|

Exhibit 99.1

|

Exhibit 99.1

Investor Presentation

June 2014

CONFIDENTIAL

Disclaimer

Forward-Looking Statements

Certain statements discussed in this Presentation constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks, uncertainties and other important factors that could cause the actual results, performance or achievements of results to differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements. Such risks, uncertainties and other important factors include, among others: the duration and ultimate speed of the current housing recovery remains uncertain; competition in the homebuilding markets in which AV Homes (“AVHI” or “Company”) operates; AVHI’s access to financing; concentrated ownership structure; the stability of certain financial markets; disruption of the credit markets and reduced availability and more stringent financing requirements for commercial and residential mortgages of all types; the number of investor and speculator resale homes for sale and homes in foreclosure in AVHI’s communities and in the geographic areas in which AVHI develops and sells homes; the increased level of unemployment; the decline in net worth and/or of income of potential buyers; the decline in consumer confidence; the failure to successfully implement AVHI’s business strategy; shifts in demographic trends affecting demand for active adult and primary housing; the level of immigration and migration into the areas in which AVHI conducts real estate activities; construction defect and home warranty claims; changes in, or the failure or inability to comply with, government regulations; the failure to successfully integrate acquisitions into AVHI’s business, including AVHI’s acquisition of Royal Oak Homes, LLC; recognition of contingent development liabilities in advance of anticipated timeframes and other factors as are described in AVHI’s Annual Report on Form 10-K for the year ended December 31, 2013. Readers are cautioned not to place undue reliance on any forward-looking statements contained herein, which reflect management’s opinions only as of the date hereof.

*Information in this Investor Presentation is as of March 31, 2014 unless otherwise stated

CONFIDENTIAL

Executive Summary

AV Homes (“AVHI” or “Company”) is a leading homebuilder with a balanced portfolio of active adult and primary residential communities in high growth housing markets

The Company owns or controls ~15,8001 residential lots in 33 communities strategically located in Phoenix, Arizona; Orlando, Florida; and Charlotte and Raleigh, North Carolina

Over the past two years, AVHI has executed numerous operational, strategic and financial initiatives

Industry veteran Roger Cregg joined the Company as CEO in December 2012 Partnered with TPG Capital on a $135 million equity raise in June 2013 Established a $65 million secured revolving credit facility in April 2014

The additional capital has been efficiently deployed in repositioning many of the Company’s existing communities, funding land acquisitions and the acquisition of Royal Oak Homes in Orlando, FL

1 | | Includes ~800 lots that are not included in management’s near term development plan |

Management Presenters

CONFIDENTIAL

Roger Cregg

— Director, President and Chief Executive Officer

— Over 35 years of experience

— Former CFO at PulteGroup from 1998 to 2011

— Current Director of Comerica Inc. and former Director and Chair of the Federal Reserve Bank of Chicago, Detroit Branch

Michael Burnett

— Chief Financial Officer and Executive Vice President

— Over 20 years of experience in accounting / corporate finance

— Former CFO of American Traffic Solutions

— Former Senior Vice President, Finance, Treasury and Investor Relations at JDA Software

— Previously served in various financial roles at Allied Waste Industries and as a certified public accountant with Arthur Andersen LLP

Company Overview

CONFIDENTIAL

AVHI Overview

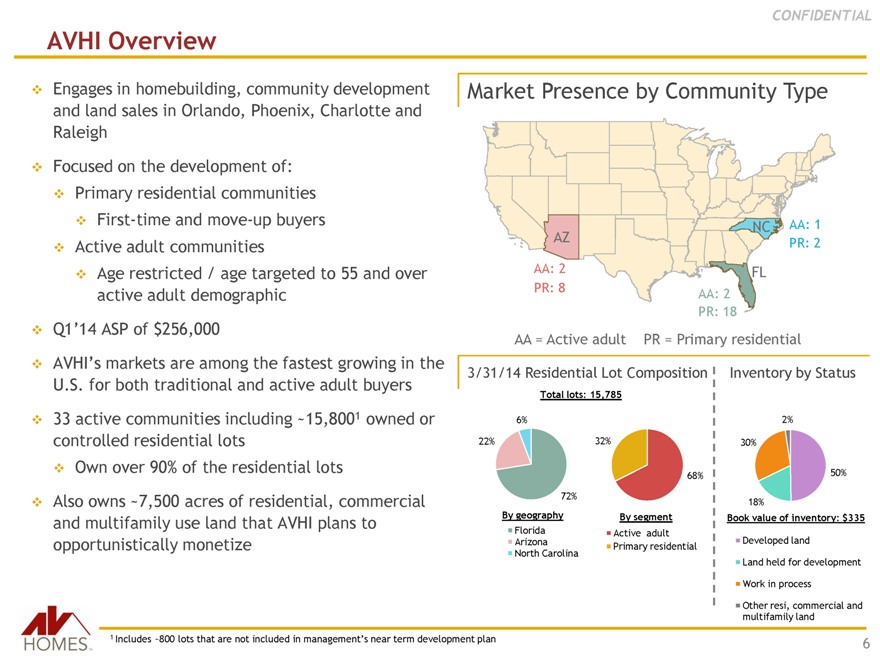

Engages in homebuilding, community development and land sales in Orlando, Phoenix, Charlotte and Raleigh

Focused on the development of:

Primary residential communities

First-time and move-up buyers

Active adult communities

Age restricted/age targeted to 55 and over active adult demographic

Q1’14 ASP of $256,000

AVHI’s markets are among the fastest growing in the U.S. for both traditional and active adult buyers

33 active communites including ~15,8001 owned or controlled residential lots

Own over 90% of the residential lots

Also owns ~ 7,500 acres of residential, commercial and multifamily use land that AVHI plans to opportunistically monetize

Market Presence by Community Type

AA: 2

PR: 8

AA: 2

PR: 18

AA: 1

PR: 2

AA = Active adult

PR = Primary residential

3/31/14 Residential Lot Composition

Total lots: 15,785

6%

22%

72%

32%

68%

By geography

Florida

Arizona

North Carolina

By segment

Active adult

Primary residential

Inventory by Status

2%

30%

18%

50%

Book value of inventory: $335

Developed land

Land Held for development

Work in process

Other resi, commercial and multifamily land

1 includes~800 lots that are not included in managent’s near term development plan

CONFIDENTIAL

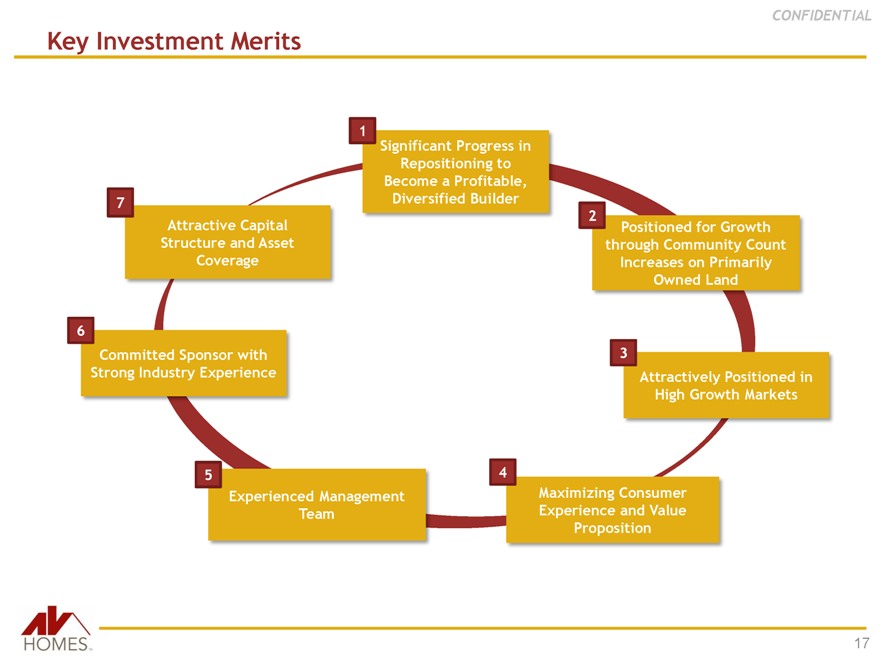

Key Investment Merits

1 | | Significant progress in repositioning to become a profitable, diversified builder |

Balanced mix of primary residential and active adult communities Renewed focus on best-in-class amenities, home quality and design

2 | | Positioned for growth through community count increases on primarily owned land |

Re-capitalized existing communities and introduced new communities 33 existing communities in various stages of development from 7 in 2013 Entered North Carolina market

3 | | Attractively positioned in high growth markets |

# 1 ranked active adult builder and a top 5 primary residential builder in Central Florida Top 5 active adult market share in all the existing markets Attractive market profile across key demographic and housing metrics

4 | | Maximizing consumer experience and value proposition |

Amenitized according to targeted customer profiles Committed to providing a quality product

5 | | Experienced management team |

Roger Cregg and Mike Burnett have over 35 years and 24 years of experience, respectively

AVHI’s Division Presidents have significant industry experience with a track record of managing large platforms

6 | | Committed sponsor with strong industry experience |

TPG is one of the largest and most respected private equity firms in the world Ability to leverage its competency through its investments in other homebuilders

7 | | Attractive capital structure and asset coverage |

Among the lowest leverage ratios in the industry

Strong asset coverage of 3.9x, with conservatively marked inventory Ample liquidity of $117 million1

1 As of March 31, 2014, pro forma for repurchase in April 2014 of $5.4mm, 4.5% convertible notes due 2024 and adjusted for $65 million in available borrowings under senior credit facility as of June 10, 2014

CONFIDENTIAL

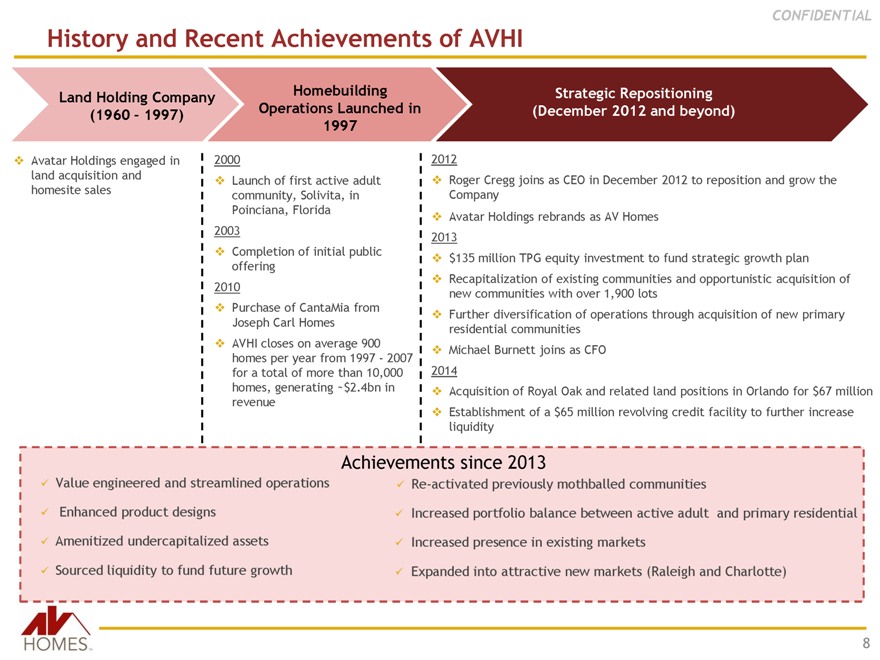

History and Recent Achievements of AVHI

Land Holding Company (1960 – 1997)

Avatar Holdings engaged in land acquisition and homesite sales

Homebuilding Operations Launched in 1997

2000

Launch of first active adult community, Solivita, in Poinciana, Florida 2003 Completion of initial public offering 2010 Purchase of CantaMia from Joseph Carl Homes AVHI closes on average 900 homes per year from 1997—2007 for a total of more than 10,000 homes, generating ~$2.4bn in revenue

Strategic Repositioning (December 2012 and beyond)

2012

Roger Cregg joins as CEO in December 2012 to reposition and grow the Company Avatar Holdings rebrands as AV Homes 2013 $135 million TPG equity investment to fund strategic growth plan Recapitalization of existing communities and opportunistic acquisition of new communities with over 1,900 lots Further diversification of operations through acquisition of new primary residential communities Michael Burnett joins as CFO

2014

Acquisition of Royal Oak and related land positions in Orlando for $67 million Establishment of a $65 million revolving credit facility to further increase liquidity

Achivement since 2013

Value engineered and streamlined operations Re-activated previously mothballed communities

Enhanced product designs Increased portfolio balance between active adult and primary residential Amenitized undercapitalized assets Increased presence in existing markets Sourced liquidity to fund future growth Expanded into attractive new markets (Raleigh and Charlotte)

