Gap Inc. Fiscal 2021 Katrina O’Connell CHIEF FINANCIAL OFFICER Sonia Syngal CHIEF EXECUTIVE OFFICER FOURTH QUARTER EARNINGS RESULTS

Forward Looking Statements / Non-GAAP Financial Measures FORWARD LOOKING STATEMENTS This conference call and webcast contain forward-looking statements within the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995. All statements other than those that are purely historical are forward-looking statements. Forward-looking statements include statements identified as such in our March 3, 2022 press release. Because these forward-looking statements involve risks and uncertainties, there are important factors that could cause our actual results to differ materially from those in the forward-looking statements. Additional information regarding factors that could cause results to differ can be found in the Company's Annual Report on Form 10-K for the fiscal year ended January 30, 2021, as well as the Company’s subsequent filings with the Securities and Exchange Commission. These forward-looking statements are based on information as of March 3, 2022. We assume no obligation to publicly update or revise our forward-looking statements even if experience or future changes make it clear that any projected results expressed or implied therein will not be realized. SEC REGULATION G This presentation includes the non-GAAP measures adjusted gross profit, adjusted operating expenses, adjusted operating income (loss), adjusted net income (loss), and adjusted diluted earnings per share for each of Q4 and full year 2021 as well as adjusted expected diluted earnings per share, and adjusted expected operating margin. The description and reconciliation of these measures from GAAP is included in our March 3, 2022 earnings press release, which is available on investors.gapinc.com.

We grow purpose-led, billion-dollar lifestyle brands

Power Plan 2023 Power of our Brands Grow purpose-led, billion-dollar lifestyle brands Power of our Platform Leverage our omni capabilities and scaled operations, and extend our engineered approach to cost and growth Power of our Portfolio Extend customer reach across every age, body and occasion through our collective power

• Fiscal 2021 sales reached $16.7B, growing 21% year-over-year and 2% versus 2019 • Expanded gross margin significantly through ROD leverage and higher product margins from AUR growth versus 2019 • Returned over $400M to shareholders through dividend program and share repurchase plan • Restructured long-term debt, generating $140M in annual interest expense savings beginning in 2022 FY 2021 Financial Highlights

Q4 2021 P&L Summary (REPORTED) Q4 2021 (1) Q4 2020 (2) Q4 2021 vs. Q4 2020 Q4 2019 (3) Q4 2021 vs. Q4 2019 Net Sales $4,525 $4,424 +2% $4,674 (3%) Comparable Sales +3% +3% Gross Profit % of Sales $1,523 33.7% $1,668 37.7% (9%) (400 bps) $1,674 35.8% (9%) (210 bps) Merchandise Margin B/(W) ROD % of Sales B/(W) (280 bps) (120 bps) (490 bps) +280 bps Operating Expenses % of Sales $1,515 33.5% $1,534 34.7% (1%) (120 bps) $1,919 41.1% (21%) (760 bps) Operating Income (Loss) % of Sales $8 0.2% $134 3.0% (94%) (280 bps) ($245) (5.2%) n/a (540 bps) Net Income (Loss) Diluted EPS ($16) ($0.04) $234 $0.61 n/a ($0.65) ($184) ($0.49) (91%) ($0.45) ($ Millions) (1) Includes costs related to changes in the company’s European operating model. (2) Includes $56 million in non-cash impairment charges related to Intermix. (3) Fourth quarter of fiscal 2019 information provided due to unique comparisons to 2020 as a result of COVID-19. UNAUDITED

