FROZEN FOOD EXPRESS INDUSTRIES, INC. NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 18, 2011

TO THE SHAREHOLDERS OF

FROZEN FOOD EXPRESS INDUSTRIES, INC.:

Notice is hereby given that the 2011 annual meeting of shareholders of Frozen Food Express Industries, Inc., a Texas corporation (the “Company”), will be held on Wednesday, May 18, 2011, at 2:00 p.m., Central time, in the Las Colinas Country Club, 4400 North O’Connor Boulevard, Irving, TX 75062-2796, for the following purposes:

| 1. | | To elect three Class I directors for a three-year term, or until their respective successors are elected and qualified; |

| 2. | | To ratify the selection of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2011; |

| 3. | | To provide an advisory vote on compensation of the Company’s named executive officers as disclosed in the enclosed proxy statement under “Executive Compensation;” |

| 4. | | To provide an advisory vote on how often the Company conducts an advisory vote on the compensation of the Company’s named executive officers, with the Company recommending a triennial vote; and |

| 5. | | To transact such other business as may properly be brought before the Annual Meeting or any adjournment thereof. |

We encourage you to attend the 2011 annual meeting in person. Whether or not you plan to attend the meeting, please complete, date, sign and return the accompanying proxy or vote using the telephone or Internet at your earliest convenience.

The proxy statement and annual report to shareholders are also available on our hosted website at http://www.cfpproxy.com/6412. For additional related information, please refer to the "Important Notice of Electronic Availability of Materials for the Shareholder Meeting to be held on May 18, 2011" in the enclosed proxy statement.

Shareholders of record at the close of business on March 23, 2011, are entitled to notice of, and to vote at, the 2011 annual meeting or any adjournment of the meeting. A list of all shareholders entitled to vote at the meeting is on file and available for inspection by shareholders at our corporate offices, located at 1145 Empire Central Place, Dallas, Texas 75247.

| | By Order of the Board of Directors |

| | |

| Dallas, Texas | LEONARD W. BARTHOLOMEW |

| April 19, 2011 | Corporate Secretary |

| | |

| General Information | | 1 |

| Outstanding Capital Stock; Principal Shareholders | | 5 |

| Equity Compensation Plan Information | | 7 |

| Executive Officers | | 7 |

| Corporate Governance | | 8 |

| Board of Directors-Meetings and Committees | | 8 |

| Director Attendance at the Annual Meetings of Shareholders | | 9 |

| Board Leadership Structure and Role in Risk Oversight | | 9 |

| Compensation Risk Assessment | | 10 |

| Consideration of Director Nominees; Nominating and Corporate Governance Committee | | 10 |

| Procedures for Recommendations of Director Nominees by Shareholders | | 11 |

| Shareholder Communications with the Board | | 11 |

| Audit Committee | | 12 |

| Related Party Transactions Policy | | 12 |

| Compensation Committee | | 14 |

| Compensation Committee Interlocks and Insider Participation | | 14 |

| Nominating and Corporate Governance Committee | | 14 |

| Proposal 1: Election of Directors | | 15 |

| Information Concerning Nominees and Directors | | 15 |

| Director Nominees-Class I (Term Ending 2011) | | 16 |

| Director Continuing in Office-Class II (Term Ending 2012) | | 17 |

| Director Continuing in Office -Class III (Term Ending 2013) | | 18 |

| Compensation Discussion and Analysis | | 20 |

| Executive Compensation Philosophy, Strategy and Objectives | | 20 |

| 2010 Compensation Decisions | | 21 |

| Competitive Market | | 22 |

| Role of the Compensation Committee | | 22 |

| Role of Management | | 23 |

| Role of the Compensation Consultant | | 23 |

| Executive Compensation Components | | 23 |

| Other Compensation Considerations | | 27 |

| Committee Decisions on Executive Officer Compensation for 2011 | | 27 |

| Change in Control Agreements | | 27 |

| Report of the Compensation Committee of the Board of Directors | | 29 |

| Executive Compensation | | 30 |

| 2010 Summary Compensation Table | | 30 |

| 2010 All Other Compensation Table | | 31 |

| 2010 Grants of Plan-Based Awards Table | | 32 |

| Outstanding Equity Awards at Fiscal Year Ended 2010 Table | | 33 |

| 2010 Option Exercises and Stock Vested Table | | 34 |

| 2010 Non-Qualified Deferred Compensation Table | | 34 |

| Potential Payments Upon Termination | | 34 |

| 2010 Director Compensation Table | | 35 |

| Transactions with Management and Directors | | 36 |

| Report of the Audit Committee of the Board of Directors | | 36 |

| Audit Committee Members | | 37 |

| Proposal 2: Ratification of Appointment of Independent Registered Public Accounting Firm | | 38 |

| Audit and Non-Audit Fees | | 38 |

| Policy on Audit Committee Pre-Approval of Audit and Non-Audit Services | | 38 |

| Proposal 3: Advisory Vote on Executive Compensation | | 39 |

| Proposal 4: Advisory Vote on Frequency of Conducting Advisory Vote on Executive Compensation | | 40 |

| Section 16(a) Beneficial Ownership Reporting Compliance | | 41 |

| Shareholder Proposals for the 2012 Annual Meeting | | 41 |

FROZEN FOOD EXPRESS INDUSTRIES, INC. 1145 Empire Central Place

Dallas, Texas 75247

Telephone: (214) 630-8090

Proxy Statement for Annual Meeting of

Shareholders to be Held on May 18, 2011

ABOUT THE MEETING

| · | What is a proxy? |

| · | What is the difference between a "shareholder of record" and a "street name" holder? |

| · | Why did I receive more than one proxy card? |

| · | Who is qualified to vote? |

| · | How many shares of common stock may vote at the annual meeting? |

| · | Who can sign the proxy? |

| · | How do I Vote if I am a Shareholder of Record? |

| · | How do I Vote Shares Held in Street Name by a Broker, Bank or Other Nominee? |

| · | Can I vote in person at the annual meeting? |

| · | What are the Board's recommendations on how I should vote? |

| · | What are my choices when voting? |

| · | How will my shares be voted if I do not specify how they should be voted? |