CONFIDENTIAL

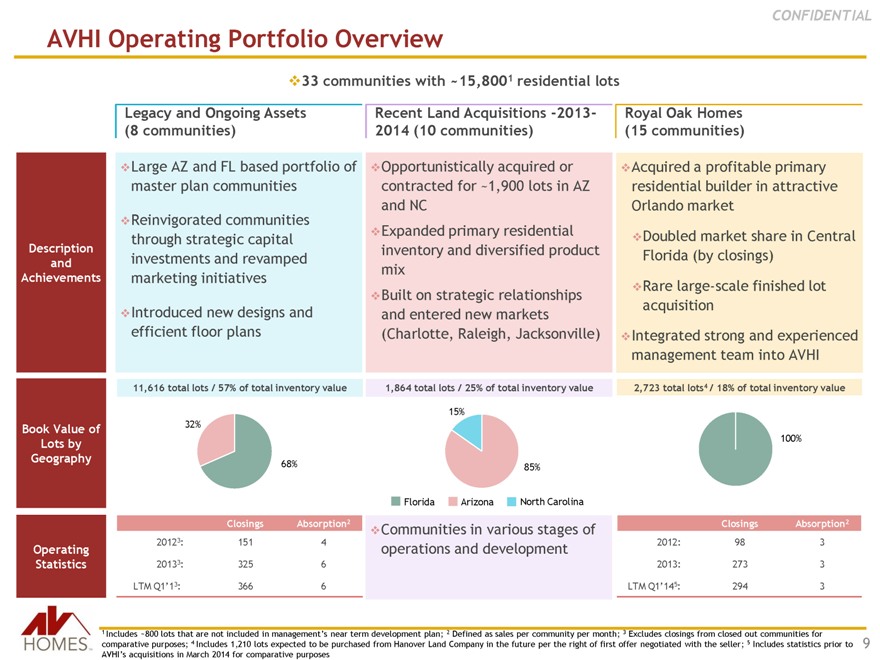

AVHI Operating Portfolio Overview

33 communities with ~15,8001 residential lots

Legacy and Ongoing Assets (8 communities)

AZ and FL based portfolio of master plan communities

Reinvigorated communities

through strategic capital investments and revamped marketing initiatives

Introduced new designs and efficient floor plans

11,616 total lots / 57% of total inventory value

Recent Land Acquisitions -2013-2014 (10 communities)

Opportunistically acquired or

contracted for ~1,900 lots in AZ and NC

Expanded primary residential inventory and diversified product mix

Build on strategic relationships and entered new markets (Charlotte, Raleigh, Jacksonville)

1,864 total lots / 25% of total inventory value

Royal Oak Homes

(15 communities)

Acquired a profitable primary residential builder in attractive Orlando market Doubled market share in Central Florida (by closings) Rare large-scale finished lot acquisition Integrated strong and experienced management team into AVHI

2,723 total lots4 / 18% of total inventory value

Description and Achievements

Book Value of Lots by Geography

Operating Statistics

32%

68%

Closings Absorption2

20123: 151 4

20133: 325 6

LTM Q1’13: 366 6

15%

85%

Florida Arizona North Carolina

Communities in various stages of operations and development

100%

Closings Absorption2

2012: 98 3 2013: 273 3 LTM Q1’145: 294 3

1 Includes ~800 lots that are not included in management’s near term development plan; 2 Defined as sales per community per month; 3 Excludes closings from closed out communities for comparative purposes; 4 Includes 1,210 lots expected to be purchased from Hanover Land Company in the future per the right of first offer negotiated with the seller; 5 Includes statistics prior to

AVHI’s acquisitions in March 2014 for comparative purposes

9

CONFIDENTIAL

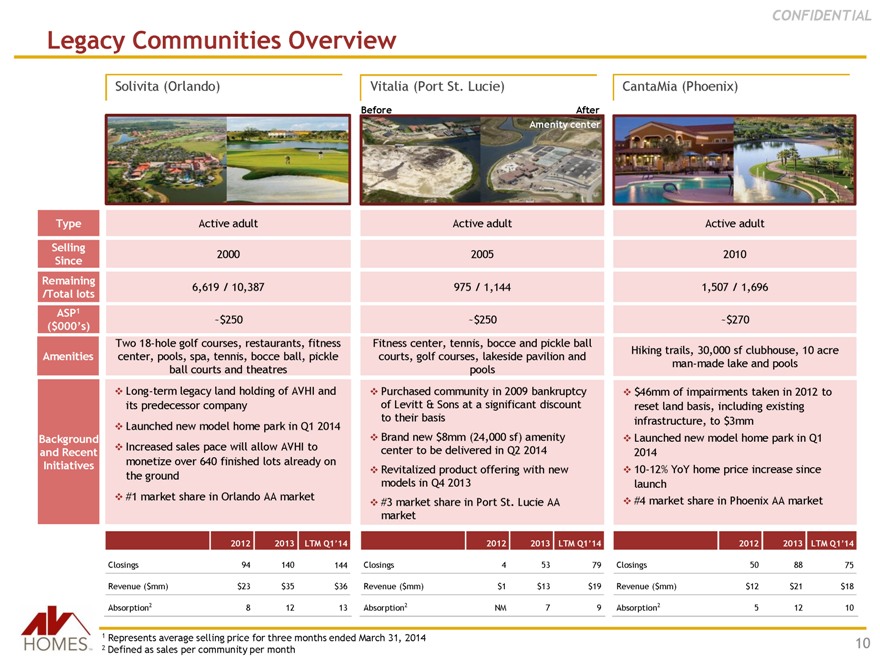

Legacy Communities Overview

Solivita (Orlando)

Active adult

2000

6,619 / 10,387

~$250

Two 18-hole golf courses, restaurants, fitness center, pools, spa, tennis, bocce ball, pickle ball courts and theatres Long-term legacy land holding of AVHI and its predecessor company Launched new model home park in Q1 2014 Increased sales pace will allow AVHI to monetize over 640 finished lots already on the ground #1 market share in Orlando AA market

Vitalia (Port St. Lucie)

Before After Amenity center

Active adult

2005

975 / 1,144

~$250

Fitness center, tennis, bocce and pickle ball courts, golf courses, lakeside pavilion and pools Purchased community in 2009 bankruptcy of Levitt & Sons at a significant discount to their basis Brand new $8mm (24,000 sf) amenity center to be delivered in Q2 2014 Revitalized product offering with new models in Q4 2013 #3 market share in Port St. Lucie AA market

CantaMia (Phoenix)

Active adult

2010

1,507 / 1,696

~$270

Hiking trails, 30,000 sf clubhouse, 10 acre man-made lake and pools

$46mm of impairments taken in 2012 to reset land basis, including existing infrastructure, to $3mm Launched new model home park in Q1 2014 10-12% YoY home price increase since launch #4 market share in Phoenix AA market

Type

Selling Since Remaining /Total lots ASP1

($000’s)

Amenities

Background and Recent Initiatives

2012 2013 LTM Q1’14

Closings 94 140 144 Revenue ($mm) $23 $35 $36 Absorption2 8 12 13

2012 2013 LTM Q1’14

Closings 4 53 79 Revenue ($mm) $1 $13 $19 Absorption2 NM 7 9

2012 2013 LTM Q1’14

Closings 50 88 75 Revenue ($mm) $12 $21 $18 Absorption2 5 12 10

1 | | Represents average selling price for three months ended March 31, 2014 |

2 | | Defined as sales per community per month |

10

CONFIDENTIAL

Legacy Communities Overview

Eastmark (Phoenix)

Active adult

2015

905

NA

15,000 sf activity center offering exercise machines, yoga, pools, spa and tennis courts Acquired Eastmark for $60,000 per acre in 2014 from DMB, the master planned developer Highly desirable location adjacent to the new 202 loop interchange AVHI has exclusive rights to offer AA homes in Eastmark

Began land development in Q1’14 with plan to launch home sales in

Q1’15

Bellalago and IOB (Orlando)

Primary residential

2002 / 2004

1,033 / 2,328

Bellalago: ~$260, IOB: ~$200 Access to Lake Toho, boat ramps, piers, water complex, fitness centers and sports complex ~1,559 acre master planned community developed in 2002

408 finished lots with a significant concentration of premier lake front lots remaining

Waterview (Orlando)

Before After Aerial shot

Primary residential

2014

527

NA

Pools with cabanas, community playgrounds and close proximity to schools Waterview was a long-term raw land holding located right on the main intersection and across from a school

Prior to TPG’s investment, AVHI did not have the capital to begin development at Waterview

Given improving sub-market fundamentals, AVHI began land development in 2014

AVHI pre-sold 28 homes in Q1’14

2012 2013 LTM Q1’14

Closings 3 32 43 Revenue ($mm) $1 $10 $12 Absorption2 1 2 2

Type Selling Since

Remaining / Total lots

ASP1

($000’s)

Amenities

Recent Initiatives

1 | | Represents average selling price for three months ended March 31, 2014 |

2 | | Defined as sales per community per month |

11

CONFIDENTIAL

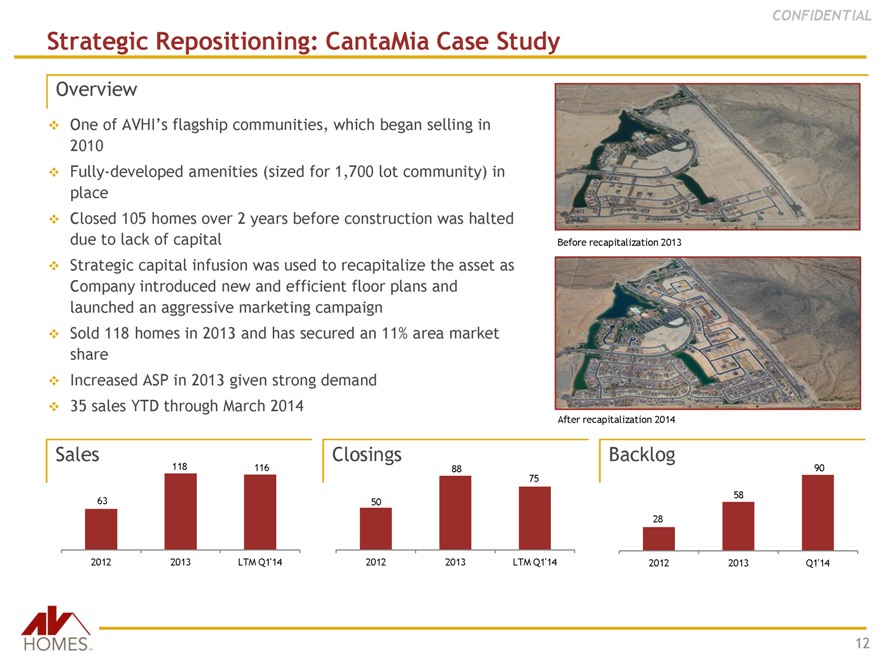

Strategic Repositioning: CantaMia Case Study

Overview

One of AVHI’s flagship communities, which began selling in

2010

Fully-developed amenities (sized for 1,700 lot community) in place Closed 105 homes over 2 years before construction was halted due to lack of capital Strategic capital infusion was used to recapitalize the asset as Company introduced new and efficient floor plans and launched an aggressive marketing campaign Sold 118 homes in 2013 and has secured an 11% area market share Increased ASP in 2013 given strong demand 35 sales YTD through March 2014

Before recapitalization 2013

After recapitalization 2014

Sales 118

116

63

2012 2013 LTM Q1’14

Closings

88 75 50

2012 2013 LTM Q1’14

Backlog

90 58 28

2012 2013 Q1’14

12

CONFIDENTIAL

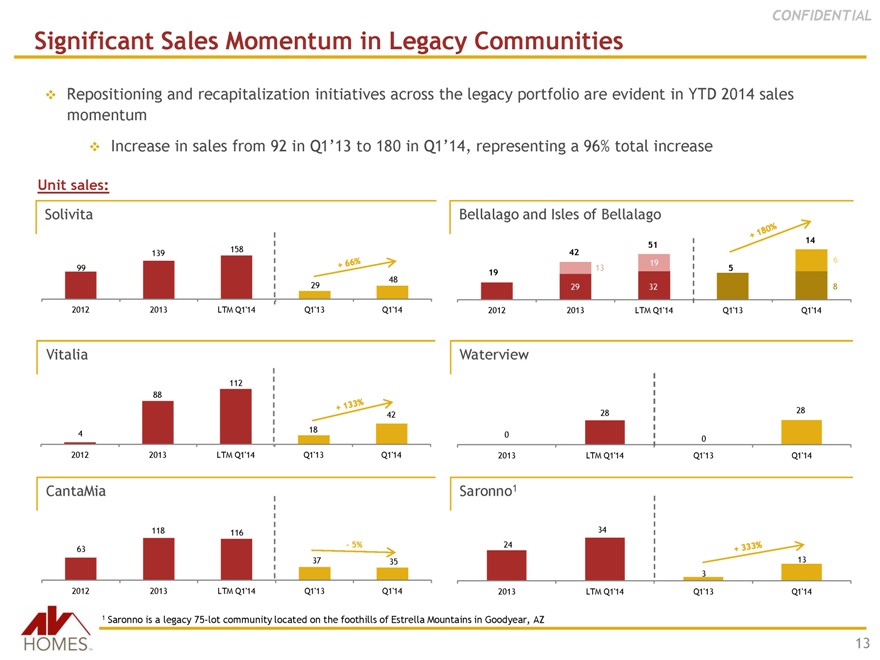

Significant Sales Momentum in Legacy Communities

Repositioning and recapitalization initiatives across the legacy portfolio are evident in YTD 2014 sales momentum

