Contents | ||||

46 | Management’s Discussion of Financial Responsibility | We begin with a letter from our Chief Executive and Financial | ||

| Officers discussing our unyielding commitment to rigorous | ||||

| oversight, controllership and visibility to investors. | ||||

47 | Management’s Annual Report on Internal Control | |||

Over Financial Reporting | In this report our Chief Executive and Financial Officers provide | |||

| their assessment of the effectiveness of our internal control | ||||

| over financial reporting. This report is new for 2004 as required | ||||

| by Section 404 of the Sarbanes-Oxley Act of 2002. | ||||

47 | Report of Independent Registered Public Accounting Firm | Our auditors, KPMG LLP, express their independent opinions that | ||

| our financial statements are fairly presented and our internal | ||||

| controls, effective. | ||||

48 | Management’s Discussion and Analysis (MD&A) | |||

48 | Operations | We begin the Operations section of MD&A with an overview of | ||

| our earnings, including a perspective on how the global economic | ||||

| environment has affected our businesses over the last three years. | ||||

| This year, we added a discussion of the types of risks we face and | ||||

| the ways we manage those risks. We then discuss various key | ||||

| operating results for GE industrial (GE) and financial services (GECS). | ||||

| Because of the fundamental differences in these businesses, | ||||

| reviewing certain information separately for GE and GECS offers a | ||||

| more meaningful analysis. Our discussion of segment results | ||||

| includes quantitative and qualitative disclosure about the factors | ||||

| affecting segment revenues and profits, and the effects of recent | ||||

| acquisitions, dispositions and significant transactions. We conclude | ||||

| the Operations section with an overview of our operations from a | ||||

global perspective and a discussion of environmental matters. | ||||

59 | Financial Resources and Liquidity | In our Financial Resources and Liquidity section of MD&A, we | ||

| provide an overview of the major factors that affected our | ||||

| consolidated financial position and insight into the liquidity | ||||

and cash flow activities of GE and GECS. | ||||

66 | Selected Financial Data | Selected Financial Data provides five years of financial information | ||

| for GE and GECS. This table includes commonly used metrics that | ||||

facilitate comparison with other companies. | ||||

68 | Critical Accounting Estimates | Critical Accounting Estimates are necessary for us to prepare | ||

| our financial statements. In this section, we discuss what these | ||||

| estimates are, why they are important, how they are developed | ||||

and uncertainties to which they are subject. | ||||

70 | Other Information | We conclude MD&A with an explanation of a new accounting | ||

| standard and supplemental information to reconcile certain | ||||

| “non-GAAP” financial measures referred to in our report to the | ||||

most closely associated GAAP financial measures. | ||||

72 | Audited Financial Statements and Notes | |||

72 | Statement of Earnings | |||

72 | Consolidated Statement of Changes in Shareowners’ Equity | |||

74 | Statement of Financial Position | |||

76 | Statement of Cash Flows | |||

78 | Notes to Consolidated Financial Statements | |||

112 | Glossary | For your convenience, we provide a Glossary of key terms | ||

| used in our financial statements. | ||||

| We also present our financial information electronically | ||||

atwww.ge.com/investor. This award-winning site is | ||||

| interactive and informative. | ||||

Management’s Discussion of Financial Responsibility

We believe that great companies are built on a foundation of reliable financial information and compliance with the spirit and letter of the law. For GE, that foundation includes rigorous management oversight of, and an unyielding dedication to, controllership. The financial disclosures in this report are one product of our commitment to high quality financial reporting. In addition, we make every effort to adopt appropriate accounting policies, we devote our full resources to ensuring that those policies are applied properly and consistently and we do our best to fairly present our financial results in a manner that is complete and understandable. While we take pride in our financial reporting, we tirelessly seek improvements, and we welcome your suggestions.

RIGOROUS MANAGEMENT OVERSIGHT

Members of our corporate leadership team review each of our businesses routinely on matters that range from overall strategy and financial performance to staffing and compliance. Our business leaders monitor financial and operating systems, enabling us to identify potential opportunities and concerns at an early stage and positioning us to respond rapidly. Our Board of Directors oversees management’s business conduct, and our Audit Committee, which consists entirely of independent directors, oversees our system of internal controls and procedures.We continually examine our governance practices in an effort to enhance investor trust and improve the Board’s overall effectiveness. The Board and its committees annually conduct a performance self-evaluation and recommend improvements. Our Presiding Director led three meetings of non-employee directors this year, helping us sharpen our full Board meetings to better cover significant topics. Compensation policies for our executives are aligned with the long-term interests of GE investors. For example, payout of CEO equity grants are contingent on our Company meeting key performance metrics.

DEDICATION TO CONTROLLERSHIP

We maintain a dynamic system of internal controls and procedures—including internal control over financial reporting—designed to ensure reliable financial record-keeping, transparent financial reporting and disclosure, and protection of physical and intellectual property. We recruit, develop and retain a world-class financial team. Our internal audit function, 530 auditors, including 380 members of our Corporate Audit Staff, conducts thousands of financial, compliance and process improvement audits each year, in every geographic area, at every GE business. We recognized the contributions of our controllers and these auditors with a Chairman’s Leadership Award in 2005. The Audit Committee oversees the scope and evaluates the overall results of these reviews. Our global integrity policies—the “Spirit & Letter”— require compliance with law and policy, and pertain to such vital issues as upholding financial integrity and avoiding conflicts of interest. These integrity policies are available in 27 languages, and we have provided them to every one of GE’s more than 300,000 global employees, holding each of these individuals—from our top management down—personally accountable for compliance. Our integrity policies serve to reinforce key employee responsibilities around the world, and we inquire extensively about compliance. Our strong compliance culture reinforces these efforts by requiring employees to raise any compliance concerns and byprohibiting retribution for doing so. To facilitate open and candid communication, we have designated ombudspersons throughout the Company to act as independent resources for reporting integrity or compliance concerns. We hold our consultants, agents and independent contractors to the same integrity standards.

VISIBILITY TO INVESTORS

We are keenly aware of the importance of full and open presentation of our financial position and operating results and rely for this purpose on our disclosure controls and procedures, including our Disclosure Committee, which comprises senior executives with detailed knowledge of our businesses and the related needs of our investors. We ask this committee to evaluate the fairness of our financial and non-financial disclosures, and to report their findings to us and to the Audit Committee. We further ensure strong disclosure by holding more than 250 analyst and investor meetings every year. Recognizing the effectiveness of our disclosure policies, investors surveyed annually byInvestor Relationsmagazine have given us 24 awards in the last nine years, including Best Overall Investor Relations Program by a mega-cap company for six of those years. We are in regular contact with representatives of the major rating agencies, and our debt continues to receive their highest ratings. We welcome the strong oversight of our financial reporting activities by our independent registered public accounting firm, KPMG LLP, who are engaged by and report directly to the Audit Committee. Beginning this year, U.S. legislation requires management to report on internal control over financial reporting and for auditors to render an opinion on such controls. Our report and the KPMG LLP report for 2004 appear on page 47.

A GREAT COMPANY

GE continues to earn the admiration of the business world. We were named “The World’s Most Respected Company” for the seventh consecutive year in theFinancial Times/ PricewaterhouseCoopers annual CEO survey, and again ranked first in corporate governance.

We present our financial information proudly, with the expectation that those who use it will understand our Company, recognize our commitment to performance with integrity, and share our confidence in GE’s future.

| /s/ JEFFREY R. IMMELT | /s/ KEITH S. SHERIN | ||

| JEFFREY R. IMMELT Chairman of the Board and Chief Executive Officer | KEITH S. SHERIN Senior Vice President, Finance and Chief Financial Officer |

February 11, 2005

Management’s Annual Report on Internal Control Over Financial Reporting

The management of General Electric Company is responsible for establishing and maintaining adequate internal control over financial reporting for the company. With the participation of the Chief Executive Officer and the Chief Financial Officer, our management conducted an evaluation of the effectiveness of our internal control over financial reporting based on the framework and criteria established inInternal Control—Integrated Framework, issued by the Committee of Sponsoring Organizations of the Treadway Commission. Based on this evaluation, our management has concluded that our internal control over financial reporting was effective as of December 31, 2004.

General Electric Company’s independent auditor, KPMG LLP, a registered public accounting firm, has issued an audit report on our management’s assessment of our internal control over financial reporting. This audit report appears below.

| /s/ JEFFREY R. IMMELT | /s/ KEITH S. SHERIN | ||

| JEFFREY R. IMMELT Chairman of the Board and Chief Executive Officer | KEITH S. SHERIN Senior Vice President, Finance and Chief Financial Officer |

February 11, 2005

Report of Independent Registered Public Accounting Firm

To Shareowners and Board of Directors of General Electric Company

We have audited the accompanying statement of financial position of General Electric Company and consolidated affiliates (“GE”) as of December 31, 2004 and 2003, and the related statements of earnings, changes in shareowners’ equity and cash flows for each of the years in the three-year period ended December 31, 2004. We also have audited management’s assessment, included in the accompanying Management’s Annual Report on Internal Control Over Financial Reporting, that GE maintained effective internal control over financial reporting as of December 31, 2004, based on criteria established inInternal Control—Integrated Frameworkissued by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”). GE management is responsible for these consolidated financial statements, for maintaining effective internal control over financial reporting, and for its assessment of the effectiveness of internal control over financial reporting. Our responsibility is to express an opinion on these consolidated financial statements, an opinion on management’s assessment, and an opinion on the effectiveness of GE’s internal control over financial reporting based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement and whether effective internal control over financial reporting was maintained in all material respects. Our audit of financial statements included examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our audit of internal control over financial reporting included obtaining an understanding of internal control over financial reporting, evaluating management’s assessment, testing and evaluating the design and operating effectiveness of internal control, andperforming such other procedures as we considered necessary in the circumstances. We believe that our audits provide a reasonable basis for our opinions.

