UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

[☑] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2020

OR

[☐] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______ to _______

Commission File Number 1-3671

GENERAL DYNAMICS CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 13-1673581 | ||||||||||||||||

| State or other jurisdiction of incorporation or organization | I.R.S. Employer Identification No. | ||||||||||||||||

| 11011 Sunset Hills Road | Reston, | Virginia | 20190 | ||||||||||||||

| Address of principal executive offices | Zip code | ||||||||||||||||

| (703) | 876-3000 | ||||

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| Common Stock | GD | New York Stock Exchange | ||||||

Securities registered pursuant to Section 12(g) of the Act:

| None | ||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes _ü_ No ___

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ___ No _ü_

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes _ü_ No ___

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes _ü_ No ___

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer _ü_ Accelerated filer ___ Non-accelerated filer ___ Smaller reporting company ___☐ Emerging growth company ___☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ___

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes _ü_ ☑ No ___

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ___ No _ü_☐☑

The aggregate market value of the voting common equity held by non-affiliates of the registrant was $36,917,915,083 as of June 28, 2020 (based on the closing price of the shares on the New York Stock Exchange).

286,264,679 shares of the registrant’s common stock, $1 par value per share, were outstanding on January 31, 2021.

DOCUMENTS INCORPORATED BY REFERENCE:

Part III incorporates by reference information from certain portions of the registrant’s definitive proxy statement for the 2021 annual meeting of shareholders to be filed with the Securities and Exchange Commission within 120 days after the close of the fiscal year.

INDEX

| PART I | PAGE | |||||||

| Item 1. | ||||||||

| Item 1A. | ||||||||

| Item 1B. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| PART II | ||||||||

| Item 5. | ||||||||

| Item 6. | ||||||||

| Item 7. | ||||||||

| Item 7A. | ||||||||

| Item 8. | ||||||||

| Item 9. | ||||||||

| Item 9A. | ||||||||

| Item 9B. | ||||||||

| PART III | ||||||||

| Item 10. | ||||||||

| Item 11. | ||||||||

| Item 12. | ||||||||

| Item 13. | ||||||||

| Item 14. | Principal Accountant Fees and Services | |||||||

| PART IV | ||||||||

| Item 15. | ||||||||

| Item 16. | ||||||||

2

PART I

ITEM 1. BUSINESS

(Dollars in millions, except per-share amounts or unless otherwise noted)

BUSINESS OVERVIEW

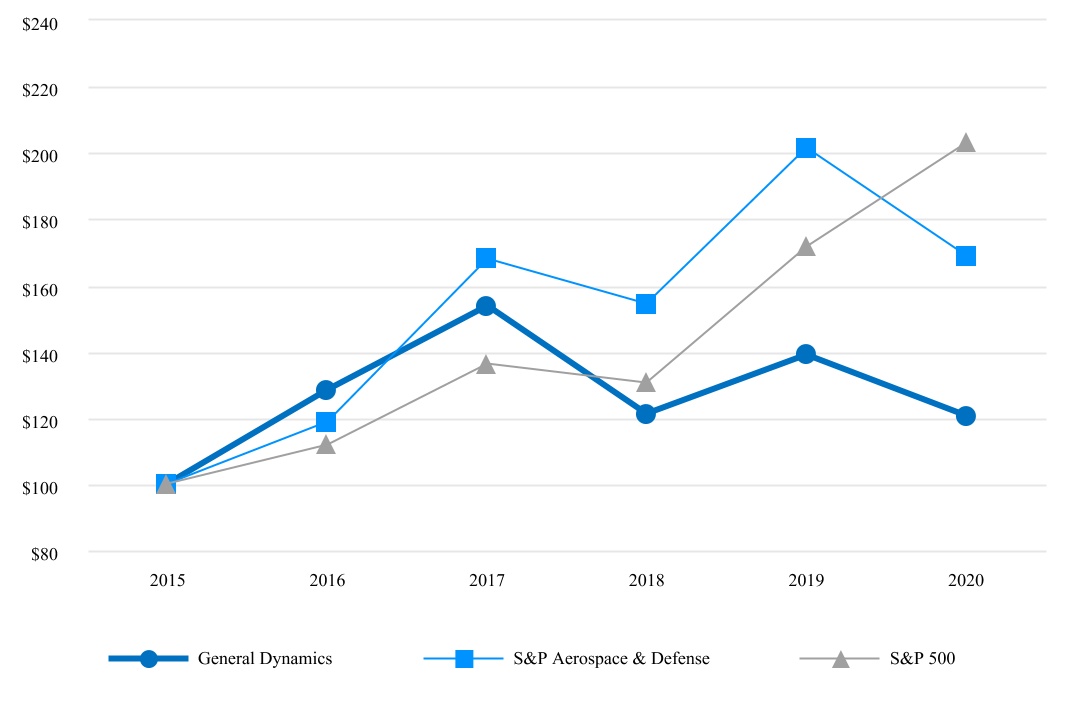

General Dynamics is a global aerospace and defense company that specializes in high-end design, engineering and manufacturing to deliver state-of-the-art solutions to our customers. We offer a broad portfolio of products and services in business aviation; ship construction and repair; land combat vehicles, weapons systems and munitions; and technology products and services. Our leadership positions in attractive business aviation and defense markets enable us to deliver superior and enduring shareholder returns.

Our company consists of 10 business units, which are organized into four operating segments: Aerospace, Marine Systems, Combat Systems and Technologies. We refer to the latter three collectively as our defense segments. To optimize its market focus, customer intimacy, agility and operating expertise, each business unit is responsible for the development and execution of its strategy and operating results. This structure allows for a lean corporate function, which sets the overall strategy and governance for the company and is responsible for allocating and deploying capital.

Our business units seek to deliver superior operating results by endeavoring to build industry-leading franchises. To achieve this goal, we invest in advanced technologies, pursue a culture of continuous improvement, and strive to be the low-cost, high-quality provider in each of our markets. The result is long-term value creation measured by strong earnings and cash flow and an attractive return on capital.

Over the past eight years, we have invested nearly $20 billion to create, renew or expand our portfolio of products and services across our businesses to drive long-term growth and shareholder value creation. This includes product development investments in Aerospace to bring to market an all-new lineup of business jet aircraft, capital investments in Marine Systems to support significant growth in U.S. Navy ship and submarine construction plans over the next two decades, development of next-generation platforms and technologies to meet customers’ emerging requirements in Combat Systems, and strategic acquisitions to achieve critical mass and build out a complete spectrum of solutions for our Technologies customers.

Following is additional information on each of our operating segments. For a supplemental discussion of segment performance and backlog, see Management’s Discussion and Analysis of Financial Condition and Results of Operations in Item 7.

AEROSPACE

Our Aerospace segment is recognized as a leading producer of business jets and the standard bearer in aircraft repair, support and completion services. The segment consists of our Gulfstream and Jet Aviation business units. We have earned our reputation through:

•superior aircraft design, quality, performance, safety and reliability;

•technologically advanced flight deck and cabin systems; and

•industry-leading customer support.

3

We believe the key to long-term value creation in the business jet industry is steady investment in new aircraft models and technologies and in customer service capabilities. As a result, since we acquired Gulfstream over 20 years ago, we have made significant investments in research and development (R&D), state-of-the-art manufacturing facilities, and maintenance and support through a combination of product development efforts, capital expansion and the acquisition of Jet Aviation’s global support network.

We are committed to continual investment in R&D to create new aircraft that consistently broaden customer offerings while raising the bar for safety and performance. The result is the unprecedented development of an all-new lineup of the most technologically advanced business jet aircraft in the world. These aircraft offer industry-leading cabin, cockpit and safety technologies and the longest ranges at the fastest speeds in their respective classes.

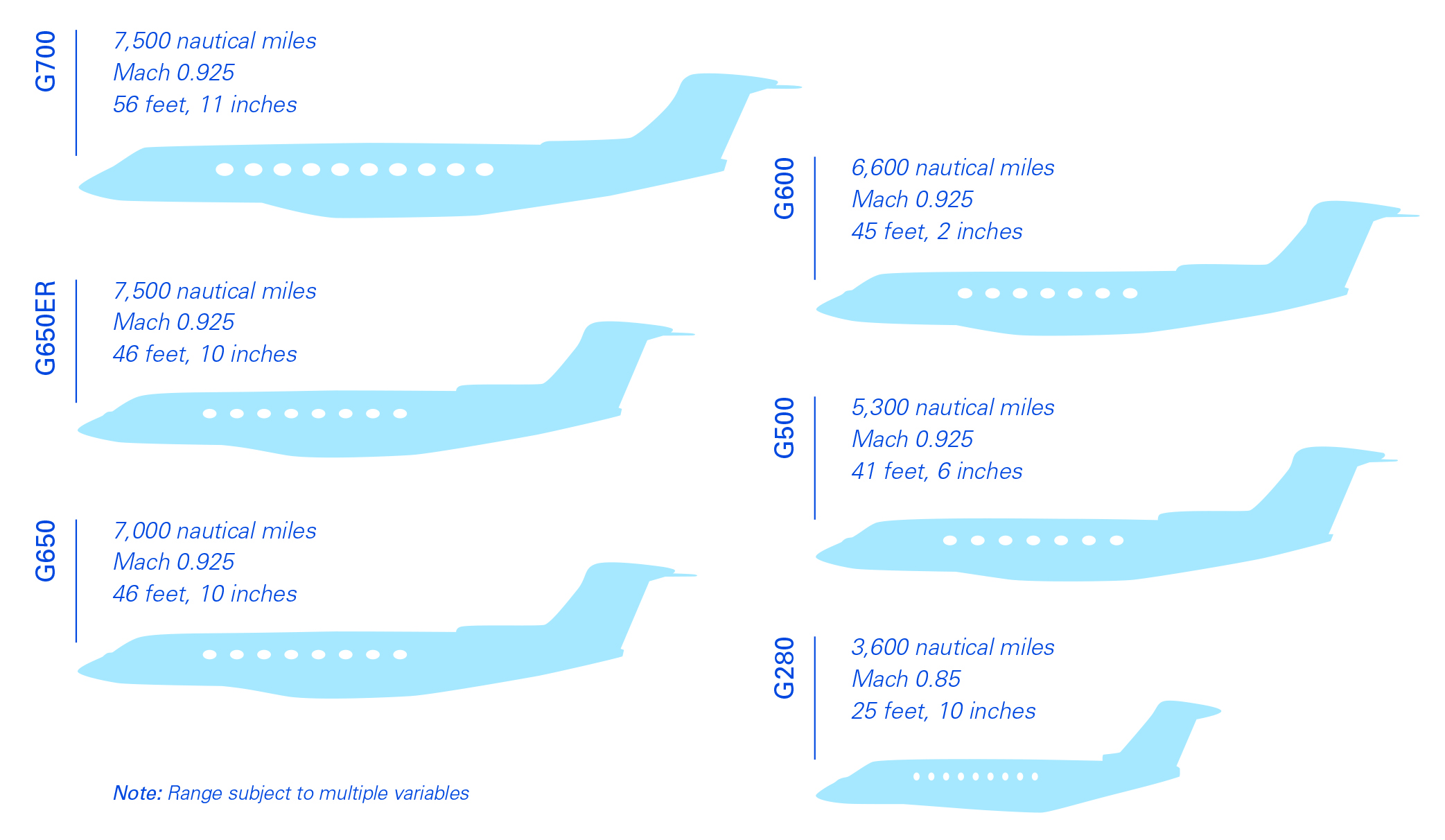

The following represents Gulfstream’s current product line, along with the maximum range, maximum speed and cabin length (excluding baggage) for each aircraft:

The most recent additions to the Gulfstream fleet are two new large-cabin aircraft, the G500 and G600, which entered service in 2018 and 2019, respectively. These clean-sheet (i.e., all-new) aircraft replace the G450 and G550 models, which have a combined installed base of more than 1,650 aircraft around the world. Our investment included development of a new wing, new avionics, new fuselage and new ergonomically designed larger interiors, as well as systems and technologies to improve the manufacturing process and quality of the platform. As a result, the G500 and G600 are faster, more fuel efficient and have greater cabin volume, more range and improved flight controls compared with the aircraft they are replacing. At year-end 2020, cumulative deliveries for the two new aircraft totaled almost 100.