Increase in sales from 92 in Q1’13 to 180 in Q1’14, representing a 96% total increase

Unit sales:

Solivita Bellalago and Isles of Bellalago

14 51

139 158 42

99 13 19 5 6

19

+66%

+180%

+133%

48

29 29 32 8 2012 2013 LTM Q1’14 Q1’13 Q1’14 2012 2013 LTM Q1’14 Q1’13 Q1’14

Vitalia Waterview

112 88

28 28 42

0

0

2012 2013 LTM Q1’14 Q1’13 Q1’14 2013 LTM Q1’14 Q1’13 Q1’14

CantaMia Saronno1

118 116 34

- 5% 24

63

37 35 13 3 2012 2013 LTM Q1’14 Q1’13 Q1’14 2013 LTM Q1’14 Q1’13 Q1’14

1 | | Saronno is a legacy 75-lot community located on the foothills of Estrella Mountains in Goodyear, AZ |

13

CONFIDENTIAL

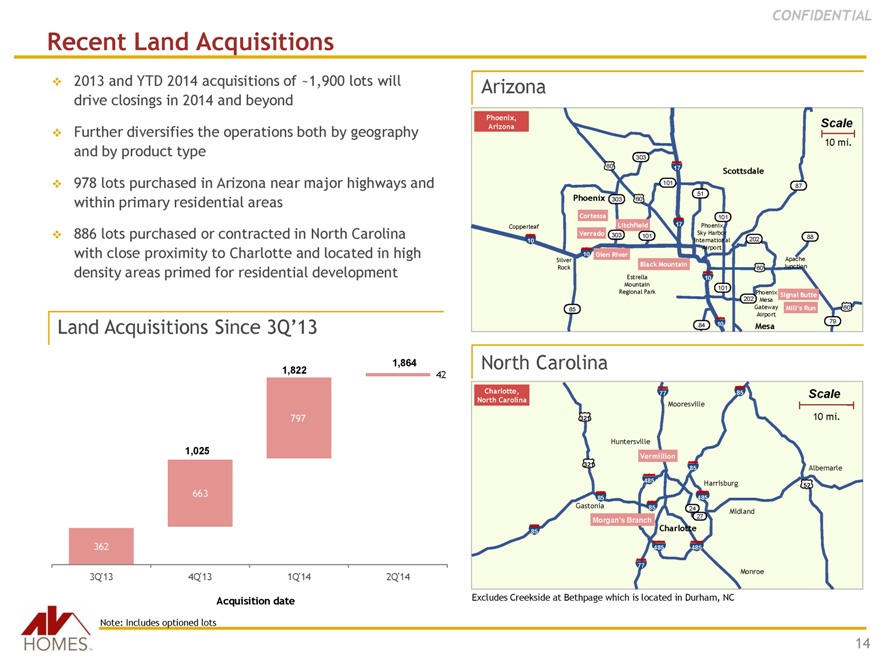

Recent Land Acquisitions

2013 and YTD 2014 acquisitions of ~1,900 lots will drive closings in 2014 and beyond

Further diversifies the operations both by geography and by product type

978 lots purchased in Arizona near major highways and within primary residential areas

886 lots purchased or contracted in North Carolina with close proximity to Charlotte and located in high density areas primed for residential development

Land Acquisitions Since 3Q’13

1,864 1,822 42

797

1,025

663

362

3Q’13 4Q’13 1Q’14 2Q’14

Acquisition date

Arizona

Phoenix,

Arizona Scale

10 mi.

303

60 17

Scottsdale

101

87

Phoenix 303 60 51

Cortessa 101

Copperleaf Litchfield 17 Phoenix Verrado 303 Sky Harbor

101 88

10 International 202 Airport

10 Glen River

Silver Apache

Rock Black Mountain Junction

60

Estrella 10 Mountain

101

Regional Park Phoenix Signal Butte 202 Mesa

85 Gateway Mill’s Run 60

Airport

79

84 10 Mesa

North Carolina

Charlotte, 77 85 Scale North Carolina

Mooresville

321 10 mi.

Huntersville

Vermillion

321

85 Albemarle 485 Harrisburg

52

85 485

Gastonia 85 24

27 Midland

Morgan’s Branch Charlotte

85

485 485

77 Monroe

Excludes Creekside at Bethpage which is located in Durham, NC

Note: Includes optioned lots

14

CONFIDENTIAL

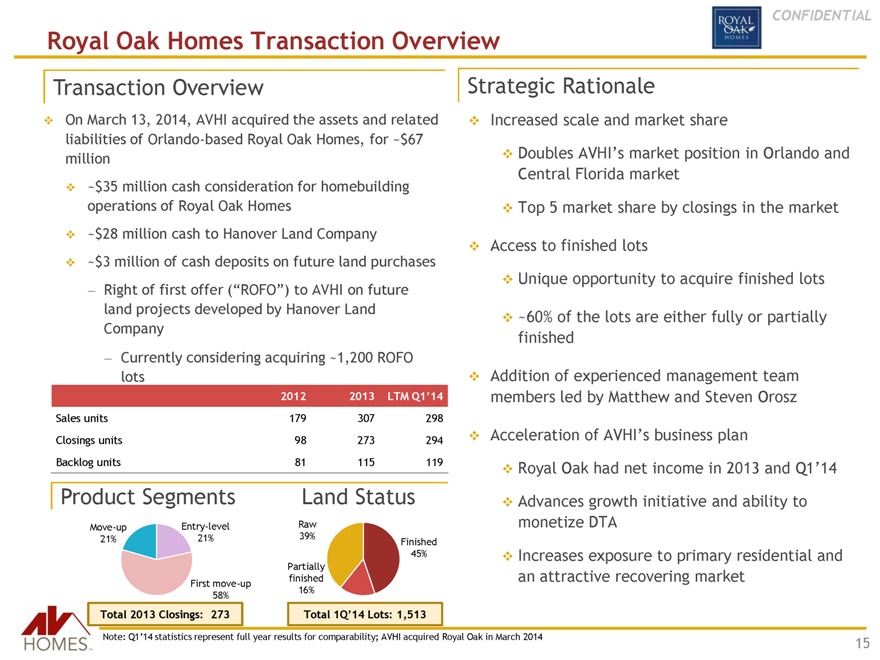

Royal Oak Homes Transaction Overview

Transaction Overview

On March 13, 2014, AVHI acquired the assets and related liabilities of Orlando-based Royal Oak Homes, for ~$67 million ~$35 million cash consideration for homebuilding operations of Royal Oak Homes ~$28 million cash to Hanover Land Company ~$3 million of cash deposits on future land purchases

— Right of first offer (“ROFO”) to AVHI on future land projects developed by Hanover Land Company

— Currently considering acquiring ~1,200 ROFO lots

2012 2013 LTM Q1’14

Sales units 179 307 298 Closings units 98 273 294 Backlog units 81 115 119

Strategic Rationale

Increased scale and market share

Doubles AVHI’s market position in Orlando and

Central Florida market

Top 5 market share by closings in the market

Access to finished lots

Unique opportunity to acquire finished lots

~60% of the lots are either fully or partially finished

Addition of experienced management team members led by Matthew and Steven Orosz

Acceleration of AVHI’s business plan

Royal Oak had net income in 2013 and Q1’14

Advances growth initiative and ability to monetize DTA

Increases exposure to primary residential and an attractive recovering market

Product Segments

Move-up Entry-level 21% 21%

First move-up 58%

Total 2013 Closings: 273

Land Status

Raw 39%

Finished 45% Partially finished 16%

Total 1Q’14 Lots: 1,513

Note: Q1’14 statistics represent full year results for comparability; AVHI acquired Royal Oak in March 2014

15

Key Investment Merits

CONFIDENTIAL

Key Investment Merits

Significant Progress in Repositioning to Become a Profitable, Diversified Builder

Attractive Capital Structure and Asset Coverage

Positioned for Growth through Community Count Increases on Primarily Owned Land

Attractively Positioned in High Growth Markets

Maximizing Consumer Experience and Value Proposition

Experienced Management Team

Committed Sponsor with Strong Industry Experience

17

CONFIDENTIAL

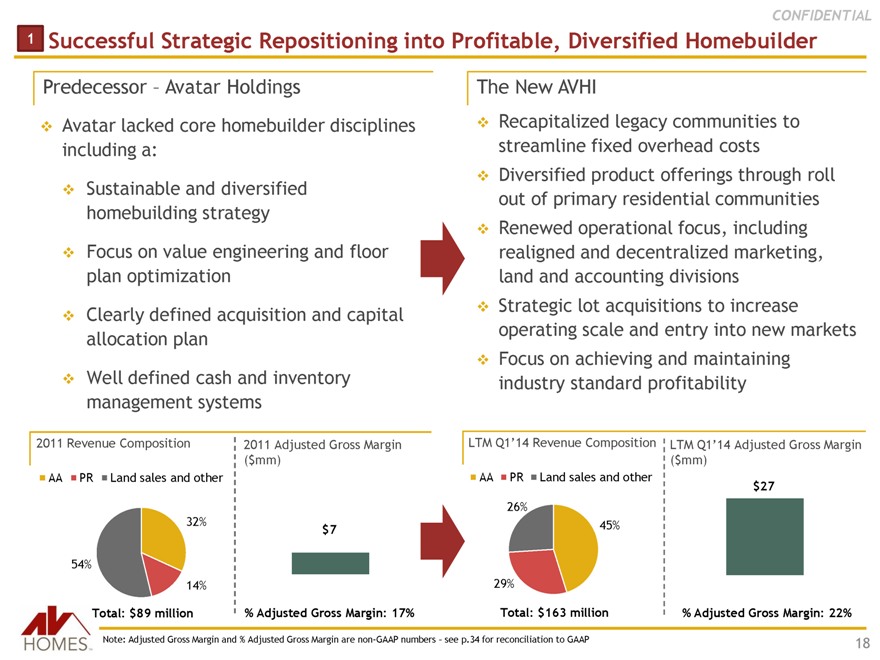

1 | | Successful Strategic Repositioning into Profitable, Diversified Homebuilder |

Predecessor – Avatar Holdings

Avatar lacked core homebuilder disciplines including a:

Sustainable and diversified homebuilding strategy

Focus on value engineering and floor plan optimization

Clearly defined acquisition and capital allocation plan

Well defined cash and inventory management systems

The New AVHI

Recapitalized legacy communities to streamline fixed overhead costs Diversified product offerings through roll out of primary residential communities Renewed operational focus, including realigned and decentralized marketing, land and accounting divisions

Strategic lot acquisitions to increase operating scale and entry into new markets Focus on achieving and maintaining industry standard profitability

2011 Revenue Composition

AA PR Land sales and other

32%

54%

14%

Total: $89 million

2011 Adjusted Gross Margin ($mm)

$7

% Adjusted Gross Margin: 17%

LTM Q1’14 Revenue Composition

AA PR Land sales and other

26%

45%

29%

Total: $163 million

LTM Q1’14 Adjusted Gross Margin

($mm) $27

% Adjusted Gross Margin: 22%

Note: Adjusted Gross Margin and % Adjusted Gross Margin are non-GAAP numbers – see p.34 for reconciliation to GAAP

18

CONFIDENTIAL

2 | | Positioned for Growth through Community Count Increases on Primarily Owned Land |

Attractive mix of finished land positions for near-term homebuilding operations and longer-term strategic land positions to support future growth

Substantially all of 2014 and 2015 closings come from existing land inventory

Legacy Closed out communities Recent land acquisitions Royal Oak

Significant community count growth through acquisition of Royal Oak and additional communities from recent land acquisitions to come on-line over the next 12-18 months

Active Community count

33

15

10

~5x increase

2012

Active adult focus

Lack of capital hindered maximizing the full potential of AVHI’s communities

2013

Diversification into PR communities through land acquisitions Reinforced efforts in building and marketing flagship AA communities

2014 / 2015

Integration of Royal Oak communities Expansion into North Carolina markets Addition of new communities through recent land acquisitions Addition of 2 AA communities: Eastmark in Phoenix and Creekside in Durham, NC

