| | | | | | | | |

| GATX Corporation 233 S. Wacker Drive Chicago, IL 60606-7147

|

Thomas A. Ellman Executive Vice President and Chief Financial Officer

Tel: 312.621.4560 Fax: 312.499.7332 thomas.ellman@gatx.com

|

August 14, 2023

Division of Corporation Finance

Office of Energy & Transportation

100 F Street, N.E.

Washington, D.C. 20549

| | | | | |

| Attention: | Ms. Yolanda Guobadia |

| Mr. Robert Babula |

| |

| Re: | GATX Corporation |

| Form 10-K for the Fiscal Year Ended December 31, 2022 |

| Filed February 16, 2023 |

| File No. 001-02328 |

Dear Sir or Madam:

On behalf of GATX Corporation (“GATX” or the “Company”), I am submitting the Company’s response to the comment from the staff of the Division of Corporation Finance (the “Staff”) of the U.S. Securities and Exchange Commission raised in your letter dated July 7, 2023. The Staff’s comment was provided with respect to the Company’s letter dated June 26, 2023 (the “Prior Response”), which was provided in response to the Staff’s comment letter dated June 9, 2023. For ease of reference, the Staff’s comment is duplicated below in bold type and is followed immediately by the Company’s response.

Form 10-K for the Fiscal Year Ended December 31, 2022

Financial Statements

Note 12 – Share-Based Compensation, page 87

We understand from your response to prior comment one that although the errors concerning participating securities resulted in higher earnings per share during each quarter over the last three fiscal years than should have been reported, you do not consider the errors to be material and would prefer to limit compliance with the requirements in FASB ASC 260, concerning use of the two-class method of calculating basic and diluted earnings per share, to future filings beginning with your next quarterly report.

Please clarify how you will address the errors in the comparable periods when filing future periodic reports and the manner by which you will advise investors in a timely fashion of the correct earnings per share figures that pertain to the last three fiscal years.

August 14, 2023

Securities and Exchange Commission

Page 2

As detailed in the Company’s Prior Response, considering quantitative and qualitative factors, we concluded that the impacts of this error to basic and diluted earnings per share (“EPS”) for the first quarter of 2023 and annual and interim periods of 2022, 2021 and 2020 are immaterial. As a result, when filing future periodic reports (and consistent with our Quarterly Report on Form 10-Q for the quarter ended June 30, 2023, which was filed on July 27, 2023), the Company does not intend to address the effect of this immaterial error in the comparable periods or disclose the corrected EPS figures that pertain to the last three fiscal years, which is in accordance with ASC 105-10-05-6 (“The provisions of the [Financial Accounting Standards Board Accounting Standards] Codification need not be applied to immaterial items.”)

We believe our approach is appropriate given the immaterial nature of the error and the fact that a reasonable investor, considering the mix of information available, would not be impacted by the correction of this immaterial error in prior periods. In addition to the SAB 99 analysis provided in our Prior Response, we believe the below quantitative and qualitative factors further support our conclusion that correcting this immaterial error in prior periods is not necessary or meaningful to investors:

•The impact of the error correction would result in a change to basic and diluted EPS from continuing operations of between 0.9% and 3.9% for all reporting periods, except for two quarters (the second quarters of 2022 and 2021).

◦Net income in the second quarter of 2022 was unusually low due to the negative impact of a $31.5 million impairment of assets designated as held for sale, and net income from the second quarter of 2021 was unusually low due to the negative impact of $39.7 million related to an enacted tax rate change in the United Kingdom. The impact of each of these two unusual events is explained in the Quarterly Report on Form 10-Q filed for each of those quarters.

◦Although the percentage impact of the error correction for these two quarters would be higher than all other reported periods presented (all of which are 3.9% or less), the dollar impact of the change to basic and diluted EPS was only $0.01 and $0.01, respectively, for the second quarter of 2022 and only $0.02 and $0.01, respectively, for the second quarter of 2021.

