Earnings Call: Fourth Quarter 2024 January 23, 2025 (NASDAQ: IBCP)

Cautionary note regarding forward-looking statements This presentation contains forward-looking statements, which are any statements or information that are not historical facts. These forward-looking statements include statements about our anticipated future revenue and expenses and our future plans and prospects. Forward-looking statements involve inherent risks and uncertainties, and important factors could cause actual results to differ materially from those anticipated. For example, deterioration in general business and economic conditions or turbulence in domestic or global financial markets could adversely affect our revenues and the values of our assets and liabilities, reduce the availability of funding to us, lead to a tightening of credit, and increase stock price volatility. Our results could also be adversely affected by changes in interest rates; increases in unemployment rates; deterioration in the credit quality of our loan portfolios or in the value of the collateral securing those loans; deterioration in the value of our investment securities; legal and regulatory developments; changes in customer behavior and preferences; breaches in data security; and management’s ability to effectively manage the multitude of risks facing our business. Key risk factors that could affect our future results are described in more detail in our Annual Report on Form 10-K for the year ended December 31, 2023 and the other reports we file with the SEC, including under the heading “Risk Factors.” Investors should not place undue reliance on forward-looking statements as a prediction of our future results. Any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update any forward-looking statement, whether as a result of new information, future events, or otherwise. 2 2

• Formal Remarks − William B. (Brad) Kessel President and Chief Executive Officer − Gavin A. Mohr Executive Vice President and Chief Financial Officer − Joel F. Rahn Executive Vice President – Commercial Banking • Question and Answer session • Closing Remarks Note: This presentation is available at www.IndependentBank.com in the Investor Relations area under the “Presentations” tab. Agenda 3

4Q'24 Overview • Total loans increased 9.7% annualized while maintaining a disciplined approach to new loan production • New loan production continues to be largely focused on new commercial clients that bring deposits to the bank • Asset quality remained exceptional with NPAs/Total Assets at 0.13% and NCO of 0.01% of average loans in the quarter • Total deposit growth of $27.2 million • Generated a ROAA and ROAE of 1.39% and 16.31%, respectively • Continued rotation into higher yielding assets contributed to net interest margin of 3.45% • Commercial loan growth of 24.4% annualized • Tangible book value per share increased from end of prior quarter • Balance sheet liquidity remains strong with loan-to-deposit ratio of 87% • Net income of $18.5 million, or $0.87 per diluted share • Increase in net interest income of $2.7 million over the prior year quarter and $1.0 million over the third quarter of 2024 • Strong profitability and prudent balance sheet management results in further growth in tangible book value per share Healthy Capital & Liquidity Positions Positive Trends in Key Metrics Solid Loan Growth and Strong Asset Quality 4Q'24 Earnings 4 4

$ 4 .3 $ 4 .4 $ 4 .5 $ 4 .5 $ 4 .6 $ 4 .6 $ 4 .6 $ 4 .6 $ 4 .6 $ 4 .7 0 .3 3 % 0 .7 8 % 1 .2 6 % 1 .5 7 % 1 .8 0 % 1 .9 9 % 2 .0 1 % 2 .0 3 % 2 .1 1 % 1 .9 3 % Q 3 '2 2 Q 4 '2 2 Q 1 '2 3 Q 2 '2 3 Q 3 '2 3 Q 4 '2 3 Q 1 '2 4 Q 2 '2 4 Q 3 '2 4 Q 4 '2 4 Total Deposits Cost Of Deposits Non-interest Bearing 22% Savings and Interest- bearing Checking 43% Reciprocal 19% Time 13% Brokered 2% Low-Cost Deposit Franchise Focused on Core Deposit Growth • Substantial core funding – $3.92 billion of non-maturity deposit accounts (84.1% of total deposits). • Core deposit decrease of $42.9 million (3.7% annualized) in 4Q'24. • Time deposit increase of $7.8 (5.0% annualized) million in 4Q'24. • Total deposits increased $31.2 million (0.7%) since 12/31/23 with non-interest bearing down $62.4 million, savings and interest- bearing checking up $89.6 million, reciprocal up $75.0 million, time up $104.0 million and brokered time down $174.9 million. • Deposits by Customer Type: − Retail – 47.3% − Commercial – 36.4% − Municipal – 16.2% Deposit Composition 12/31/24 Cost of Deposits (%)/Total Deposits ($B) 5 Core Deposits: 84.1% $4.7B

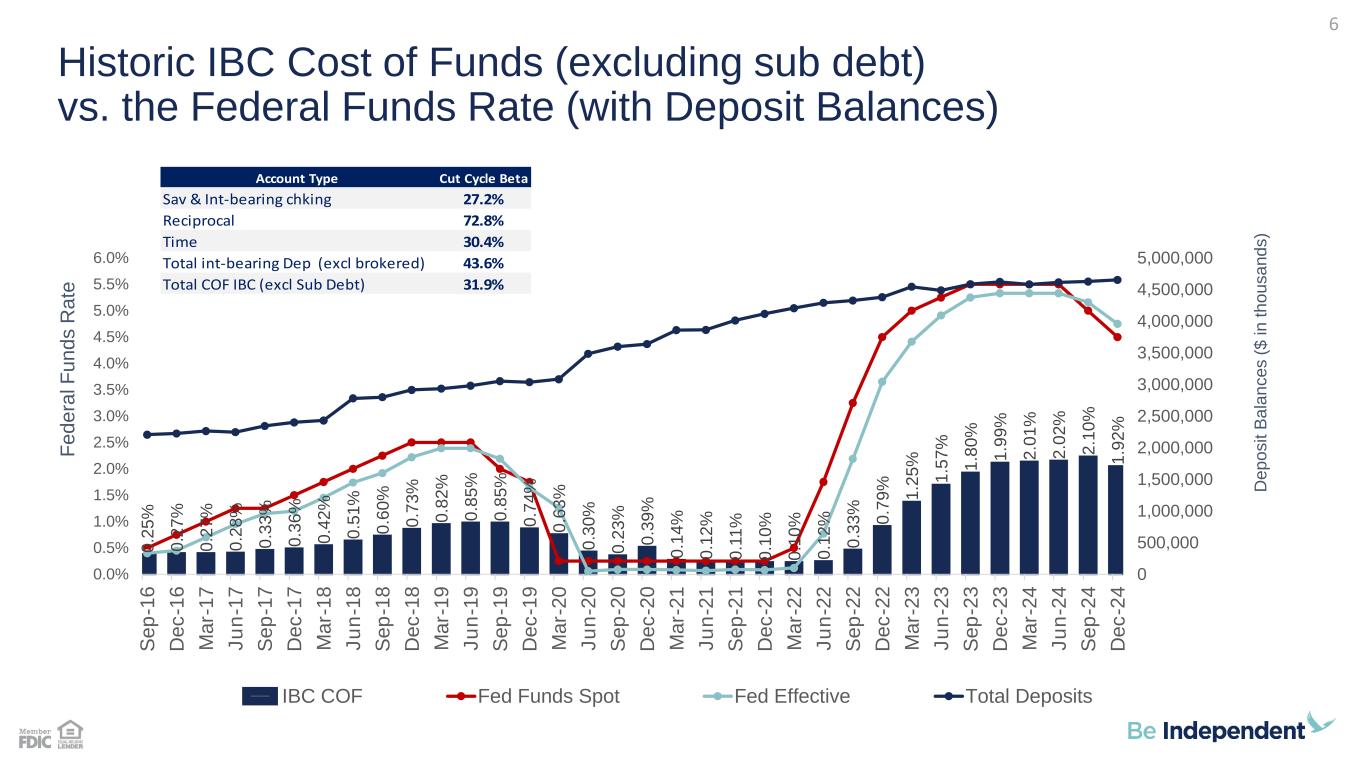

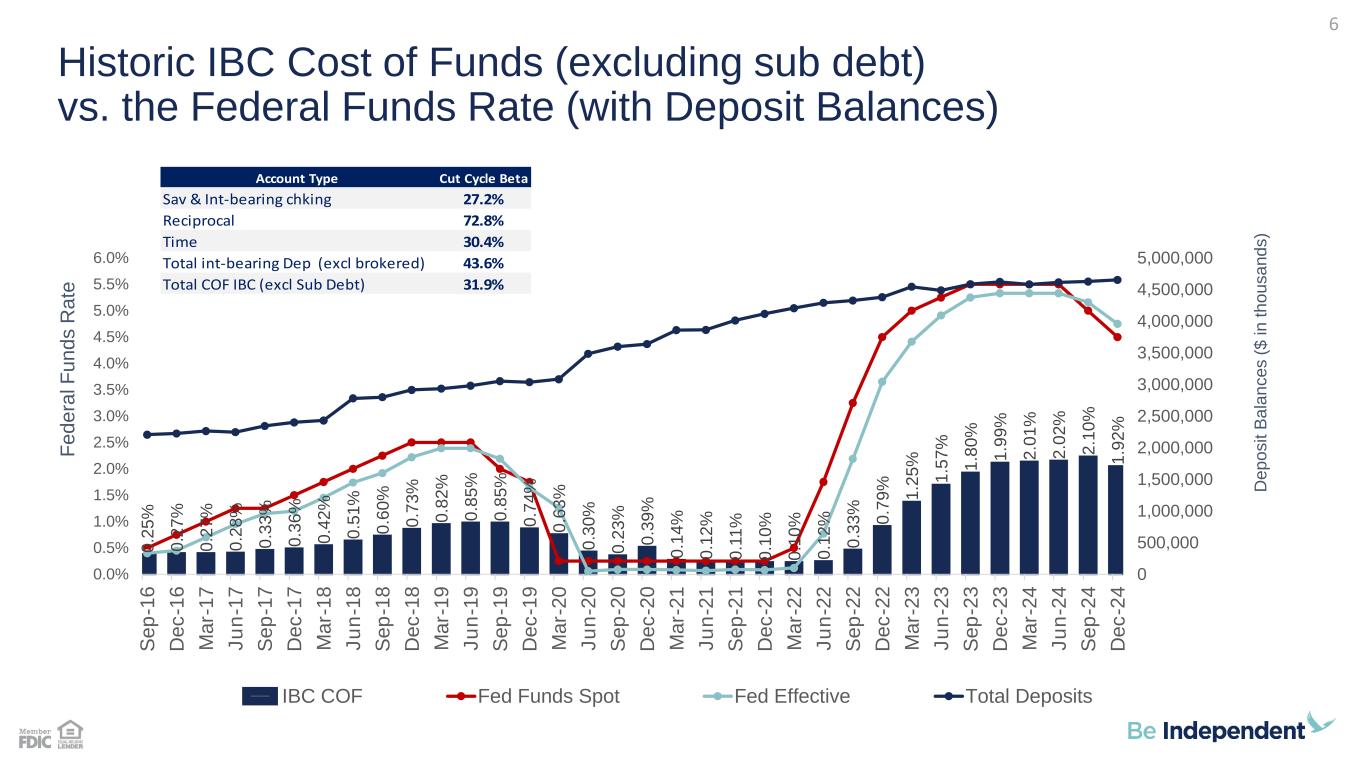

0 .2 5 % 0 .2 7 % 0 .2 7 % 0 .2 8 % 0 .3 3 % 0 .3 6 % 0 .4 2 % 0 .5 1 % 0 .6 0 % 0 .7 3 % 0 .8 2 % 0 .8 5 % 0 .8 5 % 0 .7 4 % 0 .6 3 % 0 .3 0 % 0 .2 3 % 0 .3 9 % 0 .1 4 % 0 .1 2 % 0 .1 1 % 0 .1 0 % 0 .1 0 % 0 .1 2 % 0 .3 3 % 0 .7 9 % 1 .2 5 % 1 .5 7 % 1 .8 0 % 1 .9 9 % 2 .0 1 % 2 .0 2 % 2 .1 0 % 1 .9 2 % 0 500,000 1,000,000 1,500,000 2,000,000 2,500,000 3,000,000 3,500,000 4,000,000 4,500,000 5,000,000 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% 5.0% 5.5% 6.0% S e p -1 6 D e c -1 6 M a r- 1 7 J u n -1 7 S e p -1 7 D e c -1 7 M a r- 1 8 J u n -1 8 S e p -1 8 D e c -1 8 M a r- 1 9 J u n -1 9 S e p -1 9 D e c -1 9 M a r- 2 0 J u n -2 0 S e p -2 0 D e c -2 0 M a r- 2 1 J u n -2 1 S e p -2 1 D e c -2 1 M a r- 2 2 J u n -2 2 S e p -2 2 D e c -2 2 M a r- 2 3 J u n -2 3 S e p -2 3 D e c -2 3 M a r- 2 4 J u n -2 4 S e p -2 4 D e c -2 4 IBC COF Fed Funds Spot Fed Effective Total Deposits Historic IBC Cost of Funds (excluding sub debt) vs. the Federal Funds Rate (with Deposit Balances) D e p o s it B a la n c e s ( $ i n t h o u s a n d s ) 6 F e d e ra l F u n d s R a te Account Type Cut Cycle Beta Sav & Int-bearing chking 27.2% Reciprocal 72.8% Time 30.4% Total int-bearing Dep (excl brokered) 43.6% Total COF IBC (excl Sub Debt) 31.9%

Commercial 48% Mortgage 37% Installment 14% Held for Sale 0% $ 3 .4 $ 3 .4 $ 3 .5 $ 3 .6 $ 3 .7 $ 3 .8 $ 3 .8 $ 3 .9 $ 3 .9 $ 4 .0 4 .3 9 % 4 .9 0 % 5 .0 7 % 5 .3 6 % 5 .5 3 % 5 .7 3 % 5 .8 0 % 5 .9 3 % 5 .9 6 % 5 .8 3 % 3 Q '2 2 4 Q '2 2 1 Q '2 3 2 Q '2 3 3 Q '2 3 4 Q '2 3 1 Q '2 4 2 Q '2 4 3 Q '2 4 4 Q '2 4 Total Portfolio Loans Yield on Loans Diversified Loan Portfolio Focused on High Quality Growth • Portfolio loan changes in 4Q'24: − Commercial – increased $112.1 million. …Average new origination yield of 7.00% vs a 6.53% portfolio yield. − Mortgage – increased $5.3 million. …Average new origination yield of 6.92% vs a 4.80% portfolio yield. − Installment – decreased $20.9 million. …Average new origination yield of 7.89% vs a 5.00% portfolio yield. • Mortgage loan portfolio weighted average FICO of 749 and average balance of $185,936. • Installment weighted average FICO of 755 and average balance of $25,468. • Commercial loan rate mix: − 42% fixed / 58% variable. − Indices – 42% tied to Prime, 1% tied to a US Treasury rate and 57% tied to SOFR. • Mortgage loan (including HELOC) rate mix: − 63% fixed / 37% adjustable or variable. − 9% tied to a US Treasury rate and 91% tied to SOFR. Note: Portfolio loans exclude loans HFS. Loan Composition 012/31/24 Yield on Loans (%)/ Total Portfolio Loans ($B) 7 $4.0B

