- GD Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

General Dynamics (GD) DEF 14ADefinitive proxy

Filed: 24 Mar 22, 3:08pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

| Filed by the Registrant |  | Filed by a Party other than the Registrant |

| Check the appropriate box: | |

| Preliminary Proxy Statement |

| Confidential, for Use of the Commission Only (as permitted by Rule 14A-6(E)(2)) |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material under §240.14a-12 |

GENERAL DYNAMICS CORPORATION

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check all boxes that apply): | |

| No fee required |

| Fee paid previously with preliminary materials |

| Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

March 24, 2022

DEAR FELLOW SHAREHOLDER: Enclosed you will find the 2022 General Dynamics Proxy Statement. We encourage you to read this proxy statement to learn more about our sound corporate governance practices, our pay-for-performance approach to executive compensation and the ways in which we have engaged with and responded to our shareholders.

| As the pandemic continued through 2021, our business units remained engaged with our customers, worked effectively with our suppliers and acted with the utmost concern for our employees. Despite the pandemic, we continued to make very good progress on our long-term investment plans. Gulfstream revealed the G800 and G400, and Electric Boat reached 60% completion on its facility modernization plan. With our ongoing focus on operating excellence, we generated cash from operations of $4.3 billion, a new record, and we achieved diluted earnings per share of $11.55, exceeding our projection. Our defense segments collectively delivered record revenue and operating earnings. We produced $3.4 billion of free cash flow,(1) an amount that exceeded our net earnings. Our backlog remained strong at $87.6 billion. With Aerospace orders topping $13.3 billion, Gulfstream had its strongest order year in over a decade.

In addition to investing in our company, we repurchased 10.3 million outstanding shares and increased our dividend by 8%, marking the 24th consecutive year of annual increases. We value our shareholders’ input. In our regular conversations with investors, we discussed company performance, sustainability, corporate governance and compensation. We strive to be responsive to our shareholders. Since my letter to you last year, we have taken substantial and concrete steps to continue to bolster our sustainability initiatives, including creating a new fully independent Sustainability Committee of the Board, issuing a new Sustainability Report and announcing a greenhouse gas reduction goal. Board Engagement and Qualifications Your Board’s diverse directors bring a wealth of knowledge, judgment and wisdom gained through leadership roles in business, government and the military. The Board benefits from its years-long track record of deliberate and thoughtful refreshment. As a result of this process, your Board comprises well-qualified business leaders, aerospace and defense industry experts, and financial and strategic advisors.

On behalf of the Board of Directors, I am pleased to invite you to the 2022 Annual Meeting of Shareholders, which we will hold as a virtual Annual Meeting. If you are unable to attend, we encourage you to vote by proxy as all shareholder votes are important. In this proxy statement, we describe the items on which you are asked to vote. We ask that you vote in accordance with the recommendations of the Board of Directors. | ||

Sincerely,

Phebe N. Novakovic |

| (1) | See Appendix A for a discussion of this non-GAAP measure. |

| GENERAL DYNAMICS / 2022 PROXY STATEMENT | 1 |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

DATE AND TIME |  VIRTUAL MEETING SITE |  WHO CAN VOTE |

Wednesday, May 4, 2022 9 a.m. Eastern Time | www.VirtualShareholderMeeting.com/GD2022

| Shareholders as of March 9, 2022, |

Proposal | Board Recommendation | Additional Information | ||

1 | Election of Directors |

| See pages 14 through 23 for more information on the nominees | |

2 | Advisory Vote on the Selection of Independent Auditors |

| See page 37 for details | |

3 | Advisory Vote to Approve Executive Compensation | �� |

| See page 39 for details |

4 | Shareholder Proposal — Independent Board Chairman |

| See pages 84 through 86 for details | |

5 | Shareholder Proposal — Human Rights Report |

| See pages 87 through 90 for details | |

HOW TO VOTE

| INTERNET Access www.ProxyVote.com and follow the instructions. | |

| Sign and date each proxy card received and return each card using the prepaid postage envelope. | |

| TELEPHONE Call 1-800-690-6903 if you are a registered holder. If you are a beneficial holder, call the phone number listed on your voter instruction form. | |

| ATTEND THE VIRTUAL MEETING To be admitted to the virtual meeting, you must register in advance by accessing www.ProxyVote.com and following the instructions by 11:59 p.m. Eastern Time on April 29, 2022. Once registered, you can access the virtual meeting at www.VirtualShareholderMeeting.com/ | |

|  | |

Shareholders will also act on all other business that properly comes before the meeting or any adjournment or postponement of the meeting.

Shareholders may raise other matters as described in the accompanying Proxy Statement.

The Board of Directors set the close of business on March 9, 2022, as the record date for determining the shareholders entitled to receive notice of, and to vote at, the Annual Meeting. It is important that your shares be represented and voted at the meeting. Please complete, sign and return a proxy card or use the telephone or internet voting systems.

A copy of the 2021 Annual Report accompanies this Notice and Proxy Statement and is available on the website listed below. These proxy materials are first being mailed or made available on the internet to shareholders on or about March 24, 2022.

By Order of the Board of Directors,

Gregory S. Gallopoulos

Secretary

Reston, Virginia

March 24, 2022

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to Be Held on The Proxy Statement and 2021 Annual Report are Available at www.gd.com/2022proxy |

| GENERAL DYNAMICS / 2022 PROXY STATEMENT | 2 |

| GENERAL DYNAMICS / 2022 PROXY STATEMENT | 3 |

This summary highlights selected information that is provided in more detail throughout this Proxy Statement. This summary does not contain all the information you should consider before voting. You should read the full Proxy Statement before casting your vote.

Voting Matters and Board Recommendations

At this year’s Annual Meeting, we are asking shareholders of our Common Stock, par value $1.00 per share (Common Stock) to vote on the following matters:

PROPOSAL 1

ELECTION OF DIRECTORS |

|

|

✔ The Board recommends a vote FOR all director nominees. |

| See page 14 |

|

|

|

PROPOSAL 2

ADVISORY VOTE ON THE SELECTION OF INDEPENDENT AUDITORS |

|

|

✔ The Board recommends a vote FOR this proposal. |

| See page 37 |

|

|

|

PROPOSAL 3

ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION |

|

|

✔ The Board recommends a vote FOR this proposal. |

| See page 39 |

|

|

|

PROPOSAL 4

SHAREHOLDER PROPOSAL — INDEPENDENT BOARD CHAIRMAN |

|

|

✘ The Board recommends a vote AGAINST this proposal. |

| See page 84 |

|

|

|

PROPOSAL 5

SHAREHOLDER PROPOSAL — HUMAN RIGHTS REPORT |

|

|

✘ The Board recommends a vote AGAINST this proposal. |

| See page 87 |

| GENERAL DYNAMICS / 2022 PROXY STATEMENT | 4 |

Overview of Our Business and Strategy

General Dynamics is a global aerospace and defense company. From Gulfstream business jets and nuclear-powered submarines to combat vehicles, IT services, and communications and networking systems, our customers depend on us to produce the world’s most technologically advanced products and services to ensure their safety and security. We offer these products and services through our 10 business units, which are organized into four operating segments: Aerospace, Marine Systems, Combat Systems and Technologies.

To optimize market focus, customer intimacy, agility and operating expertise, each business unit is responsible for the development and execution of its strategy and operating results. This structure allows for a lean corporate function, which sets the overall strategy and governance for the company and is responsible for allocating and deploying capital.

Our business units seek to deliver superior operating results by building industry-leading franchises. To achieve this goal, we invest in advanced technologies, pursue a culture of continuous improvement, and strive to be the low-cost, high-quality provider in each of our markets. The result is long-term value creation measured by strong earnings and cash flow and an attractive return on capital.

This model, which has served us well for many years, has been vital to our ability to navigate the challenges brought on by the COVID-19 pandemic.

As the pandemic has continued, our business units have evolved their processes and procedures to stay engaged with customers, work effectively with our suppliers, and act with the utmost concern for our employees. In addition, we made very good progress on our long-term investment plans. Gulfstream revealed the G800 and G400 aircraft, extending the top of its product line and expanding the market for the smaller end of its portfolio, and Electric Boat reached 60% completion on its facility modernization plan. With our ongoing focus on operating excellence, we generated record-high cash from operations of $4.3 billion.

