Company and Industry Profile GATX CORPORATION APRIL 2014 Unless otherwise noted, GATX is the source for data provided.

Forward-Looking Statements Certain statements in this document may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are subject to the safe harbor provisions of those sections and the Private Securities Litigation Reform Act of 1995. These statements refer to information that is not purely historical, such as estimates, projections and statements relating to our business plans, objectives and expected operating results, and the assumptions on which those statements are based. Some of these statements may be identified by words like “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” “predict,” “project” or other similar words. Investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, including those described in our Annual Report on Form 10-K for the year ended December 31, 2013 and other filings with the SEC, that could cause actual results or developments to differ materially from the forward-looking statements. These risks and uncertainties include, but are not limited to: Given these risks and uncertainties, readers are cautioned not to place undue reliance on these forward-looking statements, which reflect our analysis, judgment, belief or expectation only as of the date hereof. We have based these forward-looking statements on information currently available and disclaim any intention or obligation to update or revise these forward-looking statements to reflect subsequent events or circumstances. • changes in regulatory requirements for tank cars in crude, ethanol, and other flammable liquid commodity service • competitive factors in our primary markets, including lease pricing and asset availability • weak economic conditions, financial market volatility, and other factors that may negatively affect the rail, marine, and other industries served by us and our customers • inability to maintain satisfactory lease rates or utilization levels for our assets, or increased operating costs in our primary operating segments • changes to laws, rules, and regulations applicable to GATX and our rail, marine, and other assets, or failure to comply with those laws, rules and regulations • operational disruption and increased costs associated with compliance maintenance programs and other maintenance initiatives • financial and operational risks associated with long-term railcar purchase commitments • deterioration of conditions in the capital markets, reductions in our credit ratings, or increases in our financing costs • unfavorable conditions affecting certain assets, customers or regions where we have a large investment • risks related to our international operations and expansion into new geographic markets • inadequate allowances to cover credit losses in our portfolio or declines in the credit quality of our customer base • impaired asset charges that may result from weak economic or market conditions, changes to laws, rules, and regulations affecting our assets, events related to particular customers or asset types, or portfolio management decisions we implement • environmental remediation costs or a negative outcome in our pending or threatened litigation • our inability to obtain cost-effective insurance • operational and financial risks related to our affiliate investments, particularly where certain affiliates may contribute significantly to our consolidated operating profit • reduced opportunities to generate asset remarketing income • failure to successfully negotiate collective bargaining agreements with the unions representing a substantial portion of our employees NYSE: GMT 2

GATX Corporation Clear vision and rich history 3 Vision We strive to be recognized as the finest railcar leasing company in the world by our customers, our shareholders, our employees and the communities where we operate. History 1898 Founded as a railcar lessor Initiated quarterly dividends • Railcar leasing remains primary business • 95th consecutive year of uninterrupted dividends 1919 2014

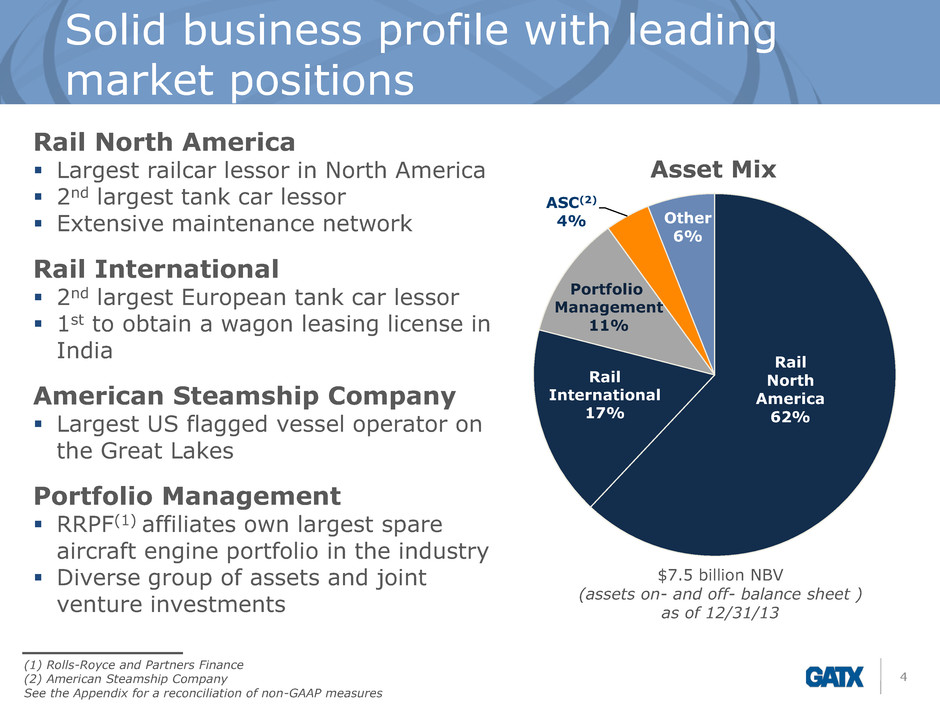

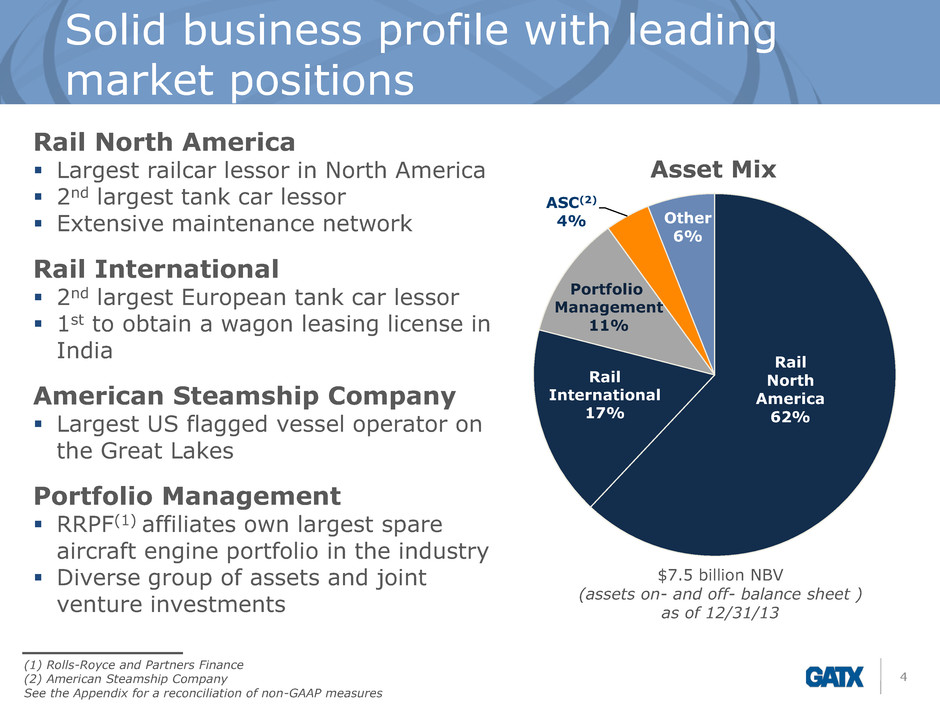

Solid business profile with leading market positions 4 Rail North America Largest railcar lessor in North America 2nd largest tank car lessor Extensive maintenance network Rail International 2nd largest European tank car lessor 1st to obtain a wagon leasing license in India American Steamship Company Largest US flagged vessel operator on the Great Lakes Portfolio Management RRPF(1) affiliates own largest spare aircraft engine portfolio in the industry Diverse group of assets and joint venture investments Rail North America 62% ASC(2) 4% Other 6% Portfolio Management 11% Rail International 17% (1) Rolls-Royce and Partners Finance (2) American Steamship Company See the Appendix for a reconciliation of non-GAAP measures Asset Mix $7.5 billion NBV (assets on- and off- balance sheet ) as of 12/31/13

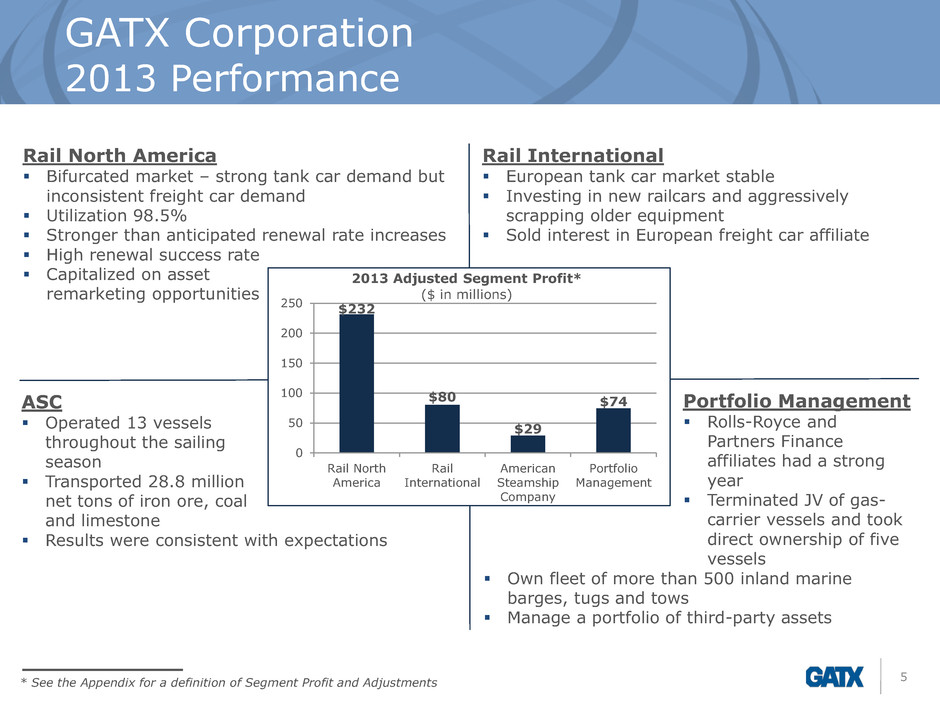

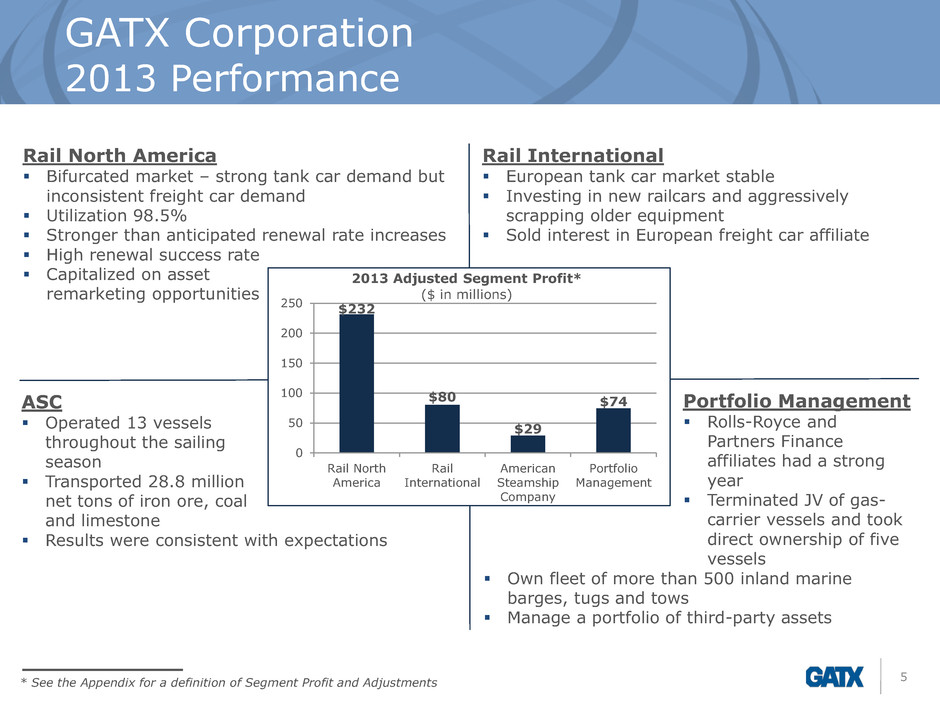

GATX Corporation 2013 Performance 5 Portfolio Management Rolls-Royce and Partners Finance affiliates had a strong year Terminated JV of gas- carrier vessels and took direct ownership of five vessels Own fleet of more than 500 inland marine barges, tugs and tows Manage a portfolio of third-party assets Rail North America Bifurcated market – strong tank car demand but inconsistent freight car demand Utilization 98.5% Stronger than anticipated renewal rate increases High renewal success rate Capitalized on asset remarketing opportunities Rail International European tank car market stable Investing in new railcars and aggressively scrapping older equipment Sold interest in European freight car affiliate $232 $80 $29 $74 0 50 100 150 200 250 Rail North America Rail International American Steamship Company Portfolio Management 2013 Adjusted Segment Profit* ($ in millions) ASC Operated 13 vessels throughout the sailing season Transported 28.8 million net tons of iron ore, coal and limestone Results were consistent with expectations * See the Appendix for a definition of Segment Profit and Adjustments

6 GATX’s Worldwide Railcar Fleet & Railcar Leasing

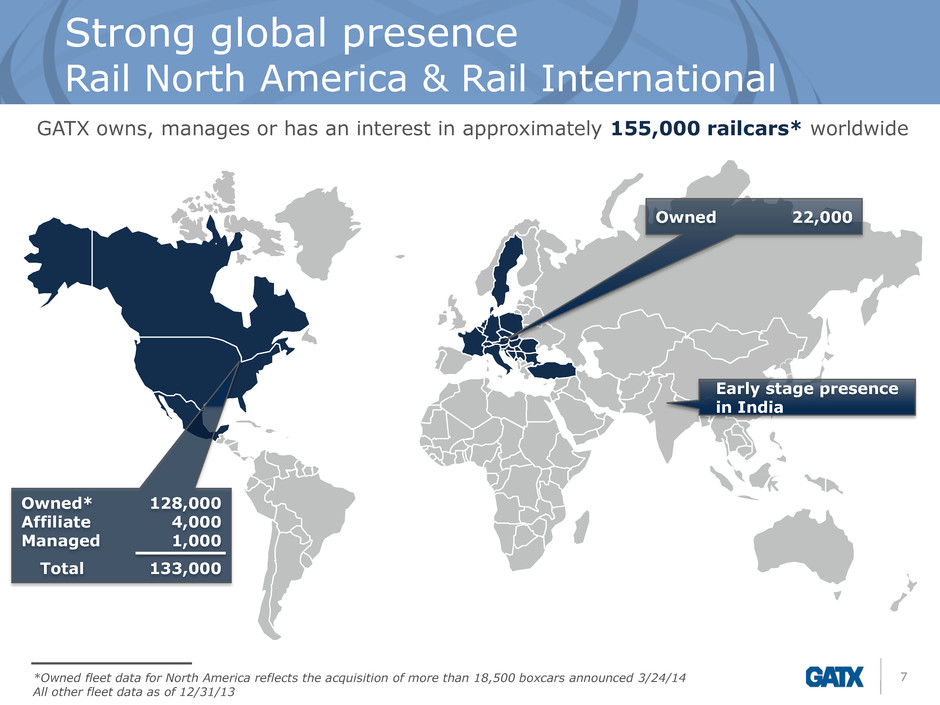

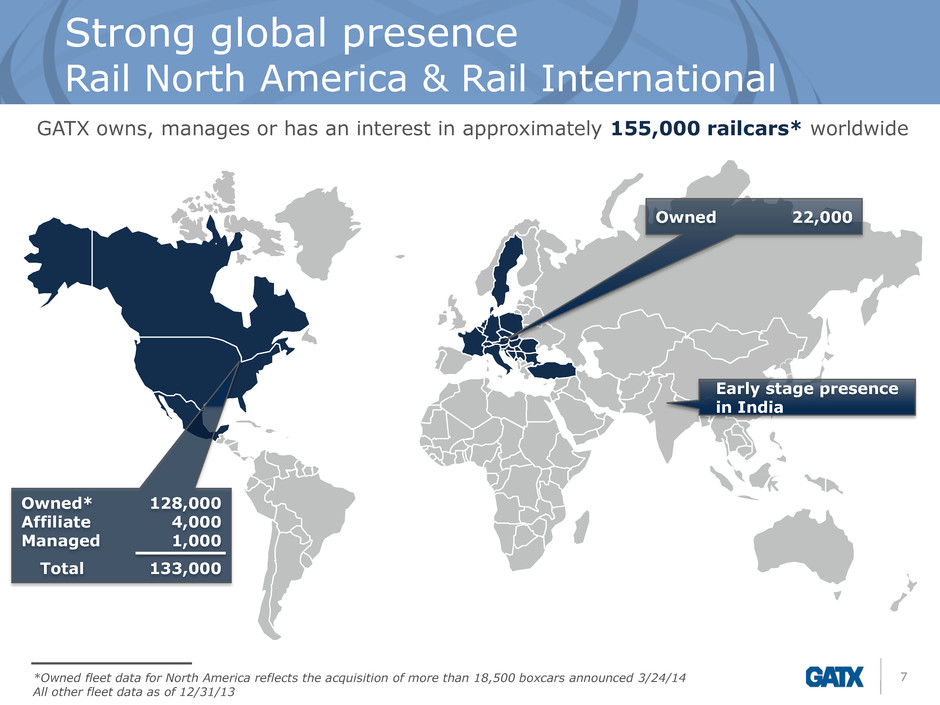

Owned* 128,000 Affiliate 4,000 Managed 1,000 Total 133,000 Owned 22,000 GATX owns, manages or has an interest in approximately 155,000 railcars* worldwide Strong global presence Rail North America & Rail International *Owned fleet data for North America reflects the acquisition of more than 18,500 boxcars announced 3/24/14 All other fleet data as of 12/31/13 7 Early stage presence in India

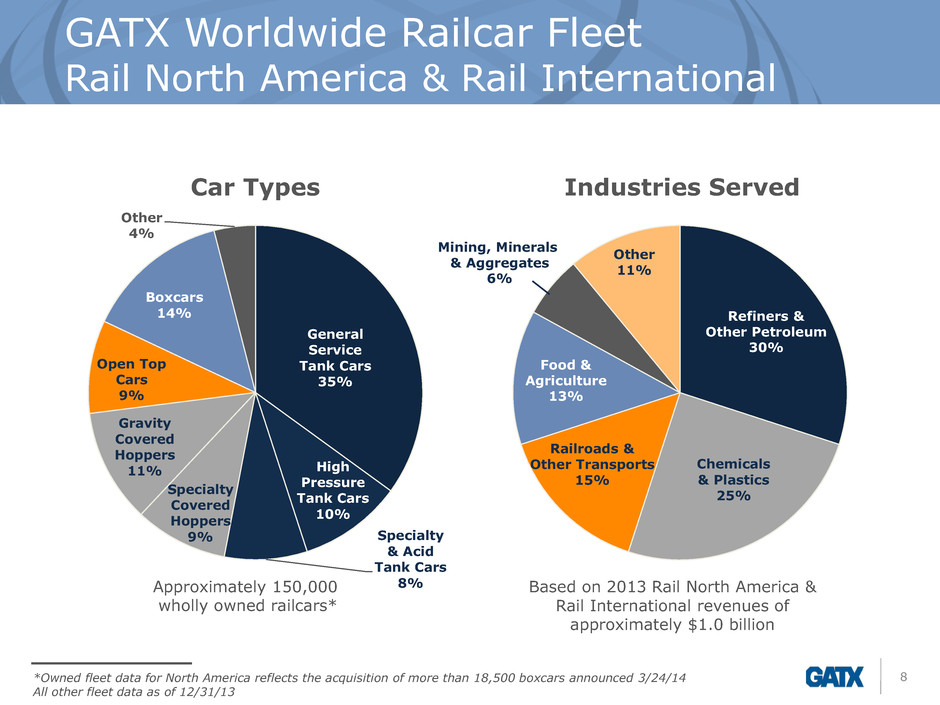

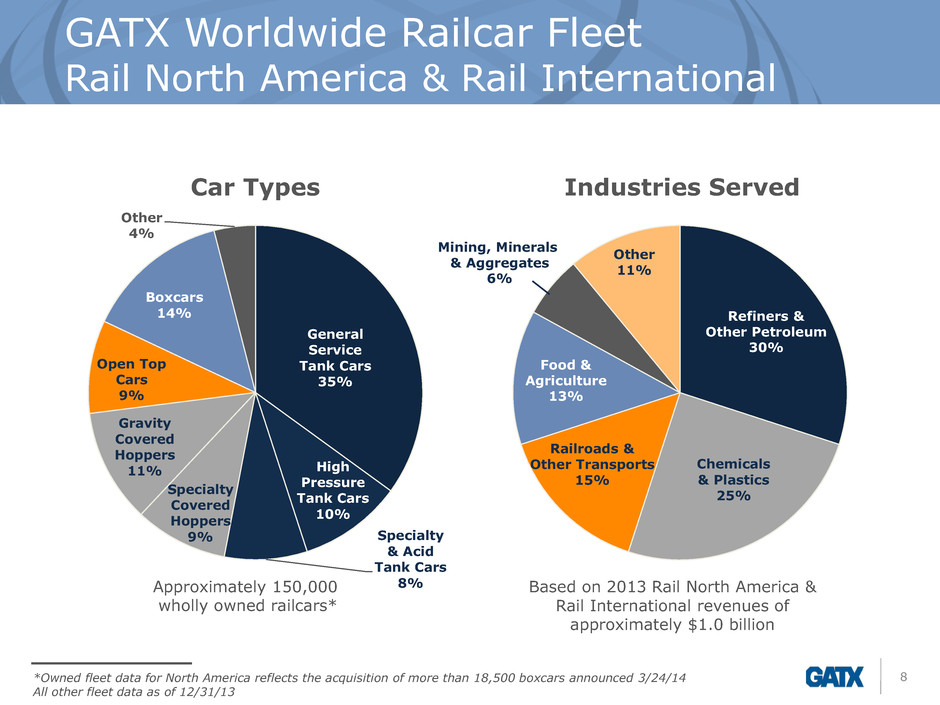

GATX Worldwide Railcar Fleet Rail North America & Rail International General Service Tank Cars 35% High Pressure Tank Cars 10% Specialty & Acid Tank Cars 8% Specialty Covered Hoppers 9% Gravity Covered Hoppers 11% Open Top Cars 9% Boxcars 14% Other 4% Car Types 8 Approximately 150,000 wholly owned railcars* Chemicals & Plastics 25% Other 11% Industries Served Refiners & Other Petroleum 30% Based on 2013 Rail North America & Rail International revenues of approximately $1.0 billion Railroads & Other Transports 15% Food & Agriculture 13% Mining, Minerals & Aggregates 6% *Owned fleet data for North America reflects the acquisition of more than 18,500 boxcars announced 3/24/14 All other fleet data as of 12/31/13

Creating value through railcar leasing 9 •New and used •Car type, markets and customers served, timing of purchase and price are the key investment factors Buy long-lived assets •Repeatedly, maintaining high utilization • Top-tier customer base • Useful life of a railcar in excess of 30 years • Average remaining lease term of North American railcar fleet is approximately four years Lease to customers •Provide premier customer service through maintenance, engineering, training, technology and participation in the regulatory landscape Full-service leases • Fleet optimization Scrap or sell railcars 4 3 2 1

Buy long-lived assets Creating value through railcar leasing 10 1

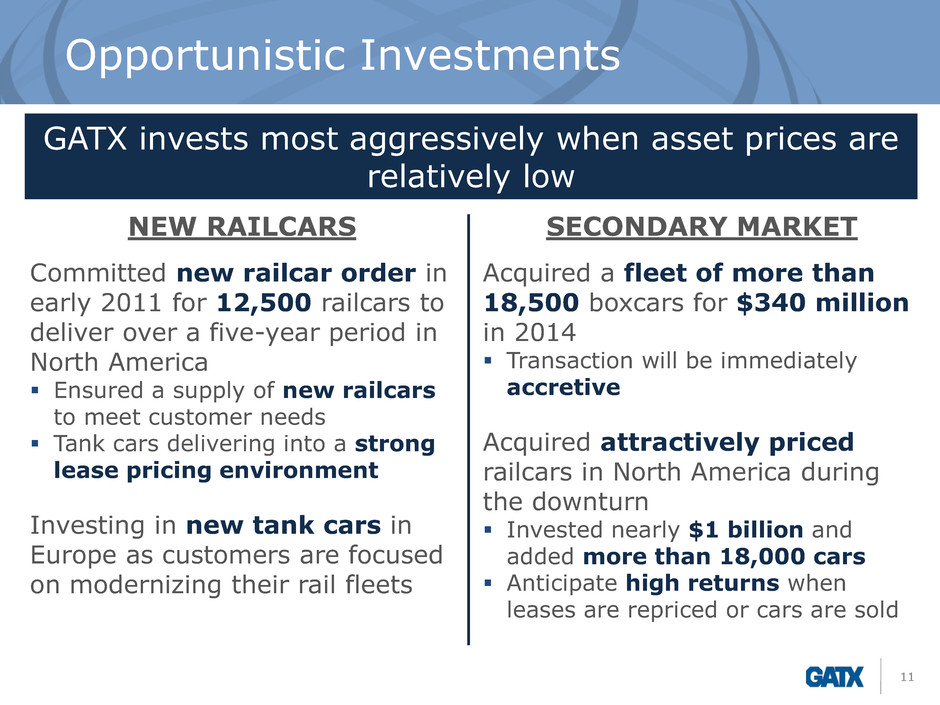

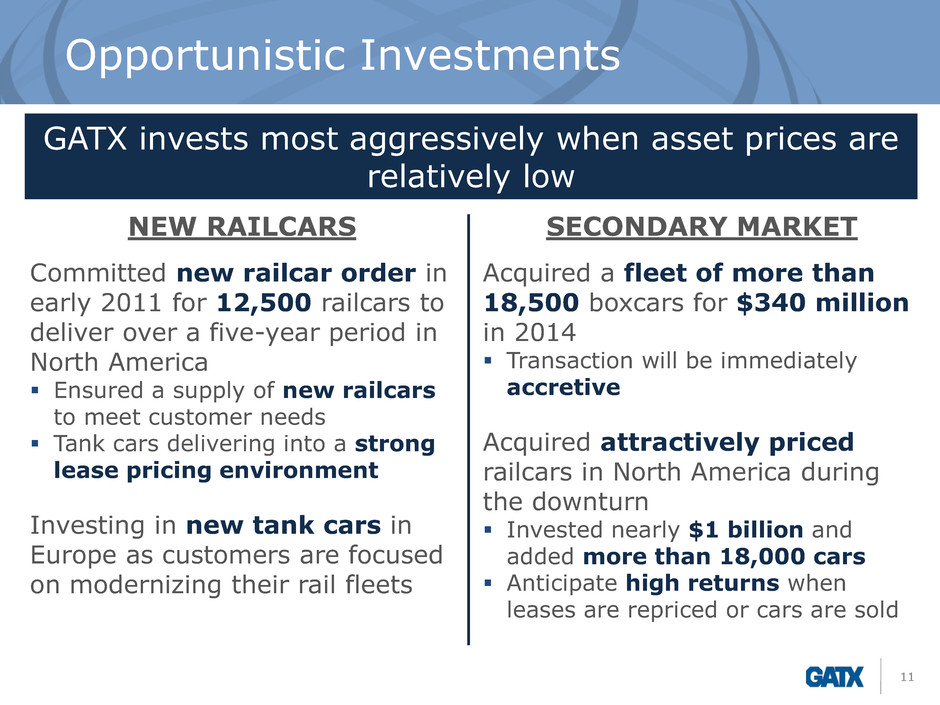

Opportunistic Investments 11 GATX invests most aggressively when asset prices are relatively low NEW RAILCARS Committed new railcar order in early 2011 for 12,500 railcars to deliver over a five-year period in North America Ensured a supply of new railcars to meet customer needs Tank cars delivering into a strong lease pricing environment Investing in new tank cars in Europe as customers are focused on modernizing their rail fleets SECONDARY MARKET Acquired a fleet of more than 18,500 boxcars for $340 million in 2014 Transaction will be immediately accretive Acquired attractively priced railcars in North America during the downturn Invested nearly $1 billion and added more than 18,000 cars Anticipate high returns when leases are repriced or cars are sold