| · | What vote is required to approve each proposal? |

| · | What constitutes a quorum ? |

| · | Can I change my vote after I have mailed in my proxy card? |

| · | Who will count the votes? |

| · | Who pays the cost of this proxy solicitation? |

| · | Is this proxy statement the only way that proxies are being solicited? |

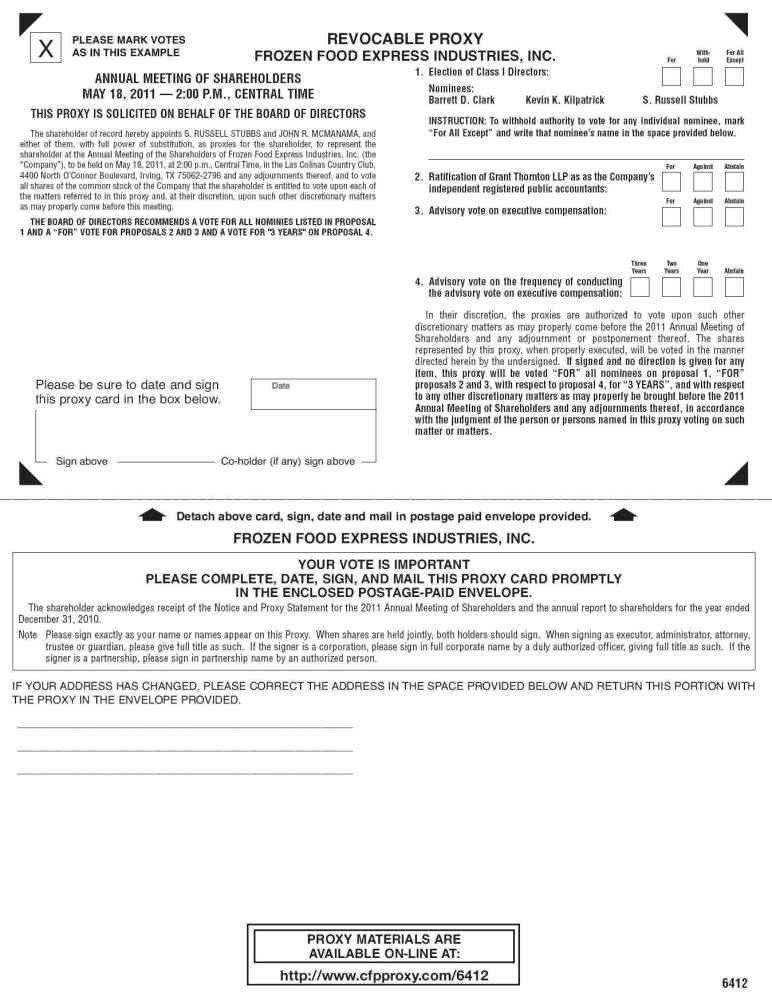

This proxy statement, the accompanying proxy card and the annual report to shareholders for the year ended December 31, 2010, of Frozen Food Express Industries, Inc. ("we", "us" or the "Company") are being mailed on or about April 19, 2011. Our Board of Directors (the "Board" or “Board of Directors”) is soliciting your proxy to vote your shares at the annual meeting of shareholders or any adjourned sessions of the meeting to be held on May 18, 2011, at 2:00 p.m., Central time, in the Las Colinas Country Club, 4400 North O’Connor Boulevard, Irving, TX 75062-2796. You can find directions to the annual meeting on the outside back cover of this proxy statement. The Board is soliciting your proxy to give all shareholders of record the opportunity to vote on matters that will be presented at the annual meeting, even if shareholders are not able to attend the meeting. All proxies in the enclosed form that are properly executed and received by us before or at the annual meeting and not revoked will be voted at the annual meeting or any adjournments in accordance with the instructions on the proxy. Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before it is voted. Proxies may be revoked by (i) filing with our Corporate Secretary, at or before the taking of the vote at the annual meeting, a written notice of revocation bearing a later date than the date of the proxy, (ii) duly executing a subsequent proxy relating to the same shares and delivering it to our Corporate Secretary before the annual meeting or (iii) attending the annual meeting and voting in person (although attendance at the annual meeting will not in and of itself constitute a revocation of a proxy). This proxy statement provides you with information on these matters to assist you in voting your shares.

IMPORTANT NOTICE OF ELECTRONIC AVAILABILITY OF MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD MAY 18, 2011

This proxy statement and the Company’s annual report for the year ended December 31, 2010 are also available electronically on our hosted website at http://www.cfpproxy.com/6412.

To access and review the materials made available electronically:

| · | Go to: http://www.cfpproxy.com/6412. |

| · | Click the “Proxy Statement.pdf” link. |

We encourage you to review all of the important information contained in the proxy materials before voting. If you would like to attend the annual meeting in person, please refer to the inside back cover of this proxy statement.

What is a proxy?

A proxy is your legal designation of another person to vote on your behalf. By completing and returning the enclosed proxy card, you are giving the proxies appointed by our Board and identified on the proxy card the authority to vote your shares in the manner you indicate on your proxy card.

What is the difference between a "shareholder of record" and a "street name" holder?

These terms describe how your shares are held. If your shares are registered directly in your name with our transfer agent and registrar, you are a "shareholder of record". If your shares are held in the name of a broker, bank, trust or other nominee as a custodian, you are a "street name" holder.

Why did I receive more than one proxy card?

You will receive multiple proxy cards if you hold your shares in different ways (e.g., joint tenancy, trusts, custodial accounts) or in multiple accounts. If your shares are held in "street name", you will receive your proxy card or other voting information from your broker or other custodian, and you will return your proxy card or cards to your broker or other custodian. You should complete and sign each proxy card you receive.

Who is qualified to vote?

You are qualified to receive notice of, and to vote at, the annual meeting if you owned shares of our common stock, par value $1.50 per share, at the close of business on March 23, 2010, the record date for the annual meeting.

How many shares of common stock may vote at the annual meeting?

As of the record date, there were 17,565,467 shares of common stock outstanding and entitled to vote. Each share of our common stock is entitled to one vote regarding each matter presented.

Who can sign the proxy?

If a shareholder is a company, the accompanying proxy should be signed in its full company name by its president or other authorized officer, who should indicate his or her title. If a shareholder is a partnership, the proxy should be signed in the partnership name by an authorized person. If stock is registered in the name of two or more trustees or other persons, the proxy should be signed by each of them. If stock is registered in the name of a decedent, the proxy should be signed by an executor or an administrator. The executor or administrator should attach to the proxy appropriate instruments showing his or her qualification and authority. Proxies signed by a person as agent, attorney, administrator, executor, guardian or trustee should indicate such person's full title following his or her signature.

How do I Vote if I am a Shareholder of Record?

If you are a shareholder of record mark the enclosed proxy card, date and sign it, and return it in the enclosed postage-paid envelope.

If you are a record holder and you sign your proxy card without giving specific instructions, your shares will be voted in accordance with the recommendations of our Board (“FOR” all three of our nominees to the Board, “FOR” ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year 2011, “FOR” the approval of the advisory (non-binding) resolution on executive compensation and for conducting the advisory vote on executive compensation TRIENNIALLY).

How do I Vote Shares Held in Street Name by a Broker, Bank or Other Nominee

If your shares are held in street name by a broker, bank, or other nominee, you may direct your vote by submitting your voting instructions to your broker, bank, or other nominee. Please refer to the voting instructions provided by your account manager. Your broker or other nominee is not permitted to vote your shares on election of directors unless you provide voting instructions. Brokers also do not have discretionary authority to vote on the advisory (non-binding) resolution to approve executive compensation or on the advisory (non-binding) resolution on the frequency of the vote to approve executive compensation unless you provide voting instructions. Therefore, to be sure your shares are voted, please instruct your broker or other nominee as to how you wish it to vote.

Can I vote in person at the annual meeting?

If you are a shareholder of record, you may vote your shares in person at the annual meeting. If you hold your shares in street name, you must obtain a proxy from your broker, banker, trustee or nominee, giving you the right to vote the shares at the annual meeting.

What are the Board's recommendations on how I should vote?

The Board recommends that you vote:

FOR the election of each of the three nominees to serve as directors on the Board of Directors for a three-year term;

FOR the ratification of the selection of Grant Thornton LLP as our independent registered public accounting firm for the 2011 fiscal year;

FOR the approval of the advisory (non-binding) resolution on executive compensation; and

FOR conducting the advisory vote on executive compensation triennially.

What are my choices when voting?

With respect to:

| | Proposal 1 - | You may (i) vote “FOR” electing all Director nominees as a group, (ii) withhold your vote on all Director nominees as a group or (iii) vote “FOR” electing Director nominees as a group except those nominees identified by you in the appropriate area on the proxy card. |

| | Proposal 2 - | You may vote “FOR” or “AGAINST” the ratification of the selection of Grant Thornton LLP as the Company’s independent auditor for fiscal year ending December 31, 2011, or you may elect to abstain from voting. |

| | Proposal 3 - | You may vote “FOR” or “AGAINST” the approval of the compensation of the Company’s named executive officers as described in this proxy statement under “Executive Compensation,” or you may elect to abstain from voting. |

| | Proposal 4 - | You may vote to conduct an advisory vote on the compensation of the Company’s named executive officers (i) every three years, (ii) every two years, (iii) every year, or you may elect to abstain from voting. |

How will my shares be voted if I do not specify how they should be voted?

If you sign and return a proxy card but fail to give voting instructions, the proxy agents will vote your shares in accordance with the recommendations of our Board of Directors. The Board of Directors recommends you vote FOR the election of each of the three nominees to serve as directors on the Board of Directors for a three-year term, FOR ratification of the selection of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2011, FOR the advisory (non-binding) resolution to approve executive compensation, and FOR the advisory (non-binding) resolution to vote on the frequency that the shareholders have an advisory vote on executive compensation every three years. The proxy agents will vote according to their best judgment on any other matter that properly comes before the Annual Meeting. At present, the Board of Directors does not know of any other such matters.

What vote is required to approve each proposal?

Election of directors. Under our Amended and Restated Bylaws (as heretofore amended, the "Bylaws"), the presence, in person or by proxy, of the holders of a majority of the outstanding shares of our common stock entitled to vote is necessary to constitute a quorum at the annual meeting. Upon establishment of a quorum at the annual meeting, Directors will be elected by a plurality of the votes of the issued and outstanding shares of our common stock represented in person or by proxy at the annual meeting and entitled to vote on Proposal 1. In a plurality voting, the nominee who receives the most votes for his or her election is elected. If you do not instruct your broker how to vote with respect to this itm, your broker may not vote with respect to this proposal.

