GAP INC. FISCAL 2019 THIRD QUARTER EARNINGS RESULTS ROBERT J. FISHER INTERIM PRESIDENT & CHIEF EXECUTIVE OFFICER TERI LIST-STOLL EXECUTIVE VICE PRESIDENT & CHIEF FINANCIAL OFFICER

DISCLOSURE STATEMENT FORWARD LOOKING STATEMENTS This conference call and webcast contain forward-looking statements within the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995. All statements other than those that are purely historical are forward-looking statements. Forward-looking statements include statements identified as such in our November 21, 2019 press release. Because these forward-looking statements involve risks and uncertainties, there are important factors that could cause our actual results to differ materially from those in the forward-looking statements. Information regarding factors that could cause results to differ can be found in our November 21, 2019 earnings press release, our Annual Report on Form 10-K for the fiscal year ended February 2, 2019, and our subsequent filings with the U.S. Securities and Exchange Commission, all of which are available on gapinc.com. These forward-looking statements are based on information as of November 21, 2019. We assume no obligation to publicly update or revise our forward-looking statements even if experience or future changes make it clear that any projected results expressed or implied therein will not be realized. SEC REGULATION G This presentation includes the non-GAAP measures adjusted gross profit, adjusted gross margin, adjusted operating expenses, adjusted operating expenses as a percent of net sales, adjusted operating income, adjusted operating income as a percent of net sales, adjusted income taxes, adjusted net income, adjusted earnings per share, expected adjusted earnings per share, and