A company’s internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company’s internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company’s assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

In our opinion, the consolidated financial statements appearing on pages 72, 74, 76, 53 and 78–111 present fairly, in all material respects, the financial position of GE as of December 31, 2004 and 2003, and the results of its operations and its cash flows for each of the years in the three-year period ended December 31, 2004, in conformity with U.S. generally accepted accounting principles. Also, in our opinion, management’s assessment that GE maintained effective internal control over financial reporting as of December 31, 2004, is fairly stated, in all material respects, based on criteria established inInternal Control—Integrated Frameworkissued by COSO. Furthermore, in our opinion, GE maintained, in all material respects, effective internal control over financial reporting as of December 31, 2004, based on criteria established inInternal Control—Integrated Frameworkissued by COSO.

As discussed in note 1 to the consolidated financial statements, GE in 2004 and 2003 changed its method of accounting for variable interest entities, in 2003 changed its method of accounting for asset retirement obligations and in 2002 changed its methods of accounting for goodwill and other intangible assets and for stock-based compensation.

Our audits of GE’s consolidated financial statements were made for the purpose of forming an opinion on the consolidated financial statements taken as a whole. The accompanying consolidating information appearing on pages 73, 75 and 77 is presented for purposes of additional analysis of the consolidated financial statements rather than to present the financial position, results of operations and cash flows of the individual entities. The consolidating information has been subjected to the auditing procedures applied in the audits of the consolidated financial statements and, in our opinion, is fairly stated in all material respects in relation to the consolidated financial statements taken as a whole.

KPMG LLP

Stamford, Connecticut

February 11, 2005

MANAGEMENT'S DISCUSSION AND ANALYSIS

Operations

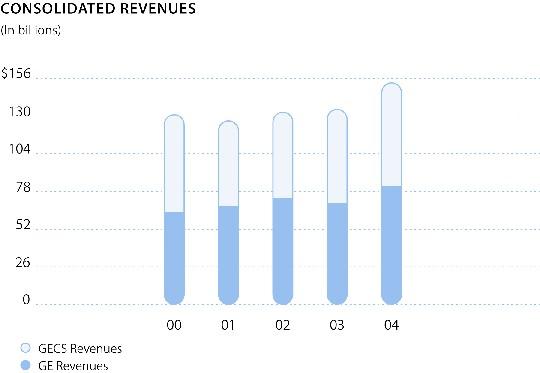

Our consolidated financial statements combine the industrial manufacturing, services and media businesses of General Electric Company (GE) with the financial services businesses of General Electric Capital Services, Inc. (GECS or financial services).

We present Management’s Discussion of Operations in five parts: Overview of Our Earnings from 2002 through 2004, Global Risk Management, Segment Operations, Global Operations and Environmental Matters.

In the accompanying analysis of financial information, we sometimes use information derived from consolidated financial information but not presented in our financial statements prepared in accordance with U.S. generally accepted accounting principles (GAAP). Certain of these data are considered “non-GAAP financial measures” under the U.S. Securities and Exchange Commission (SEC) rules; those rules require the supplemental explanations and reconciliations provided on page 70.

2004 WAS A YEAR OF PORTFOLIO TRANSITION.As described in our report last year, we simplified our organization on January 1, 2004, by realigning certain businesses within our segment structure. Certain prior-period amounts in this financial section have been reclassified to reflect this reorganization.

We continued making progress toward our objectives through strategic acquisitions, mergers and dispositions.

- In April 2004, we acquired Amersham plc (Amersham), a world leader in medical diagnostics and life sciences, to complement our existing Healthcare business.

- In May 2004, we combined NBC with Vivendi Universal Entertainment LLLP (VUE) to create one of the world’s leading media companies, NBC Universal.

- In May 2004, we also completed an initial public offering of Genworth Financial, Inc. (Genworth), our formerly wholly-owned subsidiary that conducts most of our consumer insurance business, including life and mortgage insurance operations. We sold approximately 30% of the common shares of Genworth to the public, and we expect (subject to market conditions) to reduce our ownership over the next two years as Genworth transitions to full independence. This transaction resulted in a second quarter pre-tax loss of $0.6 billion ($0.3 billion after tax), recognized in the Insurance segment.

- In December 2004, we sold a majority interest in Gecis, our global business processing operation, to two leading private investment firms. We received cash proceeds of $0.6 billion and retained a 40% investment in Gecis. This transaction resulted in a fourth quarter pre-tax gain of $0.4 billion ($0.3 billion after tax), recognized in the Equipment & Other Services segment.

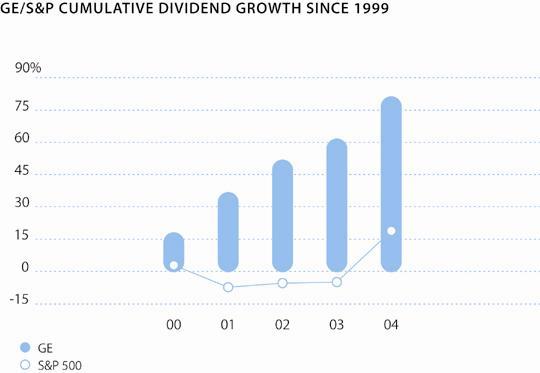

WE DECLARED $8.6 BILLION IN DIVIDENDS IN 2004.Per-share dividends of $0.82 were up 6% from 2003, following a 5% increase from the preceding year. In December 2004, our Board of Directors raised our quarterly dividend 10% to $0.22 per share. We have rewarded our shareowners with over 100 consecutive years of dividends, with 29 consecutive years of dividend growth, and our dividend growth for the past five years has significantly outpaced that of companies in the Standard & Poor’s 500 stock index.

Except as otherwise noted, the analysis in the remainder of this section presents the results of GE (with GECS included on a one-line basis) and GECS. See the Segment Operations section on page 52 for a more detailed discussion of the businesses within GE and GECS.

Overview of Our Earnings from 2002 through 2004

The global economic environment must be considered when evaluating our results over the last several years. Important factors for us included slow global economic growth, a weakening U.S. dollar, lower global interest rates, a mild U.S. recession that did not cause significantly higher credit losses, developments in three industries—power generation, property and casualty insurance and commercial aviation—that are significant to us, and escalating raw material prices. As the following pages show in detail, our diversification and risk management strategies enabled us to continue to grow during this challenging time.

Three segments whose operations have a significant effect on our consolidated results and reflect their changing economic environments are Energy, Insurance and Transportation.

- Energy (14% and 22% of consolidated three-year revenues and total segment profit, respectively) participated in the period of unprecedented U.S. power industry demand that peaked in 2002, a period often referred to as the “U.S. power bubble.” The return to normal demand levels is reflected in lower shipments of large heavy-duty gas turbines. In 2004, we sold 122 such units, compared with 175 in 2003 and 323 in 2002. We accurately foresaw the end of the bubble and took action to reduce the effect, right-sizing the business and growing and investing in other lines of the power generation business such as product services and wind energy. We believe the Energy segment is well positioned for its markets in 2005 and beyond.

- Insurance (17% and 4% of consolidated three-year revenues and total segment profit, respectively) was much like most of the property and casualty reinsurance industry, facing volatility throughout the period. In 2002, we recognized losses on our 1997–2001 business, increasing related reserves by $3.5 billion before tax. In 2003, our turnaround efforts started to pay off and we realized benefits from improved operations as earnings increased by $2.3 billion to a profit of $0.5 billion at GE Insurance Solutions. In 2004, improved core performance at

- Transportation (10% and 14% of consolidated three-year revenues and total segment profit, respectively) continued to invest in market-leading technology and services. While the commercial aviation industry continues to face challenges and financial pressures that affect our commercial aviation business, our business model succeeds by diversification. Product services, the military engines business and our rail equipment and services business continued to be strong. Overall, Transportation reported segment profit that grew $0.6 billion in 2004 and $0.2 billion in 2003.

Results at two major segments, Healthcare and NBC Universal, reflected continued investment and growth over the last three years.

- Healthcare (8% and 9% of consolidated three-year revenues and total segment profit, respectively) continued to show strong growth as 2004 revenues and segment profit both rose about 50% since 2002. Our acquisitions of Amersham in 2004 and Instrumentarium in 2003 contributed $3.2 billion and $0.6 billion to Healthcare revenues and segment profit, respectively, in 2004. These acquisitions also expanded the breadth of our product and services offerings to the healthcare industry, positioning us well for continued growth.

- NBC Universal (6% and 10% of consolidated three-year revenues and total segment profit, respectively) also contributed a strong performance during the last three years as we continued to invest through acquisitions. Through the combination of NBC and VUE in 2004, and successful acquisitions of Telemundo and Bravo in 2002, we have created a diversified world-class media company. Earnings from the segment increased $0.6 billion in 2004 following a $0.3 billion increase in 2003.

Most of our other operations achieved operating results in line with our expectations in the 2002 to 2004 economic environment.

- Commercial and Consumer Finance (in total, 25% and 31% of consolidated three-year revenues and total segment profit, respectively) are large, profitable growth businesses in which we continue to invest with confidence. In a challenging economic environment, these businesses grew earnings by $0.9 billion and $1.0 billion in 2004 and 2003, respectively. Solid core growth, disciplined risk management and successful acquisitions have delivered these strong results.

- Infrastructure (2% of consolidated three-year revenues and total segment profit), with growth platforms such as security and water treatment, continued to grow significantly through acquisitions. We foresee dramatic revenue and earnings growth in these platforms through integration of these acquisitions, expanded distribution and new product introductions.