◦The percentage impact was higher in these quarters because reported GAAP net income from continuing operations was only $2.6 million and $5.5 million, respectively, in these quarters, due to the unusual events mentioned above. However, GAAP net income from continuing operations was not lower than $17.8 million in any other quarter presented, with an average of $40.5 million over the 13 periods discussed and presented in our Prior Response. Our reported annual GAAP net income was $155.9 million and $143.1 million for 2022 and 2021, respectively, which further illustrates that the events in these quarters were unique and not representative of, or impactful to, the trend of earnings.

◦ASC 250-10-45-27, which addresses materiality in the context of interim financial reporting, provides “In considering materiality for the purpose of reporting the correction of an error, amounts shall be related to the estimated income for the full fiscal year and also to the effect on the trend of earnings.” In consideration of this guidance, the impact of this error to annual basic EPS from continuing operations was 2.7% in both 2022 and 2021 and 1.4% and 1.5% to diluted EPS from continuing operations in 2022 and 2021, respectively, which is quantitatively and qualitatively immaterial as discussed in our Prior Response. These two quarters, in

August 14, 2023

Securities and Exchange Commission

Page 3

particular, are not representative of historical or expected financial trends of the Company and result from the unique and unusual circumstances described above. Further, the Company does not provide quarterly guidance, a fact that is well known among the Company’s investors. For this reason, the error does not represent information that a reasonable investor would consider to alter the total mix of information available.

•The error does not mask a change in earnings or other trends and does not change a loss into income or vice versa. The error does not impact any revenues, expenses, segment profit, earnings or other financial statement trends.

•The use of the two-class method versus the treasury stock method does not result in any change or modification to the Consolidated Balance Sheet, non-EPS related Consolidated Income Statement information, Consolidated Statement of Shareholders’ Equity, Consolidated Statement of Cash Flows, net income, excluding tax adjustments and other items (non-GAAP), or return on equity, excluding tax adjustments and other items (non-GAAP), for any reporting period.

•The error did not affect management’s compensation, as management is not compensated on EPS. As described in the Compensation Discussion and Analysis section of the proxy statement for the applicable years, management’s annual performance compensation was and is based on consolidated net income, and management’s long-term incentive plan was and is based on a combination of investment volume and return on equity.

•The error does not hide a failure to meet analysts’ expectations.

◦Management does not provide quarterly earnings guidance or discuss quarterly results in the context of analysts’ estimates. Management regularly states that quarterly EPS can vary dramatically and therefore investors and analysts focus on full-year results.