Creating value through railcar leasing 12 Lease to customers 2

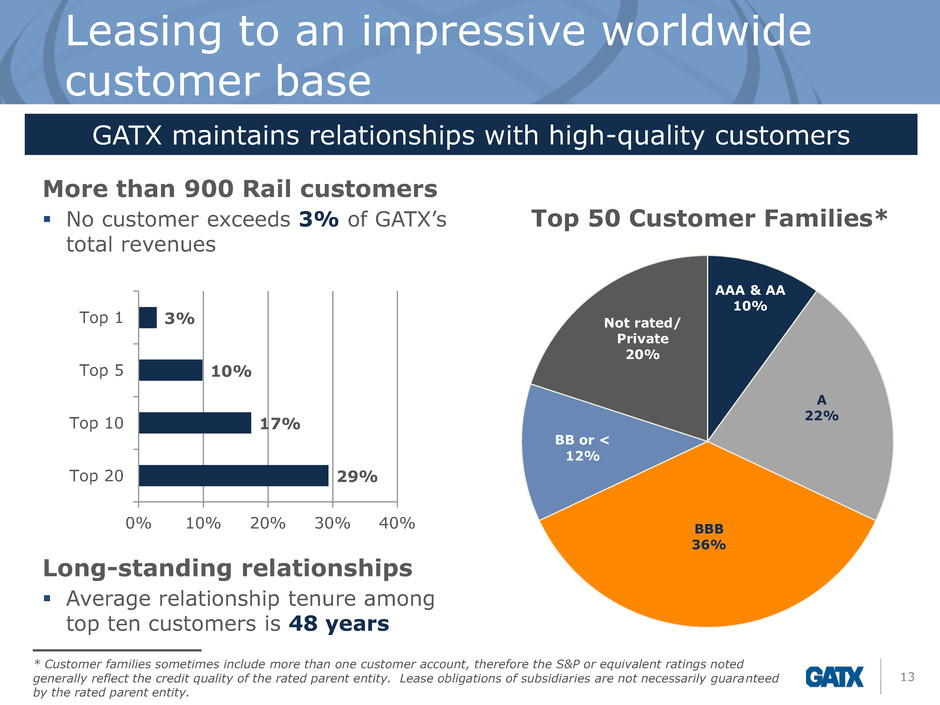

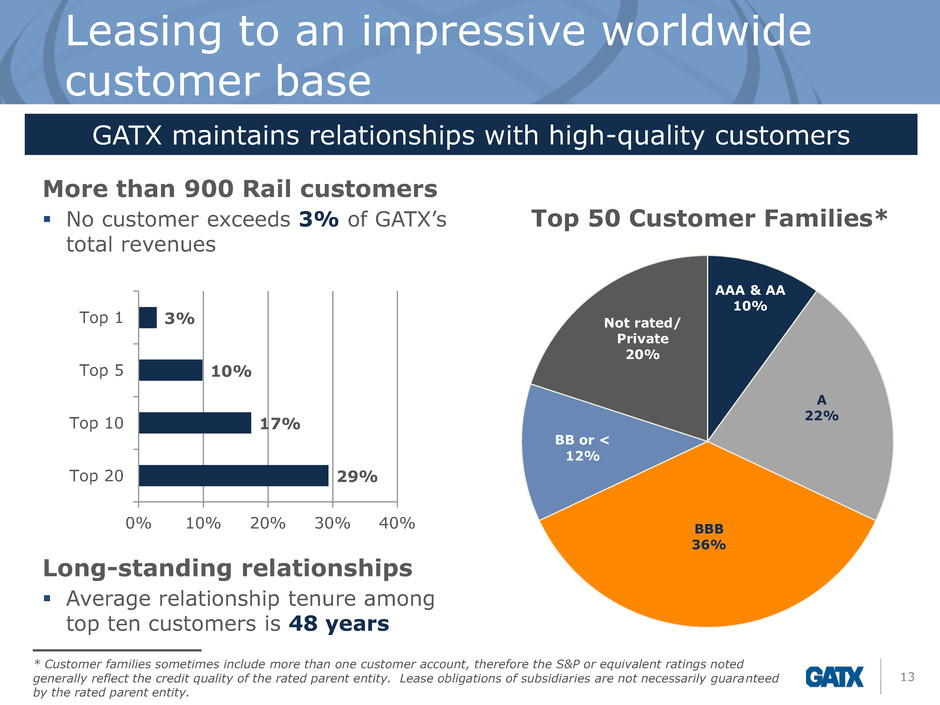

Leasing to an impressive worldwide customer base 13 GATX maintains relationships with high-quality customers AAA & AA 10% A 22% BBB 36% BB or < 12% Top 50 Customer Families* * Customer families sometimes include more than one customer account, therefore the S&P or equivalent ratings noted generally reflect the credit quality of the rated parent entity. Lease obligations of subsidiaries are not necessarily guaranteed by the rated parent entity. More than 900 Rail customers No customer exceeds 3% of GATX’s total revenues Long-standing relationships Average relationship tenure among top ten customers is 48 years 29% 17% 10% 3% 0% 10% 20% 30% 40% Top 20 Top 10 Top 5 Top 1 Not rated/ Private 20%

Managing lease terms through cycles 14 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Approximate # of cars scheduled for renewal 23,000 20,000 20,000 17,500 15,000 17,000 21,000 20,000 21,000 20,000 L P I* d a ta Rate change 9.9% 16.8% 13.5% 5.2% -11.0% -15.8% 6.9% 25.6% 34.5% 30% – 35% range Term (months) 50 64 67 63 41 35 45 60 62 Renewal success rate 81% 77% 73% 60% 54% 62% 77% 82% 81% In favorable pricing environments, GATX increases lease rates and stretches lease terms In weak pricing environments, GATX lowers lease rates and shortens lease terms *LPI = Lease Price Index: The average renewal lease rate change is reported as the % change between the average renewal lease rate and the average expiring lease rate, weighted by GATX’s North American fleet composition. North American railcar fleet: Leases are typically fixed rate, paid monthly The average remaining lease term is approximately four years

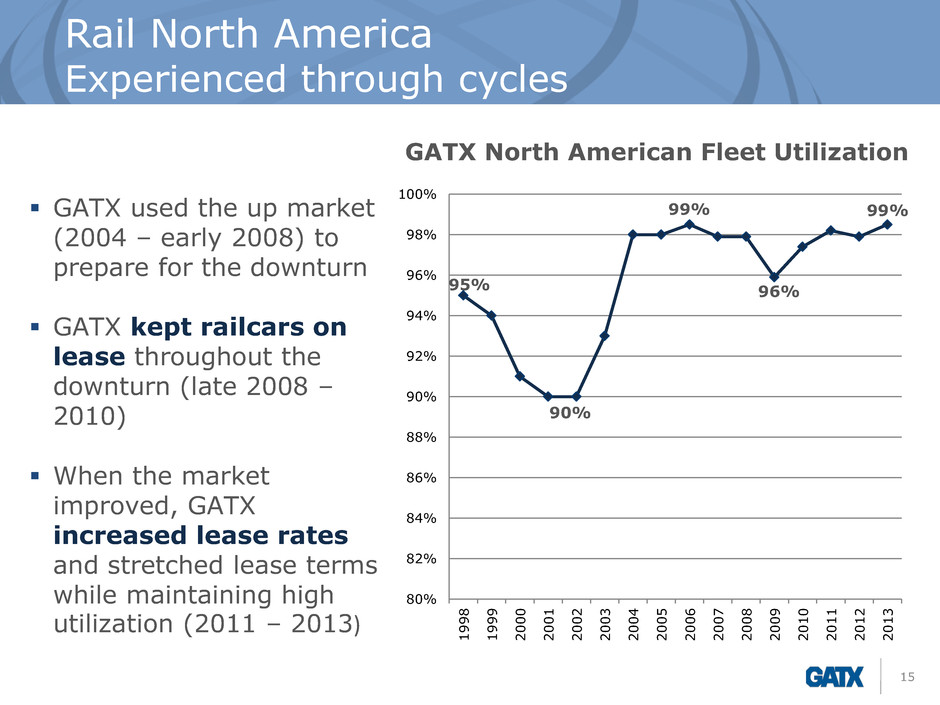

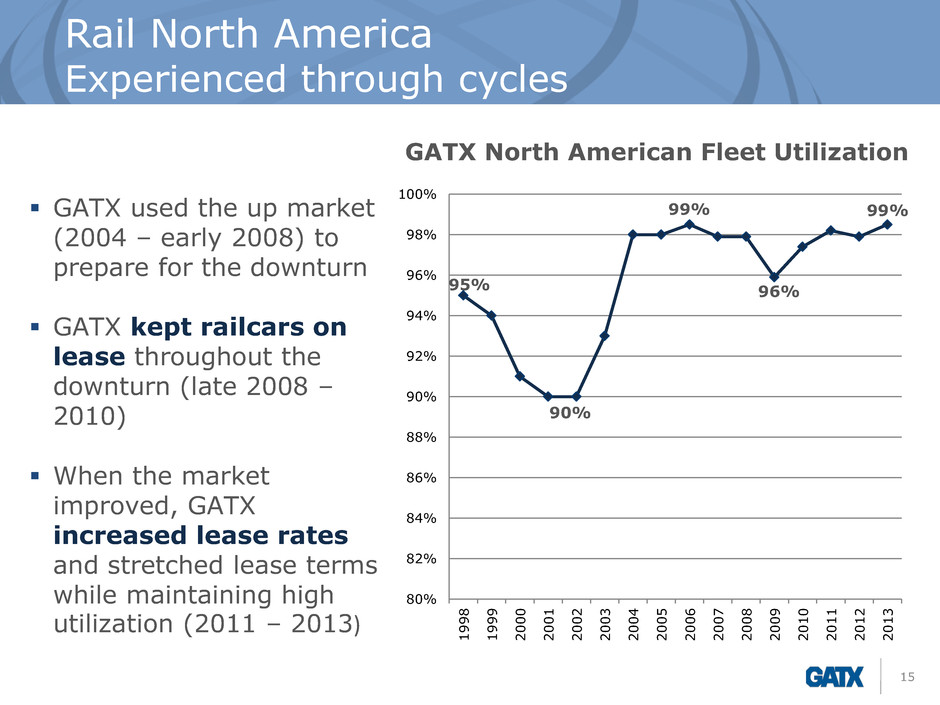

Rail North America Experienced through cycles 15 GATX used the up market (2004 – early 2008) to prepare for the downturn GATX kept railcars on lease throughout the downturn (late 2008 – 2010) When the market improved, GATX increased lease rates and stretched lease terms while maintaining high utilization (2011 – 2013) GATX North American Fleet Utilization 80% 82% 84% 86% 88% 90% 92% 94% 96% 98% 100% 1 9 9 8 1 9 9 9 2 0 0 0 2 0 0 1 2 0 0 2 2 0 0 3 2 0 0 4 2 0 0 5 2 0 0 6 2 0 0 7 2 0 0 8 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 95% 90% 99% 96% 99%

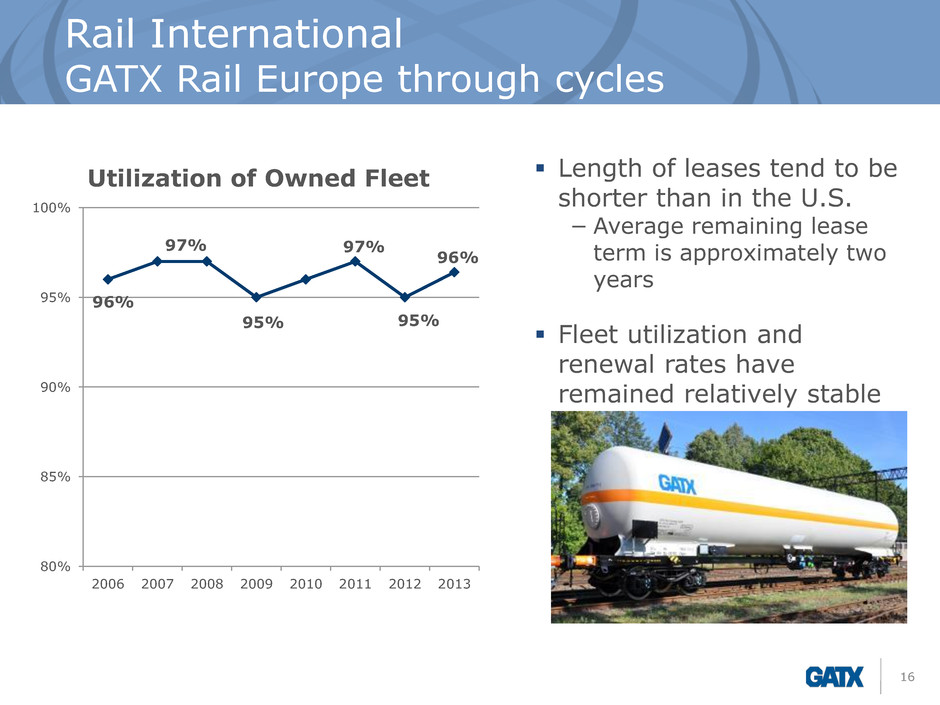

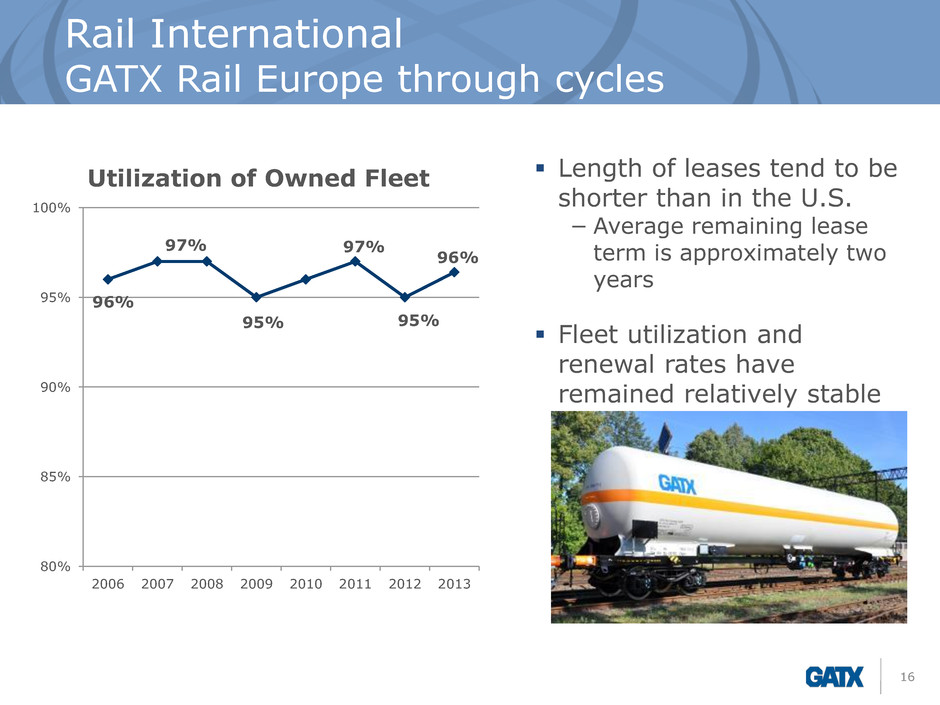

Rail International GATX Rail Europe through cycles 16 96% 97% 95% 97% 95% 96% 80% 85% 90% 95% 100% 2006 2007 2008 2009 2010 2011 2012 2013 Utilization of Owned Fleet Length of leases tend to be shorter than in the U.S. − Average remaining lease term is approximately two years Fleet utilization and renewal rates have remained relatively stable

Creating value through railcar leasing 17 Full-service leases 3

Premium customer service through full-service leasing 18 GATX has built and maintained a strong market position by focusing on full-service leasing GATX consistently provides safe, reliable equipment and superior service to help our customers achieve their business objectives − Maintenance − Engineering − Training − Technology As a full-service railcar leasing provider, GATX takes an active role in the complex regulatory landscape

Maintenance facilities Rail North America & Rail International 19 Maintaining railcars and locomotives is necessary and complicated − Customers rely on GATX to manage the maintenance process Extensive maintenance network in North America − Six major service centers − Five repair centers − Six customer-dedicated sites − Twenty mobile repair units − Third party-owned shops In 2013, GATX performed an aggregate of 82,000 service events in its owned and third-party maintenance network in North America In Europe, GATX has major service centers in Germany and Poland, as well as a customer site location in Poland

We are known for integrity, the safety and quality of our operations, and superior execution Using continuous improvement, we constantly identify and evaluate opportunities to increase efficiency − Efficiency in the shops minimizes the time our customers are without their cars Services range from routine maintenance and regulatory programs to car modifications and rebuilds, including: − All mechanical repairs − Interior cleaning − Interior/exterior blasting − Interior/exterior coatings Comprehensive maintenance services 20 GATX maintains its railcars to the highest standards

Engineering Expertise 21 GATX’s engineering team, comprised of experienced mechanical, structural, and chemical engineers, is regularly communicating with customers GATX’s engineers draw on decades of experience to identify solutions tailored to meet customer needs − Each customer faces a unique set of transportation challenges −Factors such as a customer’s commodity focus or the location and layout of their manufacturing facilities must be considered The engineering group supports GATX’s effort to provide quality equipment as GATX continues to grow in emerging rail markets Examples of engineering support − Preventative maintenance/inspection plans − Car design/specifications −Chemical engineering − Customer enhancements

Customer training 22 GATX’s service offering includes ongoing training for customers −Since customers are the operators of the railcars, they need to be well-versed in the equipment and related regulations GATX offers training at Company headquarters and through its TankTrainerTM mobile classroom −This rolling classroom is used to provide training at customer facilities across North America GATX’s commitment to providing safe, reliable assets goes beyond maintenance and engineering

Fleet management technology 23 MyGATXRail.com helps our customers by providing real-time maintenance data and fleet management capability

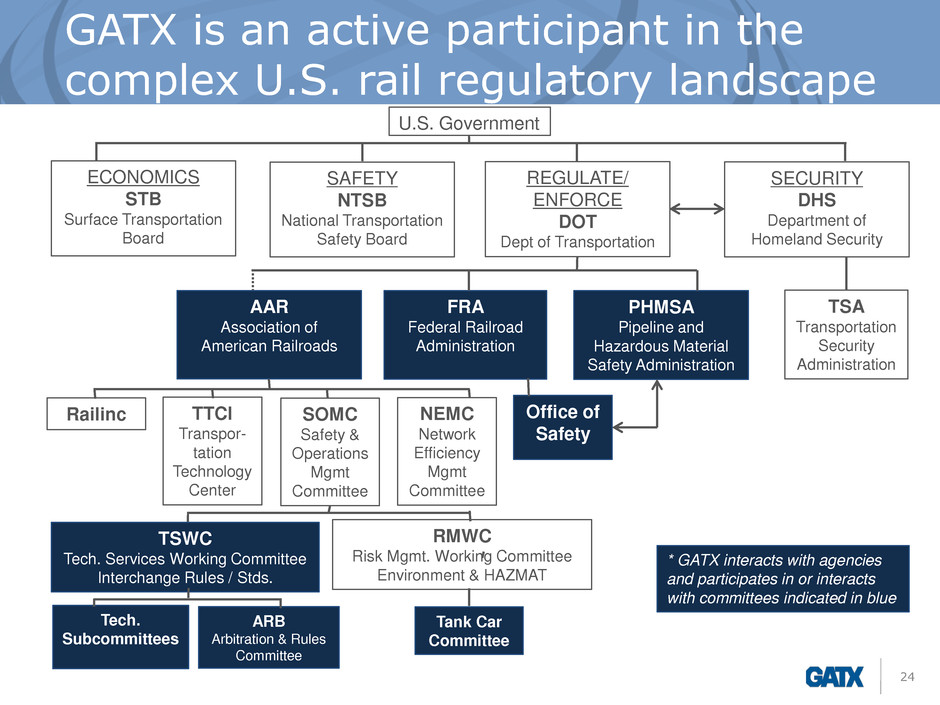

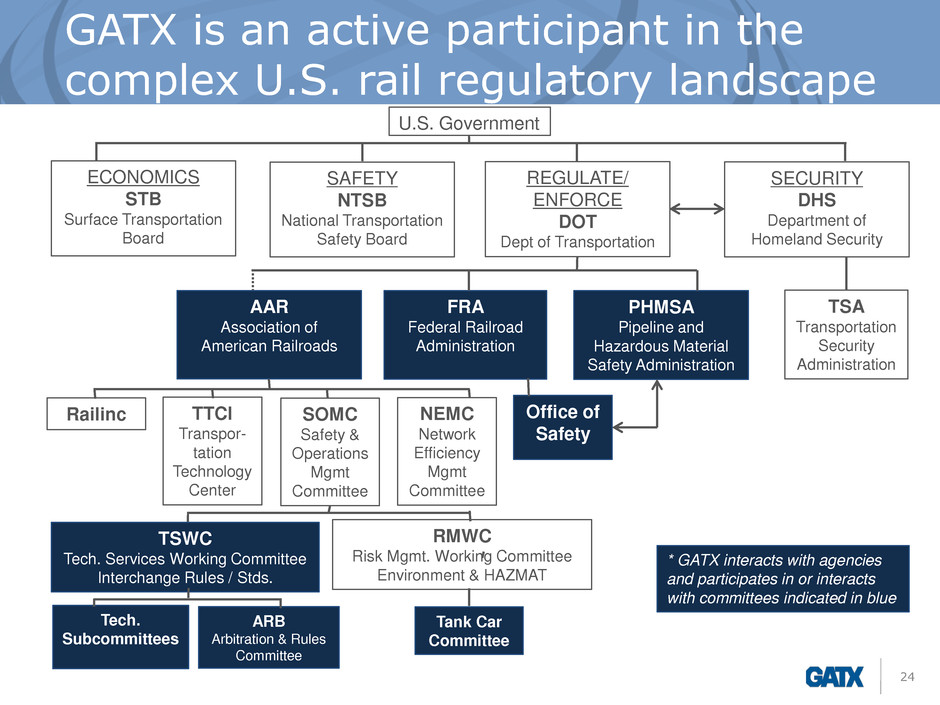

U.S. Government ECONOMICS STB Surface Transportation Board SAFETY NTSB National Transportation Safety Board REGULATE/ ENFORCE DOT Dept of Transportation SECURITY DHS Department of Homeland Security TSA Transportation Security Administration AAR Association of American Railroads FRA Federal Railroad Administration PHMSA Pipeline and Hazardous Material Safety Administration Office of Safety SOMC Safety & Operations Mgmt Committee Railinc TTCI Transpor- tation Technology Center NEMC Network Efficiency Mgmt Committee TSWC Tech. Services Working Committee Interchange Rules / Stds. RMWC Risk Mgmt. Working Committee Environment & HAZMAT Tech. Subcommittees ARB Arbitration & Rules Committee Tank Car Committee * GATX interacts with agencies and participates in or interacts with committees indicated in blue GATX is an active participant in the complex U.S. rail regulatory landscape 24

GATX is involved with regulatory agencies and industry groups 25 GATX actively participates in or interacts with several committees within various industry groups in the United States GATX employees have roles on boards and committees within the AAR: Associates Advisory Board Advanced Safety & Efficiency Committee Arbitration & Rules Committee Car Repair Billing Committee Equipment Assets Committee Equipment Health Monitoring Committee Locomotive Committee Tank Car Committee UMLER Committee Wheels, Axles, Bearings & Lubrication Committee GATX employees are involved with various Trade and Supplier Associations: American Chemistry Council American Petroleum Institute Chlorine Institute Equipment Leasing & Finance Association The Fertilizer Institute North American Freight Car Association Railway Supply Institute Renewable Fuels Association Sulfur Institute

Scrap or sell railcars Creating value through railcar leasing 26 4

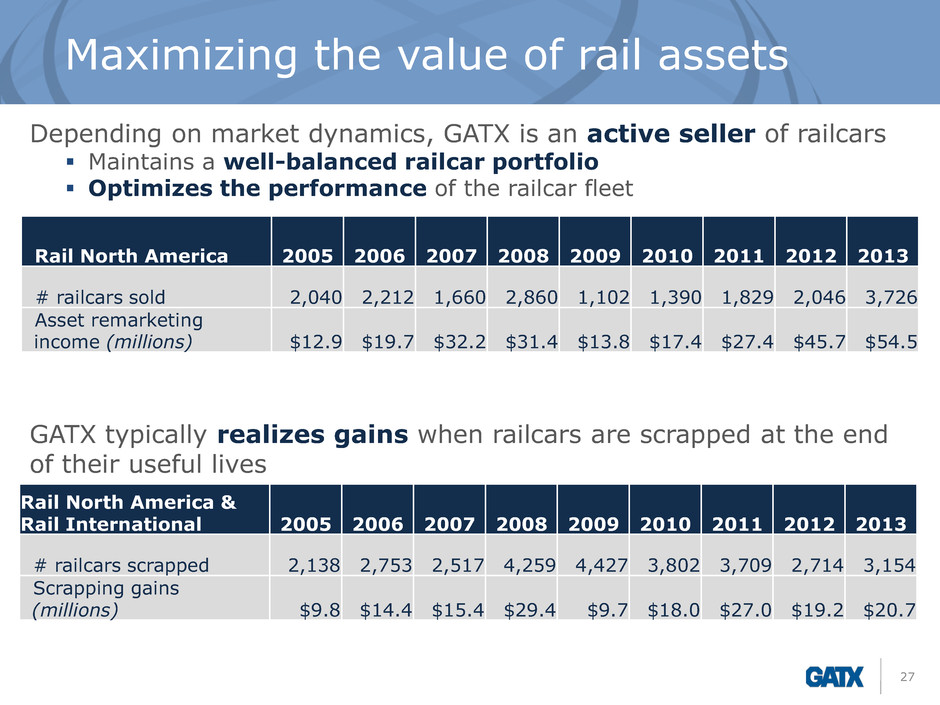

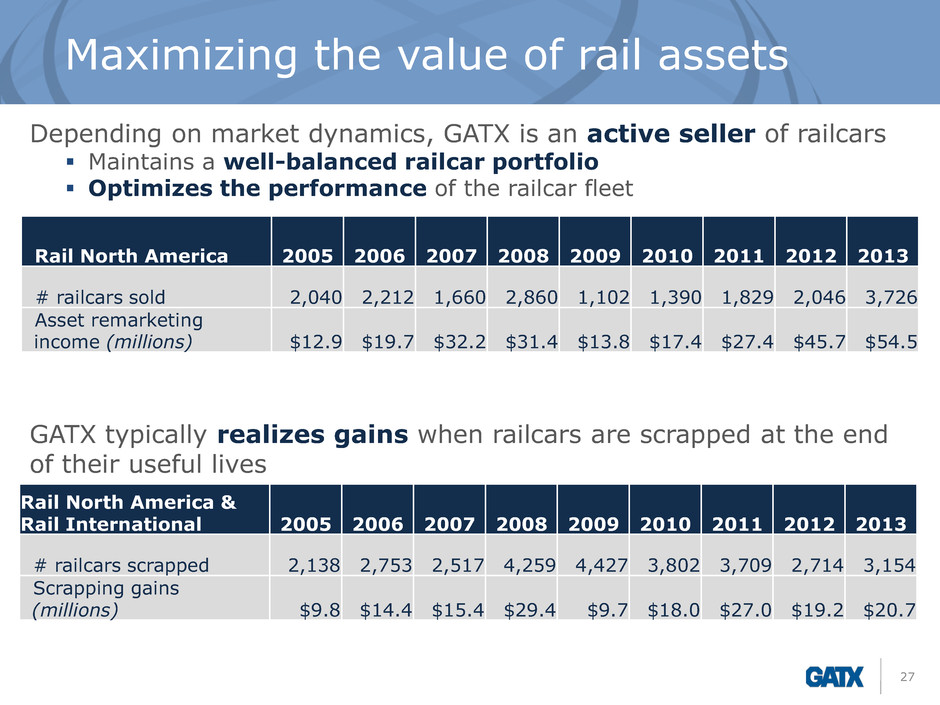

Maximizing the value of rail assets 27 Depending on market dynamics, GATX is an active seller of railcars Maintains a well-balanced railcar portfolio Optimizes the performance of the railcar fleet GATX typically realizes gains when railcars are scrapped at the end of their useful lives Rail North America 2005 2006 2007 2008 2009 2010 2011 2012 2013 # railcars sold 2,040 2,212 1,660 2,860 1,102 1,390 1,829 2,046 3,726 Asset remarketing income (millions) $12.9 $19.7 $32.2 $31.4 $13.8 $17.4 $27.4 $45.7 $54.5 Rail North America & Rail International 2005 2006 2007 2008 2009 2010 2011 2012 2013 # railcars scrapped 2,138 2,753 2,517 4,259 4,427 3,802 3,709 2,714 3,154 Scrapping gains (millions) $9.8 $14.4 $15.4 $29.4 $9.7 $18.0 $27.0 $19.2 $20.7

