TEGNA

2017 INVESTOR DAY

2017 INVESTOR DAY

MARGE

MAGNER

CHAIRMAN OF THE BOARD, TEGNA

2017 INVESTOR DAY

GRACIA

MARTORE

PRESIDENT & CEO, TEGNA

2017 INVESTOR DAY

DAVE

LOUGEE

INCOMING PRESIDENT & CEO, TEGNA

2017 INVESTOR DAY

DAVE LOUGEE25-Year Industry Career

Broadcasting Hall of Fame Inductee

Joint of Board the National Chair Association of Broadcasters

TEGNA

2017 INVESTOR DAY

2017 INVESTOR DAY

FORWARD LOOKING STATEMENT

Any statements contained in this presentation that do not describe historical facts may constitute forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995, including statements with respect to the potential separation and distribution of TEGNA’s digital automotive marketplace business to its stockholders (the“spin-off ”) and the expected financial results of the company after thespin-off. Any forward-looking statements contained herein are based on our management’s current beliefs and expectations, but are subject to a number of risks, uncertainties and “changes in circumstances, which may cause the company’s actual results or actions to differ materially from what is expressed or implied by these statements. Such risks include, but are not limited to: uncertainties as to the timing of thespin-off or whether it will be completed, the possibility that various closing conditions for thespin-off may not be satisfied or may be waived, the expected tax treatment of thespin-off, the impact of thespin-off on the company’s business and the availability and terms of financing. Economic, competitive, governmental, technological and other factors and risks that may affect the company’s operations or financial results expressed in this presentation are discussed in the company’s Annual Report on Form10-K for the fiscal year ended December 31, 2016, and in the company’s subsequent filings with the U.S. Securities and Exchange Commission (SEC). We disclaim any obligation to update these forward-looking statements other than as required by law. This presentation also contains a discussion of anon-GAAP financial measure that the company presents in order to allow investors and analysts to measure, analyze and compare its financial condition and results of operations in a meaningful and consistent manner. A reconciliation of thenon-GAAP financial measure to the most directly comparable GAAP measure can be found in the Form8-K.