Ratification of independent registered public accounting firm. Under our Bylaws, the affirmative vote of a majority of the total number of votes cast at the meeting is needed to ratify the selection of Grant Thornton LLP as our independent registered public accounting firm.

Advisory resolution on the compensation of the Company’s named executive officers. Under our Bylaws, the affirmative vote of a majority of the total number of votes cast at the meeting is needed to approve the advisory resolution on the compensation of the Company’s named executive officers. Abstentions will count as votes cast on this proposal, but will not count as votes “FOR” the proposal. Therefore, abstentions will have the same effect as votes “against” the proposal. Additionally, broker non-votes will not be considered to have voted on this proposal, and therefore will have no effect on the proposal. The individuals named as proxies on the enclosed proxy card will vote your proxy “FOR” this proposal unless you instruct otherwise on the proxy or you will withhold authority to vote.

Frequency of the shareholder vote to approve the compensation of the Company’s named executive officers. The time period that receives the affirmative vote of a plurality of the votes of the issued and outstanding shares of our common stock represented in person or by proxy at the annual meeting and entitled to vote will be considered passed. Abstentions and broker non-votes will have no effect on the proposal.

What constitutes a quorum?

In order for business to be conducted at the meeting, a quorum must be present in person or represented by valid proxies. For each of the proposals to be presented at the meeting, a quorum consists of the holders of a majority of the shares of common stock issued and outstanding on March 23, 2011, the record date, or at least 8,782,734 shares.

Shares of common stock represented in person or by proxy (including “broker non-votes” and shares that abstain or do not vote with respect to a particular proposal to be voted upon) will be counted for the purpose of determining whether a quorum exists at the meeting for that proposal.

If a quorum is not present, the meeting will be adjourned until a quorum is obtained.

Can I change my vote after I have mailed in my proxy card?

You may revoke your proxy by doing one of the following:

| · | by sending a written notice of revocation to our Corporate Secretary that is received prior to the annual meeting, stating that you revoke your proxy; |

| · | by signing a later-dated proxy card and submitting it so that it is received prior to the annual meeting; or |

| · | by attending the annual meeting and voting your shares in person. |

Who will count the votes?

Representatives from Registrar and Transfer Company, our transfer agent, will count the votes. Our Corporate Secretary will serve as our inspector of election at the annual meeting.

Who pays the cost of this proxy solicitation?

We pay the costs of soliciting proxies. Upon request, we will reimburse brokers, dealers, banks, trustees and other nominees for reasonable expenses incurred in forwarding these proxy materials to beneficial owners of shares of our common stock.

Is this proxy statement the only way that proxies are being solicited?

No. In addition to mailing these proxy materials on behalf of our Board, certain of our Directors, officers or employees may solicit proxies by telephone, facsimile, e-mail or personal contact. They will not be specifically compensated for doing so.

If you have any further questions about voting or attending the annual meeting please contact our Corporate Secretary at secretary@ffex.net or by telephone at 1-800-569-9200.

OUTSTANDING CAPITAL STOCK; PRINCIPAL SHAREHOLDERS

At the close of business on the March 23, 2011, the record date, there were 17,565,467 shares of our common stock outstanding and entitled to be voted at the annual meeting. The following table sets forth certain information as of the record date, except as otherwise indicated, with respect to (i) each person known to our management to be the beneficial owner of more than 5% of our common stock; (ii) each Director and Director nominee; (iii) each “named executive officer” (as defined in Item 402(a)(3) of Regulation S-K, the "NEOs") identified in the Summary Compensation Table and (iv) all current Directors and executive officers as a group.

| | | | Shares Beneficially Owned (1) |

| Beneficial Owner | Address | | Number | | Percent |

| Beneficial Owners of More than 5% | | | | | | | |

| Hawkshaw Capital Management, LLC | 400 Madison Avenue, 14th Floor New York, NY 10017 | | | 1,842,220 | (2) | 10.49 | % |

| Stoney M. Stubbs, Jr. | 158 Jellico Circle Southlake, TX 76092 | | | 1,779,171 | (3) | 10.13 | % |

| Sarah M. Daniel | 612 Linda El Paso, TX 79922 | | | 1,717,642 | (4) | 9.78 | % |

| Lucile W. Knight | 104 South Commerce St. Lockhart, TX 78644 | | | 1,620,200 | (5) | 9.22 | % |

| Dimensional Fund Advisors, LP | Palisades West, Building One 6300 Bee Cave Road Austin, TX 78746 | | | 1,413,813 | (6) | 8.05 | % |

| FMR LLC | 82 Devonshire Street Boston, MA 02109 | | | 1,337,657 | (7) | 7.62 | % |

| Frozen Food Express Industries, Inc. 401(k) Savings Plan, by Delaware Charter Guarantee & Trust Company, as Trustee | 1013 Centre Road Wilmington, DE 19805 | | | 1,173,786 | (8) | 6.68 | % |

| DePrince, Race & Zollo, Inc. | 250 Park Ave South, Ste 250 Winter Park, FL 32789 | | | 1,136,025 | (9) | 6.47 | % |

| Directors, Nominees and NEOs | | | | | | |

| Stoney M. Stubbs, Jr. | | | 1,779,171 | (3) | 10.13 | % |

| S. Russell Stubbs | | | 415,197 | (10) | 2.36 | % |

| John T. Hickerson | | | 149,285 | (11) | * | |

| Brian R. Blackmarr | | | 49,332 | (12) | * | |

| John R. McManama | | | 35,168 | (13) | * | |

| Jerry T. Armstrong | | | 28,044 | (14) | * | |

| T. Michael O'Connor | | | 23,707 | (15) | * | |

| W. Mike Baggett | | | 18,450 | (16) | * | |

| Barrett D. Clark | | | 12,343 | (17) | * | |

| Kevin K. Kilpatrick | | | 7,191 | (18) | * | |

| All Directors and Executive Officers as a Group (10 persons) | | | 2,517,888 | (19) | 14.33 | % |

* Less than 1%.

| (1) | Except as otherwise noted, all shares are held directly, and the owner has sole voting and investment power. |

| (2) | Information concerning the number of shares owned by Hawkshaw Capital Management, LLC is as of December 31, 2010 and was obtained from a Schedule 13G/A filed on February 14, 2011. |

| (3) | Includes 386,027 shares issuable pursuant to options exercisable within 60 days of March 23, 2011, 2,740 shares of restricted stock for which Mr. Stoney M. Stubbs, Jr. has voting power, 10,606 shares allocated to his account in the Frozen Food Express Industries, Inc. 401(k) Savings Plan, 28,300 shares allocated to his account in the FFE Transportation Services, Inc. 401(k) Wrap Plan, 69,705 shares held in his IRA and 1,012,256 shares held in family partnerships controlled by Mr. Stoney M. Stubbs, Jr. |

| (4) | Information concerning the number of shares owned by Ms. Daniel is as of August 19, 2009 and was obtained from a Schedule 13D/A filed on August 19, 2009. Ms. Daniel has sole voting and dispositive power over 53,590 shares, joint voting and dispositive power with her husband over 45,092 shares and shared voting and dispositive power with Ms. Knight over 1,321,332 shares owned by Weller Investment, Ltd. and 297,628 shares owned by Two Sisters LLC. |

| (5) | Information concerning the number of shares owned by Ms. Knight is as of August 19, 2009 and was obtained from a Schedule 13D/A filed on August 19, 2009. Ms. Knight has sole voting and dispositive power over 1,240 shares and shared voting and dispositive power with Ms. Daniel over 1,321,332 shares owned by Weller Investment Ltd. and 297,628 shares owned by Two Sisters LLC. |

| (6) | Information concerning the number of shares owned by Dimensional Fund Advisors, LP is as of December 31, 2010 and was obtained from a Schedule 13G/A filed on February 11, 2011. |

| (7) | Information concerning the number of shares owned by FMR LLC, the successor to FMR Corp. is as of December 31, 2010 and was obtained from a Schedule 13G/A filed on February 11, 2011. Fidelity Management & Research Company (“Fidelity”), a wholly-owned subsidiary of FMR LLC and an investment adviser is the beneficial owner of 1,337,657 shares or our common stock, as a result of acting as investment adviser to various investment companies. Edward C. Johnson 3d and FMR LLC, through its control of Fidelity, each has sole power to dispose of the 1,337,657 shares. |