28 RAIL NORTH AMERICA

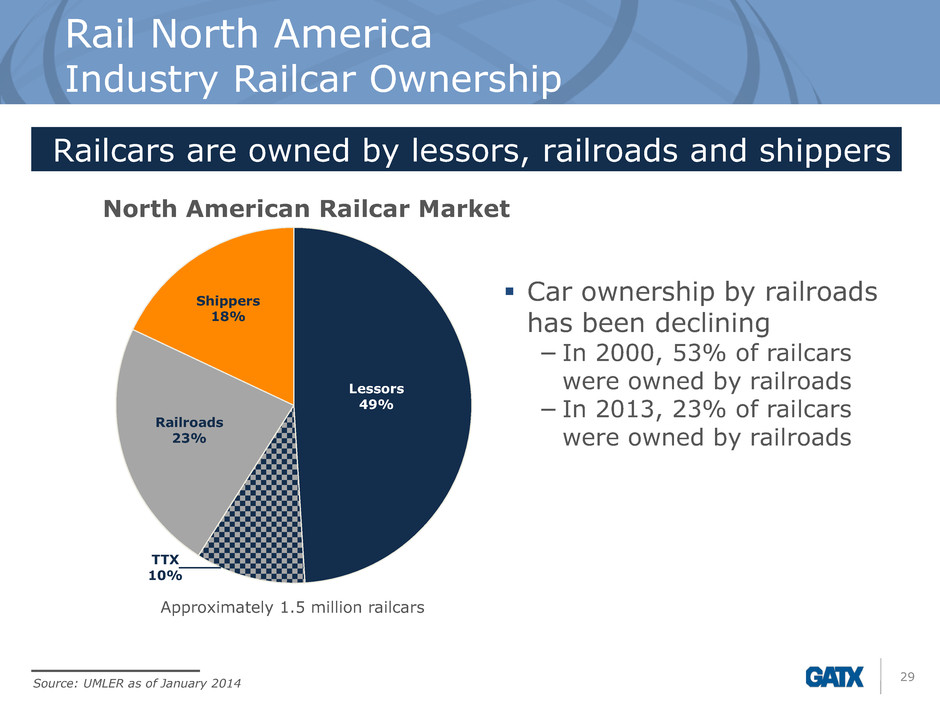

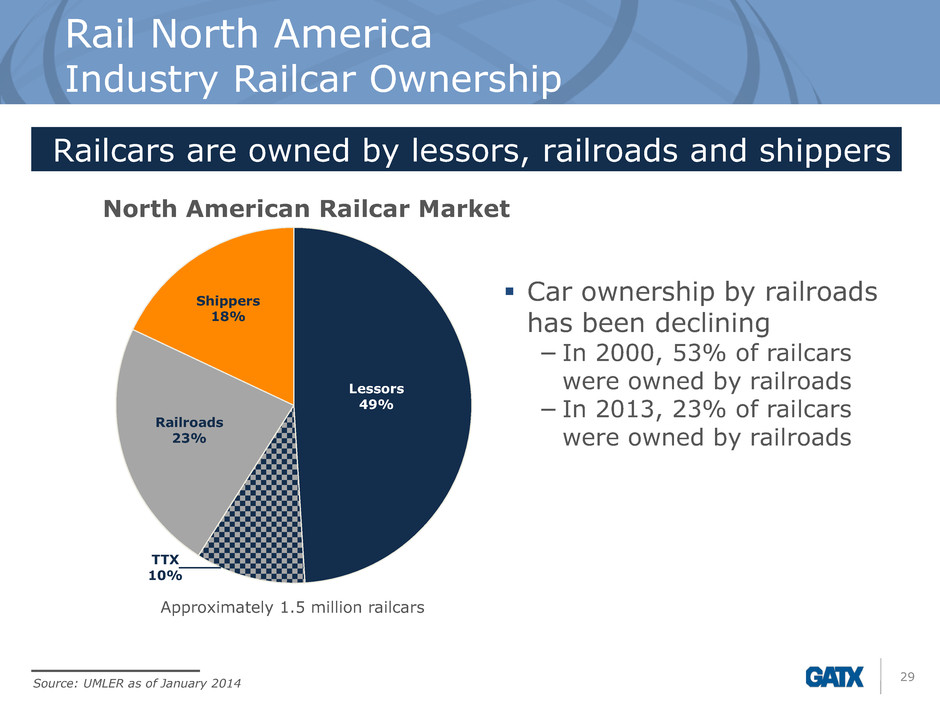

Rail North America Industry Railcar Ownership 29 Railroads 23% TTX 10% Shippers 18% North American Railcar Market Railcars are owned by lessors, railroads and shippers Source: UMLER as of January 2014 Approximately 1.5 million railcars Car ownership by railroads has been declining − In 2000, 53% of railcars were owned by railroads − In 2013, 23% of railcars were owned by railroads Lessors 49%

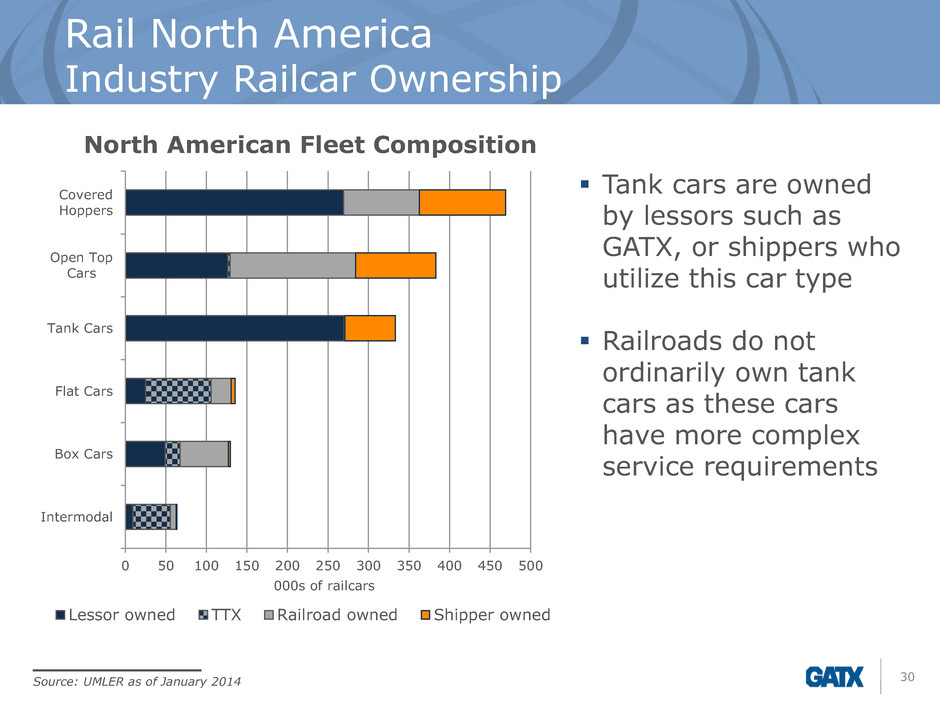

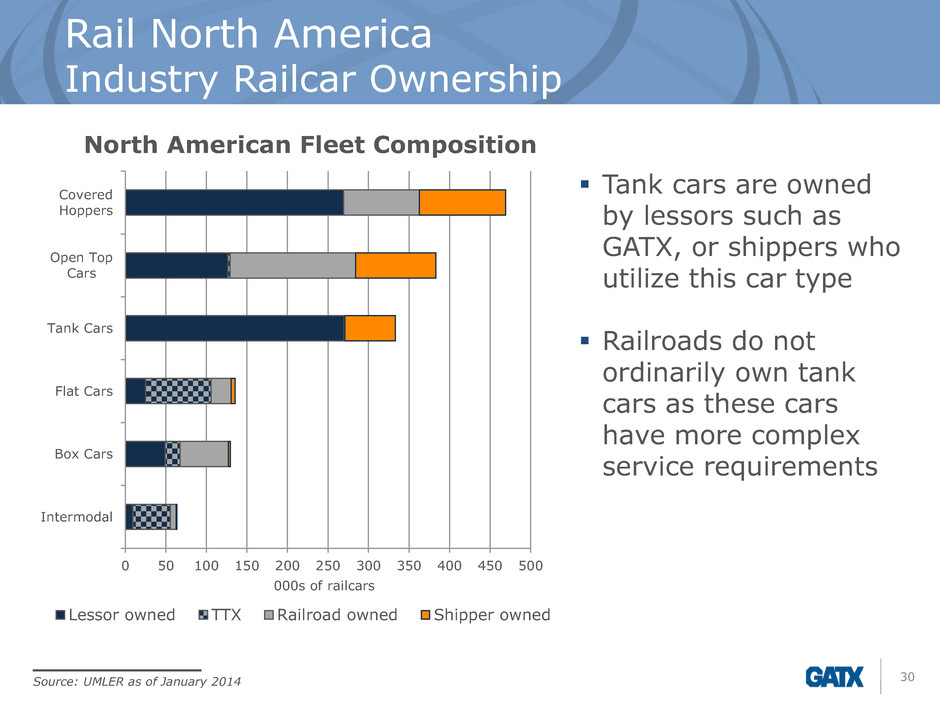

Rail North America Industry Railcar Ownership 30 0 50 100 150 200 250 300 350 400 450 500 Intermodal Box Cars Flat Cars Tank Cars Open Top Cars Covered Hoppers Lessor owned TTX Railroad owned Shipper owned 000s of railcars Tank cars are owned by lessors such as GATX, or shippers who utilize this car type Railroads do not ordinarily own tank cars as these cars have more complex service requirements North American Fleet Composition Source: UMLER as of January 2014

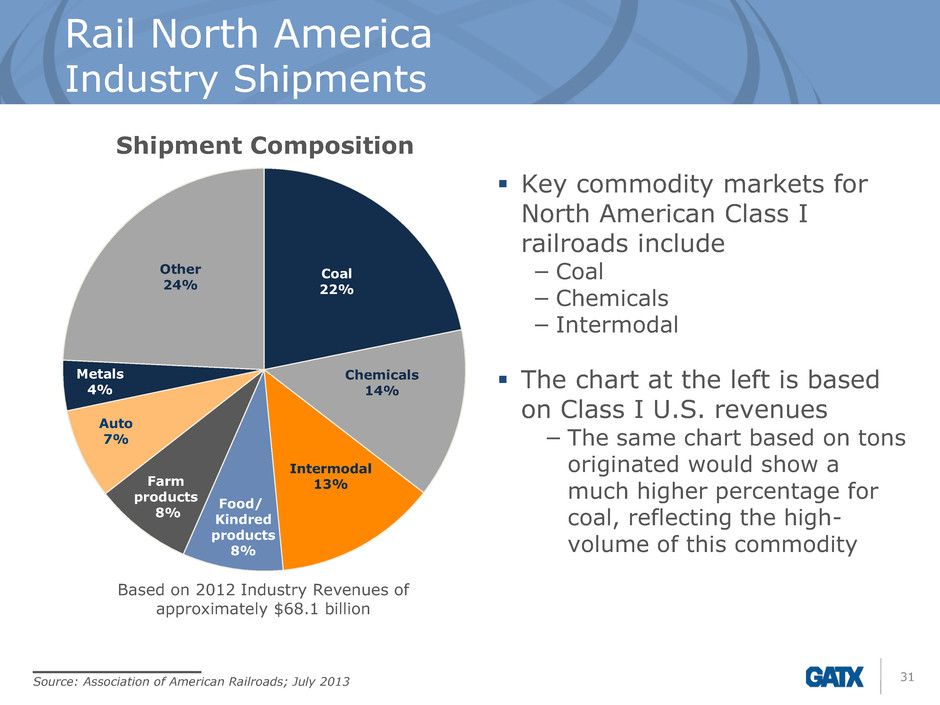

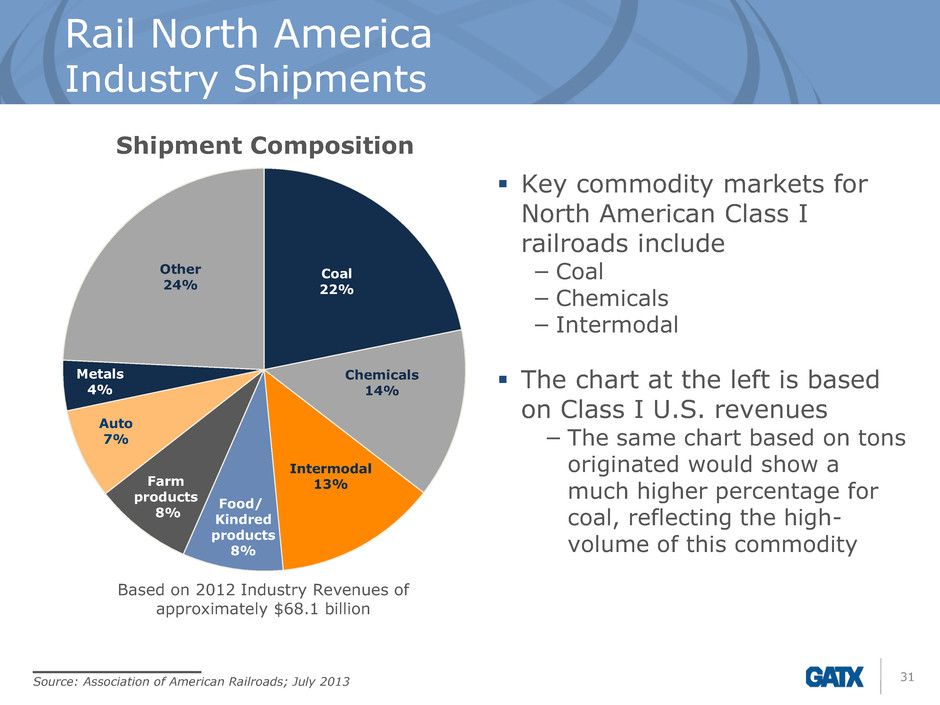

Rail North America Industry Shipments 31 Coal 22% Auto 7% Metals 4% Farm products 8% Food/ Kindred products 8% Key commodity markets for North American Class I railroads include − Coal − Chemicals − Intermodal The chart at the left is based on Class I U.S. revenues − The same chart based on tons originated would show a much higher percentage for coal, reflecting the high- volume of this commodity Shipment Composition Based on 2012 Industry Revenues of approximately $68.1 billion Source: Association of American Railroads; July 2013 Chemicals 14% Intermodal 13% Other 24%

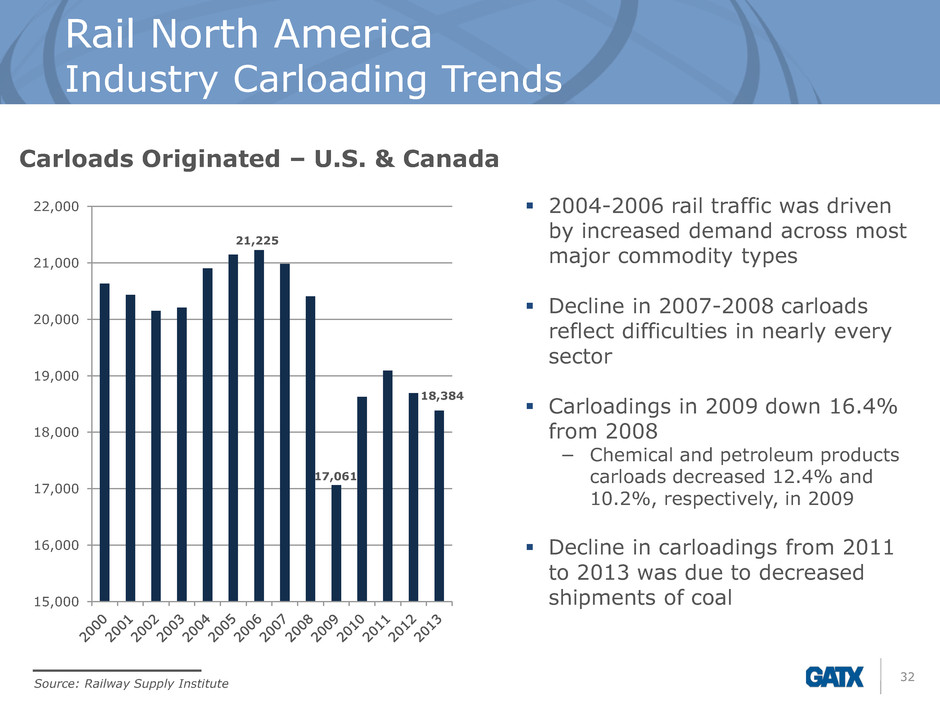

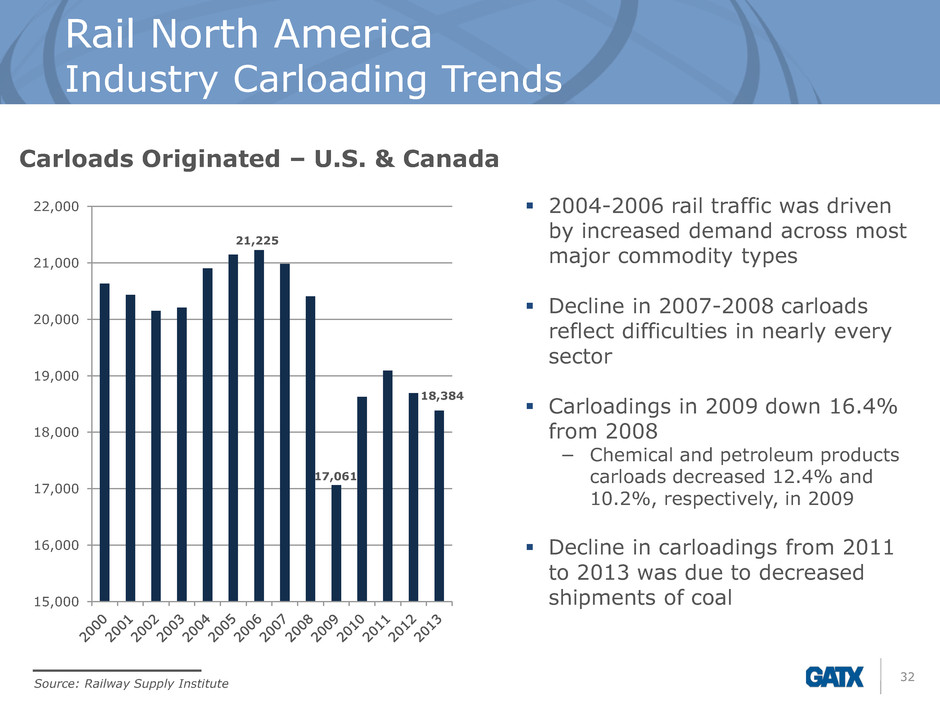

Rail North America Industry Carloading Trends 32 15,000 16,000 17,000 18,000 19,000 20,000 21,000 22,000 17,061 2004-2006 rail traffic was driven by increased demand across most major commodity types Decline in 2007-2008 carloads reflect difficulties in nearly every sector Carloadings in 2009 down 16.4% from 2008 − Chemical and petroleum products carloads decreased 12.4% and 10.2%, respectively, in 2009 Decline in carloadings from 2011 to 2013 was due to decreased shipments of coal Carloads Originated – U.S. & Canada Source: Railway Supply Institute 21,225 18,384

Source: Railway Supply Institute Railcar Manufacturing Backlog 33 U.S. Railcar Manufacturing Backlog - 10,000 20,000 30,000 40,000 50,000 60,000 70,000 80,000 90,000 100,000 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Tank 8,724 7,763 8,673 9,181 Freight 54,729 55,357 61,185 57,209 Cyclicality of the industry is illustrated by the backlog of orders at the railcar manufacturers The recent increase in tank car backlog is due to growth in energy markets 20 0 2 20 20 20 8 2 20 2014

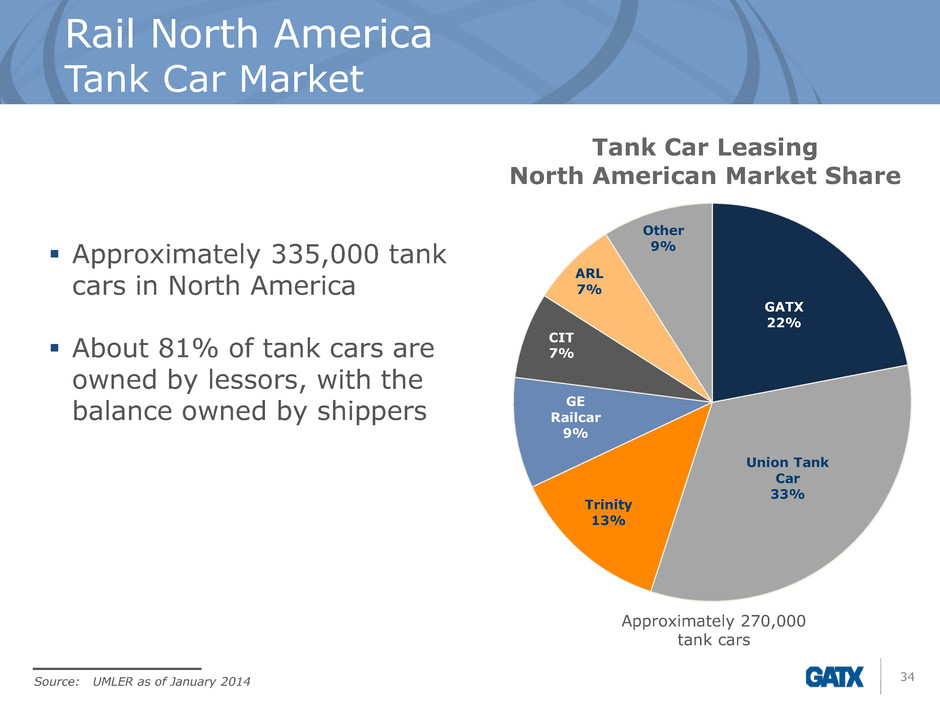

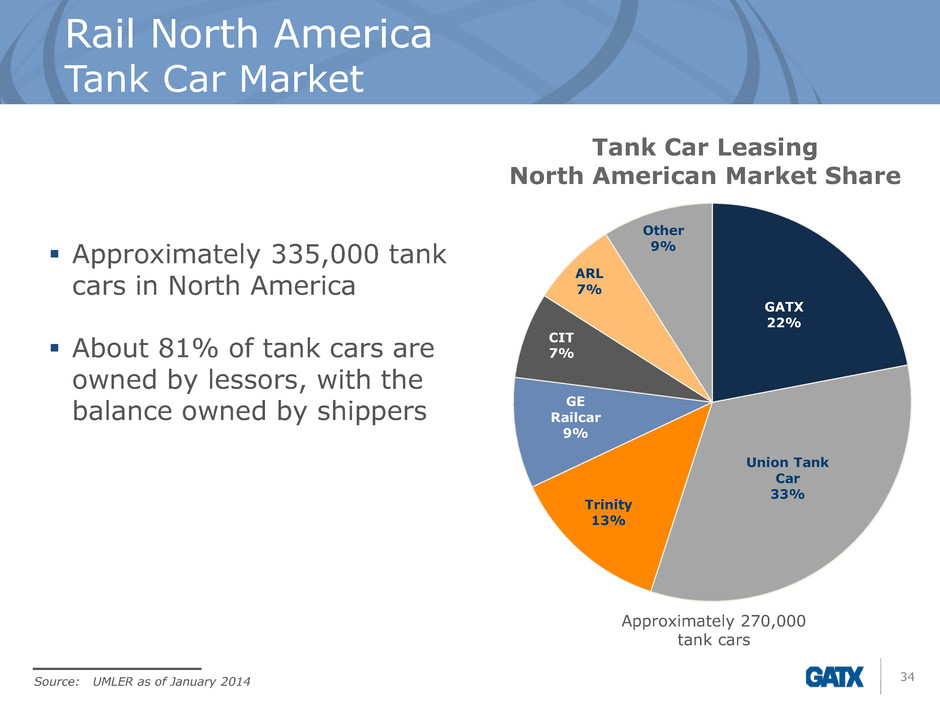

Rail North America Tank Car Market 34 Approximately 335,000 tank cars in North America About 81% of tank cars are owned by lessors, with the balance owned by shippers GATX 22% Union Tank Car 33% GE Railcar 9% Trinity 13% ARL 7% Other 9% Tank Car Leasing North American Market Share Source: UMLER as of January 2014 Approximately 270,000 tank cars CIT 7%

