Exhibit 99.1 H.B. Fuller Lender’s Presentation October 2017

Today’s Presenters John Corkrean Executive Vice President and Chief Financial Officer Jim Owens President and Chief Executive Officer

Safe Harbor for Forward-looking Statements Certain statements in this document may be considered forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are subject to various risks and uncertainties, including but not limited to the following: risks to consummation of the transaction, including the risk that the transaction will not be consummated within the expected time period or at all, the risk that conditions to the closing of the transaction, including receipt of required regulatory approvals, may not be satisfied, and the risk that the transaction may be terminated in circumstances requiring us to pay the $78.75 million termination fee; the transaction may involve unexpected costs, liabilities or delays; our business or stock price may suffer as a result of uncertainty surrounding the transaction; we may be unable to secure the financing necessary for the transaction on favorable terms, or at all; the substantial amount of debt we would incur to finance our acquisition of Royal, our ability to repay or refinance it or incur additional debt in the future, our need for a significant amount of cash to service and repay the debt and to pay dividends on our common stock, and the effect of restrictions to be contained in our debt agreements that limit the discretion of management in operating the business or ability to pay dividends; various risks to stockholders of not receiving dividends and risks to our ability to pursue growth opportunities if we continue to pay dividends according to the current dividend policy; we may be unable to achieve expected synergies and operating efficiencies from the transaction within the expected time frames or at all; we may be unable to successfully integrate Royal’s operations into our own, or such integration may be more difficult, time consuming or costly than expected; following the transaction, revenues may be lower than expected, and operating costs, customer loss and business disruption (including, without limitation, difficulties in maintaining relationships with employees, customers, clients or suppliers) may be greater than expected; the outcome of any legal proceedings related to the transaction; risks that the pending transaction disrupts current plans and operations and the potential difficulties in employee retention as a result of the pending transaction; the ability to effectively implement Project ONE; political and economic conditions; product demand; competitive products and pricing; costs of and savings from restructuring initiatives; geographic and product mix; availability and price of raw materials; the Company’s relationships with its major customers and suppliers; changes in tax laws and tariffs; devaluations and other foreign exchange rate fluctuations; the impact of litigation and environmental matters; the effect of new accounting pronouncements and accounting charges and credits; and similar matters. All forward-looking information represents management’s best judgment as of this date based on information currently available that in the future may prove to have been inaccurate. Additionally, the variety of products sold by the Company and the regions where the Company does business make it difficult to determine with certainty the increases or decreases in net revenue resulting from changes in the volume of products sold, currency impact, changes in product mix, and selling prices. However, management’s best estimates of these changes as well as changes in other factors have been included. Additional Information Further information about the various risks and uncertainties can be found in the Company’s SEC 10-K filing for the fiscal year ended December 3, 2016.

Agenda 1 3 5 6 2 4 Transaction Overview Key Credit Highlights Closing Remarks and Q&A Appendix Introduction to Royal Adhesives Historical Performance Overview

Transaction Overview Section 1

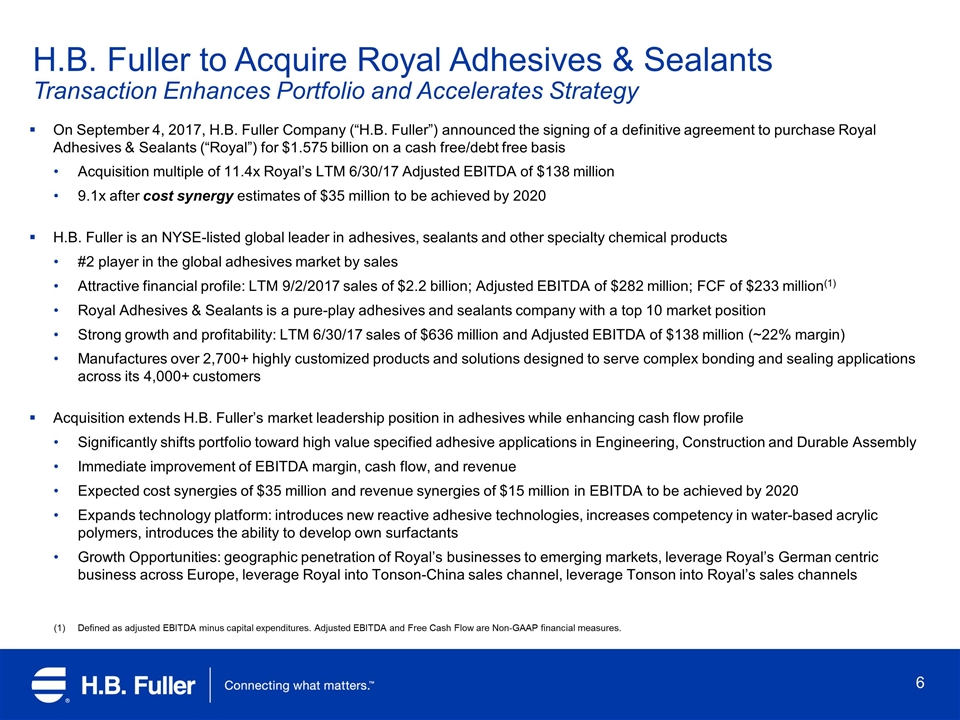

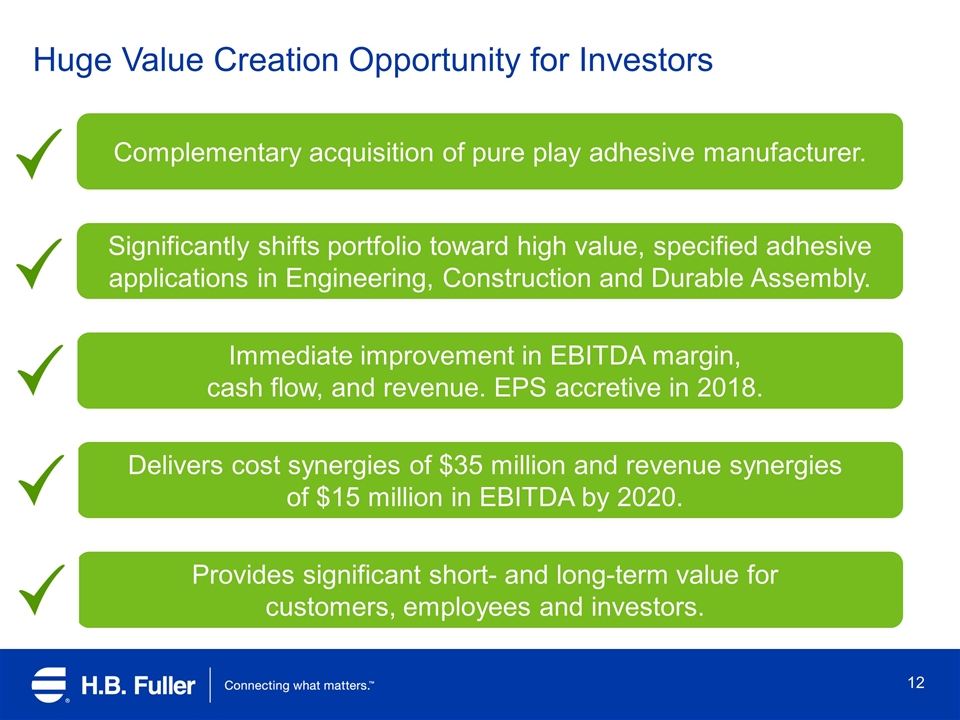

On September 4, 2017, H.B. Fuller Company (“H.B. Fuller”) announced the signing of a definitive agreement to purchase Royal Adhesives & Sealants (“Royal”) for $1.575 billion on a cash free/debt free basis Acquisition multiple of 11.4x Royal’s LTM 6/30/17 Adjusted EBITDA of $138 million 9.1x after cost synergy estimates of $35 million to be achieved by 2020 H.B. Fuller is an NYSE-listed global leader in adhesives, sealants and other specialty chemical products #2 player in the global adhesives market by sales Attractive financial profile: LTM 9/2/2017 sales of $2.2 billion; Adjusted EBITDA of $282 million; FCF of $233 million(1) Royal Adhesives & Sealants is a pure-play adhesives and sealants company with a top 10 market position Strong growth and profitability: LTM 6/30/17 sales of $636 million and Adjusted EBITDA of $138 million (~22% margin) Manufactures over 2,700+ highly customized products and solutions designed to serve complex bonding and sealing applications across its 4,000+ customers Acquisition extends H.B. Fuller’s market leadership position in adhesives while enhancing cash flow profile Significantly shifts portfolio toward high value specified adhesive applications in Engineering, Construction and Durable Assembly Immediate improvement of EBITDA margin, cash flow, and revenue Expected cost synergies of $35 million and revenue synergies of $15 million in EBITDA to be achieved by 2020 Expands technology platform: introduces new reactive adhesive technologies, increases competency in water-based acrylic polymers, introduces the ability to develop own surfactants Growth Opportunities: geographic penetration of Royal’s businesses to emerging markets, leverage Royal’s German centric business across Europe, leverage Royal into Tonson-China sales channel, leverage Tonson into Royal’s sales channels H.B. Fuller to Acquire Royal Adhesives & Sealants Transaction Enhances Portfolio and Accelerates Strategy Defined as adjusted EBITDA minus capital expenditures. Adjusted EBITDA and Free Cash Flow are Non-GAAP financial measures.

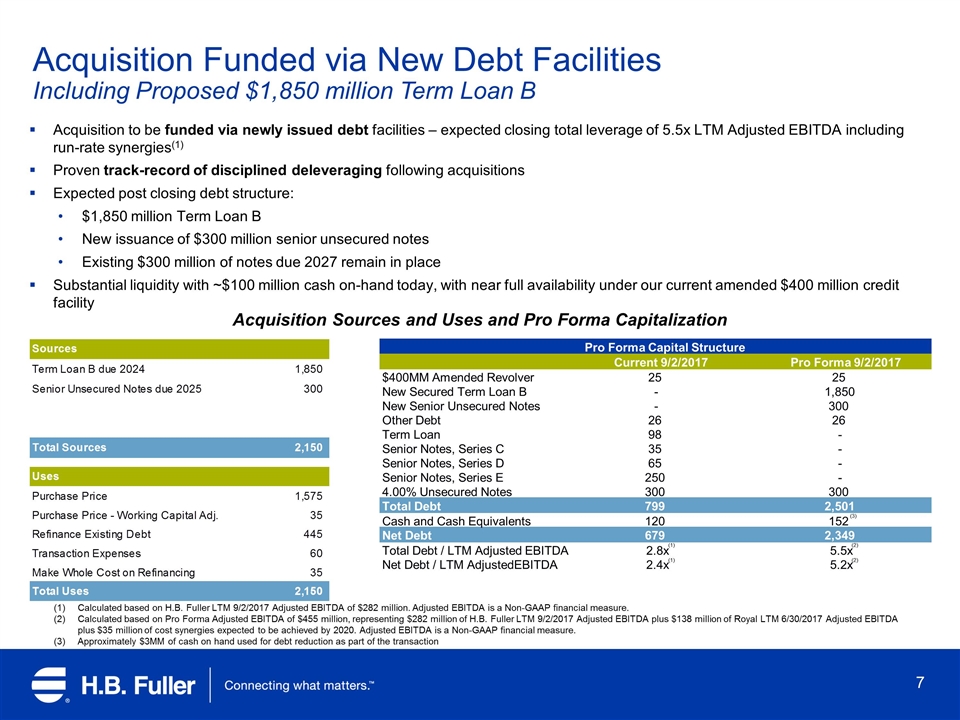

Acquisition to be funded via newly issued debt facilities – expected closing total leverage of 5.5x LTM Adjusted EBITDA including run-rate synergies(1) Proven track-record of disciplined deleveraging following acquisitions Expected post closing debt structure: $1,850 million Term Loan B New issuance of $300 million senior unsecured notes Existing $300 million of notes due 2027 remain in place Substantial liquidity with ~$100 million cash on-hand today, with near full availability under our current amended $400 million credit facility Acquisition Funded via New Debt Facilities Including Proposed $1,850 million Term Loan B Calculated based on H.B. Fuller LTM 9/2/2017 Adjusted EBITDA of $282 million. Adjusted EBITDA is a Non-GAAP financial measure. Calculated based on Pro Forma Adjusted EBITDA of $455 million, representing $282 million of H.B. Fuller LTM 9/2/2017 Adjusted EBITDA plus $138 million of Royal LTM 6/30/2017 Adjusted EBITDA plus $35 million of cost synergies expected to be achieved by 2020. Adjusted EBITDA is a Non-GAAP financial measure. Approximately $3MM of cash on hand used for debt reduction as part of the transaction Acquisition Sources and Uses and Pro Forma Capitalization (1) (1) (2) (2) (3) Pro Forma Capital Structure Current 9/2/2017 Pro Forma 9/2/2017 $400MM Amended Revolver 25 25 New Secured Term Loan B - 1,850 New Senior Unsecured Notes - 300 Other Debt 26 26 Term Loan 98 - Senior Notes, Series C 35 - Senior Notes, Series D 65 - Senior Notes, Series E 250 - 4.00% Unsecured Notes 300 300 Total Debt 799 2,501 Cash and Cash Equivalents 120 152 Net Debt 679 2,349 Total Debt / LTM Adjusted EBITDA 2.8x 5.5x Net Debt / LTM AdjustedEBITDA 2.4x 5.2x