19

CONFIDENTIAL

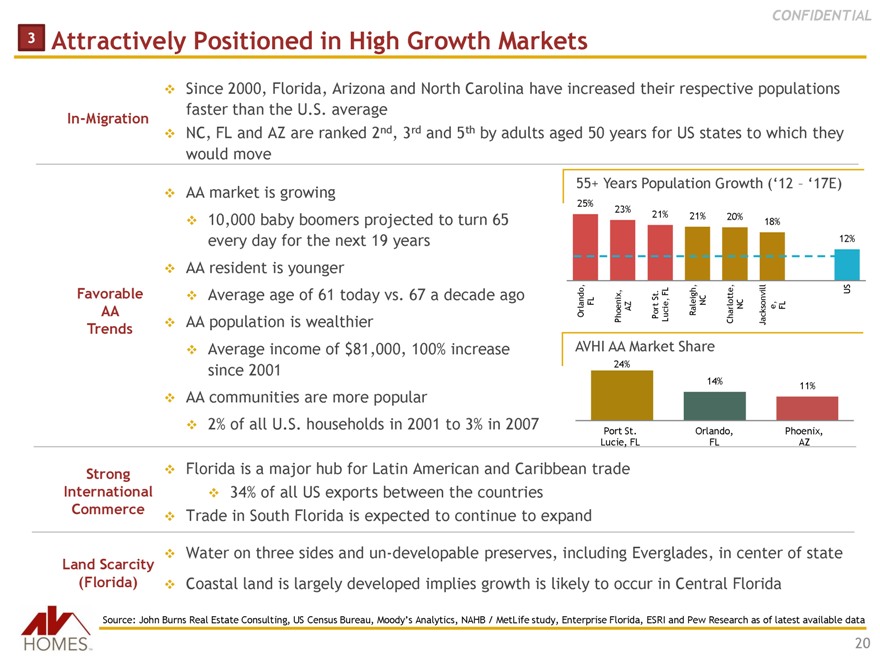

3 | | Attractively Positioned in High Growth Markets |

Since 2000, Florida, Arizona and North Carolina have increased their respective populations faster than the U.S. average

In-Migration and AZ nd rd th

NC, FL are ranked 2 , 3 and 5 by adults aged 50 years for US states to which they would move

AA market is growing

10,000 baby boomers projected to turn 65 every day for the next 19 years AA resident is younger Average age of 61 today vs. 67 a decade ago AA population is wealthier Average income of $81,000, 100% increase since 2001 AA communities are more popular 2% of all U.S. households in 2001 to 3% in 2007

Florida is a major hub for Latin American and Caribbean trade 34% of all US exports between the countries Trade in South Florida is expected to continue to expand

Water on three sides and un-developable preserves, including Everglades, in center of state Coastal land is largely developed implies growth is likely to occur in Central Florida

Favorable AA

Trends

Strong International Commerce

Land Scarcity (Florida)

Source: John Burns Real Estate Consulting, US Census Bureau, Moody’s Analytics, NAHB / MetLife study, Enterprise Florida, ESRI and Pew Research as of latest available data

55+ Years Population Growth (‘12 – ‘17E)

25%

23%

21% 21% 20%

18%

12%

US FL

St.

Orlando, FL Phoenix, AZ Port Lucie, Raleigh, NC Charlotte, NC Jacksonvill e, FL

AVHI AA Market Share

24%

14%

11%

Port St. Orlando, Phoenix, Lucie, FL FL AZ

20

3

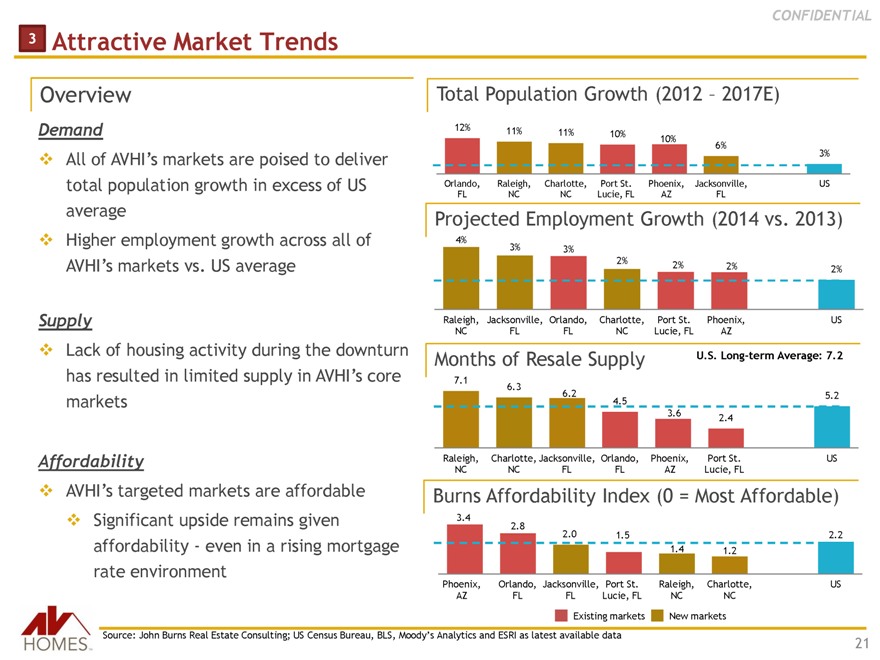

Attractive Market Trends

CONFIDENTIAL

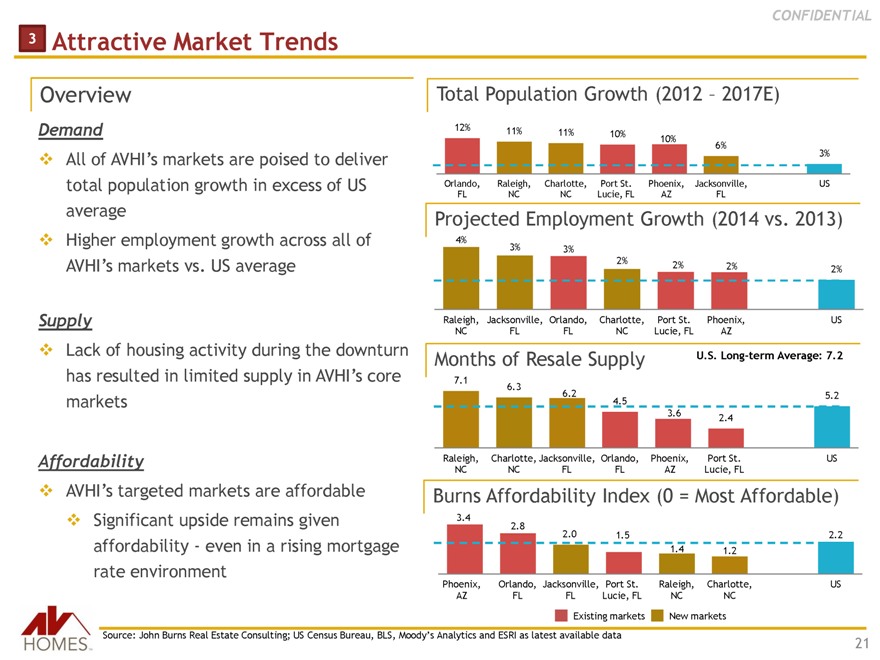

Overview

Demand

All of AVHI’s markets are poised to deliver total population growth in excess of US average Higher employment growth across all of

AVHI’s markets vs. US average

Supply

Lack of housing activity during the downturn has resulted in limited supply in AVHI’s core markets

Affordability

AVHI’s targeted markets are affordable

Significant upside remains given affordability—even in a rising mortgage rate environment

Total Population Growth (2012 – 2017E)

12% 11%

11% 10%

10%

6%

3%

Orlando, Raleigh, Charlotte, Port St. Phoenix, Jacksonville, US FL NC NC Lucie, FL AZ FL

Projected Employment Growth (2014 vs. 2013)

4%

3% 3%

2% 2%

2% 2%

Raleigh, Jacksonville, Orlando, Charlotte, Port St. Phoenix, US NC FL FL NC Lucie, FL AZ

Months of Resale Supply U.S. Long-term Average: 7.2

7.1

6.3

6.2 5.2 4.5 3.6 2.4

Raleigh, Charlotte, Jacksonville, Orlando, Phoenix, Port St. US NC NC FL FL AZ Lucie, FL

Burns Affordability Index (0 = Most Affordable)

3.4 2.8

2.0 1.5 2.2 1.4 1.2

Phoenix, Orlando, Jacksonville, Port St. Raleigh, Charlotte, US AZ FL FL Lucie, FL NC NC

Existing markets New markets

Source: John Burns Real Estate Consulting; US Census Bureau, BLS, Moody’s Analytics and ESRI as latest available data

21

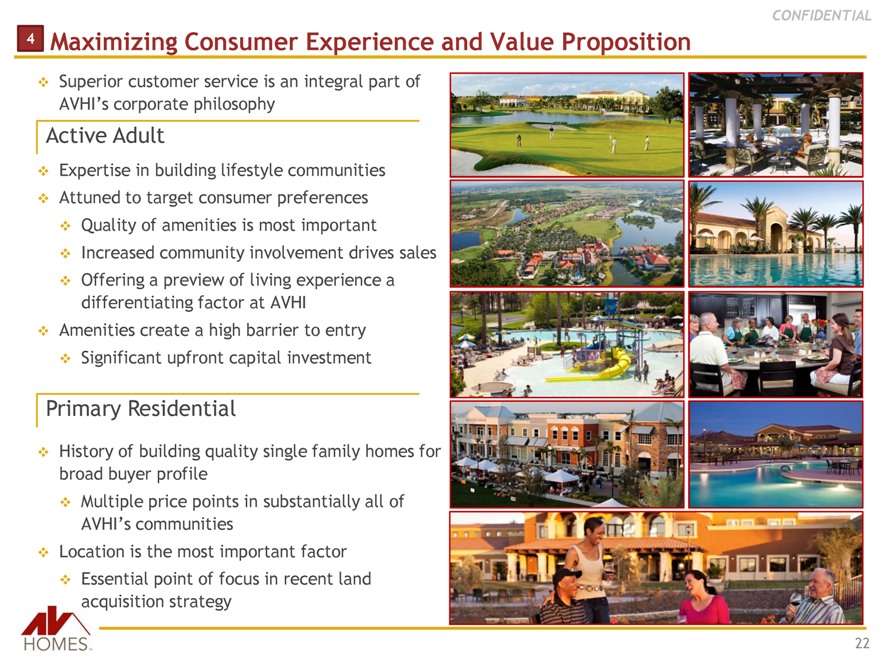

4 Maximizing Consumer Experience and Value Proposition

CONFIDENTIAL

Superior customer service is an integral part of

AVHI’s corporate philosophy

Active Adult

Expertise in building lifestyle communities Attuned to target consumer preferences Quality of amenities is most important Increased community involvement drives sales Offering a preview of living experience a differentiating factor at AVHI

Amenities create a high barrier to entry Significant upfront capital investment

Primary Residential

History of building quality single family homes for broad buyer profile Multiple price points in substantially all of

AVHI’s communities

Location is the most important factor Essential point of focus in recent land acquisition strategy