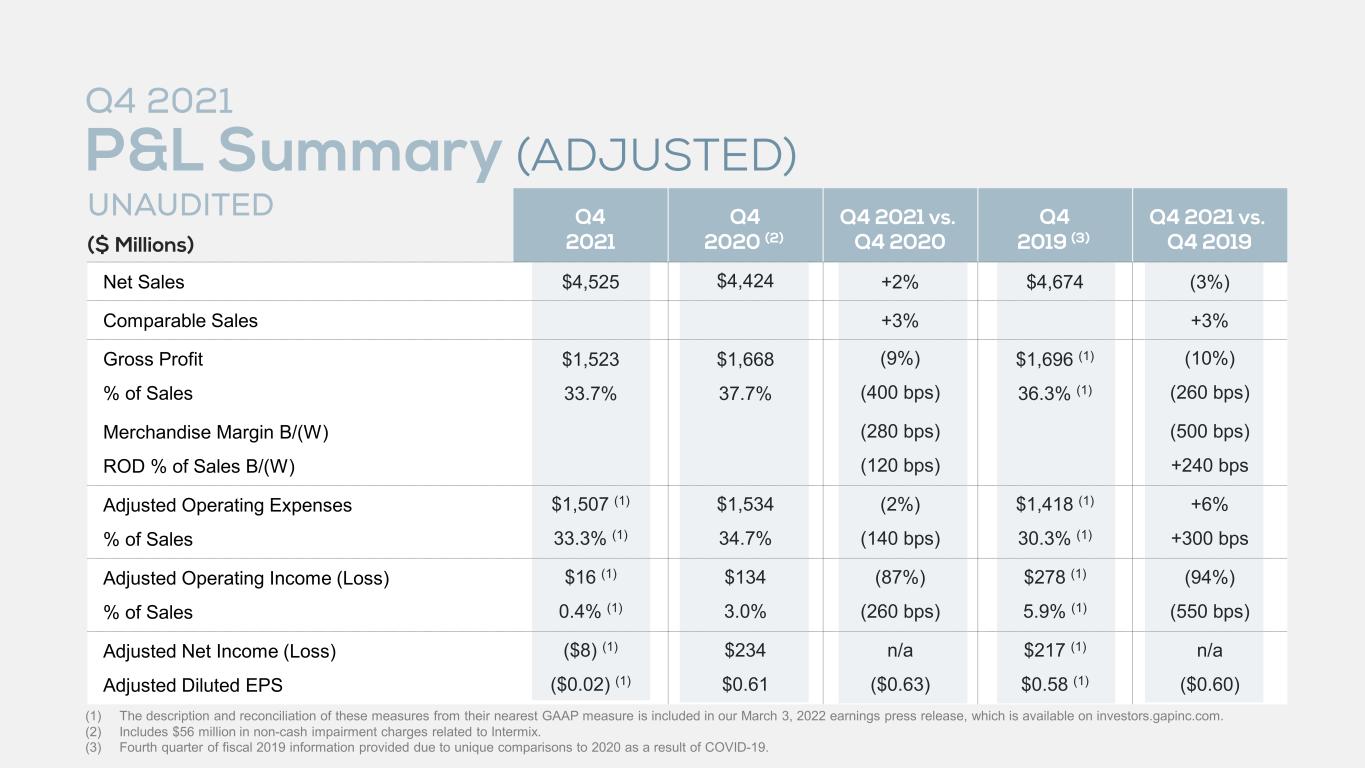

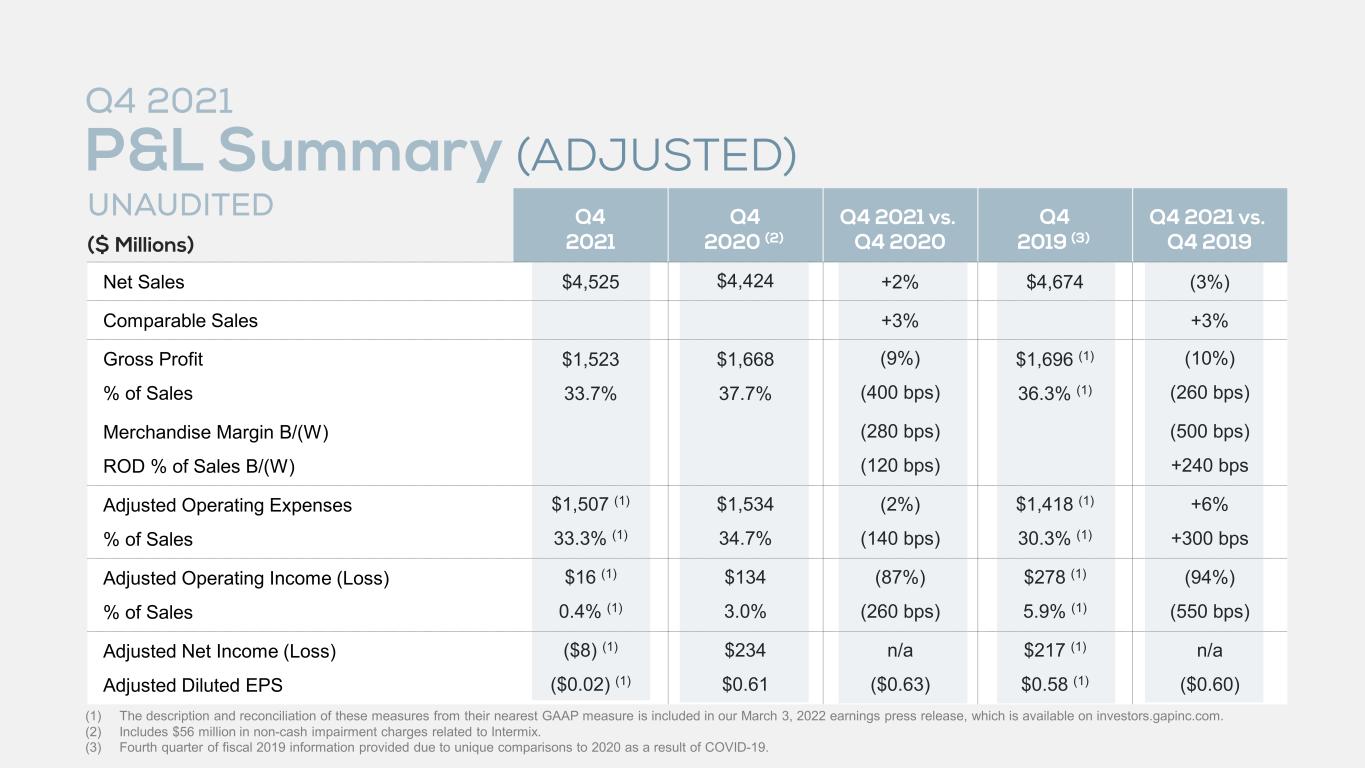

Q4 2021 P&L Summary (ADJUSTED) ($ Millions) (1) The description and reconciliation of these measures from their nearest GAAP measure is included in our March 3, 2022 earnings press release, which is available on investors.gapinc.com. (2) Includes $56 million in non-cash impairment charges related to Intermix. (3) Fourth quarter of fiscal 2019 information provided due to unique comparisons to 2020 as a result of COVID-19. Q4 2021 Q4 2020 (2) Q4 2021 vs. Q4 2020 Q4 2019 (3) Q4 2021 vs. Q4 2019 Net Sales $4,525 $4,424 +2% $4,674 (3%) Comparable Sales +3% +3% Gross Profit % of Sales $1,523 33.7% $1,668 37.7% (9%) (400 bps) $1,696 (1) 36.3% (1) (10%) (260 bps) Merchandise Margin B/(W) ROD % of Sales B/(W) (280 bps) (120 bps) (500 bps) +240 bps Adjusted Operating Expenses % of Sales $1,507 (1) 33.3% (1) $1,534 34.7% (2%) (140 bps) $1,418 (1) 30.3% (1) +6% +300 bps Adjusted Operating Income (Loss) % of Sales $16 (1) 0.4% (1) $134 3.0% (87%) (260 bps) $278 (1) 5.9% (1) (94%) (550 bps) Adjusted Net Income (Loss) Adjusted Diluted EPS ($8) (1) ($0.02) (1) $234 $0.61 n/a ($0.63) $217 (1) $0.58 (1) n/a ($0.60) UNAUDITED

+18%(3%) Q4 2021 Net Sales Growth +22%+7%+2% +2% (11%)(13%)(3%) +52% vs. FY20 vs. FY19 Note: Consistent with prior quarters in fiscal 2021, comparisons to the fourth quarter of 2019 are also included. STORE CLOSURES: ~17 points STORE CLOSURES: ~10 points vs. FY19 ESTIMATED IMPACT FROM: STORE CLOSURES/ DIVESTITURES ~9 points

Q4 2021 Comparable Sales (6%) +26%+10%+3% +12% (0%) (2%)+3%+3% +42% NORTH AMERICA COMP VS. FY19: +12% Note: Consistent with prior quarters in fiscal 2021, comparisons to the fourth quarter of 2019 are also included. vs. FY20 vs. FY19