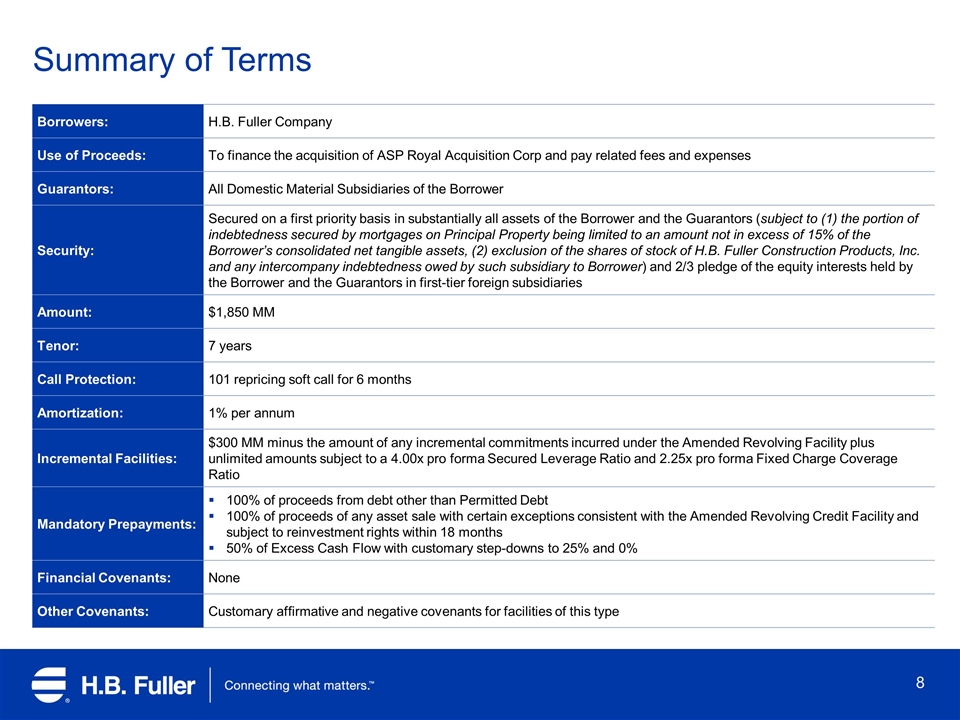

Borrowers: H.B. Fuller Company Use of Proceeds: To finance the acquisition of ASP Royal Acquisition Corp and pay related fees and expenses Guarantors: All Domestic Material Subsidiaries of the Borrower Security: Secured on a first priority basis in substantially all assets of the Borrower and the Guarantors (subject to (1) the portion of indebtedness secured by mortgages on Principal Property being limited to an amount not in excess of 15% of the Borrower’s consolidated net tangible assets, (2) exclusion of the shares of stock of H.B. Fuller Construction Products, Inc. and any intercompany indebtedness owed by such subsidiary to Borrower) and 2/3 pledge of the equity interests held by the Borrower and the Guarantors in first-tier foreign subsidiaries Amount: $1,850 MM Tenor: 7 years Call Protection: 101 repricing soft call for 6 months Amortization: 1% per annum Incremental Facilities: $300 MM minus the amount of any incremental commitments incurred under the Amended Revolving Facility plus unlimited amounts subject to a 4.00x pro forma Secured Leverage Ratio and 2.25x pro forma Fixed Charge Coverage Ratio Mandatory Prepayments: 100% of proceeds from debt other than Permitted Debt 100% of proceeds of any asset sale with certain exceptions consistent with the Amended Revolving Credit Facility and subject to reinvestment rights within 18 months 50% of Excess Cash Flow with customary step-downs to 25% and 0% Financial Covenants: None Other Covenants: Customary affirmative and negative covenants for facilities of this type Summary of Terms

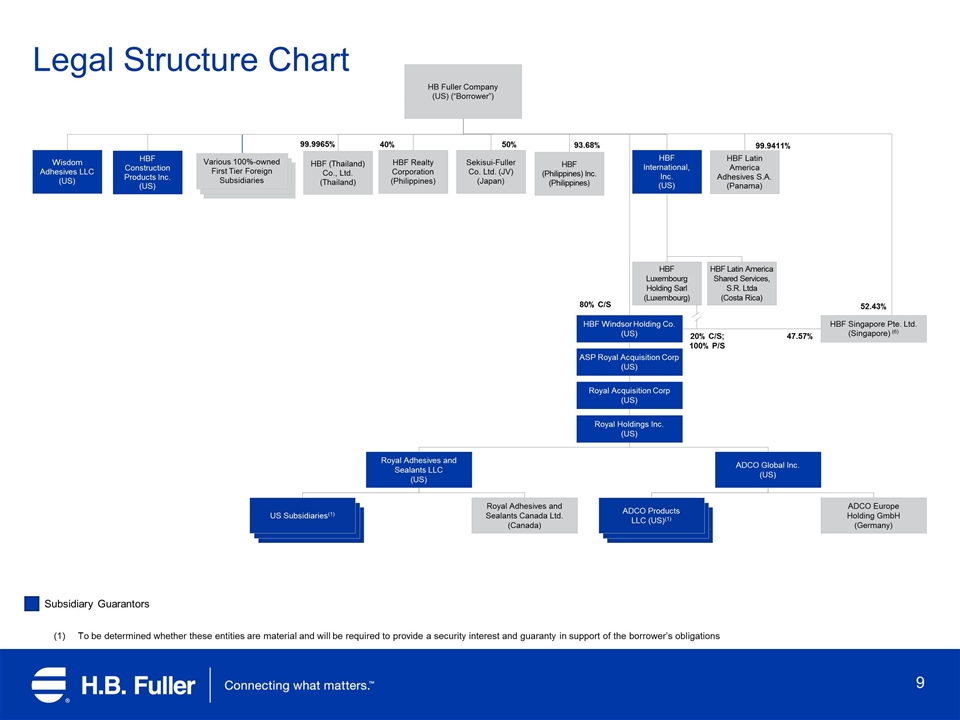

Legal Structure Chart HB Fuller Company (US) (“Borrower”) HBF International, Inc. (US) Sekisui‐Fuller Co. Ltd. (JV) (Japan) Wisdom Adhesives LLC (US) HBF Realty Corporation (Philippines) HBF Singapore Pte. Ltd. (Singapore) (6) HBF (Philippines) Inc. (Philippines) HBF Construction Products Inc. (US) HBF (Thailand) Co., Ltd. (Thailand) HBF Latin America Adhesives S.A. (Panama) HBF Latin America Shared Services, S.R. Ltda (Costa Rica) HBF Luxembourg Holding Sarl (Luxembourg) ASP Royal Acquisition Corp (US) Royal Acquisition Corp (US) Royal Holdings Inc. (US) HBF Windsor Holding Co. (US) Royal Adhesives and Sealants LLC (US) Royal Adhesives and Sealants Canada Ltd. (Canada) US Subsidiaries(1) ADCO Global Inc. (US) ADCO Europe Holding GmbH (Germany) ADCO Products LLC (US)(1) 40% 50% 99.9965% 93.68% 99.9411% 52.43% 80% C/S 20% C/S; 100% P/S 47.57% Subsidiary Guarantors Various 100%-owned First Tier Foreign Subsidiaries To be determined whether these entities are material and will be required to provide a security interest and guaranty in support of the borrower’s obligations

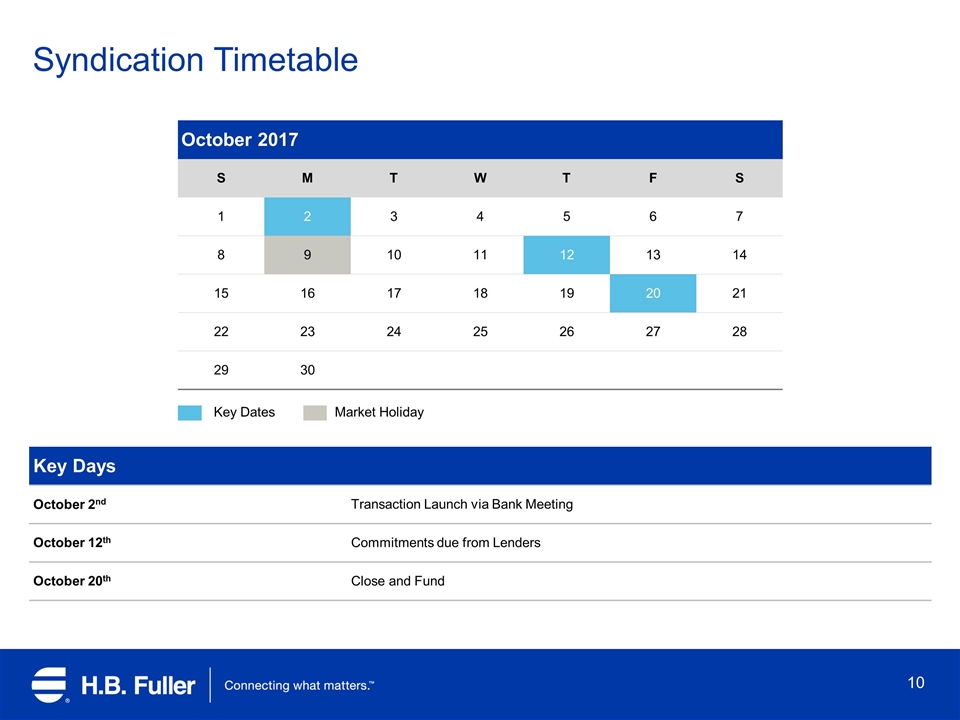

Syndication Timetable October 2017 S M T W T F S 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 Key Dates Market Holiday Key Days October 2nd Transaction Launch via Bank Meeting October 12th Commitments due from Lenders October 20th Close and Fund