The next model to join the Gulfstream lineup is the ultra-long-range, ultra-large-cabin G700. It combines our most spacious cabin with our advanced Symmetry Flight Deck and the superior high-

4

speed performance of all-new engines to create best-in-class capabilities. Gulfstream is in the process of flight testing and certification of the G700, which we expect to enter service in the fourth quarter of 2022.

The ultra-long-range, ultra-large-cabin G650 and G650ER continue to generate significant customer interest, with more than 430 aircraft of this family currently operating in 50 countries. Since the first G650 entered service in 2012, its capabilities and reliability have led to significant sales and expansion of our installed base around the globe. Gulfstream’s current product line holds more than 300 city-pair speed records, more than any other business jet manufacturer, led by the G650ER, which holds the National Aeronautic Association’s polar and westbound around-the-world speed records.

Our disciplined and consistent approach to new product development allows us to repeatedly introduce first-to-market capabilities that set industry standards for safety, performance, quality, speed and comfort. Product enhancement and development efforts include initiatives in advanced avionics, composites, flight-control and vision systems, acoustics, and cabin technologies.

Gulfstream designs, develops and manufactures aircraft in Savannah, Georgia, including all large-cabin models. The mid-cabin G280 is assembled by a non-U.S. partner. All models are outfitted in Gulfstream’s U.S. facilities. In support of Gulfstream’s growing aircraft portfolio and customer base, we have invested in our facilities and operations. At our Savannah campus, we added new purpose-built manufacturing facilities, increased aircraft service capacity, and opened a customer-support distribution center and a dedicated R&D campus.

We offer comprehensive support for the more than 2,900 Gulfstream aircraft in service around the world and operate the largest factory-owned service network in the industry. We continue to invest in these maintenance, repair and overhaul (MRO) facilities and inventory to accommodate fleet growth. We also operate a 24/7 year-round customer support center and offer on-call Gulfstream aircraft technicians ready to deploy around the world for customer service requirements under our Field and Airborne Support Team (FAST) rapid-response unit.

In addition to expanding the reach of Gulfstream’s aircraft maintenance network outside the United States, Jet Aviation provides a comprehensive suite of innovative aircraft services for aircraft owners and operators around the world. With approximately 50 locations throughout North America, Europe, the Middle East and the Asia-Pacific region, our offerings include maintenance, aircraft management, charter, staffing and fixed-base operator (FBO) services.

Jet Aviation manages nearly 300 business aircraft globally on behalf of individuals and corporate owners. We operate a leading global FBO network and support all aircraft types with the full-range of maintenance services, including 24/7 global aircraft-on-ground support. We also operate one of the world’s largest custom completion and refurbishment centers for both narrow- and wide-body aircraft and perform modifications, upgrades and lifecycle sustainment support for various government fleets. We continue to grow our global footprint through acquisitions, expansions and significant renovations in key business-aviation markets.

5

The following map demonstrates the broad reach of our combined Gulfstream and Jet Aviation services network, including authorized service centers:

The Aerospace segment is committed to sustainability and the reduction of aviation’s carbon footprint. In support of this strategy, Gulfstream and Jet Aviation offer sustainable aviation fuel through our combined services network and lead the industry in total gallons supplied to the business jet market. Furthermore, we offer carbon offset credits to our customers, enabling them to operate aircraft on a carbon-neutral basis.

Revenue for the Aerospace segment was 21% of our consolidated revenue in 2020, 25% in 2019 and 23% in 2018. Revenue by major products and services was as follows:

| Year Ended December 31 | 2020 | 2019 | 2018 | ||||||||||||||

| Aircraft manufacturing | $ | 6,115 | $ | 7,541 | $ | 6,262 | |||||||||||

| Aircraft services and completions | 1,960 | 2,260 | 2,193 | ||||||||||||||

| Total Aerospace | $ | 8,075 | $ | 9,801 | $ | 8,455 | |||||||||||

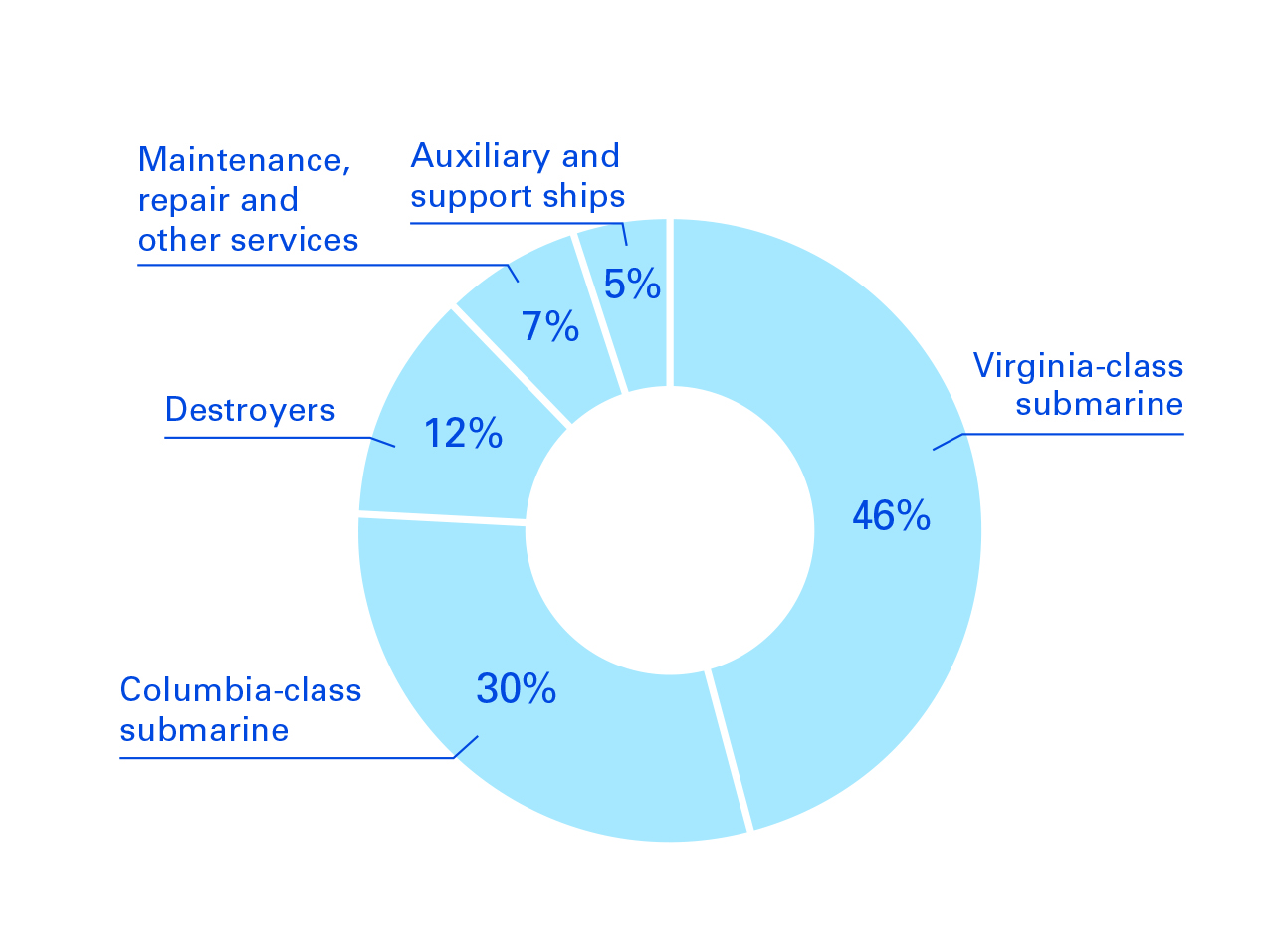

MARINE SYSTEMS

Our Marine Systems segment is the leading designer and builder of nuclear-powered submarines and a leader in surface combatants and auxiliary ship design and construction for the U.S. Navy. We also provide maintenance, modernization and lifecycle support services for Navy ships and maintain the most sophisticated marine engineering expertise in the world to support future capabilities. Our ability to design, build and maintain our nation’s most technologically sophisticated warships is a critical element of the U.S. defense industrial base. In addition to Navy ships, we design and build ocean-going Jones

6

Act ships for commercial customers. Marine Systems consists of three business units — Electric Boat, Bath Iron Works and NASSCO.

In support of our Navy customer’s significant increase in demand for submarines and surface ships, we are making substantial investments to expand our facilities, grow and train our workforce, and support our supply chain, particularly in our submarine business. The resulting increase in capacity and capabilities will support the unprecedented growth expected in our shipbuilding business, especially submarines, for the next two decades.