- Advanced Materials, Consumer & Industrial and Equipment & Other Services (in total, 19% and 7% of consolidated three-year revenues and total segment profit, respectively) are particularly sensitive to economic conditions and consequently were affected adversely by the U.S. recession in 2002 and by slow global growth in developed countries. Higher capacity, in combination with declining or weak volume growth in many of these industries, resulted in fierce competitive price pressures. Advanced Materials was hit particularly hard because of additional pressures from significant inflation in certain raw materials such as benzene and natural gas.

As the preceding comments about Healthcare, Insurance and NBC Universal illustrate, acquisitions and dispositions played an important role in our growth strategy. We integrate acquisitions as quickly as possible and only revenues and earnings from the date we complete the acquisition through the end of the fourth following quarter are attributed to such businesses. Acquisitions contributed $12.3 billion, $5.4 billion and $7.2 billion to consolidated revenues in 2004, 2003 and 2002, respectively. Our consolidated net earnings in 2004, 2003 and 2002 included approximately $1.2 billion, $0.5 billion and $0.6 billion, respectively, from acquired businesses. Dispositions affected our operations through lower revenues and earnings in 2004 of $3.4 billion and $1.2 billion, respectively, and in 2003 through lower revenues of $2.3 billion and higher earnings of $0.2 billion.

Significant matters relating to our Statement of Earnings, which appears on pages 72 and 73, are explained below.

GE SALES OF PRODUCT SERVICESwere $25.8 billion in 2004, a 12% increase over 2003. Increases in product services in 2004 and 2003 were widespread, led by continued strong growth at Transportation, Healthcare, Infrastructure and Energy. Operating profit from product services was approximately $6.4 billion in 2004, up 21% from 2003, reflecting ongoing improvements at Transportation, Energy and Healthcare.

POSTRETIREMENT BENEFIT PLANSreduced pre-tax earnings by $1.2 billion and $0.2 billion in 2004 and 2003, respectively, after contributing $0.6 billion to pre-tax earnings in 2002. Costs of our principal pension plans increased in 2004 and 2003 primarily because of the effects of:

- Prior years investment losses (reducing pre-tax earnings by $0.6 billion in 2004 and $0.4 billion in 2003), and

- Lowering pension discount rates used to calculate 2004 and 2003 pension costs from 6.75% to 6.0% and 7.25% to 6.75%, respectively. Pre-tax earnings in 2004 and 2003 were $0.4 billion and $0.2 billion lower, respectively, because of these discount rate reductions.

Benefit costs for these plans in 2003 also increased as compared with 2002 because of plan changes resulting from union negotiations as well as increases in retiree medical and drug costs.

Considering current and expected asset allocations, as well as historical and expected returns on various categories of assets in which our plans are invested, we have assumed that long-term returns on our principal pension plan assets would be 8.5% throughout this period and in 2005. U.S. accounting principles provide for recognition of differences between assumed and actual returns over the average future service life of employees.

We believe our postretirement benefit costs will increase again in 2005 for a number of reasons, including further reduction in discount rates at December 31, 2004, continued recognition of prior years investment losses relating to our principal pension plans, and increases in retiree healthcare costs.

Our principal pension plans had a surplus of $6.7 billion at December 31, 2004. We will not make any contributions to the GE Pension Plan in 2005. To the best of our ability to forecast the next five years, we do not anticipate making contributions to that plan so long as expected investment returns are achieved. At December 31, 2004, the fair value of assets for our affiliate and other pension plans was $2.6 billion less than their respective projected benefit obligations. In 2004, we contributed $0.4 billion to such plans and expect to contribute $0.3 billion to these plans in 2005.

The funding status of our postretirement benefit plans and future effects on operating results depend on economic conditions and investment performance. See notes 5 and 6 for additional information about funding status, components of earnings effects and actuarial assumptions. See page 70 for discussion of pension assumptions.

GE OTHER COSTS AND EXPENSESare selling, general and administrative expenses, which increased 22% to $12.0 billion in 2004, following an 8% increase in 2003, substantially the result of acquisitions.

INTEREST ON BORROWINGS AND OTHER FINANCIAL CHARGESamounted to $11.9 billion, $10.8 billion and $10.2 billion in 2004, 2003 and 2002, respectively. Substantially all of our borrowings are done through GECS, where interest expense was $11.4 billion, $10.3 billion and $9.9 billion in 2004, 2003 and 2002, respectively. Changes over the three-year period reflected increased average borrowings, partially offset by the effects of lower interest rates. GECS average borrowings were $322.6 billion, $309.0 billion and $250.1 billion in 2004, 2003 and 2002, respectively. GECS average composite effective interest rate was 3.6% in 2004, comparedwith 3.3% in 2003 and 4.1% in 2002. Proceeds of these borrowings were used in part to finance asset growth and acquisitions. In 2004, GECS average assets of $577.3 billion were 11% higher than in 2003, which in turn were 15% higher than in 2002. See page 62 for a discussion of interest rate risk management.

INCOME TAXESare a significant cost. As a global commercial enterprise, our tax rates are strongly affected by many factors, including our global mix of earnings, legislation, acquisitions, dispositions and tax characteristics of our income. Our tax returns are routinely audited and settlements of issues raised in these audits sometimes affect our tax provisions. Because of the number of variables affecting our reported tax results, we have prepared this section to facilitate an understanding of our income tax rates.

Income taxes on consolidated earnings before accounting changes were 17.5%, compared with 21.7% in 2003 and 19.9% in 2002. Our consolidated income tax rate was 4.2 percentage points lower in 2004 than 2003 because the 2004 tax benefits from favorable U.S. Internal Revenue Service (IRS) settlements, the NBC Universal transaction, a partial reorganization of our aircraft leasing business and the sale of a majority interest in Gecis were greater than the tax benefits from certain business dispositions in 2003. Our consolidated income tax rate increased by 1.8 percentage points in 2003 because our tax benefits from 2003 business dispositions were less than our 2002 tax benefits from settlements with the IRS. Income tax rates for all three years were lower because of the increasing share of earnings from lower taxed global operations. A more detailed analysis of differences between the U.S. federal statutory rate and the consolidated rate, as well as other information about our income tax provisions, is provided in note 7. The nature of business activities and associated income taxes differ for GE and for GECS, and a separate analysis of each is presented in the paragraphs that follow.

Because GE tax expense does not include taxes on GECS earnings, the GE effective tax rate is best analyzed in relation to GE earnings excluding GECS. GE’s pre-tax earnings excluding GECS were $10.4 billion, $10.7 billion and $14.3 billion for 2004, 2003 and 2002, respectively. On this basis, GE’s effective tax rate was 19.0% in 2004, lower by 7.7 percentage points than the 26.7% rate in 2003 and 2002. The 2004 reduction was primarily a result of two items

The 2003 GE rate was reduced by 1.7 percentage points because certain reductions in pre-tax earnings—specifically, lower earnings at Energy and higher costs related to our principal pension plans—affected income taxed at higher than our average rate. The 2003 GE rate was also reduced by 1.0 percentage point (after adjusting for the effect of the lower earnings at Energy and higher costs related to our principal pension plans) from a tax benefit on the disposition of shares of GE Superabrasives U.S., Inc., included in the line “All other—net” in note 7. In 2002, GE entered into settlements with the IRS concerning certain export tax benefits. The effect of these settlements, the tax portion of which is included in the line “Tax on global activities including exports” in note 7, was a reduction of the GE tax rate of 2.7 percentage points. Also in 2002, GE entered into a tax-advantaged transaction to exchange certain assets for the cable network Bravo. The related reduction of 1.0 percentage point in the GE effective tax rate is reflected in the line “All other—net” in note 7.

GECS effective tax rate increased to 15.9% in 2004 from 15.8% in 2003 and negative 1.7% in 2002. The 2004 GECS rate reflects the net benefits, discussed below, of legislation and a partial reorganization of our aircraft leasing operation, which decreased the effective tax rate 1.6 percentage points and is included in the line “Tax on global activities including exports” in note 7; tax benefits from favorable IRS settlements, which decreased the effective tax rate 1.2 percentage points and are included in the line “All other—net” in note 7; and the low-taxed disposition of a majority interest in Gecis which decreased the effective tax rate 0.9 percentage points, and is included in the line “Tax on global activities including exports” in note 7. Offsetting these benefits was the nonrecurrence of the 2003 tax benefit on the disposition of shares of ERC Life Reinsurance Corporation (ERC Life).

As a result of the repeal of the extraterritorial income (ETI) taxing regime as part of the American Jobs Creation Act of 2004 (the Act), the aircraft leasing operations of Commercial Finance no longer qualify for a reduced U.S. tax rate. However, the Act also extended to foreign aircraft leasing, the U.S. tax deferral benefits that were already available to GE’s other active foreign operations. As stated above, these legislative changes, coupled with a partial reorganization of our aircraft leasing business and a favorable Irish tax ruling, decreased GECS effective tax rate 1.6 percentage points.

The increase in the effective tax rate from 2002 to 2003 reflects the nonrecurrence of the 2002 losses at GE Insurance Solutions and GE Equity as well as certain 2002 IRS settlements discussedbelow, partially offset by a 2.7 percentage point decrease because of the 2003 tax benefit on the disposition of shares of ERC Life.

GECS 2002 effective tax rate reflects the effects of pre-tax losses at GE Insurance Solutions and GE Equity, which reduced the effective tax rate of GECS by 16.7 percentage points, the effects of lower taxed earnings from global operations and favorable tax settlements with the IRS. The benefits of these settlements, which reduced the GECS rate 4.0 percentage points (excluding the GE Insurance Solutions and GE Equity losses), are included in the line “All other—net” in note 7.