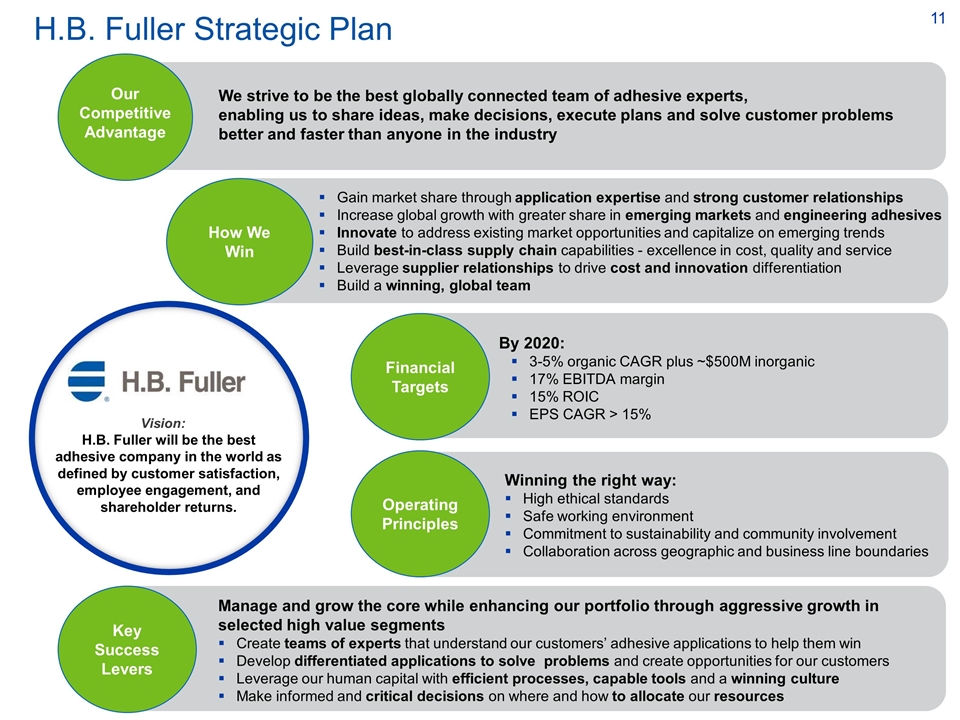

Gain market share through application expertise and strong customer relationships Increase global growth with greater share in emerging markets and engineering adhesives Innovate to address existing market opportunities and capitalize on emerging trends Build best-in-class supply chain capabilities - excellence in cost, quality and service Leverage supplier relationships to drive cost and innovation differentiation Build a winning, global team How We Win By 2020: 3-5% organic CAGR plus ~$500M inorganic 17% EBITDA margin 15% ROIC EPS CAGR > 15% Financial Targets Manage and grow the core while enhancing our portfolio through aggressive growth in selected high value segments Create teams of experts that understand our customers’ adhesive applications to help them win Develop differentiated applications to solve problems and create opportunities for our customers Leverage our human capital with efficient processes, capable tools and a winning culture Make informed and critical decisions on where and how to allocate our resources Key Success Levers H.B. Fuller will be the best adhesive company in the world as defined by customer satisfaction, employee engagement, and shareholder returns. Vision: H.B. Fuller Strategic Plan Operating Principles Winning the right way: High ethical standards Safe working environment Commitment to sustainability and community involvement Collaboration across geographic and business line boundaries Our Competitive Advantage We strive to be the best globally connected team of adhesive experts, enabling us to share ideas, make decisions, execute plans and solve customer problems better and faster than anyone in the industry

Huge Value Creation Opportunity for Investors Significantly shifts portfolio toward high value, specified adhesive applications in Engineering, Construction and Durable Assembly. Immediate improvement in EBITDA margin, cash flow, and revenue. EPS accretive in 2018. Delivers cost synergies of $35 million and revenue synergies of $15 million in EBITDA by 2020. Provides significant short- and long-term value for customers, employees and investors. Complementary acquisition of pure play adhesive manufacturer.

Introduction to Royal Adhesives Section 2

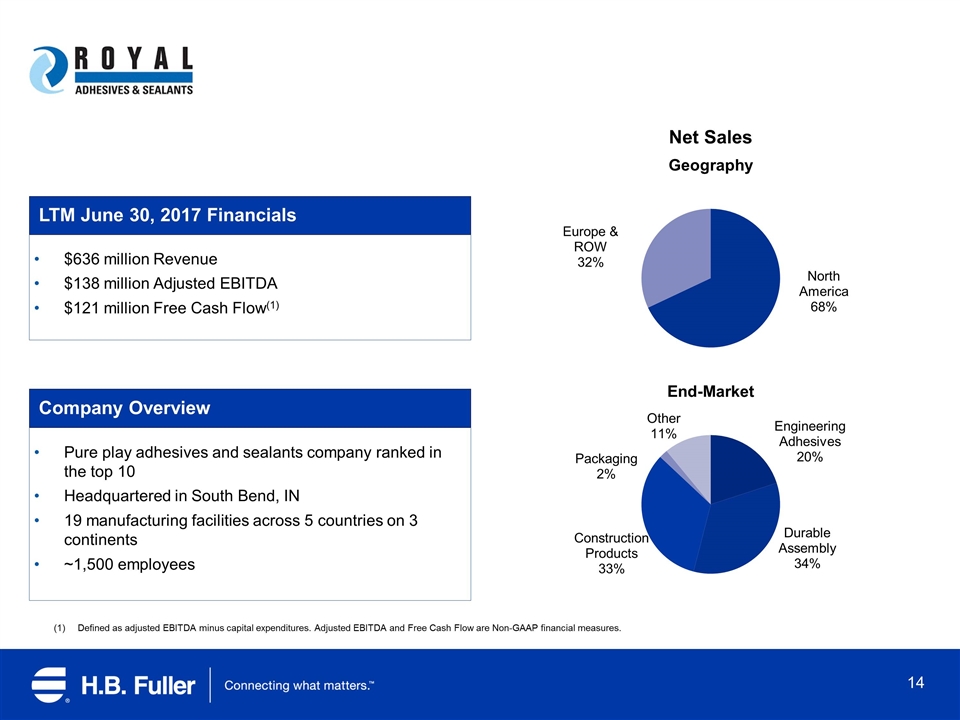

16 18 21 21 Net Sales LTM June 30, 2017 Financials $636 million Revenue $138 million Adjusted EBITDA $121 million Free Cash Flow(1) Company Overview Pure play adhesives and sealants company ranked in the top 10 Headquartered in South Bend, IN 19 manufacturing facilities across 5 countries on 3 continents ~1,500 employees Geography End-Market Defined as adjusted EBITDA minus capital expenditures. Adjusted EBITDA and Free Cash Flow are Non-GAAP financial measures.

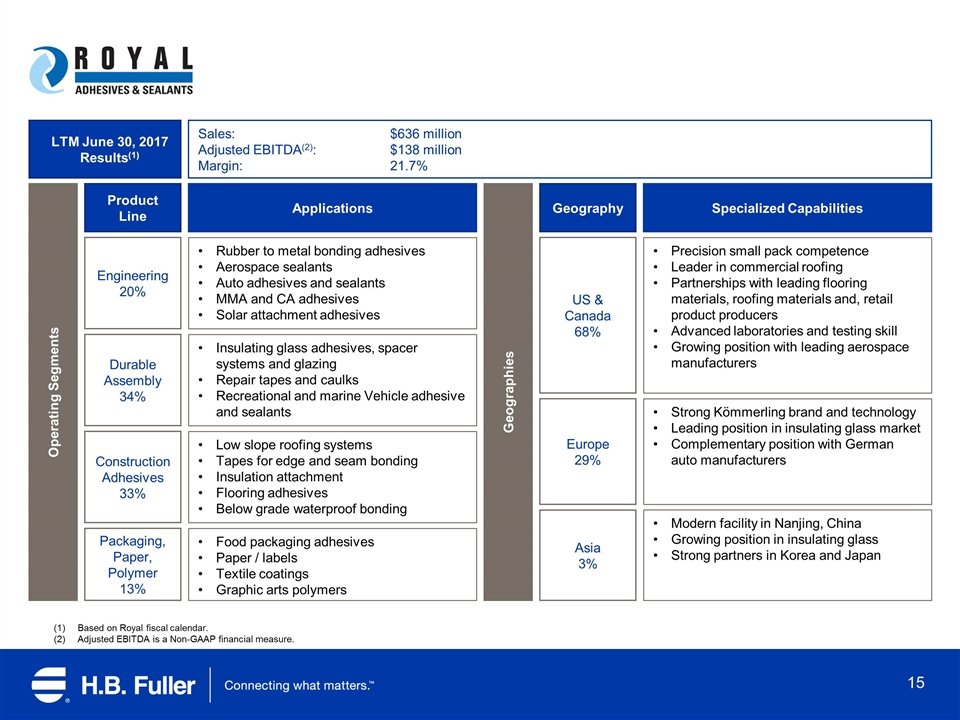

Based on Royal fiscal calendar. Adjusted EBITDA is a Non-GAAP financial measure. Operating Segments Geographies LTM June 30, 2017 Results(1) Sales:$636 million Adjusted EBITDA(2):$138 million Margin:21.7% Product Line Applications Engineering 20% Construction Adhesives 33% Durable Assembly 34% Packaging, Paper, Polymer 13% Rubber to metal bonding adhesives Aerospace sealants Auto adhesives and sealants MMA and CA adhesives Solar attachment adhesives Insulating glass adhesives, spacer systems and glazing Repair tapes and caulks Recreational and marine Vehicle adhesive and sealants Low slope roofing systems Tapes for edge and seam bonding Insulation attachment Flooring adhesives Below grade waterproof bonding Food packaging adhesives Paper / labels Textile coatings Graphic arts polymers Geography Specialized Capabilities Asia 3% Precision small pack competence Leader in commercial roofing Partnerships with leading flooring materials, roofing materials and, retail product producers Advanced laboratories and testing skill Growing position with leading aerospace manufacturers Strong Kömmerling brand and technology Leading position in insulating glass market Complementary position with German auto manufacturers Modern facility in Nanjing, China Growing position in insulating glass Strong partners in Korea and Japan US & Canada 68% Europe 29%

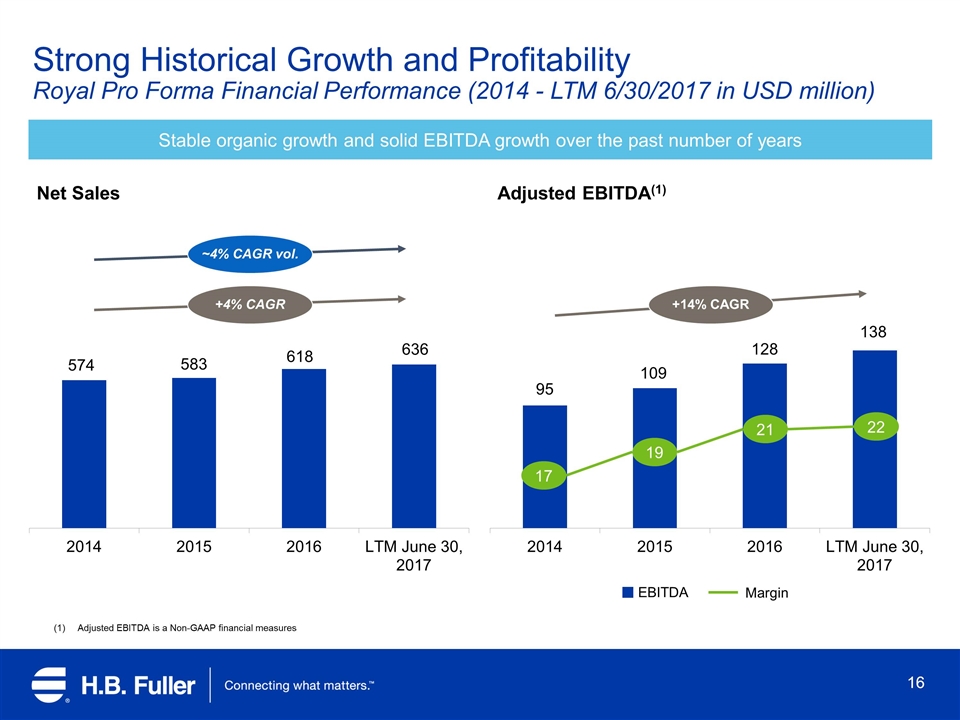

Strong Historical Growth and Profitability Royal Pro Forma Financial Performance (2014 - LTM 6/30/2017 in USD million) Adjusted EBITDA is a Non-GAAP financial measures Stable organic growth and solid EBITDA growth over the past number of years Adjusted EBITDA(1) Net Sales ~4% CAGR vol. +4% CAGR +14% CAGR EBITDA Margin 19 17 21 22