$38.5 billion | $11.55 | 11.9% | $1.19 per share |

REVENUE | DILUTED EARNINGS PER SHARE (EPS) | RETURN ON INVESTED CAPITAL (ROIC)(1) | QUARTERLY DIVIDEND |

A 1.4% increase despite some ongoing COVID-related disruptions | Exceeded our EPS projections for the year | Improvement due to lower average invested capital and higher net operating profit after taxes | 24th consecutive year |

$3.3 billion | 10.8% | $4.3 billion | $87.6 billion |

NET EARNINGS | OPERATING MARGIN | CASH FROM OPERATING ACTIVITIES | BACKLOG |

Fourth-straight year of net earnings in excess of $3.0 billion | Delivered solid double-digit performance | Highest-ever cash from operations; generated free cash flow (FCF) of $3.4 billion, or 104% of net earnings | Aerospace segment backlog achieved a nine-year high |

See Appendix A for a discussion of this non-GAAP measure.

| GENERAL DYNAMICS / 2022 PROXY STATEMENT | 5 |

2022 Board of Director Nominees

Name and Primary Occupation | Independent | Director Since | Other Public Company Boards | Committee Membership | |||||

AC | CC | FBPC | NCGC | SC | |||||

| JAMES S. CROWN Lead Director Chairman and CEO, Henry Crown and Company | ✔

| 1987 | 1 |  |  |

|  |  |

| RUDY F. DELEON Senior Fellow, Center for American Progress | ✔

| 2014 |

|

|  |  |

|  |

| CECIL D. HANEY Retired Admiral, U.S. Navy | ✔

| 2019 | 1 |  |

|

|  |

|

| MARK M. MALCOLM Former President and CEO, Tower International | ✔

| 2015 |

|  |

|  |

|

|

| JAMES N. MATTIS Former United States Secretary of Defense and Retired General, U.S. Marine Corps | ✔

| 2019 |

|  |

|

|  |

|

| PHEBE N. NOVAKOVIC Chairman and CEO, General Dynamics |

| 2012 | 1 |

|

|

|

|

|

| C. HOWARD NYE Chairman, President and CEO, Martin Marietta Materials | ✔

| 2018 | 1 |  |  |

|

|

|

| CATHERINE B. REYNOLDS Chairman and CEO, EduCap | ✔

| 2017 | 1 |  |

|  |

|  |

| LAURA J. SCHUMACHER Vice Chairman, External Affairs | ✔

| 2014 | 1 |

|  |

|  |

|

| ROBERT K. STEEL Partner and Chairman, Perella Weinberg Partners | ✔

| 2021 | 1 |

|  |  |  |  |

| JOHN G. STRATTON Executive Chairman, Frontier Communications | ✔

| 2020 | 2 |  |

|  |

|

|

| PETER A. WALL Retired General, British Army | ✔

| 2016 |

|

|

|  |  |  |

|

| AC = Audit Committee CC = Compensation Committee FBPC = Finance and Benefit Plans Committee NCGC = Nominating and Corporate Governance Committee SC = Sustainability Committee | |||||||

| GENERAL DYNAMICS / 2022 PROXY STATEMENT | 6 |

Composition of the General Dynamics Board

(As Nominated for Election at the Annual Meeting)

|  | ||

|  |  | |

Nominees | Nominees | Nominees are Ethnic or Racial Minorities

1 Black/African-American 1 Hispanic/Latino | |

| GENERAL DYNAMICS / 2022 PROXY STATEMENT | 7 |

A Commitment to Sound Corporate Governance

Our Board of Directors believes that a commitment to good corporate governance enhances shareholder value. Sound corporate governance starts with a strong value system, and the value system starts in the boardroom. The General Dynamics Ethos — our distinguishing moral nature — is rooted in four overarching values.

Drive how we operate our business.

Govern how we interact with each other and our customers, partners and suppliers.

Guide the way we treat our workforce.

Determine how we connect with our communities and impact our environment.

By adhering to our Ethos, we ensure that we continue to be good stewards of the investments in us by our shareholders, customers, employees and communities.

| GENERAL DYNAMICS / 2022 PROXY STATEMENT | 8 |

Corporate Governance Highlights

Governance Practice |

|

| For more information |

Stock Ownership | • Market-leading stock ownership requirements provide that executive officers must hold shares of our Common Stock worth eight to 15 times base salary. Director ownership guidelines provide that directors should hold shares having a value of at least eight times the annual retainer. |

| P. 67 |

• We prohibit hedging and pledging of our Common Stock by directors and executive officers. | P. 68 | ||

Board Structure and Governance | • Thoughtful Board refreshment supports Board diversity and a balanced mix of new and more seasoned directors with an average tenure of 7.5 years. |

| P. 7 |

• An independent Lead Director with a robust set of responsibilities is elected annually | P. 25 | ||

• Eleven of our 12 director nominees are independent. All of our Board committees are chaired by independent directors and are 100% independent. | P. 23 | ||

• Our independent directors meet in executive session, without management | P. 30 | ||

• Our directors attended 100% of Board and committee meetings in 2021. | P. 30 | ||

• Diligent Board oversight of risk is a cornerstone of our risk management program. | P. 28 | ||

• The Board and each committee conduct annual self-assessments of their performance and effectiveness. | P. 33 | ||

• Our related person transactions policy ensures appropriate Board review of related person transactions. | P. 34 | ||

• Our directors are elected annually based on a majority voting standard for | P. 93; Bylaws* | ||

• We prevent overboarding by providing that directors may not serve on more than four other public company boards, and Audit Committee members may not serve on the audit committees of more than two other public companies. | CGG* | ||

Corporate Responsibility | • In 2021, our board established a fully-independent Sustainability Committee to oversee corporate practices relating to corporate sustainability, including environmental, health and safety, human rights, and social matters. |

| SC Charter* |

• In March 2022, we released an updated and expanded Corporate Sustainability Report that discusses our Ethos, our commitment to our stakeholders and communities and our commitment to diversity and inclusion. | CSR** | ||

• Our ethics program includes strong Codes of Ethics for all employees globally, with specific codes for our directors and financial professionals. | GD Website** | ||

• Disclosure of our corporate political contributions and our trade association dues describes the process and oversight we employ in each area. | GD Website *** | ||

• We have a strong corporate commitment to respecting the dignity, human rights and autonomy of others. | CSR**; GD Website** | ||

Shareholder Rights | • Our proxy access bylaws enable shareholders meeting the requirements in our bylaws to nominate director candidates and have those nominees included in our proxy statement. |

| Bylaws* |

• We do not have a shareholder rights plan, or poison pill. Any such future plan would require shareholder approval. | CGG* | ||

• Our Bylaws do not restrict our shareholders’ right under Delaware law to act by written consent. | Bylaws* | ||

• Our shareholders have the right to request a special meeting of shareholders. | Bylaws* | ||

• Voting rights are proportional to economic interests. One share equals one vote. | Certificate of Incorporation* | ||

* Our Corporate Governance Guidelines (CGG), Certificate of Incorporation, Bylaws and Sustainability Committee Charter (SC Charter) are available on our website at www.gd.com/CorporateGovernance. ** Our Standards of Business Ethics and Conduct, Codes of Ethics, Corporate Sustainability Report (CSR) and Human Rights Policy are available on our website at www.gd.com/Responsibility. *** See www.gd.com/AdditionalDisclosure. | |||

| GENERAL DYNAMICS / 2022 PROXY STATEMENT | 9 |

In 2021, we reached out to shareholders representing approximately: | KEY ITEMS DISCUSSED WITH SHAREHOLDERS IN 2021 | |

| Board of Directors and Corporate Governance | • Board refreshment and succession planning • Director diversity • Shareholder rights |

Executive Compensation | • Program structure, including role of equity compensation • Pay-for-performance alignment • Strong shareholder support in 2021 say-on-pay vote | |

Corporate Responsibility and Sustainability

| • Board oversight, including Sustainability Committee • Greenhouse gas (GHG) emissions target and climate transition • Human capital management • Diversity and inclusion initiatives | |

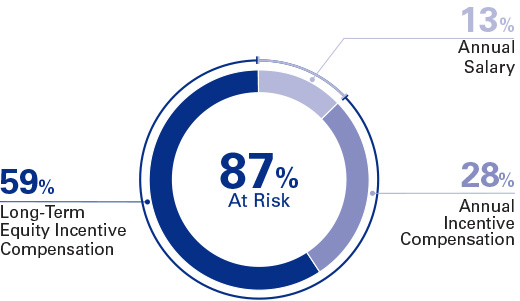

Executive Compensation Highlights

Components of 2021 Compensation Program

|

|

| |

| CEO | Other NEOs | Description |

| Annual Base Salary | ||

|  | • Base Salary is targeted to be a market competitive rate and also reflects the experience, potential and performance track-record of executives. | |

Annual Incentive Compensation | |||

|  | • Targeted around the median of our peers, the annual incentive is designed to motivate and align management with current year business goals and varies based on achievements. The incentive includes a balance of financial and strategic and operational measures to align with annual key priorities. • Incorporates financial metrics — EPS (25%), FCF (25%) and operating margin (20%) — as well as strategic and operational goals (30%). • Strategic and operational performance measures include but are not limited to: financial performance improvements, prudent allocation of capital, environmental, social, and governance (ESG) management, debt management, segment performance, cost reductions, leadership and other significant factors not contemplated at the start of the year. | |