Global Risk Management

A disciplined approach to risks is important in a diversified organization such as ours in order to ensure that we are executing according to our strategic objectives and that we only accept risks for which we are adequately compensated. It is necessary for us to manage risk at the individual transaction level, and to consider aggregate risk at the customer, industry, geography and collateral-type levels, where appropriate.

GE’s Board of Directors oversees the risk management process through clearly established delegation of authority. Board meeting agendas are jointly developed with management to cover the same risk topics as our Corporate Risk Committee reviews, including environmental, compliance, liquidity, credit, market and event risks.

GECS Board of Directors oversees the risk management process for financial services, including the approval of all significant acquisitions and dispositions and the establishment of borrowing and investment approval limits delegated to the Investment Committee of the Board, the Chairman, the Chief Financial Officer and the Chief Risk Officer. All participants in the risk management process must comply with these approval limits.

The GECS Chief Risk Officer is responsible, through the Corporate Risk Function, for establishing standards for the measurement, reporting and limiting of risk; for managing and evaluating risk managers; for approving risk management policies and for reviewing major risk exposures and concentrations across the organization. The GECS Corporate Risk Function analyzes certain business risks and assesses them in relation to aggregate risk appetite and approval limits set by the GECS Board of Directors.

Threshold responsibility for identifying, quantifying and mitigating risks is assigned to our individual businesses. Because the risks and their interdependencies are complex, we apply a Six Sigma-based analytical approach to each major product line that monitors performance against external benchmarks, proactively manages changing circumstances, provides early warning detection of risk and facilitates communication to all levels of authority. Other corporate functions such as Financial Planning and Analysis, Treasury, Legal and our Corporate Audit Staff support business-level risk management. Businesses that, for example, hedge risk with derivative financial instruments must do so using our centrally-managed Treasury function, providing assurance that the business strategy complies with our corporate policies and achieves economies of scale. We review risks periodically with business-level risk managers, senior management and our Board of Directors.

GECS employs about 10,000 dedicated risk professionals, including 2,700 involved in collection activities and 1,400 specialized asset managers who evaluate leased asset residuals and remarket off-lease equipment.

GE and GECS manage a variety of risks including liquidity, credit, market and event risks.

- Liquidity risk is the risk of being unable to accommodate liability maturities, fund asset growth and meet contractual obligations through access to funding at reasonable market rates. Additional information about our liquidity and how we manage this risk can be found on page 59 and in notes 18 and 28.

- Credit risk is the risk of financial loss arising from a customer or counterparty’s failure to meet its contractual obligations. We face credit risk in our lending and leasing activities (see pages 59 and 68 and notes 1, 12, 13 and 30) and derivative financial instruments activities (see note 28).

- Market risk is the potential loss in value of investment and other asset and liability portfolios, including financial instruments, caused by changes in market variables, such as interest and currency exchange rates and equity and commodity prices. We are exposed to market risk in the normal course of our business operations as a result of our ongoing investing and funding activities. We attempt to mitigate the risks to our various portfolios arising from changes in interest and currency exchange rates in a variety of ways that often include offsetting positions in local currencies or use of derivatives. Additional information about how we mitigate the risks to our various portfolios from changes in interest and currency exchange rates can be found on page 62 and in note 28.

- Event risk is that body of risk beyond liquidity, credit and market risk. Event risk includes the possibility of adverse occurrences both within and beyond our control. Examples of event risk include natural disasters, availability of necessary materials, guarantees of product performance and business interruption. This type of risk is often insurable, and success in managing this risk is ultimately determined by the balance between the level of risk retained or assumed and the cost of transferring the risk to others. The decision as to the appropriate level of event risk to retain or cede is evaluated in the framework of business decisions. Additional information about how we mitigate event risk can be found in note 30.

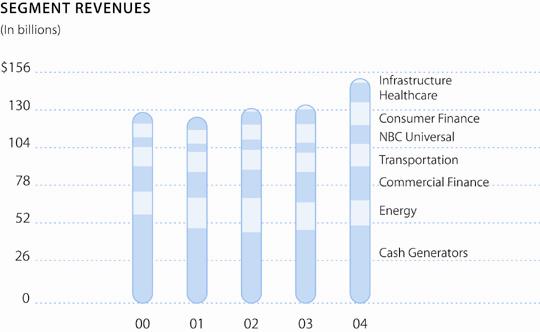

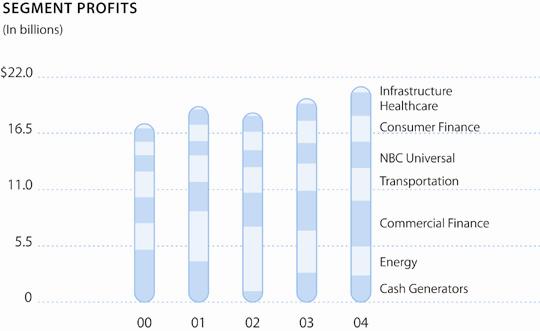

Segment Operations

Revenues and segment profit for operating segments are shown on page 53. Effective January 1, 2004, we made changes to the way we report our segments. We have reclassified certain prior-period amounts to conform to the current period’s presentation. For additional information, including a description of the products and services included in each segment, see pages 110 and 111.

Segment profit is determined based on internal performance measures used by the Chief Executive Officer to assess the performance of each business in a given period. In connection with that assessment, the Chief Executive Officer may exclude matters such as charges for restructuring; rationalization and other similar expenses; in-process research and development and certain other acquisition-related charges; certain gains and losses from dispositions; and litigation settlements or other charges, responsibility for which precedes the current management team.

Segment profit always excludes the effects of principal pension plans and accounting changes. Segment profit excludes or includes interest and other financial charges and segment income taxes according to how a particular segment’s management is measured—excluded in determining operating profit for Advanced Materials, Consumer & Industrial, Energy, Healthcare, Infrastructure, NBC Universal and Transportation; included in determining segment profit, which we refer to as “segment net earnings,” for Commercial Finance, Consumer Finance, Equipment & Other Services and Insurance.

| General Electric Company and consolidated affiliates | |||||||||||||||

| For the years ended December 31 (In millions) | 2004 | 2003 | 2002 | 2001 | 2000 | ||||||||||

| REVENUES | |||||||||||||||

| Advanced Materials | $ | 8,290 | $ | 7,078 | $ | 6,963 | $ | 7,069 | $ | 8,020 | |||||

| Commercial Finance | 23,489 | 20,813 | 19,592 | 17,723 | 17,549 | ||||||||||

| Consumer Finance | 15,734 | 12,845 | 10,266 | 9,508 | 9,320 | ||||||||||

| Consumer & Industrial | 13,767 | 12,843 | 12,887 | 13,063 | 13,406 | ||||||||||

| Energy | 17,348 | 19,082 | 23,633 | 21,030 | 15,703 | ||||||||||

| Equipment & Other Services | 8,483 | 4,427 | 5,545 | 7,735 | 15,074 | ||||||||||

| Healthcare | 13,456 | 10,198 | 8,955 | 8,409 | 7,275 | ||||||||||

| Infrastructure | 3,447 | 3,078 | 1,901 | 392 | 486 | ||||||||||

| Insurance | 23,070 | 26,194 | 23,296 | 23,890 | 24,766 | ||||||||||

| NBC Universal | 12,886 | 6,871 | 7,149 | 5,769 | 6,797 | ||||||||||

| Transportation | 15,562 | 13,515 | 13,685 | 13,885 | 13,285 | ||||||||||

| Corporate items and eliminations | (3,169 | ) | (2,757 | ) | (1,662 | ) | (2,057 | ) | (1,296 | )) | |||||

CONSOLIDATED REVENUES | $ | 152,363 | $ | 134,187 | $ | 132,210 | $ | 126,416 | $ | 130,385 | |||||

| SEGMENT PROFIT | |||||||||||||||

| Advanced Materials | $ | 710 | $ | 616 | $ | 1,000 | $ | 1,433 | $ | 1,864 | |||||

| Commercial Finance | 4,465 | 3,910 | 3,310 | 2,879 | 2,528 | ||||||||||

| Consumer Finance | 2,520 | 2,161 | 1,799 | 1,602 | 1,295 | ||||||||||

| Consumer & Industrial | 716 | 577 | 567 | 894 | 1,270 | ||||||||||

| Energy | 2,845 | 4,109 | 6,294 | 4,897 | 2,598 | ||||||||||

| Equipment & Other Services | 607 | (419 | ) | (388 | ) | (222 | ) | (212 | ) | ||||||

| Healthcare | 2,286 | 1,701 | 1,546 | 1,498 | 1,321 | ||||||||||

| Infrastructure | 563 | 462 | 297 | 26 | 45 | ||||||||||

| Insurance | 569 | 2,102 | (95 | ) | 1,879 | 2,201 | |||||||||

| NBC Universal | 2,558 | 1,998 | 1,658 | 1,408 | 1,609 | ||||||||||

| Transportation | 3,213 | 2,661 | 2,510 | 2,577 | 2,511 | ||||||||||

| Total segment profit | 21,052 | 19,878 | 18,498 | 18,871 | 17,030 | ||||||||||

| GECS goodwill amortization | — | — | — | (552 | ) | (620 | ) | ||||||||

| GE corporate items and eliminations | (1,507 | ) | (491 | ) | 1,041 | 819 | 935 | ||||||||

| GE interest and other financial charges | (979 | ) | (941 | ) | (569 | ) | (817 | ) | (811 | ) | |||||

| GE provision for income taxes | (1,973 | ) | (2,857 | ) | (3,837 | ) | (4,193 | ) | (3,799 | ) | |||||

| Earnings before accounting changes | 16,593 | 15,589 | 15,133 | 14,128 | 12,735 | ||||||||||

| Cumulative effect of accounting changes | — | (587 | ) | (1,015 | ) | (444 | ) | — | |||||||

CONSOLIDATED NET EARNINGS | $ | 16,593 | $ | 15,002 | $ | 14,118 | $ | 13,684 | $ | 12,735 | |||||

The notes to consolidated financial statements on pages 78–111 are an integral part of this summary.