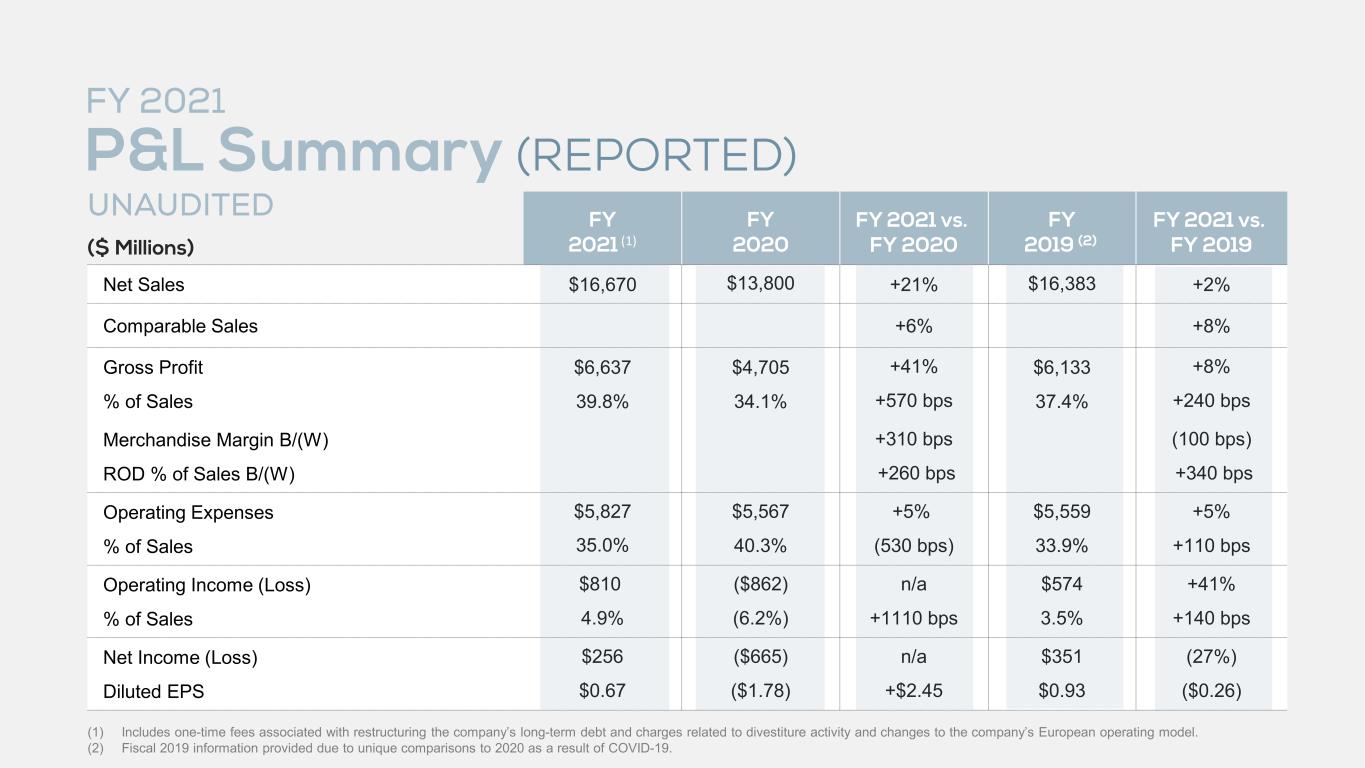

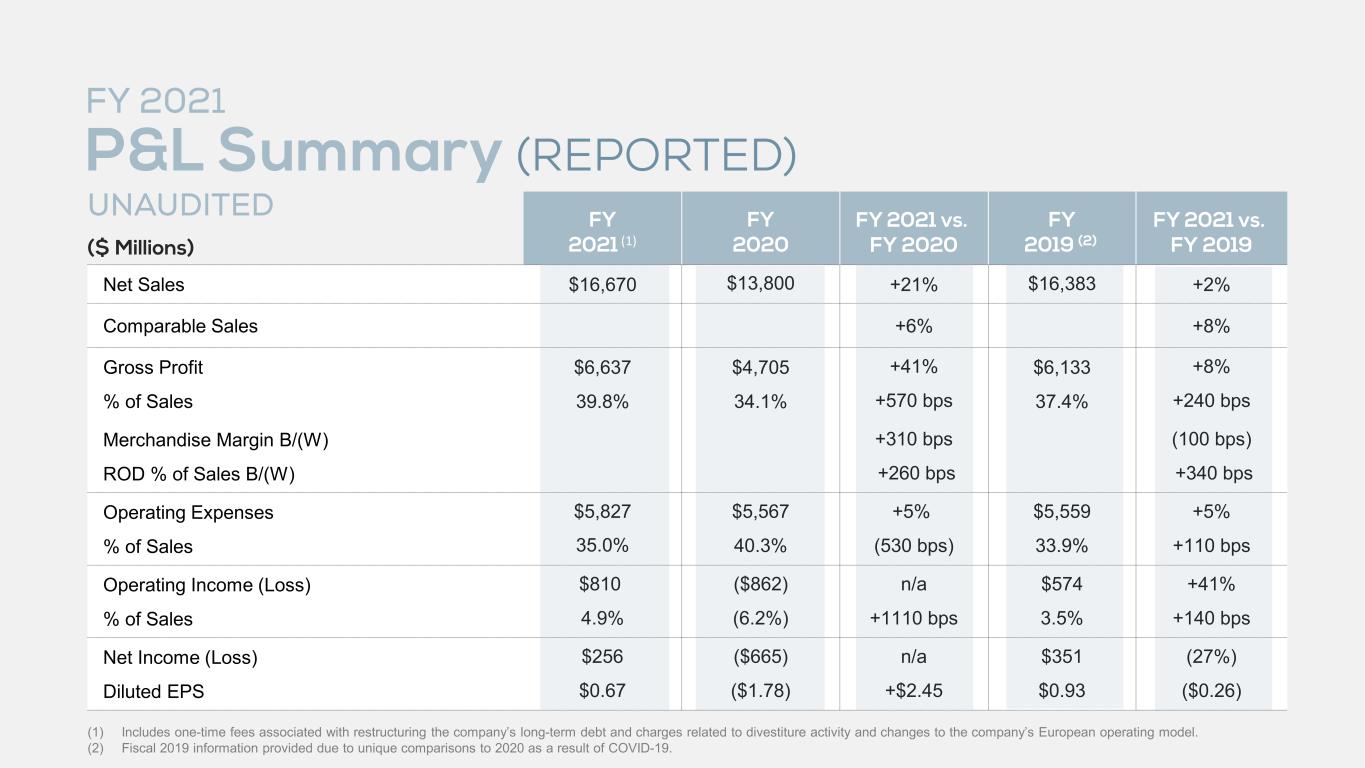

FY 2021 P&L Summary (REPORTED) FY 2021 (1) FY 2020 FY 2021 vs. FY 2020 FY 2019 (2) FY 2021 vs. FY 2019 Net Sales $16,670 $13,800 +21% $16,383 +2% Comparable Sales +6% +8% Gross Profit % of Sales $6,637 39.8% $4,705 34.1% +41% +570 bps $6,133 37.4% +8% +240 bps Merchandise Margin B/(W) ROD % of Sales B/(W) +310 bps +260 bps (100 bps) +340 bps Operating Expenses % of Sales $5,827 35.0% $5,567 40.3% +5% (530 bps) $5,559 33.9% +5% +110 bps Operating Income (Loss) % of Sales $810 4.9% ($862) (6.2%) n/a +1110 bps $574 3.5% +41% +140 bps Net Income (Loss) Diluted EPS $256 $0.67 ($665) ($1.78) n/a +$2.45 $351 $0.93 (27%) ($0.26) ($ Millions) (1) Includes one-time fees associated with restructuring the company’s long-term debt and charges related to divestiture activity and changes to the company’s European operating model. (2) Fiscal 2019 information provided due to unique comparisons to 2020 as a result of COVID-19. UNAUDITED