August 14, 2023

Securities and Exchange Commission

Page 4

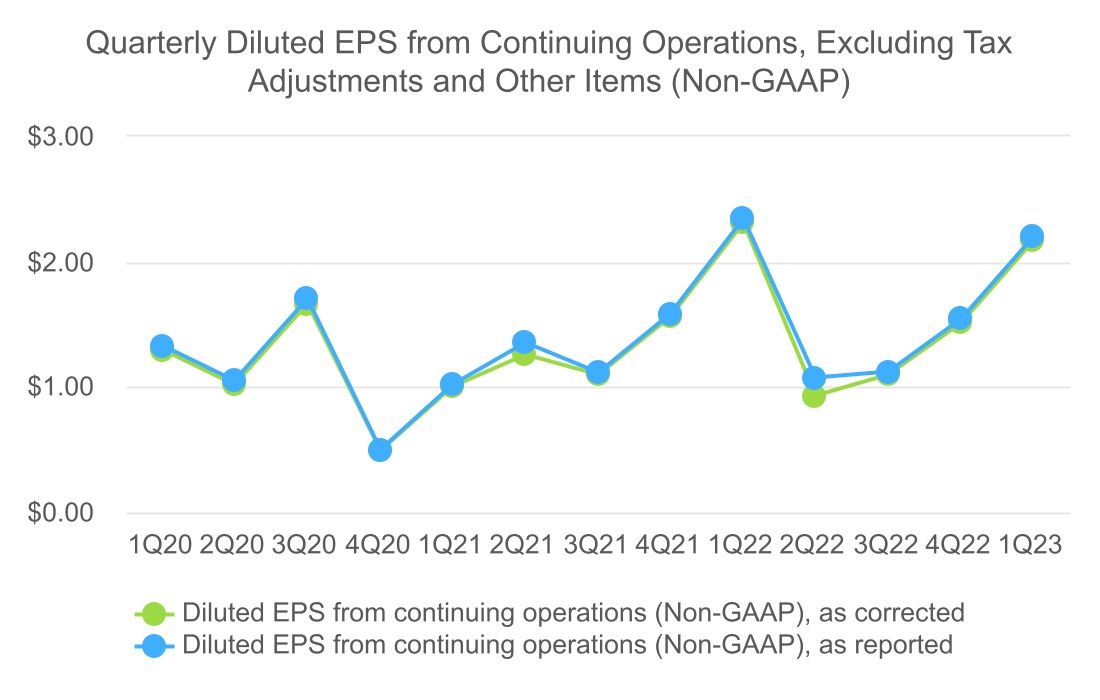

◦Management provides annual earnings guidance only, by giving a range of anticipated diluted EPS, excluding tax adjustments and other items (non-GAAP), for the year. The use of the two-class method versus the treasury stock method would not have caused our reported diluted EPS from continuing operations, excluding tax adjustments and other items (non-GAAP), to fall below the range given, nor would it have impacted whether we exceeded or missed analysts’ consensus estimate for the years shown below:

(Please note that in 2020 the Company suspended guidance as a result of the COVID-19 pandemic.)

| | | | | | | | | | | | | | | | | | | | | | | |

| Guidance range1 | | Non-GAAP diluted EPS from continuing operations, as reported | | Non-GAAP diluted EPS from continuing operations, as corrected | | Analysts’ consensus range2 |

| 2021 | $4.00 - $4.50 | | $ | 5.06 | | | $ | 4.99 | | | $4.12 - $4.51 |

| 2022 | $5.50 - $6.00 | | $ | 6.07 | | | $ | 5.99 | | | $5.19 - $5.96 |

______________________________

1 Management increased guidance in the second quarter of 2021 and 2022. In the second quarter of 2021, guidance was increased from $4.00 - $4.30 to $4.30 - $4.50. In the second quarter of 2022, guidance was increased from $5.50 - $5.80 to $5.60 - $6.00.

2 Analysts update annual estimates throughout the year. The final consensus was $4.51 and $5.96 in 2021 and 2022, respectively.