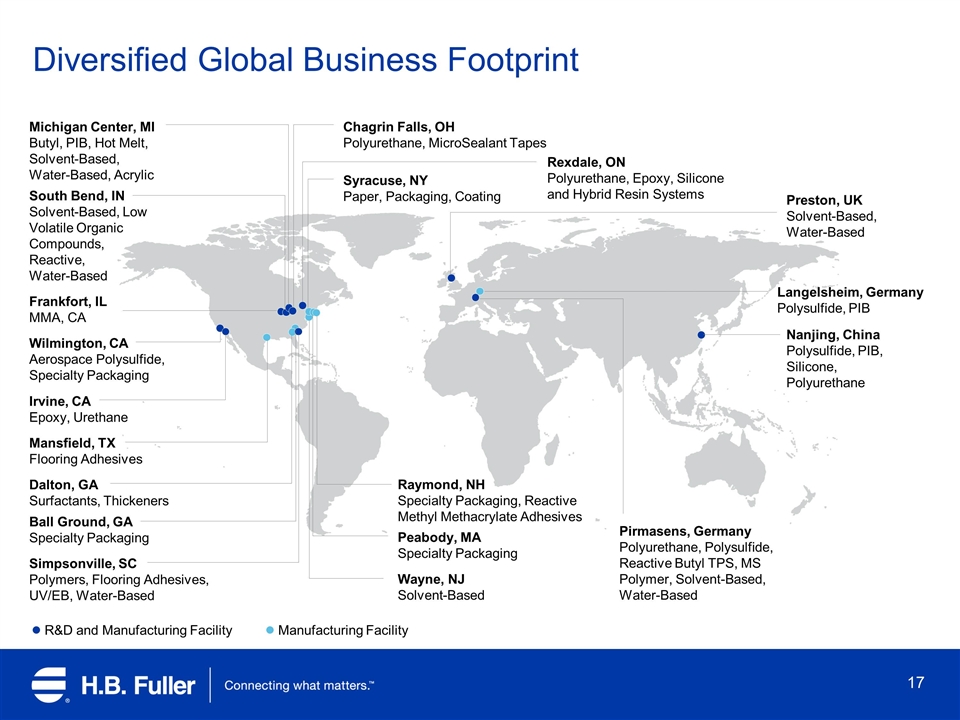

Diversified Global Business Footprint R&D and Manufacturing Facility Manufacturing Facility Michigan Center, MI Butyl, PIB, Hot Melt, Solvent-Based, Water-Based, Acrylic South Bend, IN Solvent-Based, Low Volatile Organic Compounds, Reactive, Water-Based Chagrin Falls, OH Polyurethane, MicroSealant Tapes Wilmington, CA Aerospace Polysulfide, Specialty Packaging Simpsonville, SC Polymers, Flooring Adhesives, UV/EB, Water-Based Mansfield, TX Flooring Adhesives Dalton, GA Surfactants, Thickeners Raymond, NH Specialty Packaging, Reactive Methyl Methacrylate Adhesives Peabody, MA Specialty Packaging Wayne, NJ Solvent-Based Pirmasens, Germany Polyurethane, Polysulfide, Reactive Butyl TPS, MS Polymer, Solvent-Based, Water-Based Langelsheim, Germany Polysulfide, PIB Nanjing, China Polysulfide, PIB, Silicone, Polyurethane Rexdale, ON Polyurethane, Epoxy, Silicone and Hybrid Resin Systems Syracuse, NY Paper, Packaging, Coating Preston, UK Solvent-Based, Water-Based Ball Ground, GA Specialty Packaging Irvine, CA Epoxy, Urethane Frankfort, IL MMA, CA

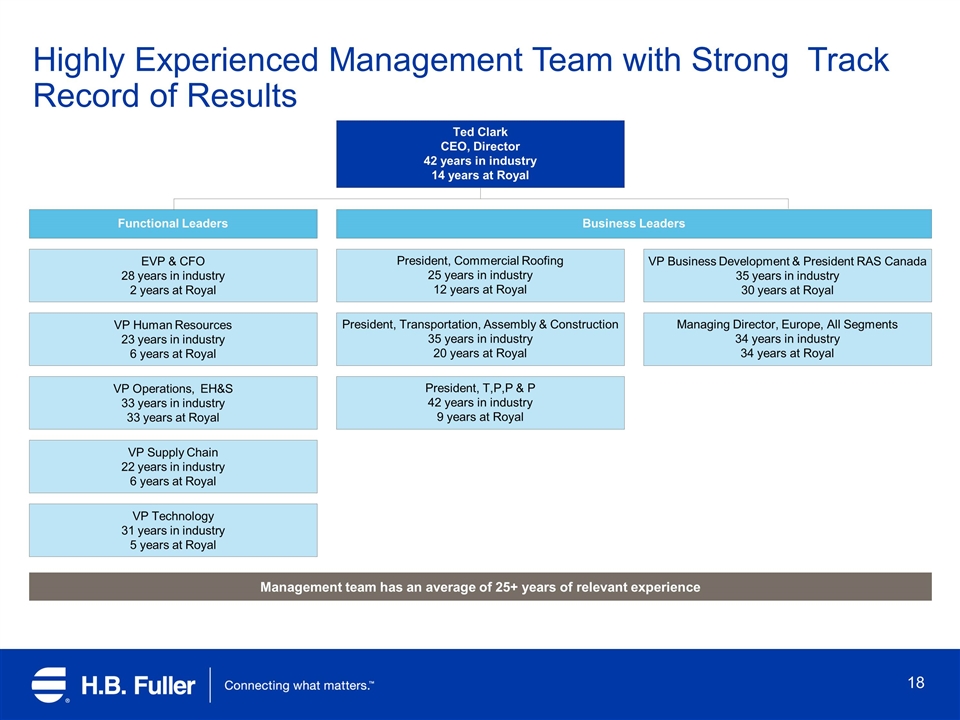

18 Highly Experienced Management Team with Strong Track Record of Results Management team has an average of 25+ years of relevant experience VP Human Resources 23 years in industry 6 years at Royal VP Operations, EH&S 33 years in industry 33 years at Royal EVP & CFO 28 years in industry 2 years at Royal VP Supply Chain 22 years in industry 6 years at Royal VP Technology 31 years in industry 5 years at Royal President, Commercial Roofing 25 years in industry 12 years at Royal VP Business Development & President RAS Canada 35 years in industry 30 years at Royal President, Transportation, Assembly & Construction 35 years in industry 20 years at Royal Managing Director, Europe, All Segments 34 years in industry 34 years at Royal President, T,P,P & P 42 years in industry 9 years at Royal Functional Leaders Business Leaders Ted Clark CEO, Director 42 years in industry 14 years at Royal

Key Credit Highlights Section 3

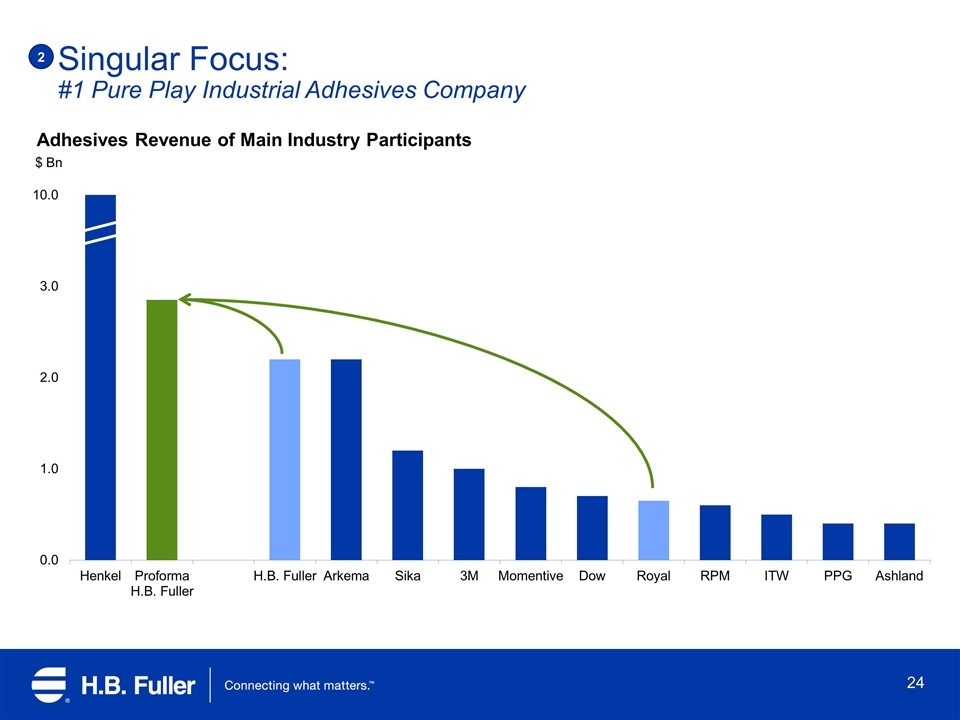

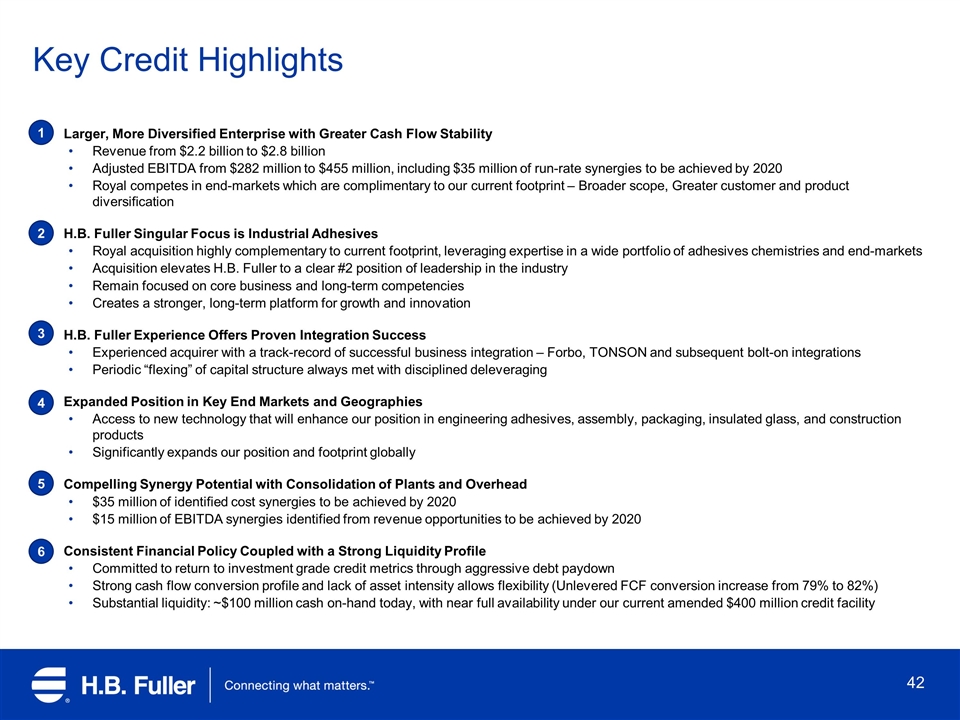

Key Credit Highlights Larger, More Diversified Enterprise with Greater Cash Flow Stability Revenue from $2.2 billion to $2.8 billion Adjusted EBITDA from $282 million to $455 million, including $35 million of run-rate synergies to be achieved by 2020 Royal competes in end-markets which are complimentary to our current footprint – Broader scope, Greater customer and product diversification H.B. Fuller Singular Focus is Industrial Adhesives Royal acquisition highly complementary to current footprint, leveraging expertise in a wide portfolio of adhesives chemistries and end-markets Acquisition elevates H.B. Fuller to a clear #2 position of leadership in the industry Remain focused on core business and long-term competencies Creates a stronger, long-term platform for growth and innovation H.B. Fuller Experience Offers Proven Integration Success Experienced acquirer with a track-record of successful business integration – Forbo, TONSON and subsequent bolt-on integrations Periodic “flexing” of capital structure always met with disciplined deleveraging Expanded Position in Key End Markets and Geographies Access to new technology that will enhance our position in engineering adhesives, assembly, packaging, insulated glass, and construction products Significantly expands our position and footprint globally Compelling Synergy Potential with Consolidation of Plants and Overhead $35 million of identified cost synergies to be achieved by 2020 $15 million of EBITDA synergies identified from revenue opportunities to be achieved by 2020 Consistent Financial Policy Coupled with a Strong Liquidity Profile Committed to return to investment grade credit metrics through aggressive debt paydown Strong cash flow conversion profile and lack of asset intensity allows flexibility (Unlevered FCF conversion increase from 79% to 82%) Substantial liquidity: ~$100 million cash on-hand today, with near full availability under our current amended $400 million credit facility 1 2 3 4 5 6