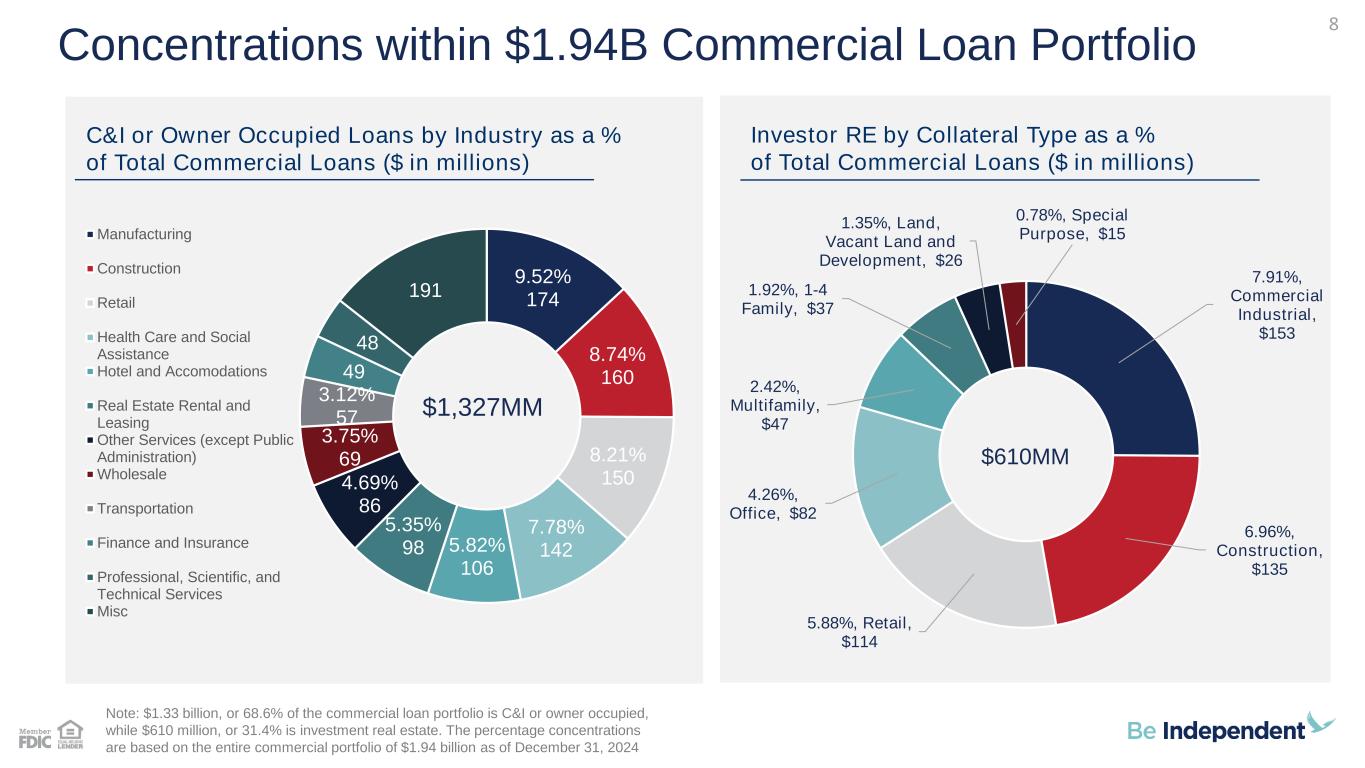

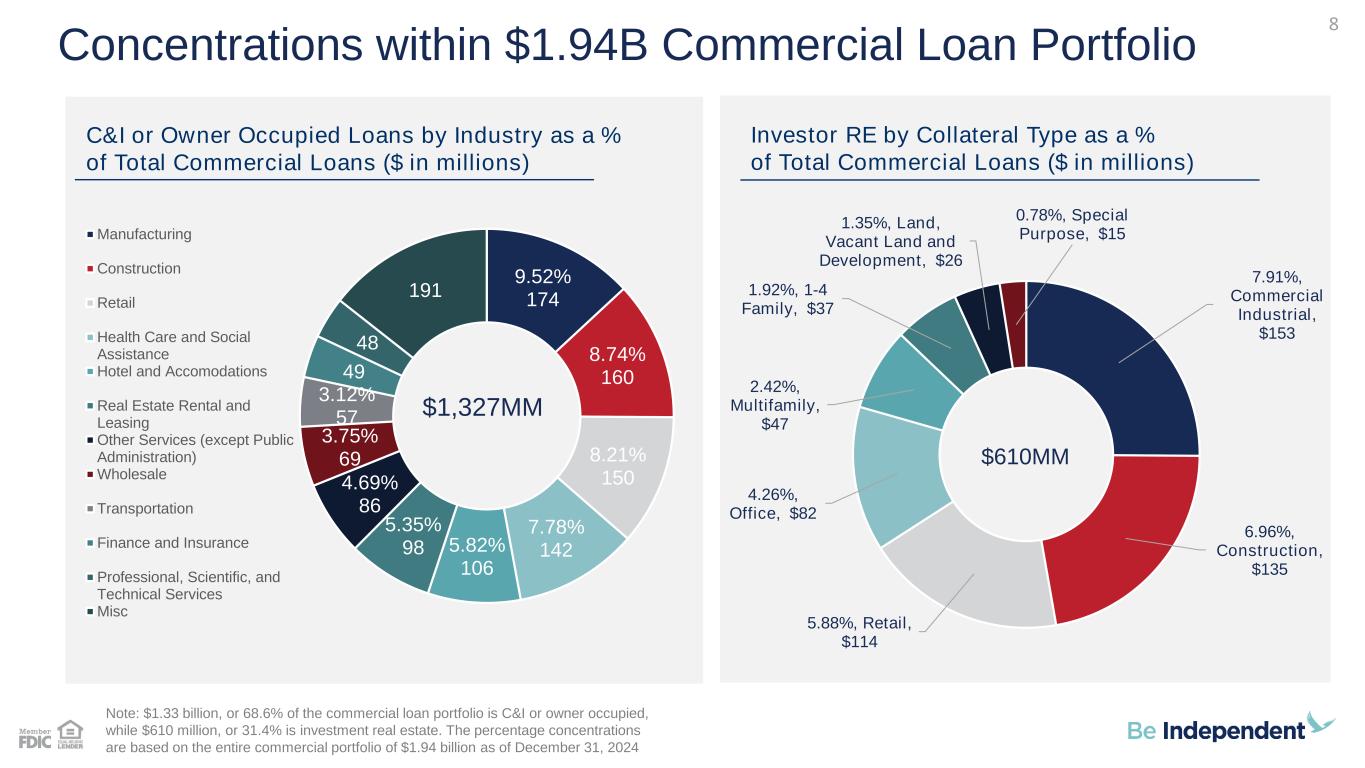

9.52% 174 8.74% 160 8.21% 150 7.78% 1425.82% 106 5.35% 98 4.69% 86 3.75% 69 3.12% 57 49 48 191 $1,327MM Manufacturing Construction Retail Health Care and Social Assistance Hotel and Accomodations Real Estate Rental and Leasing Other Services (except Public Administration) Wholesale Transportation Finance and Insurance Professional, Scientific, and Technical Services Misc 7.91%, Commercial Industrial, $153 6.96%, Construction, $135 5.88%, Retail, $114 4.26%, Office, $82 2.42%, Multifamily, $47 1.92%, 1-4 Family, $37 1.35%, Land, Vacant Land and Development, $26 0.78%, Special Purpose, $15 Concentrations within $1.94B Commercial Loan Portfolio C&I or Owner Occupied Loans by Industry as a % of Total Commercial Loans ($ in millions) Investor RE by Collateral Type as a % of Total Commercial Loans ($ in millions) Note: $1.33 billion, or 68.6% of the commercial loan portfolio is C&I or owner occupied, while $610 million, or 31.4% is investment real estate. The percentage concentrations are based on the entire commercial portfolio of $1.94 billion as of December 31, 2024 8 $610MM

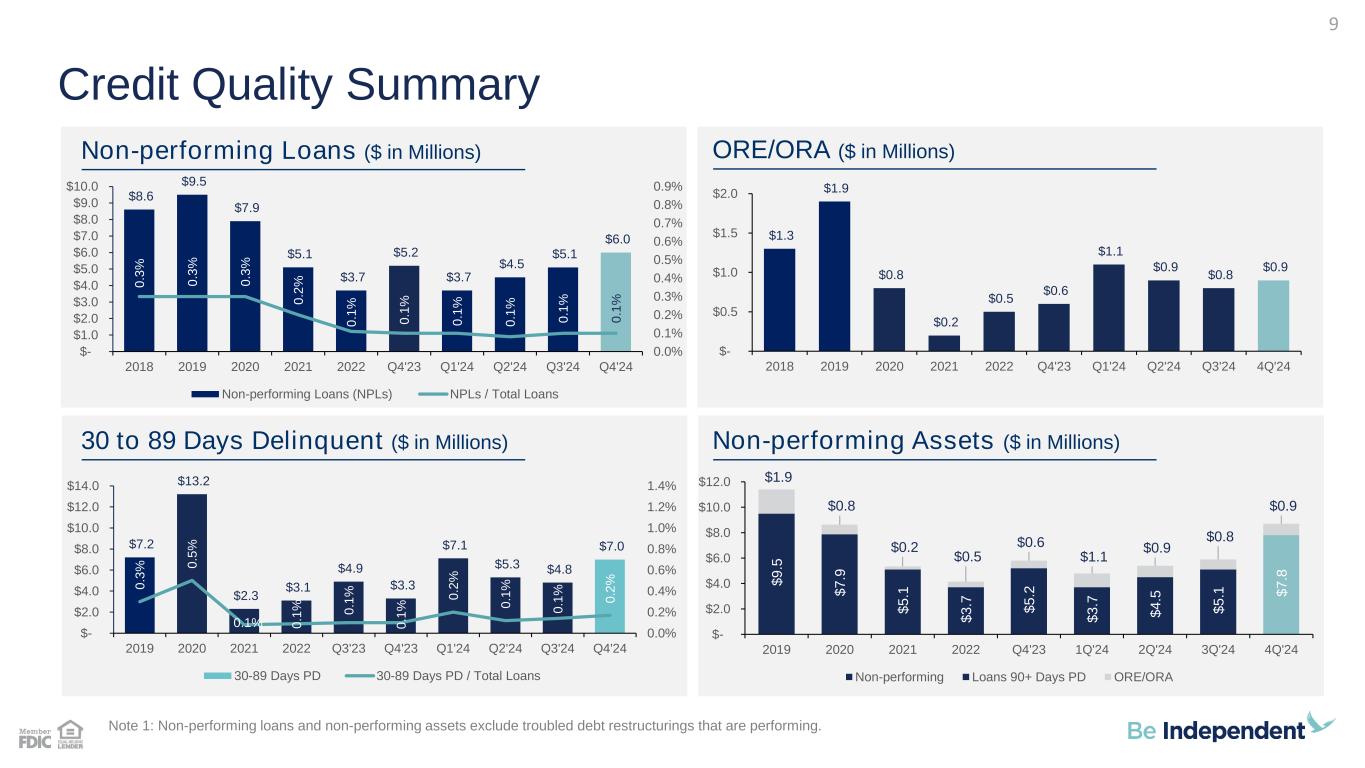

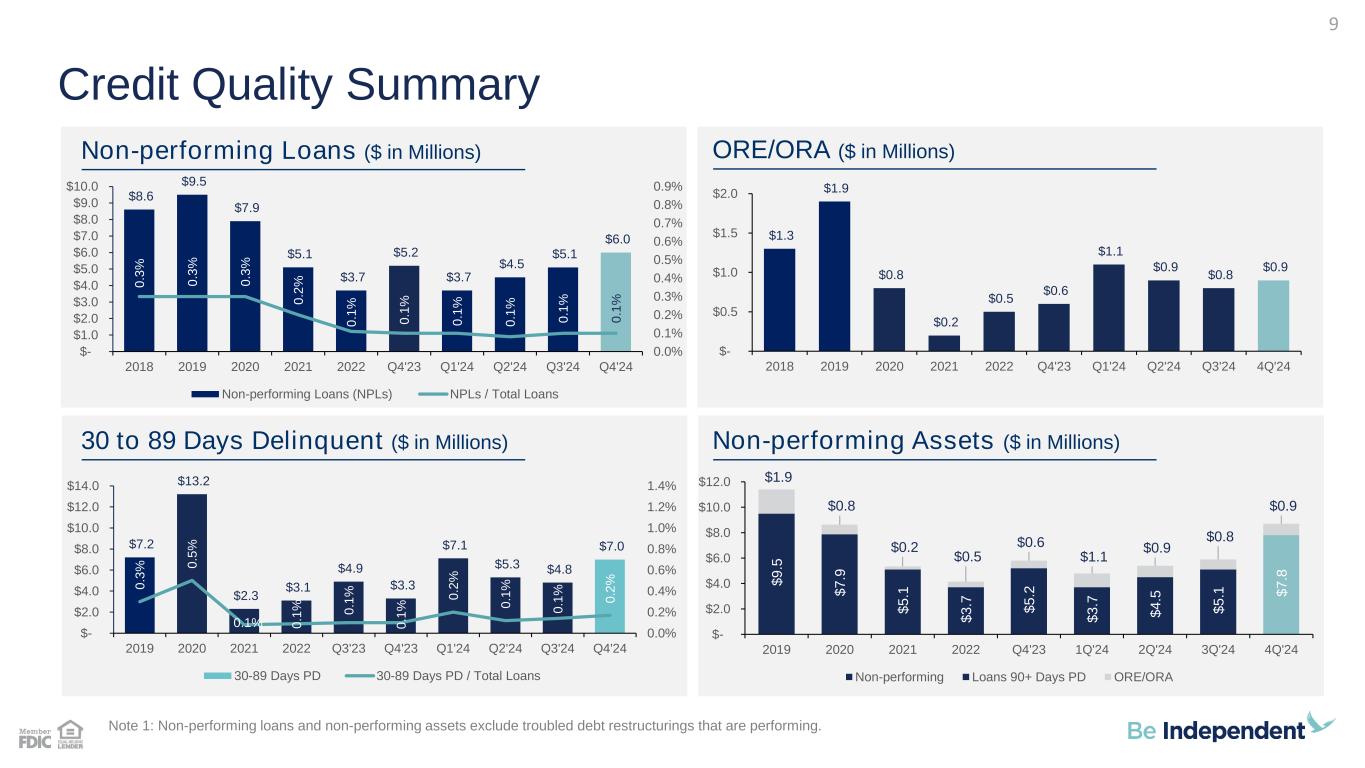

$8.6 $9.5 $7.9 $5.1 $3.7 $5.2 $3.7 $4.5 $5.1 $6.0 0 .3 % 0 .3 % 0 .3 % 0 .2 % 0 .1 % 0 .1 % 0 .1 % 0 .1 % 0 .1 % 0 .1 % 0.0% 0.1% 0.2% 0.3% 0.4% 0.5% 0.6% 0.7% 0.8% 0.9% $- $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 $7.0 $8.0 $9.0 $10.0 2018 2019 2020 2021 2022 Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 Non-performing Loans (NPLs) NPLs / Total Loans $ 9 .5 $ 7 .9 $ 5 .1 $ 3 .7 $ 5 .2 $ 3 .7 $ 4 .5 $ 5 .1 $ 7 .8 $1.9 $0.8 $0.2 $0.5 $0.6 $1.1 $0.9 $0.8 $0.9 $- $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 2019 2020 2021 2022 Q4'23 1Q'24 2Q'24 3Q'24 4Q'24 Non-performing Loans 90+ Days PD ORE/ORA $7.2 $13.2 $2.3 $3.1 $4.9 $3.3 $7.1 $5.3 $4.8 $7.0 0 .3 % 0 .5 % 0.1% 0 .1 % 0 .1 % 0 .1 % 0 .2 % 0 .1 % 0 .1 % 0 .2 % 0.0% 0.2% 0.4% 0.6% 0.8% 1.0% 1.2% 1.4% $- $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 2019 2020 2021 2022 Q3'23 Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 30-89 Days PD 30-89 Days PD / Total Loans $1.3 $1.9 $0.8 $0.2 $0.5 $0.6 $1.1 $0.9 $0.8 $0.9 $- $0.5 $1.0 $1.5 $2.0 2018 2019 2020 2021 2022 Q4'23 Q1'24 Q2'24 Q3'24 4Q'24 Note 1: Non-performing loans and non-performing assets exclude troubled debt restructurings that are performing. Credit Quality Summary Non-performing Loans ($ in Millions) ORE/ORA ($ in Millions) 30 to 89 Days Delinquent ($ in Millions) Non-performing Assets ($ in Millions) 9

