UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2011

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________ to ________

Commission file number 1-10006

FROZEN FOOD EXPRESS INDUSTRIES, INC. (Exact name of registrant as specified in its charter)

TEXAS (State or other jurisdiction of incorporation or organization) | | 75-1301831 (I.R.S. Employer Identification No.) |

1145 EMPIRE CENTRAL PLACE, DALLAS, TEXAS (Address of principal executive offices) | | 75247-4305 (Zip Code) |

Registrant's telephone number, including area code: (214) 630-8090

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | | Name of Each Exchange on Which Registered |

i) Common Stock $1.50 par value ii) Rights to purchase Common Stock | | The NASDAQ Stock Market LLC (NASDAQ Global Select Market) |

Securities registered pursuant to Section 12(g) of the Act: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act: Yes [ ] No [ X ]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act: Yes [ ] No [ X ]

Indicate by check mark whether the registrant (l) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ X ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or smaller reporting company. See the definition of “large accelerated filer”, “accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [X] Smaller reporting company [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

The aggregate market value of 15,653,114 shares of the registrant’s $1.50 par value common stock held by non-affiliates as of June 30, 2011 was approximately $55,881,616 (based upon $3.57 per share).

As of March 23, 2012, the number of outstanding shares of the registrant’s common stock was 17,868,269.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's Annual Report to Stockholders for the year ended December 31, 2011 and Proxy Statement for use in connection with its Annual Meeting of Stockholders to be held on May 16, 2012, to be filed with the Securities and Exchange Commission pursuant to Regulation 14A not later than 120 days after December 31, 2011, are incorporated by reference in Part III (Items 10, 11, 12, 13 and 14).

TABLE OF CONTENTS

| | | PAGE |

| | | |

| Business | 1 |

| | | |

| Risk Factors | 8 |

| | | |

| Unresolved Staff Comments | 12 |

| | | |

| Properties | 12 |

| | | |

| Legal Proceedings | 12 |

| | | |

| Mine Safety Disclosures | 12 |

| | | |

| | | |

| | | |

| Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 13 |

| | | |

| Selected Financial Data | 15 |

| | | |

| Management's Discussion and Analysis of Financial Condition and Results of Operations | 15 |

| | | |

| Quantitative and Qualitative Disclosures about Market Risk | 30 |

| | | |

| Financial Statements and Supplementary Data | 32 |

| | | |

| Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 47 |

| | | |

| Controls and Procedures | 47 |

| | | |

| Other Information | 47 |

| | | |

| | | |

| | | |

| Directors and Executive Officers and Corporate Governance | 48 |

| | | |

| Executive Compensation | 48 |

| | | |

| Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 49 |

| | | |

| Certain Relationships and Related Transactions, and Director Independence | 49 |

| | | |

| Principal Accountant Fees and Services | 49 |

| | | |

| | | |

| | | |

| Exhibits and Financial Statement Schedules | 49 |

| | | |

| | | |

| | | |

| | | 50 |

| | | |

| | | 51 |

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains information and forward-looking statements that are based on management's current beliefs and expectations and assumptions we made based upon information currently available. Such statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Any statements not of historical fact may be considered forward-looking statements. Forward-looking statements include statements relating to our plans, strategies, objectives, expectations, intentions and adequacy of resources , including whether the Company will return to profitability in fiscal 2012, and may be identified by words such as “will”, “could”, “should”, “believe”, “expect”, “intend”, “plan”, “schedule”, “estimate”, “project” or other variations of these or similar words, identify such statements. These statements are based on our current expectations and are subject to uncertainty and change.

Although we believe the expectations reflected in such forward-looking statements are reasonable, actual results could differ materially from the expectations reflected in such forward-looking statements. Should one or more of the risks or uncertainties underlying such expectations not materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those we expect.

Factors that are not within our control that could cause actual results to differ materially from those in such forward-looking statements include demand for our services and products, and our ability to meet that demand, which may be affected by, among other things, competition, weather conditions and the general economy, the demand for bulk tank water transportation services, the availability and cost of labor and owner-operators, our ability to negotiate favorably with lenders and lessors, continued availability of credit on commercially reasonable terms, the effects of terrorism and war, the availability and cost of equipment, fuel and supplies, the market for previously-owned equipment, the impact of changes in the tax and regulatory environment in which we operate, operational risks and insurance, risks of lawsuits and unfavorable judgements, risks associated with the technologies and systems we use and the other risks and uncertainties described in Item 1A, Risk Factors of this report and risks and uncertainties described elsewhere in our filings with the Securities and Exchange Commission (“SEC”). We undertake no obligation to correct or update any forward-looking statements, whether as a result of new information, future events, or otherwise.

References in the Annual Report to “we”, “us”, “our”, or the Company or similar terms refer to Frozen Food Express Industries, Inc. and it’s consolidated subsidiaries unless the context otherwise requires.

ITEM 1. Business

OVERVIEW

Frozen Food Express Industries, Inc. is one of the leading providers of temperature-controlled truckload and less-than-truckload services in the United States with operations in the transport of temperature-controlled products and perishable goods including food, health care and confectionary products. Transportation services are offered in over-the-road and intermodal modes for temperature-controlled truckload and less-than-truckload. We also provide brokerage and logistics services, including ocean, air, both domestic and international expedited services and oil field water delivery services, as well as dedicated fleets to our customers.

We were incorporated in Texas in 1969, as successor to a company formed in 1946. Our principal office is located at 1145 Empire Central Place, Dallas, Texas 75247-4305. Our telephone number is (214) 630-8090 and our website is www.ffeinc.com.

Our growth strategy is to expand our business internally by offering shippers a high level of service with flexible shipping capacity. We market our temperature-controlled truckload services primarily to large shippers that require consistent freight capacity within our preferred lanes, desire the high service level we provide and understand the pricing necessary to support these service levels. We market our temperature-controlled less-than-truckload services to shippers who need the flexibility to ship varying quantities based upon scheduled departure and delivery times. Our fleet of company and independent contractor tractors allows us to offer a high quality of service and on-time performance within tight time windows at stringent temperature standards.

Our services are further described below:

| · | TRUCKLOAD (“TL”) LINEHAUL SERVICE: This service provides for the shipment of a load, typically weighing between 20,000 and 40,000 pounds and usually from a single shipper, which fills the trailer. Normally, a truckload shipment has a single destination, although we are also able to provide multiple stop deliveries. We are one of the largest temperature-controlled truckload carriers in the United States. In prior years up and through the third quarter of 2011, we offered dry-freight services using dry-van equipment. In the fourth quarter of 2011, we completed a sale of our dry-van equipment; however, dry-freight services are offered using refrigerated trailers. |

| · | DEDICATED FLEETS: This service provides trucks and drivers to handle certain of our customers’ transportation needs, including guaranteed year-round capacity without the capital investment, insurance risks and equipment utilization issues of private fleets. Providing this service allows our customers to eliminate all or a portion of their internal dedicated fleet to lower their customers’ transportation costs and improve the quality of service. |

| · | LESS-THAN-TRUCKLOAD ("LTL") LINEHAUL SERVICE: This service provides for the shipment of a load, typically consisting of up to 30 shipments, which may weigh as little as 50 pounds or as much as 20,000 pounds, from multiple shippers destined to multiple locations. Our temperature-controlled LTL operation is the largest in the United States and the only one offering regularly scheduled nationwide service. In providing temperature-controlled LTL service, multi-compartment trailers enable us to haul products requiring various levels of temperatures in a single load. |

| · | BROKERAGE and LOGISTICS SERVICES: Our brokerage and logistics services help us to balance the level of demand in our core business. Orders for shipments to be transported for which we have no readily available transportation assets are assigned to other unaffiliated motor carriers through our brokerage service. Our services also include ocean, air, and both domestic and international expedited services as well as water related delivery services for the oil field industry. We establish the price to be paid by the customer, invoice the customer and pay the service provider. We also assume the credit risk associated with the transaction. |

| · | EQUIPMENT RENTAL: Revenue from equipment rental includes amounts we charge to independent contractors for the use of trucks we own and lease to them. We also lease refrigerated trailers for the storage and transportation of perishable items as needed by our customers. |