|

|

2017 INVESTOR DAY

AGENDA

1 INVESTMENT THESIS

2 GROWTH STRATEGY

3 STRATEGIC INITIATIVES

4 REGULATORY ENVIRONMENT

5 CAPITAL ALLOCATION AND FINANCIAL OUTLOOK

6 Q&A

2017 INVESTOR DAY

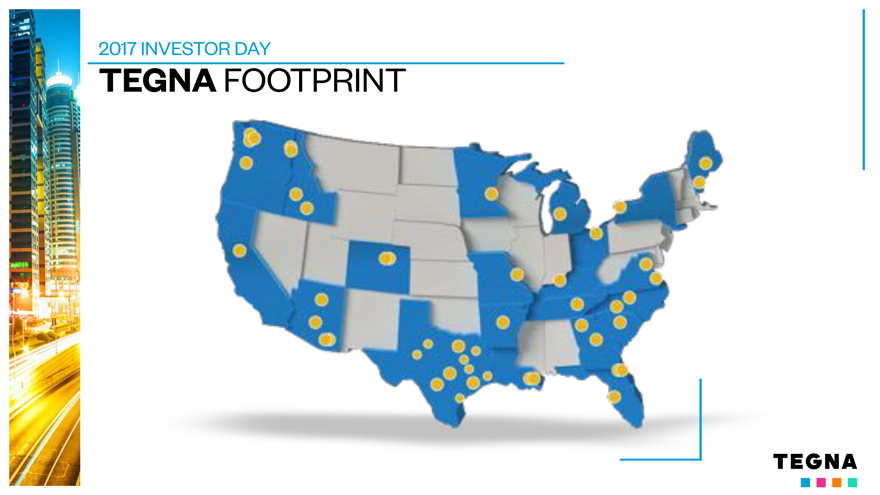

TEGNA FOOTPRINT

2017 INVESTOR DAY

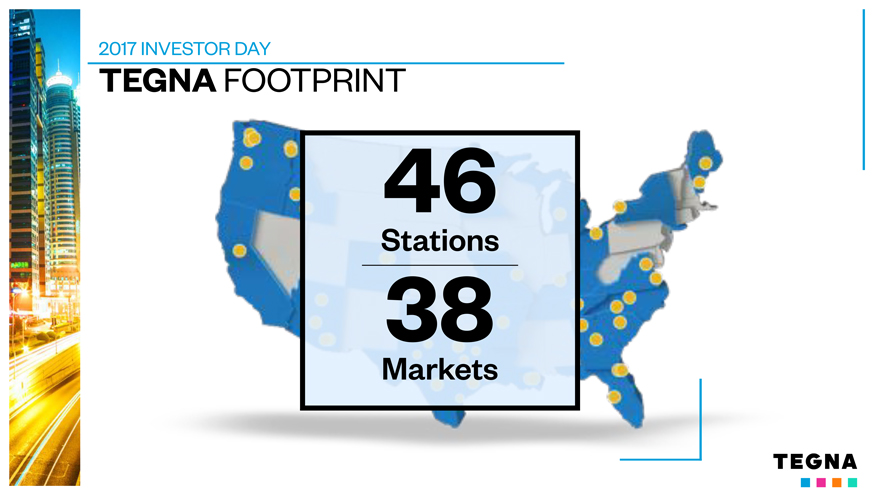

TEGNA FOOTPRINT

46

Stations

38

Markets

2017 INVESTOR DAY

TEGNA FOOTPRINT

Largest owner of top 4 a?liates in the top 25 markets

2017 INVESTOR DAY

TEGNA FOOTPRINT

Largest NBC a?liate group

2017 INVESTOR DAY

TEGNA FOOTPRINT

1/3

of TV Households

2017 INVESTOR DAY

TEGNA FOOTPRINT

27 20

#1 or #2 in #1 or #2 in late news morning news

2017 INVESTOR DAY

Trusted Content Original Storytelling Impactful Investigations

2017 INVESTOR DAY

Marketing Solutions

2017 INVESTOR DAY

TEGNA PURPOSE

To Serve the Greater Good of our Communities

2017 INVESTOR DAY

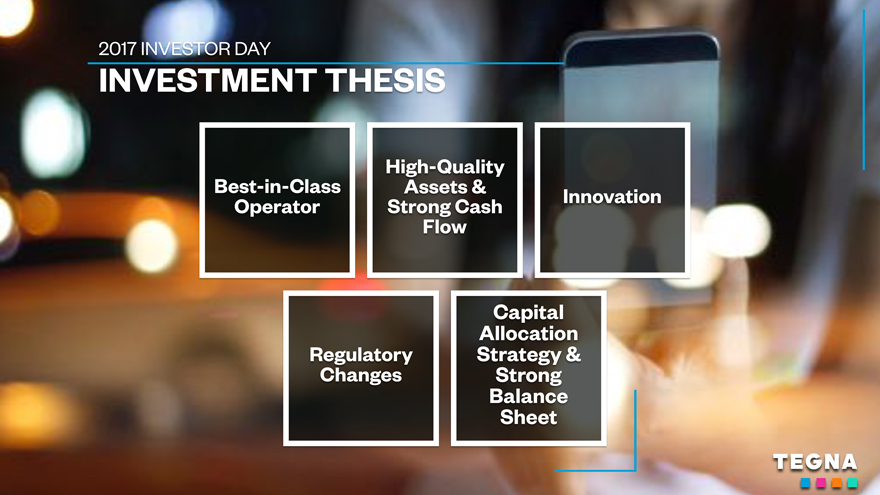

INVESTMENT THESIS

Best-in-Class Operator

2017 INVESTOR DAY

INVESTMENT THESIS

High-Quality Assets & Strong Cash Flow

2017 INVESTOR DAY

INVESTMENT THESIS

Innovation

2017 INVESTOR DAY

INVESTMENT THESIS

Regulatory Changes

2017 INVESTOR DAY

INVESTMENT THESIS

Capital Allocation Strategy & Strong Balance Sheet

2017 INVESTOR DAY

GROWTH STRATEGY

Embracing change, growing market share, and expanding the markets we are targeting Accelerating the growth and monetization of our multi-platform businesses Growing subscriber revenues with both traditional cable and satellite operators and new OTT entrants in light of shifting audience preferences Further diversifying our revenue base by investing in new business models that leverage our strong assets and scale