| (8) | Information concerning the number of shares owned by Frozen Food Express Industries, Inc. 401(k) Savings Plan, by Delaware Charter Guarantee & Trust Company, as Trustee, is as of December 31, 2010, and was obtained from a Schedule 13G/A filed February 8, 2011. |

| (9) | Information concerning the number of shares owned by DePrince, Race & Zollo, Inc. is as of December 31, 2010 and was obtained from a Schedule 13G filed on February 11,2011. |

| (10) | Includes 50,000 shares issuable pursuant to options exercisable within 60 days of March 23, 2011, 94,700 shares of restricted stock for which Mr. S. Russell Stubbs has voting power, 41,689 shares allocated to his account in the Frozen Food Express Industries, Inc. 401(k) Savings Plan, 6,835 shares allocated to his account in the FFE Transportation Services, Inc. 401(k) Wrap Plan, 1,112 shares held in a partnership controlled by Mr. S. Russell Stubbs, 5,727 shares held by his spouse and 6,116 shares held in irrevocable trusts of which Mr. S. Russell Stubbs is the trustee. |

| (11) | Includes 91,150 shares of restricted stock for which Mr. Hickerson has voting power, 4,891 shares allocated to his account in the Frozen Food Express Industries, Inc. 401(k) Savings Plan and 5,832 shares allocated to his account in the FFE Transportation Services, Inc. 401(k) Wrap Plan. |

| Includes 5,625 shares issuable pursuant to options exercisable within 60 days of March 23, 2011 and 7,192 shares of restricted stock for which Mr. Blackmarr has voting power. |

| (13) | Includes 33,350 shares of restricted stock for which Mr. McManama has voting power and 452 shares allocated to his account in the FFE Transportation Services, Inc. 401 (k) Wrap Plan. |

| (14) | Includes 13,125 shares issuable pursuant to options exercisable within 60 days of March 23, 2011 and 7,192 shares of restricted stock for which Mr. Armstrong has voting power. |

| (15) | Includes 5,625 shares issuable pursuant to options exercisable within 60 days of March 23, 2011 and 7,192 shares of restricted stock for which Mr. O'Connor has voting power. |

| (16) | Includes 2,409 shares issuable pursuant to options exercisable within 60 days of March 23, 2011 and 7,192 shares of restricted stock for which Mr. Baggett has voting power. |

| (17) | Includes 7,192 shares of restricted stock for which Mr. Clark has voting power. |

| (18) | Includes 6,333 shares of restricted stock for which Mr. Kilpatrick has voting power. |

| (19) | Includes 462,811 shares issuable pursuant to options exercisable within 60 days of March 23, 2011, 264,233 shares of restricted stock with voting power, 57,186 shares allocated to the Frozen Food Express Industries, Inc. 401(k) Savings Plan 41,419 shares allocated to the FFE Transportation Services, Inc, 401(k) Wrap Plan, 1,013,368 shares held by family partnerships, 5,727 shares held by a spouse, and 6,116 shares held by trusts. |

EQUITY COMPENSATION PLAN INFORMATION

The following table presents information concerning our compensation plans under which shares of our common stock are authorized for issuance as of December 31, 2010:

| | | Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) | | Weighted-average exercise price of outstanding options, warrants and rights (b) | | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c) |

| Equity compensation plans approved by security holders | | 897,000 | | $6.40 | | 894,000 |

We have two equity compensation plans approved by security holders: (i) the Amended and Restated Frozen Food Express Industries, Inc. 2005 Stock Incentive Plan (the “2005 Stock Incentive Plan”) and (ii) the Amended and Restated Non-Employee Director Restricted Stock Plan (the “Director Plan).

The 2005 Stock Incentive Plan, as amended and restated, was approved by the Company’s shareholders on May 20, 2009. The 2005 Stock Incentive Plan has a ten-year term and a total of 2,700,000 shares are reserved for issuance under it, except that no more than 1,000,000 shares of common stock may be awarded in the form of shares of restricted stock, stock units, or performance shares. The 2005 Stock Incentive Plan provides for the grant of incentive stock options, nonstatutory options, shares of restricted stock, stock appreciation rights ("SARs"), stock units and performance share awards to key employees, including officers and directors who may be employees, and non-employee consultants or advisors. The 2005 Stock Incentive Plan is administered by our Compensation Committee, which has full authority, subject to the terms of the 2005 Stock Incentive Plan, to determine award recipients the number of shares of common stock represented by each award, the date or dates on which options and SARs are granted and exercisable, the exercise and base price of options and SARs, and the date or dates at which shares of restricted stock, stock units or performance shares will be issued, vested or exercisable.

For additional information regarding the Director Plan, see “2010 Director Compensation Table” on page 35.

EXECUTIVE OFFICERS

The table below sets forth certain information regarding our principal officers including our current executive officers:

| Name | | Age | | Position |

Stoney M. Stubbs, Jr. (1) | | 74 | | Chairman of the Board and Former Chief Executive Officer |

S. Russell Stubbs (1) | | 47 | | Chief Executive Officer and President |

| John T. Hickerson | | 59 | | Executive Vice President, Chief Operating Officer |

| John R. McManama | | 58 | | Senior Vice President and Chief Financial Officer |

| | | | | |

| | | | | |

| Mr. Stoney M. Stubbs, Jr. retired as Chief Executive Officer (“CEO”) effective at the end of day February 28, 2011. Mr. Stubbs will remain on the company’s Board of Directors, continuing his role as Chairman of the Board. Mr. Stubbs will be replaced as CEO by S. Russell Stubbs, who will also retain his position as President of the company. |

See Stoney M. Stubbs, Jr.’s biography under Proposal 1: Election of Directors.

See S. Russell Stubbs’ biography under Proposal 1: Election of Directors.

See John T. Hickerson’s biography under Proposal 1: Election of Directors.

John R. McManama – 58

Mr. McManama is our Senior Vice President and Chief Financial Officer since May 19, 2010 and previously served as Vice President and Interim Chief Financial Officer since November 6, 2009. Mr. McManama is a Certified Public Accountant. He previously served as Vice President of Finance since April 2009, Vice President of Strategic Planning since April 2008 of FFE Transportation Services, Inc. and Director of Operations of FFE Logistics Inc. since November 2007, both wholly-owned subsidiaries of the Company. From September 2007 until October 2007, Mr. McManama was President and Chief Executive Officer of Blue Wing Global Logistics and from August 2006 until September 2007, he was their Chief Financial Officer. From April 2005 until July 2006, he was Vice President of Finance for Central Freight Lines, Inc. Mr. McManama is a graduate of the University of Alabama, Birmingham and has an MBA from the University of Houston.

CORPORATE GOVERNANCE

We are committed to having sound corporate governance principles. Having such principles is essential to running our business with integrity and maintaining our credibility with our customers, our vendors, our employees, our shareholders and the general public. Our Board of Directors has adopted charters for the following standing committees: the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. The charters for these committees, as well as our Code of Business Conduct and Ethics (the “Code of Ethics”) and our Policy Regarding Related Party Transactions may be accessed under "Documents & Charters" under subsection "Corporate Governance" within our "Investors" section of our website at www.ffex.net. You may also request copies of these documents, without charge, from our Corporate Secretary. Such requests should be directed to our Corporate Secretary at Frozen Food Express Industries, Inc., 1145 Empire Central Place, Dallas, Texas 75247 or emailed to secretary@ffex.net.

The Code of Ethics applies to all of our Directors and employees, including the principal executive officer, principal financial officer, principal accounting officer or controller and other persons performing similar functions. The Code of Ethics addresses all NASDAQ Stock Market ("NASDAQ") content requirements and includes provisions addressing conflicts of interest, corporate opportunities, confidentiality, fair dealing, protection and proper use of our assets, compliance with our policies, and with laws, rules and regulations. No waivers of the Code of Ethics were requested or granted in 2010.

The Board, its standing committees and management remain committed to proactive pursuit of best practices of corporate governance, accountability and transparency. Our website has links to our filings with the Securities and Exchange Commission (the "SEC"), including all Forms 3, 4 or 5 filed pursuant to Section 16 of the Securities Exchange Act of 1934 (the "Exchange Act"). Additional information may be accessed under the “Investors” section of our website at www.ffex.net, including information on the composition and functions of our Board of Directors and its committees and instructions for submission of shareholder communications to the Board.

