Gap Inc. Fiscal 2021 Katrina O’Connell CHIEF FINANCIAL OFFICER Sonia Syngal CHIEF EXECUTIVE OFFICER THIRD QUARTER EARNINGS RESULTS

Forward Looking Statements / Non-GAAP Financial Measures FORWARD LOOKING STATEMENTS This conference call and webcast contain forward-looking statements within the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995. All statements other than those that are purely historical are forward-looking statements. Forward-looking statements include statements identified as such in our November 23, 2021 press release. Because these forward-looking statements involve risks and uncertainties, there are important factors that could cause our actual results to differ materially from those in the forward-looking statements. Additional information regarding factors that could cause results to differ can be found in the Company's Annual Report on Form 10-K for the fiscal year ended January 30, 2021, as well as the Company’s subsequent filings with the Securities and Exchange Commission. These forward-looking statements are based on information as of November 23, 2021. We assume no obligation to publicly update or revise our forward-looking statements even if experience or future changes make it clear that any projected results expressed or implied therein will not be realized. SEC REGULATION G This presentation includes the non-GAAP measures free cash flow, adjusted gross margin, adjusted operating expenses, adjusted operating income, adjusted operating margin, adjusted diluted earnings per share, and adjusted expected diluted earnings per share. The description and reconciliation of these measures from GAAP is included in our November 23, 2021 earnings press release, which is available on investors.gapinc.com.

We grow purpose-led, billion-dollar lifestyle brands

Power Plan 2023 Power of our Brands Grow purpose-led, billion-dollar lifestyle brands Power of our Platform Leverage our omni capabilities and scaled operations, and extend our engineered approach to cost and growth Power of our Portfolio Extend customer reach across every age, body and occasion through our collective power

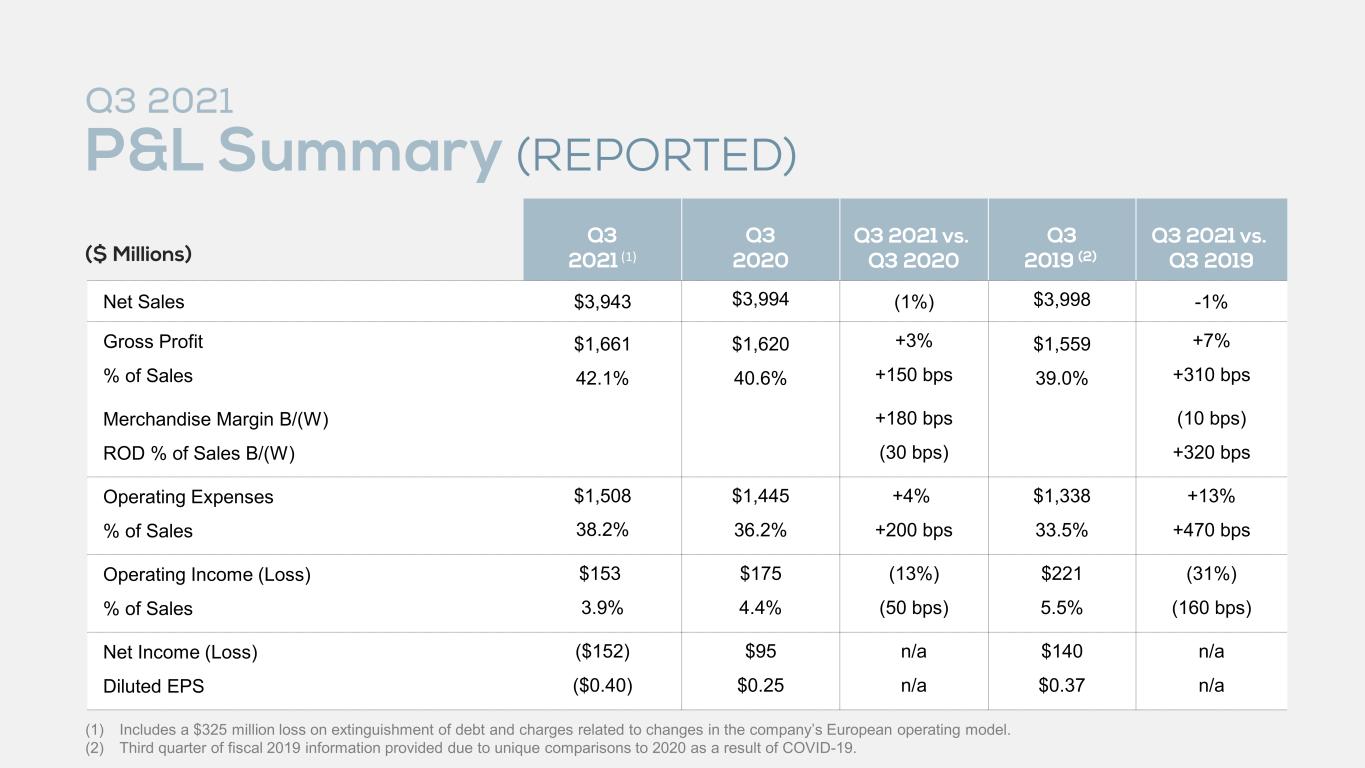

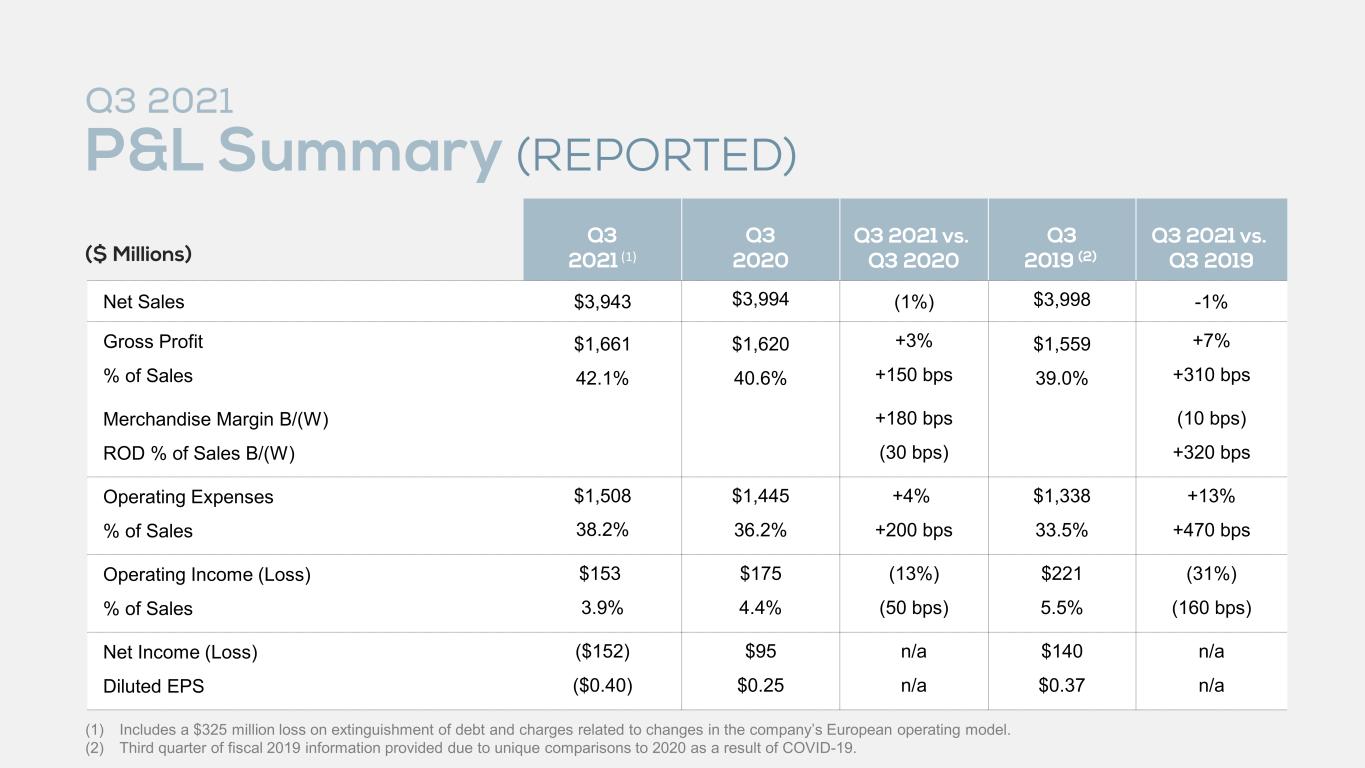

Q3 2021 P&L Summary (REPORTED) Q3 2021 (1) Q3 2020 Q3 2021 vs. Q3 2020 Q3 2019 (2) Q3 2021 vs. Q3 2019 Net Sales $3,943 $3,994 (1%) $3,998 -1% Gross Profit % of Sales $1,661 42.1% $1,620 40.6% +3% +150 bps $1,559 39.0% +7% +310 bps Merchandise Margin B/(W) ROD % of Sales B/(W) +180 bps (30 bps) (10 bps) +320 bps Operating Expenses % of Sales $1,508 38.2% $1,445 36.2% +4% +200 bps $1,338 33.5% +13% +470 bps Operating Income (Loss) % of Sales $153 3.9% $175 4.4% (13%) (50 bps) $221 5.5% (31%) (160 bps) Net Income (Loss) Diluted EPS ($152) ($0.40) $95 $0.25 n/a n/a $140 $0.37 n/a n/a ($ Millions) (1) Includes a $325 million loss on extinguishment of debt and charges related to changes in the company’s European operating model. (2) Third quarter of fiscal 2019 information provided due to unique comparisons to 2020 as a result of COVID-19.