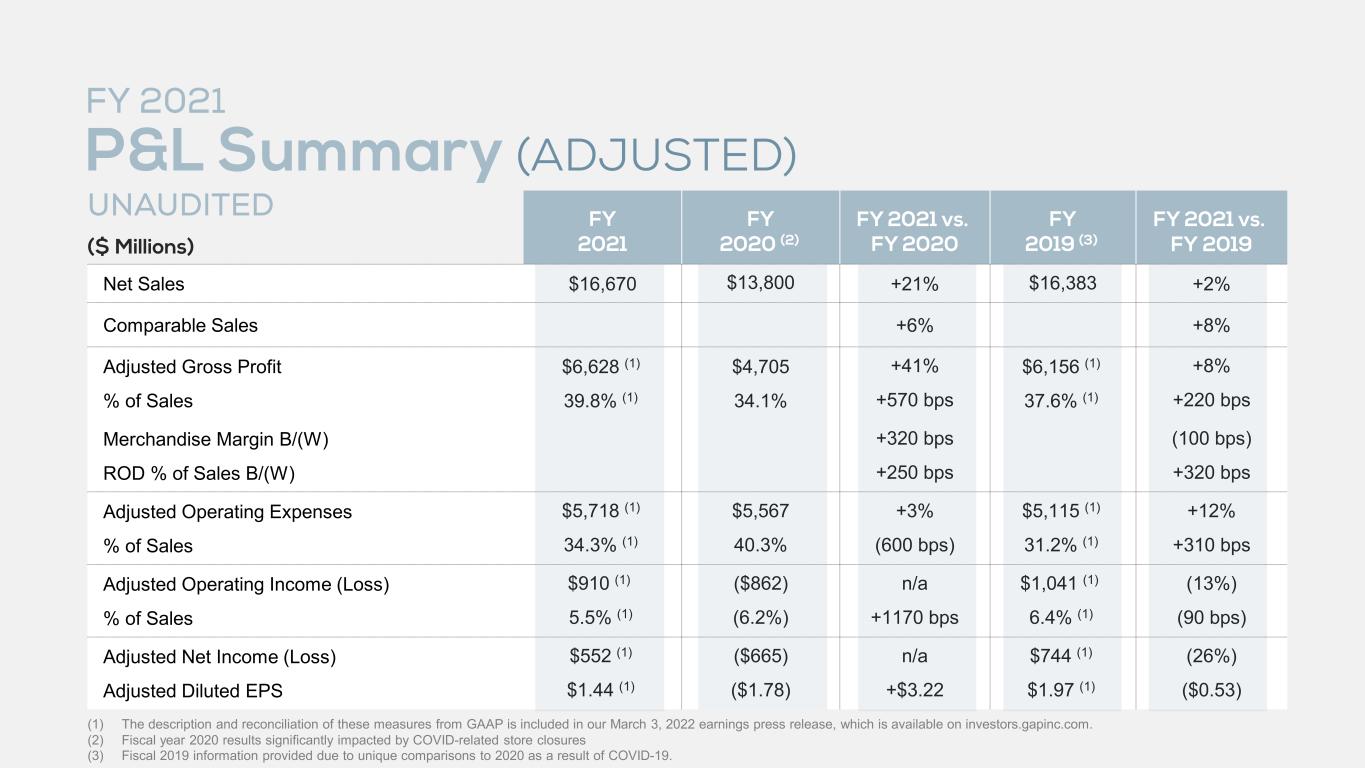

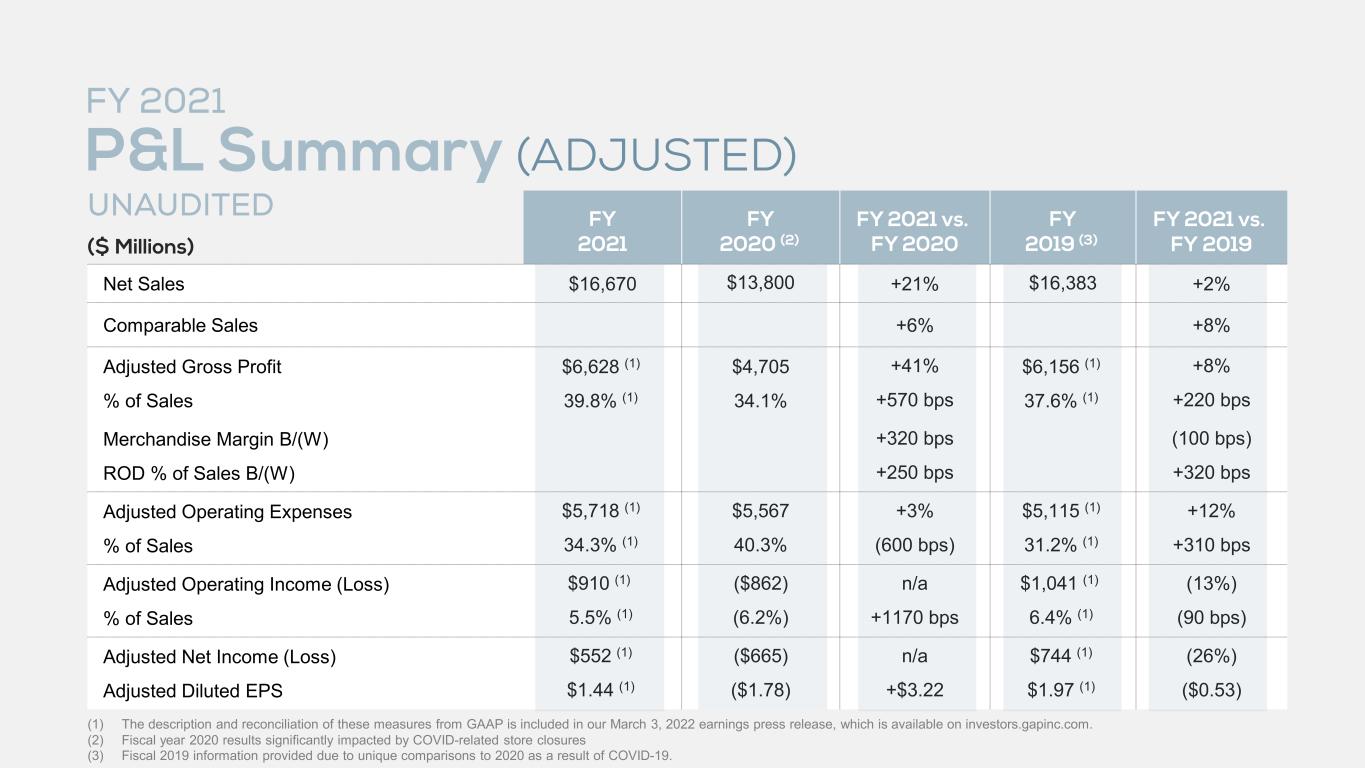

FY 2021 P&L Summary (ADJUSTED) ($ Millions) (1) The description and reconciliation of these measures from GAAP is included in our March 3, 2022 earnings press release, which is available on investors.gapinc.com. (2) Fiscal year 2020 results significantly impacted by COVID-related store closures (3) Fiscal 2019 information provided due to unique comparisons to 2020 as a result of COVID-19. FY 2021 FY 2020 (2) FY 2021 vs. FY 2020 FY 2019 (3) FY 2021 vs. FY 2019 Net Sales $16,670 $13,800 +21% $16,383 +2% Comparable Sales +6% +8% Adjusted Gross Profit % of Sales $6,628 (1) 39.8% (1) $4,705 34.1% +41% +570 bps $6,156 (1) 37.6% (1) +8% +220 bps Merchandise Margin B/(W) ROD % of Sales B/(W) +320 bps +250 bps (100 bps) +320 bps Adjusted Operating Expenses % of Sales $5,718 (1) 34.3% (1) $5,567 40.3% +3% (600 bps) $5,115 (1) 31.2% (1) +12% +310 bps Adjusted Operating Income (Loss) % of Sales $910 (1) 5.5% (1) ($862) (6.2%) n/a +1170 bps $1,041 (1) 6.4% (1) (13%) (90 bps) Adjusted Net Income (Loss) Adjusted Diluted EPS $552 (1) $1.44 (1) ($665) ($1.78) n/a +$3.22 $744 (1) $1.97 (1) (26%) ($0.53) UNAUDITED