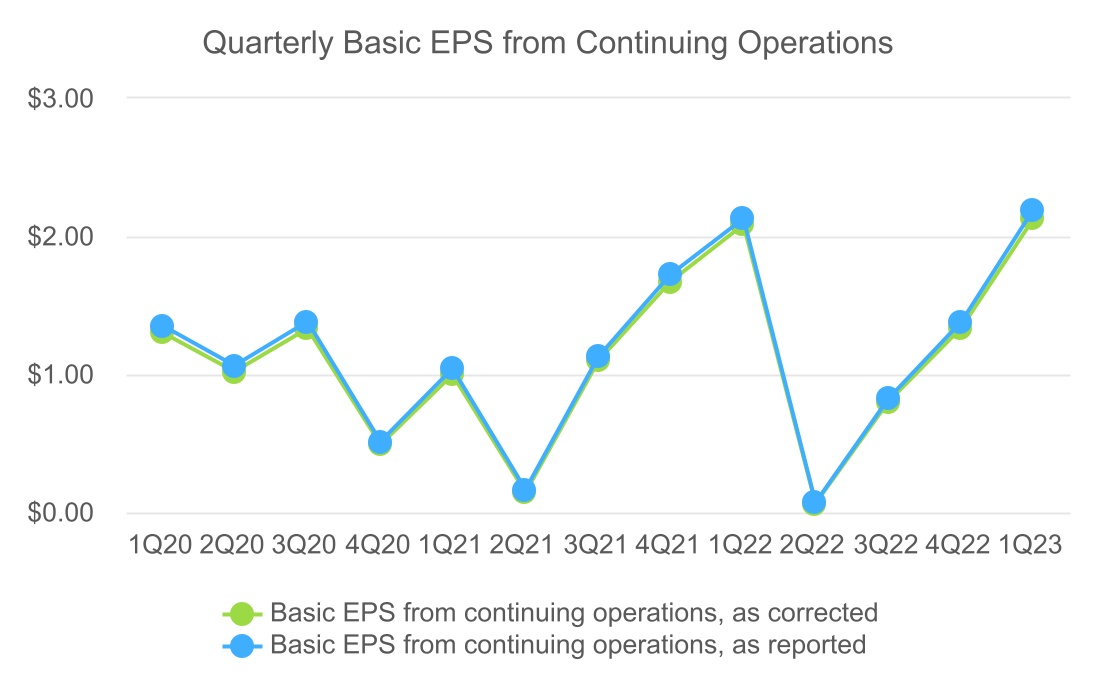

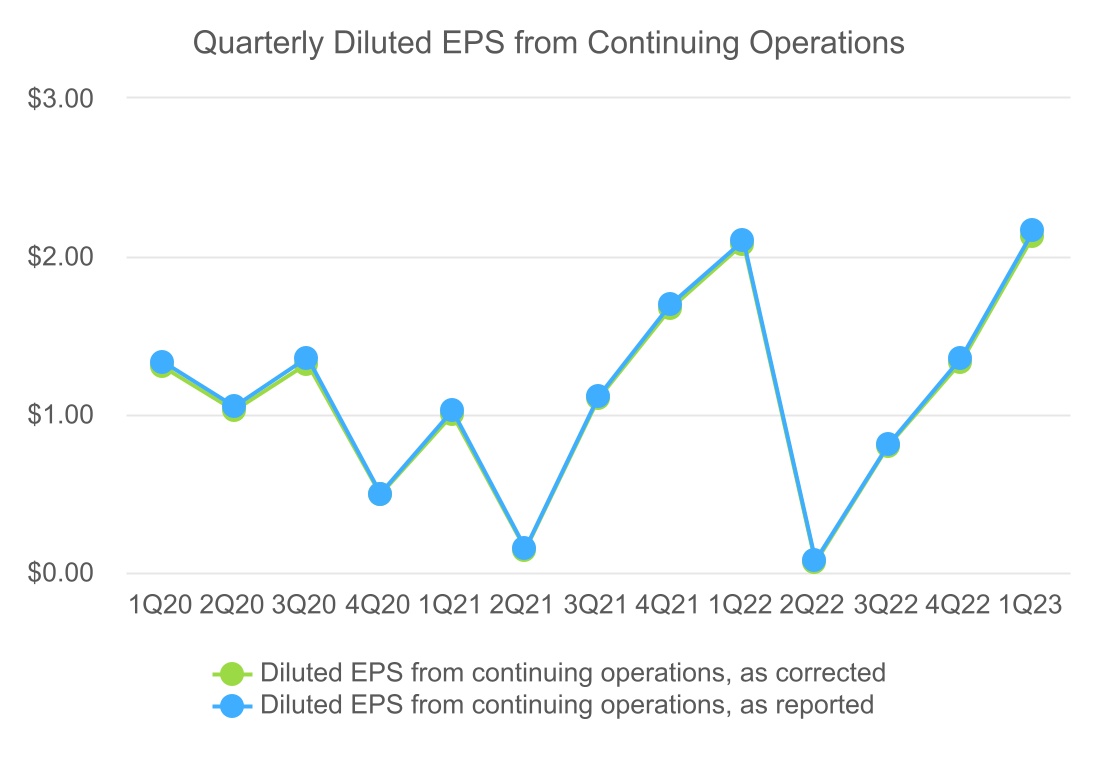

•EPS trend analysis and an examination of Company guidance provides additional evidence that it is unnecessary to correct EPS for prior periods. (Refer to Exhibit A for quarterly trends of basic EPS from continuing operations, diluted EPS from continuing operations and diluted EPS from continuing operations, excluding tax adjustments and other items (non-GAAP), as reported and as corrected.) The following table shows the trend of annual diluted EPS from continuing operations, excluding tax adjustments and other items (non-GAAP). A reasonable investor would likely consider this trend analysis unchanged if the 2020-2022 numbers were corrected for adoption of the two-class method:

| | | | | | | | | | | | | | | | | |

| 2020 | | 2021 | | 2022 |

| Diluted EPS from continuing operations (Non-GAAP), as reported | $ | 4.59 | | | $ | 5.06 | | | $ | 6.07 | |

| Diluted EPS from continuing operations (Non-GAAP), as corrected | $ | 4.48 | | | $ | 4.99 | | | $ | 5.99 | |

| Trend in Earnings y/y: % Change, as reported | n/a | | 10.2 | % | | 20.0 | % |

| Trend in Earnings y/y: % Change, as corrected | n/a | | 11.4 | % | | 20.0 | % |

Further, the Company’s guidance for full-year 2023 EPS provided at the beginning of the year was $6.50 - $6.90 per share (diluted EPS, excluding tax adjustments and other items, non-GAAP). The Company updated this guidance in our second quarter earnings release and earnings conference call “to be at the upper end of or modestly exceed our previously announced guidance range of $6.50 - $6.90 per diluted share.” When we updated guidance, we considered the impact under both the two-class method and the treasury stock method and our updated guidance is the same under either method. This also represents a positive trend from the reported diluted EPS from continuing operations, excluding tax adjustments and other items (non-GAAP), of $6.07 in 2022, $5.06 in 2021, and $4.59 in 2020.

August 14, 2023

Securities and Exchange Commission

Page 5

Additionally, investor and analyst behavior consistently highlights that they would consider the error to be immaterial and insignificant. Investors and analysts focus on specific metrics and topics during investor conferences and other communications, and the Company’s coverage analysts focus on these same items in their analyst reports to understand what effect, if any, operating and industry metrics could have on the Company’s full-year guidance. These items include:

•Segment profit – our internal performance measure to assess the profitability of each segment;

•Investment volume – our internal performance measure, which is predominately composed of acquired railcars and also includes capitalized repairs and improvements to owned railcars and our maintenance facilities;

•Company fleet utilization – the number of railcars on lease to customers divided by the total fleet size;

•Company renewal success rate – the percentage of railcars on expiring leases that are renewed with the existing lessee (the renewal success rate is an important metric because railcars returned by our customers may remain idle or incur additional maintenance and freight costs prior to being leased to new customers);

•Company lease price index – a comparison of the new lease rates to the expiring lease rates for cars renewed;

•Industry trends in market lease rates – an estimate of how current market lease rates compare to the prior quarter, the prior year, and long-term averages;

•Company asset remarketing gains – the gain on sales of existing assets (typically with leases attached);

•Industry strength of the secondary market – an estimate of the overall level of interest from railcar investors in purchasing railcars in the secondary market;

•Class 1 railroad performance – average Class 1 railroad velocity, dwell time, and shipper perception of on-time performance;

•New railcar builder backlog – the number of railcars ordered, but not yet produced, and the amount of time between order and delivery; and

•Industry railcars in storage – the number of industry railcars that have not had a loaded move in the last 60 days.

As further evidence of investor and analyst focal points, we reviewed earnings call transcripts for the 13 quarters presented and there were no questions regarding quarterly EPS comparisons, either versus prior year quarter or sequentially. There were also no questions regarding quarterly EPS results versus consensus estimates.

August 14, 2023

Securities and Exchange Commission

Page 6

Based on the above analysis, the Company has concluded that a correction of the error would not be viewed by a reasonable investor as having significantly changed the total mix of information available for the periods presented. Therefore, the Company respectfully submits that it is appropriate and fully consistent with U.S. GAAP and the Staff’s guidance on materiality not to correct this immaterial error in prior periods and to present EPS using the two-class method in all future filings, which the Company began doing in its Quarterly Report on Form 10-Q for the quarter ended June 30, 2023.

With regard to your assessment of internal control over financial reporting, explain to us the specific nature and design of the control or controls that you believe had failed regarding this error, and describe in further detail your evaluation of the severity of the control deficiencies and how you considered whether it was reasonably possible that such control deficiencies would fail to prevent or detect a material misstatement.