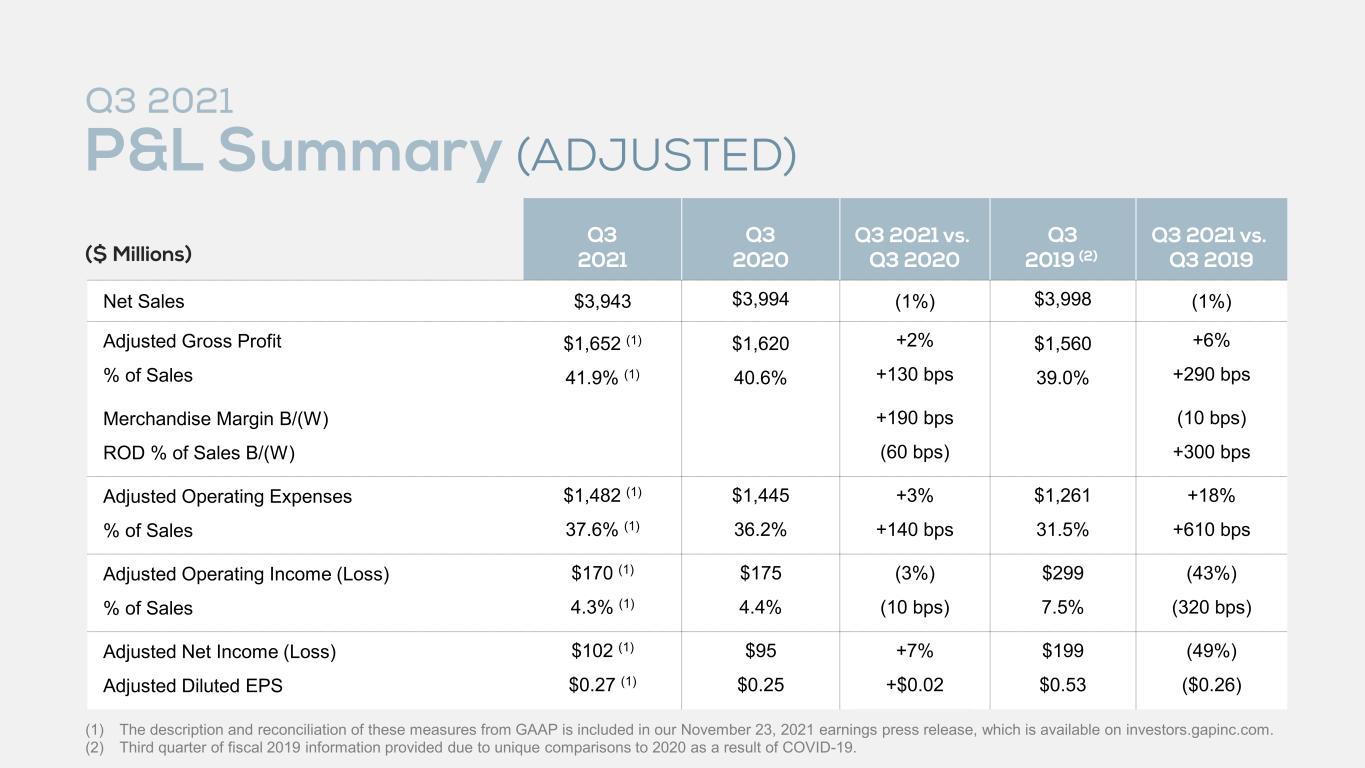

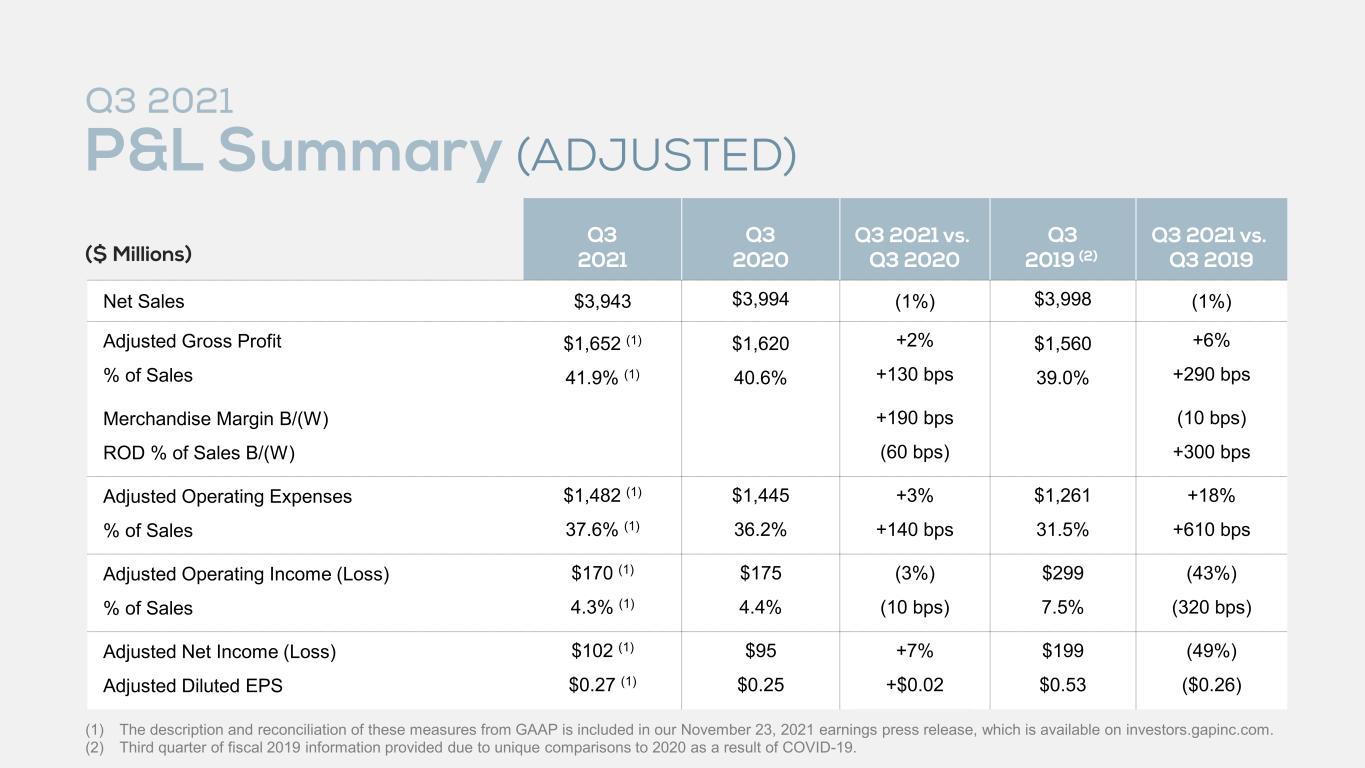

Q3 2021 P&L Summary (ADJUSTED) ($ Millions) (1) The description and reconciliation of these measures from GAAP is included in our November 23, 2021 earnings press release, which is available on investors.gapinc.com. (2) Third quarter of fiscal 2019 information provided due to unique comparisons to 2020 as a result of COVID-19. Q3 2021 Q3 2020 Q3 2021 vs. Q3 2020 Q3 2019 (2) Q3 2021 vs. Q3 2019 Net Sales $3,943 $3,994 (1%) $3,998 (1%) Adjusted Gross Profit % of Sales $1,652 (1) 41.9% (1) $1,620 40.6% +2% +130 bps $1,560 39.0% +6% +290 bps Merchandise Margin B/(W) ROD % of Sales B/(W) +190 bps (60 bps) (10 bps) +300 bps Adjusted Operating Expenses % of Sales $1,482 (1) 37.6% (1) $1,445 36.2% +3% +140 bps $1,261 31.5% +18% +610 bps Adjusted Operating Income (Loss) % of Sales $170 (1) 4.3% (1) $175 4.4% (3%) (10 bps) $299 7.5% (43%) (320 bps) Adjusted Net Income (Loss) Adjusted Diluted EPS $102 (1) $0.27 (1) $95 $0.25 +7% +$0.02 $199 $0.53 (49%) ($0.26)