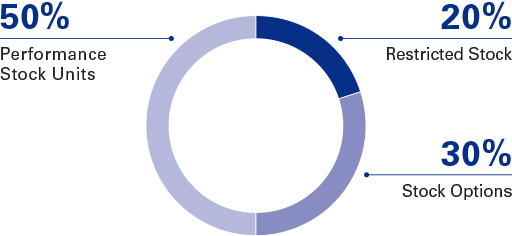

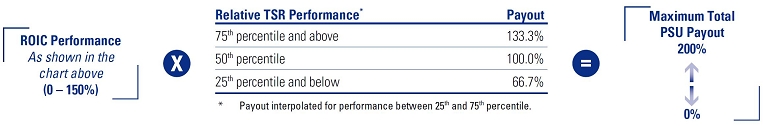

| Long-Term Incentive (LTI) Compensation | ||

|  | • LTI awards are targeted around a market competitive range of our peers and also reflect the experience, potential and performance track-record of executives. LTI awards have multi-year performance metrics designed to align NEOs with the objectives of our company and shareholders. • A mix of elements serves to: - Focus leaders on specific long-term performance results; - Provide a balance of rewards focused on different objectives over varying time periods; - Reward management for improvements in shareholder value; - Retain key employees through longer-term vesting and performance periods; and - Provide an opportunity for wealth accumulation over time that is consistent with the shareholder experience. | |

50%

30%

20% | |||

| GENERAL DYNAMICS / 2022 PROXY STATEMENT | 10 |

Our Board and management take seriously our commitment to corporate responsibility, and we implement our ESG program in a way that benefits our stakeholders, including investors, customers, employees, suppliers and communities. This imperative is rooted in our Ethos — our defining moral character as a company and the standard to which we hold ourselves.

Ongoing engagement with stakeholders has been an integral part of building and evolving our sustainability program. We remain committed to reducing our global environmental impact, including our carbon footprint; protecting and promoting human rights; increasing the diversity and inclusiveness of our workforce; supporting the health, welfare and safety of our employees; and being transparent on these issues. As with all aspects of our business, we strive for constant improvement. Our sustainability initiatives are no exception.

As with everything we do, our oversight of ESG topics starts with our Board of Directors. The Board continually focuses on material risks and opportunities, including those related to sustainability and ESG matters, as it discharges its duties. This year the Board established a fully-independent, standing Sustainability Committee to increase our focus on these important topics. The Sustainability Committee assists the Board in overseeing corporate practices relating to sustainability, including environmental, health and safety, human rights, and social matters. The Sustainability Committee is chaired by Robert K. Steel, who has unique experience and brings key insights into sustainability issues.

Oversight of material risks is among the most critical functions of our Board. The Board has long-established governance structures designed to assure that potentially material risks, including those attendant to sustainability issues, are adequately identified and escalated. Pursuant to these structures, senior management, as part of its day-to-day management of the business, identifies and evaluates the materiality of ESG issues and, where appropriate, escalates these issues within our governance structure. In addition, applicable policies are subject to our rigorous internal audit program, which reports directly to the Board’s Audit Committee.

We understand the value of engaging stakeholders and providing robust disclosures on how General Dynamics’ Board and management identify and address ESG risks. In March, we published an updated and expanded Corporate Sustainability Report for 2021, which follows Sustainability Accounting Standards Board (SASB) disclosure standards. Also in 2021, we redesigned and made more information available on our website located at www.gd.com/responsibility. Furthermore, we have increased our discussion of sustainability and its attendant risks and opportunities in our engagement with shareholders and other stakeholders. We view engagement and disclosure as areas of continuous improvement and will seek new ways to enhance these efforts.

| GENERAL DYNAMICS / 2022 PROXY STATEMENT | 11 |

Our approach to sustainability matters is guided by strong corporate governance processes and characterized by a culture of transparency.

| GOVERNANCE Our Board, as a whole and through its Sustainability Committee, maintains oversight over our sustainability practices and is committed to continuous improvement. |

|  | TRANSPARENCY We publish key ESG information, including our comprehensive Corporate Sustainability Report that follows the SASB framework, our EEO-1 workforce diversity data and our CDP disclosure of climate-related data. This information is available on our website. |

Our governance processes described above ensure that our business decisions recognize the economic, environmental and social considerations in our operational strategy. Some of the sustainability areas on which the Board and management focus considerable attention are the environmental impacts of our operations; human capital management, including diversity and inclusion; and human rights and the end-use of our products.

| ENVIRONMENT As a company with multiple business lines that include heavy manufacturing, we recognize that our actions have an impact on our planet. In keeping with our commitment to environmental stewardship, we adopted a company-wide target to reduce our GHG emissions by 40% by 2034 compared to our 2019 emissions. |

|  | HUMAN CAPITAL MANAGEMENT People are the heart of our company. We are committed to the safety, health and well-being of our employees, including fair compensation for the work they perform, so that they can remain focused on their mission. |

| ||||

| HUMAN RIGHTS We recognize the fundamental human dignity of all people. As a company with operations and suppliers around the world, we appreciate the importance of ensuring that we respect basic human rights in our business activities. |

|  | DIVERSITY AND INCLUSION We believe that a diverse workplace yields better ideas and outcomes. We are committed to promoting a workforce that reflects a rich tapestry of different backgrounds, experiences and perspectives, where all are welcomed. |

Our approach to sustainability is grounded in our corporate Ethos, which compels responsible business practices, transparency of our actions and accountability to our commitments. Our Ethos ensures that we behave according to our shared values and use those values to guide our every endeavor. This moral character not only unifies our standards and commitment, but also compels us to make General Dynamics sustainable for our shareholders, customers, employees and communities, both local and global.

| GENERAL DYNAMICS / 2022 PROXY STATEMENT | 12 |

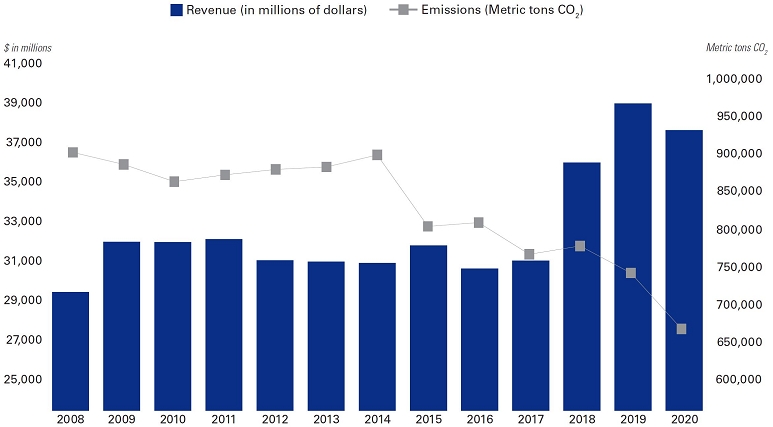

Like many of our investors, employees and community members, we are committed to minimizing the impact our business has on the environment. This is a priority across all levels of our company. We are actively instituting initiatives across the company to improve our environmental performance and reduce our global carbon footprint. We are also committed to transparency in this area. In 2021, we received a CDP score of A-. Our CO2 emissions from 2008 through 2020 declined 23%, even as our revenue increased 29%, resulting in a 40% decrease in our CO2 emissions per dollar of revenue.

GHG Emissions Target. Continuing our efforts, we have adopted a science-based, company-wide target to reduce GHG emissions by 40% by 2034 compared to our 2019 emissions. This target is consistent with the international ambition to limit the global temperature increase to well below 2 degrees Celsius.

| GENERAL DYNAMICS / 2022 PROXY STATEMENT | 13 |

| PROPOSAL 1 |

Election of Directors

Accomplished slate of nominees, with diversity of thought, experience and skills beneficial to our company

All nominees are independent, except the chairman

Average director tenure of 7.5 years

| YOUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR ALL DIRECTOR NOMINEES. |

Directors are elected at each Annual Meeting of Shareholders and hold office for one-year terms or until successors are elected and qualified. The Nominating and Corporate Governance Committee leads consideration of director nominees from various sources and identifies nominees with the primary goal of ensuring the Board collectively serves the interests of shareholders.