ADVANCED MATERIALS revenues in 2004 were up 17% to $8.3 billion reflecting higher volume ($0.7 billion), higher prices ($0.4 billion) and the effects of the weaker U.S. dollar ($0.2 billion). Volume increases resulted from the OSi acquisition ($0.4 billion) and higher demand for plastic resins and quartz products. Operating profit of $0.7 billion was 15% higher than in 2003 as productivity ($0.4 billion) and higher prices ($0.4 billion) more than offset the effect of higher material costs ($0.6 billion), primarily from commodities such as benzene and natural gas.

COMMERCIAL FINANCE | ||||||||||

| (In millions) | 2004 | 2003 | 2002 | |||||||

REVENUES | $ | 23,489 | $ | 20,813 | $ | 19,592 | ||||

NET REVENUES | ||||||||||

| Total revenues | $ | 23,489 | $ | 20,813 | $ | 19,592 | ||||

| Interest expense | 6,083 | 5,789 | 5,979 | |||||||

| Total net revenues | $ | 17,406 | $ | 15,024 | $ | 13,613 | ||||

NET EARNINGS | $ | 4,465 | $ | 3,910 | $ | 3,310 | ||||

| December 31 (In millions) | 2004 | 2003 | ||||||||

TOTAL ASSETS | $ | 232,123 | $ | 214,125 |

| (In millions) | 2004 | 2003 | 2002 | |||||||

| Real Estate(a) | ||||||||||

| Revenues | $ | 2,519 | $ | 2,386 | $ | 2,124 | ||||

| Net earnings | 957 | 834 | 650 | |||||||

| Aviation Services(a) | ||||||||||

| Revenues | 3,159 | 2,881 | 2,694 | |||||||

| Net earnings | 520 | 506 | 454 | |||||||

| December 31 (In millions) | 2004 | 2003 | ||||||||

| Real Estate(a) | ||||||||||

| Total assets | $ | 33,497 | $ | 27,767 | ||||||

| Aviation Services(a) | ||||||||||

| Total assets | 37,384 | 33,271 |

| (a) | We provide additional information on two of our segment product lines, Real Estate (commercial real estate financing) and Aviation Services (commercial aircraft financing). Each of these product lines finances a single form of collateral, and each has understandable concentrations of risk and opportunities. | |||

CONSUMER FINANCE | ||||||||||

| (In millions) | 2004 | 2003 | 2002 | |||||||

REVENUES | $ | 15,734 | $ | 12,845 | $ | 10,266 | ||||

NET REVENUES | ||||||||||

| Total revenues | $ | 15,734 | $ | 12,845 | $ | 10,266 | ||||

| Interest expense | 3,564 | 2,696 | 2,143 | |||||||

| Total net revenues | $ | 12,170 | $ | 10,149 | $ | 8,123 | ||||

NET EARNINGS | $ | 2,520 | $ | 2,161 | $ | 1,799 | ||||

| December 31 (In millions) | 2004 | 2003 | ||||||||

TOTAL ASSETS | $ | 151,255 | $ | 106,530 |

| (In millions) | 2004 | 2003 | 2002 | |||||||

| REVENUES | $ | 8,483 | $ | 4,427 | $ | 5,545 | ||||

| NET EARNINGS | $ | 607 | $ | (419 | ) | $ | (388 | ) | ||

| • | The exit of certain European operations at IT Solutions ($1.3 billion) in response to intense competition and transition of the computer equipment market to a direct distribution model, |

| • | Continued poor market conditions and ongoing dispositions and run-offs of IT Solutions and the Auto Financial Services business ($0.3 billion), and |

| • | Lower asset utilization and price ($0.2 billion), an effect of industry-wide excess equipment capacity reflective of the then current conditions in the road and rail transportation sector. |

| (In millions) | 2004 | 2003 | 2002 | |||||||

| REVENUES | $ | 23,070 | $ | 26,194 | $ | 23,296 | ||||

| NET EARNINGS | $ | 569 | $ | 2,102 | $ | (95 | ) | |||

| GE Insurance Solutions(a) | ||||||||||

| Revenues | $ | 10,005 | $ | 11,600 | $ | 9,432 | ||||

| Net earnings | 36 | 481 | (1,794 | ) | ||||||

| (a) | Formerly GE Global Insurance Holding Corporation, the parent of Employers Reinsurance Corporation (ERC). | |||

| (In millions) | 2004 | 2003 | 2002 | |||||||

| REVENUES | ||||||||||

| Eliminations | $ | (3,169 | ) | $ | (2,757 | ) | $ | (1,662 | ) | |

| OPERATING PROFIT | ||||||||||

| Principal pension plans | $ | 124 | $ | 1,040 | $ | 1,556 | ||||

| Eliminations | (438 | ) | (504 | ) | (558 | ) | ||||

| Underabsorbed corporate overhead | (777 | ) | (582 | ) | (367 | ) | ||||

| Not allocated | (548 | ) | (354 | ) | (11) | ) | ||||

| Other | 132 | (91 | ) | 421 | ||||||

| Total | $ | (1,507 | ) | $ | (491 | ) | $ | 1,041 | ||

| (In millions) | 2004 | 2003 | 2002 | |||||||

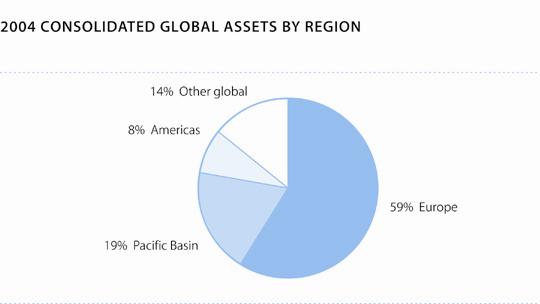

| Europe | $ | 37,000 | $ | 30,500 | $ | 24,800 | ||||

| Pacific Basin | 13,100 | 13,100 | 12,000 | |||||||

| Americas | 7,200 | 5,900 | 5,200 | |||||||

| Other global | 5,400 | 4,600 | 3,900 | |||||||

| 62,700 | 54,100 | 45,900 | ||||||||

| Exports from the U.S. to external customers | 9,100 | 6,700 | 7,500 | |||||||

| Total | $ | 71,800 | $ | 60,800 | $ | 53,400 | ||||

| • | During 2004, we completed the acquisition of Amersham by Healthcare and the combination of NBC and VUE. GECS completed acquisitions of the commercial lending business of Transamerica Finance Corporation; Sophia S.A., a real estate company in France; the U.S. leasing business of IKON Office Solutions; and Benchmark Group PLC, a U.K.-listed real estate property company at Commercial Finance. Consumer Finance completed acquisitions of AFIG and WMC. At their respective acquisition dates, these financial services transactions resulted in a combined increase in total assets of $32.1 billion, of which $23.0 billion was financing receivables before allowance for losses, and a combined increase in total liabilities of approximately $20.5 billion, of which $18.9 billion was debt. |

| • | Minority interest in equity of consolidated affiliates increased $10.2 billion during 2004. In connection with the combination of NBC and VUE, NBC Universal issued 20% of its shares to a subsidiary of Vivendi Universal. This is the principal reason GE’s minority interest increased $6.6 billion. GECS minority interest increased $3.6 billion, primarily because of our sale of approximately 30% of the common shares of Genworth, our formerly wholly-owned subsidiary that conducts most of our consumer insurance business, including life and mortgage insurance operations. |

| • | We adopted Financial Accounting Standards Board (FASB) Interpretation No. (FIN) 46R, Consolidation of Variable Interest Entities (Revised), on January 1, 2004, adding $2.6 billion of assets and $2.1 billion of liabilities to our consolidated balance sheet as of that date, primarily relating to Penske. |

| 2004 | 2003 | 2002 | ||||||||

| Commercial Finance | 1.40 | % | 1.38 | % | 1.75 | % | ||||

| Consumer Finance | 4.85 | 5.62 | 5.62 | |||||||

| • | If, on January 1, 2005, interest rates had increased 100 basis points across the yield curve (a “parallel shift” in that curve) and that increase remained in place for 2005, we estimate, based on our year-end 2004 portfolio and holding everything else constant, that our 2005GE and GECS net earnings would decline pro-forma by $0.1 billion and $0.2 billion, respectively. |

| • | If, on January 1, 2005, currency exchange rates were to decline by 10% against the U.S. dollar and that decline remained in place for 2005, we estimate, based on our year-end 2004 portfolio and holding everything else constant, that the effect on our 2005GE and GECS net earnings would be insignificant. |