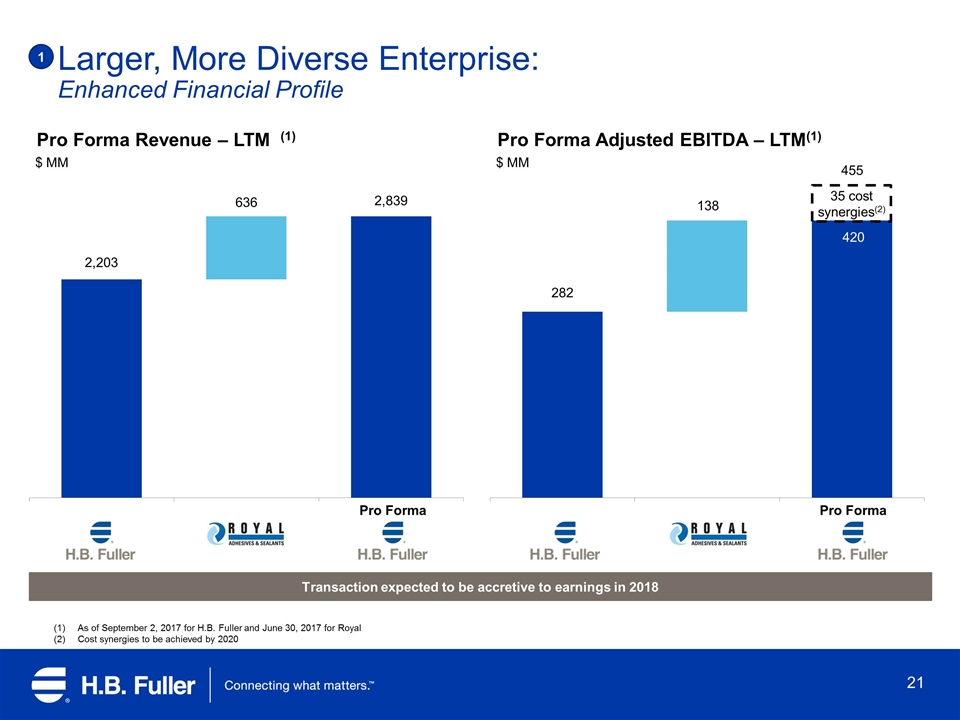

$ MM 35 cost synergies(2) 1 Larger, More Diverse Enterprise: Enhanced Financial Profile $ MM Pro Forma Adjusted EBITDA – LTM(1) Pro Forma Revenue – LTM (1) Pro Forma Pro Forma Transaction expected to be accretive to earnings in 2018 As of September 2, 2017 for H.B. Fuller and June 30, 2017 for Royal Cost synergies to be achieved by 2020 455

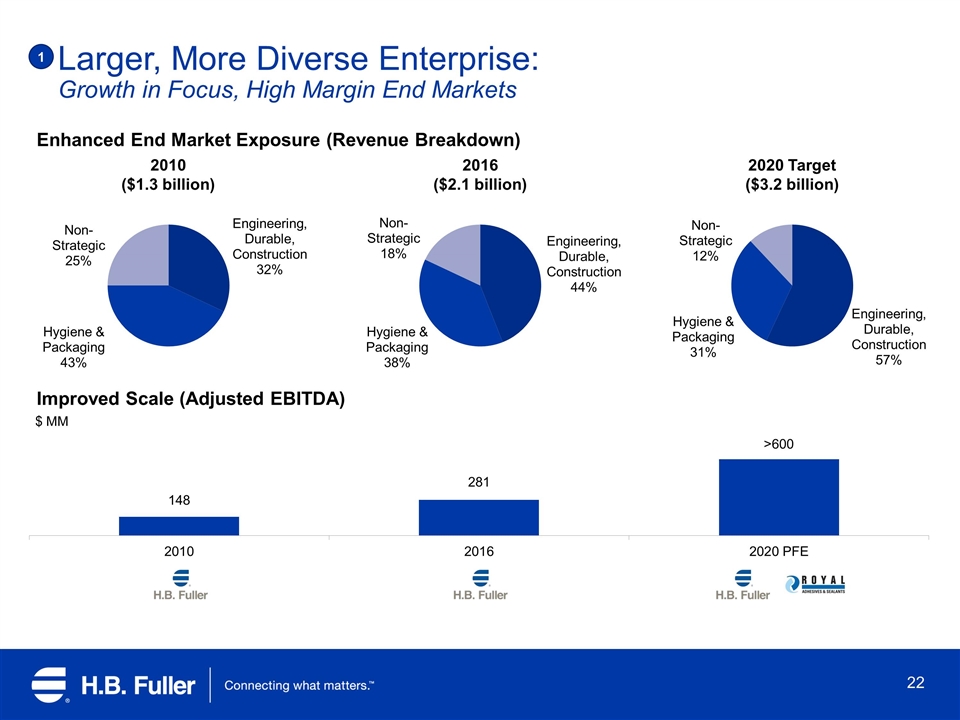

Larger, More Diverse Enterprise: Growth in Focus, High Margin End Markets 1 Enhanced End Market Exposure (Revenue Breakdown) Improved Scale (Adjusted EBITDA) 2010 ($1.3 billion) 2016 ($2.1 billion) 2020 Target ($3.2 billion) $ MM

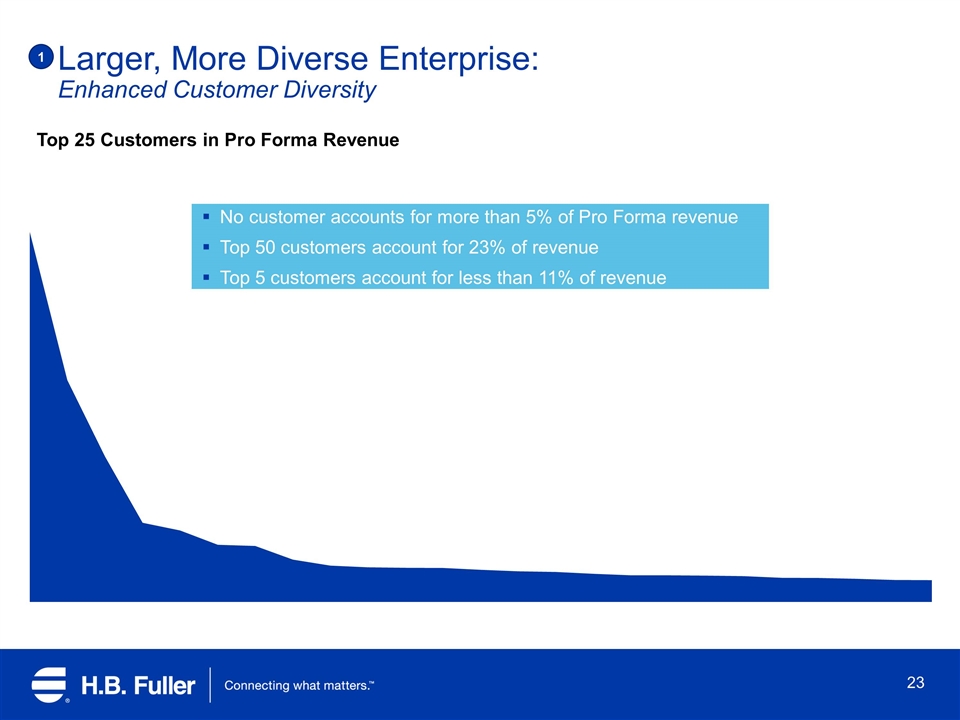

Larger, More Diverse Enterprise: Enhanced Customer Diversity 1 No customer accounts for more than 5% of Pro Forma revenue Top 50 customers account for 23% of revenue Top 5 customers account for less than 11% of revenue Top 25 Customers in Pro Forma Revenue

Singular Focus: #1 Pure Play Industrial Adhesives Company 2 Adhesives Revenue of Main Industry Participants $ Bn

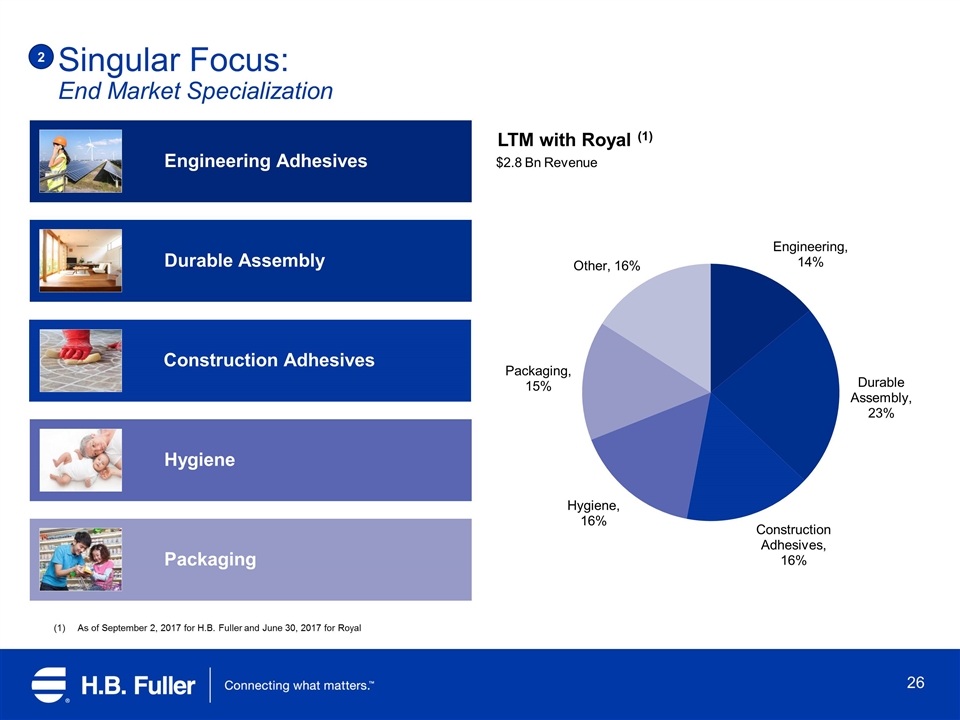

Singular Focus Diverse exposure to the Global Industrial Economy Direct presence in 44 countries; customers in over 100 geographies Sales into 40 end markets- from hygiene to aerospace Low cyclicality; consumable products Long history of winning with customers to create specified solutions in highly diverse markets Global presence – more than half of $2.84 billion pro-forma revenue outside of the U.S. 2 2

Hygiene Construction Adhesives Engineering Adhesives Durable Assembly Packaging Singular Focus: End Market Specialization LTM with Royal (1) $2.8 Bn Revenue 2 As of September 2, 2017 for H.B. Fuller and June 30, 2017 for Royal