NOMINEES ARE THOROUGHLY EVALUATED TO ENSURE A BALANCED AND EFFECTIVE BOARD

Ability to devote sufficient |

|  Absence of conflicts |

|  Background and |

|  Diversity of key skills |

|

|  Ethics |

|  Gender and racial / |

|  For Incumbents: Performance, |

|

|

Potential Board candidates are evaluated in the context of the current Board composition to ensure diversity of backgrounds, talent, skills and expertise. This ensures that our directors bring a broad perspective to the company on a range of important issues.

| GENERAL DYNAMICS / 2022 PROXY STATEMENT | 14 |

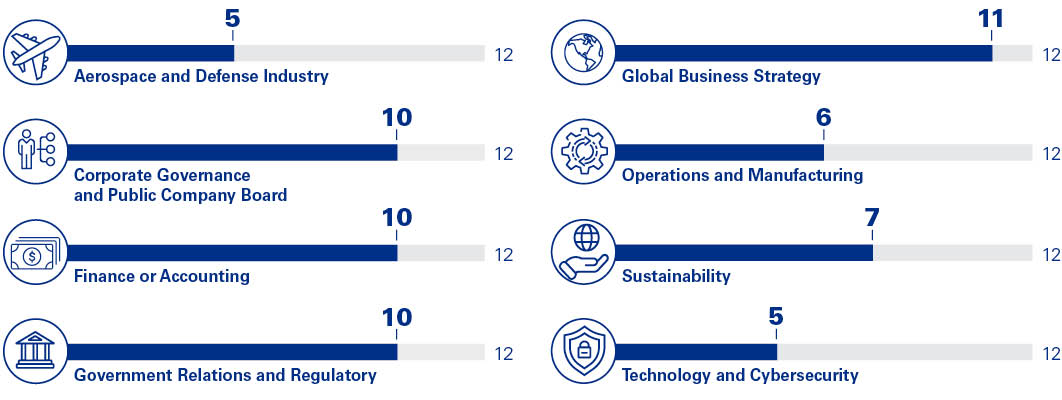

In considering Board nominees, the Nominating and Corporate Governance Committee considers each individual’s background and personal and professional experiences in addition to general qualifications. Nominees are evaluated in the context of the Board as a whole, with a focus on achieving an appropriate mix of skills needed to lead the company at the Board level. The committee regularly assesses and communicates with the Board about the current and future skills and backgrounds to ensure the Board maintains an appropriate mix. These skills are reflected in the following table. Each nominee also possesses additional skills and experience that are not highlighted among those listed below.

|

| Importance to General Dynamics |  |  |  |  |  |  |  |  |  |  |  |  |

| Aerospace and Defense Industry | Supports oversight of the company’s business performance and strategic developments in our industry |

|  |  |

|  |  |

|

|

|

|

|  |

| Corporate Governance and Public Company Board | Provides the background and knowledge necessary to provide effective oversight and governance |  |  |  |  |

|  |  |  |  |  |  |

|

| Finance or Accounting | Enables in-depth analysis of our financial statements and understanding of our capital structure, financial transactions |  |

|  |  |  |  |  |  |  |  |  |

|

| Government Relations and Regulatory | Critical for an understanding of |

|  |  |

|  |  |  |  |  |  |  |  |

| Global Business and Strategy | Important for oversight of a complex organization with operations worldwide |  |  |

|  |  |  |  |  |  |  |  |  |

| Operations and Manufacturing | Necessary in overseeing a sustainable, complex, global manufacturing company |

|

|  |  |  |  |  |

|

|

|

|  |

| Sustainability | Supports oversight of environmental, human capital, human rights and social matters |  |  |

|

|  |

|  |  |

|  |

|  |

| Technology and Cybersecurity | Supports our businesses in navigating the rapidly changing landscape for technology and cybersecurity |

|

|  |

|  |

|

|

|  |

|  |  |

| GENERAL DYNAMICS / 2022 PROXY STATEMENT | 15 |

In order to sustain a global business, we must bring together a group of people with a vision for the future and diversity of thought. We must have leadership, at both the executive and Board levels, to develop and execute our business objectives better than our competition. At the heart of our company are diverse executives, managers and employees worldwide who rely on their intimate knowledge of customer requirements and a unique blend of skills and innovation to develop and deliver the best possible products and services.

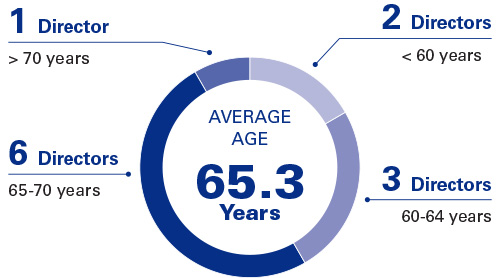

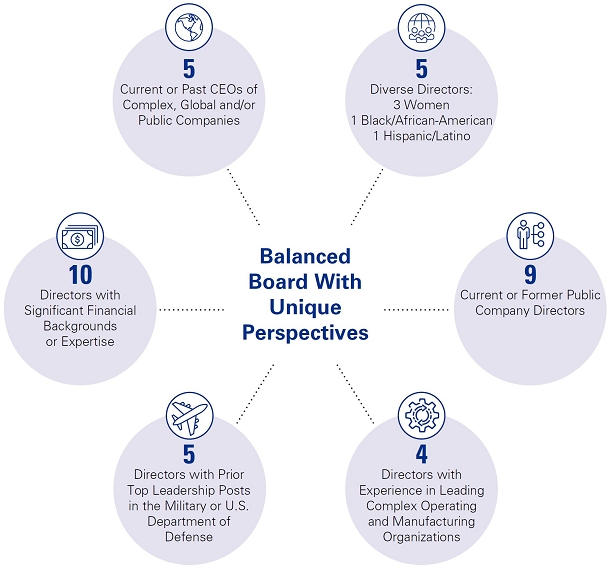

Highlights of the composition of the Board of Directors, as nominated, include:

Consistent with our director nominee evaluation criterion that each nominee must have the ability to devote sufficient time and attention to Board responsibilities, our directors may not serve on more than four other public company boards, and Audit Committee members may not serve on the audit committees of more than two other public companies.

Directors typically may not stand for election after reaching the age of 72. If the Nominating and Corporate Governance Committee and two-thirds of the directors then in office determine that having a particular person on the Board would provide a significant benefit to the company, that individual may stand for election after reaching the age of 72. Our Bylaws prohibit directors from standing for election after reaching the age of 75.

| GENERAL DYNAMICS / 2022 PROXY STATEMENT | 16 |

The following 12 nominees are standing for election to the Board of Directors at the Annual Meeting. If any nominee withdraws or for any reason is unable to serve as a director, your proxy will be voted for any remaining nominees (except as otherwise indicated in your proxy) and any replacement nominee designated by the Nominating and Corporate Governance Committee of the Board of Directors.

Age: 68 Director since: INDEPENDENT Committees: | JAMES S. CROWN — Lead Director | ||

BACKGROUND | KEY ATTRIBUTES/SKILLS/EXPERIENCE | ||

• Lead Director since May 2010 • Chairman and Chief Executive Officer of Henry Crown and Company since 2018; President of Henry Crown and Company, 2002 to 2018; Vice President of Henry Crown and Company, 1985 to 2002 • Mr. Crown currently serves as a director of J.P. Morgan Chase & Co. | As the longest-serving member of our Board and a significant shareholder, Mr. Crown has an abundance of knowledge regarding General Dynamics and our history. As chairman and chief executive officer of Henry Crown and Company, a private investment firm with diversified interests, Mr. Crown has broad experience in business management and capital deployment strategies. His many years of service as a director of our company and other large public companies provide him with a deep understanding of the roles and responsibilities of a board of a public company. | ||

• Audit • Compensation • Nominating and Corporate Governance (Chair) • Sustainability | |||

Age: 69 Director since: INDEPENDENT Committees: | RUDY F. DELEON | ||

BACKGROUND | KEY ATTRIBUTES/SKILLS/EXPERIENCE | ||

• Senior Fellow with the Center for American Progress since 2007 • Senior Vice President of The Boeing Company, 2001 to 2006 • Deputy Secretary of Defense, 2000 to 2001; Undersecretary of Defense for Personnel and Readiness, 1997 to 2000 • Undersecretary of the U.S. Air Force, 1994 to 1997. | Mr. deLeon’s experience as the second-highest ranking civilian official in the U.S. Department of Defense and as a foreign policy and military advisor gives him a keen understanding of the complexities of the U.S. military and the defense industry. His experience in government, combined with his leadership at The Boeing Company as a senior vice president leading all U.S. federal, state and local government liaison operations, provides him with a deep understanding of the aerospace and defense industry, enabling him to serve General Dynamics with valuable perspectives on the business. | ||

• Compensation • Finance and Benefit Plans (Chair) • Sustainability | |||

| GENERAL DYNAMICS / 2022 PROXY STATEMENT | 17 |

Age: 66 Director since: INDEPENDENT Committees: | CECIL D. HANEY | ||

BACKGROUND | KEY ATTRIBUTES/SKILLS/EXPERIENCE | ||

• Retired Admiral, U.S. Navy; Commander, U.S. Strategic Command, 2013 to 2016; Commander, U.S. Pacific Fleet, 2012 to 2013 • Mr. Haney currently serves as a director of Tenet Healthcare Corporation. | Prior to retiring from the U.S. Navy at the rank of Admiral, Mr. Haney served as Commander of the U.S. Strategic Command and Commander of the U.S. Pacific Fleet. His leadership positions, particularly with U.S. Strategic Command, required extensive knowledge about the role of advanced technologies and cybersecurity in the national security of the United States. During his service, Mr. Haney also gained broad global experience in managing complex operational and budgetary issues. His nearly four-decade career with the U.S. Navy gives him valuable insight into key aspects of the defense industry and national security priorities. Mr. Haney’s engineering and national security educational backgrounds, together with his extensive experience with advanced technologies and cyber matters, position him as a valuable advisor to our businesses. | ||