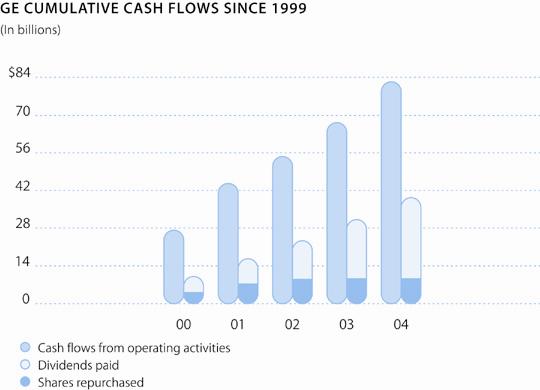

| December 31 (In billions) | 2004 | 2003 | 2002 | |||||||

| Operating cash collections | $ | 81.6 | $ | 68.4 | $ | 67.5 | ||||

| Operating cash payments | (69.5 | ) | (58.9 | ) | (59.4 | ) | ||||

| Cash dividends from GECS | 3.1 | 3.4 | 2.0 | |||||||

| GE cash from operating activities | $ | 15.2 | $ | 12.9 | $ | 10.1 | ||||

Payments due by period | ||||||||||||||||

| (In millions) | Total | 2005 | 2006-2007 | 2008-2009 | 2010 and thereafter | |||||||||||

| Borrowings (note 18) | $ | 370,907 | $ | 157,746 | $ | 85,103 | $ | 47,670 | $ | 80,388 | ||||||

| Interest on borrowings | 59,000 | 11,000 | 16,000 | 10,000 | 22,000 | |||||||||||

| Operating lease obligations (note 4) | 7,718 | 1,383 | 2,240 | 1,613 | 2,482 | |||||||||||

Purchase obligations(a)(b) | 53,000 | 35,000 | 11,000 | 4,000 | 3,000 | |||||||||||

Insurance liabilities (note 19)(c) | 92,000 | 14,000 | 19,000 | 13,000 | 46,000 | |||||||||||

Other liabilities(d) | 68,000 | 18,000 | 5,000 | 3,000 | 42,000 | |||||||||||

| (a) | Included all take-or-pay arrangements, capital expenditures, contractual commitments to purchase equipment that will be classified as equipment leased to others, software acquisition/license commitments, contractual minimum programming commitments and contractually required cash payments for acquisitions. | |||||

| (b) | Excluded funding commitments entered into in the ordinary course of business by our financial services businesses. Further information on these commitments is provided in note 30. | |||||

| (c) | Included guaranteed investment contracts, structured settlements and single premium immediate annuities based on scheduled payouts, as well as those contracts with reasonably determinable cash flows such as deferred annuities, universal life, term life, long-term care, whole life and other life insurance contracts as well as workers compensation tabular indemnity loan and long-term liability claims. | |||||

| (d) | Included an estimate of future expected funding requirements related to our pension and postretirement benefit plans. Because their future cash outflows are uncertain, the following non-current liabilities are excluded from the table above: deferred taxes, derivatives, deferred revenue and other sundry items. Refer to notes 21 and 28 for further information on these items. | |||||

| • | Earnings and profitability, including earnings quality, revenue growth, the breadth and diversity of sources of income and return on assets, |

| • | Asset quality, including delinquency and write-off ratios and reserve coverage, |

| • | Funding and liquidity, including cash generated from operating activities, leverage ratios such as debt-to-capital, market access, back-up liquidity from banks and other sources, composition of total debt and interest coverage, and |

| • | Capital adequacy, including required capital and tangible leverage ratios. |

| • | Franchise strength, including competitive advantage and market conditions and position, |

| • | Strength of management, including experience, corporate governance and strategic thinking, and |

| • | Financial reporting quality, including clarity, completeness and transparency of all financial performance communications. |

| • | 22% of operating earnings retained by GECS ($1.8 billion), |

| • | Proceeds from the Genworth initial public offering less dividend payments to GE ($1.6 billion), |

| • | Mortgage Insurance contingent note payment ($0.5 billion), |

| • | Sale of a majority interest of Gecis ($0.5 billion), and |

| • | Rationalization of Insurance and Equipment & Other Services related activities ($0.3 billion). |

| December 31 | 2004 | 2003 | |||||

| Senior notes and other long-term debt | 58 | % | 55 | % | |||

| Commercial paper | 25 | 27 | |||||

| Current portion of long-term debt | 11 | 13 | |||||

| Other—bank and other retail deposits | 6 | 5 | |||||

| Total | 100 | % | 100 | % | |||

| • | Under certain swap, forward and option contracts, if the long-term credit rating of eitherGE or GECS were to fall below A-/A3, certain remedies are required as discussed in note 28. |

| • | If GE Capital’s ratio of earnings to fixed charges, which was 1.87:1 at the end of 2004, were to deteriorate to 1.10:1 or, upon redemption of certain preferred stock, its ratio of debt to equity, which was 6.61:1 at the end of 2004, were to exceed 8:1, GE has committed to contribute capital to GE Capital. GE also has guaranteed subordinated debt of GECS with a face amount of $1.0 billion at December 31, 2004 and 2003. |

| • | If the short-term credit rating of GE Capital or certain consolidated SPEs discussed further in note 29 were to fall below A-1/P-1, GE Capital would be required to provide substitute liquidity for those entities or provide funds to retire the outstanding commercial paper. The maximum net amount that GE Capital would be required to provide in the event of such a downgrade is determined by contract, and amounted to $12.8 billion at January 1, 2005. Amounts related to non- consolidated SPEs were $1.4 billion. |

| • | If the long-term credit rating of GE Capital were to fall below AA/Aa2, GE Capital would be required to provide substitute credit support or liquidate the consolidated SPEs. The maximum amount that GE Capital would be required to substitute in the event of such a downgrade is determined by contract, and amounted to $0.9 billion at December 31, 2004. |

| • | For certain transactions, if the long-term credit rating of GE Capital were to fall below A/A2 or BBB+/Baa1 or its short-term credit rating were to fall below A-2/P-2, GE Capital could be required to provide substitute credit support or fund the undrawn commitment. GE Capital could be required to provide up to $2.3 billion in the event of such a downgrade based on terms in effect at December 31, 2004. |

Selected Financial Data | ||||||||||||||||

| (In millions; per-share amounts in dollars) | 2004 | 2003 | 2002 | 2001 | 2000 | |||||||||||

GENERAL ELECTRIC COMPANY AND CONSOLIDATED AFFILIATES | ||||||||||||||||

Revenues | $ | 152,363 | $ | 134,187 | $ | 132,210 | $ | 126,416 | $ | 130,385 | ||||||

Earnings before accounting changes | 16,593 | 15,589 | 15,133 | 14,128 | 12,735 | |||||||||||

Cumulative effect of accounting changes | — | (587 | ) | (1,015 | ) | (444 | ) | — | ||||||||

Net earnings | 16,593 | 15,002 | 14,118 | 13,684 | 12,735 | |||||||||||

Dividends declared | 8,594 | 7,759 | 7,266 | 6,555 | 5,647 | |||||||||||

Return on average shareowners’ equity excluding the | ||||||||||||||||

effect of accounting changes | 17.4 | % | 22.1 | % | 25.8 | % | 27.1 | % | 27.5 | % | ||||||

Per share | ||||||||||||||||

Earnings before accounting changes—diluted | $ | 1.59 | $ | 1.55 | $ | 1.51 | $ | 1.41 | $ | 1.27 | ||||||

Cumulative effect of accounting changes—diluted | — | (0.06 | ) | (0.10 | ) | (0.04 | ) | — | ||||||||

Earnings—diluted | 1.59 | 1.49 | 1.41 | 1.37 | 1.27 | |||||||||||

Earnings before accounting changes—basic | 1.60 | 1.56 | 1.52 | 1.42 | 1.29 | |||||||||||

Cumulative effect of accounting changes—basic | — | (0.06 | ) | (0.10 | ) | (0.04 | ) | — | ||||||||

Earnings—basic | 1.60 | 1.50 | 1.42 | 1.38 | 1.29 | |||||||||||

Dividends declared | 0.82 | 0.77 | 0.73 | 0.66 | 0.57 | |||||||||||

Stock price range | 37.75-28.88 | 32.42--21.30 | 41.84-21.40 | 52.90-28.25 | 60.50-41.67 | |||||||||||

Year-end closing stock price | 36.50 | 30.98 | 24.35 | 40.08 | 47.94 | |||||||||||

Total assets | 750,330 | 647,483 | 575,244 | 495,023 | 437,006 | |||||||||||

Long-term borrowings | 213,161 | 172,314 | 140,632 | 79,806 | 82,132 | |||||||||||

Shares outstanding—average (in thousands) | 10,399,629 | 10,018,587 | 9,947,113 | 9,932,245 | 9,897,110 | |||||||||||

Shareowner accounts—average | 658,000 | 670,000 | 655,000 | 625,000 | 597,000 | |||||||||||

GE DATA | ||||||||||||||||

Short-term borrowings | $ | 3,409 | $ | 2,555 | $ | 8,786 | $ | 1,722 | $ | 940 | ||||||

Long-term borrowings | 7,625 | 8,388 | 970 | 787 | 841 | |||||||||||

Minority interest | 7,701 | 1,079 | 1,028 | 948 | 968 | |||||||||||

Shareowners’ equity | 110,284 | 79,180 | 63,706 | 54,824 | 50,492 | |||||||||||

Total capital invested | $ | 129,019 | $ | 91,202 | $ | 74,490 | $ | 58,281 | $ | 53,241 | ||||||

Return on average total capital invested | ||||||||||||||||

excluding effect of accounting changes | 15.9 | % | 19.9 | % | 24.5 | % | 27.0 | % | 27.4 | % | ||||||

Borrowings as a percentage of total capital invested | 9.1 | % | 12.0 | % | 13.1 | % | 4.3 | % | 3.3 | % | ||||||

Working capital(a) | $ | 8,328 | $ | 5,282 | $ | 3,821 | $ | (2,398 | ) | $ | 799 | |||||

Additions to property, plant and equipment | 2,427 | 2,158 | 2,386 | 2,876 | 2,536 | |||||||||||