Board of Directors - Meetings and Committees

Our Bylaws provide that our Board shall consist of nine Directors. The Board has affirmatively certified that none of our six non-employee Directors (Jerry T. Armstrong, W. Mike Baggett, Brian R. Blackmarr, Barrett D. Clark, Kevin K. Kilpatrick and T. Michael O'Connor) has any material relationship with us (either directly or as a partner, shareholder or officer of an organization that has a relationship with us) and is independent within the meaning of NASDAQ director independence standards. Accordingly, a substantial majority of the Board is currently independent, which is consistent with the SEC rules and the NASDAQ director independence standards.

Our Board met in person or by teleconference five times during the year ended December 31, 2010. Our Board has three standing committees: the Audit, Compensation, and Nominating and Corporate Governance Committees, each of which selected a committee chairman from its members. Only independent Directors serve on the Board's standing committees. During 2010, each incumbent Director attended at least 75% of the meetings held by our Board of Directors and the committees of which he was a member. The membership of each of the committees and the number of meetings held by each committee during 2010 is reflected in the following table:

| Name of Independent Director | | Audit | | | Compensation | | | Nominating | |

| Jerry T. Armstrong | | Chairman | | | | | | | |

| W. Mike Baggett | | | X | | | | X | | | Chairman | |

| Brian R. Blackmarr | | | | | | Chairman | | | | X | |

| Barrett D. Clark | | | X | | | | | | | | X | |

| Kevin Kilpatrick | | | | | | | X | | | | | |

| T. Michael O’Connor | | | X | | | | | | | | | |

| Number of committee meetings in Fiscal 2010 | | | 9 | | | | 9 | | | | 1 | |

X = Committee member

Director Attendance at the Annual Meetings of Shareholders

Absent unusual circumstances, we expect all our Directors to attend all annual meetings of shareholders. All Directors attended our 2010 annual meeting.

Board Leadership Structure and Role in Risk Oversight

Our Board consists of nine board members, six of whom are independent within the meaning of NASDAQ listing standards. Key to the Company’s risk oversight are the requirements that all Board members who comprise the membership of the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee must be independent. Each of these three committees is lead by a committee chairman. The agenda for each committee meeting is set by the chairman, and each committee is required to report on its work to the full Board. Our independent directors meet in executive session as often as they deem appropriate, typically coinciding with regular Board meetings. In addition, the independent directors have a regularly scheduled annual meeting scheduled around the timing of our shareholders meeting. Jerry T. Armstrong presides as chairman of our independent director meetings and Brian R. Blackmarr keeps the meeting minutes. On February 23, 2011, the Board of Directors approved the Amended and Restated Bylaws, separating the positions of Chairman of the Board and Chief Executive Officer, allowing the company to have a non-executive Chairman of the Board in addition to the Chief Executive Officer. This structure provides the flexibility to allow one person to serve in both capacities or to fill each position with a different individual. Following his resignation as the Chief Executive Officer in February 2011, Stoney M. Stubbs, Jr. has remained on the company’s Board of Directors, continuing his role as Chairman of the Board.

The Board is responsible for oversight of our risk management. Much of this is managed by the Audit Committee as required by the Audit Committee Charter. The Audit Committee is responsible for reviewing with management financial and enterprise risk, including guidelines related to how this risk is managed; critical accounting policies; company compliance programs; internal control and supervision of the Internal Audit department; discussions and reviews with the independent registered public accounting firm; review of reports from legal counsel; approval of earnings releases and external reporting; and other reviews as deemed necessary or directed by the Audit Committee Charter. The Audit Committee is responsible for communication of all functions to the full Board of Directors. The Nominating and Corporate Governance Committee, in conjunction with the Audit Committee, is responsible for risk assessment as it relates to corporate governance and the Code of Ethics. The Company’s Code Compliance Officer reports to the Nominating and Corporate Governance Committee. The Compensation Committee assesses risks related to any compensation programs.

The full Board of Directors receives regular reports from the Company’s Vice President of Risk Management concerning all risk management programs. Additionally, the independent directors of the Board review all legal issues that could present significant risk to the Company. The Board of Directors believes that the work performed by all Board committees and required reporting by corporate management, as well as the leadership provided by the Chairman and Chief Executive Officer provides effective oversight of the Company’s risk management function.

We believe that the make-up of the Board, with a majority of independent directors who meet regularly as an independent body and provide leadership through the independent committees they chair, coupled with dividing the positions of non-executive Chairman of the Board and Chief Executive Officer between two individuals with extensive experience within the Company, provides the most effective form of leadership going forward for the Company. This structure provides both a non-executive to oversee the Board of Directors and a clear lead executive of our Company, who may be seen by our shareholders, customers, business partners and employees as providing strong leadership for the Company and within our industry and as a fervent member of our communities.

Compensation Risk Assessment

Our compensation programs have been designed with features that discourage executives from taking unnecessary and excessive risks. We have reviewed our compensation policies and practices for all employees and concluded that any risks arising from our policies and programs are not reasonably likely to have a material adverse effect on the Company. We believe our programs reflect sound risk management practices including:

| · | using a variety of compensation vehicles to provide a balance of long-and short-term incentives with fixed and variable components; |

| · | capping our Discretionary Bonus Plan awards at 100% of compensation; |

| · | providing for the Compensation Committee to have discretion over pre-tax targets and percentages to be used to calculate bonuses for the subsequent fiscal year under the Executive Plan, providing the bonuses are exempt from the limitation set forth in Section 162(m) of the Code; and |

| · | providing for our restricted stock awards to vest over many years, so while the potential compensation an executive can receive through the restricted stock awards is tied directly to appreciation of our stock price, taking excessive risk for a short term gain is incompatible with an executive officer maximizing the value of equity incentive awards over the long term. |

Consideration of Director Nominees; Nominating and Corporate Governance Committee

The responsibilities of the Nominating and Corporate Governance Committee (”NCGC”) include certain corporate governance activities in connection with the administration of the Code of Ethics. The NCGC’s charter outlines its primary responsibilities. Our NCGC consists of W. Mike Baggett (Chairman), Brian Blackmarr and Barrett D. Clark, each of whom is independent within the meaning of the NASDAQ listing standards. The NCGC met one time in the last fiscal year. The NCGC has the responsibility to periodically assess, develop and communicate with our Board concerning the appropriate criteria for nominating and appointing Directors, including our Board's size and composition, applicable listing standards and laws, individual Director performance, expertise, experience, willingness to serve actively, number of other public and private company boards on which a Director candidate serves, consideration of Director nominees timely proposed by shareholders in accordance with our Bylaws and other appropriate factors. Other specific duties and responsibilities of our NCGC include recommending to our Board the individuals to be nominated for election as Directors at each annual meeting of shareholders, identifying and recommending to our Board the appointees to be selected by the Board for service on the committees of the Board, retaining and terminating any search firm used to identify Director candidates, overseeing an annual review of the performance of the full Board and performing any other activities our Board considers appropriate. Our Board considers the recommendations of the NCGC with respect to the nominations of directors to the Board, but otherwise retains authority over the identification of nominees. Candidates to serve on our Board of Directors are considered based upon various criteria, such as ethics, business and professional activities, relevant business expertise, available time to carry out our Board's duties, conflicts of interest, service on other boards and commitment to our overall performance. The NCGC will make an effort to maintain representation on our Board of members who have substantial and direct experience in areas of importance to us. The NCGC has not considered racial or ethnic diversity in evaluating possible directors. It does not believe race or ethnic background is relevant to a person’s qualifications to serve on the Board. While it recognizes the benefits of diversity of training and experience, it does not believe that race or ethnic background significantly affect a person’s ability to contribute to our Board. The Nominating and Corporate Governance Committee Charter is available under "Documents & Charters" under subsection "Corporate Governance" within our "Investors" section of our internet website at www.ffex.net.