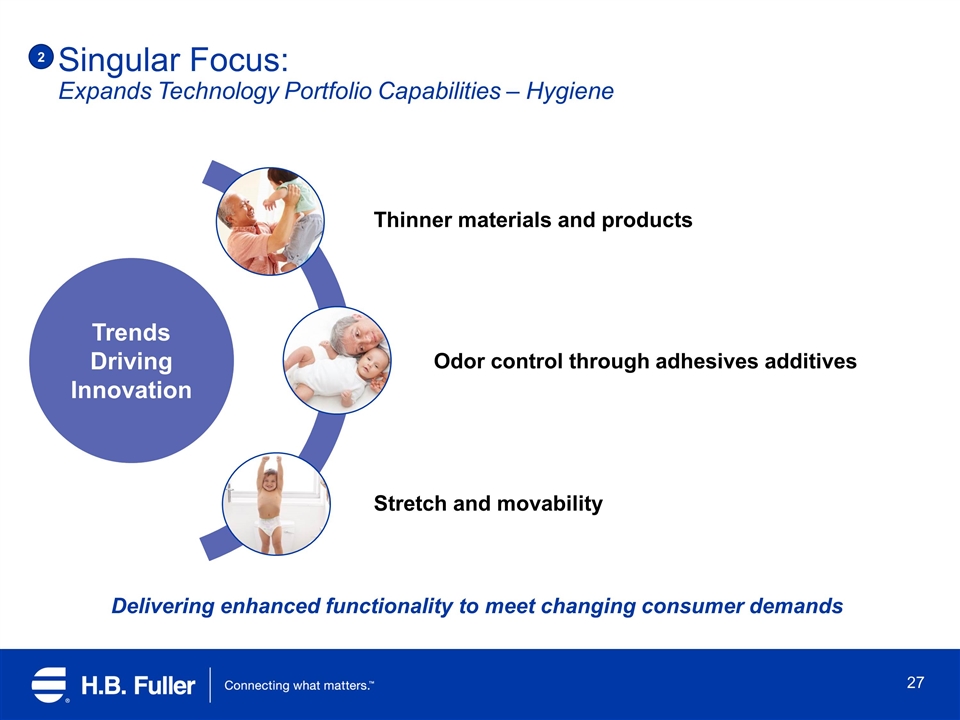

Singular Focus: Expands Technology Portfolio Capabilities – Hygiene 2 Trends Driving Innovation Thinner materials and products Odor control through adhesives additives Stretch and movability Delivering enhanced functionality to meet changing consumer demands

Singular Focus: Expands Technology Portfolio Capabilities – Packaging 2 Extending our application capabilities in new or adjacent applications Labelling & Packaging Adaptability and easy wash-off properties Low environmental profile, versatility and performance across a range of climates Addresses changing demographics and lifestyles, including demand for convenience packaging

Mobile Electronics Work to solve customer design challenges Leverage expertise across applications and technologies Deliver adhesive solutions for multiple product development programs Singular Focus: Expands Technology Portfolio Capabilities – Engineering Adhesives 2

Singular Focus: Expands Technology Portfolio Capabilities – Engineering Adhesives 2 Advanced Aerospace Sealants Perform well under demanding industry requirements 33% quicker curing time than previous solutions Resistance to aviation fuel and other chemical and petroleum products

Energy Efficient Insulating Glass Drive toward energy efficiency has led to increased performance demands Triple pane glass is a growing trend in Germany and around the world Latest spacer technology requires highly specified adhesives Singular Focus: Expands Technology Portfolio Capabilities – Durable Assembly 2

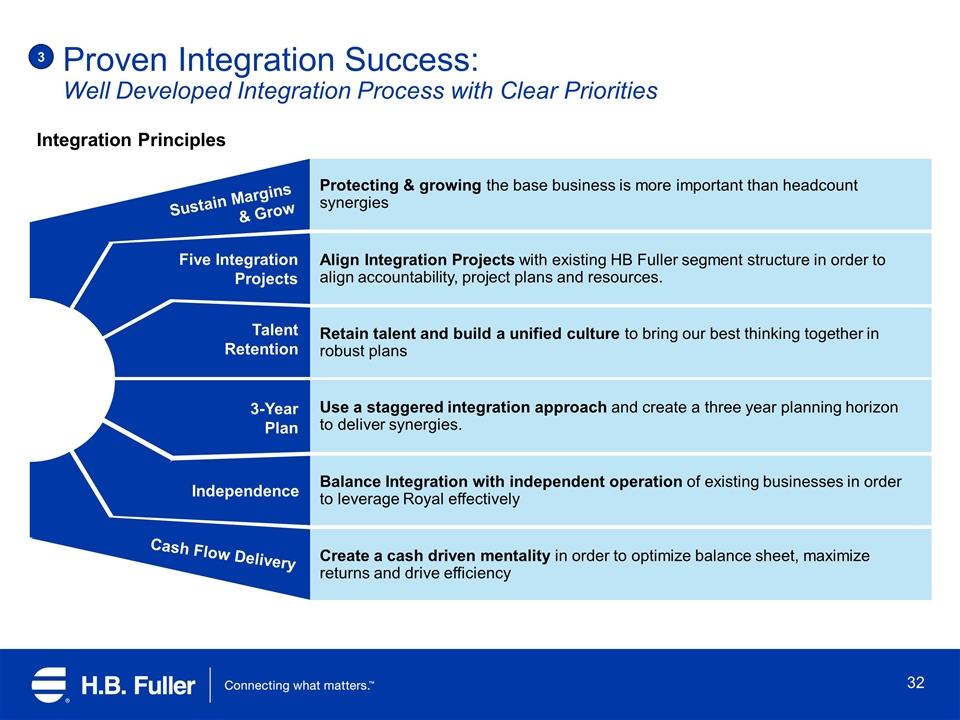

Proven Integration Success: Well Developed Integration Process with Clear Priorities 3 Protecting & growing the base business is more important than headcount synergies Align Integration Projects with existing HB Fuller segment structure in order to align accountability, project plans and resources. Balance Integration with independent operation of existing businesses in order to leverage Royal effectively Use a staggered integration approach and create a three year planning horizon to deliver synergies. Retain talent and build a unified culture to bring our best thinking together in robust plans Create a cash driven mentality in order to optimize balance sheet, maximize returns and drive efficiency Sustain Margins & Grow Five Integration Projects Independence Talent Retention 3-Year Plan Cash Flow Delivery Integration Principles

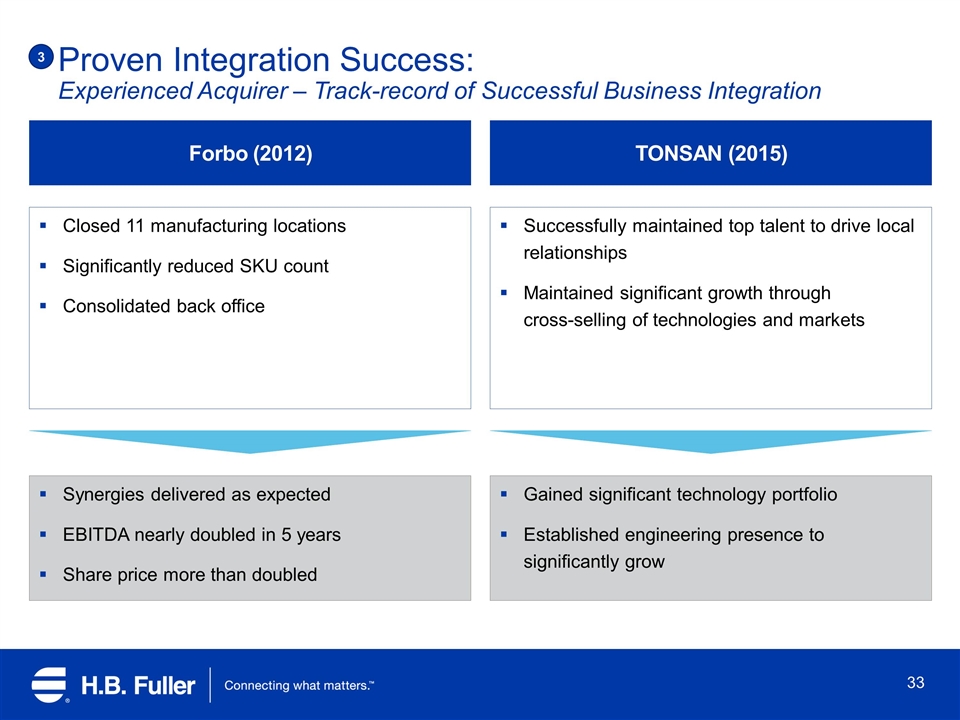

3 Proven Integration Success: Experienced Acquirer – Track-record of Successful Business Integration Forbo (2012) TONSAN (2015) Closed 11 manufacturing locations Significantly reduced SKU count Consolidated back office Successfully maintained top talent to drive local relationships Maintained significant growth through cross-selling of technologies and markets Synergies delivered as expected EBITDA nearly doubled in 5 years Share price more than doubled Gained significant technology portfolio Established engineering presence to significantly grow

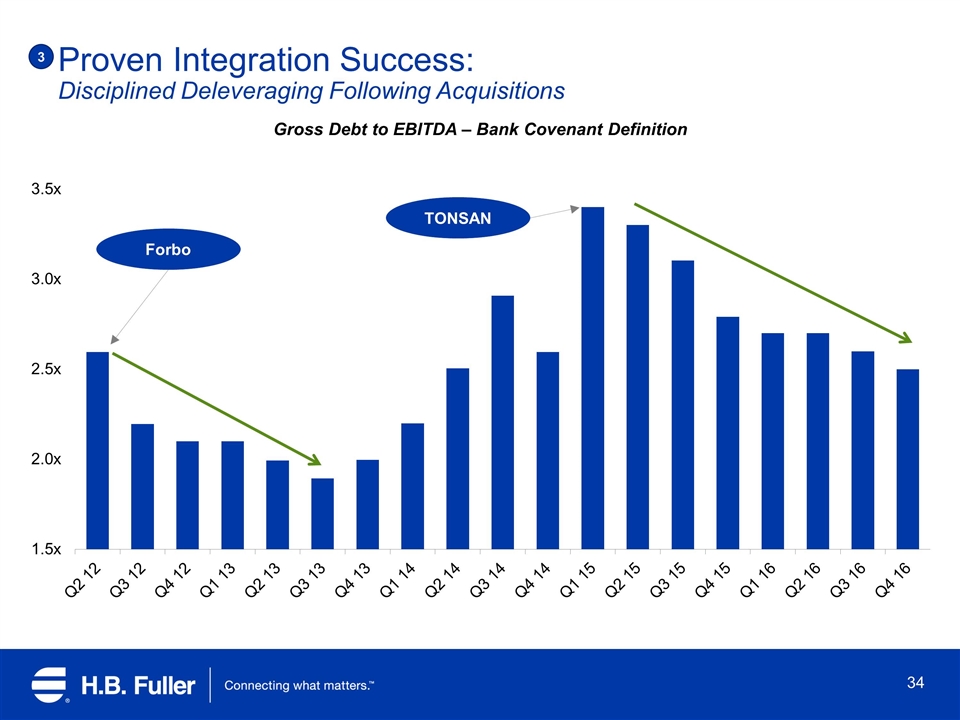

3 Proven Integration Success: Disciplined Deleveraging Following Acquisitions Gross Debt to EBITDA – Bank Covenant Definition Forbo TONSAN

4 Expanded Position: Improves and Broadens Portfolio Mix Expands Engineering Adhesives presence into Aerospace and other high value segments. Increases geographic presence in Engineering Adhesives in the Americas and Europe. Provides small pack capabilities for reactive systems in the US. Provides a stronger position in Durable Assembly in the Americas and Europe. Creates the #1 global Insulating Glass supplier, complementing our profitable business in N. America. Introduces a second, sizable construction segment—#1 player in commercial roofing space. Strengthens business in overlapping segments of Flooring and Flexible Packaging.