The following table summarizes and compares the components of our revenue for each of the years in the five-year period ended December 31, 2011: | | | (in thousands) | |

| Revenue from: | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

| Truckload linehaul services | | $ | 156,302 | | | $ | 171,392 | | | $ | 187,234 | | | $ | 214,348 | | | $ | 212,416 | |

| Dedicated fleets | | | 17,469 | | | | 17,467 | | | | 19,707 | | | | 24,609 | | | | 17,861 | |

| Less-than-truckload linehaul services | | | 112,030 | | | | 110,467 | | | | 109,054 | | | | 124,091 | | | | 127,438 | |

| Fuel surcharges | | | 80,705 | | | | 57,410 | | | | 44,876 | | | | 109,144 | | | | 73,391 | |

| Brokerage and logistics services | | | 18,524 | | | | 6,798 | | | | 7,266 | | | | 13,142 | | | | 15,586 | |

| Equipment rental | | | 3,431 | | | | 5,288 | | | | 4,914 | | | | 5,202 | | | | 5,522 | |

| Total operating revenue | | $ | 388,461 | | | $ | 368,822 | | | $ | 373,051 | | | $ | 490,536 | | | $ | 452,214 | |

Additional information regarding our business is presented in the Notes to Consolidated Financial Statements included in Item 8 and in Management's Discussion and Analysis of Financial Condition and Results of Operations in Item 7 of this Annual Report on Form 10-K.

Temperature-controlled transportation: The products we haul include meat, ice, poultry, seafood, processed foods, candy and other confectionaries, dairy products, pharmaceuticals, medical supplies, fresh and frozen fruits and vegetables, cosmetics, film and Christmas trees. In the temperature-controlled market, it may be necessary to keep freight frozen, as with ice; to keep freight cool, as with candy; or to keep freight from freezing. The common and contract hauling of temperature-sensitive cargo is highly fragmented and comprised primarily of carriers generating less than $70 million in annual revenue. In addition, many major food companies, food distribution firms and grocery chain companies transport a portion of their freight with their own fleets.

Intermodal transportation: In providing our truckload linehaul service, we often engage railroads to transport shipments between major cities. In such an arrangement, loaded trailers are transported to a rail facility and placed on flat rail cars for transport to their destination. Upon arrival, we pick up the trailer and deliver the freight to the consignee. Intermodal service is a cost effective way of providing service in major truckload markets that do not have restrictive service requirements that would limit the ability to rely on intermodal rail service.

MARKETING AND OPERATIONS

Our temperature-controlled, dedicated and brokerage logistics services, trucking operations serve nearly 4,000 customers in the United States, Mexico and Canada. Revenue from international activities was approximately 3% of total operating revenue during each of the past five years.

We strive to provide high service levels at a value added price to our customers as opposed to competing with low cost, low service providers. Our marketing efforts target shippers requesting premium service, reliable capacity, and value added service options. We market mainly temperature controlled truckload, less-than-truckload, intermodal, and brokerage logistics services, but also provide intermodal and engineering services, all focused on value added services and pricing. Due to the decline in industry-wide truckload capacity, pricing for our truckload and intermodal services has been more favorable to us. However, improved pricing for the LTL market continues to be challenging and route specific, as well as more seasonally influenced.

Excluding fuel surcharges, temperature-controlled shipments account for approximately 87% of our total operating revenue. Our customers are involved in a variety of products including food products, pharmaceuticals, medical supplies and household goods. Our customer base is diverse in that our top 5, 10 and 20 largest customers accounted for 32%, 45% and 55%, respectively, of our total operating revenue during 2011. None of our markets are dominated by any single competitor nor did any customer account for more than 8% of total operating revenue during any of the past five years. We compete with several hundred other trucking companies. The principal methods of competition are price, quality of service and availability of equipment needed to satisfy customer needs.

Our marketing efforts are conducted by a staff of dedicated sales, customer service and support personnel under the supervision of our senior management team. Sales personnel travel within assigned regions to solicit new customers and maintain contact with existing customers. We also have an enterprise sales force team that focuses primarily on large LTL and truckload temperature-controlled shippers. We utilize a group of inside sales personnel (the Account Management Center) who solicit customers who do not warrant or desire direct outside sales representation. Additionally, we market and sell our brokerage logistics services from our corporate sales and service office in Dallas, Texas. Our brokerage and brokerage logistics services include temperature-controlled, dry van and other specialized needs of our customers not typically offered by other carriers, including ocean, air, both expedited domestic and international services and oil field water delivery services.

Our operations personnel strive to improve our asset utilization by seeking freight that allows for efficient and timely use of assets, minimizes empty miles, carries a value added rate structure and allows our drivers to remain within our preferred network of lanes. Once we have established a relationship with a customer, customer service managers work closely with our fleet managers to match the customer’s needs with our capacity. Load planners or dispatchers utilize various optimization solutions to assign loads in ways that meet our customers’ needs and provide the most efficient use of our assets. We attempt to route most of our trucks over preferred lanes, which we believe assists us in meeting our customer’s needs, balancing traffic, reducing empty miles and improving the reliability of our delivery schedules. Within our LTL services, we provide for regularly scheduled pick-up and delivery times so our customers can depend upon a pre-existing schedule.

DRIVERS AND OTHER PERSONNEL

We select drivers using specific guidelines for safety records, background information, driving experience and personal evaluations. We believe that maintaining a safe and professional driver group is essential to providing excellent customer service, safer roads for others and achieving profitability. We maintain stringent screening, training and testing procedures for our drivers to reduce the risk for accidents and thereby controlling our insurance and claims cost. We train our drivers at our service centers in all phases of our policies and operations including safety techniques, fuel-efficient operation of the equipment, and customer service. We also offer computer and audio based training through our website. Heightened competition in the trucking industry for qualified drivers has resulted in additional expense to recruit and retain an adequate supply of drivers. In February of 2011, we opened a driving school, the FFE Driver Academy, and increased our recruiting efforts. This has shown excellent potential in allowing us to increase our fleet with Company trained drivers. We have graduated and hired 650 drivers from the academy for the year ended December 31, 2011. All drivers must also pass United States Department of Transportation (“DOT”) required tests prior to commencing employment.

At December 31, 2011 we had 1,439 company drivers and 266 independent contractors. Our turnover for company drivers was approximately 85%. We find that if we can retain a driver beyond the first 12 months, we have a much better opportunity to retain that driver for a longer period of time. We pay our company drivers on a fixed rate per mile basis and the independent contractors either a percentage of the earned revenue or on a per mile basis.

Independent contractors provide their tractors to pull our loaded trailers. We generally utilize the independent contractors based upon our existing capacity and the needs of our customers as those needs increase or decrease. At December 31, 2011, we had 158 independent contractors providing truckload services and 108 providing LTL services compared to 138 independent contractors providing truckload services and 166 providing LTL services for the period ended December 31, 2010. Each independent contractor pays for their driver wages, fuel, equipment related expenses and other transportation costs. We bill the customer and pay the independent contractor upon proof of delivery to the destination. The Company assumes the credit risk with the customer and provides all customer support.