Procedures for Recommendations of Director Nominees by Shareholders

Our NCGC is charged with the responsibility, among others, of recommending to the Board the individuals to be nominated for election as directors at each annual meeting of stockholders. Following a recommendation by the NCGC, all of our Directors participate in the consideration of nominees for our Board. In addition to the nominating duties performed by NCGC under its charter, our Board has adopted the nomination policy described in this section for the consideration of Director candidates whose names are submitted by our shareholders. If you wish to submit candidates for consideration at our 2012 annual meeting, you should send the following information to our Corporate Secretary at Frozen Food Express Industries, Inc., 1145 Empire Central Place, Dallas, Texas 75247 on or before December 21, 2011:

| · | your name and address as it appears on our books and records; the number and class of shares you own beneficially and of record, the length of period held and proof of ownership of such shares; |

| · | name, age and address of the candidate; |

| · | a detailed resume describing, among other things, the candidate's educational background, occupation, employment history, and material outside commitments (e.g., memberships on other boards and committees, charitable foundations, etc.); |

| · | any information regarding any relationships between us and the candidate within the last three years; |

| · | any information relating to such candidate that is required to be disclosed in solicitations of proxies for election of Directors in an election contest, or is otherwise required, in each case pursuant to the Exchange Act, and rules adopted thereunder; |

| · | a description of any arrangements or understandings between you and such candidate; |

| · | a supporting statement which describes the candidate's reasons for seeking election to our Board, and documents his or her ability to satisfy the Director qualifications; and |

| · | a signed statement from the candidate, confirming willingness to serve on our Board. |

Our Corporate Secretary will promptly forward such materials to the NCGC and will maintain copies of such materials for future reference by the NCGC for use when nominating persons for election or when filling vacant Board positions.

If a vacancy arises or if our Board decides to expand its membership, our NCGC will seek recommendations of potential candidates from a variety of sources (which may include incumbent Directors, shareholders, our management and third-party consultants). At that time, the NCGC will consider potential candidates submitted by shareholders in accordance with the procedures described above. The NCGC will then evaluate each potential candidate's educational background, employment history, outside commitments and other relevant factors to determine whether he or she is potentially qualified to serve on our Board. The NCGC will seek to identify and recruit the best available candidates and intends to evaluate qualified shareholder candidates on the same basis as those submitted by other sources.

After completing this process, our NCGC will determine whether one or more candidates are sufficiently qualified to warrant further investigation. If the process yields one or more desirable candidates, the NCGC will rank them by order of preference, depending on their respective qualifications and our needs. The NCGC will then contact the desired candidate(s) to evaluate their potential interest and to schedule interviews. All such interviews will be held in person and will include only the candidate and the NCGC. Any travel expenses incurred by the candidate may be at the expense of the candidate, at the discretion of the NCGC. Based upon interview results, the candidate's qualifications and appropriate background checks, the NCGC will then decide whether it will recommend the candidate's nomination to the full Board.

Shareholder Communications with the Board

Our Board has adopted the following procedures for shareholders to send communications to the full Board or individual Directors.

Shareholders seeking to communicate with our Board should submit their comments in writing to our Corporate Secretary at Frozen Food Express Industries, Inc., 1145 Empire Central Place, Dallas, Texas 75247 or by email to secretary@ffex.net. Our Corporate Secretary will forward all such communications (excluding routine advertisements and business solicitations and communications that the Corporate Secretary deems not a bona fide shareholder communication) to each member of our Board, or if applicable, to the individual Director(s) named in the correspondence. Subject to the following, the Chairman of the Board and our independent Directors will receive copies of such shareholder communications, including those addressed to individual Directors, unless such communications address allegations of misconduct or mismanagement on the part of the Chairman of the Board. In such an event, our Corporate Secretary will first consult with and receive the approval of our independent Directors before disclosing or otherwise discussing the communication with the Chairman of the Board.

We reserve the right to screen materials sent to our Directors for potential security risks or harassment purposes, and we also reserve the right to verify stock ownership status before forwarding communications to our Board.

Our Corporate Secretary will determine the appropriate timing for forwarding shareholder communications to our Directors. He or she will consider each communication to determine whether it should be forwarded promptly or compiled and sent with other communications and other Board materials in advance of the next scheduled Board meeting.

Shareholders can also communicate with our Board at the annual meeting of shareholders.

Audit Committee

We have established and maintain an Audit Committee in accordance with the rules promulgated under the Exchange Act. Our Audit Committee assists our Board of Directors in fulfilling its responsibilities for general oversight of the integrity of our financial statements, the qualifications of our independent registered public accounting firm, compliance with legal and regulatory requirements, our internal audit function and internal controls over financial reporting. This Committee works closely with management as well as our independent auditors and currently consists of Jerry T. Armstrong (Chairman), W. Mike Baggett, Barrett D. Clark and T. Michael O'Connor, all of whom meet the independence criteria of audit committee members prescribed by the NASDAQ listing standards' financial literacy requirements. Our Board has determined that Mr. Armstrong meets the requisite SEC criteria to qualify as an audit committee financial expert. Our Audit Committee met nine times during 2010. The Committee operates pursuant to a written charter that has been approved and adopted by our Board and is reviewed and reassessed annually by the Committee. The Audit Committee Charter is available under "Documents & Charters" under subsection "Corporate Governance" within our "Investors" section of our internet website at www.ffex.net. The “Report of the Audit Committee” is included herein and appears on page 36 of this proxy statement.

Related Party Transactions Policy

The Board has adopted written policies and procedures for the review of all “Related Party Transactions”, which include any relationship, arrangement, or transaction or any series of similar relationships, arrangements or transactions involving an amount exceeding $25,000 between the Company and any of our executive officers, directors, director nominees or 5% shareholders or their immediate family members (collectively, “Related Parties”).

All Related Party Transactions proposed to be entered into by the Company must be reported to the Company’s Chief Financial Officer who is required to submit a recommendation to the Audit Committee for review. If the Audit Committee recommends approval of the Related Party Transaction, such recommendation is required to be submitted to the independent directors of the Board (the “Independent Board”) meeting in executive session for review. The Related Party Transaction must be approved by a majority of the members of the Independent Board prior to the effectiveness or consummation of the transaction, whenever practicable. If the Chief Financial Officer determines that advance approval of a Related Party Transaction is not practicable under the circumstances, the Audit Committee who is required to review the Related Party Transaction at its next meeting and, in its discretion, may recommend ratification of the Related Party Transaction at the next meeting of the Independent Board or at the next meeting following the date that the Related Party Transaction comes to the attention of the Chief Financial Officer; provided, however, that the Chief Financial Officer is required to present a Related Party Transaction arising in the time period between meetings of the Audit Committee to the chair of the Audit Committee, who is required to review and may approve the Related Party Transaction, subject to ratification by the Audit Committee and by the Independent Board at the next meeting of the Committee and the Independent Board. Any Related Party Transaction that is not recommended by the Audit Committee and approved by the Independent Board prior to its effectiveness or consummation and that is not subsequently ratified by the Audit Committee and the Independent Board at the next meeting shall be voidable at the option of the Independent Board and all persons subject to the policy are required to take all necessary action to unwind any Related Party Transaction voided by the Audit Committee or the Independent Board on terms that are fair to the Company and its shareholders.

A Related Party Transaction reviewed will be considered approved or ratified if it is recommended by the Audit Committee and approved by the Independent Board in accordance with the standards set forth in the policy after full disclosure of the Related Party's interests in the Related Party Transaction. As appropriate, the Audit Committee and the Independent Board are required to review and consider the following:

| ● | the Related Party's relationship to the Company and interest in the Related Party Transaction (as an approximate dollar value, without regard to profit or loss); |

| ● | the approximate total dollar value involved in the Related Party Transaction; |

| ● | whether the Related Party Transaction was undertaken in the ordinary course of business of the Company; |

| ● | whether the Related Party Transaction is proposed to be, or was, entered into on the terms no less favorable to the Company than terms that could have been reached with an unrelated third party; |

| ● | whether the Related Party Transaction would impair the independence, pursuant to Nasdaq Rule 5605(a)(2), or any successor rule, of a Director on the Independent Board; |

| ● | whether the Related Party Transaction would require a waiver of our Code of Ethics; |

| ● | the terms on which the Related Party offers the products or services involved in the Related Party Transaction to unrelated parties; |

| ● | the purpose, and the potential benefits to the Company, of the Related Party Transaction; and |

| ● | any other information regarding the Related Party Transaction or the Related Party in the context of the proposed Related Party Transaction that would be material to investors and shareholders of the Company in light of the particular Related Party Transaction. |