• Audit • Nominating and Corporate Governance | |||

Age: 68 Director since: INDEPENDENT Committees: | MARK M. MALCOLM | ||

BACKGROUND | KEY ATTRIBUTES/SKILLS/EXPERIENCE | ||

• President and Chief Executive Officer of Tower International, Inc., 2007 to 2016 • Senior Advisor, Cerberus Capital Management, 2006 to 2007 • Executive Vice President and Controller of Ford Motor Credit, 2004 to 2005; Director of Finance and Strategy, Global Purchasing, of Ford Motor Company, 2002 to 2004 • Mr. Malcolm served as a director of Tower International, Inc., then a public company, within the past five years. | Mr. Malcolm’s senior executive positions at Tower International and Ford provide him with critical knowledge of the management, financial and operational requirements of a large company. In these positions, Mr. Malcolm gained extensive experience in dealing with accounting principles and financial reporting, evaluating financial results and the financial reporting process of a public company. Mr. Malcolm brings to the Board a broad knowledge of the complex business issues facing a public company in areas such as risk management, global supply chain management and corporate governance. Based on his experience, the Board has determined that Mr. Malcolm is an Audit Committee Financial Expert. | ||

• Audit (Chair) • Finance and Benefit Plans | |||

| GENERAL DYNAMICS / 2022 PROXY STATEMENT | 18 |

Age: 71 Director since: INDEPENDENT Committees: | JAMES N. MATTIS | ||

BACKGROUND | KEY ATTRIBUTES/SKILLS/EXPERIENCE | ||

• Senior Counselor, The Cohen Group since 2019 • United States Secretary of Defense, 2017 to 2019 • Retired General, U.S. Marine Corps; Commander, United States Central Command, 2010 to 2013; Commander, U.S. Joint Forces Command, 2007 to 2010; NATO Supreme Allied Commander Transformation, 2007 to 2009 • Mr. Mattis previously served as a director of the company from August 2013 to January 2017. | Mr. Mattis served as the United States Secretary of Defense, after having had a distinguished career in the U.S. Marine Corps. He served as Commander, U.S. Central Command and Commander, U.S. Joint Forces as well as NATO Supreme Allied Commander Transformation. Mr. Mattis’ unique perspective and experiences with U.S. and foreign military strategy and operations, including NATO operations, provide him with valuable insight into international and government affairs and the global defense industry. Mr. Mattis’ leadership positions also required extensive understanding of advanced technologies and cybersecurity. His demonstrated leadership and strategic skills make him well-equipped to advise on strategic opportunities and risks associated with our aerospace and defense businesses. | ||

• Audit • Nominating and Corporate Governance | |||

Age: 64 Director since: Committees: | PHEBE N. NOVAKOVIC | ||

BACKGROUND | KEY ATTRIBUTES/SKILLS/EXPERIENCE | ||

• Chairman and Chief Executive Officer of General Dynamics since January 2013; President and Chief Operating Officer, May 2012 to December 2012; Executive Vice President, Marine Systems, May 2010 to May 2012; Senior Vice President, Planning and Development, July 2005 to May 2010; Vice President, Strategic Planning, October 2002 to July 2005 • Ms. Novakovic currently serves as a director of J.P. Morgan Chase & Co. She served as a director of Abbott Laboratories within the past five years. | Ms. Novakovic’s service as a senior officer of General Dynamics since 2002 makes her a valuable and trusted leader. Through her roles as chairman and chief executive officer, president and chief operating officer, and executive vice president, Marine Systems, she has developed a deep understanding of the company’s business operations, growth opportunities, risks and challenges. As senior vice president, planning and development, she gained a strong understanding of our core customers and the global marketplace in which we operate. Ms. Novakovic’s current service as a public company director provides her with a valuable perspective on corporate governance matters and the roles and responsibilities of a public company board. | ||

• None | |||

| GENERAL DYNAMICS / 2022 PROXY STATEMENT | 19 |

Age: 59 Director since: INDEPENDENT Committees: | C. HOWARD NYE | ||

BACKGROUND | KEY ATTRIBUTES/SKILLS/EXPERIENCE | ||

• Chairman of Martin Marietta Materials, Inc. since 2014 and President and CEO since 2010; President and Chief Operating Officer, 2006 to 2009 • Executive Vice President of Hanson PLC’s North American building materials business, 2003 to 2006 • Mr. Nye currently serves as Chairman of the Martin Marietta Materials, Inc. Board of Directors. He served as a director of Cree, Inc. within the past five years. | Mr. Nye’s roles with Martin Marietta Materials, a leading supplier of aggregates and heavy building materials, position him well to advise our businesses on a range of matters in the areas of engineering, manufacturing, supply chain, mergers and acquisitions, sustainability, regulation and governance matters. Mr. Nye also brings extensive risk management experience, particularly in the area of employee health and safety. His strong business and legal background, together with service on public company boards provide him with a deep understanding of the challenges and risks facing large public companies and their boards. Based on Mr. Nye’s experience with public company financial statements and reporting, the Board has determined that Mr. Nye is an Audit Committee Financial Expert. | ||

• Audit • Compensation | |||

Age: 64 Director since: INDEPENDENT Committees: | CATHERINE B. REYNOLDS | ||

BACKGROUND | KEY ATTRIBUTES/SKILLS/EXPERIENCE | ||

• Chairman and Chief Executive Officer of EduCap, Inc. since 1989 • Co-founder of VitaKey Inc.; Chief Executive Officer since 2021 • Chairman and Chief Executive Officer of The Catherine B. Reynolds Foundation since 2000 • Founder and Chairman of Servus Financial Corporation, 1993 to 2000 • Ms. Reynolds currently serves as a director of Lindblad Expeditions Holdings, Inc. | Ms. Reynolds’ sound business experience and financial background, including her innovative development of the first asset-backed securitization structure for consumer education loans, enable her to provide valuable financial and business advice to the company. Ms. Reynolds is a certified public accountant and has served on the audit and compensation committees of a public company. Through her senior executive and board positions with EduCap and Servus Financial, she has developed critical knowledge of the financial and risk management challenges that companies face. Ms. Reynolds also has gained valuable insight into public company governance and operations through her prior and current service on public company boards. The Board has determined that Ms. Reynolds’ extensive financial and accounting background qualifies her as an Audit Committee Financial Expert. | ||

• Audit • Finance and Benefit Plans • Sustainability | |||

| GENERAL DYNAMICS / 2022 PROXY STATEMENT | 20 |

Age: 58 Director since: INDEPENDENT Committees: | LAURA J. SCHUMACHER | ||

BACKGROUND | KEY ATTRIBUTES/SKILLS/EXPERIENCE | ||

• Vice Chairman, External Affairs and Chief Legal Officer of Abbvie Inc. since December 2018; Executive Vice President, External Affairs and General Counsel of Abbvie Inc., 2013 to December 2018 • Executive Vice President, General Counsel and Secretary of Abbott Laboratories, 2007 to 2012 • Ms. Schumacher currently serves as a director of CrowdStrike Holdings, Inc. | Ms. Schumacher’s positions as chief legal officer of two large public companies provide her with extensive experience with respect to risk management and a deep knowledge of the types of legal and regulatory risks facing public companies. Her experience as a senior executive in the healthcare industry has provided her with a keen awareness of strategic considerations and challenges associated with a complex, highly regulated industry. Additionally, through her key role in the strategic consideration and execution of the separation of Abbvie from Abbott Laboratories, Ms. Schumacher brings an important understanding of and insight into corporate governance matters and complex corporate transactions. | ||

• Compensation (Chair) • Nominating and Corporate Governance | |||

Age: 70 Director since: INDEPENDENT Committees: | ROBERT K. STEEL | ||

BACKGROUND | KEY ATTRIBUTES/SKILLS/EXPERIENCE | ||

• Vice Chairman, Perella Weinberg Partners, since 2021; Chairman of Advisory, 2014 to 2021; Chief Executive Officer, 2014 to 2019; Partner since 2014 • Deputy Mayor for Economic Development, New York City, 2010 to 2013 • CEO and President of Wachovia Corporation, 2008 to 2009 • Under Secretary of Domestic Finance, United States Treasury, 2006 to 2008 • Vice Chairman of Goldman Sachs, 2002 to 2004; Co-head of Equities Division, 1996 to 2002 • Mr. Steel currently serves as a director of USHG Acquisition Corp. He served as a director of Cadence Bancorporation within the past five years. | Mr. Steel’s extensive experience with financial markets, gained through public service and private sector roles, positions him as a strong advisor to the company on financial matters. Mr. Steel gained firsthand experience with regulatory structures during his high-ranking government service both at the federal and local levels. Mr. Steel also serves as Co-Chair of the Board of Directors of the Value Reporting Foundation, which gives him unique insights into sustainability issues. Additionally, his service as the chief executive officer and president of a public company provided him with valuable insights into challenges facing public companies. | ||