free cash flow. The descriptions and reconciliations of these measures from GAAP are included in our November 21, 2019 earnings press release, which is available on gapinc.com. 2

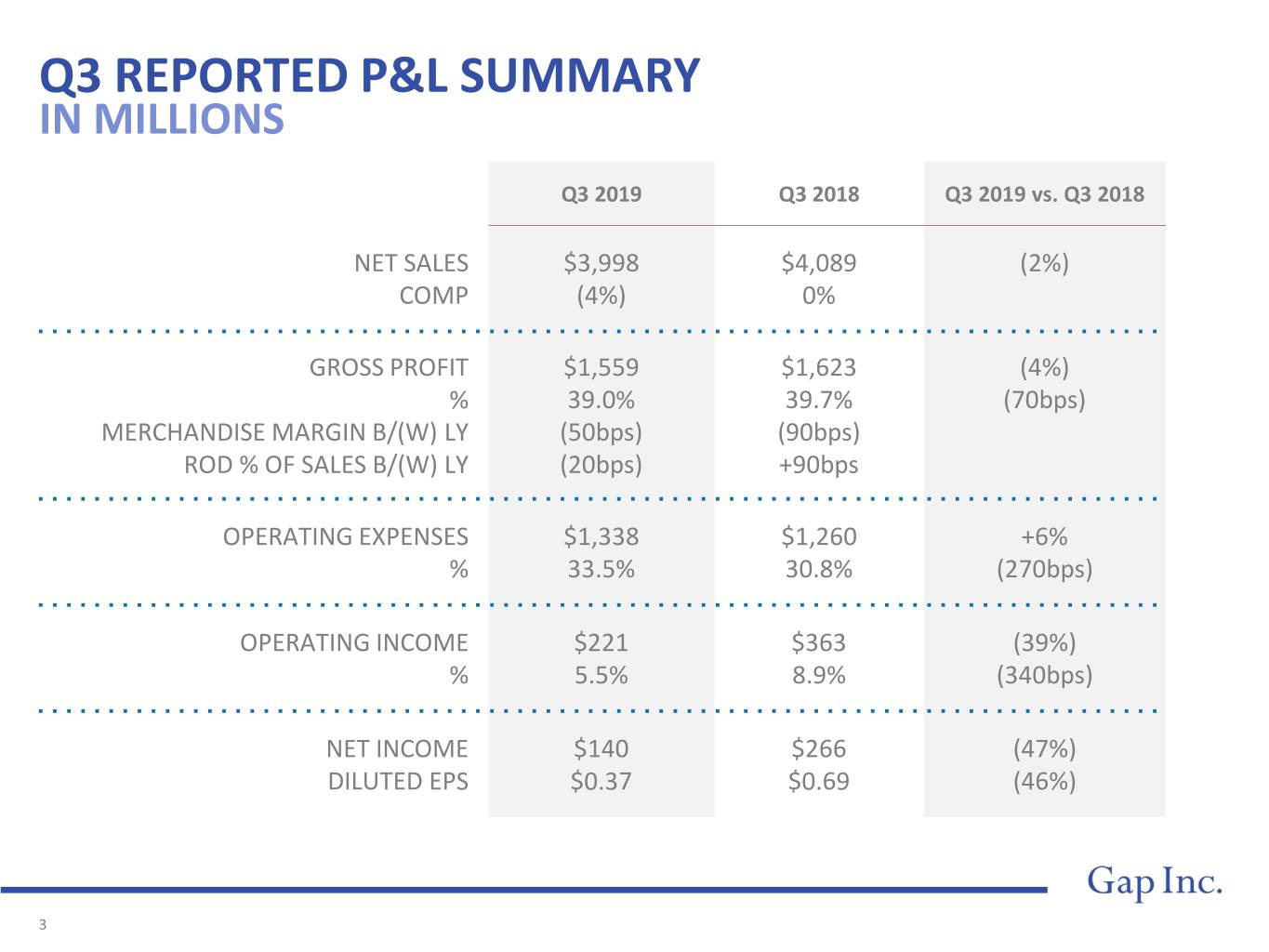

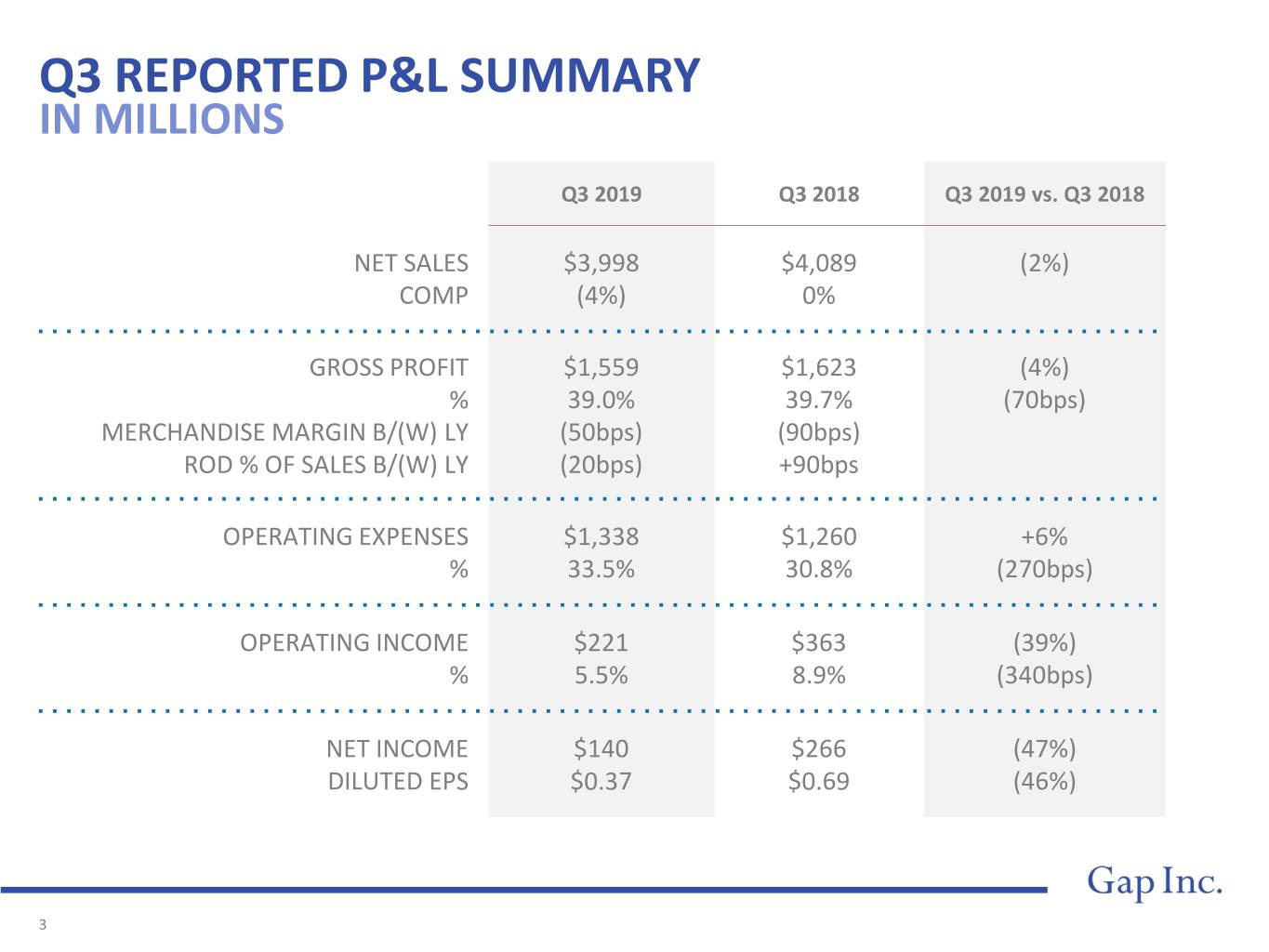

Q3 REPORTED P&L SUMMARY IN MILLIONS Q3 2019 Q3 2018 Q3 2019 vs. Q3 2018 NET SALES $3,998 $4,089 (2%) COMP (4%) 0% GROSS PROFIT $1,559 $1,623 (4%) % 39.0% 39.7% (70bps) MERCHANDISE MARGIN B/(W) LY (50bps) (90bps) ROD % OF SALES B/(W) LY (20bps) +90bps OPERATING EXPENSES $1,338 $1,260 +6% % 33.5% 30.8% (270bps) OPERATING