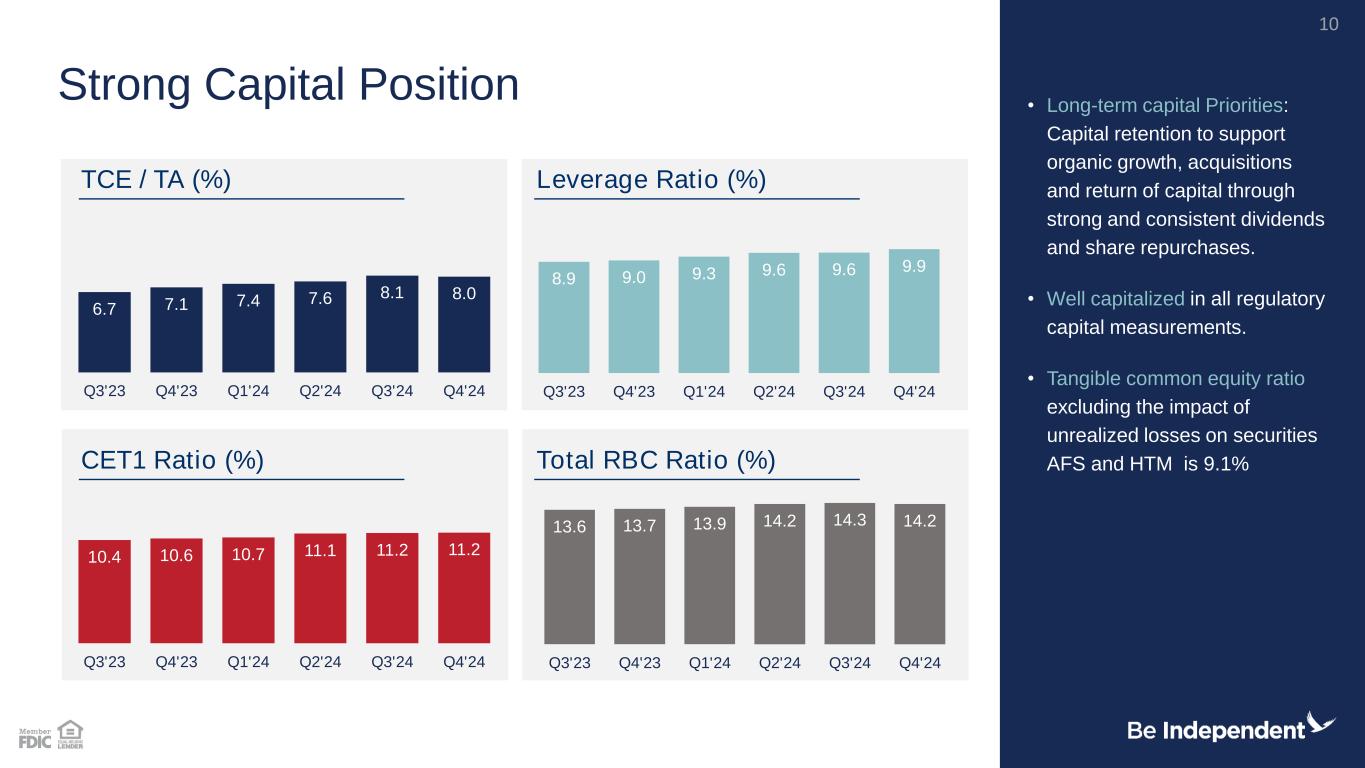

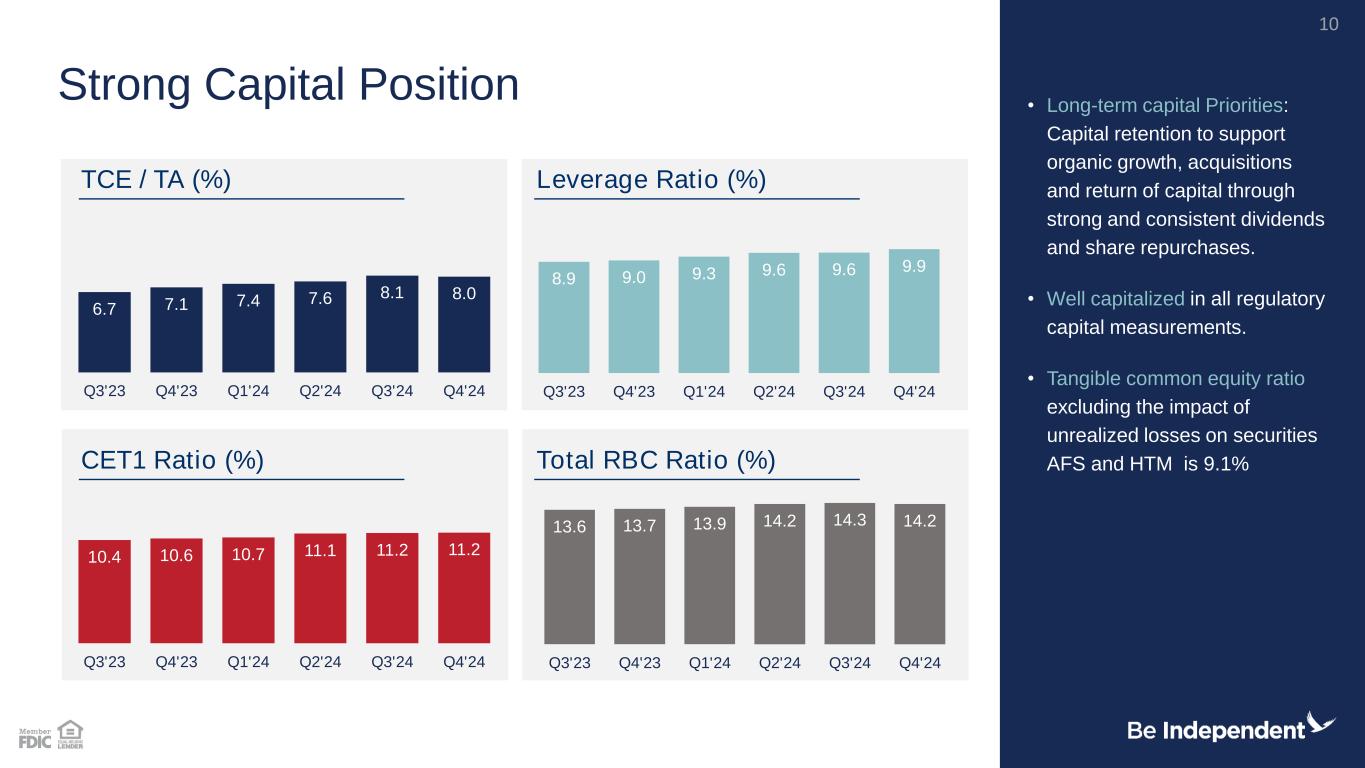

13.6 13.7 13.9 14.2 14.3 14.2 Q3'23 Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 10.4 10.6 10.7 11.1 11.2 11.2 Q3'23 Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 8.9 9.0 9.3 9.6 9.6 9.9 Q3'23 Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 6.7 7.1 7.4 7.6 8.1 8.0 Q3'23 Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 • Long-term capital Priorities: Capital retention to support organic growth, acquisitions and return of capital through strong and consistent dividends and share repurchases. • Well capitalized in all regulatory capital measurements. • Tangible common equity ratio excluding the impact of unrealized losses on securities AFS and HTM is 9.1% Strong Capital Position TCE / TA (%) Leverage Ratio (%) CET1 Ratio (%) Total RBC Ratio (%) 10

3.12 3.05 3.02 3.18 3.13 3.00 3.26 3.49 3.52 3.33 3.26 3.23 3.26 3.30 3.40 3.37 3.45 0.09 0.08 0.07 0.08 0.08 0.12 0.77 2.18 3.65 4.38 4.99 5.26 5.33 5.33 5.33 5.16 4.66 0.39 0.14 0.12 0.11 0.10 0.10 0.12 0.45 0.92 1.39 1.72 1.93 2.11 2.14 2.16 2.22 2.02 0 1 2 3 4 5 6 Q 4 '2 0 Q 1 '2 1 Q 2 '2 1 Q 3 '2 1 Q 4 '2 1 Q 1 '2 2 Q 2 '2 2 Q 3 '2 2 Q 4 '2 2 Q 1 '2 3 Q 2 '2 3 Q 3 '2 3 Q 4 '2 3 Q 1 '2 4 Q 2 '2 4 Q 3 '2 4 Q 4 '2 4 Net Interest Margin (FTE) Average Effective FF Yield Cost of Funds Net Interest Margin/Income • Net interest income was $42.9 million in 4Q'24 compared to $40.1 million in the prior year quarter. The change is due to an increase in average earning assets and the net interest margin compared to the year- ago quarter. • Net interest margin was 3.45% during the fourth quarter of 2024, compared to 3.26% in the year-ago quarter and 3.37% in the third quarter of 2024. Yields, NIM and Cost of Funds (%) Net Interest Income ($ in Millions) 11 $ 3 1 .4 $ 3 3 .8 $ 3 4 .3 $ 3 3 .0 $ 3 6 .1 $ 3 9 .9 $ 4 0 .6 $ 3 8 .4 $ 3 8 .4 $ 3 9 .4 $ 4 0 .1 $ 4 0 .2 $ 4 1 .3 $ 4 1 .9 $ 4 2 .9 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 Q4'23 Q1'24 Q2'24 Q3'24 Q4'24

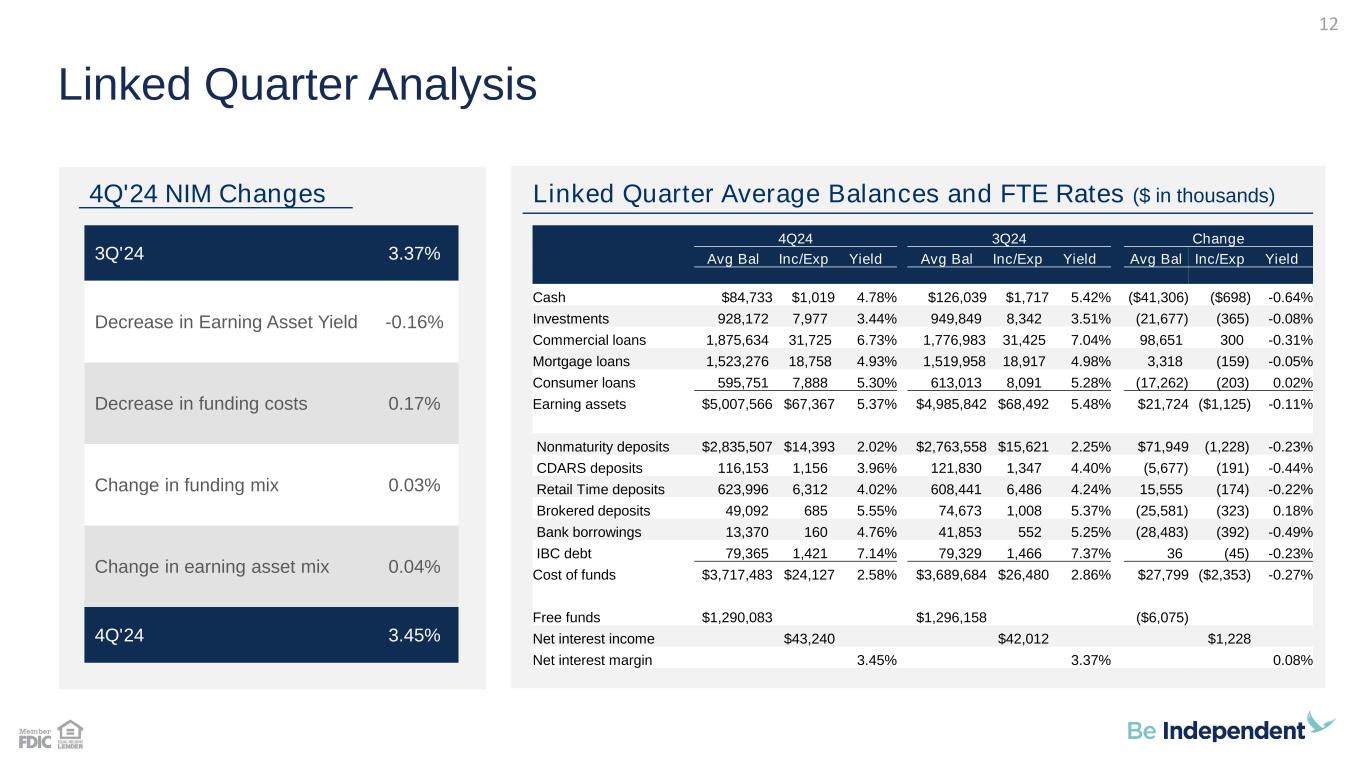

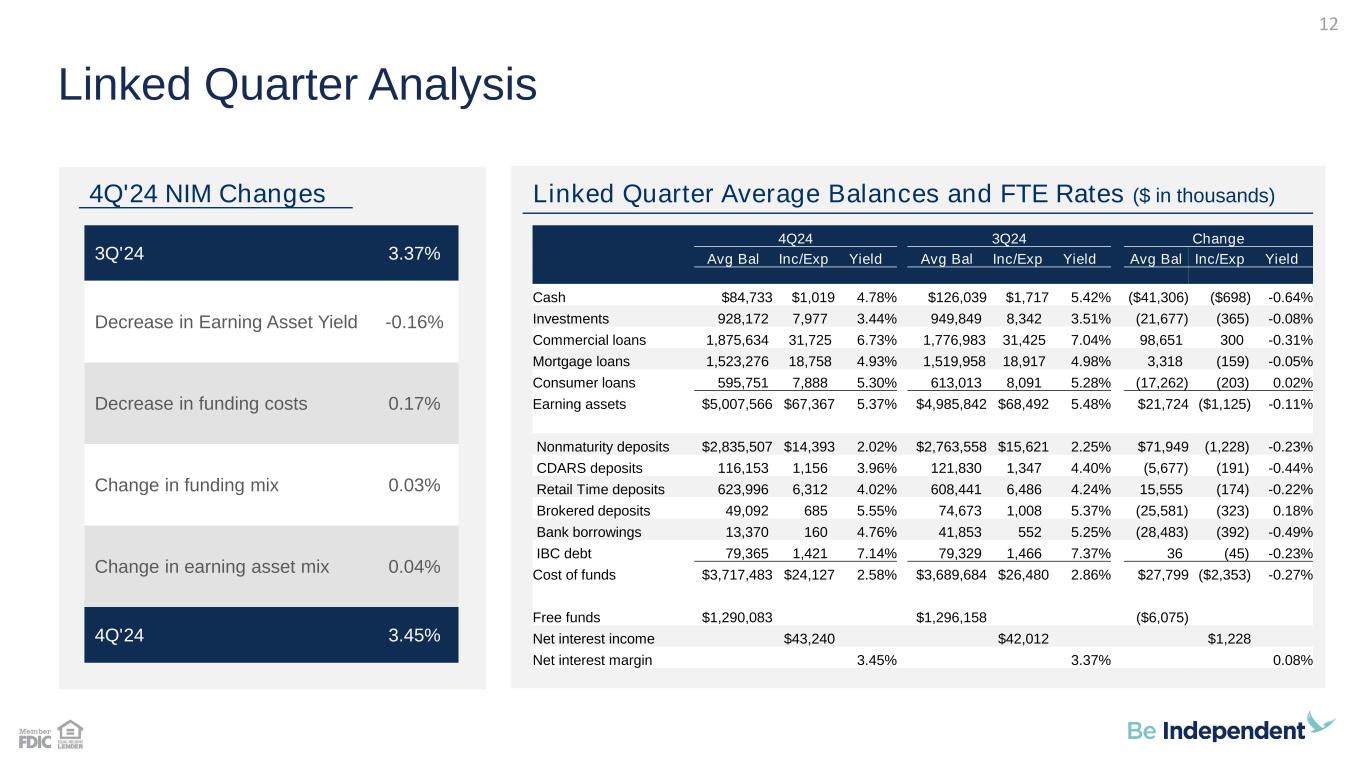

4Q24 3Q24 Change Avg Bal Inc/Exp Yield Avg Bal Inc/Exp Yield Avg Bal Inc/Exp Yield Cash $84,733 $1,019 4.78% $126,039 $1,717 5.42% ($41,306) ($698) -0.64% Investments 928,172 7,977 3.44% 949,849 8,342 3.51% (21,677) (365) -0.08% Commercial loans 1,875,634 31,725 6.73% 1,776,983 31,425 7.04% 98,651 300 -0.31% Mortgage loans 1,523,276 18,758 4.93% 1,519,958 18,917 4.98% 3,318 (159) -0.05% Consumer loans 595,751 7,888 5.30% 613,013 8,091 5.28% (17,262) (203) 0.02% Earning assets $5,007,566 $67,367 5.37% $4,985,842 $68,492 5.48% $21,724 ($1,125) -0.11% Nonmaturity deposits $2,835,507 $14,393 2.02% $2,763,558 $15,621 2.25% $71,949 (1,228) -0.23% CDARS deposits 116,153 1,156 3.96% 121,830 1,347 4.40% (5,677) (191) -0.44% Retail Time deposits 623,996 6,312 4.02% 608,441 6,486 4.24% 15,555 (174) -0.22% Brokered deposits 49,092 685 5.55% 74,673 1,008 5.37% (25,581) (323) 0.18% Bank borrowings 13,370 160 4.76% 41,853 552 5.25% (28,483) (392) -0.49% IBC debt 79,365 1,421 7.14% 79,329 1,466 7.37% 36 (45) -0.23% Cost of funds $3,717,483 $24,127 2.58% $3,689,684 $26,480 2.86% $27,799 ($2,353) -0.27% Free funds $1,290,083 $1,296,158 ($6,075) Net interest income $43,240 $42,012 $1,228 Net interest margin 3.45% 3.37% 0.08% 3Q'24 3.37% Decrease in Earning Asset Yield -0.16% Decrease in funding costs 0.17% Change in funding mix 0.03% Change in earning asset mix 0.04% 4Q'24 3.45% 4Q'24 NIM Changes Linked Quarter Average Balances and FTE Rates ($ in thousands) Linked Quarter Analysis 12