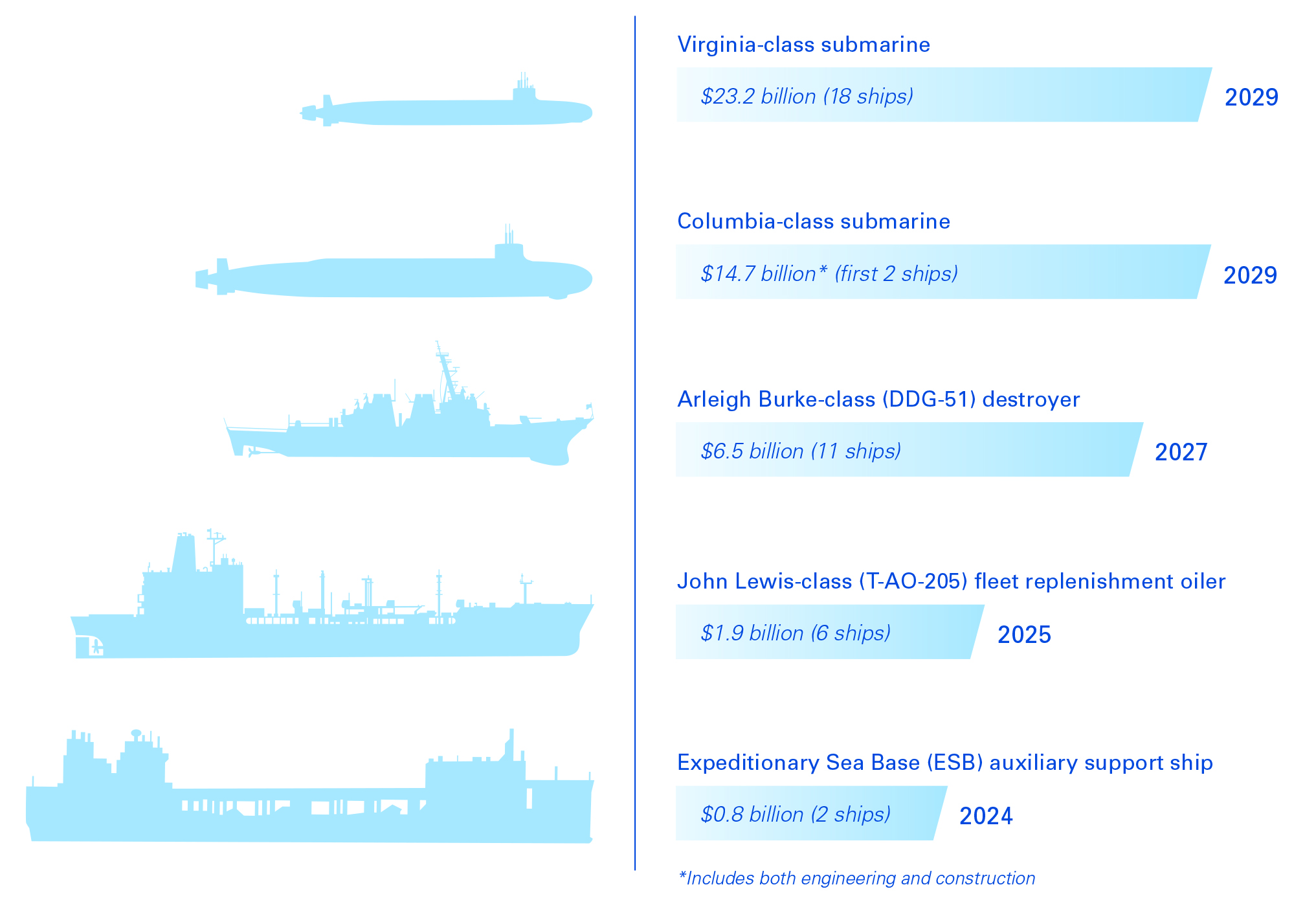

Electric Boat is the prime contractor and lead shipyard on all Navy nuclear-powered submarine programs. The business is responsible for all aspects of design and engineering and leads the construction of both the Virginia-class attack submarine and the Columbia-class ballistic-missile submarine.

The Navy procures Virginia-class submarines in multi-boat blocks, currently at a two-per-year construction rate. We are currently working on Blocks IV and V in the program, with 18 Virginia-class submarines in our backlog scheduled for delivery through 2029. Eight of the boats in Block V include the Virginia Payload Module (VPM), an 84-foot Electric Boat-designed-and-built hull section that adds four additional payload tubes, more than tripling the strike capacity of these submarines and providing unique capabilities to support special missions.

The Navy’s Columbia-class ballistic-missile submarine is a 12-boat program that the Navy considers its top priority. These submarines will provide strategic deterrent capabilities for decades, with the first boat delivering in 2027 to begin replacement of the current Ohio-class ballistic-missile submarine fleet as it reaches the end of its service life. Construction is scheduled to continue for two decades, and the value of the Navy’s program of record is in excess of $110 billion. To mitigate risk, the submarine’s design was more than 80% complete at the time we began construction of the first boat, nearly twice as mature as any other Navy submarine program at the start of construction.

We are investing $1.8 billion of capital in expanded and modernized facilities at Electric Boat to support the growth in submarine construction. Our expenditures peaked in 2020, and we will have completed a majority of these investments by the end of 2021. Equal to the commitment of capital is our commitment to our workforce, which is on track to grow approximately 30% over the next decade, particularly in support of Columbia-class production. To reach our objective, we continue to invest in the training and tools necessary for our employees to be prepared to deliver these next-generation submarines to the Navy on time and on budget. We are also working with our network of more than 3,000 suppliers — mostly small businesses — to provide for concurrent production of the two submarine programs.

Bath Iron Works builds the Arleigh Burke-class (DDG-51) guided-missile destroyers and manages modernization and lifecycle support for the class. We have a total of 11 ships in backlog scheduled for delivery through 2027. Bath Iron Works is also the hull, mechanical and electrical (HM&E) prime contractor and lifecycle support provider for the Zumwalt-class (DDG-1000) guided-missile destroyer program. We expect to complete our work on the third and final ship of this class in 2021.

NASSCO specializes in Navy auxiliary and support ships and is currently building the Expeditionary Sea Base (ESB), which serves as a forward-staging base, and the John Lewis-class (T-AO-205) fleet replenishment oiler. Work on the two ESBs in backlog will continue into 2024, while the initial ships in the T-AO-205 program have deliveries planned into 2025. NASSCO has also designed and built crude

7

oil and product tankers and container and cargo ships for commercial customers, satisfying Jones Act requirements that ships carrying cargo between U.S. ports be built in U.S. shipyards.

On December 31, 2020, backlog for our major ship construction programs and the scheduled final delivery date of ships currently in backlog were as follows:

In addition to design and construction activities, our Marine Systems segment provides comprehensive post-delivery services to extend the service life of these and other Navy ships. NASSCO conducts full-service maintenance and surface-ship repair operations in Navy fleet concentration areas in San Diego, California; Norfolk, Virginia; Mayport, Florida; and Bremerton, Washington. Electric Boat provides submarine maintenance and modernization services in a variety of U.S. locations, and Bath Iron Works provides lifecycle support services for Navy surface ships in both U.S. and overseas ports. In support of allied navies, we offer program management, planning, engineering and design support for submarine and surface-ship construction programs.

Revenue for the Marine Systems segment was 26% of our consolidated revenue in 2020, 23% in 2019 and 24% in 2018. Revenue by major products and services was as follows:

| Year Ended December 31 | 2020 | 2019 | 2018 | ||||||||||||||

| Nuclear-powered submarines | $ | 6,938 | $ | 6,254 | $ | 5,712 | |||||||||||

| Surface ships | 2,055 | 1,912 | 1,872 | ||||||||||||||

| Repair and other services | 986 | 1,017 | 918 | ||||||||||||||

| Total Marine Systems | $ | 9,979 | $ | 9,183 | $ | 8,502 | |||||||||||

8

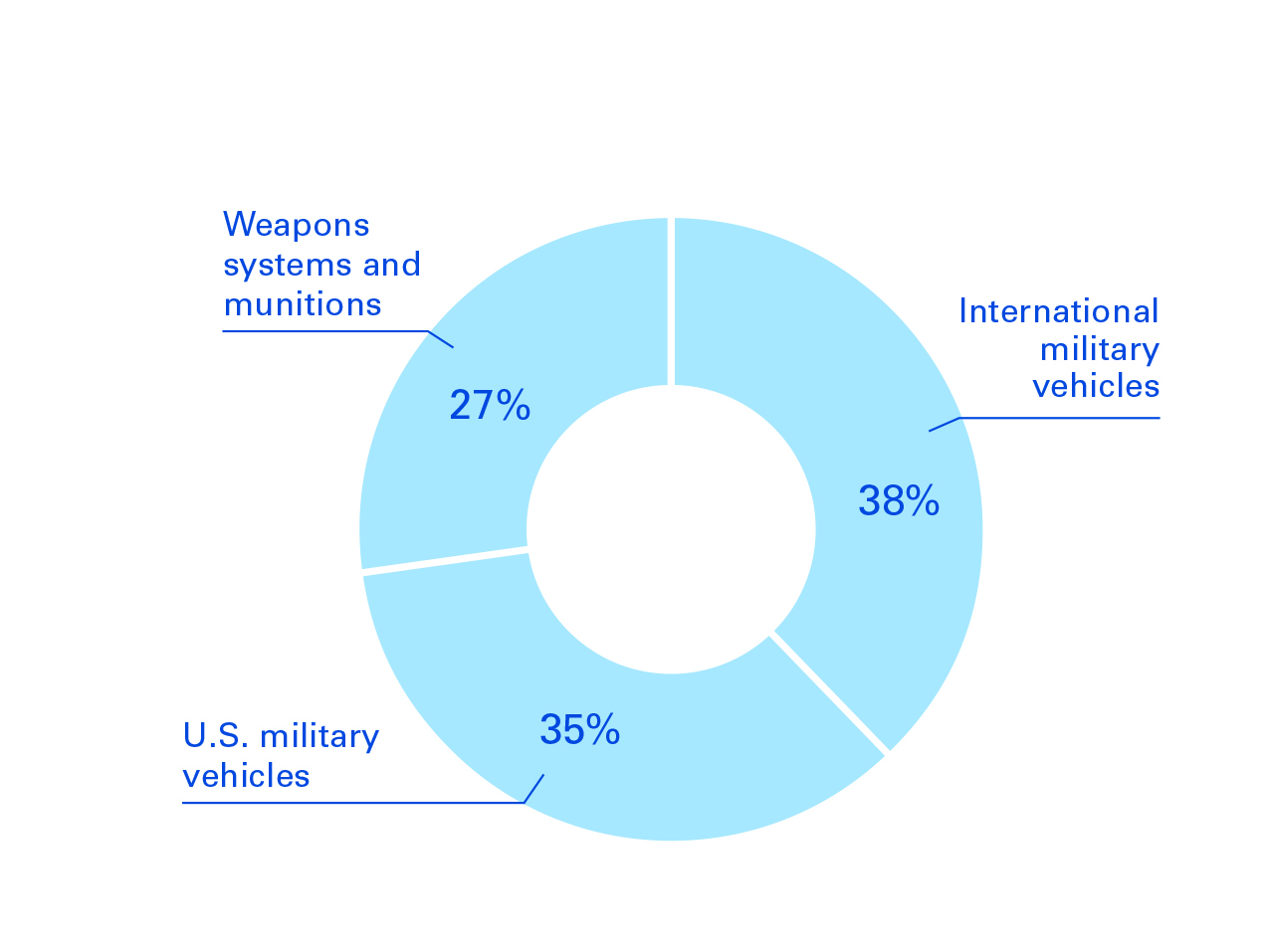

COMBAT SYSTEMS

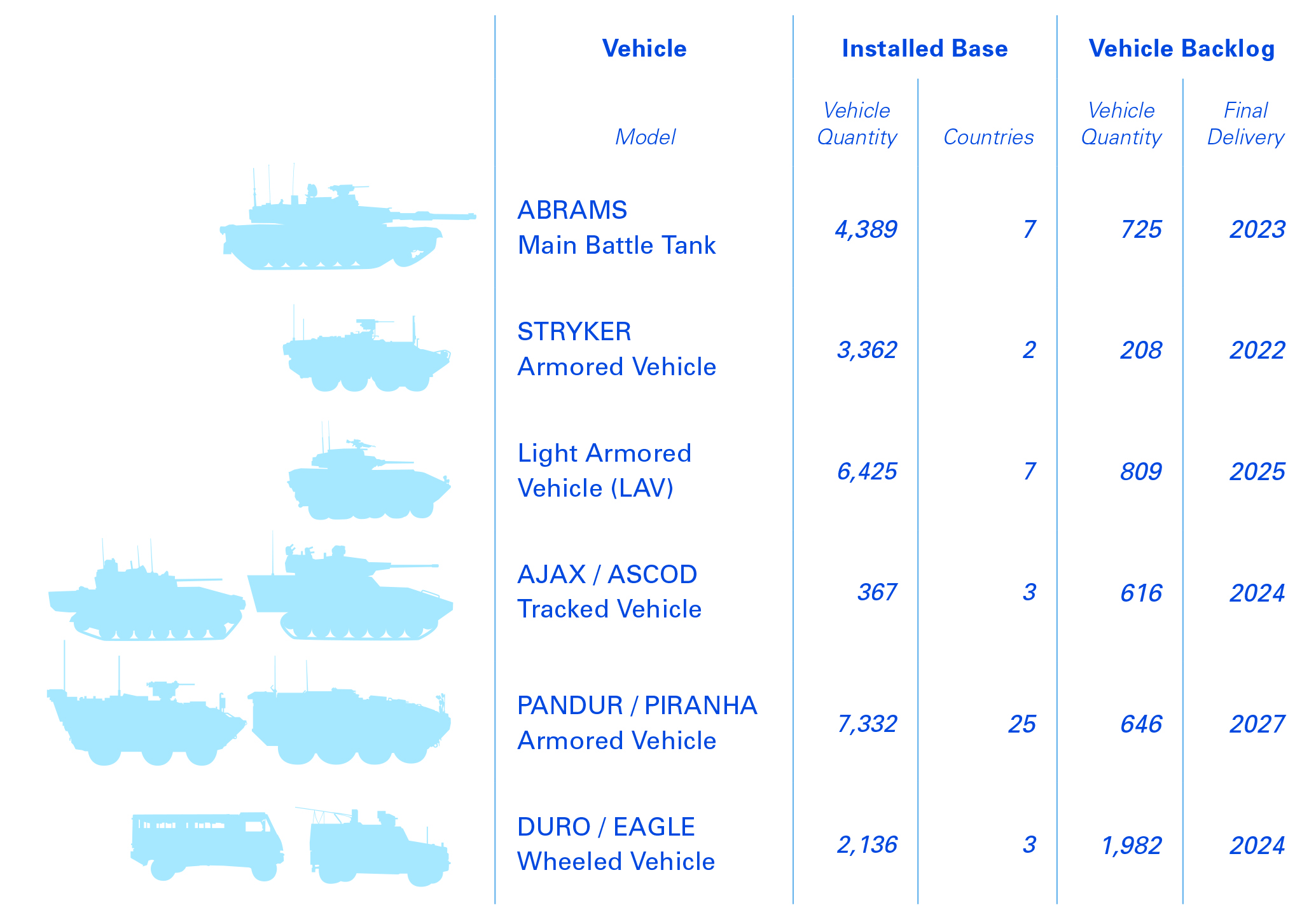

Our Combat Systems segment is a premier manufacturer and integrator of land combat solutions worldwide, including wheeled and tracked combat vehicles, weapons systems and munitions. The segment consists of three business units — Land Systems, European Land Systems (ELS), and Ordnance and Tactical Systems (OTS).

Combat Systems creates long-term value through operational excellence — high-quality, on-schedule and on-budget performance — combined with investments in innovative technologies that modernize existing platforms and develop next-generation capabilities to meet our customers’ rapidly evolving requirements. We maintain our market-leading position by focusing on innovation, affordability and speed to market to deliver increased survivability, performance and lethality on the battlefield. Our large installed base of wheeled and tracked vehicles around the world and expertise gained from research, engineering and production programs position us well for modernization programs, support and sustainment services, and future development programs.

Land Systems is the sole-source producer of two foundational products central to the U.S. Army’s warfighting capabilities — the M1A2 Abrams main battle tank and Stryker wheeled combat vehicle. Both of these platforms are critical to the multi-domain, joint war fight envisioned on the battlefield of the future.

We are maximizing the effectiveness and lethality of the Army’s tank fleet with next-generation Abrams upgrades, providing technological advancements in communications, power generation, fuel efficiency, optics and armor. Even as we are delivering this modernized platform, we are developing additional advanced capabilities for the Abrams tank, including incorporating next-generation electronic architecture technology that will allow this platform to adapt and incorporate transformative capabilities into the future. We are also upgrading Abrams tanks for several non-U.S. partners.

The Stryker is an eight-wheeled, medium-weight combat vehicle that combines lethality, mobility, survivability and stealth. Land Systems continues to develop upgrades and enhancements to this highly versatile and combat-proven platform to address the Army’s evolving operational needs. We are fielding a new generation Stryker that includes the double-V-hull (DVH) for survivability, increased power, improved cross-country mobility and an advanced digital, in-vehicle network. The first of nine brigades began fielding the A-1 platform upgrade during 2020, and we are coordinating with the Army for next-generation upgrades to this platform. Leveraging our rapid prototyping expertise and customer intimacy, we continue to expand the mission capabilities of this platform, including a 30mm weapon system, an air defense mission package (M-SHORAD), state-of-the-art electronic warfare suite, and high-energy laser and command post options.

Combat Systems provides similar capabilities for U.S. allies through export opportunities and through our operations in several countries around the world, including Canada, the United Kingdom, Spain, Switzerland, Austria and Germany. As a result, we have a market-leading position in light armored vehicles (LAVs) with approximately 14,000 of the high-mobility, versatile Pandur, Piranha and other LAVs in service worldwide.

Land Systems is producing the British Army’s AJAX armored fighting vehicle, a next-generation, medium-weight tracked combat vehicle. With six variants, the AJAX family of vehicles offers advanced electronic architecture and proven technology for an unparalleled balance of survivability, lethality and mobility, along with high reliability for a vehicle in its weight class. In addition, Land Systems is

9

producing 360 new LAVs in eight variants for the Canadian Army, as well as upgrading its existing fleet.

ELS is producing and upgrading Piranha vehicles, a premier 8x8 armored combat vehicle, around the world. We are currently providing Piranha V vehicles for several countries, including Denmark, Romania and most recently Spain. Additionally, we provide mobile bridge systems with payloads ranging from 100 kilograms to 100 tons to customers worldwide. We offer the ASCOD, a highly versatile tracked combat vehicle with multiple versions, including the Spanish Pizarro and the Austrian Ulan. ELS also offers Duro and Eagle tactical vehicles in a range of options and weight classes and is currently producing these vehicles for Denmark, Switzerland and Germany, while providing a full range of product support for the German armed forces.

On December 31, 2020, the installed base for our major vehicle programs, as well as the quantity and scheduled final delivery date of vehicles and vehicle upgrades currently in backlog were as follows:

Complementing these military-vehicle offerings, OTS designs, develops and produces a comprehensive array of sophisticated weapons systems. For ground forces, we manufacture M2/M2-A1 heavy machine guns and MK19/MK47 grenade launchers. We also produce next-generation weapons systems for shipboard and airborne applications, including high-speed Gatling guns for all U.S. fighter aircraft, including the F-35 Joint Strike Fighter.

OTS’s munitions portfolio covers the full breadth of naval, air and ground forces applications across all calibers and weapons platforms for the U.S. government and its non-U.S. partners. Globally, we maintain a market-leading position in the supply of Hydra-70 rockets, general purpose bombs and bomb

10

bodies, large-caliber tank ammunition, medium-caliber ammunition, military propellants, mortar, and artillery projectiles. OTS is also the systems integrator for the next generation of artillery solutions in support of the Army’s Indirect Fire Modernization objectives. Additionally, OTS maintains a leading position providing missile subsystems in support of U.S. tactical and strategic missiles, provisioning both legacy and next-generation missiles with critical aerostructures, control actuators, high-performance warheads and cutting-edge hypersonic rocket cases.

Revenue for the Combat Systems segment was 19% of our consolidated revenue in 2020, 18% in 2019 and 17% in 2018. Revenue by major products and services was as follows:

| Year Ended December 31 | 2020 | 2019 | 2018 | ||||||||||||||

| Military vehicles | $ | 4,687 | $ | 4,620 | $ | 4,027 | |||||||||||

| Weapons systems, armament and munitions | 1,991 | 1,906 | 1,798 | ||||||||||||||