2017 INVESTOR DAY

CONTENT TRANSFORMATION

TEGNA

2017 INVESTOR DAY

2017 INVESTOR DAY

DIGITAL FOOTPRINT

32M

Across Digital Platform

2017 INVESTOR DAY

DIGITAL FOOTPRINT

19M

Social Followers

2017 INVESTOR DAY

DIGITAL FOOTPRINT

+42%

Growth

2017 INVESTOR DAY

DIGITAL FOOTPRINT

Top 10

Facebook Publisher

2017 INVESTOR DAY

DIGITAL FOOTPRINT

Video Plays / Month

2017 INVESTOR DAY

PROGRAMMING

TEGNA

2017 INVESTOR DAY

2017 INVESTOR DAY

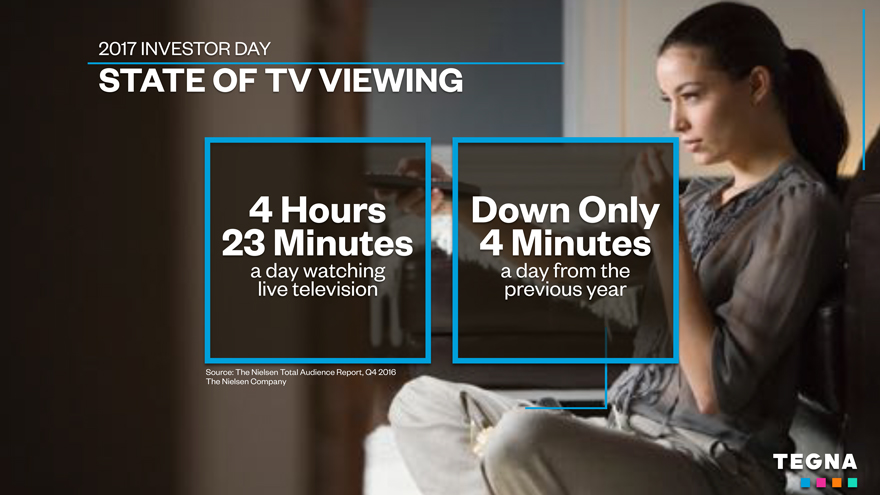

STATE OF TV VIEWING

4 Hours

23 Minutes

a day watching live television

Down Only

4 Minutes

a day from the previous year

Source: The Nielsen Total Audience Report, Q4 2016 The Nielsen Company

2017 INVESTOR DAY

2018 LIVE EVENTS

POLITICAL ADVERTISING

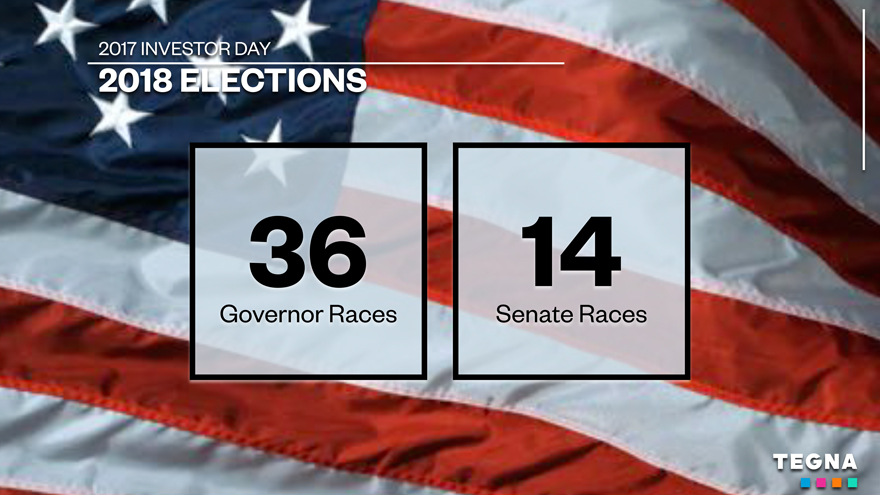

2018 ELECTIONS

2017 INVESTOR DAY

2018 ELECTIONS

36

Governor Races

14

Senate Races

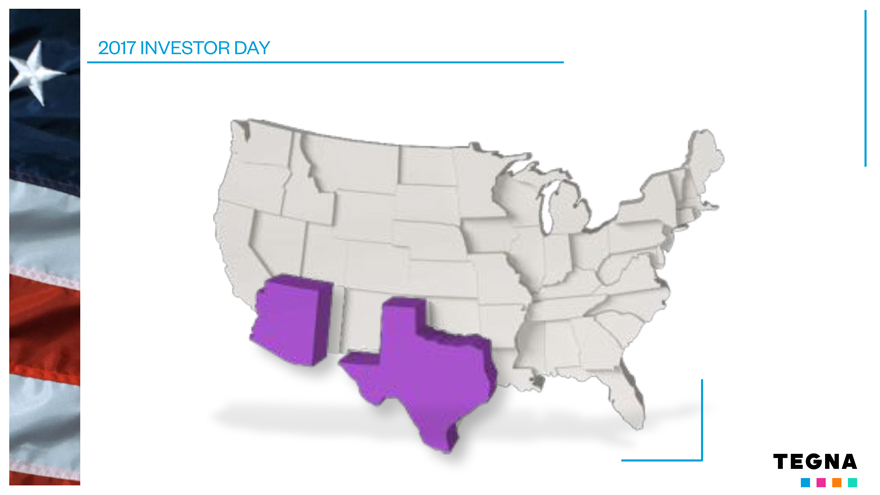

2018 ELECTIONS

2017 INVESTOR DAY

84%

2017 INVESTOR DAY

TEGNA

2017 INVESTOR DAY

2017 INVESTOR DAY

2017 INVESTOR DAY

360° CLIENT SOLUTIONS

Deep Consumer Insights

Unique Creative Solutions

Customization

2017 INVESTOR DAY

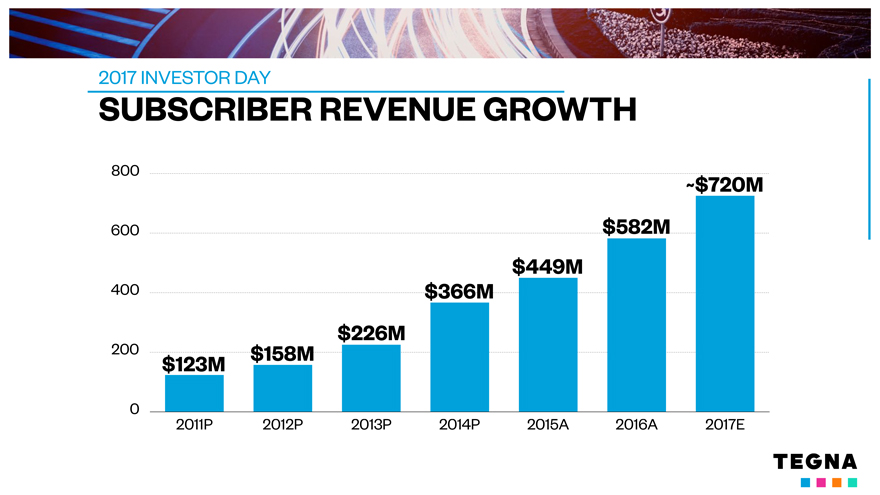

SUBSCRIBER REVENUE GROWTH

800 ~$720M

600 $582M

$449M

400 $366M

$226M

200 $123M $158M