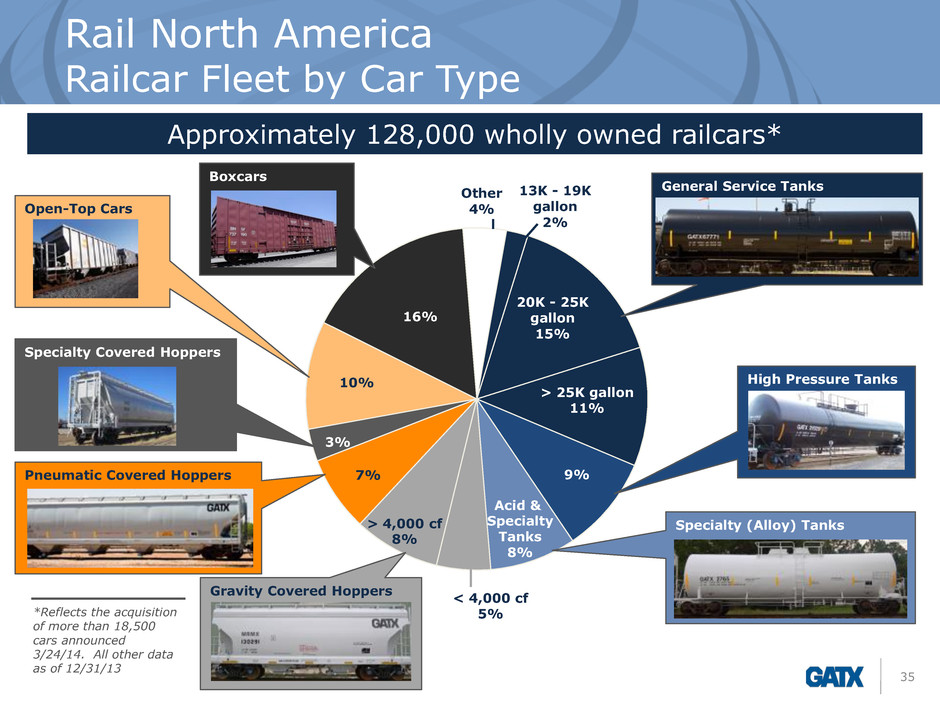

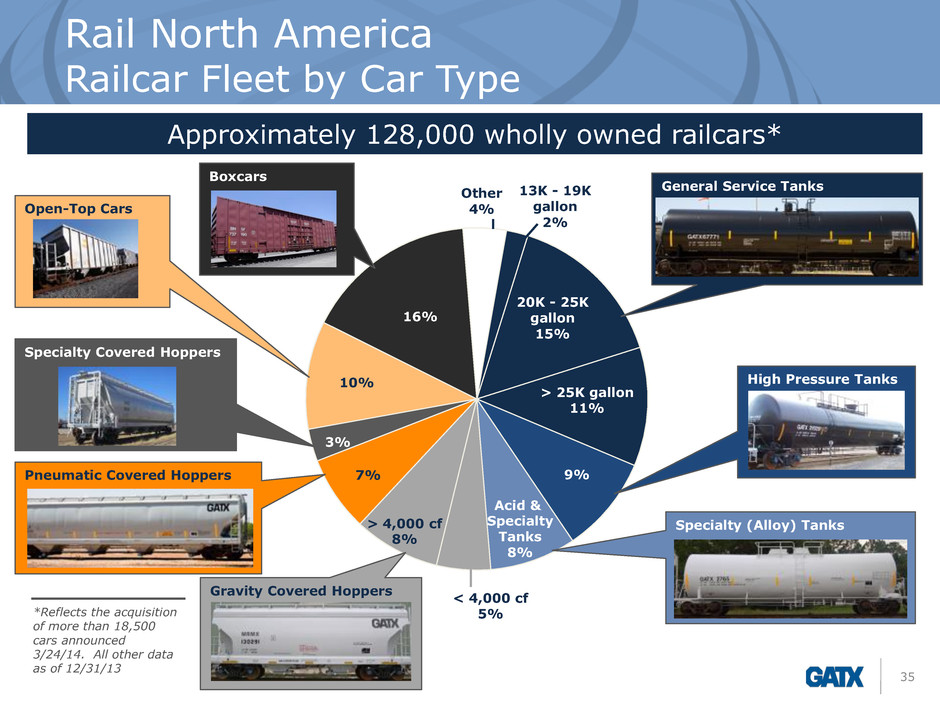

13K - 19K gallon 2% 20K - 25K gallon 15% > 25K gallon 11% < 4,000 cf 5% 16% Other 4% 9% Acid & Specialty Tanks 8% 7% 10% Rail North America Railcar Fleet by Car Type 35 Pneumatic Covered Hoppers Approximately 128,000 wholly owned railcars* General Service Tanks High Pressure Tanks Specialty (Alloy) Tanks Gravity Covered Hoppers Specialty Covered Hoppers Open-Top Cars 3% > 4,000 cf 8% Boxcars *Reflects the acquisition of more than 18,500 cars announced 3/24/14. All other data as of 12/31/13

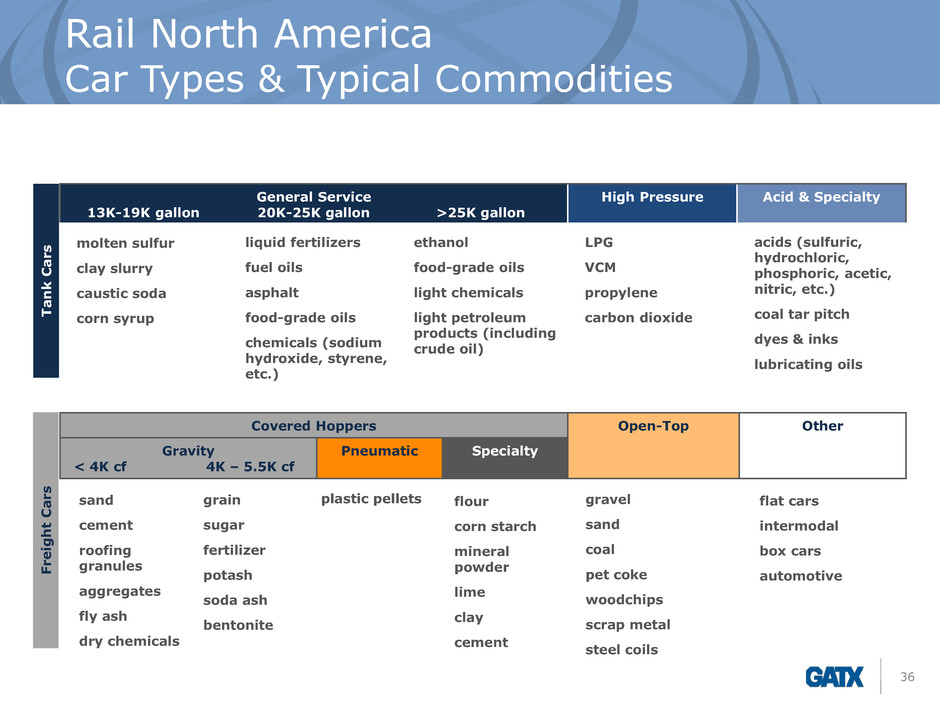

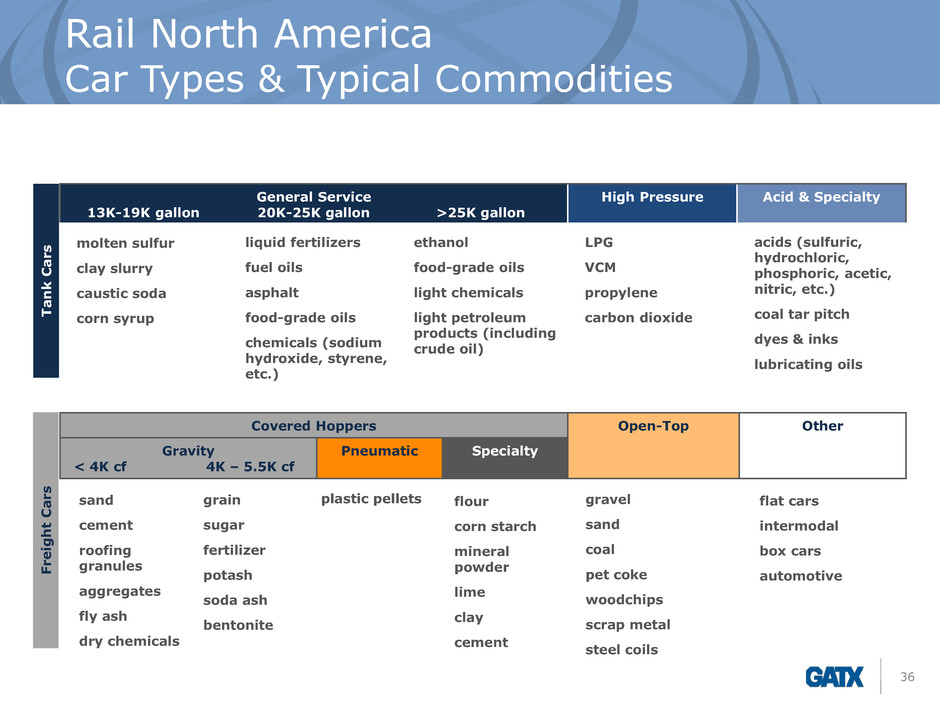

Rail North America Car Types & Typical Commodities 36 General Service 13K-19K gallon 20K-25K gallon >25K gallon High Pressure Acid & Specialty T a nk C a rs molten sulfur clay slurry caustic soda corn syrup liquid fertilizers fuel oils asphalt food-grade oils chemicals (sodium hydroxide, styrene, etc.) ethanol food-grade oils light chemicals light petroleum products (including crude oil) LPG VCM propylene carbon dioxide acids (sulfuric, hydrochloric, phosphoric, acetic, nitric, etc.) coal tar pitch dyes & inks lubricating oils Covered Hoppers Open-Top Other Gravity < 4K cf 4K – 5.5K cf Pneumatic Specialty sand cement roofing granules aggregates fly ash dry chemicals grain sugar fertilizer potash soda ash bentonite plastic pellets flour corn starch mineral powder lime clay cement gravel sand coal pet coke woodchips scrap metal steel coils flat cars intermodal box cars automotive Fr e ight C a rs

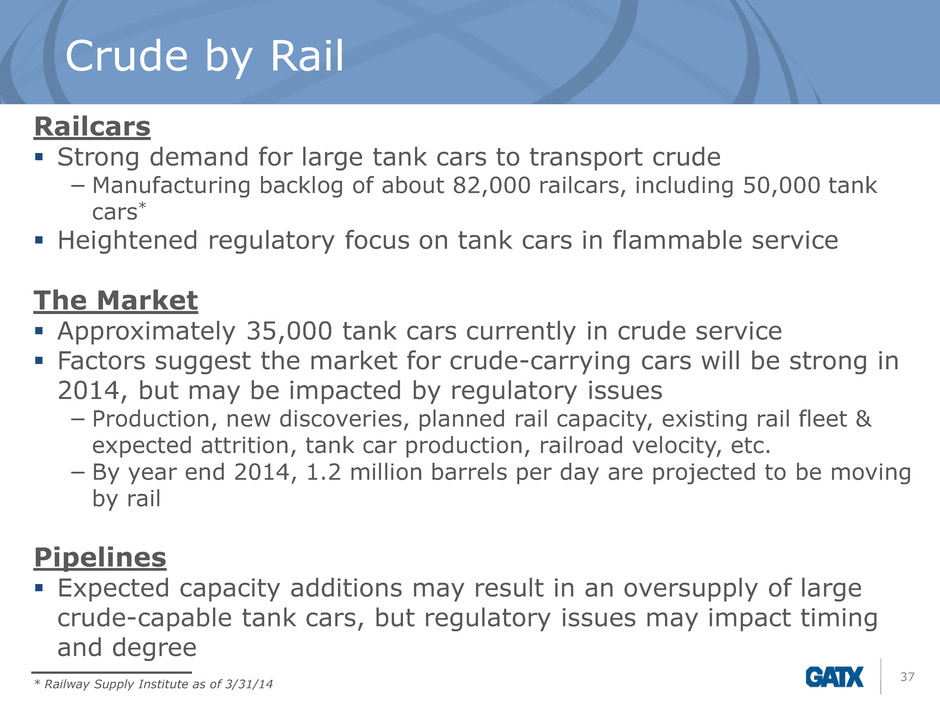

Crude by Rail 37 Railcars Strong demand for large tank cars to transport crude − Manufacturing backlog of about 82,000 railcars, including 50,000 tank cars* Heightened regulatory focus on tank cars in flammable service The Market Approximately 35,000 tank cars currently in crude service Factors suggest the market for crude-carrying cars will be strong in 2014, but may be impacted by regulatory issues − Production, new discoveries, planned rail capacity, existing rail fleet & expected attrition, tank car production, railroad velocity, etc. − By year end 2014, 1.2 million barrels per day are projected to be moving by rail Pipelines Expected capacity additions may result in an oversupply of large crude-capable tank cars, but regulatory issues may impact timing and degree * Railway Supply Institute as of 3/31/14

Crude by Rail GATX’s prudent approach 38 Diverse customer base GATX seeks a mix of growth opportunities in petroleum products, chemicals, food, agriculture and other industries Limited exposure GATX’s customers leasing railcars to transport crude have: −High credit ratings −Long lease terms Focus on safety Safety is GATX’s top priority −GATX will continue to work with regulators and shippers to proactively identify options for providing the safest railcars possible

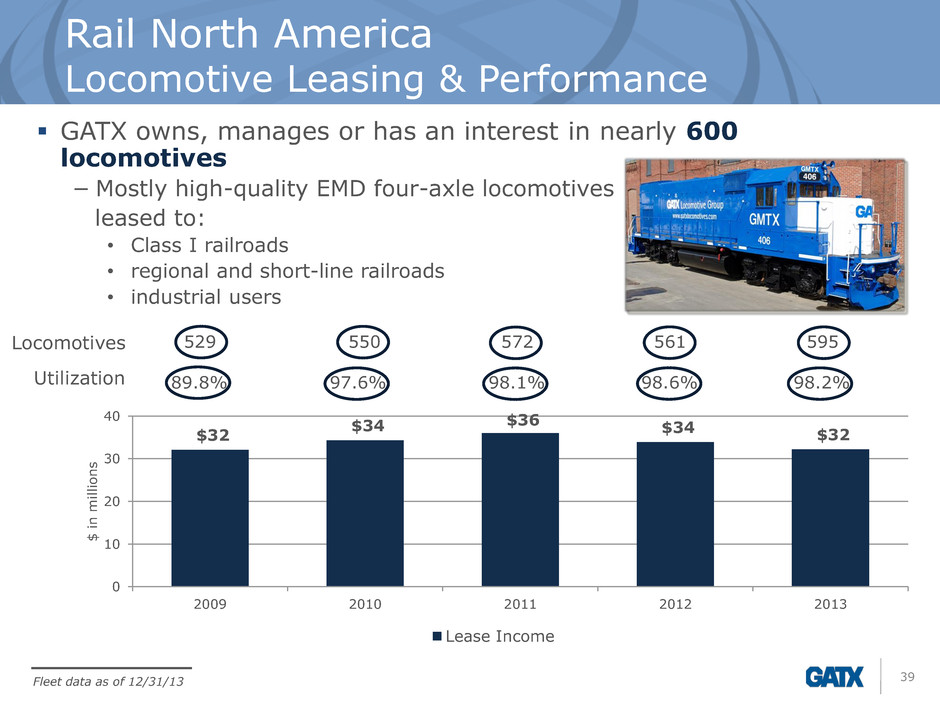

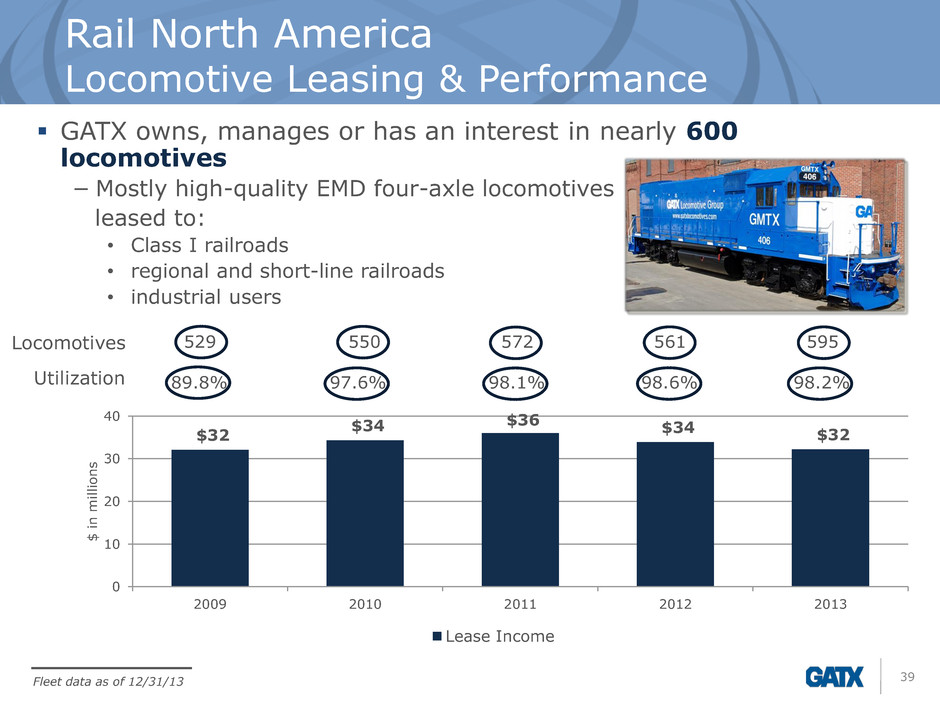

Rail North America Locomotive Leasing & Performance 39 GATX owns, manages or has an interest in nearly 600 locomotives − Mostly high-quality EMD four-axle locomotives leased to: • Class I railroads • regional and short-line railroads • industrial users $32 $34 $36 $34 $32 0 10 20 30 40 2009 2010 2011 2012 2013 $ in m il li o n s Lease Income 529 550 572 561 595 89.8% 97.6% 98.1% 98.6% 98.2% Locomotives Utilization Fleet data as of 12/31/13

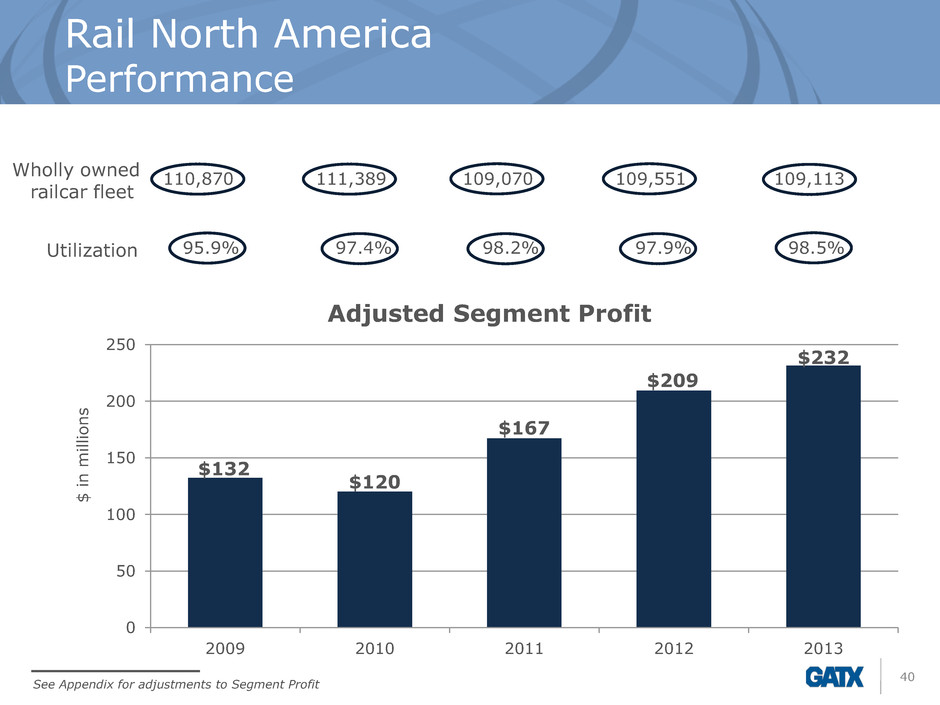

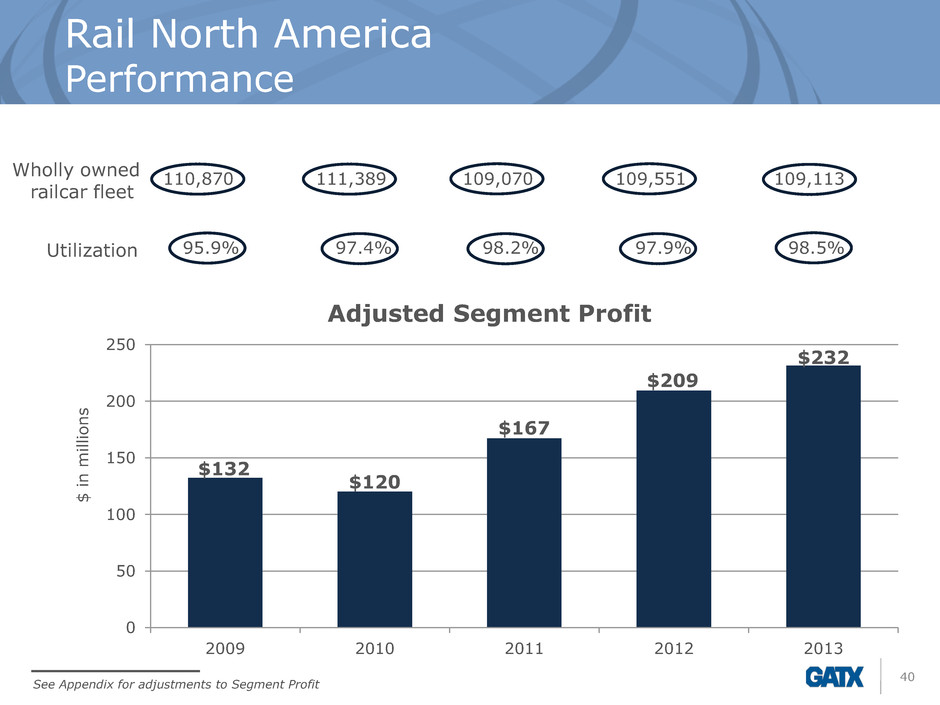

Rail North America Performance 40 110,870 111,389 109,070 109,551 109,113 95.9% 97.4% 98.2% 97.9% 98.5% $132 $120 $167 $209 $232 0 50 100 150 200 250 2009 2010 2011 2012 2013 $ in m il li on s Adjusted Segment Profit Wholly owned railcar fleet Utilization See Appendix for adjustments to Segment Profit

41 RAIL INTERNATIONAL

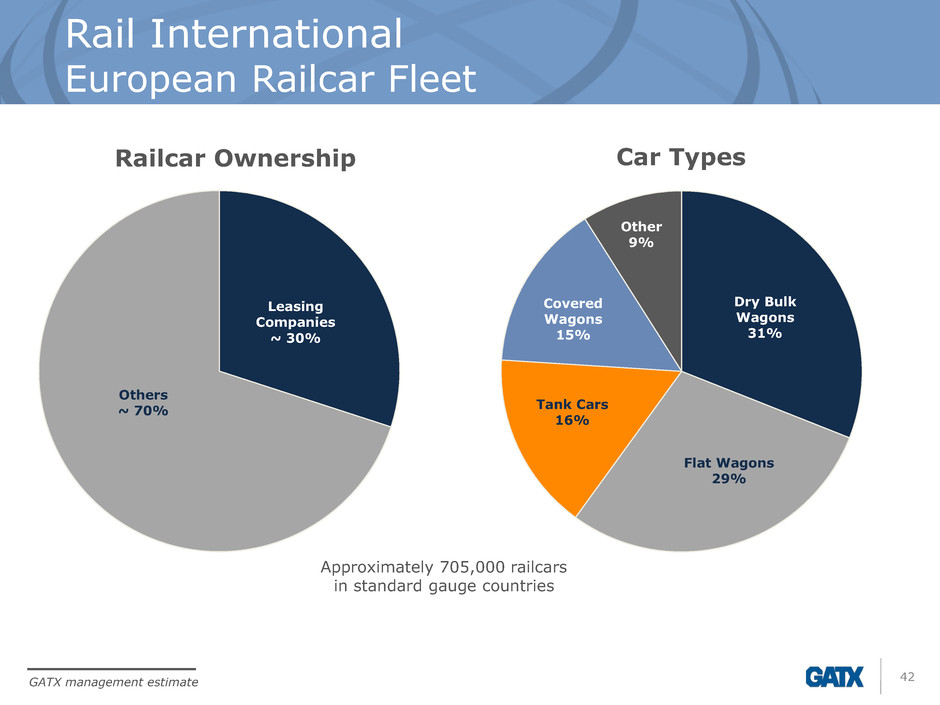

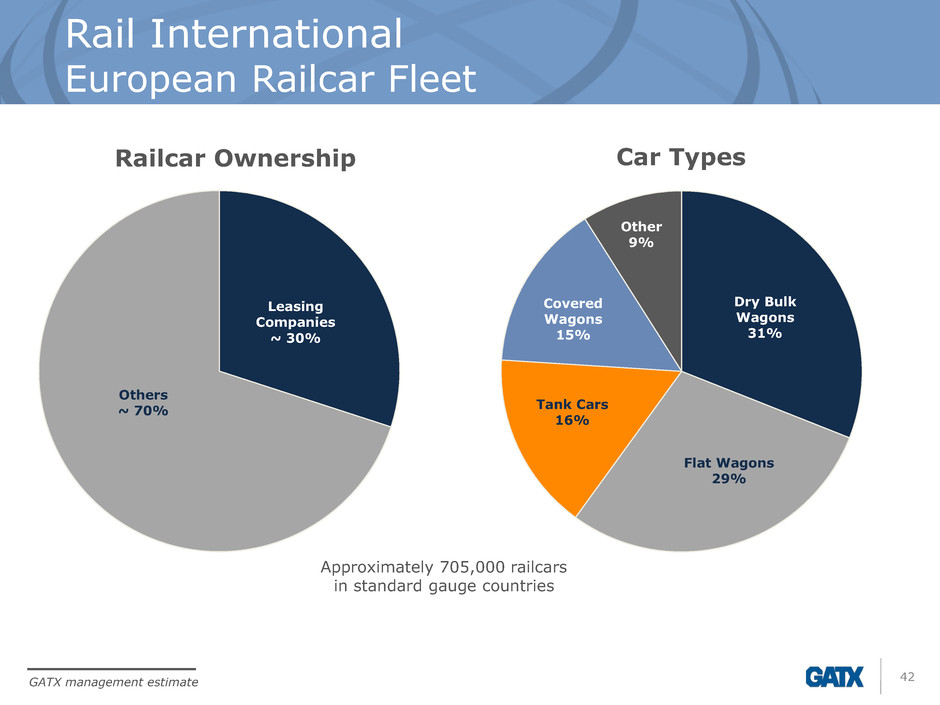

Rail International European Railcar Fleet 42 Leasing Companies ~ 30% Others ~ 70% Railcar Ownership Approximately 705,000 railcars in standard gauge countries Dry Bulk Wagons 31% Flat Wagons 29% Tank Cars 16% Covered Wagons 15% Other 9% Car Types GATX management estimate