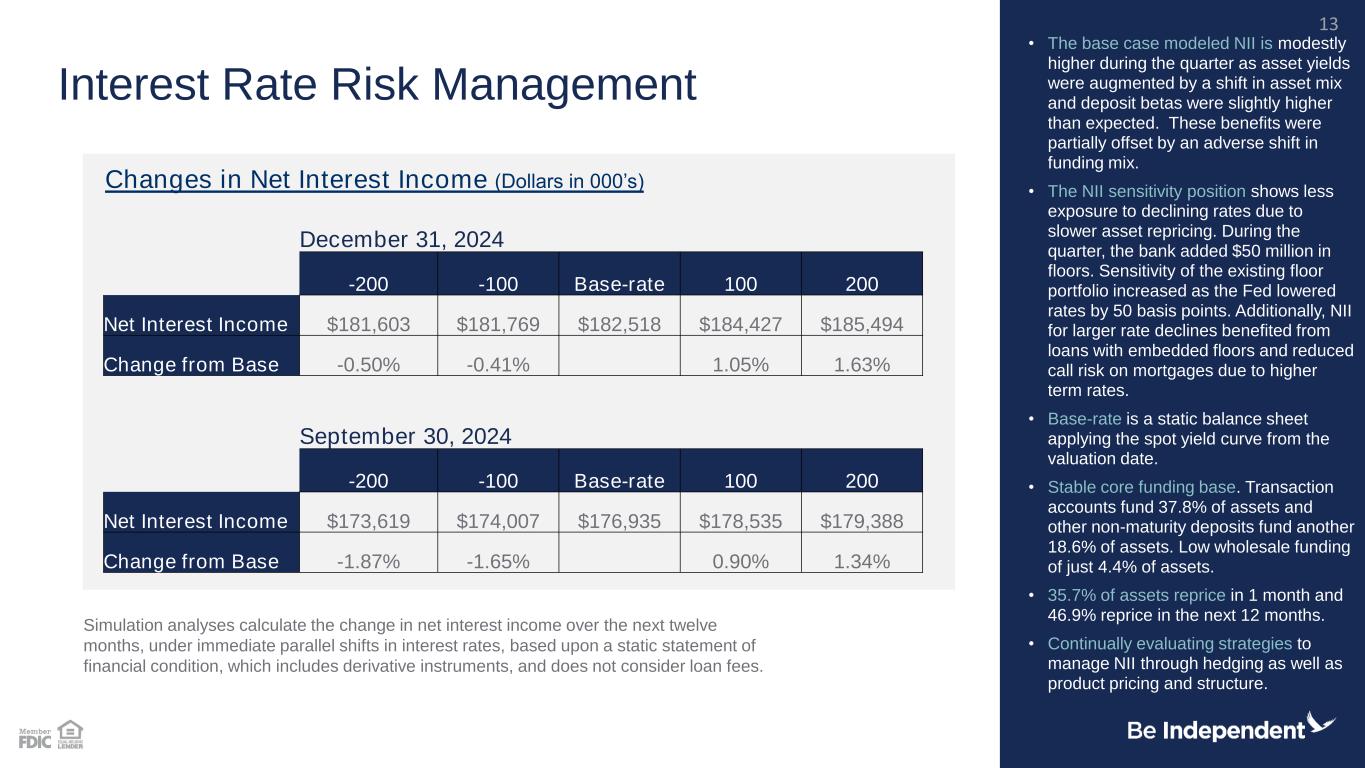

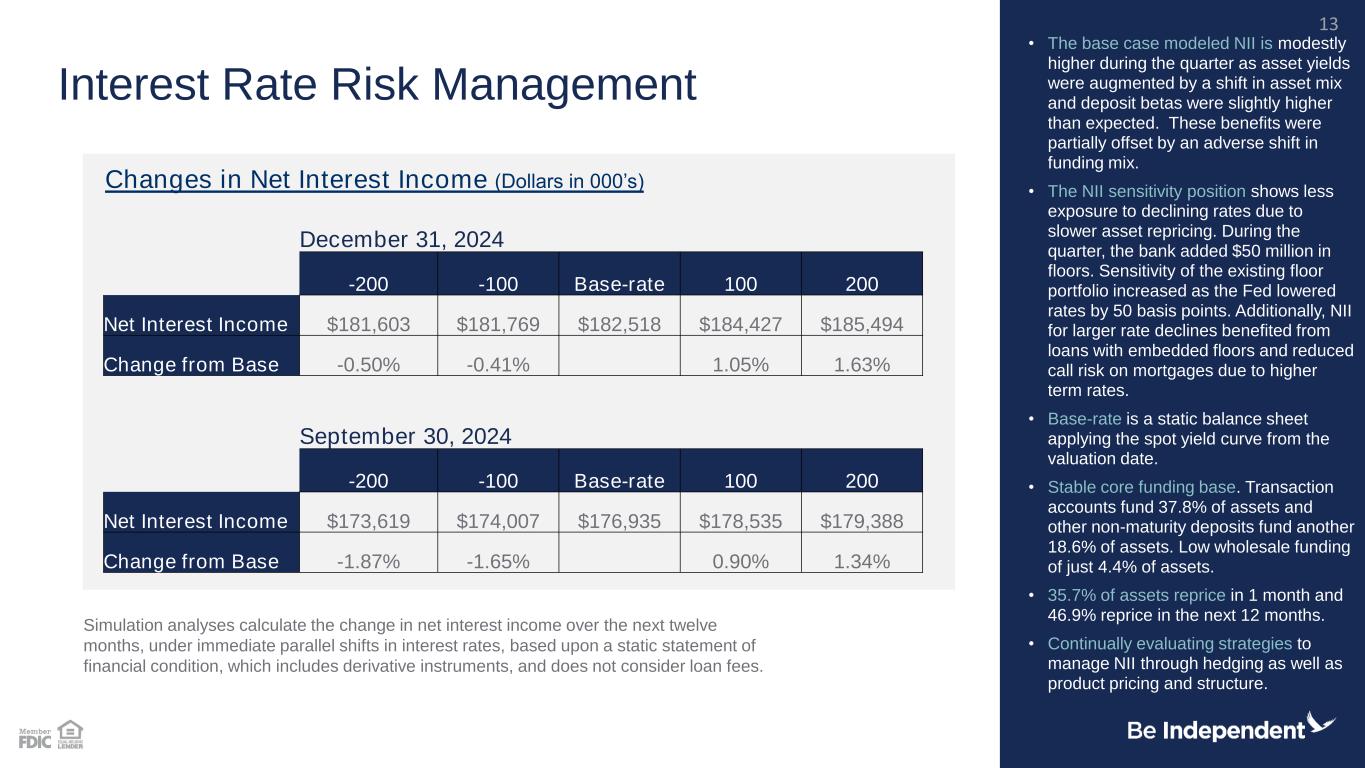

December 31, 2024 -200 -100 Base-rate 100 200 Net Interest Income $181,603 $181,769 $182,518 $184,427 $185,494 Change from Base -0.50% -0.41% 1.05% 1.63% September 30, 2024 -200 -100 Base-rate 100 200 Net Interest Income $173,619 $174,007 $176,935 $178,535 $179,388 Change from Base -1.87% -1.65% 0.90% 1.34% Interest Rate Risk Management • The base case modeled NII is modestly higher during the quarter as asset yields were augmented by a shift in asset mix and deposit betas were slightly higher than expected. These benefits were partially offset by an adverse shift in funding mix. • The NII sensitivity position shows less exposure to declining rates due to slower asset repricing. During the quarter, the bank added $50 million in floors. Sensitivity of the existing floor portfolio increased as the Fed lowered rates by 50 basis points. Additionally, NII for larger rate declines benefited from loans with embedded floors and reduced call risk on mortgages due to higher term rates. • Base-rate is a static balance sheet applying the spot yield curve from the valuation date. • Stable core funding base. Transaction accounts fund 37.8% of assets and other non-maturity deposits fund another 18.6% of assets. Low wholesale funding of just 4.4% of assets. • 35.7% of assets reprice in 1 month and 46.9% reprice in the next 12 months. • Continually evaluating strategies to manage NII through hedging as well as product pricing and structure. Changes in Net Interest Income (Dollars in 000’s) Simulation analyses calculate the change in net interest income over the next twelve months, under immediate parallel shifts in interest rates, based upon a static statement of financial condition, which includes derivative instruments, and does not consider loan fees. 13

Interchange income $3,294 Service Chg Dep $2,976 Gain (Loss)- Mortgage Sale $1,705 Equity Securities at Fair Value $- Gain (Loss)- Securities $(14) Mortgage loan servicing, net $7,761 Investment & insurance commissions $744 Bank owned life insurance $268 Other income $2,387 $ 1 1 .5 $ 1 0 .5 $ 1 5 .4 $ 1 5 .6 $ 9 .1 $ 1 2 .6 $ 1 5 .2 $ 9 .5 $ 1 9 .1 1 8 .4 % 1 6 .4 % 1 8 .6 % 2 0 .0 % 1 2 .2 % 1 6 .2 % 1 8 .6 % 1 2 .2 % 2 2 .2 % -5.0 5.0 15.0 25.0 35.0 45.0 55.0 $- $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 $40.0 Q 4 '2 2 Q 1 '2 3 Q 2 '2 3 Q 3 '2 3 Q 4 '2 3 Q 1 '2 4 Q 2 '2 4 Q 3 '2 4 Q 4 '2 4 Non-interest Income Non-interest Inc/Operating Rev (%) Strong Non-interest Income • The $10.2 million comparative quarterly decrease in mortgage loan servicing, net is primarily attributed to changes in the fair value of capitalized mortgage loan servicing rights associated with changes in mortgage loan interest rates and expected future prepayment levels. • Mortgage banking: − $1.7 million in net gains on mortgage loans in 4Q'24 vs. $2.0 million in the year ago quarter. The decrease is primarily due to lower profit margins on mortgage loan sales that was partially offset by higher loan sales volume. − $134.1 million in mortgage loan originations in 4Q'24 vs. $108.0 million in 4Q’23 and $147.5 million in 3Q'24. − 4Q'24 mortgage loan servicing includes a $6.5 million ($(0.24) per diluted share, after tax) increase in fair value adjustment due to price compared to a decrease of $3.6 million ($0.14 per diluted share, after tax) in the year ago quarter. Source: Company documents. 4Q'24 Non-interest Income (thousands) Non-interest Income Trends ($M) 14 $19.1MM

6 1 .3 % 5 9 .8 % 6 0 .4 % 5 9 .6 % 5 9 .9 % 6 0 .7 % 6 0 .3 % 6 0 .9 % 6 2 .2 % 6 0 .9 % 3 Q '2 2 4 Q '2 2 1 Q '2 3 2 Q '2 3 3 Q '2 3 4 Q '2 3 1 Q '2 4 2 Q '2 4 3 Q '2 4 4 Q '2 4 $ 3 2 .1 $ 3 1 .0 $ 3 2 .2 $ 3 2 .0 $ 3 1 .9 $ 3 2 .2 $ 3 3 .3 $ 3 2 .6 $- $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 Q 4 '2 2 Q 1 '2 3 Q 2 '2 3 Q 3 '2 3 Q 4 '2 3 Q 1 '2 4 Q 2 '2 4 Q 3 '2 4 Q 4 '2 4 Compensation and Benefits Loan and Collection Occupancy Data Processing FDIC Insurance Other Focus on Improved Efficiency • 4Q'24 efficiency ratio of 59.1%. • Compensation and employee benefits expense of $22.9 million, an increase of $3.8 million from the prior year quarter. • $2.7 million increase in performance-based compensation expense due to a higher expected payout level in 2024. • Payroll taxes and employee benefits increased $0.3 million primarily due to higher healthcare related costs. • Data processing costs increased by $0.8 million primarily due to core data processor annual asset growth and CPI related cost increases as well as the purchase of a new lending solution software. • Opportunities exist to gain additional efficiencies as we continue to optimize our delivery channels. Non-interest Expense ($M) Efficiency Ratio (4 quarter rolling average) Source: Company documents. 15 $ 3 7 .0