INCOME $221 $363 (39%) % 5.5% 8.9% (340bps) NET INCOME $140 $266 (47%) DILUTED EPS $0.37 $0.69 (46%) 3

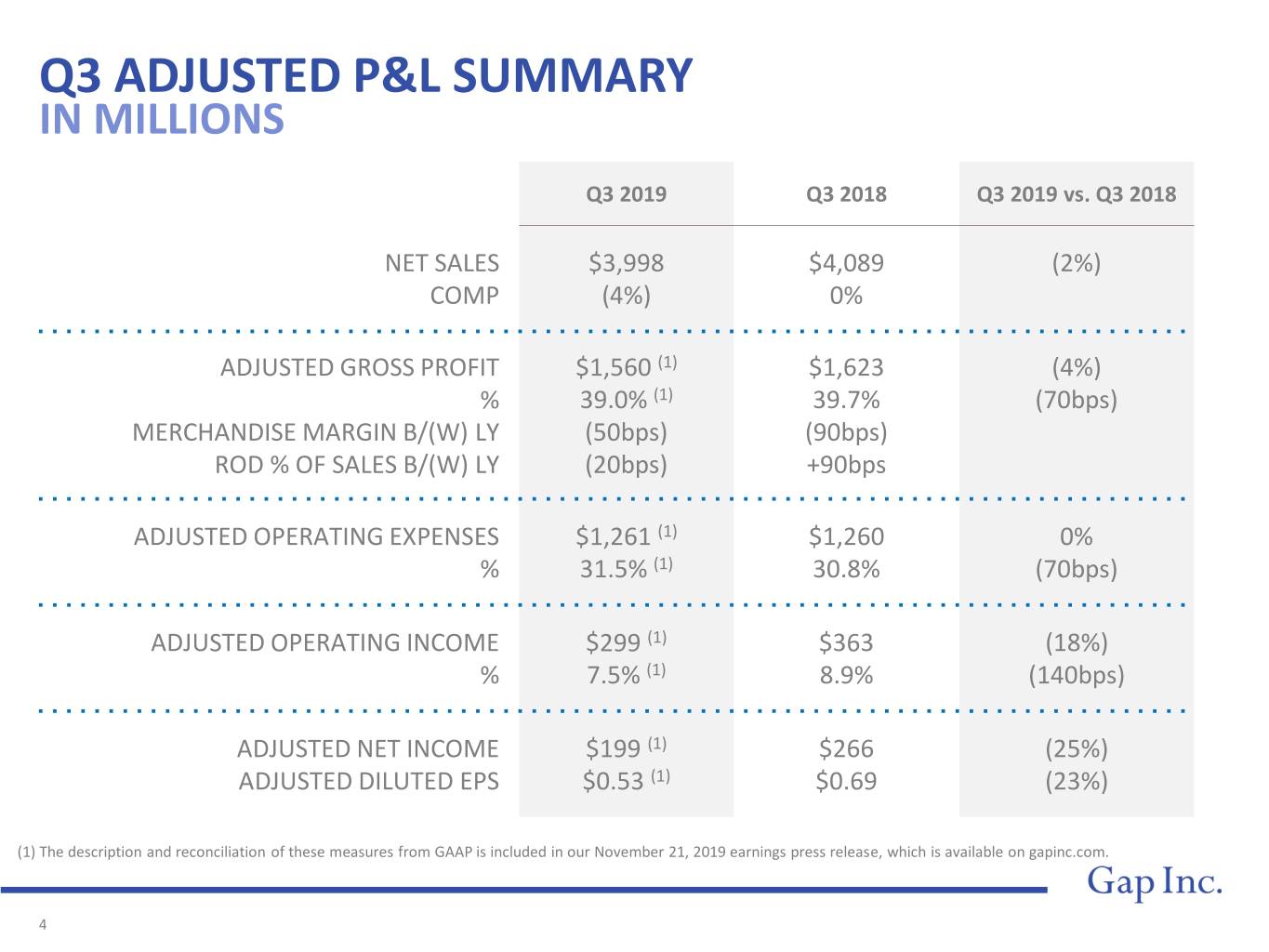

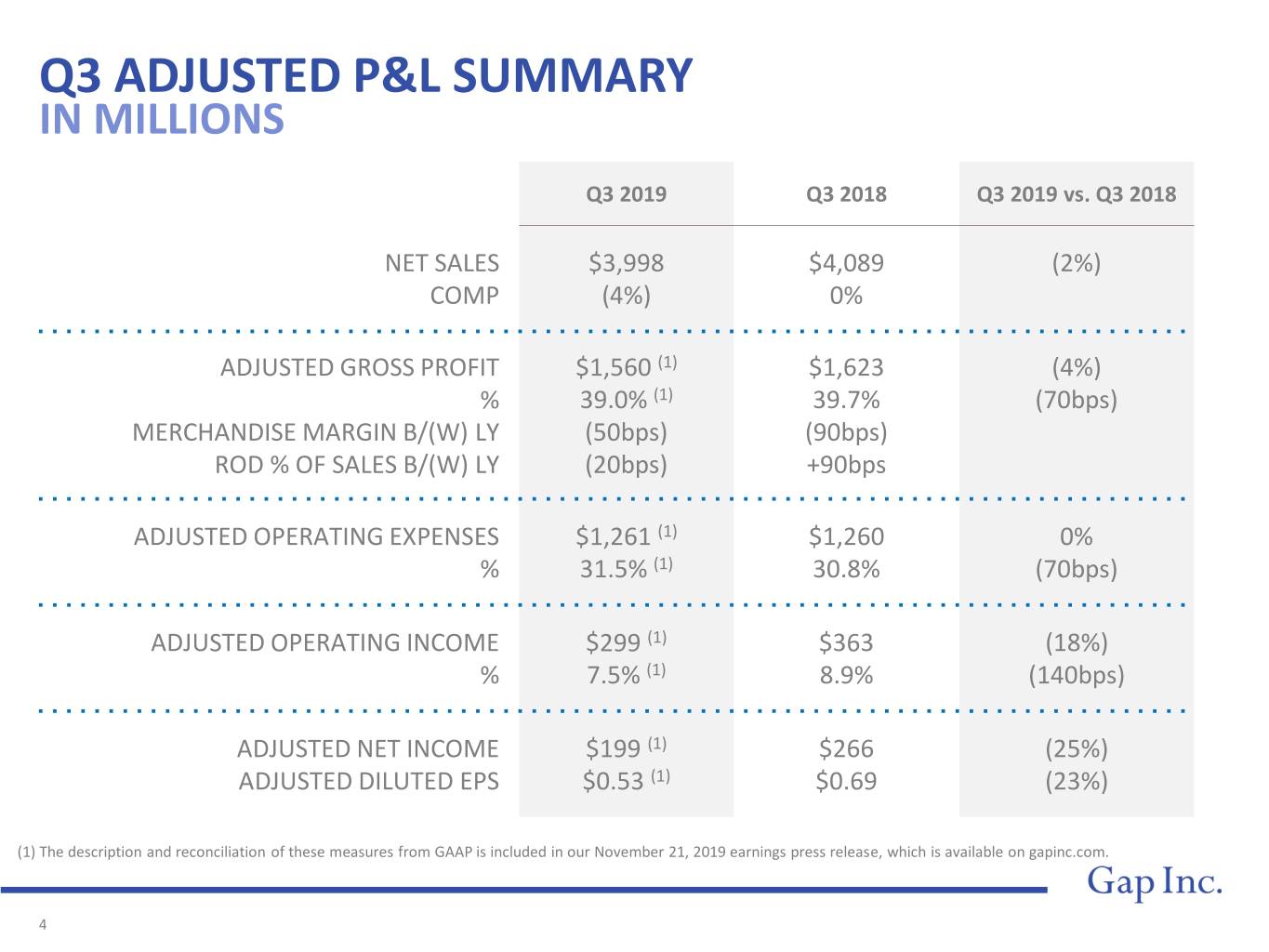

Q3 ADJUSTED P&L SUMMARY IN MILLIONS Q3 2019 Q3 2018 Q3 2019 vs. Q3 2018 NET SALES $3,998 $4,089 (2%) COMP (4%) 0% ADJUSTED GROSS PROFIT $1,560 (1) $1,623 (4%) % 39.0% (1) 39.7% (70bps) MERCHANDISE MARGIN B/(W) LY (50bps) (90bps) ROD % OF SALES B/(W) LY (20bps) +90bps ADJUSTED OPERATING EXPENSES $1,261 (1) $1,260 0% % 31.5% (1) 30.8% (70bps) ADJUSTED OPERATING INCOME $299 (1) $363 (18%) % 7.5% (1) 