In this regard, it is unclear how you would be able to support a conclusion that it was not reasonable possible that the control deficiencies that led to the errors could not have resulted in a material misstatement in some future period, considering the scenarios where earnings were unusually low, and the error percentages were significantly higher, as you have shown for the second quarters of 2022 and 2021.

Please note that a material weakness is defined as a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of annual or interim financial statements will not be prevented or detected on a timely basis.

Refer to paragraph A7 of Appendix A to PCAOB Auditing Standards (AS) No. 5.

Description of Control and Control Deficiency

The EPS calculation for each reporting period is prepared and reviewed by the Company’s Financial Reporting team, with appropriate supporting documentation for all numbers included in the EPS calculation, including net income, number of common shares outstanding, and share-based compensation data. Any changes to the share-based compensation structure or any significant changes to the number of shares are presented to management and evaluated in order to determine any potential impacts to the EPS calculation. Annually, a detailed EPS review checklist is completed and reviewed to ensure that EPS is calculated and disclosed in accordance with U.S. GAAP. If any significant changes to the share-based compensation structure are identified during an interim period, this checklist is completed and reviewed in that interim period to ensure continued compliance with U.S. GAAP.

August 14, 2023

Securities and Exchange Commission

Page 7

During the periods identified, management incorrectly applied the requirements of FASB ASC 260-10-45-60B, specifically as it related to identifying our outstanding vested and exercisable stock options and stock appreciation rights (“SARs”) as participating securities, which resulted in basic and diluted EPS being calculated utilizing the treasury stock method. Management has determined that there was a deficiency in the operating effectiveness of the EPS calculation control solely as it relates to the proper identification of vested and exercisable stock options and SARs as participating securities in the calculation. This form of share-based compensation is the only GATX instrument that allows participants the nonforfeitable right to dividends and no new instruments or changes in plan design were made or are contemplated. Vested and exercisable stock options and SARs represented between 1.9% - 3.0% of the Company’s total shares outstanding for the fiscal years 2020-2022. Accordingly, the structure of our compensation program significantly reduces any theoretical maximum exposure from this control deficiency.

Evaluation of Severity and Possibility of Material Misstatement

In assessing the control deficiency, management considered whether the operating deficiency was limited to the application of U.S. GAAP guidance to our vested and exercisable stock options and SARs or whether the deficiency was more pervasive in our analysis and calculations of EPS. Having completed a thorough review of all EPS-related processes, management has confirmed that all other aspects of the control provide reasonable assurance that a material misstatement would be timely prevented or detected. As a result, the potential magnitude of misstatement that could have resulted from the identified deficiency in question is limited to the specific error identified and quantified in our previous response. For the reasons described below, we do not consider the control deficiency relating to the identification of vested and exercisable stock options as participating securities in calculating EPS under the two-class method to be a material weakness.

A material weakness is defined under Auditing Standard (AS) 2201 as a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the company’s annual or interim financial statements will not be prevented or detected on a timely basis.

In evaluating the severity of the deficiency, we considered:

•whether there is a reasonable possibility that the Company’s controls will fail to prevent or detect a material misstatement of account balance or disclosure; and

•the magnitude of the potential misstatement resulting from the deficiency.

As indicated in our Prior Response, the use of the two-class method versus the treasury stock method did not result in any change or modification to the Consolidated Balance Sheet, non-EPS related Consolidated Statements of Comprehensive Income information, Consolidated Statements of Cash Flows or Consolidated Statements of Changes in Shareholders’ Equity for any reporting period. It also did not result in any change or modification to any calculations under any share-based compensation plans. The error and the identified control deficiency are limited to the Company’s EPS calculation only as it relates to the identification of vested and exercisable stock options and SARs as participating securities. For this reason, the Company has concluded that there is no reasonable possibility that the quantitative significance of the error could have become greater than the amounts identified and provided in our Prior Response for all periods presented.