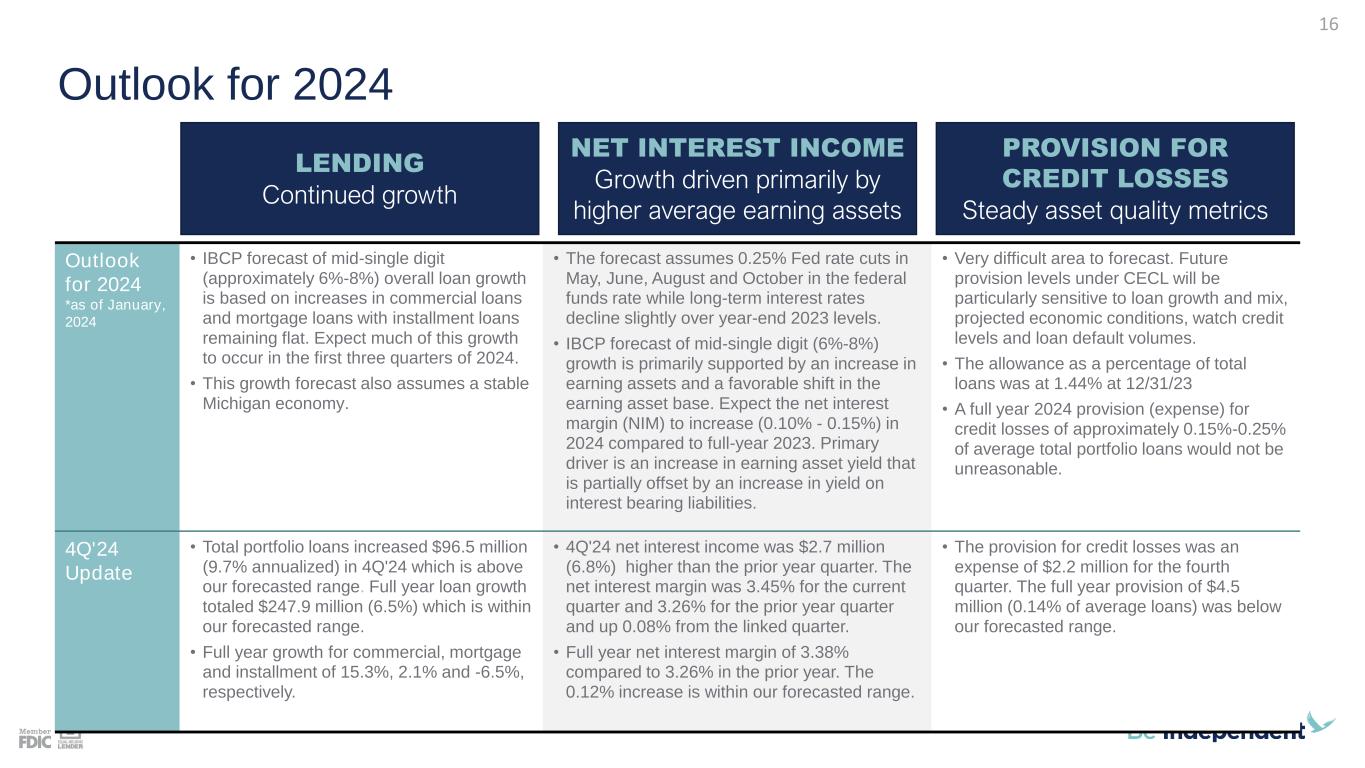

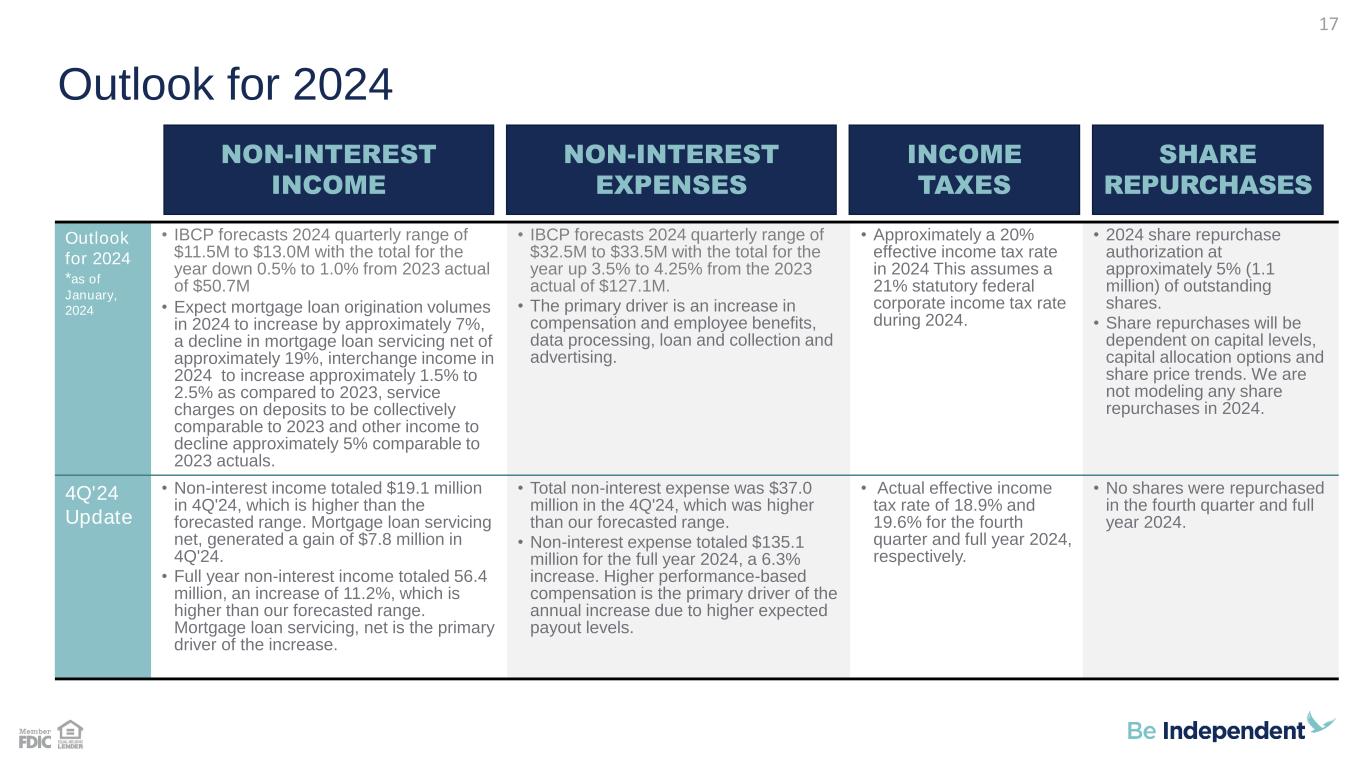

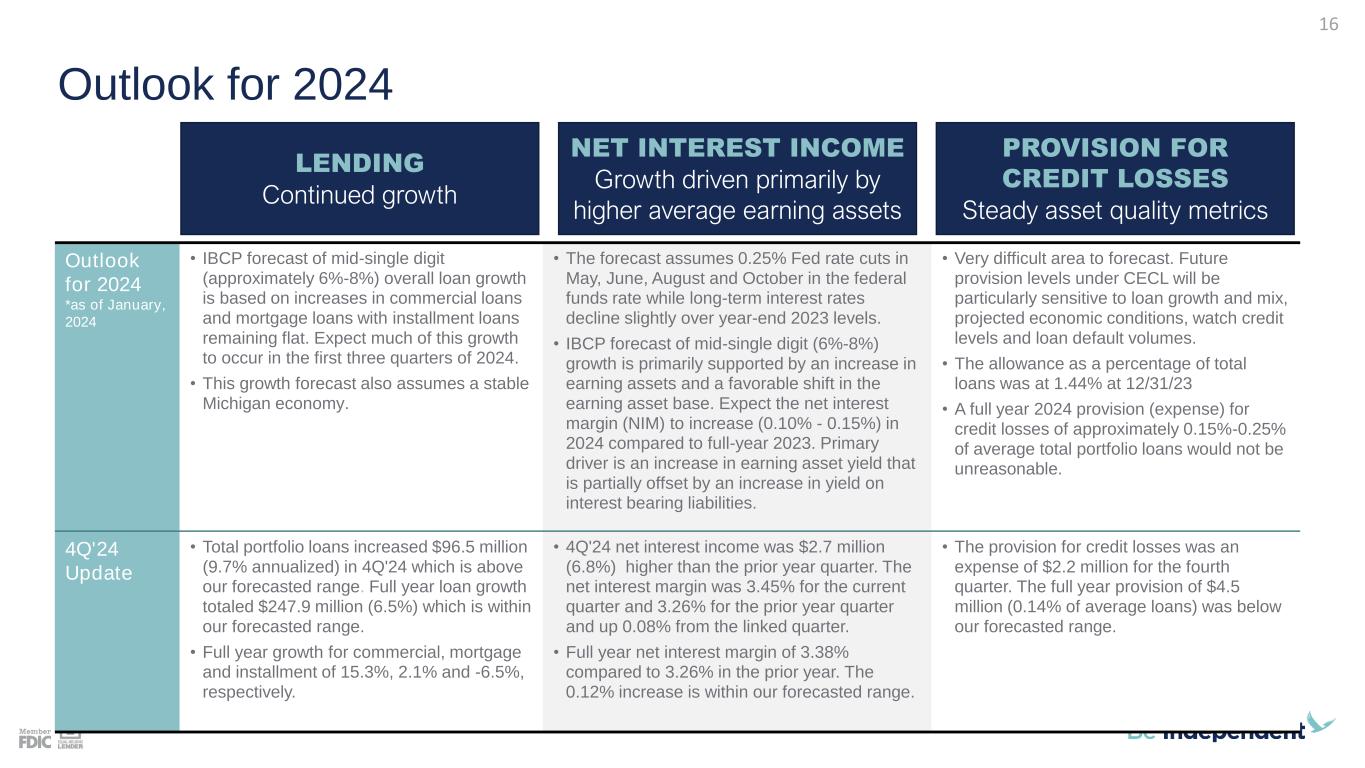

Outlook for 2024 Outlook for 2024 *as of January, 2024 • IBCP forecast of mid-single digit (approximately 6%-8%) overall loan growth is based on increases in commercial loans and mortgage loans with installment loans remaining flat. Expect much of this growth to occur in the first three quarters of 2024. • This growth forecast also assumes a stable Michigan economy. • The forecast assumes 0.25% Fed rate cuts in May, June, August and October in the federal funds rate while long-term interest rates decline slightly over year-end 2023 levels. • IBCP forecast of mid-single digit (6%-8%) growth is primarily supported by an increase in earning assets and a favorable shift in the earning asset base. Expect the net interest margin (NIM) to increase (0.10% - 0.15%) in 2024 compared to full-year 2023. Primary driver is an increase in earning asset yield that is partially offset by an increase in yield on interest bearing liabilities. • Very difficult area to forecast. Future provision levels under CECL will be particularly sensitive to loan growth and mix, projected economic conditions, watch credit levels and loan default volumes. • The allowance as a percentage of total loans was at 1.44% at 12/31/23 • A full year 2024 provision (expense) for credit losses of approximately 0.15%-0.25% of average total portfolio loans would not be unreasonable. 4Q'24 Update • Total portfolio loans increased $96.5 million (9.7% annualized) in 4Q'24 which is above our forecasted range. Full year loan growth totaled $247.9 million (6.5%) which is within our forecasted range. • Full year growth for commercial, mortgage and installment of 15.3%, 2.1% and -6.5%, respectively. • 4Q'24 net interest income was $2.7 million (6.8%) higher than the prior year quarter. The net interest margin was 3.45% for the current quarter and 3.26% for the prior year quarter and up 0.08% from the linked quarter. • Full year net interest margin of 3.38% compared to 3.26% in the prior year. The 0.12% increase is within our forecasted range. • The provision for credit losses was an expense of $2.2 million for the fourth quarter. The full year provision of $4.5 million (0.14% of average loans) was below our forecasted range. LENDING Continued growth NET INTEREST INCOME Growth driven primarily by higher average earning assets PROVISION FOR CREDIT LOSSES Steady asset quality metrics 16

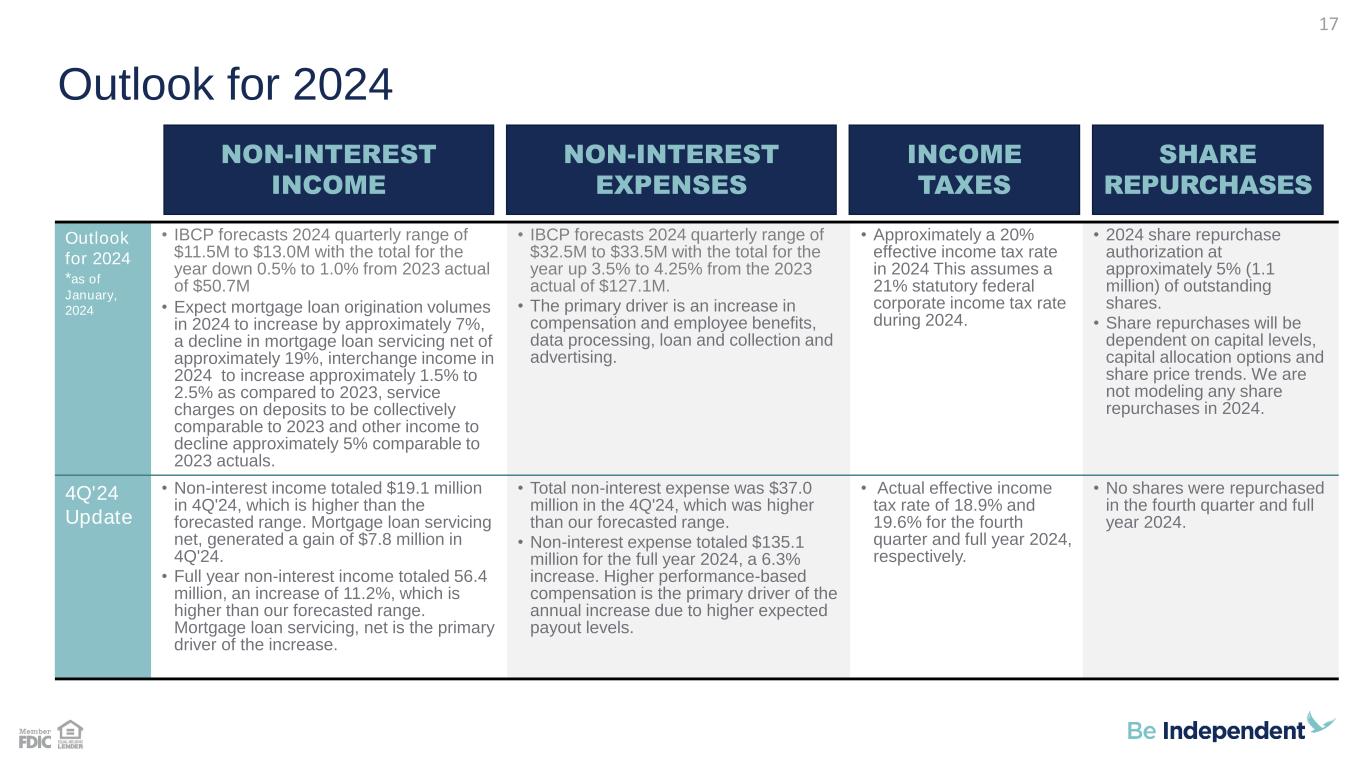

Outlook for 2024 Outlook for 2024 *as of January, 2024 • IBCP forecasts 2024 quarterly range of $11.5M to $13.0M with the total for the year down 0.5% to 1.0% from 2023 actual of $50.7M • Expect mortgage loan origination volumes in 2024 to increase by approximately 7%, a decline in mortgage loan servicing net of approximately 19%, interchange income in 2024 to increase approximately 1.5% to 2.5% as compared to 2023, service charges on deposits to be collectively comparable to 2023 and other income to decline approximately 5% comparable to 2023 actuals. • IBCP forecasts 2024 quarterly range of $32.5M to $33.5M with the total for the year up 3.5% to 4.25% from the 2023 actual of $127.1M. • The primary driver is an increase in compensation and employee benefits, data processing, loan and collection and advertising. • Approximately a 20% effective income tax rate in 2024 This assumes a 21% statutory federal corporate income tax rate during 2024. • 2024 share repurchase authorization at approximately 5% (1.1 million) of outstanding shares. • Share repurchases will be dependent on capital levels, capital allocation options and share price trends. We are not modeling any share repurchases in 2024. 4Q'24 Update • Non-interest income totaled $19.1 million in 4Q'24, which is higher than the forecasted range. Mortgage loan servicing net, generated a gain of $7.8 million in 4Q'24. • Full year non-interest income totaled 56.4 million, an increase of 11.2%, which is higher than our forecasted range. Mortgage loan servicing, net is the primary driver of the increase. • Total non-interest expense was $37.0 million in the 4Q'24, which was higher than our forecasted range. • Non-interest expense totaled $135.1 million for the full year 2024, a 6.3% increase. Higher performance-based compensation is the primary driver of the annual increase due to higher expected payout levels. • Actual effective income tax rate of 18.9% and 19.6% for the fourth quarter and full year 2024, respectively. • No shares were repurchased in the fourth quarter and full year 2024. NON-INTEREST INCOME NON-INTEREST EXPENSES INCOME TAXES SHARE REPURCHASES 17

Outlook for 2025 Outlook for 2025 *as of January, 2025 • IBCP forecast of mid-single digit (approximately 5%-6%) overall loan growth is based on increases in commercial loans (9%-10%) and mortgage loans (2%-3%) with installment loans declining (2%-3%). • This growth forecast also assumes a stable Michigan economy. • The forecast assumes 0.25% Fed rate cuts in March and August in the federal funds rate while long-term interest rates increase slightly over year-end 2024 levels. • IBCP forecast of high-single digit (8%-9%) growth is primarily supported by an increase in earning assets and a favorable shift in the earning asset base. Expect the net interest margin (NIM) to increase (0.20% - 0.25%) in 2025 compared to full-year 2024. Primary driver is a decrease in yield on interest bearing liabilities that is partially offset by a decrease in earning asset yield. • Very difficult area to forecast. Future provision levels under CECL will be particularly sensitive to loan growth and mix, projected economic conditions, watch credit levels and loan default volumes. • The allowance as a percentage of total loans was at 1.47% at 12/31/24 • A full year 2025 provision (expense) for credit losses of approximately 0.15%-0.20% of average total portfolio loans would not be unreasonable. LENDING Continued growth NET INTEREST INCOME Growth driven primarily by higher average earning assets PROVISION FOR CREDIT LOSSES Steady asset quality metrics 18