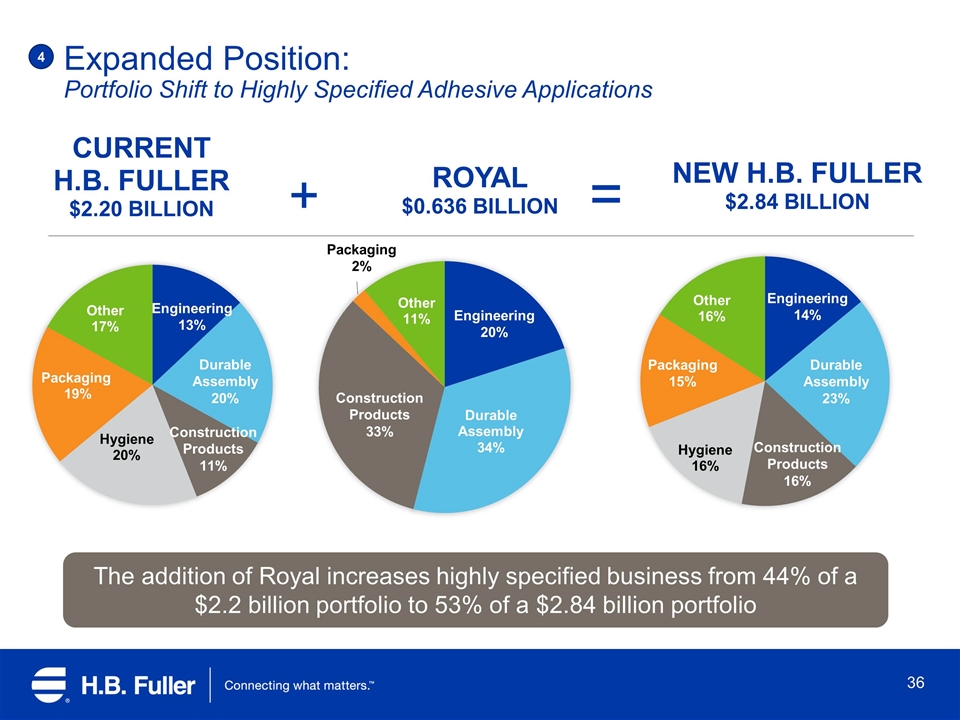

+ = The addition of Royal increases highly specified business from 44% of a $2.2 billion portfolio to 53% of a $2.84 billion portfolio 4 Expanded Position: Portfolio Shift to Highly Specified Adhesive Applications

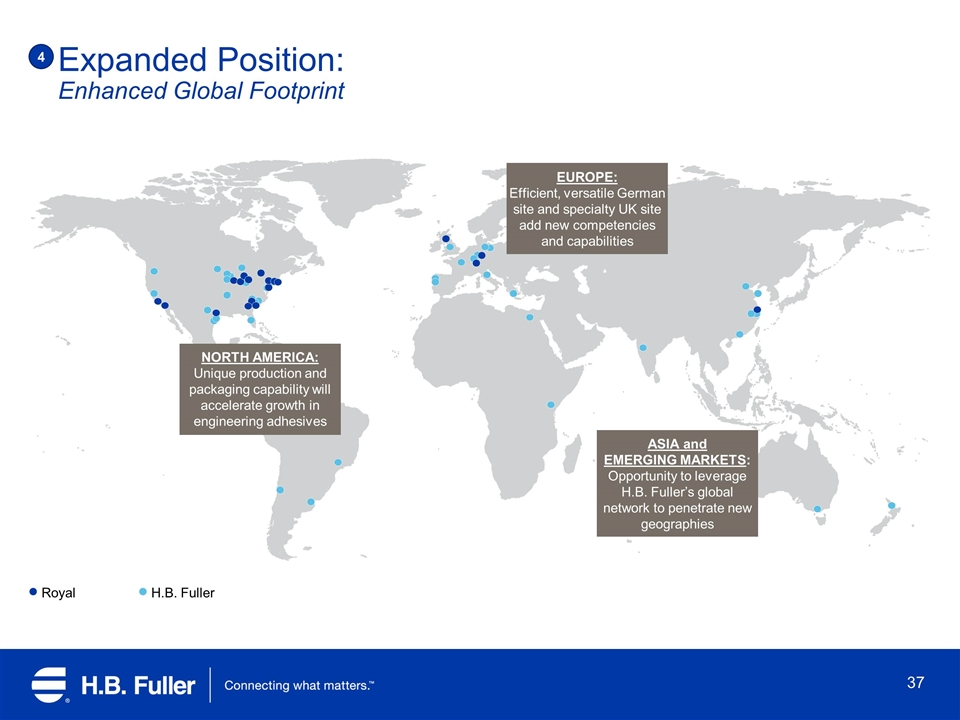

4 Expanded Position: Enhanced Global Footprint Royal H.B. Fuller EUROPE: Efficient, versatile German site and specialty UK site add new competencies and capabilities NORTH AMERICA: Unique production and packaging capability will accelerate growth in engineering adhesives ASIA and EMERGING MARKETS: Opportunity to leverage H.B. Fuller’s global network to penetrate new geographies

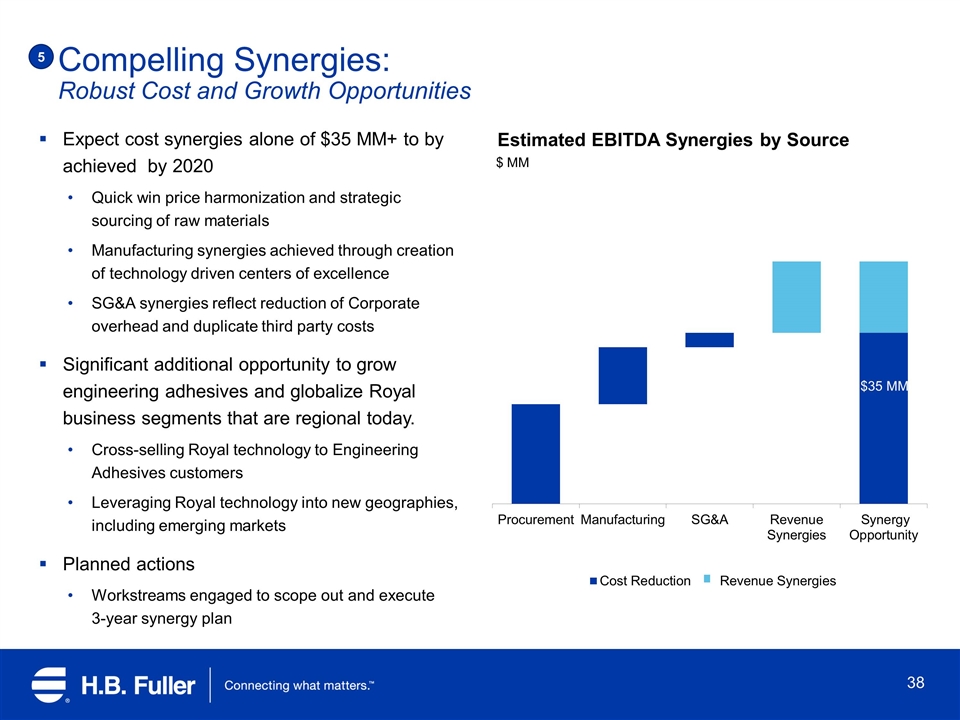

5 Compelling Synergies: Robust Cost and Growth Opportunities Expect cost synergies alone of $35 MM+ to by achieved by 2020 Quick win price harmonization and strategic sourcing of raw materials Manufacturing synergies achieved through creation of technology driven centers of excellence SG&A synergies reflect reduction of Corporate overhead and duplicate third party costs Significant additional opportunity to grow engineering adhesives and globalize Royal business segments that are regional today. Cross-selling Royal technology to Engineering Adhesives customers Leveraging Royal technology into new geographies, including emerging markets Planned actions Workstreams engaged to scope out and execute 3-year synergy plan $ MM Estimated EBITDA Synergies by Source

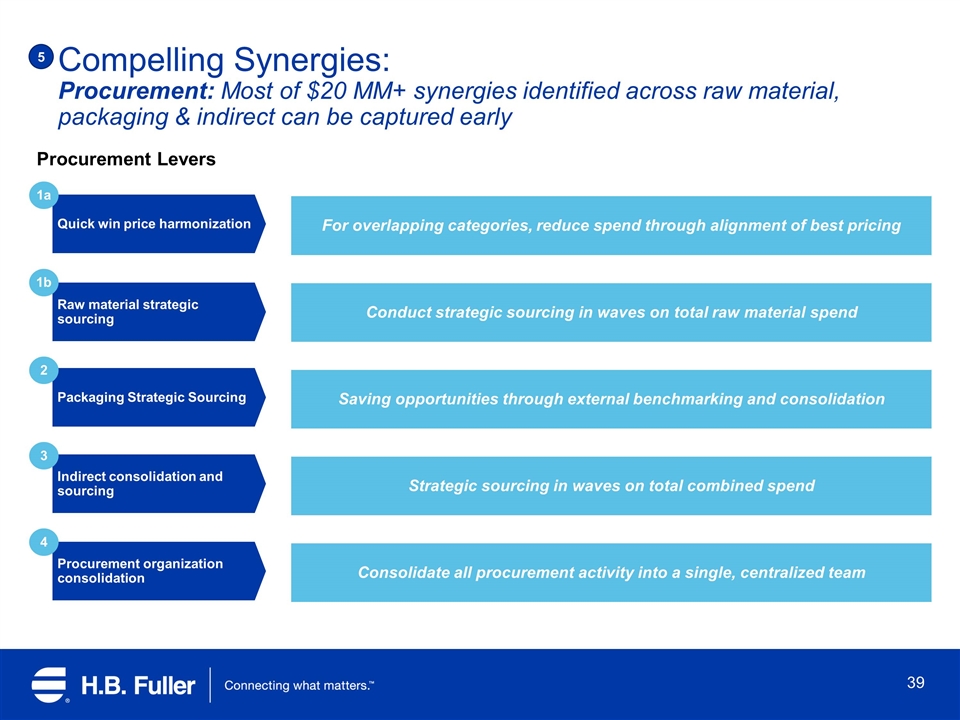

5 Compelling Synergies: Procurement: Most of $20 MM+ synergies identified across raw material, packaging & indirect can be captured early Procurement Levers Quick win price harmonization 1a Indirect consolidation and sourcing 3 Procurement organization consolidation 4 Raw material strategic sourcing 1b Packaging Strategic Sourcing 2 For overlapping categories, reduce spend through alignment of best pricing Consolidate all procurement activity into a single, centralized team Conduct strategic sourcing in waves on total raw material spend Saving opportunities through external benchmarking and consolidation Strategic sourcing in waves on total combined spend

