerated LTL carrier

n

10 terminals; 8 recruiting centers/offices

n

Scheduled routes and service

p

Limited customer concentration

n

No customers make up 10% of revenue

n

Top 20 customers make up 40% of revenue

n

Approximately 10,000 total customers

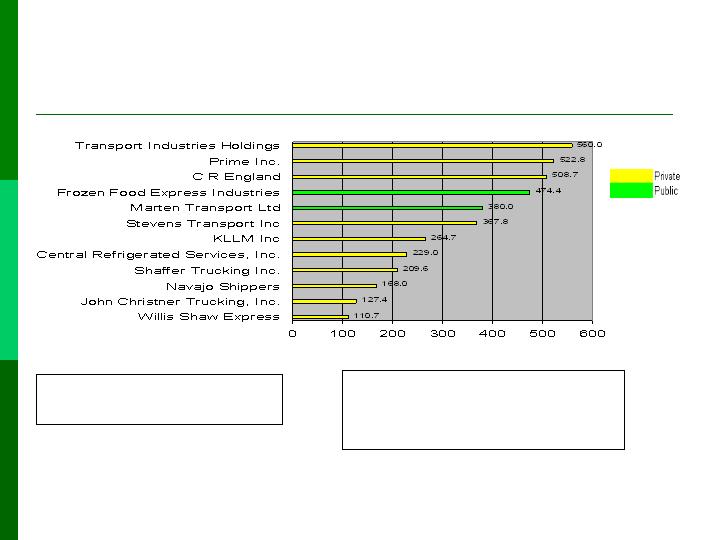

Source: Refrigerated Transporter Magazine, September 2005 & FFE estimates

Refrigerated sector: market size of

$8-$9B; approximately 41 carriers

over $1mm in annual revenue. Top

ten carriers comprise $3.4B of

market share.

2004 Annual Revenue ($MM)

Total Dry and Refrigerated

Industry has market size of

approximately $622.9B

- Restore consistent

revenue growth

Ø

Capitalize on new opportunities to

enhance revenue and profitability:

1. Grow new intermodal division and focus on brokerage, dedicated and LTL business as top priorities.

2. Use increased LTL freight lanedensity to add revenue without appreciably adding expenses.

3. Reorganize sales and marketing department to streamline pricing and customer contact functions.

4. Leverage network optimization opportunities and decision support tools (Profit Analyzer and Network Dashboard software) to provide for a more strategic forecast in process.

FFEX Challenges/Opportunities

Listed below are opportunities that we have in response to industry

Ø

Grow service offerings that

don’t require additional drivers:

1.

LTL (through increased

density levels)

4.

Selective, strategic

acquisitions

Ø

Use our geographical and

operational diversity to offer a

variety of opportunities to

meet driver’s lifestyle needs.

FFEX Challenges/Opportunities (Cont)…

- Operational

Effectiveness

Ø

Create back-office synergies

through:

1. Streamlining redundant functions such as billing, collections, payroll, order entry.

2. Aligning business drivers and key performance indicators with measurable goals.

3. Revamping our planning and budgeting processes to help everyone on our team better understand expectations.

4. Innovative IT solutions that support a diverse business going through change; while at the same time being flexible enough to handle the needs of our customers in the most seamless manner as possible.

FFEX Challenges/Opportunities (Cont)…

- Freight Network

Utilization

Ø

Increase profitability through freight

network optimization:

1. Focus on keeping and attracting the most profitable lanes belonging to our most valued customers.

2. Fully integrate Profit Analyzer software throughout our freight management system(s) to automate optimization process.

3. Provide a disciplined TL freight network that generates predictable freight which creates value to both customers and drivers.

FFEX Challenges/Opportunities (Cont)…

Investment Considerations

p

Industry dynamics create new opportunities.

p

Competitively differentiated by our diversified service

offerings.

p

Unique flexibility to allocate resources from TL to LTL.

p

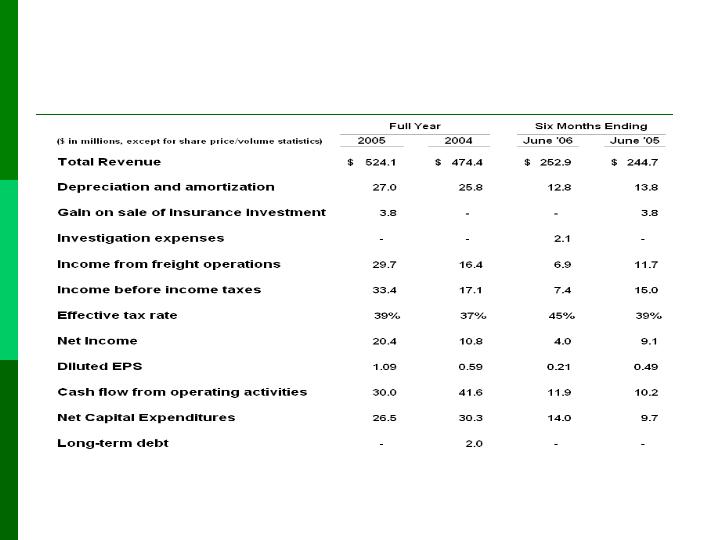

Strong balance sheet and cash flows provide financial

flexibility.

| | | |

| | |

Frozen Food Express Industries, Inc. 1145 Empire Central Place |