Employees at year end | ||||||||||||||||

United States | 129,000 | 122,000 | 125,000 | 125,000 | 131,000 | |||||||||||

Other countries | 98,000 | 96,000 | 94,000 | 94,000 | 92,000 | |||||||||||

Total employees | 227,000 | 218,000 | 219,000 | 219,000 | 223,000 | |||||||||||

GECS DATA | ||||||||||||||||

Revenues | $ | 70,776 | $ | 64,279 | $ | 58,699 | $ | 58,856 | $ | 66,709 | ||||||

Earnings before accounting changes | 8,161 | 7,754 | 4,626 | 5,586 | 5,192 | |||||||||||

Cumulative effect of accounting changes | — | (339 | ) | (1,015 | ) | (169 | ) | — | ||||||||

Net earnings | 8,161 | 7,415 | 3,611 | 5,417 | 5,192 | |||||||||||

Shareowner’s equity | 53,755 | 45,308 | 36,929 | 28,590 | 23,022 | |||||||||||

Minority interest | 8,682 | 5,115 | 4,445 | 4,267 | 3,968 | |||||||||||

Total borrowings | 361,342 | 320,318 | 270,962 | 239,935 | 205,371 | |||||||||||

Ratio of debt to equity at GE Capital | 6.61: 1 | 6.74: 1 | 6.58: 1 | 7.31: 1 | 7.53: 1 | |||||||||||

Total assets | $ | 618,327 | $ | 554,688 | $ | 489,828 | $ | 425,484 | $ | 370,636 | ||||||

Insurance premiums written | 15,250 | 18,602 | 16,999 | 15,843 | 16,461 | |||||||||||

Employees at year end | ||||||||||||||||

United States | 36,000 | 33,000 | 36,000 | 33,000 | 37,000 | |||||||||||

Other countries | 44,000 | 54,000 | 60,000 | 58,000 | 53,000 | |||||||||||

Total employees | 80,000 | 87,000 | 96,000 | 91,000 | 90,000 | |||||||||||

| Transactions between GE and GECS have been eliminated from the consolidated information. | ||||||||||||||||

| (a)Working capital is defined as the sum of receivables from the sales of goods and services, plus inventories, less trade accounts payable and progress collections. | ||||||||||||||||

| • | Discount rate—A 25 basis point reduction in discount rate would increase pension expense in 2005 by $0.1 billion. |

| • | Expected return on assets—A 50 basis point increase in the expected return on assets would decrease pension expense in 2005 by $0.3 billion. |

| • | Organic revenue growth in 2004, |

| • | Earnings growth, excluding Insurance dispositions, in 2004, |

| • | Growth in Industrial CFOA in 2004, |

| • | GE earnings before income taxes and accounting changes excluding GECS earnings, and the corresponding effective tax rate, for the three years ended December 31, 2004, |

| • | Net revenues (revenues from services less interest) of the Commercial Finance and Consumer Finance segments for the three years ended December 31, 2004, and |

| • | Delinquency rates on financing receivables of the Commercial Finance and Consumer Finance segments for 2004, 2003 and 2002. |

| (In millions) | 2004 | 2003 | % change | |||||||

| Revenues as reported | $ | 152,363 | $ | 134,187 | ||||||

| Less: | ||||||||||

| Effects of acquisitions, dispositions and currency exchange rates | 19,244 | 1,289 | ||||||||

| Insurance | 23,070 | 26,194 | ||||||||

| Energy | 17,348 | 19,082 | ||||||||

Revenues excluding the effects of acquisitions, dispositions and currency exchange rates, Insurance and Energy (organic revenues) | $ | 92,701 | $ | 87,622 | 6 | % | ||||

| (In millions) | 2004 | 2003 | % change | |||||||

| Earnings before accounting changes | ||||||||||

| as reported | $ | 16,593 | $ | 15,589 | ||||||

| Less effect of Insurance dispositions | (721 | ) | 728 | |||||||

| Earnings, excluding Insurance | ||||||||||

| dispositions | $ | 17,314 | $ | 14,861 | 17 | % | ||||

| (In millions) | 2004 | 2003 | % change | |||||||

| Cash from GE’s operating activities | ||||||||||

| as reported | $ | 15,204 | $ | 12,975 | ||||||

| Less GECS dividends | 3,105 | 3,435 | ||||||||

| Cash from GE’s operating activities | ||||||||||

| excluding dividends from GECS | ||||||||||

| (Industrial CFOA) | $ | 12,099 | $ | 9,540 | 27 | % | ||||

| (In millions) | 2004 | 2003 | 2002 | |||||||

| GE earnings before income taxes and accounting changes | $ | 18,566 | $ | 18,446 | $ | 18,970 | ||||

| Less GECS earnings | 8,161 | 7,754 | 4,626 | |||||||

| Total | $ | 10,405 | $ | 10,692 | $ | 14,344 | ||||

| Provision for income taxes | $ | 1,973 | $ | 2,857 | $ | 3,837 | ||||

| Effective tax rate | 19.0 | % | 26.7 | % | 26.7 | % | ||||

| December 31 | 2004 | 2003 | 2002 | |||||||

| Managed | 1.40 | % | 1.38 | % | 1.75 | % | ||||

| Off-book | 0.90 | 1.27 | 0.09 | |||||||

| On-book | 1.58 | 1.41 | 2.16 | |||||||

| December 31 | 2004 | 2003 | 2002 | |||||||

| Managed | 4.85 | % | 5.62 | % | 5.62 | % | ||||

| Off-book | 5.09 | 5.04 | 4.84 | |||||||

| On-book | 4.84 | 5.67 | 5.76 | |||||||

AUDITED FINANCIAL STATEMENTS

General Electric Company and consolidated affiliates | ||||||||||

For the years ended December 31 (In millions; per-share amounts in dollars) | 2004 | 2003 | 2002 | |||||||

REVENUES | ||||||||||

| Sales of goods | $ | 55,005 | $ | 49,963 | $ | 55,096 | ||||

| Sales of services | 29,700 | 22,391 | 21,138 | |||||||

| Other income (note 2) | 1,064 | 602 | 1,013 | |||||||

| Earnings of GECS before accounting changes | — | — | — | |||||||

| GECS revenues from services (note 3) | 66,594 | 61,231 | 54,963 | |||||||

| Total revenues | 152,363 | 134,187 | 132,210 | |||||||

COSTS AND EXPENSES (note 4) | ||||||||||

| Cost of goods sold | 42,645 | 37,189 | 38,833 | |||||||

| Cost of services sold | 19,114 | 14,017 | 14,023 | |||||||

| Interest and other financial charges | 11,907 | 10,825 | 10,216 | |||||||

| Insurance losses and policyholder and annuity benefits | 15,627 | 16,369 | 17,608 | |||||||

| Provision for losses on financing receivables (note 13) | 3,888 | 3,752 | 3,084 | |||||||

| Other costs and expenses | 38,148 | 31,821 | 29,229 | |||||||

| Minority interest in net earnings of consolidated affiliates | 928 | 310 | 326 | |||||||

| Total costs and expenses | 132,257 | 114,283 | 113,319 | |||||||

EARNINGS BEFORE INCOME TAXES AND ACCOUNTING CHANGES | 20,106 | 19,904 | 18,891 | |||||||

| Provision for income taxes (note 7) | (3,513 | ) | (4,315 | ) | (3,758 | ) | ||||

EARNINGS BEFORE ACCOUNTING CHANGES | 16,593 | 15,589 | 15,133 | |||||||

| Cumulative effect of accounting changes (note 1) | — | (587 | ) | (1,015 | ) | |||||

NET EARNINGS | $ | 16,593 | $ | 15,002 | $ | 14,118 | ||||

| Per-share amounts (note 8) | ||||||||||

| Per-share amounts before accounting changes | ||||||||||

| Diluted earnings per share | $ | 1.59 | $ | 1.55 | $ | 1.51 | ||||

| Basic earnings per share | 1.60 | 1.56 | 1.52 | |||||||

| Per-share amounts after accounting changes | ||||||||||

| Diluted earnings per share | 1.59 | 1.49 | 1.41 | |||||||

| Basic earnings per share | 1.60 | 1.50 | 1.42 | |||||||

DIVIDENDS DECLARED PER SHARE | $ | 0.82 | $ | 0.77 | $ | 0.73 | ||||

| (In millions) | 2004 | 2003 | 2002 | |||||||

CHANGES IN SHAREOWNERS’ EQUITY (note 24) | ||||||||||

| Balance at January 1 | $ | 79,180 | $ | 63,706 | $ | 54,824 | ||||

| Dividends and other transactions with shareowners | 10,009 | (5,520 | ) | (6,382 | ) | |||||

| Changes other than transactions with shareowners | ||||||||||

| Increase attributable to net earnings | 16,593 | 15,002 | 14,118 | |||||||

| Investment securities—net | 412 | 710 | 1,378 | |||||||

| Currency translation adjustments—net | 3,942 | 5,123 | 1,000 | |||||||

| Cash flow hedges—net | 569 | 320 | (1,157 | ) | ||||||

| Minimum pension liabilities—net | (421 | ) | (161 | ) | (75 | ) | ||||

| Total changes other than transactions with shareowners | 21,095 | 20,994 | 15,264 | |||||||

| Balance at December 31 | $ | 110,284 | $ | 79,180 | $ | 63,706 |

GE | GECS | ||||||||||||||||||

For the years ended December 31 (In millions; per-share amounts in dollars) | 2004 | 2003 | 2002 | 2004 | 2003 | 2002 | |||||||||||||