August 14, 2023

Securities and Exchange Commission

Page 8

We respectfully acknowledge the Staff’s comment noting that in the second quarters of 2022 and 2021, when earnings were unusually low, the error percentages were higher relative to all other affected quarters and annual trends. In these two instances, we assert that the judgment of a reasonable investor relying on those interim financial statements would not have been changed or influenced by the correction of the error, as basic and diluted EPS calculations for these particular quarters were only impacted by one to two cents and there were unique circumstances (i.e., impairment related to the planned disposition of an asset class and a tax law change) that resulted in unusually low earnings. The Company’s investors, analysts, and other readers of our filings were aware of those circumstances, and a reasonable investor would not form different conclusions on the results of those quarters had EPS numbers been reported under the two-class method. In particular, and as noted above, the percentage impact was higher in these quarters because reported GAAP net income from continuing operations was only $2.6 million and $5.5 million, respectively, in these quarters, due to the unusual events. However, GAAP net income from continuing operations was not lower than $17.8 million in any other quarter presented with an average of $40.5 million over the 13 periods discussed and presented in our Prior Response. Our reported annual net income was $155.9 million and $143.1 million for 2022 and 2021, respectively, which illustrates these quarters were not representative of the Company’s historical or future trends.

In assessing the potential magnitude of errors that could have resulted from the identified control deficiency, the Company also analyzed historical data regarding its stock options and SARs. In particular, and as previously noted (and as shown in the table below), vested and exercisable stock options and SARs represented between 1.9% - 3.0% of the Company’s total shares outstanding for the fiscal years 2020 – 2022 and the total number could never have exceeded 3.0% of the Company’s total shares outstanding during that period.

| | | | | | | | | | | | | | | | | |

| In millions | 2022 | | 2021 | | 2020 |

| Weighted average vested and exercisable options and SARs | 0.66 | | 0.79 | | 1.04 |

| Weighted average common shares outstanding | 35.4 | | 35.4 | | 35.0 |

| % of vested and exercisable to shares outstanding | 1.9 | % | | 2.2 | % | | 3.0 | % |

Given the number of common shares outstanding, the nature of the Company’s share-based compensation plans, the total number of employees eligible for share-based compensation plans, the timeline for vesting and expiration of awards, and the limited number of outstanding vested and exercisable stock options actually outstanding at any given time, the Company has determined that there is no reasonable possibility that this error could rise to a level that would cause the calculation and disclosure to be materially misstated in any period. Specifically, our stock options are fully vested by year 3 and must be exercised by year 7, so there is always a natural attrition to the number of options outstanding. To further this point, historical data shows that the average expected term of our options is approximately 4.3 years and this average term has been stable throughout economic cycles. Lastly, our employee base eligible for stock options has remained fairly stable, with 156 employees granted options in 2020 and 164 employees granted options in 2023, which further supports the conclusion that the number of vested and exercisable stock options outstanding has an upper limit that it is not reasonably likely to rise to a material level.

Given the control deficiency is limited to outstanding vested and exercisable stock options, and other aspects of the EPS control were operating effectively, we do not believe there is a reasonable possibility that the control would fail to prevent or detect a material misstatement in the calculation of basic and diluted EPS.

August 14, 2023

Securities and Exchange Commission

Page 9

Finally, management evaluated the possibility that the Company could face a sustained period of lower earnings, such that the phenomenon noted in the second quarters of 2022 and 2021 would have manifested over a full year, leading to a quantitatively significant difference between basic and diluted EPS calculated under the two-class method, as opposed to the treasury stock method. Based on management’s evaluation, the Company concluded that the likelihood of this potential outcome is remote and, in our judgment, does not represent a risk of material misstatement.

Our assessment of this likelihood is supported by the historical performance and stability of our business, as evidenced by the strong financial results in 2020 - during the height of the COVID-19 pandemic. Even in a period of greatly reduced industrial production and therefore lower demand for rail transportation, GAAP net income from continuing operations was $150.2 million and the impact of calculating basic and diluted EPS under the two-class method, as opposed to the treasury stock method was immaterial. There are several reasons for this operational stability, including:

•125 years of experience in the same industry, railcar leasing;

•long average remaining lease terms, leading to high quality committed contractual lease receipts of over $3.4 billion as of December 31, 2022;

•strong long-term customer relationships, consisting primarily of companies with investment grade credit;

•typically, less than 20% of the fleet up for renewal in a single year; and

•ability to generate significant asset remarketing gains at all points in the cycle.