0

2011P 2012P2013P2014P2015A2016A2017E

2017 INVESTOR DAY

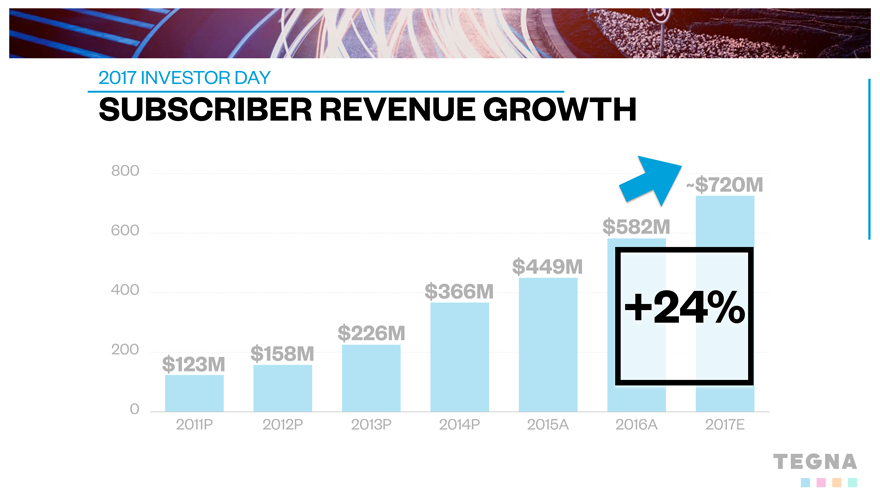

SUBSCRIBER REVENUE GROWTH

800

$720M 600 $582M $449M

400 $366M +24% $226M

200 $158M $123M

0 2011P 2012P 2013P 2014P 2015A 2016A 2017E

TEGNA

2017 INVESTOR DAY

2017 INVESTOR DAY

OTT PROVIDERS AND SKINNY BUNDLES

2017 INVESTOR DAY

OTT PROVIDERS AND SKINNY BUNDLES

Abc

Nbc

Cbs

Direct Conversations

TEGNA

2017 INVESTOR DAY

2017 INVESTOR DAY

OTT

Positive Economics Insulate TEGNA from Cord Cutting

2017 INVESTOR DAY

ED BUSBY

SENIOR VICE PRESIDENT, STRATEGY

2017 INVESTOR DAY

BUSINESS

DIVERSIFICATION

Intelligent Ad Automation

B2B Marketing Services

2017 INVESTOR DAY

INTELLIGENT AD AUTOMATION

2017 INVESTOR DAY

PREMION CONTENT PARTNERS

2017 INVESTOR DAY

INTELLIGENT AD AUTOMATION

2017 INVESTOR DAY

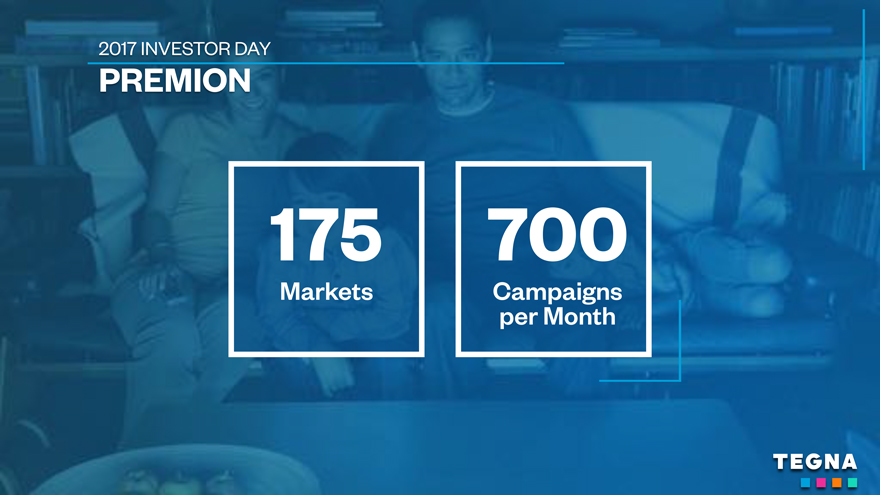

PREMION

175

Markets

700

Campaigns per Month

2017 INVESTOR DAY

PRICING

Big

Data

Machine Learning

2017 INVESTOR DAY

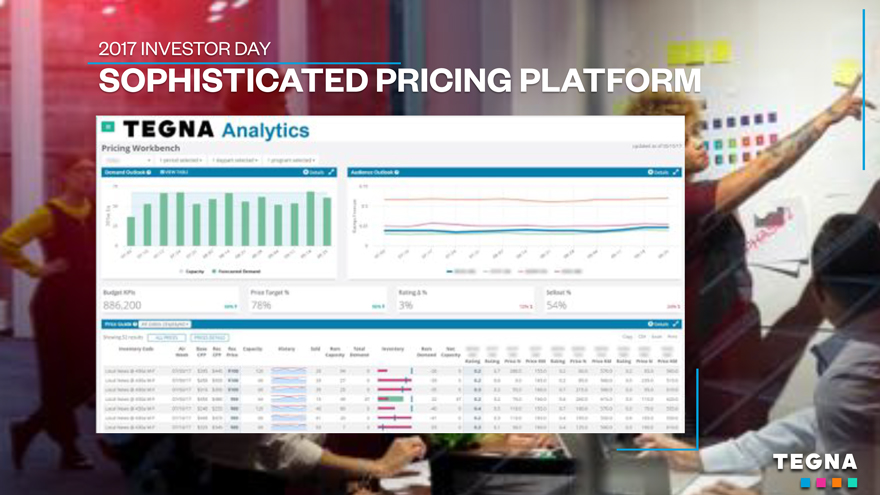

SOPHISTICATED PRICING PLATFORM

TEGNA

2017 INVESTOR DAY

2017 INVESTOR DAY

B2B MARKETING SERVICES

2017 INVESTOR DAY

B2B MARKETING SERVICES

Search

Email

Targeted Banner

Social Reputation Management

2017 INVESTOR DAY

B2B MARKETING SERVICES