For the year ended December 31, 2011, we had 2,125 employees, consisting of 1,439 drivers, 499 field and operations personnel and 187 sales, general and administrative employees, compared to 1,572 drivers, 503 field and operations personnel and 211 sales and general and administrative employees for the period ended December 31, 2010. None of our employees are represented by a collective bargaining unit, and we consider relations with our employees to be good. The decrease in personnel at the end of 2011 resulted from a reduction in back-office work force and the sale of certain dry-freight equipment in the fourth quarter of 2011, which reduced our company paid drivers.

FUEL

We are dependent on diesel fuel for our transportation services and our customers and we are impacted by the volatility of fuel prices. The price and availability of diesel fuel can vary significantly and are subject to political, economic and market factors that are beyond our control. While we do not hedge our exposure to volatile energy prices, we attempt to minimize our exposure through volume fuel purchasing arrangements with national fuel centers and bulk purchases of fuel at our service centers. During 2011, approximately 93.1% of our fuel purchases were made within this national network.

We further manage the price volatility through fuel surcharge programs with our customers. The Company adjusts fuel surcharge factors on a weekly basis; however, it may not fully recover price increases in the preceding week. Compared to fuel price levels in 2010, the surge in fuel prices in 2011 has increased shippers’ resistance to fuel price surcharges. Fuel surcharges help to offset the higher cost of tractor fuel only and do not offset higher fuel costs related to refrigerated trailers. Net fuel prices per gallon increased approximately 33.6% compared to 2010, but not with the volatility we witnessed in 2008. Nevertheless, in the current economy, shippers continued to be resistant to fuel surcharge programs.

Factors that could prevent us from fully recovering fuel cost increases include the competitive environment, empty miles, out-of-route miles, tractor engine idling and fuel to power our trailer refrigeration units. Such fuel consumption often cannot be attributed to a particular load, and therefore, there is no incremental revenue to which a fuel surcharge may be applied.

In most years, states increase fuel and road use taxes. Our recovery of future increases or realization of future decreases in fuel prices and fuel taxes, if any, will continue to depend upon competitive freight market conditions.

INSURANCE AND CLAIMS

We self-insure for a portion of our claims exposure resulting from workers’ compensation, auto liability, general liability, cargo and property damage claims and employees’ health insurance. We are also responsible for our proportionate share of the legal expenses related to such claims. We reserve currently for anticipated losses and related expenses and periodically evaluate and adjust our insurance and claims reserves to reflect our experience. The Company is responsible for the first $4.0 million on each personal injury and property damage claim and $300,000 for employees’ health claims. We have excess coverage from $4.0 million to $75.0 million. We are also responsible for the first $500,000 for workers’ compensation claims generated outside of Texas and for $500,000 on work injury claims filed in Texas. We are fully insured for auto and general liability exposures between $4.0 million and $75.0 million. We are fully insured between our retention of $500,000 and $1.5 million for Texas work injury claims and between our retention of $500,000 and state statutory limits for workers’ compensation claims outside of Texas. We have a $300,000 stop-loss retention on employee health claims. Our significant self-insured retention exposes us to the possibility of significant fluctuations in claims expense between periods depending on the frequency, severity and timing of claims and to adverse financial results if we incur large or numerous losses. In the event of an uninsured claim above our insurance coverage, a claim that approaches the maximum self-insured retention level or an increase in the frequency or severity of claims within our self-insured retention, our financial condition and results of operations could be materially and adversely affected. In the second half of 2011, the Company was affected with unfavorable settlements and legal costs, some dating back to 2005, which increased our claims and insurance expense by approximately $8.9 million. As of December 31, 2011, we have $3.0 million in standby letters of credit to guarantee settlement of claims under agreements with our insurance carriers and regulatory authorities.

Insurance rates have proven to be influenced by events outside of our Company’s control. As a result, our insurance and claims expense could increase, or we could raise our self-insured retention when our policies are renewed in 2012. Although insurance rates have declined the last several years, our risk management program is founded on the continual enhancement of safety in our operations. Our safety department conducts programs that include driver education and over-the-road observation and requires that drivers meet or exceed specific safety guidelines, driving experience, drug testing and physical examinations.

Our insurance and claims accruals represent our estimate of ultimate claims outcomes and are established based on the information available at the time of an incident. As additional information regarding the incident becomes available, any necessary adjustments are made to previously recorded amounts, including any expenses related to the incident.

INFORMATION TECHNOLOGY

The demanding shipping requirements of today’s world creates a need for continued investment in information technology to maintain a successful temperature-controlled trucking operation. In 2011, we handled approximately 125,000 truckload and 278,000 LTL shipments. These shipments are tracked for quality and service reasons. Our technology continues to advance and provides improved tracking systems, driver communication and routing systems and driver safety systems. Additionally, federal regulations continue to create demand for new systems such as electronic driver log systems, which are part of our current on board communication and routing system.

Our truckload and LTL fleets use computer and satellite technology to enhance efficiency and customer service. The mobile communications system provides automatic position updates of each truckload tractor and permits real-time communication between operations personnel and drivers. Dispatchers relay pick-up, delivery, weather, road conditions and other information to the drivers. Additionally, our on board systems have back-office integration to allow us to identify out-of-route mileage by matching actual driven location data with prescribed routes, thereby flagging cases of non-compliant driving. By utilizing these tools to analyze the situations, we can quickly identify route compliance issues by vehicle and driver, and make corrections to reduce costly excess miles driven. With this, we will reduce accident risks, save money and time, while also reducing driver frustrations that are associated with going off route.

The Company has also invested in the following technology that we believe allows us to operate more efficiently:

| · | Freight optimization software that assists us in selecting loads that match our overall criteria, including profitability, repositioning, identifying capacity for expedited loads, driver availability and home time, and other factors; |

| · | Fuel-routing software that optimizes the fuel stops for each trip to take advantage of volume discounts available in our national fuel network; |

| · | Electronic data interchange and internet communication with various customers concerning freight tendering, invoices, shipment status and other information; |

| · | Costing software that allows us to develop the appropriate pricing to our customers and to determine the profitability of specific moves; and |

| · | Trailer tracking devices utilizing global positioning system technology, which provides product traceability and desktop control of the refrigerated trailers. |

REVENUE EQUIPMENT

We operate premium company-owned tractors in order to help attract and retain qualified employee-drivers, promote safe operations, minimize repair and maintenance costs and ensure dependable service to our customers. We believe the higher initial investment for our equipment is recovered through more efficient vehicle performance offered by such premium tractors and improved resale value. Major repair costs are mostly recovered through manufacturers' warranties, but routine and preventative maintenance is our responsibility.

Changes in the size of our fleet depend upon developments in the nation's economy, demand for our services and the availability of qualified drivers. Continued emphasis will be placed on improving the operating efficiency and increasing the utilization of the fleet through enhanced driver training and retention and reducing the percentage of empty, non-revenue producing miles.

As of December 31, 2011, we operated a fleet of 1,656 tractors, including 1,390 company-owned tractors and 266 tractors supplied by independent contractors. The average age of our tractors was approximately 2.2 years. We typically replace our tractors within 42 months after purchase. As of December 31, 2011, we maintained 3,388 trailers. Our general policy is to retire our refrigerated trailers after seven years of service. Occasionally, we retain older equipment for use in local delivery operations.