| Engineering and other services | 545 | 481 | 416 | ||||||||||||||

| Total Combat Systems | $ | 7,223 | $ | 7,007 | $ | 6,241 | |||||||||||

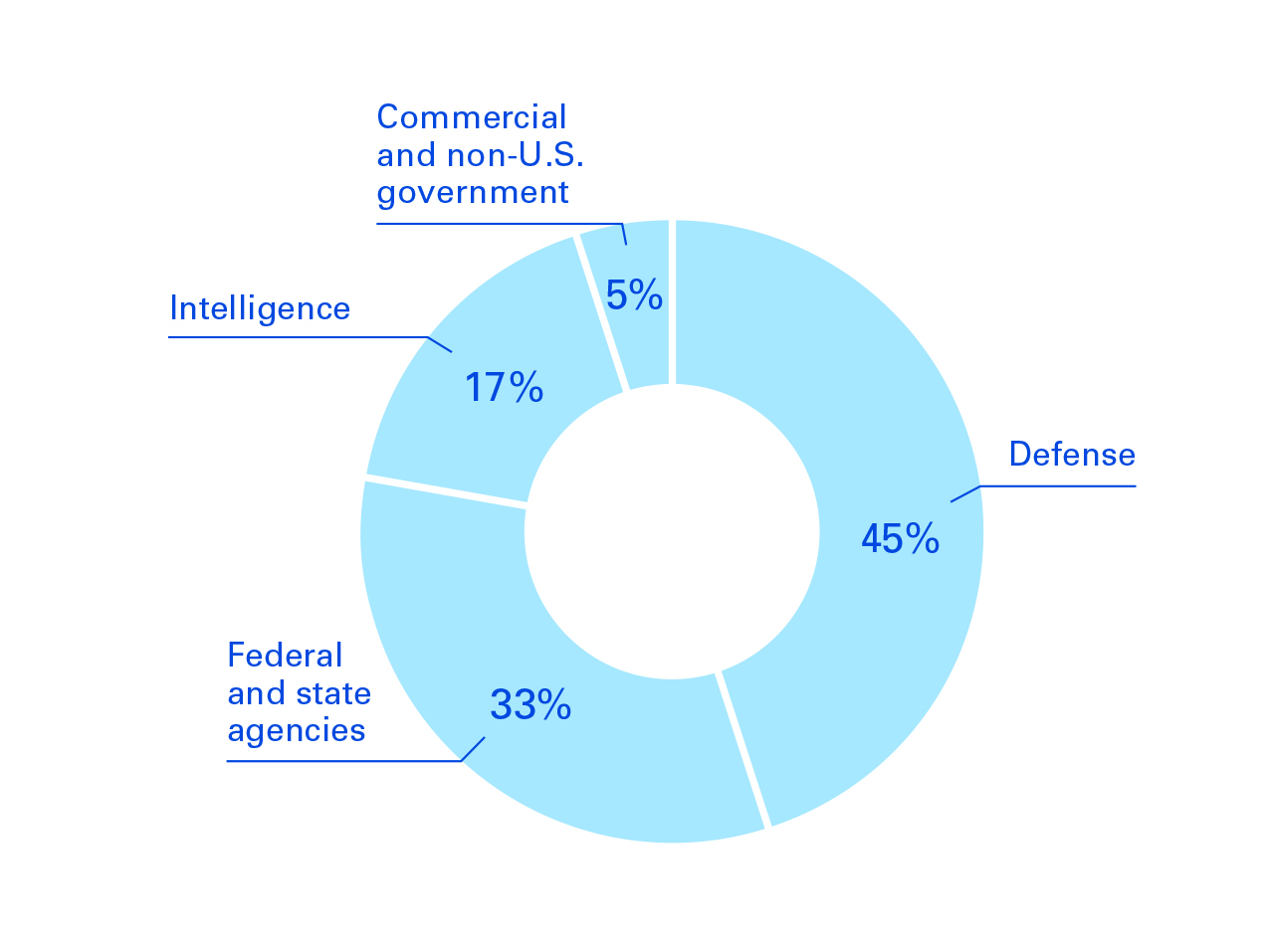

TECHNOLOGIES

Our Technologies segment provides a full spectrum of services, technologies and products to an expanding market that increasingly seeks solutions combining leading-edge electronic hardware with specialized software. The segment is organized into two business units — Information Technology (GDIT) and Mission Systems. Together they serve a wide range of military, intelligence and federal civilian customers with a diverse portfolio that includes:

•information technology (IT) solutions and mission-support services;

•mobile communication, computers and command-and-control (C4) mission systems; and

•intelligence, surveillance and reconnaissance (ISR) solutions.

This market has experienced a series of structural shifts in recent years, and our response to those trends has further solidified our position as a market leader. Over the past decade, the Department of Defense (DoD), the intelligence community and federal civilian agencies have increasingly prioritized technology solutions as a critical element of their missions. Cloud computing capabilities, cyber security threats, and advancements in artificial intelligence have transformed technology resources from short-cycle back-office support functions to a strategic priority for this customer community. The result is a significant increase in federal IT modernization and technology investments in recent years and a shift to large-scale, end-to-end, highly engineered solutions that require critical mass and a broad array of technology services and hardware offerings to meet these customer demands. The recent Coronavirus (COVID-19) pandemic has only accelerated these trends, which have included an expansion of remote connectivity and added urgency to required technology investments.

These market shifts have resulted in significant consolidation in the industry in recognition of the scale and breadth of capabilities required to meet this growing demand. In response to these market dynamics, in 2015 we combined our C4 and ISR operations into a single Mission Systems business unit, and in 2018 we acquired CSRA, Inc. (CSRA), which doubled the size of our IT services business, brought critical capabilities and repositioned the segment as a leader in this market.

During the three years following the acquisition of CSRA, GDIT and Mission Systems have undergone considerable portfolio shaping and realignment. At the top level, the two businesses share the same defense, intelligence and federal civilian customer base and increasingly go to market together to meet the ever-changing information-systems and mission-support needs of these customers. In addition,

11

with the convergence of digital technologies, we are now seeing considerable commonality and significant complementary pull-through in their core offerings and solution sets, particularly in the areas of cloud computing; artificial intelligence and machine learning (AI/ML); big data analytics; development, security and operations (DevSecOps); software-defined networks; and everything as-a-Service (XaaS). Consequently, we have reorganized these two business units into a single operating segment to reflect the evolving strategic focus and the way we are running the business.

With a network of more than 90 global partners, the segment develops solutions that keep its customers at the leading edge of technology in support of their missions. The segment’s highly skilled workforce is one of its key differentiators and comprises approximately 40,000 employees, including technologists, engineers, mission experts and cleared personnel dedicated to solving the toughest security and technology challenges facing the United States and its allies.

GDIT modernizes large-scale IT enterprises and deploys the latest technologies to optimize and protect customer networks, data and information. Operating hundreds of complex digital modernization programs across the federal government, GDIT’s expansive portfolio includes cloud strategy and services, cybersecurity, network modernization, managed services, AI, application development and high-performance computing.

Mission Systems offers solutions across all domains and produces a unique combination of products and capabilities that are purpose-built for essential C4ISR and cybersecurity applications. Our technology and products are often built into platforms and integrated systems on which our customers rely. The business’s portfolio includes prime contract programs to provide innovative defense-electronics solutions as well as subcontract efforts that enhance the capabilities of large-scale land, air, sea and space platforms.

The Technologies segment leverages its scale, partnerships and deep knowledge of its customers’ missions and challenges to bring innovation to those customers across a portfolio of thousands of contracts. While no individual contract is material to the segment’s results, the following highlights provide a sampling of the value of this combined business. GDIT has significantly expanded its cloud footprint and now holds leading positions on two of the three pillars of the Pentagon’s enterprise cloud migration strategy: milCloud 2.0, which provides defense agencies and military commands secure on-government-premise hybrid cloud services, and Defense Enterprise Office Systems (DEOS), which secures and streamlines email and collaborative tools across the DoD enterprise.

We apply AI to expand the human capacity to make better decisions and implement smarter actions as we automate, secure and enhance our customer’s operations. For the Department of Veterans Affairs (VA), GDIT leverages managed services and AI to accelerate veteran benefits claims processing, develops applications and software to improve the veteran user experience, and provides on-demand 24/7/365 IT support to more than 500,000 VA personnel nationwide. In the federal civilian sector, GDIT supports some of the fastest supercomputers in the world, responsible for biomedical research, weather forecasting and climate modeling.

To adapt to a constantly evolving threat landscape, GDIT embeds cyber solutions into every aspect of digital modernization. More than 3,000 cyber professionals support cyber projects across 30 agencies in the federal government.

Mission Systems develops and manufactures combat-proven global positioning systems (GPS) for the U.S. Army. This includes capabilities to ensure reliable satellite connectivity in any location and a suite of Assured Position, Navigation and Timing capabilities, which provide military forces the ability

12

to synchronize communications utilizing trusted data, even when GPS signals are degraded or denied. We are working with our Army customer to adapt elements of 5G technology to address battlefield realities such as jamming, spoofing, cyberattacks and lack of ground connectivity. We also provide similar capabilities to non-U.S. customers, including Canada and the United Kingdom.

On the platform side, we have a more than 60-year legacy of providing advanced fire-control systems for the Navy’s submarine programs. We are developing and integrating commercial off-the-shelf software and hardware upgrades to improve the tactical control capabilities for several submarine classes, including the Columbia and U.K. Dreadnought ballistic-missile submarines.

Revenue for the Technologies segment was 34% of our consolidated revenue in 2020 and 2019 and 36% in 2018. Revenue by major products and services was as follows:

| Year Ended December 31 | 2020 | 2019 | 2018 | ||||||||||||||

| IT services | $ | 7,892 | $ | 8,422 | $ | 8,269 | |||||||||||

| C4ISR solutions | 4,756 | 4,937 | 4,726 | ||||||||||||||

| Total Technologies | $ | 12,648 | $ | 13,359 | $ | 12,995 | |||||||||||

CUSTOMERS

In 2020, 69% of our consolidated revenue was from the U.S. government, 13% was from U.S. commercial customers, 9% was from non-U.S. commercial customers and the remaining 9% was from non-U.S. government customers.

U.S. GOVERNMENT

Our primary customer is the DoD. We also contract with other U.S. government customers, including the intelligence community and the Departments of Homeland Security and Health and Human Services. Our revenue from the U.S. government was as follows:

| Year Ended December 31 | 2020 | 2019 | 2018 | ||||||||||||||

| DoD | $ | 20,840 | $ | 19,864 | $ | 17,674 | |||||||||||

| Non-DoD | 4,726 | 5,254 | 5,306 | ||||||||||||||

| Foreign Military Sales (FMS)* | 737 | 689 | 626 | ||||||||||||||

| Total U.S. government | $ | 26,303 | $ | 25,807 | $ | 23,606 | |||||||||||

| % of total revenue | 69 | % | 66 | % | 65 | % | |||||||||||

*In addition to our direct non-U.S. sales, we sell to non-U.S. governments through the FMS program. Under the FMS program, we contract with and are paid by the U.S. government, and the U.S. government assumes the risk of collection from the non-U.S. government customer.

Our U.S. government revenue is derived from fixed-price, cost-reimbursement and time-and-materials contracts. Our production contracts are primarily fixed-price. Under these contracts, we agree to perform a specific scope of work for a fixed amount. Contracts for research, engineering, repair and maintenance, and other services are typically cost-reimbursement or time-and-materials. Under cost-reimbursement contracts, the customer reimburses contract costs incurred and pays a fixed, incentive or award-based fee. These fees are determined by our ability to achieve targets set in the contract, such as cost, quality, schedule and performance. Under time-and-materials contracts, the customer pays a fixed hourly rate for direct labor and generally reimburses us for the cost of materials.

13

Of our U.S. government revenue, fixed-price contracts accounted for 59% in 2020 and 2019 and 56% in 2018; cost-reimbursement contracts accounted for 35% in 2020 and 2019 and 38% in 2018; and time-and-materials contracts accounted for 6% in 2020, 2019 and 2018.

For information on the advantages and disadvantages of each of these contract types, see Note B to the Consolidated Financial Statements in Item 8.

U.S. COMMERCIAL

Our U.S. commercial revenue was $4.9 billion in 2020, $6 billion in 2019 and $4.8 billion in 2018, which represented 13%, 15% and 13% of our consolidated revenue in each of the respective years. The majority of this revenue was for business jet aircraft and related services where our customer base consists of individuals and public and privately held companies across a wide range of industries.

NON-U.S.