Outlook for 2025 Outlook for 2025 *as of January, 2025 • Q1/Q2 quarterly 2025 forecasted range of $11.0M to $12.0M and Q3/Q4 forecast of $12.0M to $13M. Full year down 14.0% to 14.5% from 2024 actual of $56.4M • Expect mortgage loan origination volumes and net gain on sale to be similar to 2024. Assumes mortgage loan servicing net of approximately $0.75M per quarter in 2025. • IBCP forecasts 2024 quarterly range of $34.5M to $35.5M with the total for the year up 3.0% to 4.0% from the 2024 actual of $135.1M. • The primary driver is an increase in compensation and employee benefits, data processing and occupancy. • Approximately a 19% effective income tax rate in 2025 This assumes a 21% statutory federal corporate income tax rate during 2025. • 2025 share repurchase authorization at approximately 5% (1.1 million) of outstanding shares. • Share repurchases will be dependent on capital levels, capital allocation options and share price trends. We are not modeling any share repurchases in 2025. NON-INTEREST INCOME NON-INTEREST EXPENSES INCOME TAXES SHARE REPURCHASES 19

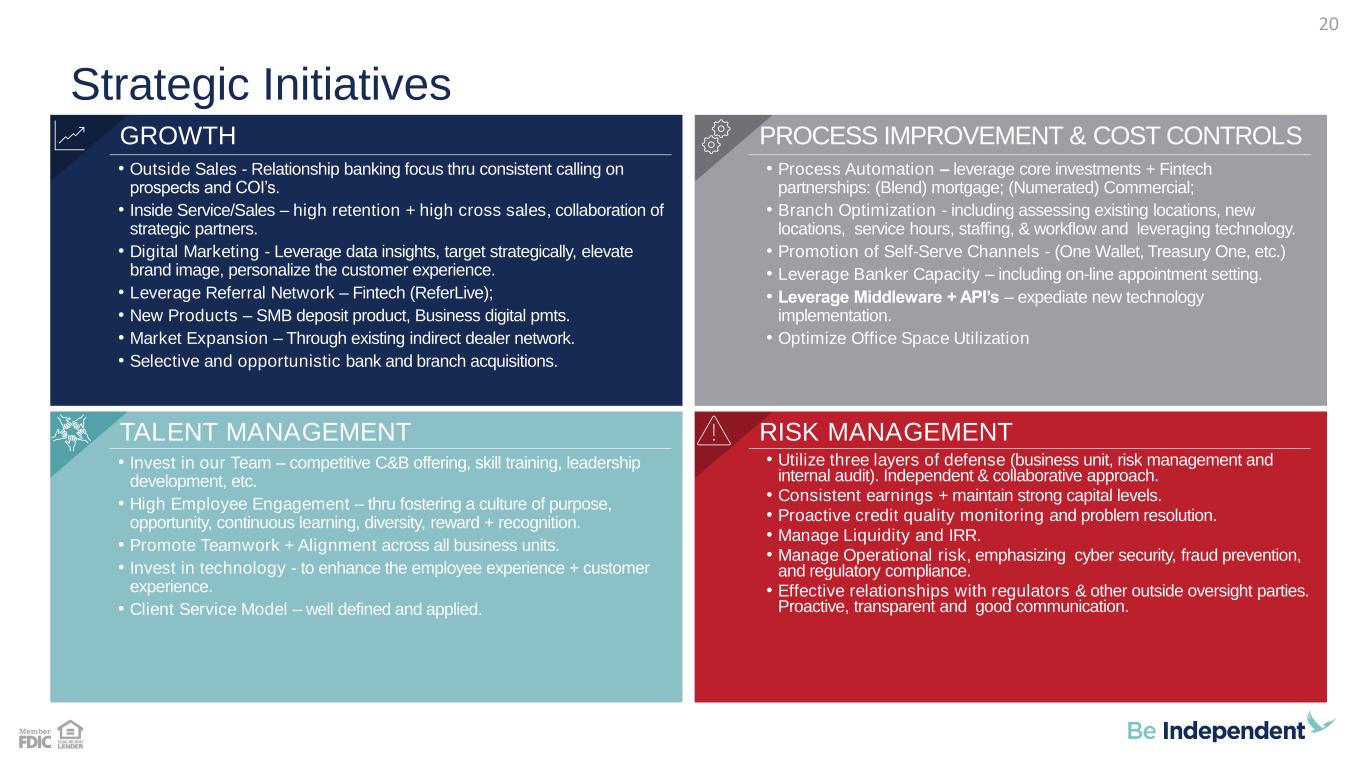

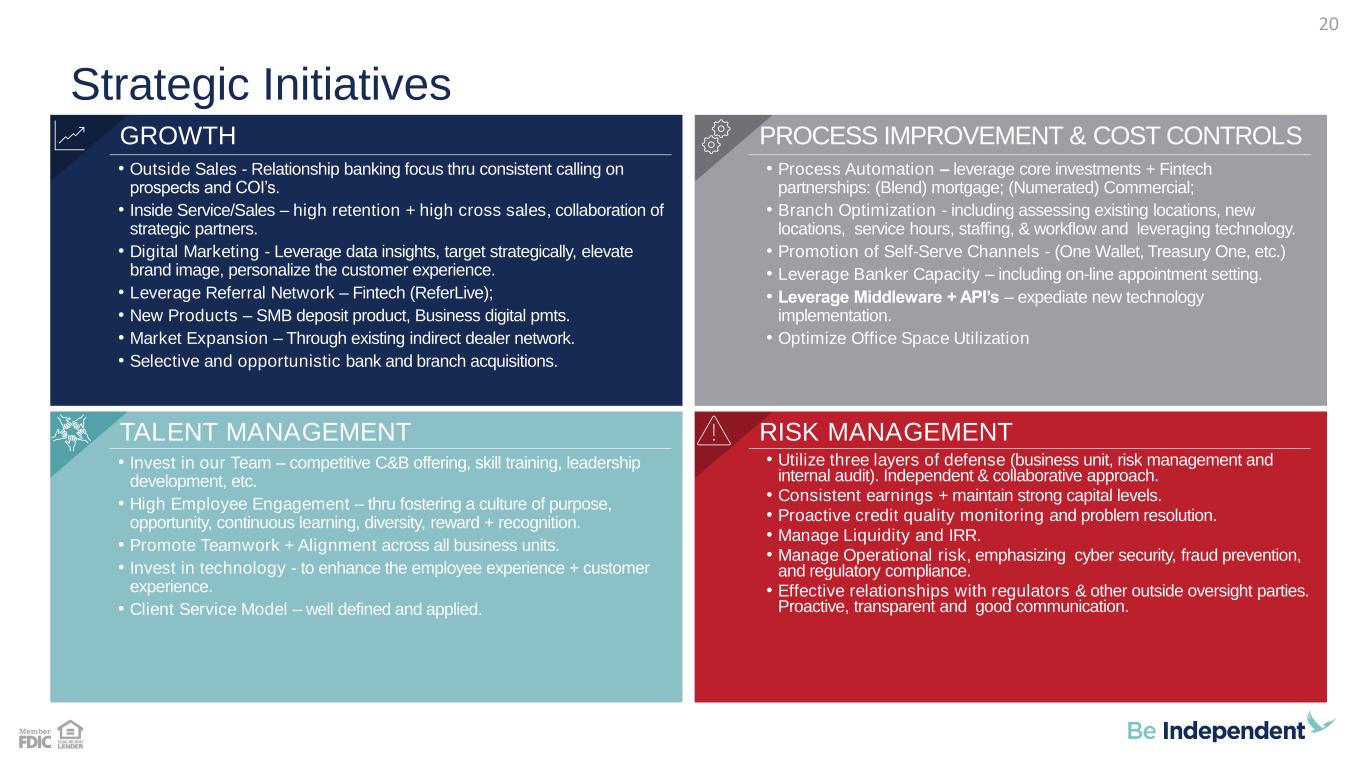

Strategic Initiatives • Outside Sales - Relationship banking focus thru consistent calling on prospects and COI’s. • Inside Service/Sales – high retention + high cross sales, collaboration of strategic partners. • Digital Marketing - Leverage data insights, target strategically, elevate brand image, personalize the customer experience. • Leverage Referral Network – Fintech (ReferLive); • New Products – SMB deposit product, Business digital pmts. • Market Expansion – Through existing indirect dealer network. • Selective and opportunistic bank and branch acquisitions. • Process Automation – leverage core investments + Fintech partnerships: (Blend) mortgage; (Numerated) Commercial; • Branch Optimization - including assessing existing locations, new locations, service hours, staffing, & workflow and leveraging technology. • Promotion of Self-Serve Channels - (One Wallet, Treasury One, etc.) • Leverage Banker Capacity – including on-line appointment setting. • Leverage Middleware + API’s – expediate new technology implementation. • Optimize Office Space Utilization • Invest in our Team – competitive C&B offering, skill training, leadership development, etc. • High Employee Engagement – thru fostering a culture of purpose, opportunity, continuous learning, diversity, reward + recognition. • Promote Teamwork + Alignment across all business units. • Invest in technology - to enhance the employee experience + customer experience. • Client Service Model – well defined and applied. • Utilize three layers of defense (business unit, risk management and internal audit). Independent & collaborative approach. • Consistent earnings + maintain strong capital levels. • Proactive credit quality monitoring and problem resolution. • Manage Liquidity and IRR. • Manage Operational risk, emphasizing cyber security, fraud prevention, and regulatory compliance. • Effective relationships with regulators & other outside oversight parties. Proactive, transparent and good communication. PROCESS IMPROVEMENT & COST CONTROLS RISK MANAGEMENT GROWTH TALENT MANAGEMENT 20

Question and Answer Session Closing Remarks NASDAQ: IBCP Thank you for attending 21