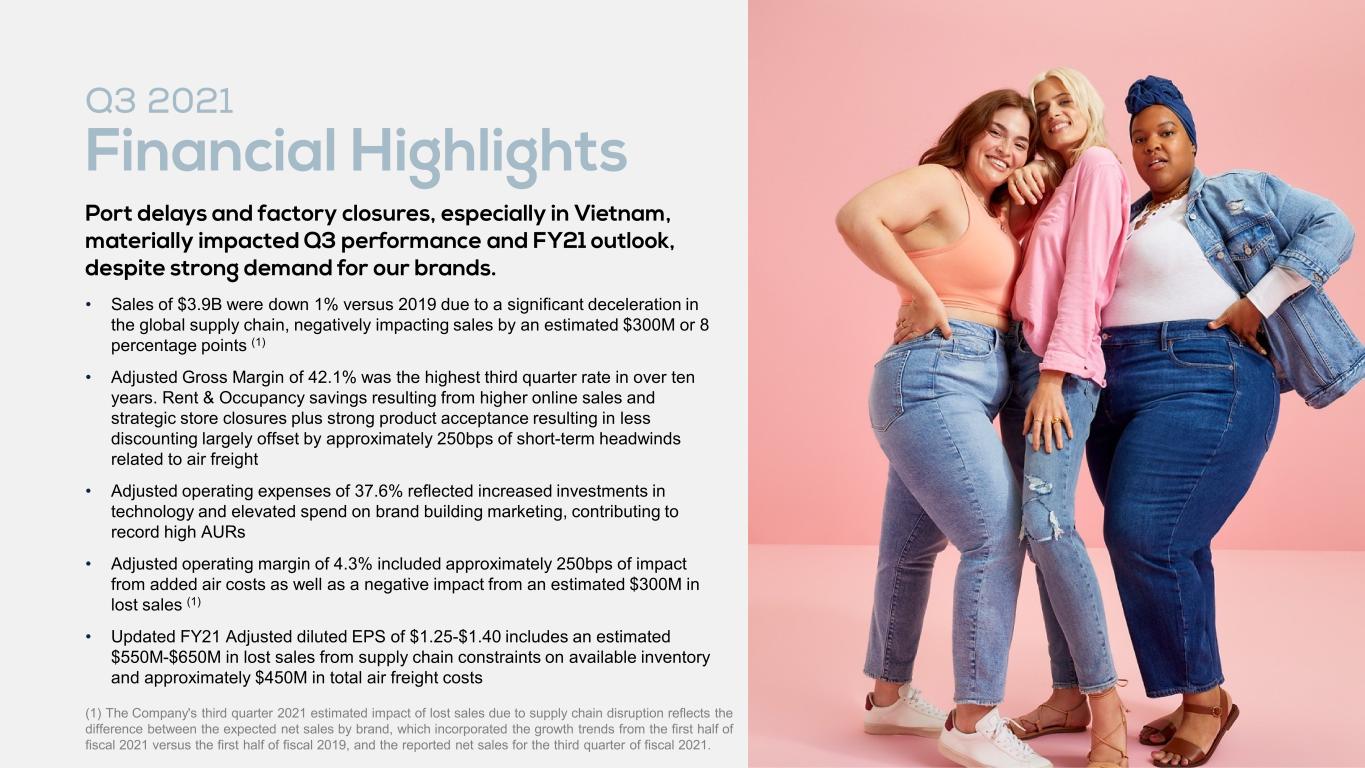

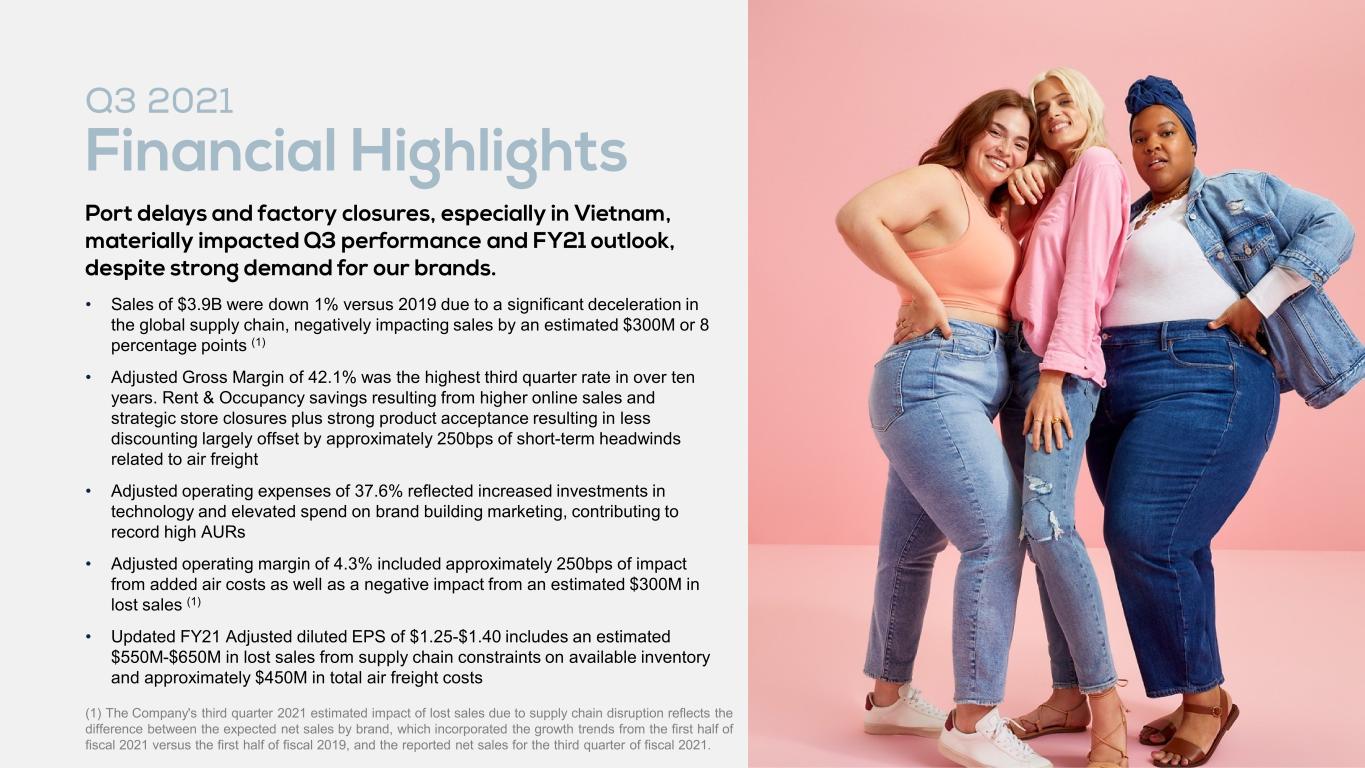

Port delays and factory closures, especially in Vietnam, materially impacted Q3 performance and FY21 outlook, despite strong demand for our brands. • Sales of $3.9B were down 1% versus 2019 due to a significant deceleration in the global supply chain, negatively impacting sales by an estimated $300M or 8 percentage points (1) • Adjusted Gross Margin of 42.1% was the highest third quarter rate in over ten years. Rent & Occupancy savings resulting from higher online sales and strategic store closures plus strong product acceptance resulting in less discounting largely offset by approximately 250bps of short-term headwinds related to air freight • Adjusted operating expenses of 37.6% reflected increased investments in technology and elevated spend on brand building marketing, contributing to record high AURs • Adjusted operating margin of 4.3% included approximately 250bps of impact from added air costs as well as a negative impact from an estimated $300M in lost sales (1) • Updated FY21 Adjusted diluted EPS of $1.25-$1.40 includes an estimated $550M-$650M in lost sales from supply chain constraints on available inventory and approximately $450M in total air freight costs (1) The Company's third quarter 2021 estimated impact of lost sales due to supply chain disruption reflects the difference between the expected net sales by brand, which incorporated the growth trends from the first half of fiscal 2021 versus the first half of fiscal 2019, and the reported net sales for the third quarter of fiscal 2021. Q3 2021 Financial Highlights

• Sales: Estimated $300M lost sales due to inventory constraints (1) • Gross Margin: Approximately $100M in air freight costs • Inventory: -11% decline vs 2019 average on-hand inventory FY Financial Impacts Mitigation Efforts Near term levers: • Secured additional air capacity to satisfy holiday demand • Moving select receipts to East Coast ports to limit impact of LA-Long Beach congestion Long term levers: • Adjusted product-to-market pipeline to move receipt timing forward • Accelerating digital product creation at Old Navy – reducing weeks from production time • Increasing geographic diversification largely through a focus on multi-national vendors Q3 Financial Impacts • Sales: Estimated $550M to $650M lost sales due to inventory constraints (1) • Gross Margin: Approximately $450M in transitory air freight costs Situation • Port delays, especially LA/Long Beach worsened during the quarter, extending to up to 15 days • Factory closures in Vietnam extended over 2 ½ months from August through October leading to Holiday inventory cancellations and delays Q3 2021 Supply Chain Update (1) The Company's third quarter 2021 estimated impact of lost sales due to supply chain disruption reflects the difference between the expected net sales by brand, which incorporated the growth trends from the first half of fiscal 2021 versus the first half of fiscal 2019, and the reported net sales for the third quarter of fiscal 2021.