REVENUES | |||||||||||||||||||

| Sales of goods | $ | 52,260 | $ | 47,767 | $ | 51,957 | $ | 2,840 | $ | 2,228 | $ | 3,296 | |||||||

| Sales of services | 29,954 | 22,675 | 21,360 | — | — | — | |||||||||||||

| Other income (note 2) | 1,076 | 645 | 1,106 | — | — | — | |||||||||||||

| Earnings of GECS before accounting changes | 8,161 | 7,754 | 4,626 | — | — | — | |||||||||||||

| GECS revenues from services (note 3) | — | — | — | 67,936 | 62,051 | 55,403 | |||||||||||||

| Total revenues | 91,451 | 78,841 | 79,049 | 70,776 | 64,279 | 58,699 | |||||||||||||

COSTS AND EXPENSES (note 4) | |||||||||||||||||||

| Cost of goods sold | 39,999 | 35,102 | 35,951 | 2,741 | 2,119 | 3,039 | |||||||||||||

| Cost of services sold | 19,368 | 14,301 | 14,245 | — | — | — | |||||||||||||

| Interest and other financial charges | 979 | 941 | 569 | 11,372 | 10,262 | 9,935 | |||||||||||||

| Insurance losses and policyholder and annuity benefits | — | — | — | 15,844 | 16,369 | 17,608 | |||||||||||||

| Provision for losses on financing receivables (note 13) | — | — | — | 3,888 | 3,752 | 3,084 | |||||||||||||

| Other costs and expenses | 12,001 | 9,870 | 9,131 | 26,840 | 22,436 | 20,343 | |||||||||||||

| Minority interest in net earnings of consolidated affiliates | 538 | 181 | 183 | 390 | 129 | 143 | |||||||||||||

| Total costs and expenses | 72,885 | 60,395 | 60,079 | 61,075 | 55,067 | 54,152 | |||||||||||||

EARNINGS BEFORE INCOME TAXES AND ACCOUNTING CHANGES | 18,566 | 18,446 | 18,970 | 9,701 | 9,212 | 4,547 | |||||||||||||

| Provision for income taxes (note 7) | (1,973 | ) | (2,857 | ) | (3,837 | ) | (1,540 | ) | (1,458 | ) | 79 | ||||||||

EARNINGS BEFORE ACCOUNTING CHANGES | 16,593 | 15,589 | 15,133 | 8,161 | 7,754 | 4,626 | |||||||||||||

| Cumulative effect of accounting changes (note 1) | — | (587 | ) | (1,015 | ) | — | (339 | ) | (1,015 | ) | |||||||||

NET EARNINGS | $ | 16,593 | $ | 15,002 | $ | 14,118 | $ | 8,161 | $ | 7,415 | $ | 3,611 | |||||||

General Electric Company and consolidated affiliates | |||||||

| At December 31 (In millions) | 2004 | 2003 | |||||

ASSETS | |||||||

| Cash and equivalents | $ | 15,328 | $ | 12,664 | |||

| Investment securities (note 9) | 135,536 | 129,269 | |||||

| Current receivables (note 10) | 14,233 | 10,732 | |||||

| Inventories (note 11) | 9,778 | 8,752 | |||||

| Financing receivables—net (notes 12 and 13) | 282,467 | 247,906 | |||||

| Insurance receivables—net (note 14) | 25,709 | 27,541 | |||||

| Other GECS receivables | 10,771 | 9,747 | |||||

| Property, plant and equipment—net (note 15) | 63,334 | 53,388 | |||||

| Investment in GECS | — | — | |||||

| Intangible assets—net (note 16) | 83,240 | 55,025 | |||||

| All other assets (note 17) | 109,934 | 92,621 | |||||

| Total assets | $ | 750,330 | $ | 647,645 | |||

LIABILITIES AND EQUITY | |||||||

| Short-term borrowings (note 18) | $ | 157,746 | $ | 157,397 | |||

| Accounts payable, principally trade accounts | 24,729 | 19,950 | |||||

| Progress collections and price adjustments accrued | 3,937 | 4,433 | |||||

| Dividends payable | 2,329 | 2,013 | |||||

| All other current costs and expenses accrued | 17,539 | 15,343 | |||||

| Long-term borrowings (note 18) | 213,161 | 172,314 | |||||

| Insurance liabilities, reserves and annuity benefits (note 19) | 140,585 | 136,428 | |||||

| All other liabilities (note 20) | 49,223 | 41,746 | |||||

| Deferred income taxes (note 21) | 14,414 | 12,647 | |||||

| Total liabilities | 623,663 | 562,271 | |||||

Minority interest in equity of consolidated affiliates (note 22) | 16,383 | 6,194 | |||||

Common stock (10,586,358,000 and 10,063,120,000 shares outstanding at year-end 2004 and 2003, respectively) | 669 | 669 | |||||

| Accumulated gains (losses)—net | |||||||

| Investment securities | 2,268 | 1,856 | |||||

| Currency translation adjustments | 6,929 | 2,987 | |||||

| Cash flow hedges | (1,223 | ) | (1,792 | ) | |||

| Minimum pension liabilities | (657 | ) | (236 | ) | |||

| Other capital | 24,265 | 17,497 | |||||

| Retained earnings | 90,795 | 82,796 | |||||

| Less common stock held in treasury | (12,762 | ) | (24,597 | ) | |||

| Total shareowners’ equity (notes 24 and 25) | 110,284 | 79,180 | |||||

| Total liabilities and equity | $ | 750,330 | $ | 647,645 | |||

GE | GECS | ||||||||||||

| At December 31 (In millions) | 2004 | 2003 | 2004 | 2003 | |||||||||

ASSETS | |||||||||||||

| Cash and equivalents | $ | 3,155 | $ | 1,670 | $ | 12,367 | $ | 11,273 | |||||

| Investment securities (note 9) | 413 | 380 | 135,152 | 128,889 | |||||||||

| Current receivables (note 10) | 14,533 | 10,973 | — | — | |||||||||

| Inventories (note 11) | 9,589 | 8,555 | 189 | 197 | |||||||||

| Financing receivables—net (notes 12 and 13) | — | — | 282,467 | 247,906 | |||||||||

| Insurance receivables—net (note 14) | — | — | 25,971 | 27,541 | |||||||||

| Other GECS receivables | — | — | 14,134 | 12,103 | |||||||||

| Property, plant and equipment—net (note 15) | 16,756 | 14,566 | 46,578 | 38,822 | |||||||||

| Investment in GECS | 53,755 | 45,308 | — | — | |||||||||

| Intangible assets—net (note 16) | 54,720 | 30,204 | 28,520 | 24,821 | |||||||||

| All other assets (note 17) | 38,123 | 30,448 | 72,949 | 63,136 | |||||||||

| Total assets | $ | 191,044 | $ | 142,104 | $ | 618,327 | $ | 554,688 | |||||

LIABILITIES AND EQUITY | |||||||||||||

| Short-term borrowings (note 18) | $ | 3,409 | $ | 2,555 | $ | 154,843 | $ | 155,468 | |||||

| Accounts payable, principally trade accounts | 11,013 | 8,753 | 17,104 | 13,566 | |||||||||

| Progress collections and price adjustments accrued | 3,937 | 4,433 | — | — | |||||||||

| Dividends payable | 2,329 | 2,013 | — | — | |||||||||

| All other current costs and expenses accrued | 17,569 | 15,343 | — | — | |||||||||

| Long-term borrowings (note 18) | 7,625 | 8,388 | 206,499 | 164,850 | |||||||||

| Insurance liabilities, reserves and annuity benefits (note 19) | — | — | 140,902 | 136,428 | |||||||||

| All other liabilities (note 20) | 23,561 | 18,449 | 25,744 | 23,217 | |||||||||

| Deferred income taxes (note 21) | 3,616 | 1,911 | 10,798 | 10,736 | |||||||||

| Total liabilities | 73,059 | 61,845 | 555,890 | 504,265 | |||||||||

Minority interest in equity of consolidated affiliates (note 22) | 7,701 | 1,079 | 8,682 | 5,115 | |||||||||

Common stock (10,586,358,000 and 10,063,120,000 shares outstanding at year-end 2004 and 2003, respectively) | 669 | 669 | 1 | 1 | |||||||||

| Accumulated gains (losses)—net | |||||||||||||

| Investment securities | 2,268 | 1,856 | 2,345 | 1,864 | |||||||||

| Currency translation adjustments | 6,929 | 2,987 | 5,183 | 2,639 | |||||||||

| Cash flow hedges | (1,223 | ) | (1,792 | ) | (1,354 | ) | (1,727 | ) | |||||

| Minimum pension liabilities | (657 | ) | (236 | ) | (150 | ) | (41 | ) | |||||

| Other capital | 24,265 | 17,497 | 12,370 | 12,268 | |||||||||

| Retained earnings | 90,795 | 82,796 | 35,360 | 30,304 | |||||||||

| Less common stock held in treasury | (12,762 | ) | (24,597 | ) | — | — | |||||||

| Total shareowners’ equity (notes 24 and 25) | 110,284 | 79,180 | 53,755 | 45,308 | |||||||||

| Total liabilities and equity | $ | 191,044 | $ | 142,104 | $ | 618,327 | $ | 554,688 | |||||

Electric Company and consolidated affiliates | ||||||||||

| For the years ended December 31 (In millions) | 2004 | 2003 | 2002 | |||||||

CASH FLOWS—OPERATING ACTIVITIES | ||||||||||

| Net earnings | $ | 16,593 | $ | 15,002 | $ | 14,118 | ||||

| Adjustments to reconcile net earnings to cash provided | ||||||||||

| from operating activities | ||||||||||

| Cumulative effect of accounting changes | — | 587 | 1,015 | |||||||

Depreciation and amortization of property, plant and equipment | 8,385 | 6,956 | 6,511 | |||||||

| Earnings (before accounting changes) retained by GECS | — | — | — | |||||||