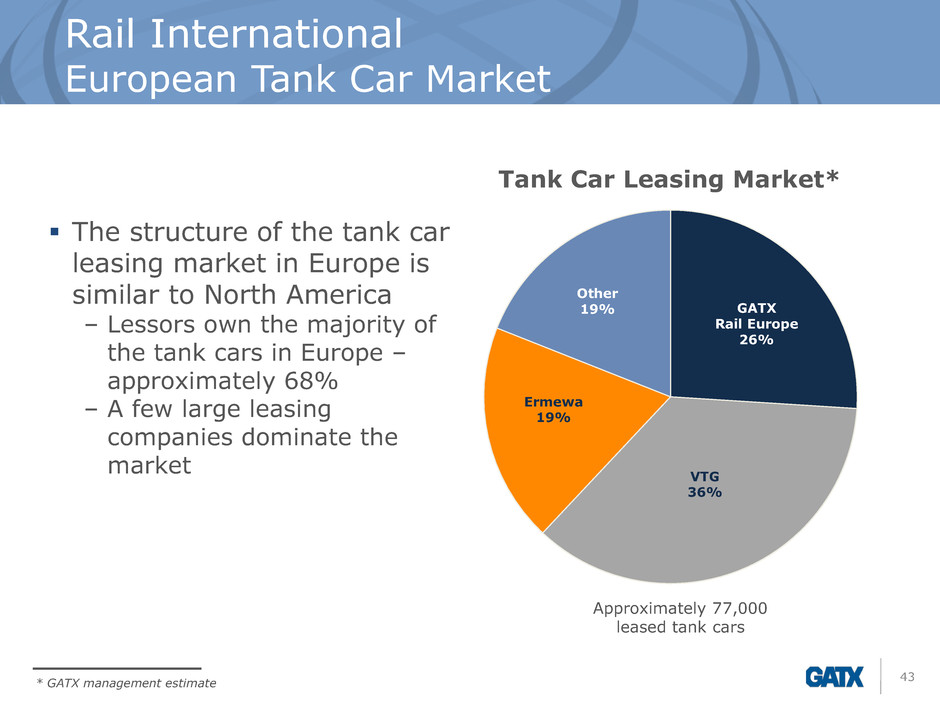

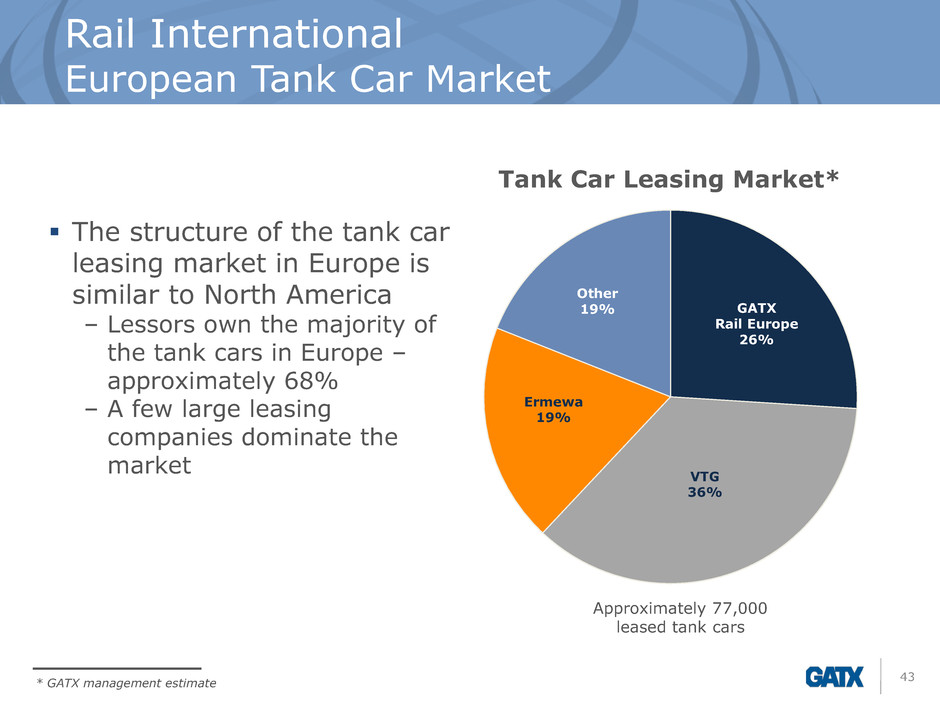

Rail International European Tank Car Market 43 Tank Car Leasing Market* * GATX management estimate Approximately 77,000 leased tank cars The structure of the tank car leasing market in Europe is similar to North America – Lessors own the majority of the tank cars in Europe – approximately 68% – A few large leasing companies dominate the market GATX Rail Europe 26% VTG 36% Ermewa 19% Other 19%

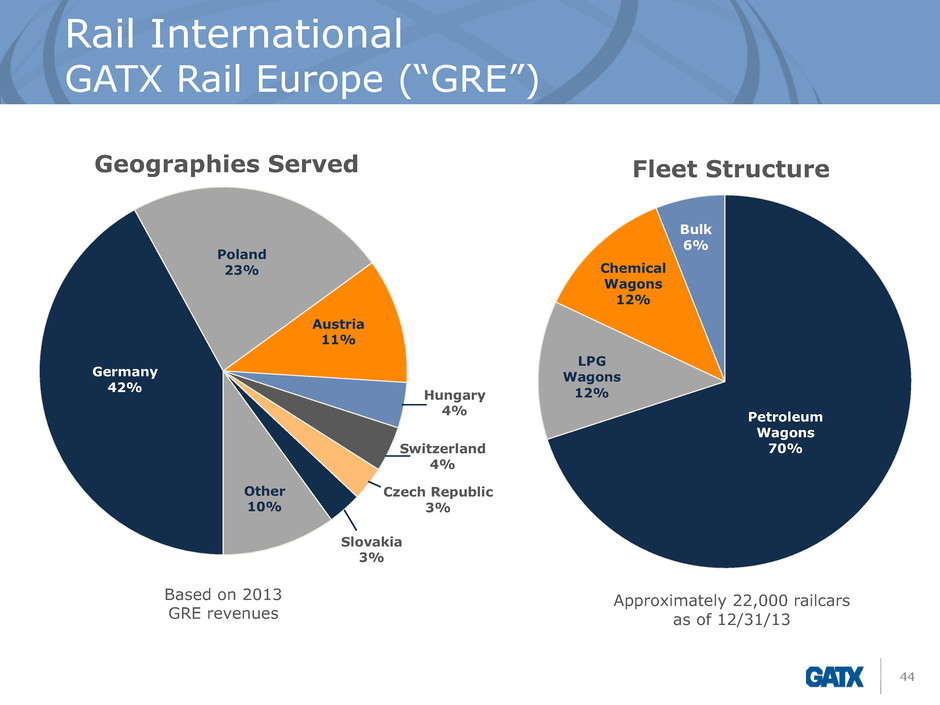

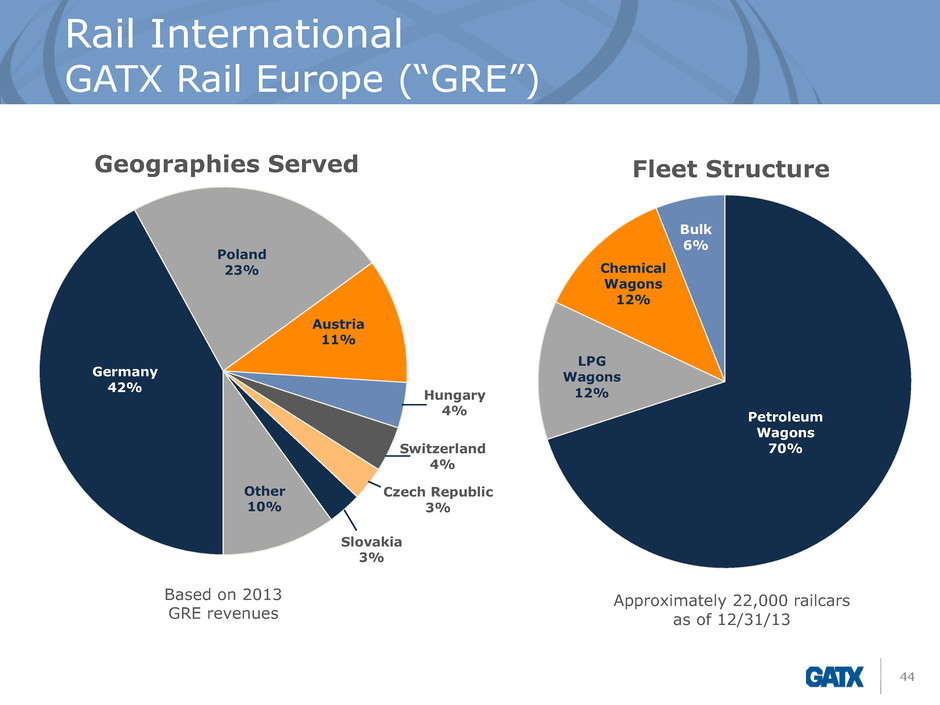

Rail International GATX Rail Europe (“GRE”) 44 LPG Wagons 12% Bulk 6% Geographies Served Fleet Structure Based on 2013 GRE revenues Approximately 22,000 railcars as of 12/31/13 Poland 23% Austria 11% Hungary 4% Switzerland 4% Slovakia 3% Other 10% Germany 42% Czech Republic 3% Petroleum Wagons 70% Chemical Wagons 12%

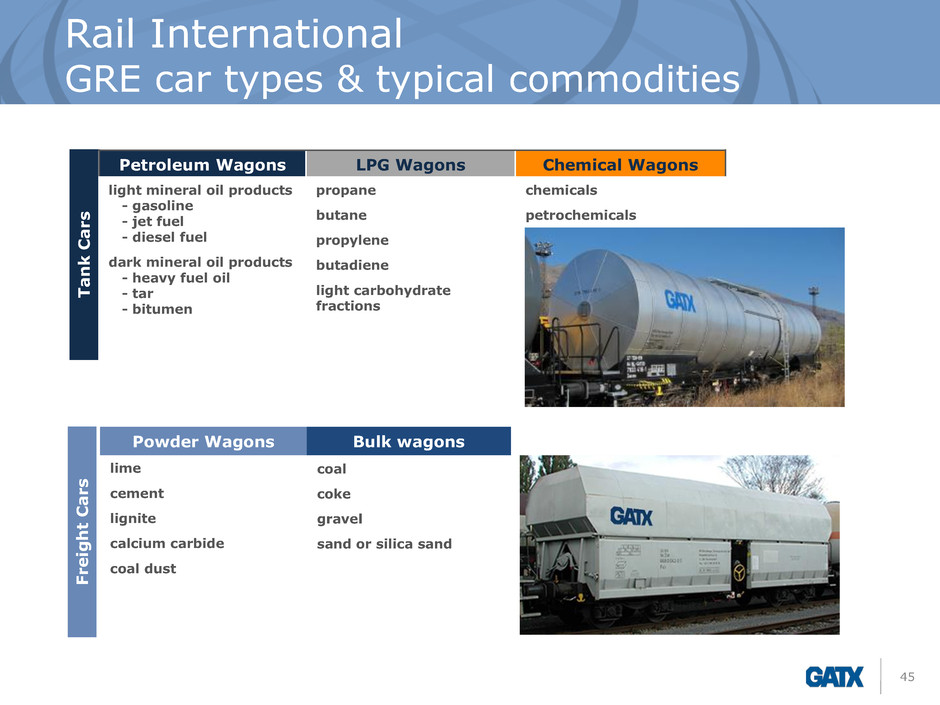

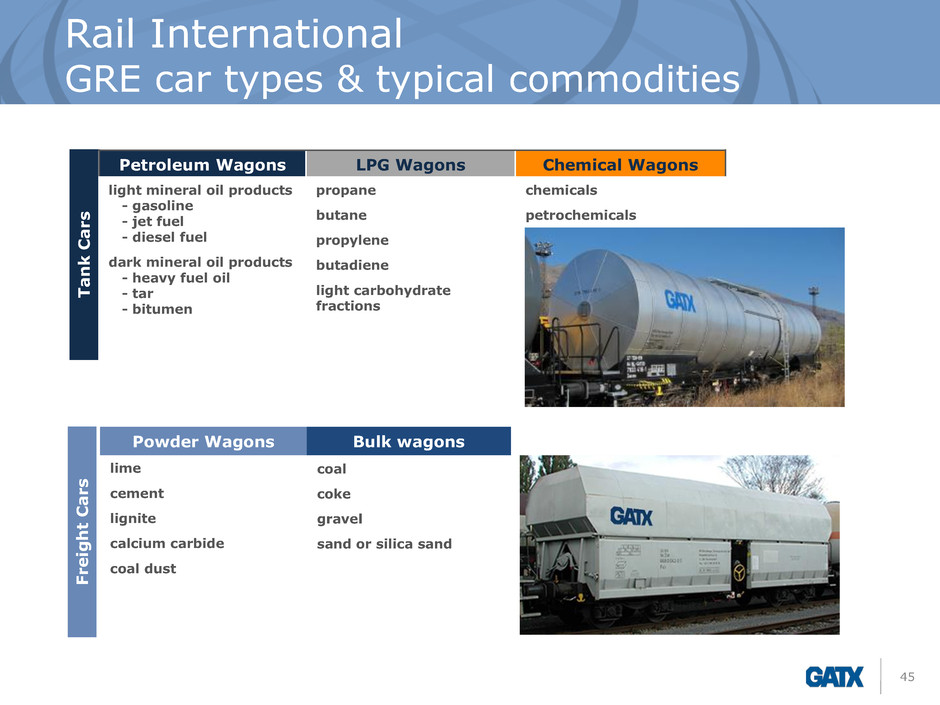

Rail International GRE car types & typical commodities 45 Petroleum Wagons LPG Wagons Chemical Wagons Tank C a rs light mineral oil products - gasoline - jet fuel - diesel fuel dark mineral oil products - heavy fuel oil - tar - bitumen propane butane propylene butadiene light carbohydrate fractions chemicals petrochemicals Powder Wagons Bulk wagons lime cement lignite calcium carbide coal dust coal coke gravel sand or silica sand F re ig h t C a rs

Rail International GATX India Private Ltd. (“GIPL”) 46 The Market World’s 4th largest rail network Dedicated Freight Corridors under construction Eastern Corridor Western Corridor - 1,839 kilometers - 1,499 kilometers - Ludhiana to Dankuni - Jawaharlal Nehru Port to Dadri GATX’s progress First ever wagon leasing license issued to GIPL in 2012 GIPL invested in container flat wagons Continue to focus on investments, lease execution and wagon quality

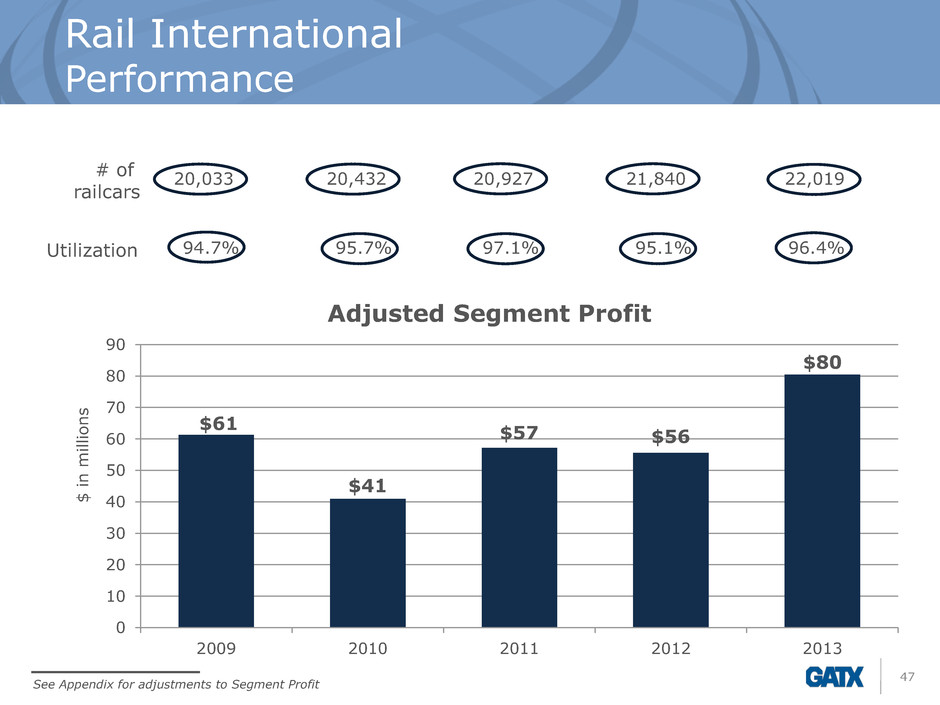

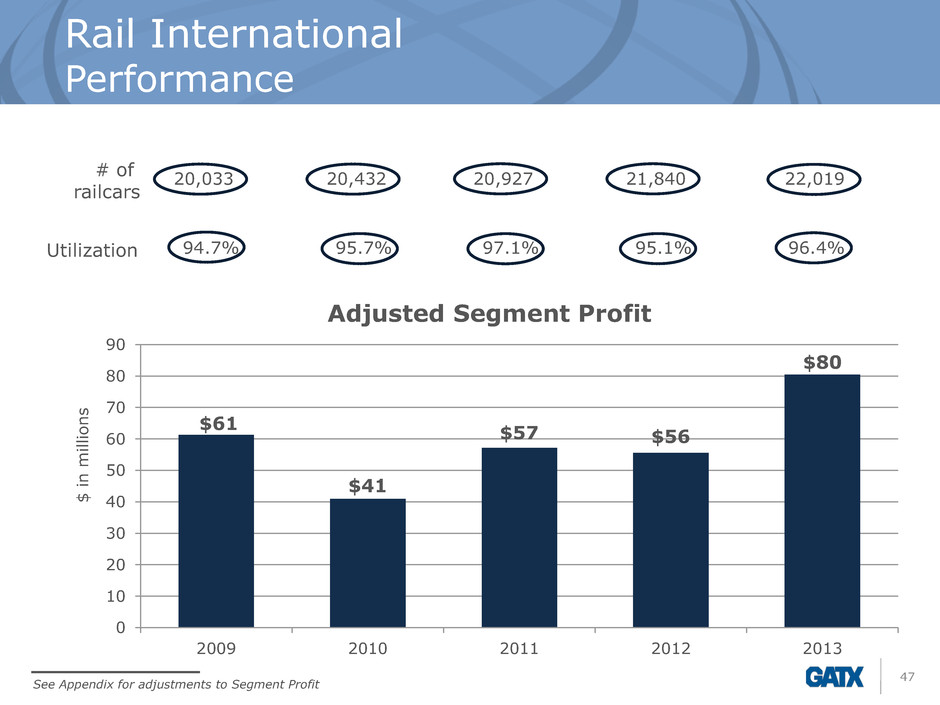

Rail International Performance 47 20,033 20,432 20,927 21,840 22,019 94.7% 95.7% 97.1% 95.1% 96.4% $61 $41 $57 $56 $80 0 10 20 30 40 50 60 70 80 90 2009 2010 2011 2012 2013 $ in m il li on s Adjusted Segment Profit # of railcars Utilization See Appendix for adjustments to Segment Profit

48 AMERICAN STEAMSHIP COMPANY

Great Lakes Shipping Industry Overview 49 Shipping industry on the Great Lakes is mature The fresh water vessels are long-lived High barriers to entry −New-build vessel costs have risen sharply in recent years − In 2012, ASC deployed the first new, US-built vessel on the Great Lakes in 12 years Customer base is highly concentrated −ASC served 23 customers in 2013 −Top five customers comprised 76% of ASC’s total revenue in 2013 Sailing season generally runs from late March through the end of December

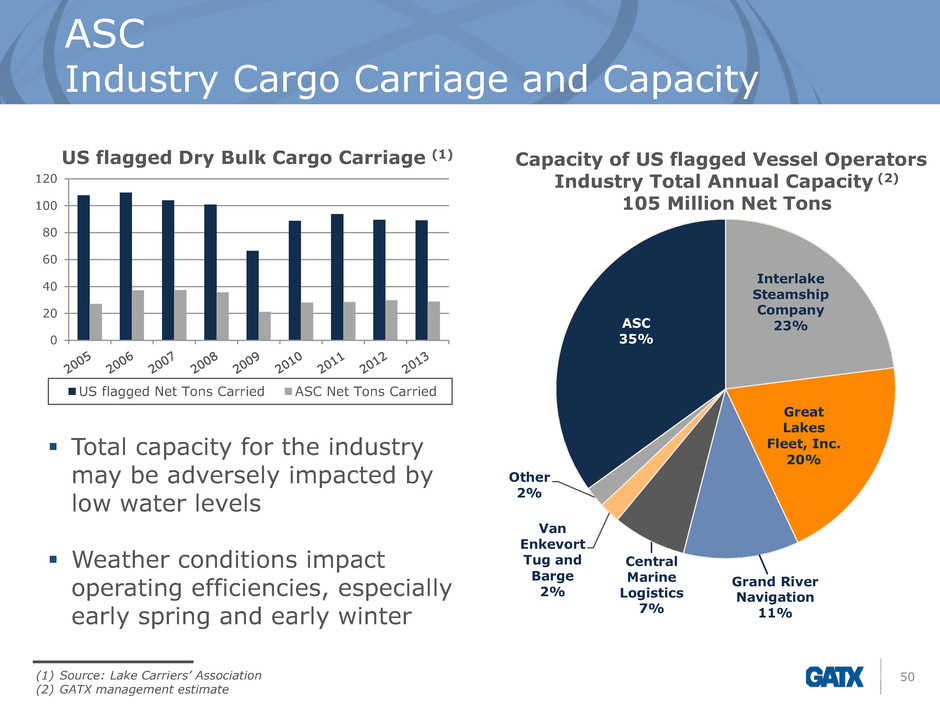

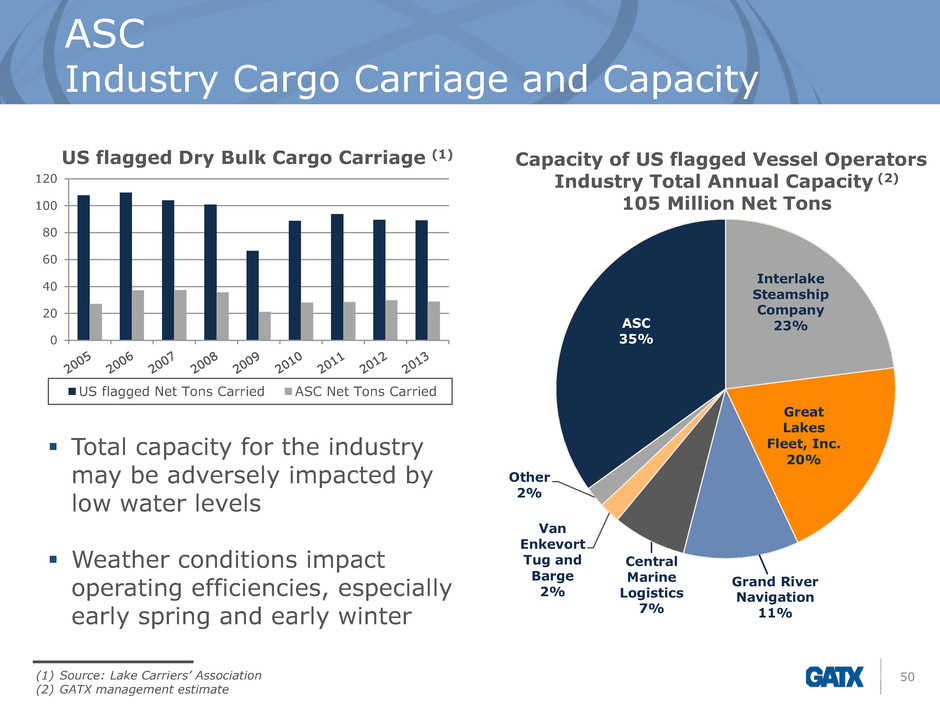

ASC Industry Cargo Carriage and Capacity 50 0 20 40 60 80 100 120 US flagged Net Tons Carried ASC Net Tons Carried US flagged Dry Bulk Cargo Carriage (1) Capacity of US flagged Vessel Operators Industry Total Annual Capacity (2) 105 Million Net Tons ASC 35% Great Lakes Fleet, Inc. 20% Van Enkevort Tug and Barge 2% Other 2% Total capacity for the industry may be adversely impacted by low water levels Weather conditions impact operating efficiencies, especially early spring and early winter (1) Source: Lake Carriers’ Association (2) GATX management estimate Interlake Steamship Company 23% Grand River Navigation 11% Central Marine Logistics 7%

ASC 51 ASC provides transportation of dry bulk commodities on the Great Lakes ASC has been operating for more than 100 years, joining GATX in 1973 Fleet of 17 self-unloading vessels − No shore side assistance required; can operate 24 hours a day, seven days a week Composition of fleet enhances ability to meet varying levels of demand − Range in length from 635’ to 1,000’ − Single trip vessel cargo volume ranges from 20,000 to 65,000 gross tons − Unloading speeds range from 5,000 to 9,000 net tons per hour

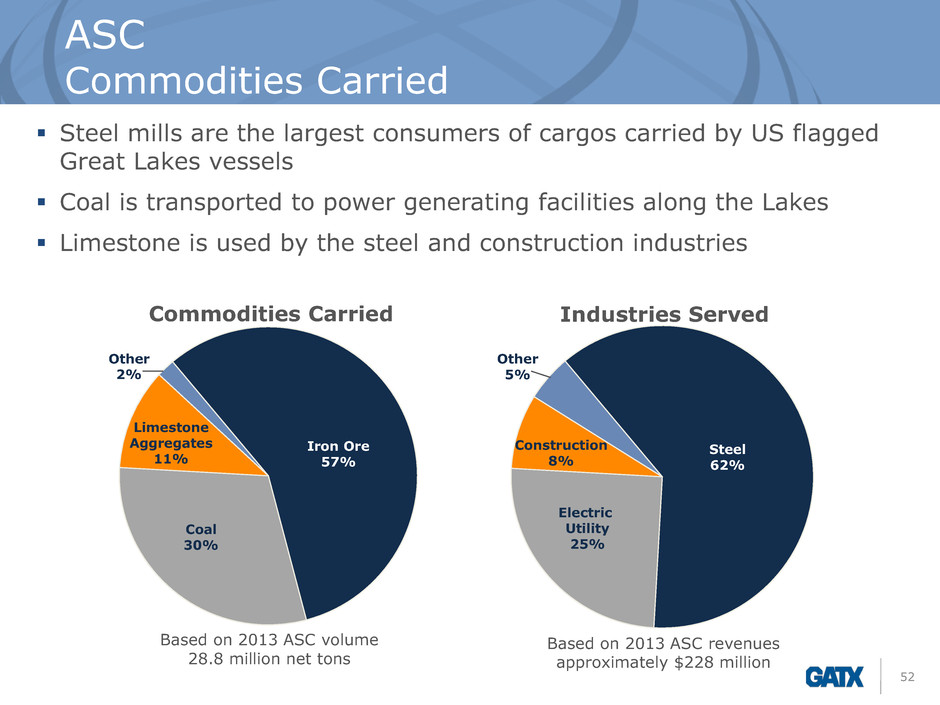

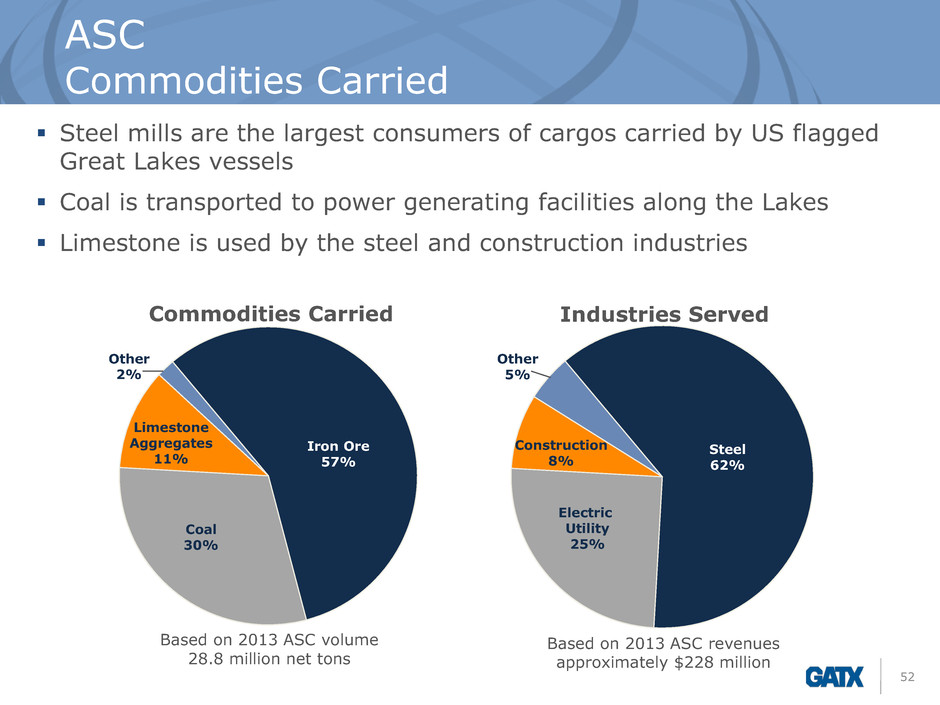

ASC Commodities Carried 52 Steel mills are the largest consumers of cargos carried by US flagged Great Lakes vessels Coal is transported to power generating facilities along the Lakes Limestone is used by the steel and construction industries Industries Served Commodities Carried Based on 2013 ASC volume 28.8 million net tons Based on 2013 ASC revenues approximately $228 million Iron Ore 57% Coal 30% Limestone Aggregates 11% Other 2% Steel 62% Electric Utility 25% Construction 8% Other 5%