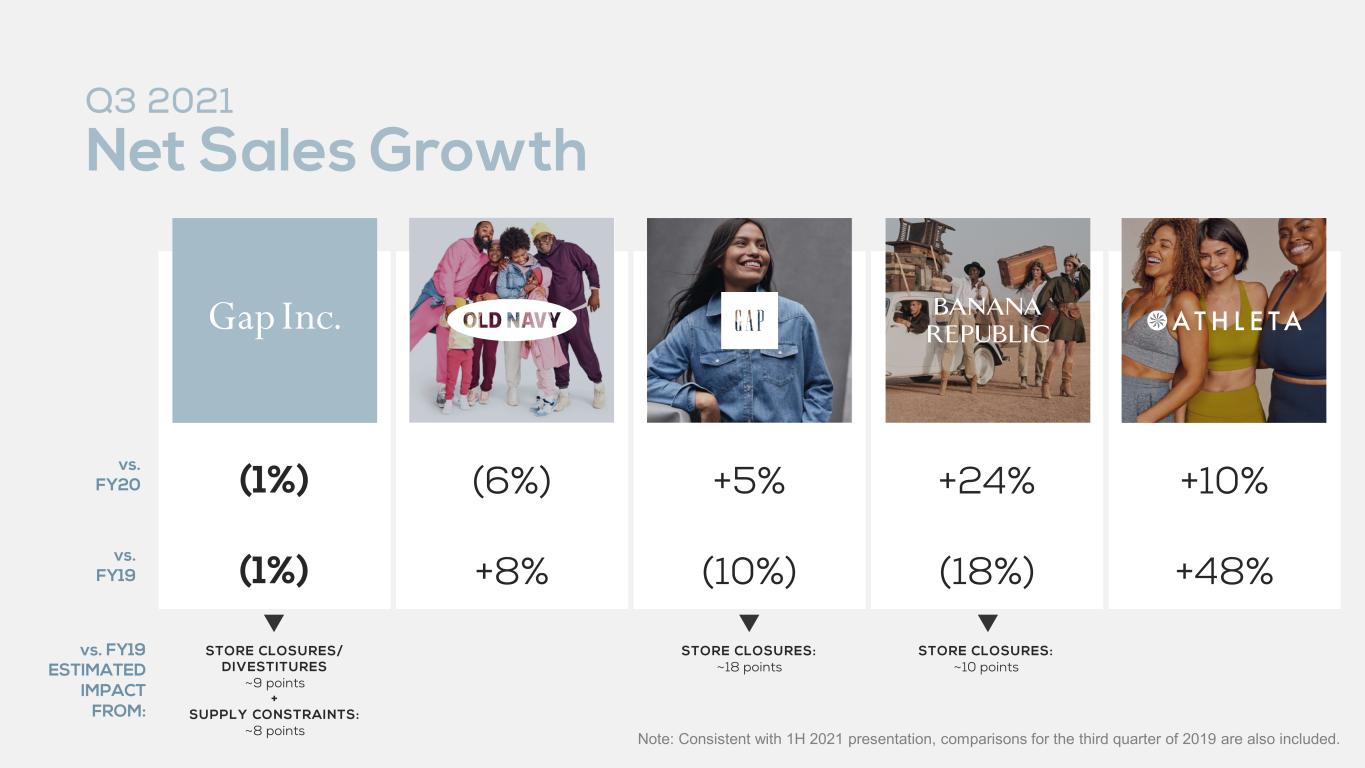

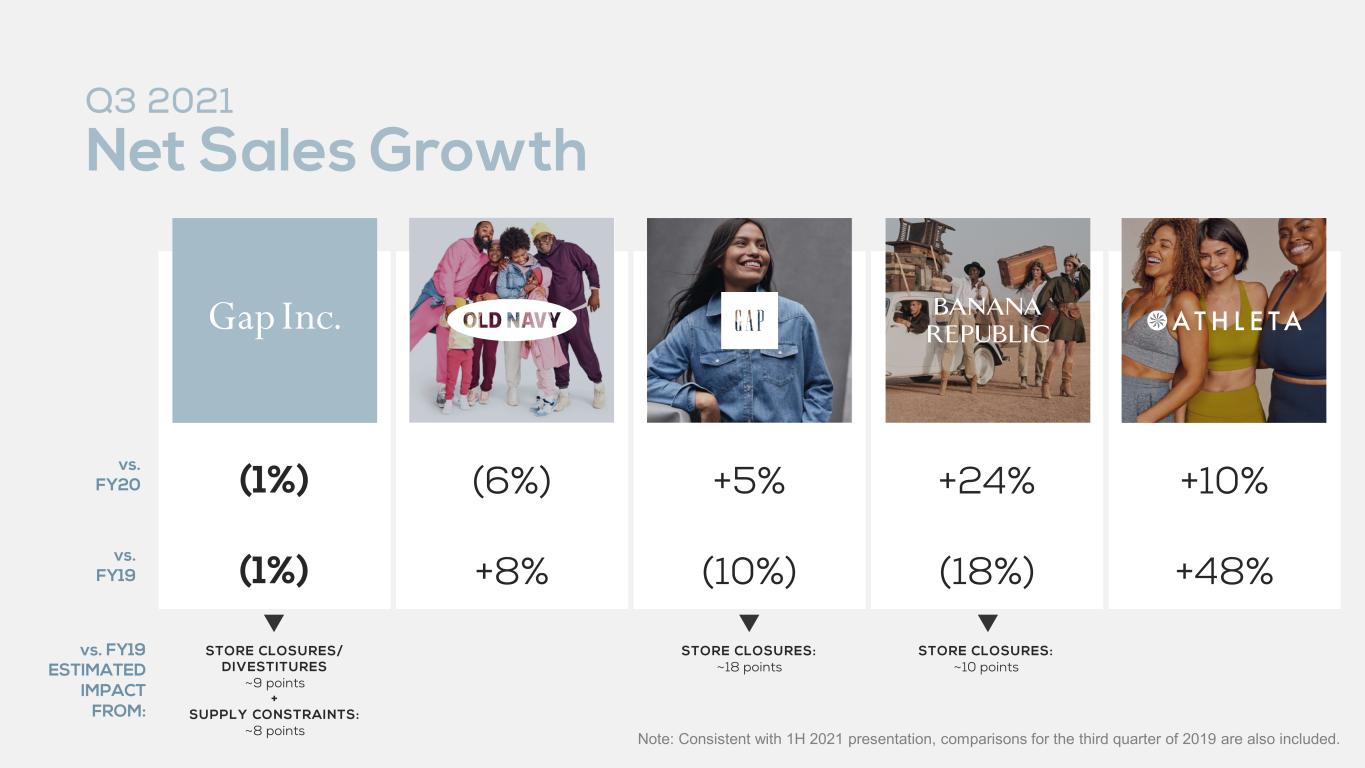

+10%(6%) Q3 2021 Net Sales Growth +24%+5%(1%) +8% (18%)(10%)(1%) +48% vs. FY20 vs. FY19 Note: Consistent with 1H 2021 presentation, comparisons for the third quarter of 2019 are also included. STORE CLOSURES: ~18 points STORE CLOSURES: ~10 points vs. FY19 ESTIMATED IMPACT FROM: STORE CLOSURES/ DIVESTITURES ~9 points + SUPPLY CONSTRAINTS: ~8 points

Q3 2021 Comparable Sales (9%) +28%+7%(1%) +2% +6% (10%)+3%+5% +41% NORTH AMERICA COMP VS. FY19: +13% Note: Consistent with 1H 2021 presentation, comparisons for the third quarter of 2019 are also included. vs. FY20 vs. FY19