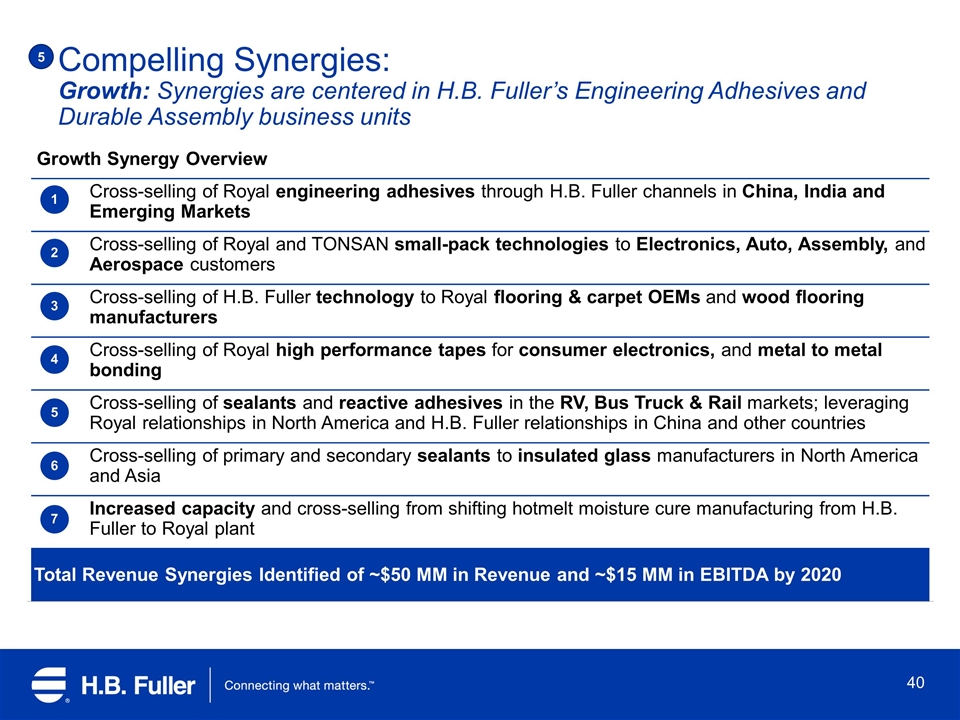

5 Compelling Synergies: Growth: Synergies are centered in H.B. Fuller’s Engineering Adhesives and Durable Assembly business units Growth Synergy Overview Cross-selling of Royal engineering adhesives through H.B. Fuller channels in China, India and Emerging Markets Cross-selling of Royal and TONSAN small-pack technologies to Electronics, Auto, Assembly, and Aerospace customers Cross-selling of H.B. Fuller technology to Royal flooring & carpet OEMs and wood flooring manufacturers Cross-selling of Royal high performance tapes for consumer electronics, and metal to metal bonding Cross-selling of sealants and reactive adhesives in the RV, Bus Truck & Rail markets; leveraging Royal relationships in North America and H.B. Fuller relationships in China and other countries Cross-selling of primary and secondary sealants to insulated glass manufacturers in North America and Asia Increased capacity and cross-selling from shifting hotmelt moisture cure manufacturing from H.B. Fuller to Royal plant Total Revenue Synergies Identified of ~$50 MM in Revenue and ~$15 MM in EBITDA by 2020 1 2 3 4 5 7 6 Growth: Synergies are centered in H.B. Fuller’s Engineering Adhesives and Durable Assembly business units 5

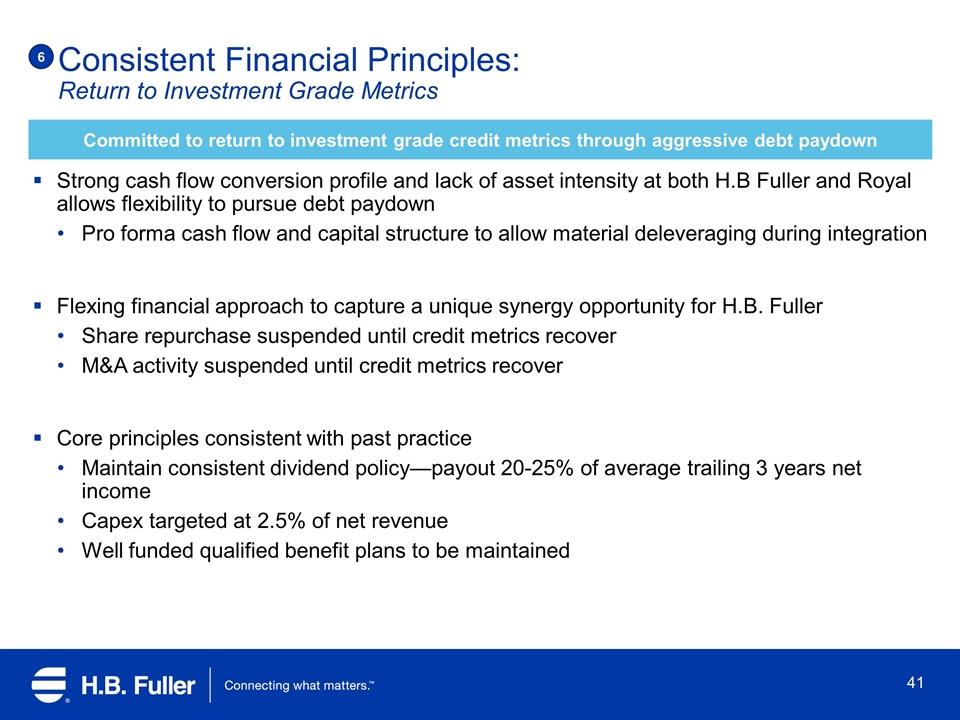

6 Consistent Financial Principles: Return to Investment Grade Metrics Committed to return to investment grade credit metrics through aggressive debt paydown Strong cash flow conversion profile and lack of asset intensity at both H.B Fuller and Royal allows flexibility to pursue debt paydown Pro forma cash flow and capital structure to allow material deleveraging during integration Flexing financial approach to capture a unique synergy opportunity for H.B. Fuller Share repurchase suspended until credit metrics recover M&A activity suspended until credit metrics recover Core principles consistent with past practice Maintain consistent dividend policy—payout 20-25% of average trailing 3 years net income Capex targeted at 2.5% of net revenue Well funded qualified benefit plans to be maintained

Key Credit Highlights Larger, More Diversified Enterprise with Greater Cash Flow Stability Revenue from $2.2 billion to $2.8 billion Adjusted EBITDA from $282 million to $455 million, including $35 million of run-rate synergies to be achieved by 2020 Royal competes in end-markets which are complimentary to our current footprint – Broader scope, Greater customer and product diversification H.B. Fuller Singular Focus is Industrial Adhesives Royal acquisition highly complementary to current footprint, leveraging expertise in a wide portfolio of adhesives chemistries and end-markets Acquisition elevates H.B. Fuller to a clear #2 position of leadership in the industry Remain focused on core business and long-term competencies Creates a stronger, long-term platform for growth and innovation H.B. Fuller Experience Offers Proven Integration Success Experienced acquirer with a track-record of successful business integration – Forbo, TONSON and subsequent bolt-on integrations Periodic “flexing” of capital structure always met with disciplined deleveraging Expanded Position in Key End Markets and Geographies Access to new technology that will enhance our position in engineering adhesives, assembly, packaging, insulated glass, and construction products Significantly expands our position and footprint globally Compelling Synergy Potential with Consolidation of Plants and Overhead $35 million of identified cost synergies to be achieved by 2020 $15 million of EBITDA synergies identified from revenue opportunities to be achieved by 2020 Consistent Financial Policy Coupled with a Strong Liquidity Profile Committed to return to investment grade credit metrics through aggressive debt paydown Strong cash flow conversion profile and lack of asset intensity allows flexibility (Unlevered FCF conversion increase from 79% to 82%) Substantial liquidity: ~$100 million cash on-hand today, with near full availability under our current amended $400 million credit facility 1 2 3 4 5 6

Historical Performance Overview Section 4

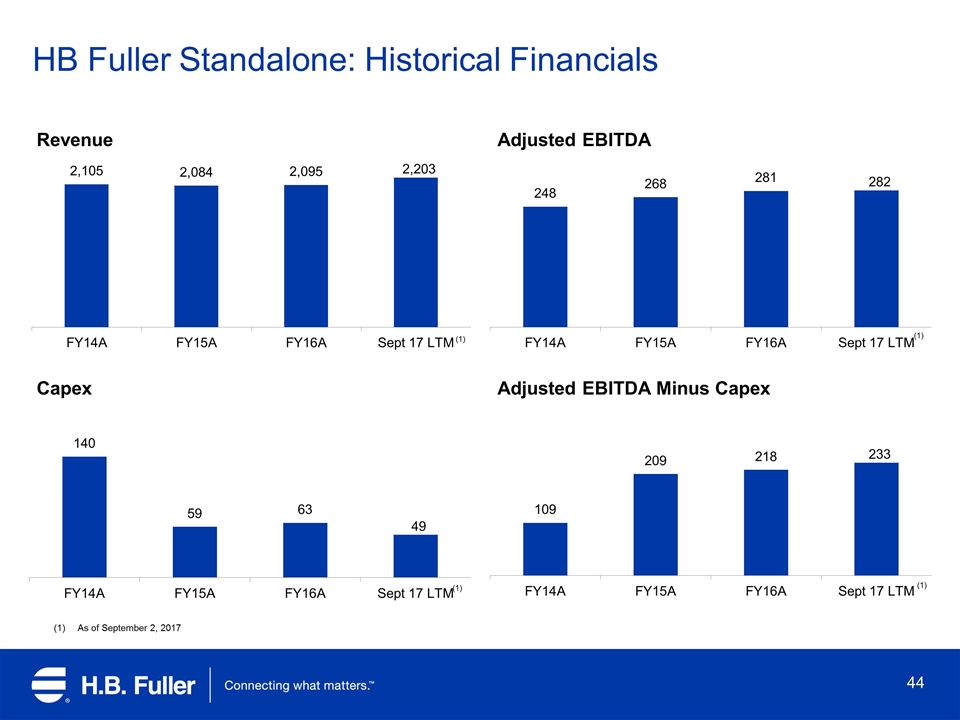

HB Fuller Standalone: Historical Financials Adjusted EBITDA Revenue Adjusted EBITDA Minus Capex Capex As of September 2, 2017 (1) (1) (1) (1)

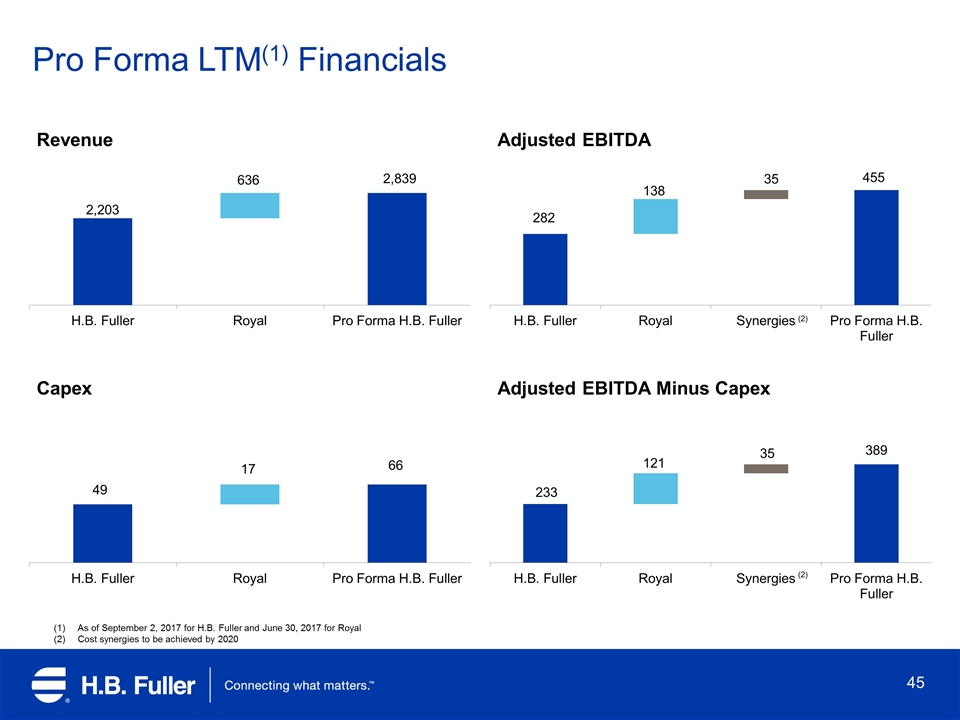

Pro Forma LTM(1) Financials Adjusted EBITDA Revenue Adjusted EBITDA Minus Capex Capex As of September 2, 2017 for H.B. Fuller and June 30, 2017 for Royal Cost synergies to be achieved by 2020 (2) (2)

Closing Remarks and Q&A Section 5

Closing Remarks Royal Adhesives & Sealants is a pure-play adhesives and sealants company with a top 10 market position Acquisition significantly shifts portfolio toward high value specified adhesive applications in Engineering, Construction and Durable Assembly Immediate improvement of EBITDA margin, cash flow, and revenue Delivers cost synergies of $35 MM and potential revenue synergies of $15 MM in EBITDA to be achieved by 2020 Acquisition extends H.B. Fuller’s market leadership position in adhesives while enhancing cash flow profile Strong cash flow conversion profile and lack of asset intensity at both H.B Fuller and Royal allows flexibility to pursue debt paydown Committed to return to investment grade credit metrics