The following represents a breakdown of the age of our tractors and trailers at the end of 2011 and 2010:

| | | Age in Years | | | | | | | |

| Tractors | | Less than 1 | | | 1 through 3 | | | More than 3 | | | Total | |

| | | 2011 | | | 2010 | | | 2011 | | | 2010 | | | 2011 | | | 2010 | | | 2011 | | | 2010 | |

| Company-owned and leased | | | 446 | | | | 205 | | | | 635 | | | | 815 | | | | 309 | | | | 479 | | | | 1,390 | | | | 1,499 | |

| Owner-operator provided | | | 43 | | | | 87 | | | | 133 | | | | 134 | | | | 90 | | | | 83 | | | | 266 | | | | 304 | |

| | | | 489 | | | | 292 | | | | 768 | | | | 949 | | | | 399 | | | | 562 | | | | 1,656 | | | | 1,803 | |

| | | Age in Years | | | | | | | |

| Trailers | | Less than 1 | | | 1 through 5 | | | More than 5 | | | Total | |

| | | 2011 | | | 2010 | | | 2011 | | | 2010 | | | 2011 | | | 2010 | | | 2011 | | | 2010 | |

| Company-owned and leased | | | 501 | | | | 289 | | | | 1,075 | | | | 1,484 | | | | 1,812 | | | | 1,730 | | | | 3,388 | | | | 3,503 | |

| | | | 501 | | | | 289 | | | | 1,075 | | | | 1,484 | | | | 1,812 | | | | 1,730 | | | | 3,388 | | | | 3,503 | |

Approximately 99% of our trailers are insulated and equipped with refrigeration units capable of providing the temperature control necessary to maintain perishable freight. Trailers used primarily in LTL operations are equipped with movable partitions permitting the transportation of goods requiring different temperatures. Company-operated trailers are primarily 102 inches wide. Truckload trailers used in temperature-controlled linehaul operations are primarily 53 feet long.

Since approximately 2004, the federal government, through the Environmental Protection Agency (the “EPA”), has mandated the phase in of truck engines that reduce particulate matter count, nitrous oxides and sulfur emissions. This new technology serves to reduce emissions from diesel engines but generally also reduces miles per gallon and increases the new cost of the engines, as well as maintenance cost.�� We have been in full compliance of these programs due to our vehicle replacement programs that replace tractors at a rate that maintains proper ratios as required by the EPA. While the EPA-compliant engines are more costly to purchase and maintain, we are committed to the EPA’s SmartWay Transport Partner Program (“SmartWay”) to minimize the negative environmental impacts of diesel-powered equipment.

INTERNATIONAL OPERATIONS

We provide services to and from Canada and Mexico. We utilize tractors from our fleets for services provided to and from Canada. We partner with Mexico-based trucking companies to facilitate freight moving both ways across the southern United States border. Freight moving from Mexico is hauled in our trailers to the border by the Mexico-based carrier, where the trailers are exchanged. Southbound shipments work much the same way. This arrangement has been in place for more than ten years, and we do not expect to change our manner of dealing with freight to or from Mexico and the Mexican border. Changes in United States, Canadian, or Mexican government regulations could cause us to change our operations, including border management, taxation, or various transportation and safety practices. Approximately 3% of our total operating revenue during 2011 involved international shipments, all of which were billed and collected in United States currency.

REGULATION

Our trucking operations are regulated by the DOT. The DOT generally governs matters such as safety requirements, registration to engage in motor carrier operations, certain mergers, insurance, consolidations and acquisitions. The DOT conducts periodic on-site audits of our compliance with its safety rules and procedures. Our most recent audit, which was completed in October of 2010, resulted in a rating of "satisfactory", the highest safety rating available.

During 2005, the Federal Motor Carrier Safety Administration ("FMCSA") began to enforce changes to the regulations that govern drivers' hours of service. Hours of Service ("HOS") rules issued by the FMCSA, in effect since 1939, generally limit the number of consecutive hours and consecutive days that a driver may work. The new rules reduced by one hour the number of hours that a driver may work in a shift, but increased by one hour the number of hours that a driver may drive during the same shift. Drivers are often working at times they are not driving. Duties such as fueling, loading and waiting to load count as part of a driver's shift that are not considered driving. Under the old rules, a driver was required to rest for at least eight hours between shifts. The new rules increased that to ten hours, thereby reducing the amount of time a driver can be "on duty" by two hours. We believe we are well equipped to minimize the economic impact of the current HOS rules on our business. In many cases, we have negotiated time delay charges with our customers. Additionally, we work directly with our customers in an effort to manage our drivers’ non-driving activities such as loading, unloading or waiting and we continue to communicate with our customers regarding these matters. We also are able to assess detention and other charges to offset losses in productivity resulting from the current HOS regulations. A new HOS rule was issued on December, 27, 2011, the final ruling is effective February 27, 2012 and the compliance date of selected provisions is July 1, 2013. According to the Regulatory Impact Analysis (RIA), the economic impact on this ruling will reduce the productivity level of the driver. At this point, we are unable to confirm the impact on productivity level or additional expense.

In December 2010, the FMCSA launched the Compliance Safety Accountability (“CSA”) program. The program was created to provide a better view into how well large commercial motor vehicle carriers and drivers are complying with safety rules and regulations. The program will allow FMCSA to reach more carriers earlier and deploy interventions as needed. The CSA Operation Model has three major components: measurement, evaluation and intervention. We have taken an aggressive pro-active approach toward monitoring drivers through installation of electronic on board recorders as well as inspections. We have seen a slight increase in maintenance costs on minor non-safety related repairs in coordination to this program.

We have experienced higher prices for new tractors over the past few years, partially as a result of government regulations applicable to newly manufactured tractors and diesel engines. The entire linehaul sleeper fleet has either the 2004-EGR (“Exhaust-Gas Recirculation”) or the 2007-EGR EPA-mandated engines. Further restrictions for clean air compliance were mandated by the EPA for all engines manufactured after January 1, 2010. All of our tractors are EPA SmartWay certified.

In 2010, the state of California enforced stricter carbon emission standards for refrigeration units on temperature-controlled trailers. Currently, approximately 90% of our trailers are C.A.R.B. (“California Air Research Board”) compliant and all of our trailers located in California are C.A.R.B. compliant. We will continue to replace the non-compliant trailers during our 2012 replacement cycle. We do not anticipate a significant increase in cost for these trailers.

ENVIRONMENT

We are subject to various environmental laws and regulations by various state regulatory agencies with respect to certain aspects of our operations including the operations of fuel storage tanks, air emissions from our trucks and engine idling. We have been committed to environmental quality for many years and joined SmartWay at its inception in 2004. SmartWay is an innovative collaboration between the EPA and the freight sector designed to improve energy efficiency, reduce greenhouse gas and air pollutant emissions, and improve energy security. Currently, every truck of the Company is an EPA 2004 Engine or newer. Constant upgrades are made to replace with environmentally friendly models that have fuel-efficient tires, aerodynamic styling and skirts. We use environmentally friendly refrigerants in our refrigeration units and every truck in our fleet is ULSD (“Ultra Low Sulfur Diesel”). Furthermore, in 2009 we reduced our fleet trucks to sixty-two miles per hour to achieve greater fuel efficiency. We utilize a fuel optimizer program to reduce miles and maintain idle management devices on our trucks. We are also diligent in our recycling programs for used oil and other hazardous material by-products.

SEASONALITY

Seasonal changes affect our temperature-controlled operations. The growing seasons for fruits and vegetables in Florida, California and Texas typically create increased demand for trailers equipped to transport cargo that requires refrigeration. LTL shipment volume during the winter is normally lower than the other seasons. Shipping volumes of LTL freight are usually highest during July through October. LTL volumes also tend to increase in the weeks before holidays such as Halloween, Thanksgiving, Christmas, Valentine’s Day and Easter when significant volumes of food and candy are transported.