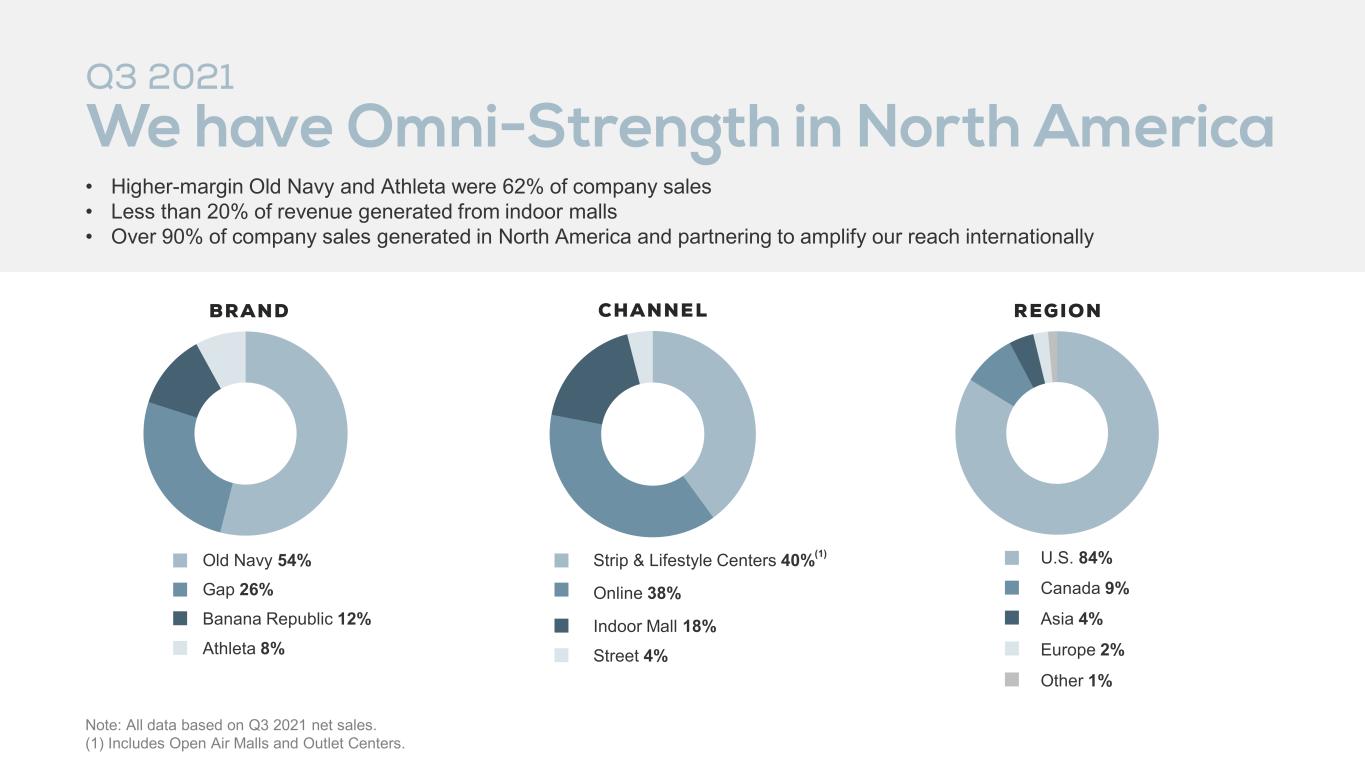

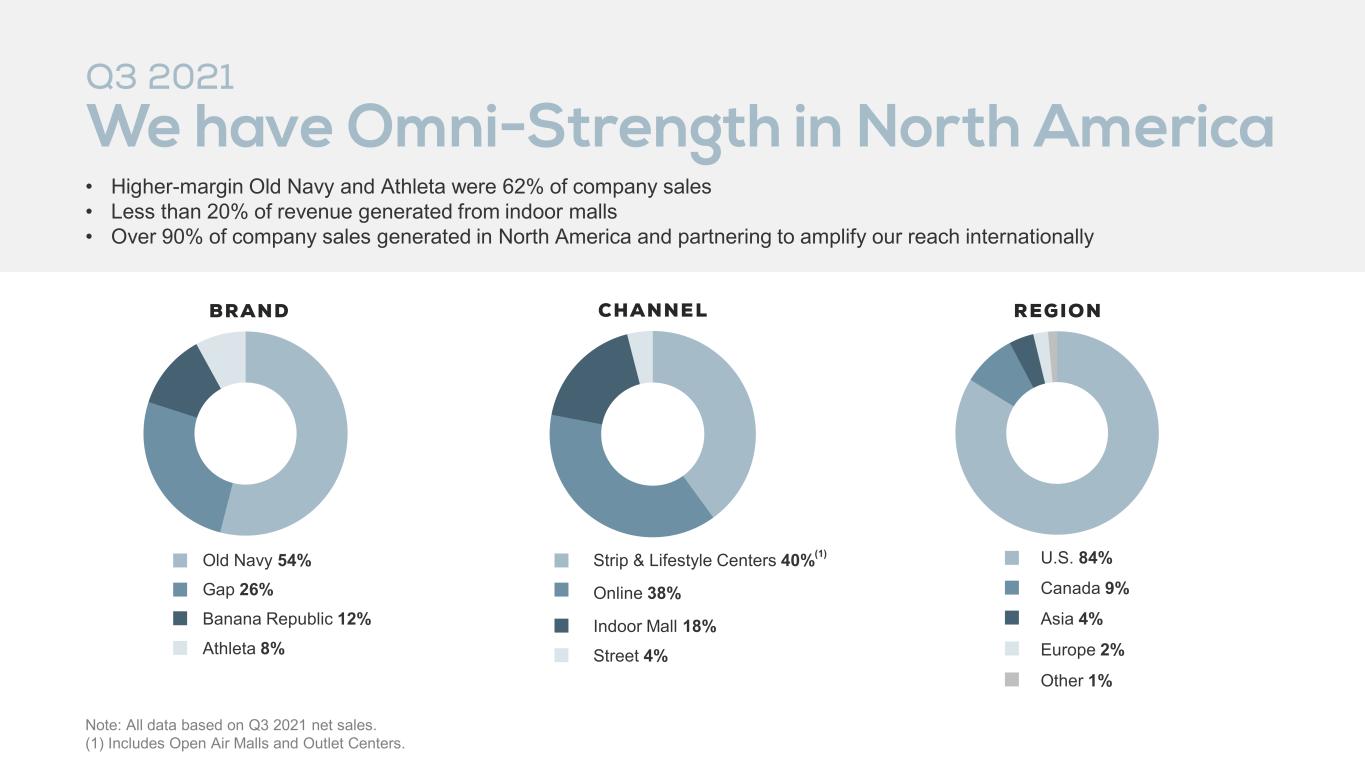

Q3 2021 We have Omni-Strength in North America CHANNEL REGION Note: All data based on Q3 2021 net sales. (1) Includes Open Air Malls and Outlet Centers. • Higher-margin Old Navy and Athleta were 62% of company sales • Less than 20% of revenue generated from indoor malls • Over 90% of company sales generated in North America and partnering to amplify our reach internationally ■ Old Navy 54% ■ Gap 26% ■ Banana Republic 12% ■ Athleta 8% ■ U.S. 84% ■ Canada 9% ■ Asia 4% ■ Europe 2% ■ Other 1% ■ Strip & Lifestyle Centers 40%(1) ■ Online 38% ■ Indoor Mall 18% ■ Street 4% BRAND

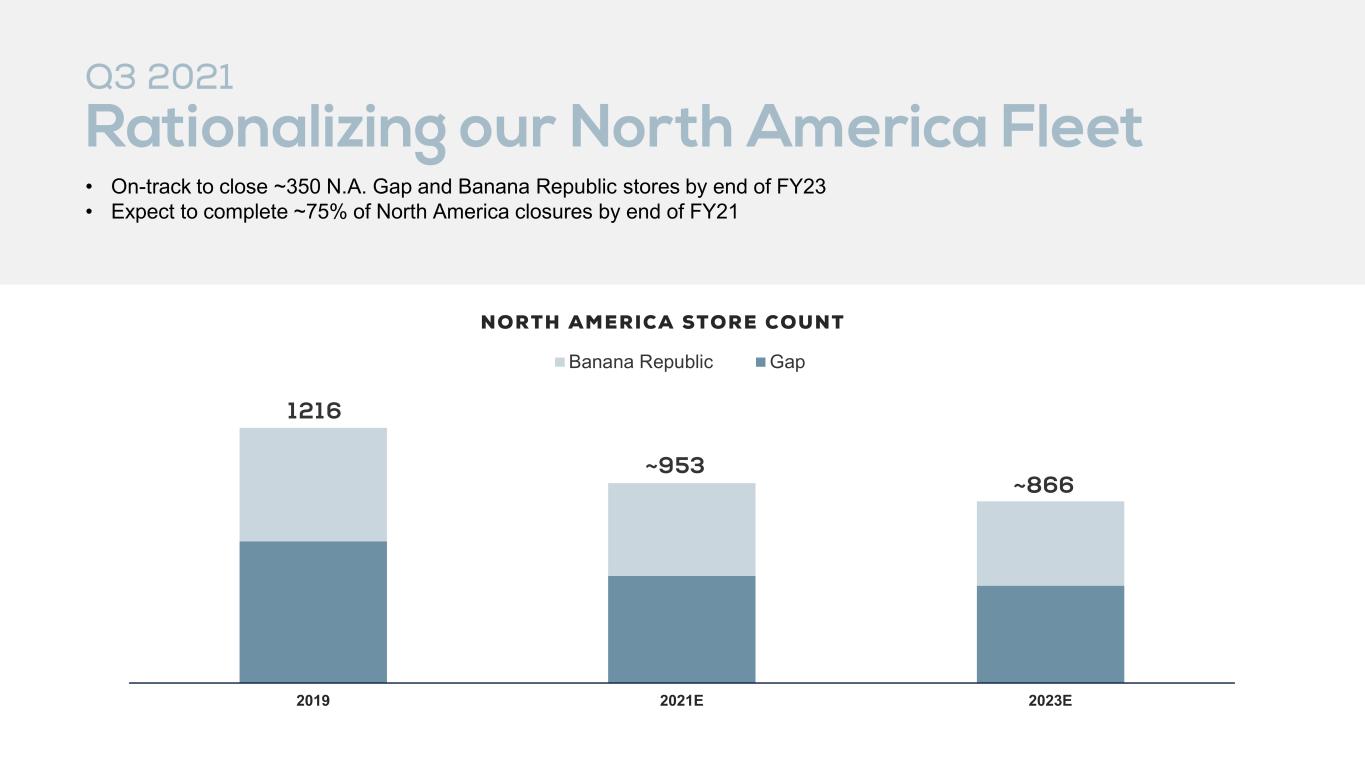

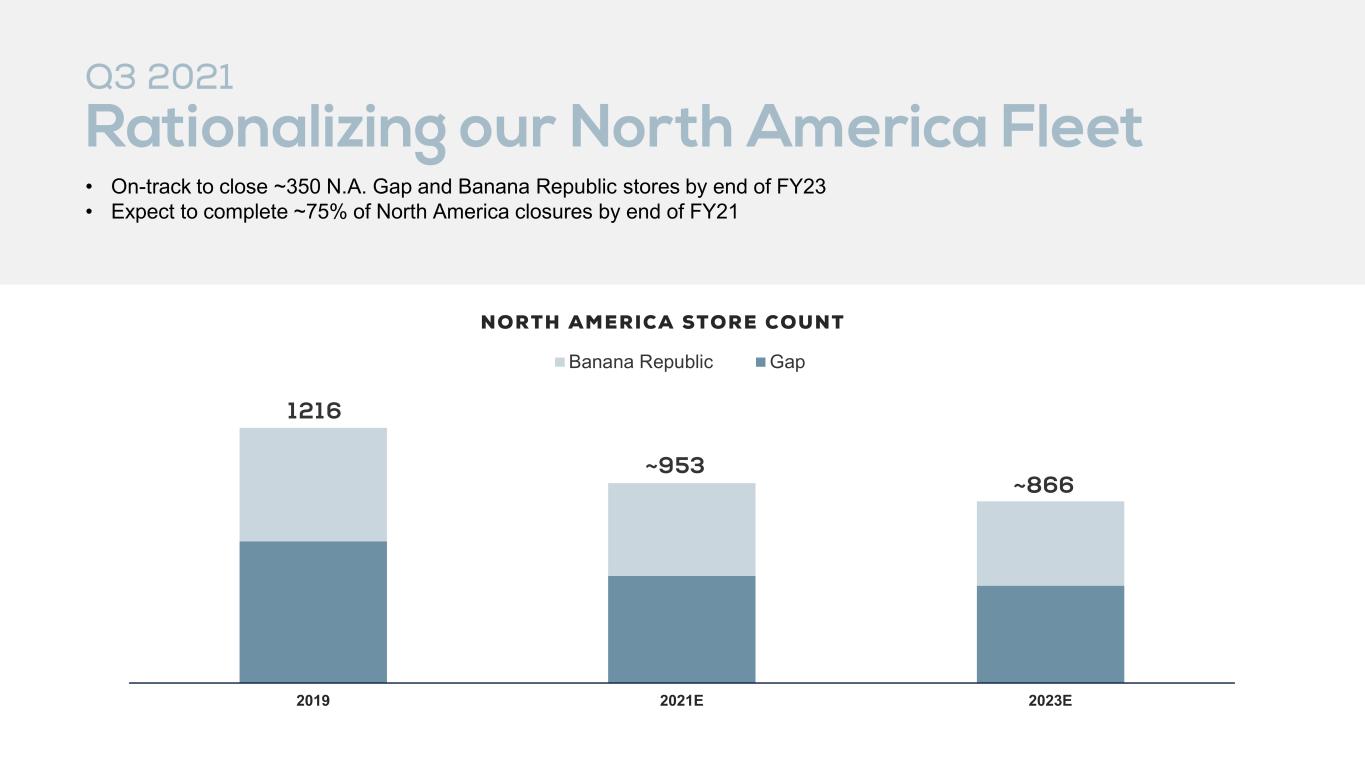

Q3 2021 Rationalizing our North America Fleet • On-track to close ~350 N.A. Gap and Banana Republic stores by end of FY23 • Expect to complete ~75% of North America closures by end of FY21 121 6 ~953 ~866 2019 2021E 2023E NORTH AMERICA STORE COUNT Banana Republic Gap