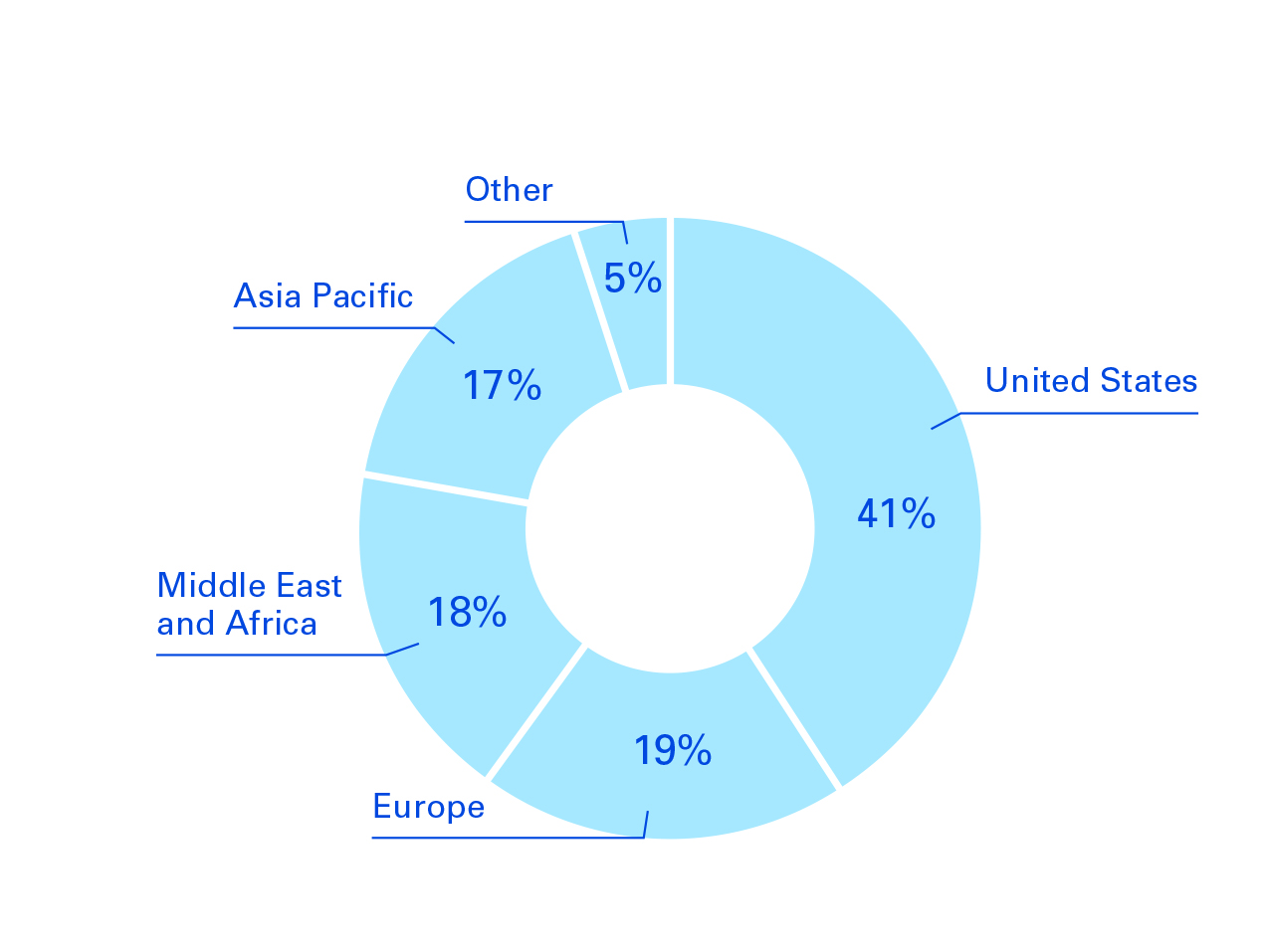

Our revenue from non-U.S. government and commercial customers was $6.7 billion in 2020, $7.6 billion in 2019 and $7.8 billion in 2018, which represented 18%, 19% and 22% of our consolidated revenue in each of the respective years.

We conduct business with customers around the world. Our non-U.S. defense subsidiaries maintain long-term relationships with their customers and have established themselves as principal regional suppliers and employers, providing a broad portfolio of products and services.

Our non-U.S. commercial revenue consists primarily of business jet aircraft exports and worldwide aircraft services. While the installed base of aircraft is concentrated in North America, orders from customers outside North America represent a significant portion of our aircraft business with approximately 60% of the Aerospace segment’s aircraft backlog on December 31, 2020.

COMPETITION

Several factors determine our ability to compete successfully in the defense and business-aviation markets. While customers’ evaluation criteria vary, the principal competitive elements include:

•the technical excellence, reliability, safety and cost competitiveness of our products and services;

•our ability to innovate and develop new products and technologies that improve mission performance and adapt to dynamic threats;

•successful program execution and on-time delivery of complex, integrated systems;

•our global footprint and accessibility to customers;

•the reputation and customer confidence derived from past performance; and

•the successful management of customer relationships.

DEFENSE MARKET COMPETITION

The U.S. government contracts with numerous domestic and non-U.S. companies for products and services. We compete against other contractors as well as smaller companies that specialize in a particular technology or capability. Outside the United States, we compete with global defense contractors’ exports and the offerings of private and state-owned defense manufacturers. Our Marine Systems segment has one primary competitor with which it also partners on the Virginia-class and Columbia-class submarine programs. Our Combat Systems segment competes with a large number of U.S. and non-U.S. businesses. Our Technologies segment competes with many companies, from large

14

government contracting and commercial technology companies to small niche competitors with specialized technologies or expertise. The operating cycle of many of our major programs can result in sustained periods of program continuity when we perform successfully.

We are involved in teaming and subcontracting relationships with some of our competitors. Competitions for major defense and other government contracting programs often require companies to form teams to bring together a spectrum of capabilities to meet the customer’s requirements. Opportunities associated with these programs include roles as the program’s integrator, overseeing and coordinating the efforts of all participants on a team, or as a provider of a specific component or subsystem.

BUSINESS JET AIRCRAFT MARKET COMPETITION

The Aerospace segment has several competitors for each of its Gulfstream products. Key competitive factors include aircraft safety, reliability and performance; comfort and in-flight productivity; service quality, global footprint and responsiveness; technological and new-product innovation; and price. We believe that Gulfstream competes effectively in all of these areas.

The Aerospace segment competes worldwide in the business jet aircraft services market primarily on the basis of quality, price and timeliness. While competition for each type of service varies somewhat, the segment faces a number of competitors of varying sizes for each of its offerings.

INTELLECTUAL PROPERTY

We develop technology, manufacturing processes and systems-integration practices. In addition to owning a large portfolio of proprietary intellectual property, we license some intellectual property rights to and from others. The U.S. government holds licenses to many of our patents developed in the performance of U.S. government contracts, and it may use or authorize others to use the inventions covered by these patents. Although these intellectual property rights are important to the operation of our business, no existing patent, license or other intellectual property right is of such importance that its loss or termination would have a material impact on our business.

HUMAN CAPITAL MANAGEMENT

Our more than 100,000 employees are a community dedicated to our ethos of transparency, trust, honesty and alignment. Every day, these four values drive how we operate our business; govern how we interact with each other and our customers, partners, and suppliers; guide the way that we treat our workforce; and determine how we connect with our communities. Our commitment to ethical business practices is outlined in our Standards of Business Ethics and Conduct, commonly known as our Blue Book. Each employee is asked to acknowledge receipt, understanding of and compliance with our standards.

Due to the highly specialized nature of our business, we are required to hire and train skilled and qualified personnel to design and build the products and perform the services required by our customers. We recognize that our success as a company depends on our ability to attract, develop and retain our workforce. As such, we promote the health, welfare and safety of our employees. Part of our responsibility includes treating all employees with dignity and respect and providing them with fair, market-based, competitive and equitable compensation. We recognize and reward the performance of

15

our employees in line with our pay-for-performance philosophy and provide a comprehensive suite of benefit options that enables our employees and their dependents to live healthy and productive lives.

Safety in our workplaces is paramount. Across our businesses, we take measures to prevent workplace hazards, encourage safe behaviors and enforce a culture of continuous improvement to ensure our processes help reduce incidents and illnesses and comply with governing health and safety laws. This was never more important than in 2020 given the challenges presented by the COVID-19 pandemic.

We are committed to promoting diversity of thought, experience, perspectives, backgrounds and capabilities to drive innovation and strengthen the solutions we deliver to our customers because we believe the results lead to a better outcome. We proudly support a culture of inclusion and encourage a work environment that respects diverse opinions, values individual skills and celebrates the unique experiences our employees bring. We are dedicated to equal employment opportunity that fosters and supports diversity in a principled, productive and inclusive work environment. We stand for basic universal human rights, including that employment must be voluntary. We track, measure and analyze our workforce trends to establish accountability for continuing to cultivate diverse and inclusive environments across our businesses and at every level of our company.

Our values motivate us to promote strong workplace practices with opportunities for development and training. Our training and development efforts focus on ensuring that the workforce is appropriately trained on critical job skills as well as leadership behaviors that are consistent with our ethos. We conduct rigorous succession planning exercises to ensure that key positions have the appropriate level of bench strength to provide for future key positions and leadership transitions. We listen to our workforce to assess areas of concern and levels of engagement.

2020 WORKFORCE STATISTICS

•Approximately 85% of our employees are based in the United States, of which roughly 70% are white, 30% are people of color and 20% are veterans of the U.S. armed forces. The remaining 15% of our workforce is based internationally in over 65 countries with the primary concentrations in North America and Europe.

•Our global workforce is approximately 77% male and 23% female with our senior leadership teams across the business represented by 75% males and 25% females. During 2020, the diversity profile of our workforce continued to improve across our businesses as we hired approximately 15,000 individuals of which 72% were male and 28% were female. For our 2020 U.S.-based hires, approximately 62% were white and 38% were people of color.

RAW MATERIALS AND SUPPLIERS

We depend on suppliers and subcontractors for raw materials, components and subsystems. Our U.S. government customer is a supplier on some of our programs. These supply networks can experience price fluctuations and capacity constraints, which can put pressure on our costs. Effective management and oversight of suppliers and subcontractors is an important element of our successful performance. We sometimes rely on only one or two sources of supply that, if disrupted, could impact our ability to meet our customer commitments. We attempt to mitigate risks with our suppliers by entering into long-term agreements and leveraging company-wide agreements to achieve economies of scale and by negotiating flexible pricing terms in our customer contracts. We have not experienced, and do not foresee,

16

significant difficulties in obtaining the materials, components or supplies necessary for our business operations.

REGULATORY MATTERS

U.S. GOVERNMENT CONTRACTS

U.S. government contracts are subject to procurement laws and regulations. The Federal Acquisition Regulation (FAR) and the Cost Accounting Standards (CAS) govern the majority of our contracts. The FAR mandates uniform policies and procedures for U.S. government acquisitions and purchased services. Also, individual agencies can have acquisition regulations that provide implementing language for the FAR or that supplement the FAR. For example, the DoD implements the FAR through the Defense Federal Acquisition Regulation Supplement (DFARS). For all federal government entities, the FAR regulates the phases of any product or service acquisition, including:

•acquisition planning;

•competition requirements;

•contractor qualifications;

•protection of source selection and supplier information; and

•acquisition procedures.

In addition, the FAR addresses the allowability of our costs, while the CAS addresses the allocation of those costs to contracts. The FAR and CAS subject us to audits and other government reviews covering issues such as cost, performance, internal controls and accounting practices relating to our contracts.

NON-U.S. REGULATORY

Our non-U.S. operations are subject to the applicable government regulations and procurement policies and practices, as well as U.S. policies and regulations. We are also subject to regulations governing investments, exchange controls, repatriation of earnings and import-export control.