22

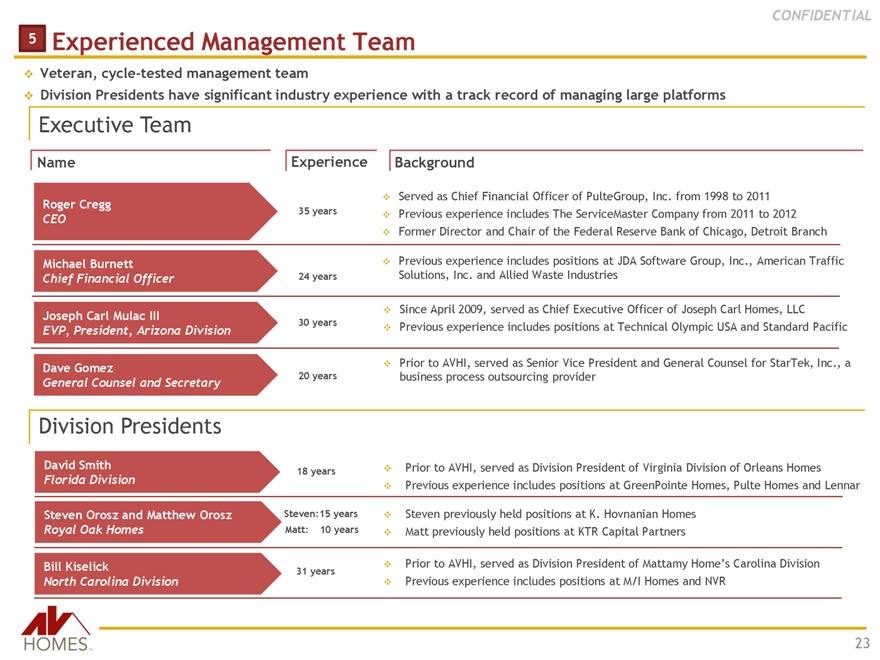

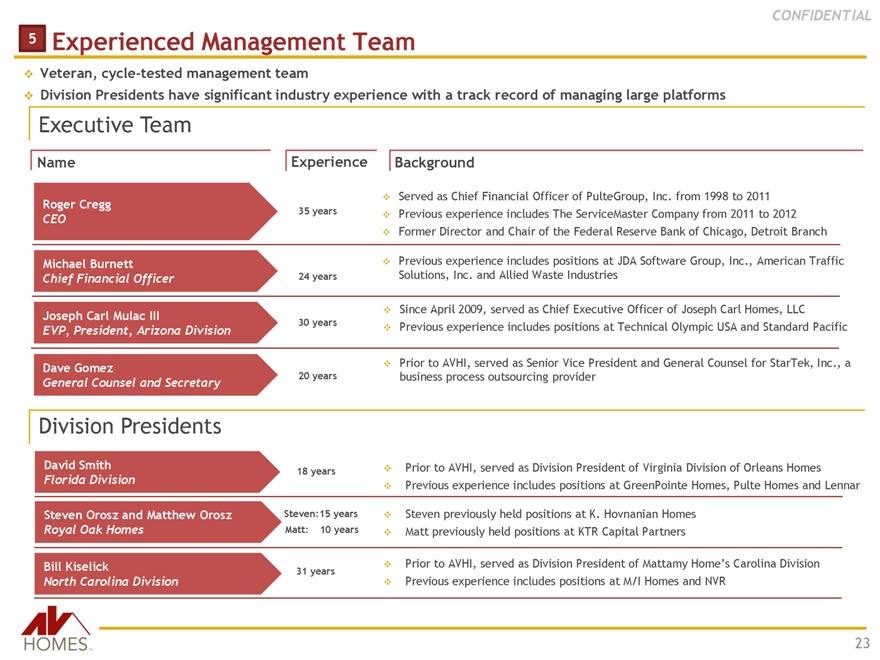

5 Experienced Management Team

CONFIDENTIAL

Veteran, cycle-tested management team

Division Presidents have significant industry experience with a track record of managing large platforms

Executive Team

Name

Roger Cregg

CEO

Michael Burnett

Chief Financial Officer

Joseph Carl Mulac III

EVP, President, Arizona Division

Dave Gomez

General Counsel and Secretary

Experience

35 years 24 years 30 years 20 years

Background

Served as Chief Financial Officer of PulteGroup, Inc. from 1998 to 2011 Previous experience includes The ServiceMaster Company from 2011 to 2012 Former Director and Chair of the Federal Reserve Bank of Chicago, Detroit Branch

Previous experience includes positions at JDA Software Group, Inc., American Traffic Solutions, Inc. and Allied Waste Industries

Since April 2009, served as Chief Executive Officer of Joseph Carl Homes, LLC

Previous experience includes positions at Technical Olympic USA and Standard Pacific

Prior to AVHI, served as Senior Vice President and General Counsel for StarTek, Inc., a business process outsourcing provider

Division Presidents

David Smith

Florida Division

Steven Orosz and Matthew Orosz

Royal Oak Homes

Bill Kiselick

North Carolina Division

18 years

Steven:15 years Matt: 10 years

31 years

Prior to AVHI, served as Division President of Virginia Division of Orleans Homes

Previous experience includes positions at GreenPointe Homes, Pulte Homes and Lennar

Steven previously held positions at K. Hovnanian Homes Matt previously held positions at KTR Capital Partners

Prior to AVHI, served as Division President of Mattamy Home’s Carolina Division

Previous experience includes positions at M/I Homes and NVR

23

6 Committed Sponsor with Strong Industry Experience

CONFIDENTIAL

Overview of

A leading private investment firm founded in 1992 $59bn of assets under management 18 global offices

Long history of growth investing and backing highly accomplished management teams of world-class franchises

Experienced investor of minority stakes in public companies; recent investments include: Armstrong World Industries, Copano Energy and Parkway Properties

Recent investments in the U.S. real estate sector:

— $135 million in AV Homes (NASDAQ: AVHI)

— $200 million in Parkway Properties (NYSE: PKY)

— $464 million in Taylor Morrison (NYSE: TMHC)

— $505 million in Catellus

24

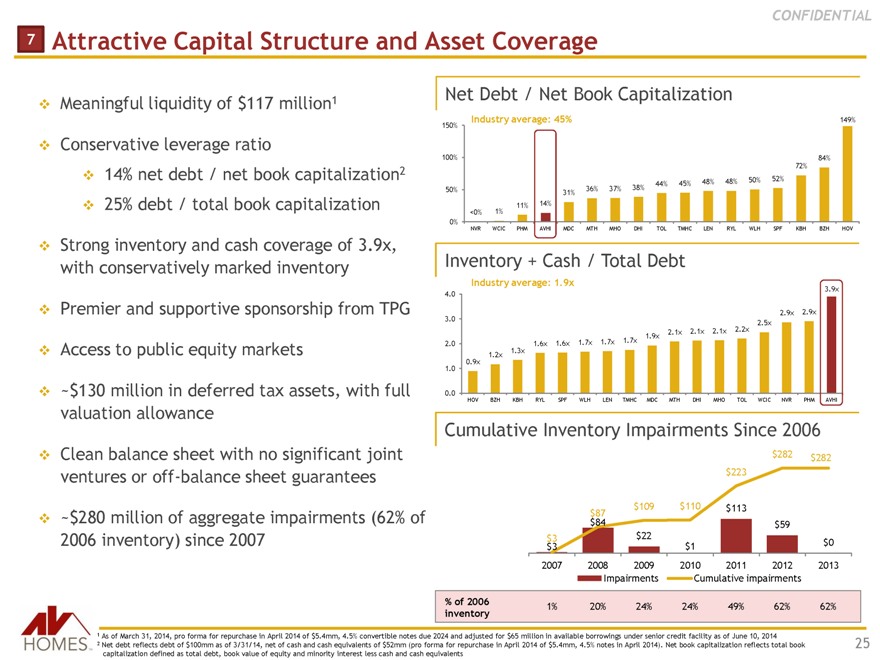

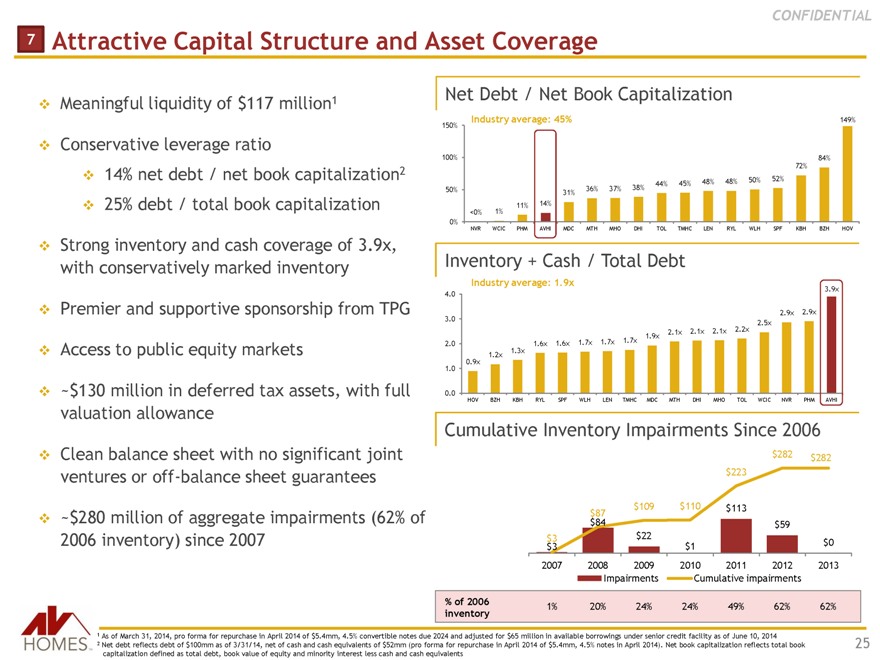

7 Attractive Capital Structure and Asset Coverage

CONFIDENTIAL

Meaningful liquidity of $117 million 1

Conservative leverage ratio

14% net debt / net book capitalization 2

25% debt / total book capitalization

Strong inventory and cash coverage of 3.9x, with conservatively marked inventory

Premier and supportive sponsorship from TPG

Access to public equity markets

~$130 million in deferred tax assets, with full valuation allowance

Clean balance sheet with no significant joint ventures or off-balance sheet guarantees

~$280 million of aggregate impairments (62% of 2006 inventory) since 2007

Net Debt / Net Book Capitalization

Industry average: 45% 149%

150%

100% 84% 72% 48% 48% 50% 52% 44% 45% 50% 36% 37% 38% 31% 11% 14% <0% 1% 0%

NVR WCIC PHM AVHI MDC MTH MHO DHI TOL TMHC LEN RYL WLH SPF KBH BZH HOV

Inventory + Cash / Total Debt

Industry average: 1.9x

3.9x 4.0

3.0 2.9x 2.9x 2.2x 2.5x 2.1x 2.1x 2.1x 1.9x 2.0 1.6x 1.6x 1.7x 1.7x 1.7x 1.3x 0.9x 1.2x 1.0

0.0

HOV BZH KBH RYL SPF WLH LEN TMHC MDC MTH DHI MHO TOL WCIC NVR PHM AVHI

Cumulative Inventory Impairments Since 2006

$282 $282 $223

$109 $110 $113 $ $84 87 $59

$3 $22

$3 $1 $0 2007 2008 2009 2010 2011 2012 2013 Impairments Cumulative impairments

% of 2006

1% 20% 24% 24% 49% 62% 62% inventory

1 As of March 31, 2014, pro forma for repurchase in April 2014 of $5.4mm, 4.5% convertible notes due 2024 and adjusted for $65 million in available borrowings under senior credit facility as of June 10, 2014

2 Net debt reflects debt of $100mm as of 3/31/14, net of cash and cash equivalents of $52mm (pro forma for repurchase in April 2014 of $5.4mm, 4.5% notes in April 2014). Net book capitalization reflects total book capitalization defined as total debt, book value of equity and minority interest less cash and cash equivalents

25

CONFIDENTIAL

Operating and Financial Strategy

Short Term Strategy

Continue opportunistic lot purchases to leverage platform

Build out additional primary residential communities on newly acquired lot position Target new product development mix: 2/3 primary residential; 1/3 active adult Streamline costs for profitability through a rigorous focus on value engineering

Provide customers with diverse price points across communities to target various buyer profiles Continue geographic diversification through build out of North Carolina communities in 2014 Migrate towards industry profitability

Long Term Strategy

Maintain a balanced portfolio of active adult and primary residential communities Maintain a sufficient supply of raw land in key markets for future build out

Continue to enhance capital allocation across existing markets and consider opportunistic entry into new markets Build a recognizable brand name associated with a high quality product Continue to opportunistically monetize non-strategic assets for additional liquidity Maintain prudent capital structure Closely manage debt to book capitalization