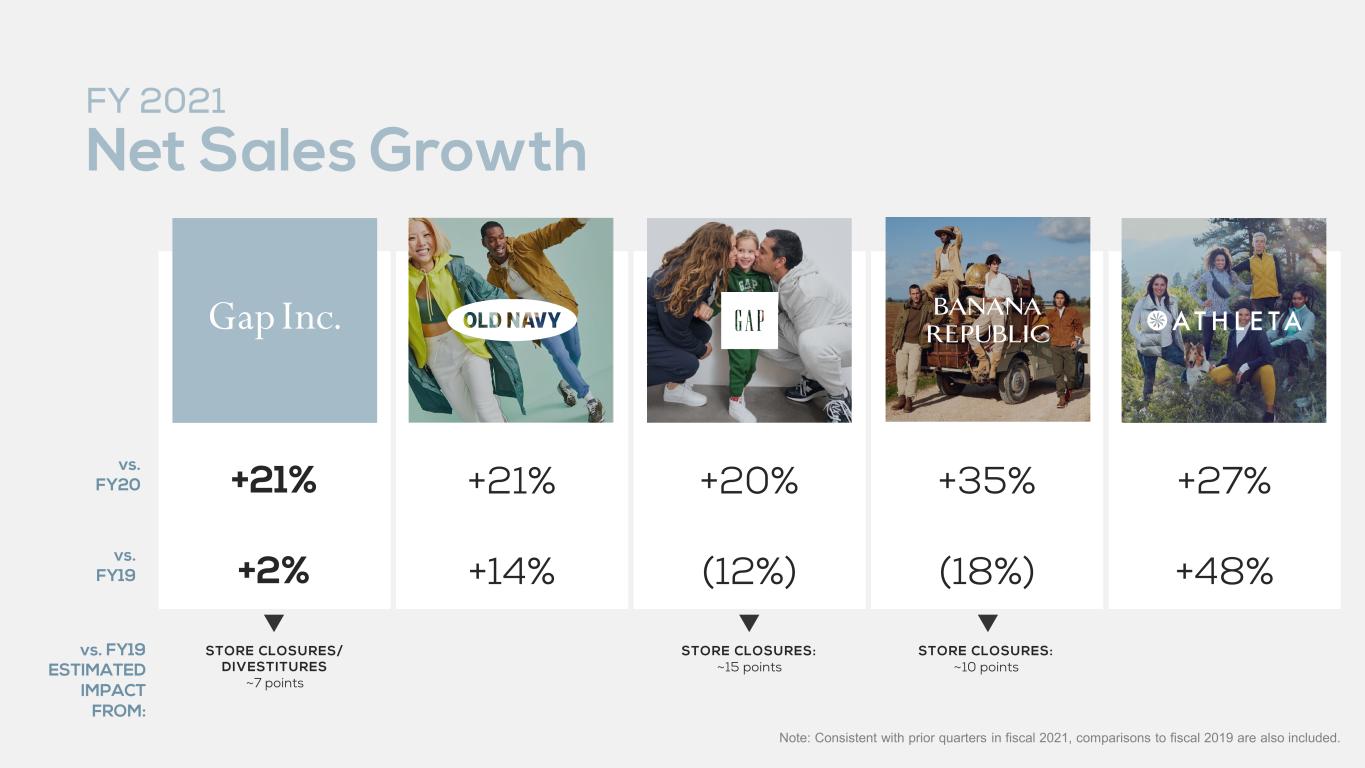

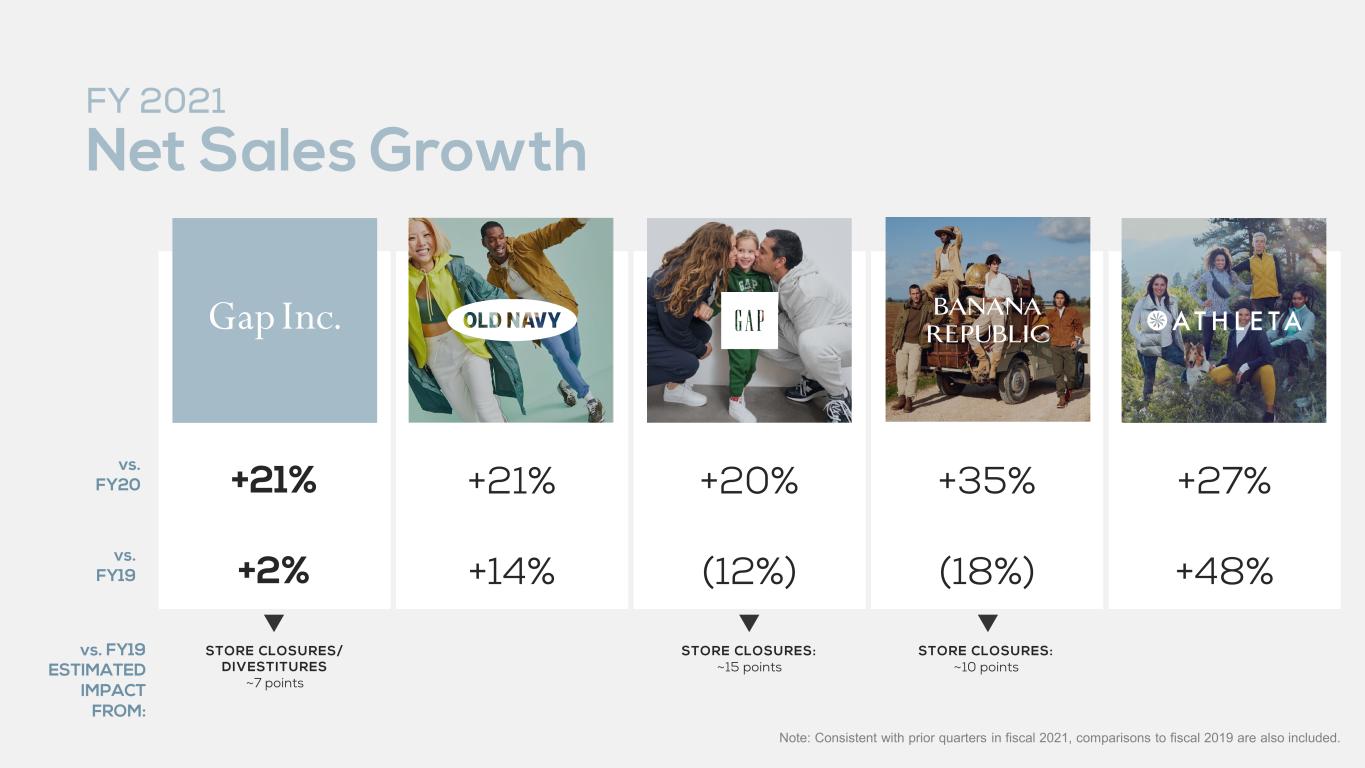

+27%+21% FY 2021 Net Sales Growth +35%+20%+21% +14% (18%)(12%)+2% +48% vs. FY20 vs. FY19 Note: Consistent with prior quarters in fiscal 2021, comparisons to fiscal 2019 are also included. STORE CLOSURES: ~15 points STORE CLOSURES: ~10 points vs. FY19 ESTIMATED IMPACT FROM: STORE CLOSURES/ DIVESTITURES ~7 points

FY 2021 Comparable Sales 0% +24%+8%+6% +12% +12% (9%)+2%+8% +39% NORTH AMERICA COMP VS. FY19: +12% Note: Consistent with prior quarters in fiscal 2021, comparisons to fiscal 2019 are also included. vs. FY20 vs. FY19