EFFECT OF CLIMATE CHANGES

Considering a significant portion of our total operating revenue excluding fuel surcharges is from temperature controlled transport of goods, the climate could affect our customers’ service needs and our service product. As the climate becomes warmer, more refrigerated capacity would be needed. In a cold, harsh winter, we could be required to heat more products and handle freight that would not normally need a temperature controlled environment.

Greenhouse gas emissions have increasingly become the subject of a large amount of international, national, regional, state and local attention. Cap and trade initiatives to limit greenhouse gas emissions have been introduced in the European Union (“EU”). Similarly, numerous bills related to climate change have been introduced in the United States Congress, which could adversely impact all industries. In addition, future regulation of greenhouse gases could occur pursuant to future U.S. treaty obligations, statutory or regulatory changes under the Clean Air Act or new climate change legislation. It is uncertain whether any of these initiatives will be implemented, although, based on published media reports, we believe it is not reasonably likely the current proposed initiatives will be implemented without substantial modification. If such initiatives are implemented, restrictions, caps, taxes, or other controls on emissions of greenhouse gases, including diesel exhaust, could significantly increase our operating costs. Restrictions on emissions could also affect our customers that use significant amounts of energy or burn fossil fuels in producing or delivering the products we carry including, but not limited to, food producers and distributors. Although significant cost increases, government regulation, and changes of consumer needs or preferences for goods or services relating to alternative sources of energy or emissions reductions or changes in our customers' shipping needs could materially affect the markets for the products we carry, which in turn could have a material adverse effect on our results of operations, financial condition, and liquidity, or, in the alternative, could result in increased demand for our transportation services. We are currently unable to predict the manner or extent of such effect.

INTERNET WEB SITE

We maintain a web site, www.ffeinc.com, on the Internet where additional information about our company is available. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, press releases, earnings releases and other reports filed with and furnished to the SEC, pursuant to Section 13 or 15(d) of the Exchange Act are available, free of charge, on our web site as soon as practical after they are filed.

We have adopted a Code of Business Conduct and Ethics that applies to our board of directors, chief executive office, principal financial officer, controller, or persons performing similar functions as well as all employees. We also have charters for the Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee of our Board of Directors. Copies of the foregoing documents may be obtained on our web site, and such information is available in print to any shareholder who requests it. Such requests should be made to the Senior Vice President and Chief Financial Officer at 1145 Empire Central Place, Dallas, Texas 75247.

SEC FILINGS

The annual, quarterly, special and other reports we file with and furnish to the SEC are available at the SEC's Public Reference Room, located at 100 F Street, NE, Room 1580, Washington, D.C. 20549. Information may be obtained on the operation of the Public Reference Room by calling the SEC at 1-800-732-0330. The SEC also maintains a web site at www.sec.gov. The SEC site also contains information we file with and furnish to the agency.

ITEM 1A. Risk Factors

The following factors are important and should be considered carefully in connection with any evaluation of our business, financial condition, results of operations, prospects, or an investment in our common stock. The risks and uncertainties described below are those we currently believe may materially affect our company or our financial results. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business operations or affect our financial results.

Our business is subject to general economic factors and business risks that are largely out of our control, any of which could have a material adverse effect on our operating results. Our business is subject to general economic factors and business factors that may have a material adverse effect on our results of operations, many of which are beyond our control. These factors include excess capacity in the trucking and temperature-controlled industry, strikes, or other work stoppages, significant increases in interest rates, fuel costs, taxes and license and registration fees. Recessionary economic cycles, changes in customers' business activities and excess tractor or trailer capacity in comparison with shipping demands could materially affect our operations. Economic conditions that decrease shipping demand or an increase in the supply of tractors and trailers generally available in the transportation sector of the economy can exert downward pressure on our pricing programs and equipment utilization, thereby decreasing asset profitability. Economic conditions also may adversely influence our customers and their ability to pay for our services.

Financial institutions may continue to consolidate or cease to do business, which could result in tightening of the credit markets, lower levels of liquidity in many financial markets, and increased volatility in fixed income, credit, currency and equity markets. A credit crisis could negatively impact our business, including through the impaired credit availability and financial stability of our customers, including our distribution partners and channels. A disruption in the financial markets may also have an effect on our banking partners on which we rely for operating cash management. We may need to incur indebtedness or issue debt or equity securities in the future to fund working capital requirements, make investments in revenue generating equipment, or for general operating purposes. Continued losses may impact our ability to obtain sufficient financing due to the inability to access the capital markets on financially economical or feasible terms. This could impact our ability to provide services to our customers and may materially and adversely affect our business, financial results, current operations, results of operations and potential investments.

It is not possible to predict the effects on the economy or consumer confidence of actual or threatened armed conflicts or terrorist attacks, efforts to combat terrorism, military action against a foreign state or group located in a foreign state, or heightened security requirements.

We operate in a highly competitive and fragmented industry and numerous competitive factors could impair our growth and profitability. Some of these factors include:

| · | We compete with many other transportation carriers of varying sizes, some of which have more equipment and greater capital resources than we do or have other competitive advantages; |

| · | Some of our competitors periodically reduce their freight rates to gain business, especially during times of reduced growth rates in the economy, which may limit our ability to maintain or increase freight rates or maintain our profitability levels; |

| · | Many customers reduce the number of carriers they use by selecting so-called “core carriers” as approved transportation service providers or current bids from multiple carriers, and in some instances we may not be selected; |

| · | Many customers periodically accept bids from multiple carriers for their shipping needs, and this process may depress freight rates or result in the loss of some business to competitors as a core carrier; |

| · | Certain of our customers that operate private fleets to transport their own freight could decide to expand their operations; |

| · | Competition from freight logistics and brokerage companies may negatively impact our customer relationships and freight rates; and |

| · | Economies of scale that may be passed onto smaller carriers by procurement aggregation providers may improve such carriers’ ability to compete with us. |

We derive a significant portion of our revenue from our major customers, the loss of one or more of which could have a material adverse effect on our business. A significant portion of our revenue is generated from our major customers. For 2011, our top 20 customers accounted for approximately 55% of our revenue; our top 10 customers accounted for 45% of our revenue; and our top 5 customers accounted for approximately 32% of our revenue. Generally, we enter into one-year agreements with our major customers, which generally do not contain minimum shipment volumes with us. We cannot ensure that, upon expiration of existing contracts, these customers will continue to utilize our services at the current levels. Many of our customers periodically solicit bids from multiple carriers for their shipping needs, and this process may depress freight rates or result in a loss of business to one of our competitors. Some of our customers also operate their own private fleets and the expansion of those fleets may result in lowering the demand for our services with such customers.

Future insurance and claims expense could reduce our earnings. Our future insurance and claims expense might exceed historical levels, which could reduce our earnings. We self-insure significant portions of our claims exposure resulting from work-related injuries, auto liability, general liability, cargo and property damage claims, as well as employees' health insurance. We currently reserve for anticipated losses and expenses. We periodically evaluate and adjust our claims reserves to reflect our experience. However, ultimate results usually differ from our estimates, which could result in losses in excess of our reserved amounts.

We maintain insurance above the amounts for which we self-insure. Although we believe the aggregate insurance limits should be sufficient to cover reasonably expected claims, it is possible that one or more claims could exceed our aggregate coverage limits. Insurance carriers have raised premiums for many businesses, including transportation companies. As a result, our insurance and claims expense could increase, or we could raise our self-insured retention when our policies are renewed. If these expenses increase, if we experience a claim in excess of our coverage limits, or if we experience a claim for which coverage is not provided, results of our operations and financial condition could be materially affected. We were affected by unfavorable settlements of claims from prior years in the second half of 2011 reflected by the increase in insurance and claims expense.