Marketing Center of Excellence

2017 INVESTOR DAY

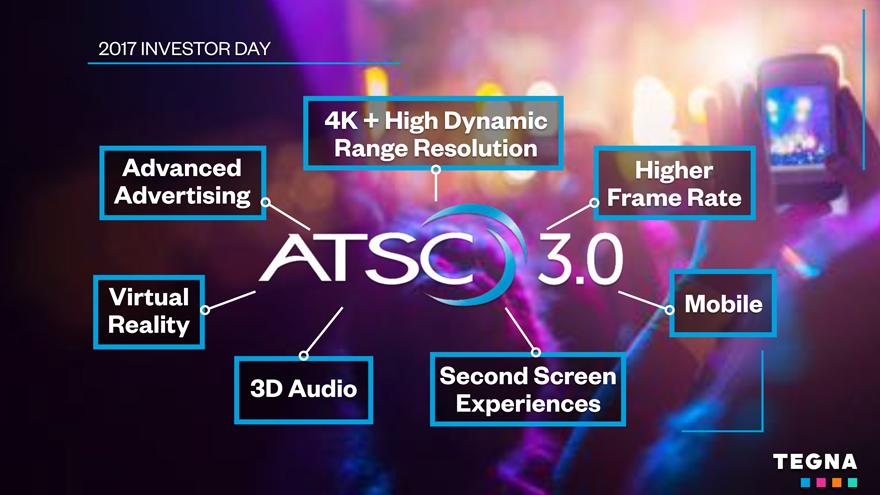

Advanced

Advertising

4K + High Dynamic Range Resolution

Higher Frame Rate

Virtual Reality

3D Audio

Second Screen Experiences

Mobile

TEGNA

2017 INVESTOR DAY

2017 INVESTOR DAY

REGULATORY CHANGES

UHF Discount Reinstated

Expected Relaxation ofIn-Market Rules

TEGNA

2017 INVESTOR DAY

2017 INVESTOR DAY

VICTORIA

HARKER

EXECUTIVE VICE PRESIDENT AND CHIEF FINANCIAL OFFICER

TEGNA

2017 INVESTOR DAY

2017 INVESTOR DAY

KEY DRIVERS OF VALUE CREATION

Driving Organic Revenue Growth and Strong Cash Flow

Content and Sales Innovation

High

Impact

Acquisitions and

New

Growth

Opportunities

TEGNA

2017 INVESTOR DAY

MEDIA RESULTS

2017 INVESTOR DAY

2017 INVESTOR DAY

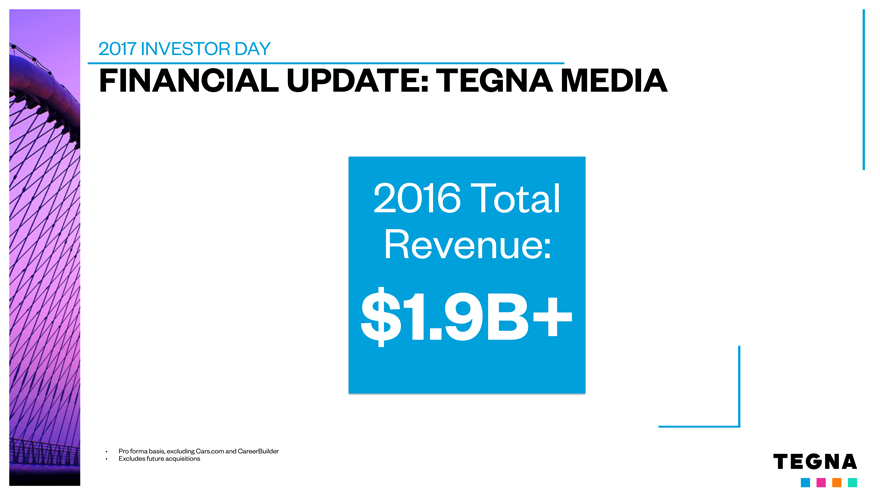

FINANCIAL UPDATE: TEGNA MEDIA

2016 Total Revenue:

$1.9B+

• Pro forma basis, excluding Cars.com and CareerBuilder

• Excludes future acquisitions

2017 INVESTOR DAY

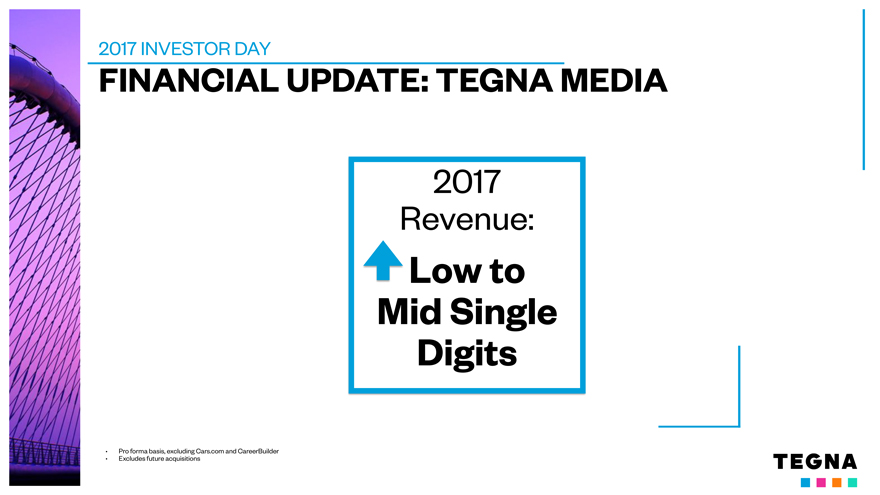

FINANCIAL UPDATE: TEGNA MEDIA

2017 Revenue:

Low to Mid Single Digits

• Pro forma basis, excluding Cars.com and CareerBuilder

• Excludes future acquisitions

2017 INVESTOR DAY

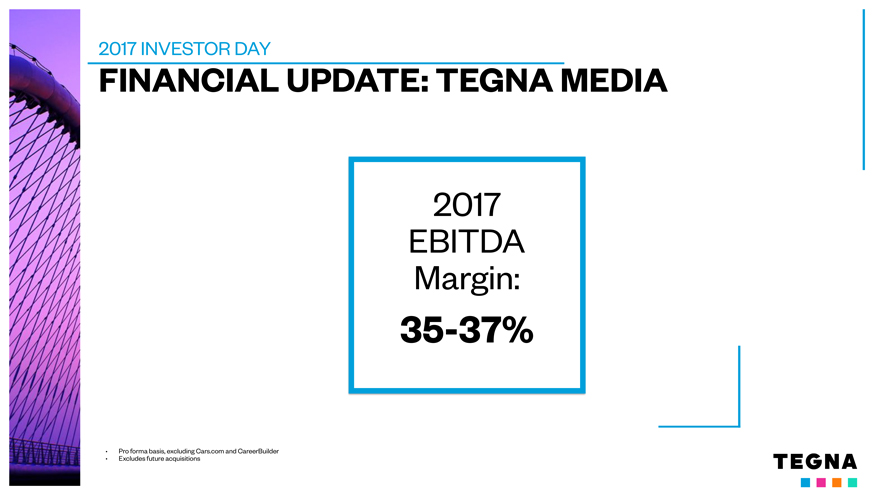

FINANCIAL UPDATE: TEGNA MEDIA