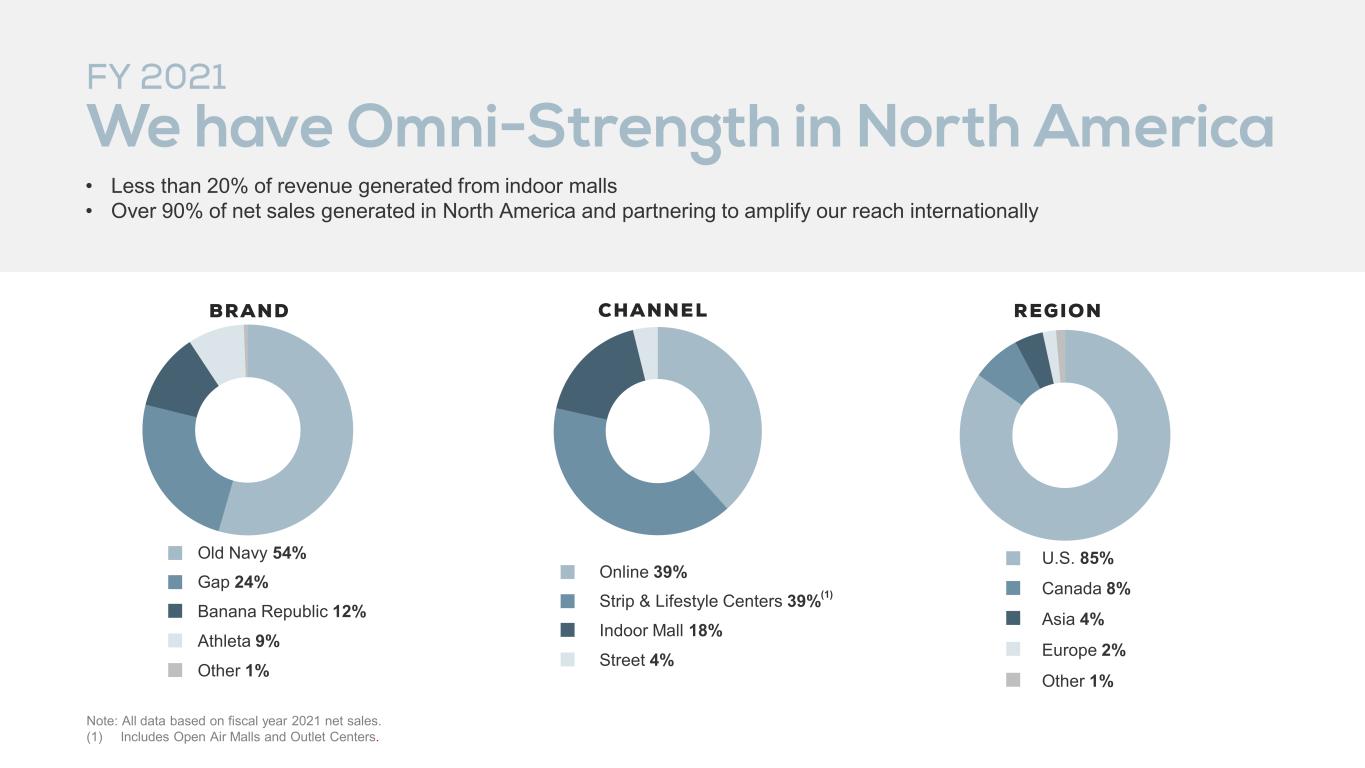

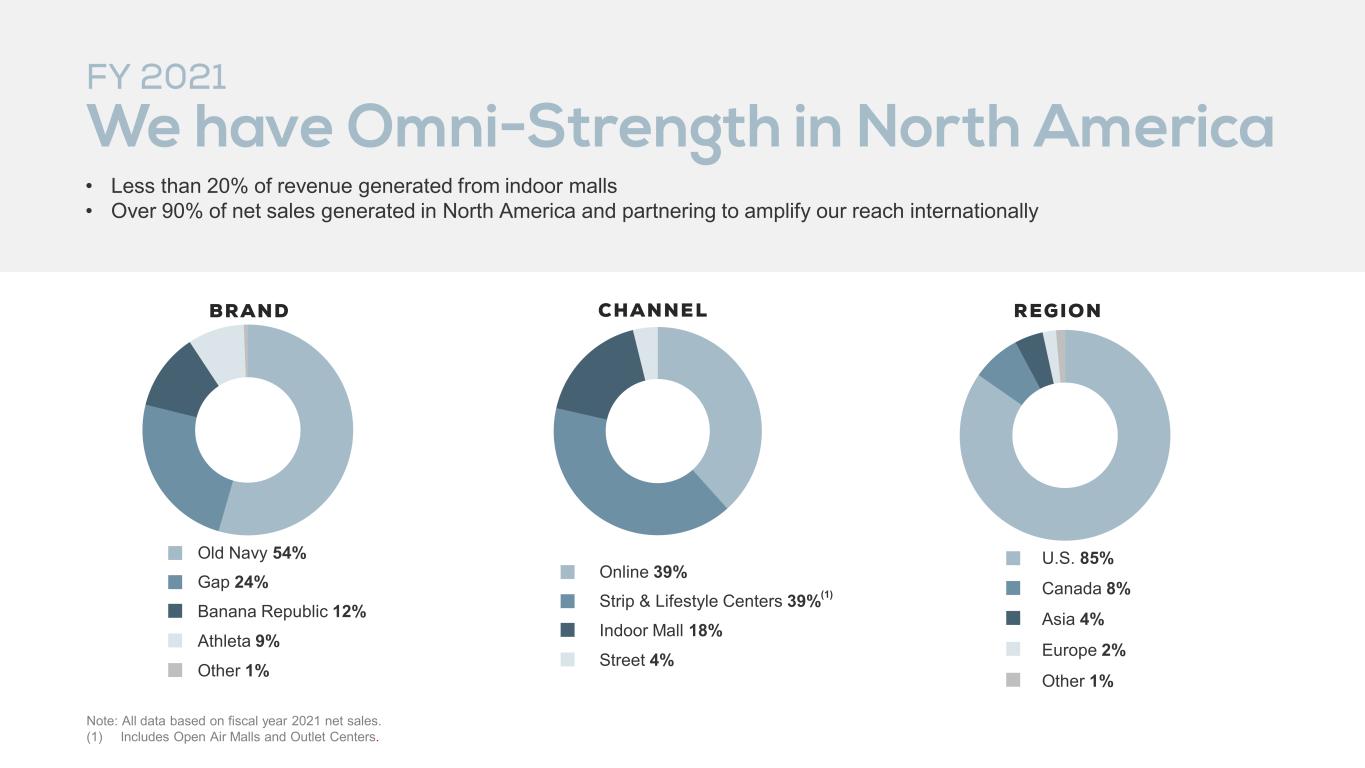

FY 2021 We have Omni-Strength in North America CHANNEL REGION • Less than 20% of revenue generated from indoor malls • Over 90% of net sales generated in North America and partnering to amplify our reach internationally ■ Old Navy 54% ■ Gap 24% ■ Banana Republic 12% ■ Athleta 9% ■ Other 1% ■ U.S. 85% ■ Canada 8% ■ Asia 4% ■ Europe 2% ■ Other 1% BRAND ■ Online 39% ■ Strip & Lifestyle Centers 39%(1) ■ Indoor Mall 18% ■ Street 4% Note: All data based on fiscal year 2021 net sales. (1) Includes Open Air Malls and Outlet Centers.

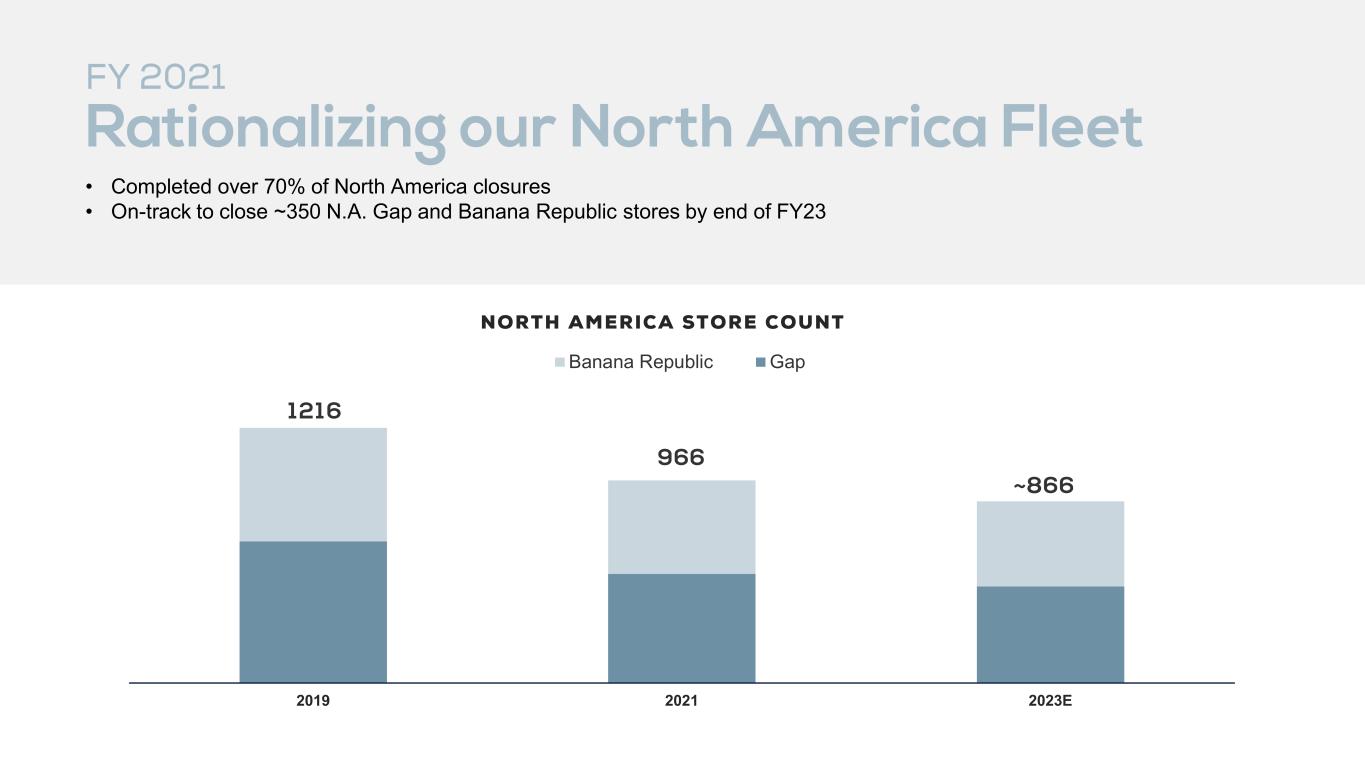

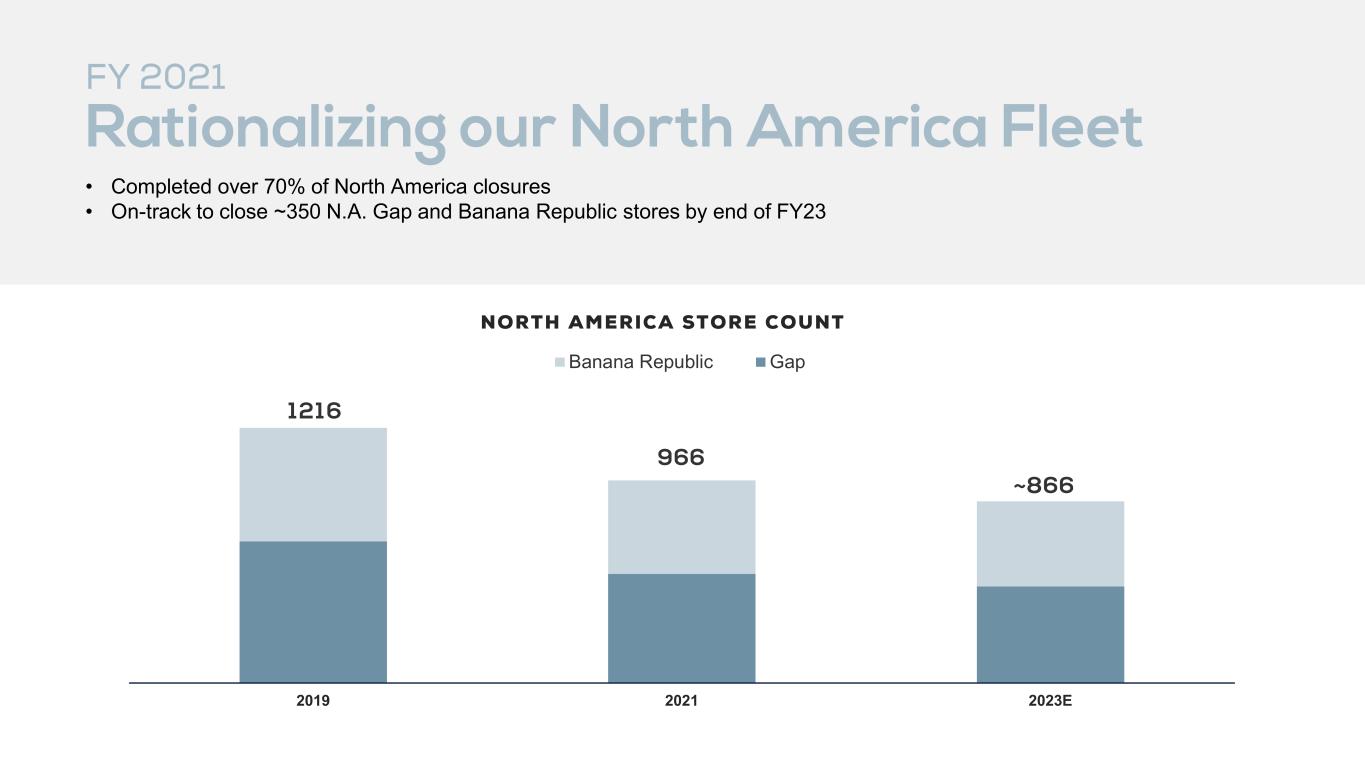

FY 2021 Rationalizing our North America Fleet • Completed over 70% of North America closures • On-track to close ~350 N.A. Gap and Banana Republic stores by end of FY23 121 6 966 ~866 2019 2021 2023E NORTH AMERICA STORE COUNT Banana Republic Gap