Fluctuations in the price or availability of fuel may increase our cost of operations, which could materially affect our profitability. We are subject to risk with respect to purchases of fuel for use in our tractors and refrigerated trailers. Fuel prices are influenced by many factors that are not within our control.

Because our operations are dependent upon diesel fuel, significant increases in diesel fuel costs could materially and adversely affect our results of operations and financial condition unless we are able to pass increased costs on to customers through rate increases or fuel surcharges. Historically, we have sought to recover increases in fuel prices from customers through fuel surcharges. Fuel surcharges that can be collected have not always fully offset the increase in the cost of diesel fuel in the past, and there can be no assurance that fuel surcharges that can be collected will offset the increase in the cost of diesel fuel in the future.

Seasonality and the impact of weather can affect our profitability. Our tractor productivity generally decreases during the winter season because inclement weather impedes operations and some shippers reduce their shipments. At the same time, operating expenses generally increase, with fuel efficiency declining because of engine idling and harsh weather creating higher accident frequency, increased claims and more equipment repairs. During extended periods of excessive heat, we may experience higher reefer fuel and repair costs. We can also suffer short-term impacts from weather-related events, such as hurricanes, blizzards, ice-storms and floods, which may increase in severity or frequency due to the physical effects of climate change that could harm our results or make our results more volatile.

We will have significant ongoing capital requirements that could negatively affect our growth and profitability. The trucking industry is capital intensive, and replacing older equipment requires significant investment. If we elect to expand our fleet in future periods, our capital needs would increase. We expect to pay for our capital expenditures with cash flows from operations, borrowings under our revolving credit facility and leasing arrangements. If we are unable to generate sufficient cash from operations and obtain financing on favorable terms, we may need to limit our growth, enter into less favorable financing arrangements or operate our revenue equipment for longer periods, any of which could affect our profitability. Continued losses may inhibit our ability to obtain financing for our ongoing capital requirements.

We rely on our key management and other employees and depend on recruitment and retention of qualified personnel. Difficulty in attracting or retaining qualified employee-drivers and independent contractors who provide tractors for use in our business could impede our growth and profitability. A limited number of key executives manage our business. Their departure could have a material effect on our operations. In addition, our performance is primarily dependent upon our ability to attract and retain qualified drivers. Our independent contractors are responsible for paying for their own equipment, labor, fuel, and other operating costs. Significant increases in these costs could cause them to seek higher compensation from us or other opportunities. Competition for employee-drivers continues to increase. If a shortage of employee-drivers occurs, or if we were unable to continue to sufficiently contract with independent contractors, we could be forced to limit our growth or experience an increase in the number of our tractors without drivers, which would lower our profitability.

Service instability in the railroad industry could increase our operating costs and reduce our ability to offer intermodal services, which could adversely affect our revenue, results of operations and customer relationships. Our intermodal operations are dependent on railroads, and our dependence on railroads may increase if we expand our intermodal services. In most markets, rail service is limited to a few railroads or even a single railroad. Any reduction in service by the railroads may increase the cost of the rail-based services we provide and reduce the reliability, timeliness and overall attractiveness of our rail-based services. Railroads are relatively free to adjust their rates as market conditions change. That could result in higher costs to our customers and influence our ability to offer intermodal services. There is no assurance that we will be able to negotiate replacement of or additional contracts with railroads, which could limit our ability to provide this service and may affect our profitability.

Interruptions in the operation of our computer and communications systems could reduce our income. We depend on the efficient and uninterrupted operation of our computer and communications systems and infrastructure. Our operations and those of our technology and communications service providers are vulnerable to interruption by fire, earthquake, power loss, telecommunications failure, terrorist attacks, internet failures, computer viruses and other events beyond our control. In the event of a system failure, our business could experience significant disruption. We have established an off-site facility where our data and processing functions are replicated; however, there can be no assurances that the business recovery plan will work as intended or may not prevent significant interruptions of our operations.

Changes in the availability of or the demand for new and used trucks could reduce our growth and negatively affect our income. More restrictive federal emissions standards require new technology diesel engines. As a result, we expect to continue to pay increased prices for equipment and incur additional expenses and related financing costs for the foreseeable future.

We have a conditional commitment from our principal tractor vendor regarding the amount we will be paid on the disposal of most of our tractors as part of a trade-in program. We could incur a financial loss upon disposition of our equipment if the vendor cannot meet its obligations under these agreements.

If we are unable to obtain favorable prices for our used equipment, or if the cost of new equipment continues to increase, we will increase our depreciation expense or recognize less gain (or a loss) on the disposition of our tractors and trailers. This may affect our earnings and cash flows.

We operate in a highly regulated industry, and increased costs of compliance with, or liability for violation of, existing or future regulations could have a material adverse effect on our business. The DOT and various state and local agencies exercise broad powers over our business, generally governing such activities as authorization to engage in motor carrier operations, safety and insurance requirements. Our company drivers and independent contractors must also comply with the safety and fitness regulations promulgated by the DOT, including those relating to drug and alcohol testing and hours-of-service. We may also become subject to new or more restrictive regulations relating to fuel emissions, drivers’ hours-of-service, ergonomics, or other matters affecting our safety or operating methods.

Other agencies, such as the EPA, FMCSA and the Department of Homeland Security, also regulate our equipment, operations, and drivers. In December 2010, the FMCSA launched the Compliance Safety Accountability (“CSA”) program. The program was created to provide a better view into how well large commercial motor vehicle carriers and drivers are complying with safety rules and regulations. The program will allow FMCSA to reach more carriers earlier and deploy interventions as needed. The CSA Operation Model has three major components: measurement, evaluation and intervention. We could be affected by increases in maintenance costs on minor non-safety related repairs in coordination to this program. Future laws and regulations may be more stringent and require changes in our operating practices, influence the demand for transportation services, or require us to incur significant additional costs: see Part I, Item 1. Business - Regulation.

Our operations are subject to various environmental laws and regulations, the violation of which could result in substantial fines or penalties. We are subject to various environmental laws and regulations dealing with the handling of hazardous materials, fuel storage tanks, air emissions from our vehicles and facilities, engine idling, and discharge and retention of storm water. We operate in industrial areas, where truck terminals and other industrial activities are located and where groundwater or other forms of environmental contamination have occurred. Our operations involve the risks of fuel spillage or seepage, environmental damage, and hazardous waste disposal, among others. Although we have instituted programs to monitor and control environmental risks and promote compliance with applicable environmental laws and regulations, if we are involved in a spill or other accident involving hazardous substances or if we are found to be in violation of applicable laws or regulations, we could be subject to liabilities, including substantial fines or penalties or civil and criminal liability, any of which could have a material adverse effect on our business and operating results.

We may not be able to improve our operating efficiency rapidly enough to meet market conditions. Because the markets in which we operate are highly competitive, we must continue to improve our operating efficiency in order to achieve, maintain or improve our profitability. Although we have been able to improve efficiency and reduce costs in the past, there is no assurance we will continue to do so in the future. In addition, the need to reduce ongoing operating costs may result in significant up-front costs to reduce workforce, close or consolidate facilities, or upgrade equipment and technology.

Our operations could be affected by a work stoppage at locations of our customers. Although none of our employees are covered by a collective bargaining agreement, a strike or other work stoppage at a customer location could negatively affect our revenue and earnings and could cause us to incur unexpected costs to redeploy or deactivate assets and personnel.