Appendix Additional Financial Data and Non-GAAP Reconciliations 22

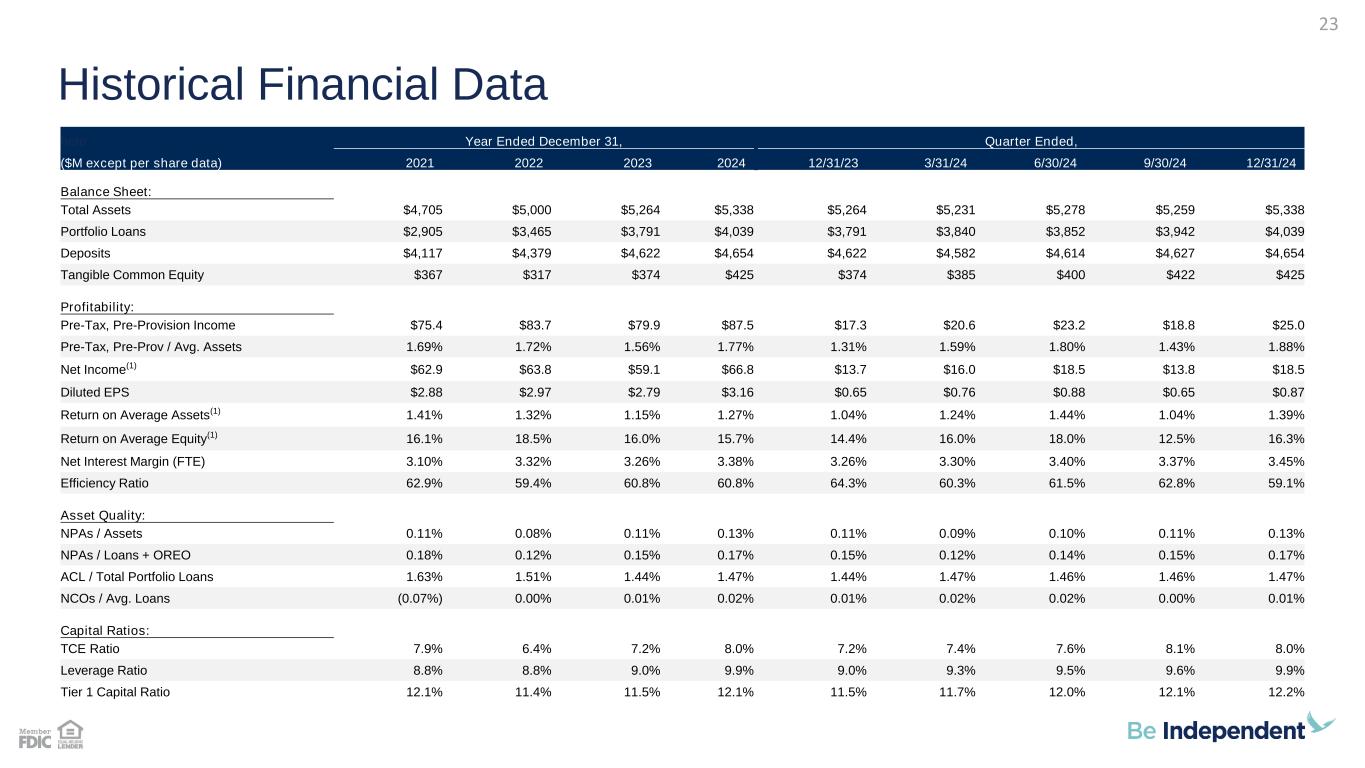

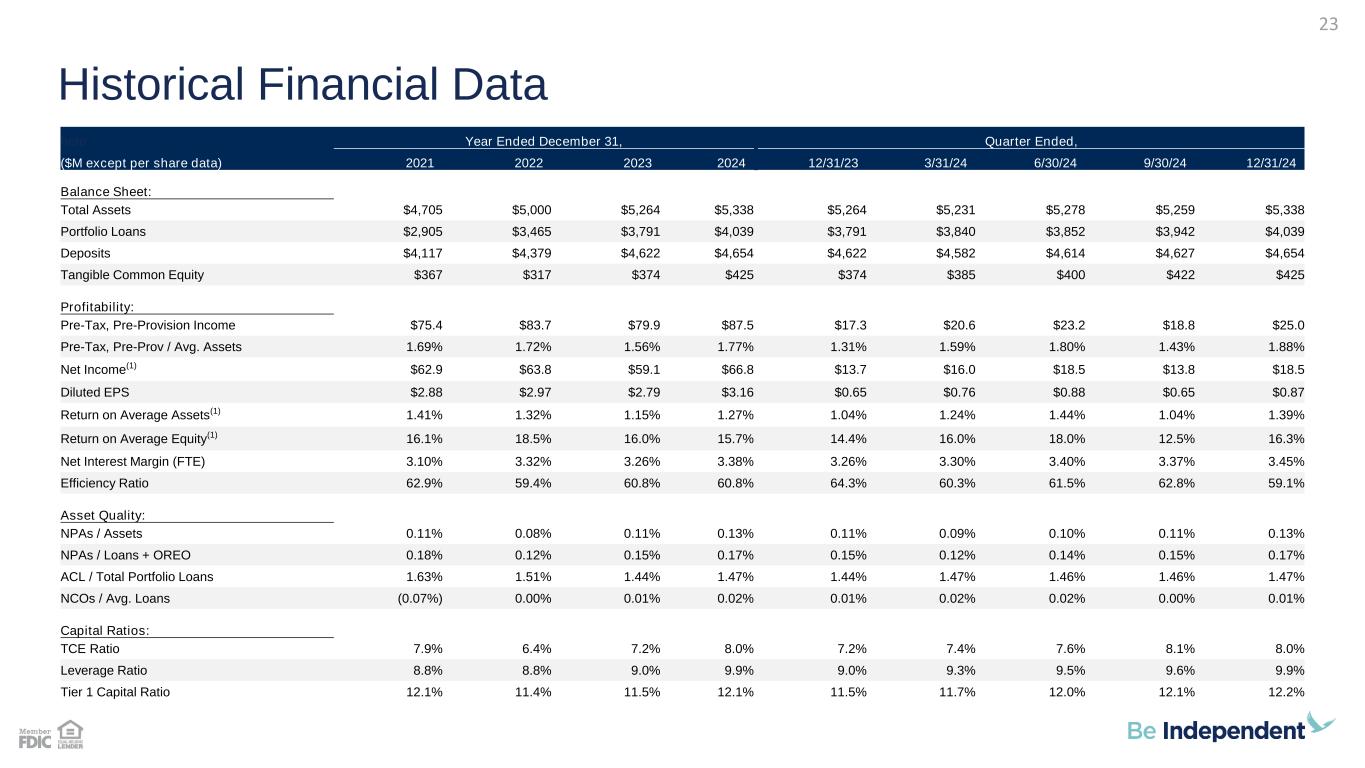

here Year Ended December 31, Quarter Ended, ($M except per share data) 2021 2022 2023 2024 12/31/23 3/31/24 6/30/24 9/30/24 12/31/24 Balance Sheet: Total Assets $4,705 $5,000 $5,264 $5,338 $5,264 $5,231 $5,278 $5,259 $5,338 Portfolio Loans $2,905 $3,465 $3,791 $4,039 $3,791 $3,840 $3,852 $3,942 $4,039 Deposits $4,117 $4,379 $4,622 $4,654 $4,622 $4,582 $4,614 $4,627 $4,654 Tangible Common Equity $367 $317 $374 $425 $374 $385 $400 $422 $425 Profitability: Pre-Tax, Pre-Provision Income $75.4 $83.7 $79.9 $87.5 $17.3 $20.6 $23.2 $18.8 $25.0 Pre-Tax, Pre-Prov / Avg. Assets 1.69% 1.72% 1.56% 1.77% 1.31% 1.59% 1.80% 1.43% 1.88% Net Income(1) $62.9 $63.8 $59.1 $66.8 $13.7 $16.0 $18.5 $13.8 $18.5 Diluted EPS $2.88 $2.97 $2.79 $3.16 $0.65 $0.76 $0.88 $0.65 $0.87 Return on Average Assets(1) 1.41% 1.32% 1.15% 1.27% 1.04% 1.24% 1.44% 1.04% 1.39% Return on Average Equity(1) 16.1% 18.5% 16.0% 15.7% 14.4% 16.0% 18.0% 12.5% 16.3% Net Interest Margin (FTE) 3.10% 3.32% 3.26% 3.38% 3.26% 3.30% 3.40% 3.37% 3.45% Efficiency Ratio 62.9% 59.4% 60.8% 60.8% 64.3% 60.3% 61.5% 62.8% 59.1% Asset Quality: NPAs / Assets 0.11% 0.08% 0.11% 0.13% 0.11% 0.09% 0.10% 0.11% 0.13% NPAs / Loans + OREO 0.18% 0.12% 0.15% 0.17% 0.15% 0.12% 0.14% 0.15% 0.17% ACL / Total Portfolio Loans 1.63% 1.51% 1.44% 1.47% 1.44% 1.47% 1.46% 1.46% 1.47% NCOs / Avg. Loans (0.07%) 0.00% 0.01% 0.02% 0.01% 0.02% 0.02% 0.00% 0.01% Capital Ratios: TCE Ratio 7.9% 6.4% 7.2% 8.0% 7.2% 7.4% 7.6% 8.1% 8.0% Leverage Ratio 8.8% 8.8% 9.0% 9.9% 9.0% 9.3% 9.5% 9.6% 9.9% Tier 1 Capital Ratio 12.1% 11.4% 11.5% 12.1% 11.5% 11.7% 12.0% 12.1% 12.2% Historical Financial Data 23

24 Historic Financial Performance Year Ended December 31, ($M except per share data) 2019 2020 2021 2022 2023 2024 5 Year CAGR Balance Sheet: Total Assets $3,565 $4,204 $4,705 $5,000 $5,264 $5,338 8.4% Portfolio Loans $2,725 $2,734 $2,905 $3,465 $3,791 $4,039 8.2% Deposits $3,037 $3,637 $4,117 $4,379 $4,623 $4,654 8.9% Tangible Common Equity $317 $357 $367 $317 $374 $425 6.1% Profitability: Pre-Tax, Pre-Provision Income $58.6 $81.9 $75.4 $83.1 $79.9 $87.5 8.4% Pre-Tax, Pre-Prov / Avg. Assets 1.70% 2.08% 1.62% 1.68% 1.56% 1.77% - Net Income(1) $46.4 $56.2 $62.9 $63.4 $59.1 $66.8 7.5% Diluted EPS $2.00 $2.53 $2.88 $2.97 $2.79 $3.16 9.6% Return on Average Assets(1) 1.35% 1.43% 1.41% 1.31% 1.15% 1.27% - Return on Average Equity(1) 13.63% 15.68% 16.13% 18.41% 16.04% 15.70% - Net Interest Margin (FTE) 3.80% 3.34% 3.10% 3.32% 3.26% 3.38% - Efficiency Ratio 64.90% 59.24% 62.87% 59.71% 60.76% 60.80% - Asset Quality: NPAs / Assets 0.32% 0.21% 0.11% 0.08% 0.11% 0.13% - NPAs / Loans + OREO 0.42% 0.32% 0.18% 0.12% 0.15% 0.17% - Reserves / Total Loans 0.96% 1.30% 1.63% 1.51% 1.44% 1.47% - NCOs / Avg. Loans (0.02%) 0.11% (0.07%) 0.00% 0.01% 0.02% - Capital Ratios: TCE Ratio 9.0% 8.6% 7.9% 6.4% 7.2% 8.0% - Leverage Ratio 10.1% 9.2% 8.8% 8.8% 9.1% 9.9% - Tier 1 Capital Ratio 12.7% 13.3% 12.2% 11.4% 11.6% 12.1% - Total Capital Ratio 13.7% 16.0% 14.7% 13.7% 13.8% 14.2% - Shareholder Value: TBV/Share $ 14.08 $ 16.33 $ 17.33 $ 15.04 $ 17.96 $ 20.33 7.6% Dividends Paid per Share $ 0.72 $ 0.80 $ 0.84 $ 0.88 $ 0.92 $ 0.96 5.9% Value of Shares Repurchased $ 26.3 $ 14.2 $ 17.3 $ 4.0 $ 5.2 $ - -

Sources of Liquidity 4Q 2024 Current On-balance sheet Excess reserves at the Fed $ 62.9 Unpledged AFS Securities $ 553.2 Total On-balance sheet $ 616.1 On balance sheet liquidity to total deposits 13% Available Sources of Liquidity Unused FHLB & FRB (including BTFP) $ 1,581.3 Borrow capacity on unpledged bonds $ 483.8 Total Available Sources $ 2,065.1 Sources of Liquidity to total deposits 44% 85% 73% 79% 74% 76% 60% 58% 2 4 0 % 2 2 2 % 2 3 7 % 2 3 8 % 2 2 2 % 2 1 8 % 1 9 5 % 2Q23 3Q23 4Q23 1Q24 2Q24 3Q'24 4Q,24 On-balance sheet / Uninsured Deposits Available Sources / Uninsured Deposits Note: Portfolio loans exclude loans HFS. Liquidity / Uninsured Deposits Strong Liquidity Position • Significant liquidity position to manage the current environment. • Total available liquidity significantly exceeds (195%) estimated uninsured deposit balances. • Attractive loan to deposit ratio of 86.8%. • Uninsured deposit to total deposits of approximately 22.8%, excluding brokered time deposits. Sources of Liquidity 25

$1,934 $1,091 $459 $110 $243 $530 $287 $2,177 $1,621 $746 $110 Consumer Commercial Public Funds Brokered Insured Deposits Uninsured Deposits Granular Deposit Base • Average deposit account balance of approximately $21,905. • Average deposit balance excluding reciprocal deposit of $17,231. • Average Commercial deposit balance of $102,170. • Average retail deposit balance of $11,182. • 10 largest deposit accounts total $448.9 million or 9.70% of total deposits. − $358.2 million in ICS with FDIC coverage. • 100 largest deposit accounts total $1.14 billion or 24.74% of total deposits. − $719.8 million in ICS with FDIC coverage. Note: Uninsured deposit calculation is an approximation. Uninsured Deposit by Segment (12/31/24) Uninsured Deposit Trend ($MM) 26 $ 3 ,5 7 0 $ 3 ,5 7 5 $ 3 ,6 6 1 $ 3 ,6 0 5 $ 3 ,6 3 6 $ 3 ,5 7 0 $ 3 ,5 9 4 $918 $1,011 $962 $977 $978 $1,057 $1,060 $4,488 $4,586 $4,623 $4,582 $4,614 $4,627 $4,654 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 Insured Deposits Uninsured Deposits

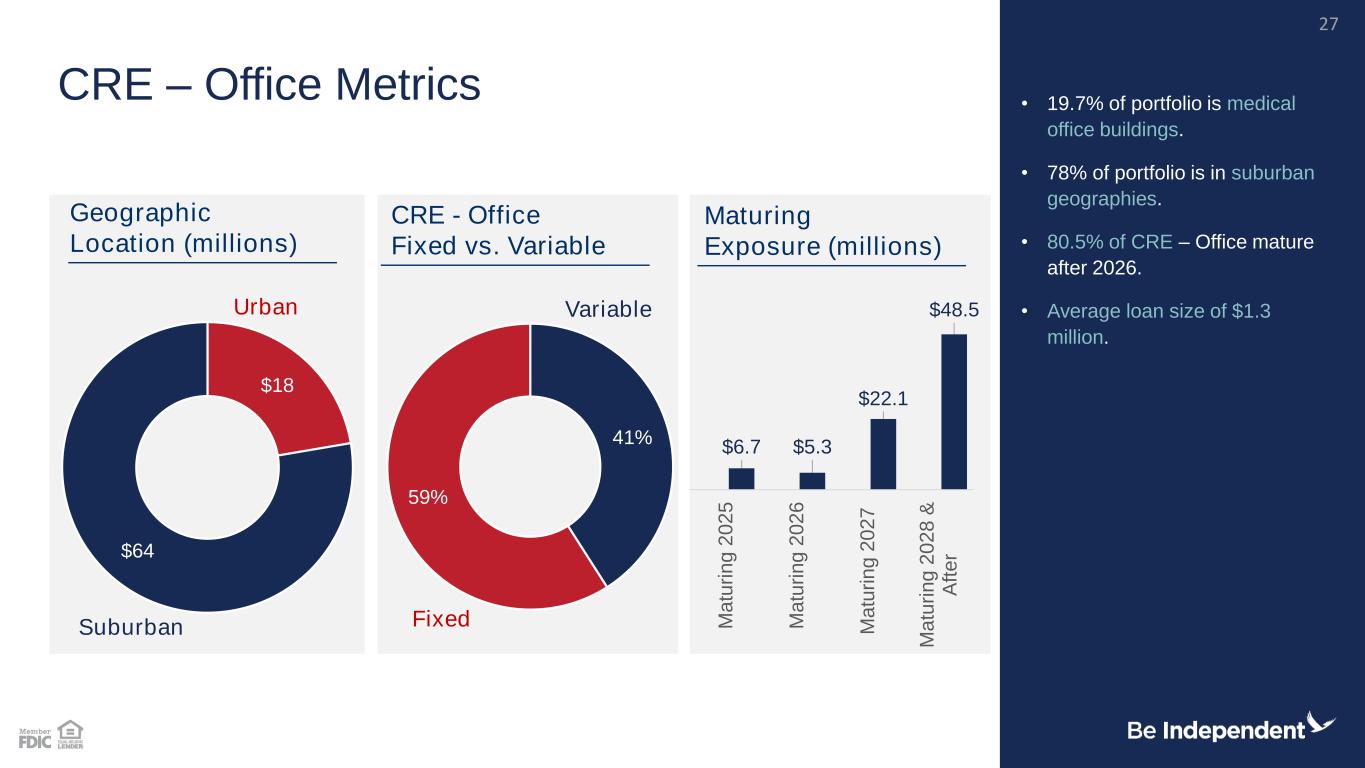

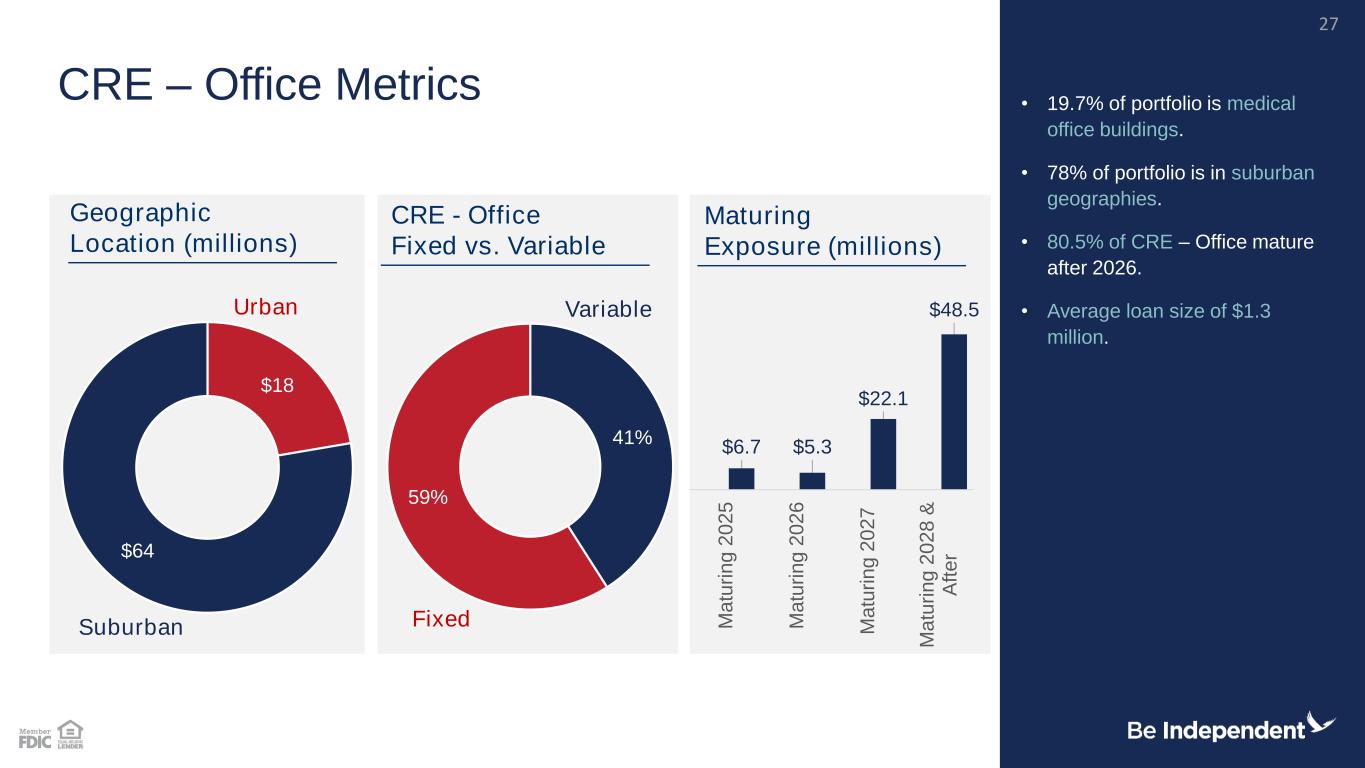

41% 59% $6.7 $5.3 $22.1 $48.5 M a tu ri n g 2 0 2 5 M a tu ri n g 2 0 2 6 M a tu ri n g 2 0 2 7 M a tu ri n g 2 0 2 8 & A ft e r $18 $64 CRE – Office Metrics • 19.7% of portfolio is medical office buildings. • 78% of portfolio is in suburban geographies. • 80.5% of CRE – Office mature after 2026. • Average loan size of $1.3 million. Maturing Exposure (millions) CRE - Office Fixed vs. Variable Geographic Location (millions) 27 Urban Suburban Fixed Variable