The table below shows our net income trend (GAAP and non-GAAP) over the last 10 years, which illustrates that the Company’s business is extremely resilient through economic cycles, including during the COVID-19 pandemic:

| | | | | | | | | | | |

| Annual GAAP Net Income from Continuing Operations1 | | Annual Non-GAAP Net Income from Continuing Operations1 |

| 2013 | $ | 169.3 | | | $ | 164.8 | |

| 2014 | 205.0 | | | 205.0 | |

| 2015 | 205.3 | | | 234.9 | |

| 2016 | 257.1 | | | 235.9 | |

| 2017 | 467.8 | | | 173.5 | |

| 2018 | 190.5 | | | 178.8 | |

| 2019 | 180.8 | | | 178.0 | |

| 2020 | 150.2 | | | 162.5 | |

| 2021 | 143.1 | | | 182.2 | |

| 2022 | 155.9 | | | 217.7 | |

______________________________

1 The information for periods prior to 2017 was not recast for discontinued operations presentation and represents consolidated operations.

August 14, 2023

Securities and Exchange Commission

Page 10

We also considered other indicators of material weaknesses as outlined in AS 2201:

Identification of fraud, whether or not material, on the part of senior management

The error and deficiency were not the result of fraud.

Restatement of previously issued financial statements to reflect the correction of a material misstatement

As described in our Prior Response and detailed above, management determined that restatement of its previously issued financial statements was not required as the error is clearly immaterial for all periods presented.

Identification by the auditor of a material misstatement of financial statements in the current period in circumstances that indicate that the misstatement would not have been detected by the company’s internal control over financial reporting

As described in the Prior Response and detailed above, the error was clearly immaterial, a conclusion with which our auditor has concurred.

Ineffective oversight of the company’s external financial reporting and internal control over financial reporting by the company’s audit committee

Management has evaluated the Company’s existing financial reporting oversight controls and has concluded that they are designed and operate effectively to detect material misstatements in our calculation of EPS. As a result, the Company respectfully submits that its internal control over financial reporting is performing as designed in order to detect and prevent material misstatements. The Company reviews its EPS calculation on a quarterly basis and shares its findings with senior management. Senior management of the Company reviews the quarterly and annual financial statements within the Form 10-Qs and Form 10-Ks and provides these to the Audit Committee for review and approval prior to filing. The Company’s EPS control was functioning effectively for the calculation of EPS with the exception of outstanding vested and exercisable stock options and SARs, which are immaterial relative to the Company’s total shares outstanding and capital structure. Therefore, management has concluded that the immaterial error identified is not indicative of ineffective oversight of the Company’s financial reporting and internal control over financial reporting.

Management evaluates, at least annually, whether our internal control over financial reporting is designed and operating effectively to prevent and detect material misstatement. Control deficiencies or exceptions identified through management’s evaluation and testing activities are analyzed, remediated as needed and reported to the Audit Committee of our Board of Directors. Based on the results of these regular evaluations, along with the detailed deficiency analysis described above, management has concluded the Company’s internal control over financial reporting remains effective.

August 14, 2023

Securities and Exchange Commission

Page 11

Based on our review of the provisions in paragraph 69 of PCAOB Auditing Standard No. 5 and the definition of a material weakness as provided in paragraph A7 of Appendix A to PCAOB Auditing Standard No. 5, management evaluated the severity of the deficiency in internal control over financial reporting related to the error and concluded that the control deficiency does not constitute a material weakness.

**********

If you have any questions or comments regarding the Company’s response, or if you require any additional information, please call me at (312) 621-4560.

Sincerely,

| | |

| /s/ Thomas A. Ellman |

| Thomas A. Ellman |

| Executive Vice President and Chief Financial Officer |

Attachment

August 14, 2023

Securities and Exchange Commission

Page 12

Exhibit A

August 14, 2023

Securities and Exchange Commission

Page 13