We are subject to anticipated future increases in the statutory federal tax rate. An increase in the statutory tax rate would increase our tax expense. In addition, our net deferred tax asset is stated net of offsetting deferred tax liabilities. The assets consist of anticipated future tax deductions for items such as personal and work-related injuries and bad debt expenses, which have been reflected on our financial statements but which are not yet tax deductible. Due to probable tax rate increases in the future, we would be required to adjust our deferred tax liabilities at that time to reflect higher federal tax rates.

Changes in market demand may have an unfavorable impact on our operating efficiency. We provide transportation services to a number of customers that ship a variety of products including, but not limited to, food, health care, and confectionary products. Should the demand for our customers’ products decline, our revenues could be negatively affected. Should those conditions arise, there is no assurance that we will be able to adjust our operating costs sufficiently to offset the decline in revenue.

We are subject to potential litigation and claims. We are exposed to litigation involving personal injury, property damage, work-related injuries, cargo losses, Equal Employment Opportunity Commission (“EEOC”), unemployment claims and general liability during the normal course of operating our business, any of which could affect our results depending on the severity and resolution of the aforementioned exposures.

A negative economic impact on our customers’ businesses may adversely affect our credit risk. Certain customers may not be able to meet their financial obligations due to deterioration of their own financial condition, credit ratings, or bankruptcy. While we do record an allowance for doubtful accounts, a considerable amount of judgment is required in assessing the realization of these receivables which could affect our cash collections and operating results.

We are dependent on our customers’ product safety and quality control procedures to ensure product integrity. As most shipments tendered to us are packaged in such a way to prevent inspection and testing, we are dependent upon our customers’ quality control to ensure our other customers’ products are not subject to chemicals, bacteria, or other harmful agents that could contaminate their products. Such contamination could result in loss of business, consumer confidence in our Company, and possibly cause public health concerns resulting in fines, costly litigation, and/or loss of operating authority.

ITEM 1B. Unresolved Staff Comments

None.

ITEM 2. Properties

At December 31, 2011, we maintained service centers or office facilities of 10,000 square feet or more in or near the cities listed below. We also occupy a number of smaller rented recruiting and sales offices around the country. Remaining lease terms range from one month to approximately thirteen years. We expect our present facilities are sufficient to support our operations.

The following table sets forth certain information regarding our properties at December 31, 2011:

| | | Approximate Square Footage | | Approximate Acreage | | Owned or Leased | | Lease Expiration Date |

| Dallas, TX | | | | | | | | |

| Maintenance, service center and freight handling | | 100,000 | | 80 | | Owned | | NA |

| Corporate office | | 34,000 | | 2 | | Owned | | NA |

| Burlington, NJ | | 84,000 | | 10 | | Leased | | May 2024 |

| Ft. Worth, TX | | 34,000 | | 7 | | Owned | | NA |

| Chicago, IL | | 37,000 | | 5 | | Owned | | NA |

| Lakeland, FL | | 26,000 | | 15 | | Owned | | NA |

| Atlanta, GA | | 50,000 | | 13 | | Owned | | NA |

| Ontario, CA | | 92,000 | | * | | Leased | | October 2020 |

| Salt Lake City, UT | | 12,500 | | * | | Leased | | November 2015 |

| Miami, FL | | 17,500 | | * | | Leased | | January 2014 |

| Olive Branch, MS | | 16,000 | | * | | Leased | | September 2017 |

| | | | | | | | |

*Facilities are part of an industrial park in which we share acreage with other tenants.

ITEM 3. Legal Proceedings

Due to the nature of our industry, we are regularly involved in litigation incidental to our operations, primarily involving claims for personal injury, property damage, work-related injuries and cargo losses incurred in the ordinary and routine transportation of freight. Based on our current assessment of information on-hand, we believe that the routine litigation is adequately covered by our insurance reserves and adverse effects arising from these events will not have a material impact on our financial statements. However, litigation is highly unpredictable and unexpected unfavorable jury verdicts may have a material impact on the financial statements in the future, such as we experienced in the third and fourth quarters of the year ending, December 31, 2011.

ITEM 4. Mine Safety Disclosures

None.

ITEM 5. Market for Registrant's Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities

Market for Registrant's Common Equity and Related Shareholder Matters

Our common stock is listed on the NASDAQ Global Select Market under the symbol “FFEX”. The table below shows the range of high and low bid prices for the quarters indicated on the NASDAQ Global Select Market. Such quotations reflect inter-dealer prices, without retail markups, markdowns or commissions and therefore, may not necessarily represent actual transactions. The following table sets forth the high and low prices of our stock within each quarter of the previous two years:

| | | Price Range | |

| Year Ended December 31, 2011 | | High | | | Low | |

| Fourth Quarter | | $ | 2.10 | | | $ | 1.09 | |

| Third Quarter | | | 4.30 | | | | 1.99 | |

| Second Quarter | | | 4.28 | | | | 3.04 | |

| First Quarter | | | 5.00 | | | | 3.11 | |

| | | | | | | | | |

| Year Ended December 31, 2010 | | | | | | | | |

| Fourth Quarter | | $ | 4.96 | | | $ | 2.78 | |

| Third Quarter | | | 3.91 | | | | 2.68 | |

| Second Quarter | | | 4.99 | | | | 3.50 | |

| First Quarter | | | 4.42 | | | | 3.09 | |

On March 21, 2012, we had approximately 2,200 beneficial shareholders of our common stock.

Unregistered Sales of Equity Securities and Use of Proceeds

On November 9, 2007, our Board of Directors renewed our authorization to purchase up to 1.3 million shares of our common stock. At December 31, 2011, there were a total of 747,200 remaining authorized shares that could be repurchased. There were no shares repurchased in the fourth quarter of 2011. The authorization did not specify an expiration date. Shares may be purchased from time to time on the open market or through private transactions at such times as management deems appropriate. Purchases may be discontinued by our Board of Directors at any time. | Period | | Total Number of Shares Purchased (a) | | Average Price Paid per Share (b) | | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs (c) | | Maximum Number (or Approximate Dollar Value) of Shares (or Units) that May Yet Be Purchased Under the Plans or Programs (d) | |

| October 2011 | | - | | | - | | - | | | 747,200 | |

| November 2011 | | - | | | - | | - | | | 747,200 | |

| December 2011 | | - | | | - | | - | | | 747,200 | |

| Total | | - | | | - | | - | | | 747,200 | |

Comparative Stock Performance

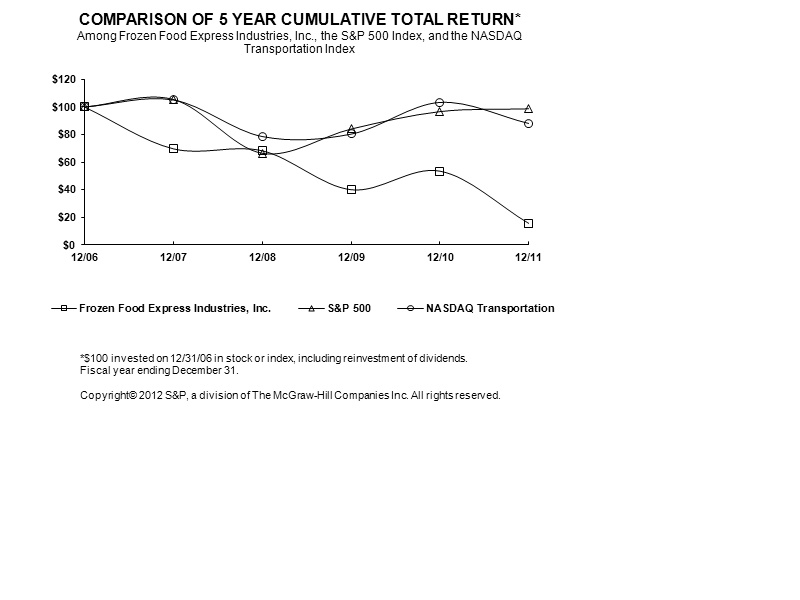

The graph below compares the cumulative total stockholder return on our common stock with the NASDAQ Transportation Index and the S&P 500 Index for the last five years. The graph assumes $100 is invested in our common stock, the NASDAQ Transportation Index and the S&P 500 Index on December 31, 2006, with reinvestment of dividends. The comparisons in the graph are based on historical data and are not intended to predict future performance of our stock. The information in the graph shall be deemed “furnished” and not “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section.