26

Financial Overview

CONFIDENTIAL

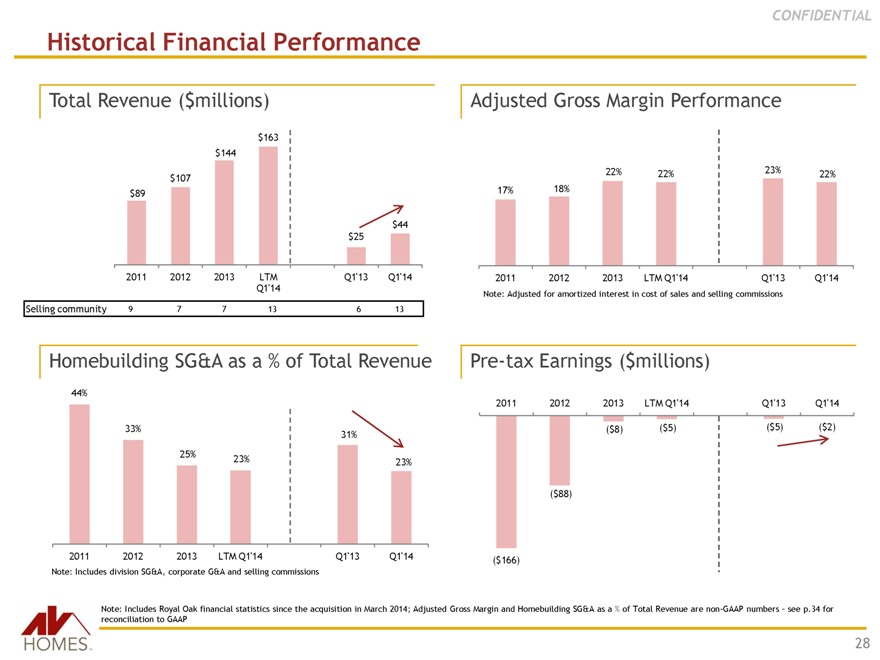

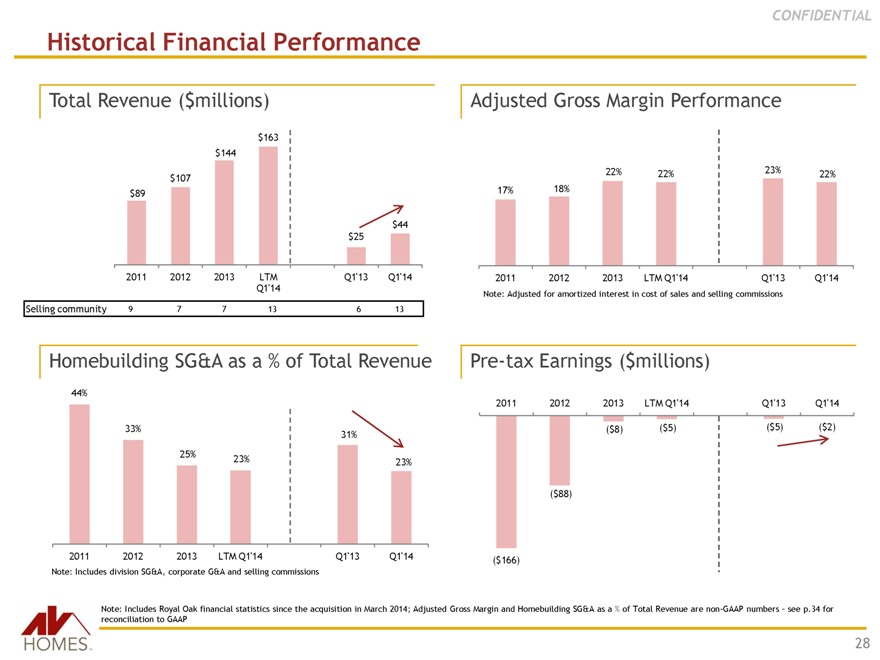

Historical Financial Performance

Total Revenue ($millions)

$163 $144

$107 $89

$44 $25

2011 2012 2013 LTM Q1’13 Q1’14 Q1’14

Adjusted Gross Margin Performance

22% 22% 23% 22% 17% 18%

2011 2012 2013 LTM Q1’14 Q1’13 Q1’14

Note: Adjusted for amortized interest in cost of sales and selling commissions

Selling community 9 7 7 13 6 13

Homebuilding SG&A as a % of Total Revenue

44%

33%

31% 25%

23% 23%

2011 2012 2013 LTM Q1’14 Q1’13 Q1’14

Pre-tax Earnings ($millions)

2011 2012 2013 LTM Q1’14 Q1’13 Q1’14

($8) ($5) ($5) ($2)

($88)

($166)

Note: Includes division SG&A, corporate G&A and selling commissions

Note: Includes Royal Oak financial statistics since the acquisition in March 2014; Adjusted Gross Margin and Homebuilding SG&A as a % of Total Revenue are non-GAAP numbers – see p.34 for reconciliation to GAAP

28

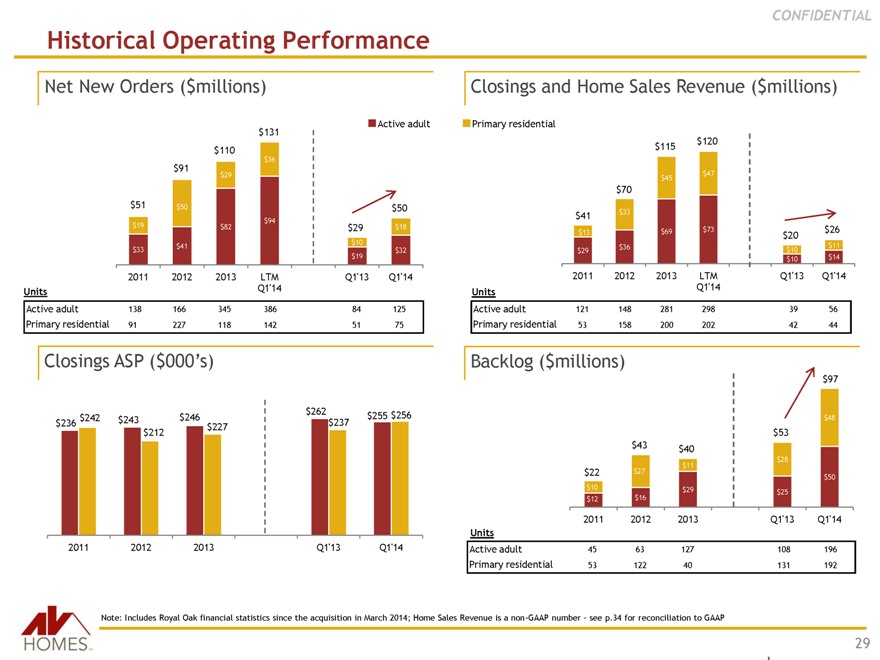

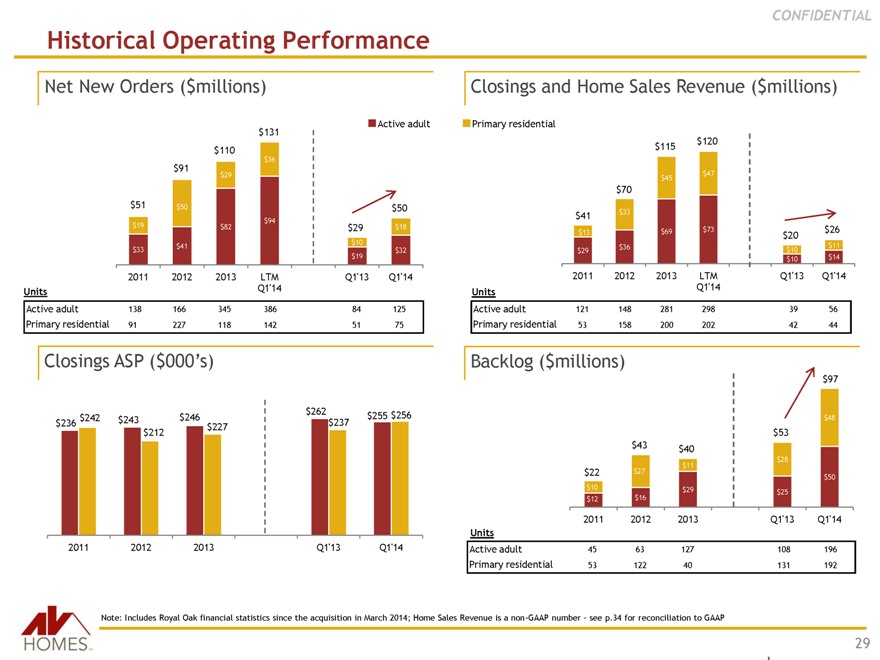

Historical Operating Performance

CONFIDENTIAL

Net New Orders ($millions)

Active adult $131 $110

$91 $36

$29

$51 $50 $50

$94

$19 $82 $29 $18 $10 $41

$33 $19 $32

2011 2012 2013 LTM Q1’13 Q1’14 Q1’14

Units Q1’14

Active adult 138 166 345 386 84 125

Primary residential 91 227 118 142 51 75

Closings and Home Sales Revenue ($millions)

Primary residential $120 $115

$47 $45

$70

$41 $33

$13 $69 $73 $26

$20

$36 $11

$29 $10

$10 $14

2011 2012 2013 LTM Q1’13 Q1’14 Q1’14

Units

Active adult 121 148 281 298 39 56

Primary residential 53 158 200 202 42 44

Closings ASP ($000’s)

$262 $255 $256 $242 $243 $246 $236 $227 $237 $212

2011 2012 2013 Q1’13 Q1’14

Backlog ($millions)

$43 $40

$11

$22 $27

$10 $29

$12 $16

2011 2012 2013

$97

$48

$53

$28

$50 $25

Q1’13 Q1’14

Units

Active adult 45 63 127 108 196

Primary residential 53 122 40 131 192

Note: Includes Royal Oak financial statistics since the acquisition in March 2014; Home Sales Revenue is a non-GAAP number – see p.34 for reconciliation to GAAP

29

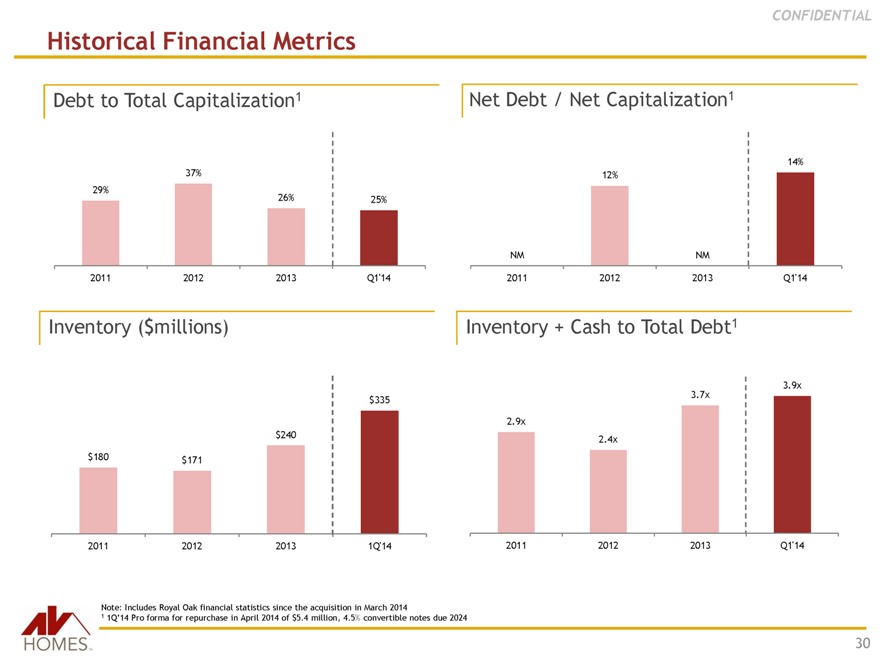

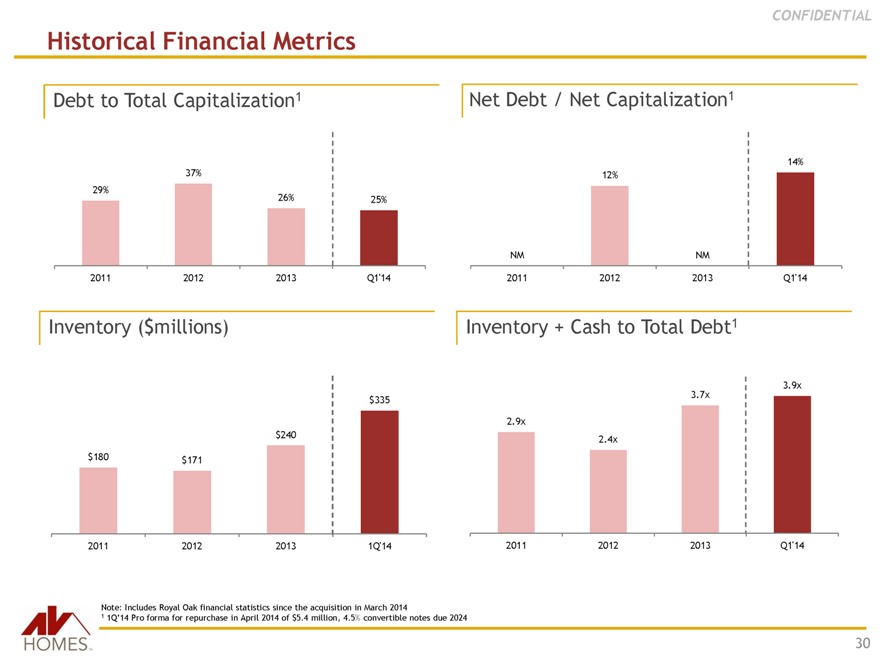

Historical Financial Metrics

CONFIDENTIAL

Debt to Total Capitalization1

37% 29%

26% 25%

2011 2012 2013 Q1’14

Net Debt / Net Capitalization1

14% 12%

NM NM

2011 2012 2013 Q1’14

Inventory ($millions)

$335

$240

$180 $171

2011 2012 2013 1Q’14

Inventory + Cash to Total Debt1

3.7x 3.9x

2.9x

2.4x

2011 2012 2013 Q1’14

Note: Includes Royal Oak financial statistics since the acquisition in March 2014

1 1Q’14 Pro forma for repurchase in April 2014 of $5.4 million, 4.5% convertible notes due 2024

