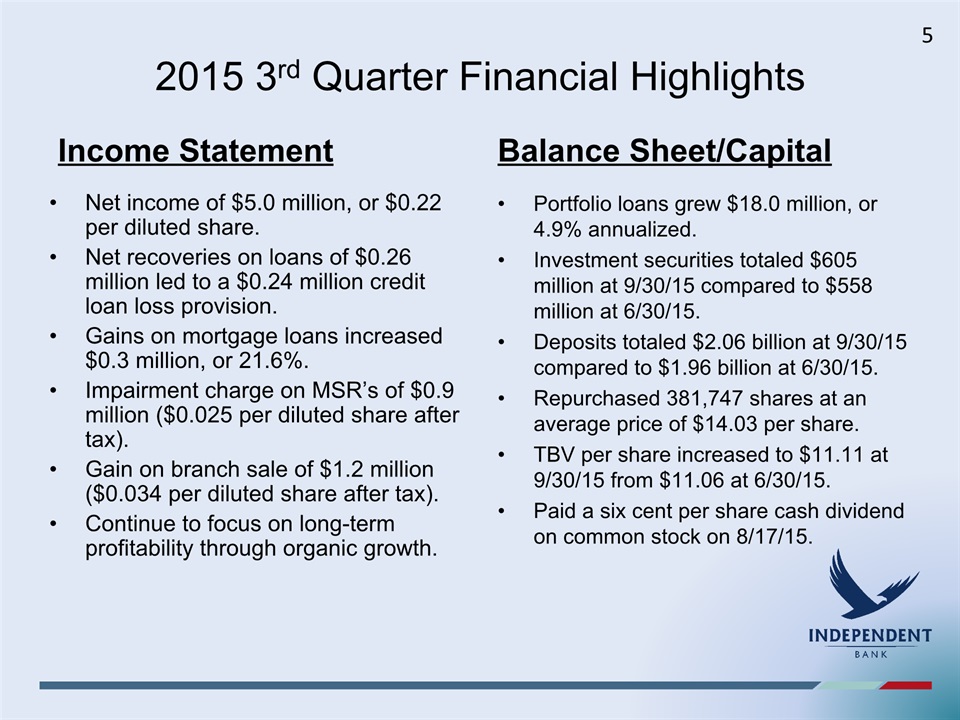

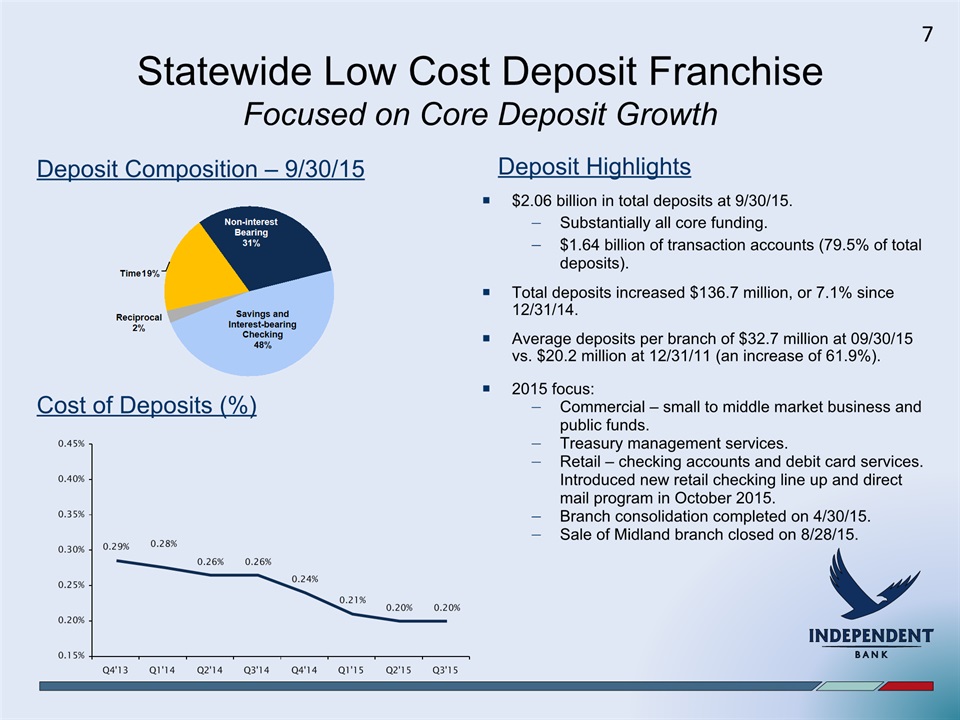

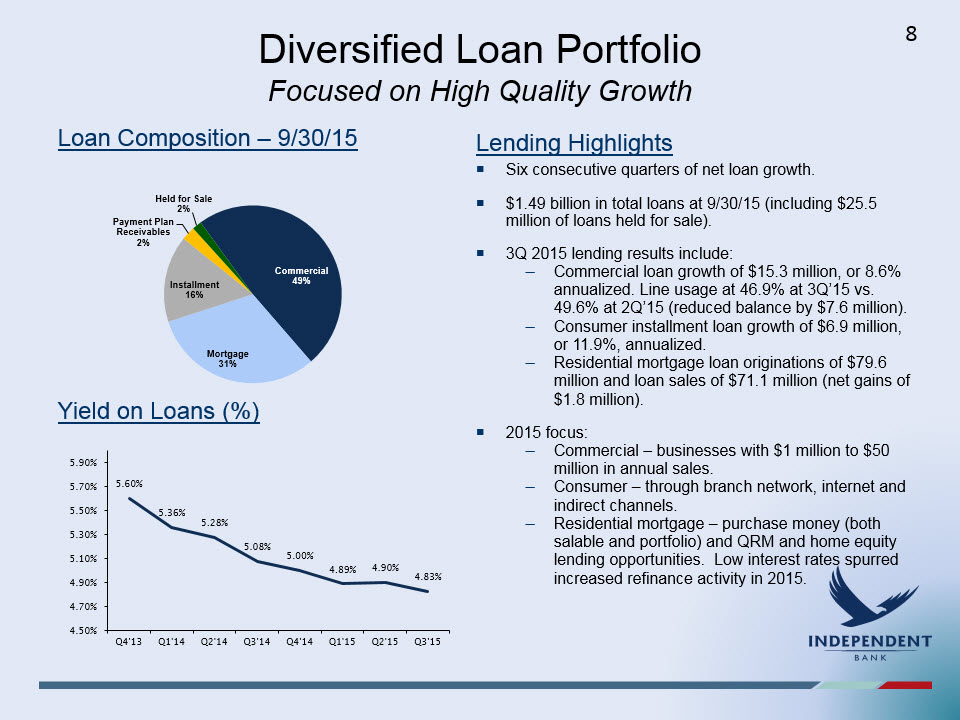

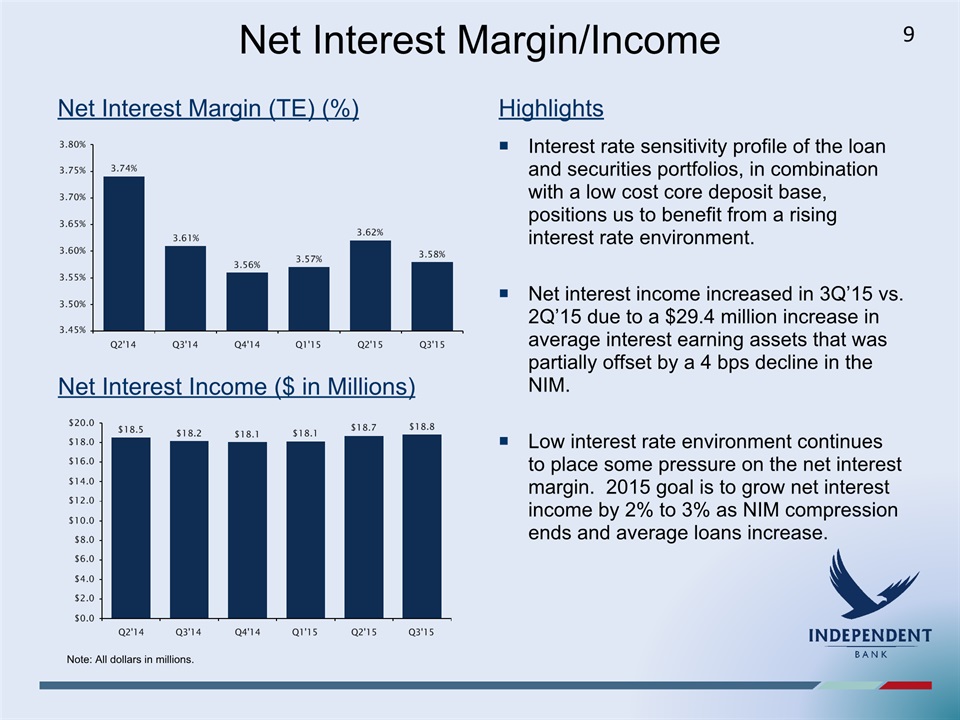

Financial Summary 3Q’15 2Q’15 1Q’15 4Q’14 3Q’14 Diluted EPS $ 0.22 $ 0.24 $ 0.16 $ 0.17 $ 0.21 Income before taxes 7,325 8,243 5,561 5,438 7,274 Net income 5,047 5,619 3,781 3,902 4,929 Return on average assets 0.86% 0.98% 0.67% 0.69% 0.87% Return on average equity 7.84% 8.86% 6.05% 6.19% 7.95% Total assets $2,394,861 $2,288,954 $2,329,296 $2,248,730 $2,239,857 Total portfolio loans 1,467,999 1,450,007 1,422,959 1,409,962 1,398,784 Total deposits 2,060,962 1,961,417 2,000,473 1,924,302 1,895,895 Shareholders’ equity 252,980 254,375 253,625 250,371 247,067 Tangible BV per share 11.11 11.06 10.94 10.79 10.65 TCE to tangible assets 10.48% 11.02% 10.79% 11.03% 10.92% Note: Dollars in 000’s, except per share data. 4