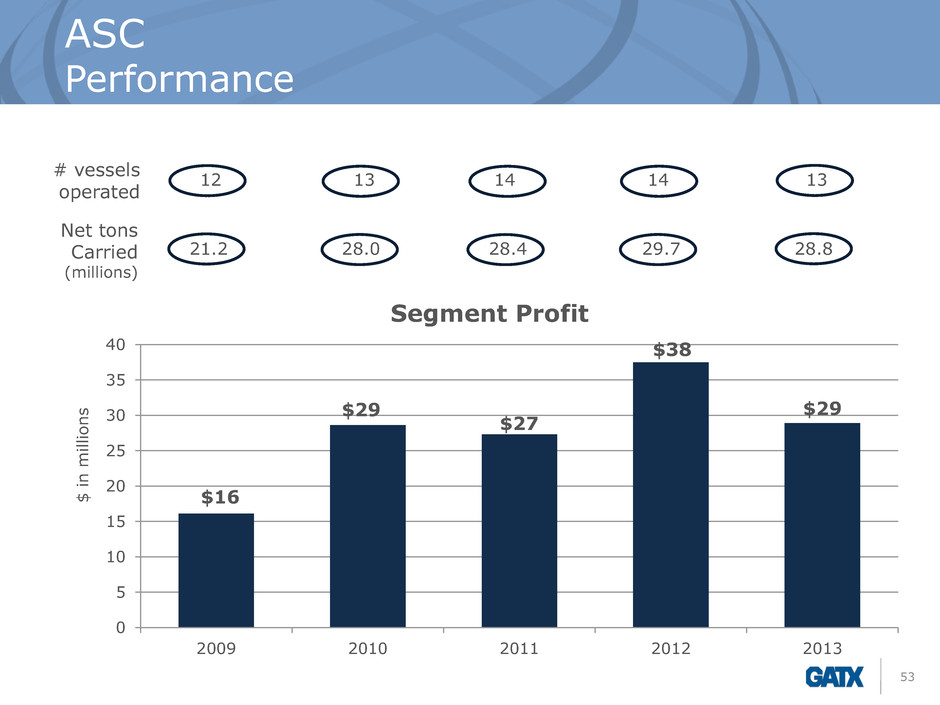

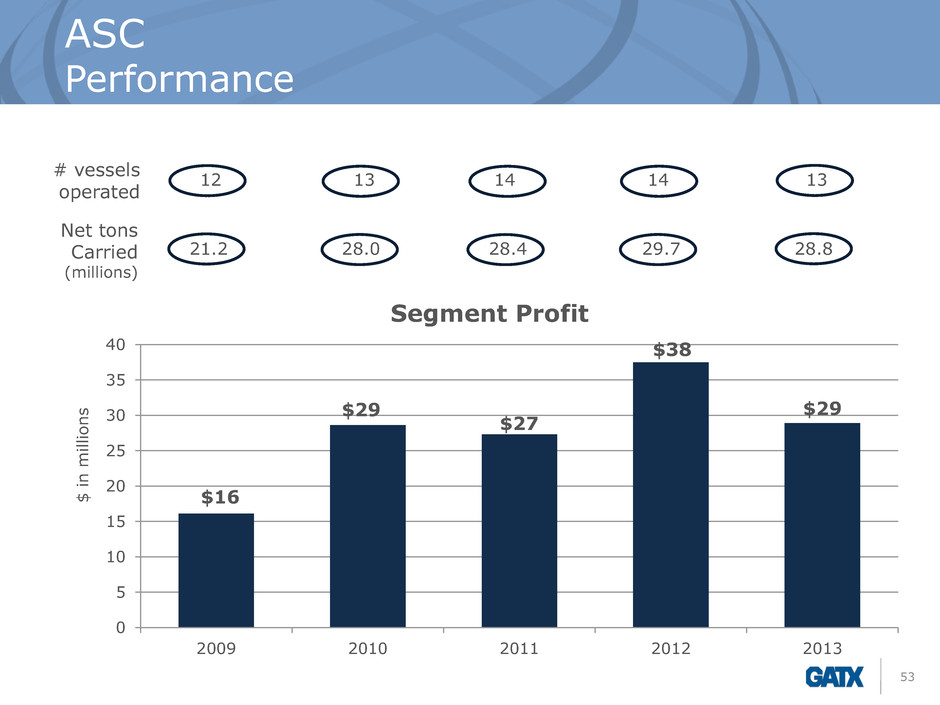

ASC Performance 53 12 13 14 14 13 21.2 28.0 28.4 29.7 28.8 $16 $29 $27 $38 $29 0 5 10 15 20 25 30 35 40 2009 2010 2011 2012 2013 $ in m il li on s Segment Profit # vessels operated Net tons Carried (millions)

54 PORTFOLIO MANAGEMENT

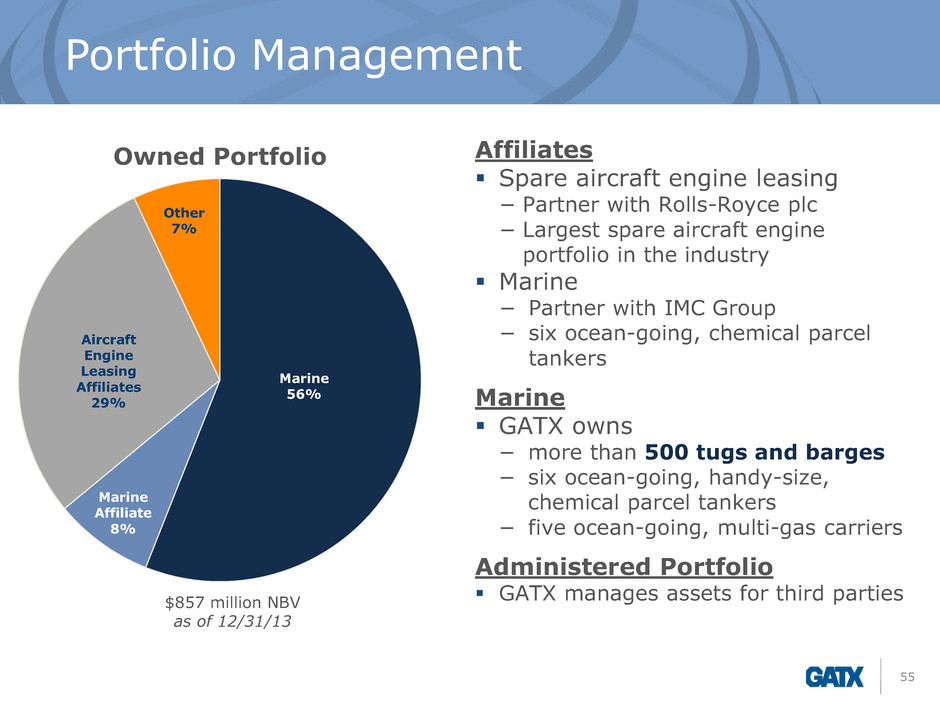

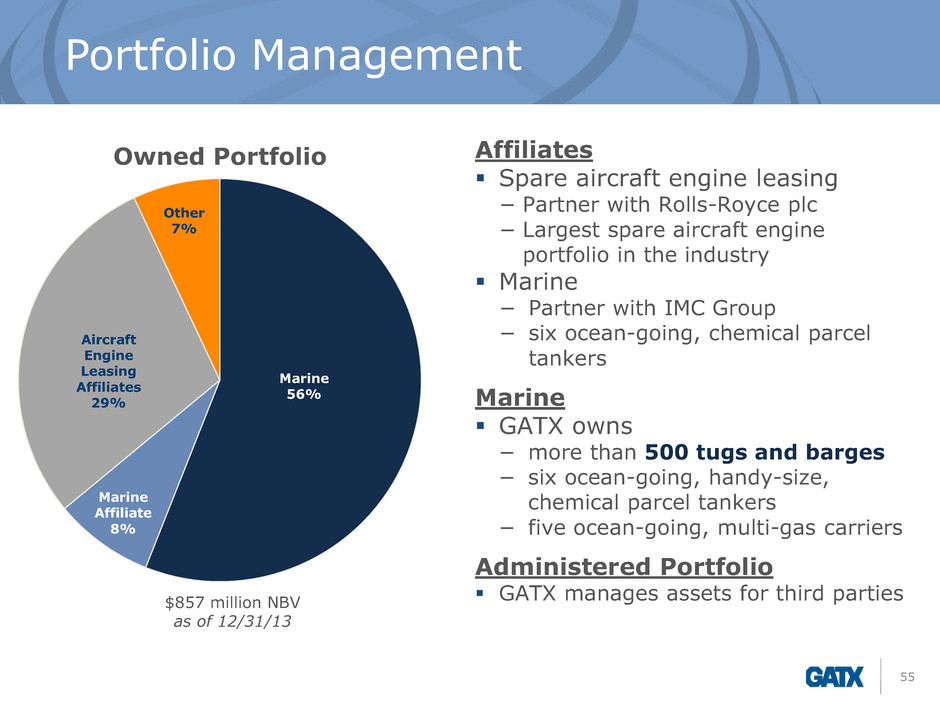

Portfolio Management 55 Marine 56% Marine Affiliate 8% Aircraft Engine Leasing Affiliates 29% Other 7% Owned Portfolio Affiliates Spare aircraft engine leasing − Partner with Rolls-Royce plc − Largest spare aircraft engine portfolio in the industry Marine − Partner with IMC Group − six ocean-going, chemical parcel tankers Marine GATX owns − more than 500 tugs and barges − six ocean-going, handy-size, chemical parcel tankers − five ocean-going, multi-gas carriers Administered Portfolio GATX manages assets for third parties $857 million NBV as of 12/31/13

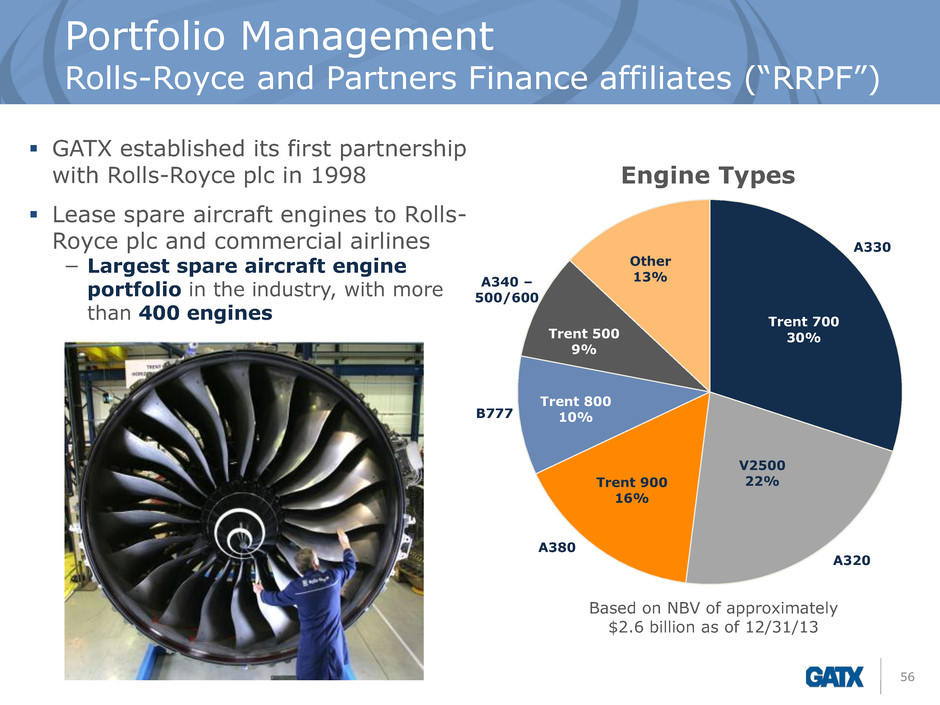

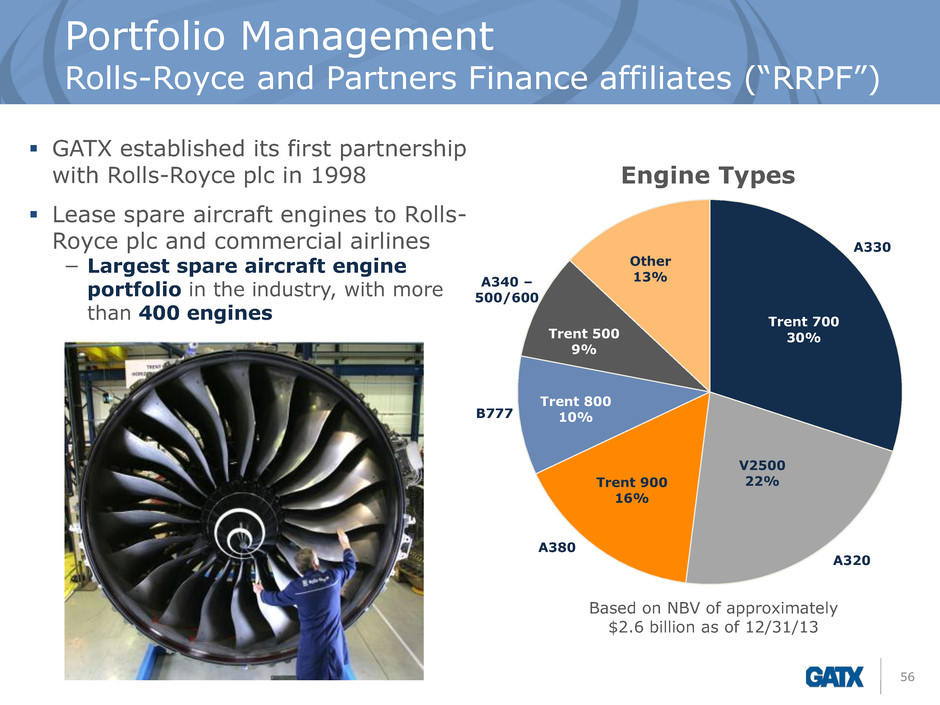

Portfolio Management Rolls-Royce and Partners Finance affiliates (“RRPF”) 56 GATX established its first partnership with Rolls-Royce plc in 1998 Lease spare aircraft engines to Rolls- Royce plc and commercial airlines − Largest spare aircraft engine portfolio in the industry, with more than 400 engines Trent 700 30% V2500 22% Trent 900 16% Trent 800 10% Trent 500 9% Other 13% Engine Types A330 Based on NBV of approximately $2.6 billion as of 12/31/13 A320 B777 A340 – 500/600 A380

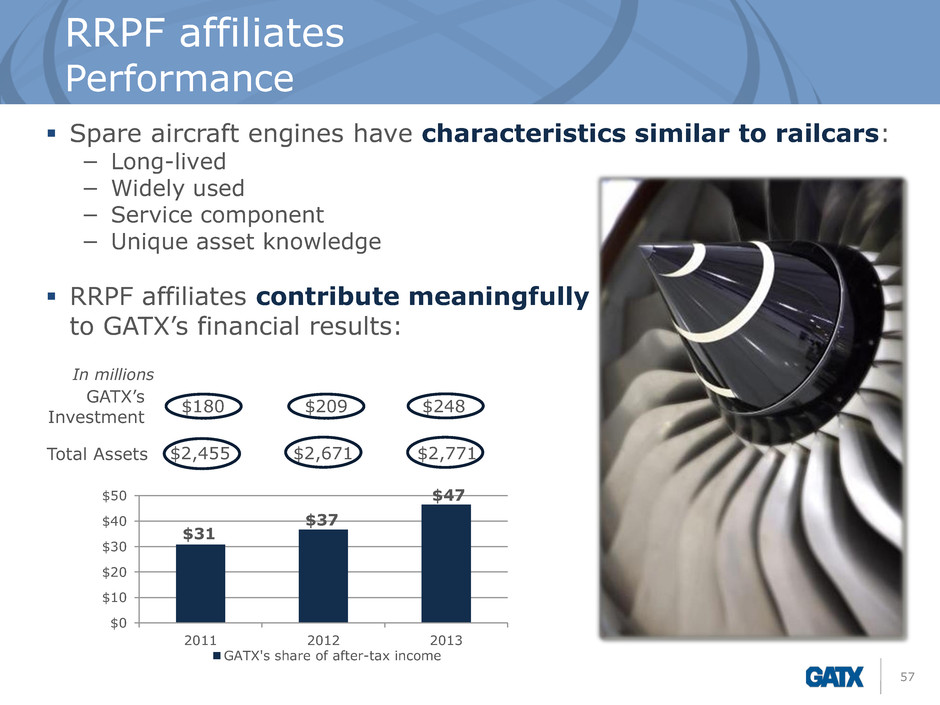

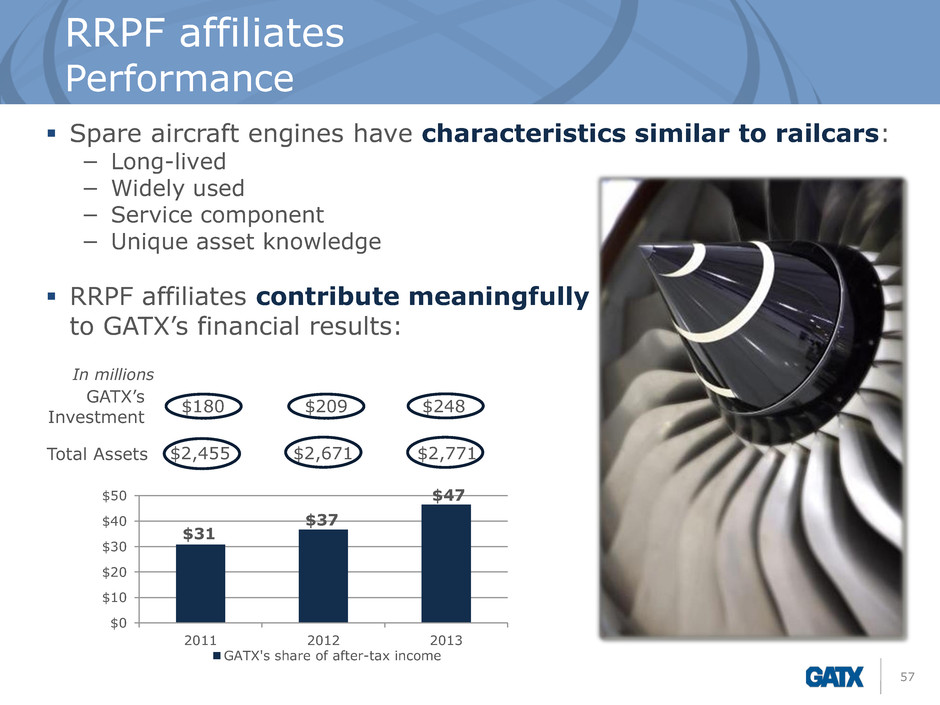

RRPF affiliates Performance 57 $180 $209 $248 $2,455 $2,671 $2,771 $31 $37 $47 $0 $10 $20 $30 $40 $50 2011 2012 2013 GATX's share of after-tax income GATX’s Investment Total Assets Spare aircraft engines have characteristics similar to railcars: − Long-lived − Widely used − Service component − Unique asset knowledge RRPF affiliates contribute meaningfully to GATX’s financial results: In millions

Portfolio Management Administered Portfolio 58 GATX has no investment in the administered portfolio GATX manages portfolios of assets for third-party owners − re-leasing initiatives − asset sales − advisory services − back-office functions GATX is paid a management fee and typically retains a “residual interest” when an asset is sold − The higher the sale price, the greater the gain for GATX Power 50% Rail 38% Aircraft 12% Administered Portfolio $125 million NBV as of 12/31/13

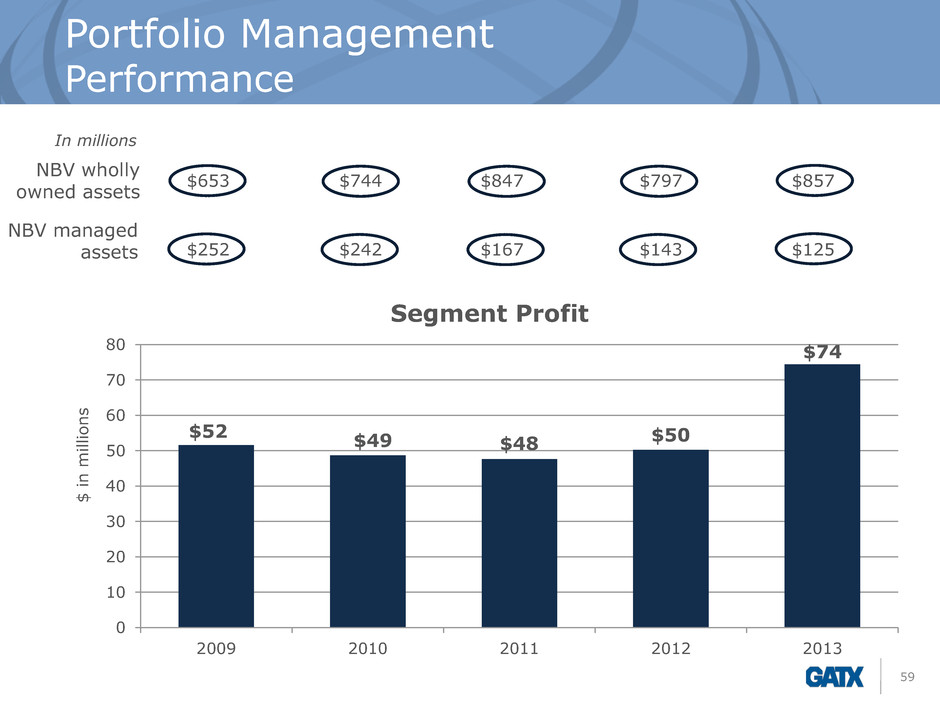

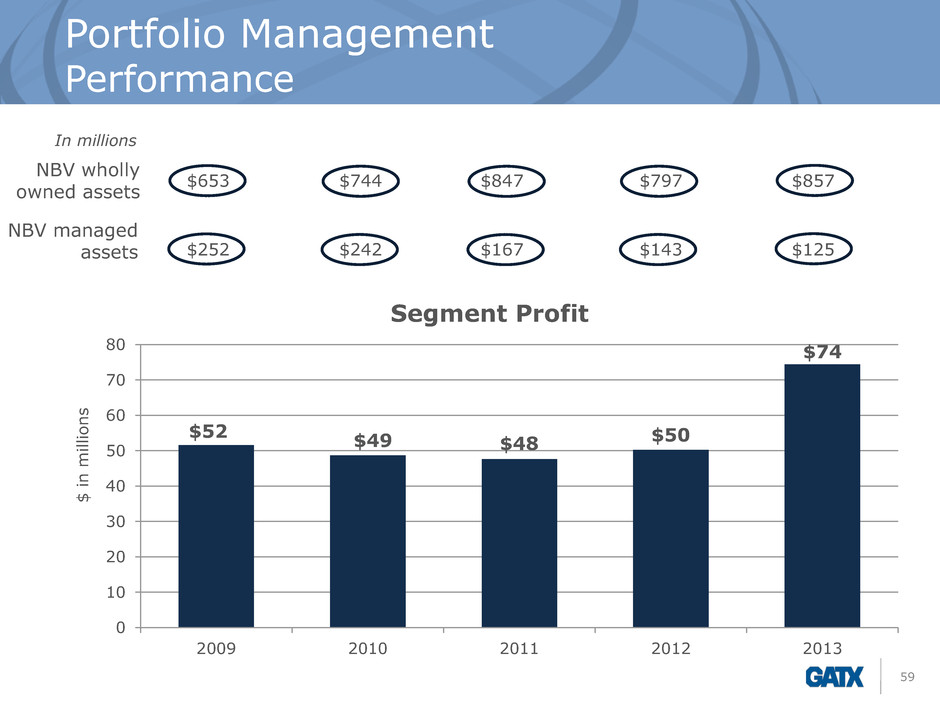

Portfolio Management Performance 59 $653 $744 $847 $797 $857 $252 $242 $167 $143 $125 $52 $49 $48 $50 $74 0 10 20 30 40 50 60 70 80 2009 2010 2011 2012 2013 $ in m il li on s Segment Profit NBV wholly owned assets NBV managed assets In millions

60 Financial Highlights

Financial Profile 61 Strong cash flow and revenue under long-term contracts Targeted and effective asset remarketing Solid and well-diversified access to capital Strategic investment philosophy Track record of returning capital to shareholders Improving EPS and ROE with a resilient asset base

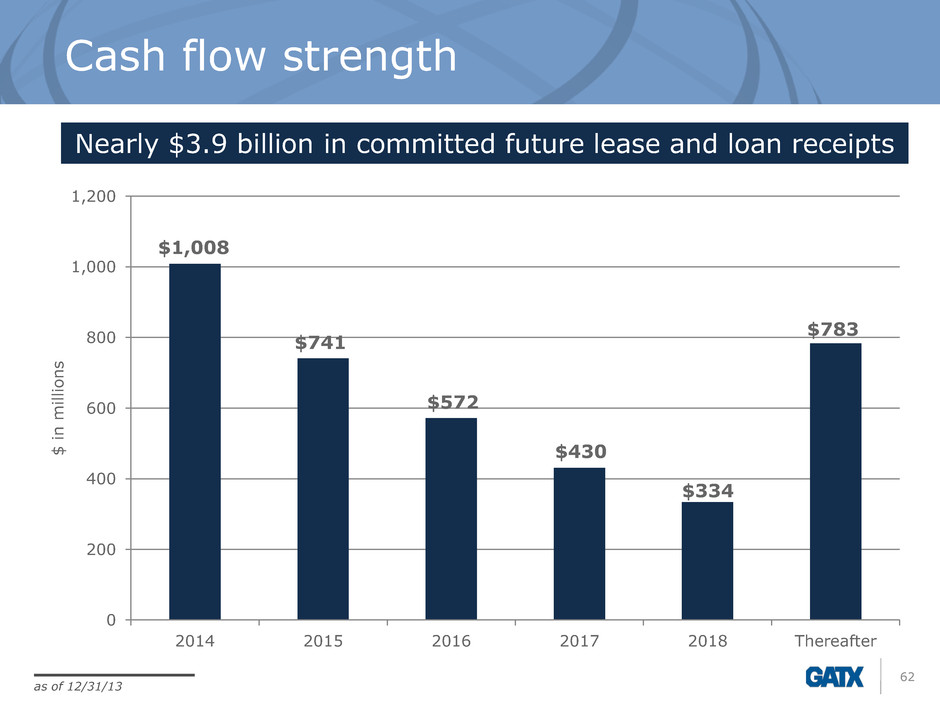

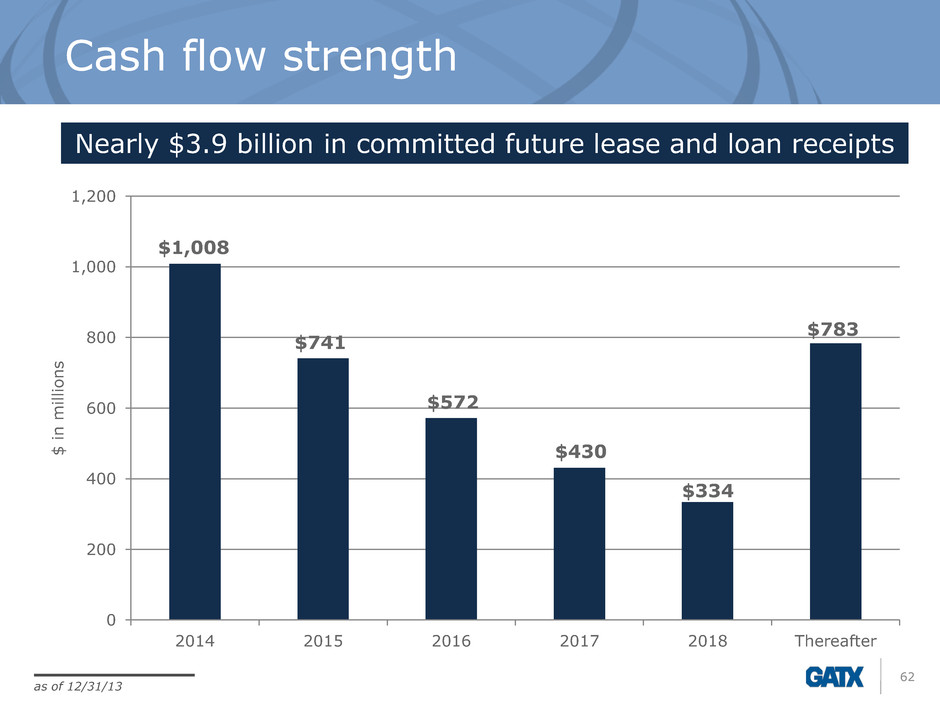

Cash flow strength 62 Nearly $3.9 billion in committed future lease and loan receipts $1,008 $741 $572 $430 $334 $783 0 200 400 600 800 1,000 1,200 2014 2015 2016 2017 2018 Thereafter $ i n m il li o n s as of 12/31/13