8.9% (140bps) ADJUSTED NET INCOME $199 (1) $266 (25%) ADJUSTED DILUTED EPS $0.53 (1) $0.69 (23%) (1) The description and reconciliation of these measures from GAAP is included in our November 21, 2019 earnings press release, which is available on gapinc.com. 4

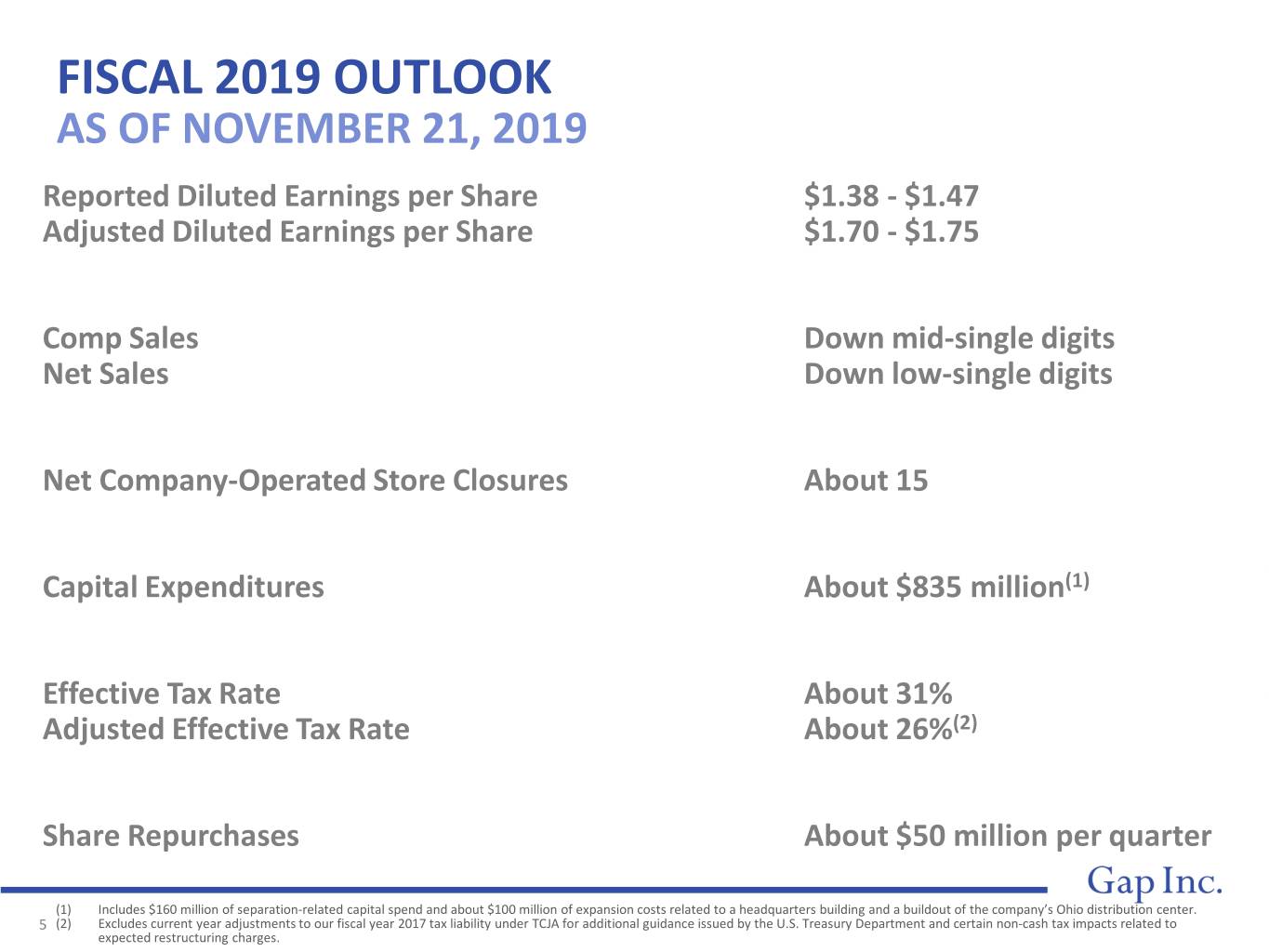

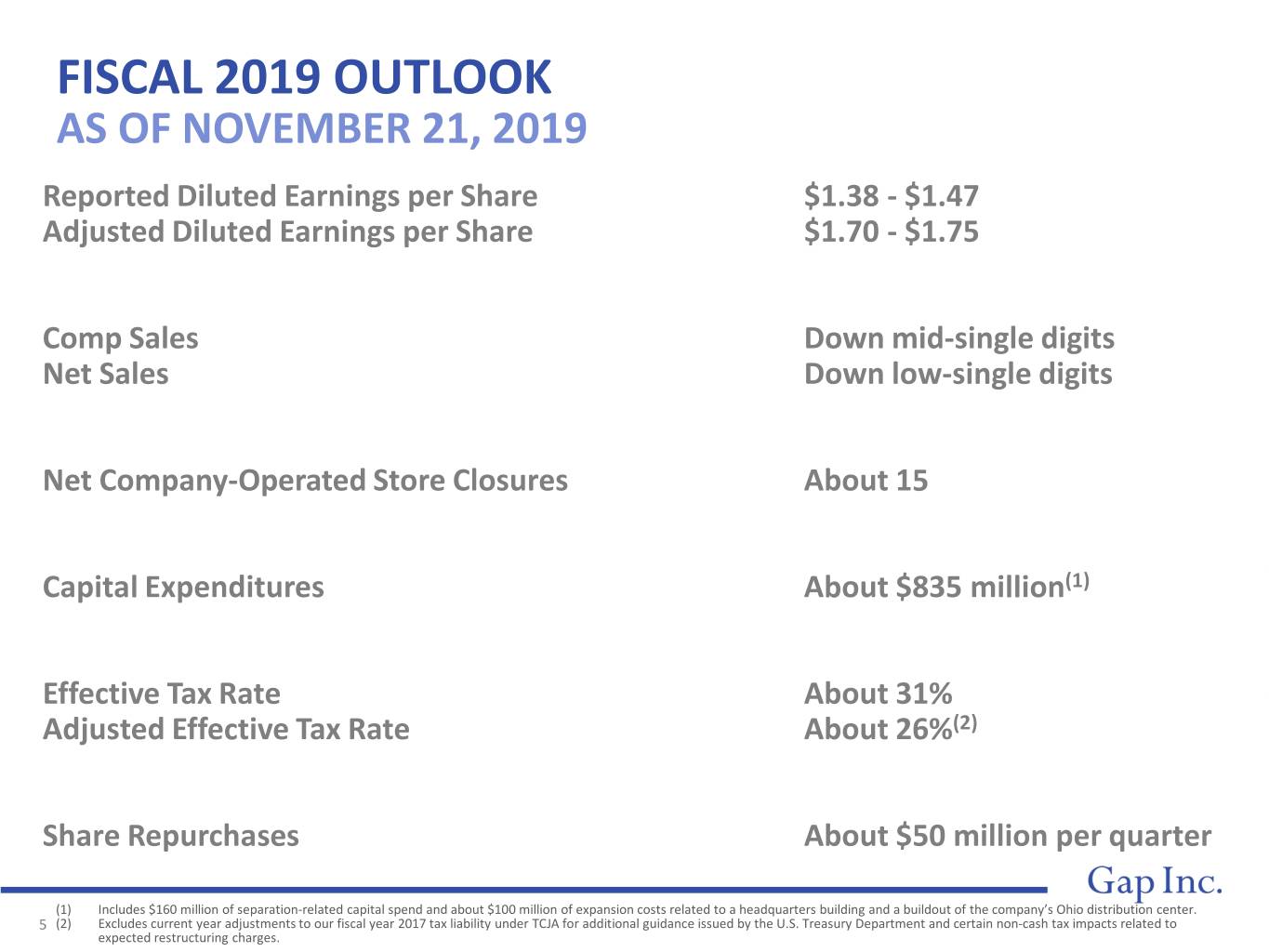

FISCAL 2019 OUTLOOK AS OF NOVEMBER 21, 2019 Reported Diluted Earnings per Share $1.38 - $1.47 Adjusted Diluted Earnings per Share $1.70 - $1.75 Comp Sales Down mid-single digits Net Sales Down low-single digits Net Company-Operated Store Closures About 15 Capital Expenditures About $835 million(1) Effective Tax Rate About 31% Adjusted Effective Tax Rate About 26%(2) Share Repurchases About $50 million per quarter (1) Includes $160 million of separation-related capital spend and about $100 million of expansion costs related to a headquarters building and a buildout of the company’s Ohio distribution center. 5 (2) Excludes current year adjustments to our fiscal year 2017 tax liability under TCJA for additional guidance issued by the U.S. Treasury Department and certain non-cash tax impacts related to expected restructuring charges.