2017 EBITDA Margin:

35-37%

• Pro forma basis, excluding Cars.com and CareerBuilder

• Excludes future acquisitions

2017 INVESTOR DAY

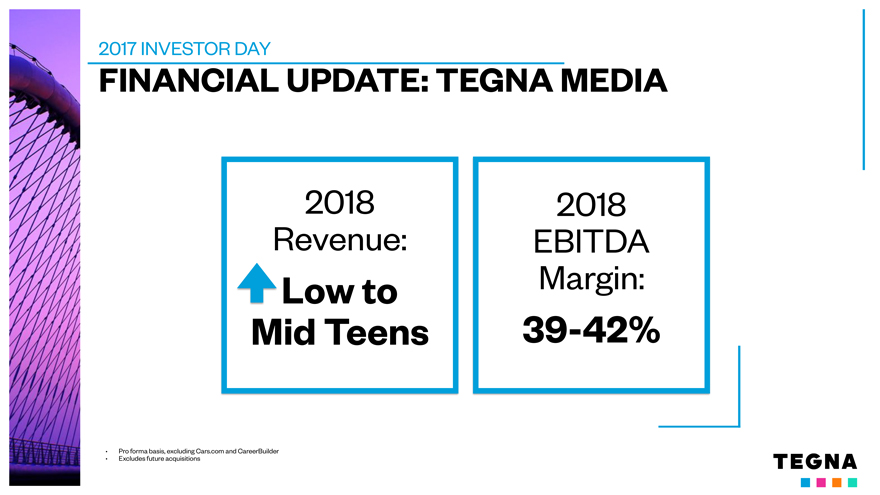

FINANCIAL UPDATE: TEGNA MEDIA

2018 Revenue:

Low to Mid Teens

2018 EBITDA Margin:

39-42%

• Pro forma basis, excluding Cars.com and CareerBuilder

• Excludes future acquisitions

2017 INVESTOR DAY

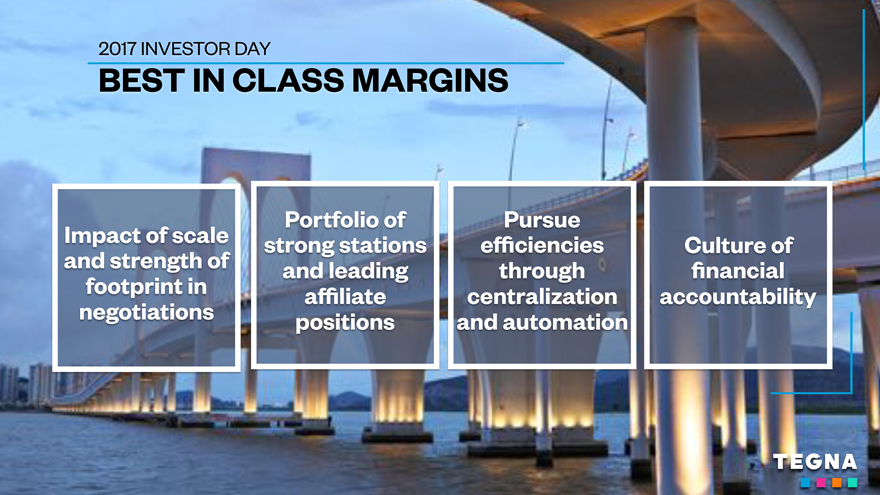

BEST IN CLASS MARGINS

Impact of scale and strength of footprint in negotiations

Portfolio of strong stations and leading a?liate positions

Pursue e?ciencies through centralization and automation

Culture of ?nancial accountability

TEGNA

2017 INVESTOR DAY

2017 INVESTOR DAY

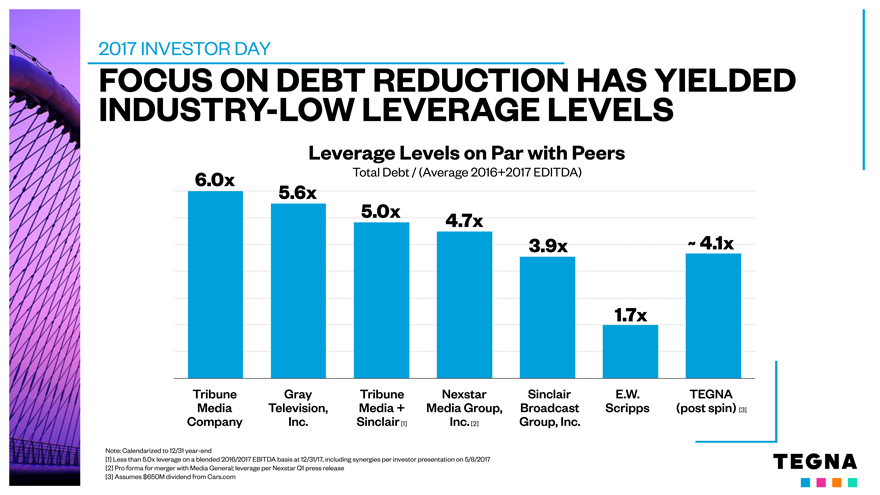

FOCUS ON DEBT REDUCTION HAS YIELDEDINDUSTRY-LOW LEVERAGE LEVELS

Leverage Levels on Par with Peers

Total Debt / (Average 2016+2017 EDITDA)

6.0x Total Debt / (Average 2016+2017 EDITDA)

5.6x

5.0x 4.7x

3.9x ~ 4.1x

1.7x

Tribune Gray Tribune Nexstar Sinclair E.W. TEGNA Media Television, Media + Media Group, Broadcast Scripps (post spin) [3] Company Inc. Sinclair [1] Inc. [2] Group, Inc.

Note: Calendarized to 12/31year-end