BUSINESS JET AIRCRAFT

The Aerospace segment is subject to Federal Aviation Administration (FAA) regulation in the United States and other similar aviation regulatory authorities internationally, including the Civil Aviation Administration of Israel (CAAI), the European Aviation Safety Agency (EASA) and the Civil Aviation Administration of China (CAAC). For an aircraft to be manufactured and sold, the model must receive a type certificate from the appropriate aviation authority, and each aircraft must receive a certificate of airworthiness. Aircraft outfitting and completions also require approval by the appropriate aviation authority, which is often accomplished through a supplemental type certificate. Aviation authorities can require changes to a specific aircraft or model type before granting approval. Maintenance facilities and charter operations must be licensed by aviation authorities as well.

ENVIRONMENTAL

We are subject to a variety of federal, state, local and foreign environmental laws and regulations. These laws and regulations cover the discharge, treatment, storage, disposal, investigation and remediation of materials, substances and wastes identified in the laws and regulations. We are directly or indirectly involved in environmental investigations or remediation at some of our current and former facilities and at third-party sites that we do not own but where we have been designated a potentially responsible party

17

(PRP) by the U.S. Environmental Protection Agency or a state environmental agency. As a PRP, we are potentially liable to the government or third parties for the cost of remediating contamination. In cases where we have been designated a PRP, we generally seek to mitigate these environmental liabilities through available insurance coverage and by pursuing appropriate cost-recovery actions. In the unlikely event that we are required to fully fund the remediation of a site, the current statutory framework would allow us to pursue contributions from other PRPs. We regularly assess our compliance status and management of environmental matters.

Operating and maintenance costs associated with environmental compliance and management of contaminated sites are a normal, recurring part of our operations. Historically, these costs have not been material. Environmental costs are often recoverable under our contracts with the U.S. government. Based on information currently available and current U.S. government policies relating to cost recovery, we do not expect continued compliance with environmental regulations to have a material impact on our results of operations, financial condition or cash flows. For additional information relating to the impact of environmental matters, see Note O to the Consolidated Financial Statements in Item 8.

AVAILABLE INFORMATION

We file reports and other information with the Securities and Exchange Commission (SEC) pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended. These reports and information include an annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and proxy statements. Free copies of these items are made available on our website (www.gd.com) as soon as practicable. The SEC maintains a website (www.sec.gov) that contains reports, proxy and information statements, and other information.

In addition to the information contained in this Form 10-K, information about the company can be found on our website and our Investor Relations website (investorrelations.gd.com). Our Investor Relations website contains a significant amount of information about the company, including financial information, our corporate governance principles and practices, and other information for investors. We encourage investors to visit our website, as we frequently update and post new information about our company, and it is possible that this information could be deemed to be material information.

References to our website and the SEC’s website in this Form 10-K do not constitute, and should not be viewed as, incorporation by reference of the information contained on, or available through, the websites. The information should not be considered a part of this Form 10-K, unless otherwise expressly incorporated by reference.

ITEM 1A. RISK FACTORS

An investment in our common stock or debt securities is subject to risks and uncertainties. Investors should consider the following factors, in addition to the other information contained in this Annual Report on Form 10-K, before deciding whether to purchase our securities.

Investment risks can be market-wide as well as unique to a specific industry or company. The market risks faced by an investor in our stock are similar to the uncertainties faced by investors in a broad range of industries. There are some risks that apply more specifically to our business.

Our revenue is concentrated with the U.S. government. This customer relationship involves some specific risks. In addition, our sales to non-U.S. customers expose us to different financial and legal

18

risks. Despite the varying nature of our government and commercial operations and the markets they serve, each segment shares some common risks, such as the ongoing development of high-technology products and the price, availability and quality of commodities and subsystems.

Risks Relating to Our Business and Industry

The U.S. government provides a significant portion of our revenue. In 2020, approximately 70% of our consolidated revenue was from the U.S. government. Levels of U.S. defense spending are driven by threats to national security. Competing demands for federal funds can pressure various areas of spending. Decreases in U.S. government defense and other spending or changes in spending allocation or priorities could result in one or more of our programs being reduced, delayed or terminated, which could impact our financial performance.

For additional information relating to U.S. budget matters, see the Business Environment section of Management’s Discussion and Analysis of Financial Condition and Results of Operations in Item 7.

U.S. government contracts are not always fully funded at inception, and any funding is subject to disruption or delay. Our U.S. government revenue is funded by agency budgets that operate on an October-to-September fiscal year. Early each calendar year, the President of the United States presents to the Congress the budget for the upcoming fiscal year. This budget proposes funding levels for every federal agency and is the result of months of policy and program reviews throughout the executive branch. For the remainder of the year, the Appropriations and Authorization Committees of the Congress review the President’s budget proposals and establish the funding levels for the upcoming fiscal year. Once these levels are enacted into law, the Executive Office of the President administers the funds to the agencies.

There are two primary risks associated with the U.S. government budget cycle. First, the annual process may be delayed or disrupted. If the annual budget is not approved by the beginning of the government fiscal year, portions of the U.S. government can shut down or operate under a continuing resolution that maintains spending at prior-year levels, which can impact funding for our programs and timing of new awards. Second, the Congress typically appropriates funds on a fiscal-year basis, even though contract performance may extend over many years. Future revenue under existing multi-year contracts is conditioned on the continuing availability of congressional appropriations. Changes in appropriations in subsequent years may impact the funding available for these programs. Delays or changes in funding can impact the timing of available funds or lead to changes in program content.

Our U.S. government contracts are subject to termination rights by the customer. U.S. government contracts generally permit the government to terminate a contract, in whole or in part, for convenience. If a contract is terminated for convenience, a contractor usually is entitled to receive payments for its allowable costs incurred and the proportionate share of fees or earnings for the work performed. The government may also terminate a contract for default in the event of a breach by the contractor. If a contract is terminated for default, the government in most cases pays only for the work it has accepted. The termination of multiple or large programs could have a material adverse effect on our future revenue and earnings.

Government contractors operate in a highly regulated environment and are subject to audit by the U.S. government. Numerous U.S. government agencies routinely audit and review government contractors. These agencies review a contractor’s performance under its contracts and compliance with applicable laws, regulations and standards. The U.S. government also reviews the adequacy of, and compliance with, internal control systems and policies, including the contractor’s purchasing, property,

19

estimating, material, earned value management and accounting systems. In some cases, audits may result in delayed payments or contractor costs not being reimbursed or subject to repayment. If an audit or investigation were to result in allegations against a contractor of improper or illegal activities, civil or criminal penalties and administrative sanctions could result, including termination of contracts, forfeiture of profits, suspension of payments, fines and suspension or prohibition from doing business with the U.S. government. In addition, reputational harm could result if allegations of impropriety were made. In some cases, audits may result in disputes with the respective government agency that can result in negotiated settlements, arbitration or litigation. Moreover, new laws, regulations or standards, or changes to existing ones, can increase our performance and compliance costs and reduce our profitability.

Our Aerospace segment is subject to changing customer demand for business aircraft. The business jet market is driven by the demand for business-aviation products and services by corporate, individual and government customers in the United States and around the world. The Aerospace segment’s results also depend on other factors, including general economic conditions, the availability of credit, pricing pressures and trends in capital goods markets. In addition, if customers default on existing contracts and the contracts are not replaced, the segment’s anticipated revenue and profitability could be reduced materially.

Earnings and margin depend on our ability to perform on our contracts. When agreeing to contractual terms, our management team makes assumptions and projections about future conditions and events. The accounting for our contracts and programs requires assumptions and estimates about these conditions and events. These projections and estimates assess:

•the productivity and availability of labor;

•the complexity of the work to be performed;

•the cost and availability of materials and components; and

•schedule requirements.

If there is a significant change in one or more of these circumstances, estimates or assumptions, or if the risks under our contracts are not managed adequately, the profitability of contracts could be adversely affected. This could affect earnings and margin materially.

Earnings and margin depend in part on subcontractor and supplier performance. We rely on other companies to provide materials, components and subsystems for our products. Subcontractors also perform some of the services that we provide to our customers. We depend on these subcontractors and suppliers to meet our contractual obligations in full compliance with customer requirements and applicable law. Misconduct by subcontractors, such as a failure to comply with procurement regulations or engaging in unauthorized activities, may harm our future revenue and earnings. We manage our supplier base carefully to avoid or minimize customer issues. We sometimes rely on only one or two sources of supply that, if disrupted, could have an adverse effect on our ability to meet our customer commitments. Our ability to perform our obligations may be materially adversely affected if one or more of these suppliers is unable to provide the agreed-upon materials, perform the agreed-upon services in a timely and cost-effective manner, or engages in misconduct or other improper activities.

Our future success depends in part on our ability to develop new products and technologies and maintain a qualified workforce to meet the needs of our customers. Many of the products and services we provide involve sophisticated technologies and engineering, with related complex manufacturing and system-integration processes. Our customers’ requirements change and evolve regularly. Accordingly, our future performance depends in part on our ability to continue to develop,

20

manufacture and provide innovative products and services and bring those offerings to market quickly at cost-effective prices. Some new products, particularly in our Aerospace segment, must meet extensive and time-consuming regulatory requirements that are often outside our control and may result in unanticipated delays. Additionally, due to the highly specialized nature of our business, we must hire and retain the skilled and qualified personnel necessary to perform the services required by our customers. To the extent that the demand for skilled personnel exceeds supply, we could experience higher labor, recruiting or training costs in order to attract and retain such employees. If we were unable to develop new products that meet customers’ changing needs and satisfy regulatory requirements in a timely manner or successfully attract and retain qualified personnel, our future revenue and earnings may be materially adversely affected.

Risks Relating to Our International Operations

Sales and operations outside the United States are subject to different risks that may be associated with doing business in foreign countries. In some countries there is increased chance for economic, legal or political changes, and procurement procedures may be less robust or mature, which may complicate the contracting process. Our non-U.S. operations may be sensitive to and impacted by changes in a foreign government’s national policies and priorities, political leadership and budgets, which may be influenced by changes in threat environments, geopolitical uncertainties, volatility in economic conditions and other economic and political factors. Changes and developments in any of these matters or factors may occur suddenly and could impact funding for programs or delay purchasing decisions or customer payments. Non-U.S. transactions can involve increased financial and legal risks arising from foreign exchange rate variability and differing legal systems. Our non-U.S. operations are subject to U.S. and foreign laws and regulations, including laws and regulations relating to import-export controls, technology transfers, the Foreign Corrupt Practices Act (FCPA) and other anti-corruption laws, and the International Traffic in Arms Regulations (ITAR). An unfavorable event or trend in any one or more of these factors or a failure to comply with U.S. or foreign laws could result in administrative, civil or criminal liabilities, including suspension or debarment from government contracts or suspension of our export privileges, and could materially adversely affect revenue and earnings associated with our non-U.S. operations.

In addition, some non-U.S. government customers require contractors to enter into letters of credit, performance or surety bonds, bank guarantees and other similar financial arrangements. We may also be required to agree to specific in-country purchases, manufacturing agreements or financial support arrangements, known as offsets, that require us to satisfy investment or other requirements or face penalties. Offset requirements may extend over several years and could require us to team with local companies to fulfill these requirements. If we do not satisfy these financial or offset requirements, our future revenue and earnings may be materially adversely affected.