30

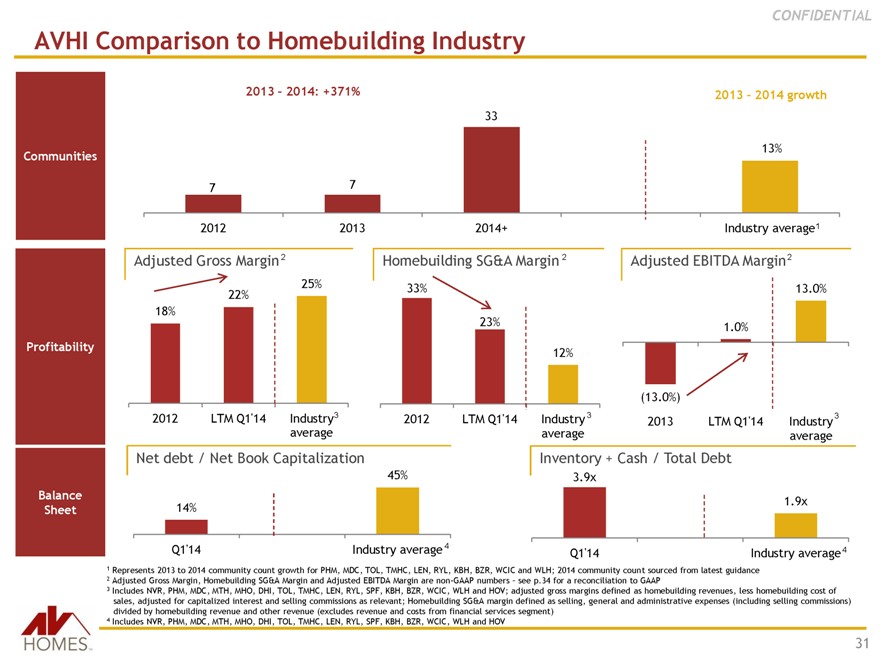

AVHI Comparison to Homebuilding Industry

CONFIDENTIAL

Communities

Profitability

Balance Sheet

2013 – 2014: +371%

33

7 7

2012 2013 2014+

2013 – 2014 growth

13%

Industry average1

Adjusted Gross Margin 2

Homebuilding SG&A Margin 2

Adjusted EBITDA Margin2

22% 25% 18%

2012 LTM Q1’14 Industry3 average

33%

23%

12%

2012 LTM Q1’14 Industry 3 average

13.0%

1.0%

(13.0%)

2013 LTM Q1’14 Industry 3 average

Net debt / Net Book Capitalization

14%Q1’14

45%

Industry average 4

Inventory + Cash / Total Debt

3.9x

Q1’14

1.9x

Industry average 4

1 Represents 2013 to 2014 community count growth for PHM, MDC, TOL, TMHC, LEN, RYL, KBH, BZR, WCIC and WLH; 2014 community count sourced from latest guidance

2 Adjusted Gross Margin, Homebuilding SG&A Margin and Adjusted EBITDA Margin are non-GAAP numbers – see p.34 for a reconciliation to GAAP

3 Includes NVR, PHM, MDC, MTH, MHO, DHI, TOL, TMHC, LEN, RYL, SPF, KBH, BZR, WCIC, WLH and HOV; adjusted gross margins defined as homebuilding revenues, less homebuilding cost of sales, adjusted for capitalized interest and selling commissions as relevant; Homebuilding SG&A margin defined as selling, general and administrative expenses (including selling commissions) divided by homebuilding revenue and other revenue (excludes revenue and costs from financial services segment)

4 Includes NVR, PHM, MDC, MTH, MHO, DHI, TOL, TMHC, LEN, RYL, SPF, KBH, BZR, WCIC, WLH and HOV

31

CONFIDENTIAL

Key takeaways

Significant progress in repositioning to become a profitable, diversified builder Well positioned for growth through increased community count, principally on already owned land

Attractively positioned in high growth markets

Maximizing consumer experience and value proposition Experienced management team Committed sponsor with strong industry expertise Attractive capital structure and asset coverage

32

Appendix

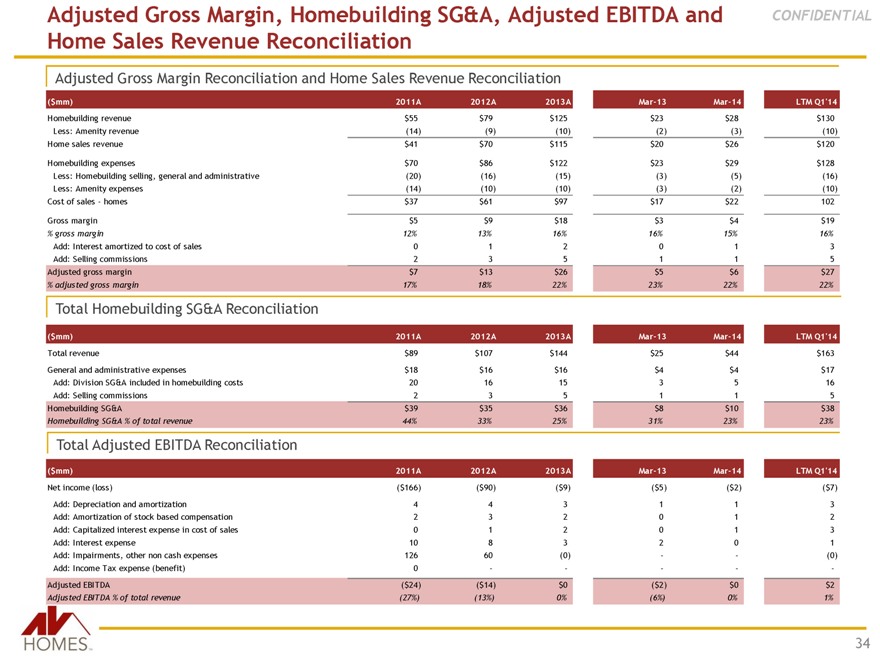

Adjusted Gross Margin, Homebuilding SG&A, Adjusted EBITDA and Home Sales Revenue Reconciliation

CONFIDENTIAL

Adjusted Gross Margin Reconciliation and Home Sales Revenue Reconciliation

($mm) 2011A 2012A 2013A Mar-13 Mar-14 LTM Q1’14

Homebuilding revenue $55 $79 $125 $23 $28 $130

Less: Amenity revenue(14)(9)(10)(2)(3)(10)

Home sales revenue $41 $70 $115 $20 $26 $120

Homebuilding expenses $70 $86 $122 $23 $29 $128

Less: Homebuilding selling, general and administrative(20)(16)(15)(3)(5)(16)

Less: Amenity expenses(14)(10)(10)(3)(2)(10)

Cost of sales—homes $37 $61 $97 $17 $22 102

Gross margin $5 $9 $18 $3 $4 $19

% gross margin 12% 13% 16% 16% 15% 16%

Add: Interest amortized to cost of sales 0 1 2 0 1 3

Add: Selling commissions 2 3 5 1 1 5

Adjusted gross margin $7 $13 $26 $5 $6 $27

% adjusted gross margin 17% 18% 22% 23% 22% 22%

Total Homebuilding SG&A Reconciliation

($mm) 2011A 2012A 2013A Mar-13 Mar-14 LTM Q1’14

Total revenue $89 $107 $144 $25 $44 $163

General and administrative expenses $18 $16 $16 $4 $4 $17

Add: Division SG&A included in homebuilding costs 20 16 15 3 5 16

Add: Selling commissions 2 3 5 1 1 5

Homebuilding SG&A $39 $35 $36 $8 $10 $38

Homebuilding SG&A % of total revenue 44% 33% 25% 31% 23% 23%

Total Adjusted EBITDA Reconciliation

($mm) 2011A 2012A 2013A Mar-13 Mar-14 LTM Q1’14

Net income (loss)($166)($90)($9)($5)($2)($7)

Add: Depreciation and amortization 4 4 3 1 1 3

Add: Amortization of stock based compensation 2 3 2 0 1 2

Add: Capitalized interest expense in cost of sales 0 1 2 0 1 3

Add: Interest expense 10 8 3 2 0 1

Add: Impairments, other non cash expenses 126 60(0) —(0)

Add: Income Tax expense (benefit) 0 — — -

Adjusted EBITDA($24)($14) $0($2) $0 $2

Adjusted EBITDA % of total revenue(27%)(13%) 0%(6%) 0% 1%

34

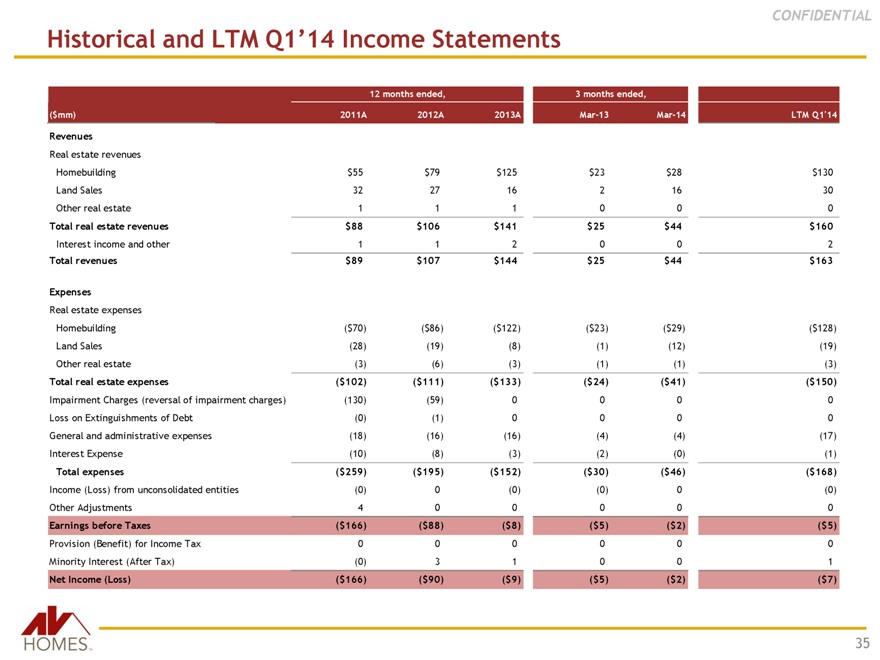

Historical and LTM Q1’14 Income Statements

CONFIDENTIAL

12 months ended, 3 months ended,

($mm) 2011A 2012A 2013A Mar-13 Mar-14 LTM Q1’14

Revenues

Real estate revenues

Homebuilding $55 $79 $125 $23 $28 $130

Land Sales 32 27 16 2 16 30

Other real estate 1 1 1 0 0 0

Total real estate revenues $88 $106 $141 $25 $44 $160

Interest income and other 1 1 2 0 0 2

Total revenues $89 $107 $144 $25 $44 $163

Expenses

Real estate expenses

Homebuilding ($70) ($86) ($122) ($23) ($29) ($128)

Land Sales (28) (19) (8) (1) (12) (19)

Other real estate (3) (6) (3) (1) (1) (3)

Total real estate expenses ($102) ($111) ($133) ($24) ($41) ($150)

Impairment Charges (reversal of impairment charges) (130) (59) 0 0 0 0

Loss on Extinguishments of Debt (0) (1) 0 0 0 0

General and administrative expenses (18) (16) (16) (4) (4) (17)

Interest Expense (10) (8) (3) (2) (0) (1)

Total expenses ($259) ($195) ($152) ($30) ($46) ($168)

Income (Loss) from unconsolidated entities (0) 0 (0) (0) 0 (0)

Other Adjustments 4 0 0 0 0 0

Earnings before Taxes ($166) ($88) ($8) ($5) ($2) ($5)

Provision (Benefit) for Income Tax 0 0 0 0 0 0

Minority Interest (After Tax) (0) 3 1 0 0 1

Net Income (Loss) ($166) ($90) ($9) ($5) ($2) ($7)