[1] Less than 5.0x leverage on a blended 2016/2017 EBITDA basis at 12/31/17, including synergies per investor presentation on 5/8/2017 [2] Pro forma for merger with Media General; leverage per Nexstar Q1 press release [3] Assumes $650M dividend from Cars.com

2017 INVESTOR DAY

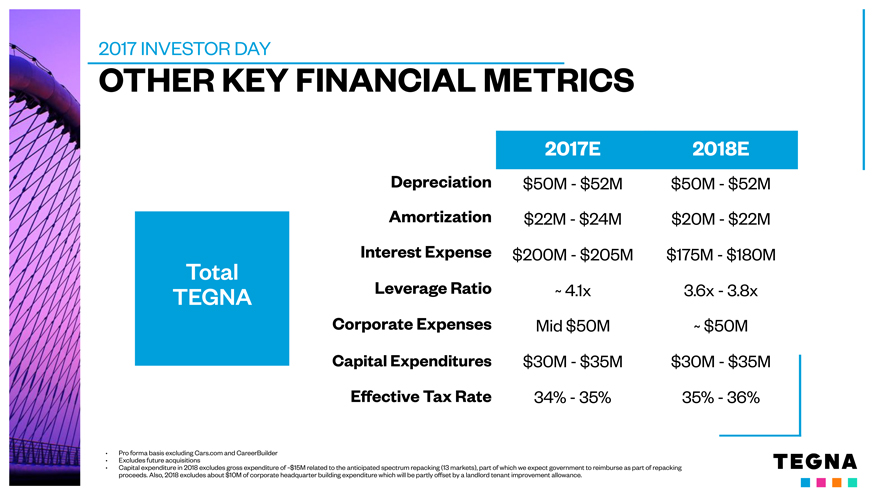

OTHER KEY FINANCIAL METRICS

2017E 2018E

Depreciation $50M—$52M $50M—$52M Amortization $22M—$24M $20M—$22M

Interest Expense $200M—$205M $175M—$180M

Total

TEGNA Leverage Ratio ~ 4.1x 3.6x—3.8x

Corporate Expenses Mid $50M ~ $50M

Capital Expenditures $30M—$35M $30M—$35M E?ective Tax Rate 34%—35% 35%—36%

• Pro forma basis excluding Cars.com and CareerBuilder

• Excludes future acquisitions

• Capital expenditure in 2018 excludes gross expenditure of ~$15M related to the anticipated spectrum repacking (13 markets), part of which we expect government to reimburse as part of repacking proceeds. Also, 2018 excludes about $10M of corporate headquarter building expenditure which will be partly offset by a landlord tenant improvement allowance.

2017 INVESTOR DAY

FINANCIAL UPDATE: TOTAL COMPANY WITH CAREERBUILDER EXCLUDING CARS.COM

2016 REVENUE: $2.7B

(PRO FORMA BASIS)

2017 REVENUE:In-Line

(PRO FORMA BASIS) with 2016

• Pro forma represents TEGNA reported GAAP revenues of $3.3B less $0.6B of Cars.com revenues. Cars.com is expected to be spun on May 31, 2017.