• Compensation • Finance and Benefit Plans • Nominating and Corporate Governance • Sustainability (Chair) | |||

| GENERAL DYNAMICS / 2022 PROXY STATEMENT | 21 |

Age: 61 Director since: INDEPENDENT Committees: | JOHN G. STRATTON | ||

BACKGROUND | KEY ATTRIBUTES/SKILLS/EXPERIENCE | ||

• Executive Chairman of Frontier Communications, Inc. since April 2021 • Executive Vice President and President of Global Operations, Verizon Communications, Inc., 2015 to 2018; Executive Vice President of Global Enterprise and Consumer Wireline, 2014 to 2015; Executive Vice President and President of Verizon Enterprise, 2012 to 2014; Executive Vice President and Chief Operating Officer of Verizon Wireless, 2010 to 2012 • Mr. Stratton currently serves as Executive Chairman of the Board of Frontier Communications and a director of Abbott Laboratories. | Through his leadership positions at Frontier Communications and, previously, at Verizon Communications, Mr. Stratton gained extensive business and management experience operating global public companies, including business strategy and risk management. Mr. Stratton also gained extensive insight into the importance and role of technology, including opportunities and risks associated with rapidly developing new technologies and cybersecurity. His experience in the telecommunications industry also provides him with an understanding of business operations in a highly regulated industry. | ||

• Audit • Finance and Benefit Plans | |||

Age: 66 Director since: INDEPENDENT Committees: | PETER A. WALL | ||

BACKGROUND | KEY ATTRIBUTES/SKILLS/EXPERIENCE | ||

• Retired General, British Army, Chief of the General Staff, 2010 to 2014; Commander in Chief, Land Command, 2009 to 2010 • Director of Operations, United Kingdom Ministry of Defence, 2007 to 2009 • Director, Amicus (strategic leadership advisory firm) since 2014 | Mr. Wall had a distinguished career in the British Army before retiring at the rank of General in 2014. He also served as Director of Operations for the United Kingdom Ministry of Defence, directing operations worldwide. As Chief of the General Staff of the British Army, Mr. Wall managed significant operating budgets and led a major transformation of the British Army, including capital investment to harness the latest military technology. Mr. Wall’s service in the U.K. Ministry of Defence and in the British Army give him an in-depth understanding and appreciation of the complexities of the U.K. military, its allies and the overall defense industry. Mr. Wall brings to the Board important insight into the operational requirements of our customers, the application of technology and a deep understanding of global security issues. | ||

• Finance and Benefit Plans • Nominating and Corporate Governance • Sustainability | |||

| GENERAL DYNAMICS / 2022 PROXY STATEMENT | 22 |

Our Board of Directors has established an objective that at least two-thirds of the directors be independent. The Board has established director independence guidelines (the Director Independence Guidelines) that are consistent with the rules of the New York Stock Exchange to assist in determining director independence. Our Board of Directors regularly assesses the independence of our directors and examines the nature and extent of any relationships between General Dynamics and our directors, their families and their affiliates. For a director to be considered independent, the Board must determine that a director does not have any direct or indirect material relationship with General Dynamics. The Director Independence Guidelines are a part of our Corporate Governance Guidelines, which are available at www.gd.com/CorporateGovernance.

The Board has determined that each current non-management director — Ms. Reynolds, Ms. Schumacher and Messrs. Crown, deLeon, Haney, Malcolm, Mattis, Nye, Steel, Stratton and Wall — qualifies as an independent director.

In March of each year and at other times during the year for director nominations or appointments occurring outside the annual meeting, the Board of Directors considers whether each director and nominee to the Board meets the definition of an “independent director” in accordance with the rules of the New York Stock Exchange and the company’s Director Independence Guidelines. To make these independence determinations, the Board reviewed all relationships between General Dynamics and the directors and affirmatively determined that none of the individuals qualifying as independent has a material business, financial or other type of relationship with General Dynamics, other than as a director or shareholder of the company. Specifically, the Board considered the relationships listed below and the related person transactions listed on page 34 of this Proxy Statement and found them to be immaterial. For each of the relationships that the Board considered for 2019, 2020 and 2021, the payments made or received by General Dynamics, and the charitable contributions made by General Dynamics, fell below the thresholds in our Director Independence Guidelines (the greater of $1 million or 2% of the consolidated gross revenue of the other company). Listed below are the relationships that existed in 2021 that were considered by the Board as part of their independence determinations.

Ms. Reynolds, Ms. Schumacher, and Messrs. Crown, deLeon, Nye and Steel serve as members of the boards of trustees or boards of directors of charitable and other non-profit organizations to which General Dynamics (i) has made payments for memberships, sponsorships, trade show exhibit space or tuition in the usual course of our business, (ii) made and received payments for products and services in the usual course of our business or (iii) made contributions as part of our annual giving program. The 2021 payments fell below the greater of $1 million or 2% of the consolidated gross revenue of the organizations.

Mr. Mattis’ brother is an employee (and not an executive officer) of a subsidiary of General Dynamics. The compensation paid to Mr. Mattis’ brother in 2021 did not exceed $120,000.

Messrs. Crown, Haney, Nye and Stratton serve as directors of companies, and Messrs. Crown, Mattis, Nye and Ms. Schumacher are employees or executive officers of companies to which General Dynamics has sold products and services, or from which General Dynamics has purchased products and services, in the ordinary course of business. None of the directors had any material interest in, or received any compensation in connection with, these ordinary-course business relationships. Each of the payments made or received by General Dynamics in 2021 fell below the greater of $1 million or 2% of the other company’s gross revenue.

The Nominating and Corporate Governance Committee will consider director nominees recommended by shareholders in the same manner as it considers and evaluates potential directors identified by the company. Recommendations by shareholders should be submitted in writing to the chair of the Nominating and Corporate Governance Committee, c/o Corporate Secretary, 11011 Sunset Hills Road, Reston, VA 20190. Our Bylaws address the requirements for nominations of directors, including a proxy access provision that permits a shareholder or a group of up to 20 shareholders who have owned 3% or more of our outstanding shares of capital stock continuously for three years to submit director nominees for inclusion in our proxy statement if the shareholder(s) and the nominee(s) satisfy the requirements specified in our Bylaws. The requirements for director nominations, including requirements for proxy access, can be found in Article II, Section 10 of our Bylaws, which are available on our website at www.gd.com/CorporateGovernance.

| GENERAL DYNAMICS / 2022 PROXY STATEMENT | 23 |

The General Dynamics Board of Directors believes that good corporate governance enhances shareholder value. To that end, General Dynamics is committed to employing strong corporate governance practices to promote a culture of ethics and integrity that defines how we do business. At the core, we are in business to earn a fair return for our shareholders.

On the recommendation of the Nominating and Corporate Governance Committee, the Board has adopted the General Dynamics Corporate Governance Guidelines to provide a framework for effective governance of the Board and the company. The guidelines establish policies and practices with respect to Board operations and responsibilities, including board structure and composition, director independence, executive and director compensation, succession planning, and the receipt of concerns and complaints by the Board. The Board regularly reviews these guidelines and updates them periodically in response to changing regulatory requirements, feedback from shareholders on governance matters and evolving best practices in corporate governance.

Our key corporate governance practices are summarized below. Our Corporate Governance Guidelines are available at www.gd.com/CorporateGovernance.

As part of our commitment to strong corporate governance practices, we maintain an active and robust ethics program. Our ethics program is rooted in our Ethos — our distinguishing moral nature. Our Ethos is defined by four values: transparency, trust, alignment and honesty. These values:

Drive how we operate our business.

Govern how we interact with each other and our customers, partners and suppliers.

Guide the way we treat our workforce.

Determine how we connect with our communities and impact our environment.

By adhering to our Ethos, we ensure that we continue to be good stewards of the investments in us by our shareholders, customers, employees, suppliers and communities.

We have a Standards of Business Ethics and Conduct Handbook that applies to all employees. This handbook, known as the Blue Book, has been updated and improved as we have grown and changed over the years. Our ethics program also includes periodic training on ethics and compliance topics for all employees and a 24-hour ethics helpline, which employees can access via telephone or online to communicate any business-related ethics concerns.

We also have adopted ethics codes specifically applicable to our Board of Directors and our financial professionals. The Code of Conduct for Members of the Board of Directors embodies our Board’s commitment to manage our business in accordance with the highest standards of ethical conduct. The Code of Ethics for Financial Professionals, which supplements the Blue Book, applies to our chief executive officer, chief financial officer, controller and individuals performing similar financial functions.

Any amendments to or waivers from the Standards of Business Ethics and Conduct, Code of Ethics for Financial Professionals or Code of Conduct for Members of the Board of Directors on behalf of any of our executive officers, financial professionals or directors will be disclosed on our website. The current Standards of Business Ethics and Conduct are available on our website at www.gd.com/Responsibility.

| GENERAL DYNAMICS / 2022 PROXY STATEMENT | 24 |

Our Board comprises independent, accomplished and experienced directors who provide advice and oversight to further the interests of our company and our shareholders. The Board regularly evaluates its leadership structure, including whether to combine the positions of chairman and chief executive officer. Our Board currently believes that combining the chairman and chief executive roles while retaining a strong Lead Director provides a framework for independent leadership and engagement while ensuring appropriate insight into the company’s operations and strategic issues.