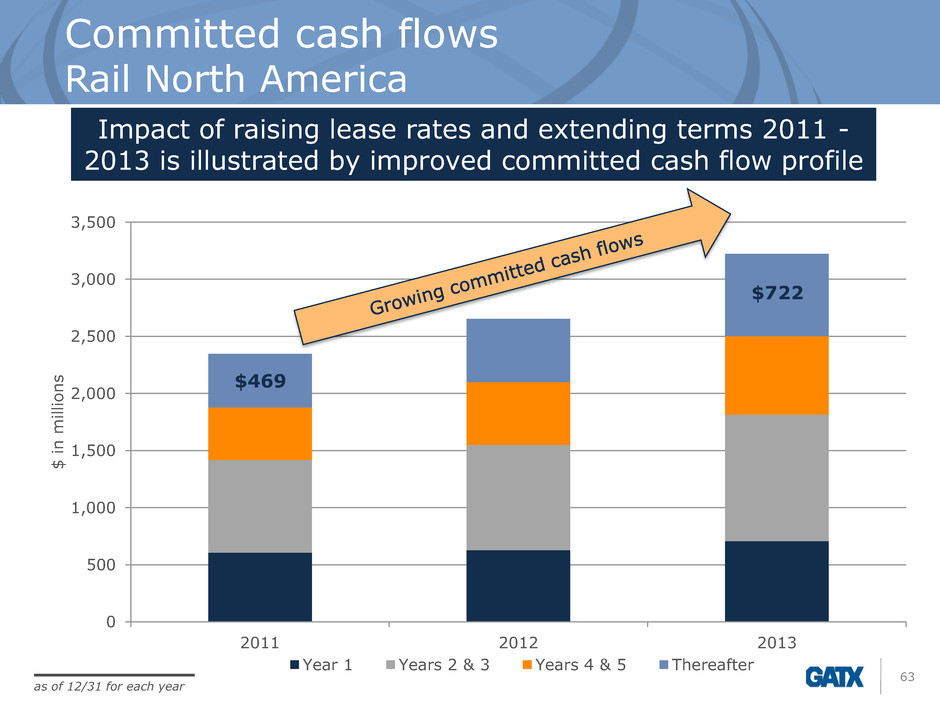

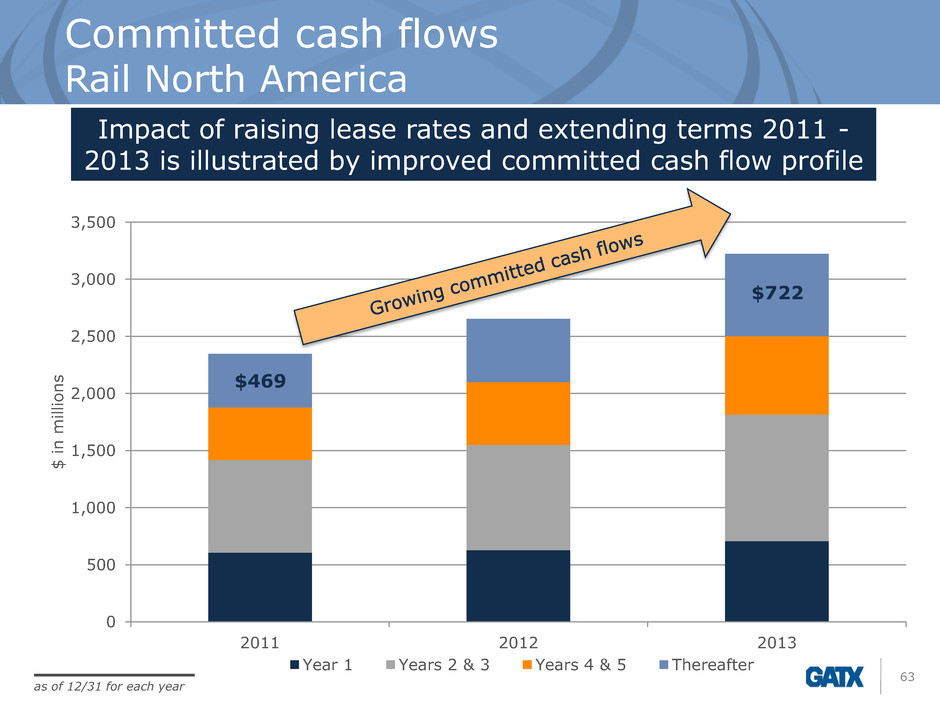

Committed cash flows Rail North America 63 0 500 1,000 1,500 2,000 2,500 3,000 3,500 2011 2012 2013 $ i n m il li o n s Year 1 Years 2 & 3 Years 4 & 5 Thereafter Impact of raising lease rates and extending terms 2011 - 2013 is illustrated by improved committed cash flow profile as of 12/31 for each year $469 $722

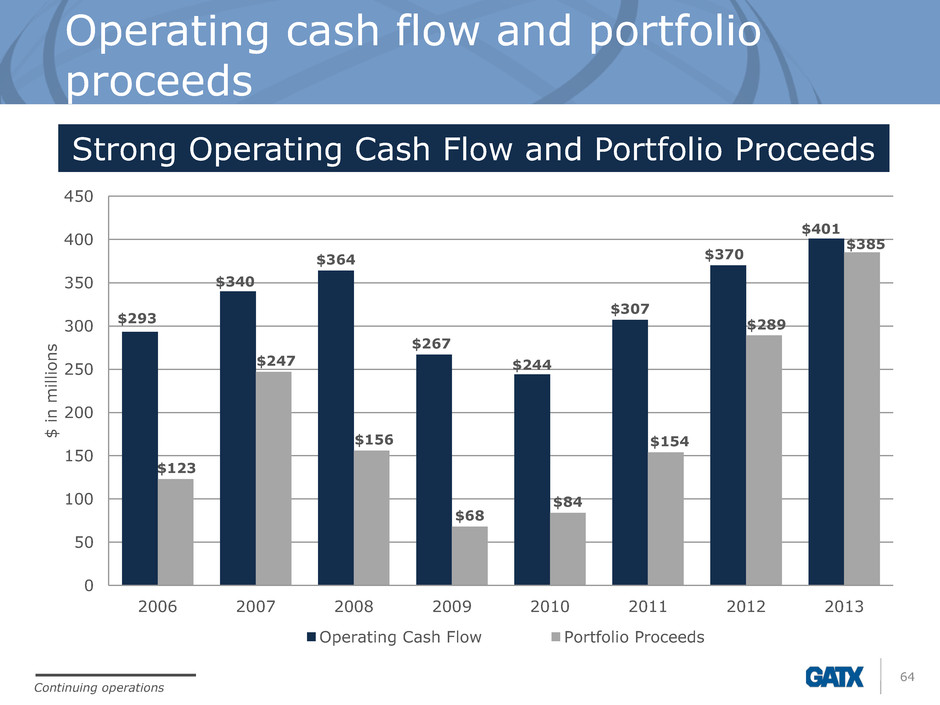

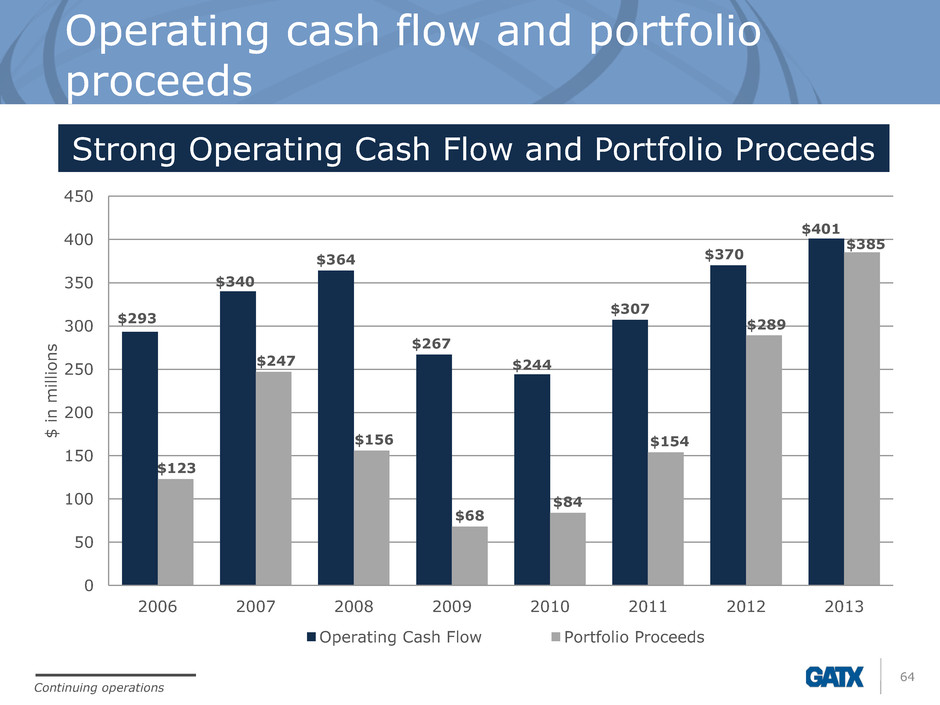

Operating cash flow and portfolio proceeds 64 Strong Operating Cash Flow and Portfolio Proceeds $293 $340 $364 $267 $244 $307 $370 $401 $123 $247 $156 $68 $84 $154 $289 $385 0 50 100 150 200 250 300 350 400 450 2006 2007 2008 2009 2010 2011 2012 2013 $ i n m il li o n s Operating Cash Flow Portfolio Proceeds Continuing operations

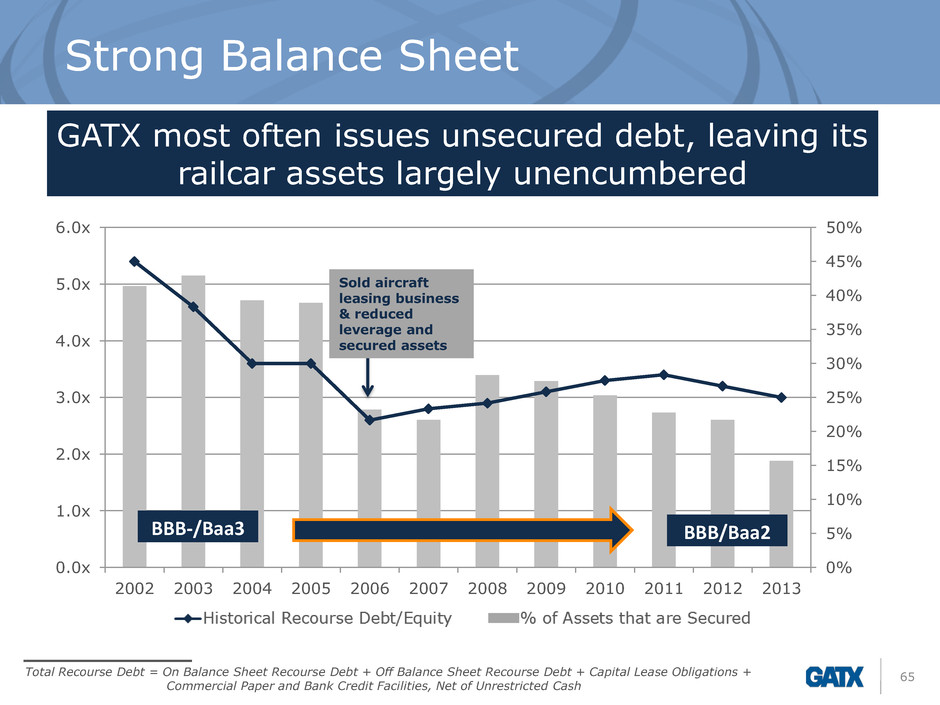

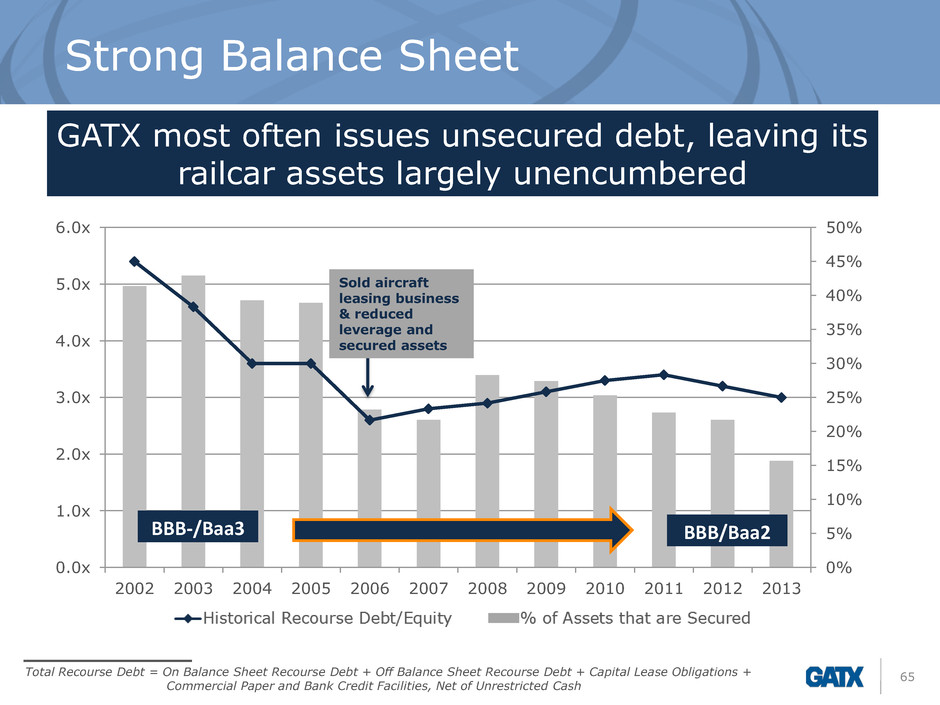

Strong Balance Sheet 65 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50% 0.0x 1.0x 2.0x 3.0x 4.0x 5.0x 6.0x 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 BBB-/Baa3 BBB/Baa2 Total Recourse Debt = On Balance Sheet Recourse Debt + Off Balance Sheet Recourse Debt + Capital Lease Obligations + Commercial Paper and Bank Credit Facilities, Net of Unrestricted Cash GATX most often issues unsecured debt, leaving its railcar assets largely unencumbered Sold aircraft leasing business & reduced leverage and secured assets

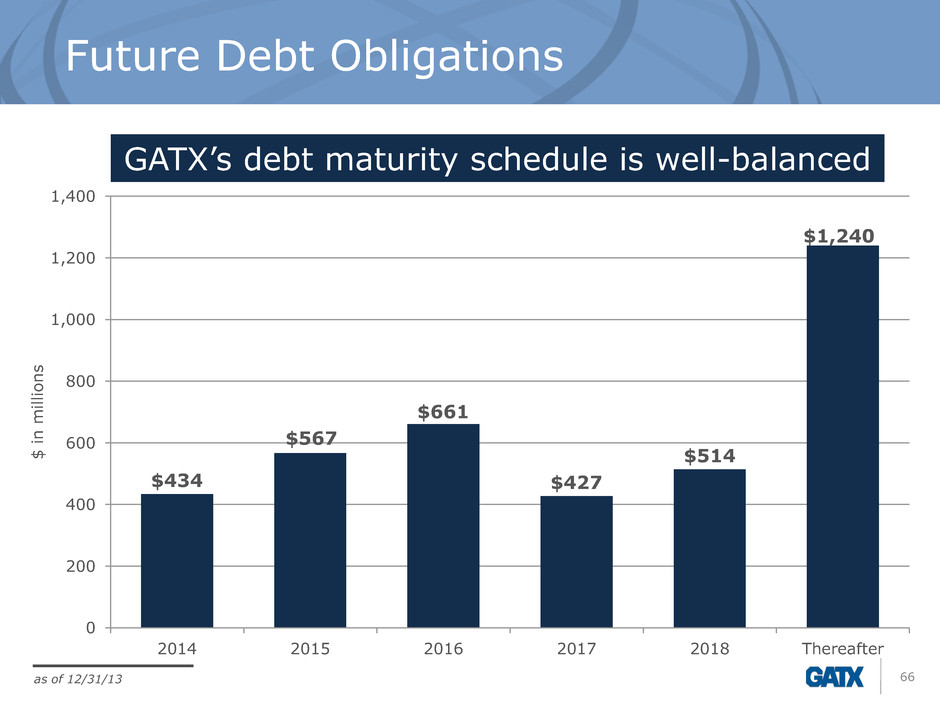

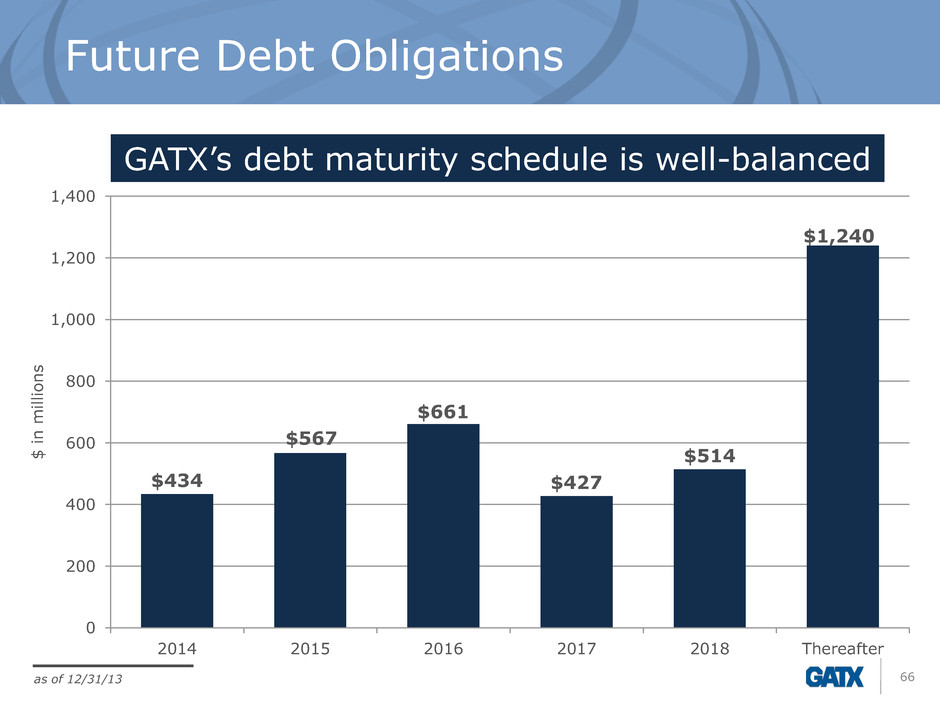

Future Debt Obligations 66 GATX’s debt maturity schedule is well-balanced $434 $567 $661 $427 $514 $1,240 0 200 400 600 800 1,000 1,200 1,400 2014 2015 2016 2017 2018 Thereafter $ i n m il li o n s as of 12/31/13

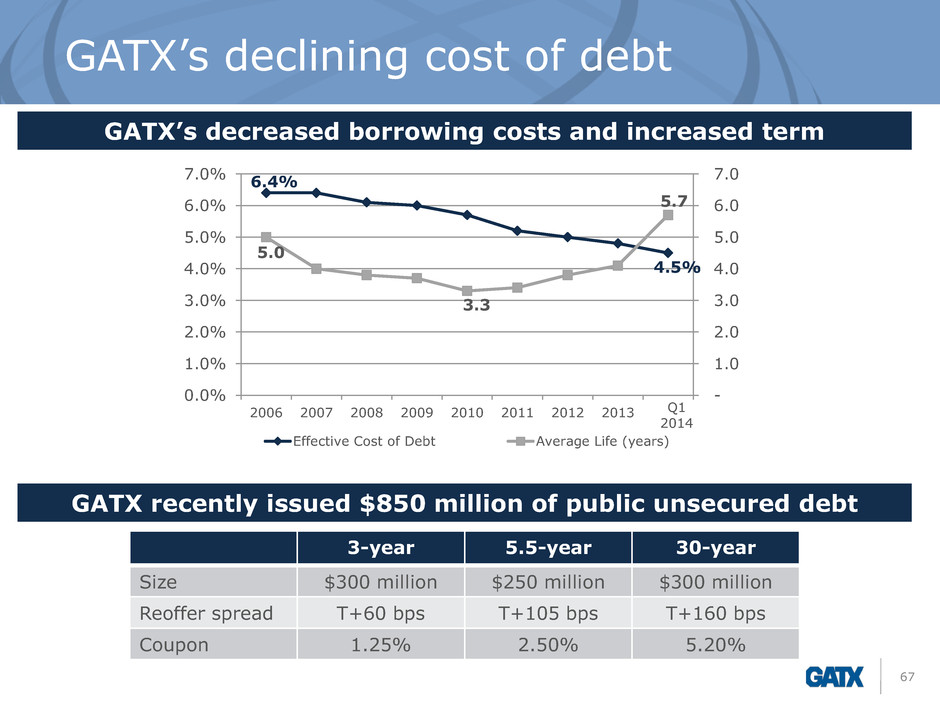

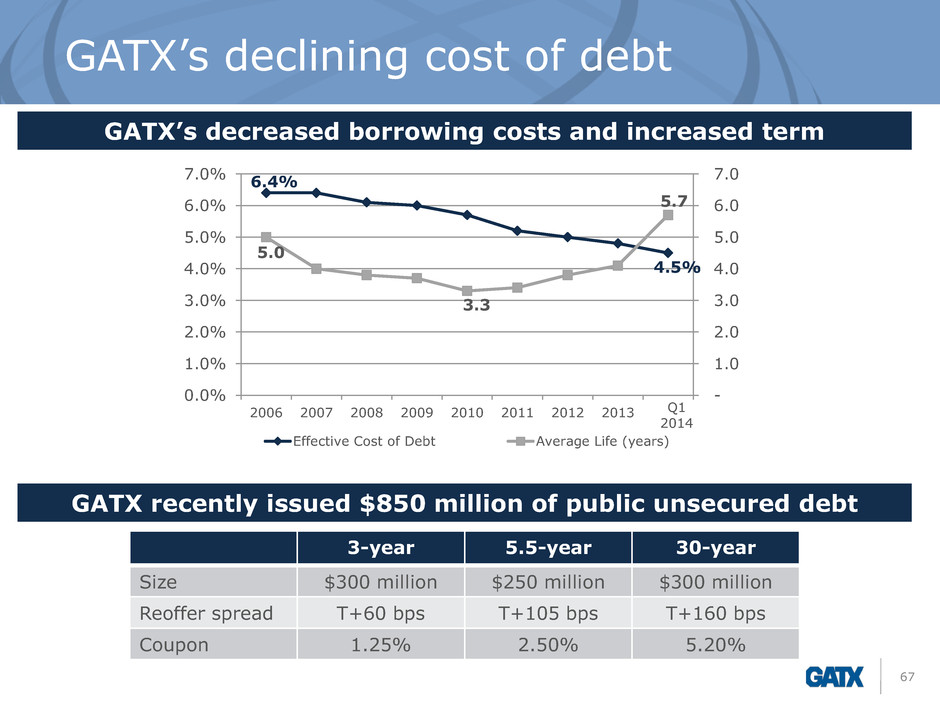

GATX’s declining cost of debt 67 GATX recently issued $850 million of public unsecured debt 3-year 5.5-year 30-year Size $300 million $250 million $300 million Reoffer spread T+60 bps T+105 bps T+160 bps Coupon 1.25% 2.50% 5.20% 6.4% 4.5% 5.0 3.3 5.7 - 1.0 2.0 3.0 4.0 5.0 6.0 7.0 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 2006 2007 2008 2009 2010 2011 2012 2013 Effective Cost of Debt Average Life (years) Q1 2014 GATX’s decreased borrowing costs and increased term

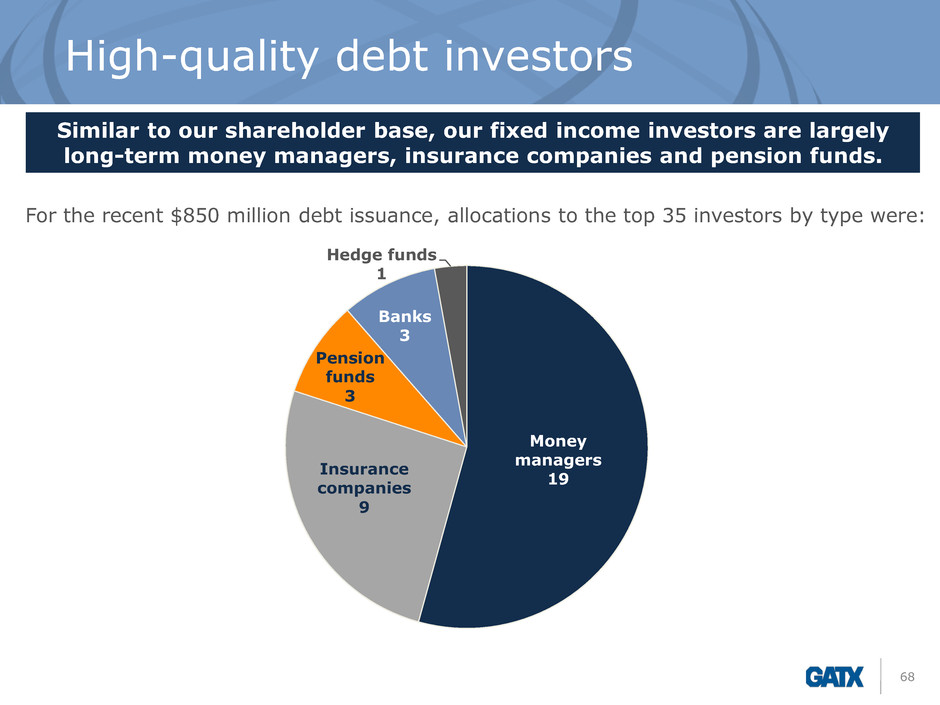

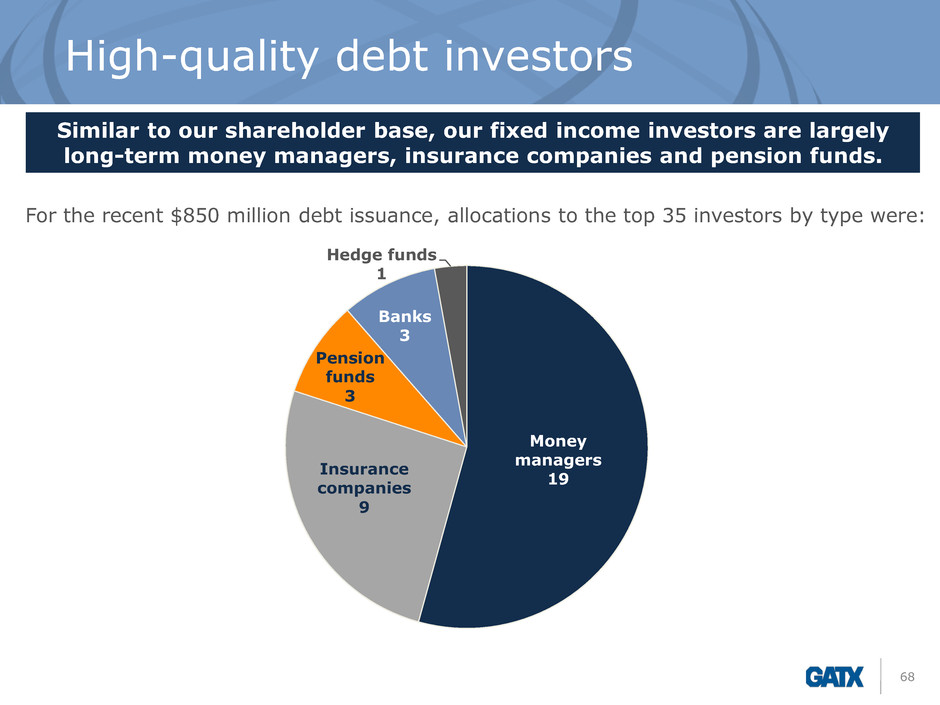

High-quality debt investors 68 Similar to our shareholder base, our fixed income investors are largely long-term money managers, insurance companies and pension funds. Money managers 19 Insurance companies 9 Pension funds 3 Banks 3 Hedge funds 1 For the recent $850 million debt issuance, allocations to the top 35 investors by type were:

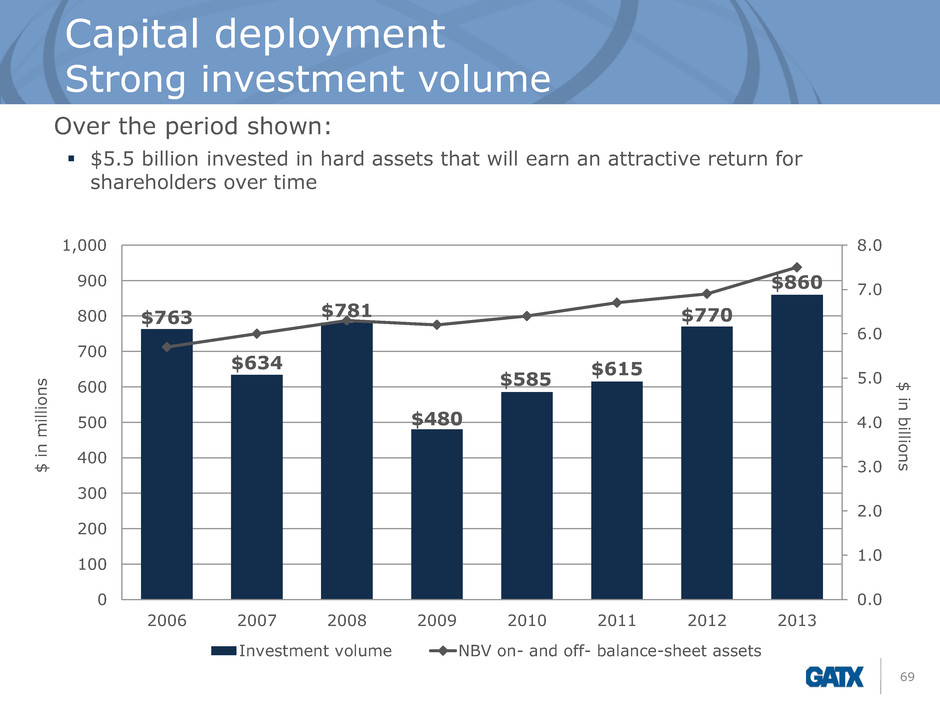

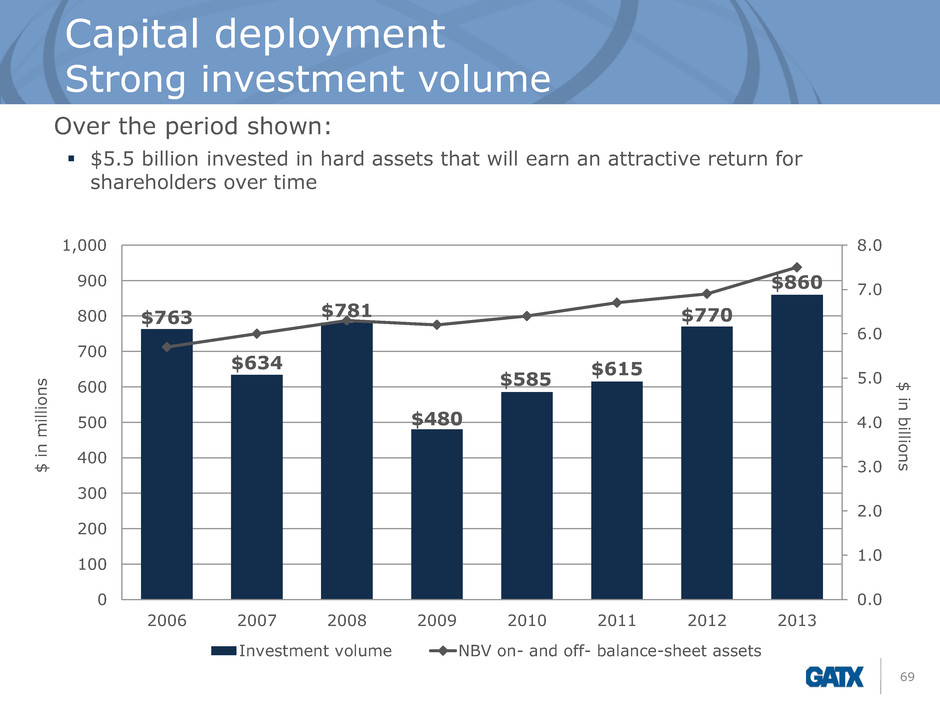

$5.5 billion invested in hard assets that will earn an attractive return for shareholders over time Capital deployment Strong investment volume 69 $763 $634 $781 $480 $585 $615 $770 $860 0.0 1.0 2.0 3.0 4.0 5.0 6.0 7.0 8.0 0 100 200 300 400 500 600 700 800 900 1,000 2006 2007 2008 2009 2010 2011 2012 2013 $ in b illio n s $ i n m il li o n s Investment volume NBV on- and off- balance-sheet assets Over the period shown:

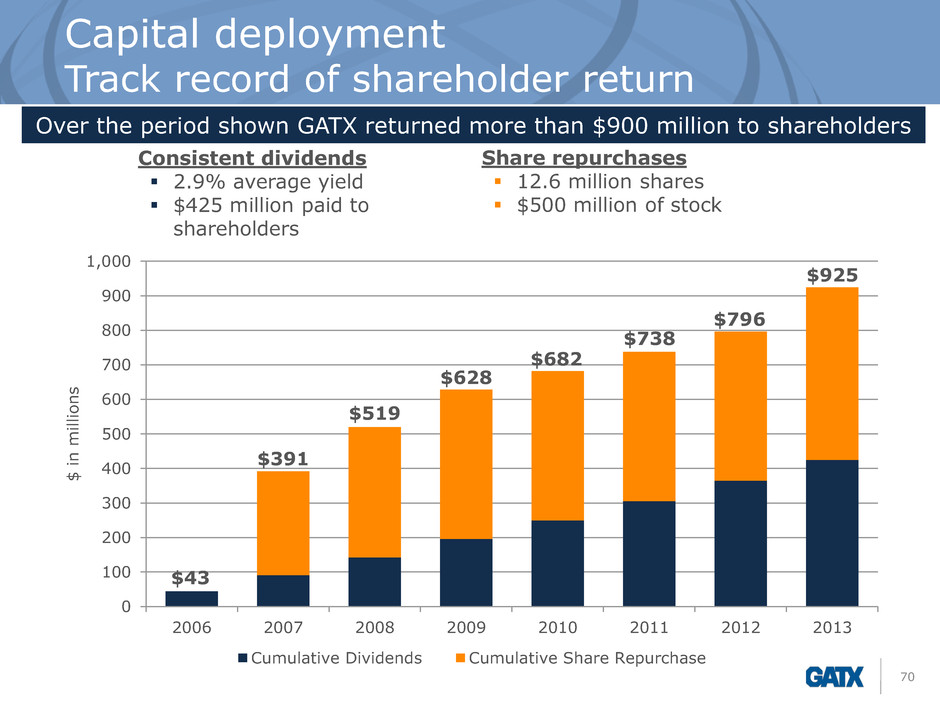

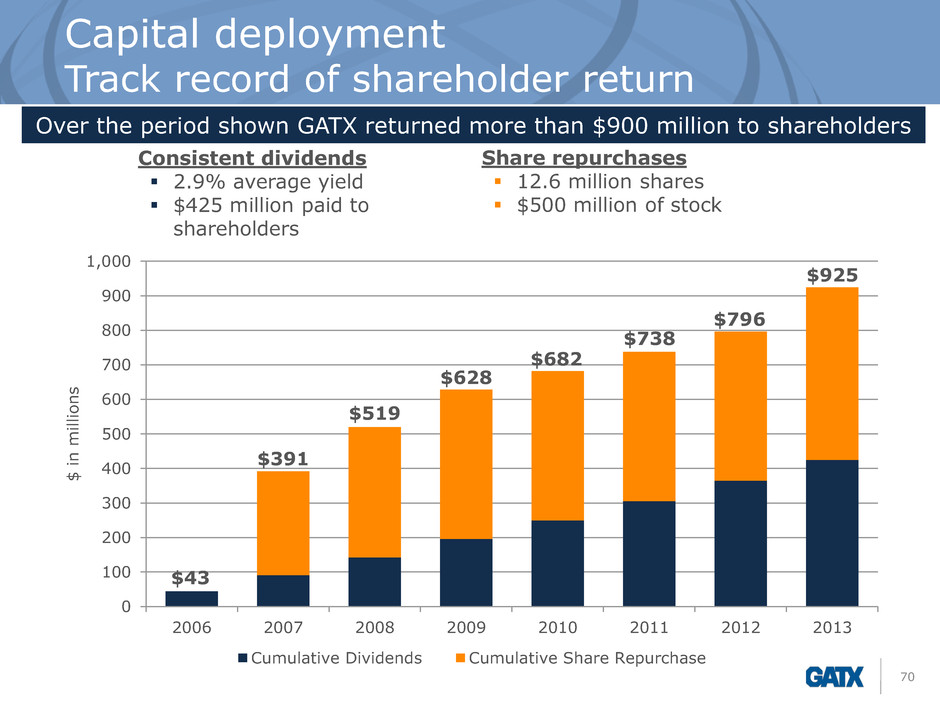

Capital deployment Track record of shareholder return $43 $391 $519 $628 $682 $738 $796 $925 0 100 200 300 400 500 600 700 800 900 1,000 2006 2007 2008 2009 2010 2011 2012 2013 $ i n m il li o n s Cumulative Dividends Cumulative Share Repurchase 70 Consistent dividends 2.9% average yield $425 million paid to shareholders Share repurchases 12.6 million shares $500 million of stock Over the period shown GATX returned more than $900 million to shareholders

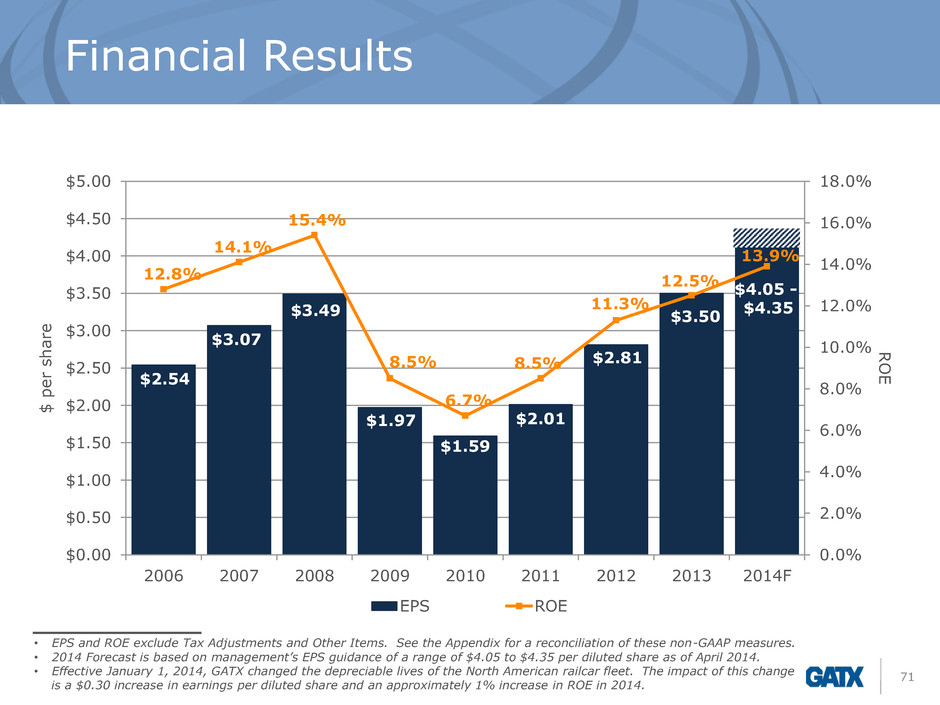

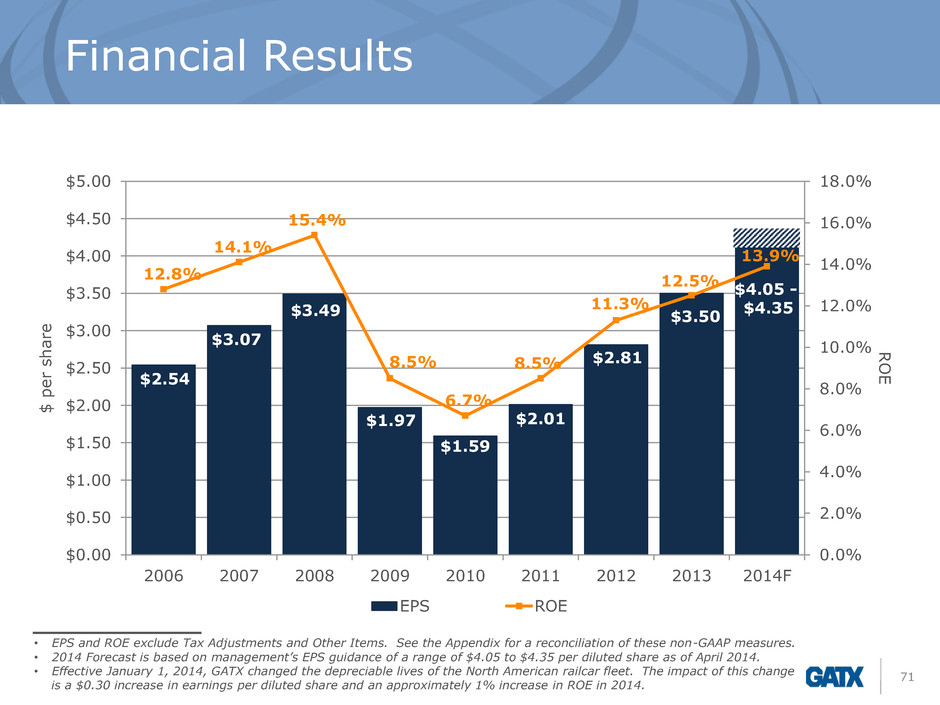

Financial Results 71 $2.54 $3.07 $3.49 $1.97 $1.59 $2.01 $2.81 $3.50 12.8% 14.1% 15.4% 8.5% 6.7% 8.5% 11.3% 12.5% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 18.0% $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 $4.00 $4.50 $5.00 2006 2007 2008 2009 2010 2011 2012 2013 2014F R O E $ p e r s h ar e EPS ROE $4.05 - $4.35 • EPS and ROE exclude Tax Adjustments and Other Items. See the Appendix for a reconciliation of these non-GAAP measures. • 2014 Forecast is based on management’s EPS guidance of a range of $4.05 to $4.35 per diluted share as of April 2014. • Effective January 1, 2014, GATX changed the depreciable lives of the North American railcar fleet. The impact of this change is a $0.30 increase in earnings per diluted share and an approximately 1% increase in ROE in 2014. 13.9%

Summary and Opportunity 72 GATX has consistently been a market force in the rail industry for more than 115 years GATX provides premium assets and services to a high- quality customer base GATX continues to benefit from strength in the tank car market GATX has the desire to make disciplined investments in North America and in International rail markets GATX is focused on generating attractive, risk-adjusted returns for our shareholders

73 Appendix

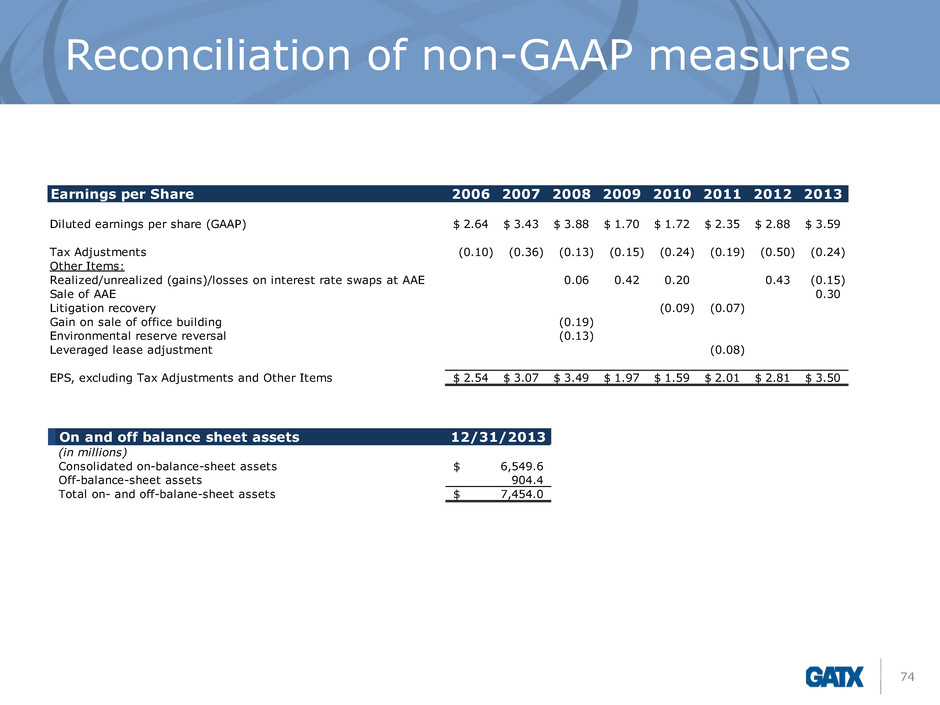

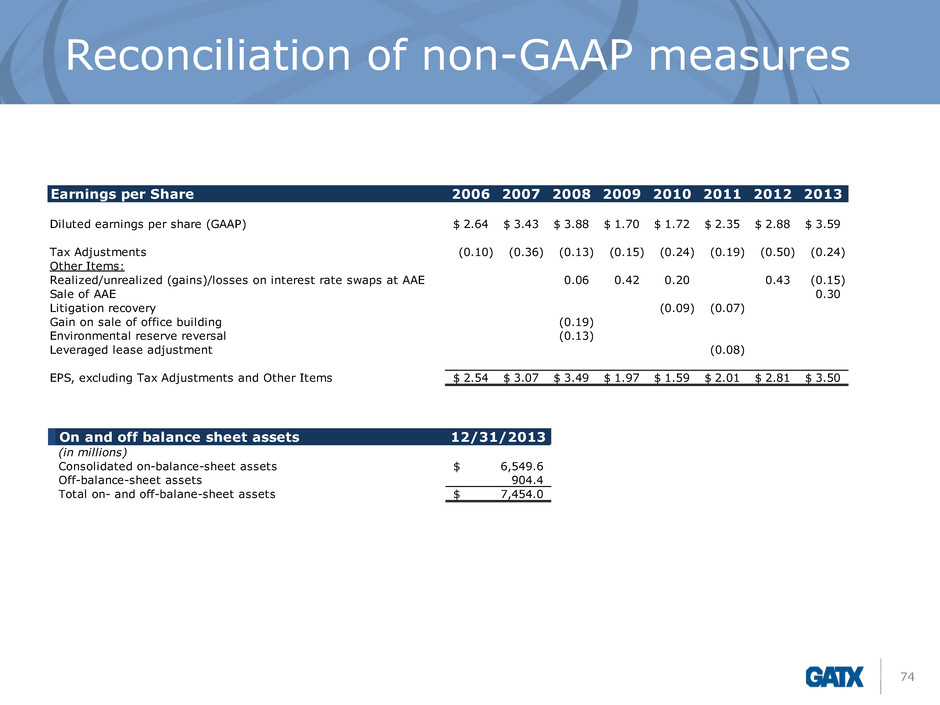

Reconciliation of non-GAAP measures 74 Earnings per Share 2006 2007 2008 2009 2010 2011 2012 2013 Diluted earnings per share (GAAP) 2.64$ 3.43$ 3.88$ 1.70$ 1.72$ 2.35$ 2.88$ 3.59$ Tax Adjustments (0.10) (0.36) (0.13) (0.15) (0.24) (0.19) (0.50) (0.24) Other Items: Realized/unrealized (gains)/losses on interest rate swaps at AAE 0.06 0.42 0.20 0.43 (0.15) Sale of AAE 0.30 Litigation recovery (0.09) (0.07) Gain on sale of office building (0.19) Environmental reserve reversal (0.13) Leveraged lease adjustment (0.08) EPS, excluding Tax Adjustments and Other Items 2.54$ 3.07$ 3.49$ 1.97$ 1.59$ 2.01$ 2.81$ 3.50$ On and off balance sheet assets 12/31/2013 (in millions) Consolidated on-balance-sheet assets 6,549.6$ Off-balance-sheet assets 904.4 Total on- and off-balane-sheet assets 7,454.0$

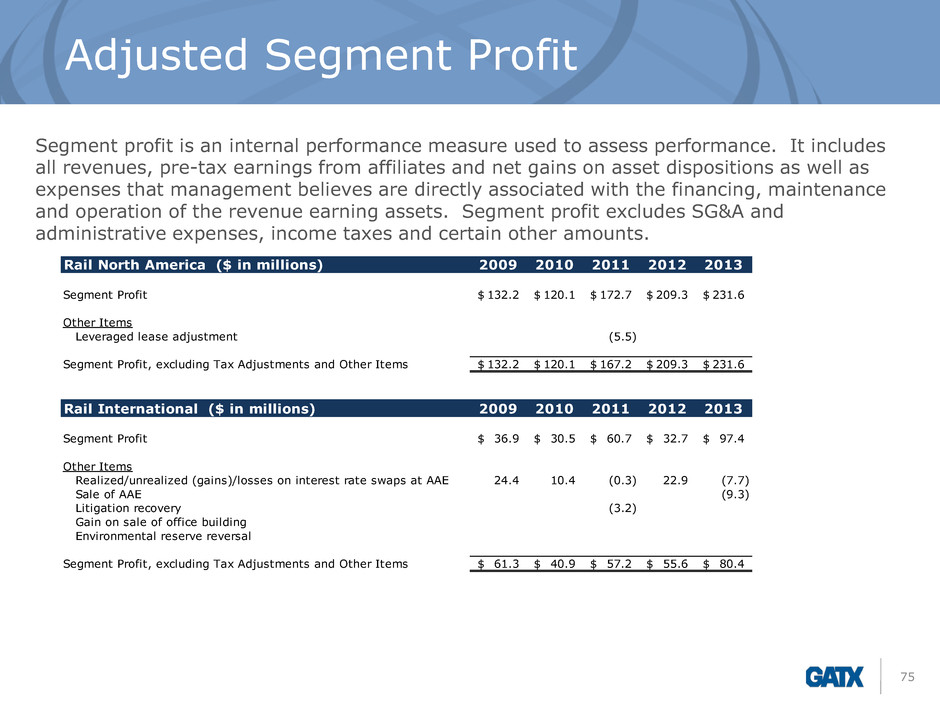

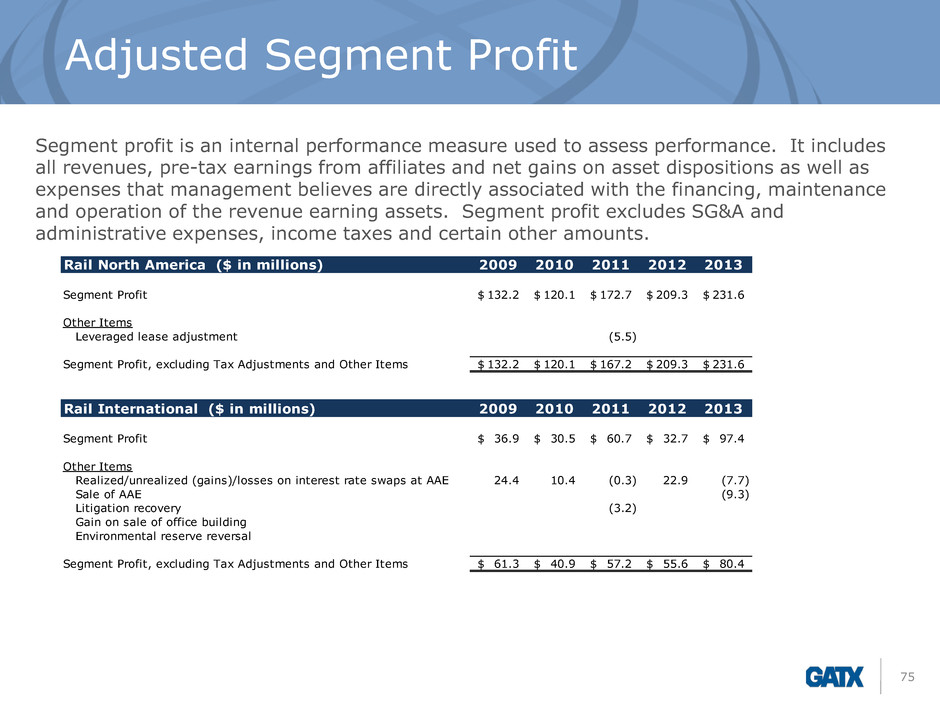

Adjusted Segment Profit 75 Rail North America ($ in millions) 2009 2010 2011 2012 2013 Segment Profit 132.2$ 120.1$ 172.7$ 209.3$ 231.6$ Other Items Leveraged lease adjustment (5.5) Segment Profit, excluding Tax Adjustments and Other Items 132.2$ 120.1$ 167.2$ 209.3$ 231.6$ Rail International ($ in millions) 2009 2010 2011 2012 2013 Segment Profit 36.9$ 30.5$ 60.7$ 32.7$ 97.4$ Other Items Realized/unrealized (gains)/losses on interest rate swaps at AAE 24.4 10.4 (0.3) 22.9 (7.7) Sale of AAE (9.3) Litigation recovery (3.2) Gain on sale of office building Environmental reserve reversal Segment Profit, excluding Tax Adjustments and Other Items 61.3$ 40.9$ 57.2$ 55.6$ 80.4$ Segment profit is an internal performance measure used to assess performance. It includes all revenues, pre-tax earnings from affiliates and net gains on asset dispositions as well as expenses that management believes are directly associated with the financing, maintenance and operation of the revenue earning assets. Segment profit excludes SG&A and administrative expenses, income taxes and certain other amounts.

For detailed financial information, please see the SUPPLEMENTAL FINANCIAL DATA contained in the Investor Relations section of www.gatx.com. GATX CORPORATION Unless otherwise noted, GATX is the source for data provided.