35

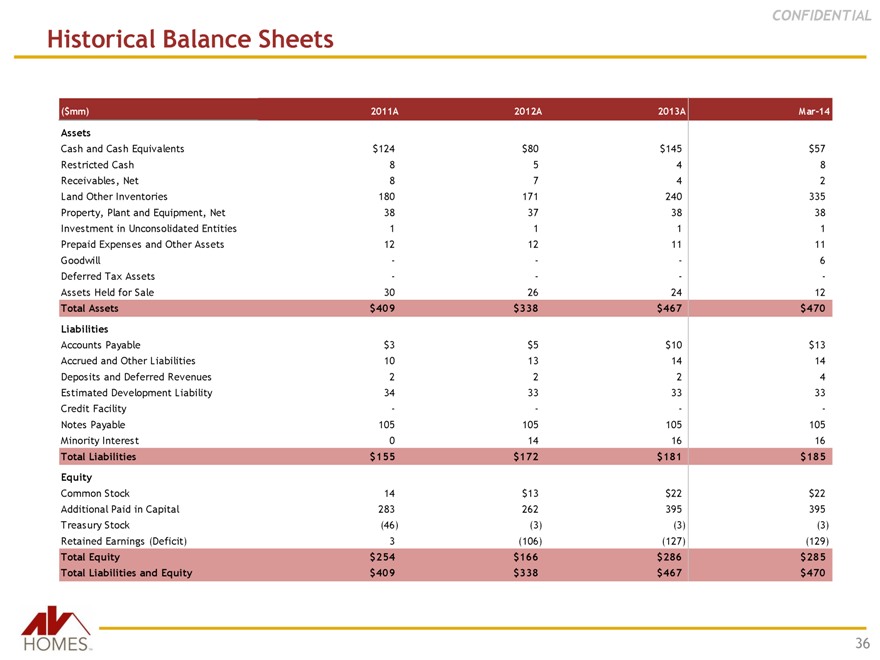

Historical Balance Sheets

CONFIDENTIAL

($mm) 2011A 2012A 2013A Mar-14

Assets

Cash and Cash Equivalents $124 $80 $145 $57 Restricted Cash 8 5 4 8 Receivables, Net 8 7 4 2 Land Other Inventories 180 171 240 335 Property, Plant and Equipment, Net 38 37 38 38 Investment in Unconsolidated Entities 1 1 1 1 Prepaid Expenses and Other Assets 12 12 11 11 Goodwill — — — 6 Deferred Tax Assets — — — -Assets Held for Sale 30 26 24 12

Total Assets $409 $338 $467 $470 Liabilities

Accounts Payable $3 $5 $10 $13 Accrued and Other Liabilities 10 13 14 14 Deposits and Deferred Revenues 2 2 2 4 Estimated Development Liability 34 33 33 33 Credit Facility — — — -Notes Payable 105 105 105 105 Minority Interest 0 14 16 16

Total Liabilities $155 $172 $181 $185 Equity

Common Stock 14 $13 $22 $22 Additional Paid in Capital 283 262 395 395 Treasury Stock (46) (3) (3) (3) Retained Earnings (Deficit) 3 (106) (127) (129)

Total Equity $254 $166 $286 $285 Total Liabilities and Equity $409 $338 $467 $470

36

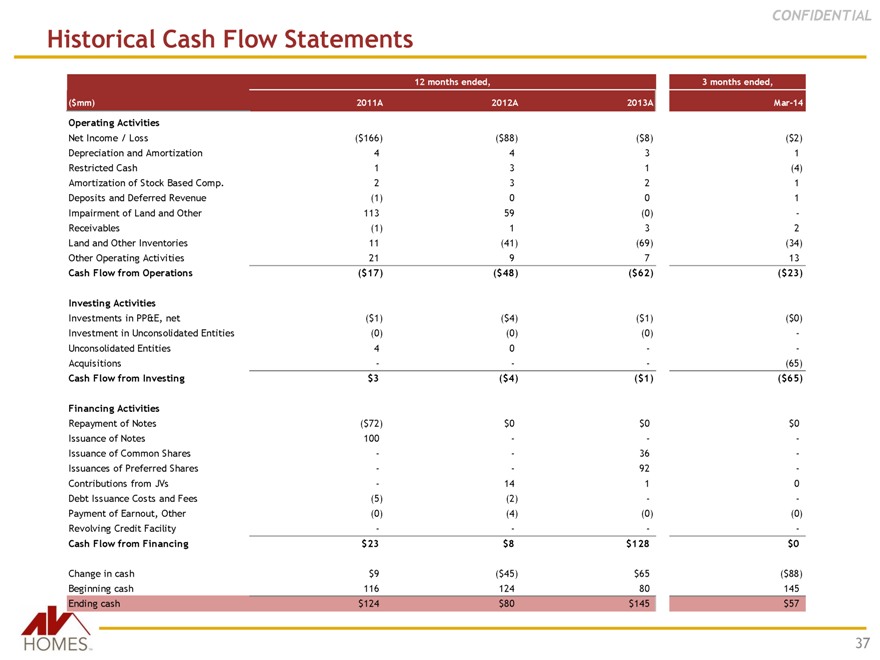

Historical Cash Flow Statements

CONFIDENTIAL

12 months ended, 3 months ended,

($mm) 2011A 2012A 2013A Mar-14

Operating Activities

Net Income / Loss($166)($88)($8)($2)

Depreciation and Amortization 4 4 3 1

Restricted Cash 1 3 1(4)

Amortization of Stock Based Comp. 2 3 2 1

Deposits and Deferred Revenue(1) 0 0 1

Impairment of Land and Other 113 59(0) -

Receivables(1) 1 3 2

Land and Other Inventories 11(41)(69)(34)

Other Operating Activities 21 9 7 13

Cash Flow from Operations($17)($48)($62)($23)

Investing Activities

Investments in PP&E, net($1)($4)($1)($0)

Investment in Unconsolidated Entities(0)(0)(0) -

Unconsolidated Entities 4 0 —

Acquisitions — -(65)

Cash Flow from Investing $3($4)($1)($65)

Financing Activities

Repayment of Notes($72) $0 $0 $0

Issuance of Notes 100 — -

Issuance of Common Shares — 36 -

Issuances of Preferred Shares — 92 -

Contributions from JVs—14 1 0

Debt Issuance Costs and Fees(5)(2) —

Payment of Earnout, Other(0)(4)(0)(0)

Revolving Credit Facility — —

Cash Flow from Financing $23 $8 $128 $0

Change in cash $9($45) $65($88)

Beginning cash 116 124 80 145

Ending cash $124 $80 $145 $57

37

Detailed Overview of AVHI’s Portfolio

CONFIDENTIAL

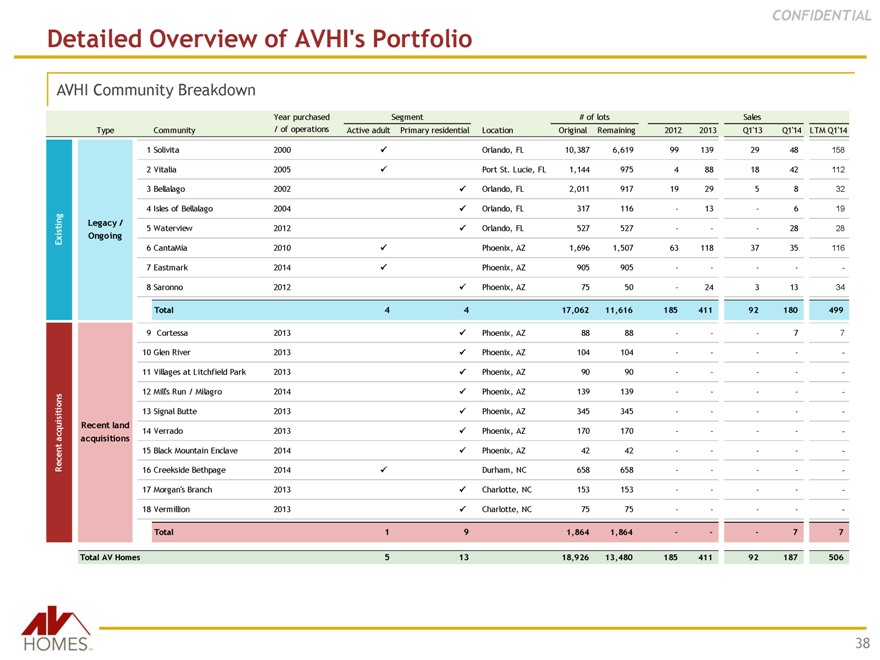

AVHI Community Breakdown

Year purchased Segment # of lots Sales

Type Community / of operations Active adult Primary residential Location Original Remaining 2012 2013 Q1’13 Q1’14 LTM Q1’14

1 Solivita 2000 Orlando, FL 10,387 6,619 99 139 29 48 158

2 Vitalia 2005 Port St. Lucie, FL 1,144 975 4 88 18 42 112

3 Bellalago 2002 Orlando, FL 2,011 917 19 29 5 8 32

4 Isles of Bellalago 2004 Orlando, FL 317 116—13—6 19

Existing

Legacy / Ongoing

5 Waterview 2012 Orlando, FL 527 527 ——28 28

6 CantaMia 2010 Phoenix, AZ 1,696 1,507 63 118 37 35 116

7 Eastmark 2014 Phoenix, AZ 905 905 — — -

8 Saronno 2012 Phoenix, AZ 75 50—24 3 13 34

Total 4 4 17,062 11,616 185 411 92 180 499

9 Cortessa 2013 Phoenix, AZ 88 88 ——7 7

10 Glen River 2013 Phoenix, AZ 104 104 — — -

11 Villages at Litchfield Park 2013 Phoenix, AZ 90 90 — — -

12 Mill’s Run / Milagro 2014 Phoenix, AZ 139 139 — — -

13 Signal Butte 2013 Phoenix, AZ 345 345 — — -

Recent Acquistions

Recent land acquisitions

14 Verrado 2013 Phoenix, AZ 170 170 — — -

15 Black Mountain Enclave 2014 Phoenix, AZ 42 42 — — -

16 Creekside Bethpage 2014 Durham, NC 658 658 — — -

17 Morgan’s Branch 2013 Charlotte, NC 153 153 — — -

18 Vermillion 2013 Charlotte, NC 75 75 — — -

Total 1 9 1,864 1,864 ——7 7

Total AV Homes 5 13 18,926 13,480 185 411 92 187 506

38

Detailed Overview of AVHI’s Portfolio

CONFIDENTIAL

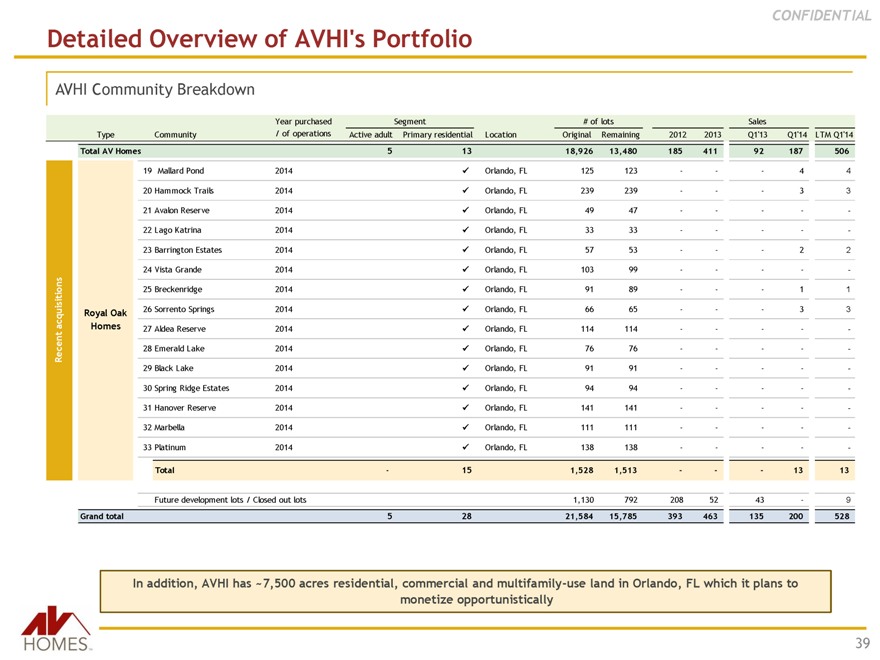

AVHI Community Breakdown

Year purchased Segment # of lots Sales

Type Community / of operations Active adult Primary residential Location Original Remaining 2012 2013 Q1’13 Q1’14 LTM Q1’14

Total AV Homes 5 13 18,926 13,480 185 411 92 187 506

19 Mallard Pond 2014 Orlando, FL 125 123 ——4 4

20 Hammock Trails 2014 Orlando, FL 239 239 ——3 3

21 Avalon Reserve 2014 Orlando, FL 49 47 — — -

22 Lago Katrina 2014 Orlando, FL 33 33 — — -

23 Barrington Estates 2014 Orlando, FL 57 53 ——2 2

24 Vista Grande 2014 Orlando, FL 103 99 — — -

Recent acquisitions

25 Breckenridge 2014 Orlando, FL 91 89 ——1 1

Royal Oak Homes

26 Sorrento Springs 2014 Orlando, FL 66 65 ——3 3

27 Aldea Reserve 2014 Orlando, FL 114 114 — — -

28 Emerald Lake 2014 Orlando, FL 76 76 — — -

29 Black Lake 2014 Orlando, FL 91 91 — — -

30 Spring Ridge Estates 2014 Orlando, FL 94 94 — — -

31 Hanover Reserve 2014 Orlando, FL 141 141 — — -

32 Marbella 2014 Orlando, FL 111 111 — — -

33 Platinum 2014 Orlando, FL 138 138 — — -

Total—15 1,528 1,513 ——13 13

Future development lots / Closed out lots 1,130 792 208 52 43—9

Grand total 5 28 21,584 15,785 393 463 135 200 528

In addition, AVHI has ~7,500 acres residential, commercial and multifamily-use land in Orlando, FL which it plans to monetize opportunistically

39