members of our integrated loyalty program (1) 50+ MILLION Spend 2X more annually 2X more likely to shop multiple brands 3X more likely to shop across channels Q4 2021 Improving Value by Turning Customers into Lifetime Loyalists (1) Includes credit card holders.

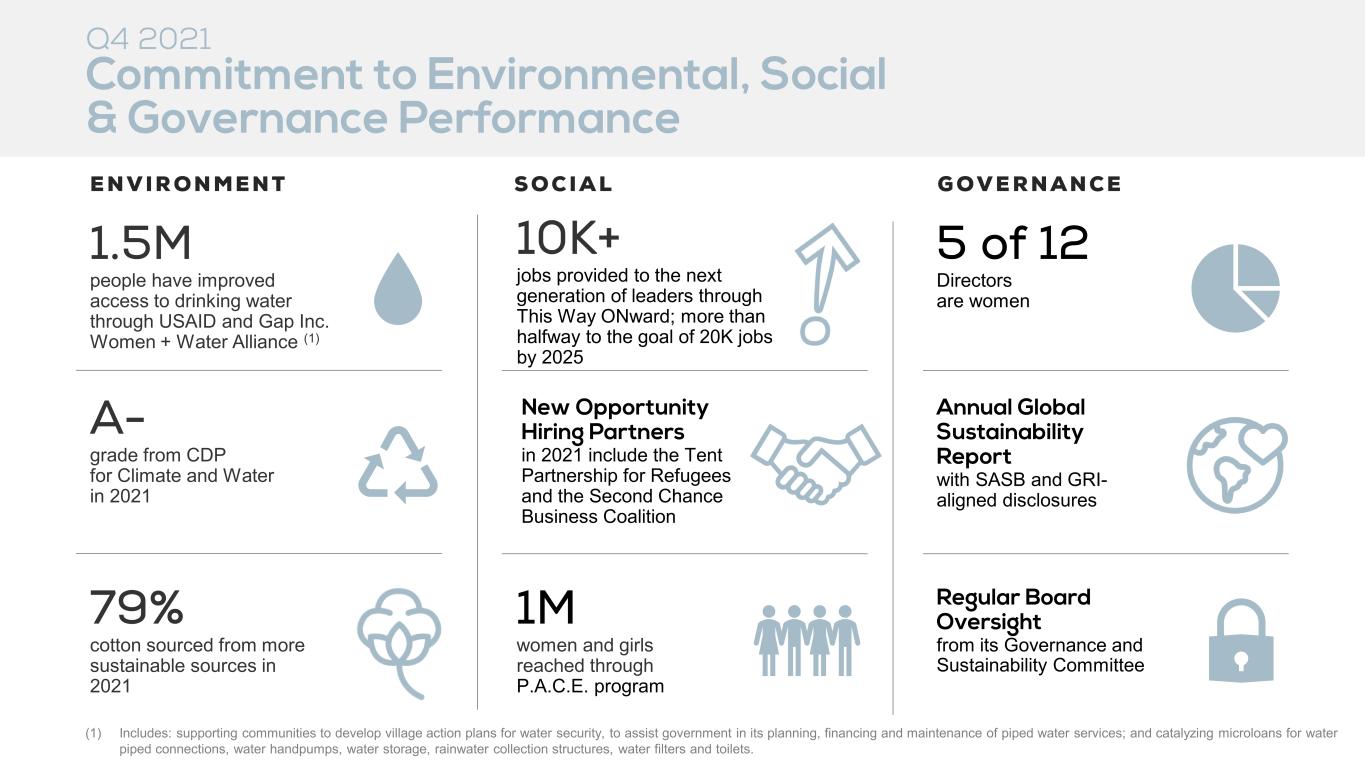

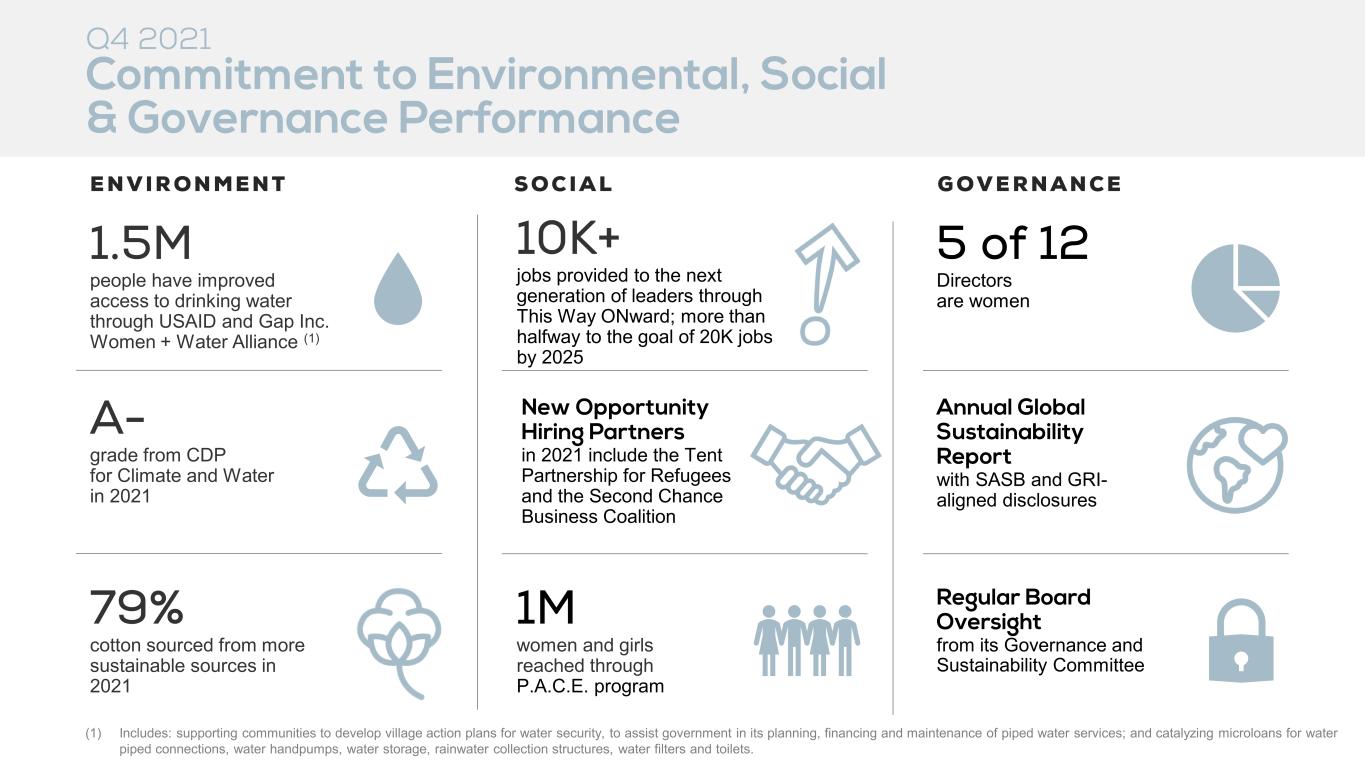

1.5M people have improved access to drinking water through USAID and Gap Inc. Women + Water Alliance (1) A- grade from CDP for Climate and Water in 2021 79% cotton sourced from more sustainable sources in 2021 E N V I R O N M E N T Q4 2021 Commitment to Environmental, Social & Governance Performance S O C I A L 10K+ jobs provided to the next generation of leaders through This Way ONward; more than halfway to the goal of 20K jobs by 2025 Annual Global Sustainability Report with SASB and GRI- aligned disclosures Regular Board Oversight from its Governance and Sustainability Committee G O V E R N A N C E 5 of 12 Directors are women 1M women and girls reached through P.A.C.E. program New Opportunity Hiring Partners in 2021 include the Tent Partnership for Refugees and the Second Chance Business Coalition (1) Includes: supporting communities to develop village action plans for water security, to assist government in its planning, financing and maintenance of piped water services; and catalyzing microloans for water piped connections, water handpumps, water storage, rainwater collection structures, water filters and toilets.