Strong and Effective Leadership

Our Board elects a chairman annually from among the directors. The Board believes that Ms. Novakovic’s deep understanding of the company’s business, day-to-day operations, growth opportunities, challenges and risk management practices gained through several leadership positions, including nine years as chief executive officer, enable her to provide strong and effective leadership to the Board and to ensure the Board is informed of important issues facing the company. The Board also believes that having a combined role promotes a cohesive, strong and consistent vision and strategy for the company.

Additional Independent Oversight

The Board has created the position of a Lead Director, elected annually by the Board from among the independent directors. Mr. Crown currently serves as Lead Director. The Board believes that Mr. Crown’s tenure and experience enable him to bring valuable and independent views to the boardroom, and his affiliation with our largest shareholder ensures that his interests are closely aligned with the interests of other shareholders. The Board believes the Lead Director position provides additional independent oversight of senior management and Board matters. The selection of a Lead Director facilitates communication among the directors or between any of them and the chairman. Directors frequently communicate among themselves and directly with the chairman. The Lead Director’s authority and responsibilities are as follows:

Lead Director Authority and Responsibilities

Acts as chair at Board meetings when the chairman is not present, including meetings of the non-management directors.

Works with the chairman to develop and agree to meeting schedules and agendas, and agree to the nature of the information that will be provided to directors in advance of meetings.

Has the authority to call meetings of the non-management directors.

Coordinates activities of the non-management directors and serves as a liaison between the chairman and the non-management directors.

Is available for consultation and communication with significant shareholders, when appropriate.

Performs such other duties as the Board may determine from time to time.

| GENERAL DYNAMICS / 2022 PROXY STATEMENT | 25 |

The Board of Directors has established five standing committees to assist in executing its duties: Audit, Compensation, Finance and Benefit Plans, Nominating and Corporate Governance, and (new in 2021) Sustainability. The primary responsibilities of each of the committees are described below, together with the current membership and number of meetings held in 2021. Currently, all of our Board committees are composed entirely of independent, non-management directors. Charters for all five Board committees are available on our website at www.gd.com/CorporateGovernance.

Listed below are the members of each of the five standing committees as of March 9, 2022.

|

| Audit Committee |

| Compensation Committee |

| Finance and Benefit Plans Committee |

| Nominating and Corporate Governance Committee |

| Sustainability Committee |

James S. Crown |  |

|  |

|

|

|  |

|  | |

Rudy F. deLeon |

|

|  |

|  |

|

|

|  | |

Cecil D. Haney |  |

|

|

|

|

|  |

|

| |

Mark M. Malcolm |  |

|

|

|  |

|

|

|

| |

James N. Mattis |  |

|

|

|

|

|  |

|

| |

C. Howard Nye |  |

|  |

|

|

|

|

|

| |

Catherine B. Reynolds |  |

|

|

|  |

|

|

|  | |

Laura J. Schumacher |

|

|  |

|

|

|  |

|

| |

Robert K. Steel |

|

|  |

|  |

|  |

|  | |

John G. Stratton |  |

|

|

|  |

|

|

|

| |

Peter A. Wall |

|

|

|

|  |

|  |

|  | |

Lead Director Lead Director Audit Committee Financial Expert Audit Committee Financial Expert |  Chair Chair Member Member |

|

| GENERAL DYNAMICS / 2022 PROXY STATEMENT | 26 |

Following are descriptions of the primary areas of responsibility for each of the five committees.

|

|

AUDIT COMMITTEE Members: Mark M. Malcolm (Chair) John G. Stratton | RESPONSIBILITIES: • Provides oversight for accounting, financial reporting, internal control, auditing and regulatory compliance activities • Selects and oversees the independent auditor • Approves audit and non-audit services provided by the independent auditor, including a review of the scope of the audit • Reviews our consolidated financial statements with management and the independent auditor • Evaluates the performance, responsibilities, budget and staffing of internal audit • Evaluates the scope of the internal audit plan • Monitors management’s implementation of the policies, practices and programs of the company with respect to business ethics and conduct

|

COMPENSATION COMMITTEE Members: Laura J. Schumacher (Chair) Robert K. Steel Meetings in 2021: 4 | RESPONSIBILITIES: • Evaluates the performance of the chief executive officer and other officers and reviews and approves their compensation • Recommends to the Board the level and form of director compensation and benefits • Reviews and approves incentive compensation and equity-based compensation plans • Reviews and monitors succession plans for officers, including the chief executive officer • Has authority to retain and terminate external advisors in connection with the discharge of its duties • Has sole authority to approve compensation consultant fees (to be funded by the company) and the terms of the consultant’s retention

|

FINANCE AND BENEFIT PLANS COMMITTEE Members: Rudy F. deLeon (Chair) | RESPONSIBILITIES: • Oversees the management of the company’s finance policies to ensure the policies are in keeping with the company’s overall business objectives • For employee benefit plans that name the company or one of its subsidiaries as the investment fiduciary (and for which the company or one of its subsidiaries has not appointed the management investment committee as investment fiduciary): - Provides strategic oversight of the management of the assets - Reviews and approves investment policy recommendations made by management - Reviews and approves the retention of third parties for administration and management services related to trust assets

|

NOMINATING AND CORPORATE Members: James S. Crown (Chair) | RESPONSIBILITIES: • Evaluates Board and management effectiveness • Advises the Board on the appropriate size, composition, structure and operations of the Board and its committees • Reviews and recommends to the Board committee assignments for directors • Advises the Board on corporate governance matters and monitors developments, trends and best practices in corporate governance • Recommends to the Board corporate governance guidelines that comply with legal and regulatory requirements • Identifies qualified individuals as director candidates

|

SUSTAINABILITY COMMITTEE Members: Robert K. Steel (Chair) James S. Crown Rudy F. deLeon | RESPONSIBILITIES: • Reviews and monitors corporate practices related to corporate sustainability matters • Monitors developments, trends and best practices in managing corporate sustainability • Has authority to obtain advice and assistance from internal and external advisors in connection with the discharge of its duties

|

| GENERAL DYNAMICS / 2022 PROXY STATEMENT | 27 |

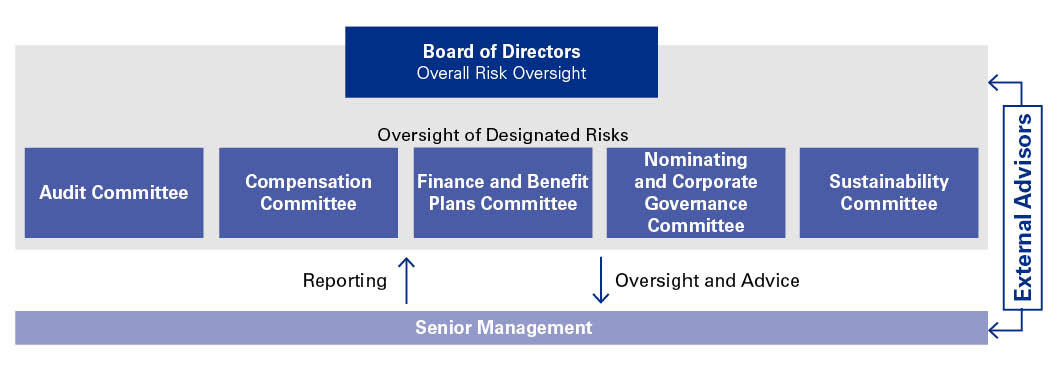

Our comprehensive risk management program is conducted by senior management and overseen by the Board of Directors. In particular, the Board oversees how management identifies and prioritizes risks that are material to our business. We believe our risk management processes are well-supported by the current board leadership structure.

ROLES IN RISK MANAGEMENT

The Board oversees risk management, focusing on the most significant risks facing the company, including strategic, operational, financial, legal, cybersecurity and reputational risks.

The Board assesses the company’s strategic and operational risks throughout the year, with particular focus on these risks at an annual multi-day Board meeting in early February.

Two Board meetings per year are devoted almost exclusively to risk management.

The Board receives briefings from senior management concerning a variety of topics and related risks as they arise.

The Board reviews, adjusts where appropriate, and approves the annual business unit and business segment goals presented by management and adopts our company operating plan for the year. These plans and related risks are monitored throughout the year as part of periodic financial and performance reports given to the Board by the chief financial officer and executive vice presidents of each business segment.

The Board considers senior management succession planning a core part of the company’s risk management program. At least annually, the Board reviews with the chief executive officer succession planning for senior leadership positions and the timing and development required to ensure continuity and diversity of leadership over the short and long term.