The Board has determined that the following transactions and circumstances do not create a material direct or indirect interest on the part of the Related Party and are not, therefore, Related Party Transactions:

| ● | transactions available to all employees generally or to all employees in the same category; |

| ● | interests arising solely from the ownership of a class of the Company’s equity securities if all holders of that class of equity securities receive the same benefit on a pro rata basis; |

| ● | transactions involving compensation to an executive officer (a) if the compensation is required to be reported in the Company’s proxy statement under the compensation disclosure requirements in Item 402 of Regulation S-K; or (b) if the compensation would be required to be reported in the Company’s proxy statement under the compensation disclosure requirements in Item 402 Regulation S-K if the executive officer was also a “named executive officer” (as defined in Item 402 of Regulation S-K), and the Compensation Committee of the Board approved (or recommended that the Board approve) such compensation, except that subsection (b) of this paragraph would be considered a Related Party Transaction if such executive officer is also an immediate family member of another executive officer or Director of the Company; |

| ● | transactions involving compensation to a Director for services as a Director of the Company if such compensation will be reported pursuant to Item 402(k) of Regulation S-K; and |

The Policy Regarding Related Party Transactions is available under "Documents & Charters" under subsection "Corporate Governance" within our "Investors" section of our internet website at www.ffex.net.

Compensation Committee

The principal functions of our Compensation Committee are to review and approve executive officer compensation and employee compensation matters, including matters regarding our various benefit plans, independently or in conjunction with our Board, as appropriate. Specific duties and responsibilities include, among others, reviewing and approving objectives relevant to executive officer compensation, evaluating performance and determining the compensation of each executive officer in accordance with those objectives, approving and amending our incentive compensation and stock option program and recommending compensation arrangements for our Directors. To fulfill its responsibilities, the Committee met nine times during 2010. The Committee currently consists of Brian R. Blackmarr (Chairman), W. Mike Baggett and Kevin K. Kilpatrick, all of whom meet the independence criteria prescribed by NASDAQ. The Committee has adopted a charter, and it is available under "Documents & Charters" under subsection "Corporate Governance" within our "Investors" section of our internet website at www.ffex.net. The “Report of the Compensation Committee” is included herein and appears on page 29 of this proxy statement.

Compensation Committee Interlocks and Insider Participation

As of December 31, 2010, no member of our Compensation Committee is involved in a relationship requiring disclosure as an interlocking executive officer/director under Item 404 of Regulation S-K.

Nominating and Corporate Governance Committee

The principal functions of the Nominating and Corporate Governance Committee ("NCGC") are to screen individuals who are eligible and qualified to serve on the Board and to recommend those individuals to the full Board, oversee our corporate governance standards and our Code of Ethics. Only people who have been screened and recommended by the NCGC can be considered by the Board for either interim appointment to the Board, or for nomination for election by shareholders to the Board of Directors. The NCGC met one time during 2010. The NCGC currently consists of Chairman W. Mike Baggett, Brian R. Blackmarr and Barrett D. Clark, each of whom meet the independence criteria prescribed by NASDAQ. The NCGC adopted a charter and it is available under "Documents & Charters" under subsection "Corporate Governance" within our "Investors" section of our internet website at www.ffex.net.

PROPOSAL 1: ELECTION OF DIRECTORS

Our Bylaws provide that our Board shall consist of nine Directors. Each year, the Directors in one of the three classes are elected to serve for a three-year term. At the 2011 Annual Meeting, three Class I directors are nominated for election for a three-year term or until their successors are elected and qualified. The current term for Class II Directors will expire at the 2012 annual meeting of shareholders and the current term for Class III Directors will expire at the 2013 annual meeting of shareholders.

Upon the recommendation of the NCGC, the Board of Directors proposes the following nominees, all of whom are currently serving as Class I directors, be elected as Class I directors for three-year terms expiring in 2014:

| | | |

| | Kevin K. Kilpatrick | |

| | S. Russell Stubbs | |

The Board recommends that you vote FOR the election of all three individuals who have been nominated to serve as a Director. Unless otherwise instructed, the persons named as proxies will vote all proxies received FOR the election of the persons named as nominees in this proxy statement. If you wish to give specific instructions with respect to the voting of Directors, you may do so by indicating your instructions on your proxy or voting instruction card.

If, at the time of the annual meeting, any of the nominees should be unable or decline to serve, the discretionary authority provided in the proxy will be used to vote for a substitute or substitutes as may be designated by the NCGC and our Board. The Board of Directors has no reason to believe that any substitute nominee or nominees will be required.

Information Concerning Nominees and Directors

Our directors bring a broad range of leadership and experience to the boardroom and regularly contribute to the dialogue involved in effectively overseeing and guiding the business and affairs of the Company. Our Board consists of two employees of the Company, our Chief Executive Officer and President, and our Chief Operating Officer, one non-employee, non-independent director and six non-employee independent directors. Though the members of the Board have been selected to provide a wide range of viewpoints, the atmosphere of our Board is professional and collaborative. Preparation, engagement and participation are expected from our directors and we insist on high personal and professional ethics, integrity and values. All of our current directors and nominees satisfy such requirements. The Board has adopted Corporate Governance Guidelines, which are observed by all directors. With a diverse mix of experience, backgrounds and skill sets, the Board believes it is well positioned to represent the best interests of the shareholders. The principal occupation, specific experience, qualifications, attributes or skills and certain other information about the nominees and other directors whose terms of office continue after the annual meeting are set forth on the following pages.

Director Nominees — Class I (Term Ending 2011)

Barrett D. Clark, Director since 2007

Mr. Clark, 38, is Managing Partner of Clark Cattle Company, a ranching operation with holdings throughout the United States and Mexico, since 1995. He also manages Trinity Country Real Estate, a land investment and brokerage company with domestic and international property holdings. Additionally, Mr. Clark sits on the oversight board of Breck Operating, Inc., a privately-owned oil and gas operating company with properties in 17 states and Canada.

Mr. Clark brings significant experience in managing large multi-location operations. His background in agricultural products and ranching provides significant insight into the workings of bringing commodity driven products to market. He is an experienced negotiator, which he has used to the Company’s benefit in various Board assignments. Mr. Clark has been very active in the improvements made to the Company’s corporate governance initiatives. Mr. Clark serves on both our Audit Committee and NCGC and is a graduate of the Texas Christian University, M.J. Neeley School of Business.

Kevin K. Kilpatrick, Director since 2009

Mr. Kilpatrick, 57, is Chairman and Chief Executive Officer of DFW Paving LLC, a concrete and asphalt company that he formed in 2006. Mr. Kilpatrick has twenty years executive level experience as a corporate executive and entrepreneur. Over a twenty year period at PESCOR Plastics as Vice President, and later President, he led the company to an annualized sales growth of over $50 million, leading to a merger with Berry Plastics. During his time at Berry Plastics, Mr. Kilpatrick developed several proprietary cup designs, including the Coca Cola Contour Cup which sold over one billion units. He was also co-owner and Executive Vice President of Sky USA Precision Manufacturing LLC, which specializes in full service precision machining to the commercial, military and aerospace industries.

Mr. Kilpatrick brings to the Board, and Company, the entrepreneurial expertise that has successfully launched two companies in disparate industries. Mr. Kilpatrick has proven expertise in sales and marketing, operations, finance and new product development. In his executive roles, Mr. Kilpatrick has developed strategic third party alliances for the benefit of his companies. His position as an executive in the construction industry provides experience in capital intensive organizations within challenging, high-turnover employment environments. Mr. Kilpatrick brings a strong customer service background that is well suited to the challenges of the transportation industry. Mr. Kilpatrick serves on our Compensation Committee and is a graduate of Texas Christian University.

S. Russell Stubbs, Chief Executive Officer and President, Director since 2005

Mr. Stubbs, 47, has served as our Chief Executive Officer and President since March 1, 2011 and previously served as our President beginning on January 15, 2010. Previously, he served as Senior Vice President and Chief Operating Officer beginning on May 17, 2006. Mr. Stubbs served as President of Lisa Motor Lines, Inc., our dedicated truckload subsidiary, from 1999 until 2006. He joined FFE Transportation Services, Inc., our primary operating subsidiary, in 1986 as a management trainee. Mr. Stubbs has significant experience in both our less-than-truckload (“LTL”) operations and truckload (“TL”) operations. While at Lisa Motor Lines, he oversaw the acquisition and consolidation of two separate companies, Middleton Transportation Company and Great Western Express. In 1996, Mr. Stubbs demonstrated the versatility of his talents by leading an eighteen month project to design, test and implement a new operating system for the company’s truckload operations. In 1999 Mr. Stubbs was asked to assume the position of President of Lisa Motor Lines with the goal to grow the Company and enhance profitability. Over the next several years, Lisa grew by thirty-three percent with steady margin improvement.