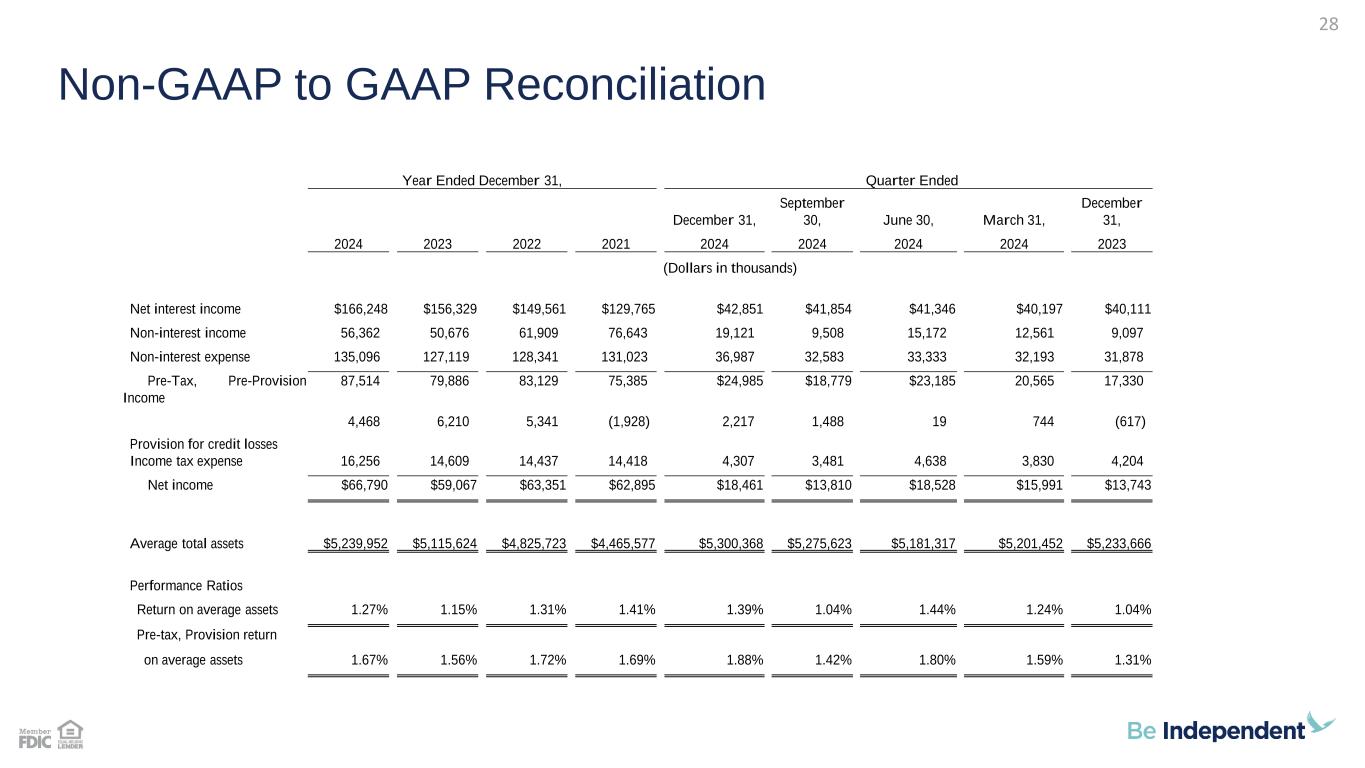

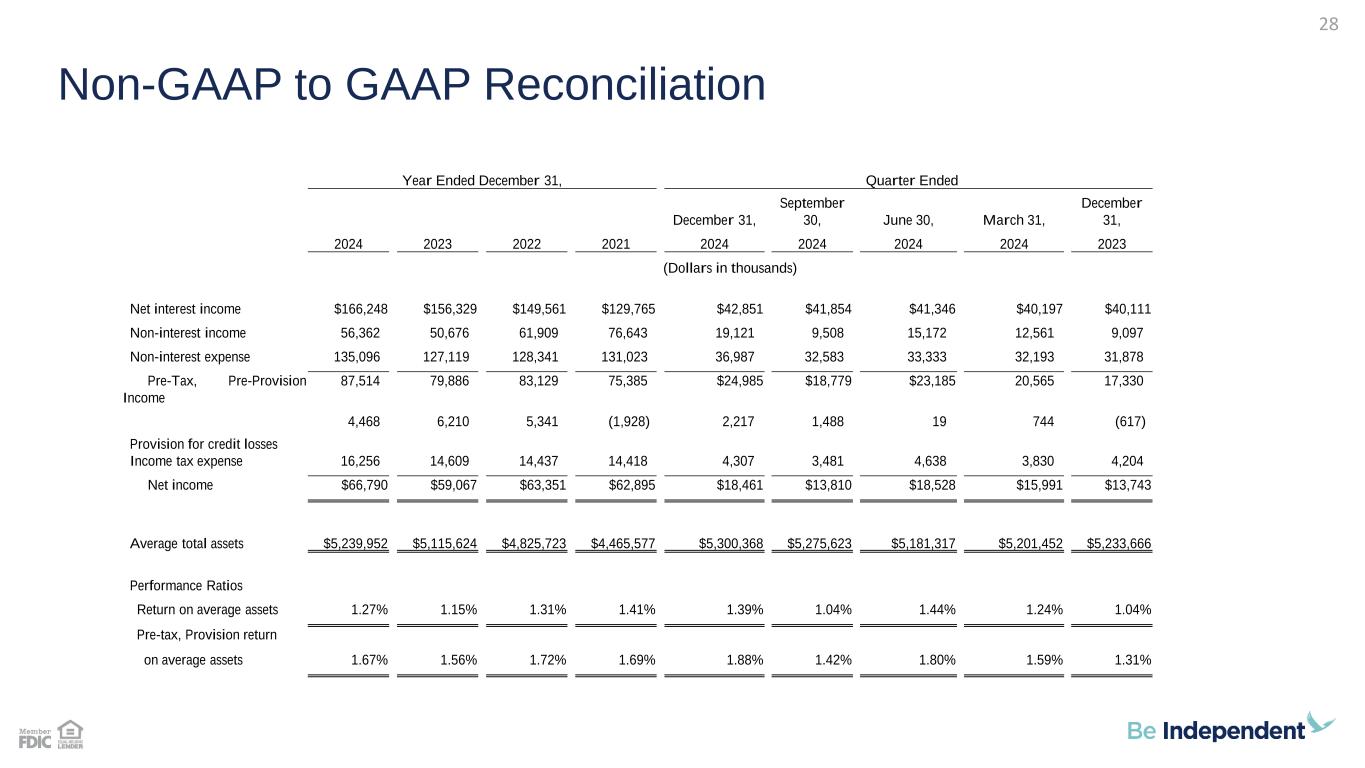

Non-GAAP to GAAP Reconciliation 28 Year Ended December 31, Quarter Ended December 31, September 30, June 30, March 31, December 31, 2024 2023 2022 2021 2024 2024 2024 2024 2023 (Dollars in thousands) Net interest income $166,248 $156,329 $149,561 $129,765 $42,851 $41,854 $41,346 $40,197 $40,111 Non-interest income 56,362 50,676 61,909 76,643 19,121 9,508 15,172 12,561 9,097 Non-interest expense 135,096 127,119 128,341 131,023 36,987 32,583 33,333 32,193 31,878 Pre-Tax, Pre-Provision Income 87,514 79,886 83,129 75,385 $24,985 $18,779 $23,185 20,565 17,330 Provision for credit losses 4,468 6,210 5,341 (1,928) 2,217 1,488 19 744 (617) Income tax expense 16,256 14,609 14,437 14,418 4,307 3,481 4,638 3,830 4,204 Net income $66,790 $59,067 $63,351 $62,895 $18,461 $13,810 $18,528 $15,991 $13,743 Average total assets $5,239,952 $5,115,624 $4,825,723 $4,465,577 $5,300,368 $5,275,623 $5,181,317 $5,201,452 $5,233,666 Performance Ratios Return on average assets 1.27% 1.15% 1.31% 1.41% 1.39% 1.04% 1.44% 1.24% 1.04% Pre-tax, Provision return on average assets 1.67% 1.56% 1.72% 1.69% 1.88% 1.42% 1.80% 1.59% 1.31%

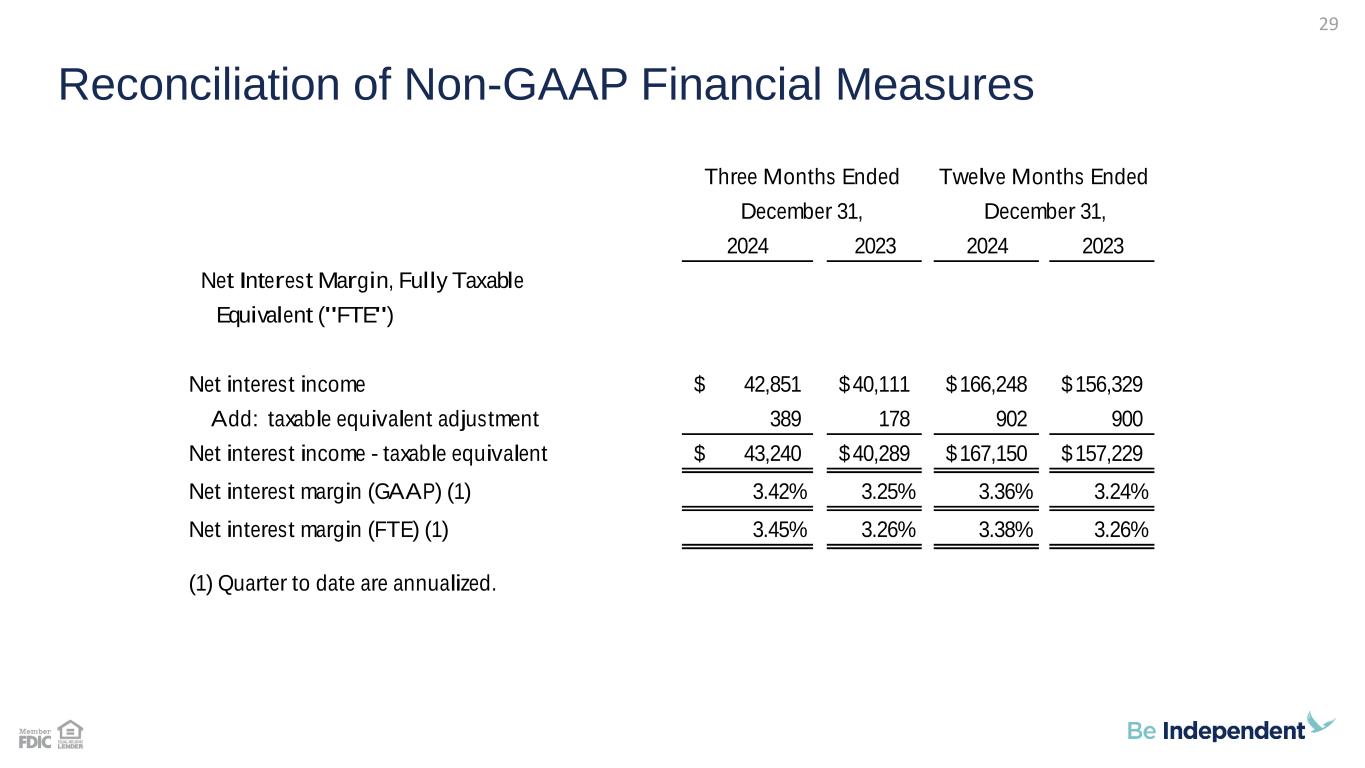

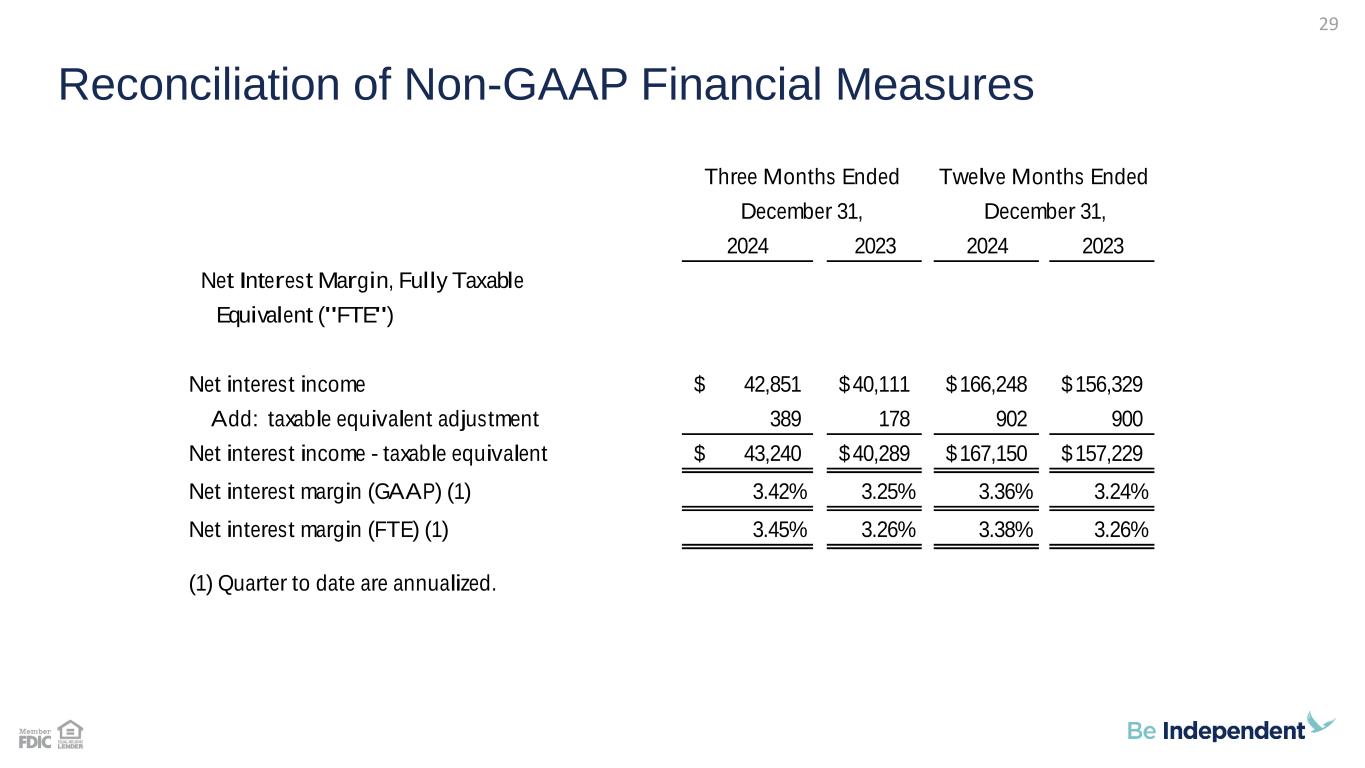

Reconciliation of Non-GAAP Financial Measures 29 2024 2023 2024 2023 Net Interest Margin, Fully Taxable Equivalent ("FTE") Net interest income 42,851$ 40,111$ 166,248$ 156,329$ Add: taxable equivalent adjustment 389 178 902 900 Net interest income - taxable equivalent 43,240$ 40,289$ 167,150$ 157,229$ Net interest margin (GAAP) (1) 3.42% 3.25% 3.36% 3.24% Net interest margin (FTE) (1) 3.45% 3.26% 3.38% 3.26% (1) Quarter to date are annualized. Three Months Ended Twelve Months Ended December 31, December 31,

Reconciliation of Non-GAAP Financial Measures (continued) 30 December 31, September 30, June 30, March 31, December 31, 2024 2023 2022 2021 2024 2024 2024 2024 2023 Common shareholders' equity 454,686$ 404,449$ 347,596$ 398,484$ 454,686$ 452,369$ 430,459$ 415,570$ 404,449$ Less: Goodwill 28,300 28,300 28,300 28,300 28,300 28,300 28,300 28,300 28,300 Other intangibles 1,488 2,004 2,551 3,336 1,488 1,617 1,746 1,875 2,004 Tangible common equity 424,898$ 374,145$ 316,745$ 366,848$ 424,898$ 422,452$ 400,413$ 385,395$ 374,145$ Total assets $5,338,104 $5,263,726 $4,999,787 $4,704,740 $ 5,338,104 $5,259,268 $ 5,277,500 $ 5,231,255 $ 5,263,726 Less: Goodwill 28,300 28,300 28,300 28,300 28,300 28,300 28,300 28,300 28,300 Other intangibles 1,488 2,004 2,551 3,336 1,488 1,617 1,746 1,875 2,004 Tangible assets $5,308,316 $5,233,422 $4,968,936 $4,673,104 $ 5,308,316 $5,229,351 $ 5,247,454 $ 5,201,080 $ 5,233,422 Common equity ratio 8.52% 7.68% 6.95% 8.47% 8.52% 8.60% 8.16% 7.94% 7.68% Tangible common equity ratio 8.00% 7.15% 6.37% 7.85% 8.00% 8.08% 7.63% 7.41% 7.15% Year Ended December 31, Quarter Ended (Dollars in thousands)