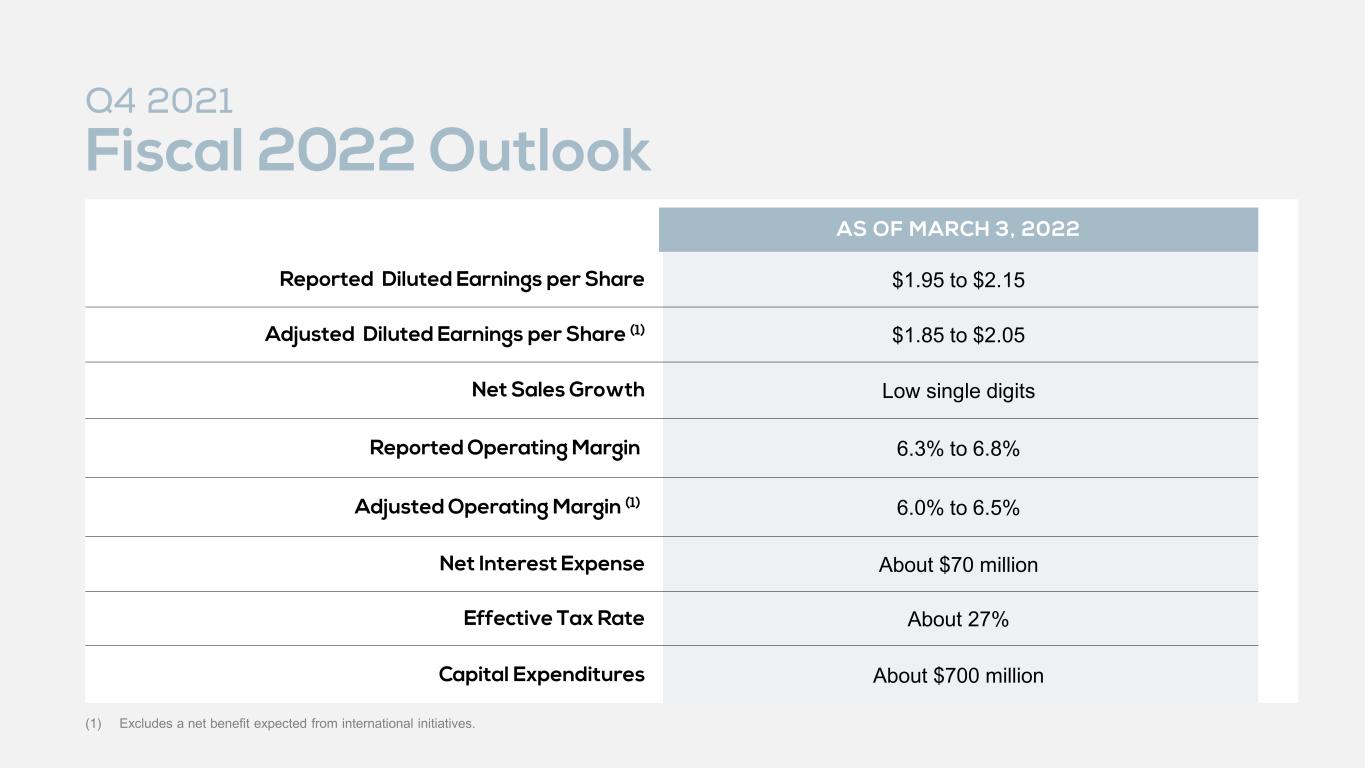

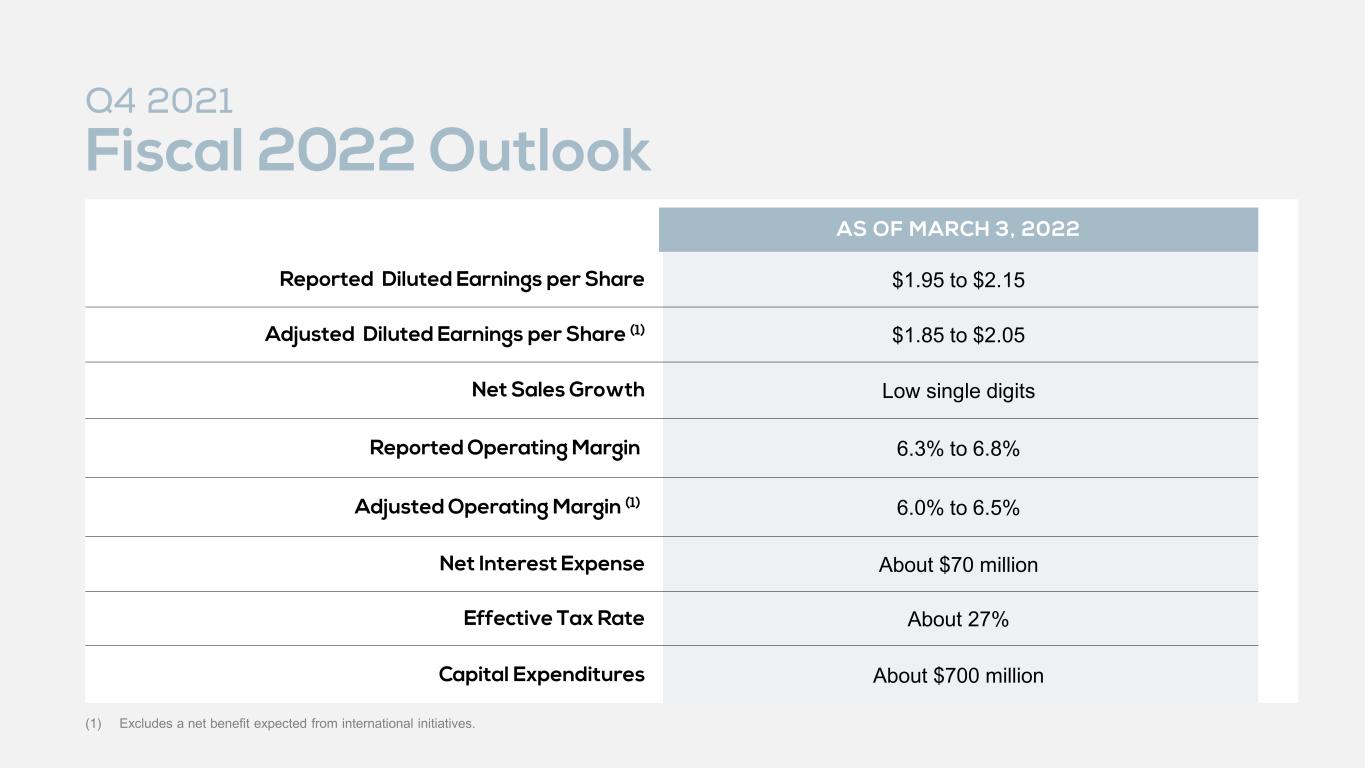

Q4 2021 Fiscal 2022 Outlook AS OF MARCH 3, 2022 Reported Diluted Earnings per Share $1.95 to $2.15 Adjusted Diluted Earnings per Share (1) $1.85 to $2.05 Net Sales Growth Low single digits Reported Operating Margin 6.3% to 6.8% Adjusted Operating Margin (1) 6.0% to 6.5% Net Interest Expense About $70 million Effective Tax Rate About 27% Capital Expenditures About $700 million (1) Excludes a net benefit expected from international initiatives.