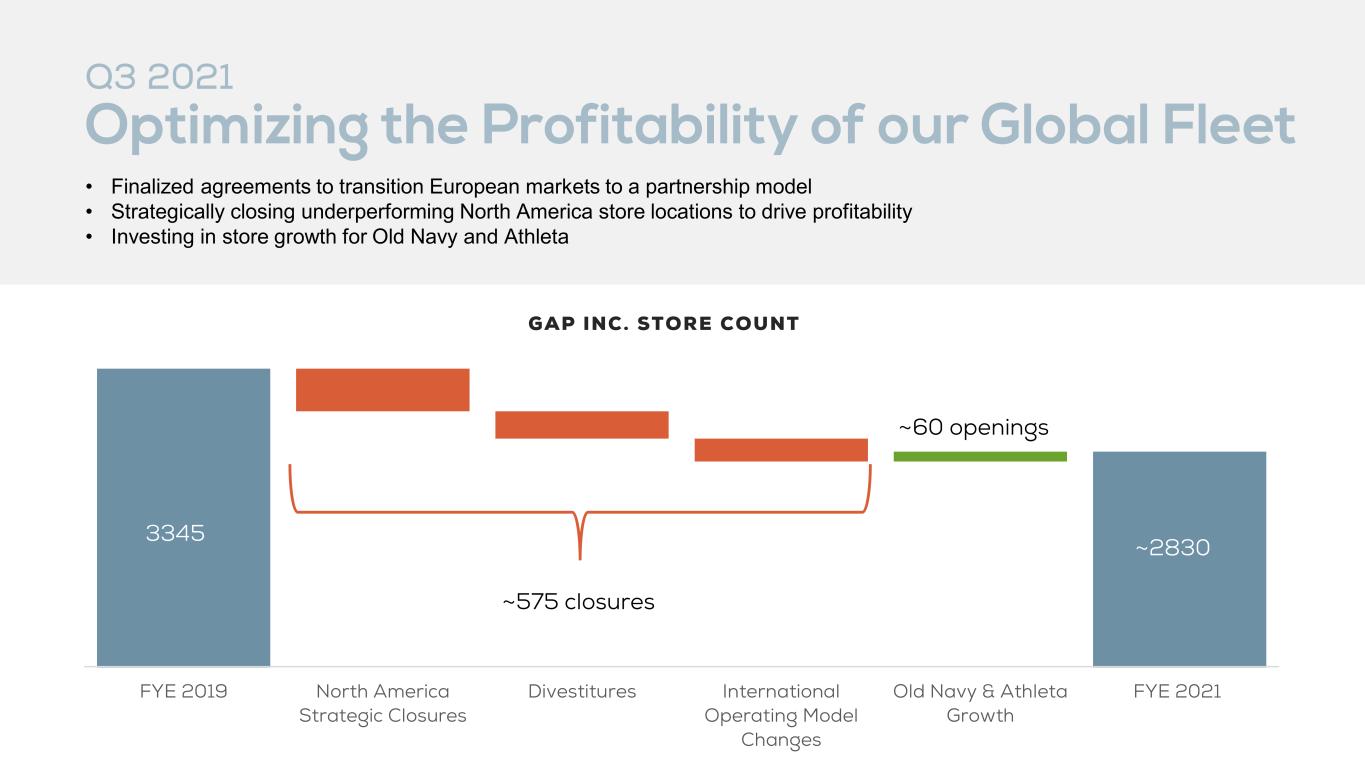

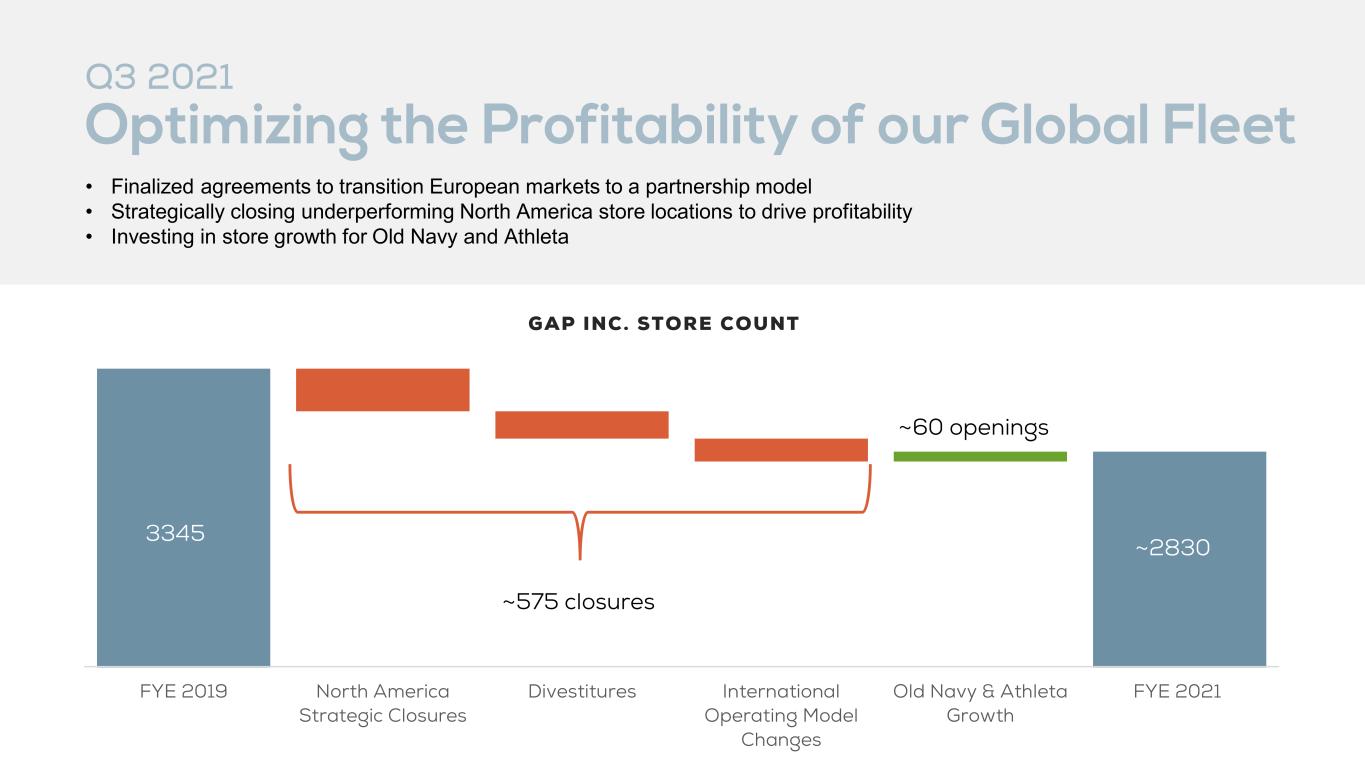

Q3 2021 Optimizing the Profitability of our Global Fleet FYE 2019 North America Strategic Closures Divestitures International Operating Model Changes Old Navy & Athleta Growth FYE 2021 GAP INC. STORE COUNT 3345 ~2830 ~575 closures ~60 openings • Finalized agreements to transition European markets to a partnership model • Strategically closing underperforming North America store locations to drive profitability • Investing in store growth for Old Navy and Athleta