Through his twenty-five years of service to the Company, a complex temperature controlled transportation and logistics enterprise, Mr. Stubbs brings to the Board and the Company a unique comprehension of our strategies and operations. This understanding of transportation extends beyond the Company through his involvement in various state and national transportation organizations. Mr. Stubbs has served as Chair of the Texas Motor Transportation Association (TMTA), Chair of the TMTA Foundation and Chair of the Regulatory and Advisory Committee of the Truckload Carriers Association (TCA). Mr. Stubbs now serves on the Executive Committee and as an Officer of the TCA. He has also been very active in the American Trucking Association. In 2009, Mr. Stubbs was recognized with the Leadership Award by the TMTA. Mr. Stubbs has been a Board member of the Company for five years and graduated from Texas A&M University. He is the son of Stoney M. Stubbs, Jr., our non-executive Chairman of the Board since March 1, 2011, a Class III Director and a former Chief Execute Officer of the Company.

Director Continuing in Office — Class II (Term Ending 2012)

Brian R. Blackmarr, Director since 1990

Mr. Blackmarr, 69, has been President and Chief Executive Officer of Fusion Laboratories, Inc., an information technology services and proprietary software company, since January 2002. Mr. Blackmarr, a Registered Professional Engineer and Certified Arbitrator, is a widely known consultant in software and technical services. He has brought several software products to market and has conducted professional seminars on a variety of technical topics in five continents. Mr. Blackmarr founded B.R. Blackmarr and Associates, the predecessor to Fusion Laboratories, Inc. He has also served on the IT Advisory Council for Texas Tech University.

Mr. Blackmarr’s extensive technology experience has been beneficial in providing guidance to the Company and Board of Directors in information technology related matters as the transportation industry has become more dependent on technology to improve service and hold costs in check. His experience in marketing, product development and as a business founder and entrepreneur contributes greatly to corporate strategy and governance. Mr. Blackmarr has been a major contributor to the Board, and Company, for two decades. Mr. Blackmarr serves as the Chairman of our Compensation Committee and serves as a member of our NCGC. He is a graduate of The University of Texas at Austin, holding both a Bachelor of Science and a Masters of Science in Mechanical and Industrial Engineering.

W. Mike Baggett, Director since 1998

Mr. Baggett, 64, is Chairman Emeritus and Shareholder of Winstead PC, a Dallas-based business law firm of 300 lawyers, from 2006, and was their Chairman and Chief Executive Officer from 1992. He has successfully argued six published opinions of the Texas Supreme Court and has tried over fifty commercial claims at the trial level. Mr. Baggett is a well known author and lecturer before judicial conferences, bar associations, law schools, trade and industry groups. His expertise in law includes commercial and securities litigation, and he is Board Certified in Civil Trial Law.

His thirty-eight years of experience as an attorney for public and private entities provides valuable guidance to our Company and our Board of Directors in all aspects of corporate law, corporate governance and finance. Mr. Baggett’s almost thirteen years as a member of the Board allows him significant insight and experience to help shape the direction of the Company. Mr. Baggett serves as the Chairman of our NCGC and serves as a member of both our Audit Committee and Compensation Committee. Mr. Baggett is a graduate of Texas A&M University in accounting, and the Baylor School of Law, cum laude.

John T. Hickerson, Executive Vice President and Chief Operating Officer, Director since 2009

Mr. Hickerson, 59, has been our Executive Vice President and Chief Operating Officer since January 15, 2010 and previously served as Senior Vice President and Chief Marketing Officer of the Company beginning on February 25, 2009. Additionally, he served as Senior Vice President and Chief Marketing Officer of FFE Transportation Services since September 26, 2007 and as President of FFE Logistics, Inc. since January 15, 2007, both wholly-owned subsidiaries of the Company. From January 2006 until January 2007, Mr. Hickerson was Chairman and CEO of Pacer Transport, Inc. From January 2004 until November 2005, he was Vice President of Domestic Intermodal at Burlington Northern Sante Fe Railway. Mr. Hickerson’s experience also includes tenures at Con-Way Transportation Services as President of Con-Way Southern Express from 1989 through 2002 and as President of the Roadway Regional Group in 2003. He also served on the Board of Directors for Blue Wing Global Logistics in 2006 and 2007.

Mr. Hickerson brings over thirty-one years of diversified transportation experience to the Company and the Board of Directors. He has served as Chairman of the Texas Motor Transportation Association, as Texas State Vice President of the American Trucking Association, on the Board of Directors of the Texas Chamber of Commerce and is currently a member of the Texas Motor Transportation Association Executive Advisory Board. In addition, Mr. Hickerson’s extensive background in diversified transportation sales and operations gives him a unique perspective for his leadership position on the Board and in the Company. Mr. Hickerson graduated from Centenary College and received post graduate education through the UCLA Anderson School of Business and Columbia University’s Senior Executive Program.

Director Continuing in Office — Class III (Term Ending 2013)

Stoney M. Stubbs, Jr., Chief Executive Officer, Director since 1980

Mr. Stubbs, 74, has been our non-executive Chairman of the Board since March 1, 2011 and previously served as Chairman of the Board and Chief Executive Officer beginning on January 15, 2010. He previously served as Chairman of the Board, President and Chief Executive Officer since 1980. Mr. Stubbs joined the company in 1960 as a management trainee and subsequently advanced through the organization until ultimately being appointed to Chairman, President and Chief Executive Officer in 1980. Mr. Stubbs has extensive experience in the transportation industry, having served as Chairman of the Truckload Carriers Association and the Texas Motor Transportation Association. Mr. Stubbs continues to serve on the Board of Directors of the Truckload Carriers Association and the Advisory Committee for the Texas Motor Transportation Association, as well as serving as Vice President at large for the American Trucking Association. Mr. Stubbs has been honored with Leadership Awards from the Truckload Carrier Association and the Texas Motor Transportation Association.

Mr. Stubbs brings five decades of experience in the transportation industry, as an industry leader and served as our Chairman of the Board, President and Chief Executive Officer for over 30 years. Mr. Stubbs graduated from Texas A&M University and is the father of S. Russell Stubbs, our Chief Executive Officer, President and a Class I Director.

T. Michael O’Connor, Director since 1992

Mr. O’Connor, 56, is a fifth generation South Texas rancher, entrepreneur and businessman. He has been Chief Executive Officer of O’Connor Ranch, with interests in agriculture and energy, since 1990. He is currently serving as Sheriff of Victoria County Texas, since January 2005. Mr. O’Connor currently serves as President of the South Texas Coastal Sheriff’s Alliance consisting of twenty-four counties in South Texas. He is also Chairman of the Law Enforcement Alliance Project and a member of the Project Safe Neighborhood Task Force of the Southern District through the United States Attorney’s Office. Mr. O’Connor serves on the Ethics and Standards Committee of the National Sheriff’s Association. Mr. O’Connor is a former Vice Chairman of the Texas A&M University System Board of Regents and served on the Texas State Government Management Task Force. He was appointed to serve on the Texas Border Security Council by Governor Rick Perry in 2007, which advises on homeland security issues. He has more than thirty years experience in law enforcement and as a successful businessman.

Mr. O’Connor brings expertise in governance, leadership, safety, security and ethics to our Board. His knowledge and leadership in law enforcement and border security provides direction to the Company’s South Texas and border operations. Over the past thirty years, Mr. O’Connor has been actively involved in various businesses and agencies related to agriculture, banking, energy, higher education and law enforcement, which have allowed him to gain experience in the areas of enterprise restructuring, policy and procedures, budgeting, audit review, investments and acquisitions. Mr. O’Connor has over eighteen years of experience on our Board and has in-depth knowledge of the company’s operations and needs. Mr. O’Connor is also a member of our Audit Committee. Mr. O’Connor is a graduate of Texas A&M University.

Jerry T. Armstrong, Director since 2003