Risk topics discussed in 2021 included: defense budget and acquisition matters; the COVID-19 pandemic; cybersecurity; legal and regulatory matters; financial risks; human capital management, including succession planning and diversity and inclusion; environmental, health and safety matters; and specific customer and program developments.

| GENERAL DYNAMICS / 2022 PROXY STATEMENT | 28 |

Oversees the company’s policies and practices concerning overall risk assessment and risk management.

Reviews and takes appropriate action regarding the company’s annual and quarterly financial statements, the internal audit program, the ethics program and internal control over financial reporting.

Receives regular briefings from members of senior management on accounting matters; the internal audit plan; internal control over financial reporting matters; significant litigation and other legal matters; and ethics program matters.

Holds separate, regular executive sessions with internal audit and the partners of the KPMG LLP audit team.

Finance and Benefit Plans Committee

Oversees the management of the company’s finance policies and the assets of the company’s defined benefit plans for employees.

Oversees market risk exposure with respect to assets within the company’s defined benefit plans, and related to the capital structure of the company, including borrowing, liquidity, allocation of capital and funding of benefit plans.

To assess risks in its areas, receives regular briefings from our senior management or external advisors on finance policies, pension plan liabilities and funding and asset performance.

Oversees our executive compensation program to ensure that the program creates incentives for strong operational performance and for the long-term benefit of the company and its shareholders without encouraging excessive risk-taking.

Receives briefings from the chairman and chief executive officer, human resources senior management and outside consultants and advisors on compensation matters.

Nominating and Corporate Governance Committee

Oversees risks related to the company’s governance structure and processes and risks arising from related person transactions.

Receives briefings from the senior vice president, general counsel and secretary.

Oversees risks relating to the company’s practices related to corporate sustainability matters.

Monitors developments, trends and best practices in managing corporate sustainability matters.

Receives briefings from the senior vice president, general counsel and secretary; the senior vice president, human resources and administration; and the senior vice president for planning, communications and trade compliance.

Responsible for day-to-day risk management; conducts a thorough assessment of the company’s risk profile through internal management processes and controls.

The chief executive officer and senior management team provide to the Board a dedicated and comprehensive briefing of material risks at least twice per year, and the Board is briefed throughout the year as needed on specific risks facing the company.

At an annual multi-day Board meeting in early February, senior management reports on opportunities and risks in the markets in which the company conducts business. Additionally, each business unit president and each business segment executive vice president presents the unit’s and segment’s respective operating plan and strategic initiatives for the year, including notable business opportunities and risks.

The chief financial officer and executive vice presidents of each business segment give periodic financial and performance reports to the Board.

| GENERAL DYNAMICS / 2022 PROXY STATEMENT | 29 |

Provide independent advice on specific risks, and review and comment on risk management processes and procedures as necessary.

Support the program by auditing our financial statements.

Review and suggest updates and improvements to our risk management processes and procedures.

Assist in the implementation of Board and senior management responsibilities regarding risk management.

Support and assist with public disclosure regarding risk management and company risks.

HIGHLIGHT ON TECHNOLOGY AND CYBERSECURITY |

Technology and cybersecurity pose a critical risk for nearly all companies. However, the defense industry faces heightened risks simply due to the nature of its work, and our company is no exception. Our company approaches its risk management in this area comprehensively, including: • Dedicated briefings to the Board on our company-wide cybersecurity risk program as part of its overall risk assessment reports, led by our chief information officer and other members of management; • In-depth Board discussions about the role of advanced technologies in our businesses, including cybersecurity capabilities and offerings of our businesses; • Calling upon the extensive experience of directors with unique perspectives obtained through their military, national security, and technology and cybersecurity business backgrounds; and • Establishment of a company-wide cyber council that includes experts from across our businesses, to collaborate on addressing cyber threats, best practices, processes and strategy. |

Engaged and Active Board of Directors

8 |

| 100% |

| 100% |

| 100% |

Board of Directors meetings in 2021 |

| Director attendance at 2021 Board and committee meetings |

| Director attendance at the 2021 Annual Meeting |

| Each 2021 Board meeting was followed by a non-management director executive session |

2021 Board meetings included a multi-day meeting in February to review our 2021 operating plan, including the operating plans of each of our business segments. |

| Strong director participation, with all Board members attending 100% of their Board and committee meetings. |

| We encourage directors to attend each Annual Meeting of Shareholders. |

| Non-management directors may also meet without management present at other times as requested by any non-management director. The independent Lead Director chairs executive sessions. |

| GENERAL DYNAMICS / 2022 PROXY STATEMENT | 30 |

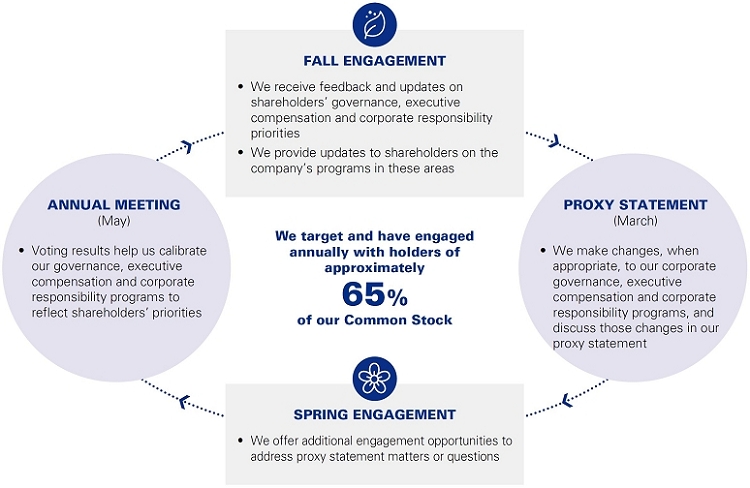

Our Board is committed to robust shareholder engagement, and shareholder engagement has become an embedded part of our investor relations and governance programs. Conversations throughout the year led by our Investor Relations team are supplemented by an annual outreach dedicated to corporate governance, executive compensation and corporate responsibility topics. In each of the past several years, we have targeted shareholders representing approximately 65% of our outstanding shares to receive their feedback on these topics. Our core shareholder engagement team comprises senior members of our investor relations, corporate governance and human resources (including executive compensation) groups, supplemented by our Lead Director or Compensation Committee chair as appropriate. Additionally, an ad hoc group of directors, anchored by the chairman and the independent Lead Director, is available to liaise with significant shareholders. Our Board remains committed to soliciting and understanding shareholder views and responding as appropriate.

OUR SHAREHOLDER ENGAGEMENT PROGRAM

| GENERAL DYNAMICS / 2022 PROXY STATEMENT | 31 |

KEY ITEMS DISCUSSED WITH SHAREHOLDERS IN 2021

BOARD OF DIRECTORS AND |

| EXECUTIVE COMPENSATION |

| CORPORATE RESPONSIBILITY |

| |||

• Board refreshment and succession planning • Director diversity • Board structure and independence • Shareholder rights |

| • Program structure, including role of equity compensation • Pay for performance alignment • Strong shareholder support in 2021 say-on-pay vote |

| • Board oversight, including Sustainability Committee • GHG emissions target and climate transition • Human capital management • Diversity and inclusion initiatives |

|

Our comprehensive director orientation and continuing education initiatives help ensure that directors have a deep and up-to-date understanding of our business.

Orientation | Site Visits | |||

• Each new director receives an orientation that consists of in-person briefings provided by corporate officers on our business operations; significant financial, accounting and risk-management matters; corporate governance; ethics; and key policies and practices. • Each new director receives briefings on the responsibilities, duties and activities of the committees on which the director will initially serve. |  | • New directors have the opportunity to visit business units within each of our segments and receive briefings from the respective executive vice president and members of business unit management teams. • All directors visit our business units periodically, allowing the directors to interact with the business unit management teams and employees, and to gain a firsthand view of our operations. | ||

Management Briefings | Operating Plan Review | |||

• The general counsel and chief financial officer periodically provide materials and briefing sessions on subjects that assist directors in fulfilling their duties. | • Annually, the Board holds a multi-day meeting with our senior management to conduct in-depth strategic and financial reviews and to approve the operating plans of each business unit, each business segment and the company as a whole. |

| GENERAL DYNAMICS / 2022 PROXY STATEMENT | 32 |

Our Board of Directors promotes continuous improvement throughout our company. In this spirit, the Board continually assesses itself for areas of potential improvement.

Any shareholder or other interested party who has a concern or question about the conduct of General Dynamics may communicate directly with our non-management directors, the chairman or the full Board. Communications may be confidential or anonymous. Communications should be submitted in writing to the chair of the Nominating and Corporate Governance Committee in care of the Corporate Secretary, General Dynamics Corporation, 11011 Sunset Hills Road, Reston, Virginia 20190. The Corporate Secretary will receive and process all written communications and will refer all substantive communications to the chair of the Nominating and Corporate Governance Committee in accordance with guidelines approved by the independent members of the Board. The chair of the Nominating and Corporate Governance Committee will review and, if necessary, investigate and address all such communications and will report the status of these communications to the non-management directors as a group or the full Board on a quarterly basis.