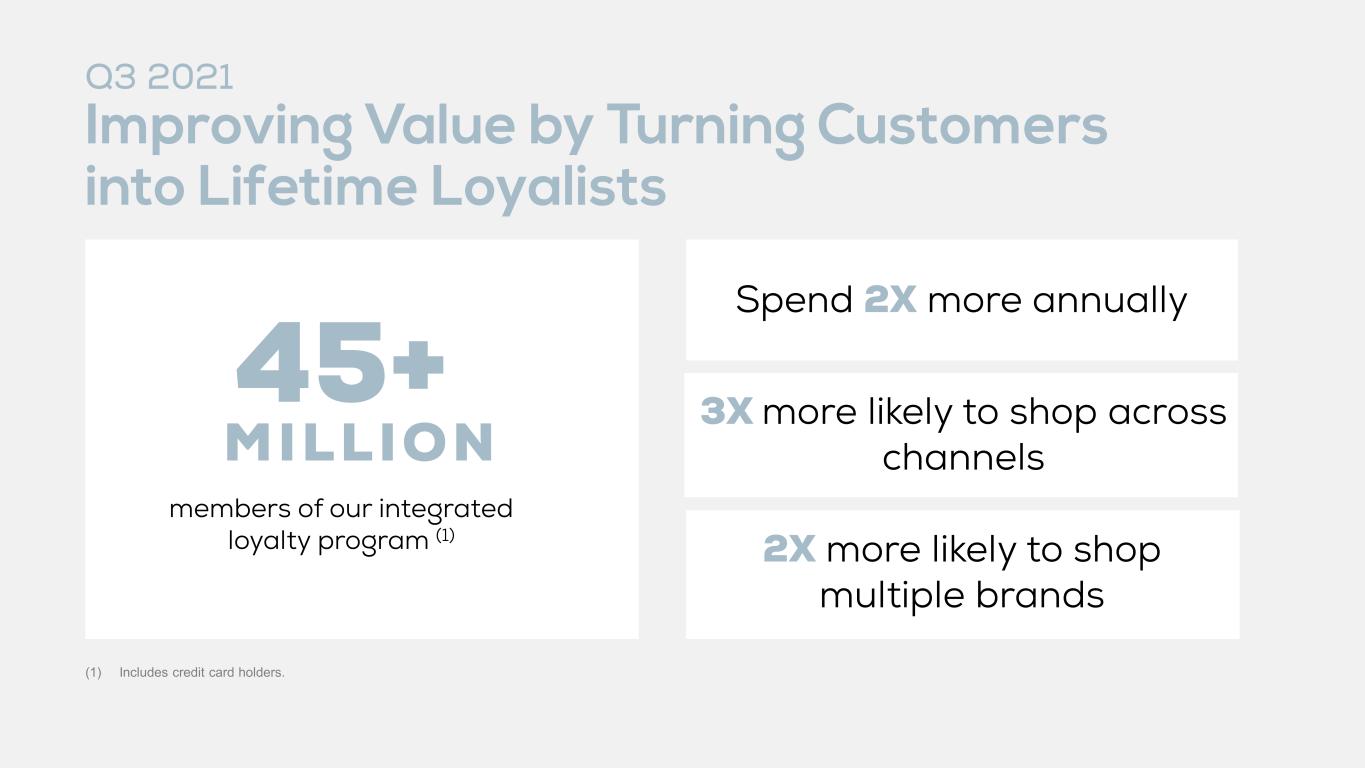

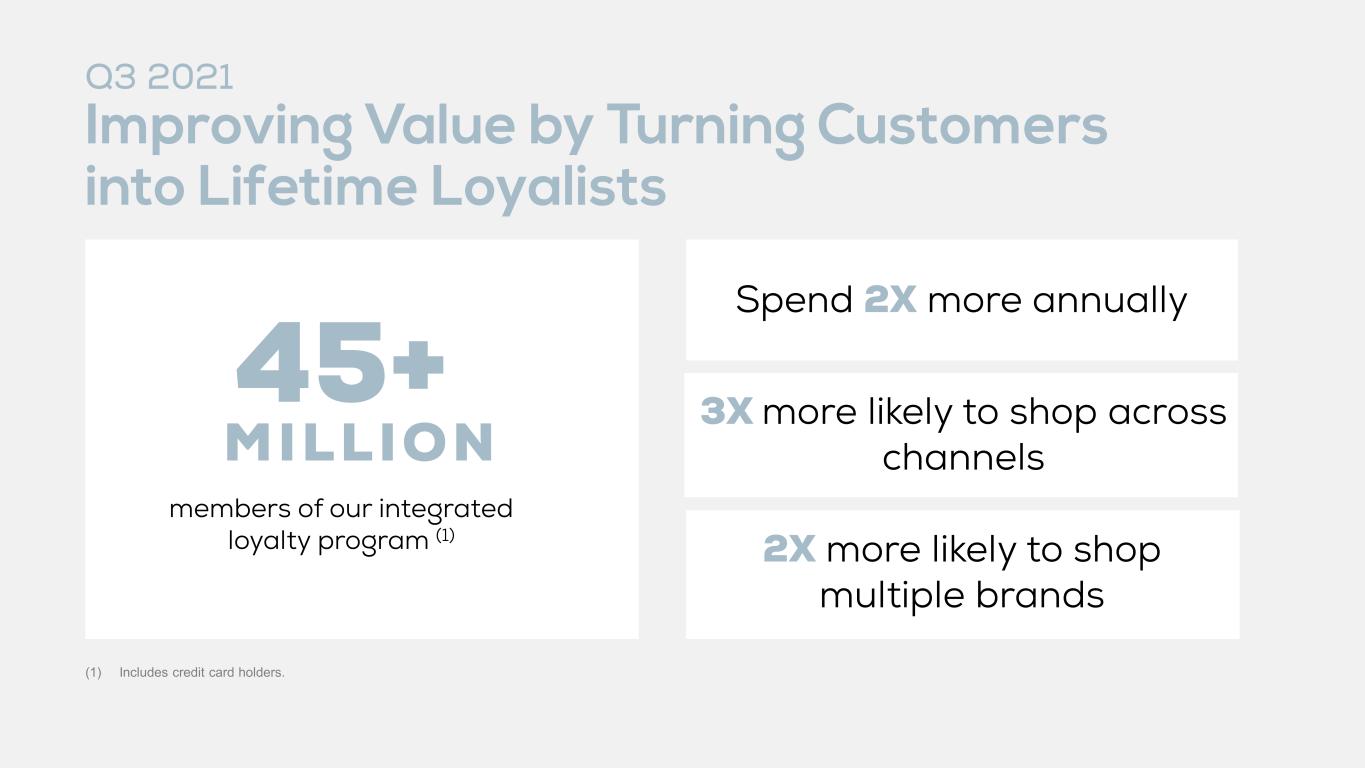

members of our integrated loyalty program (1) (1) Includes credit card holders. 45+ MILLION Spend 2X more annually 2X more likely to shop multiple brands 3X more likely to shop across channels Q3 2021 Improving Value by Turning Customers into Lifetime Loyalists