2017 INVESTOR DAY

CAPITAL ALLOCATION STRATEGY

Invest in growth through organic expansion

Opportunistically reduce debt, increasing firepower and flexibility for future investments Consider M&A and investment opportunitiesin-line with our integrated strategy Return capital to shareholders from free cash flow Dividends $0.28 per share/per year Extinguishing share repurchase program and will assess reinitiating in the future

2017 INVESTOR DAY

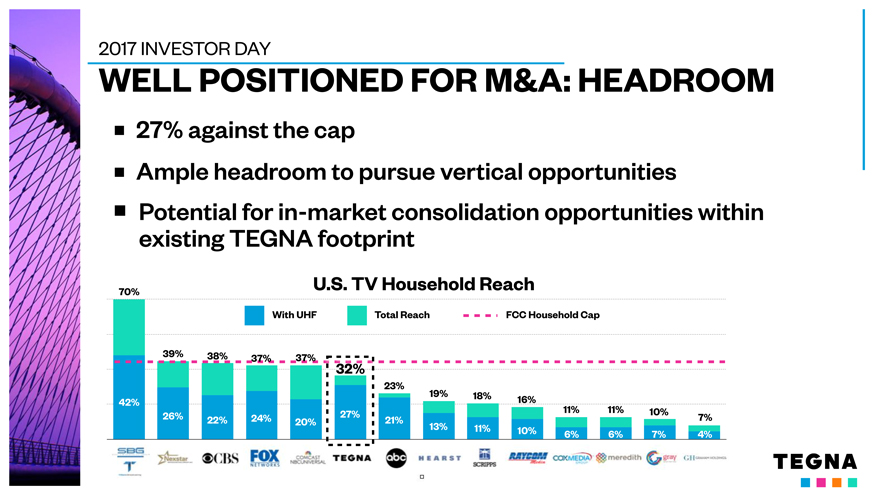

WELL POSITIONED FOR M&A: HEADROOM

27% against the cap

Ample headroom to pursue vertical opportunities

Potential forin-market consolidation opportunities within existing TEGNA footprint

U.S. TV Household Reach

70%

With UHF Total Reach FCC Household Cap

39% 38% 37% 37%

23%

19% 18%

42% 16%

11% 11% 10%

26% 22% 24% 21% 7% 20% 13% 11% 10%

6% 6% 7% 4%

2017 INVESTOR DAY

WELL POSITIONED FOR M&A: SYNERGIES

TEGNA achieves considerable cost and mechanical synergies

TEGNA’s strategic initiatives deliver additional synergies

2017 INVESTOR DAY

EXCEPTIONAL ACQUISITION AND INTEGRATION TRACK RECORD

2017 INVESTOR DAY

EXCEPTIONAL ACQUISITION AND INTEGRATION TRACK RECORD

EXPECTATIONS:

• $175M of EBITDA synergies within ? three years?

•Non-GAAP EPS accretion of $0.43 ? per share for the ? ?rst 12 months

2017 INVESTOR DAY

EXCEPTIONAL ACQUISITION AND INTEGRATION TRACK RECORD

2017 INVESTOR DAY

EXCEPTIONAL ACQUISITION AND INTEGRATION TRACK RECORD

EXPECTATIONS:

• Annual revenue ? of $50M

• Accretive to Non-? GAAP EPS within ? 12 months

2017 INVESTOR DAY

EXCEPTIONAL ACQUISITION AND INTEGRATION TRACK RECORD

ACHIEVED:

EXCEEDED TARGETS— WELL AHEAD

OF TIME

2017 INVESTOR DAY

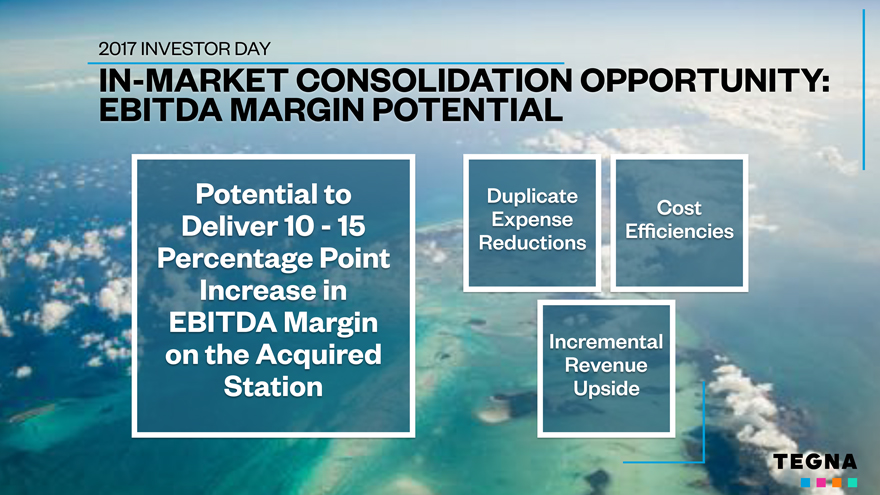

IN-MARKET CONSOLIDATION OPPORTUNITY

Represents substantial opportunity to create value Not yet occurred in majority of mid to large markets where TEGNA operates Achievable through variety of structures Substantial mechanical synergies

2017 INVESTOR DAY

IN-MARKET CONSOLIDATION OPPORTUNITY:? EBITDA MARGIN POTENTIAL

Potential to Duplicate

Cost

Deliver 10—15 Expense

E?ciencies

Percentage Point Reductions Increase in EBITDA Margin on the Acquired Incremental

Revenue

Station Upside

TEGNA

2017 INVESTOR DAY

2017 INVESTOR DAY

INVESTMENT THESIS

High-Quality

Best-in-Class Assets & Innovation Operator Strong Cash Flow

Capital Allocation

Regulatory Strategy & Changes Strong

Balance Sheet

Q & A

2017 INVESTOR DAY

TEGNA

2017 INVESTOR DAY