Non-GAAP Measures

TEGNA usesnon-GAAP financial performance measures, including adjusted EBITDA, to supplement the financial information presented on a GAAP basis. Thesenon-GAAP financial measures should not be considered in isolation from, or as a substitute for, the related GAAP measures and should be read together with financial information presented on a GAAP basis. TEGNA believes that each of thenon-GAAP measures presented provides useful information to investors and other stakeholders by allowing them to view our business through the eyes of management and our Board of Directors, facilitating comparisons of results across historical periods and focus on the underlying ongoing operating performance of our business. TEGNA also believes thesenon-GAAP measures are frequently used by investors, securities analysts and other interested parties in their evaluation of our business and other companies in the broadcast industry.

Forward Looking Statements

Certain statements in this communication may constitute “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. Any forward-looking statements contained herein are subject to a number of risks, trends and uncertainties that could cause actual results or company actions to differ materially from what is expressed or implied by these statements. Economic, competitive, governmental, technological and other factors and risks that may affect TEGNA’s operations or financial results are discussed in our Annual Report on Form10-K for the fiscal year ended December 31, 2018, and in subsequent filings with the U.S. Securities and Exchange Commission (the “SEC”). We disclaim any obligation to update these forward-looking statements other than as required by law.

Important Additional Information

TEGNA intends to file a proxy statement and GOLD proxy card with the SEC in connection with the solicitation of proxies for TEGNA’s 2020 Annual Meeting of shareholders (the “Proxy Statement” and such meeting the “2020 Annual Meeting”). TEGNA, its directors and certain of its executive officers will be participants in the solicitation of proxies from shareholders in respect of the 2020 Annual Meeting. Information regarding the names of TEGNA’s directors and executive officers and their respective interests in TEGNA by security holdings or otherwise is set forth in TEGNA’s proxy statement for the 2019 Annual Meeting of shareholders, filed with the SEC on March 11, 2019 (the “2019 Proxy Statement”). To the extent holdings of such participants in TEGNA’s securities have changed since the amounts described in the 2019 Proxy Statement, such changes have been reflected on Initial Statements of Beneficial Ownership on Form 3 or Statements of Change in Ownership on Form 4 filed with the SEC. Additional information can also be found in TEGNA’s Annual Report on Form10-K for the fiscal year ended December 31, 2018, filed with the SEC on March 1, 2019 and in TEGNA’s Quarterly Reports on Form10-Q for the first three quarters of the fiscal year ended December 31, 2019 filed with the SEC on May 9, 2019, August 6, 2019 and November 7, 2019, respectively. Details concerning the nominees of TEGNA’s Board of Directors for election at the 2020 Annual Meeting will be included in the Proxy Statement. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SHAREHOLDERS OF TEGNA ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH OR FURNISHED TO THE SEC, INCLUDING TEGNA’S DEFINITIVE PROXY STATEMENT AND ANY SUPPLEMENTS THERETO BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and shareholders will be able to obtain a copy of the definitive Proxy Statement and other documents filed by TEGNA free of charge from the SEC’s website, www.sec.gov. TEGNA’s shareholders will also be able to obtain, without charge, a copy of the definitive Proxy Statement and other relevant filed documents by directing a request by mail to TEGNA, 8350 Broad Street, Suite 2000, Tysons, VA 22102, or from the Company’s website, https://www.tegna.com.

Endnotes

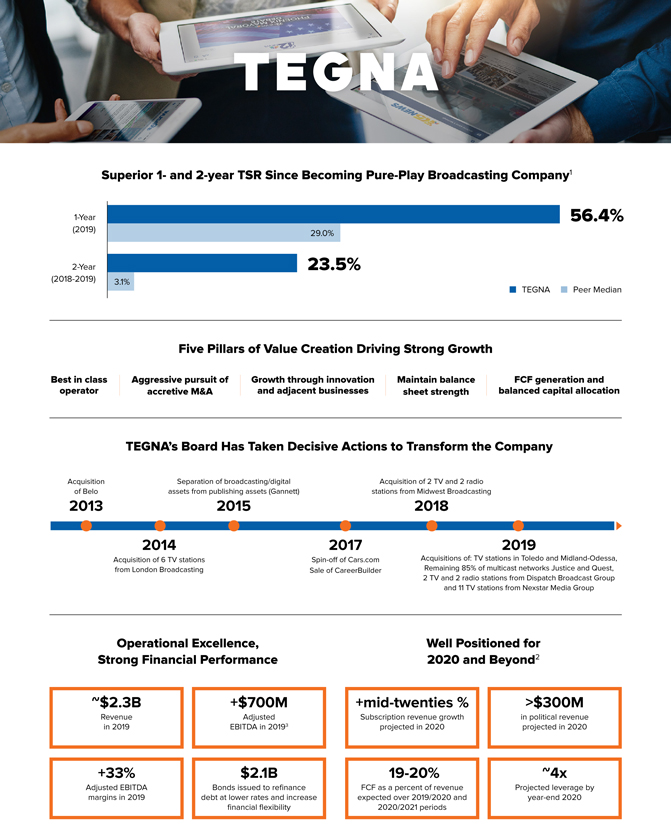

1 Total shareholder return includes impact of stock price performance and reinvested dividends; spin-offs treated as a cash dividend at time of spin, but excludes stock performance of spun entity. Peer set is E.W. Scripps, Gray TV, Meredith, Nexstar and Sinclair.

2 1/9/2020, http://investors.tegna.com/news-releases/news-release-details/tegna-announces-strong-preliminary-fourth-quarter-results

3 “Adjusted EBITDA,” anon-GAAP measure, is defined as net income attributable to the Company before (1) provision for income taxes, (2) interest expense, (3) equity income (loss) in unconsolidated investments, net, (4) othernon-operating items, net, (5) severance expense, (6) acquisition-related costs, (7) spectrum repacking reimbursements and other, (8) depreciation and (9) amortization.