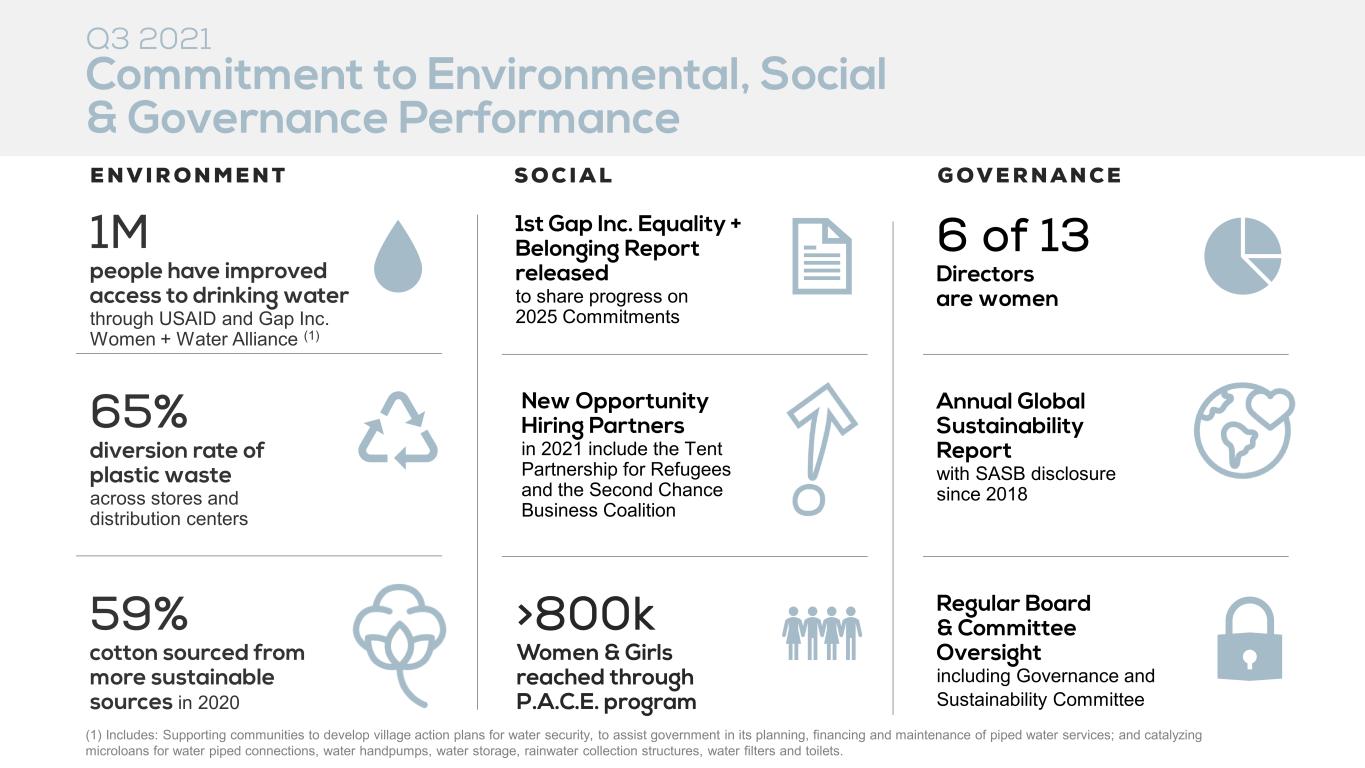

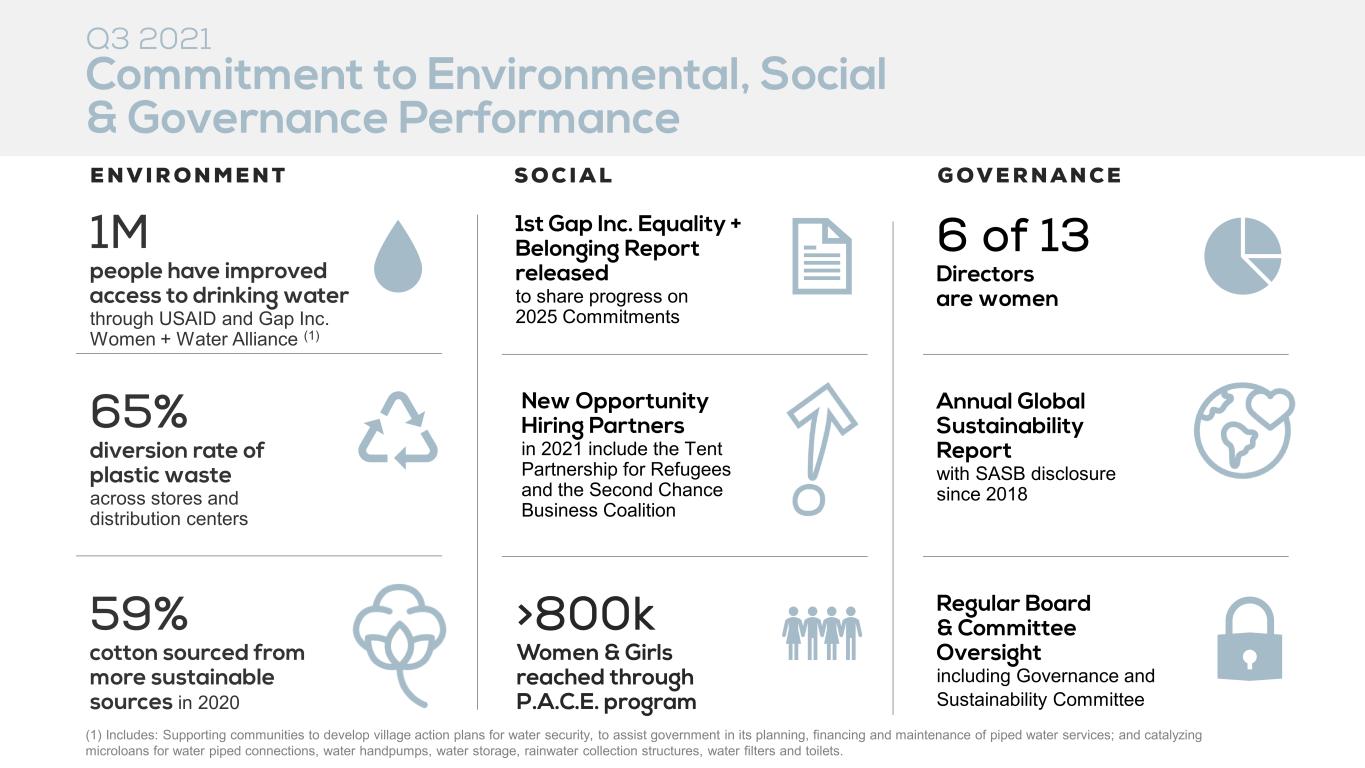

1M people have improved access to drinking water through USAID and Gap Inc. Women + Water Alliance (1) 65% diversion rate of plastic waste across stores and distribution centers 59% cotton sourced from more sustainable sources in 2020 E N V I R O N M E N T Q3 2021 Commitment to Environmental, Social & Governance Performance S O C I A L 1st Gap Inc. Equality + Belonging Report released to share progress on 2025 Commitments Annual Global Sustainability Report with SASB disclosure since 2018 Regular Board & Committee Oversight including Governance and Sustainability Committee G O V E R N A N C E 6 of 13 Directors are women >800k Women & Girls reached through P.A.C.E. program New Opportunity Hiring Partners in 2021 include the Tent Partnership for Refugees and the Second Chance Business Coalition (1) Includes: Supporting communities to develop village action plans for water security, to assist government in its planning, financing and maintenance of piped water services; and catalyzing microloans for water piped connections, water handpumps, water storage, rainwater collection structures, water filters and toilets.

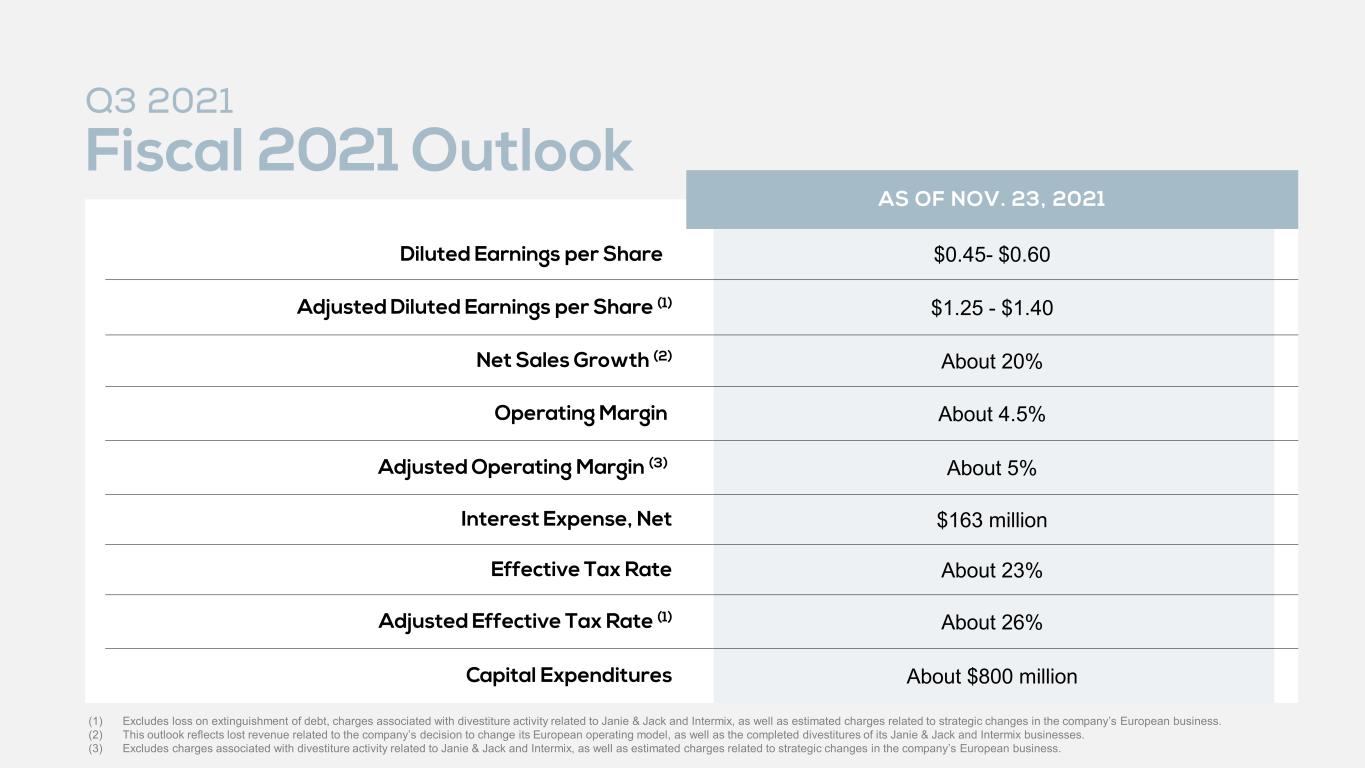

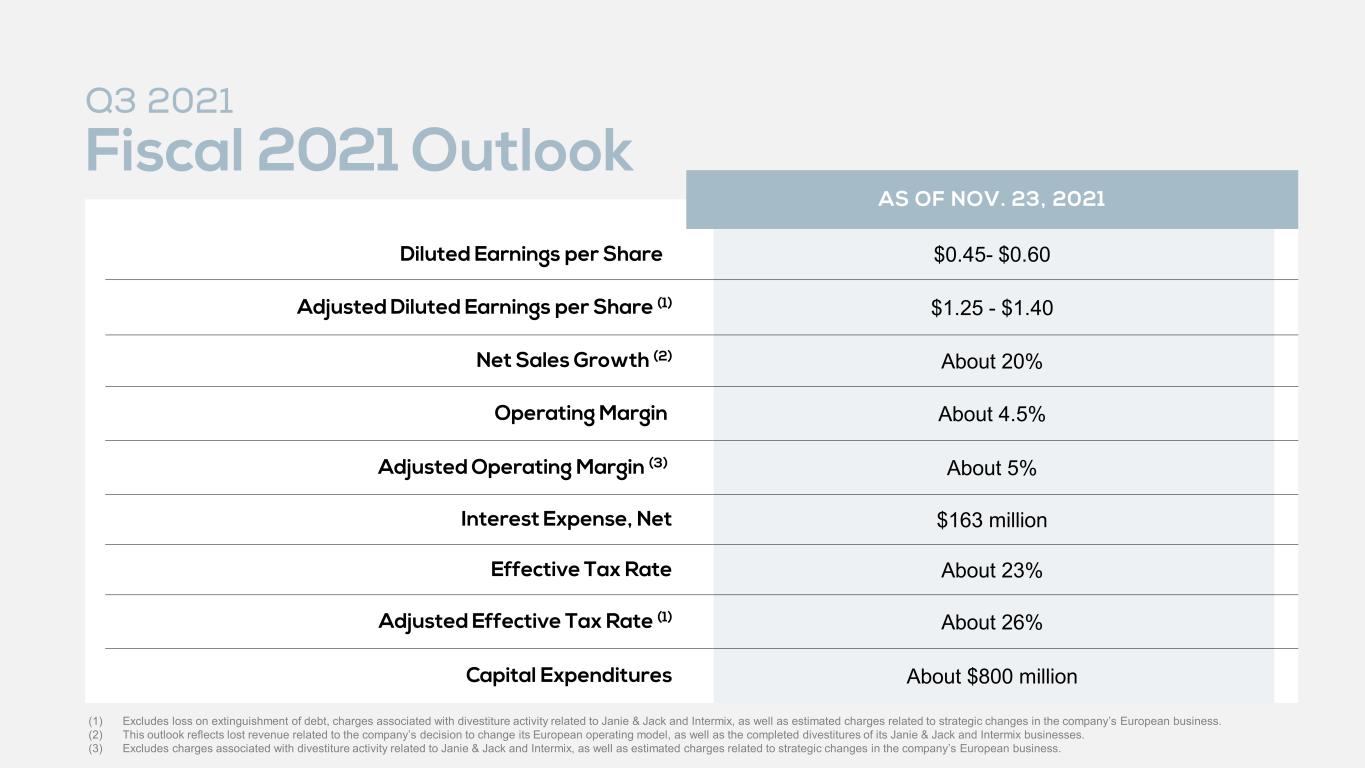

(1) Excludes loss on extinguishment of debt, charges associated with divestiture activity related to Janie & Jack and Intermix, as well as estimated charges related to strategic changes in the company’s European business. (2) This outlook reflects lost revenue related to the company’s decision to change its European operating model, as well as the completed divestitures of its Janie & Jack and Intermix businesses. (3) Excludes charges associated with divestiture activity related to Janie & Jack and Intermix, as well as estimated charges related to strategic changes in the company’s European business. Q3 2021 Fiscal 2021 Outlook AS OF NOV. 23, 2021 Diluted Earnings per Share $0.45- $0.60 Adjusted Diluted Earnings per Share (1) $1.25 - $1.40 Net Sales Growth (2) About 20% Operating Margin About 4.5% Adjusted Operating Margin (3) About 5% Interest Expense, Net $163 million Effective Tax Rate About 23% Adjusted Effective Tax Rate (1) About 26% Capital Expenditures About $800 million