Risks Relating to Our Acquisitions and Similar Investment Activities

We have made and expect to continue to make investments, including acquisitions and joint ventures, that involve risks and uncertainties. When evaluating potential acquisitions and joint ventures, we make judgments regarding the value of business opportunities, technologies, and other assets and the risks and costs of potential liabilities based on information available to us at the time of the transaction. Whether we realize the anticipated benefits from these transactions depends on multiple factors, including our integration of the businesses involved; the performance of the underlying products, capabilities or technologies; market conditions following the acquisition; and acquired liabilities, including some that may not have been identified prior to the acquisition. These factors could materially adversely affect our financial results.

21

Changes in business conditions may cause goodwill and other intangible assets to become impaired. Goodwill represents the purchase price paid in excess of the fair value of net tangible and intangible assets acquired in a business combination. Goodwill is not amortized and remains on our balance sheet indefinitely unless there is an impairment or a sale of a portion of the business. Goodwill is subject to an impairment test on an annual basis or when circumstances indicate that the likelihood of an impairment is greater than 50%. Such circumstances include a significant adverse change in the business climate for one of our reporting units or a decision to dispose of a reporting unit or a significant portion of a reporting unit. We face some uncertainty in our business environment due to a variety of challenges, including changes in government spending. We may experience unforeseen circumstances that adversely affect the value of our goodwill or intangible assets and trigger an evaluation of the amount of the recorded goodwill and intangible assets. Future write-offs of goodwill or other intangible assets as a result of an impairment in the business could materially adversely affect our results of operations and financial condition.

Other Business and Operational Risks

Our business could be negatively impacted by cybersecurity events and other disruptions. We face various cybersecurity threats, including threats to our IT infrastructure and attempts to gain access to our proprietary or classified information, denial-of-service attacks, as well as threats to the physical security of our facilities and employees, and threats from terrorist acts. We also design and manage IT systems and products that contain IT systems for various customers. We generally face the same security threats for these systems as for our own internal systems. In addition, we face cyber threats from entities that may seek to target us through our customers, suppliers, subcontractors and other third parties with whom we do business. Accordingly, we maintain information security staff, policies and procedures for managing risk to our information systems, and conduct employee training on cybersecurity to mitigate persistent and continuously evolving cybersecurity threats. However, there can be no assurance that any such actions will be sufficient to prevent cybersecurity breaches, disruptions, unauthorized release of sensitive information or corruption of data.

We have experienced cybersecurity threats such as viruses and attacks targeting our IT systems. Such prior events have not had a material impact on our financial condition, results of operations or liquidity. However, future threats could, among other things, cause harm to our business and our reputation; disrupt our operations; expose us to potential liability, regulatory actions and loss of business; challenge our eligibility for future work on sensitive or classified systems for government customers; and impact our results of operations materially. Due to the evolving nature of these security threats, the potential impact of any future incident cannot be predicted. Our insurance coverage may not be adequate to cover all the costs related to cybersecurity attacks or disruptions resulting from such events.

Our business may continue to be negatively impacted by the Coronavirus (COVID-19) pandemic or other similar outbreaks. The COVID-19 pandemic has had, and could continue to have, a negative effect on our business, results of operations and financial condition. Effects include disruptions or restrictions on our employees’ ability to work effectively, as well as temporary closures of our facilities or the facilities of our customers or suppliers, which can affect our ability to perform on our contracts. Resulting cost increases may not be fully recoverable on our contracts or adequately covered by insurance, which could impact our profitability. In addition, the COVID-19 pandemic has resulted in a widespread health crisis that is adversely affecting the economies and financial markets of many countries, which could result in a prolonged economic downturn that may negatively affect demand for our products and services. The imposition of quarantine and travel restrictions has affected and may

22

continue to negatively affect portions of our business, particularly our Aerospace and Technologies segments. The extent to which COVID-19 continues to impact our business, results of operations and financial condition is highly uncertain and will depend on future developments. Such developments may include the geographic spread and duration of the virus, the severity of the disease and the actions that may be taken by various governmental authorities and other third parties in response to the pandemic. Other outbreaks of contagious diseases or other adverse public health developments in countries where we operate or our customers are located could similarly affect our business in the future.

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements that are based on management’s expectations, estimates, projections and assumptions. Words such as “expects,” “anticipates,” “plans,” “believes,” “scheduled,” “outlook,” “estimates,” “should” and variations of these words and similar expressions are intended to identify forward-looking statements. Examples include projections of revenue, earnings, operating margin, segment performance, cash flows, contract awards, aircraft production, deliveries and backlog. In making these statements, we rely on assumptions and analyses based on our experience and perception of historical trends, current conditions and expected future developments as well as other factors we consider appropriate under the circumstances. We believe our estimates and judgments are reasonable based on information available to us at the time. Forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, as amended. These statements are not guarantees of future performance and involve risks and uncertainties that are difficult to predict. Therefore, actual future results and trends may differ materially from what is forecast in forward-looking statements due to a variety of factors, including, without limitation, the risk factors discussed in this Form 10-K.

All forward-looking statements speak only as of the date of this report or, in the case of any document incorporated by reference, the date of that document. All subsequent written and oral forward-looking statements attributable to General Dynamics or any person acting on our behalf are qualified by the cautionary statements in this section. We do not undertake any obligation to update or publicly release any revisions to forward-looking statements to reflect events, circumstances or changes in expectations after the date of this report. These factors may be revised or supplemented in subsequent reports on SEC Forms 10-Q and 8-K.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

We operate in a number of offices, manufacturing plants, laboratories, warehouses and other facilities in the United States and abroad. We believe our facilities are adequate for our present needs and, given planned improvements and construction, expect them to remain adequate for the foreseeable future.

On December 31, 2020, our segments had material operations at the following locations:

•Aerospace – Van Nuys, California; West Palm Beach, Florida; Brunswick and Savannah, Georgia; Cahokia, Illinois; Westfield, Massachusetts; Teterboro, New Jersey; New York, New York; Tulsa,

23

Oklahoma; Dallas, Texas; Dulles, Virginia; Appleton, Wisconsin; Sydney, Australia; Beijing and Shanghai, China; Mexicali, Mexico; Singapore; Basel, Switzerland; Farnborough, United Kingdom.

•Marine Systems – San Diego, California; Groton and New London, Connecticut; Jacksonville, Florida; Honolulu, Hawaii; Bath and Brunswick, Maine; Middletown and North Kingstown, Rhode Island; Norfolk and Portsmouth, Virginia; Bremerton, Washington; Mexicali, Mexico.

•Combat Systems – Anniston, Alabama; East Camden, Arkansas; Healdsburg, California; Crawfordsville, St. Petersburg and Tallahassee, Florida; Marion, Illinois; Saco, Maine; Sterling Heights, Michigan; Lima, Ohio; Eynon and Scranton, Pennsylvania; Garland, Texas; Joint Base Lewis-McChord, Washington; Vienna, Austria; La Gardeur, London and Valleyfield, Canada; Kaiserslautern, Germany; Madrid, Sevilla and Trubia, Spain; Kreuzlingen and Tägerwilen, Switzerland; Merthyr Tydfil, United Kingdom.

•Technologies – Daleville, Alabama; Scottsdale, Arizona; Orlando, Florida; Bossier City, Louisiana; Annapolis Junction, Maryland; Dedham, Pittsfield and Taunton, Massachusetts; Bloomington, Minnesota; Rensselaer, New York; Greensboro, North Carolina; Chesapeake and Marion, Virginia; multiple locations in Northern Virginia; Ottawa, Canada; Oakdale and St. Leonards, United Kingdom.

A summary of floor space by segment on December 31, 2020, follows:

| (Square feet in millions) | Company-owned Facilities | Leased Facilities | Government-owned Facilities | Total | |||||||||||||||||||

| Aerospace | 6.6 | 8.9 | 0.5 | 16.0 | |||||||||||||||||||

| Marine Systems | 8.3 | 4.3 | — | 12.6 | |||||||||||||||||||

| Combat Systems | 6.5 | 4.6 | 5.2 | 16.3 | |||||||||||||||||||

| Technologies | 3.1 | 7.8 | 0.9 | 11.8 | |||||||||||||||||||

| Total square feet | 24.5 | 25.6 | 6.6 | 56.7 | |||||||||||||||||||

ITEM 3. LEGAL PROCEEDINGS

For information relating to legal proceedings, see Note O to the Consolidated Financial Statements in Item 8.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

24

INFORMATION ABOUT OUR EXECUTIVE OFFICERS

All of our executive officers are appointed annually. None of our executive officers were selected pursuant to any arrangement or understanding between the officer and any other person. The name, age, offices and positions of our executives held for at least the past five years as of February 9, 2021, were as follows (references are to positions with General Dynamics Corporation, unless otherwise noted):

| Name, Position and Office | Age | ||||

| Jason W. Aiken - Senior Vice President and Chief Financial Officer since January 2014; Vice President of the company and Chief Financial Officer of Gulfstream Aerospace Corporation, September 2011 - December 2013; Vice President and Controller, April 2010 - August 2011; Staff Vice President, Accounting, July 2006 - March 2010 | 48 | ||||

| Christopher J. Brady - Vice President of the company and President of General Dynamics Mission Systems since January 2019; Vice President, Engineering of General Dynamics Mission Systems, January 2015 - December 2018; Vice President, Engineering of General Dynamics C4 Systems, May 2013 - December 2014; Vice President, Assured Communications Systems of General Dynamics C4 Systems, August 2004 - May 2013 | 58 | ||||

| Mark L. Burns - Vice President of the company and President of Gulfstream Aerospace Corporation since July 2015; Vice President of the company since February 2014; President, Product Support of Gulfstream Aerospace Corporation, June 2008 - June 2015 | 61 | ||||

| Danny Deep - Vice President of the company and President of General Dynamics Land Systems since April 2020; Chief Operating Officer of General Dynamics Land Systems, September 2018 - April 2020; Vice President of General Dynamics Land Systems – Canada, January 2011 - September 2018 | 51 | ||||

| Gregory S. Gallopoulos - Senior Vice President, General Counsel and Secretary since January 2010; Vice President and Deputy General Counsel, July 2008 - January 2010; Managing Partner of Jenner & Block LLP, January 2005 - June 2008 | 61 | ||||

| M. Amy Gilliland - Senior Vice President of the company since April 2015; President of General Dynamics Information Technology since September 2017; Deputy for Operations of General Dynamics Information Technology, April 2017 - September 2017; Senior Vice President, Human Resources and Administration, April 2015 - March 2017; Vice President, Human Resources, February 2014 - March 2015; Staff Vice President, Strategic Planning, January 2013 - February 2014; Staff Vice President, Investor Relations, June 2008 - January 2013 | 46 | ||||

| Kevin M. Graney - Vice President of the company and President of Electric Boat Corporation since October 2019; Vice President of the company and President of NASSCO, January 2017 - October 2019; Vice President and General Manager of NASSCO, November 2013 - January 2017 | 56 | ||||