ITEM 6. Selected Financial Data

The following unaudited data for each of the years in the five-year period ended December 31, 2011 should be read in conjunction with our Consolidated Financial Statements and Notes thereto included under Item 8 of this report and "Management's Discussion and Analysis of Financial Condition and Results of Operations" contained in Item 7.

| | | (dollars in thousands, except per share data) | |

| Summary of Operations | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

| Statement of Operations Data | | | | | | | | | | | | | | | |

| Total operating revenue | | $ | 388,461 | | | $ | 368,822 | | | $ | 373,051 | | | $ | 490,536 | | | $ | 452,214 | |

| Net (loss) income | | $ | (36,670 | ) | | $ | (11,930 | ) | | $ | (16,415 | ) | | $ | 605 | | | $ | (7,670 | ) |

| Operating expenses | | $ | 426,698 | | | $ | 386,492 | | | $ | 397,964 | | | $ | 488,482 | | | $ | 462,743 | |

Operating ratio (a) | | | 109.8 | % | | | 104.8 | % | | | 106.7 | % | | | 99.6 | % | | | 102.3 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Balance Sheet Data | | | | | | | | | | | | | | | | | | | | |

| Total assets | | $ | 126,404 | | | $ | 134,905 | | | $ | 145,800 | | | $ | 162,186 | | | $ | 173,669 | |

| Long-term debt – borrowings under credit facility | | $ | 19,888 | | | $ | 5,689 | | | $ | - | | | $ | - | | | $ | - | |

| Shareholders' equity | | $ | 42,902 | | | $ | 78,809 | | | $ | 89,735 | | | $ | 106,451 | | | $ | 107,259 | |

| | | | | | | | | | | | | | | | | | | | | |

| Per Share Data | | | | | | | | | | | | | | | | | | | | |

| Net (loss) income per common share, diluted | | $ | (2.08 | ) | | $ | (0.69 | ) | | $ | (0.96 | ) | | $ | 0.04 | | | $ | (0.45 | ) |

Book value per share (b) | | $ | 2.42 | | | $ | 4.50 | | | $ | 5.22 | | | $ | 6.32 | | | $ | 6.41 | |

| Cash dividends per share | | $ | - | | | $ | - | | | $ | 0.03 | | | $ | 0.12 | | | $ | 0.12 | |

| Weighted average diluted shares | | | 17,589 | | | | 17,275 | | | | 17,080 | | | | 16,997 | | | | 17,187 | |

| | | | | | | | | | | | | | | | | | | | | |

| Revenue From | | | | | | | | | | | | | | | | | | | | |

| Truckload linehaul services | | $ | 156,302 | | | $ | 171,392 | | | $ | 187,234 | | | $ | 214,348 | | | $ | 212,416 | |

| Dedicated fleets | | | 17,469 | | | | 17,467 | | | | 19,707 | | | | 24,609 | | | | 17,861 | |

| Less-than-truckload linehaul services | | | 112,030 | | | | 110,467 | | | | 109,054 | | | | 124,091 | | | | 127,438 | |

| Fuel surcharges | | | 80,705 | | | | 57,410 | | | | 44,876 | | | | 109,144 | | | | 73,391 | |

| Brokerage and logistics services | | | 18,524 | | | | 6,798 | | | | 7,266 | | | | 13,142 | | | | 15,586 | |

| Equipment rental | | | 3,431 | | | | 5,288 | | | | 4,914 | | | | 5,202 | | | | 5,522 | |

| Total operating revenue | | $ | 388,461 | | | $ | 368,822 | | | $ | 373,051 | | | $ | 490,536 | | | $ | 452,214 | |

| Computational Notes: |

| (a) | Operating expenses divided by total operating revenue. |

| (b) | Shareholders’ equity divided by the number of total shares issued less the number of treasury shares (excluding treasury shares held in the Rabbi Trust), all as of year-end. |

ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis of our financial condition and results of operations should be read together with the selected consolidated financial data and our consolidated financial statements and the related notes appearing elsewhere in this report. This discussion and analysis contains forward-looking statements that involve risks, uncertainties and assumptions. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of many factors, including but not limited to those under the heading “Risk Factors” beginning on page eight. We do not assume, and specifically disclaim, any obligation to update any forward-looking statement contained in this report.

OVERVIEW

The trucking industry continues to face challenges due to an uncertain economy. Higher, fuel costs, driver shortages, increasing material costs highlighted by the dramatic increase in tire prices in 2011, tight credit markets, and the uncertain political climate in the United States are challenges we faced in 2011 as we tried to restore the Company to a competitive position. In the first two months of 2011, our operations were dramatically impacted by ice storms in our major markets in the Northeast, Midwest, Southeast and Texas. Shipping was halted during extended periods, which created higher costs and lost profits estimated to be $2.4 million. Additionally, the excessive heat in the second and third quarter of 2011 resulted in increased maintenance costs, an estimated impact of $2.0 million as a result of the difficult operating conditions and the age of much of our equipment. In the second half of 2011, we lost an arbitration case, which dated back to 2005, had other unfavorable settlements and associated legal costs which increased our claims and insurance expense by approximately $8.9 million. We also incurred additional expense of approximately $3.4 million related to a contract dispute with an existing customer for new logistics services rendered and approximately $1.1 million in additional expense for the restructure of back-office personnel and sale of our dry-van equipment in the fourth quarter of 2011. The sale of our dry-van equipment generated cash of approximately $13.6 million.

Influenced by the industry driver shortage, and more specifically a reduction in owner operators, we finished the year with 31 fewer trucks in service in 2011, on average, versus 2010. However, we capitalized on the success of our driver academy, which we opened in the first half of 2011 to bolster recruitment. The FFE Driver Academy provided approximately 650 drivers to the Company during the year ended December 31, 2011 and had 274 drivers enrolled in the training program at the end of 2011. We will continue these efforts as we anticipate an industry driver shortage will remain for the foreseeable future.

Our LTL and brokerage and logistics services revenues improved for the year ended 2011 compared to 2010. LTL tonnage and shipment count increased by 0.5% and 1.3%, respectively, during 2011 compared to the same period in 2010. The Company achieved slight improvements in its revenue per total mile and revenue per hundredweight in 2011, versus the same period in 2010. However, these rate improvements were insufficient to offset increasing costs for the year. We are implementing rate increases and broadening our logistics services to offset costs and improve yield. We continue to focus on providing excellent service, as well as deploying information technology that we anticipate will differentiate our services and improve shipping efficiencies. Compared to last year’s levels, the surge in fuel prices in 2011 has renewed shippers’ resistance to fuel price surcharges which has affected net sales in 2011. Fuel surcharges help to offset the higher cost of tractor fuel only and do not offset higher fuel costs related to refrigerated trailers.