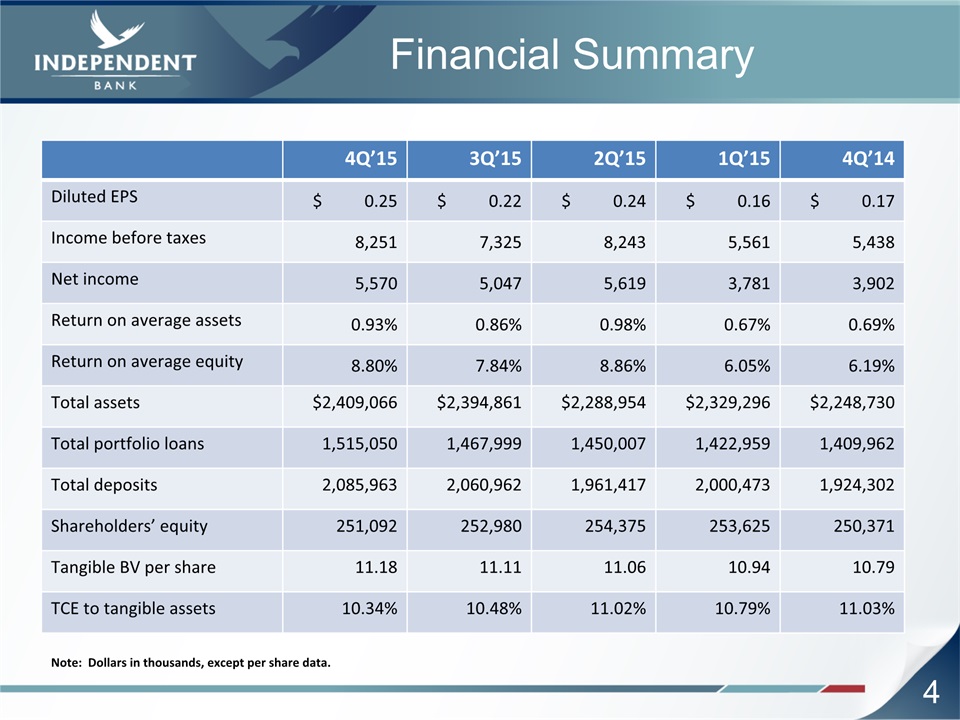

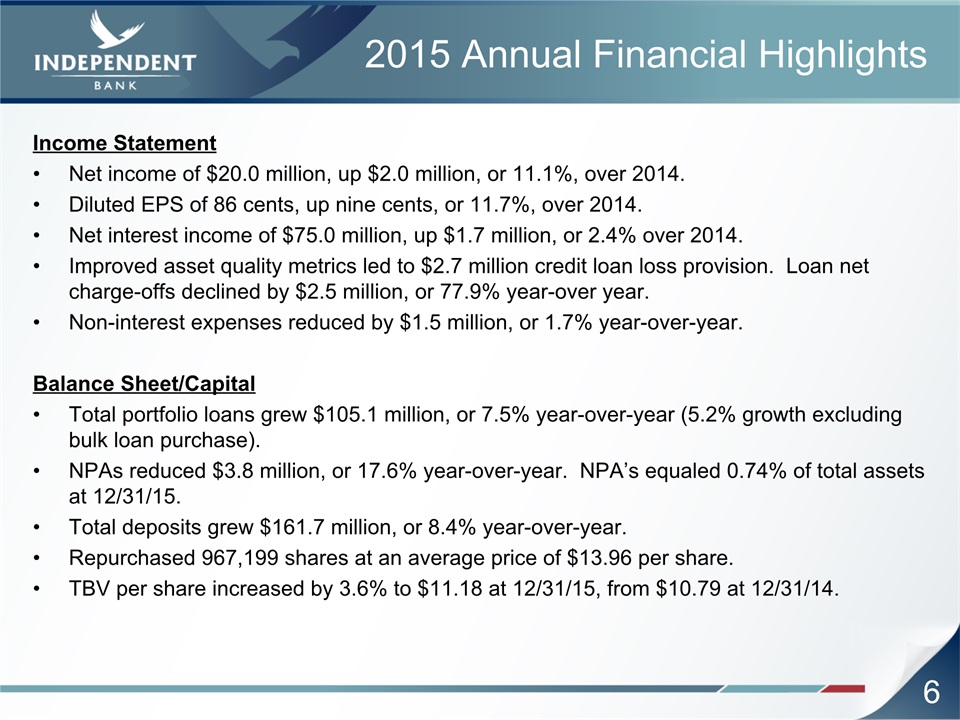

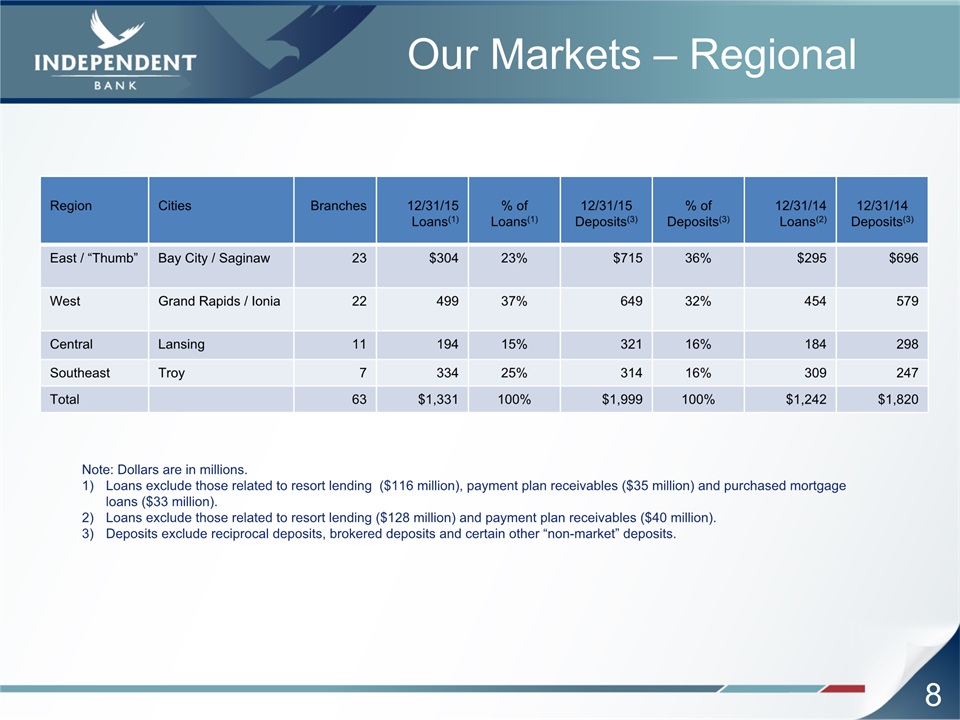

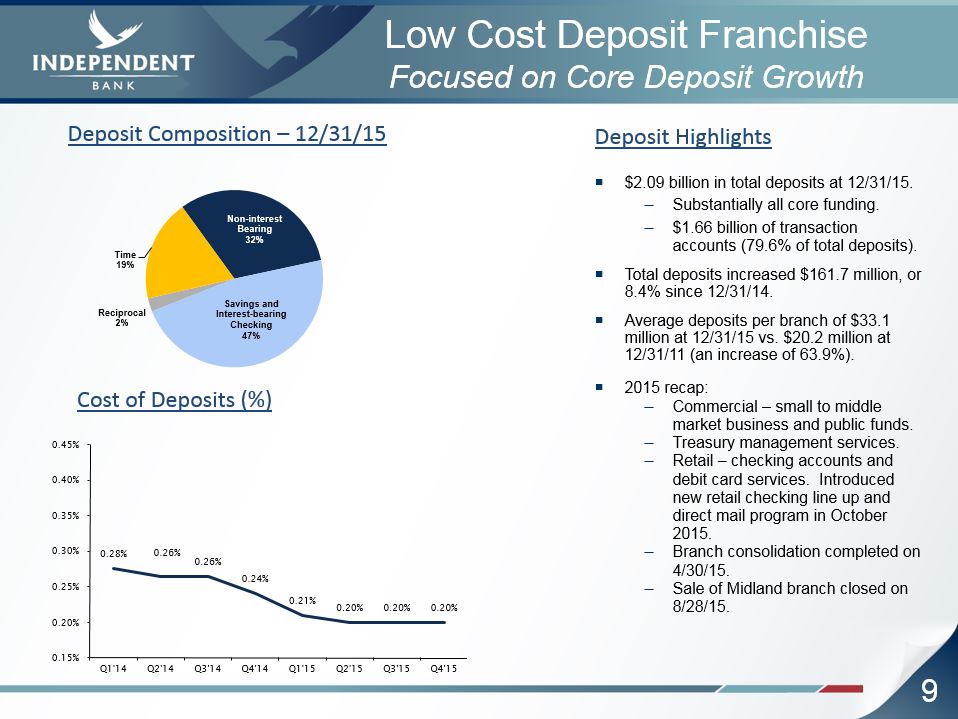

4 Financial Summary 4Q’15 3Q’15 2Q’15 1Q’15 4Q’14 Diluted EPS $ 0.25 $ 0.22 $ 0.24 $ 0.16 $ 0.17 Income before taxes 8,251 7,325 8,243 5,561 5,438 Net income 5,570 5,047 5,619 3,781 3,902 Return on average assets 0.93% 0.86% 0.98% 0.67% 0.69% Return on average equity 8.80% 7.84% 8.86% 6.05% 6.19% Total assets $2,409,066 $2,394,861 $2,288,954 $2,329,296 $2,248,730 Total portfolio loans 1,515,050 1,467,999 1,450,007 1,422,959 1,409,962 Total deposits 2,085,963 2,060,962 1,961,417 2,000,473 1,924,302 Shareholders’ equity 251,092 252,980 254,375 253,625 250,371 Tangible BV per share 11.18 11.11 11.06 10.94 10.79 TCE to tangible assets 10.34% 10.48% 11.02% 10.79% 11.03% Note: Dollars in thousands, except per share data.